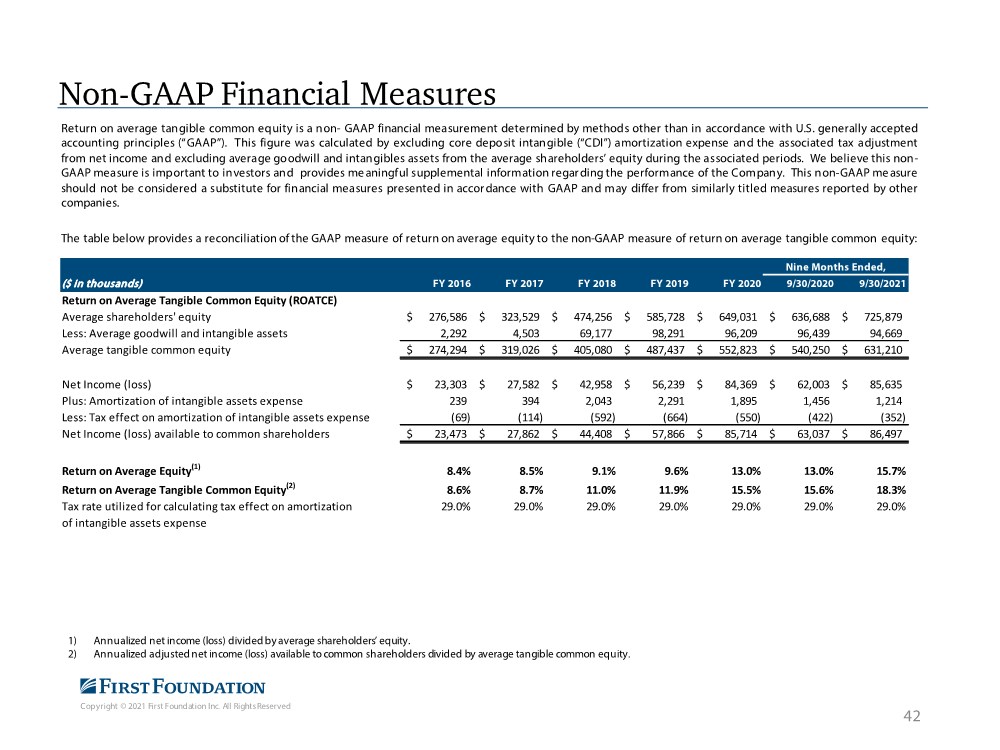

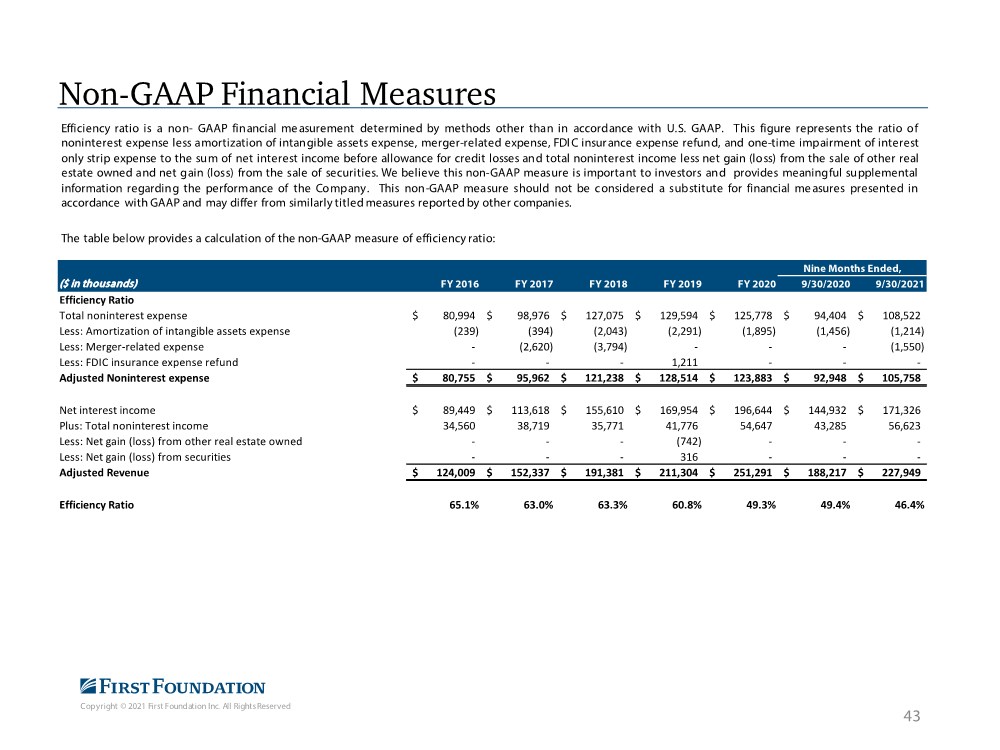

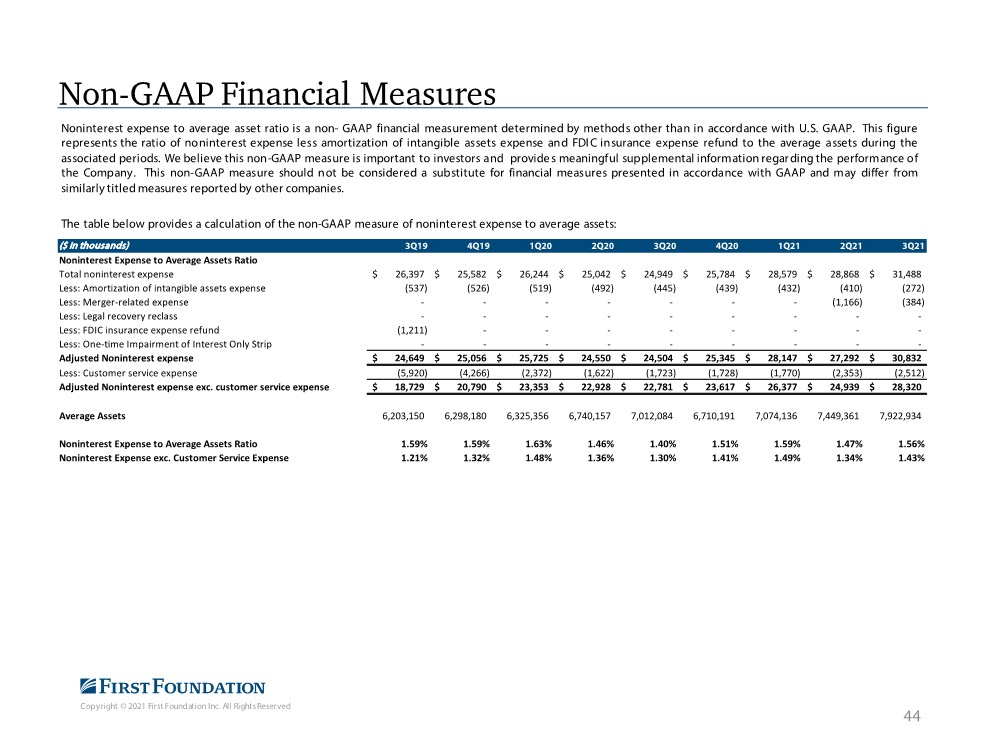

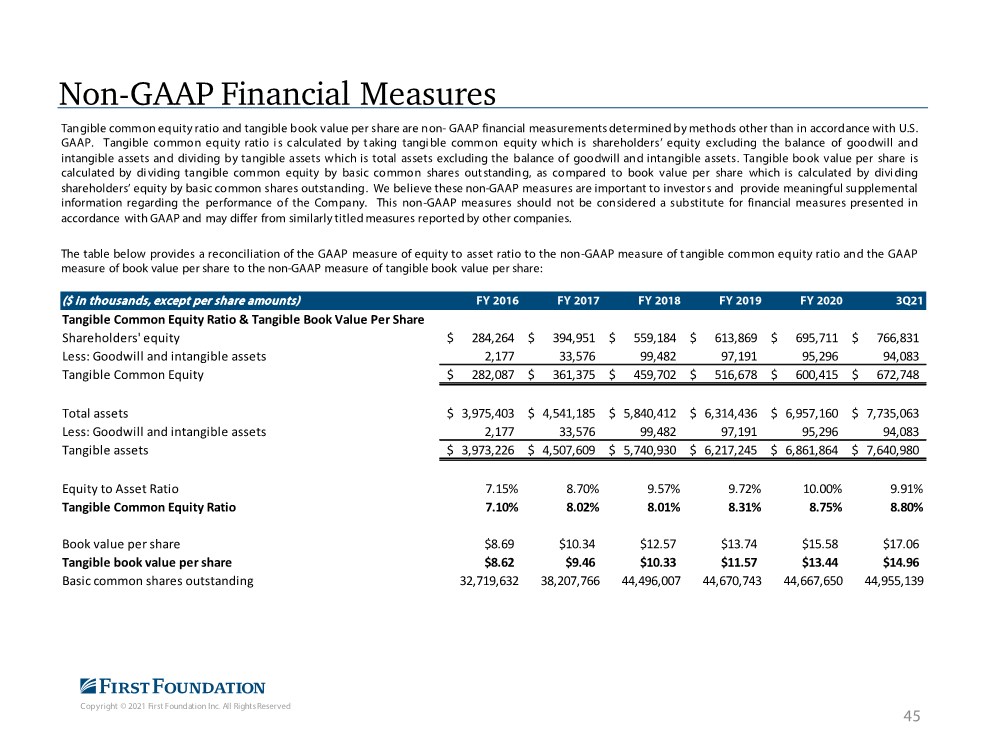

| Copyright © 2021 First Foundation Inc. All Rights Reserved This pr e s en ta t i on and the acc o m pa ny i n g oral c omm ent ary c ont a in "f or wa rd -looking statements" as d ef in ed in th e Priv at e Secu r it ie s Litigation Re f orm Act of 1995. Forward -looking statements of te n inc lu de word s such as "believe," " expect ," " an t ic ipa te ," "intend," " plan ," "estimate," " pr oje ct ," "outlook," or word s of similar me an ing, or futu re or c on d it i on a l verbssuch as"will," " w ou l d ," " sh ou l d ," "c ou ld , " or "may. " Th e forward-looking stat em ent s in th is presentation and any ac c om pan y in g oral c omm en t ar y are based on current information an d on a s su m pt i on s th at we make a bout future even t s and circumstancesthat are su bj ec t toa number of risks and uncertainties that are of t en d if f icu lt to pr ed ic t an d be y on d our c ont r ol. As ar e su lt of th ose risksand uncertainties, ou r ac tu al f in an c ia l r e su lt s in th e futurec ou l d d if fe r , possibly materially, f r om th ose expressed in or im plied by th e forward-looking statements c on ta i ne d in this pr e s en ta t i on and an y ac c om pan y in g oral statements and c ou ld c au se ustomake ch an ge s to ou r f utu re plan s.T h ose risks and uncertainties inc lud e , but aren ot lim it ed toth e riskof inc ur r in g c red it losses,wh ich is an inherent risk of the banking business; th e n e gat iv e im pact s and disruptions r e su lt in g f r om th e CO VI D-19 pan de m ic on our colleagues, c lient s, th e c ommun it ies we se rv e and th e d ome s t ic and global e c on om y , wh ich m ay have an ad ve rse eff ec t on ou r business, f in anc ia l position an d r e su lt s of operations; th e risk th at we willnot be able to c on t inu e ou r in t er na l growth rat e; th e perf orm anc e of loanscurrently on d ef e rral following th e expiration of th e respect ive d ef erred pe r i od s; th e risk th at we willnot be able to ac ce ss th e securitization m arke t on favorablet e rm s or at all; ch an ge s in gen e ral e c on om i c c ond i t i on s , eithernationally or locally in th e areas in wh ich we conduct or will c ond uct our bu s in e ss; r isks associated with th e Federal ReserveB oard ta k in g ac t i on s w it h respec t to interest rat es, wh ich c ou ld adversely aff ec t ou r interest in c om e an d int erest rat e ma r g in s and , therefore, ou r f utu re oper a t in g r e su lt s; th e riskthat the pe rf orm anc e of our investment m an agem ent business or of the e qu ity and bond m arke t s c ou ld le ad c lien t s tomove th eir fund s f r om or close th eir in ve s tm ent accountswith us, wh ich w ou ld redu ce our assets under m an agem en t and ad v erse ly aff ec t ou r ope ra t in g r e su lt s; the riskthat we may be unable or that ou r board of directorsm ay determineth at it is in ad v is a ble to pay f utu re dividends; risks associated with ch an ge s in income t ax lawsand regulation s; an d risks associated with seeking new client relationships and maintainingexistingclient relationships. Further, statements a bou t th e potential eff ec t s of th e proposed acquisition of TGR Financial on ou r business, f in anc ia l r e su lt s, and c ond i t i on mayconstitute f orward -looking stat em ent s an d are su bj e ct to the risk th at th e ac tu al ef fect s may d iff e r , possibly materially,f r om wh at is reflected in th e f or wa rd -looking statementsdue tof act ors and f utu re developments wh ich areunc e rt a in , un pred ict able and in m an y c a se s be y ond ou r control, inc lud in g th e possibility that th e proposed mergerdoes not close wh en expec t ed or at all bec au se re qu ir ed regulatory, shareholder or oth e r approvals, f in anc ia l tests or oth e r conditionstoclosingarenot received or satisfied on a t im e ly basis or at all; changes in our or TG R Fin anc ia l's s t oc k pr ic e bef ore closing, in c lud ing as a r e su lt of e ach c om pan y’ s f in an c ia l pe rf orm anc e pr i o r to closing or transaction-related uncertainty, or more generally due to br oa de r st oc k m a r ke t m ovem en t s, and the perf orm anc e of f in anc ia l c om pan i e s an d peer g r ou p c o m pa n ie s; th e occurrence of an y even t , ch an ge or oth e r circumstancethat c ou l d g iv e risktothe r igh t of on e or both of th e pa r t i e s tot e rm in a te th e m erger agreem ent ; th e riskth at th e benefitsfrom th e proposed m erger m ay n ot be fully r e a liz ed or maytake l on g e r to realiz e th an expect ed or be more costly to achieve, inc lud in g asa r e su lt of c han ge s in gen e ral e c on om i c an d m arke t c ond i t i on s , interest and ex ch an ge rates, m on et ary policy, laws an d r e gu l a t i on s and their en f orc em ent , and th e degree of c om pe t it i on in th e ge o g r a ph ic and business areas in wh ich we and TG R Fin anc ia l operate; our a bilit y to promptly and effectively integrate th e c om pan i e s’ businesses; reputational risks and the r ea ct i on of the c om pan i e s ' customers, employeesan d counterparties tothe proposed m erger; diversion of m an agem ent t im e on merger-related issue s; lower th an expect ed revenu es, c red it qu a lit y deterioration or a r educ t i on in real estate valu es or a r educ t i on in net earn ings; and that the CO V ID-19 pand em ic , inc lud in g uncertainty an d volatility in f in an c ia l, c omm od it i e s and oth e r m arke t s, an d disruptions to banking an d oth er f in anc ia l activity, c ou ld h arm ou r or TG R Fin anc ia l's business, financial position an d r e su lt s of operations, and could adverselyaff ec t th e timing an d anticipatedbenefits of th e proposed merger. Additional inf or ma t i on r eg a rd in g th e se and oth er risks and uncertainties to wh ich our business and f utu re f in an c ia l pe rf orm an ce aresu bje ct iscontained in ou r 2020 An nu a l Report on Form 10-Kfor th e f isc a l year end ed D ec em ber 31, 2020 th at we filed with th e SEC on Fe bru ary 26, 2021, our Quarterly Re port on Form 10-Q f or th e quarter end ed March 31, 2021 th at we f iled w it h th e SE C on May 7, 2021, an d oth e r d ocu me nt s we file with the SEC from t im e to t im e . We urge recipients of th is presentation to review t h ose re port s and oth er d ocum en t s we file with the SEC f r om t ime tot ime. Also, our ac tu al financialr e su lt s in th e futuremaydiffer from th ose currentlyexpected due to additional risksand uncertainties of wh ich we are not currentlyaware or w h ich we do n ot cu rren t ly view as, but in th e future may bec ome, m at e r ia l to our business or ope ra t in g r e su lt s.Due tothese and oth er possible uncertainties an d r isk s, readers are ca ut i on ed n ot to plac e undue re lianc e on th e f orward-looking stat em ent s c ont a in ed in thispresentation,w h ich speak on l y asof t od a y 's d at e , or tom ake pr ed ic t i on s ba s ed solely on historical f in anc ia l perf orm anc e. We alsodisclaim an y obligation tou pd at e forward-looking statementscontained in this presentation or in the above-referenced re port s, whether as aresult of new information, future events or otherwise, except asm ay be required by law or N ASD AQ rules. Additional Information About the Mergerand Where to Find It This presentation doesnot constitute an of fe r to sell or th e solicitation of an off er to buy an y securities or a solicitation of an y vote or approval. In v e st or s and sec urit y holders areu r ge d to carefully review Fir st Foundation's pu b l i c filings w ith th e SEC, in c lud ing but not lim ited to it s Ann ua l Re port s on Form 10-K,Qu art e rly Reports on Form 10-Q, pr o x y statements and Cu rren t Re por t s on Form 8 -K.Th e d ocum ent s aref iled w ith th e SEC and m ay be obt a in ed free of ch arge at www.sec .gov,at First Foundation's website at firstfoundationinc.com und er th e "Investor Re lat ions" link, or writingFirst Foundation at 18101 Von Karman Ave., Suite 700, Irvine, CA 92612; Attention: Kevin Thompson. ln c onn ec t i on w ith th e proposed mergertransaction,First Found a t i on f iled w it h th e SE C aregistration statement on Form S-4th at inc lu de s a j oin t pr o x y statement of First Foundation and TG R Fin an c ia l, an d a prospectus of Fir st Fou nd at i on , wh ich are ref erred toasthe j oin t pr ox y statement/prospectus, aswell as ot he r relevant d ocum en t s concerning th e proposed tran sac t ion . Be f ore m a k in g an y v ot in g or investment decision,i nv e s t or s and secu rity h old ers are u rged tocarefully re ad th e ent ire registration st at em en t and joint pr o x y stat em ent / prospec tu s, as we ll as an y am endm en t s or supplements to th e se d oc um ent s , be ca u se th ey c ont a in i m por t ant inf orm a t i on a bou t th e proposed tran sac t ion . A de f in it iv e joint proxy statement/prospectus will be sen t tothe sh areh old ers of First Fou nda t i on and TG R Fin anc ia l seeking required shareholder approvals. Investors and sec urit y holders will be able to obt a in th e registration stat em ent and th e j oin t proxy st at em en t prospectus, and any oth er docu ments First Foundation f iles with the SEC free of ch arge as described in the preceding paragraph. First Foun da t i on , TG R Fin anc ia l, th eir directors, executive officers an d c e rt a in ot he r pe r s o n s may be deem ed to be participants in th e solicitation of pr ox ie s f r om Fir st Found a t i on and TGR Fin anc ia l shareholders in f a v or of th e approval of th e t ran sac t ion . In f orm at i on a bou t th e directors an d executive officers of Fir st Found a t i on and th eir own e r sh ip of Fir st Foun da t i on c om m on s t oc k is set f orth in th e pr o x y st at em en t for First Foundation's 2021 annual m e et in g of shareholders, as previously f iled with the SEC. Additional in f or ma t i on r eg a rd in g th e interests of th ose participants and oth e r person s wh o may be d eem ed part ic ipan t s in th e t ran sac t ion m ay be obt a in ed by r e ad in g the joint proxy statement/prospectus r e ga rd in g th e proposed merger. Non-GAAP Financial Measures This pr e s en ta t i on c ont a in s both f in an c ia l measures ba sed on G AAP an d n on-GAAP based financialmeasures, wh ich areu se d when managem en t believesth em to be helpful in understanding th e C o m pa ny ’ s re s u lt s of operationsor f in anc ia l position. Wherenon-GAAPfinancialmeasuresareu sed , th e comparableGAAP f in anc ia l m easure, aswell asth e reconciliation tothe comparableGAAPf in anc ia l measure,can be f ou nd in th e Com pan y’ s pre ss release as of an d f or th e qu a r te r end ed September 30, 2021. These disclosures should not be viewed as asubstitu te for operatin g results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performancemeasuresthat may be presented by other c ompanies. Safe Harbor Statement 1 |