UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT UNDER TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT |

| OF 1934 FOR THE YEAR ENDED JULY 31, 2008 |

Commission file number 333-153331

JESTERS RESOURCES, INC.

(Exact name of registrant as specified in its charter)

NEVADA

(State or other jurisdiction of incorporation or organization)

Room 10B, #28-2518 Longhua Road

Shanghai, P. R. China 200232

(Address of principal executive offices, including zip code.)

011 86 021 5491 0221

(telephone number, including area code)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.Yes¨ Nox

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act:Yes¨ Nox

Indicate by check mark whether the registrant(1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 day.Yesx No¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy ir information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 if the Exchange Act.

| Large Accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | x |

| (Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).Yesx No¨

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as ofOctober 24, 2008: $0.

TABLE OF CONTENTS

| | | Page |

| |

| | PART I | |

| Item 1. | Business. | 3 |

| Item 1A. | Risk Factors. | 12 |

| Item 1B. | Unresolved Staff Comments. | 12 |

| Item 2. | Properties. | 13 |

| Item 3. | Legal Proceedings. | 13 |

| Item 4. | Submission of Matters to a Vote of Security Holders. | 13 |

| |

| | PART II | |

| Item 5. | Market Price for the Registrant’s Common Equity, Related Stockholders Matters | |

| | and Issuer Purchases of Equity Securities. | 13 |

| Item 6. | Selected Financial Data. | 14 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of | |

| | Operation. | 14 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. | 19 |

| Item 8. | Financial Statements and Supplementary Data. | 19 |

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial | |

| | Disclosure. | 30 |

| |

| | PART III | |

| Item 9A. | Controls and Procedures. | 30 |

| Item 9B. | Other Information. | 32 |

| Item 10. | Directors and Executive Officers, Promoters and Control Persons. | 32 |

| Item 11. | Executive Compensation. | 34 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management. | 36 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 36 |

| Item 14. | Principal Accounting Fees and Services. | 36 |

| |

| | PART IV | |

| Item 15. | Exhibits and Financial Statement Schedules. | 37 |

-2-

PART I.

ITEM 1. BUSINESS.

We were incorporated in the State of Nevada on June 19, 2007. We are an exploration stage corporation. An exploration stage corporation is one engaged in the search from mineral deposits or reserves which are not in either the development or production stage. We intend to conduct exploration activities on one property. We maintain our statutory registered agent's office at The Corporation Trust Company of Nevada, 6100 Neil Road, Suite 500, Reno, Nevada 89511 and our business office is located at Room 10B, #28-2518 Longhua Road, Shanghai, P.R. China, 200232. This is our mailing address as well. Our telephone number is 011 86 021 5491 0221. We use this space on a rent free basis.

There is no assurance that a commercially viable mineral deposit exists on the property and further exploration will be required before a final evaluation as to the economic feasibility is determined.

We have no plans to change our business activities or to combine with another business, and are not aware of any events or circumstances that might cause our plans to change.

Background

In July 2007, Yanhua Xu, our former president and sole member of the board of directors acquired one mineral property containing eight Mineral Titles Online cells in British Columbia, Canada. British Columbia allows a mineral explorer to claim a portion of available Crown lands as its exclusive area for exploration by registering the claim area on the British Columbia Mineral Titles Online system. The Mineral Titles Online system is the Internet-based British Columbia system used to register, maintain and manage the claims. A cell is an area which appears electronically on the British Columbia Internet Minerals Titles Online Grid and was formerly called a claim. A claim is a grant from the Crown of the available land within the cells to the holder to remove and sell minerals. The online grid is the geographical basis for the cell. Formerly, the claim was established by sticking stakes in the ground to defin e the area and then recording the staking information. The staking system is now antiquated in British Columbia and has been replaced with the online grid. The property was registered by James McLeod, a non-affiliated third party. James McLeod is a self-employed contract staker and field worker residing in Richmond, British Columbia.

We have no revenues, have a loss since inception, have minimal operations, have been issued a going concern opinion and rely upon the sale of our securities and loans from our officers and directors to fund operations.

We have no plans to change our business activities or to combine with another business, and are not aware of any events or circumstances that might cause us to change our plans.

Canadian jurisdictions allow a mineral explorer to claim a portion of available Crown lands as its exclusive area for exploration by registering the same on the Mineral Titles Online system. Ms. Xu paid Mr. McLeod $4,000 to register the claims on the Mineral Titles Online system. No additional payments were made or are due to James McLeod for his service. The cells were recorded in Ms. Xu’s name to avoid incurring additional costs at this time. The additional fees would be for incorporation of a British Columbia corporation and legal and accounting fees related to the incorporation. In July 2007, Ms. Xu

-3-

executed a declaration of trust acknowledging that she holds the property in trust for us and she will not deal with the property in any way, except to transfer the property to us. In the event that Ms. Xu transfers title to a third party, the declaration of trust will be used as evidence that she breached her fiduciary duty to us. Ms. Xu has not provided us with a signed or executed bill of sale in our favor. Ms. Xu will issue a bill of sale to a subsidiary corporation to be formed by us should mineralized material be discovered on the property. Mineralized material is a mineralized body, which has been delineated by appropriate spaced drilling or underground sampling to support sufficient tonnage and average grade of metals to justify removal.

Under British Columbia law title to British Columbia mining claims can only be held by British Columbia residents. In the case of corporations, title must be held by a British Columbia corporation. In order to comply with the law we would have to incorporate a British Columbia wholly owned subsidiary corporation and obtain audited financial statements. We believe those costs would be a waste of our money at this time.

In the event that we find mineralized material and the mineralized material can be economically extracted, we will form a wholly owned British Columbia subsidiary corporation and Ms. Xu will convey title to the property to the wholly owned subsidiary corporation. Should Ms. Xu transfer title to another person and that deed is recorded before we record our documents, that other person will have superior title and we will have none. If that event occurs, we will have to cease or suspend operations. However, Ms. Xu will be liable to us for monetary damages for breaching the terms of her oral agreement with us to transfer her title to a subsidiary corporation we create. To date we have not performed any work on the property. All Canadian lands and minerals which have not been granted to private persons are owned by either the federal or provincial governments in the name of Her Majesty. Ungranted minerals are c ommonly known as Crown minerals. Ownership rights to Crown minerals are vested by the Canadian Constitution in the province where the minerals are located. In the case of our property, that is the Province of British Columbia.

In the 19thcentury the practice of reserving the minerals from fee simple Crown grants was established. Legislation now ensures that minerals are reserved from Crown land dispositions. The result is that the Crown is the largest mineral owner in Canada, both as the fee simple owner of Crown lands and through mineral reservations in Crown grants. Most privately held mineral titles are acquired directly from the Crown. The property is one such acquisition. Accordingly, fee simple title to the property resides with the Crown.

The property is comprised of mining leases issued pursuant to the British Columbia Mineral Act. The lessee has exclusive rights to mine and recover all of the minerals contained within the surface boundaries of the lease vertically downward. The Crown does not have the right to reclaim provided at a minimum fee of CDN$100 is paid timely. The Crown could reclaim the property in an eminent domain proceeding, but would have to compensate the lessee for the value of the claim if it exercised the right of eminent domain. It is highly unlikely that the Crown will exercise the power of eminent domain. In general, where eminent domain has been exercised it has been in connection with incorporating the property into a provincial park.

The property is unencumbered and there are no competitive conditions which affect the property. Further, there is no insurance covering the property and we believe that no insurance is necessary since the property is unimproved and contains no buildings or improvements.

-4-

To date we have not performed any work on the property. We are presently in the exploration stage and we cannot guarantee that a commercially viable mineral deposit, a reserve, exists in the property until further exploration is done and a comprehensive evaluation concludes economic and legal feasibility.

There are no native land claims that affect title to the property. We have no plans to try interest other companies in the property if mineralization is found. If mineralization is found, we will try to develop the property ourselves.

Claims

The following is a list of tenure numbers, claim, and expiration date of our claims:

| | | Number of | Date of |

| Tenure No. | Claim Name | MTO Cells | Expiration |

| 561450 | JR | 8 | June 26, 2009 |

In order to maintain these claims we must pay a fee of CND$100 per year per cell.

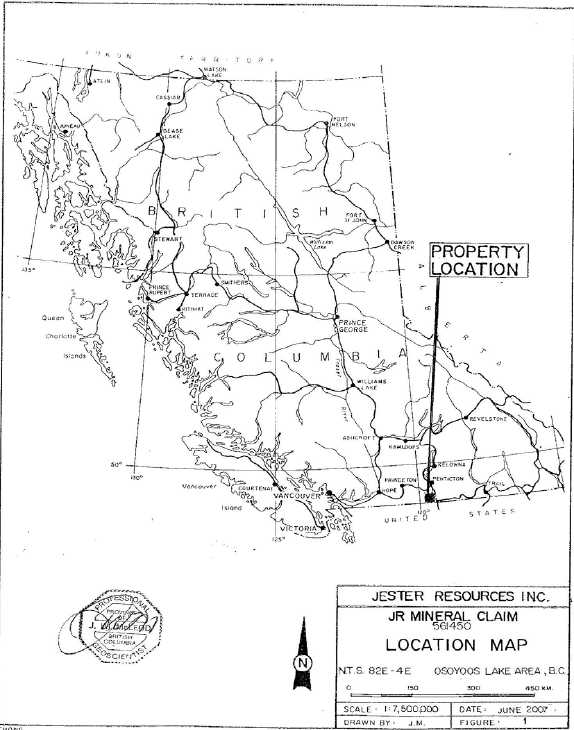

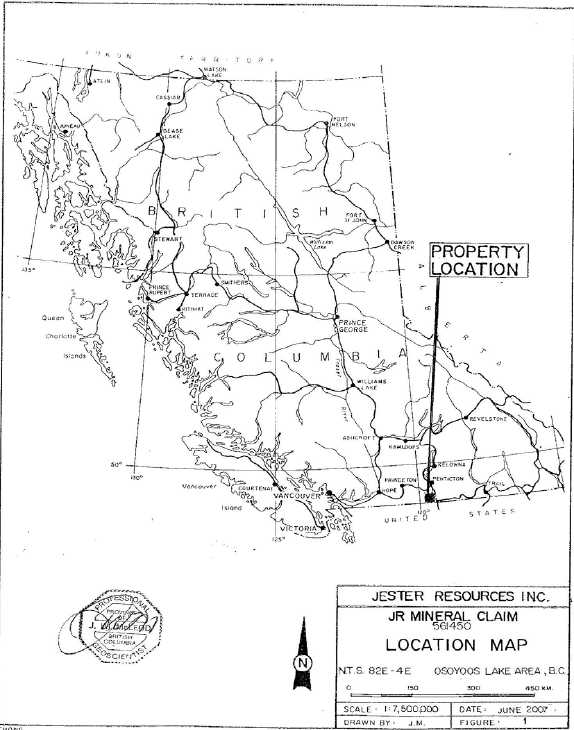

Location and Access

The property is comprised of 8 contiguous cells totaling 417 acres. At the center of the property the latitude is 49° 01’ 0" N and the longitude is 119° 35’ 50" W. The claim is motor vehicle accessible from the Town of Osoyoos, B.C. by traveling two miles west along Highway #3 and then traveling south past Kilpoola Lake for approximately 4.5 miles by gravel ranch roads to the mineral claim.

The property lies within the dry interior belt of British Columbia and experiences about 15" of precipitation annually of which about 20% may occur as a snow equivalent. The summers can experience hot weather while the winters are generally mild and last from December through March.

Much of the Okanogan Plateau area hosts patchy conifer cover of western yellow pine (ponderosa pine) and Douglas fir mingled with open range and deciduous groves of aspen and cottonwood. The general area supports a modestly active logging industry. Mining holds an historical and contemporary place in the development and economic well being of the area. Many exploration projects are underway in the general area.

The Town of Osoyoos, British Columbia which lies seven miles by road east of the mineral claim offers much of the necessary infrastructure required to base and carry-out an exploration program such as accommodations, communications, some equipment and supplies. Osoyoos is highway accessible from Vancouver, B.C. in a few hours by traveling over the Hope-Princeton provincial highway #3, in the time it takes to travel 300 miles. The overnight Greyhound bus service is a popular way to send-in samples and to receive specialty equipment and supplies.

-5-

Physiography

The claim area ranges in elevation from 2,500 feet to 3,300 feet mean sea level. The physiographic setting of the property can be described as moderately rounded, open range, plateau terrain that has been surficially altered both by the erosional and the depositional (drift cover) effects of glaciation. Thickness of drift cover in the valleys may vary considerably. The claim area lies on the western side of the Okanogan valley containing a series of north to south draining, large freshwater lakes. In the immediate area of the mineral claim there are occurrences of a number of small freshwater lakes and mineral-rich potholes.

History

There is no evidence of previous exploration activity on the property.

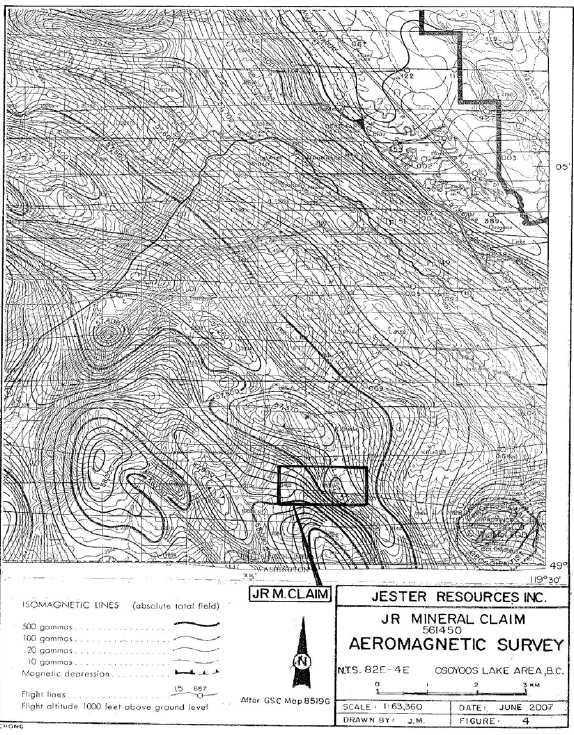

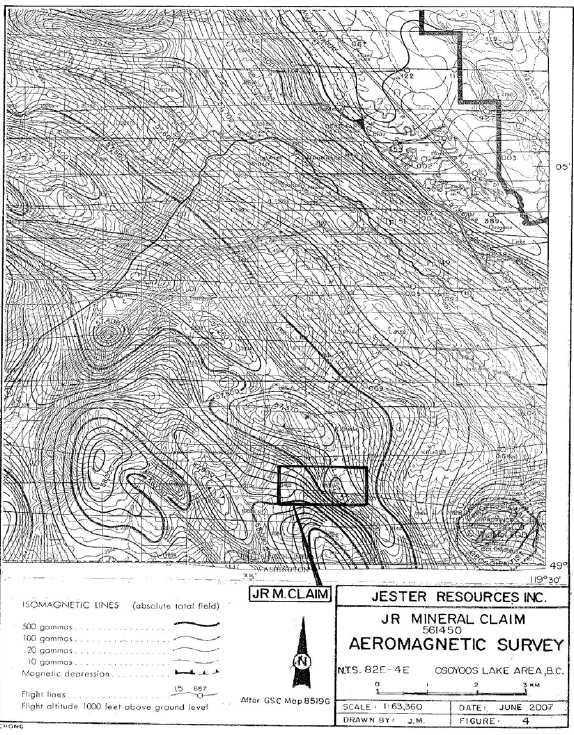

Regional Geology

The general claim area is underlain by northwest trending metamorphic rocks assigned to the Kobau Group thought to be of Carboniferous period age. These units occur mainly as quartzite, schist and greenstone and appear mainly derived from sedimentary rocks. These older units are cut in many places by Jurassic-Cretaceous aged Nelson Plutonic Rocks that exhibit a wide range in composition.

Local Geology

The property is situated in the Intermontane Belt of south-western British Columbia at the southern-end of the Thompson plateau. The oldest rocks observed in the local area are those of the Paleozoic era, Carboniferous period age Kobau Group. These units are observed to be in contact with or intruded by younger Nelson Plutonic Rocks.

Property Geology

The geology of the property may be described as being underlain by metamorphic units of the Kobau Group that are observed to be intruded by Nelson Plutonic Rocks mainly as syenites. Some or all of these units may be found to host economic mineralization.

-6-

MAP 1

-7-

MAP 2

-8-

Supplies

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, such as dynamite, and certain equipment such as bulldozers and excavators that we might need to conduct exploration. We have not attempted to locate or negotiate with any suppliers of products, equipment or materials. We will attempt to locates products, equipment and materials after this offering is complete. If we cannot find the products and equipment we need, we will have to suspend our exploration plans until we do find the products and equipment we need.

Other Property

Other than our interest in the property, we own no plants or other property. With respect to the property, our right to conduct exploration activity is based upon our oral agreement with Ms. Xu, our former president, director and shareholder. Under this oral agreement, Ms. Xu has allowed us to conduct exploration activity on the property. Ms. Xu holds the property in trust for us pursuant to a declaration of trust.

Our Proposed Exploration Program

Our exploration target is to find an ore body containing gold. Our success depends upon finding mineralized material. This includes a determination by our consultant if the property contains reserves. We have not selected a consultant as of the date of this prospectus and will not do so until our offering is successfully completed, if that occurs, of which there is no assurance. Mineralized material is a mineralized body, which has been delineated by appropriate spaced drilling or underground sampling to support sufficient tonnage and average grade of metals to justify removal. If we don’t find mineralized material or we cannot remove mineralized material, either because we do not have the money to do it or because it is not economically feasible to do it, we will cease operations and you will lose your investment.

In addition, we may not have enough money to complete our exploration of the property. If it turns out that we have not raised enough money to complete our exploration program, we will try to raise additional funds from a second public offering, a private placement or loans. At the present time, we have not made any plans to raise additional money and there is no assurance that we would be able to raise additional money in the future. In we need additional money and can’t raise it, we will have to suspend or cease operations.

We must conduct exploration to determine what amount of minerals, if any, exist on our properties and if any minerals which are found can be economically extracted and profitably processed.

The property is undeveloped raw land. Exploration and surveying has not been initiated and will not be initiated until we raise money in this offering. That is because we do not have money to start exploration. Once the offering is concluded, we intend to start exploration operations. To our knowledge, the property has never been mined. The only event that has occurred is the staking of the property by Mr. McLeod and a physical examination of the property by Ms. Xu, our former officer and director. The cost of recording the cells was included in the $4,000 paid to James McLeod Before minerals retrieval can

-9-

begin, we must explore for and find mineralized material. After that has occurred we have to determine if it is economically feasible to remove the mineralized material. Economically feasible means that the costs associated with the removal of the mineralized material will not exceed the price at which we can sell the mineralized material. We can’t predict what that will be until we find mineralized material.

We do not know if we will find mineralized material. We believe that activities occurring on adjoining properties are not material to our activities. The reason is that what ever is located under adjoining property may or may not be located under the property.

We do not claim to have any minerals or reserves whatsoever at this time on any of the property.

We intend to implement an exploration program which consists of core sampling. Core sampling is the process of drilling holes to a depth of up to 300 feet in order to extract a samples of earth. Mr. Zeng, after confirming with our consultant, will determine where drilling will occur on the property. Mr. Zeng will not receive fees for his services. The samples will be tested to determine if mineralized material is located on the property. Based upon the tests of the core samples, we will determine if we will terminate operations; proceed with additional exploration of the property; or develop the property. The proceeds from this offering are designed to only fund the costs of core sampling and testing. We intend to take our core samples to analytical chemists, geochemists and registered assayers located in Richmond, British Columbia. We have not selected any of the foregoing as of the date of this prospectus . We will only make the selections in the event we raise the minimum amount of this offering.

We estimate the cost of drilling will be $20.00 per foot drilled. The amount of drilling will be predicated upon the amount of money raised in this offering. If we raise the minimum amount of money, we will drill approximately 3,000 linear feet or 8 holes to depth of 300 feet. Assuming that we raise the maximum amount of money, we will drill approximately 7,000 linear feet, or up to 28 holes to a depth of 300 feet. We estimate that it will take up to three months to drill 28 holes to a depth of 300 feet each. We will pay a consultant up to a maximum of $5,000 per month for his services during the three month period or a total of $15,000. The total cost for analyzing the core samples will be $3,000. We will begin exploration activity ninety days after this public offering is completed, weather permitting.

The breakdowns were made in consultation with Mr. McLeod.

We do not intend to interest other companies in the property if we find mineralized materials. We intend to try to develop the reserves ourselves through the use of consultant. We have no plans to interest other companies in the property if we do not find mineralized material.

If we are unable to complete exploration because we don’t have enough money, we will cease operations until we raise more money. If we cannot or do not raise more money, we will cease operations. If we cease operations, we don't know what we will do and we don't have any plans to do anything else.

We cannot provide you with a more detailed discussion of how our exploration program will work and what we expect will be our likelihood of success. That is because we have a piece of raw land and we intend to look for mineralized material. We may or may not find any mineralized material. We hope we do, but it is impossible to predict the likelihood of such an event.

-10-

Our exploration program will not result in the generation of revenue. It is designed only to determine if mineralized material is located on the property. Revenue will only be generated if we discover mineralized material and extract the minerals and sell them. Because we have not found mineralized material yet, it is impossible to project revenue generation.

We anticipate starting exploration activity ninety days after this public offering is completed, weather permitting.

Competitive Factors

The gold mining industry is fragmented, that is there are many, many gold prospectors and producers, small and large. We do not compete with anyone. That is because there is no competition for the exploration or removal of minerals from the property. We will either find gold on the property or not. If we do not, we will cease or suspend operations. We are one of the smallest exploration companies in existence. We are an infinitely small participant in the gold mining market. Readily available gold markets exist in Canada and around the world for the sale of gold. Therefore, we will be able to sell any gold that we are able to recover.

Regulations

Our mineral exploration program is subject to the Canadian Mineral Tenure Act Regulation. This act sets forth rules for

| * | locating claims |

|

| * | posting claims |

|

| * | working claims |

|

| * | reporting work performed |

|

We are also subject to the British Columbia Mineral Exploration Code which tells us how and where we can explore for minerals. We must comply with these laws to operate our business. Compliance with these rules and regulations will not adversely affect our operations.

Environmental Law

We are also subject to the Health, Safety and Reclamation Code for Mines in British Columbia. This code deals with environmental matters relating to the exploration and development of mining properties. Its goals are to protect the environment through a series of regulations affecting:

| | 1. | Health and Safety |

| |

| 2. | Archaeological Sites |

| |

| 3. | Exploration Access |

| |

We are responsible to provide a safe working environment, not disrupt archaeological sites, and conduct our activities to prevent unnecessary damage to the property.

- -11-

We will secure all necessary permits for exploration and, if development is warranted on the property, will file final plans of operation before we start any mining operations. We anticipate no discharge of water into active stream, creek, river, lake or any other body of water regulated by environmental law or regulation. No endangered species will be disturbed. Restoration of the disturbed land will be completed according to law. All holes, pits and shafts will be sealed upon abandonment of the property. It is difficult to estimate the cost of compliance with the environmental law since the full nature and extent of our proposed activities cannot be determined until we start our operations and know what that will involve from an environmental standpoint.

We are in compliance with the act and will continue to comply with the act in the future. We believe that compliance with the act will not adversely affect our business operations in the future.

Exploration stage companies have no need to discuss environmental matters, except as they relate to exploration activities. The only “cost and effect” of compliance with environmental regulations in British Columbia is returning the surface to its previous condition upon abandonment of the property. We believe the cost of reclaiming the property will be $750 if we drill 8 holes and $2,250 if we drill 28 holes. We have not allocated any funds for the reclamation of the property and the proceeds for the cost of reclamation will not be paid from the proceeds of the offering. Mr. Zeng has agreed to pay the cost of reclaiming the property should mineralized material not be discovered.

Employees

We intend to use the services of subcontractors for manual labor exploration work on our properties.

Employees and Employment Agreements

At present, we have no full-time employees. Our sole officer and director is a part-time employee and he will devote about 10% of his time or four hours per week to our operation. Our sole officer and director does not have an employment agreement with us. We presently do not have pension, health, annuity, insurance, stock options, profit sharing or similar benefit plans; however, we may adopt plans in the future. There are presently no personal benefits available to our sole officer and director. Mr. Zeng will handle our administrative duties. Because our sole officer and director is inexperienced with exploration, he will hire qualified persons to perform the surveying, exploration, and excavating of the property. As of today, we have not looked for or talked to any geologists or engineers who will perform work for us in the future. We do not intend to do so until we complete this offering.

ITEM 1A. RISK FACTORS.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

- -12-

ITEM 2. PROPERTIES.

None.

ITEM 3. LEGAL PROCEEDINGS.

We are not presently a party to any litigation.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

During the fourth quarter, there were no matters submitted to a vote of our shareholders.

PART II

ITEM 5. MARKET PRICE FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITYSECURITIES.

There is no public trading market for our common stock. There are no outstanding options or warrants to purchase, or securities convertible into, our common stock.

Holders

There is 1 holder of record for our common stock. Yanhua Xu, our former sole officer and director, owns 1,000,000 restricted shares of our common stock.

Dividend Policy

We have never paid cash dividends on our capital stock. We currently intend to retain any profits we earn to finance the growth and development of our business. We do not anticipate paying any cash dividends in the foreseeable future.

Section 15(g) of the Securities Exchange Act of 1934

Our shares are covered by section 15(g) of the Securities Exchange Act of 1934, as amended that imposes additional sales practice requirements on broker/dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). For transactions covered by the Rule, the broker/dealer must make a special suitability determination for the purchase and have received the purchaser's written agreement to the transaction prior to the sale. Consequently, the Rule may affect the ability of broker/dealers to sell our securities and also may affect your ability to sell your shares in the secondary market.

-13-

Section 15(g) also imposes additional sales practice requirements on broker/dealers who sell penny securities. These rules require a one page summary of certain essential items. The items include the risk of investing in penny stocks in both public offerings and secondary marketing; terms important to in understanding of the function of the penny stock market, such as “bid” and “offer” quotes, a dealers “spread” and broker/dealer compensation; the broker/dealer compensation, the broker/dealers duties to its customers, including the disclosures required by any other penny stock disclosure rules; the customers rights and remedies in causes of fraud in penny stock transactions; and, the FINRA's toll free telephone number and the central number of the North American Administrators Association, for information on the disciplinary history of broker/dealers and their associated person s.

Securities authorized for issuance under equity compensation plans

We do not have any equity compensation plans and accordingly we have no securities authorized for issuance thereunder.

Use of Proceeds

On September 12, 2008, the Securities and Exchange Commission declared our Form S-1 Registration Statement effective (File number 333-153331) permitting us to offer up to 2,000,000 shares of common stock at $0.10 per share. There is no underwriter involved in our public offering. As of the date of this report no shares have been sold.

Initially, the aforementioned shares of common stock were offered by us from November 6, 2007 to September 2, 2008. The SEC file number of the previous offering was 333-146401. We were unable to sell any of the shares.

ITEM 6. SELECTED FINANCIAL DATA.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION OR RESULTS OF OPERATIONS.

This section of the report includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this report. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or our predictions.

Plan of Operation

We are a start-up, exploration stage corporation and have not yet generated or realized any revenues from our business operations.

- -14-

Our auditor has issued a going concern opinion. This means that there is substantial doubt that we can continue as an on-going business for the next twelve months unless we obtain additional capital to pay our bills. This is because we have not generated any revenues and no revenues are anticipated until we begin removing and selling minerals. There is no assurance we will ever reach this point. Accordingly, we must raise cash from sources other than the sale of minerals found on the property. That cash must be raised from other sources. Our only other source for cash at this time is investments by other. We must raise cash to implement our project and stay in business. If we raise the minimum amount of money in our offering, we believe it will last twelve months.

We will be conducting research in the form of exploration of the property. Our exploration program is explained in as much detail as possible in the business section of our prospectus. We are not going to buy or sell any plant or significant equipment during the next twelve months.

The property is comprised of 8 contiguous cells totaling 417 acres. At the center of the property the latitude is 49° 01’ 0" N and the longitude is 119° 35’ 50" W. The claim is motor vehicle accessible from the Town of Osoyoos, B.C. by traveling two miles west along Highway #3 and then traveling south past Kilpoola Lake for approximately 4.5 miles by gravel ranch roads to the mineral claim.

Our exploration target is to find an ore body containing gold. Our success depends upon finding mineralized material. This includes a determination by our consultant if the property contains reserves. We have not selected a consultant as of the date of this report and will not do so until our offering is successfully completed, if that occurs, of which there is no assurance. Mineralized material is a mineralized body, which has been delineated by appropriate spaced drilling or underground sampling to support sufficient tonnage and average grade of metals to justify removal. If we don’t find mineralized material or we cannot remove mineralized material, either because we do not have the money to do it or because it is not economically feasible to do it, we will suspend exploration operations.

In addition, we may not have enough money to complete our exploration of the property. If it turns out that we have not raised enough money to complete our exploration program, we will try to raise additional funds from a second public offering, a private placement or loans. At the present time, we have not made any plans to raise additional money and there is no assurance that we would be able to raise additional money in the future. If we need additional money and can’t raise it, we will have to suspend or cease operations.

We must conduct exploration to determine what amount of minerals, if any, exist on our property, and whether any minerals which are found can be economically extracted and profitably processed.

The property is undeveloped raw land. Exploration and surveying has not been initiated and will not be initiated until we raise money in this offering. That is because we do not have money to start exploration. Once the offering is concluded, we intend to start exploration operations. To our knowledge, the property has never been mined. The only event that has occurred is the recording of the property by James McLeod and a physical examination of the property by Ms. Xu, our sole officer and director. The registration of the cells was included in the $4,000 paid to James McLeod. No additional payments were made or are due to James McLeod for his services. The claims were recorded in Ms. Xu’s name to avoid incurring additional costs at this time. The additional fees would be for incorporation of a British Columbia corporation and legal and accounting fees related to the incorporation. In July 2007, Ms. X u executed a declaration of trust acknowledging that she holds the property in trust for us and she will not

-15-

deal with the property in any way, except to transfer the property to us. In the event that Ms. Xu transfers title to a third party, the declaration of trust will be used as evidence that she breached her fiduciary duty to us. Ms. Xu has not provided us with a signed or executed bill of sale in our favor. Ms. Xu will issue a bill of sale to a subsidiary corporation to be formed by us should mineralized material be discovered on the property. Mineralized material is a mineralized body, which has been delineated by appropriate spaced drilling or underground sampling to support sufficient tonnage and average grade of metals to justify removal. Before mineral retrieval can begin, we must explore for and find mineralized material. After that has occurred we have to determine if it is economically feasible to remove the mineralized material. Economically feasible means that the costs associated with the removal of the mineralized material wil l not exceed the price at which we can sell the mineralized material. We can’t predict what that will be until we find mineralized material. Ms. Xu does not have a right to sell the property to anyone. She may only transfer the property to us. She may not demand payment for the claims when she transfers them to us. Further, Ms. Xu does not have the right to sell the claims at a profit to us if mineralized material is discovered on the property. Ms. Xu must transfer title to us, without payment of any kind, upon our demand, whether mineralized material is found on the claims or not.

We do not know if we will find mineralized material. We believe that activities occurring on adjoining properties are not material to our activities. The reason is that what ever is located under adjoining properties may or may not be located under our property.

We do not claim to have any minerals or reserves whatsoever at this time on any of our property.

In the event that we close the minimum offering ($100,000), we intend to implement an exploration program which consists of core sampling. Core sampling is the process of drilling holes to a depth of up to 300 feet in order to extract a samples of earth. Ms. Xu, after confirming with our consultant, will determine where drilling will occur on the property. Ms. Xu will not receive fees for her services. The samples will be tested to determine if mineralized material is located on the property. Based upon the tests of the core samples, we will determine if we will terminate operations, proceed with additional exploration of the property, or develop the property. The proceeds from our public offering are designed to only fund the costs of core sampling and testing. We intend to take our core samples to analytical chemists, geochemists and registered assayers located in Richmond, British Columbia.

We estimate the cost of drilling will be $20 per foot drilled. The amount of drilling will be predicated upon the amount of money raised in our public offering. If we raise the minimum amount of money, we plan to drill approximately 3,000 linear feet or 8 holes to depth of 300 feet. Assuming that we raise the maximum amount of money, we plan to drill approximately 7,000 linear feet, or up to 28 holes to a depth of 300 feet. We estimate that it will take up to three months to drill 28 holes to a depth of 300 feet each. We will pay a consultant up to a maximum of $5,000 per month for his services during the three month period or a total of $15,000. The total cost for analyzing the core samples will be $3,000. We will begin exploration activity 90 days after the completion of our public offering, weather permitting.

We do not intend to interest other companies in the property if we find mineralized materials. We intend to try to develop the reserves ourselves through the use of consultants. To pay the consultants and develop the reserves, we will have to raise additional funds through a second public offering, a private placement or through loans. As of the date of this report, we have no plans to raise additional funds other than the funds being raised in our public offering. Further, there is no assurance we will be able to raise any additional funds even if we discover mineralized material and have a defined ore body.

-16-

If we are unable to complete any phase of exploration because we don’t have enough money, we will suspend operations until we raise more money. If we can’t or don’t raise more money, we will cease operations. If we cease operations, we don’t know what we will do and we don’t have any plans to do anything.

We don’t intend to hire additional employees at this time. All of the work on the property will be conducted by unaffiliated independent contractors that we will hire. The independent contractors will be responsible for surveying, geology, engineering, exploration, and excavation. The geologist will evaluate the information derived from the exploration and excavation and the engineer will advise us on the economic feasibility of removing the mineralized material.

Milestones

The following are our milestones:

| | 1. | 0-90 days after completion of the offering - retain our consultant to manage the exploration of the property. Cost - $5,000 to $15,000. Time of retention 0-90 days. To carry out this milestone, we must hire a consultant. There are a number of mining consultants located in Richmond, British Columbia who we intend to interview. |

| |

| 2. | 90-180 days after completion of the offering - Core drilling. Core drilling will cost $20 per foot. The number of holes to be drilled will be dependent upon the amount raised from the offering. Core drilling we be subcontracted to non-affiliated third parties. Cost - $60,500 to $142,000. Time to conduct the core drilling - 90 days. The core driller will be retained by our consultant. |

| |

| 3. | 180-210 days after completion of the offering - Have an independent third party analyze the samples from the core drilling. Determine if mineralized material is below the ground. If mineralized material is found, we will attempt to define the ore body. We estimate that it will take 30 days and cost $3,000 to analyze the core samples. |

|

The cost of the subcontractors is included in cost of the exploration services to be performed as set forth in the Use of Proceeds section and the Business section of our prospectus. All funds for the foregoing activities will be obtained from our public offering.

Limited Operating History; Need for Additional Capital

There is limited historical financial information about us upon which to base an evaluation of our performance. We are an exploration stage corporation and have not generated any revenues from operations. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources, possible delays in the exploration of our properties, and possible cost overruns due to price increases in services.

-17-

To become profitable and competitive, we must conduct research in the form of exploration on the property. We are seeking equity financing to provide the capital required to implement our research and exploration phases. We believe that the funds raised from our public offering, whether it be the minimum amount or the maximum amount, will allow us to operate for one year.

We have no assurance that future financing will be available to us on acceptable terms. If financing is not available on satisfactory terms, we may be unable to continue, develop or expand our operations. Equity financing could result in additional dilution to existing shareholders.

Liquidity and Capital Resources

To meet our need for cash we are attempting to raise money from our public offering. We cannot guarantee that we will be able to raise enough money through our public offering to stay in business. If we find mineralized material and it is economically feasible to remove the mineralized material, we will attempt to raise additional money through a subsequent private placement, public offering or through loans. If we do not raise all of the money we need from this offering to complete our exploration of the property, we will have to find alternative sources, like a second public offering, a private placement of securities, or loans from our officer or others.

Ms. Xu has agreed to advance funds as needed until the public offering is completed or failed and has agreed to pay the cost of reclaiming the property should mineralized material not be found. The foregoing agreement is oral, there is nothing in writing to evidence the same. While Ms. Xu has agreed to advance the funds, the agreement is unenforceable as a matter of law since there is no consideration for her agreement. At the present time, we have not made any arrangements to raise additional cash, other than through our public offering. If we need additional cash and can't raise it, we will either have to suspend operations until we do raise the cash, or cease operations entirely. Whether we raise the minimum amount or maximum amount, it will last a year. Other than as described in this paragraph, we have no other financing plans.

We acquired one mineral claim containing eight cells. We will begin our exploration plan upon completion of this offering. We expect to start exploration operations, weather permitting, within 90 days of completing this offering. As of the date of this report we have yet to begin operations and therefore we have yet to generate any revenues.

Since inception, we have issued 1,000,000 shares of our common stock and received $10.

We issued 1,000,000 shares of common stock to our former officer and director pursuant to the exemption from registration contained in Regulation S of the Securities Act of 1993. The purchase price of the shares was $10. This was accounted for as an acquisition of shares. Yanhua Xu subsequently advanced funds to the Company to cover expenses such as incorporation, accounting and legal fees and for registering the property. The amount owed to Ms. Xu is non-interest bearing, unsecured and has no specific terms of repayment. Further, the agreement with Ms. Xu is oral and there is no written document evidencing the agreement.

As of July 31, 2008, our total assets were $7,590 and our total liabilities were $47,968 for a stockholders' deficiency of $40,378.

-18-

Recent Accounting Pronouncements

Certain accounting pronouncements have been issued by the FASB and other standards setting organizations which are not yet effective and have not yet been adopted by the Company. The impact on the Company’s financial position and results of operations from adoption of these standards is not expected to be material.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | F-1 |

| FINANCIAL STATEMENTS | |

| Balance Sheet | F-2 |

| Statement of Operations | F-3 |

| Statement of Stockholders' Equity (Deficit) | F-4 |

| Statement of Cash Flows | F-5 |

| NOTES TO FINANCIAL STATEMENTS | F-6 |

-19-

MICHAEL T. STUDER CPA P.C.

18 East Sunrise Highway

Freeport, NY 11520

Phone: (516) 378-1000

Fax: (516) 546-6220

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Jesters Resources, Inc.

I have audited the accompanying balance sheet of Jesters Resources, Inc. (the Company), an exploration stage company, as of July 31, 2008 and the related statements of operations, stockholders’ equity and cash flows for the year ended July 31, 2008, for the period June 19, 2007 (inception) to July 31, 2007, and for the period from June 19, 2007 (inception) to July 31, 2008. These financial statements are the responsibility of the Company’s management. My responsibility is to express an opinion on these financial statements based on my audits.

I conducted my audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that I plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. I believe that my audits provide a reasonable basis for my opinion.

In my opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Jesters Resources, Inc. an exploration stage company, as of July 31, 2008 and the results of its operations and its cash flows for the year ended July 31, 2008, for the period June 19, 2007 (inception) to July 31, 2007, and for the period June 19, 2007 (inception) to July 31, 2008 in conformity with accounting principles generally accepted in the United States.

The accompanying financial statements referred to above have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company’s present financial situation raises substantial doubt about its ability to continue as a going concern. Management’s plans in regard to this matter are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

MICHAEL T. STUDER

Michael T. Studer CPA P.C.

Freeport, New York

October 27, 2008

F-1

-20-

| JESTERS RESOURCES, INC. | | | | | | |

| (An Exploration Stage Company) | | | | | | |

| Balance Sheets | | | | | | |

| (Expressed in US Dollars) | | | | | | |

| |

| |

| | | July 31, | | | July 31, | |

| | | 2008 | | | 2007 | |

| |

| ASSETS | | | | | | |

| |

| Current Assets | | | | | | |

| Cash | $ | 7,590 | | $ | 10,003 | |

| Total Current Assets | | 7,590 | | | 10,003 | |

| |

| Mining property acquisition costs, less reserve for | | | | | | |

| impairment of $1,000 | | - | | | - | |

| Total Assets | $ | 7,590 | | $ | 10,003 | |

| |

| |

| |

| |

| LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIENCY) | | | | |

| |

| Current Liabilities | | | | | | |

| Accounts payable and accrued liabilities | $ | 1,835 | | $ | - | |

| Due to related party | | 46,133 | | | 24,573 | |

| Total current liabilities | | 47,968 | | | 24,573 | |

| |

| Stockholders' Equity (Deficiency) | | | | | | |

| Preferred stock, $0.00001 par value; | | | | | | |

| authorized 100,000,000 shares, | | | | | | |

| issued and outstanding 0 shares | | - | | | - | |

| Common stock, $0.00001 par value; | | | | | | |

| authorized 100,000,000 shares, | | | | | | |

| issued and outstanding 1,000,000 shares | | 10 | | | 10 | |

| Additional paid-in capital | | - | | | - | |

| Deficit accumulated during | | | | | | |

| the exploration stage | | (40,388 | ) | | (14,580 | ) |

| |

| Total stockholders' equity (deficiency) | | (40,378 | ) | | (14,570 | ) |

| |

| Total Liabilities and Stockholders' Equity (Deficiency) | $ | 7,590 | | $ | 10,003 | |

| |

| |

| See notes to financial statements. | | | | | | |

F-2

-21-

| JESTERS RESOURCES, INC. | | | | | | | | | |

| (An Exploration Stage Company) | | | | | | | | | |

| Statements of Operations | | | | | | | | | |

| (Expressed in US Dollars) | | | | | | | | | |

| |

| |

| | | | | | | | | Cumulative | |

| | | | | | | | | during the | |

| | | | | | | | | Exploration | |

| | | | | | Period July 19, 2007 | | | Stage (June 19, | |

| | | Year ended | | | (inception) to | | | 2007 To July 31, | |

| | | July 31, 2008 | | | July 31, 2007 | | | 2008) | |

| |

| Revenue | $ | - | | $ | - | | $ | - | |

| |

| Costs and expenses | | | | | | | | | |

| Mining property exploration and carrying costs | | 771 | | | 3,000 | | | 3,771 | |

| Impairment of mining property acquisition costs | | - | | | 1,000 | | | 1,000 | |

| General and administrative expenses | | 25,037 | | | 10,580 | | | 35,617 | |

| Total Costs and Expenses | | 25,808 | | | 14,580 | | | 40,388 | |

| Net Loss | $ | (25,808 | ) | $ | (14,580 | ) | $ | (40,388 | ) |

| |

| Net Loss per share | | | | | | | | | |

| Basic and diluted | $ | (0.03 | ) | $ | (0.01 | ) | | | |

| |

| |

| Number of common shares used to compute loss per share | | | | | | | | | |

| Basic and Diluted | | 1,000,000 | | | 1,000,000 | | | | |

| |

| |

| See notes to financial statements. | | | | | | | | | |

F-3

-22-

| JESTERS RESOURCES, INC. | | | | | | | | | | | |

| (An Exploration Stage Company) | | | | | | | | | | | |

| Statements of Stockholders' Equity (Deficiency) | | | | | | | | | | |

| For the period June 19, 2007 (Inception) to July 31, 2008 | | | | | | | | |

| (Expressed in US Dollars) | | | | | | | | | | | |

| |

| |

| | | | | | | | Deficit | | | | |

| | | | | | | | Accumulated | | | Total | |

| | Common Stock, $0.00001 | | | | During the | | | Stockholders' | |

| | Par Value | | Additional | | Exploration | | | Equity | |

| | Shares | | Amount | | Paid-in Capital | | Stage | | | (Deficiency) | |

| Common stock issued | | | | | | | | | | | |

| - July, 2007 at $0.00001 per share | 1,000,000 | $ | 10 | $ | - | $ | - | | $ | 10 | |

| Net loss for the period June 19, | | | | | | | | | | | |

| 2007 (inception) to July 31, 2007 | - | | - | | - | | (14,580 | ) | | (14,580 | ) |

| Balance, July 31, 2007 | 1,000,000 | | 10 | | | | (14,580 | ) | | (14,570 | ) |

| Net loss for the year ended July 31, 2008 | - | | - | | - | | (25,808 | ) | | (25,808 | ) |

| Balance, July 31, 2008 | 1,000,000 | $ | 10 | $ | - | $ | (40,388 | ) | $ | (40,378 | ) |

| |

| |

| See notes to financial statements. | | | | | | | | | | | |

F-4

-23-

| JESTERS RESOURCES, INC. | | | | | | | | |

| (An Exploration Stage Company) | | | | | | | | |

| Statements of Cash Flows | | | | | | | | |

| (Expressed in US Dollars) | | | | | | | | |

| |

| |

| | | | | | | | Cumulative | |

| | | | | | | | during the | |

| | | | | | | | Exploration | |

| | | | | Period June 19, 2007 | | | Stage (June 19, | |

| | Year ended | | | (inception) to | | | 2007 To July 31, | |

| | July 31, 2008 | | | July 31, 2007 | | | 2008) | |

| |

| Cash Flows from Operating Activities | | | | | | | | |

| Net loss | (25,808 | ) | $ | (14,580 | ) | $ | (40,388 | ) |

| Adjustments to reconcile net loss to net cash | | | | | | | | |

| used for operating activities: | | | | | | | | |

| Impairment of mining property acquisition costs | - | | | 1,000 | | | 1,000 | |

| Increase in accounts payable and accrued liabilities | 1,835 | | | - | | | 1,835 | |

| Net cash provided by (used for) operating activities | (23,973 | ) | | (13,580 | ) | | (37,553 | ) |

| |

| Cash Flows from Investing Activities | | | | | | | | |

| Mining property acquisition cost | - | | | (1,000 | ) | | (1,000 | ) |

| Net cash provided by (used for) investing activities | - | | | (1,000 | ) | | (1,000 | ) |

| |

| Cash Flows from Financing Activities | | | | | | | | |

| Proceeds from issurance of common stock | - | | | 10 | | | 10 | |

| Due to related party | 21,560 | | | 24,573 | | | 46,133 | |

| Net cash provided by (used for) financial activities | 21,560 | | | 24,583 | | | 46,143 | |

| |

| Increase (decrease) in cash | (2,413 | ) | | 10,003 | | | 7,590 | |

| Cash, beginning of period | 10,003 | | | - | | | - | |

| |

| Cash, end of period | 7,590 | | $ | 10,003 | | $ | 7,590 | |

| |

| |

| Supplemental Disclosures of Cash Flow Information: | | | | | �� | | | |

| Interest paid | | | $ | - | | $ | - | |

| Income taxes paid | | | $ | - | | $ | - | |

| |

| |

| See notes to financial statements. | | | | | | | | |

F-5

-24-

JESTERS RESOURCES, INC.

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

July 31, 2008

(Expressed in US Dollars)

Note 1Organization and Business Operations

Jesters Resources, Inc. (the “Company”) was incorporated in the State of Nevada on June 19, 2007. The Company is an Exploration Stage Company as defined by Statement of Financial Accounting Standards (“SFAS”) No. 7. The Company has acquired a mineral property located in the Province of British Columbia, Canada, and has not yet determined whether this property contains reserves that are economically recoverable.

Note 2Summary of Significant Accounting Policies

Basis of Presentation

These financial statements have been prepared on a “going concern” basis, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. However, as of July 31, 2008, the Company had cash of $7,590 and a stockholders’ deficiency of $40,378. Further, since inception, the Company has incurred a net loss of $40,388. These factors create substantial doubt as to the Company’s ability to continue as a going concern. The Company plans to improve its financial condition by obtaining new financing. However, there is no assurance that the Company will be successful in accomplishing this objective. The financial statements do not include any adjustments that might be necessary should the Company be unable to continue as a going concern.

Mineral Property Costs

The Company is in the exploration stage since its incorporation and inception on June 19, 2007 and has not yet realized any revenues from its planned operations. It is primarily engaged in the acquisition and exploration of mining properties. Mineral property acquisition costs are capitalized and are charged to operations as the value is impaired. Exploration costs are expensed until proven and probable reserves are established. When it has been determined that a mineral property can be economically developed as a result of establishing proven and probable reserves, the costs incurred to develop such property are capitalized. Such costs will be amortized using the units-of-production method over the estimated life of the probable reserves.

F-6

- -25-

JESTERS RESOURCES, INC.

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

July 31, 2008

(Expressed in US Dollars)

Note 2Summary of Significant Accounting Policies– (cont’d)

Use of Estimates and Assumptions

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Foreign Currency Translation

The Company’s functional and reporting currency is the United States dollar.

Financial Instruments

The carrying value of the Company’s financial instruments, consisting of cash, accounts payable and accrued liabilities, and due to related party, approximates their fair value due to the short maturity of these instruments.

Environmental Costs

Environmental expenditures that relate to current operations are charged to operations or capitalized as appropriate. Expenditures that relate to an existing condition caused by past operations, and which do not contribute to current or future revenue generation, are charged to operations. Liabilities are recorded when environmental assessments and/or remedial efforts are probable, and the cost can be reasonably estimated. Generally, the timing of these accruals coincides with the earlier of completion of a feasibility study or the Company’s commitments to a plan of action based on the then known facts.

Income Taxes

Income taxes are accounted for under the assets and liability method. Deferred tax assets and liabilities are recognized for the estimated future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates in effect for the year in which those temporary differences are expected to be recovered or settled.

F-7

-26-

JESTERS RESOURCES, INC.

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

July 31, 2008

(Expressed in US Dollars)

Note 2Summary of Significant Accounting Policies– (cont’d)

Basic and Diluted Net Loss Per Share

The Company computes net income (loss) per share in accordance with SFAS No. 128, "Earnings per Share". SFAS No. 128 requires presentation of both basic and diluted earnings per share (EPS) on the face of the income statement. Basic EPS is computed by dividing net income (loss) available to common shareholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS gives effect to all potentially dilutive common shares outstanding during the period. Diluted EPS excludes all potentially dilutive shares if their effect is anti-dilutive.

Stock-based Compensation

Stock-based compensation is accounted for at fair value in accordance with SFAS Nos. 123 and 123R. To date, the Company has not adopted a stock option plan and has not granted any stock options.

Cash and Cash Equivalents

The Company considers all highly liquid instruments with a maturity of three months or less at the time of issuance to be cash equivalents.

Note 3Mineral Property

Pursuant to a mineral property purchase agreement dated June 30, 2007, the Company acquired a 100% undivided right, title and interest in the JR mineral claim, located approximately 7 miles west of the Town of Osoyoos, Okanogan Region of British Columbia, Canada, for $1,000. The Tenure Number ID is 561450, which expires June 27, 2009. The property is in the name of Yanhua Xu held by her in trust for the Company.

In June 2007, the Company received an evaluation report from a third party consulting firm recommending an exploration program with a total estimated cost of $55,000. Due to lack of working capital, the Company has not completed this program. At July 31, 2007, the Company provided a $1,000 reserve for impairment of the mining property acquisition costs.

Note 4Due to Related Party

The $46,133 amount due to related party at July 31, 2008 is due the sole stockholder and former sole officer and director of the Company, is non-interest bearing, and is due on demand.

F-8

- -27-

JESTERS RESOURCES, INC.

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

July 31, 2008

(Expressed in US Dollars)

Note 5Common Stock

In July 2007, the Company issued a total of 1,000,000 shares of common stock to its then sole officer and director for total cash proceeds of $10.

At July 31, 2008, there are no outstanding stock options or warrants.

Note 6Income Taxes

The provision for (benefit from) income taxes differs from the amount computed by applying the statutory United States federal income tax rate of 35% to income (loss) before income taxes. The sources of the difference follow:

| | | | | | Period | | | Period | |

| | | | | | from June | | | from June | |

| | | | | | 19, 2007 | | | 19, 2007 | |

| | | | | | (Date of | | | (Date of | |

| | | | | | Inception) | | | Inception) | |

| | | Year Ended | | | to | | | to | |

| | | July 31, | | | July 31, | | | July 31, | |

| | | 2008 | | | 2007 | | | 2008 | |

| |

| Expected tax at 35% | $ | (9,033 | ) | $ | (5,103 | ) | $ | (14,136 | ) |

| Increase in valuation allowance | | 9033 | | | 5103 | | | 14,136 | |

| Income tax provision | $ | - | | $ | - | | $ | - | |

Significant components of the Company’s deferred income tax assets are as follows:

| | | July 31, | | | | | | July 31, | |

| | | 2008 | | | | | | 2007 | |

| Net operating loss carryforword | $ | 14,136 | | | | | $ | 5,103 | |

| Valuation allowance | | (14,136 | ) | | | | | (5,103 | ) |

| Net deferred tax assets | $ | - | | | | | $ | - | |

No provision for income taxes has been recorded since the Company has incurred net losses since inception. Based on management’s present assessment, the Company has not yet determined it to be more likely than not that a deferred tax asset of $14,136 attributable to the future utilization of the net operating loss carryforward of $40,388 as of July 31, 2008 will be realized. Accordingly, the Company has provided a 100% allowance against the deferred tax asset in the financial statements. The Company will continue to review this valuation

F-9

- -28-

JESTERS RESOURCES, INC.

(An Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

July 31, 2008

(Expressed in US Dollars)

Note 6Income Taxes– (cont’d)

allowance and make adjustments as appropriate. The $40,388 net operating loss carryforward expires $ 14,580 in year 2027 and $25,808 in year 2028.

Current tax laws limit the amount of loss available to be offset against future taxable income when a substantial change in ownership occurs. Therefore, the amount available to offset future taxable income may be limited.

Note 7Subsequent Event

On September 12, 2008, the Securities and Exchange Commission (“SEC”) “declared effective” the Company’s registration statement on Form S-1 in connection with a public offering of up to 2,000,000 shares of common stock at $0.10 per share, or $200,000 total. The offering is being self-underwritten on a “best efforts, all or none basis” as to the first 1,000,000 shares and on a “best efforts basis” as to the remaining 1,000,000 shares for a period of up to 270 days. Subscription proceeds are to be maintained in a separate bank account until the Company receives a minimum of $100,000; in the event that 1,000,000 shares are not sold within the 270 days, all money received is to be promptly returned to the subscribers.

As of October 29, 2008, no subscription proceeds have been received by the Company.

F-10

-29-

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

There have been no disagreements on accounting and financial disclosures from the inception of our company through the date of this Form 10-K. Our financial statements for the period from inception to July 31, 2008, included in this report have been audited by Michael T. Studer CPA P.C. 18 East Sunrise Highway, Suite 311, Freeport, New York 11520, as set forth in this annual report.

PART III

ITEM 9A. CONTROLS AND PROCEDURES.

Evaluation of Disclosure Controls and Procedures

We maintain “disclosure controls and procedures,” as such term is defined in Rule 13a-15(e) under the Securities Exchange Act of 1934 (the “Exchange Act”), that are designed to ensure that information required to be disclosed in our Exchange Act reports is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission rules and forms, and that such information is accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure. We conducted an evaluation (the “Evaluation”), under the supervision and with the participation of our Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”), of the effectiveness of the design and operation of our disclosure controls and proced ures (“Disclosure Controls”) as of the end of the period covered by this report pursuant to Rule 13a-15 of the Exchange Act. Based on this Evaluation, our CEO and CFO concluded that our Disclosure Controls were effective as of the end of the period covered by this report.

Changes in Internal Controls

We have also evaluated our internal controls for financial reporting, and there have been no significant changes in our internal controls or in other factors that could significantly affect those controls subsequent to the date of their last evaluation.

Limitations on the Effectiveness of Controls

Our management, including our CEO and CFO, does not expect that our Disclosure Controls and internal controls will prevent all errors and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of a simple error or mistake. Additionally, controls can be circumvented by the indivi dual acts of some persons, by collusion of two or more people, or by management or board override of the control.

- -30-

The design of any system of controls also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions; over time, controls may become inadequate because of changes in conditions, or the degree of compliance with the policies or procedures may deteriorate. Because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected.

CEO and CFO Certifications

Appearing immediately following the Signatures section of this report there are Certifications of the CEO and the CFO. The Certifications are required in accordance with Section 302 of the Sarbanes-Oxley Act of 2002 (the Section 302 Certifications). This Item of this report, which you are currently reading is the information concerning the Evaluation referred to in the Section 302 Certifications and this information should be read in conjunction with the Section 302 Certifications for a more complete understanding of the topics presented.

Management’s Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rule 13a-15(f). The Company’s internal control over financial reporting is a process designed to provide reasonable assurance to our management and board of directors regarding the reliability of financial reporting and the preparation of the financial statements for external purposes in accordance with accounting principles generally accepted in the United States of America.

Our internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the Company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with accounting principles generally accepted in the United States of America, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the Company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal controls over financial reporting may not prevent or detect misstatements. All internal control systems, no matter how well designed, have inherent limitations, including the possibility of human error and the circumvention of overriding controls. Accordingly, even effective internal control over financial reporting can provide only reasonable assurance with respect to financial statement preparation. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Our management assessed the effectiveness of our internal control over financial reporting as of July 31, 2008. In making this assessment, it used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) inInternal Control-Integrated Framework. Based on our assessment, we believe that, as of July 31, 2008, the Company’s internal control over financial reporting was effective based on those criteria.

-31-

This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit us to provide only management’s report in this annual report.

ITEM 9B. OTHER INFORMATION

None.

ITEM 10. DIRECTORS AND EXECUTIVE OFFICERS, PROMOTERS AND CONTROLPERSONS.

Our Sole Officer and Director

Our director serves until his successor is elected and qualified. Our officer is elected by the board of directors to a term of one (1) year and serves until his successor is duly elected and qualified, or until they are removed from office. The board of directors has no nominating, auditing or compensation committees.

The name, address, age and position of our present officer and director is set forth below:

| Name | Age | Position(s) Held |

| Hao Zeng | 36 | president, principal executive officer, principal financial |

| | | officer, secretary, treasurer and a member of the |

| | | board of directors |

The person named above has held his office/position since inception of our company and is expected to hold his office/position until the next annual meeting of our stockholders.

Background of Our Sole Officer and Director

Since September 3, 2008, Hao Zeng has been our president, principal executive officer, principal financial officer, principal accounting officer, secretary, treasurer and sole director. Since June 2003, Mr. Zeng has been District Manager of Shanghai Office of Expotech (Shanghai) Company Limited located in Shanghai, China. Expotech (shanghai) Company Limited is engaged in the business of international and domestic trade show and exhibition. Form March 1998 to May 2003, Mr. Zeng was Financial Controller for Yisihan Cosmetics Inc. located in Shanghai, China. Yisihan Cosmetics Inc. is engaged in the business of manufacturing and selling of cosmetic products. Mr. Zeng holds a Bachelor of Business Administration from Xiamen University, China (1995). Other than our board of directors, Mr. Zeng has not been a member of the board of directors of any corporations during the last five years.

-32-

Involvement in Certain Legal Proceedings