OxySure® Systems, Inc.

February 11, 2011

Mr. Geoffrey Kruczek

Securities and Exchange Commission

Washington, D.C. 20549

Re: OxySure Systems, Inc.

Amendment No. 5 to Registration Statement on Form S-1/A

Filed on November 12, 2010

File Number 333-159402

Dear Mr. Kruczek:

We have received your comment letter dated February 4, 2011 (the “Comment Letter”) regarding Amendment No. 5 to our Registration Statement on Form S-1/A filed on January 13, 2011 (the “Registration Statement”). We have prepared the following responses describing the general action(s) taken regarding each comment in the Comment Letter. The following numbers herein are coordinated to the comment number in the Comment Letter.

1. There is no comment to address at this time.

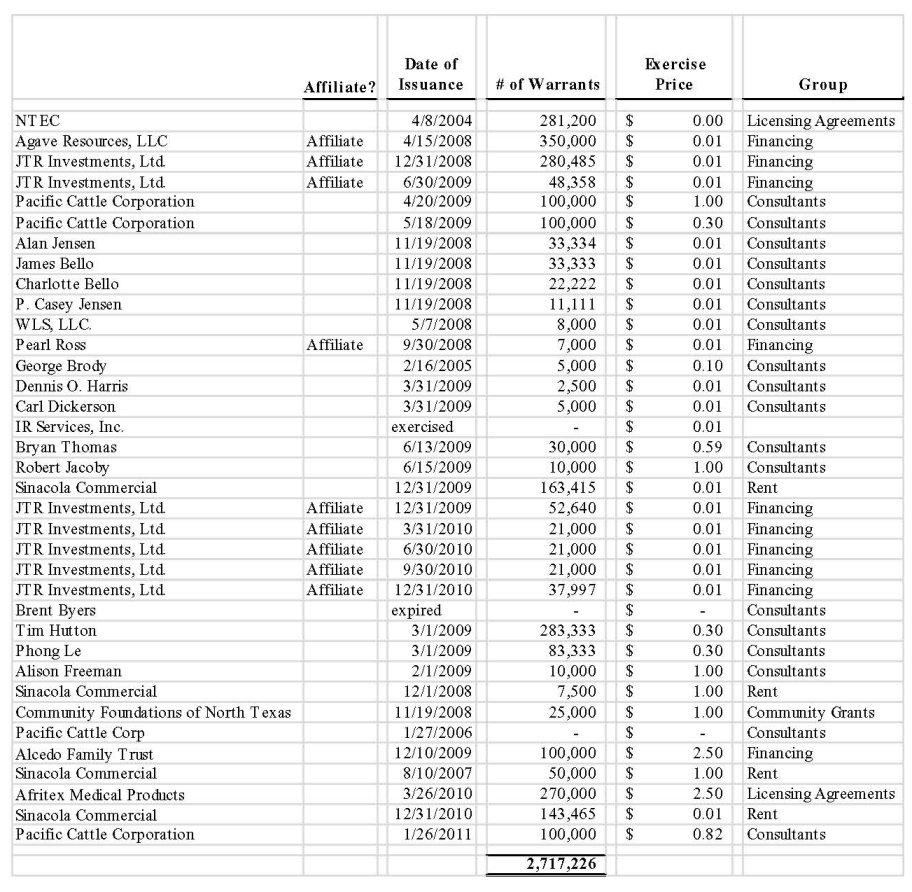

Warrants

2. We have revised the Registration Statement to state that the aggregate exercise price of all our warrants outstanding as of the date Registration Statement should have been $0.54. We have corrected the aggregate exercise prices of our warrants outstanding as follows:

| · | On page 3, the corrected table as at the date of our prior amendment (January 13, 2011) is as follows: |

| Group | | Total Number of Warrants Outstanding | | | Aggregate Exercise Price | | | Number of Warrants Exercisable Immediately | | | Number of Warrants held by Affiliates and Promoters | | | Aggregate Exercise Price of Warrants held by Affiliates and Promoters | |

| | | | | | | | | | | | | | | | |

| Licensing Agreements | | | 551,200 | | | $ | 1.22 | | | | 551,200 | | | | - | | | | - | |

| Financing | | | 939,480 | | | $ | 0.28 | | | | 939,480 | | | | 839,480 | | | $ | 0.01 | |

| Consultants | | | 837,166 | | | $ | 0.43 | | | | 837,166 | | | | - | | | | - | |

| Rent | | | 364,380 | | | $ | 0.17 | | | | 364,380 | | | | - | | | | - | |

| Community Grants | | | 25,000 | | | $ | 1.00 | | | | 25,000 | | | | - | | | | - | |

| Totals | | | 2,717,226 | | | $ | 0.54 | | | | 2,717,226 | | | | 839,480 | | | $ | 0.01 | |

| · | On page F-27, the corrected table as at the date of Registration Statement is as follows: |

| | | Warrants | | | Weighted Average Exercise Price | |

| Outstanding at January 1, 2008 | | | 566,419 | | | $ | 0.25 | |

| Granted | | | 777,985 | | | $ | 0.05 | |

| Exercised | | | (120,000 | ) | | $ | 0.01 | |

| Forfeited/Cancelled | | | - | | | $ | - | |

| Outstanding at December 31, 2008 | | | 1,224,404 | | | $ | 0.15 | |

| Granted | | | 384,166 | | | $ | 0.31 | |

| Exercised | | | - | | | $ | - | |

| Forfeited/Cancelled | | | - | | | $ | - | |

| Outstanding at March 31, 2009 | | | 1,608,570 | | | $ | 0.19 | |

| Granted | | | 1,256,777 | | | $ | 0.13 | |

| Exercised | | | - | | | $ | - | |

| Forfeited/Cancelled | | | - | | | $ | - | |

| Outstanding at June 30, 2009 | | | 2,865,347 | | | $ | 0.16 | |

| Granted | | | - | | | $ | - | |

| Exercised | | | - | | | $ | - | |

| Forfeited/Cancelled | | | - | | | $ | - | |

| Outstanding at September 30, 2009 | | | 2,865,347 | | | $ | 0.16 | |

| Granted | | | 316,055 | | | $ | 0.80 | |

| Exercised | | | (125,000 | ) | | $ | 0.01 | |

| Forfeited/Cancelled | | | (843,419 | ) | | $ | 0.01 | |

| Outstanding at December 31, 2009 | | | 2,212,983 | | | $ | 0.32 | |

| Granted | | | 291,000 | | | $ | 2.32 | |

| Exercised | | | - | | | $ | - | |

| Forfeited/Cancelled | | | - | | | $ | - | |

| Outstanding at March 31, 2010 | | | 2,503,983 | | | $ | 0.55 | |

| Granted | | | 21,000 | | | $ | 0.01 | |

| Exercised | | | - | | | $ | - | |

| Forfeited/Cancelled | | | - | | | $ | - | |

| Outstanding at June 30, 2010 | | | 2,524,983 | | | $ | 0.55 | |

| Granted | | | 21,000 | | | $ | 0.01 | |

| Exercised | | | - | | | $ | - | |

| Forfeited/Cancelled | | | - | | | $ | - | |

| Outstanding at Sept 30, 2010 | | | 2,545,983 | | | $ | 0.54 | |

We have also made conforming changes to page F-67.

Please note that as of the date of the Registration Statement, our warrants outstanding have changed: we had 2,717,226 warrants outstanding at an aggregate exercise price of $0.51.

3. We have reconciled the warrants per the comment. Our revised summary table, as of the date hereof is as follows:

| Group | | Total Number of Warrants Outstanding | | | Aggregate Exercise Price | | | Number of Warrants Exercisable Immediately | | | Number of Warrants held by Affiliates and Promoters | | | Aggregate Exercise Price of Warrants held by Affiliates and Promoters | |

| Licensing Agreements | | | 551,200 | | | $ | 1.22 | | | | 551,200 | | | | - | | | | - | |

| Financing | | | 939,480 | | | $ | 0.28 | | | | 939,480 | | | | 839,480 | | | $ | 0.01 | |

| Consultants | | | 837,166 | | | $ | 0.43 | | | | 837,166 | | | | - | | | | - | |

| Rent | | | 364,380 | | | $ | 0.17 | | | | 364,380 | | | | - | | | | - | |

| Community Grants | | | 25,000 | | | $ | 1.00 | | | | 25,000 | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | |

| Totals | | | 2,717,226 | | | $ | 0.51 | | | | 2,717,226 | | | | 839,480 | | | $ | 0.01 | |

The list of warrants of all the warrants outstanding as of the date hereof, and the holders of each warrant is as follows:

Use of Proceeds

4. We have revised the Registration Statement to correct wording of the footnotes to state, “If 100% of the shares are sold in the direct public Offering, $500,000 of the First Note will remain outstanding and the Second Note will be paid in full.” The JTR Investments Limited Second Note will be paid in full.

Dilution

5. The tables below shows how we calculated, (a) the Number of Shares held after Conversion of all Convertible Securities; and (b) the Total Consideration after Conversion of all Convertible Securities for affiliate and non-affiliate equity holders prior to the direct public offering:

| | | | | | | | | | Consideration for Dilutives |

| | | | | | Owned | | Dilutive shares | |

| Julian T. Ross: | | | | | | | |

| | common stock held by The Ross Family Trust | | | 400,000 | | | | |

| | common stock held by JTR Investments, Limited | | | 12,800,000 | | | | |

| | common stock issuable upon exercise of warrants issued to JTR Investments | | | 444,483 | | 444,483 | | $ 4,445 |

| | common stock issuable upon exercise of stock options | | | 1,173,962 | | 1,173,962 | | $ 293,491 |

| | | options on 2004 agreement | | 828,962 | | | | | |

| | | options on 2009 agreement | | 180,000 | | | | | |

| | | options on 2010 agreement | | 165,000 | | | | | |

| | Afritex warrants | | | 270,000 | | 270,000 | | $ 675,000 |

| | Afritex note | | | 270,000 | | 270,000 | | $ 270,000 |

| | common stock upon exercise of stock options issued to Pearl Ross | | | 71,500 | | 71,500 | | $ 58,630 |

| | common stock issuable upon the conversion of two (JTR) notes | | | 610,200 | | 610,200 | | $ 915,300 |

| | common stock held by Pearl Ross | | | 8,000 | | | | |

| | warrants held by Pearl Ross | | | 7,000 | | 7,000 | | $ 70 |

| | | | | | 16,055,145 | | 2,847,145 | | $ 2,216,935 |

| | | | | | 68.11% | | | | |

| | | | | %of class: | 86.45% | | | | |

| Donald Reed: | | | | | | | |

| | common stock owned by Donald Reed’s spouse, Nancy Reed | | | 120,000 | | | | |

| | common stock held by Agave Resources | | | 720,000 | | | | |

| | common stock convertible from 1,000,000 shares of preferred stock held by Agave Resources | | | 1,220,000 | | 1,220,000 | | $ - |

| | common stock issuable upon exercise of stock options | | | 7,000 | | 7,000 | | $ 7,000 |

| | common stock issuable upon exercise of warrants issued to Agave Resources | | | 350,000 | | 350,000 | | $ 3,500 |

| | common stock issuable upon the conversion of a $750,000 note held by Agave Resources, LLC | | | 500,000 | | 500,000 | | $ 750,000 |

| | | | | | 2,917,000 | | 2,077,000 | | $ 760,500 |

| | | | | | 12.79% | | | | |

| | | | | %of class: | 16.39% | | | | |

| | | | | | | | | | |

| Vicki Jones: | | | | | | | |

| | common stock issuable upon exercise of stock options | | | 1,000 | | 1,000 | | $ 1,000 |

| | common stock | | | 17,000 | | | | |

| | common stock convertible from 150,000 shares of preferred stock | | | 183,000 | | 183,000 | | $ - |

| | common stock issuable upon exercise of warrants issued to Tim Hutton | | | 283,333 | | 283,333 | | $ - |

| | | | | | 484,333 | | 467,333 | | $ 1,000 |

| | | | | | 2.29% | | | | |

| | | | | %of class: | 2.99% | | | | |

| | | | | | | | | | |

| | | | | | 19,456,478 | | 5,391,478 | | $ 2,978,435 |

| | | | | | 74.50% | | | | $ 3,123,635 |

| | | | | %of class: | 92.14% | | | | |

| | | Total | | | Owned by Affiliates | | | Owned by Non-Affiliates | | | Dilutive Shares: Non-Affiliates | | | Consideration for Dilutives: Non-Affiliates | |

| | | | | | | | | | | | | | | | |

| Common Stock issued and outstanding | | | 15,724,816 | | | | 14,065,000 | | | | 1,659,816 | | | | | | | |

| Preferred Stock issued and outstanding | | | 3,126,434 | | | | 1,150,000 | 1 | | | 1,976,434 | | | | | | $ | - | |

| Preferred Stock issued and outstanding (as-converted) | | | 3,814,249 | | | | 1,403,000 | | | | 2,411,249 | | | | 2,411,249 | | | $ | - | |

| Options issued to purchase common stock | | | 2,321,994 | | | | 1,253,462 | 2 | | | 1,068,532 | | | | 1,253,462 | | | $ | 1,113,658 | |

| Warrants issued to purchase common stock | | | 2,545,983 | | | | 1,354,816 | 3 | | | 1,191,167 | | | | 1,191,167 | | | $ | 703,879 | |

| Convertible note shares | | | 1,724,605 | | | | 1,380,200 | | | | 344,405 | 4 | | | 344,405 | | | $ | 336,540 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total fully diluted: | | | | | | | | | | | 6,675,169 | | | | | | | | | |

| Subtotal, consideration: | | | | | | | | | | | | | | | | | | $ | 2,154,077 | |

| Add, Amount paid for common stock | | | | | | | | | | | | | | | | | | $ | 2,111,436 | |

| Total consideration | | | | | | | | | | | | | | | | | | $ | 4,265,513 | |

| (1) | Comprises: | | | |

| | Agave Resources, LLC | | 1,000,000 | |

| | Vicki Jones | | 150,000 | |

| | | | 1,150,000 | |

| | | | | |

| (2) | Comprises: | | | |

| | Julian Ross options | | 1,173,962 | |

| | Pearl Ross options | | 71,500 | |

| | Don Reed options | | 7,000 | |

| | Vicki Jones options | | 1,000 | |

| | | | 1,253,462 | |

| | | | | |

| (3) | Comprises: | | | |

| | JTR Warrants | | 444,483 | |

| | Afritex warrants | | 270,000 | |

| | Pearl Ross warrants | | 7,000 | |

| | Agave warrants | | 350,000 | |

| | Vicki Jones options | | 283,333 | |

| | | | 1,354,816 | |

| | | | | |

| (4) | Includes accrued interest which is also convertible to common. | |

Selling Security Holders

6. We have revised the Registration Statement to correct footnote 74 to state, “0.0005” rather than “0.005.”

Stock-Based Compensation

7. We have revised the Registration Statement to correct pages 44 and F-9 to state that: “The risk-free interest rate assumption is based on the five-year U.S. Treasury zero-coupon rate appropriate for the expected term of the stock options.”

Liquidity and Capital Resources

8. We have revised the Registration Statement to state, “The increase in Notes Payable was primarily due to a net increase in Current Notes Payable, from $332,928 at December 31, 2009 to $827,026 at September 30, 2010, representing an increase of $498,098 in our Current Notes Payable. This increase is primarily comprised of: A new short term note in the amount of $270,000 issued during 1Q 2010 in connection with a license agreement and a distribution agreement, both entered into with a new distributor; a net increase of $124,600 in borrowings from JTR Investments Limited during the period; and a new short term loan of $100,000 received in December 2009.”

9. The only interest-bearing notes we have outstanding as of September 30, 2010 were the Afritex Note and the Alcedo Note. The accrued interest on both of these notes is convertible into common stock (along with the principal) at our option. We have accrued the interest on these notes under “Accrued Expenses and Other Current Liabilities.”

| · | We have removed the reference indicating that “We have reduced our expenses.” |

| · | Our prior comment response 15 indicated as follows: “The Vencore deferred amount is contained under capital leases-current (stated as $307,667.83 as of September 30, 2010). The amount deemed deferred in connection with the Vencore lease is higher because our capital leases-current account is stated net of negative amounts related to premiums on capital leases.” That means, the net amount (net of any premiums, etc.) of our capital leases as at September 30, 2010 was $291,178, which is consistent with the disclosures on pages 49 and F-1. The gross amount of the capital leases-current related to Vencore specifically was $307,667.83 as of September 30, 2010. |

10. We deleted the eighth bullet regarding new products because we source the products from other manufacturers or suppliers, and therefore we act only as a distributor in such cases. This part of our business is at a very early stage, and we regard it as “non-core,” and there can be no assurance that we will continue to provide this capability to our customers. Given the infancy, non-core nature, and uncertainty of this part of our business, we believe it may not be appropriate for inclusion as a reliable measure to enhance our cash flow in the following 12 months.

Going Concern

11. We have revised page F-36 to state, “We received a loan from one person for $100,000.” The disclosure was misstated by the auditors on page F-36 because we are not conducting an offering nor are we conducting a bridge financing.

12. We have revised the Registration Statement to state that, “We have migrated to selling solutions, thereby diversifying our revenue opportunities. Our early sales efforts are focused primarily on institutional customers, such as for example schools and school districts, colleges, and churches. We sell to these customers primarily through distributors. Generally, the buying decisions for our customers are made or influenced by individuals such as safety managers, risk managers, nurses, administrators, facilities managers and medical directors. These individuals are usually also responsible for acquiring other safety or health emergency solutions or products, such as Automated External Defibrillators (“AEDs”), resuscitator bags (used for CPR), first aid kits, etc. We have recently started sourcing AEDs, resuscitator bags, and first aid kits in order to provide our customers with bundled solutions for their health emergency and preparedness requirements. That means, our customers can order these products from us as a single source, along with our portable emergency oxygen products.”

13. We have revised the Registration Statement to enhance our response to prior comment 19. Revenue Recognition—Principal Agent Considerations [formerly contained in EITF 99-19], includes the following 11 indicators of gross and net arrangements.

Indicators to evaluate gross treatment include:

| · | The seller is the primary obligor in the transaction. |

| · | The seller has inventory risk (general inventory risk before customer order is placed or upon customer return or risk of loss after customer order or during shipping). |

| · | The seller has latitude in establishing price. |

| · | The seller changes the product or performs part of the service. |

| · | The seller has discretion in supplier selection. |

| · | The seller is involved in the determination of product or service specifications. |

| · | The seller has physical loss inventory risk. |

| · | The seller has credit risk. |

Indicators of net treatment include:

| · | The seller is not the primary obligor. |

| · | The amount the seller earns is fixed. |

| · | The seller does not have credit risk. |

The determination of gross versus net reporting is a matter of judgment, and the above factors should each be evaluated. In our case, we require products (for example AEDs, resuscitator bags, display wall boxes, and so forth) that are manufactured and sold by third party suppliers and manufacturers. In order to facilitate sales to our customers, we offer for sale both our own products and the third party products to our customers. We guarantee the performance of the third party products and offer a full refund to our customers on nonconforming parts. We have a right to return the third party products for returns made by our customers for a replacement or a full refund from our third party suppliers. While we may agree with our third party suppliers not to sell their products for less than their list price, we can charge any price at or above list price for these third party products. We generally receive anywhere between a 10% and 40% discount off the list prices when we purchase products from our third party suppliers.

With the above in mind, the analysis is as follows (we are the “Seller”):

| Gross treatment | Yes or No |

| The seller is the primary obligor in the transaction | Yes |

| The seller has inventory risk (general inventory risk before customer order is placed or upon customer return or risk of loss after customer order or during shipping) | Yes |

| The seller has latitude in establishing price | Yes |

| The seller changes the product or performs part of the service | Product dependent |

| The seller has discretion in supplier selection | Yes |

| The seller is involved in the determination of product or service specifications | Product dependent |

| The seller has physical loss inventory risk | Yes |

| The seller has credit risk | Yes |

| | |

| Net treatment | Yes or No |

| The seller is not the primary obligor | No |

| The amount the seller earns is fixed | No |

| The seller does not have credit risk | No |

Given the analysis above, it is clear that we should record revenues from our third party products on a gross basis under ASC 605-45-45.

Results of Operations

14. We have revised the Registration Statement to state that, “Total revenues from products declined from $267,426 for the nine months ended September 30, 2009 to $104,919 for the nine months ended September 30, 2010. The decrease in revenue from products can be attributed to the fact that our management’s time and resources were substantially diverted by:

| · | The time and resources required to be spent on a complete re-audit of fiscal years ended December 31, 2008 and 2009, precipitated by the deregistration by the PCAOB of the Blackwing Group, our former auditor, due to PCAOB violations by the Blackwing Group unrelated to us; |

| · | The time and resources required to be spent on this registration process; |

| · | Considerable time, effort and resources spent on developing the Afritex license transaction and distribution agreement; and |

| · | Limited sales capability and financial resources. |

As of the date hereof, we have received the following purchase orders from Afritex:

| Purchase Order Date | Amount | Terms | Payment Received? | Date of Received Payment |

| 5/14/2010 | $120,955 | Prepayment; FOB Frisco, TX USA | Yes | 5/26/2010 |

| 10/18/2010 | $49,100 | Prepayment; FOB Frisco, TX USA | Yes | 10/21/2010 |

| 12/2/2010 | $85,600 | Prepayment; FOB Frisco, TX USA | Yes | 12/7/2010 |

Total orders received (and paid for) from Afritex (in addition to the license fees) during the first nine months subsequent to us entering into the distribution agreement with Afritex is $255,655.

Including the license fee, the total revenue received by us from Afritex in cash during the first nine months subsequent to us entering into the distribution agreement and the license agreement with them is $480,655.

15. Our inventories have increased because we are purchasing larger quantities of raw materials, inputs or components, as the case may be in order to minimize the impact of order lead times and to reduce our cost of goods sold (larger quantity purchases generally means lower piece part costs).

16. We have deleted the reference to the number of churches and the corresponding footnote 8.

Executive Officers and Directors

17. We have revised the Registration Statement to add a sentence for each officer and director which is substantially similar to the following sentence, ���The above experience, qualifications, attributes and skill led us to the conclusion that Julian T. Ross shall serve as our CEO, President, CFO, and director.”

18. We have revised the Registration Statement to state, “Agave Resources, LLC is a private company which consults with and invests in early and mid-stage development companies.”

Executive Compensation

19. We have revised the Registration Statement to update the executive compensation table as of December 31, 2010.

Warrants and Options

20. We have revised the Registration Statement to correct the error in the low end of the warrant exercise price to state, “0.0005” rather than “0.005.”

Interest of Named Experts and Counsel

21. We have added the missing LLC to the name of our registered public accounting firm on page F-38.

Related Party Transactions

22. We have revised the Registration Statement to provide the Related Party Transactions as of the date of the Registration Statement.

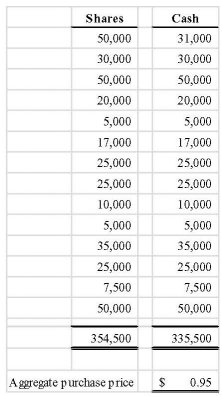

September 2008 Private Placement

23. The reconciliation for the number of shares sold during the period and the cash received is as follows:

We have revised the Registration Statement as follows:

“September 2008 Private Placement

In September 2008, we commenced a private placement of common stock pursuant to which we sold an aggregate of 354,500 shares of common stock to 14 accredited investors, under Rule 506 of Regulation D of the Act, at an aggregate purchase price of $0.95 per share, for gross proceeds of $335,500.”

Foreign Currency Risk

24. We have revised the Registration Statement to correct our disclosure regarding exchange rate fluctuations to state, “Substantially all of our operations are conducted in the United States and our primary operational currency is the U.S. Dollar (“USD”). Therefore, the effect of the fluctuations of the USD exchange rates has no appreciable impact on our business operations. Substantially all of our revenues and expenses are denominated in USD, and we use the USD for financial reporting purposes.”

Statement of Operations and Accumulated Deficit

25. We have added the disclosures required by ASC 250-10-50-7 for the nine months ended September 30, 2009 as Footnote 16. The word “restated” was removed from the heading for the Statement of Operations and Accumulated Deficit for the 3 months ended September 30, 2009.

Statements of Cash Flows

26. The purchases of property, plant, and equipment in the amount of $2,455 for the nine months ended September 30, 2010 is stated on a gross basis. Our sales of property, plant and equipment for the period was zero. We have considered ASC 230-10-45-7, 45-12, and 45-13 in our response.

Deferred Revenue and Income

27. The amount of $41,711 in deferred revenue was reduced to zero during the fourth quarter 2009, resulting in zero deferred revenue as at December 31, 2009. We satisfied all our obligations pursuant to this order and shipped the products during the fourth quarter of 2009. Therefore, we recognized the revenue of $41,711 during 4Q 2009 and debited deferred revenue by that same amount.

Notes Payable

Frisco Note

28. Ordinarily, the discount would be amortized over the remaining life of the FEDC Note, concomitantly with the forgiveness of portions of the note pursuant to the achievement of milestones by us. However, as previously disclosed we have been in the process of negotiating a restructure of the FEDC Note and the related FEDC Performance Agreement, and the operation of the performance agreement has been suspended during the nine months to September 30, 2010, and until such time as a debt restructuring has been determined or finalized. From an accounting point of view, we believe we must determine how to recognize the effects of the debt restructuring, including the treatment of the unamortized discount of $66,468, once the restructuring is completed.

There are various possibilities as to the eventual accounting treatment of the FEDC Note, the unamortized discount and any related accounting effects upon a final restructure. For example, we may determine that there are similarities to a so-called “Troubled Debt Restructuring.” Once a final restructure or renegotiation is completed, factors that might be applicable in such a determination include the following:

How a “Troubled Debt Structuring” is Determined?

No single characteristic or factor taken alone is determinative of whether a modification of terms or an exchange of a debt instrument is a troubled debt restructuring. Thus, making this determination requires the exercise of judgment. To determine whether the troubled debt structuring applies in our case, two questions need to be possessed:

1. Are we experiencing financial difficulty or difficulty performing to the debt requirements?

2. Has the FEDC granted us a concession?

The answer to question (i) is clearly yes, as we have disclosed in our Registration Statement. As regards to question (ii), the FEDC will have granted us a concession if our effective borrowing rate on the restructured FEDC Note (if applicable) is less than the effective borrowing rate immediately prior to the restructuring. This affects the imputed interest in the note, and consequently the discount. The effective borrowing rate should give effect to all the terms of the restructured debt, including options, warrants, guarantees, and so forth, if applicable. Also, the effective borrowing rate of the new debt should be compared to the effective borrowing rate of the original debt.

Conversely, in any of the following four situations, a concession granted by the FEDC does not automatically qualify as a restructuring:

| · | The fair value of the assets or equity interest accepted by the FEDC from us in full satisfaction of its receivable is at least equal to the FEDC’s recorded investment in the receivable. |

| · | The fair value of the assets or equity interest transferred by us to the FEDC in full settlement of our payable is at least equal to the carrying value of the payable. |

| · | The FEDC changes the effective interest rate to reflect a change in current interest rates or a change in the risk, in order to maintain the relationship. |

| · | We, in exchange for the old debt, issue new debt with an imputed interest rate that reflects current market rates. |

ASC No 470-60-55-1 notes that, the definition does not apply to debtors in bankruptcy unless the restructuring does not result from a general restatement of the debtor’s liabilities in bankruptcy proceedings. That is, the definition applies only if the debt restructuring is isolated to the creditor.

A troubled debt restructuring can occur one of two ways:

1. The first is a settlement of the debt at less than the carrying amount.

2. The second is a continuation of the debt with a modification of terms (i.e., changes in performance criteria, reduction face amount, or an extension of the payment dates or performance dates).

How we might approach accounting treatment if, for accounting purposes, the FEDC modification represents a so-called “Troubled Debt Restructuring”:

If the debt is settled by the exchange of assets, for example a gain is recognized in the period of transfer for the difference between the carrying amount of the debt (defined as the face amount of the debt increased or decreased by applicable accrued interest and applicable unamortized premium, discount, or issue costs) and the consideration given to extinguish the debt. A two-step process should then be used:

| · | Step-1. Any non-cash assets used to settle the debt are revalued at fair market value and the associated ordinary gain or loss is recognized; and |

| · | Step-2. The debt restructuring gain is determined and recognized. |

The gain or loss is evaluated under the “unusual and infrequent” criteria of ASC Topic 225-20. If stock is issued to settle the liability, the stock is recorded at its fair market value.

29. We have corrected the amount for deferred financing charges as at September 30, 2010 to $179,226 in the Registration Statement. The revised table for current notes payable now properly sums to the total disclosed. A conforming change has also been made to page F-21.

During the quarter ended September 30, 2010, the JTR Senior Note increased by $45,000 pursuant to the Exchange Modification. Please see Exhibit 10.7 for the significant terms of the JTR Senior Note.

30 We have corrected the amount for deferred financing charges as at September 30, 2010 to $179,226. The revised, future minimum payment schedule as at September 30, 2010 is as follows:

| | | September 30, | |

| Loan | | 2010 | | | 2011 | | | 2012 | |

| Frisco EDC | | | 60,000 | | | | 86,802 | | | | |

| Agave First Note | | | | | | | | | | | 750,000 | |

| JTR Second Note | | | | | | | | | | | 250,000 | |

| JTR Senior Note | | | | | | | | | | | 422,850 | |

| JTR Senior Note | | | 192,450 | | | | | | | | | |

| Sinacola Second Landlord Note | | | | | | | | | | | 126,407 | |

| Sinacola First Landlord Note | | | | | | | | | | | 125,000 | |

| Don Reed loan | | | 20,500 | | | | | | | | | |

| Alcedo Note | | | | | | | 100,000 | | | | | |

| Afritex Note | | | | | | | 270,000 | | | | | |

| Deferred financing | | | 179,226 | | | | | | | | | |

| Other related party loans | | | 4,850 | | | | | | | | | |

| | | | 457,026 | | | | 456,802 | | | | 1,674,257 | |

The maturities table on page F-59 did not include the deferred financing charges of $22,328 on the balance sheet as of December 31, 2009. We have corrected the table to include this amount, and the revised, future minimum payment schedule as at December 31, 2009 is as follows:

| | | December 31, | |

| Loan | | 2010 | | | 2011 | | | 2012 | |

| Frisco EDC | | | 60,000 | | | | 86,802 | | | | |

| Agave First Note | | | | | | | | | | | 750,000 | |

| JTR Second Note | | | | | | | | | | | 250,000 | |

| JTR Senior Note | | | | | | | 422,850 | | | | | |

| JTR Senior Note | | | 115,850 | | | | | | | | | |

| Sinacola Second Landlord Note | | | | | | | 126,407 | | | | | |

| Sinacola First Landlord Note | | | | | | | 125,000 | | | | | |

| Don Reed loan | | | 20,500 | | | | | | | | | |

| Alcedo Note | | | 100,000 | | | | | | | | | |

| Deferred financing | | | 22,328 | | | | | | | | | |

| Other related party loans | | | 14,250 | | | | | | | | | |

| | | | 332,928 | | | | 761,059 | | | | 1,000,000 | |

Note 6. Stock Options and Warrants

31. We have revised the table on page F-24 to include the appropriate headings for each column.

Note 8. License and Service Agreements

32. Afritex License and Service Agreement Summary

On March 26, 2010, we entered into a “Licensing Agreement”, a “Distribution Agreement” and a “Note Purchase Agreement” with Afritex Medical Products (Pty) Ltd. (“Afritex”) to provide Afritex the non-exclusive right to develop new derivative products and to provide Afritex the right to serve as an exclusive distributor of OxySure products in Africa in the countries of South Africa, Angola, Botswana, Democratic Republic of Congo, Lesotho, Madagascar, Malawi, Mauritius, Mozambique, Namibia, Seychelles, Swaziland, Tanzania, Zambia, and Zimbabwe (collectively, the SADC Countries). The key items of the Agreements are as follows along with the accounting treatment of the transactions:

“Licensing Agreement”

The License Agreement dated March 26, 2010 and amended December 16, 2010 - The intent of Afritex was to obtain from us a license to manufacture and distribute certain new derivative products in Afritex markets utilizing our intellectual property. We desired to grant such a license to Afritex.

As a result of the License Agreement, we sold Afritex the licensing rights to develop new derivative products utilizing our intellectual property for a one-time, non-refundable license fee of $225,000. We have no further obligation under the License Agreement regarding the sale of the license fee. Afritex could optionally engage us in a new and separate agreement if they wished to obtain any additional help with development of new derivative products. Alternatively, Afritex may elect to obtain such help, if necessary, from other providers, such as prototyping companies, engineering companies, manufacturing companies, and so forth, more than likely local (meaning, South Africa based) companies. Such engineering and product development expertise is readily available in the market place to provide such services, if needed.

In accordance with SAB 104, revenue is generally earned and realized or realizable when all of the following criteria are met:

* (1) persuasive evidence of an arrangement exists (the License Agreement),

* (2) delivery has occurred or services has been rendered (our intellectual property was provided to Afritex for development of new derivative products),

* (3) the seller’s price to the buyer is fixed or determinable ($225,000) and

* (4) collectability is reasonably assured (payment was made to us in the amount of $225,000).

In our judgment, revenue recognition rules do not specifically address a situation of this nature. Our management reviewed relevant literature and concluded that given the following elements of the agreement:

| - | the apparent intent of the parties that our intellectual property is sold is evidenced, in part, by: |

| o | Section 8(b)(ii) Rights and Obligations at Termination. "Upon expiration or termination of this Agreement for any reason: Unless otherwise provided for herein, Afritex and Customers shall continue to have the right to use the OxySure IP in form associated with the OxySure IP sold hereunder." |

| - | the non-exclusive nature of the agreement, |

| - | the readily available engineering and product development expertise in the market place, |

| - | the lack of additional research and development requirements on our part, |

| - | the lack of other service requirements on our part and |

| - | the perpetual nature of the intellectual property rights, evidenced, in part, by: |

| o | Section 5(b) which states, in part: “Company grants Afritex under this license, a non-exclusive right to grant to others the perpetual, non-exclusive sublicenses…” |

| o | Section 8(b)(ii) Rights and Obligations at Termination. "Upon expiration or termination of this Agreement for any reason: Unless otherwise provided for herein, Afritex and Customers shall continue to have the right to use the OxySure IP in form associated with the OxySure IP sold hereunder;" |

the full amount of the license fee can be recorded as revenue immediately and not be deferred.

This transaction specifically lacks the normal or typical continuing involvement of the seller that causes the upfront fee to be deferred over the life of the service agreement (i.e., cellular phones, health club initiation fees, technology access fees, registration charges, etc.). As a result of meeting all revenue recognition criteria coupled with the non-exclusive nature of the agreement, readily available expertise in the marketplace, lack of R&D commitments and perpetual rights to our intellectual property, we have recognized revenues of $225,000.

“Distribution Agreement”

The Distribution Agreement provides Afritex exclusive distribution rights of our products in certain southern parts of Africa (South Africa, Angola, Botswana, Democratic Republic of Congo, Lesotho, Madagascar, Malawi, Mauritius, Mozambique, Namibia, Seychelles, Swaziland, Tanzania, Zambia, and Zimbabwe (collectively, the SADC Countries)) while requiring an initial purchase order(s) totaling US $145,000 upon signing the agreement and a minimum annual purchase commitment of US $480,000. To date, Afritex has issued and purchased items totaling $255,655 pursuant to the Distribution Agreement (this amount is in addition to the initial, upfront, non-refundable license fee). Please also see comment response 14 for additional disclosure regarding the purchase amounts, dates and terms.

The initial term of the “Distribution Agreement” is one year and is automatically renewable for additional consecutive one year terms unless terminated sooner. This is typical for our distribution agreements, and the Afritex Distribution Agreement substantively follows our form of distribution agreement, previously filed with the SEC as Exhibit 10.33 to this Registration Statement.

“Note Purchase Agreement”

As a part of signing the Distribution Agreement, Afritex committing to an initial purchase order(s) of US $145,000, Afritex committing to an annual commitment of US $480,000 and the signing of the Note Purchase Agreement, we agreed to provide Afritex a Subordinated Convertible Promissory Note (the “Afritex Note”) payable in the amount of $270,000 with an interest rate of 16% per annum. (See Rationale for Issuing Note and Warrants below.) In connection with the exchange, we recorded a Credit to Notes Payable-Current in the amount of $270,000, and a Debit in the amount of $270,000 to “Other Assets.” We further amortize this asset using a reasonable mechanism – please see more detail below, under “Capitalization of Note Purchase and Amortization of the Intangible Asset.”

The Afritex Note has a maturity of 270 days from the date of issuance. The maturity date was subsequently (on December 21, 2010) extended to 360 days from the date of issuance. The convertible feature allows us to convert the Afritex Note, at our option, to common stock at a conversion price of $1.00 per Conversion Share at or prior to the maturity of the Note Payable.

In connection with the “Note Purchase Agreement,” we also issued Afritex a warrant to purchase 270,000 shares of common stock at an exercise price of $2.50 per share. In other words, the convertible note has a detachable warrant associated with it. The fair value of the warrant issued to Afritex, in the amount of $70,267 was recorded in the consolidated balance sheet as a Debit to Deferred Financing Charges (under Current Notes Payable) and a Credit to APIC – Options & Warrants. The amount in Deferred Financing Charges is amortized over the life of the Afritex Note by way of BCF Interest (please see our BCF schedule). Further, the fair value of the warrant is re-measured to market on each measurement date. Any changes upon remeasurement are recorded as changes to the Deferred Financing Charges and APIC – Options & Warrants accounts, respectively.

Upon issuance (March 26, 2010), the fair value of the warrant issued to Afritex was estimated to be $70,267 using the Black-Scholes pricing model with a volatility of 55% and the following assumptions: no dividend yield, exercise price of $2.50 per share with a $1.00 current price of the underlying per share, life of 5.00 years and a risk-free interest rate of 2.59% based on the 5-year zero coupon rate.

As of September 30, 2010, the fair value of the warrant issued to Afritex was estimated to be $1,358 using the Black-Scholes pricing model with a volatility of 20% and the following assumptions: no dividend yield, exercise price of $2.50 per share with a $1.00 current price of the underlying per share, life of 4.49 years and a risk-free interest rate of 1.27% based on the 5-year zero coupon rate.

In summary then: The portion allocated to the warrant issued to Afritex was treated as a discount to the Afritex note and amortized over the life of the note. Additionally, as a result of issuing the warrant with the subordinated convertible promissory note, a beneficial conversion charge was estimated to be amortized as (BCF) interest expense reflecting the incremental intrinsic value benefit provided to Afritex. We recorded total BCF interest expense of $48,146 for the nine months ended September 30, 2010 in connection with the Afritex Note.

Rationale for Issuing Note and Warrants:

In negotiating the Afritex License Agreement, Distribution Agreement and Note Purchase Agreement, our negotiations focused on a cost effective and longer term mechanism to ensure development of new Afritex derivative products, distribution of our product in Africa and minimization of overall expansion cost and market development cost to us. The Afritex Note and associated warrant were viewed as a cost effective means to create a long-term partnership with Afritex. There is intangible value to us of having Afritex as a business partner in addition to being a distributor in a key area (South Africa and surrounding countries) of growth and market opportunity. Put differently, it is customary for manufacturers, especially for new innovative products, to spend significant amounts of capital developing their markets. The success of Afritex as a licensee and distributor will further enhance the development of other foreign and domestic distributors, a key component of our continued growth.

Capitalization of Note Purchase and Amortization of the Intangible Asset:

As indicated in our prior comment response number 100 of our comment response letter dated October 4, 2010 (in response to the SEC comment letter dated August 11, 2010), we capitalized the amount ($270,000) of the note under “Other Assets,” to be amortized 30% over one year (initial term of the distribution agreement) plus 70% over seven years (term of the license agreement during which we cannot license additional licensees in Afritex’s territory), based on a reasonable weighting of the expected, discounted cash value provided by these agreements. We evaluate impairment of the intangible asset every quarter to assess the intangible value versus the expected future cash flow (see below).

| | Present value | Y0 | Y1 | Y2 |

| | License agreement: | | | |

| License Fee | 225,000 | 225,000 | | |

| | | 100% | | |

| Subtotal | 225,000 | | | |

| | | | | |

| | Distribution agreement: | | |

PO Gross Margin(1) | 60,478 | 60,478 | | |

| PO Gross Margin | 58,565(2) | | 67,350 | |

| Subtotal | 119,043 | | | |

| Total | 344,043 | | Value received from Afritex to date(3) |

| | | | | |

| | | As at September 30, 2010: |

| | | 219,240 | Value of intangible asset as at September 30, 2010 |

| | | 1,358 | Fair value of Afritex warrant as at September 30, 2010 |

| | | 220,598 | Value of instruments issued to Afritex |

| | | 123,445 | Net approximate positive value received so far on Afritex deals |

| (1) | Using 50% as an approximation. |

| (2) | Using 15% as discount rate. |

| (3) | As at December 2, 2010. |

The above analysis is based, conservatively just on actual receipts from Afritex so far, and does not take into account any potential future revenues. It also can be one way that management can be guided as to whether any impairment is necessary to the intangible asset, over and above the amortization schedule. From the above it appears the answer is no.

33. We have corrected the disclosure on page F-30 to be consistent with our accounting treatment.

Note 9. Commitments and Contingency

34. We revised the Registration Statement to remove the reference “…of which $139,426 was deferred.” This reference was incorrect. The corrected disclosure now simply states: “Rental expense for the nine months ended September 30, 2010 was $145,800.”

Capital Lease

35. Per our disclosure on page 37 and page F-34, we entered into a master lease agreement with a VenCore Solutions, LLC that allowed us to lease up to $750,000 of equipment. This maximum amount available under this lease was subsequently increased to $805,000. The lease agreement requires a security deposit of 10% of the amount of each individual lease schedule, a payment of Series A Convertible Preferred Stock shares equal to 5% of the lease divided by $1.00, and 36 monthly payments of 3.33% of the lease (up to a maximum total – for all lease schedules – of 30,737 shares of Series A Convertible Preferred Stock). We have the option to purchase the equipment at the end of each lease term at the lesser of 12% of the original equipment cost or the fair market value.

ASC Topic 840-30 - Capital Leases provides for the following lease classification criteria to determine how to account for leases:

(A) Ownership transfer - Ownership is transferred by the end of the lease term

(B) Bargain purchase option - Lessee has an option purchase at the price lower than the fair value

(C) Lease term: 75% rule - Lease term ≥ 75% of economic life of the leased property

(D) Minimum lease payment: 90% rule - Present value of minimum lease payments > 90% of fair value of the leased property

Based on the above, we are treating our Vencore leases as capital leases. The fair value of the preferred shares issued in connection with the lease schedules was treated as “Premium to Notes Payable-Capital Leases.” For example, during 2006 we purchased $499,625 in machinery and equipment on the Vencore master lease. The accounting entry for the 2006 transactions is as follows:

| Account | | Debit | | Credit |

| Machinery & Equipment-Cap Lease | | 499,625.00 | | |

| Premium on Notes Pay-Cap Lease | | 60,924.39 | | |

| Notes Pay-Cap Lease-VenCore | | | | 499,625.00 |

| Additional Paid in Capital | | | | 60,911.90 |

| Preferred Stock | | | | 12.49 |

| | | 560,549.39 | | 560,549.39 |

Similarly, the accounting entry that records the premium for all the 2007 lease schedules is as follows:

| Account | | Debit | | Credit |

| Premium on Notes Pay-Cap Lease | | 17,553.96 | | |

| Amortizn-NP Premium-Cap Lease | | 25,410.33 | | |

| Premium on Notes Pay-Cap Lease | | | | 25,410.33 |

| Additional Paid in Capital | | | | 17,551.08 |

| Preferred Stock | | | | 2.88 |

| | | 42,964.29 | | 42,964.29 |

We also record interest expense monthly. We amortize the equipment over their useful life, generally three years in the case of the Vencore equipment.

36. Our prior comment response 15 states any amounts outstanding towards Vencore are “deemed deferred.” We do not have a deferment agreement with Vencore. We believe Vencore, as are our shareholders are waiting for the completion of this registration process. We have not received any default notices from Vencore, nor have we received any notices regarding any modifications, interest, penalties or any other notices that creates the need for a change in accounting treatment.

37. We have revised the registration statement to disclose, in accordance with ASC 840-30-50-1, a separate deduction from the total for the amount of the imputed interest in our table of future minimum lease payments.

On page F-32, the disclosure is as follows:

| Annual maturities of capital lease obligations at September 30, 2010 are as follows: |

| |

| 2010 | | 338,971 |

| 2011 | | 27,629 |

| 2012 | | 22,909 |

| 2013 | | 935 |

| Total | | 390,444 |

| | | |

| Less amounts representing interest | | (43,757) |

| | | |

| Total | | 346,687 |

Our gross amounts of assets recorded under capital leases by major class, and the related accumulated amortization at September 30, 2010 are as follows:

| Machinery & equipment | | | 916,029.02 | |

| Less accumulated depreciation | | | (851,114.91 | ) |

| Machinery & equipment, net | | | 64,914.11 | |

| | | | | |

| Computer equipment | | | 3,707.00 | |

| Less accumulated depreciation | | | (3,707.00 | ) |

| Computer equipment, net | | | - | |

On page F-70, the disclosure is as follows:

| Annual maturities of capital lease obligations at December 31, 2009 are as follows: |

| | | |

| 2010 | | 361,595 |

| 2011 | | 27,629 |

| 2012 | | 22,909 |

| 2013 | | 935 |

| Total | | 413,067 |

| | | |

| Less amounts representing interest | | (39,974) |

| | | |

| Total | | 373,093 |

Our gross amounts of assets recorded under capital leases by major class, and the related accumulated amortization at December 31, 2009 are as follows:

| Machinery & equipment | | | 916,029.02 | |

| Less accumulated depreciation | | | (794,380.38 | ) |

| Machinery & equipment, net | | | 121,648.64 | |

| | | | | |

| Computer equipment | | | 3,707.00 | |

| Less accumulated depreciation | | | (3,501.06 | ) |

| Computer equipment, net | | | 205.94 | |

Note 10. Related Party Transactions

38. We have added the following to the Registration Statement on page F-32 in accordance with ASC 850-10-50-1.

“Our President and CEO, Julian Ross also serves on the Board of Directors of Afritex.”

Note 11. Net Income (loss) per Share

39. 260-10-45-10 requires that net loss per common share is computed as follows: Basic net loss per share is computed by dividing net loss by the weighted average number of shares of common stock outstanding during the period. Diluted net loss per share is computed by dividing net loss by the weighted average number of shares of common stock and potentially outstanding shares of common stock during each period to reflect the potential dilution that could occur from common shares issuable through stock options, warrants and convertible notes. We agree with the comment, and have revised the weighted average shares outstanding for September 30, 2010 and 2009 accordingly – please see the revised Registration Statement on page F-33. There are no changes to the basic and diluted loss per share numbers. We have also made conforming changes to page F-11 of the Registration Statement.

Note 12. Fair Value Measurements

40. We agree and have included the warrant liabilities under Level 3 on page F-71 and the revised disclosure now includes the following:

Assets Measured at Fair Value on a Recurring Basis Using Significant Unobservable Inputs (Level 3):

| | Warrant liabilities(1) |

| Balance at December 31, 2008 | $950,466 |

| Change in fair value included in earnings | $180,566 |

| Balance at December 31, 2009 | $1,131,032 |

| Losses included in earnings attributable to the change in unrealized losses relating to assets still held at December 31, 2009 | $180,566 |

| Losses included in earnings attributable to the change in unrealized losses relating to assets still held at December 31, 2009 | |

(1) Included in Additional Paid in Capital on the Company’s Balance Sheet.

Report of Independent Registered Public Accounting Firm

41. We have revised our independent accountant report by omitting our disclaimer in assessing the internal control. We stated that because we wanted to make it clear that we are not offering opinion related to the Company's internal control. However, we agree with removing this wording to avoid confusion.

42. We have added a paragraph to refer to footnote 17 in our accountant report.

Balance Sheets

43. In response to the prior comment letter we provided our BCF schedule, which calculates, in respect of all the convertible notes issued with detachable warrants, the warrant liability upon issuance and upon each remeasurement, and the BCF Interest expense for each reporting period. In respect of the Agave First Note, which was issued on April 15, 2008, the total BCF amount was $346,786. Of this amount, $245,640 – the amount to accrete 8.5 months of interest on the beneficial conversion feature (from April 15 2000 through December 31, 2008) - was recorded as a Prior period adjustment in 2009. The difference - $101,146 ($346,786 less $245,640), along with all the relevant effects to APIC and BCF Interest by period is reflected in the following schedule:

| As of 12/31/2009 | | | | | | | | | | | | |

| | | Total loan | | | Debt issuance cost | | | Net notes payable | | | | |

| Agave (First Note) | | | (648,854 | ) | | | (101,146 | ) | | | (750,000 | ) | | | 101,146 | |

| JTR 2008 indebtedness | | | (581,050 | ) | | | - | | | | (581,050 | ) | | | - | |

| JTR 2009 indebtedness | | | (207,650 | ) | | | - | | | | (207,650 | ) | | | 100,105 | |

| Sinacola 1st | | | (125,000 | ) | | | 77,180 | | | | (47,820 | ) | | | 3,356 | |

| Sinacola 2nd | | | (126,407 | ) | | | 78,049 | | | | (48,358 | ) | | | 3,393 | |

| Alcedo | | | (100,000 | ) | | | 23,695 | | | | (76,305 | ) | | | 1,998 | |

| | | | (1,788,961 | ) | | | 77,777 | | | | (1,711,184 | ) | | | 209,999 | |

| As of 12/31/2008 | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | Total loan | | | Debt discount | | | Net notes payable | | | Period BCF Interest exp | |

| Agave (First Note) | | | (750,000 | ) | | | 101,146 | | | | (648,854 | ) | | | 245,640 | |

| JTR 2008 indebtedness | | | (581,050 | ) | | | - | | | | (581,050 | ) | | | 277,957 | |

| Sinacola 1st | | | - | | | | - | | | | - | | | | - | |

| Sinacola 2nd | | | - | | | | - | | | | - | | | | - | |

| Alcedo | | | - | | | | - | | | | - | | | | - | |

| | | | (1,331,050 | ) | | | 101,146 | | | | (1,229,904 | ) | | | 523,597 | |

| | | | | | | | | | �� | | | | | | | |

| | | Interest Exp | | | Notes payable | | | APIC | | | | | |

| year 2008 | | | 523,597 | | | | 101,146 | | | | (624,743 | ) | | | | |

| year 2009 | | | 209,999 | | | | 77,777 | | | | (287,776 | ) | | | | |

| | | | 733,596 | | | | 178,923 | | | | (912,519 | ) | | | | |

From the schedule it can be seen that Deferred Financing Charges, which is a sub-account of Current Notes Payable is decreased by $101,146 during 2008 (and consequently, so does total liabilities). At the same time, Additional Paid in Capital increases by that same amount (and consequently, so does total equity). Please also see Note 4, page F-54 and page F-59.

The amount of $627 was a prior period adjustment in 2008 previously disclosed. Please see page F-77.

44. The difference of $22,328 represents the net effect of unrecorded changes during 2009 from our BCF schedule. The reconciliation of the amount of $22,328 is as follows:

| Net debt issuance cost during 2009: | | $ | (77,777 | ) |

Unrecorded BCF Interest expense in re JTR 2009 indebtedness | | $ | 100,105 | |

| Net change | | $ | 22,328 | |

This amount is recorded in Deferred Financing Charges (a sub-account of Current Notes Payable). Please also see this amount disclosed on page F-59.

The decrease of $249,489 is the net effect of changes to our “APIC-Options & Warrants” account during 2009. The reconciliation is as follows:

| | | Before | | After | | Change |

| APIC | | 8,317,834 | | 8,068,345 | | 249,489 |

| APIC-Options & Warrants | | 2,685,337 | | 2,435,848 | | 249,489 |

| Prepaid Warrants | | 167,750 | | 167,750 | | Same |

| APIC-Preferred Stock | | 3,214,401 | | 3,214,401 | | Same |

| APIC-Common Stock | | 2,250,346 | | 2,250,346 | | Same |

| | | 8,317,834 | | 8,068,345 | | |

| Net effect of changes in only the "APIC-Options & Warrants" account: | | | | |

| | | 1,200 | | 1,200 | | |

| | | 135,729 | | | | |

| | | 123,909 | | 123,909 | | |

| | | 133,604 | | 133,604 | | |

| | | 515,286 | | 515,286 | | |

| | | 132,574 | | | | |

| | | | | 595,349 | | |

| | | | | (677,681) | | |

| Net effect: | | 1,042,302 | | 691,667 | | 350,635 |

| Prior period change iro Agave - please see BCF schedule | | | | | | (101,146) |

| Net change in APIC for 2009 | | | | | | 249,489 |

In our prior comment response 51 we stated that we have removed the separate presentation of accumulated other comprehensive income (loss) in our financial statements. The amount of $82,641 is included in Accumulated Deficit.

As indicated above Accumulated Deficit includes the amount of $82,641 in Other Comprehensive Income which was previously presented separately. Accumulated deficit was lower by $22,328 as a result of the net effect of changes during 2009 from our BCF schedule (please see the first bullet above).

Statements of Operations and Accumulated Deficit

45. The SG&A decreased from $2,597,954 to $1,637,198 due to the reclassification of the interest expenses. Previously we considered all the warrants issued to convertible notes as stock compensation under ASC 718. Upon revision, we considered all the warrants issued in connection with convertible notes, which have beneficial conversion features, as interest expense under ASC 470-20-30. As a result the previous stock compensation expenses that we recorded in SG&A have been reversed and BCF Interest have been recorded, per our BCF schedule. The difference of $960,756 in SG&A indicates the net effect of all these changes combined.

Please refer to the BCF schedule under “Recap” for detail of the BCF interest expense calculation of $209,999.

The net loss decreased by $960,756 because our SG&A increased by $960,756, as described in bullet 1 above.

46. The reconciliation of the prior period adjustment in the amount of $440,329 in Year 2009 is as follows:

Prior period adjustment of in connection with Agave/JTR notes for 2008 per corrected BCF schedule | | $ | (523,597 | ) |

| Accumulated other comprehensive income, 2009 | | $ | 83,268 | |

| Subtotal (as shown under 2009 Accumulated Deficit column, page F-42) | | $ | (440,329 | ) |

Please see comment response 50 for the reconciliation of the shareholders’ equity of $(1,117,383).

47. The requirements of ASC 250-10-45-23 are as follows:

Any error in the financial statements of a prior period discovered after the financial statements are issued or are available to be issued (as discussed in Section 855-10-25) shall be reported as an error correction, by restating the prior-period financial statements. Restatement requires all of the following:

a. The cumulative effect of the error on periods prior to those presented shall be reflected in the carrying amounts of assets and liabilities as of the beginning of the first period presented.

b. An offsetting adjustment, if any, shall be made to the opening balance of retained earnings (or other appropriate components of equity or net assets in the statement of financial position) for that period.

c. Financial statements for each individual prior period presented shall be adjusted to reflect correction of the period-specific effects of the error.

Kindly see our comment response 72 for the details regarding effects of the prior period corrections.

48. The significant components of our interest expense are as follows:

| | | 9 Months to September 30, 2010 | | | FY 2009 | | | FY 2008 | |

| | | | | | | | | | |

| Interest on leases | | | 2,450 | | | | 48,243 | | | | 68,583 | |

| Interest on Notes Payable/Loans | | | 40,520 | | | | - | | | | - | |

| BCF Interest | | | 195,007 | | | | 209,999 | | | | - | * |

| | | | | | | | | | | | | |

| Totals | | | 237,977 | | | | 258,242 | | | | 68,583 | |

* An amount of $523,597 related to BCF Interest for 2008 was treated as a prior period adjustment in 2009.

Statements of Cash Flows

49. The reconciliation for 2008 (page F-41) is as follows:

| Previously recorded as "Common Stock warrants issued pursuant to financing" | | $ | 677,681 | |

| 2008 Debt issuance cost associated with Agave First Note | | $ | 101,146 | |

| Total | | $ | 778,827 | |

The reconciliation for 2009 (page F-42) is as follows:

| | - Debt issuance cost during 2009, net, per BCF schedule | | 77,777 | |

| | - Fair value, revised of Agave note as at December 31, 2009, per BCF schedule | | 346,786 | |

| | - Fair value, revised of JTR note as at December 31, 2009, per BCF schedule | | 277,957 | |

| | - Previously recorded as "Common Stock warrants issued pursuant to financing" | | 135,729 | |

| | - To reverse warrant expense previously recorded in connection with JTR warrant issued in June 2009 | | (47,936) | |

| | - To reverse warrant expense previously recorded in connection with JTR warrant issued in December 2009 | | (77,793) | |

| | - Net effect of changes for investor relations warrant expenses | | (24,772) | (1) |

| | - Net effect of changes to debt issuance cost in respect of Agave/JTR notes in 2008 | | (101,146) | (2) |

| | - Period BCF Interest for Sinacola First Landlord Note, per BCF schedule | | 3,356 | |

| | - Period BCF Interest for Sinacola Second Landlord Note, per BCF schedule | | 3,393 | |

| | - Period BCF Interest for Alcedo note, per BCF schedule | | 1,998 | |

| | | | | |

| | | | 595,350 | |

| | Notes: | | | |

| (1) | The $24,772 is due to the difference between: | | | |

| | The incorrect fair value of the warrants issued for investor relations, net of cancellations (S-1A filed in Nov 2010) | 99,137 | |

| | Corrected fair value of the warrants issued for investor relations, net of cancellation (S-1 filed in Jan 2011) | | (123,909) | |

| | | | (24,772) | |

| (2) | We need to deduct $101,146 here because the total cost for Agave/JTR was only $422,451 which is debt issuance | | |

| | cost of ($101,146) and the interest expense for Agave $245,640 and JTR 2008 $277,957 | | | |

50. The following table illustrates the requested reconciliation:

| Prior period adjustment as shown on page F-43: | | $ | (1,117,383 | ) |

| | | | | |

| Reconciliation with Statement of Equity: | | | | |

| Prior period adjustment of Agave/JTR notes for 2008 | | $ | (677,681 | ) |

| previously recorded as "financing expense" during 2008 | | | | |

| | | | | |

| Prior period adjustment of in connection with Agave/JTR notes for 2008 | | $ | (523,597 | ) |

| per corrected BCF schedule | | | | |

| Accumulated other comprehensive income, 2009 | | $ | 83,268 | |

| Subtotal (as shown under 2009 Accumulated Deficit column, page F-42) | | $ | (440,329 | ) |

| | | | | |

| Add back: Accumulated other comprehensive income from 2008 | | $ | 627 | |

| | | | | |

| | | $ | (1,117,383 | ) |

51. The carrying values as at December 31, 2009 in “Prepaid expense (current asset)” and “Other asset (long term)” related to our rental agreement were $46,709 and $138,563.76, respectively. When we concluded the rent satisfaction agreement in December 2009 (the “2009 RSA”), it was determined that these accounts should be relieved of these amounts, and the total impairment expensed as rent expense.

Accordingly, the following adjusting entry was made on December 31, 2009:

• Rent – Debit $185,272.76

• Prepaid expense (current asset) – Credit $46,709.00

• Other asset (long term) – Credit $138,563.76

This transaction had the impact of increasing rent expense by $185,272.76 for FY 2009, and accordingly it increased selling, general and administrative expense by $185,272.76. Net loss per share increased by $.012 per share as a result of this transaction.

The transaction is a non-cash transaction, and therefore we had to reconcile net income to net cash.

52. We calculate BCF in accordance with ASC 470-20-30-27 through 30-28, “Debt with conversion and other options.” Only the periodic BCF interest expenses impact our statements of operations. We have to reconcile net income to net cash used due to the issuance of the warrants and the changes to deferred financing charges because of the non-cash nature of the fair value of the warrants being recorded. Please see our BCF schedule for the journal entries.

53. Only the periodic BCF Interest Expense is included in our statements of operations (included in the total amount for “Interest Expense”).

Deferred Revenue and Income

54. We have revised our disclosure on page F-45 (it is now consistent with the disclosure on page F-7) as follows:

“The Company defers revenue and income when advance payments are received from customers before performance obligations have been completed and/or services have been performed. Deferred revenue and income do not include amounts from products delivered to distributors that the distributors have not yet sold through to their end customers. Deferred Revenue was $0 and $91,207 for the years ended December 31, 2009 and 2008 respectively.”

Note 4. Notes Payable

55. The relevant literature is as follows:

In evaluating whether a warrant is considered as liabilities under ASC 480-10-15, the warrant is a freestanding financial instrument that embodies an obligation to repurchase the issuer's equity shares and may require the issuer to settle the obligation by transferring assets.

ASC 480 requires the warrant to be classified as a liability and initially measured at fair value. In allocating the proceeds between the debt and warrant, the Company should first measure the fair value of the warrant liability and then assign any residual amount of the proceeds received to the debt. The initial carrying amount assigned to the debt would then be the difference between the total proceeds received and the fair value of the warrant. Any resulting discount from the par amount of the debt should be accreted to par using the effective-interest (level-yield) method.

This method of allocating proceeds is sometimes referred to as a "with-and-without" method on the basis of the fair value of the warrants. It is similar to the method of allocating the basis of a hybrid instrument between a host contract and an embedded derivative under ASC 815 (see ASC 815-15-30-2). It is different, however, from the method of allocating proceeds received for debt issued with detachable warrants classified in equity. ASC 470-20-25-2 through 25-3 require the issuer of those instruments to allocate the proceeds received on a relative-fair-value basis.

In reference to all our warrants (both those issued in connection with the convertible notes, and those that are not):

| · | The warrants do NOT provide the holders with a put. Meaning, there is no circumstance whatsoever, where the warrant holder has the right to sell the instrument back to us for cash; |

| · | The warrants provide the holders with the option, but not the obligation, to convert the warrants into common stock. Generally, the warrant holders have five years within which to exercise. This also means that the company cannot force the holder to exercise the warrant. |

For these reasons, it appears we are treating these warrants correctly, as equity and not as liabilities.

The warrant liabilities have been reflected under “Additional paid-in capital.” The fair value of the warrant liabilities was $912,361 and $950,466 as of December 31, 2009 and September 30, 2010, respectively. Please refer to the BCF schedule for detail.

56. We provided the BCF Schedules (which contains all our BCF transactions as well as the relevant accounting entries, tied to our financial statements) as indicated in our prior responses. The BCF schedule was couriered to the SEC via Federal Express, waybill number 7943 2374 7271 on Monday, January 17, 2011, and was received and signed for by “D.SIEFERT” on January 18, 2011. The package was addressed to Mr. Geoffrey Kruczek.

Agave/JTR Subordinated Notes

57. We have corrected the disclosure on page F-53. The applicable disclosure now states:

“During March 2008, the Company completed a $1 million financing package consisting of a promissory note for $750,000 (“First Note”) and a promissory note with a draw down provision for $250,000 (“Second Note”) (collectively, the “Notes”). The Notes are subordinated notes…”

JTR Senior Note

58. The balance of $331,050 is the balance of the JTR Senior Note as at December 31, 2008. The balance of $422,850 is the balance as at December 31, 2009, due to an increase of $91,800 to the amount outstanding on the JTR Senior Note during 2009.

Sinacola Subordinated Convertible Notes

59. The amount outstanding prior to entering into the agreement is $251,407. The total of the face amounts of the Sinacola First Landlord Note ($125,000) and the Sinacola Second Landlord Note ($126,407) equals this amount. Please see Exhibit 10.27 to this Registration Statement. The recorded accounting entry is as follows:

| | | Debit | | | Credit | |

| Accounts Payable | | | 244,461 | | | | |

| Rent | | | 6,946 | | | | |

| N/P Sinacola 1st Landlord Note | | | | | | | 125,000 | |

| N/P Sinacola 2nd Landlord Note | | | | | | | 126,407 | |

| | | | 251,407 | | | | 251,407 | |

The warrants were issued in connection with convertible notes. For this reason, we treated the warrants in the same manner we treated the warrants issued in connection with, for example, the Agave/JTR notes, the Alcedo Note, etc. The form of warrant is the same. Kindly refer to comment response 55 for the analysis, and the BCF schedule for account entries and amounts.

Kindly refer to the analysis in comment response 55 and our BCF schedule.

Kindly refer to comment response 68, which provides the complete analysis.

60. For a reconciliation of the amount of ($101,146) please see comment response 46 and our BCF schedule. For a reconciliation of the amount of $22,328 please see our comment response 44, as well as comment response 30.

Note 5. Shareholders’ Equity

61.

| Preferred Stock | | Common Stock | | |

| 25,000 | | | | Preferred shares returned |

| 8,197 | | | | Preferred shares sold |

| 16,803 | | 20,500 | | Common shares, as converted |

| | | | | |

| | | 50,000 | | Issued in transaction with Pacific Cattle Corp. (please see page F-41, 7th item below the Jan 1, 2008 totals) |

| | | 20,500 | | Common shares, as converted, based on 1.22:1 ratio |

| | | 29,500 | | Newly issued common shares to Pacific Cattle Corp. |

62. The accounting entries, which provide evidence of the impact in stockholders equity, and which reconcile our disclosures to date, are as follows:

| Preferred Stock Sale Transaction: | | | | |

| Cash | | 25,000 | | |

| Preferred Stock | | | | 4.10 |

| APIC (Preferred Stock) | | | | 24,995.90 |

| | | 25,000 | | 25,000 |

| | | | | |

| Common Stock Sale Transaction: | | | | |

| Cash | | 31,000 | | |

| Common Stock | | | | 20 |

| APIC (Common Stock) | | | | 30,980 |

| | | 31,000 | | 31,000 |

| | | | | |

| To account for the $75,000: | | | | |

| Professional Services | | 75,000 | | |

| Accounts Payable | | | | 75,000 |

| | | 75,000 | | 75,000 |

Note 6. Stock Options and Warrants

63.

| stock based compensation reconciliation | | | | | Cash flow statement | |

| F-42 schedule | 12/31/09 | | 12/31/08 | | 12/31/09 | | 12/31/08 | |

| Additional paid in capital - stock comp for regular employees | 133,604 | F-48 | 89,957 | F-48 | 133,604 | F-43 | 89,957 | F-43 |

| | | | | | | | | |

| Options issued for consultants | | | | | | | | |

| Additional paid in capital - issued for investor relationship | 123,909 | | | | | | | |

| Additional paid in capital - issued for services | 515,286 | | 143,687 | | 639,195 | | 143,687 | |

| Additional paid in capital - convertible loan | 595,349 | | 778,827 | | 595,349 | | 677,681 | |

| Prior period adjustment - correction of error | (677,681) | | | | (677,681) | a | | |

| Additional paid in capital - community grant | | | 10,959 | | - | | 10,959 | |

| Total stock comp for consultants | 556,863 | F-48 | 933,473 | F-48 | 556,863 | F-43 | 832,327 | F-43 |

| Prior period adjustment - BCF expense for Agave/JTR to reconcile to cash | | | | | | | 101,146 | b |

| Total stock compensation | 690,467 | | 1,023,430 | | 690,467 | | 1,023,430 | |

a - Total PPA under cash flow as of 12/31/09 was $1,117,383, $677,681 was related to the stock based compensation that we calculated based on Black-schole previously.

b - The amount of $101,146 is the amortized debt issuance cost in 2008 related to the Agave First Note, which resides in Notes Payable (Deferred Financing Charges) - Cash Flow from financing, creating a timing difference and has to be added back.

64. Our revised footnote regarding forfeitures states: “FASB ASC 718 requires forfeitures to be estimated at the time of grant and revised, if necessary, in subsequent periods if actual forfeitures differ from those estimates. The Company only records stock-based compensation expense for awards that are expected to vest. While the Company generally considers historical forfeitures in its estimates, judgment is also required in estimating the amount of stock-based awards that are expected to be forfeited. The Company’s estimates for forfeitures may differ from actual forfeitures. If actual results differ significantly from these estimates, stock-based compensation expense and its results of operations could be materially impacted when the Company records a true-up for the difference in the period that the awards vest. Forfeitures were estimated based on historical experience. The Company adjusts stock-based compensation expense based on its actual forfeitures on an annual basis, if necessary.”

65. Per our BCF schedule, as at December 31, 2009 we have issued the following convertible notes with warrants:

| · | JTR 2008 indebtedness (which includes the JTR Second Note, plus the 2008 tranche of the JTR Senior Note) |

| · | JTR 2009 indebtedness (which includes 2 tranches of the JTR Senior Note, one issued in June 2009 and the other issued in December 2009) |

| · | Sinacola First Landlord Note |

| · | Sinacola Second Landlord Note |

The relevant literature is as follows:

In evaluating whether a warrant is considered as liabilities under ASC 480-10-15, the warrant is a freestanding financial instrument that embodies an obligation to repurchase the issuer's equity shares and may require the issuer to settle the obligation by transferring assets.

ASC 480 requires the warrant to be classified as a liability and initially measured at fair value. In allocating the proceeds between the debt and warrant, the Company should first measure the fair value of the warrant liability and then assign any residual amount of the proceeds received to the debt. The initial carrying amount assigned to the debt would then be the difference between the total proceeds received and the fair value of the warrant. Any resulting discount from the par amount of the debt should be accreted to par using the effective-interest (level-yield) method.

This method of allocating proceeds is sometimes referred to as a "with-and-without" method on the basis of the fair value of the warrants. It is similar to the method of allocating the basis of a hybrid instrument between a host contract and an embedded derivative under ASC 815 (see ASC 815-15-30-2). It is different, however, from the method of allocating proceeds received for debt issued with detachable warrants classified in equity. ASC 470-20-25-2 through 25-3 require the issuer of those instruments to allocate the proceeds received on a relative-fair-value basis.

In reference to the warrants issued in connection with the convertible notes above, therefore (the detachable warrants), as well as the detachable warrants we issued with convertible notes in 2010, as well our warrants not issued with notes:

| · | The warrants do NOT provide the holders with a put. Meaning, there is no circumstance whatsoever, where the warrant holder has the right to sell the instrument back to us for cash; |

| · | The warrants provide the holders with the option, but not the obligation, to convert the warrants into common stock. Generally, the warrant holders have 5 years within which to exercise. This also means that the company cannot force the holder to exercise the warrant. |

For these reasons, it appears we are treating these warrants correctly, as equity and not as liabilities.

The warrant liabilities have been reflected under “Additional paid-in capital.” The fair value of the warrant liabilities was $912,361 and $950,466 as of December 31, 2009 and September 30, 2010, respectively. Please refer to the BCF schedule for detail.

66. The difference of 843,419 relates to the cancellation of 843,419 warrants during 4Q 2009 in connection with the cancellation of the IR Services agreement. Please see Exhibit 10.92, as well as prior comments, comment responses and disclosures in this regard, including the following:

Comment response 10 in our comment response letter dated November 12, 2010, in response to your comment letter dated October 22, 2010 (the “Comment Letter”) regarding Amendment No. 3 to our Registration Statement on Form S-1/A filed on October 5, 2010. Our response states:

“Please be advised that we did not renegotiate the terms of the private transaction. IR Services, Inc. did not perform under the Agreement dated April 20, 2009 and the amended Agreement dated June 22, 2009. IR Services, Inc. gave back the right to receive 125,000 warrants of the 250,000 warrants for the filing of the Registration Statement. We did not renegotiate the terms of the original contract. IR Services breached the original contract. Therefore, we entered into the Cancellation Agreement and Mutual Release with IR Services, Inc. on December 15, 2009. Prior to the entry into the Cancellation Agreement and Mutual Release, IR Services, Inc. exercised 125,000 warrants on October 9, 2009. Although not completely clear, the Cancellation Agreement and Mutual Release provided for IR Services to receive only 125,000 warrants, which warrants were exercised on October 9, 2009.