2014 First-Quarter Results April 17, 2014 Exhibit 99.3

2 Introduction ● Unless otherwise stated, we will be talking about results for the first-quarter of 2014 and comparing them to the same period in 2013 ● References to PMI volumes are to PMI shipments ● Industry volume and market shares are PMI estimates based on the latest data available from a number of internal and external sources ● Net revenues exclude excise taxes ● Operating Companies Income, or “OCI”, is defined as operating income, excluding general corporate expenses and the amortization of intangibles, plus equity (income) or loss in unconsolidated subsidiaries, net. OCI growth rates are on an adjusted basis, which excludes asset impairment, exit and other costs ● Data tables showing adjustments to net revenues and OCI for currency, asset impairment, exit and other costs, free cash flow calculations, adjustments to EPS, and reconciliations to U.S. GAAP measures are at the end of today’s webcast slides, which are also posted on our web site ● Trademarks in this presentation are italicized

3 Forward-Looking and Cautionary Statements ● This presentation and related discussion contain forward-looking statements. Achievement of projected results is subject to risks, uncertainties and inaccurate assumptions, and PMI is identifying important factors that, individually or in the aggregate, could cause actual results to differ materially from those contained in any forward-looking statements made by PMI ● PMI’s business risks include: significant increases in cigarette-related taxes; the imposition of discriminatory excise tax structures; fluctuations in customer inventory levels due to increases in product taxes and prices; increasing marketing and regulatory restrictions, often with the goal of reducing or preventing the use of tobacco products; health concerns relating to the use of tobacco products and exposure to environmental tobacco smoke; litigation related to tobacco use; intense competition; the effects of global and individual country economic, regulatory and political developments; changes in adult smoker behavior; lost revenues as a result of counterfeiting, contraband and cross-border purchases; governmental investigations; unfavorable currency exchange rates and currency devaluations; adverse changes in applicable corporate tax laws; adverse changes in the cost and quality of tobacco and other agricultural products and raw materials; and the integrity of its information systems. PMI’s future profitability may also be adversely affected should it be unsuccessful in its attempts to produce products with the potential to reduce the risk of smoking-related diseases; if it is unable to successfully introduce new products, promote brand equity, enter new markets or improve its margins through increased prices and productivity gains; if it is unable to expand its brand portfolio internally or through acquisitions and the development of strategic business relationships; or if it is unable to attract and retain the best global talent ● PMI is further subject to other risks detailed from time to time in its publicly filed documents, including the Form 10-K for the year ended December 31, 2013. PMI cautions that the foregoing list of important factors is not a complete discussion of all potential risks and uncertainties. PMI does not undertake to update any forward-looking statement that it may make from time to time, except in the normal course of its public disclosure obligations

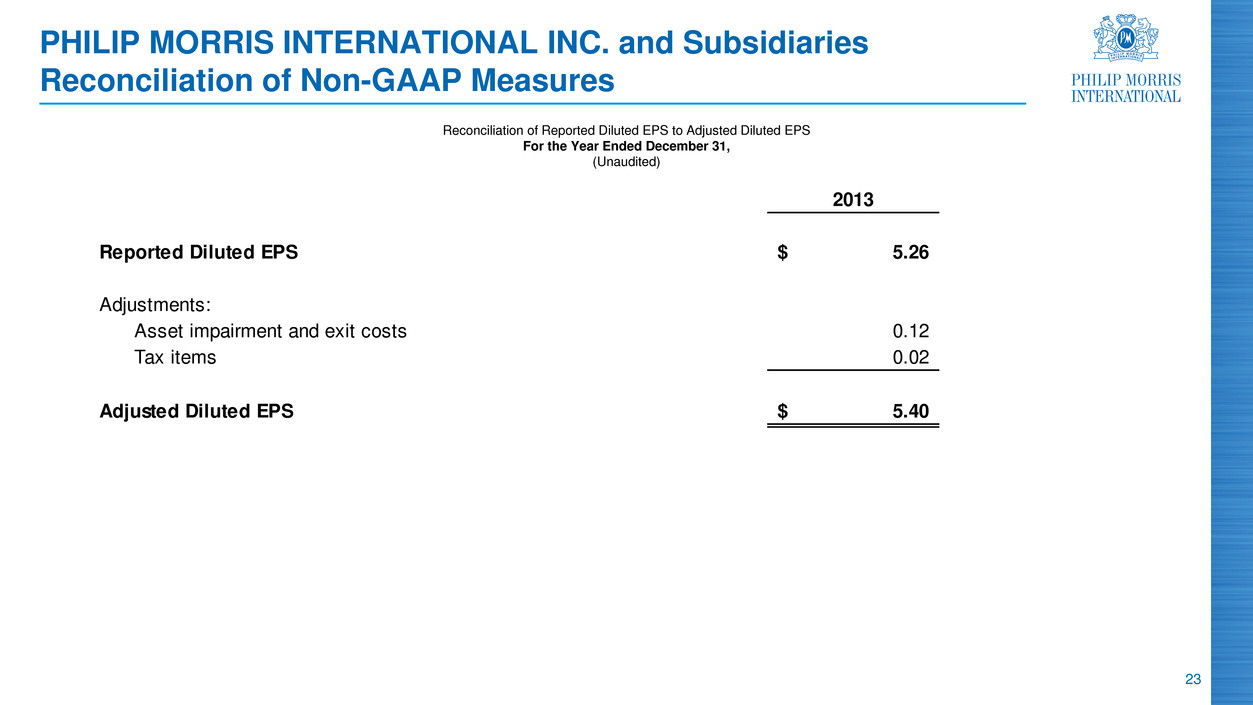

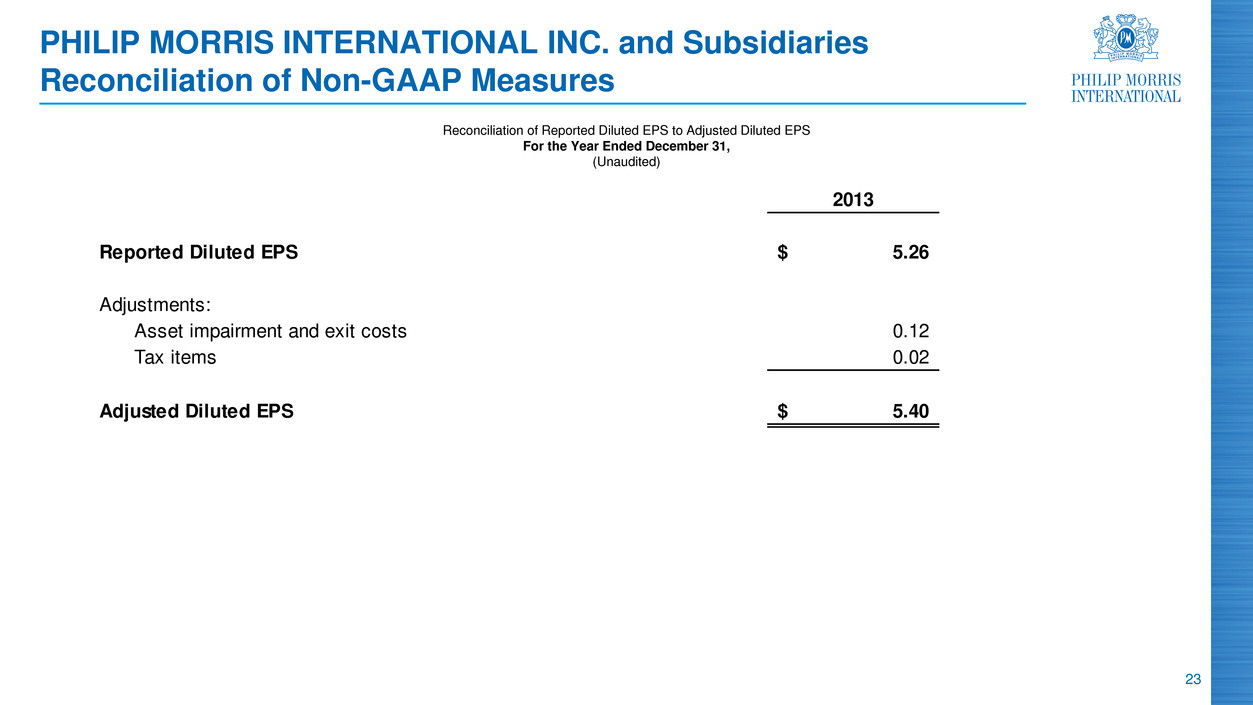

4 2014 EPS Guidance ● Business results in the first quarter are in line with our February 2014 annual guidance ● Quarter impacted by a number of distortions that masked a much better performance at the net revenue and OCI level ● Reported diluted EPS guidance for 2014 revised to $5.09 to $5.19 at prevailing exchange rates, compared to $5.26 in 2013 ● Revised guidance includes 61 cents of unfavorable currency at prevailing exchange rates (versus 71 cents previously) and a 3 cent restructuring charge related to the closure of our Australian factory ● Excluding currency and this restructuring charge, our guidance represents a growth rate of approximately 6% to 8%, compared to our adjusted diluted EPS of $5.40 in 2013 Source: PMI Financials and PMI forecasts

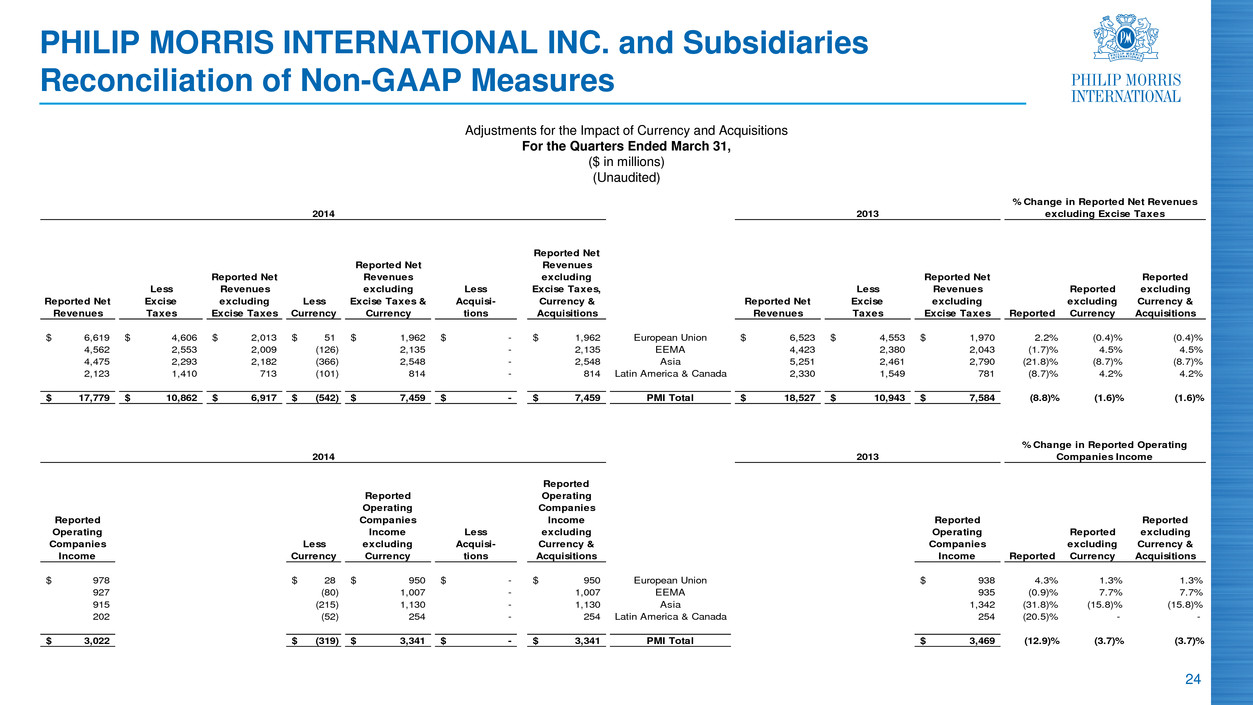

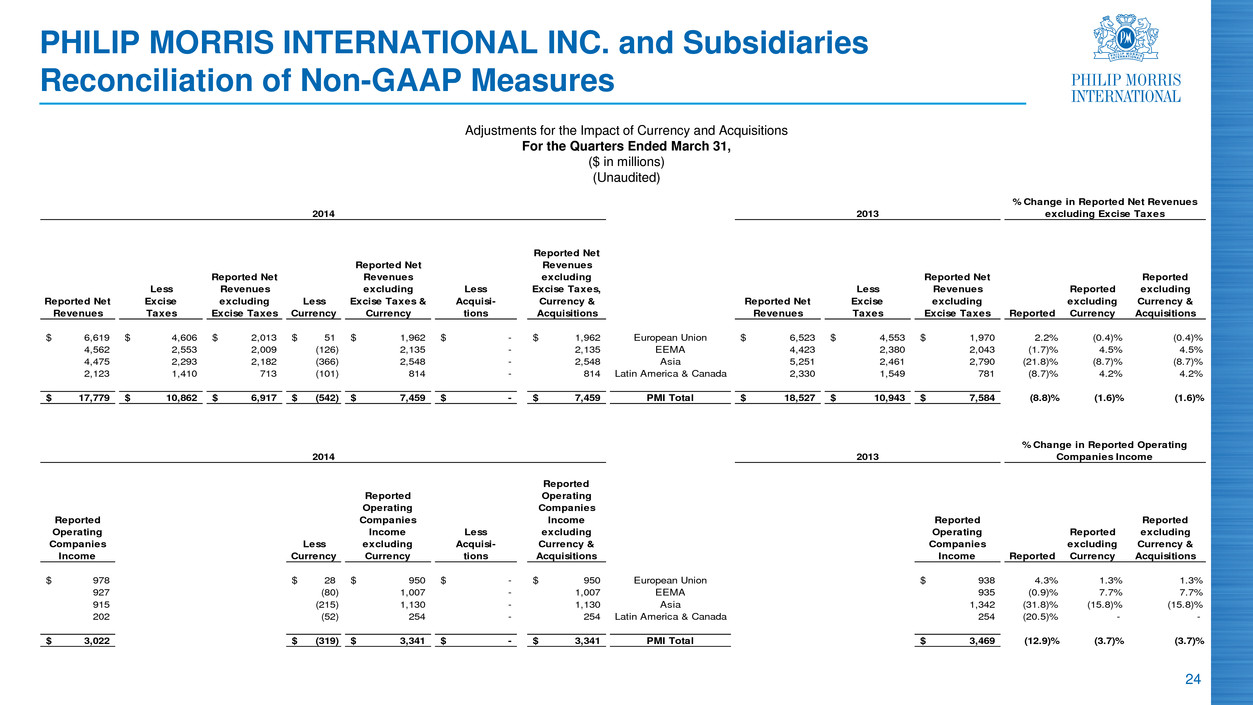

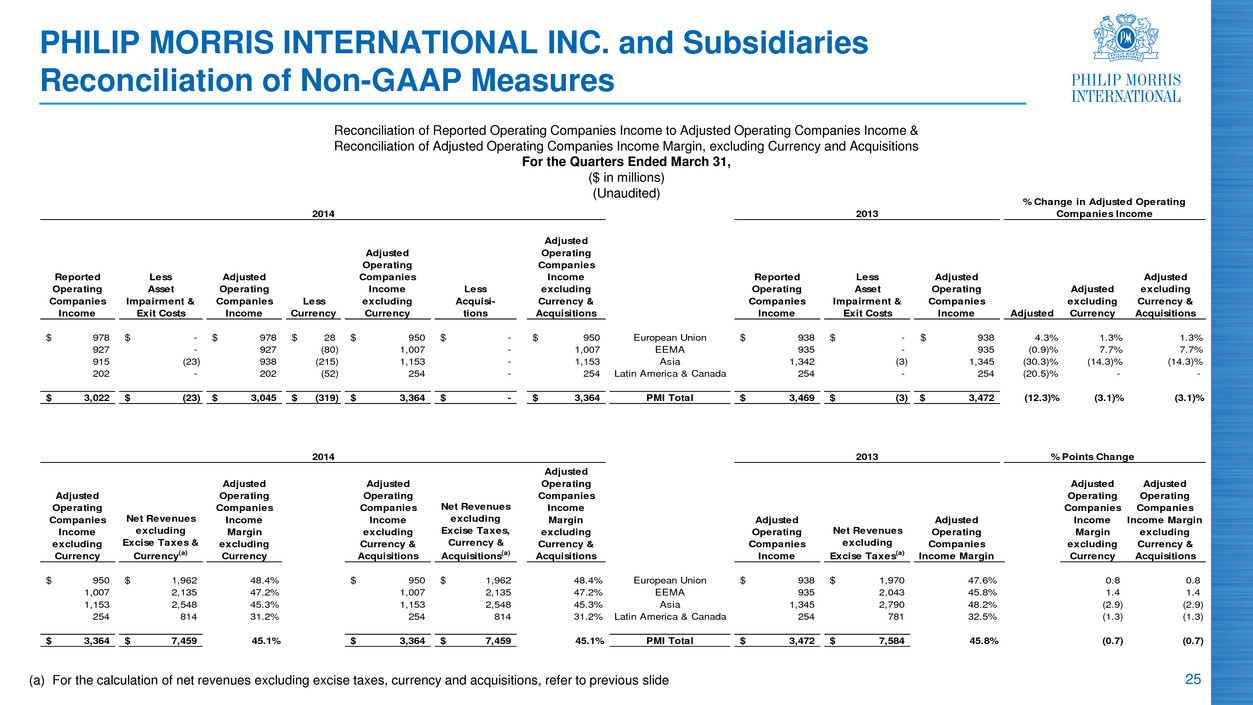

5 First-Quarter 2014 Results: In Line with Expectations ● Cigarette volume declined by 4.4%, driven by total industry volume contraction and unfavorable inventory movements. Absent these inventory distortions, our underlying volume was down by around 2.0% ● Net revenues, excluding currency, were 1.6% lower ● Adjusted OCI, excluding currency, decreased by 3.1% ● Lower revenues and OCI mainly attributable to Japan and the Philippines, both of which were impacted by distortions ● Adjusted diluted EPS, excluding currency, increased by 4.7% Source: PMI Financials

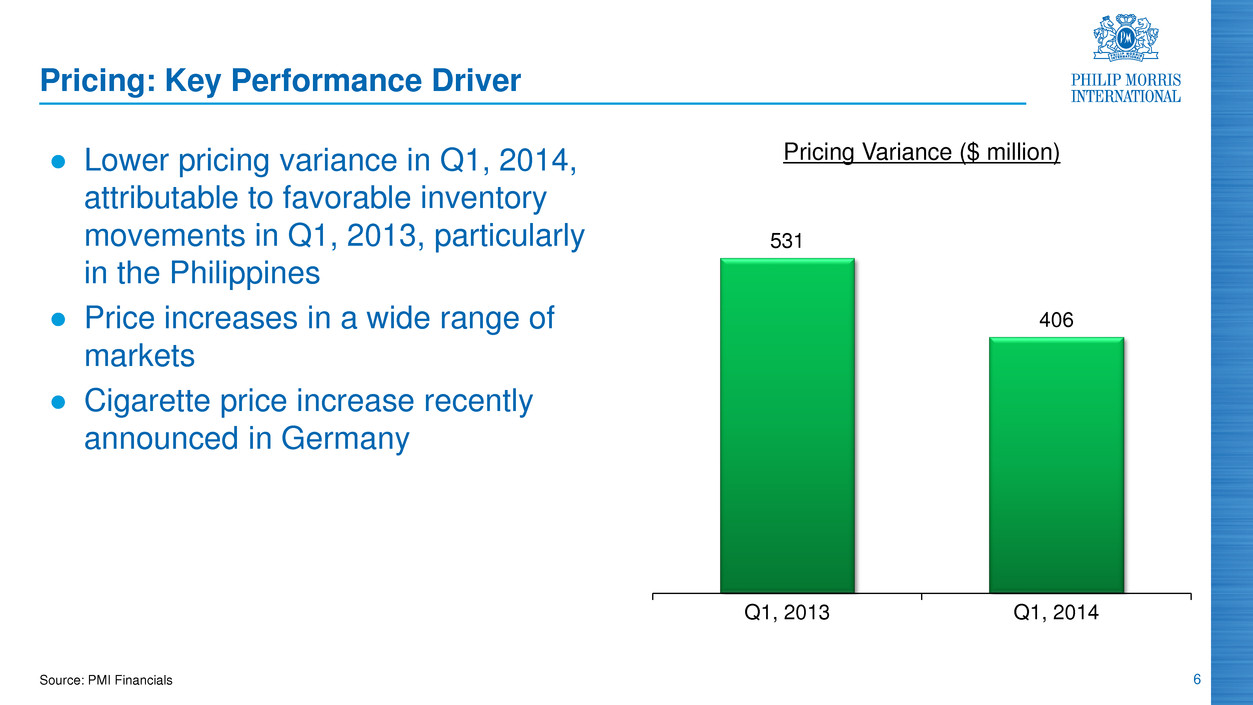

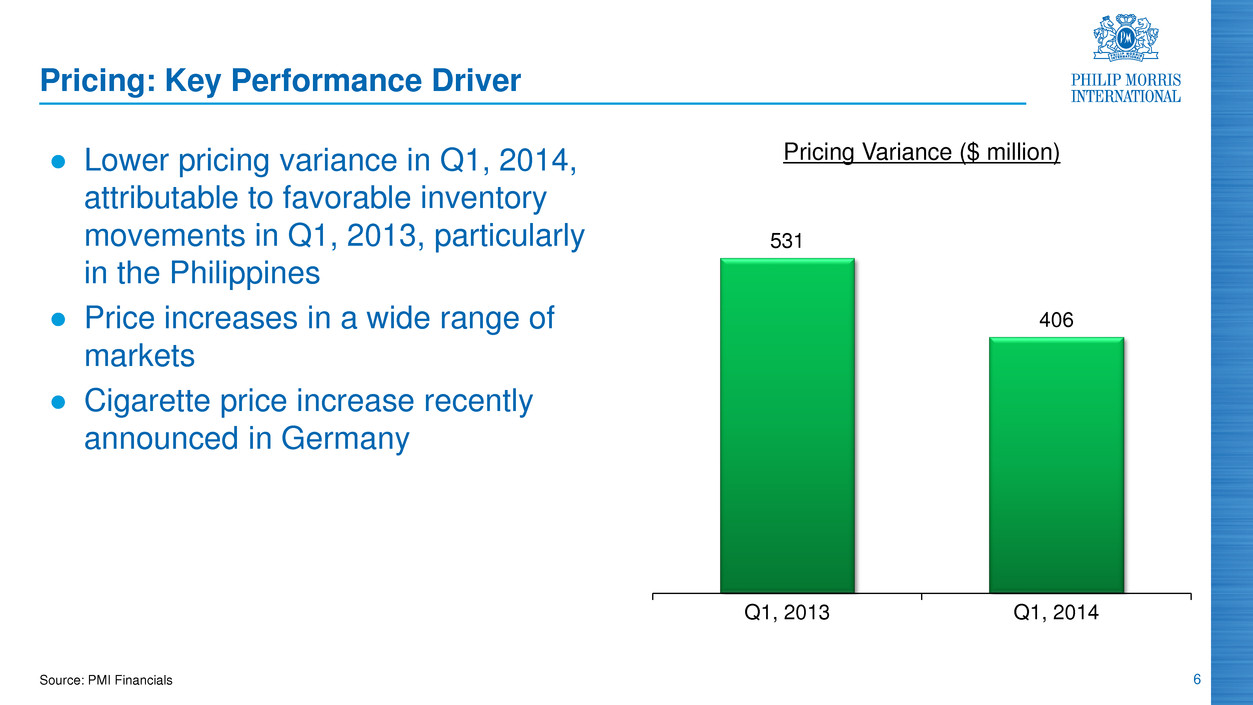

6 Source: PMI Financials Pricing: Key Performance Driver ● Lower pricing variance in Q1, 2014, attributable to favorable inventory movements in Q1, 2013, particularly in the Philippines ● Price increases in a wide range of markets ● Cigarette price increase recently announced in Germany 531 406 Q1, 2013 Q1, 2014 Pricing Variance ($ million)

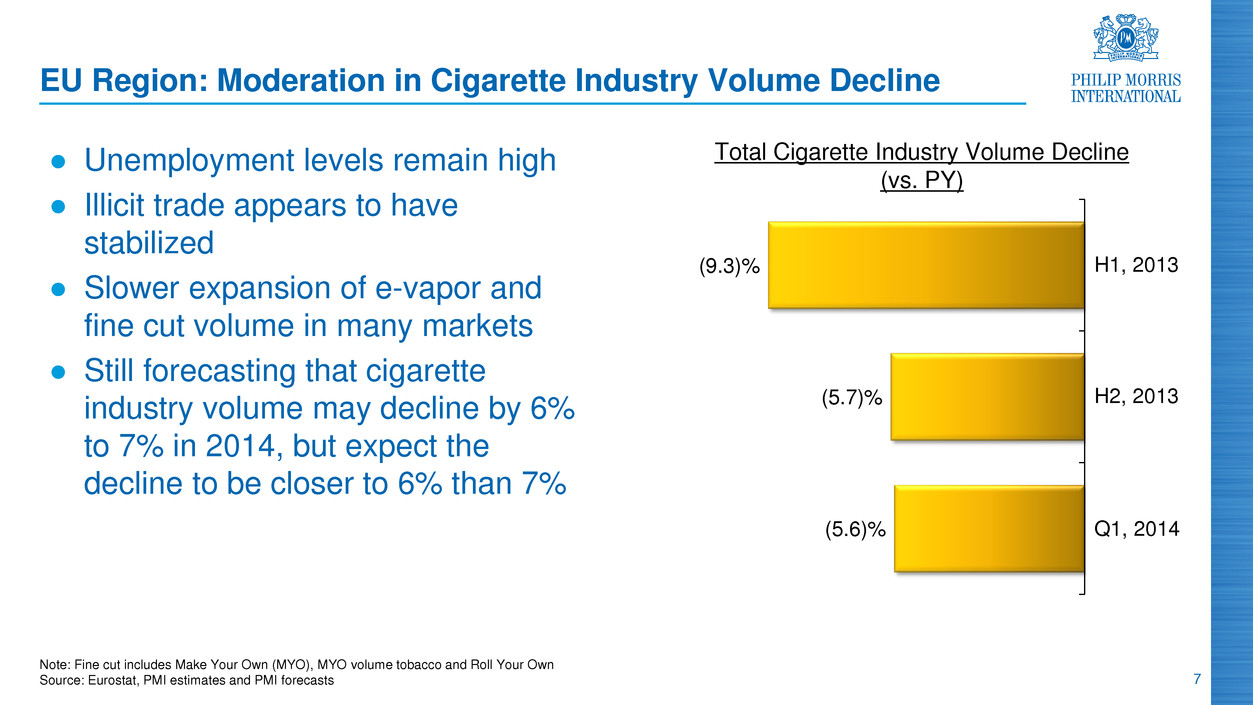

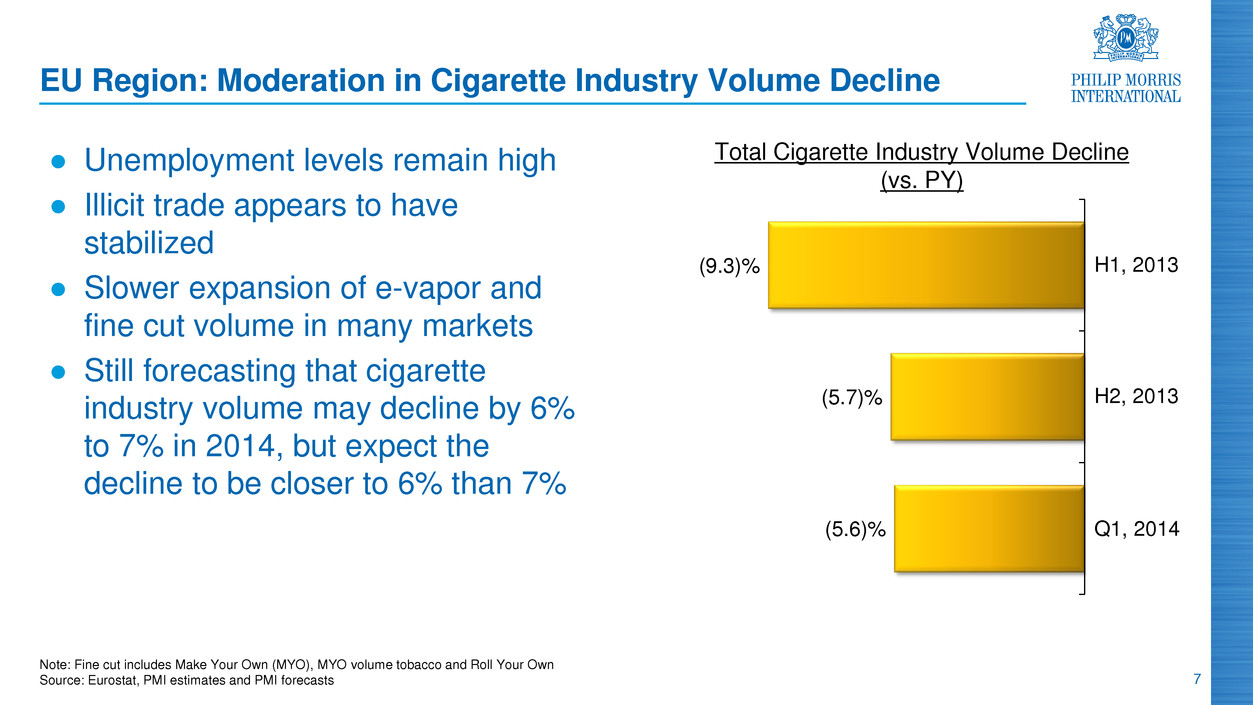

7 EU Region: Moderation in Cigarette Industry Volume Decline ● Unemployment levels remain high ● Illicit trade appears to have stabilized ● Slower expansion of e-vapor and fine cut volume in many markets ● Still forecasting that cigarette industry volume may decline by 6% to 7% in 2014, but expect the decline to be closer to 6% than 7% Note: Fine cut includes Make Your Own (MYO), MYO volume tobacco and Roll Your Own Source: Eurostat, PMI estimates and PMI forecasts (5.6)% (5.7)% (9.3)% Total Cigarette Industry Volume Decline (vs. PY) H1, 2013 H2, 2013 Q1, 2014

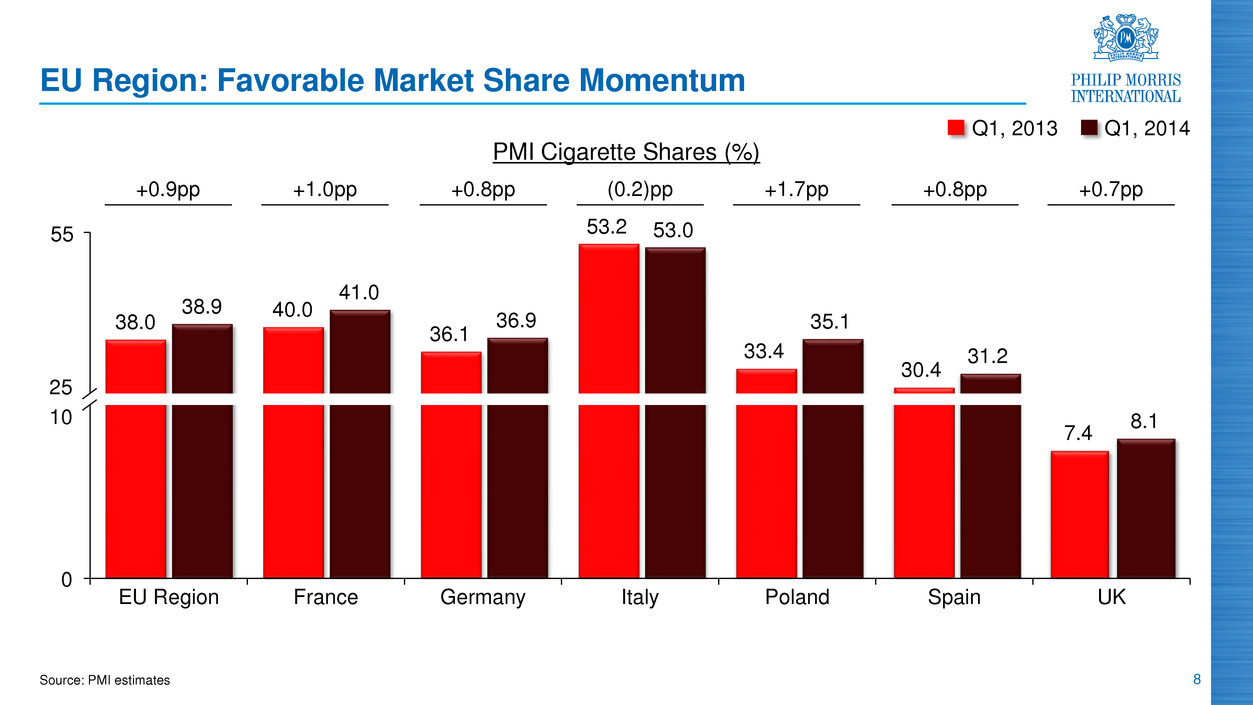

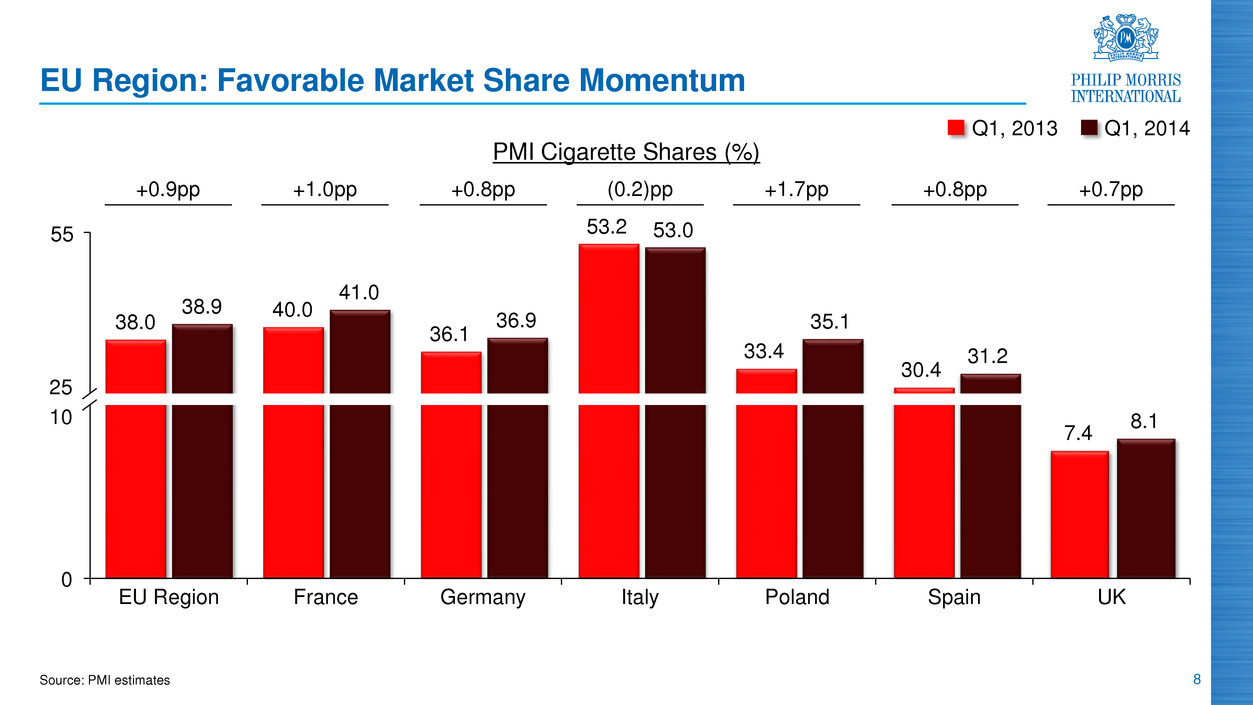

8 EU Region: Favorable Market Share Momentum 38.0 40.0 36.1 53.2 33.4 30.4 7.4 38.9 41.0 36.9 53.0 35.1 31.2 8.1 0 20 EU Region France Germany Italy Poland Spain UK PMI Cigarette Shares (%) Source: PMI estimates Q1, 2013 Q1, 2014 25 10 55 +0.9pp +1.0pp +0.8pp (0.2)pp +1.7pp +0.8pp +0.7pp

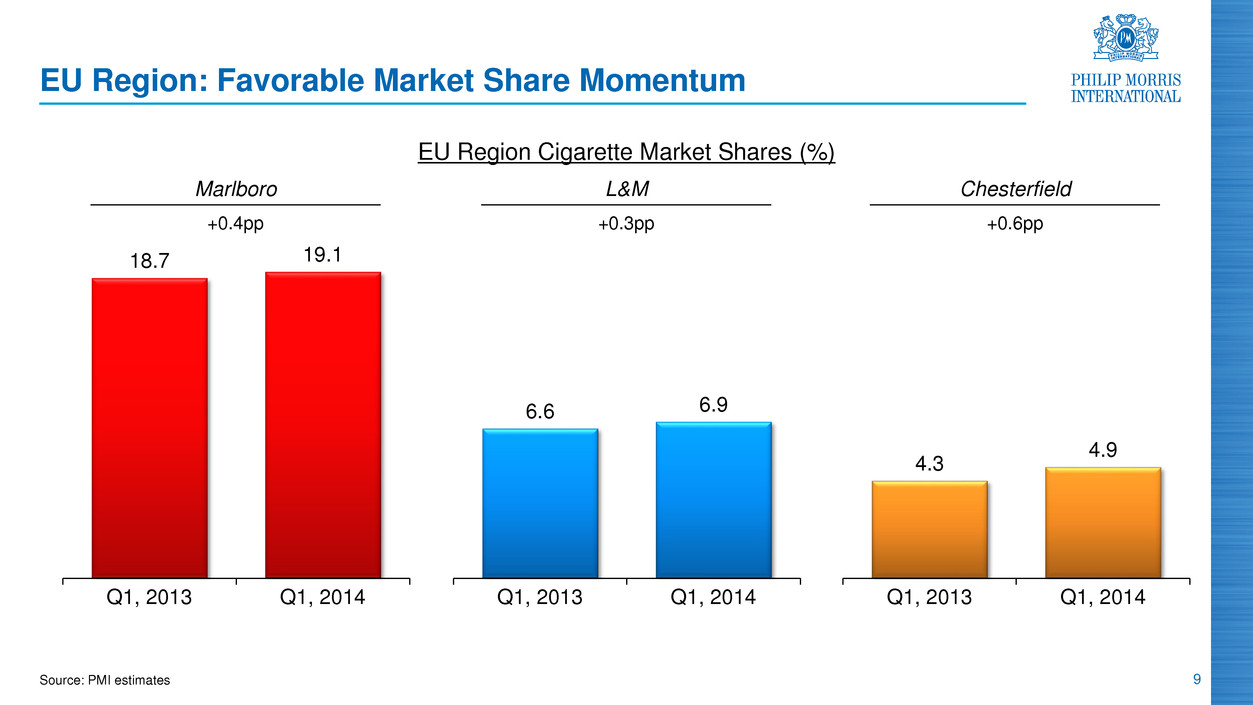

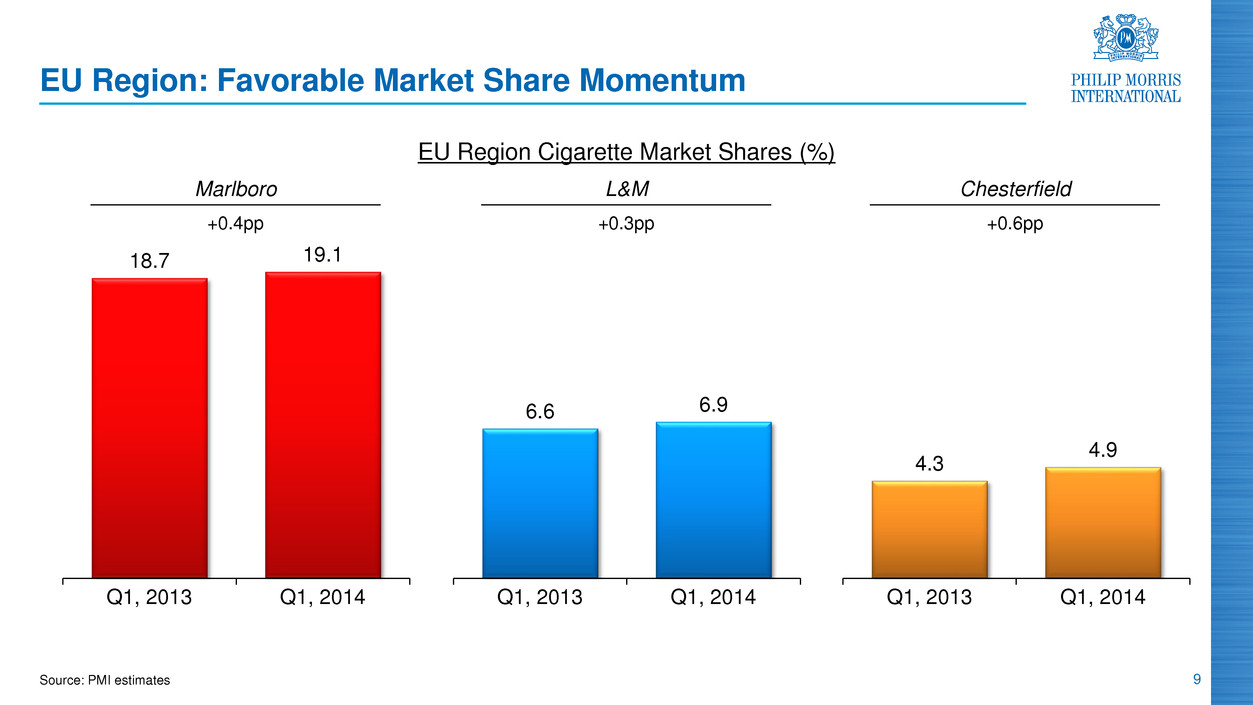

9 EU Region: Favorable Market Share Momentum Source: PMI estimates EU Region Cigarette Market Shares (%) 18.7 19.1 Q1, 2013 Q1, 2014 6.6 6.9 Q1, 2013 Q1, 2014 4.3 4.9 Q1, 2013 Q1, 2014 Marlboro L&M Chesterfield +0.4pp +0.3pp +0.6pp

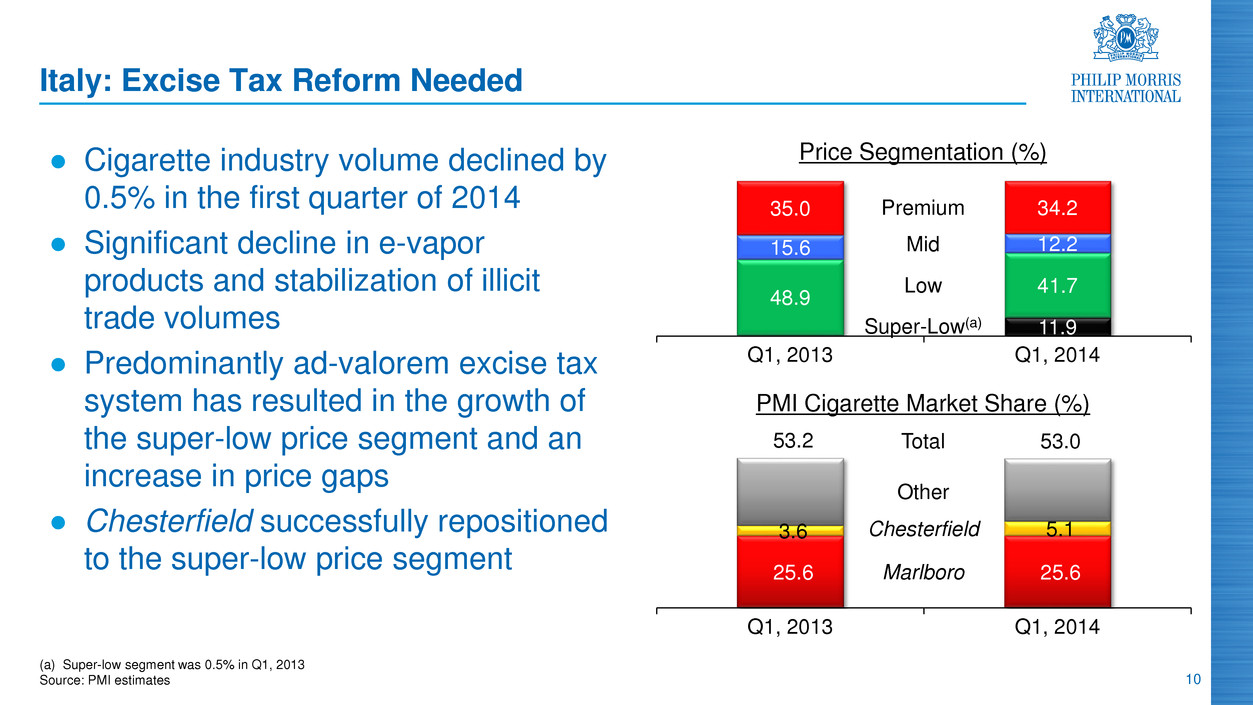

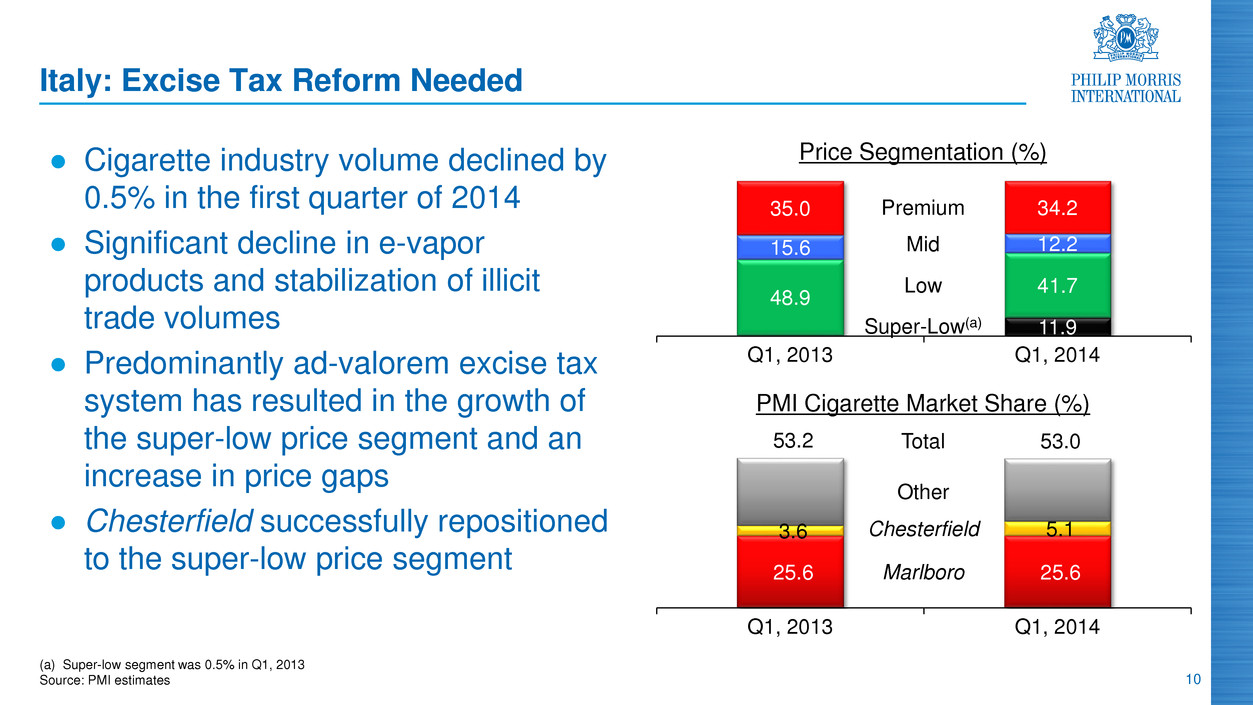

10 Italy: Excise Tax Reform Needed ● Cigarette industry volume declined by 0.5% in the first quarter of 2014 ● Significant decline in e-vapor products and stabilization of illicit trade volumes ● Predominantly ad-valorem excise tax system has resulted in the growth of the super-low price segment and an increase in price gaps ● Chesterfield successfully repositioned to the super-low price segment 11.9 48.9 41.7 15.6 12.2 35.0 34.2 Q1, 2013 Q1, 2014 Price Segmentation (%) 25.6 25.6 3.6 5.1 53.2 53.0 Q1, 2013 Q1, 2014 PMI Cigarette Market Share (%) Marlboro Chesterfield Other Total (a) Super-low segment was 0.5% in Q1, 2013 Source: PMI estimates Low Mid Premium Super-Low(a)

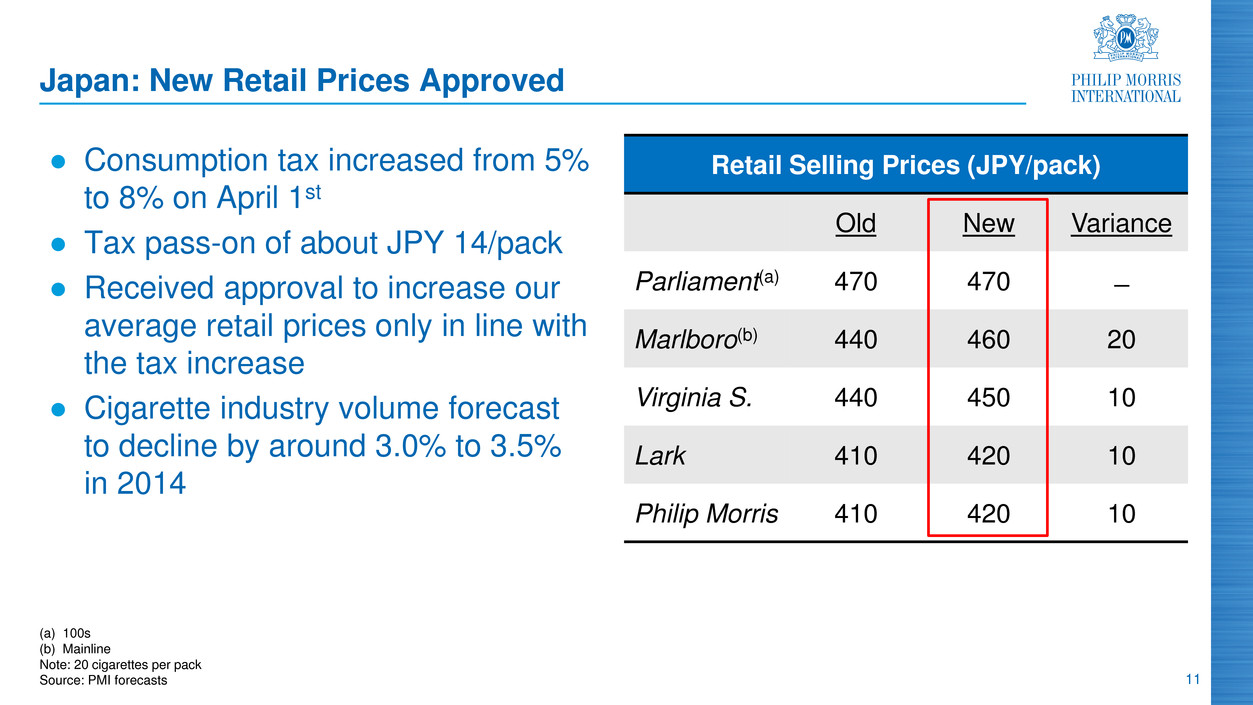

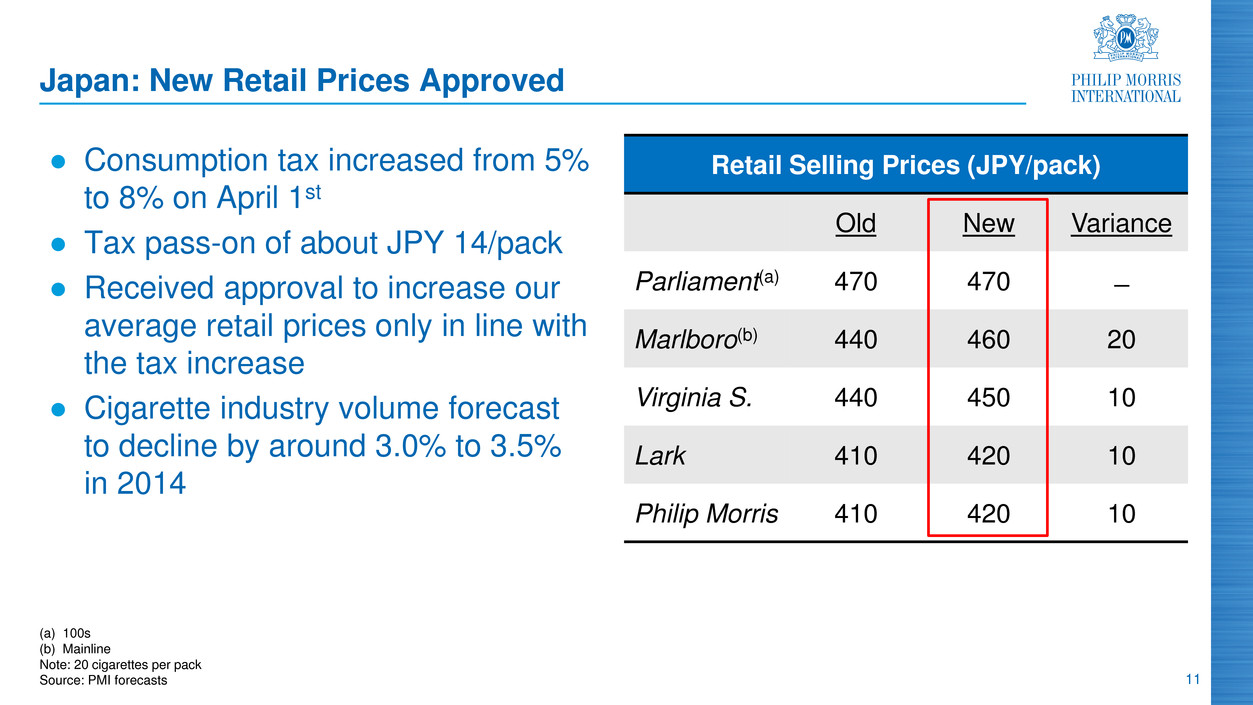

11 (a) 100s (b) Mainline Note: 20 cigarettes per pack Source: PMI forecasts Japan: New Retail Prices Approved ● Consumption tax increased from 5% to 8% on April 1st ● Tax pass-on of about JPY 14/pack ● Received approval to increase our average retail prices only in line with the tax increase ● Cigarette industry volume forecast to decline by around 3.0% to 3.5% in 2014 Retail Selling Prices (JPY/pack) Old New Variance Parliament(a) 470 470 ̶ Marlboro(b) 440 460 20 Virginia S. 440 450 10 Lark 410 420 10 Philip Morris 410 420 10

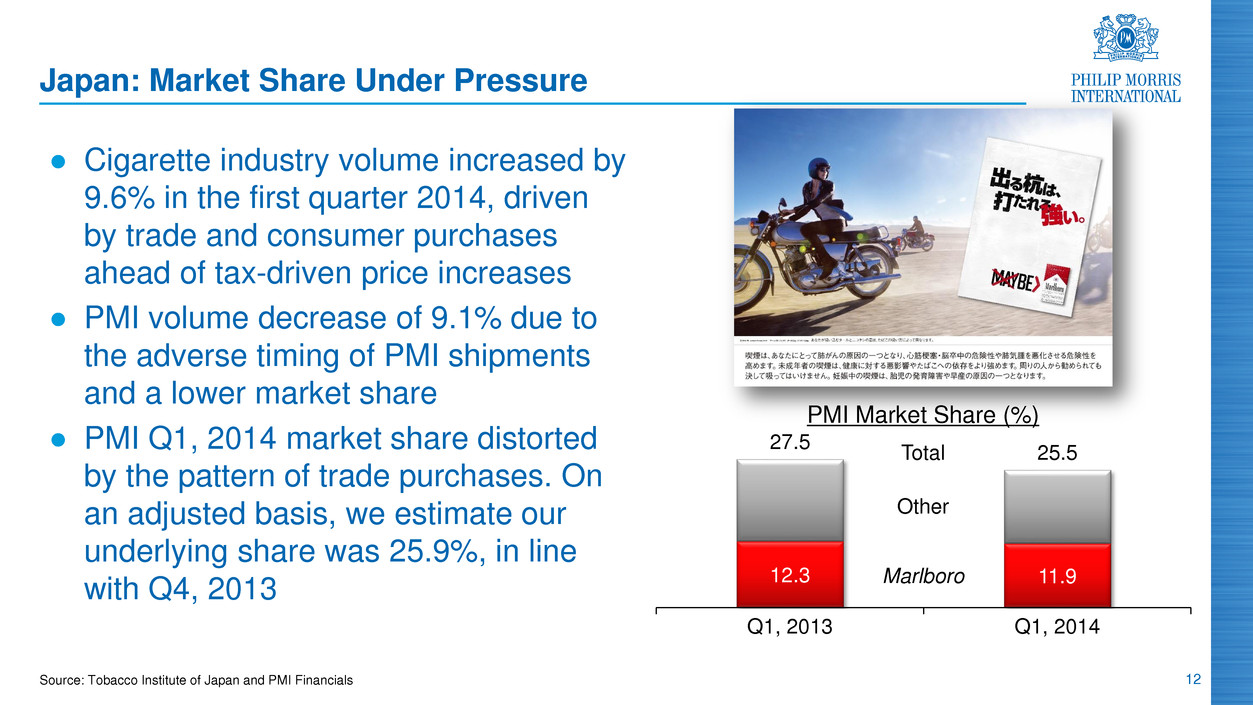

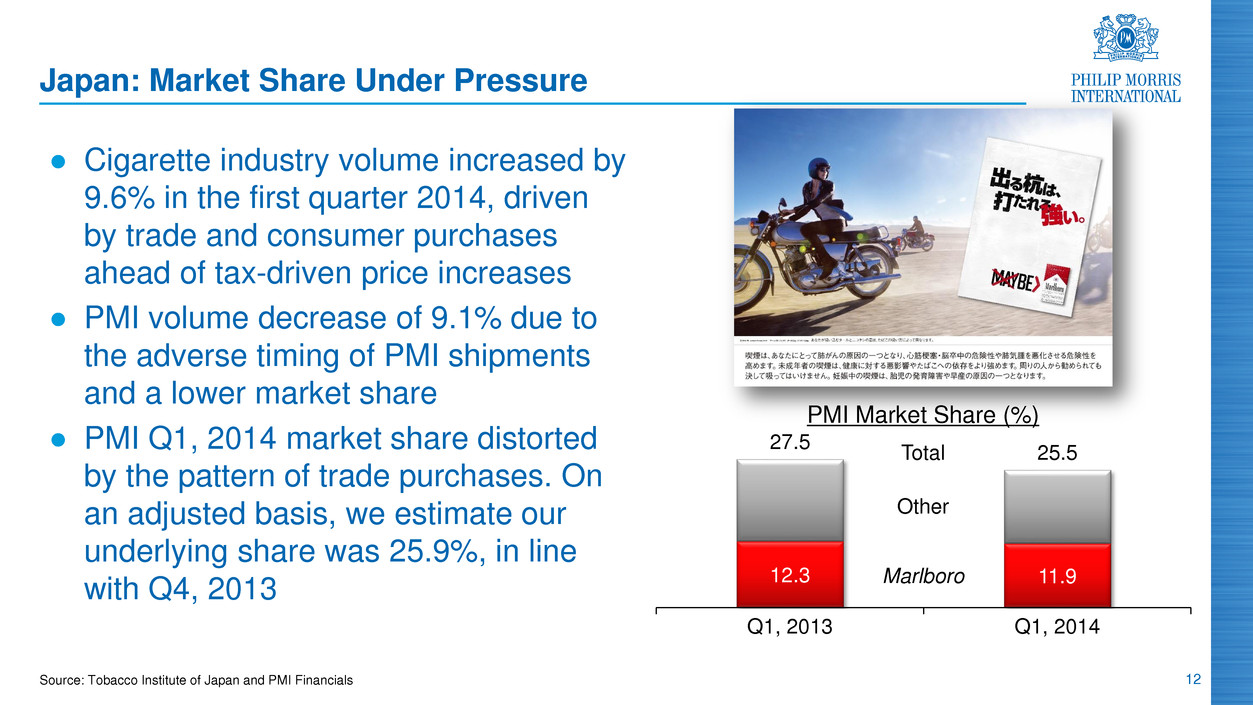

12 Source: Tobacco Institute of Japan and PMI Financials Japan: Market Share Under Pressure ● Cigarette industry volume increased by 9.6% in the first quarter 2014, driven by trade and consumer purchases ahead of tax-driven price increases ● PMI volume decrease of 9.1% due to the adverse timing of PMI shipments and a lower market share ● PMI Q1, 2014 market share distorted by the pattern of trade purchases. On an adjusted basis, we estimate our underlying share was 25.9%, in line with Q4, 2013 12.3 11.9 27.5 25.5 Q1, 2013 Q1, 2014 Marlboro Other Total PMI Market Share (%)

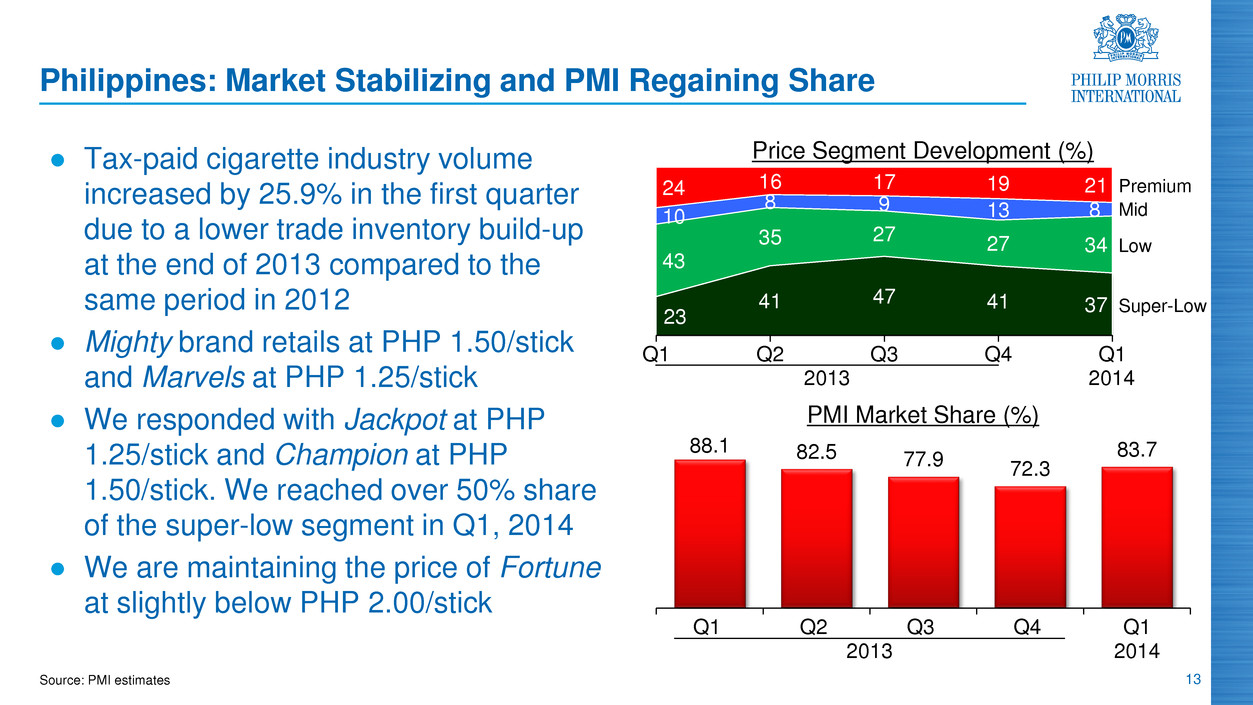

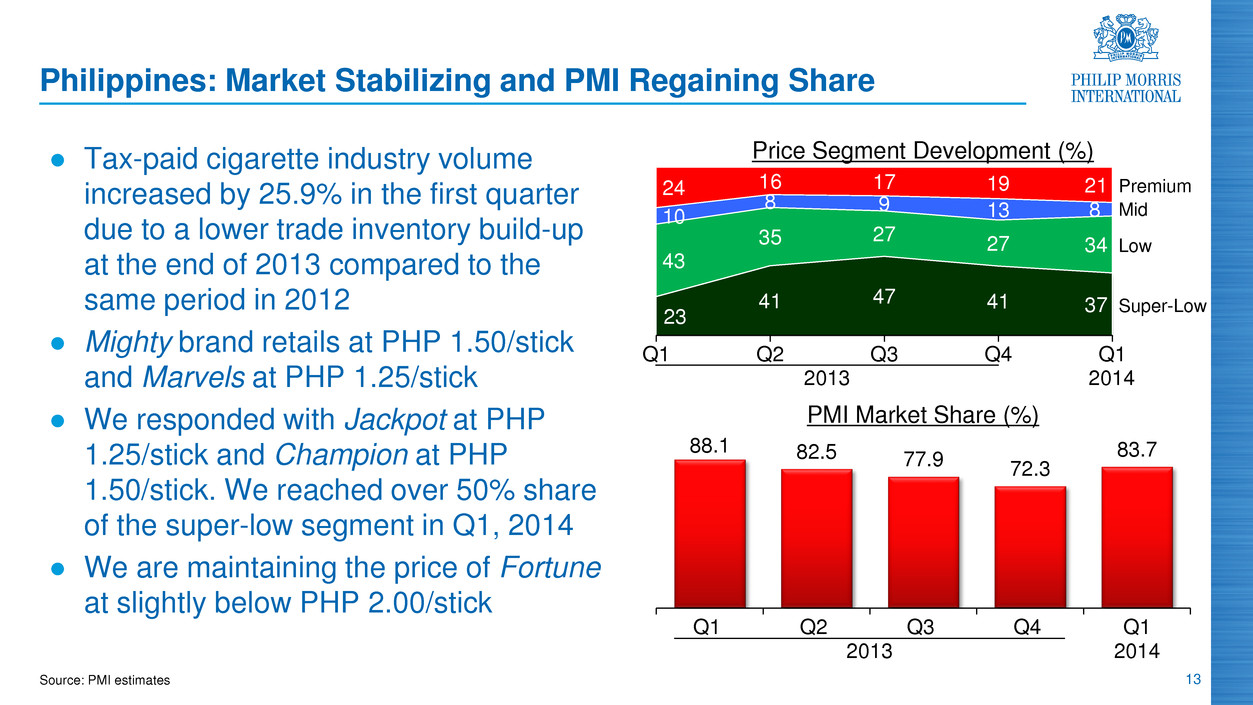

13 Source: PMI estimates Philippines: Market Stabilizing and PMI Regaining Share ● Tax-paid cigarette industry volume increased by 25.9% in the first quarter due to a lower trade inventory build-up at the end of 2013 compared to the same period in 2012 ● Mighty brand retails at PHP 1.50/stick and Marvels at PHP 1.25/stick ● We responded with Jackpot at PHP 1.25/stick and Champion at PHP 1.50/stick. We reached over 50% share of the super-low segment in Q1, 2014 ● We are maintaining the price of Fortune at slightly below PHP 2.00/stick 23 41 47 41 37 43 35 27 27 34 10 8 9 13 8 24 16 17 19 21 Q1 Q2 Q3 Q4 Q1 Price Segment Development (%) Super-Low Low Mid 2013 Premium 2014 88.1 82.5 77.9 72.3 83.7 Q1 Q2 Q3 Q4 Q1 20142013 PMI Market Share (%)

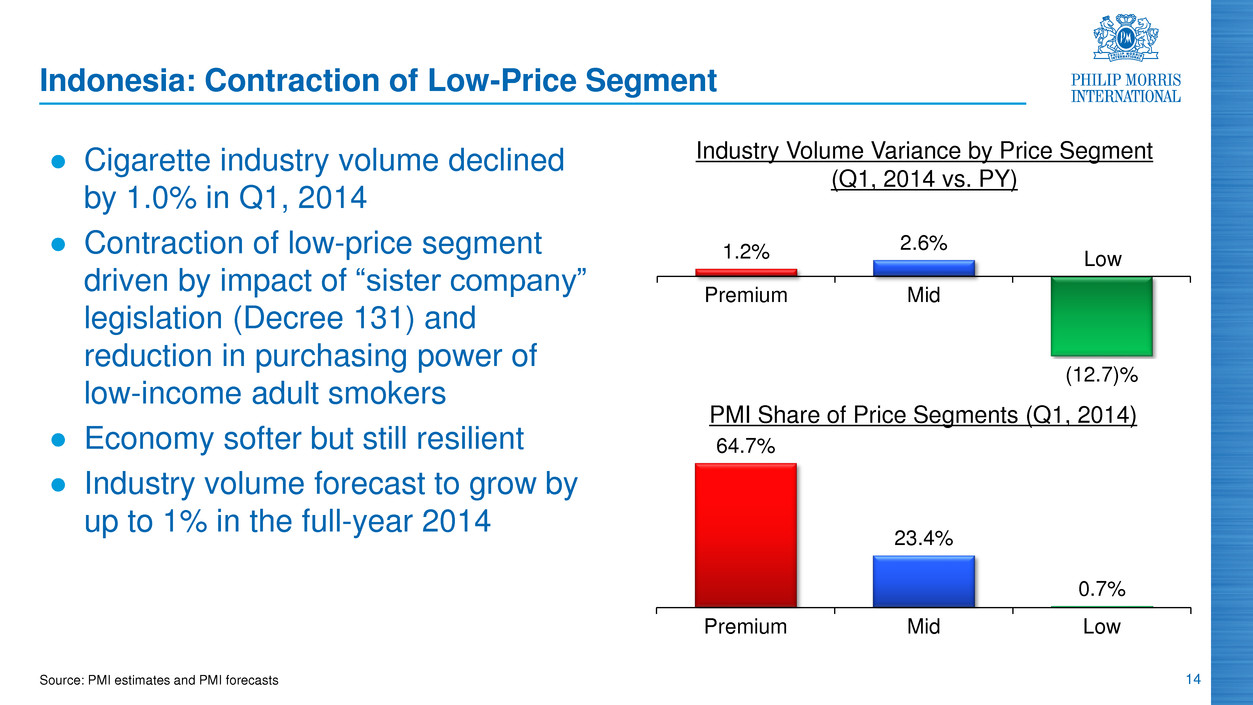

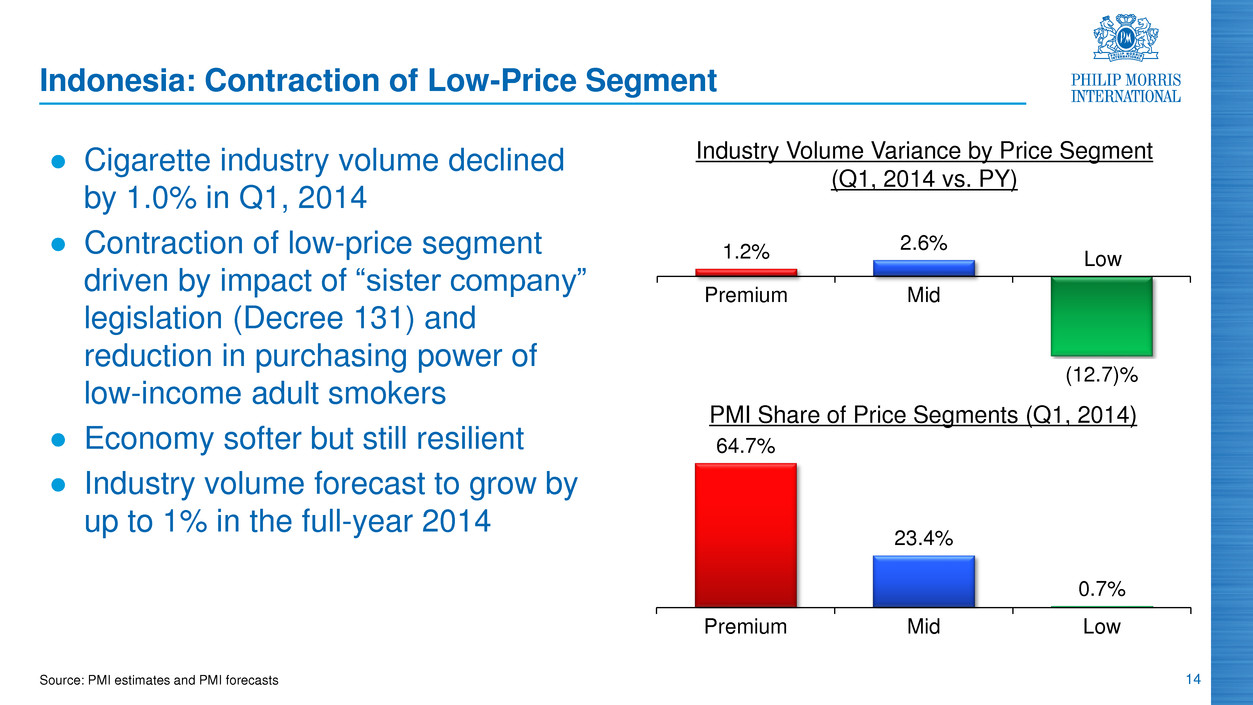

14 Indonesia: Contraction of Low-Price Segment ● Cigarette industry volume declined by 1.0% in Q1, 2014 ● Contraction of low-price segment driven by impact of “sister company” legislation (Decree 131) and reduction in purchasing power of low-income adult smokers ● Economy softer but still resilient ● Industry volume forecast to grow by up to 1% in the full-year 2014 Source: PMI estimates and PMI forecasts 1.2% 2.6% (12.7)% Premium Mid Low 64.7% 23.4% 0.7% Premium Mid Low PMI Share of Price Segments (Q1, 2014) Industry Volume Variance by Price Segment (Q1, 2014 vs. PY)

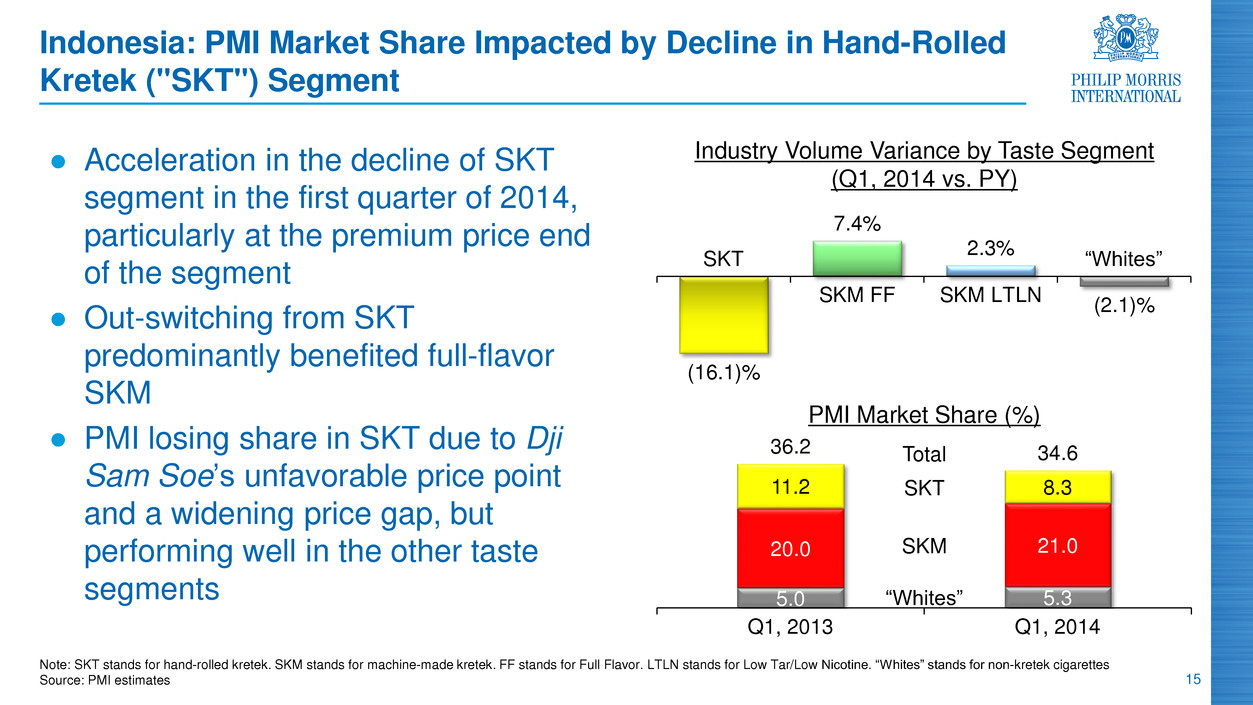

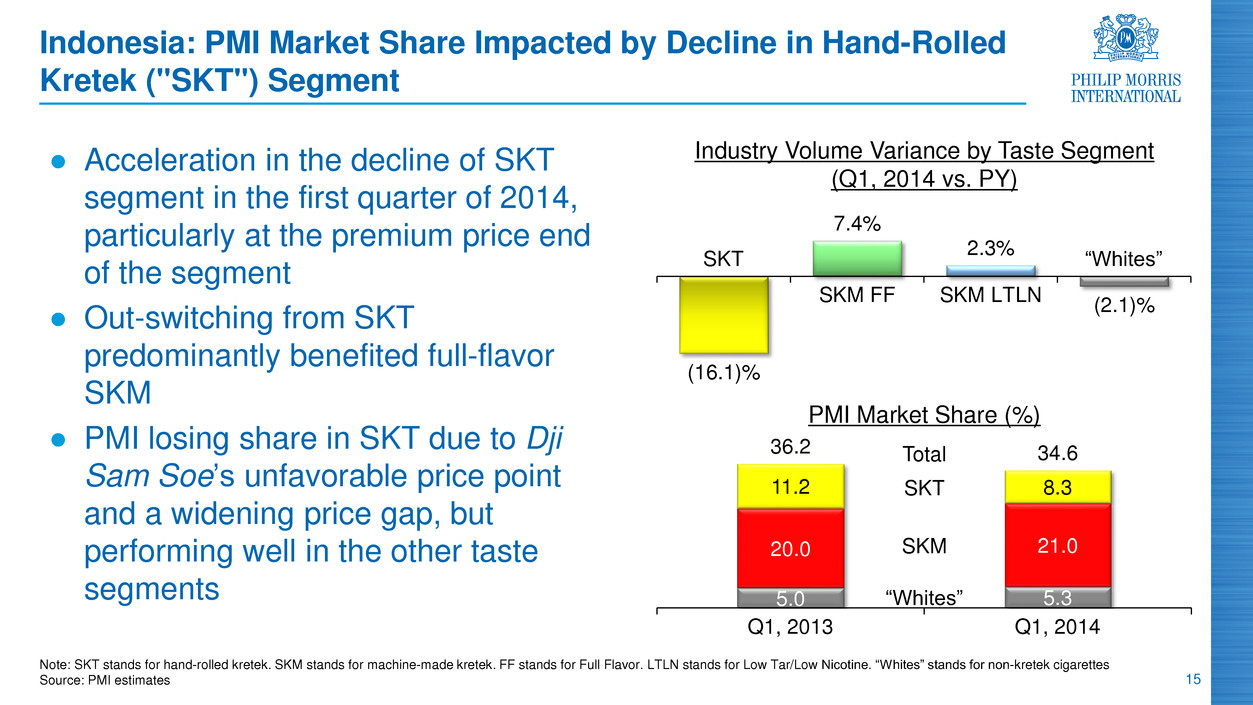

15 Note: SKT stands for hand-rolled kretek. SKM stands for machine-made kretek. FF stands for Full Flavor. LTLN stands for Low Tar/Low Nicotine. “Whites” stands for non-kretek cigarettes Source: PMI estimates 5.0 5.3 20.0 21.0 11.2 8.3 36.2 34.6 Q1, 2013 Q1, 2014 Indonesia: PMI Market Share Impacted by Decline in Hand-Rolled Kretek ("SKT") Segment ● Acceleration in the decline of SKT segment in the first quarter of 2014, particularly at the premium price end of the segment ● Out-switching from SKT predominantly benefited full-flavor SKM ● PMI losing share in SKT due to Dji Sam Soe’s unfavorable price point and a widening price gap, but performing well in the other taste segments Industry Volume Variance by Taste Segment (Q1, 2014 vs. PY) (16.1)% 7.4% 2.3% (2.1)% SKM FF SKM LTLN PMI Market Share (%) SKT SKM SKT “Whites” Total “Whites”

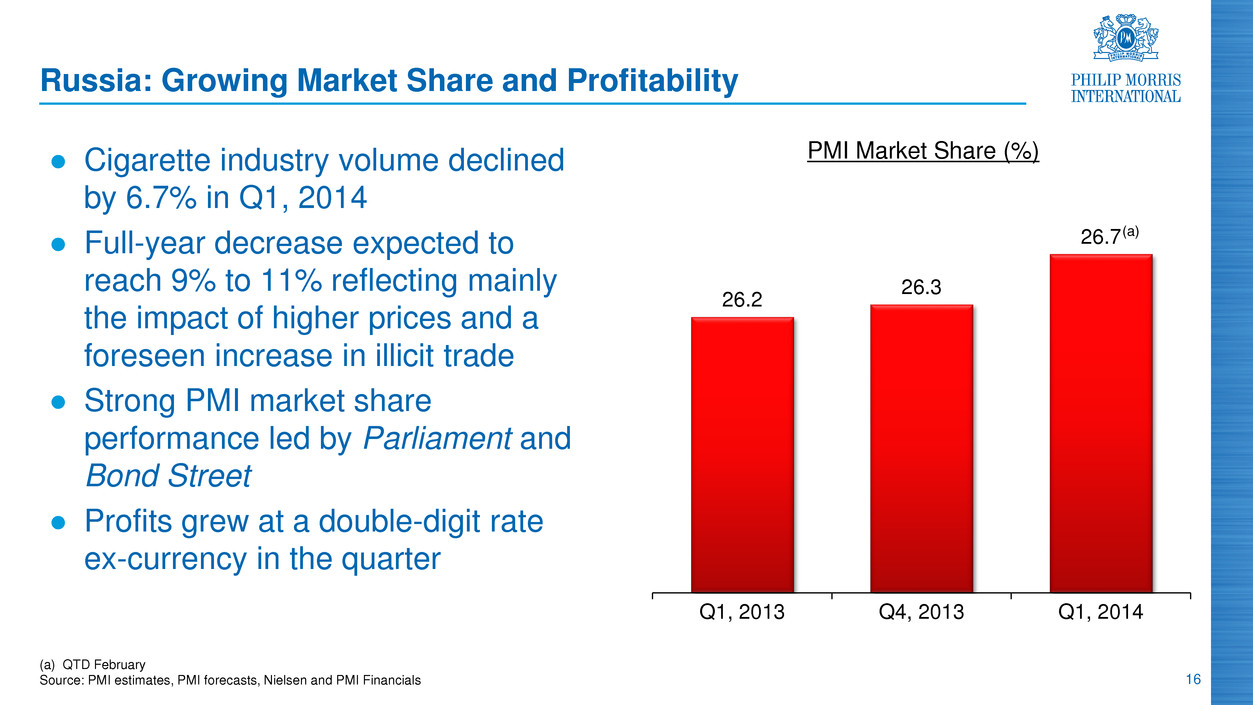

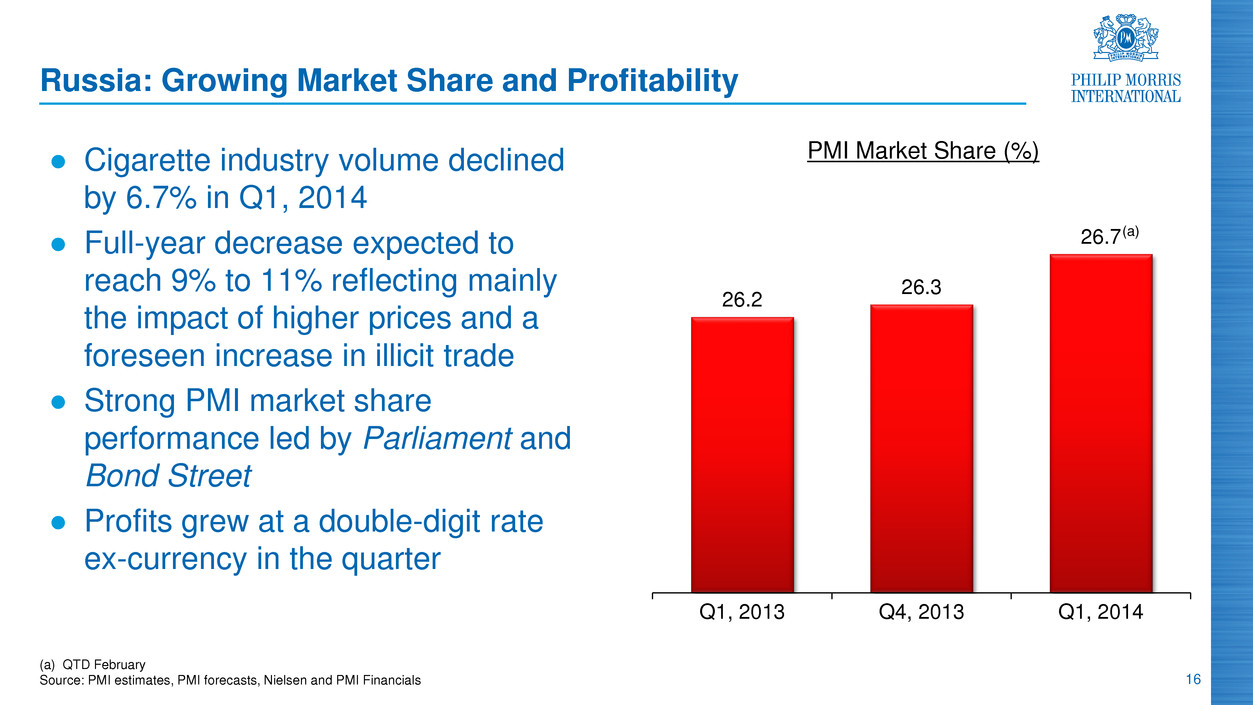

16 Russia: Growing Market Share and Profitability ● Cigarette industry volume declined by 6.7% in Q1, 2014 ● Full-year decrease expected to reach 9% to 11% reflecting mainly the impact of higher prices and a foreseen increase in illicit trade ● Strong PMI market share performance led by Parliament and Bond Street ● Profits grew at a double-digit rate ex-currency in the quarter 26.2 26.3 26.7 Q1, 2013 Q4, 2013 Q1, 2014 (a) QTD February Source: PMI estimates, PMI forecasts, Nielsen and PMI Financials (a) PMI Market Share (%)

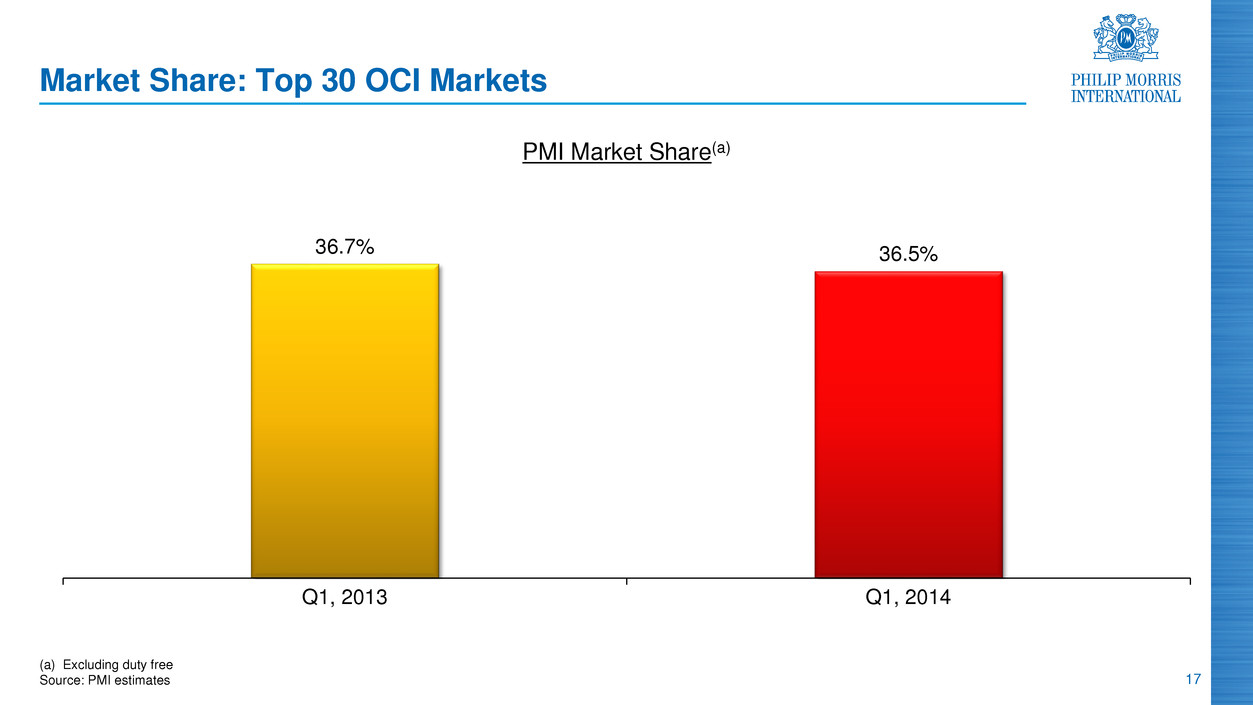

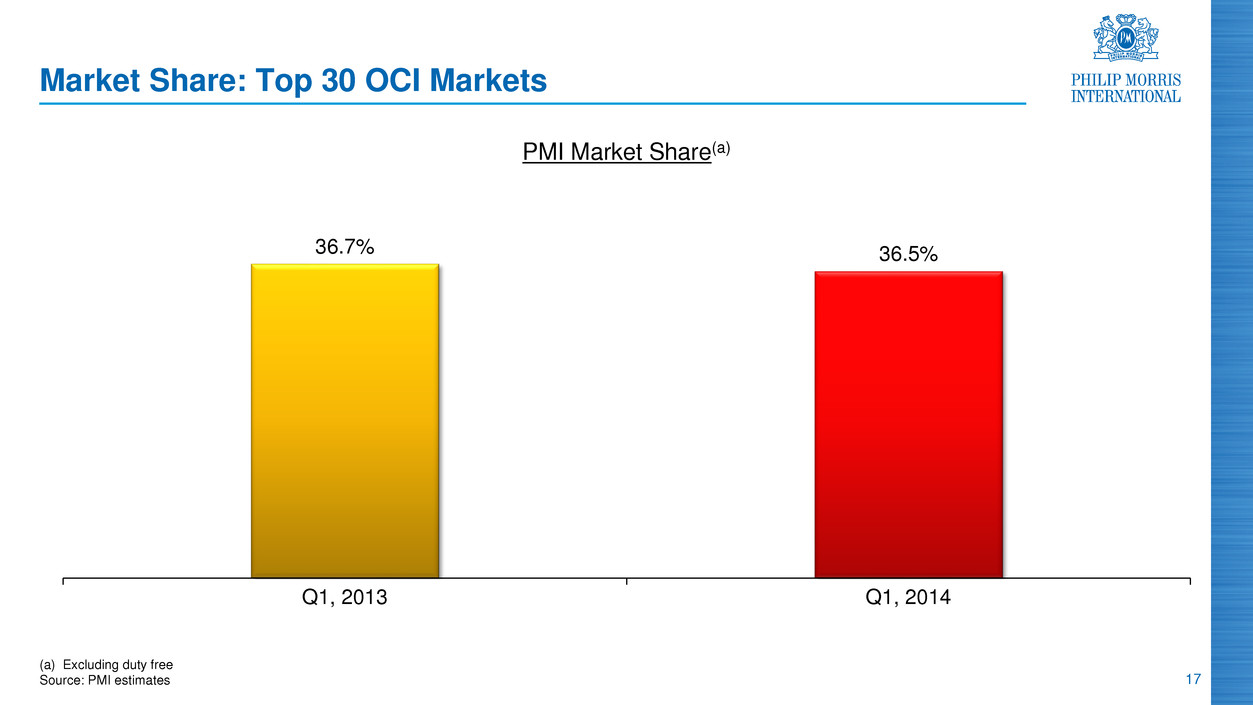

17 Market Share: Top 30 OCI Markets 36.7% 36.5% Q1, 2013 Q1, 2014 PMI Market Share(a) (a) Excluding duty free Source: PMI estimates

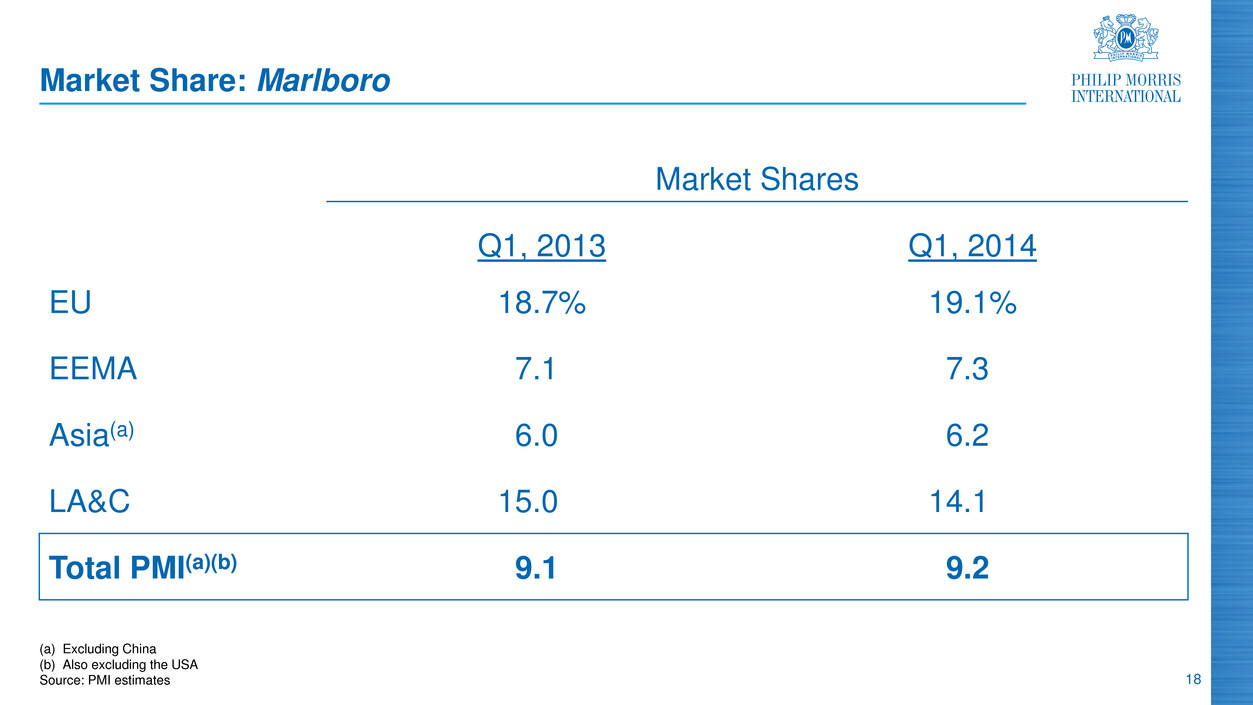

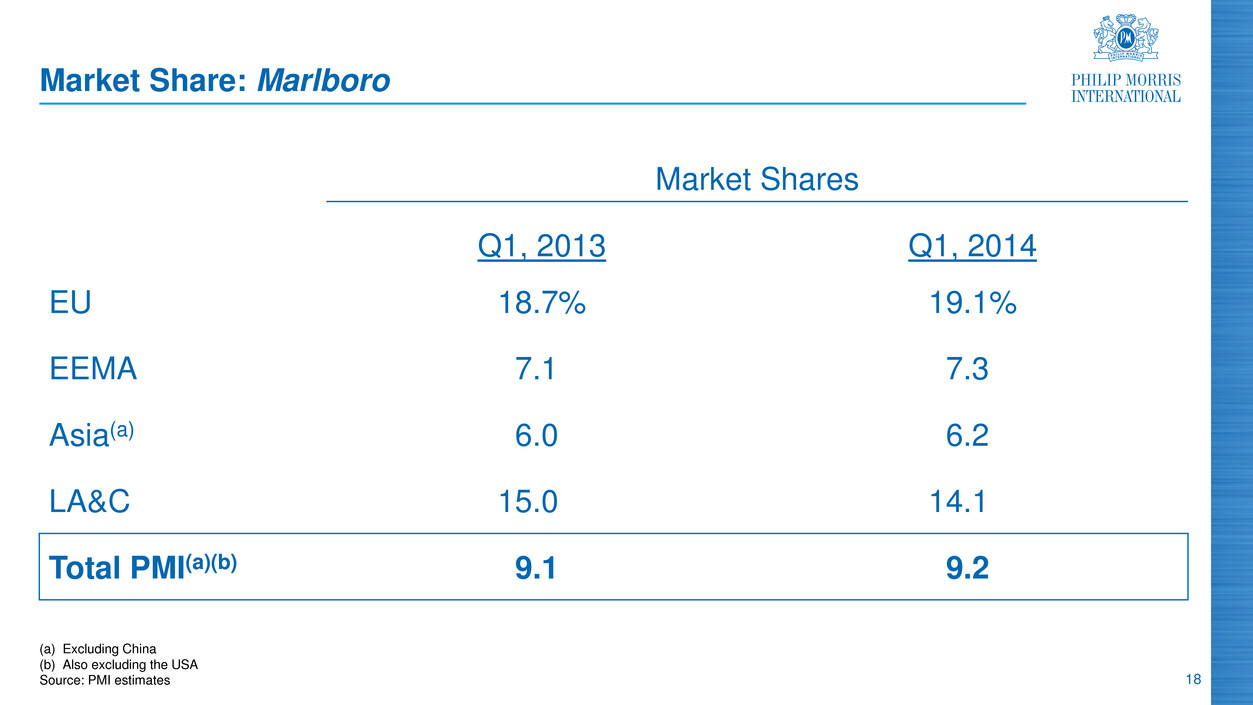

18 Market Share: Marlboro Market Shares Q1, 2013 Q1, 2014 EU 18.7% 19.1% EEMA 7.1% 7.3% Asia(a) 6.0% 6.2% LA&C 15.0% 14.1% Total PMI(a)(b) 9.1% 9.2% (a) Excluding China (b) Also excluding the USA Source: PMI estimates

19 Source: PMI forecasts Cost Savings: Productivity and Global Manufacturing Footprint Optimization ● Annual cost savings and productivity target of $300 million in 2014 ● Closure announced of manufacturing facility in Melbourne, Australia ● Consultations underway on proposal to discontinue cigarette production at Bergen op Zoom, Netherlands

20 Rewarding Our Shareholders ● Target dividend pay-out ratio remains an attractive 65% ● Dividend yield of 4.5% last Friday ● During the first quarter, we spent $1.25 billion to repurchase 15.4 million shares at an average price of $81.12 ● Target for share repurchases remains $4.0 billion in 2014 Source: PMI Financials and PMI forecasts

21 Conclusion ● Our guidance reflects a full-year growth rate of approximately 6% to 8% in adjusted diluted EPS, excluding currency and the restructuring charge ● Unfavorable volume/mix remains a challenge ● Improvement in business performance in the EU Region ● Signs of a stabilization in our underlying share performance in Japan and the Philippines ● Decline of hand-rolled segment and unfavorable price points impacted our market share in Indonesia ● Growth in share and profits in Russia ● Pricing complemented by cost savings and productivity improvements ● Preparing the launch of Reduced-Risk Products Note: Reduced-Risk Products is the term we use to refer to products that have the potential to reduce individual risk and population harm Source: PMI forecasts, PMI Financials, Tobacco Institute of Japan, PMI estimates and Nielsen

2014 First-Quarter Results Questions & Answers

23 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS For the Year Ended December 31, (Unaudited) 2013 Reported Diluted EPS 5.26$ Adjustments: Asset impairment and exit costs 0.12 Tax items 0.02 Adjuste Diluted EPS 5.40$

24 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Adjustments for the Impact of Currency and Acquisitions For the Quarters Ended March 31, ($ in millions) (Unaudited) Reported Net Revenues Less Excise Taxes Reported Net Revenues excluding Excise Taxes Less Currency Reported Net Revenues excluding Excise Taxes & Currency Less Acquisi- tions Reported Net Revenues excluding Excise Taxes, Currency & Acquisitions Reported Net Revenues Less Excise Taxes Reported Net Revenues excluding Excise Taxes Reported Reported excluding Currency Reported excluding Currency & Acquisitions 6,619$ 4,606$ 2,013$ 51$ 1,962$ -$ 1,962$ European Union 6,523$ 4,553$ 1,970$ 2.2% (0.4)% (0.4)% 4,562 2,553 2,009 (126) 2,135 - 2,135 EEMA 4,423 2,380 2,043 (1.7)% 4.5% 4.5% 4,475 2,293 2,182 (366) 2,548 - 2,548 Asia 5,251 2,461 2,790 (21.8)% (8.7)% (8.7)% 2,123 1,410 713 (101) 814 - 814 Latin America & Canada 2,330 1,549 781 (8.7)% 4.2% 4.2% 17,779$ 10,862$ 6,917$ (542)$ 7,459$ -$ 7,459$ PMI Total 18,527$ 10,943$ 7,584$ (8.8)% (1.6)% (1.6)% Reported Operating Companies I come Less Currency Reported Operating Companies Income excluding Currency Less Acquisi- tions Reported Operating Companies Income excluding Currency & Acquisitions Reported Operating Companies Income Reported Reported excluding Currency Reported excluding Currency & Acquisitions 978$ 28$ 950$ -$ 950$ European Union 938$ 4.3% 1.3% 1.3% 927 (80) 1,007 - 1,007 EEMA 935 (0.9)% 7.7% 7.7% 915 (215) 1,130 - 1,130 Asia 1,342 (31.8)% (15.8)% (15.8)% 202 (52) 254 - 254 Latin America & Canada 254 (20.5)% - - 3,022$ (319)$ 3,341$ -$ 3,341$ PMI Total 3,469$ (12.9)% (3.7)% (3.7)% 2014 2013 % Change in Reported Operating Companies Income 2014 2013 % Change in Reported Net Revenues excluding Excise Taxes

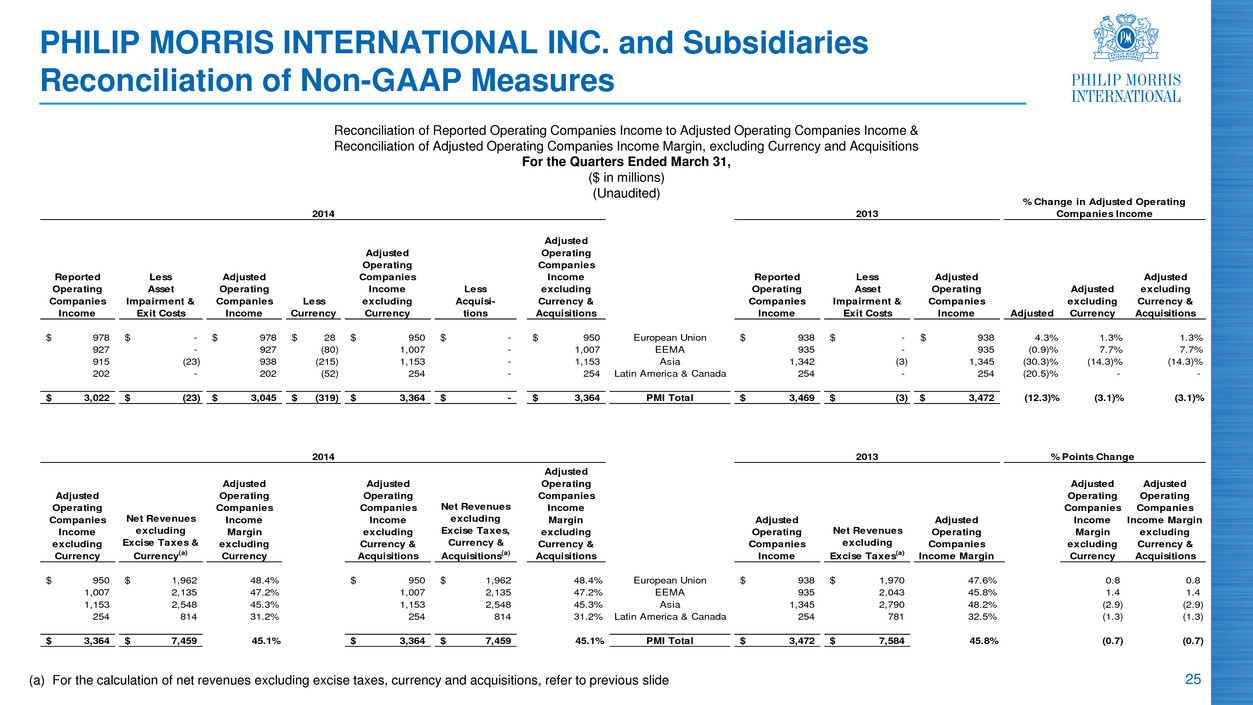

25 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Operating Companies Income to Adjusted Operating Companies Income & Reconciliation of Adjusted Operating Companies Income Margin, excluding Currency and Acquisitions For the Quarters Ended March 31, ($ in millions) (Unaudited) (a) For the calculation of net revenues excluding excise taxes, currency and acquisitions, refer to previous slide Reported Operating Companies Income Less Asset Impairment & Exit Costs Adjusted Operating Companies Income Less Currency Adjusted Operating Companies Income excluding Currency Less Acquisi- tions Adjusted Operating Companies Income excluding Currency & Acquisitions Reported Operating Companies Income Less Asset Impairment & Exit Costs Adjusted Operating Companies Income Adjusted Adjusted excluding Currency Adjusted excluding Currency & Acquisitions 978$ -$ 978$ 28$ 950$ -$ 950$ European Union 938$ -$ 938$ 4.3% 1.3% 1.3% 927 - 927 (80) 1,007 - 1,007 EEMA 935 - 935 (0.9)% 7.7% 7.7% 915 (23) 938 (215) 1,153 - 1,153 Asia 1,342 (3) 1,345 (30.3)% (14.3)% (14.3)% 202 - 202 (52) 254 - 254 Latin America & Canada 254 - 254 (20.5)% - - 3,022$ (23)$ 3,045$ (319)$ 3,364$ -$ 3,364$ PMI Total 3,469$ (3)$ 3,472$ (12.3)% (3.1)% (3.1)% % Points Change Adjusted Operating Companies Income excluding Currency Net Revenues excluding Excise Taxes & Currency(a) Adjusted Operating Companies Income Margin excluding Currency Adjusted Operating Companies Income excluding Currency & Acquisitions Net Revenues excluding Excise Taxes, Currency & Acquisitions(a) Adjusted Operating Companies Income Margin excluding Currency & Acquisitions Adjusted Operating Companies Income Net Revenues excluding Excise Taxes(a) Adjusted Operating Companies Income Margin Adjusted Operating Companies Income Margin excluding Currency Adjusted Operating Companies Income Margin excluding Currency & Acquisitions 950$ 1,962$ 48.4% 950$ 1,962$ 48.4% European Union 938$ 1,970$ 47.6% 0.8 0.8 1,007 2,135 47.2% 1,007 2,135 47.2% EEMA 935 2,043 45.8% 1.4 1.4 1,153 2,548 45.3% 1,153 2,548 45.3% Asia 1,345 2,790 48.2% (2.9) (2.9) 254 814 31.2% 254 814 31.2% Latin America & Canada 254 781 32.5% (1.3) (1.3) 3,364$ 7,459$ 45.1% 3,364$ 7,459$ 45.1% PMI Total 3,472$ 7,584$ 45.8% (0.7) (0.7) 2014 2013 2014 2013 % Change in Adjusted Operating Companies Income

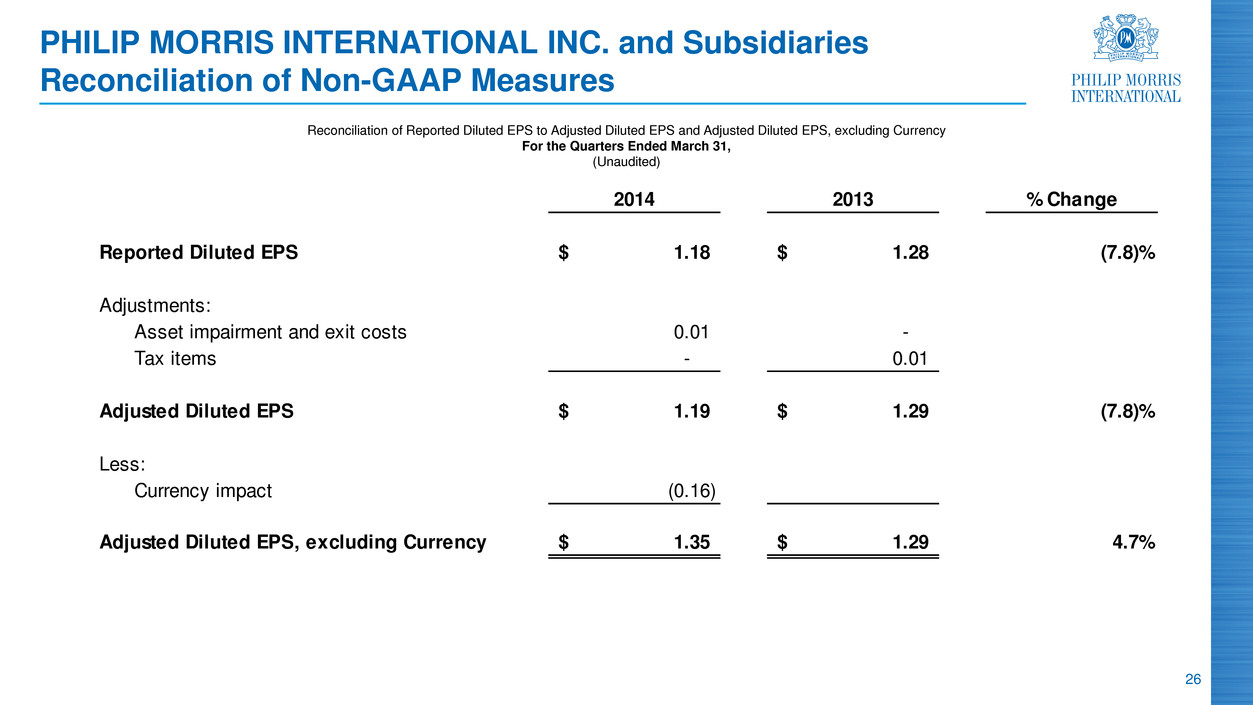

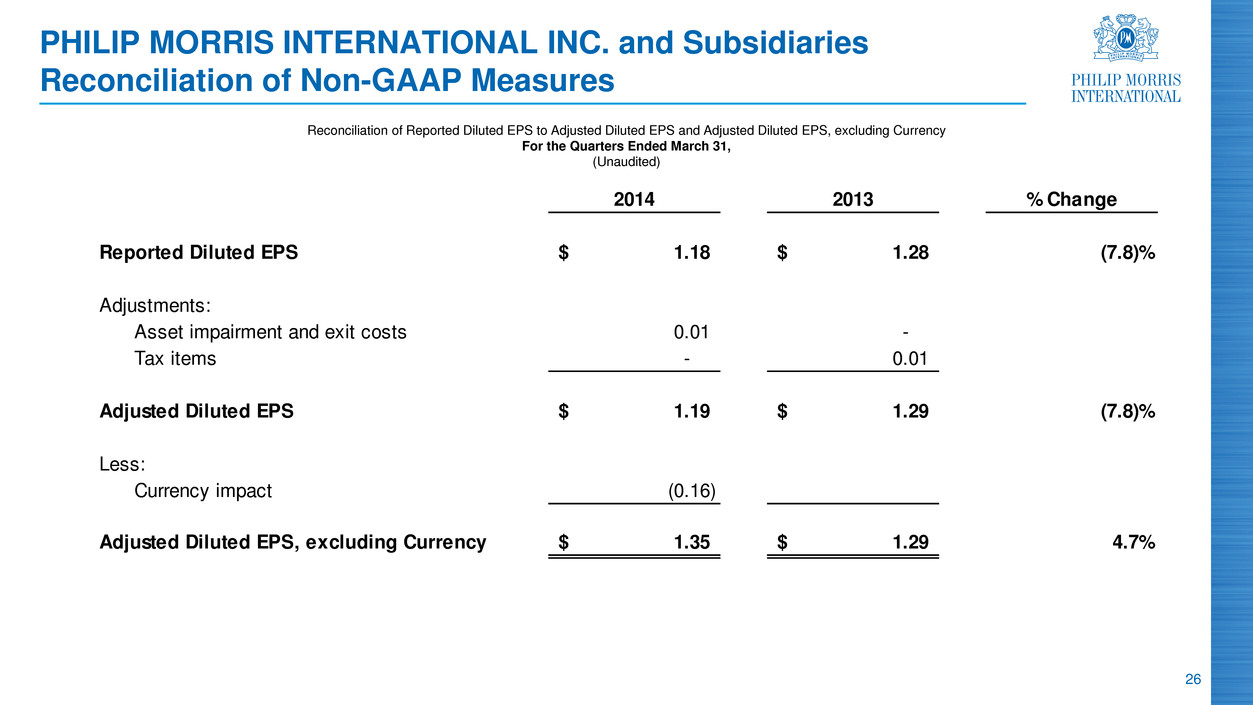

26 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS and Adjusted Diluted EPS, excluding Currency For the Quarters Ended March 31, (Unaudited) 2014 2013 % Change Reported Diluted EPS 1.18$ 1.28$ (7.8)% Adjustments: Asset impairment and exit costs 0.01 - Tax items - 0.01 Adjuste iluted EPS 1.19$ 1.29$ (7.8)% Less: Currency impact (0.16) Adjusted Diluted EPS, excluding Currency 1.35$ 1.29$ 4.7%

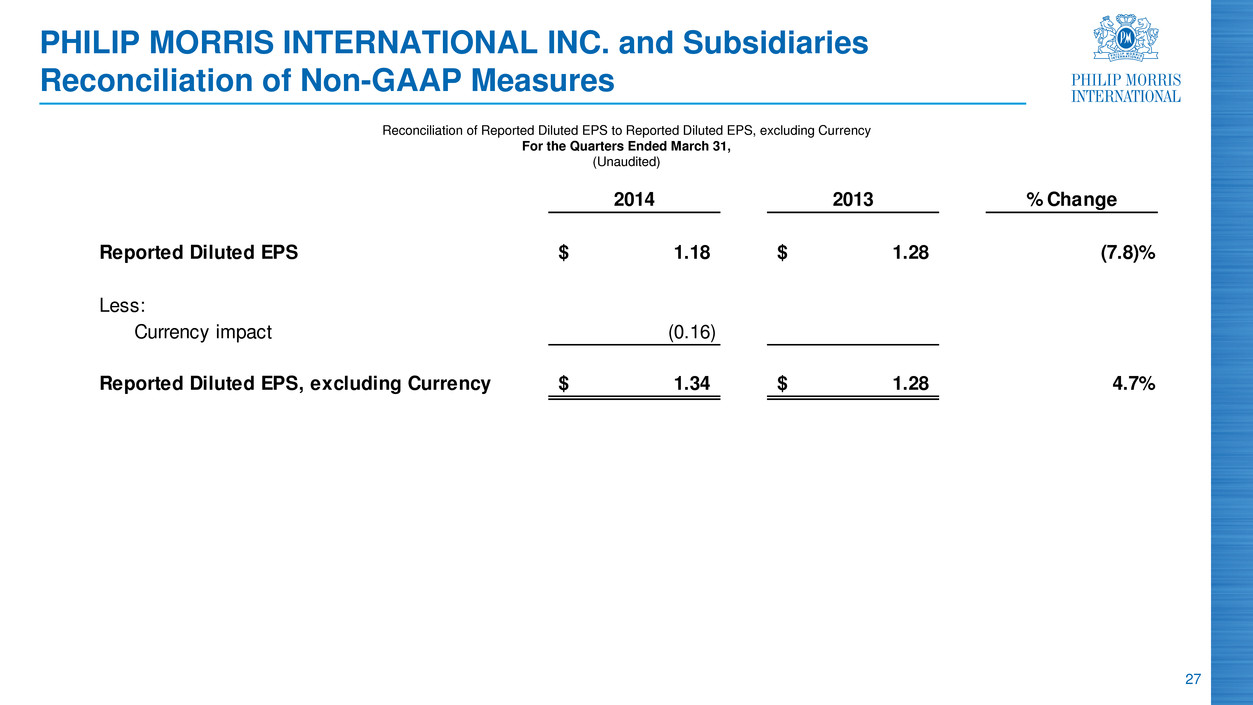

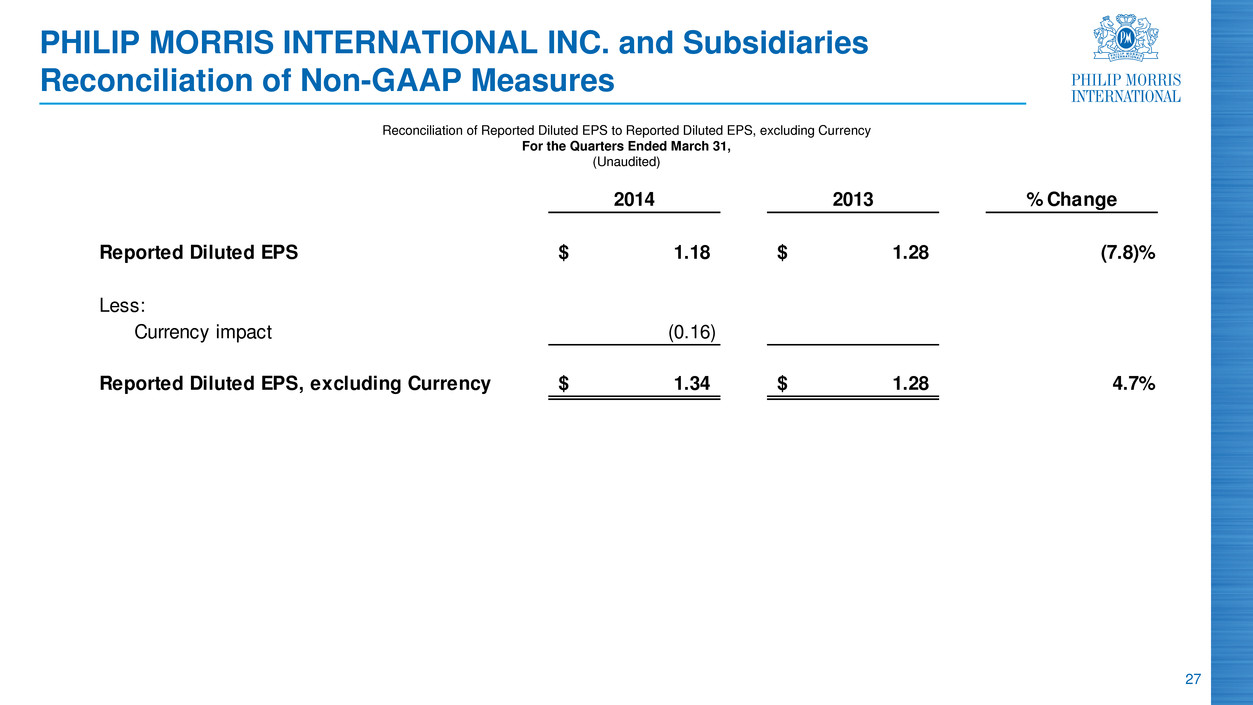

27 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Diluted EPS to Reported Diluted EPS, excluding Currency For the Quarters Ended March 31, (Unaudited) 2014 2013 % Change Reported Diluted EPS 1.18$ 1.28$ (7.8)% Less: Currency impact (0.16) Reported Diluted EPS, excluding Currency 1.34$ 1.28$ 4.7%