2015 First-Quarter Results April 16, 2015 Exhibit 99.3

2 Introduction ● Unless otherwise stated, we will be talking about results for the first quarter of 2015 and comparing them to the same period in 2014 ● A glossary of terms, data tables showing adjustments to net revenues and OCI for currency and acquisitions, asset impairment, exit and other costs, adjustments to EPS, and reconciliations to U.S. GAAP measures, are at the end of today’s webcast slides, which are also posted on our website ● Reduced-Risk Products ("RRPs") is the term the company uses to refer to products with the potential to reduce individual risk and population harm in comparison to smoking combustible cigarettes. PMI’s RRPs are in various stages of development, and we are conducting extensive and rigorous scientific studies to determine whether we can support claims for such products of reduced exposure to harmful and potentially harmful constituents in smoke, and ultimately claims of reduced disease risk, when compared to smoking combustible cigarettes. Before making any such claims, we will need to rigorously evaluate the full set of data from the relevant scientific studies to determine whether they substantiate reduced exposure or risk. Any such claims may also be subject to government review and approval, as is the case in the U.S. today

3 Forward-Looking and Cautionary Statements ● This presentation and related discussion contain forward-looking statements. Achievement of projected results is subject to risks, uncertainties and inaccurate assumptions, and PMI is identifying important factors that, individually or in the aggregate, could cause actual results to differ materially from those contained in any forward-looking statements made by PMI ● PMI’s business risks include: significant increases in cigarette-related taxes; the imposition of discriminatory excise tax structures; fluctuations in customer inventory levels due to increases in product taxes and prices; increasing marketing and regulatory restrictions, often with the goal of reducing or preventing the use of tobacco products; health concerns relating to the use of tobacco products and exposure to environmental tobacco smoke; litigation related to tobacco use; intense competition; the effects of global and individual country economic, regulatory and political developments; changes in adult smoker behavior; lost revenues as a result of counterfeiting, contraband and cross-border purchases; governmental investigations; unfavorable currency exchange rates and currency devaluations; adverse changes in applicable corporate tax laws; adverse changes in the cost and quality of tobacco and other agricultural products and raw materials; and the integrity of its information systems. PMI’s future profitability may also be adversely affected should it be unsuccessful in its attempts to produce products that have the potential to reduce exposure to harmful constituents in smoke, individual risk and population harm; if it is unable to successfully introduce new products, promote brand equity, enter new markets or improve its margins through increased prices and productivity gains; if it is unable to expand its brand portfolio internally or through acquisitions and the development of strategic business relationships; or if it is unable to attract and retain the best global talent ● PMI is further subject to other risks detailed from time to time in its publicly filed documents, including the Form 10-K for the year ended December 31, 2014. PMI cautions that the foregoing list of important factors is not a complete discussion of all potential risks and uncertainties. PMI does not undertake to update any forward-looking statement that it may make from time to time, except in the normal course of its public disclosure obligations

4 Raising 2015 EPS Guidance ● Raising 2015 reported diluted EPS guidance to a range of $4.32 to $4.42, at prevailing exchange rates ● Increase reflects a better-than-expected volume and share performance in Q1, 2015, and an improved outlook for the balance of the year ● Guidance continues to include approximately $1.15 of unfavorable currency at prevailing exchange rates ● Excluding currency, guidance represents a growth rate of 9% to 11% compared to adjusted diluted EPS of $5.02 in 2014 Source: PMI Financials or estimates

5 Source: PMI Financials or estimates Q1, 2015: Strong Organic Volume Performance ● Organic cigarette volume grew by 1.4%, driven by: - Market share gains across all Regions - Favorable inventory movements - Partly offset by lower cigarette industry volume ● Excluding inventory movements, organic cigarette volume declined by an estimated 0.5%

6 (a) Excluding currency and acquisitions (b) Excluding currency Source: PMI Financials or estimates 9.1% 16.3% 23.5% Net Revenues Adjusted OCI Adjusted Diluted EPS Q1, 2015: Strong Currency-Neutral Financial Results Growth (Q1, 2015 vs. PY) (a) (a) (b)

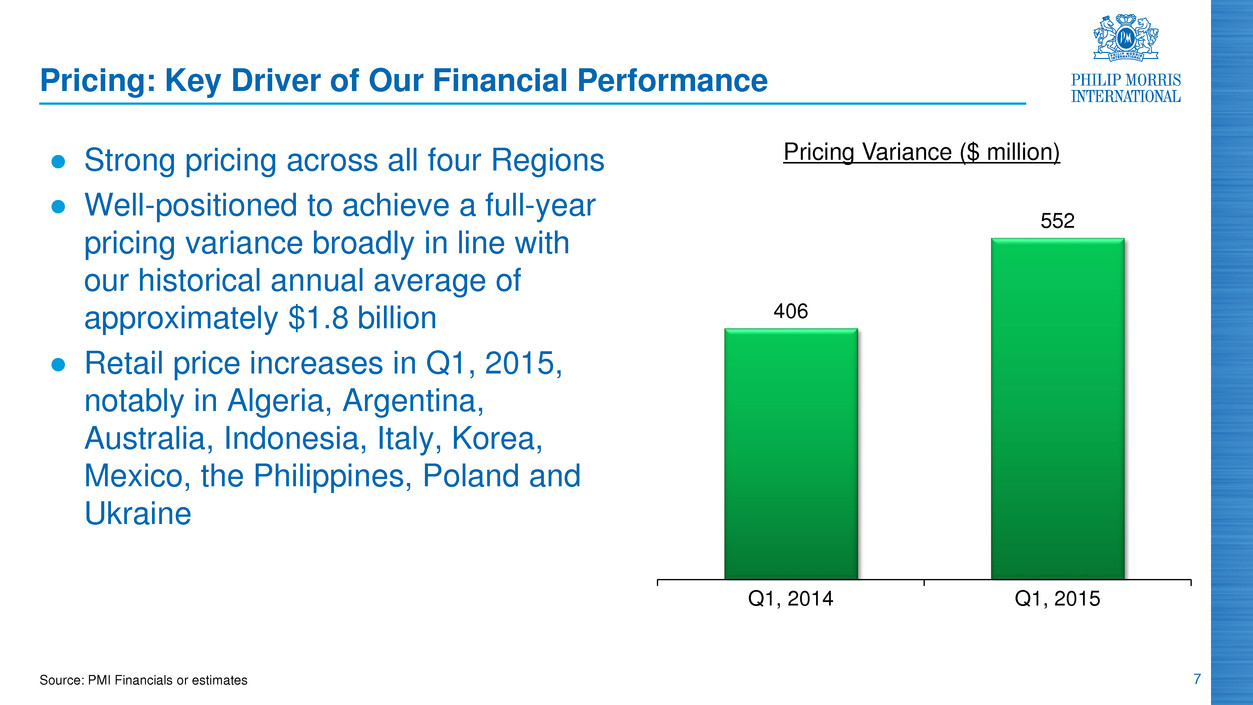

7 Pricing: Key Driver of Our Financial Performance ● Strong pricing across all four Regions ● Well-positioned to achieve a full-year pricing variance broadly in line with our historical annual average of approximately $1.8 billion ● Retail price increases in Q1, 2015, notably in Algeria, Argentina, Australia, Indonesia, Italy, Korea, Mexico, the Philippines, Poland and Ukraine 406 552 Q1, 2014 Q1, 2015 Pricing Variance ($ million) Source: PMI Financials or estimates

8 Market Share Momentum: Top-30 OCI Markets Note: Excluding duty free Source: PMI Financials or estimates [VALUE] [VALUE] Q1, 2014 Q1, 2015 +1.2pp PMI Market Share in Top-30 OCI Markets (%)

9 Regional Market Share Gains Underpinned by Marlboro (a) Excluding China Source: PMI Financials or estimates [VALUE] [VALUE] [VALUE] [VALUE] LA&C Asia EEMA EU PMI Share Variance (Q1, 2015 vs. PY) Regional Marlboro [VALUE] [VALUE] [VALUE] (0.1)pp 39.6% 24.9% 24.7% 38.3% 19.2% 7.9% 6.1% 14.6% (a) Q1, 2015 SoM Q1, 2015 SoM

10 EEMA Region: Largest Contributor to Our Strong Q1, 2015 Results ● Regional share increased by 0.7 points to 24.9% in Q1, 2015: - Parliament, Marlboro and L&M performing strongly - Share gains in North Africa, Russia and Saudi Arabia ● Double-digit growth in net revenues and adjusted OCI, ex-currency and acquisitions, driven by: - Higher pricing - Favorable volume/mix 10 (a) Excluding currency and acquisitions Source: PMI Financials or estimates and Nielsen [VALUE]% [VALUE]% Net Revenues Adjusted OCI Growth (Q1, 2015 vs. PY)(a)

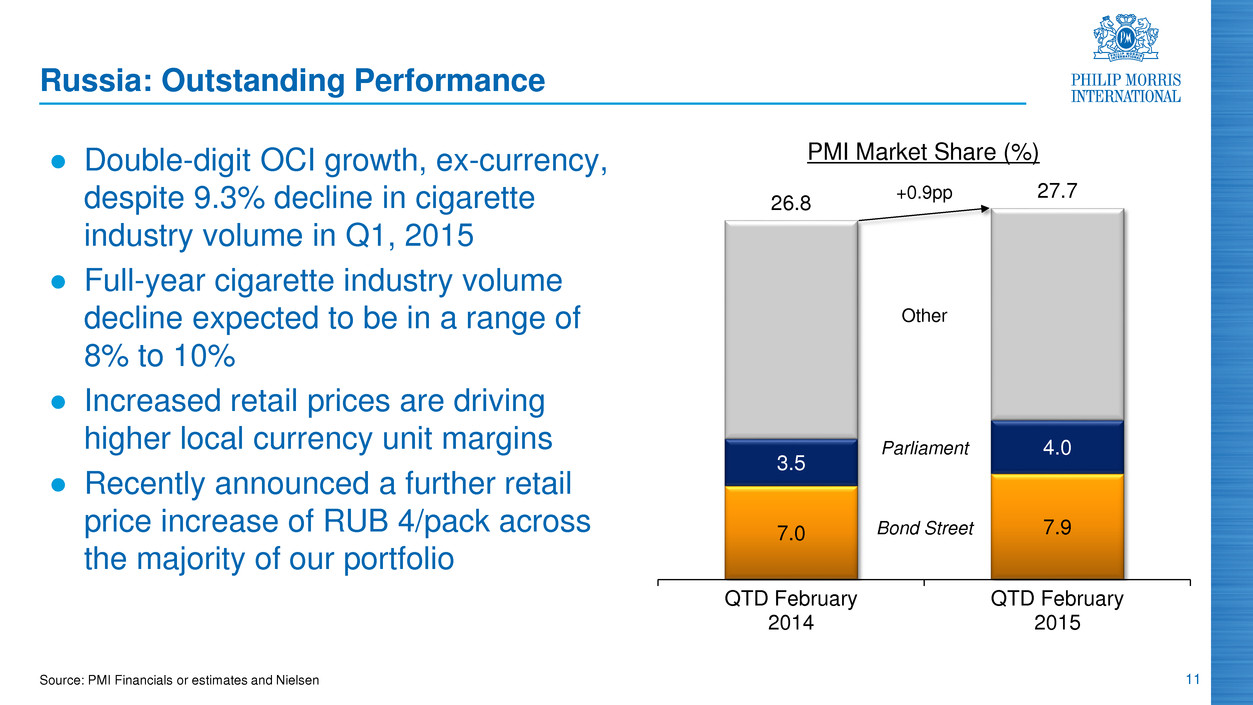

11 Russia: Outstanding Performance ● Double-digit OCI growth, ex-currency, despite 9.3% decline in cigarette industry volume in Q1, 2015 ● Full-year cigarette industry volume decline expected to be in a range of 8% to 10% ● Increased retail prices are driving higher local currency unit margins ● Recently announced a further retail price increase of RUB 4/pack across the majority of our portfolio Source: PMI Financials or estimates and Nielsen 7.0 7.9 3.5 4.0 26.8 27.7 QTD February 2014 QTD February 2015 PMI Market Share (%) Bond Street Other +0.9pp Parliament

12 Source: PMI Financials or estimates EU Region: Continued PMI Cigarette Market Share Momentum ● Cigarette industry volume down by an estimated 2.7% in Q1, 2015, excluding trade inventory movements ● Forecast a cigarette industry volume decline of approximately 4% in 2015 ● Regional cigarette share up by 0.4 points in Q1, 2015, to 39.6% ● Share growth in the five largest markets by cigarette industry volume [VALUE] [VALUE] [VALUE] Chesterfield L&M Marlboro SoM 19.2% 7.0% 5.8% Industry Rank #1 #2 #3 Cigarette Market Share Growth (Q1, 2015 vs. PY) Q1, 2015

13 EU Region: Returning to Currency-Neutral OCI Growth in 2015 ● First-quarter adjusted OCI, ex-currency and acquisitions, grew by 12.9%, driven by: - Higher pricing - Favorable volume/mix, notably in Southern Europe ● Expect the Region to be a positive contributor to PMI’s full-year adjusted OCI growth, ex-currency and acquisitions Source: PMI Financials or estimates

14 Note: Translation from Japanese: "Evolved Marlboro now in your hand" Source: PMI Financials or estimates and Tobacco Institute of Japan Japan: Investing in Our Brands ● Cigarette industry volume declined by 13.9% in Q1, 2015 ● Adjusted for inventory movements, the decline was an estimated 3.5% ● Forecast 2015 cigarette industry volume decline of 2.5% to 3.0% ● Expect full-year share to benefit from: - Recent roll-out of Marlboro 2.0 - Strong pipeline of innovations 25.5 25.6 Q1, 2014 Q1, 2015 PMI Market Share (%)

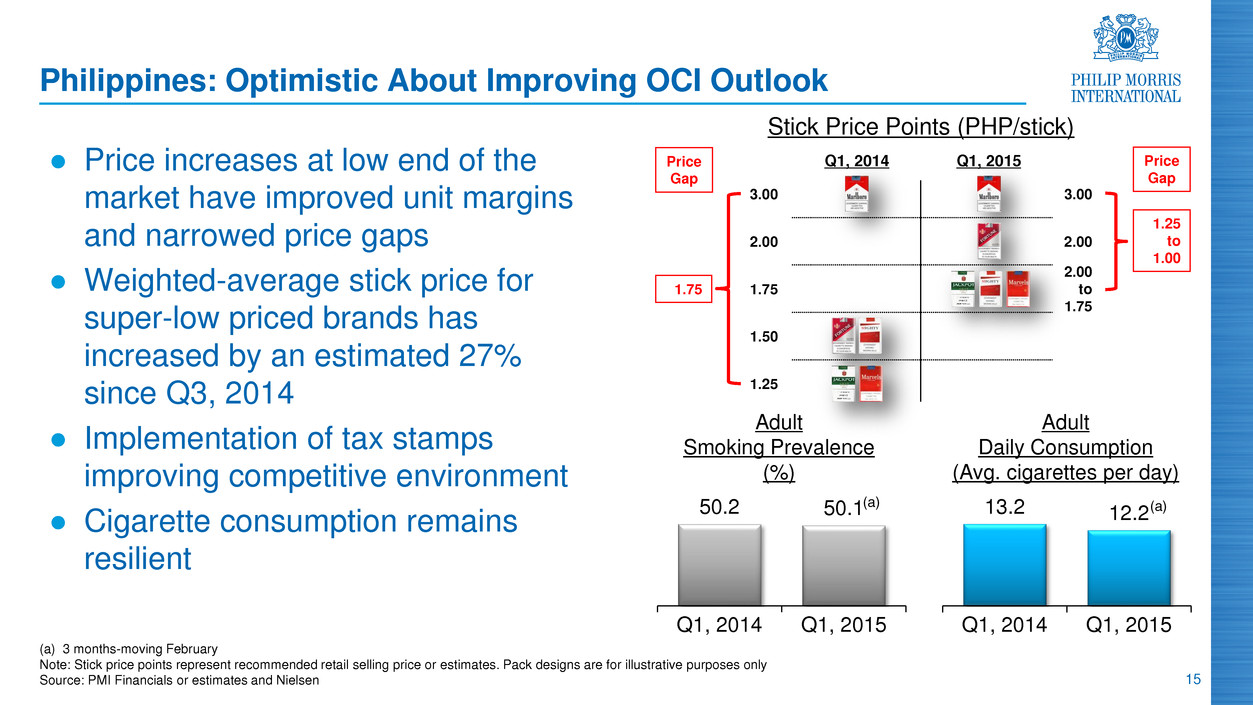

15 (a) 3 months-moving February Note: Stick price points represent recommended retail selling price or estimates. Pack designs are for illustrative purposes only Source: PMI Financials or estimates and Nielsen Philippines: Optimistic About Improving OCI Outlook ● Price increases at low end of the market have improved unit margins and narrowed price gaps ● Weighted-average stick price for super-low priced brands has increased by an estimated 27% since Q3, 2014 ● Implementation of tax stamps improving competitive environment ● Cigarette consumption remains resilient Stick Price Points (PHP/stick) 50.2 50.1 Q1, 2014 Q1, 2015 Adult Smoking Prevalence (%) 13.2 12.2 Q1, 2014 Q1, 2015 Adult Daily Consumption (Avg. cigarettes per day) (a) (a) Q1, 2014 Q1, 2015 1.25 to 1.00 1.75 1.50 Price Gap 1.25 2.00 3.00 Price Gap 1.75 3.00 2.00 2.00 to 1.75

16 5.3 5.2 5.1 5.0 5.1 21.0 21.7 22.4 22.7 23.1 8.3 7.8 7.7 7.6 7.2 34.6 34.7 35.2 35.3 35.4 Q1 Q2 Q3 Q4 Q1 Note: Whites stands for non-kretek cigarettes Source: PMI Financials or estimates Indonesia: Continued Share Growth in Q1, 2015 ● Cigarette industry volume grew by 5.9% in Q1, 2015 ● Forecast cigarette industry volume growth in 2015 of approximately 2% ● Q1, 2015 market share growth driven by strong performance in the growing machine-made kretek segment ● Continued pressure on our hand- rolled kretek brands ● Four consecutive quarters of sequential market share growth 2014 Hand-Rolled Kretek Machine-Made Kretek Whites 2015 PMI Market Share (%)

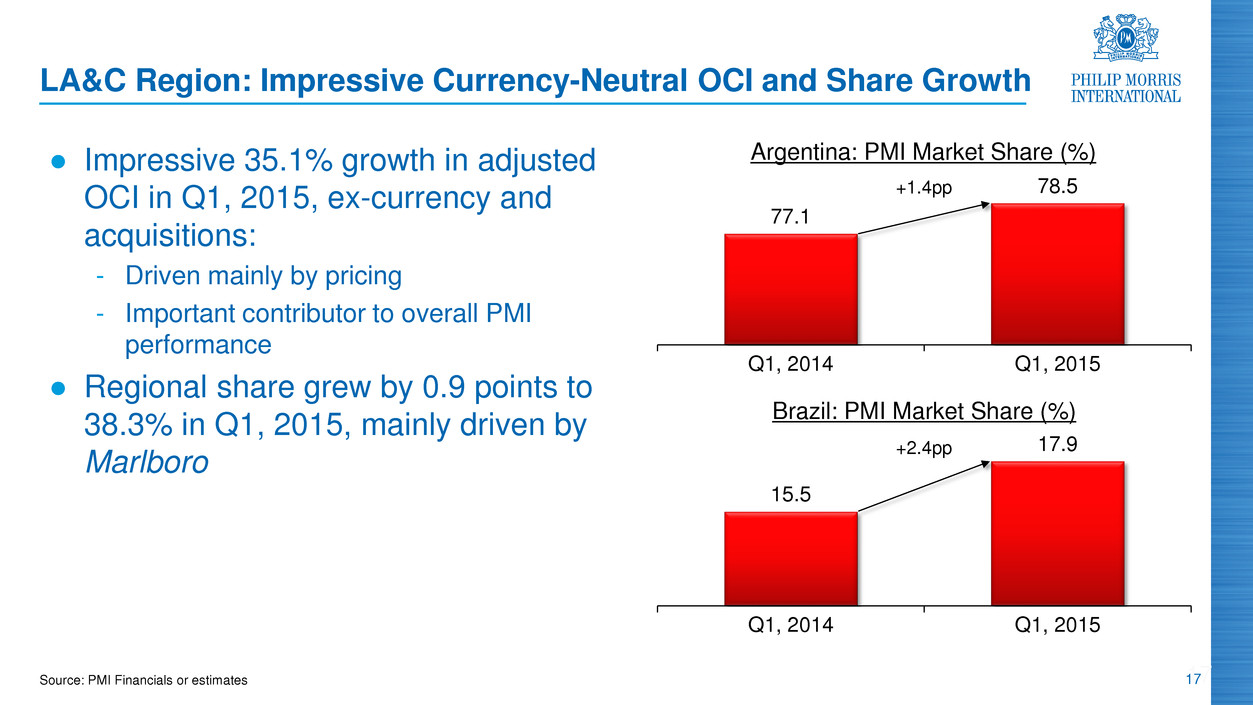

17 Source: PMI Financials or estimates LA&C Region: Impressive Currency-Neutral OCI and Share Growth ● Impressive 35.1% growth in adjusted OCI in Q1, 2015, ex-currency and acquisitions: - Driven mainly by pricing - Important contributor to overall PMI performance ● Regional share grew by 0.9 points to 38.3% in Q1, 2015, mainly driven by Marlboro 7 15.5 17.9 Q1, 2014 Q1, 2015 Brazil: PMI Market Share (%) 77.1 78.5 Q1, 2014 Q1, 2015 +1.4pp +2.4pp Argentina: PMI Market Share (%)

18 Note: Reduced-Risk Products ("RRPs") is the term we use to refer to products with the potential to reduce individual risk and population harm in comparison to smoking combustible cigarettes Source: PMI Financials or estimates iQOS: On Track ● Performance is in line with, or exceeds, our expectations ● Sales of HeatSticks are growing sequentially ● Pilot launches providing valuable learnings ● On track with plans to commence national expansion in Japan and Italy, as well as pilot or national launches in other markets, later this year

19 Attractive Dividend Yield 2.0% 3.1% 5.1% 10-Year U.S. Treasury Proxy Peer Group PMI PMI vs. Benchmarks (April 10, 2015) 2.7% 3.9% 4.0% 5.1% Japan Tobacco Imperial Tobacco BAT PMI PMI vs. Main International Tobacco Competitors (April 10, 2015) Note: Dividend yield represents the annualized dividend on April 10, 2015, over the closing share price on that date. The closing share price for PMI was $77.90 on April 10, 2015. The current annualized dividend for PMI was $4.00. The Proxy Peer Group includes the Compensation Survey and Tobacco Peer Groups, which are defined in the glossary Source: FactSet and Bloomberg, compiled by Centerview

20 Note: Reduced-Risk Products ("RRPs") is the term we use to refer to products with the potential to reduce individual risk and population harm in comparison to smoking combustible cigarettes Source: PMI Financials or estimates Conclusion: An Excellent Start to the Year ● Strong currency-neutral results in Q1, 2015, driven by business fundamentals ● Superior brands, supported by a superb commercial organization, driving positive market share momentum and strong pricing ● We continue to focus vigorously on our cost base ● iQOS pilot launches performing well. On track with plans for national expansions and additional launches this year ● Managing our cash flow prudently ● Attractive dividend yield ● Raising our 2015 reported diluted EPS guidance which, on a currency-neutral basis, reflects a growth rate of 9% to 11% versus 2014 adjusted diluted EPS of $5.02

2015 First-Quarter Results Questions & Answers Download PMI’s Investor Relations App iOS Android

Glossary and Reconciliation of Non-GAAP Measures

23 Glossary: General Terms ● PMI stands for Philip Morris International Inc. and its subsidiaries ● Until March 28, 2008, PMI was a wholly owned subsidiary of Altria Group, Inc. ("Altria"). Since that time the company has been independent and is listed on the New York Stock Exchange (ticker symbol "PM") ● PMI volumes refer to PMI cigarette shipment data, unless otherwise stated ● Organic volume refers to volume excluding acquisitions ● References to total international cigarette market, total cigarette market, total market and market shares reflect our best estimates based on a number of internal and external sources ● Trademarks are italicized

24 Glossary: Financial Terms ● Net revenues exclude excise taxes ● EPS stands for Earnings per Share ● Operating Companies Income, or "OCI", is defined as operating income, excluding general corporate expenses and the amortization of intangibles, plus equity (income) or loss in unconsolidated subsidiaries, net. OCI growth rates are on an adjusted basis, which excludes asset impairment, exit and other costs ● Adjusted OCI is defined as reported OCI adjusted for asset impairment, exit and other costs

25 Glossary: Industry/Market Terms ● EEMA refers to the Eastern Europe, Middle East & Africa Region ● EU refers to the European Union Region ● LA&C refers to the Latin America & Canada Region ● North Africa: Algeria, Egypt, Libya, Morocco and Tunisia ● Southern Europe: Andorra, Azores, Canary Islands, Cyprus, Greece, Italy, Madeira, Malta, Portugal and Spain ● Smoking prevalence refers to the percentage of the adult population that regularly smoke factory-made cigarettes in a given time period ● SoM stands for Share of Market

26 Glossary: Reduced-Risk Products ● HeatStick tobacco sticks are novel patented tobacco products specifically designed by PMI for use with PMI’s iQOS system. The tobacco in the HeatStick is heated by our iQOS technology to provide adult smokers with real tobacco taste and satisfaction without combustion ● iQOS is the new brand name under which PMI has chosen to commercialize the Platform 1 electronic system ● Reduced-Risk Products ("RRPs") is the term the company uses to refer to products with the potential to reduce individual risk and population harm in comparison to smoking combustible cigarettes. PMI’s RRPs are in various stages of development, and we are conducting extensive and rigorous scientific studies to determine whether we can support claims for such products of reduced exposure to harmful and potentially harmful constituents in smoke, and ultimately claims of reduced disease risk, when compared to smoking combustible cigarettes. Before making any such claims, we will need to rigorously evaluate the full set of data from the relevant scientific studies to determine whether they substantiate reduced exposure or risk. Any such claims may also be subject to government review and approval, as is the case in the U.S. today

27 PMI Peer Groups (a) Effective until September 30, 2012 (b) Effective as of October 1, 2012 - BAT - Bayer - Coca-Cola - Diageo - GlaxoSmithKline - Heineken - Imperial Tobacco - Johnson & Johnson - Kraft(a) - McDonald’s - Mondelēz International(b) - Nestlé - Novartis - PepsiCo - Pfizer - Roche - Unilever - Vodafone - Altria - BAT - Imperial Tobacco - Japan Tobacco - Lorillard - Reynolds American Compensation Survey Group Tobacco Peer Group

28 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS For the Year Ended December 31, (Unaudited) 2014 Reported Diluted EPS 4.76$ Adjustments: Asset impairment and exit costs 0.26 Tax items - Adjuste Diluted EPS 5.02$

29 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Adjustments for the Impact of Currency and Acquisitions For the Quarters Ended March 31, ($ in millions) (Unaudited) Reported Net Revenues Less Excise Taxes Reported Net Revenues excluding Excise Taxes Less Currency Reported Net Revenues excluding Excise Taxes & Currency Less Acquisi- tions Reported Net Revenues excluding Excise Taxes, Currency & Acquisitions Reported Net Revenues Less Excise Taxes Reported Net Revenues excluding Excise Taxes Reported Reported excluding Currency Reported excluding Currency & Acquisitions 5,940$ 4,048$ 1,892$ (278)$ 2,170$ 7$ 2,163$ European Union 6,619$ 4,606$ 2,013$ (6.0)% 7.8% 7.5% 4,429 2,586 1,843 (445) 2,288 - 2,288 EEMA 4,562 2,553 2,009 (8.3)% 13.9% 13.9% 4,764 2,609 2,155 (128) 2,283 - 2,283 Asia 4,475 2,293 2,182 (1.2)% 4.6% 4.6% 2,219 1,493 726 (88) 814 1 813 Latin America & Canada 2,123 1,410 713 1.8% 14.2% 14.0% 17,352$ 10,736$ 6,616$ (939)$ 7,555$ 8$ 7,547$ PMI Total 17,779$ 10,862$ 6,917$ (4.4)% 9.2% 9.1% Reported Operating Companies I come Less Currency Reported Operating Companies Income excluding Currency Less Acquisi- tions Reported Operating Companies Income excluding Currency & Acquisitions Reported Operating Companies Income Reported Reported excluding Currency Reported excluding Currency & Acquisitions 913$ (191)$ 1,104$ -$ 1,104$ European Union 978$ (6.6)% 12.9% 12.9% 880 (271) 1,151 - 1,151 EEMA 927 (5.1)% 24.2% 24.2% 934 (79) 1,013 - 1,013 Asia 915 2.1% 10.7% 10.7% 230 (44) 274 1 273 Latin America & Canada 202 13.9% 35.6% 35.1% 2,957$ (585)$ 3,542$ 1$ 3,541$ PMI Total 3,022$ (2.2)% 17.2% 17.2% 2015 2014 % Change in Reported Operating Companies Income 2015 2014 % Change in Reported Net Revenues excluding Excise Taxes

30 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Operating Companies Income to Adjusted Operating Companies Income & Reconciliation of Adjusted Operating Companies Income Margin, excluding Currency and Acquisitions For the Quarters Ended March 31, ($ in millions) (Unaudited) (a) For the calculation of net revenues excluding excise taxes, currency and acquisitions, refer to previous slide Reported Operating Companies Income Less Asset Impairment & Exit Costs Adjusted Operating Companies Income Less Currency Adjusted Operating Companies Income excluding Currency Less Acquisi- tions Adjusted Operating Companies Income excluding Currency & Acquisitions Reported Operating Companies Income Less Asset Impairment & Exit Costs Adjusted Operating Companies Income Adjusted Adjusted excluding Currency Adjusted excluding Currency & Acquisitions 913$ -$ 913$ (191)$ 1,104$ -$ 1,104$ European Union 978$ -$ 978$ (6.6)% 12.9% 12.9% 880 - 880 (271) 1,151 - 1,151 EEMA 927 - 927 (5.1)% 24.2% 24.2% 934 - 934 (79) 1,013 - 1,013 Asia 915 (23) 938 (0.4)% 8.0% 8.0% 230 - 230 (44) 274 1 273 Latin America & Canada 202 - 202 13.9% 35.6% 35.1% 2,957$ -$ 2,957$ (585)$ 3,542$ 1$ 3,541$ PMI Total 3,022$ (23)$ 3,045$ (2.9)% 16.3% 16.3% % Points Change Adjusted Operating Companies Income excluding Currency Net Revenues excluding Excise Taxes & Currency(a) Adjusted Operating Companies Income Margin excluding Currency Adjusted Operating Companies Income excluding Currency & Acquisitions Net Revenues excluding Excise Taxes, Currency & Acquisitions(a) Adjusted Operating Companies Income Margin excluding Currency & Acquisitions Adjusted Operating Companies Income Net Revenues excluding Excise Taxes(a) Adjusted Operating Companies Income Margin Adjusted Operating Companies Income Margin excluding Currency Adjusted Operating Companies Income Margin excluding Currency & Acquisitions 1,104$ 2,170$ 50.9% 1,104$ 2,163$ 51.0% European Union 978$ 2,013$ 48.6% 2.3 2.4 1,151 2,288 50.3% 1,151 2,288 50.3% EEMA 927 2,009 46.1% 4.2 4.2 1,013 2,283 44.4% 1,013 2,283 44.4% Asia 938 2,182 43.0% 1.4 1.4 274 814 33.7% 273 813 33.6% Latin America & Canada 202 713 28.3% 5.4 5.3 3,542$ 7,555$ 46.9% 3,541$ 7,547$ 46.9% PMI Total 3,045$ 6,917$ 44.0% 2.9 2.9 2015 2014 2015 2014 % Change in Adjusted Operating Companies Income

31 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS and Adjusted Diluted EPS, excluding Currency For the Quarters Ended March 31, (Unaudited) 2015 2014 % Change Reported Diluted EPS 1.16$ 1.18$ (1.7)% Adjustments: Asset impairment and exit costs - 0.01 Tax items - - Adjuste iluted EPS 1.16$ 1.19$ (2.5)% Less: Currency impact (0.31) Adjusted Diluted EPS, excluding Currency 1.47$ 1.19$ 23.5%

32 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Diluted EPS to Reported Diluted EPS, excluding Currency For the Quarters Ended March 31, (Unaudited) 2015 2014 % Change Reported Diluted EPS 1.16$ 1.18$ (1.7)% Less: Currency impact (0.31) Reported Diluted EPS, excluding Currency 1.47$ 1.18$ 24.6%

33 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Operating Cash Flow to Free Cash Flow and Free Cash Flow, excluding Currency Reconciliation of Operating Cash Flow to Operating Cash Flow, excluding Currency For the Quarters Ended March 31, ($ in millions) (Unaudited) (a) Operating Cash Flow 2015 2014 % Change Net cash provided by operating activities(a) (375)$ 715$ >(100.0)% Less: Capital expenditures 203 256 Free cash flow (578)$ 459$ >(100.0)% Less: Currency impact (956) Free cash flow, excluding currency 378$ 459$ (17.6)% 2015 2014 % Change et cash provided by operating activities(a) (375)$ 715$ >(100.0)% Less: Currency impact (986) Net cash provided by operating activities, excluding currency 611$ 715$ (14.5)% March 31, For the Quarters Ended For the Quarters Ended March 31,

2015 First-Quarter Results April 16, 2015