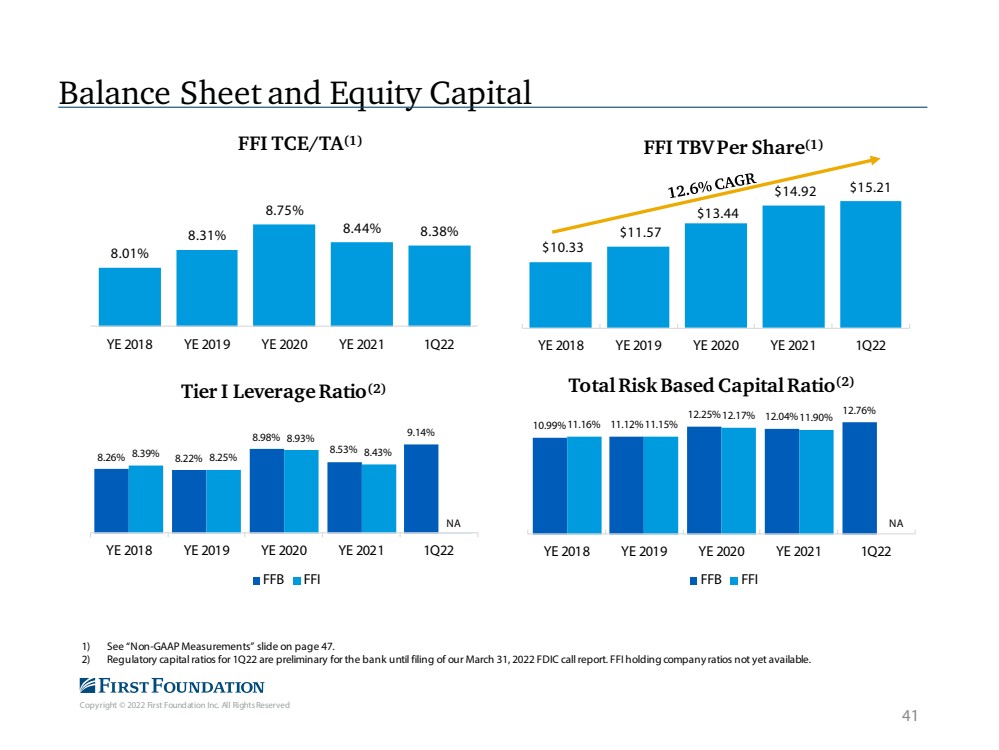

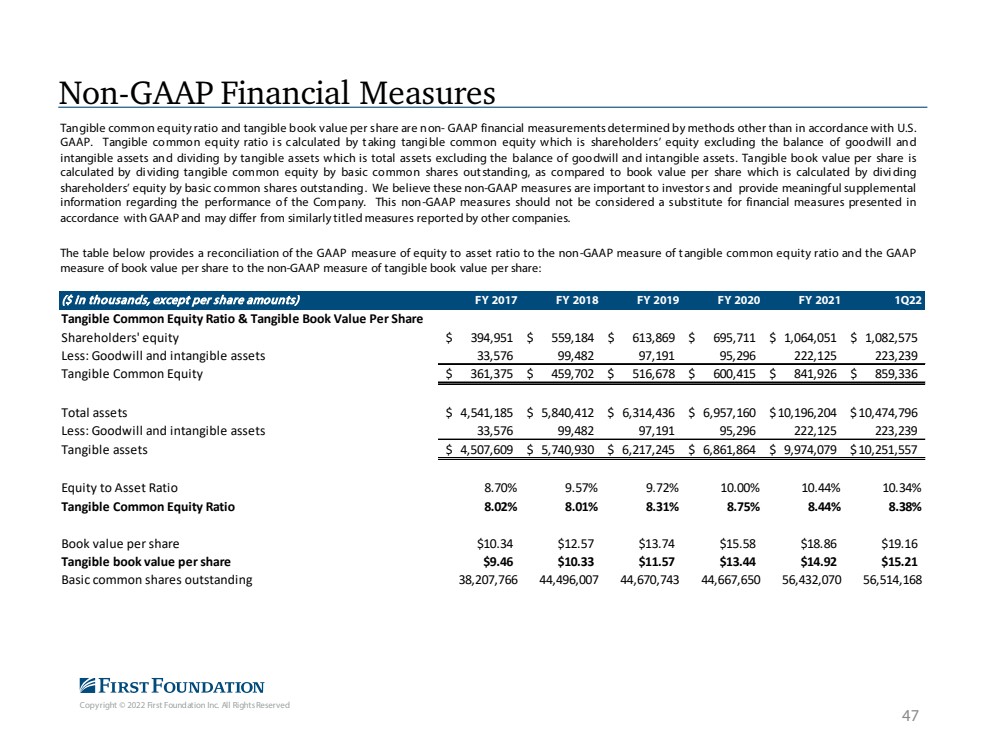

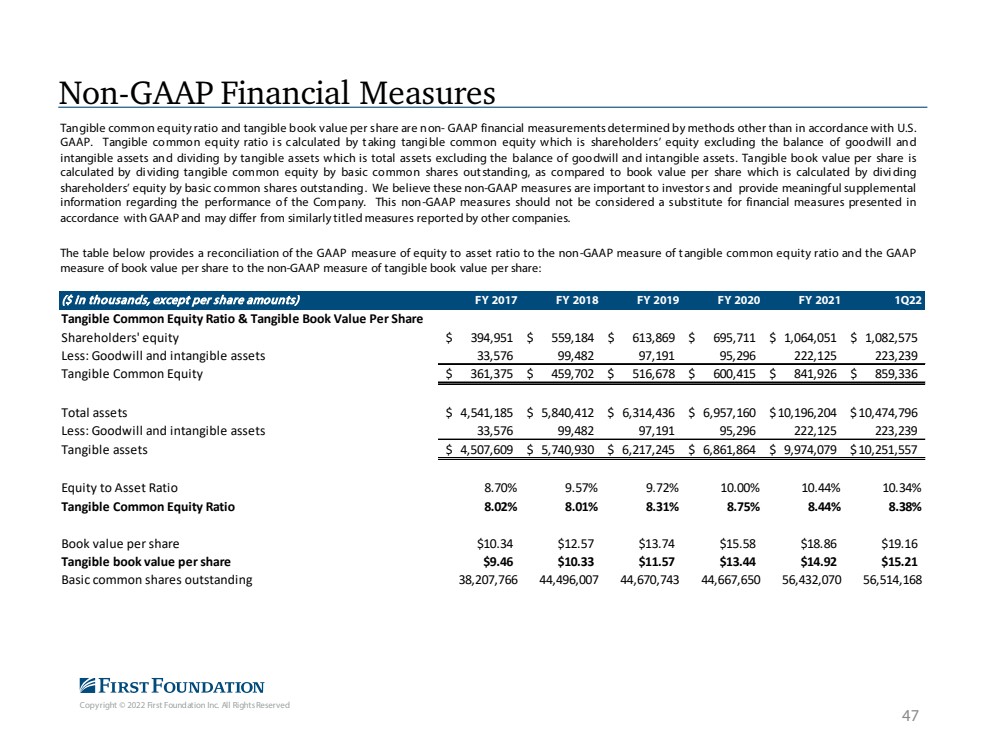

| Copyright © 2022 First Foundation Inc. All Rights Reserved Non-GAAP Financial Measures47 Tangiblecommonequityratioandtangiblebookvaluepersharearenon-GAAPfinancialmeasurementsdeterminedbymethodsotherthaninaccordancewithU.S.GAAP.Tangiblecommonequityratioiscalculatedbytakingtangiblecommonequitywhichisshareholders’equityexcludingthebalanceofgoodwillandintangibleassetsanddividingbytangibleassetswhichistotalassetsexcludingthebalanceofgoodwillandintangibleassets.Tangiblebookvaluepershareiscalculatedbydividingtangiblecommonequitybybasiccommonsharesoutstanding,ascomparedtobookvaluepersharewhichiscalculatedbydividingshareholders’equitybybasiccommonsharesoutstanding.Webelievethesenon-GAAPmeasuresareimportanttoinvestorsandprovidemeaningfulsupplementalinformationregardingtheperformanceoftheCompany.Thisnon-GAAPmeasuresshouldnotbeconsideredasubstituteforfinancialmeasurespresentedinaccordancewithGAAPandmaydifferfromsimilarlytitledmeasuresreportedbyothercompanies.ThetablebelowprovidesareconciliationoftheGAAPmeasureofequitytoassetratiotothenon-GAAPmeasureoftangiblecommonequityratioandtheGAAPmeasureofbookvaluepersharetothenon-GAAPmeasureoftangiblebookvaluepershare: ($ in thousands, except per share amounts)FY 2017FY 2018FY 2019FY 2020FY 20211Q22Tangible Common Equity Ratio & Tangible Book Value Per ShareShareholders' equity394,951$ 559,184$ 613,869$ 695,711$ 1,064,051$ 1,082,575$ Less: Goodwill and intangible assets33,576 99,482 97,191 95,296 222,125 223,239 Tangible Common Equity361,375$ 459,702$ 516,678$ 600,415$ 841,926$ 859,336$ Total assets4,541,185$ 5,840,412$ 6,314,436$ 6,957,160$ 10,196,204$ 10,474,796$ Less: Goodwill and intangible assets33,576 99,482 97,191 95,296 222,125 223,239 Tangible assets4,507,609$ 5,740,930$ 6,217,245$ 6,861,864$ 9,974,079$ 10,251,557$ Equity to Asset Ratio8.70%9.57%9.72%10.00%10.44%10.34%Tangible Common Equity Ratio8.02%8.01%8.31%8.75%8.44%8.38%Book value per share$10.34$12.57$13.74$15.58$18.86$19.16Tangible book value per share$9.46$10.33$11.57$13.44$14.92$15.21Basic common shares outstanding38,207,76644,496,00744,670,74344,667,65056,432,07056,514,168 |