2015 Second-Quarter Results July 16, 2015 Exhibit 99.3

2 Introduction ● Unless otherwise stated, we will be talking about results for the second quarter of 2015 and comparing them to the same period in 2014 ● A glossary of terms, data tables showing adjustments to net revenues and OCI for currency and acquisitions, asset impairment, exit and other costs, free cash flow calculations, adjustments to EPS, and reconciliations to U.S. GAAP measures, are at the end of today’s webcast slides, which are also posted on our website ● Reduced-Risk Products ("RRPs") is the term the company uses to refer to products with the potential to reduce individual risk and population harm in comparison to smoking combustible cigarettes. PMI’s RRPs are in various stages of development and commercialization, and we are conducting extensive and rigorous scientific studies to determine whether we can support claims for such products of reduced exposure to harmful and potentially harmful constituents in smoke, and ultimately claims of reduced disease risk, when compared to smoking combustible cigarettes. Before making any such claims, we will rigorously evaluate the full set of data from the relevant scientific studies to determine whether they substantiate reduced exposure or risk. Any such claims may also be subject to government review and approval, as is the case in the U.S. today

3 Forward-Looking and Cautionary Statements ● This presentation and related discussion contain forward-looking statements. Achievement of projected results is subject to risks, uncertainties and inaccurate assumptions, and PMI is identifying important factors that, individually or in the aggregate, could cause actual results to differ materially from those contained in any forward-looking statements made by PMI ● PMI’s business risks include: significant increases in cigarette-related taxes; the imposition of discriminatory excise tax structures; fluctuations in customer inventory levels due to increases in product taxes and prices; increasing marketing and regulatory restrictions, often with the goal of reducing or preventing the use of tobacco products; health concerns relating to the use of tobacco products and exposure to environmental tobacco smoke; litigation related to tobacco use; intense competition; the effects of global and individual country economic, regulatory and political developments; changes in adult smoker behavior; lost revenues as a result of counterfeiting, contraband and cross-border purchases; governmental investigations; unfavorable currency exchange rates and currency devaluations; adverse changes in applicable corporate tax laws; adverse changes in the cost and quality of tobacco and other agricultural products and raw materials; and the integrity of its information systems. PMI’s future profitability may also be adversely affected should it be unsuccessful in its attempts to produce products with the potential to reduce exposure to harmful constituents in smoke, individual risk and population harm; if it is unable to successfully introduce new products, promote brand equity, enter new markets or improve its margins through increased prices and productivity gains; if it is unable to expand its brand portfolio internally or through acquisitions and the development of strategic business relationships; or if it is unable to attract and retain the best global talent ● PMI is further subject to other risks detailed from time to time in its publicly filed documents, including the Form 10-Q for the quarter ended March 31, 2015. PMI cautions that the foregoing list of important factors is not a complete discussion of all potential risks and uncertainties. PMI does not undertake to update any forward-looking statement that it may make from time to time, except in the normal course of its public disclosure obligations

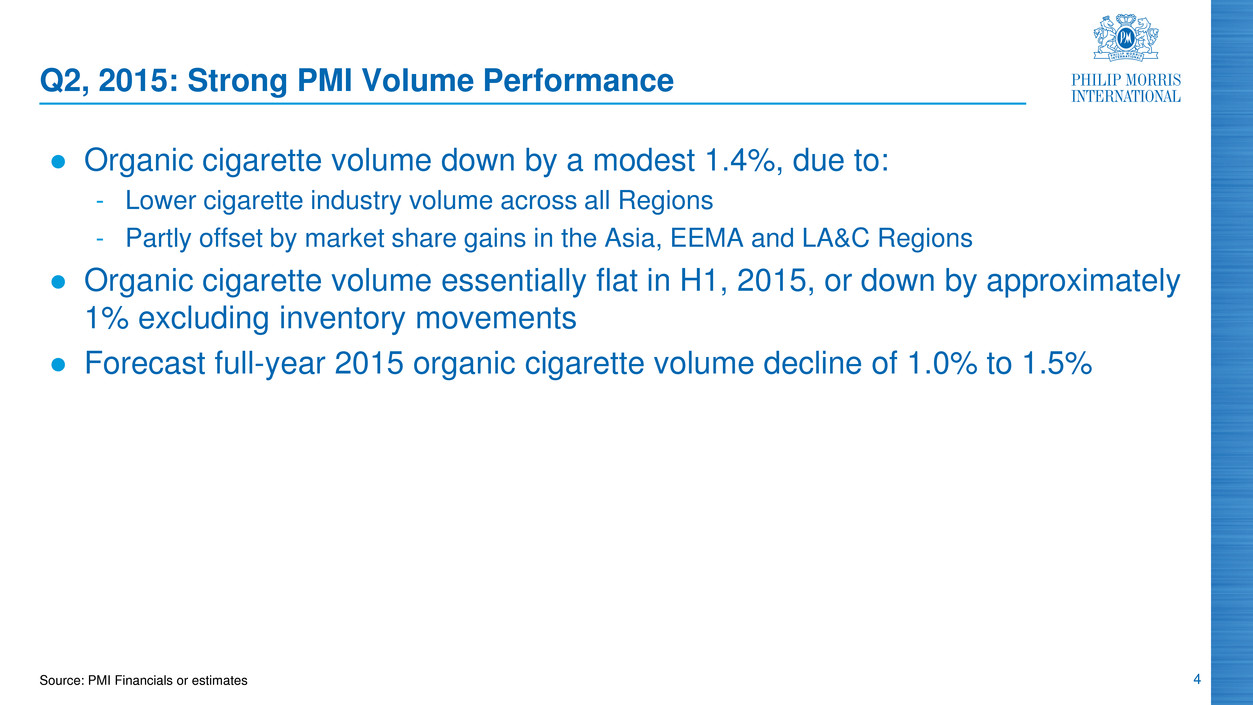

4 Q2, 2015: Strong PMI Volume Performance ● Organic cigarette volume down by a modest 1.4%, due to: - Lower cigarette industry volume across all Regions - Partly offset by market share gains in the Asia, EEMA and LA&C Regions ● Organic cigarette volume essentially flat in H1, 2015, or down by approximately 1% excluding inventory movements ● Forecast full-year 2015 organic cigarette volume decline of 1.0% to 1.5% Source: PMI Financials or estimates

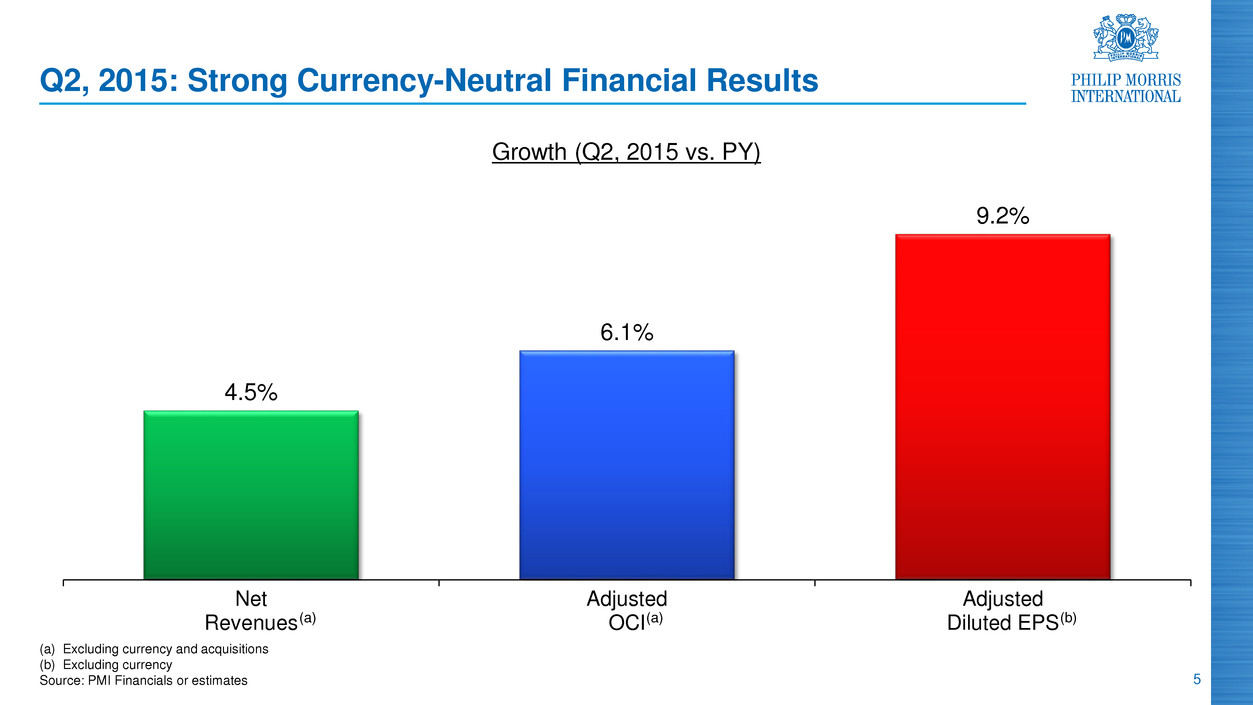

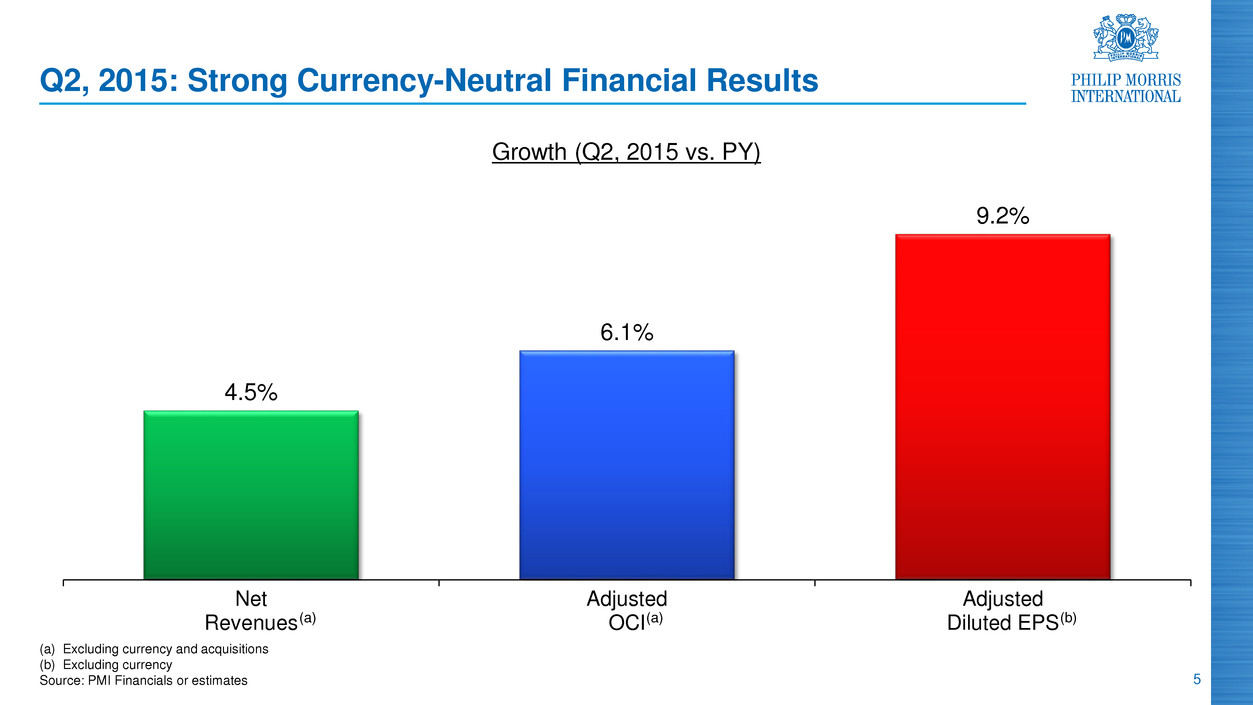

5 (a) Excluding currency and acquisitions (b) Excluding currency Source: PMI Financials or estimates 4.5% 6.1% 9.2% Net Revenues Adjusted OCI Adjusted Diluted EPS Q2, 2015: Strong Currency-Neutral Financial Results Growth (Q2, 2015 vs. PY) (a) (a) (b)

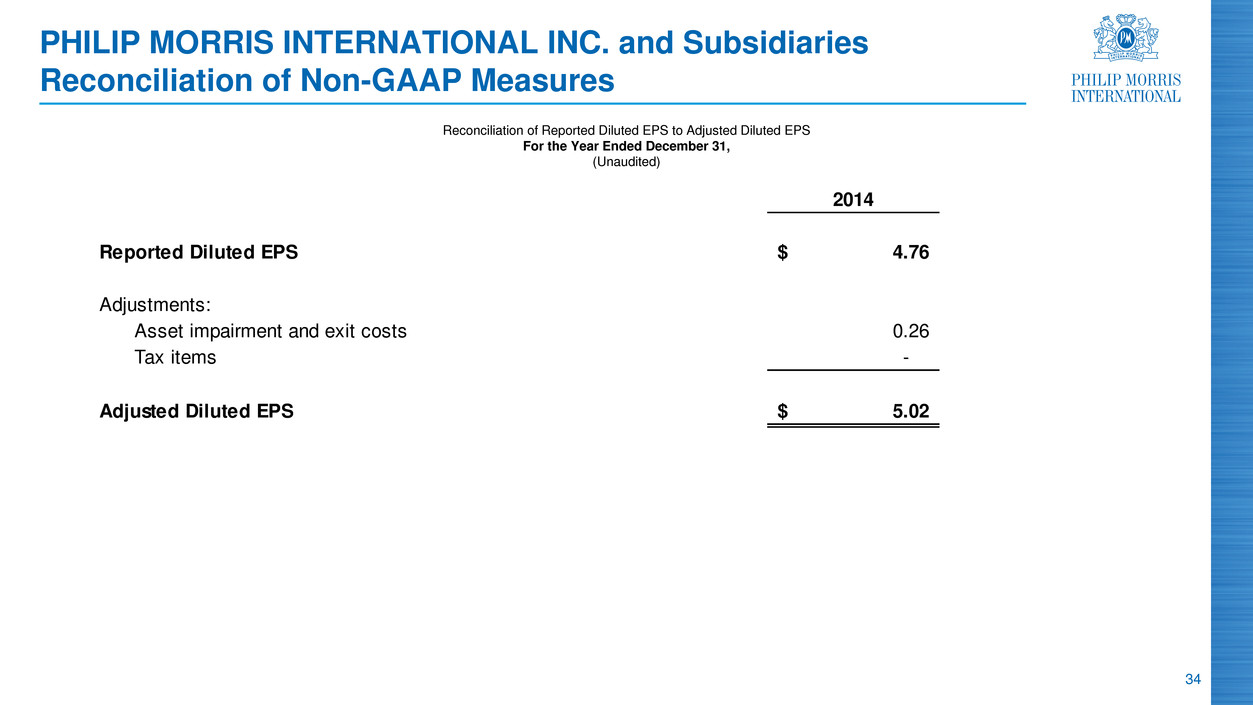

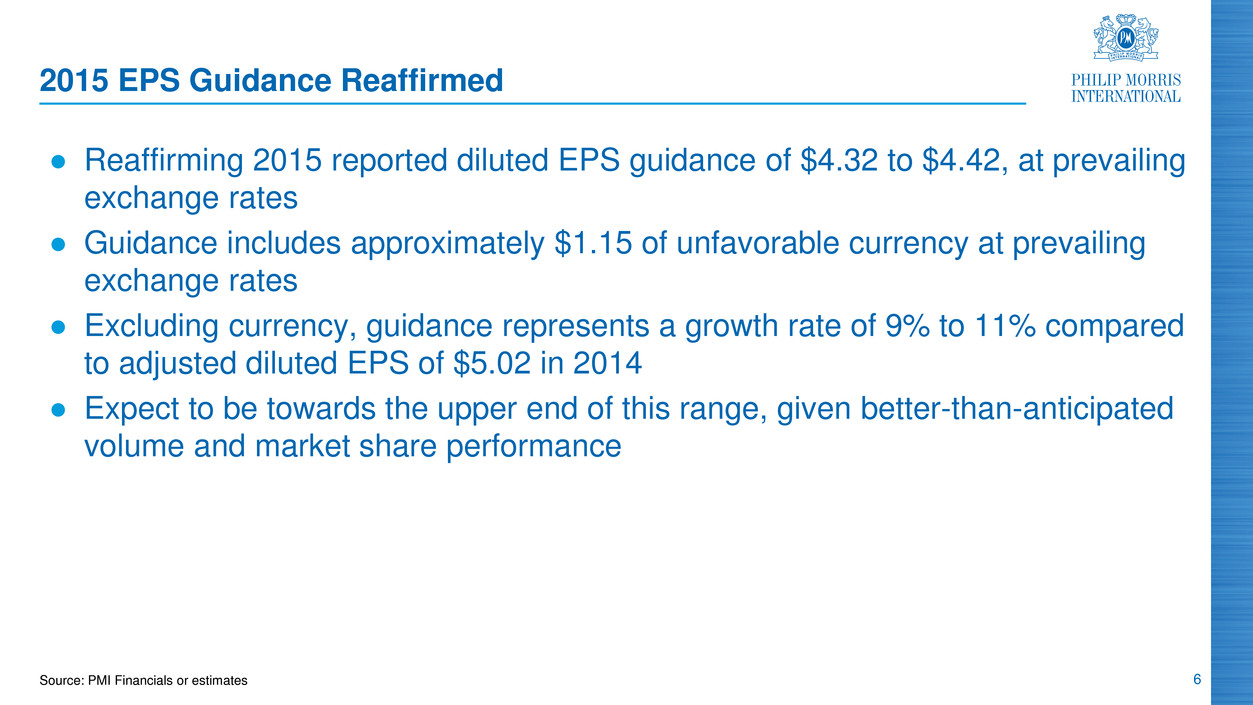

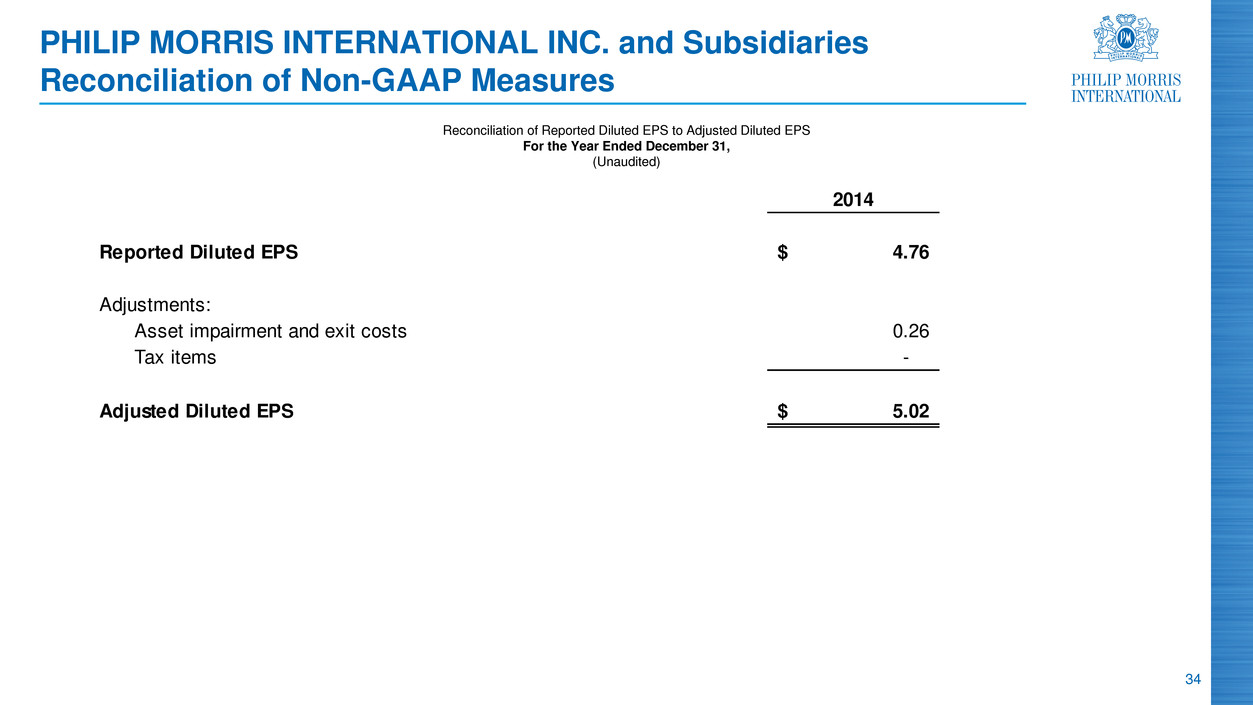

6 2015 EPS Guidance Reaffirmed ● Reaffirming 2015 reported diluted EPS guidance of $4.32 to $4.42, at prevailing exchange rates ● Guidance includes approximately $1.15 of unfavorable currency at prevailing exchange rates ● Excluding currency, guidance represents a growth rate of 9% to 11% compared to adjusted diluted EPS of $5.02 in 2014 ● Expect to be towards the upper end of this range, given better-than-anticipated volume and market share performance Source: PMI Financials or estimates

7 (a) Australian Dollar, British Pound, Canadian Dollar, Danish Krone, Hong Kong Dollar, Israeli Shekel, New Zealand Dollar, Norwegian Krone, Singapore Dollar, South Korean Won, Swedish Krona, Swiss Franc and U.S. Dollar (b) Includes notably the Argentine Peso, Brazilian Real, Kazakhstan Tenge, Mexican Peso, Polish Zloty, Turkish Lira and Ukrainian Hryvnia Note: List of emerging markets based on Dow Jones Source: PMI Financials or estimates Currency: Impact on PMI EPS Guidance ($ per share) Currency Variance Impact on PMI EPS Guidance (vs. PY) February 2015 Guidance April 2015 Guidance July 2015 Guidance July vs. April Guidance Japanese Yen (0.13) (0.14) (0.14) - Euro (0.15) (0.19) (0.15) 0.04 Other Developed(a) (0.15) (0.09) (0.10) (0.01) Russian Ruble (0.48) (0.35) (0.38) (0.03) Indonesian Rupiah (0.06) (0.08) (0.08) - Other Emerging(b) (0.18) (0.30) (0.30) - Total Currency Impact (1.15) (1.15) (1.15) -

8 Strong Pricing: The Key Driver of Our Financial Performance ● Pricing variance of $514 million in Q2, 2015, reflecting higher pricing across all four Regions ● Q2, 2015 retail price increases in key markets such as Argentina, Germany, Indonesia and Russia ● Cumulative pricing variance of $1.1 billion in H1, 2015 406 552 494 514 900 1,066 H1, 2014 H1, 2015 Pricing Variance ($ million) Source: PMI Financials or estimates Q1 Q2

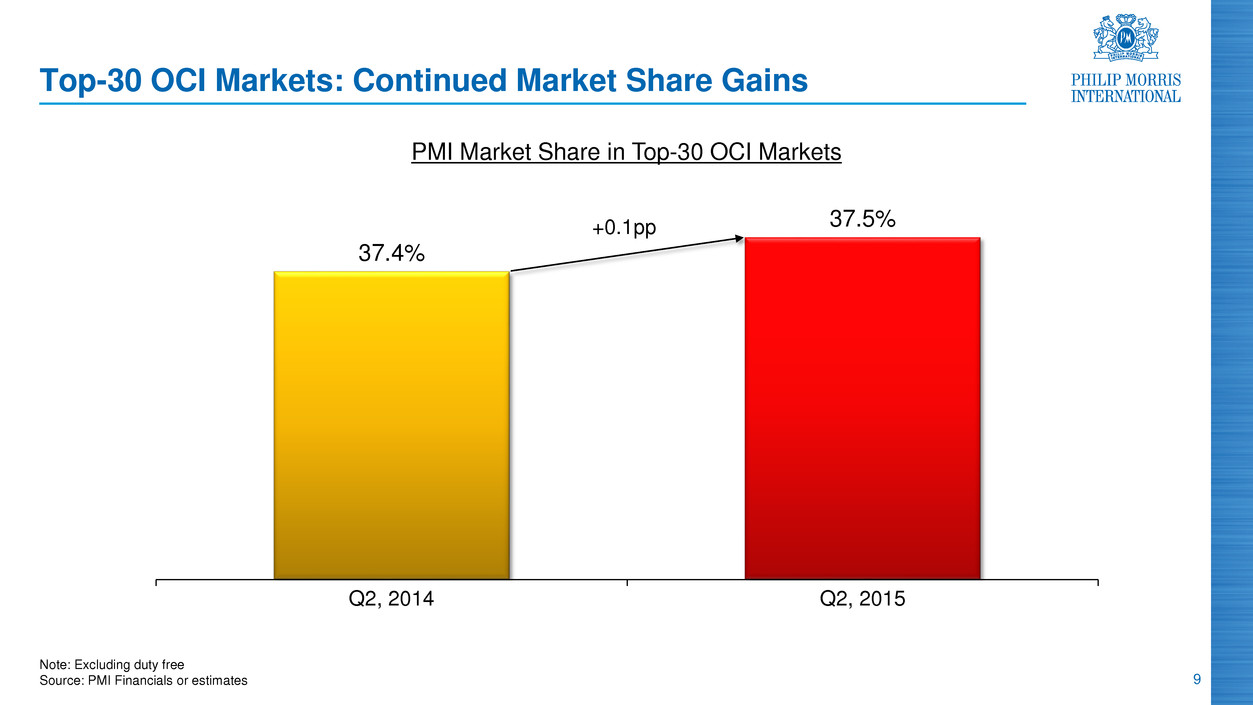

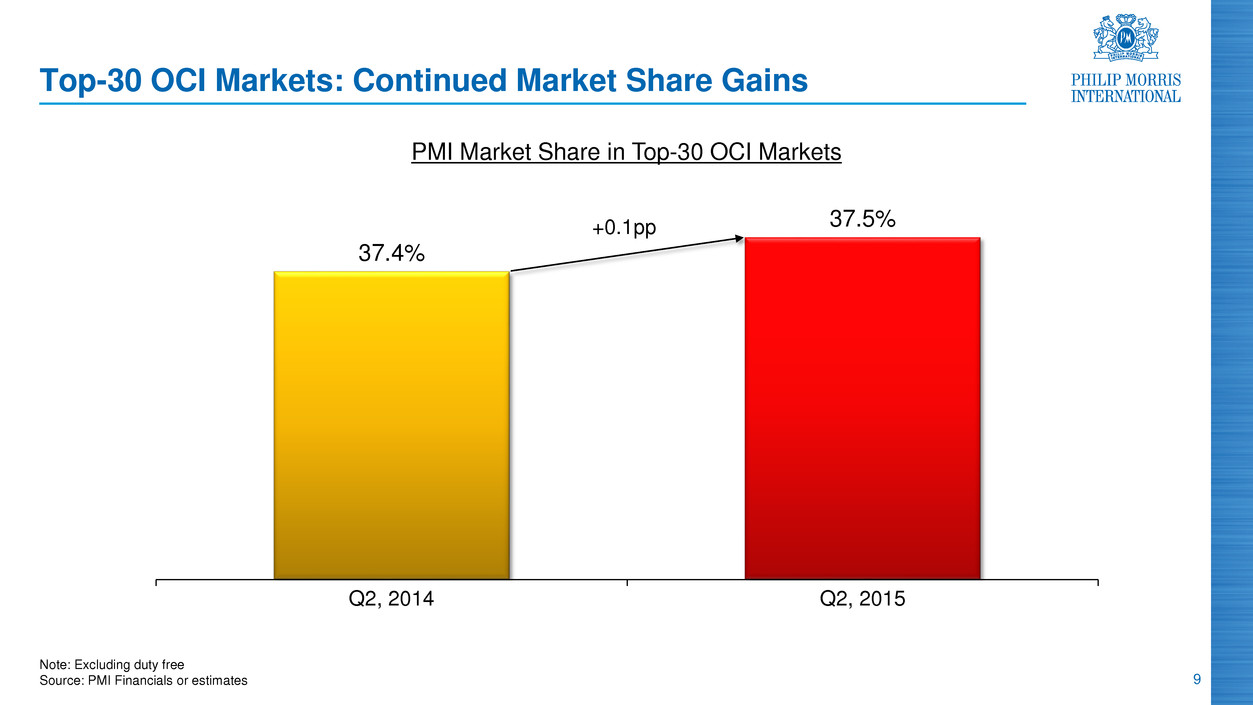

9 Top-30 OCI Markets: Continued Market Share Gains Note: Excluding duty free Source: PMI Financials or estimates 37.4% 37.5% Q2, 2014 Q2, 2015 +0.1pp PMI Market Share in Top-30 OCI Markets

10 Marlboro: Key Contributor to Market Share Growth ● Marlboro gained share in all four Regions in Q2, 2015 ● In Q2, 2015, introduced Marlboro 2.0 in some 20 additional markets, predominantly in the EEMA Region ● By year-end 2015, expect to have rolled out Marlboro 2.0 in approximately 100 markets 9.2% 9.5% Q2, 2014 Q2, 2015 Marlboro Share of International Market(a) (a) Excluding China and the U.S. Source: PMI Financials or estimates +0.3pp

11Source: PMI Financials or estimates EU Region: Improving Cigarette Industry Volume Trend ● Cigarette industry volume down by an estimated 2.3% in Q2, 2015, excluding trade inventory movements ● Expect 2015 cigarette industry volume decline of 3.0% to 3.5% (vs. previous forecast of approximately 4%): - Improving macroeconomic conditions - Moderation in the level of illicit trade - Less out-switching to fine cut products - Lower prevalence of e-vapor products

12 Q2, 2015 Source: PMI Financials or estimates EU Region: Strong Brands Driving OCI Growth, Ex-Currency ● Regional cigarette share stable at 40.4% in Q2, 2015 ● Marlboro cigarette share was up in four of the top six largest EU Region markets by industry volume in Q2, 2015, with particularly strong growth in Germany and Spain ● Adjusted OCI growth of 4.9%, ex- currency and acquisitions, in Q2, 2015, driven by strong pricing 0.1pp 0.1pp 0.2pp SoM 19.6% 7.3% 5.8% Industry Rank #1 #2 #3 Cigarette Market Share Growth (Q2, 2015 vs. PY)

13 Note: Next market share includes Next by Dubliss Source: PMI Financials or estimates and Nielsen ● Cigarette industry volume decreased by 6.5% in H1, 2015 ● Forecast 2015 cigarette industry volume decline towards the lower end of our 8% to 10% range ● Economic environment remains fragile with some signs of down-trading ● PMI cigarette volume growth of 5.3% in Q2, 2015 ● Strong double-digit OCI growth, ex- currency, in Q2, 2015, driven by significant retail price increases Russia: Excellent Performance 3.4 4.2 7.4 8.1 3.6 3.8 26.8 27.6 QTD May 2014 QTD May 2015 Next Other +0.8pp Parliament Bond Street PMI Market Share (%)

14 Notre: FF stands for Full Flavor. LTLN stands for Low Tar/Low Nicotine Source: PMI Financials or estimates Indonesia: Growing Share Driven by Machine-Made Kretek Brands ● Cigarette industry volume increased by 0.4% in H1, 2015 ● Market share grew by 0.5 points to 35.2% in Q2, 2015, led by Dji Sam Soe Magnum and Sampoerna A ● Further realigned our production from hand-rolled to machine-made kretek cigarettes in Q2, 2015 ● Cigarette industry volume growth forecast: - Mid to long-term: 1% to 3% annually - 2015: towards lower end of the range 41.1 41.6 41.8 41.9 41.6 41.2 31.4 31.8 32.0 32.2 33.0 33.8 20.9 20.1 19.8 19.7 19.2 18.8 6.6 6.5 6.4 6.2 6.2 6.2 Q1 Q2 Q3 Q4 Q1 Q2 Hand-Rolled Kretek Machine-Made FF Kretek Non-Kretek 2015 Machine-Made LTLN Kretek Industry Category Segmentation (%) 2014

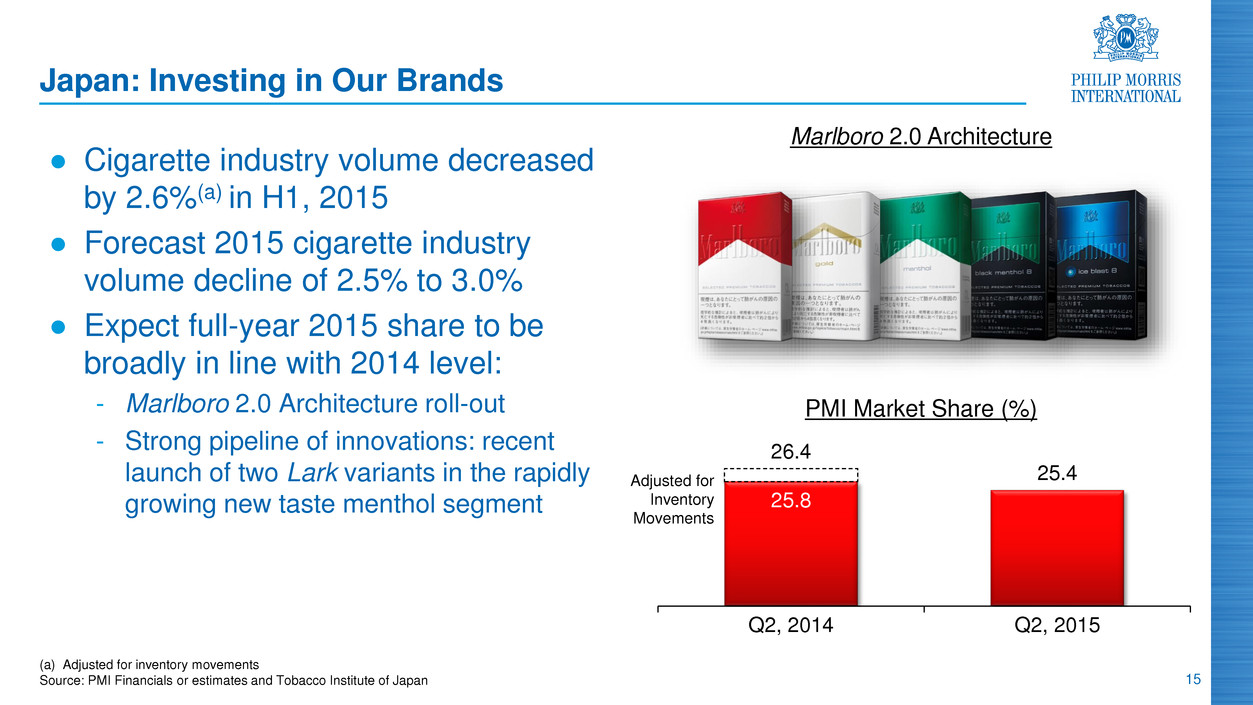

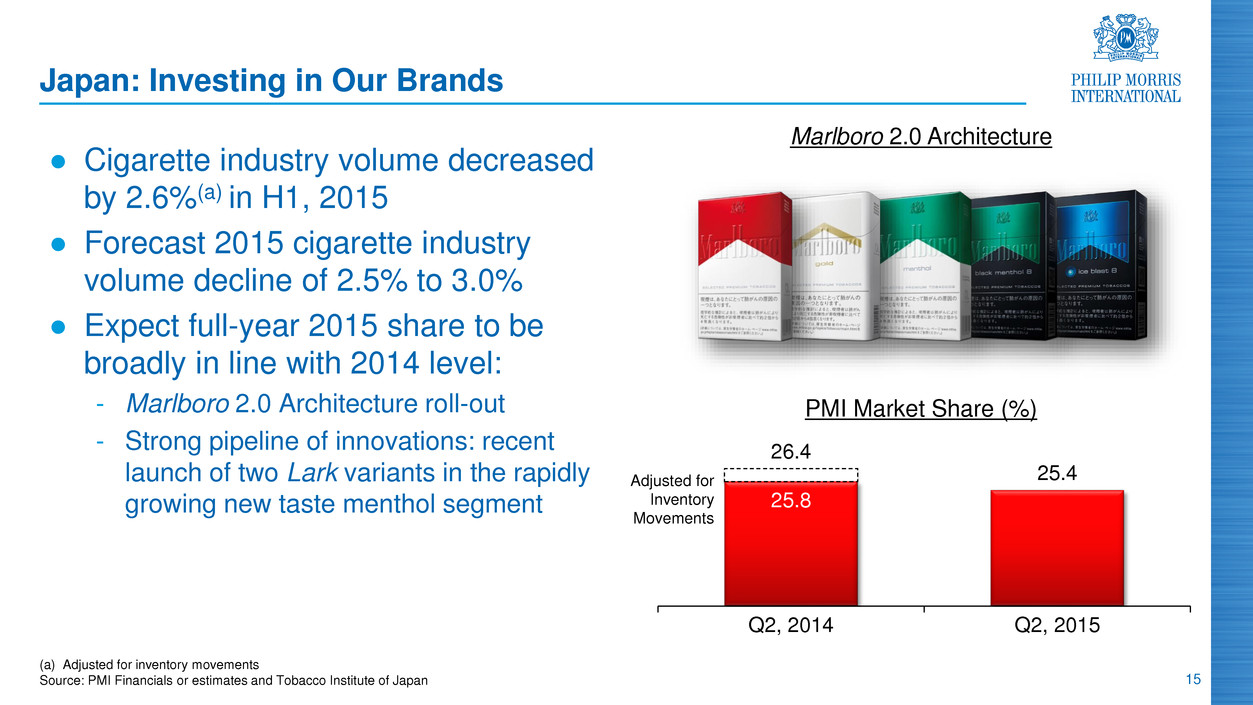

15 (a) Adjusted for inventory movements Source: PMI Financials or estimates and Tobacco Institute of Japan Japan: Investing in Our Brands ● Cigarette industry volume decreased by 2.6%(a) in H1, 2015 ● Forecast 2015 cigarette industry volume decline of 2.5% to 3.0% ● Expect full-year 2015 share to be broadly in line with 2014 level: - Marlboro 2.0 Architecture roll-out - Strong pipeline of innovations: recent launch of two Lark variants in the rapidly growing new taste menthol segment 25.8 26.4 25.4 Q2, 2014 Q2, 2015 Marlboro 2.0 Architecture Adjusted for Inventory Movements PMI Market Share (%)

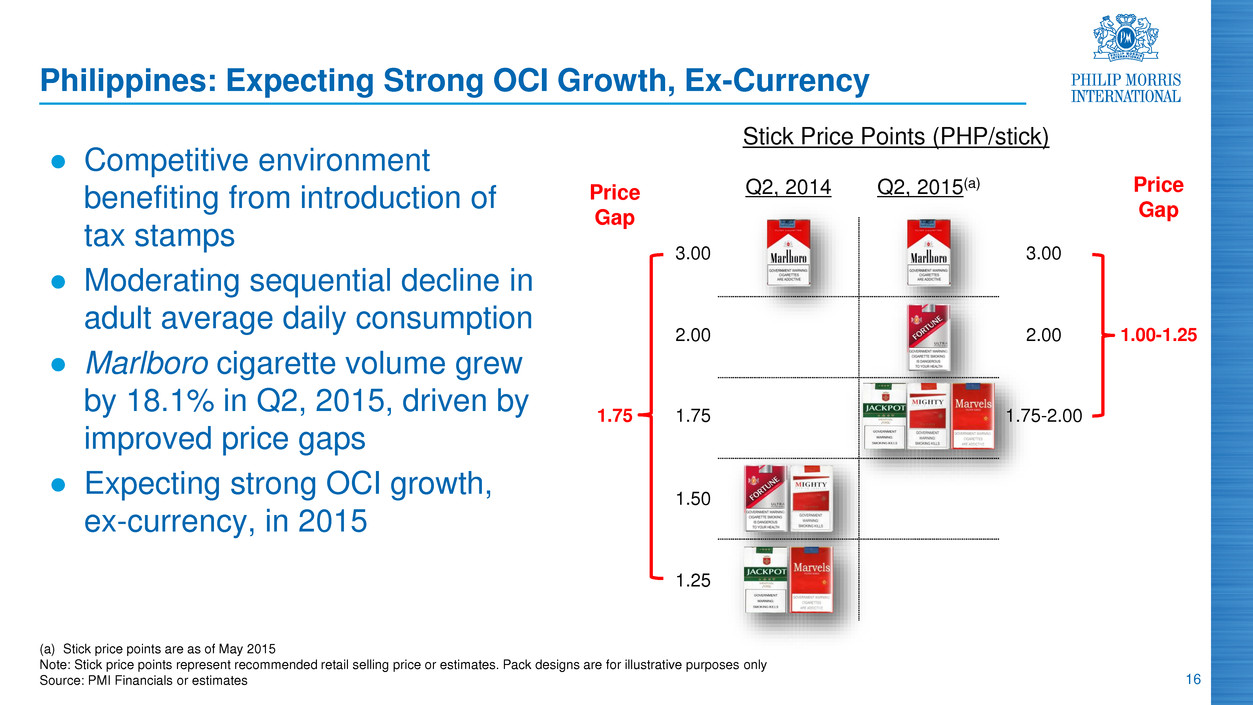

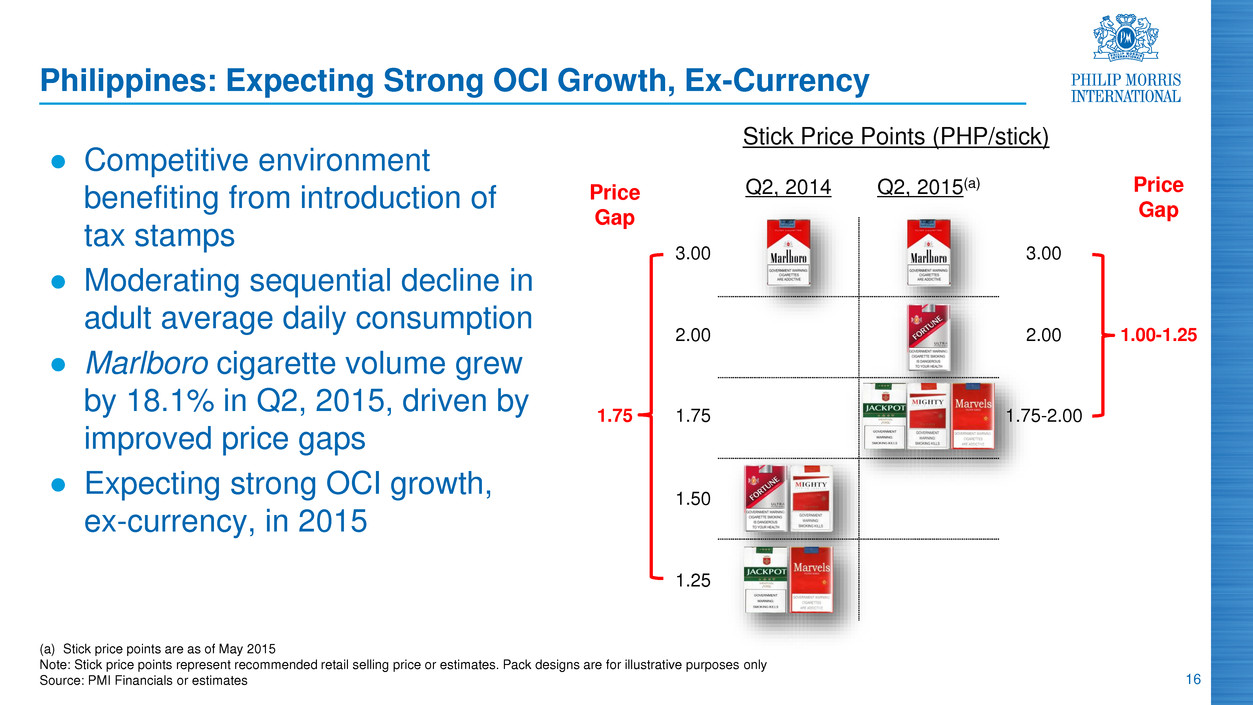

16 (a) Stick price points are as of May 2015 Note: Stick price points represent recommended retail selling price or estimates. Pack designs are for illustrative purposes only Source: PMI Financials or estimates Philippines: Expecting Strong OCI Growth, Ex-Currency ● Competitive environment benefiting from introduction of tax stamps ● Moderating sequential decline in adult average daily consumption ● Marlboro cigarette volume grew by 18.1% in Q2, 2015, driven by improved price gaps ● Expecting strong OCI growth, ex-currency, in 2015 Q2, 2014 Q2, 2015(a) 1.00-1.25 1.75 1.50 Price Gap 1.25 2.00 3.00 1.75 Price Gap 3.00 2.00 1.75-2.00 Stick Price Points (PHP/stick)

17 Note: Reduced-Risk Products ("RRPs") is the term we use to refer to products with the potential to reduce individual risk and population harm in comparison to smoking combustible cigarette. Translation from Japanese: "iQOS. Satisfying tastes that you can choose. Marlboro HeatStick series. Regular: Deep and Rich Taste. NEW Balanced Regular: Balanced, Sophisticated Taste. NEW Mint: Light, Refreshing Taste. Menthol: Strong, Refreshing taste". iQOS: National Expansion in Japan and Italy Japan: ● National expansion to commence in September: - Roll-out across key regions - Upgraded version of iQOS priced at JPY 9,980 Italy: ● On track with expansion plan for later this year

18 iQOS: Launch in Switzerland ● Launch: August 2015 ● Five major cities with retail distribution in approximately 250 outlets by end of October ● Marlboro HeatSticks available in regular, smooth and menthol variants Basel Bern Geneva Lausanne Zurich iQOS Kit CHF 80(a) Marlboro HeatSticks CHF 8/pack(a) (a) Retail selling price on www.iqos.ch, subject to change Note: Reduced-Risk Products ("RRPs") is the term we use to refer to products with the potential to reduce individual risk and population harm in comparison to smoking combustible cigarettes. Visuals are for illustrative purposes only. 20 HeatStick tobacco sticks per pack

19 Free Cash Flow: Resilient Performance in H1, 2015 ● H1, 2015 free cash flow in line with prior year ● Prudent cash flow management, particularly with regard to working capital and capital expenditures ● Forecast 2015 free cash flow to be broadly in line with 2014, despite significant currency headwind 2,912 2,887 H1, 2014 H1, 2015 PMI Free Cash Flow ($ million) Source: PMI Financials or estimates

20 Note: Reduced-Risk Products ("RRPs") is the term we use to refer to products with the potential to reduce individual risk and population harm in comparison to smoking combustible cigarettes. Dividend yield represents the annualized dividend on July 10, 2015, over the closing share price on that date. The current annualized dividend rate for PMI is $4.00. The closing share price for PMI was $82.16 on July 10, 2015 Source: PMI Financials or estimates Conclusion: Strong Outlook for 2015 ● Modest organic cigarette volume decline and strong currency-neutral financial results, driven by robust business fundamentals ● Superior brands, supported by a superb commercial organization, driving strong pricing and continued market share gains ● iQOS on track in Japan and Italy. Launch in Switzerland in August ● Committed to returning around 100% of free cash flow to shareholders ● Attractive dividend yield of 4.9% ● 2015 EPS guidance, ex-currency, reflects a growth rate of 9% to 11% versus 2014 adjusted diluted EPS of $5.02 ● Expect to be towards the upper end of our guidance range

2015 Second-Quarter Results Questions & Answers Download PMI’s Investor Relations App iOS Android

Glossary and Reconciliation of Non-GAAP Measures

23 Glossary: General Terms ● PMI stands for Philip Morris International Inc. and its subsidiaries ● Until March 28, 2008, PMI was a wholly owned subsidiary of Altria Group, Inc. ("Altria"). Since that time the company has been independent and is listed on the New York Stock Exchange (ticker symbol "PM") ● Unless otherwise stated, results are compared to those of the same period in the preceding year ● PMI volumes refer to PMI cigarette shipment data, unless otherwise stated ● Organic volume refers to volume excluding acquisitions ● References to total international cigarette market, total cigarette market, total market and market shares reflect our best estimates based on a number of internal and external sources ● Trademarks are italicized

24 Glossary: Financial Terms ● Net revenues exclude excise taxes ● Operating Companies Income, or "OCI", is defined as operating income, excluding general corporate expenses and the amortization of intangibles, plus equity (income) or loss in unconsolidated subsidiaries, net ● Adjusted OCI is defined as reported OCI adjusted for asset impairment, exit and other costs ● OCI growth rates are on an adjusted basis ● EPS stands for Earnings per Share ● Free cash flow is defined as net cash provided by operating activities less capital expenditures

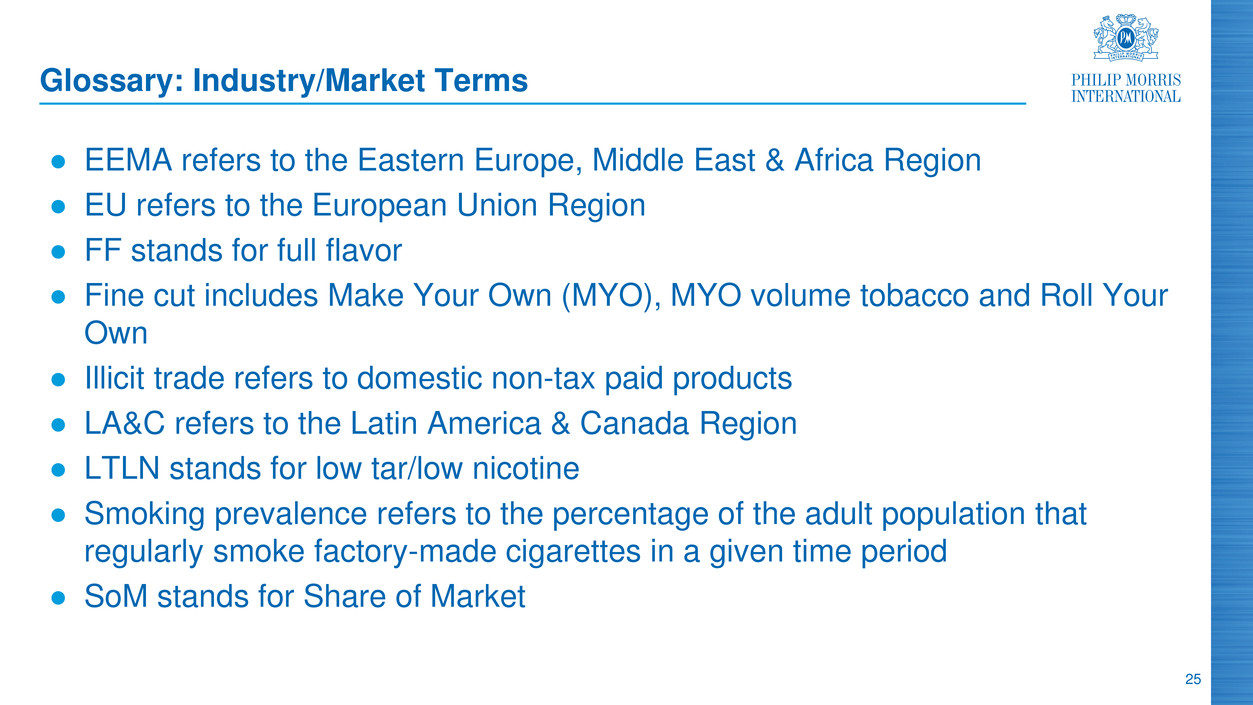

25 Glossary: Industry/Market Terms ● EEMA refers to the Eastern Europe, Middle East & Africa Region ● EU refers to the European Union Region ● FF stands for full flavor ● Fine cut includes Make Your Own (MYO), MYO volume tobacco and Roll Your Own ● Illicit trade refers to domestic non-tax paid products ● LA&C refers to the Latin America & Canada Region ● LTLN stands for low tar/low nicotine ● Smoking prevalence refers to the percentage of the adult population that regularly smoke factory-made cigarettes in a given time period ● SoM stands for Share of Market

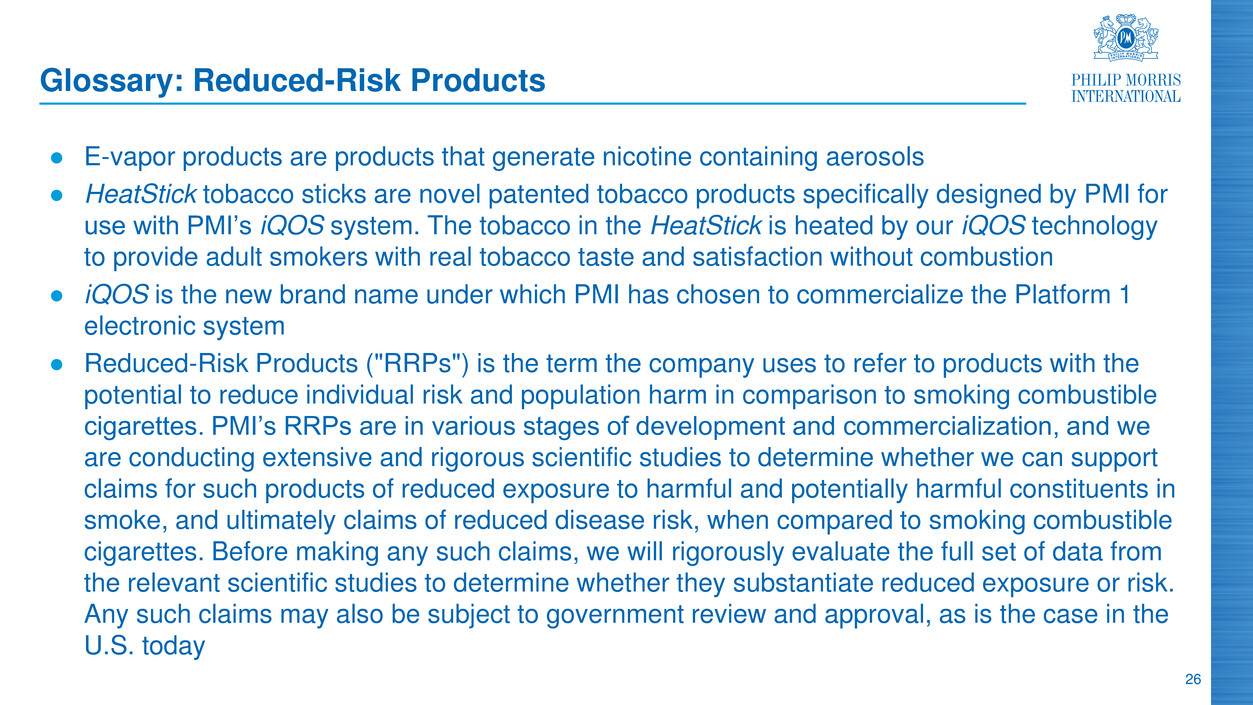

26 Glossary: Reduced-Risk Products ● E-vapor products are products that generate nicotine containing aerosols ● HeatStick tobacco sticks are novel patented tobacco products specifically designed by PMI for use with PMI’s iQOS system. The tobacco in the HeatStick is heated by our iQOS technology to provide adult smokers with real tobacco taste and satisfaction without combustion ● iQOS is the new brand name under which PMI has chosen to commercialize the Platform 1 electronic system ● Reduced-Risk Products ("RRPs") is the term the company uses to refer to products with the potential to reduce individual risk and population harm in comparison to smoking combustible cigarettes. PMI’s RRPs are in various stages of development and commercialization, and we are conducting extensive and rigorous scientific studies to determine whether we can support claims for such products of reduced exposure to harmful and potentially harmful constituents in smoke, and ultimately claims of reduced disease risk, when compared to smoking combustible cigarettes. Before making any such claims, we will rigorously evaluate the full set of data from the relevant scientific studies to determine whether they substantiate reduced exposure or risk. Any such claims may also be subject to government review and approval, as is the case in the U.S. today

27 PMI Peer Groups (a) Effective until September 30, 2012 (b) Effective as of October 1, 2012 - BAT - Bayer - Coca-Cola - Diageo - GlaxoSmithKline - Heineken - Imperial Tobacco - Johnson & Johnson - Kraft(a) - McDonald’s - Mondelēz International(b) - Nestlé - Novartis - PepsiCo - Pfizer - Roche - Unilever - Vodafone - Altria - BAT - Imperial Tobacco - Japan Tobacco - Lorillard - Reynolds American Compensation Survey Group Tobacco Peer Group

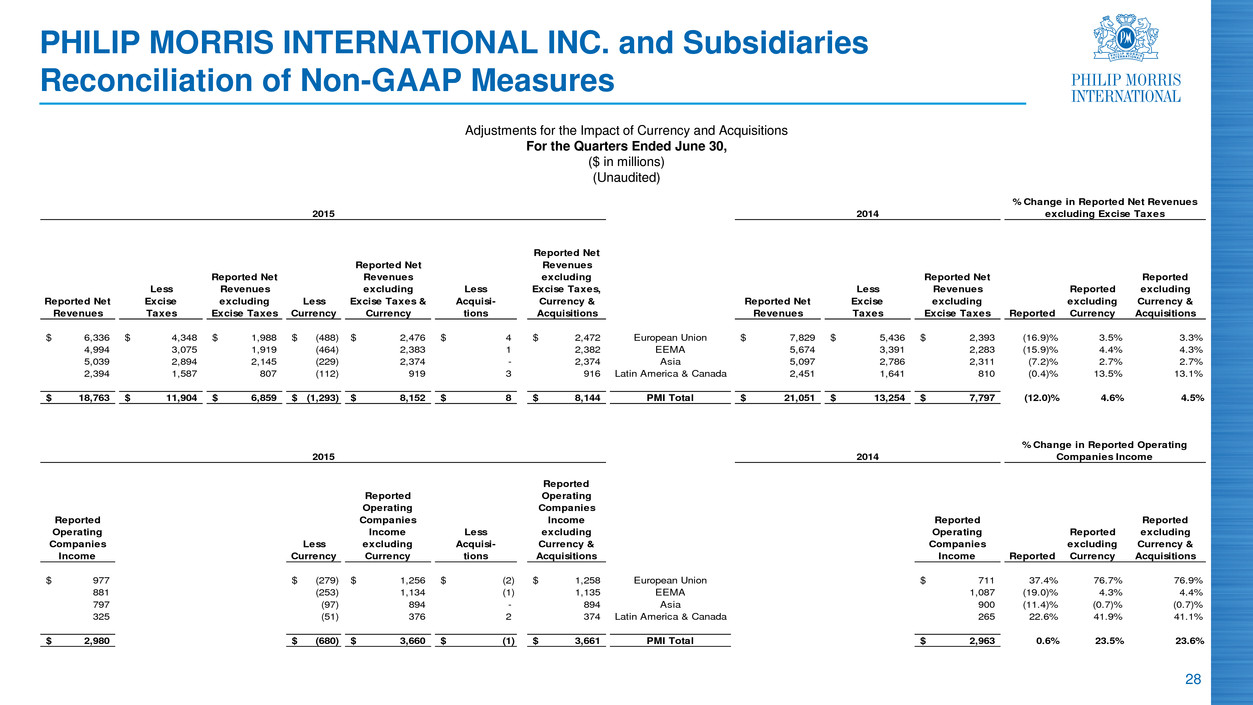

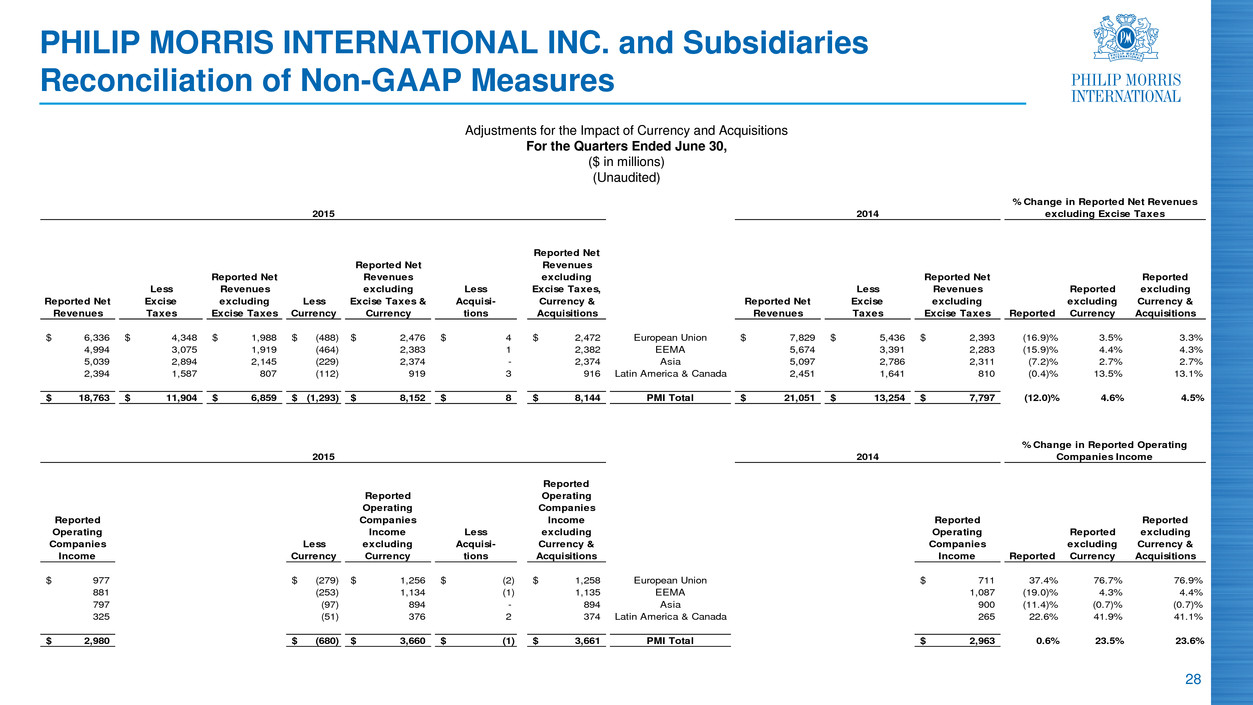

28 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Adjustments for the Impact of Currency and Acquisitions For the Quarters Ended June 30, ($ in millions) (Unaudited) Reported Net Revenues Less Excise Taxes Reported Net Revenues excluding Excise Taxes Less Currency Reported Net Revenues excluding Excise Taxes & Currency Less Acquisi- tions Reported Net Revenues excluding Excise Taxes, Currency & Acquisitions Reported Net Revenues Less Excise Taxes Reported Net Revenues excluding Excise Taxes Reported Reported excluding Currency Reported excluding Currency & Acquisitions 6,336$ 4,348$ 1,988$ (488)$ 2,476$ 4$ 2,472$ European Union 7,829$ 5,436$ 2,393$ (16.9)% 3.5% 3.3% 4,994 3,075 1,919 (464) 2,383 1 2,382 EEMA 5,674 3,391 2,283 (15.9)% 4.4% 4.3% 5,039 2,894 2,145 (229) 2,374 - 2,374 Asia 5,097 2,786 2,311 (7.2)% 2.7% 2.7% 2,394 1,587 807 (112) 919 3 916 Latin America & Canada 2,451 1,641 810 (0.4)% 13.5% 13.1% 18,763$ 11,904$ 6,859$ (1,293)$ 8,152$ 8$ 8,144$ PMI Total 21,051$ 13,254$ 7,797$ (12.0)% 4.6% 4.5% Reported Operating Companies I come Less Currency Reported Operating Companies Income excluding Currency Less Acquisi- tions Reported Operating Companies Income excluding Currency & Acquisitions Reported Operating Companies Income Reported Reported excluding Currency Reported excluding Currency & Acquisitions 977$ (279)$ 1,256$ (2)$ 1,258$ European Union 711$ 37.4% 76.7% 76.9% 881 (253) 1,134 (1) 1,135 EEMA 1,087 (19.0)% 4.3% 4.4% 797 (97) 894 - 894 Asia 900 (11.4)% (0.7)% (0.7)% 325 (51) 376 2 374 Latin America & Canada 265 22.6% 41.9% 41.1% 2,980$ (680)$ 3,660$ (1)$ 3,661$ PMI Total 2,963$ 0.6% 23.5% 23.6% 2015 2014 % Change in Reported Operating Companies Income 2015 2014 % Change in Reported Net Revenues excluding Excise Taxes

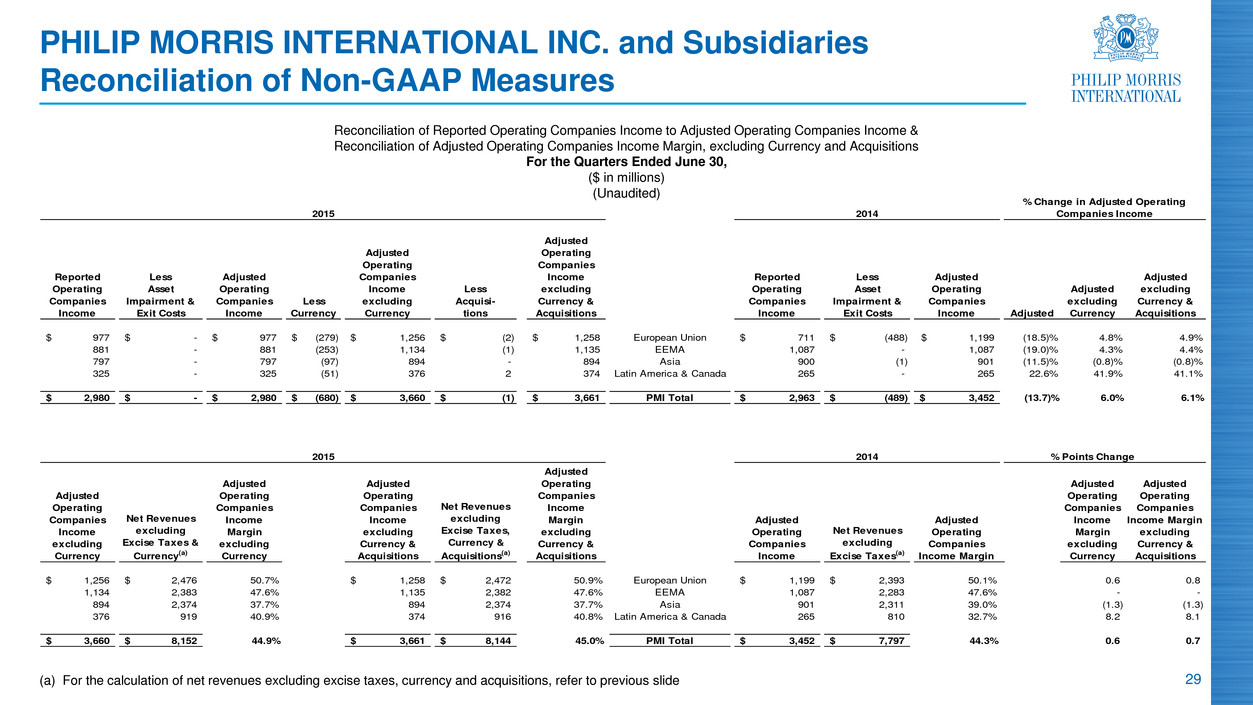

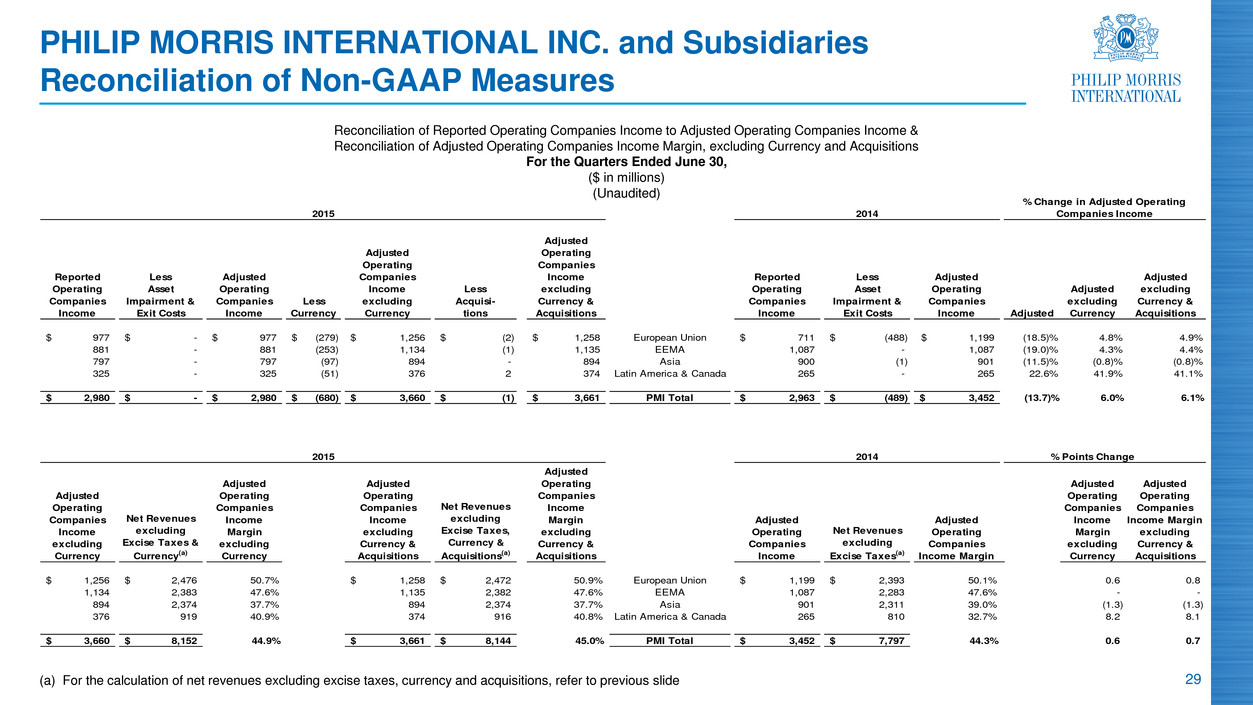

29(a) For the calculation of net revenues excluding excise taxes, currency and acquisitions, refer to previous slide PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Operating Companies Income to Adjusted Operating Companies Income & Reconciliation of Adjusted Operating Companies Income Margin, excluding Currency and Acquisitions For the Quarters Ended June 30, ($ in millions) (Unaudited) Reported Operating Companies Income Less Asset Impairment & Exit Costs Adjusted Operating Companies Income Less Currency Adjusted Operating Companies Income excluding Currency Less Acquisi- tions Adjusted Operating Companies Income excluding Currency & Acquisitions Reported Operating Companies Income Less Asset Impairment & Exit Costs Adjusted Operating Companies Income Adjusted Adjusted excluding Currency Adjusted excluding Currency & Acquisitions 977$ -$ 977$ (279)$ 1,256$ (2)$ 1,258$ European Union 711$ (488)$ 1,199$ (18.5)% 4.8% 4.9% 881 - 881 (253) 1,134 (1) 1,135 EEMA 1,087 - 1,087 (19.0)% 4.3% 4.4% 797 - 797 (97) 894 - 894 Asia 900 (1) 901 (11.5)% (0.8)% (0.8)% 325 - 325 (51) 376 2 374 Latin America & Canada 265 - 265 22.6% 41.9% 41.1% 2,980$ -$ 2,980$ (680)$ 3,660$ (1)$ 3,661$ PMI Total 2,963$ (489)$ 3,452$ (13.7)% 6.0% 6.1% % Points Change Adjusted Operating Companies Income excluding Currency Net Revenues excluding Excise Taxes & Currency(a) Adjusted Operating Companies Income Margin excluding Currency Adjusted Operating Companies Income excluding Currency & Acquisitions Net Revenues excluding Excise Taxes, Currency & Acquisitions(a) Adjusted Operating Companies Income Margin excluding Currency & Acquisitions Adjusted Operating Companies Income Net Revenues excluding Excise Taxes(a) Adjusted Operating Companies Income Margin Adjusted Operating Companies Income Margin excluding Currency Adjusted Operating Companies Income Margin excluding Currency & Acquisitions 1,256$ 2,476$ 50.7% 1,258$ 2,472$ 50.9% European Union 1,199$ 2,393$ 50.1% 0.6 0.8 1,134 2,383 47.6% 1,135 2,382 47.6% EEMA 1,087 2,283 47.6% - - 894 2,374 37.7% 894 2,374 37.7% Asia 901 2,311 39.0% (1.3) (1.3) 376 919 40.9% 374 916 40.8% Latin America & Canada 265 810 32.7% 8.2 8.1 3,660$ 8,152$ 44.9% 3,661$ 8,144$ 45.0% PMI Total 3,452$ 7,797$ 44.3% 0.6 0.7 2015 2014 2015 2014 % Change in Adjusted Operating Companies Income

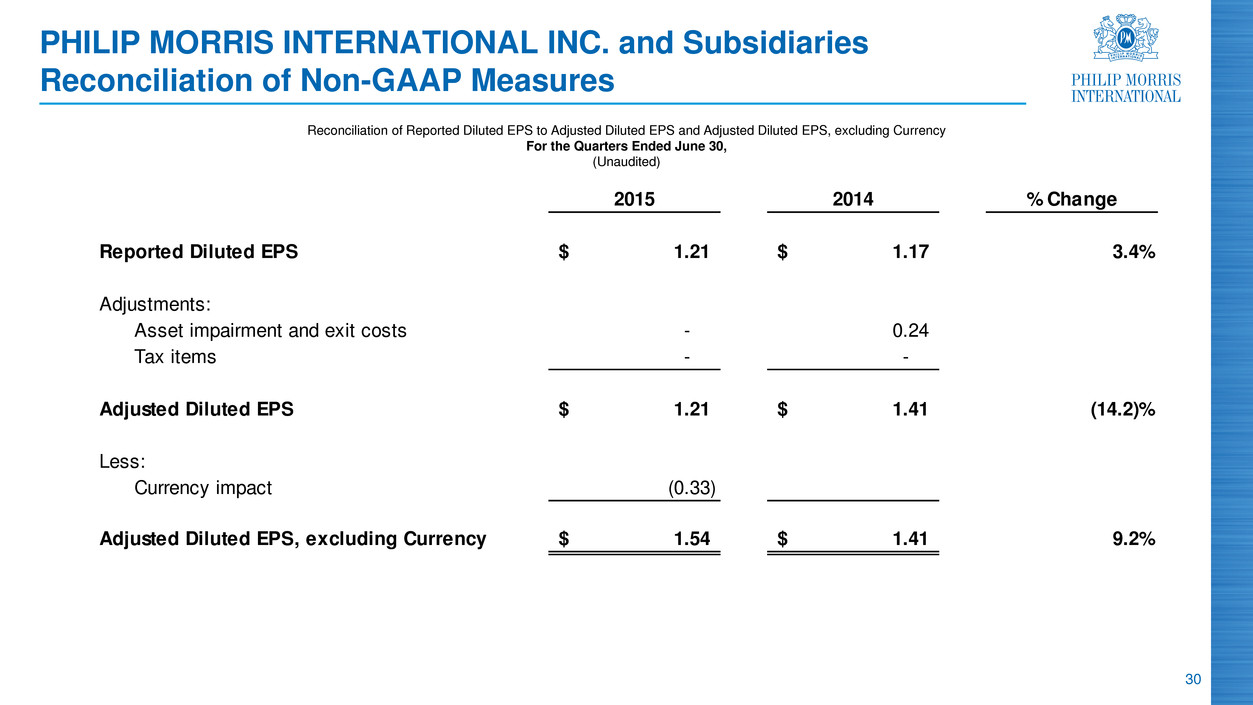

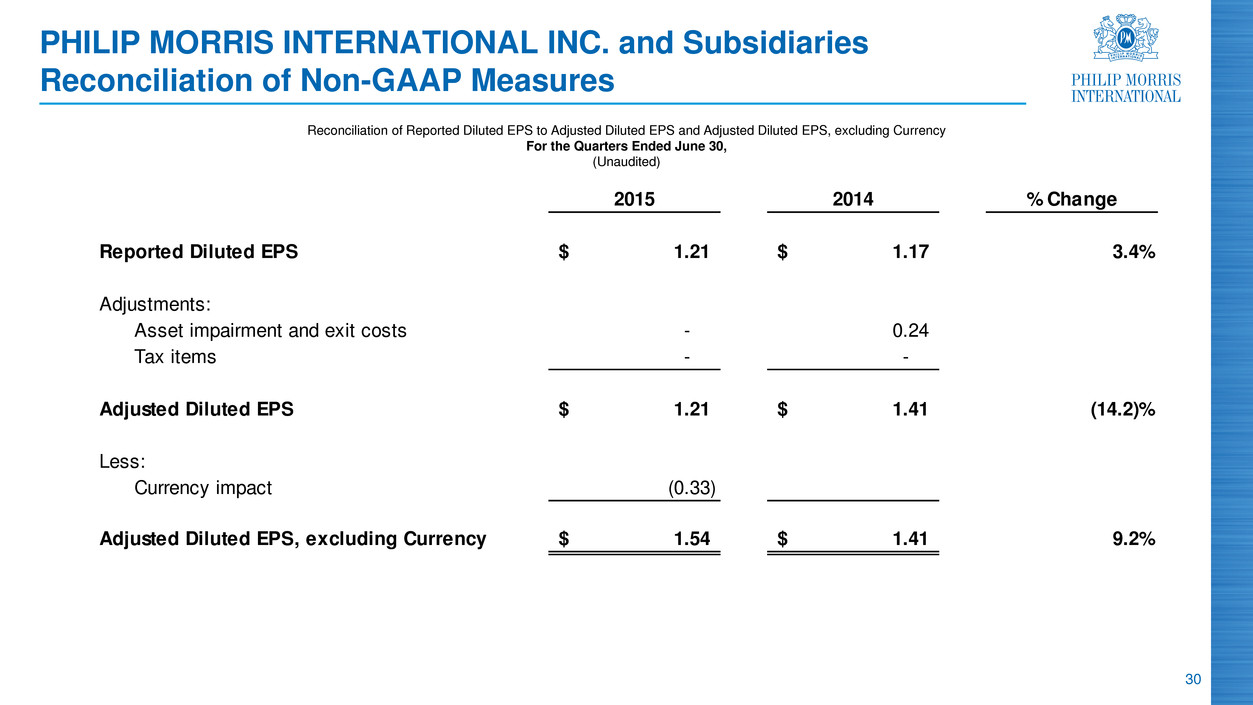

30 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS and Adjusted Diluted EPS, excluding Currency For the Quarters Ended June 30, (Unaudited) 2015 2014 % Change Reported Diluted EPS 1.21$ 1.17$ 3.4% Adjustments: Asset impairment and exit costs - 0.24 Tax items - - Adjuste iluted EPS 1.21$ 1.41$ (14.2)% Less: Currency impact (0.33) Adjusted Diluted EPS, excluding Currency 1.54$ 1.41$ 9.2%

31 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Diluted EPS to Reported Diluted EPS, excluding Currency For the Quarters Ended June 30, (Unaudited) 2015 2014 % Change Reported Diluted EPS 1.21$ 1.17$ 3.4% Less: Currency impact (0.33) Reporte Diluted EPS, excluding Currency 1.54$ 1.17$ 31.6%

32 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS and Adjusted Diluted EPS, excluding Currency For the Six Months Ended June 30, (Unaudited) 2015 2014 % Change Reported Diluted EPS 2.37$ 2.35$ 0.9% Adjustments: Asset impairment and exit costs - 0.25 Tax items - - Adjuste iluted EPS 2.37$ 2.60$ (8.8)% Less: Currency impact (0.64) Adjusted Diluted EPS, excluding Currency 3.01$ 2.60$ 15.8%

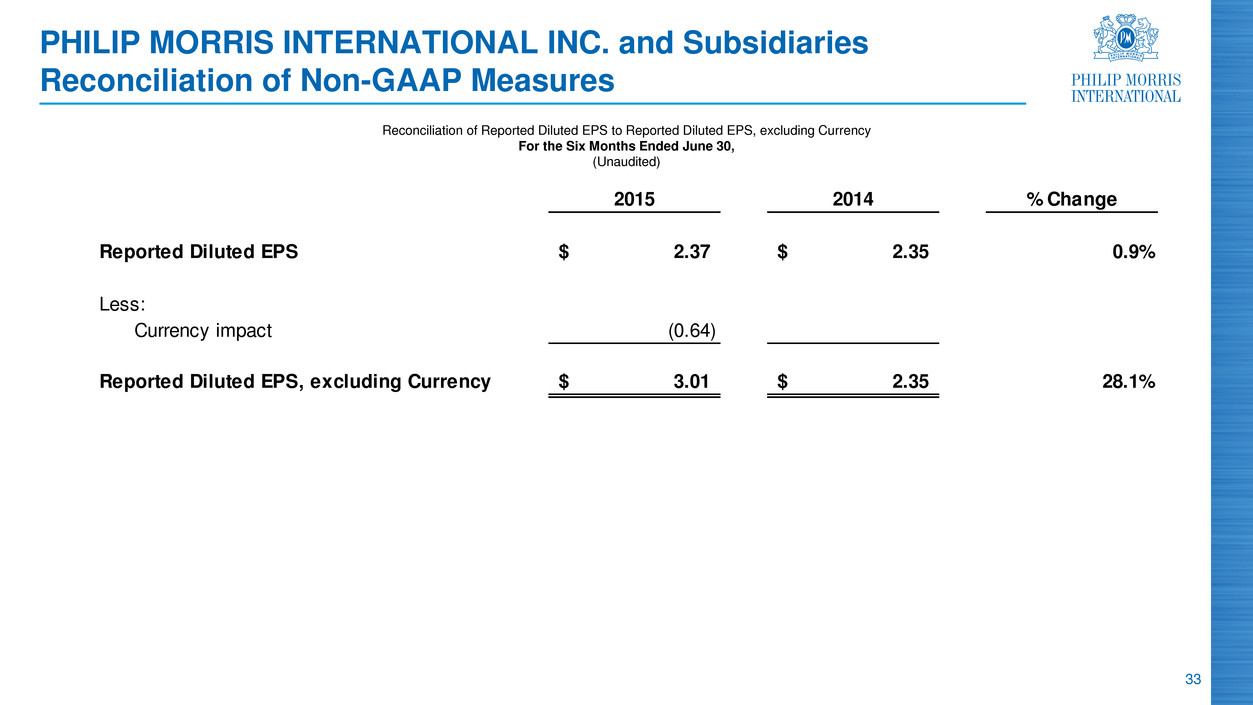

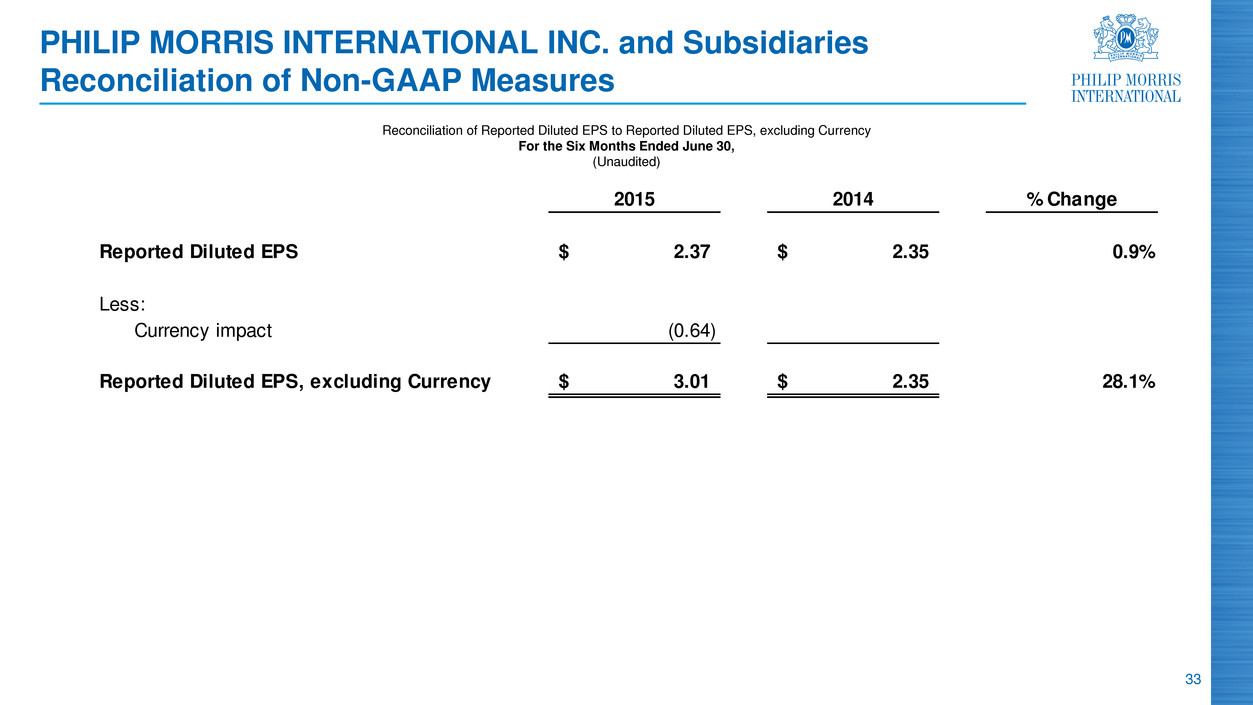

33 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Diluted EPS to Reported Diluted EPS, excluding Currency For the Six Months Ended June 30, (Unaudited) 2015 2014 % Change Reported Diluted EPS 2.37$ 2.35$ 0.9% Less: Currency impact (0.64) Reporte Diluted EPS, excluding Currency 3.01$ 2.35$ 28.1%

34 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS For the Year Ended December 31, (Unaudited) 2014 Reported Diluted EPS 4.76$ Adjustments: Asset impairment and exit costs 0.26 Tax items - Adjuste Diluted EPS 5.02$

35 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Operating Cash Flow to Free Cash Flow and Free Cash Flow, excluding Currency For the Quarters and Six Months Ended June 30, ($ in millions) (Unaudited) (a) Operating Cash Flow For the Quarters Ended For the Six Months Ended June 30, June 30, 2015 2014 % Change 2015 2014 % Change Net cash provided by operating activities(a) 3,675$ 2,705$ 35.9% 3,300$ 3,420$ (3.5)% Less: Capital expenditures 210 252 413 508 Free C Flow 3,465$ 2,453$ 41.3% 2,887$ 2,912$ (0.9)% Less: Currency impact (598) (1,554) Free Cash Flow, excluding Currency 4,063$ 2,453$ 65.6% 4,441$ 2,912$ 52.5%

2015 Second-Quarter Results July 16, 2015