2014 Fourth-Quarter and Full-Year Results February 5, 2015 Exhibit 99.3

2 Introduction ● Unless otherwise stated, we will be talking about results for the fourth-quarter and full-year 2014 and comparing them to the same periods in 2013 ● A glossary of terms, data tables showing adjustments to net revenues and OCI, for currency and acquisitions, asset impairment, exit and other costs, adjustments to EPS, and reconciliations to U.S. GAAP measures are at the end of today’s webcast slides, which are also posted on our web site ● Reduced-Risk Products ("RRPs") is the term the company uses to refer to products with the potential to reduce individual risk and population harm in comparison to smoking combustible cigarettes. PMI’s RRPs are in various stages of development, and we are conducting extensive and rigorous scientific studies to determine whether we can support claims for such products of reduced exposure to harmful and potentially harmful constituents in smoke, and ultimately claims of reduced disease risk, when compared to smoking combustible cigarettes. Before making any such claims, we will need to rigorously evaluate the full set of data from the relevant scientific studies to determine whether they substantiate reduced exposure or risk. Any such claims may also be subject to government review and approval, as is the case in the USA today

3 Forward-Looking and Cautionary Statements ● This presentation and related discussion contain forward-looking statements. Achievement of projected results is subject to risks, uncertainties and inaccurate assumptions, and PMI is identifying important factors that, individually or in the aggregate, could cause actual results to differ materially from those contained in any forward-looking statements made by PMI ● PMI’s business risks include: significant increases in cigarette-related taxes; the imposition of discriminatory excise tax structures; fluctuations in customer inventory levels due to increases in product taxes and prices; increasing marketing and regulatory restrictions, often with the goal of reducing or preventing the use of tobacco products; health concerns relating to the use of tobacco products and exposure to environmental tobacco smoke; litigation related to tobacco use; intense competition; the effects of global and individual country economic, regulatory and political developments; changes in adult smoker behavior; lost revenues as a result of counterfeiting, contraband and cross-border purchases; governmental investigations; unfavorable currency exchange rates and currency devaluations; adverse changes in applicable corporate tax laws; adverse changes in the cost and quality of tobacco and other agricultural products and raw materials; and the integrity of its information systems. PMI’s future profitability may also be adversely affected should it be unsuccessful in its attempts to produce products that have the potential to reduce exposure to harmful constituents in smoke, individual risk and population harm; if it is unable to successfully introduce new products, promote brand equity, enter new markets or improve its margins through increased prices and productivity gains; if it is unable to expand its brand portfolio internally or through acquisitions and the development of strategic business relationships; or if it is unable to attract and retain the best global talent ● PMI is further subject to other risks detailed from time to time in its publicly filed documents, including the Form 10-Q for the quarter ended September 30, 2014. PMI cautions that the foregoing list of important factors is not a complete discussion of all potential risks and uncertainties. PMI does not undertake to update any forward-looking statement that it may make from time to time, except in the normal course of its public disclosure obligations

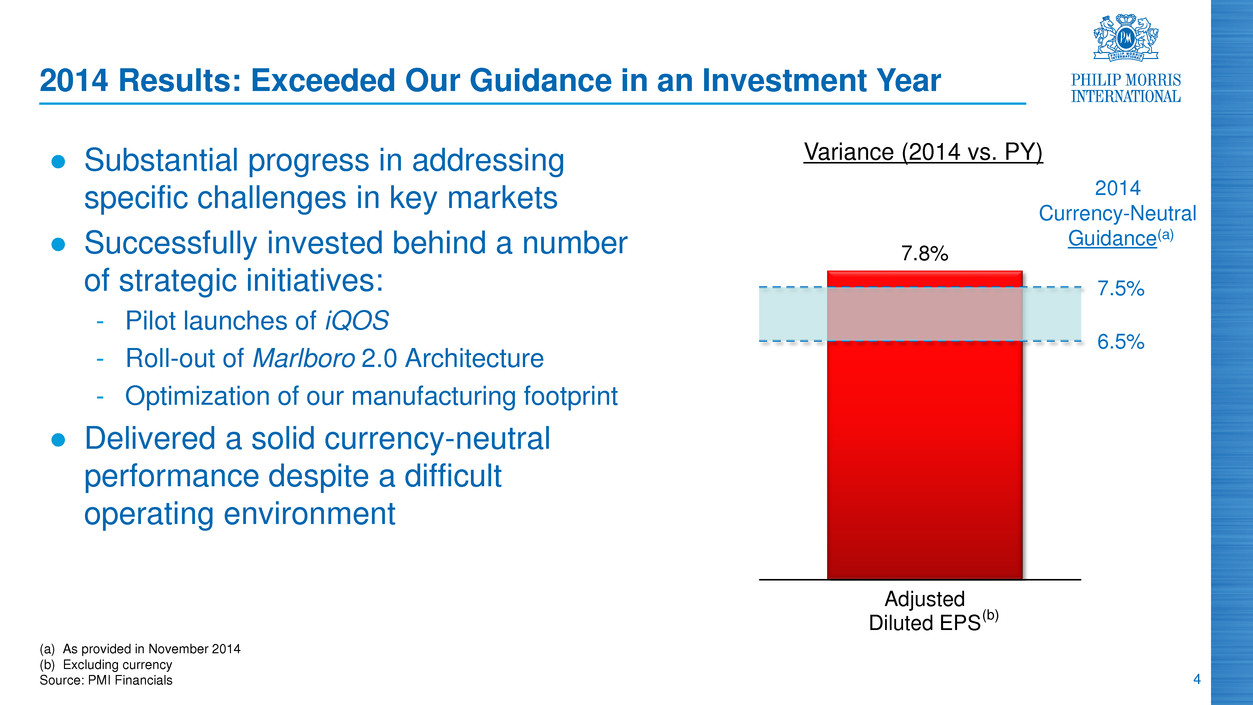

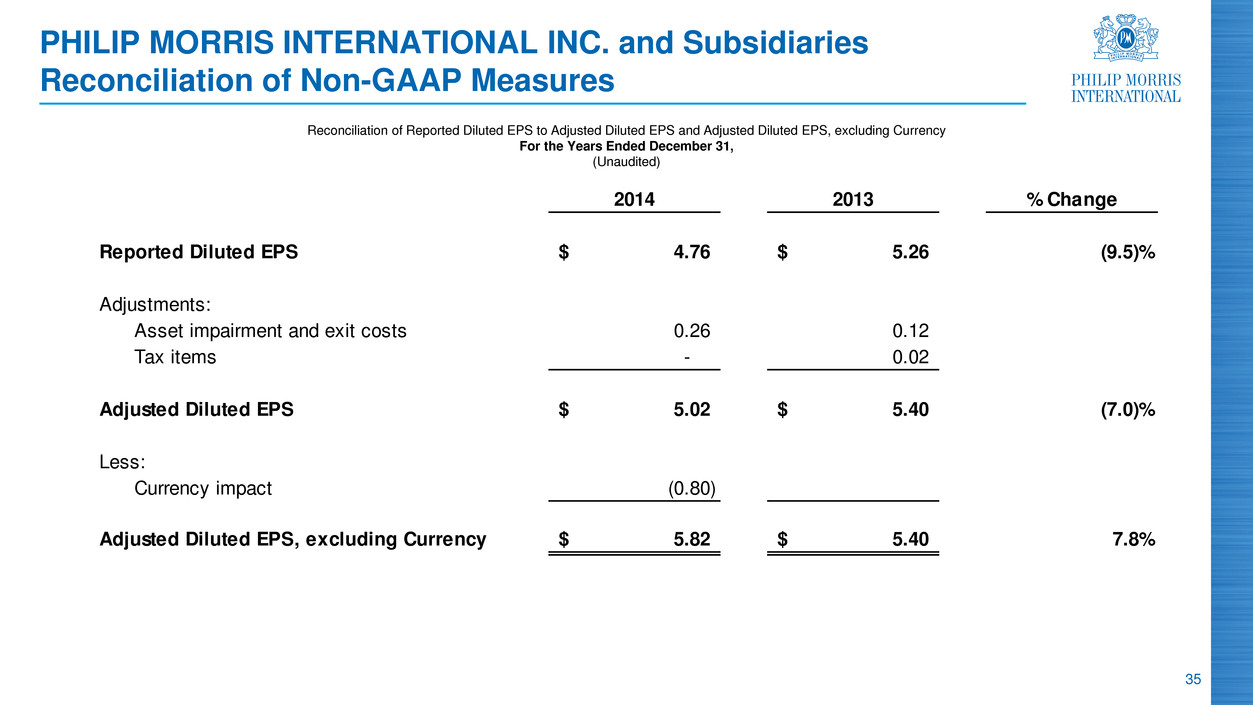

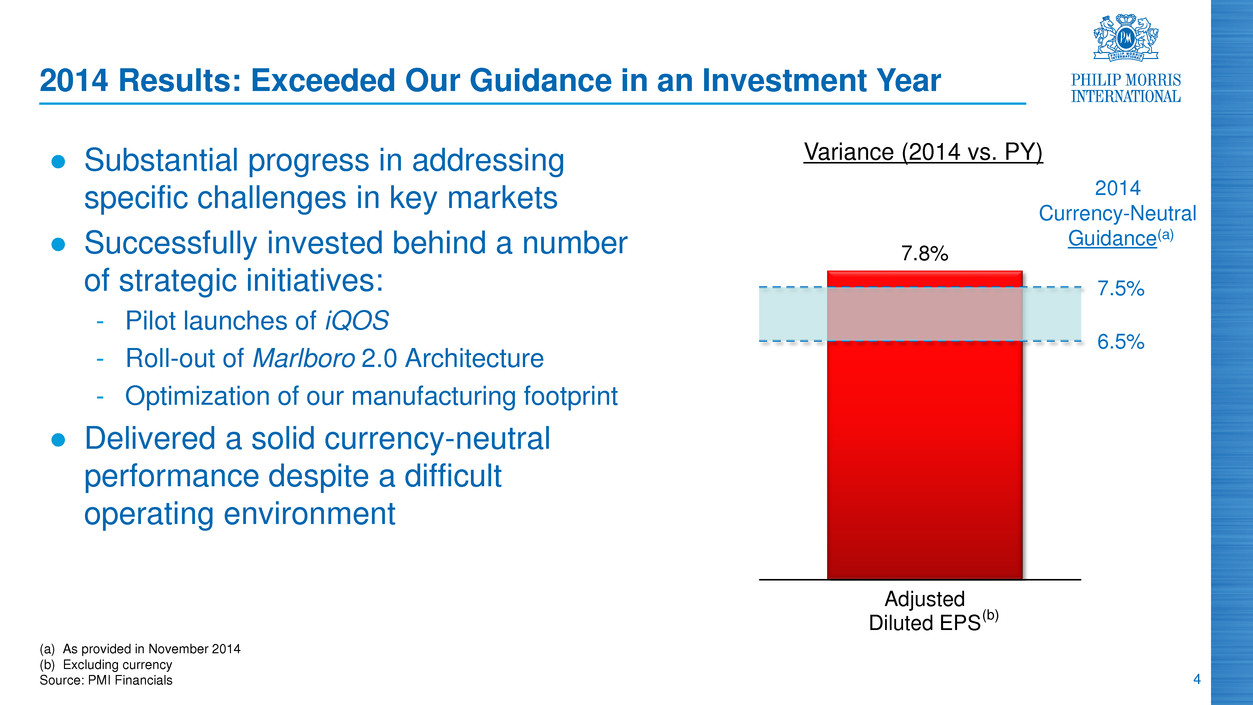

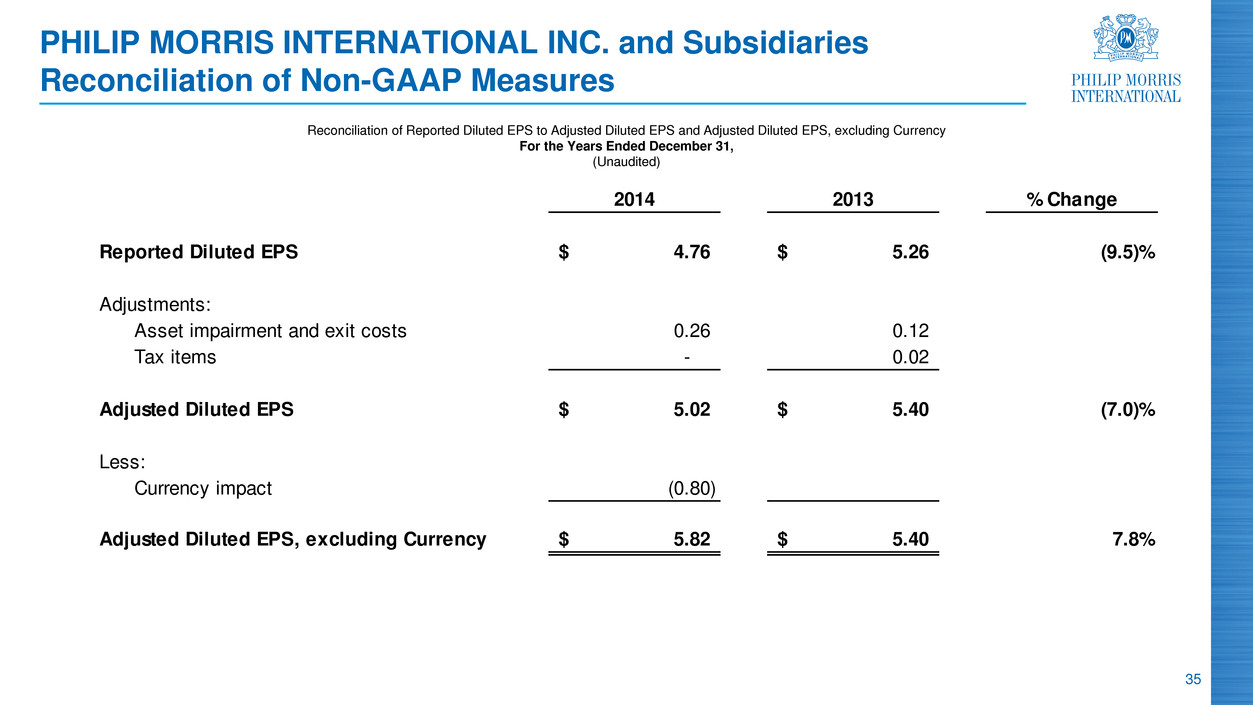

4 (a) As provided in November 2014 (b) Excluding currency Source: PMI Financials ● Substantial progress in addressing specific challenges in key markets ● Successfully invested behind a number of strategic initiatives: - Pilot launches of iQOS - Roll-out of Marlboro 2.0 Architecture - Optimization of our manufacturing footprint ● Delivered a solid currency-neutral performance despite a difficult operating environment 7.8% Adjusted Diluted EPS 2014 Currency-Neutral Guidance(a) 7.5% 6.5% (b) 2014 Results: Exceeded Our Guidance in an Investment Year Variance (2014 vs. PY)

5 Q4, 2014: Challenging Quarter as Anticipated ● Results below our exceptionally strong performance in Q4, 2013: - Pattern of expenses and timing of key investments skewed towards Q4, 2014 ● Organic cigarette volume declined by 3.8% ● Net revenues increased by 1.1%, excluding currency and acquisitions, driven by favorable pricing that more than offset unfavorable volume/mix ● Adjusted OCI declined by 10.6%, excluding currency and acquisitions, due mainly to the impact of the pattern of expenses and the timing of investments ● Adjusted diluted EPS, excluding currency, of $1.31 decreased by 4.4%, versus a 19.4% increase in Q4, 2013 Source: PMI Financials

6 (a) Also excluding acquisitions Source: PMI Financials and PMI forecasts 2015 EPS Guidance ● Strong business fundamentals driving confidence in our 2015 currency-neutral annual growth targets: - 4% to 6% in net revenues(a) - 6% to 8% in adjusted OCI(a) ● Reported diluted EPS guidance for 2015 is $4.27 to $4.37 at prevailing exchange rates, compared to $4.76 in 2014: - Includes approximately $1.15 of unfavorable currency at prevailing exchange rates - Includes incremental spending versus 2014 for the deployment of iQOS - Does not include any share repurchases for the year ● Excluding currency, our guidance represents a growth rate of approximately 8% to 10% in adjusted diluted EPS, compared to $5.02 in 2014

7 ● $1.15 of unfavorable currency in our 2015 guidance, at prevailing exchange rates, is due primarily to: - Russian Ruble: 42% - Euro: 13% - Japanese Yen: 11% - Indonesian Rupiah: 5% ● We have currently hedged approximately 60% of our 2015 forecast sales to Japan, which, at prevailing exchange rates, translates to an effective rate of 110 Yen to the U.S. Dollar Source: PMI forecasts and PMI Financials Impact of Currency on 2015 EPS Guidance Over 70%

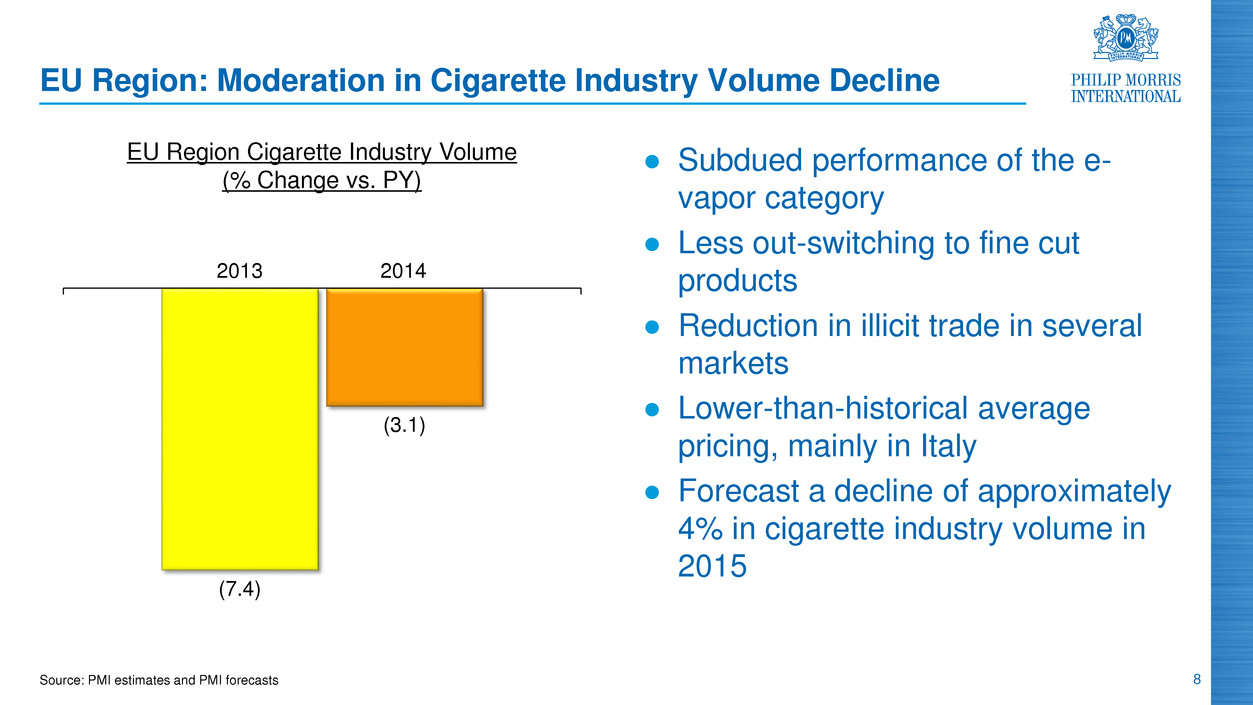

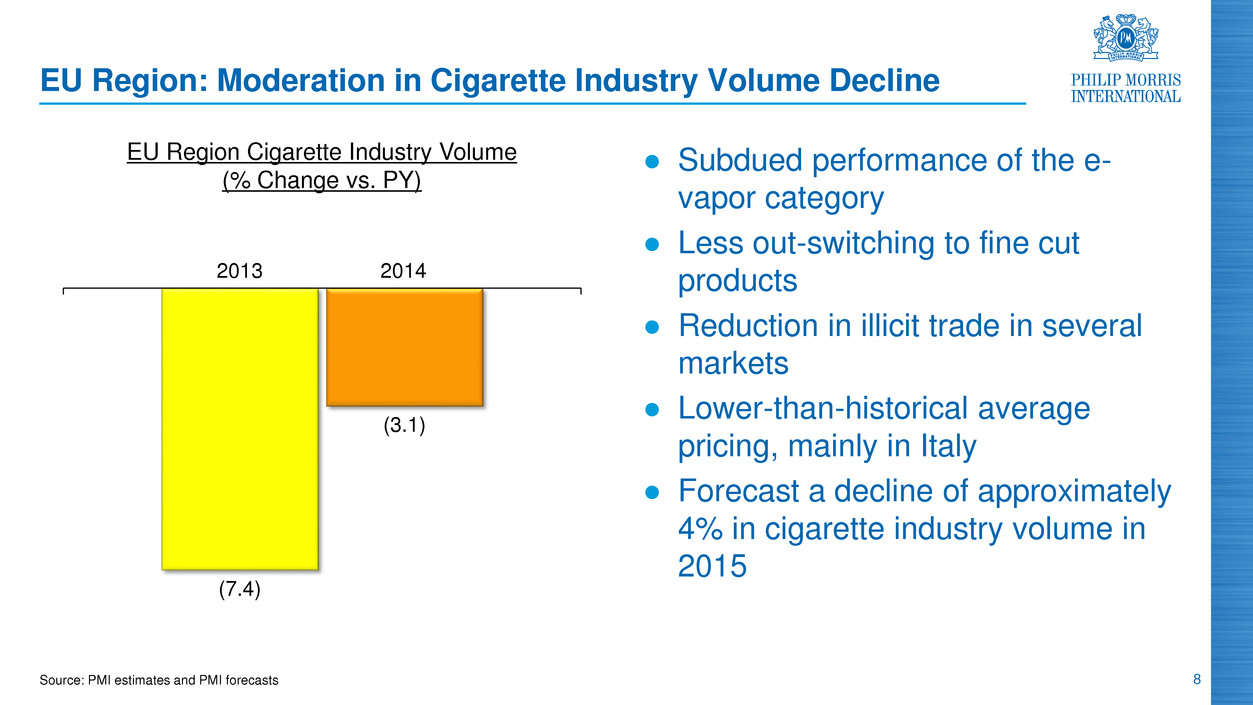

8 EU Region: Moderation in Cigarette Industry Volume Decline Source: PMI estimates and PMI forecasts ● Subdued performance of the e- vapor category ● Less out-switching to fine cut products ● Reduction in illicit trade in several markets ● Lower-than-historical average pricing, mainly in Italy ● Forecast a decline of approximately 4% in cigarette industry volume in 2015 (7.4) (3.1) EU Region Cigarette Industry Volume (% Change vs. PY) 2013 2014

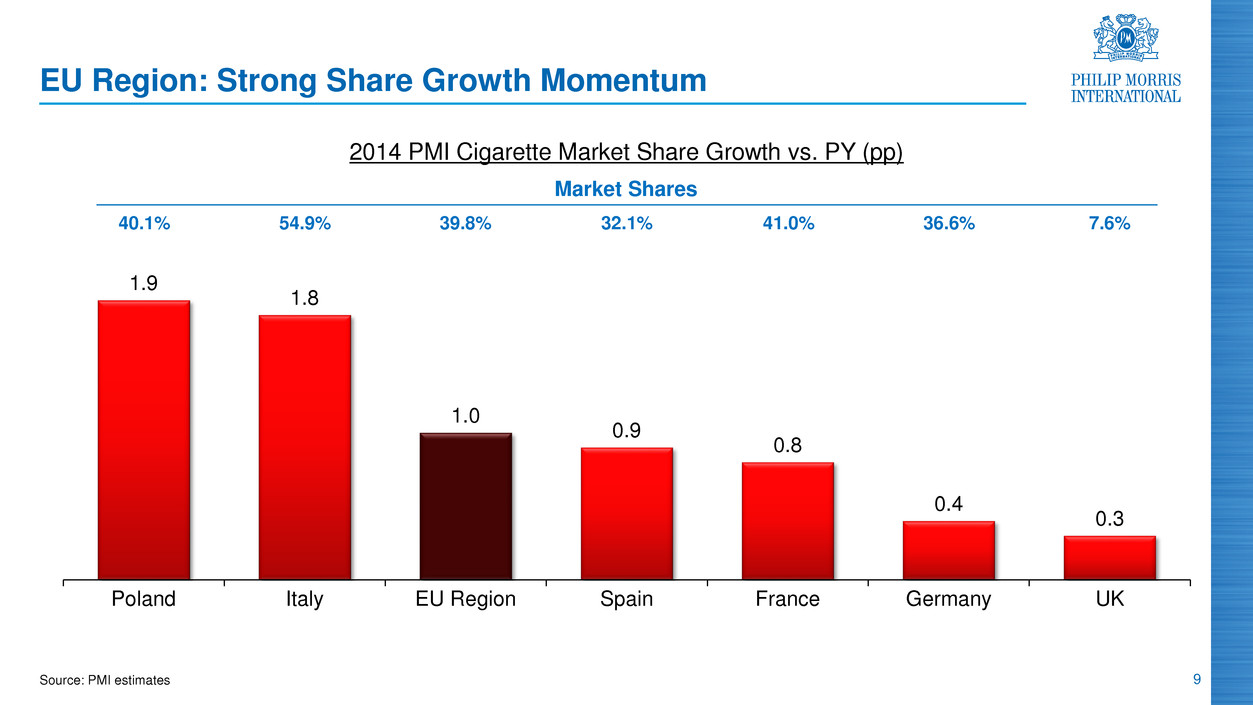

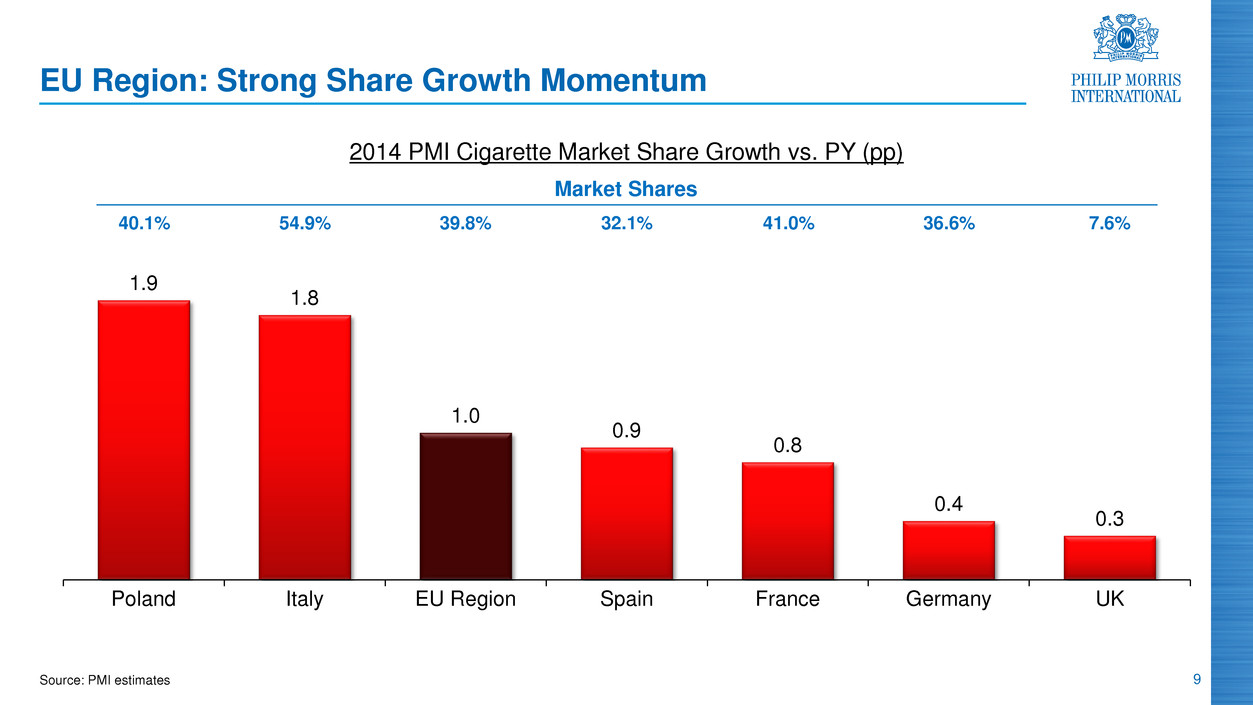

9 Source: PMI estimates 1.9 1.8 1.0 0.9 0.8 0.4 0.3 Poland Italy EU Region Spain France Germany UK EU Region: Strong Share Growth Momentum 2014 PMI Cigarette Market Share Growth vs. PY (pp) 40.1% 54.9% 39.8% 32.1% 41.0% 36.6% 7.6% Market Shares

10 EU Region: Strong Share Growth Momentum Cigarette Market Shares (%) 19.0 19.3 2013 2014 6.9 7.1 2013 2014 4.4 5.5 2013 2014 Marlboro L&M Chesterfield +0.2pp +1.1pp +0.3pp Source: PMI estimates

11 EU Region: Target Return to Profit Growth in 2015 ● Target low single-digit adjusted OCI growth target, excluding currency and acquisitions, in 2015 ● Rational excise tax environment ● Leading brand portfolio ● Recent cigarette price increases in key markets such as Italy, Poland and Spain Source: PMI forecasts

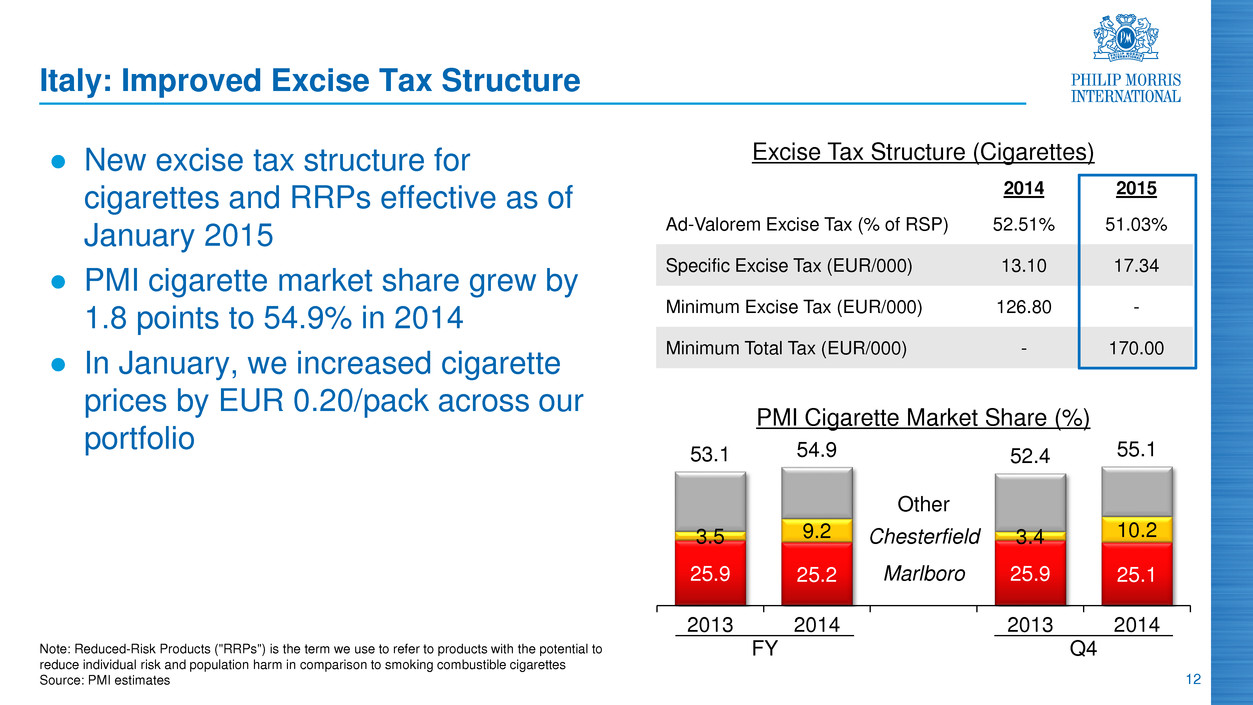

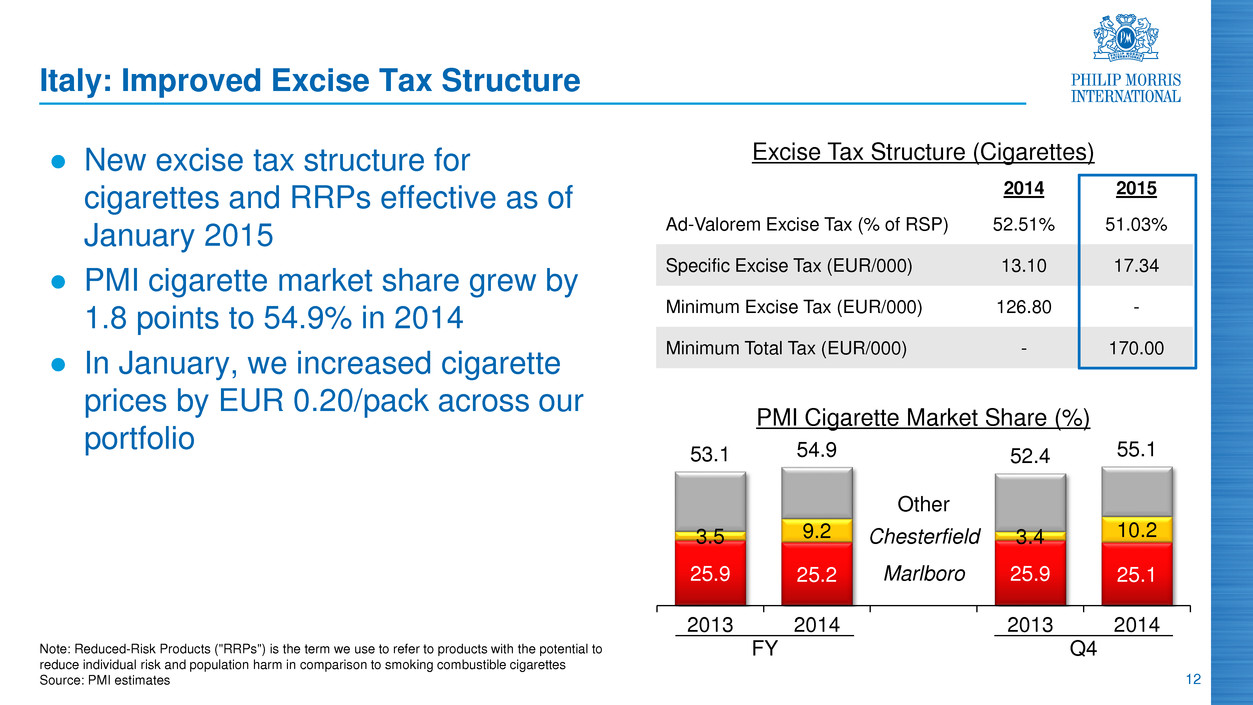

12 Italy: Improved Excise Tax Structure ● New excise tax structure for cigarettes and RRPs effective as of January 2015 ● PMI cigarette market share grew by 1.8 points to 54.9% in 2014 ● In January, we increased cigarette prices by EUR 0.20/pack across our portfolio 25.9 25.2 25.9 25.1 3.5 9.2 3.4 10.2 53.1 54.9 52.4 55.1 2013 2014 2013 2014 FY Q4 Marlboro Chesterfield Other 2014 2015 Ad-Valorem Excise Tax (% of RSP) 52.51% 51.03% Specific Excise Tax (EUR/000) 13.10 17.34 Minimum Excise Tax (EUR/000) 126.80 - Minimum Total Tax (EUR/000) - 170.00 Excise Tax Structure (Cigarettes) Note: Reduced-Risk Products ("RRPs") is the term we use to refer to products with the potential to reduce individual risk and population harm in comparison to smoking combustible cigarettes Source: PMI estimates PMI Cigarette Market Share (%)

13 Note: Translation from Japanese: "Crush the Conventions of Menthol! Marlboro Fusion Blast. Exotic Fresh. World First Taste" Source: Tobacco Institute of Japan and PMI forecasts Japan: Market Share Successfully Stabilized ● Market share stabilized at 25.9% in 2014, driven by: - Be Marlboro marketing campaign - Launch of Marlboro Clear Hybrid - Strengthening of the Lark brand family ● Robust innovation pipeline. Launched Marlboro Fusion Blast in December ● Cigarette industry volume declined by 3.4% in 2014 ● Forecast 2015 cigarette industry volume decline of 2.5% to 3.0% 26.7 25.9 25.9 26.0 FY Q4 FY Q4 2013 2014 PMI Market Share (%)

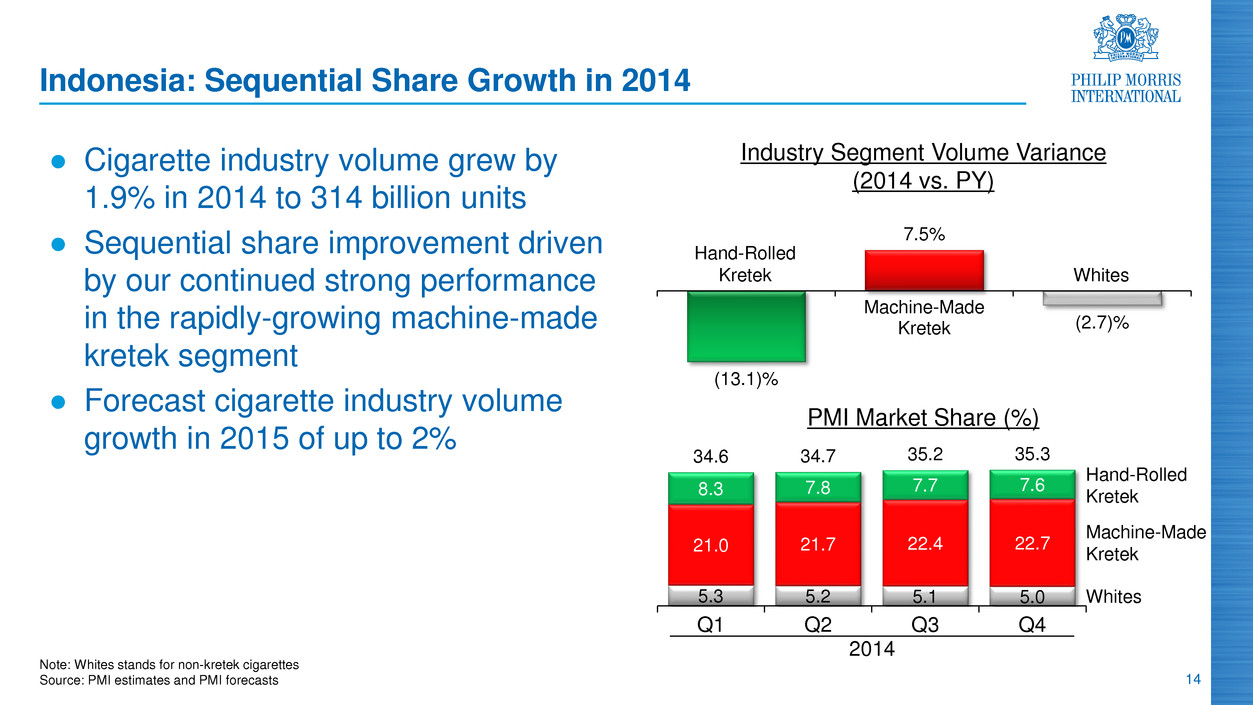

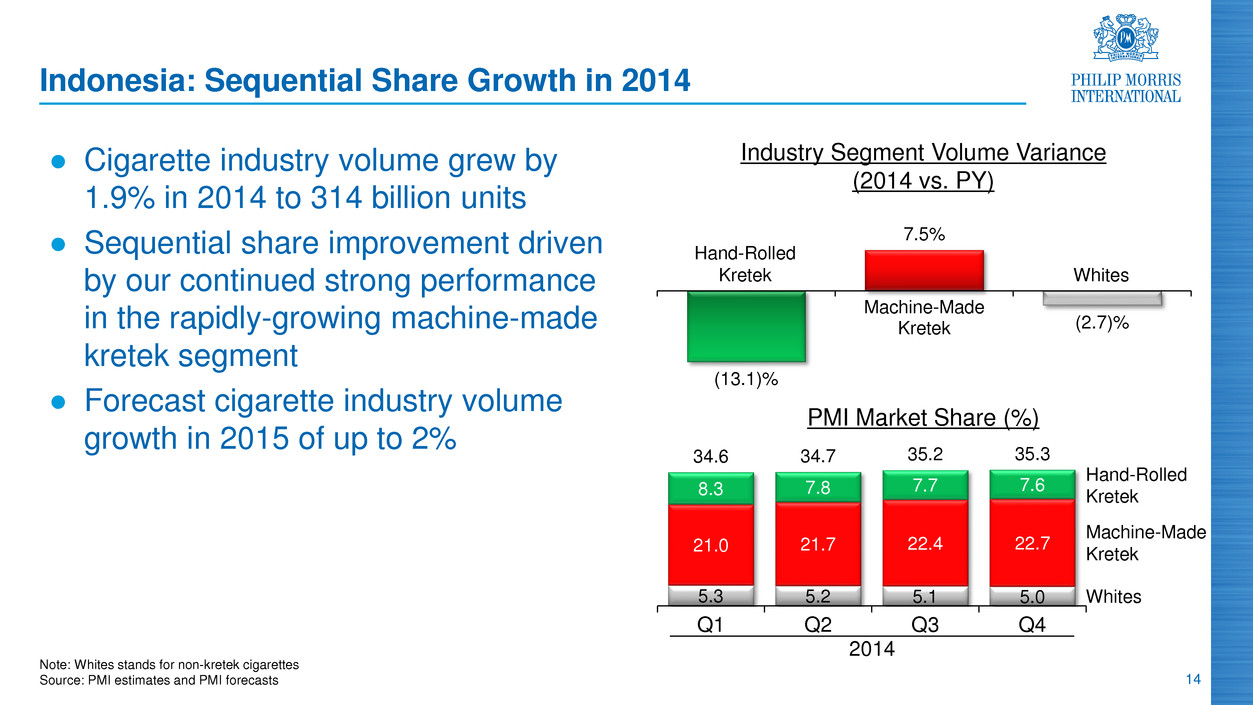

14 Note: Whites stands for non-kretek cigarettes Source: PMI estimates and PMI forecasts 5.3 5.2 5.1 5.0 21.0 21.7 22.4 22.7 8.3 7.8 7.7 7.6 34.6 34.7 35.2 35.3 Q1 Q2 Q3 Q4 Indonesia: Sequential Share Growth in 2014 ● Cigarette industry volume grew by 1.9% in 2014 to 314 billion units ● Sequential share improvement driven by our continued strong performance in the rapidly-growing machine-made kretek segment ● Forecast cigarette industry volume growth in 2015 of up to 2% (13.1)% 7.5% (2.7)% Machine-Made Kretek Hand-Rolled Kretek Whites 2014 Hand-Rolled Kretek Machine-Made Kretek Whites PMI Market Share (%) Industry Segment Volume Variance (2014 vs. PY)

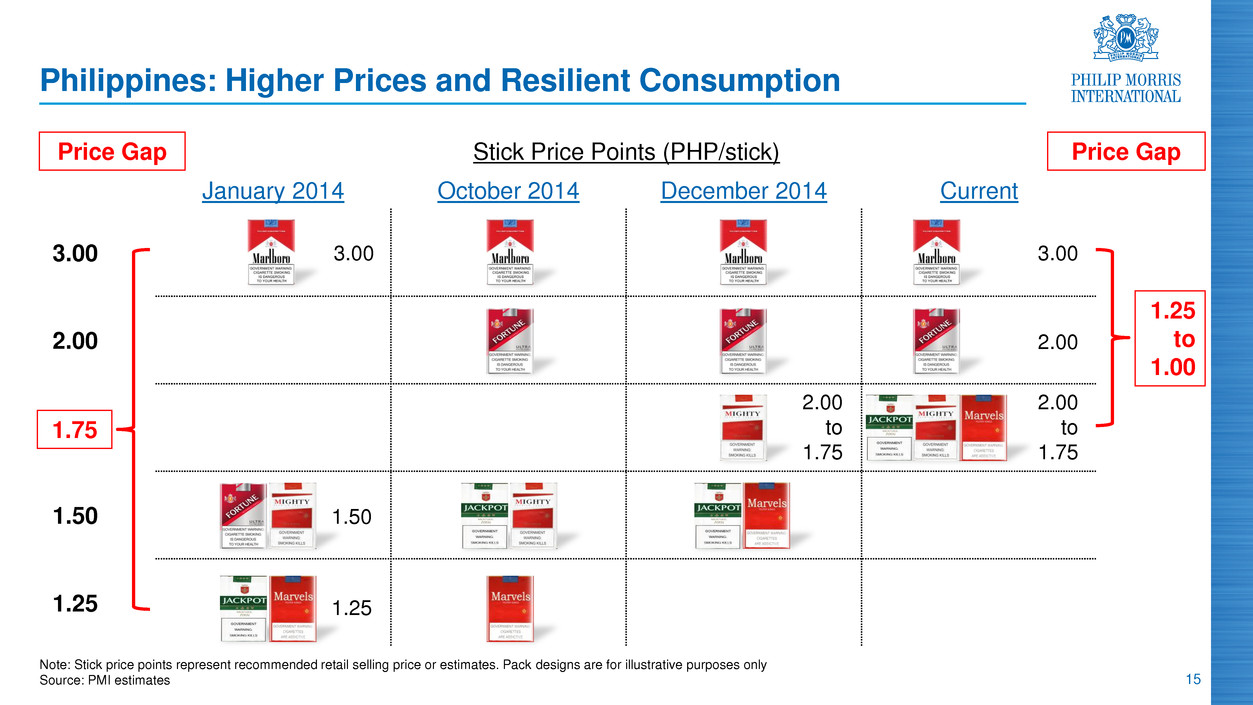

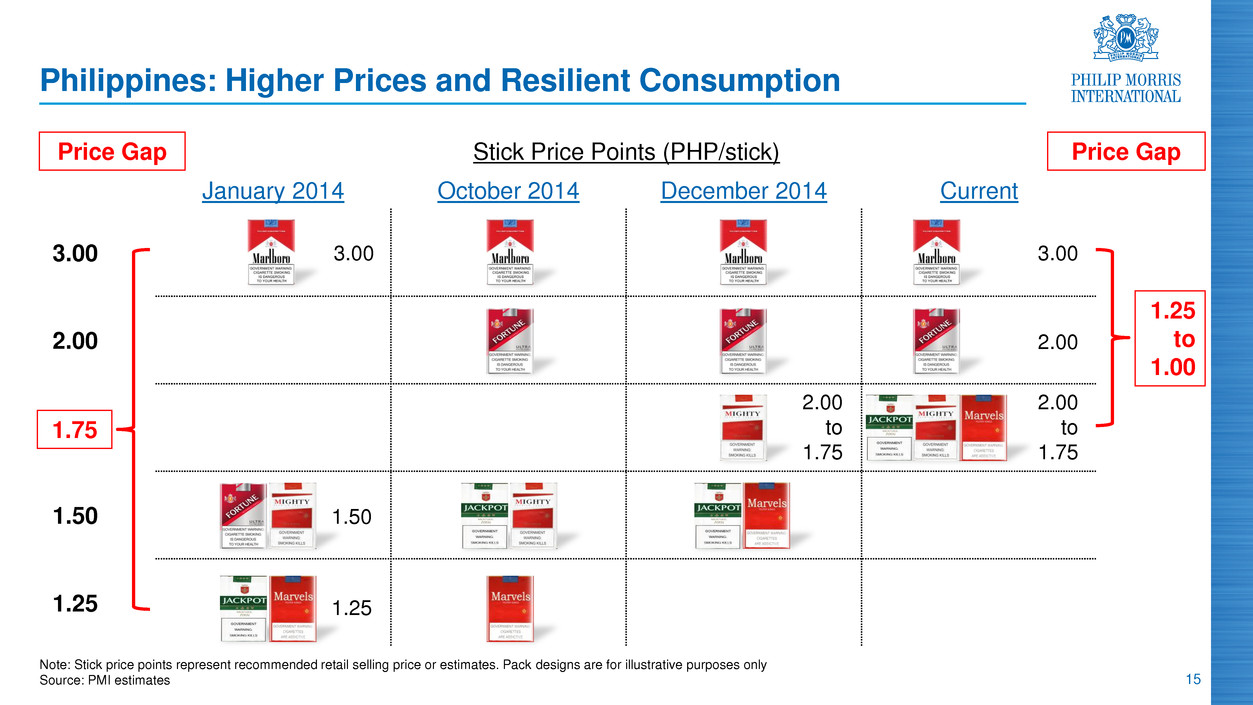

15 Note: Stick price points represent recommended retail selling price or estimates. Pack designs are for illustrative purposes only Source: PMI estimates Philippines: Higher Prices and Resilient Consumption January 2014 October 2014 December 2014 Current 3.00 2.00 1.50 1.25 1.25 3.00 3.00 2.00 2.00 to 1.75 1.75 1.25 to 1.00 Stick Price Points (PHP/stick) 1.50 2.00 to 1.75 Price Gap Price Gap

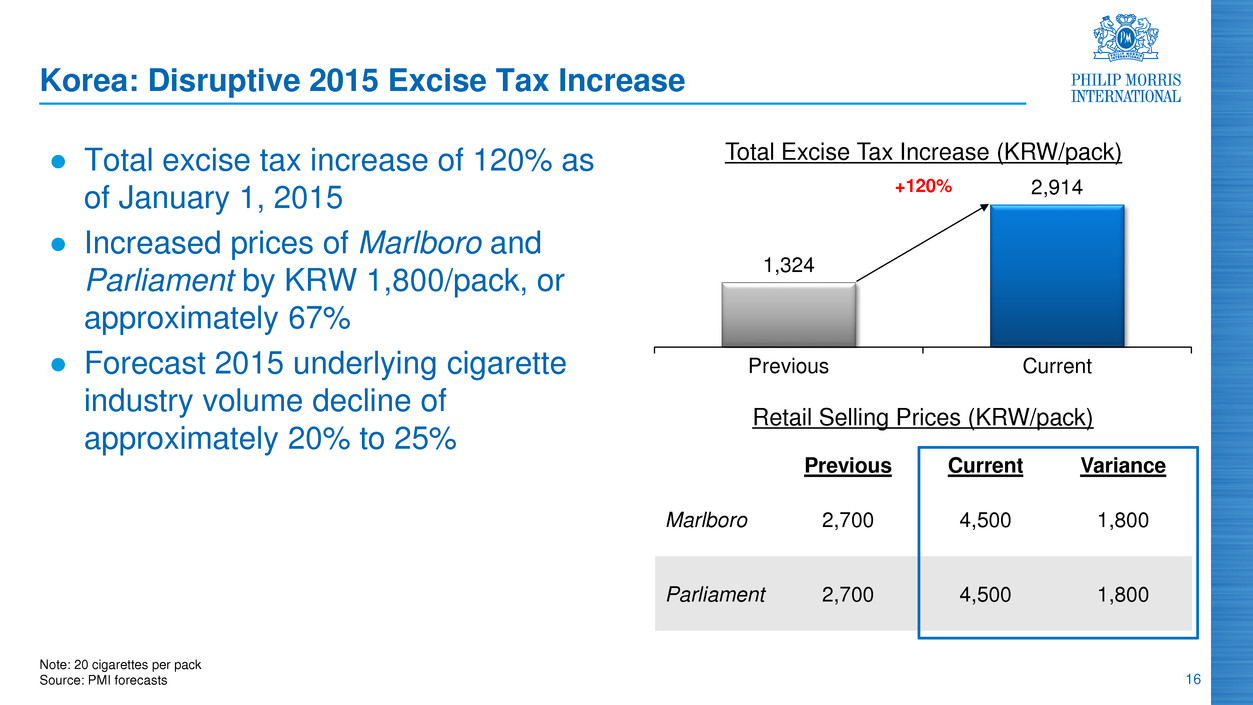

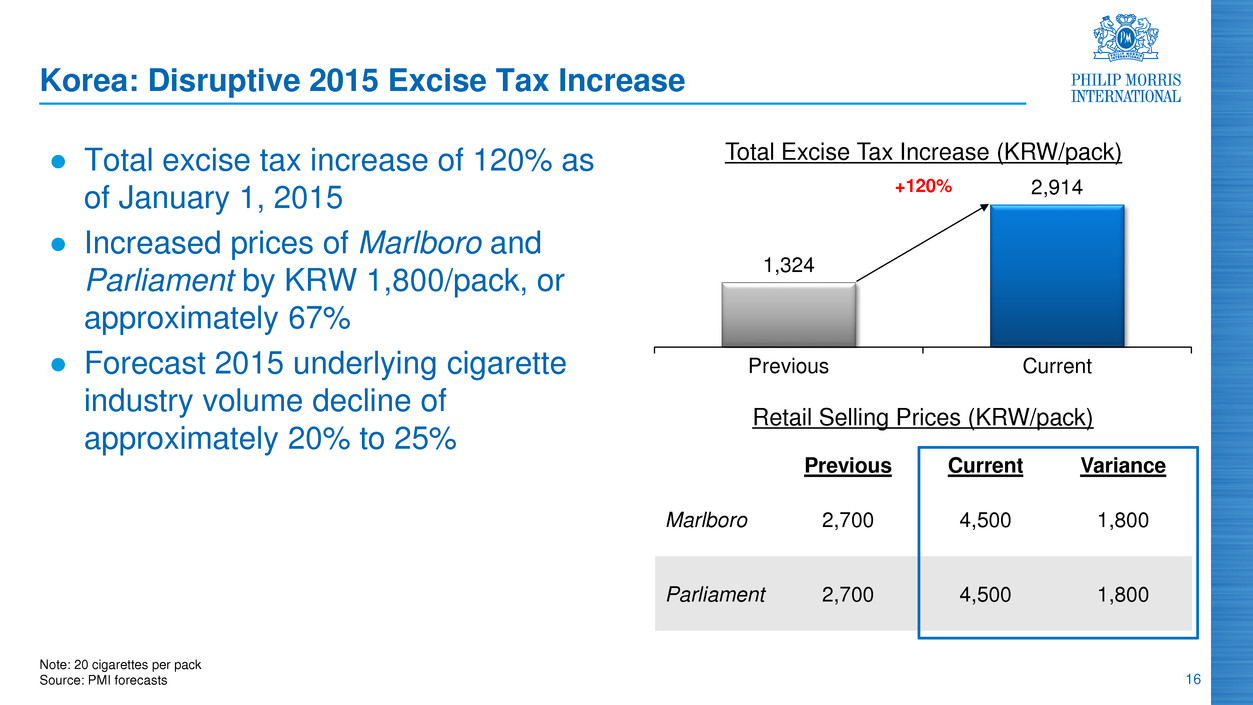

16 1,324 2,914 Previous Current Note: 20 cigarettes per pack Source: PMI forecasts Korea: Disruptive 2015 Excise Tax Increase ● Total excise tax increase of 120% as of January 1, 2015 ● Increased prices of Marlboro and Parliament by KRW 1,800/pack, or approximately 67% ● Forecast 2015 underlying cigarette industry volume decline of approximately 20% to 25% Previous Current Variance Marlboro 2,700 4,500 1,800 Parliament 2,700 4,500 1,800 Total Excise Tax Increase (KRW/pack) Retail Selling Prices (KRW/pack) +120%

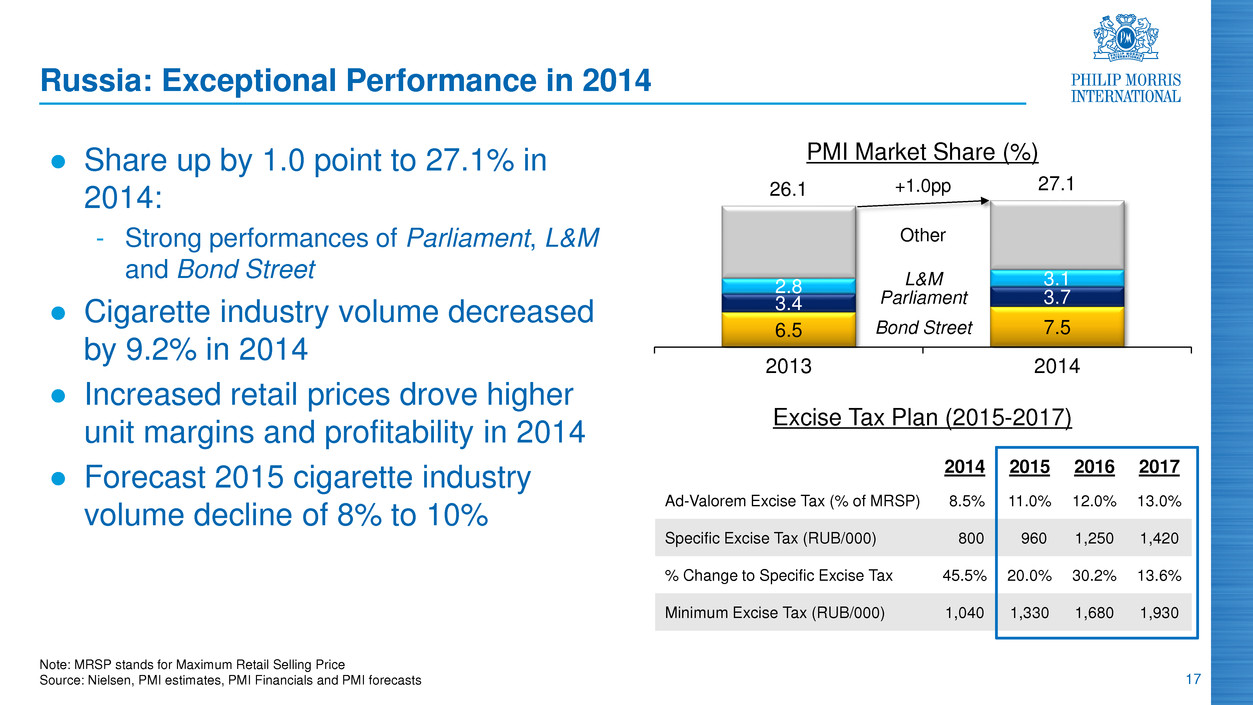

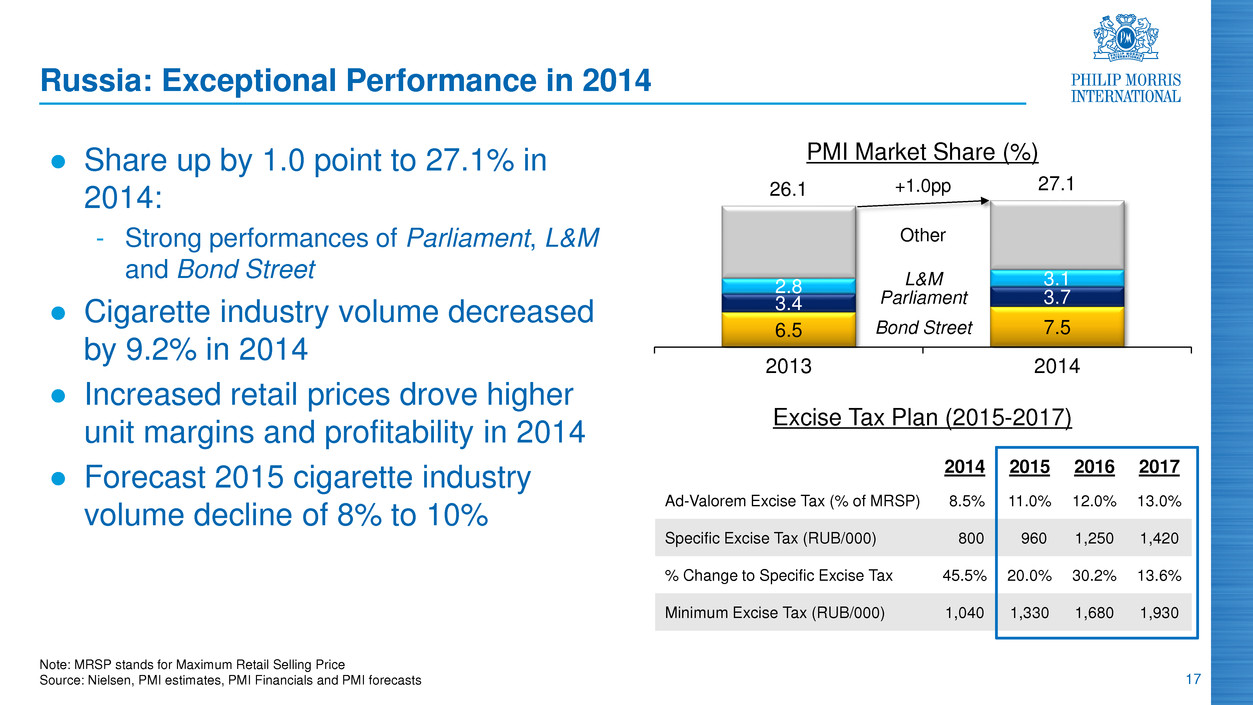

17 Note: MRSP stands for Maximum Retail Selling Price Source: Nielsen, PMI estimates, PMI Financials and PMI forecasts 6.5 7.5 3.4 3.7 2.8 3.1 26.1 27.1 2013 2014 Russia: Exceptional Performance in 2014 ● Share up by 1.0 point to 27.1% in 2014: - Strong performances of Parliament, L&M and Bond Street ● Cigarette industry volume decreased by 9.2% in 2014 ● Increased retail prices drove higher unit margins and profitability in 2014 ● Forecast 2015 cigarette industry volume decline of 8% to 10% PMI Market Share (%) Bond Street Parliament L&M Other +1.0pp 2014 2015 2016 2017 Ad-Valorem Excise Tax (% of MRSP) 8.5% 11.0% 12.0% 13.0% Specific Excise Tax (RUB/000) 800 960 1,250 1,420 % Change to Specific Excise Tax 45.5% 20.0% 30.2% 13.6% Minimum Excise Tax (RUB/000) 1,040 1,330 1,680 1,930 Excise Tax Plan (2015-2017)

18 Marlboro: Regional Market Share Momentum (a) Excluding China Source: PMI estimates 19.0 19.3 2013 2014 Marlboro Market Shares (%) 6.1 6.1 2013 2014 7.2 7.5 2013 2014 15.0 15.0 2013 2014 ̶ pp +0.3pp ̶ pp +0.3pp EU Asia(a) EEMA LA&C

19 Note: Excluding China. Translation from Polish: "Now in Multiple Formats". Translation form German: "Foreign & Friends" Source: PMI Financials ● Parliament cigarette volume grew by 5.6% to 47.2 billion units ● Chesterfield cigarette volume grew by 22.6% to 42.1 billion units ● L&M cigarette volume essentially stable or growing in Asia, EU and LA&C Regions Strong Performance of Parliament, Chesterfield and L&M in 2014

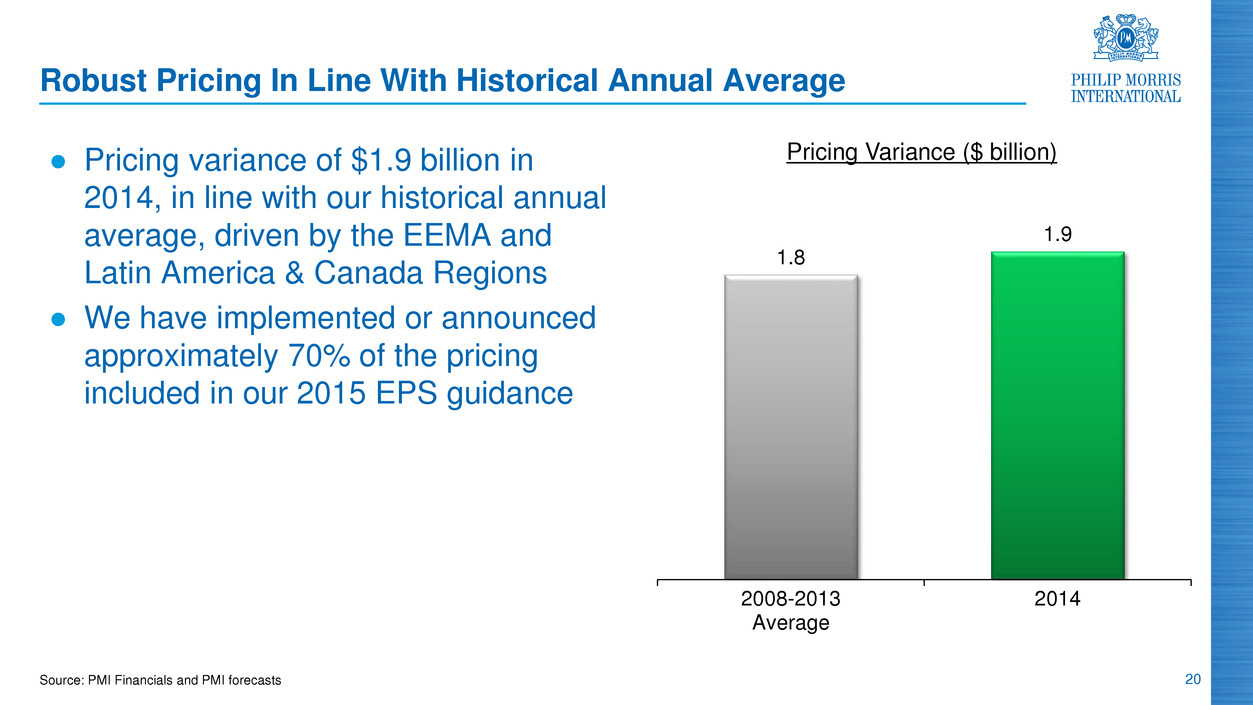

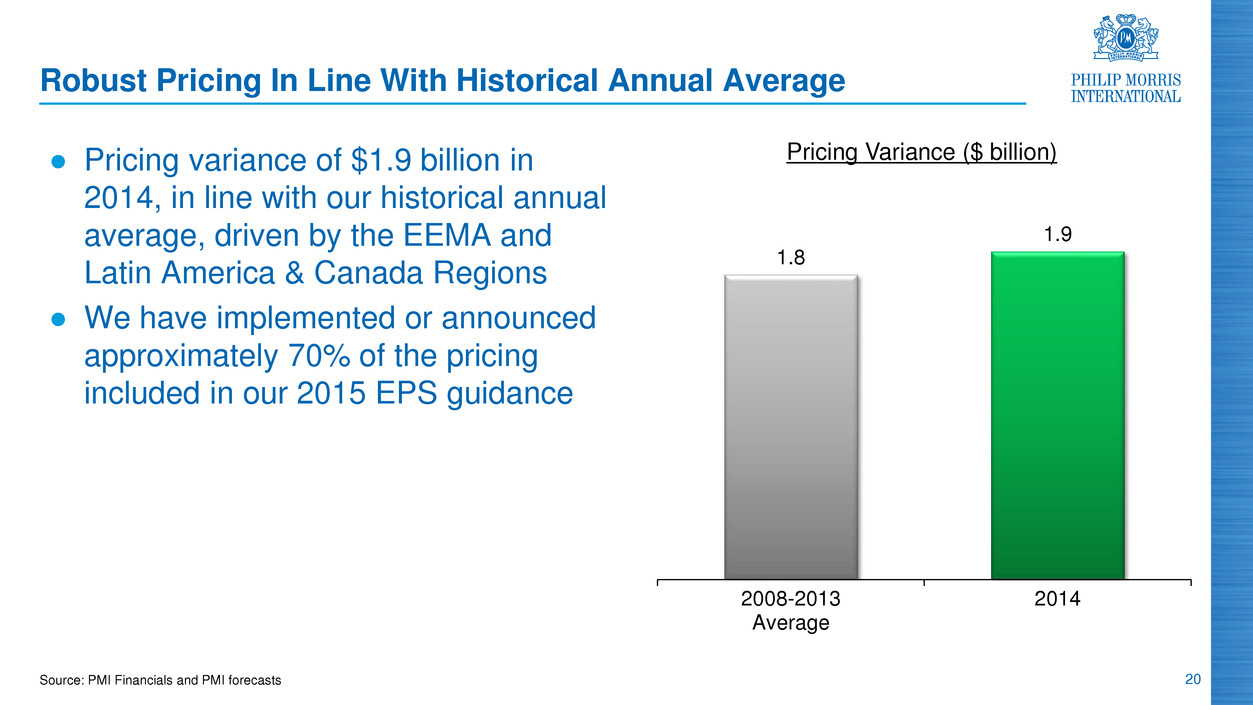

20 Source: PMI Financials and PMI forecasts 1.8 1.9 2008-2013 Average 2014 Robust Pricing In Line With Historical Annual Average ● Pricing variance of $1.9 billion in 2014, in line with our historical annual average, driven by the EEMA and Latin America & Canada Regions ● We have implemented or announced approximately 70% of the pricing included in our 2015 EPS guidance Pricing Variance ($ billion)

21 Productivity and Cost Savings Programs ● In 2014, we exceeded our $300 million annual gross productivity and cost savings target ● In 2015, we expect the total company cost base to grow by approximately 1%, excluding RRPs and currency, thanks to our ongoing productivity and cost savings programs and the manufacturing footprint initiatives implemented last year Note: Reduced-Risk Products ("RRPs") is the term we use to refer to products with the potential to reduce individual risk and population harm in comparison to smoking combustible cigarettes Source: PMI Financials and PMI forecasts

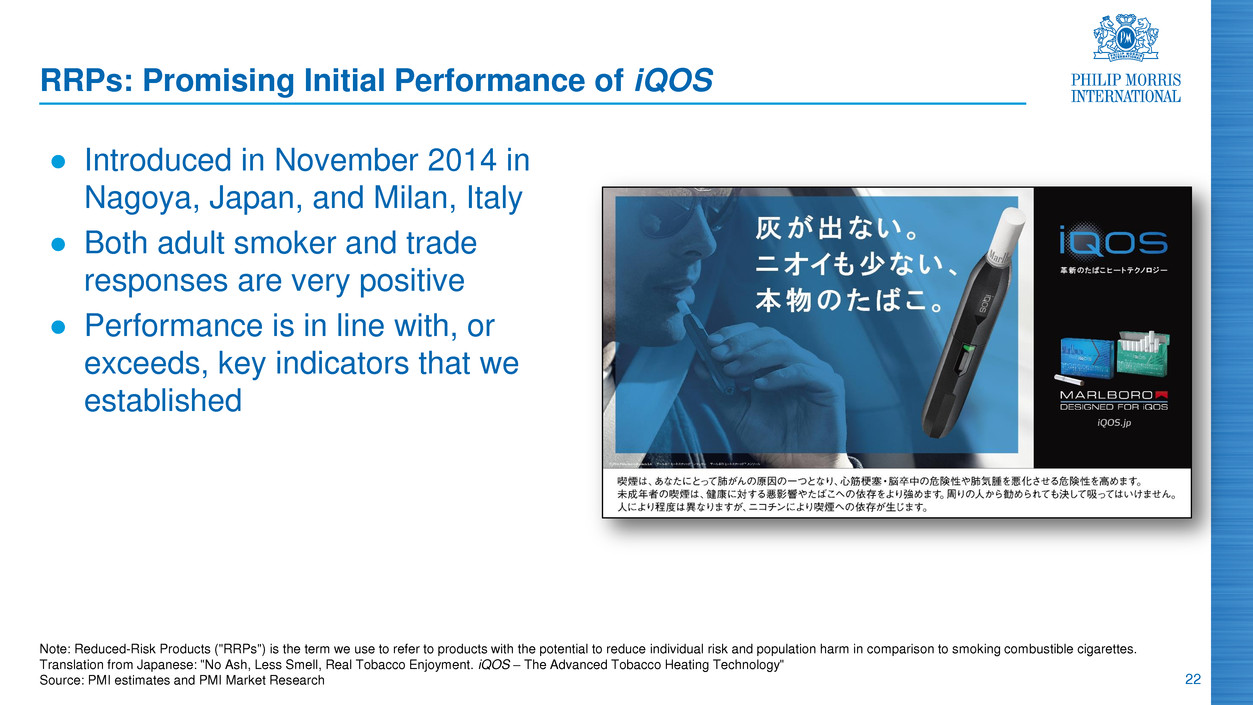

22 RRPs: Promising Initial Performance of iQOS ● Introduced in November 2014 in Nagoya, Japan, and Milan, Italy ● Both adult smoker and trade responses are very positive ● Performance is in line with, or exceeds, key indicators that we established Note: Reduced-Risk Products ("RRPs") is the term we use to refer to products with the potential to reduce individual risk and population harm in comparison to smoking combustible cigarettes. Translation from Japanese: "No Ash, Less Smell, Real Tobacco Enjoyment. iQOS – The Advanced Tobacco Heating Technology" Source: PMI estimates and PMI Market Research

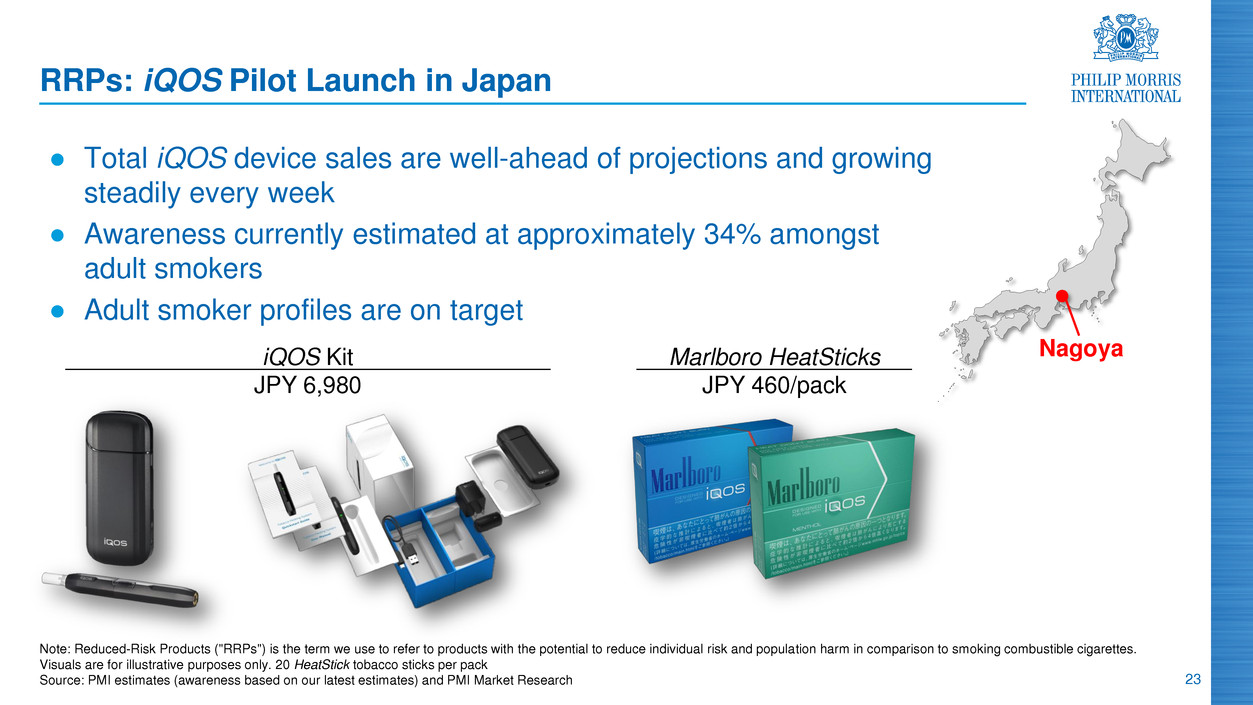

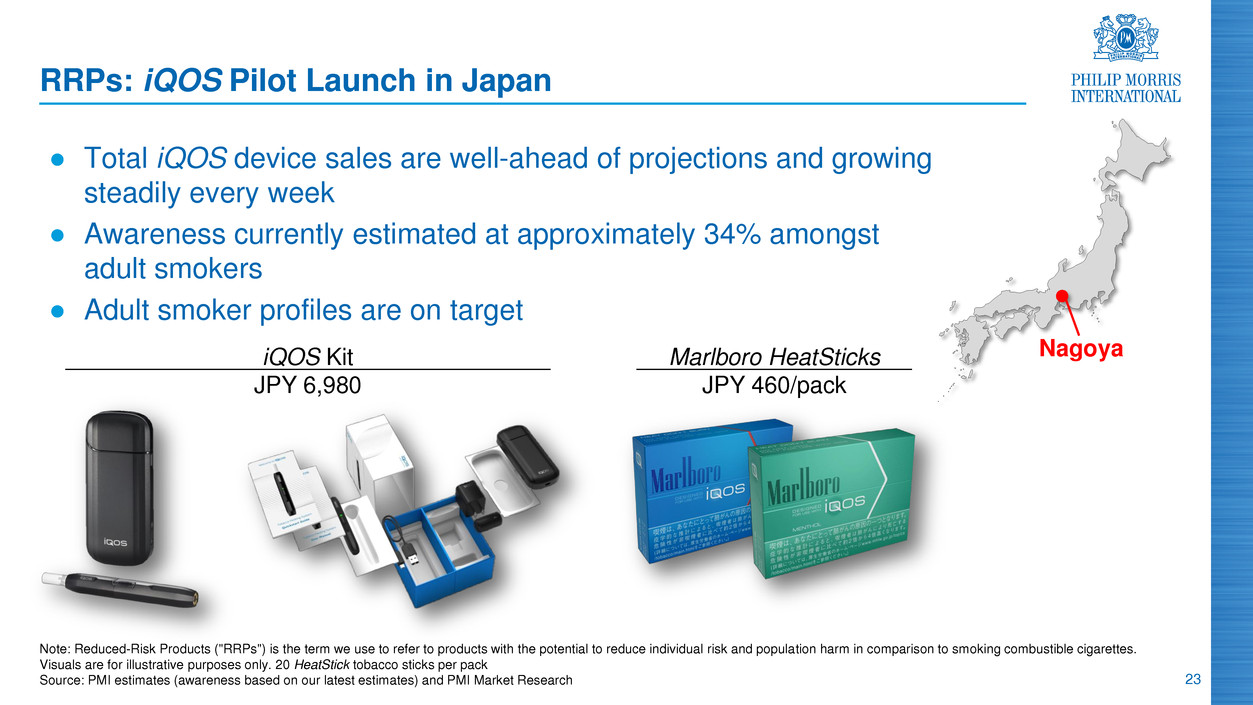

23 RRPs: iQOS Pilot Launch in Japan ● Total iQOS device sales are well-ahead of projections and growing steadily every week ● Awareness currently estimated at approximately 34% amongst adult smokers ● Adult smoker profiles are on target iQOS Kit JPY 6,980 Marlboro HeatSticks JPY 460/pack Note: Reduced-Risk Products ("RRPs") is the term we use to refer to products with the potential to reduce individual risk and population harm in comparison to smoking combustible cigarettes. Visuals are for illustrative purposes only. 20 HeatStick tobacco sticks per pack Source: PMI estimates (awareness based on our latest estimates) and PMI Market Research Nagoya

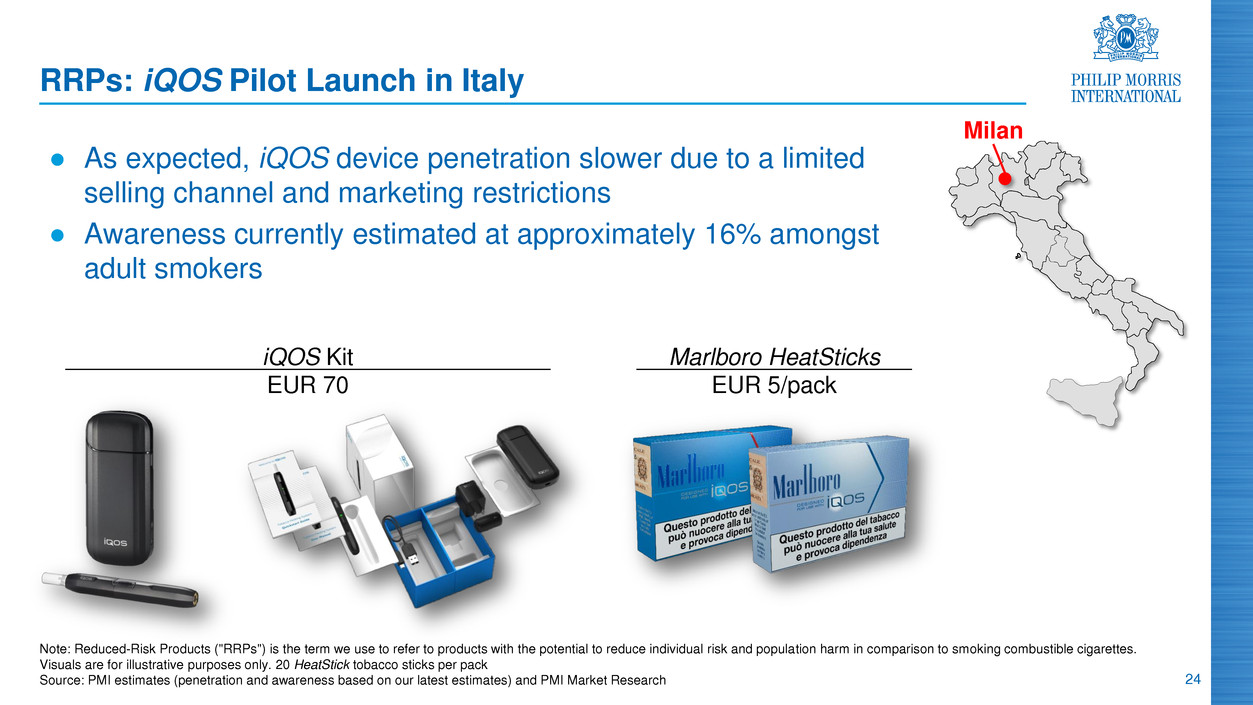

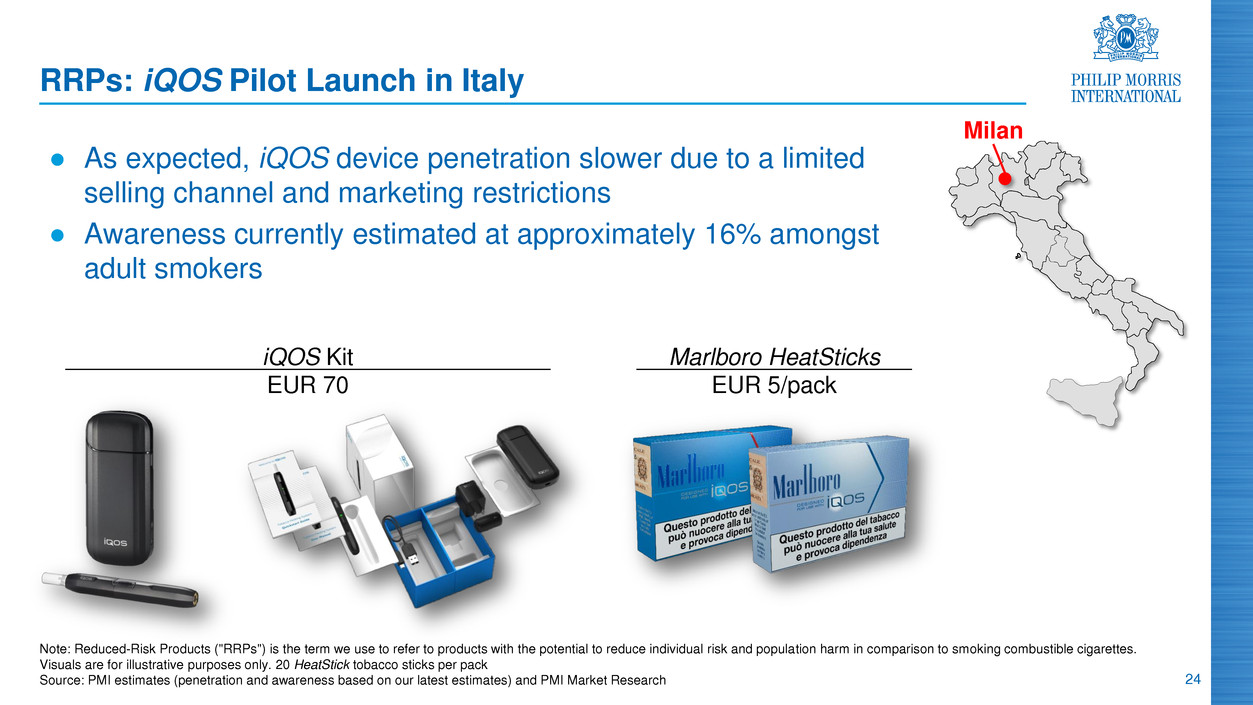

24 RRPs: iQOS Pilot Launch in Italy ● As expected, iQOS device penetration slower due to a limited selling channel and marketing restrictions ● Awareness currently estimated at approximately 16% amongst adult smokers iQOS Kit EUR 70 Marlboro HeatSticks EUR 5/pack Milan Note: Reduced-Risk Products ("RRPs") is the term we use to refer to products with the potential to reduce individual risk and population harm in comparison to smoking combustible cigarettes. Visuals are for illustrative purposes only. 20 HeatStick tobacco sticks per pack Source: PMI estimates (penetration and awareness based on our latest estimates) and PMI Market Research

25 RRPs: 2015 Outlook for iQOS ● Commencing national expansion in Japan and Italy, as well as pilot or national launches in other markets, later this year ● Launches will be supported by a new release of iQOS that incorporates feedback from the pilot markets and features a variety of colors and textures to broaden the product’s appeal amongst adult smokers ● Our 2015 guidance includes incremental spending versus 2014 for the deployment of iQOS, which is skewed towards the second half of the year Source: PMI forecasts

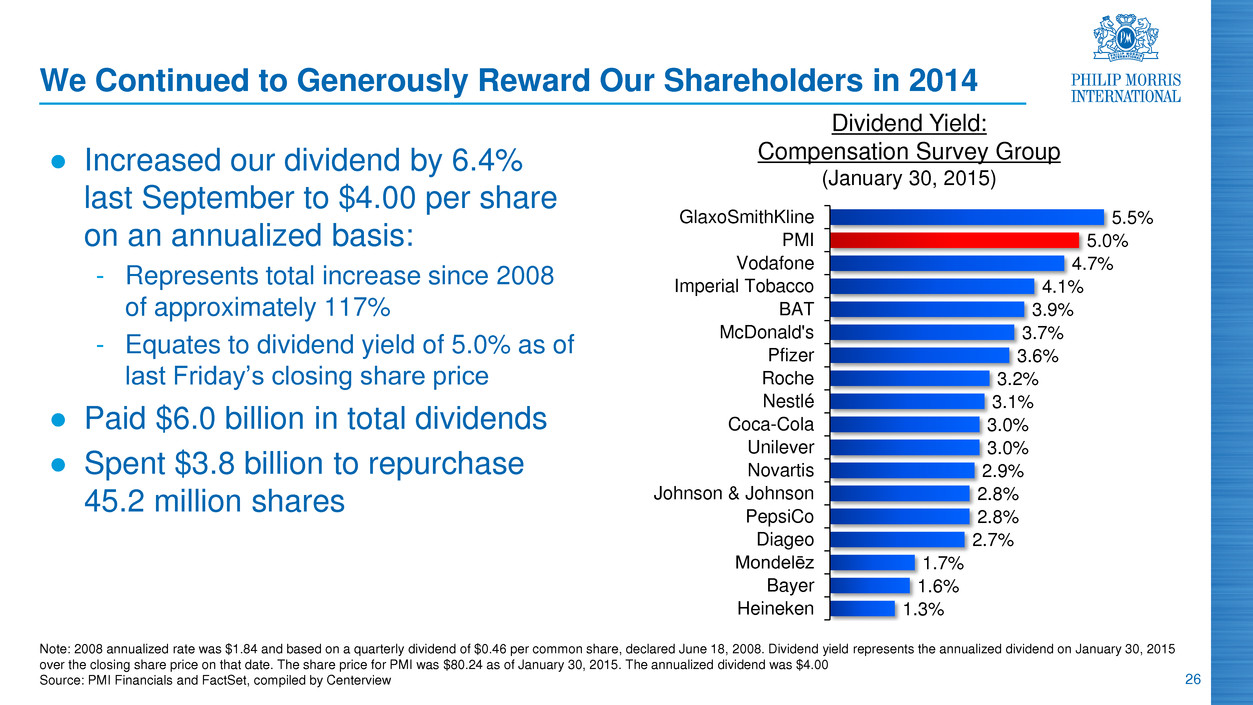

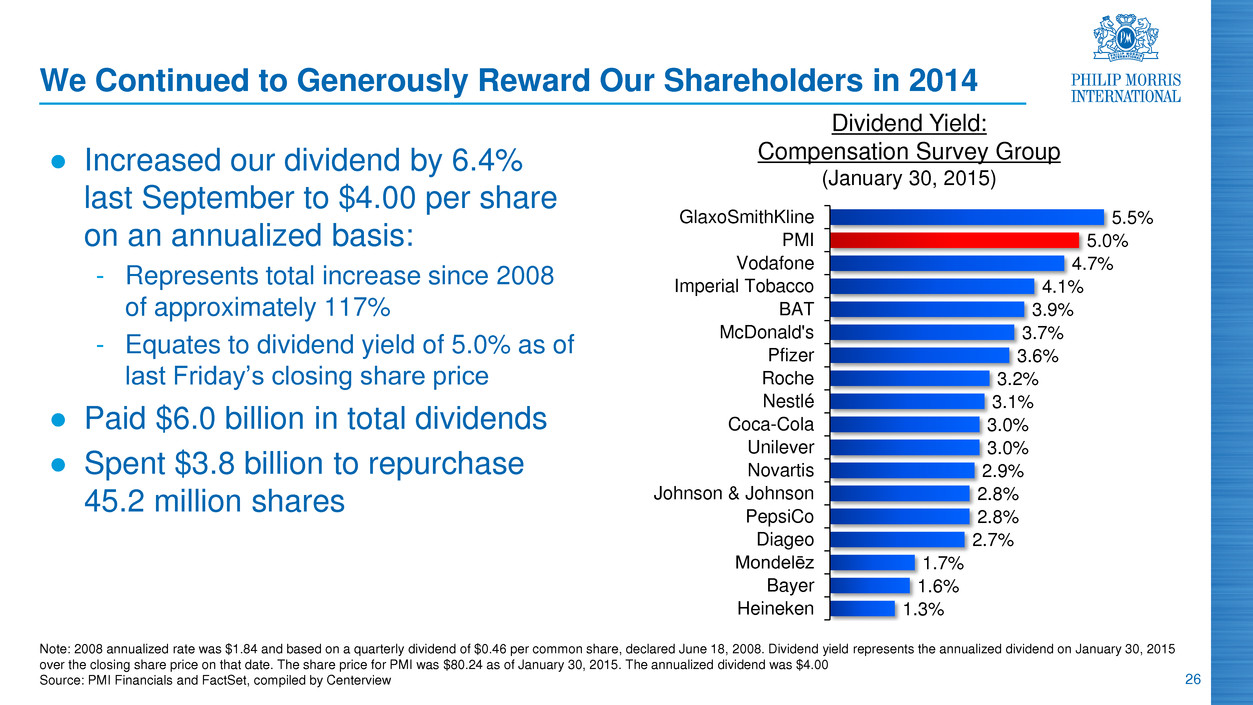

26 We Continued to Generously Reward Our Shareholders in 2014 ● Increased our dividend by 6.4% last September to $4.00 per share on an annualized basis: - Represents total increase since 2008 of approximately 117% - Equates to dividend yield of 5.0% as of last Friday’s closing share price ● Paid $6.0 billion in total dividends ● Spent $3.8 billion to repurchase 45.2 million shares Note: 2008 annualized rate was $1.84 and based on a quarterly dividend of $0.46 per common share, declared June 18, 2008. Dividend yield represents the annualized dividend on January 30, 2015 over the closing share price on that date. The share price for PMI was $80.24 as of January 30, 2015. The annualized dividend was $4.00 Source: PMI Financials and FactSet, compiled by Centerview 1.3% 1.6% 1.7% 2.7% 2.8% 2.8% 2.9% 3.0% 3.0% 3.1% 3.2% 3.6% 3.7% 3.9% 4.1% 4.7% 5.0% 5.5% Heineken Bayer Mondelēz Diageo PepsiCo Johnson & Johnson Novartis Unilever Coca-Cola Nestlé Roche Pfizer McDonald's BAT Imperial Tobacco Vodafone PMI GlaxoSmithKline Dividend Yield: Compensation Survey Group (January 30, 2015)

27 Rewarding Our Shareholders: 2015 Target ● Currently operating in a debt level corridor that is close to the maximum that would still allow us to maintain our single-A credit rating ● Aim to return around 100% of our free cash flow to our shareholders ● Remain committed to managing our cash flow prudently and maintaining our financial flexibility ● While we do not currently envisage any share repurchases in 2015, we will revisit the potential for such purchases as the year unfolds, depending on the currency environment Source: PMI forecasts

28 (a) Also excluding acquisitions Source: PMI Financials, PMI estimates and PMI forecasts Conclusion: Confidence in Business Outlook Entering 2015 ● Delivered a solid currency-neutral performance in 2014 ● Strong fundamentals and positive momentum, despite significant currency headwind ● Leading brand portfolio driving robust pricing and market share gains ● Excited by prospects for iQOS, following pilot launches in late-2014 ● Confident in our ability to meet currency-neutral annual growth targets: - Net revenues: 4% to 6%(a) - Adjusted OCI: 6% to 8%(a) - Adjusted diluted EPS: 8% to 10%

2014 Fourth-Quarter and Full-Year Results Questions & Answers

Glossary and Reconciliation of Non-GAAP Measures

31 Glossary: General Terms ● PMI stands for Philip Morris International Inc. and its subsidiaries ● Until March 28, 2008, PMI was a wholly owned subsidiary of Altria Group, Inc. ("Altria"). Since that time the company has been independent and is listed on the New York Stock Exchange (ticker symbol "PM") ● PMI volumes refer to PMI cigarette shipment data, unless otherwise stated ● Organic volume refers to volume excluding acquisitions ● References to total international cigarette market, total cigarette market, total market and market shares reflect our best estimates based on a number of internal and external sources ● Trademarks are italicized

32 Glossary: Financial Terms ● Net revenues exclude excise taxes ● Adjusted OCI is defined as reported OCI adjusted for asset impairment, exit and other costs ● EPS stands for Earnings per Share ● Free cash flow is defined as net cash provided by operating activities less capital expenditures ● Operating Companies Income, or "OCI", is defined as operating income, excluding general corporate expenses and the amortization of intangibles, plus equity (income) or loss in unconsolidated subsidiaries, net. OCI growth rates are on an adjusted basis, which excludes asset impairment, exit and other costs

33 Glossary: Industry/Market Terms ● EEMA refers to the Eastern Europe, Middle East & Africa Region ● EU refers to the European Union Region ● LA&C refers to the Latin America & Canada Region ● Fine cut includes Make-Your-Own (MYO), MYO volume tobacco and Roll-Your- Own (RYO) ● Illicit trade refers to domestic non-tax paid products

34 Glossary: Reduced-Risk Products ● E-vapor products are products that generate nicotine containing aerosols without combustion ● HeatStick tobacco sticks are novel patented tobacco products specifically designed by PMI for use with PMI’s iQOS system. The tobacco in the HeatStick is heated by our iQOS technology to provide adult smokers with real tobacco taste and satisfaction without combustion ● iQOS is the new brand name under which PMI has chosen to commercialize the Platform 1 electronic system ● Reduced-Risk Products ("RRPs") is the term the company uses to refer to products with the potential to reduce individual risk and population harm in comparison to smoking combustible cigarettes. PMI’s RRPs are in various stages of development, and we are conducting extensive and rigorous scientific studies to determine whether we can support claims for such products of reduced exposure to harmful and potentially harmful constituents in smoke, and ultimately claims of reduced disease risk, when compared to smoking combustible cigarettes. Before making any such claims, we will need to rigorously evaluate the full set of data from the relevant scientific studies to determine whether they substantiate reduced exposure or risk. Any such claims may also be subject to government review and approval, as is the case in the USA today

35 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS and Adjusted Diluted EPS, excluding Currency For the Years Ended December 31, (Unaudited) 2014 2013 % Change Reported Diluted EPS 4.76$ 5.26$ (9.5)% Adjustments: Asset impairment and exit costs 0.26 0.12 Tax items - 0.02 Adjuste iluted EPS 5.02$ 5.40$ (7.0)% Less: Currency impact (0.80) Adjusted Diluted EPS, excluding Currency 5.82$ 5.40$ 7.8%

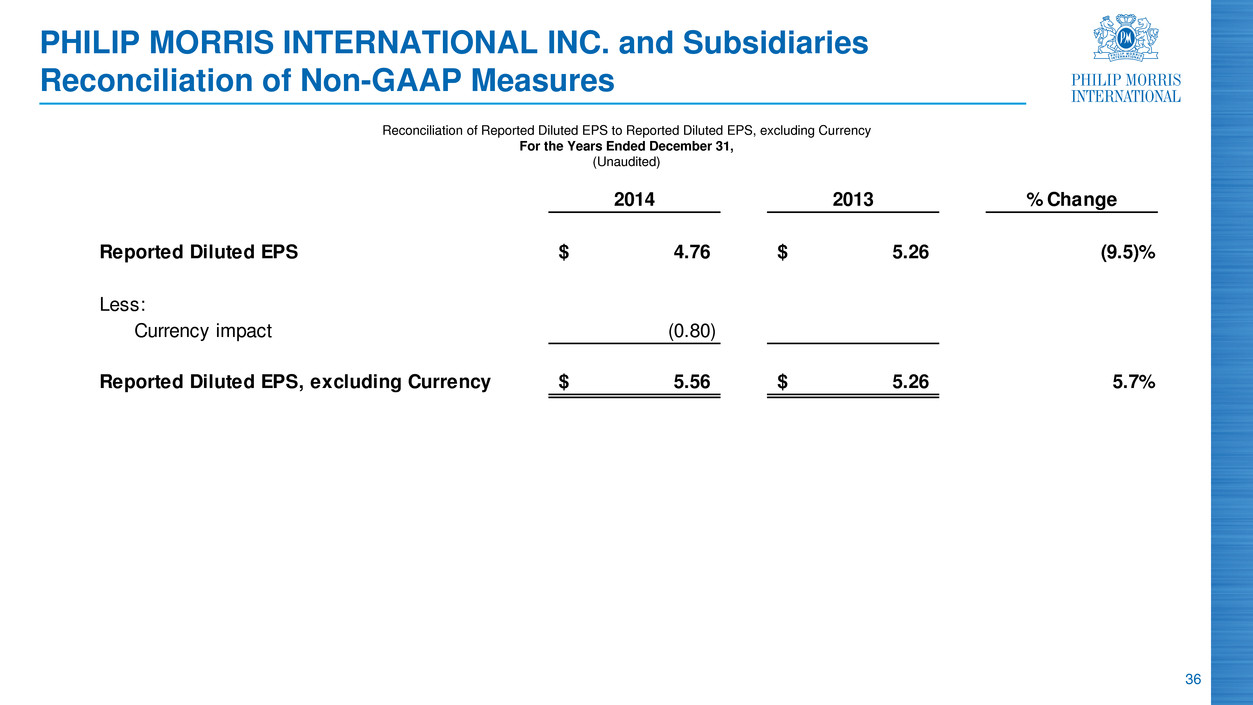

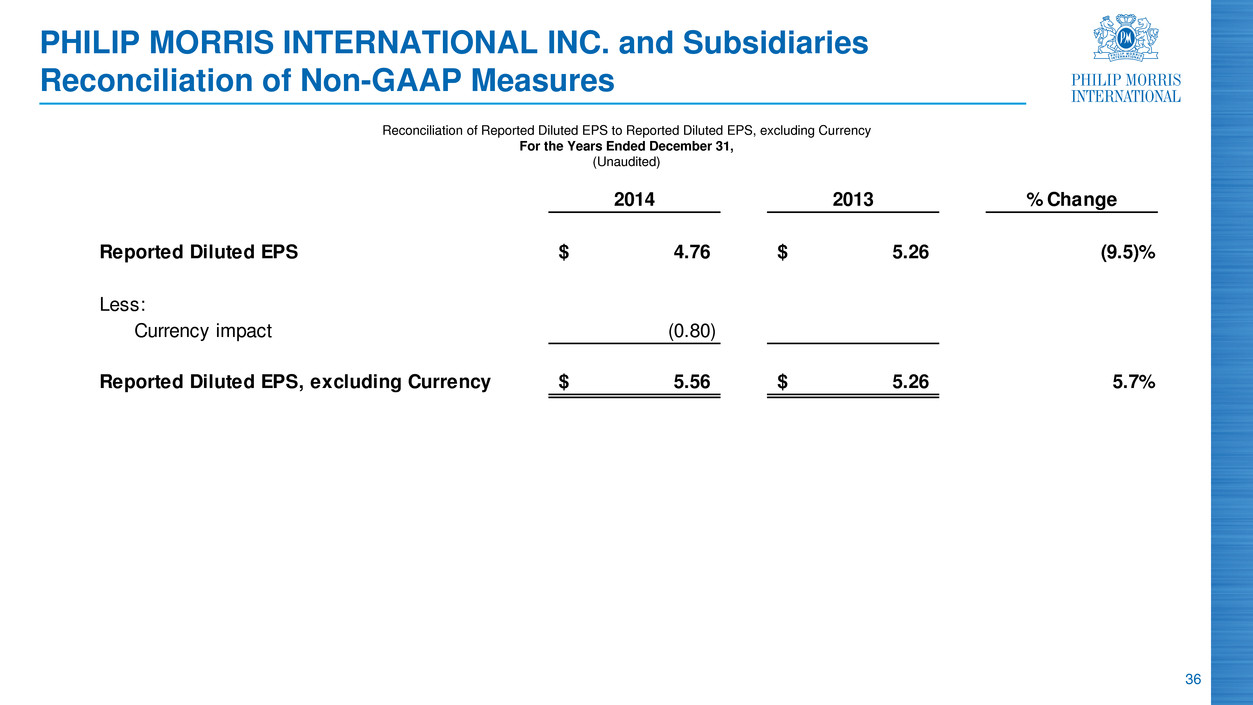

36 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Diluted EPS to Reported Diluted EPS, excluding Currency For the Years Ended December 31, (Unaudited) 2014 2013 % Change Reported Diluted EPS 4.76$ 5.26$ (9.5)% Less: Currency impact (0.80) Reported Diluted EPS, excluding Currency 5.56$ 5.26$ 5.7%

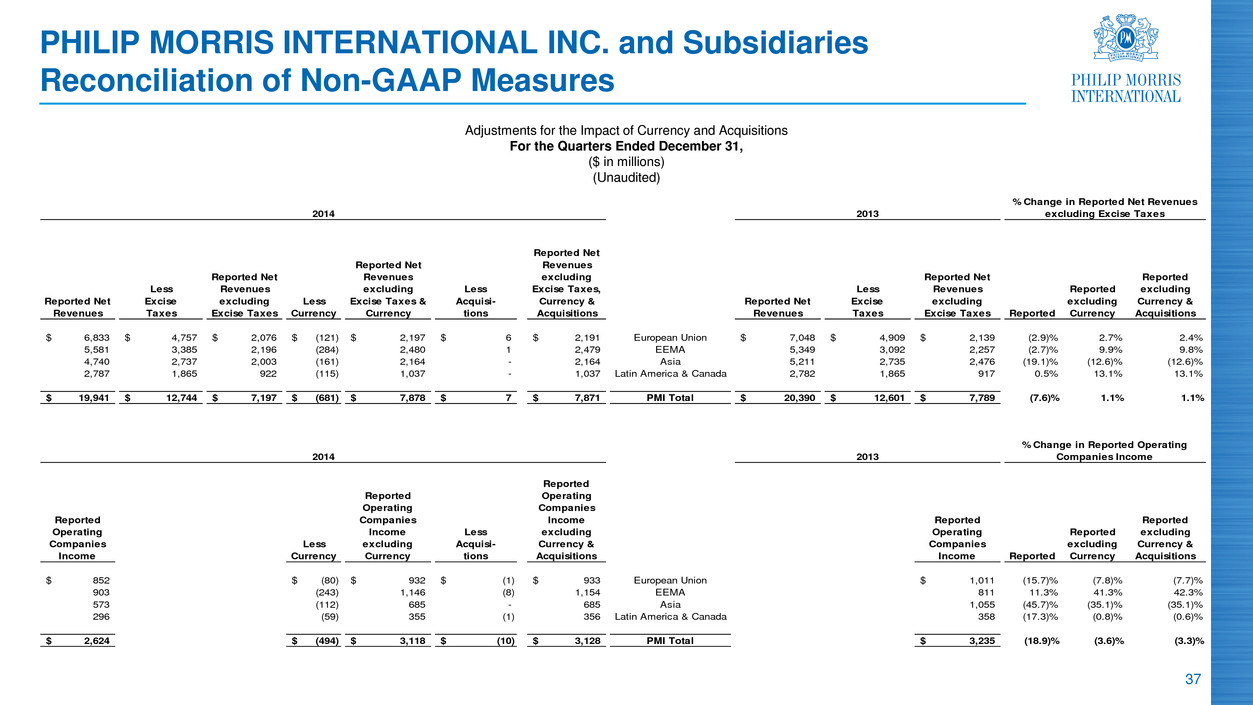

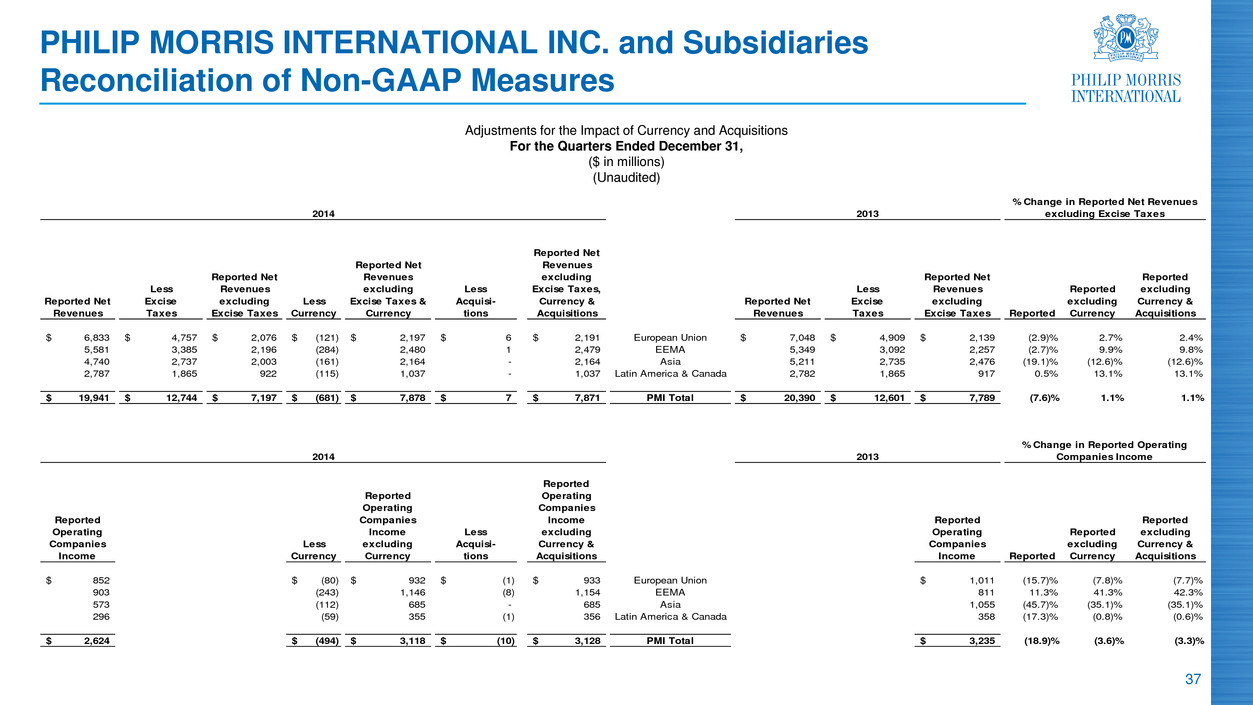

37 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Adjustments for the Impact of Currency and Acquisitions For the Quarters Ended December 31, ($ in millions) (Unaudited) Reported Net Revenues Less Excise Taxes Reported Net Revenues excluding Excise Taxes Less Currency Reported Net Revenues excluding Excise Taxes & Currency Less Acquisi- tions Reported Net Revenues excluding Excise Taxes, Currency & Acquisitions Reported Net Revenues Less Excise Taxes Reported Net Revenues excluding Excise Taxes Reported Reported excluding Currency Reported excluding Currency & Acquisitions 6,833$ 4,757$ 2,076$ (121)$ 2,197$ 6$ 2,191$ European Union 7,048$ 4,909$ 2,139$ (2.9)% 2.7% 2.4% 5,581 3,385 2,196 (284) 2,480 1 2,479 EEMA 5,349 3,092 2,257 (2.7)% 9.9% 9.8% 4,740 2,737 2,003 (161) 2,164 - 2,164 Asia 5,211 2,735 2,476 (19.1)% (12.6)% (12.6)% 2,787 1,865 922 (115) 1,037 - 1,037 Latin America & Canada 2,782 1,865 917 0.5% 13.1% 13.1% 19,941$ 12,744$ 7,197$ (681)$ 7,878$ 7$ 7,871$ PMI Total 20,390$ 12,601$ 7,789$ (7.6)% 1.1% 1.1% Reported Operating Companies I come Less Currency Reported Operating Companies Income excluding Currency Less Acquisi- tions Reported Operating Companies Income excluding Currency & Acquisitions Reported Operating Companies Income Reported Reported excluding Currency Reported excluding Currency & Acquisitions 852$ (80)$ 932$ (1)$ 933$ European Union 1,011$ (15.7)% (7.8)% (7.7)% 903 (243) 1,146 (8) 1,154 EEMA 811 11.3% 41.3% 42.3% 573 (112) 685 - 685 Asia 1,055 (45.7)% (35.1)% (35.1)% 296 (59) 355 (1) 356 Latin America & Canada 358 (17.3)% (0.8)% (0.6)% 2,624$ (494)$ 3,118$ (10)$ 3,128$ PMI Total 3,235$ (18.9)% (3.6)% (3.3)% 2014 2013 % Change in Reported Operating Companies Income 2014 2013 % Change in Reported Net Revenues excluding Excise Taxes

38 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Operating Companies Income to Adjusted Operating Companies Income & Reconciliation of Adjusted Operating Companies Income Margin, excluding Currency and Acquisitions For the Quarters Ended December 31, ($ in millions) (Unaudited) (a) For the calculation of net revenues excluding excise taxes, currency and acquisitions, refer to previous slide Reported Operating Companies Income Less Asset Impairment & Exit Costs Adjusted Operating Companies Income Less Currency Adjusted Operating Companies Income excluding Currency Less Acquisi- tions Adjusted Operating Companies Income excluding Currency & Acquisitions Reported Operating Companies Income Less Asset Impairment & Exit Costs Adjusted Operating Companies Income Adjusted Adjusted excluding Currency Adjusted excluding Currency & Acquisitions 852$ (18)$ 870$ (80)$ 950$ (1)$ 951$ European Union 1,011$ (13)$ 1,024$ (15.0)% (7.2)% (7.1)% 903 (2) 905 (243) 1,148 (8) 1,156 EEMA 811 (264) 1,075 (15.8)% 6.8% 7.5% 573 (11) 584 (112) 696 - 696 Asia 1,055 (19) 1,074 (45.6)% (35.2)% (35.2)% 296 (1) 297 (59) 356 (1) 357 Latin America & Canada 358 (5) 363 (18.2)% (1.9)% (1.7)% 2,624$ (32)$ 2,656$ (494)$ 3,150$ (10)$ 3,160$ PMI Total 3,235$ (301)$ 3,536$ (24.9)% (10.9)% (10.6)% % Points Change Adjusted Operating Companies Income excluding Currency Net Revenues excluding Excise Taxes & Currency(a) Adjusted Operating Companies Income Margin excluding Currency Adjusted Operating Companies Income excluding Currency & Acquisitions Net Revenues excluding Excise Taxes, Currency & Acquisitions(a) Adjusted Operating Companies Income Margin excluding Currency & Acquisitions Adjusted Operating Companies Income Net Revenues excluding Excise Taxes(a) Adjusted Operating Companies Income Margin Adjusted Operating Companies Income Margin excluding Currency Adjusted Operating Companies Income Margin excluding Currency & Acquisitions 950$ 2,197$ 43.2% 951$ 2,191$ 43.4% European Union 1,024$ 2,139$ 47.9% (4.7) (4.5) 1,148 2,480 46.3% 1,156 2,479 46.6% EEMA 1,075 2,257 47.6% (1.3) (1.0) 696 2,164 32.2% 696 2,164 32.2% Asia 1,074 2,476 43.4% (11.2) (11.2) 356 1,037 34.3% 357 1,037 34.4% Latin America & Canada 363 917 39.6% (5.3) (5.2) 3,150$ 7,878$ 40.0% 3,160$ 7,871$ 40.1% PMI Total 3,536$ 7,789$ 45.4% (5.4) (5.3) 2014 2013 2014 2013 % Change in Adjusted Operating Companies Income

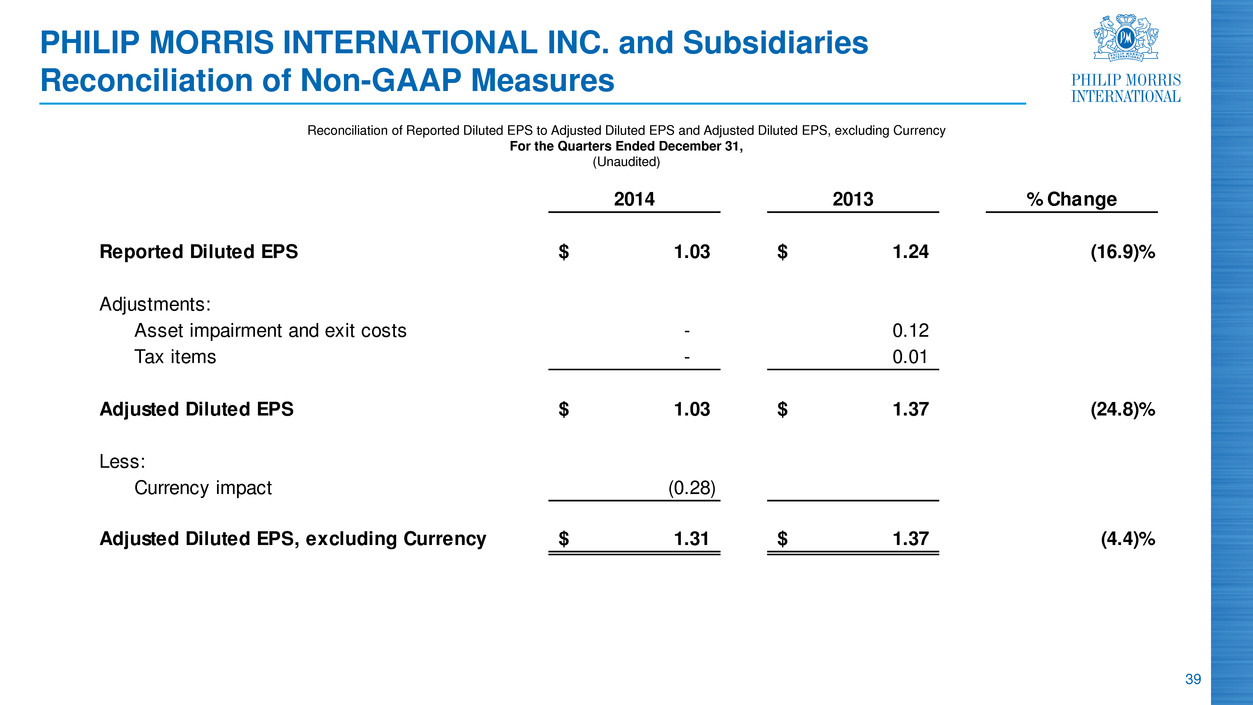

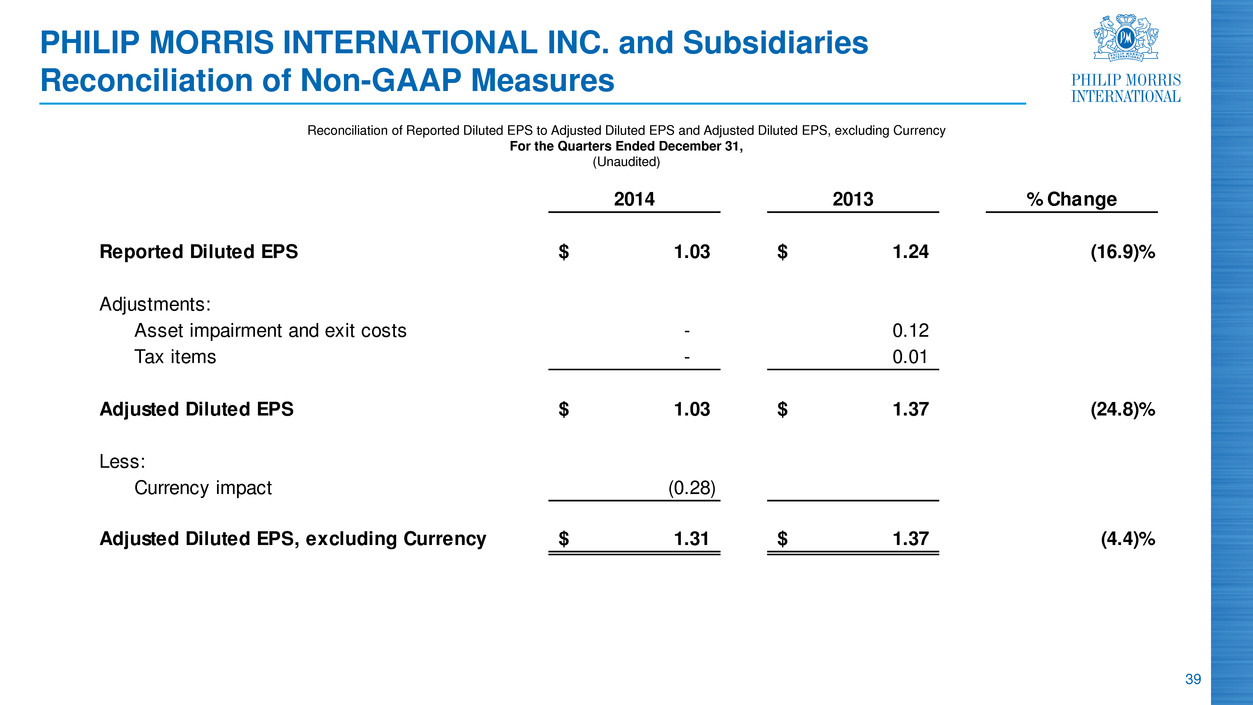

39 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS and Adjusted Diluted EPS, excluding Currency For the Quarters Ended December 31, (Unaudited) 2014 2013 % Change Reported Diluted EPS 1.03$ 1.24$ (16.9)% Adjustments: Asset impairment and exit costs - 0.12 Tax items - 0.01 Adjuste iluted EPS 1.03$ 1.37$ (24.8)% Less: Currency impact (0.28) Adjusted Diluted EPS, excluding Currency 1.31$ 1.37$ (4.4)%

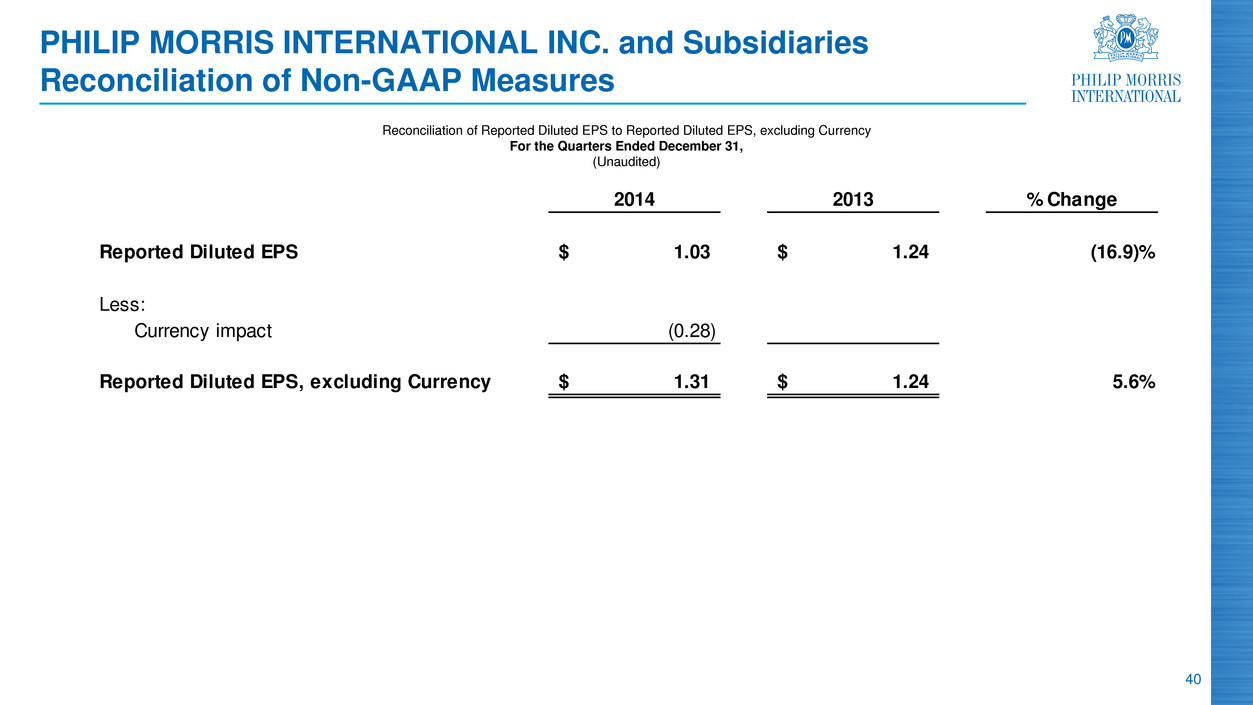

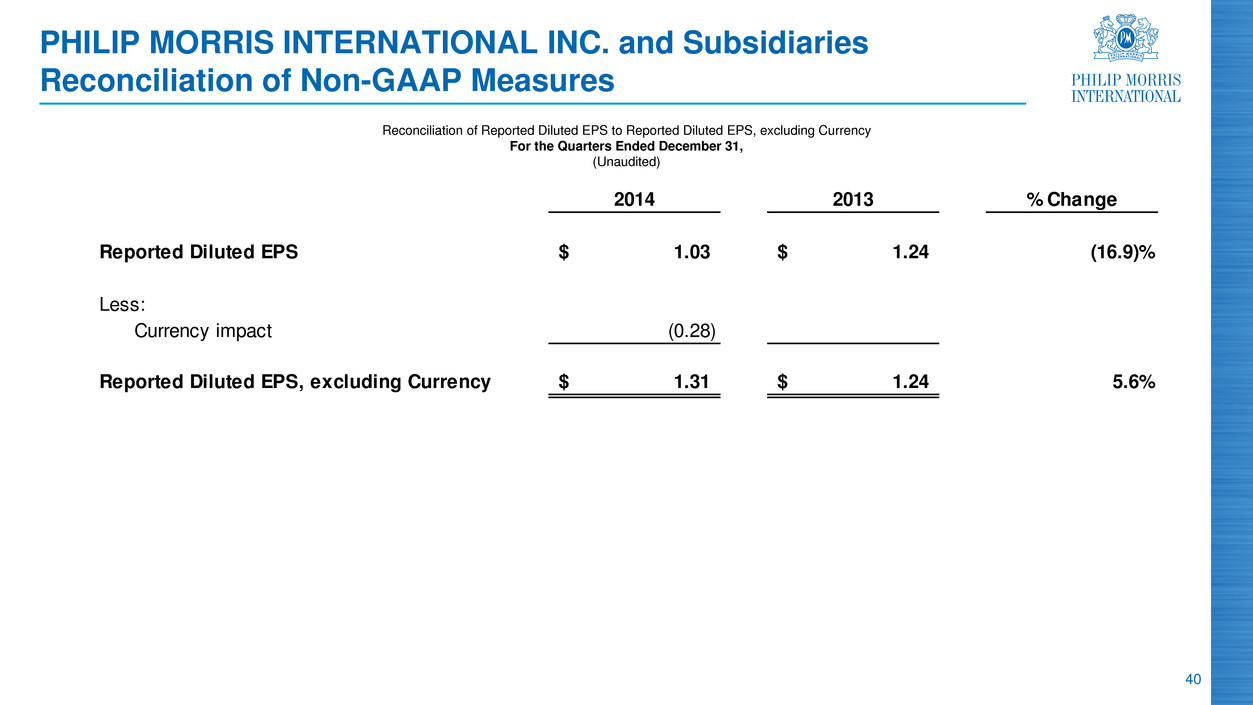

40 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Diluted EPS to Reported Diluted EPS, excluding Currency For the Quarters Ended December 31, (Unaudited) 2014 2013 % Change Reported Diluted EPS 1.03$ 1.24$ (16.9)% Less: Currency impact (0.28) Reported Diluted EPS, excluding Currency 1.31$ 1.24$ 5.6%

41 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS and Adjusted Diluted EPS, excluding Currency For the Quarters Ended December 31, (Unaudited) 2013 2012 % Change Reported Diluted EPS 1.24$ 1.25$ (0.8)% Adjustments: Asset impairment and exit costs 0.12 0.01 Tax items 0.01 (0.02) Adjuste iluted EPS 1.37$ 1.24$ 10.5% Less: Currency impact (0.11) Adjusted Diluted EPS, excluding Currency 1.48$ 1.24$ 19.4%

2014 Fourth-Quarter and Full-Year Results February 5, 2015