- FFWM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

First Foundation (FFWM) CORRESPCorrespondence with SEC

Filed: 18 Feb 21, 12:00am

| Michelle Miller | February 18, 2021 |

Sharon Blume

Division of Corporate Finance

United States Securities and Exchange Commission

Washington D.C. 20549

| Re: | First Foundation Inc. |

Form 10-K for Fiscal Year Ended December 31, 2019

Filed March 2, 2020

Form 10-Q for the Quarterly Period Ending September 30, 2020

File No. 001-36461

Dear Ms. Miller; Ms. Blume:

As an addendum to our response on January 19, 2021 regarding Note 5—Allowance for Credit Losses (page 16) in your letter dated January 12, 2021, we are providing the following materiality and control assessments. As noted in our previous response, we have determined that the roll forward disclosure of the allowance for credit losses in Note 5 of our 10-Q filings for each of the first, second, and third quarters of 2020 was misstated. We analyzed the financial statements for the first three quarters of 2020, including the income statement, balance sheet, and statement of cash flows. We have determined that there are no errors in our reporting of the financial statements. As detailed in our analysis below, we do not feel the misstatement was material and we propose restating the ACL roll forward disclosure in the 2020 10-K filing, showing the disclosure as reported and the corrected disclosure.

Furthermore, due to this misstatement, we performed additional due diligence by evaluating our internal controls over financial reporting. We assessed the severity of the root cause of the misstatement and evaluated if a control deficiency, or a combination of control deficiencies, constituted a material weakness. Due to several factors, we determined this is an isolated incident and we have not had these types of errors in the past. The factors that contributed to the error include a change in the Chief Financial Officer in the year, operating in the difficult environment of the pandemic, and the adoption of the complex new CECL accounting standard that led to some confusion in interpretation.

In order to streamline our internal controls going forward, we have instituted various process improvements and controls around implementing new accounting standards. We have also enhanced the company’s Disclosure Committee to better monitor, review, and interpret new accounting standards and the associated disclosures.

U.S. Securities and Exchange Commission Staff Accounting Bulletin (SAB) 99 states that the assessment of errors in a financial report should evaluate both quantitative and qualitative considerations. Registrants may use quantitative thresholds as “rules of thumb” to assist in the preparation of financial statements; however, exclusive reliance on this has no basis in the accounting literature or the law. When using thresholds, the registrant must be cognizant of qualitative factors that may render a small quantitative misstatement as material.

Set forth below are our quantitative and qualitative analyses regarding Note 5. Allowance for Credit Losses (page 16) in your letter dated January 12, 2021. Our analysis suggests that it is unlikely that the judgement of a reasonable person relying upon the report would have been changed or influenced by the inclusion or correction of the item. Additionally, we do not believe the misstatement is material enough that it would have significantly altered the “total mix” of information made available to an investor.

Quantitative Assessment:

Note 5 - Allowance for Credit Losses (ACL) Roll Forward

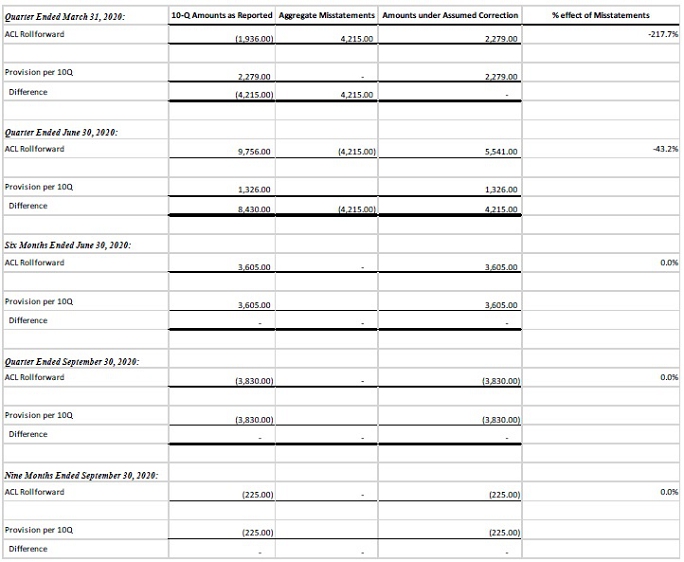

As detailed in Exhibit A (ACL Roll forward), the aggregate misstatement for quarter one of 2020 was an ASC 326 Provision increase of $4.2 million. The 10-Q ACL roll forward reported a provision of $2.3 million and we determined that the amount under an assumed correction should have been a benefit of $1.9 million, resulting in a 217.7% misstatement.

The aggregate misstatement for quarter two was a $4.2 million decrease that should have been recorded in quarter one. The ACL roll forward reported a $9.7 million provision and we determined the amount under an assumed correction should have been $5.5 million, resulting in a 43.2% misstatement.

For the six months ended June 30, 2020, and the nine months ended September 30, 2020, the impact is zero as the cumulative adjustments net to zero. Although there are adjustments in the first two quarters, the Company’s ACL ending balance is correct for all quarters. As demonstrated, the cumulative adjustment does not impact the Income Statement, balance sheet, or cash flow statement, but has a material quantitative impact to the ACL roll forward disclosures reported in quarter one and two.

Qualitative Assessment:

Below are excerpts from SAB No. 99, Topic 1. We have included our comments as part of our qualitative assessment that indicates that the misstatement is not material.

Among the considerations that may well render material a quantitatively small misstatement of a financial statement item are –

| · | whether the misstatement arises from an item capable of precise measurement or whether it arises from an estimate and, if so, the degree of imprecision inherent in the estimate |

| o | The CECL standard is a new and complex standard that requires a high degree of historical knowledge and quantitative modeling. During the Q2 2020 CECL evaluation, the Company determined that the purchased credit impaired loans were not properly transitioned to the new purchase credit deteriorated standard on day one of 2020. All adjustments to properly implement the standard were made in the second quarter of 2020. |

| · | whether the misstatement masks a change in earnings or other trends |

| o | The misstatement does not mask a change in earnings or other trends for the year and only impacts the ACL roll forward disclosure. |

| · | whether the misstatement hides a failure to meet analysts' consensus expectations for the enterprise |

| o | The misstatement does not hide a failure to meet analysts’ expectations and only impacts the ACL roll forward disclosure. |

| · | whether the misstatement changes a loss into income or vice versa |

| o | The misstatement has no income statement impact as the ending provision balance at December 31, 2020 remains the same at $6.75 million. |

| · | whether the misstatement concerns a segment or other portion of the registrant's business that has been identified as playing a significant role in the registrant's operations or profitability |

| o | The effect of the misstatement is related to the significant banking operations of the company. As noted above, the misstatement has no income statement impact as of December 31, 2020. |

| · | whether the misstatement affects the registrant's compliance with regulatory requirements |

| o | Management is not aware of any compliance or regulatory issues related to these misstatements. |

| · | whether the misstatement affects the registrant's compliance with loan covenants or other contractual requirements |

| o | There are no compliance issues with loan covenants or other contractual requirements that result from this misstatement. |

| · | whether the misstatement has the effect of increasing management's compensation – for example, by satisfying requirements for the award of bonuses or other forms of incentive compensation |

| o | Management’s incentive plans have no connection to the disclosure presentation of Note 5. |

| · | whether the misstatement involves concealment of an unlawful transaction |

| o | This misstatement does not involve any concealment of an unlawful transaction. When comparing the presentation of Note 5 in the 10-Q and the revised format, the ending balance for both the Allowance for Credit Losses and Provision balances at December 31, 2020 remain the same at $24.2 million and $6.75 million, respectively. |

Conclusion:

The Company believes that the identified misstatement is not material to the Company’s reported 10-Q filings. As described in the quantitative analysis, the presentation of the ACL roll forward was incorrect for the first two quarters; however, the cumulative impact is zero for the subsequent quarters and the qualitative assessment indicates the misstatement is not material. When both the quantitative and qualitative analyses are taken into consideration, we believe that it is unlikely that the judgement of a reasonable person relying upon the report would have been changed or influenced by the inclusion or correction of the item.

In addition, we have determined this misstatement did not result from a material control weakness, and we have implemented new control processes to prevent such misstatements going forward.

We propose restating the ACL roll forward in the 2020 10-K for all individual and year to date quarters in 2020 to properly reflect the adjustments. The disclosure will present the amounts reported in previous 10-Q filings and the amounts that should have been reported, providing transparency regarding the misstatement. See our proposed disclosure in Exhibit B.

Please contact me if you have any questions regarding the responses we provided. I can be reached at (949) 202-4164, or kthompson@ff-inc.com.

| Sincerely, | |||

| By: | /s/ KEVIN L. THOMPSON | ||

| Name: Kevin L. Thompson | |||

| Title: Chief Financial Officer | |||

Exhibit A (ACL Roll forward)

The following is an excerpt of the Bank’s ACL roll forward for the first three quarters of 2020. The table presents and clarifies the impact of the provision misstatement in relation to the ACL roll forward balances.

Exhibit B (ACL Reported & Restated)

The following is an example of the ACL table that will be added to the 2020 10-K for all individual and year to date quarters in 2020. The disclosure will present the amounts reported in previous 10-Q filings and the amounts that should have been reported.