AUGUST 2018 Investor Presentation Exhibit 99.1

This presentation and the accompanying oral commentary contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements express our current assumptions, beliefs, plans and expectations about our future financial performance and achievements and are necessarily based on current information available to us. Forward-looking statements include all statements that are not statements of historical facts and can be identified by words such as “anticipates,” “believes,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts, “projects,” “should,” “could,” “will,” “would” or similar expressions and the negatives of those expressions. In particular, forward-looking statements contained in this presentation and the accompanying oral commentary relate to, among other things, our future or assumed financial condition, results of operations, strategic plans and objectives, competitive position and potential growth opportunities. The realization of our future financial performance and the achievement of our plans and objectives, including the achievement of our strategic plans and the realization of our potential growth opportunities, as set forth in the forward-looking statements contained in this presentation and the accompanying oral commentary, are subject to substantial known and unknown risks and uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements contained in this presentation or expressed in the accompanying oral commentary. For a discussion of some of these risks, please see the section entitled "Risk Factors" in our Annual Report on Form 10-K filed with the SEC on March 16, 2018, and in the other documents we file with the SEC from time to time. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons our actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available to us in the future. Safe Harbor Statement

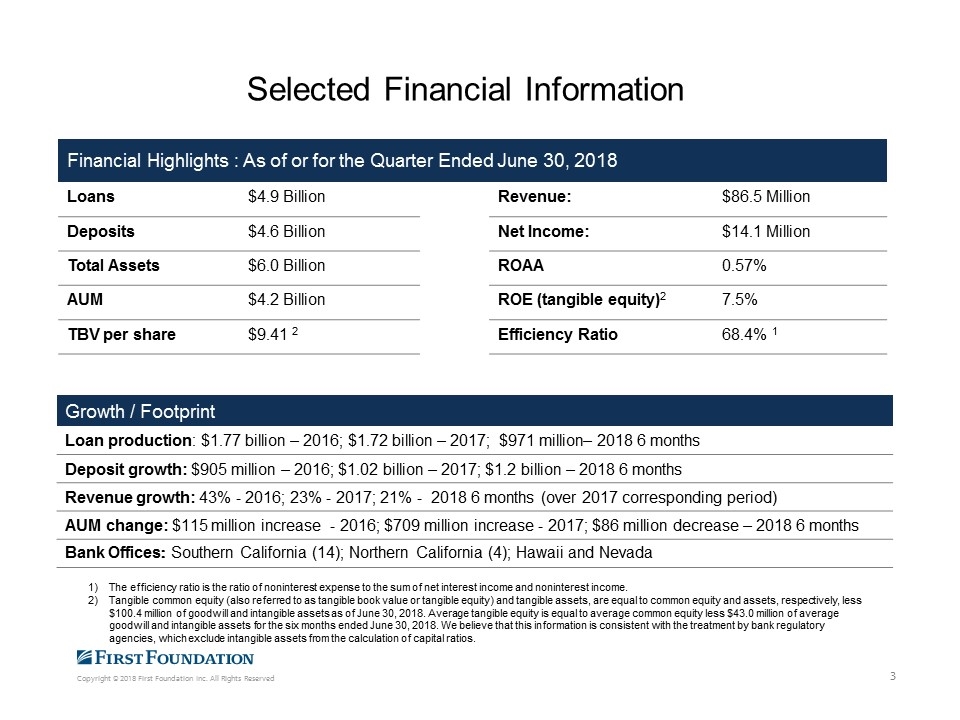

Selected Financial Information Financial Highlights : As of or for the Quarter Ended June 30, 2018 Loans $4.9 Billion Revenue: $86.5 Million Deposits $4.6 Billion Net Income: $14.1 Million Total Assets $6.0 Billion ROAA 0.57% AUM $4.2 Billion ROE (tangible equity)2 7.5% TBV per share $9.41 2 Efficiency Ratio 68.4% 1 Growth / Footprint Loan production: $1.77 billion – 2016; $1.72 billion – 2017; $971 million– 2018 6 months Deposit growth: $905 million – 2016; $1.02 billion – 2017; $1.2 billion – 2018 6 months Revenue growth: 43% - 2016; 23% - 2017; 21% - 2018 6 months (over 2017 corresponding period) AUM change: $115 million increase - 2016; $709 million increase - 2017; $86 million decrease – 2018 6 months Bank Offices: Southern California (14); Northern California (4); Hawaii and Nevada The efficiency ratio is the ratio of noninterest expense to the sum of net interest income and noninterest income. Tangible common equity (also referred to as tangible book value or tangible equity) and tangible assets, are equal to common equity and assets, respectively, less $100.4 million of goodwill and intangible assets as of June 30, 2018. Average tangible equity is equal to average common equity less $43.0 million of average goodwill and intangible assets for the six months ended June 30, 2018. We believe that this information is consistent with the treatment by bank regulatory agencies, which exclude intangible assets from the calculation of capital ratios.

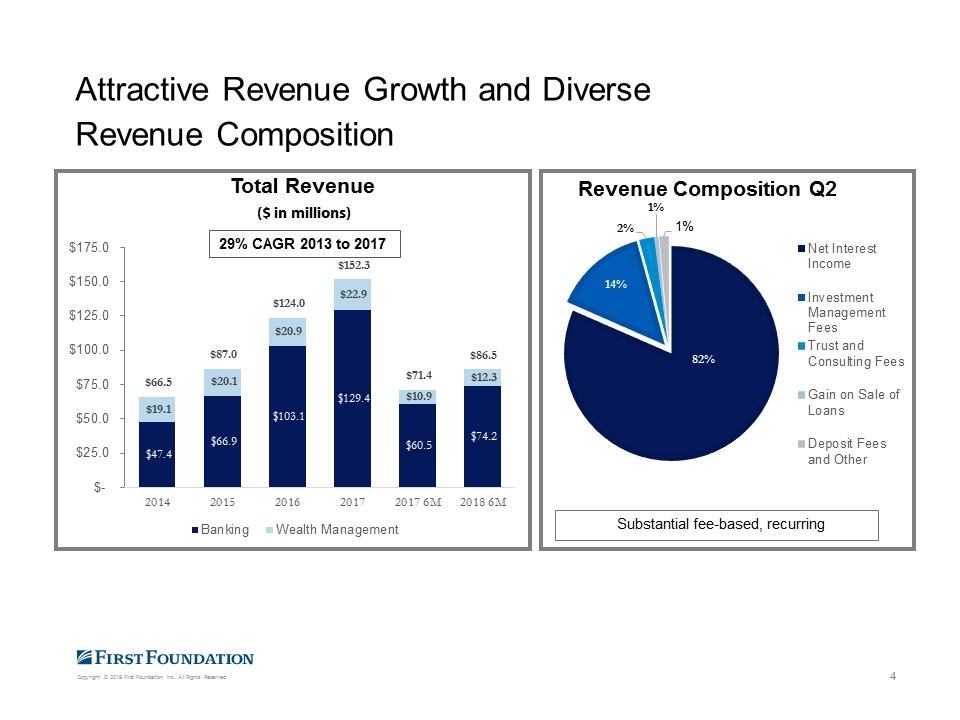

Attractive Revenue Growth and Diverse Revenue Composition

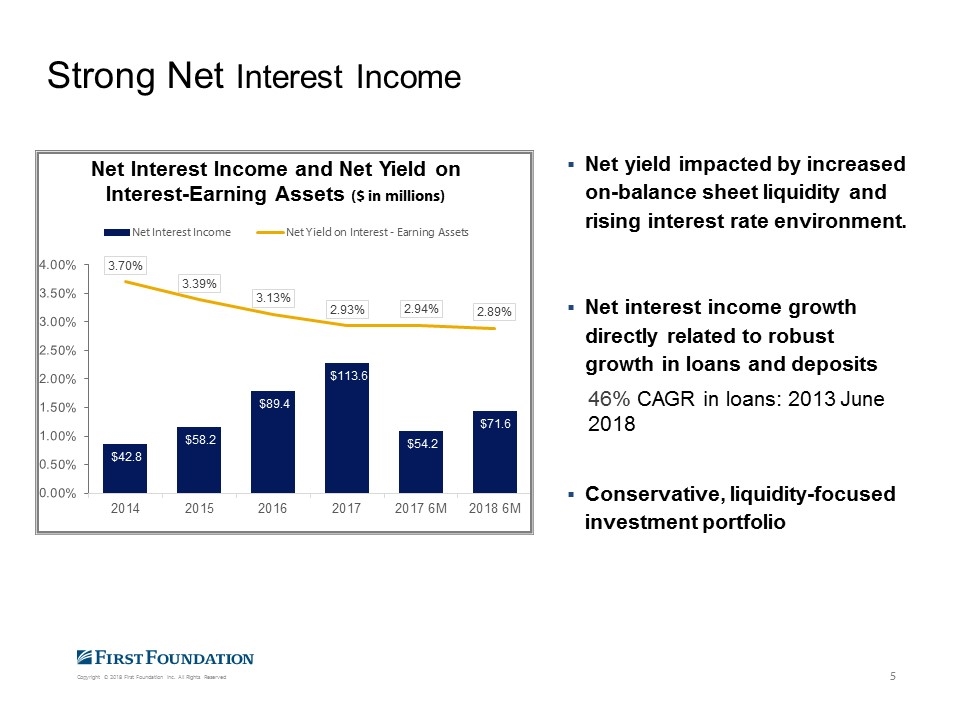

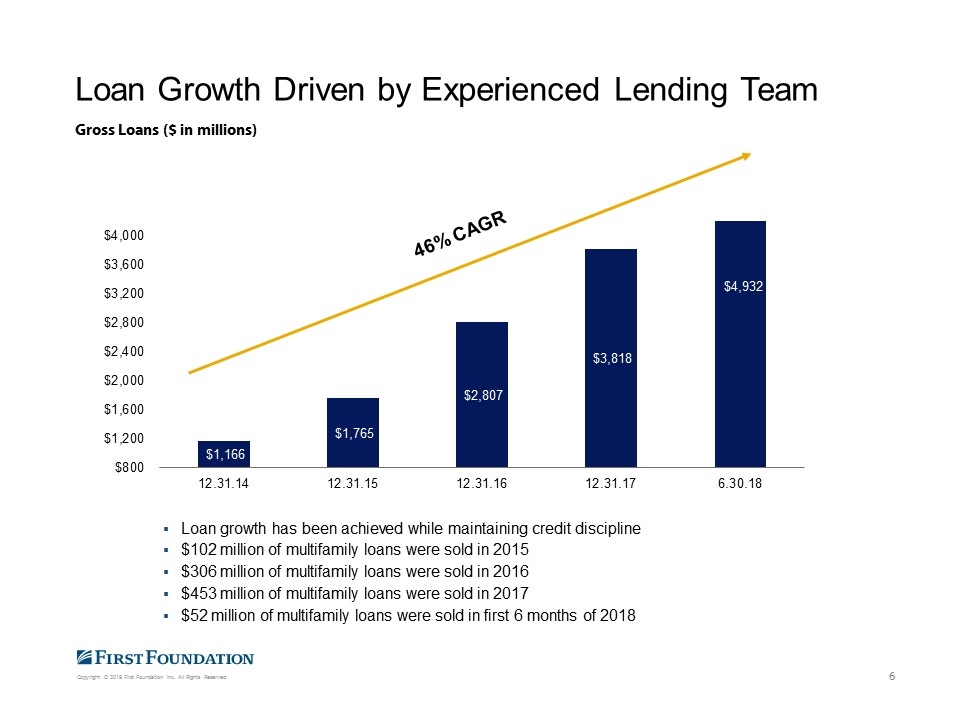

Net yield impacted by increased on-balance sheet liquidity and rising interest rate environment. Net interest income growth directly related to robust growth in loans and deposits 46% CAGR in loans: 2013 June 2018 Conservative, liquidity-focused investment portfolio Strong Net Interest Income

Loan growth has been achieved while maintaining credit discipline $102 million of multifamily loans were sold in 2015 $306 million of multifamily loans were sold in 2016 $453 million of multifamily loans were sold in 2017 $52 million of multifamily loans were sold in first 6 months of 2018 Loan Growth Driven by Experienced Lending Team Gross Loans ($ in millions)

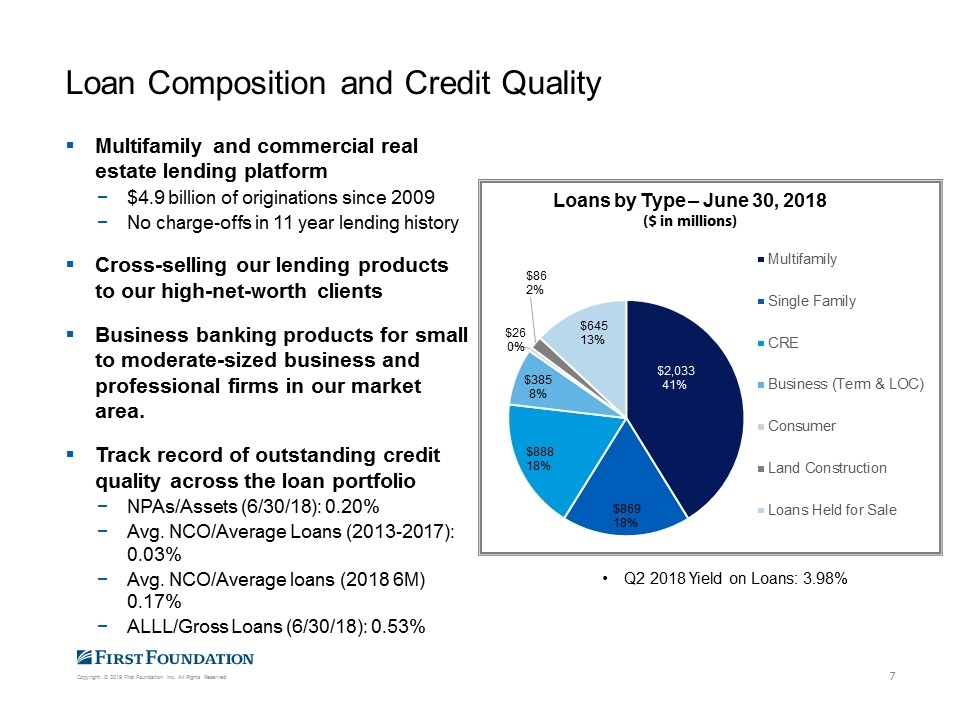

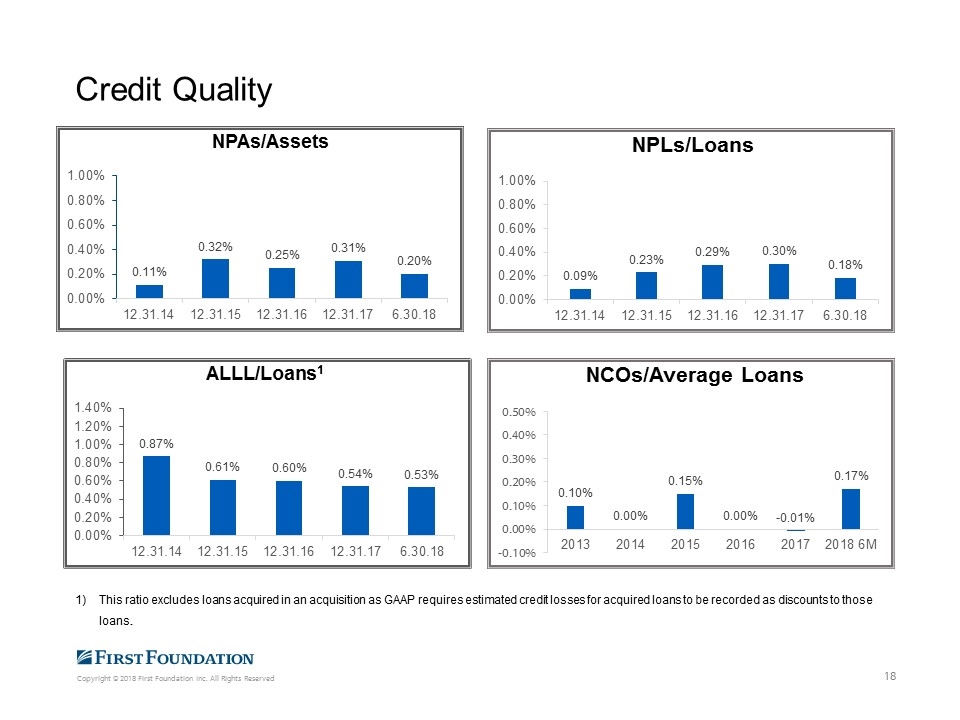

Multifamily and commercial real estate lending platform $4.9 billion of originations since 2009 No charge-offs in 11 year lending history Cross-selling our lending products to our high-net-worth clients Business banking products for small to moderate-sized business and professional firms in our market area. Track record of outstanding credit quality across the loan portfolio NPAs/Assets (6/30/18): 0.20% Avg. NCO/Average Loans (2013-2017): 0.03% Avg. NCO/Average loans (2018 6M) 0.17% ALLL/Gross Loans (6/30/18): 0.53% Loan Composition and Credit Quality Q2 2018 Yield on Loans: 3.98%

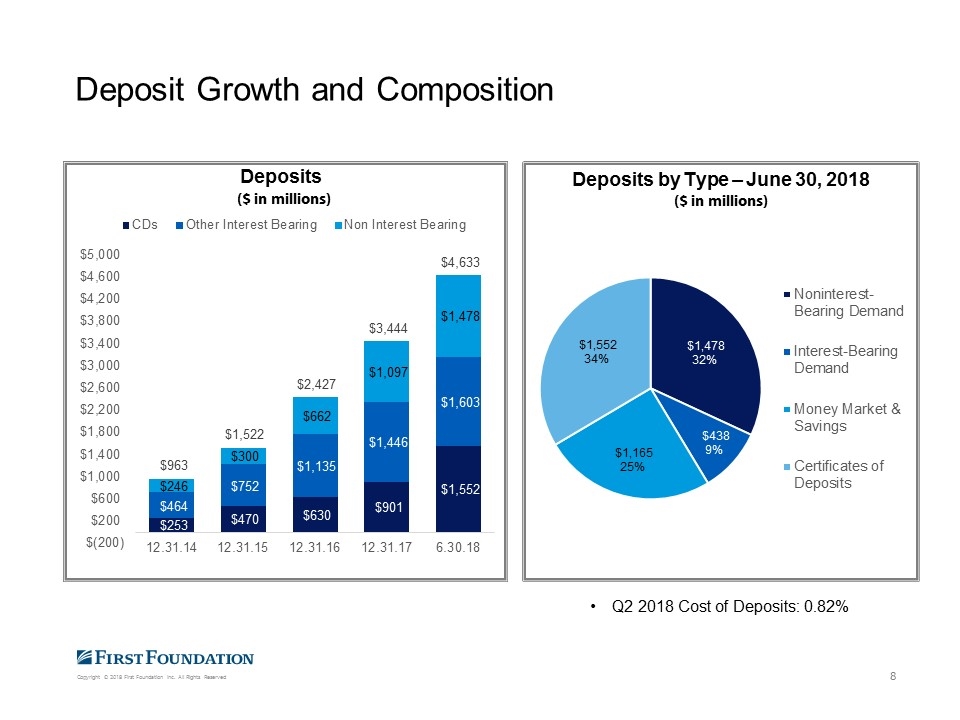

Deposit Growth and Composition Q2 2018 Cost of Deposits: 0.82%

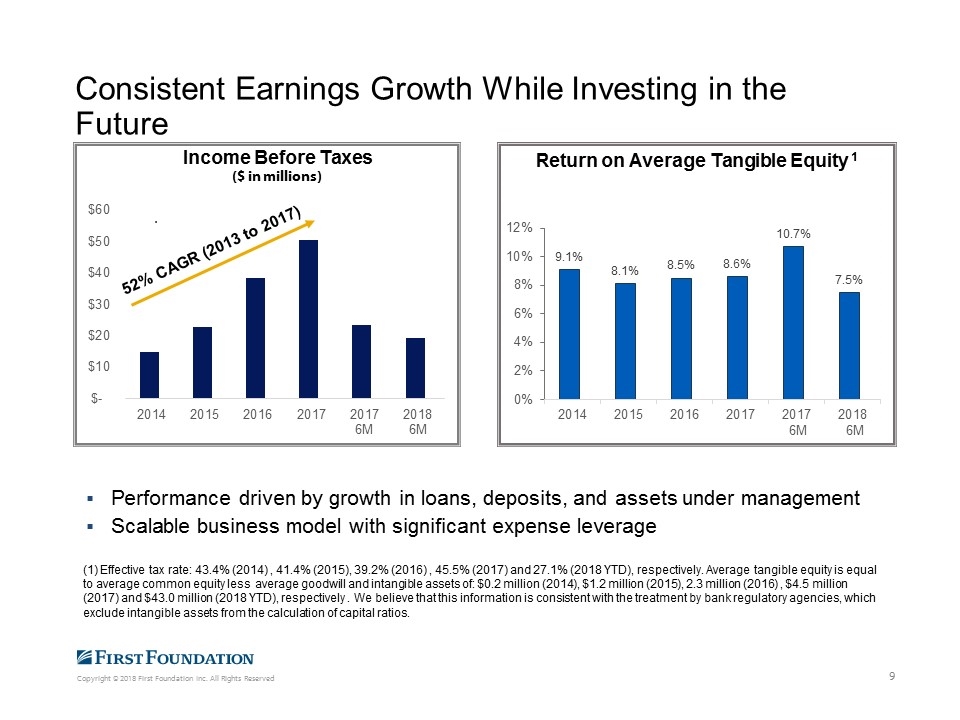

Consistent Earnings Growth While Investing in the Future Performance driven by growth in loans, deposits, and assets under management Scalable business model with significant expense leverage (1) Effective tax rate: 43.4% (2014) , 41.4% (2015), 39.2% (2016) , 45.5% (2017) and 27.1% (2018 YTD), respectively. Average tangible equity is equal to average common equity less average goodwill and intangible assets of: $0.2 million (2014), $1.2 million (2015), 2.3 million (2016) , $4.5 million (2017) and $43.0 million (2018 YTD), respectively . We believe that this information is consistent with the treatment by bank regulatory agencies, which exclude intangible assets from the calculation of capital ratios.

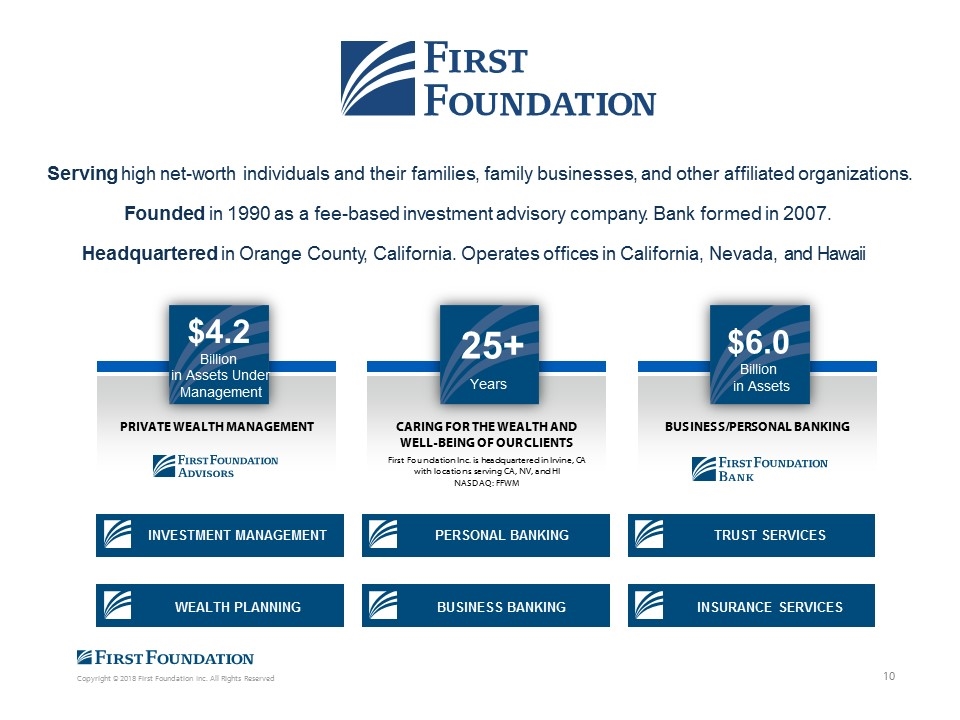

Serving high net-worth individuals and their families, family businesses, and other affiliated organizations. Founded in 1990 as a fee-based investment advisory company. Bank formed in 2007. Headquartered in Orange County, California. Operates offices in California, Nevada, and Hawaii 25+ CARING FOR THE WEALTH AND WELL-BEING OF OUR CLIENTS Years $4.2 Billion PRIVATE WEALTH MANAGEMENT in Assets Under Management $6.0 Billion BUSINESS/PERSONAL BANKING in Assets First Foundation Inc. is headquartered in Irvine, CA with locations serving CA, NV, and HI NASDAQ: FFWM INVESTMENT MANAGEMENT WEALTH PLANNING PERSONAL BANKING BUSINESS BANKING TRUST SERVICES INSURANCE SERVICES

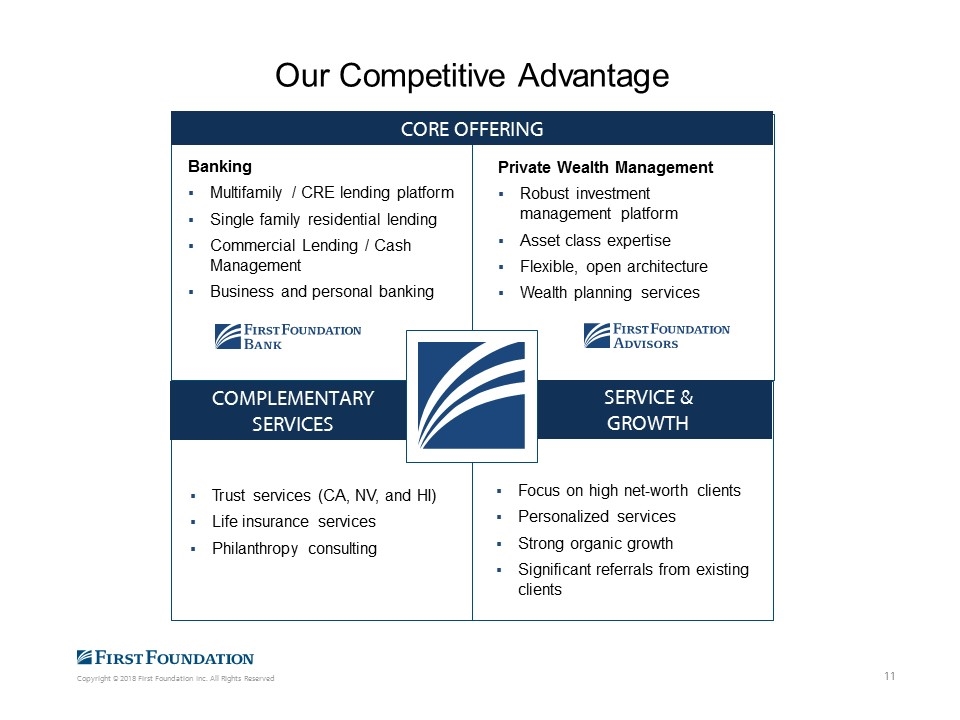

Our Competitive Advantage Focus on high net-worth clients Personalized services Strong organic growth Significant referrals from existing clients Private Wealth Management Robust investment management platform Asset class expertise Flexible, open architecture Wealth planning services Trust services (CA, NV, and HI) Life insurance services Philanthropy consulting Banking Multifamily / CRE lending platform Single family residential lending Commercial Lending / Cash Management Business and personal banking Core Offering Complementary Services Service & Growth

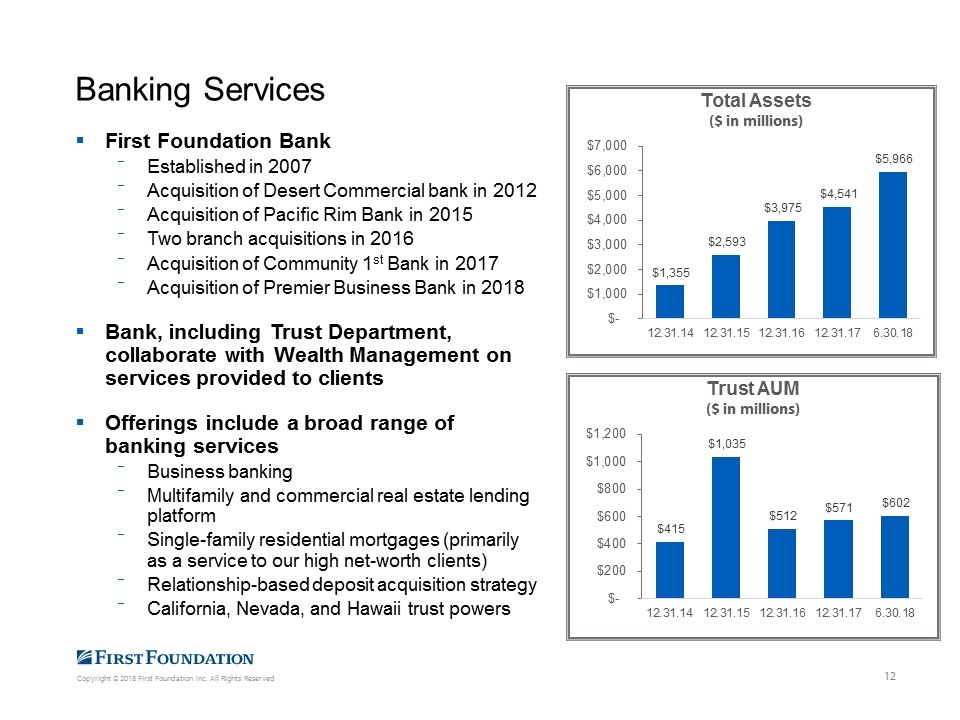

First Foundation Bank Established in 2007 Acquisition of Desert Commercial bank in 2012 Acquisition of Pacific Rim Bank in 2015 Two branch acquisitions in 2016 Acquisition of Community 1st Bank in 2017 Acquisition of Premier Business Bank in 2018 Bank, including Trust Department, collaborate with Wealth Management on services provided to clients Offerings include a broad range of banking services Business banking Multifamily and commercial real estate lending platform Single-family residential mortgages (primarily as a service to our high net-worth clients) Relationship-based deposit acquisition strategy California, Nevada, and Hawaii trust powers Banking Services

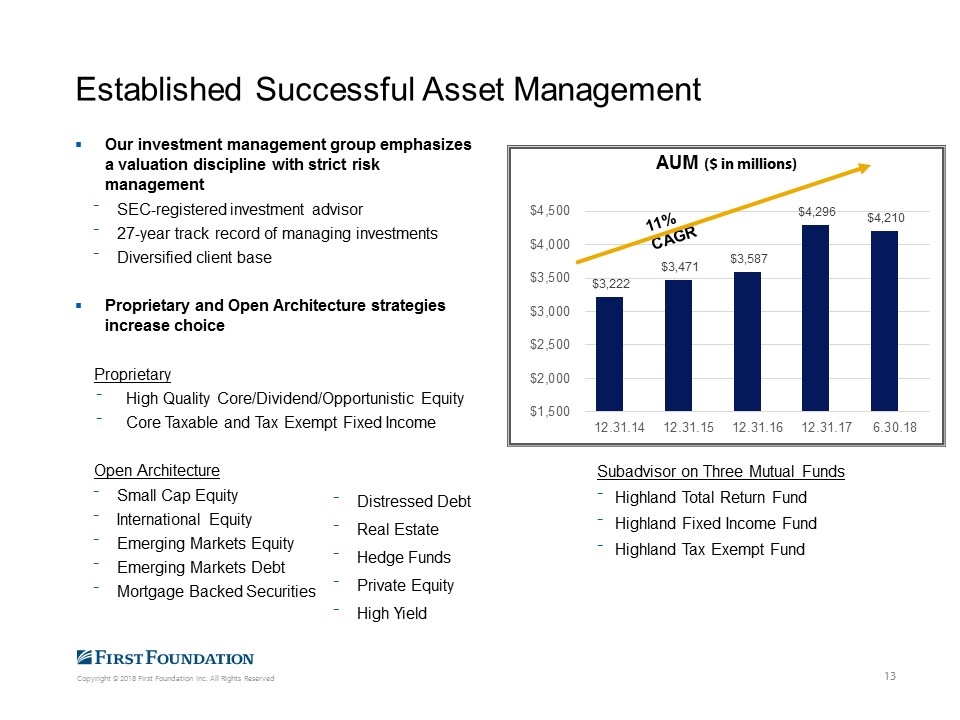

Our investment management group emphasizes a valuation discipline with strict risk management SEC-registered investment advisor 27-year track record of managing investments Diversified client base Proprietary and Open Architecture strategies increase choice Proprietary High Quality Core/Dividend/Opportunistic Equity Core Taxable and Tax Exempt Fixed Income Open Architecture Small Cap Equity International Equity Emerging Markets Equity Emerging Markets Debt Mortgage Backed Securities Distressed Debt Real Estate Hedge Funds Private Equity High Yield Established Successful Asset Management Subadvisor on Three Mutual Funds Highland Total Return Fund Highland Fixed Income Fund Highland Tax Exempt Fund 11% CAGR

Growing our team of experienced bankers and relationship managers Obtaining new client referrals from key referral sources Marketing our services directly to prospective new clients Cross-promoting our services among our banking and wealth management clients Making opportunistic acquisitions Leveraging existing infrastructure to create economies of scale Our Growth Strategy

Why Invest in First Foundation Management Team with Demonstrated Ability to Grow Strong Credit Culture Diverse Revenue Base Well-Positioned in Strategic Markets with Attractive Demographics Broad Range of Financial Products in Banking and Wealth Management Significant Insider Ownership – Incentives Aligned with Shareholders

Appendix

Effective tax rate of 17.2% (2013), 43.4% (2014) and 41.4% (2015) 39.2% (2016), 45.5% (2017), and 27.1% (2018) respectively. Average tangible equity is equal to average common equity less average goodwill and intangible assets of: $0.2 million (2014), $1.2 million (2015), 2.3 million (2016) , $4.5 million (2017) and $43.0 million (2018 YTD), respectively . We believe that this information is consistent with the treatment by bank regulatory agencies, which exclude intangible assets from the calculation of capital ratios. The efficiency ratio is the ratio of noninterest expense to the sum of net interest income and noninterest income and excludes one-time items of income or expense. For the six months ended June 30, 2018 and the year ended December 31, 2017, $3.8 million and $2.6 million of acquisition costs respectively were excluded from noninterest expenses for purposes of this computation. Profitability

This ratio excludes loans acquired in an acquisition as GAAP requires estimated credit losses for acquired loans to be recorded as discounts to those loans. Credit Quality

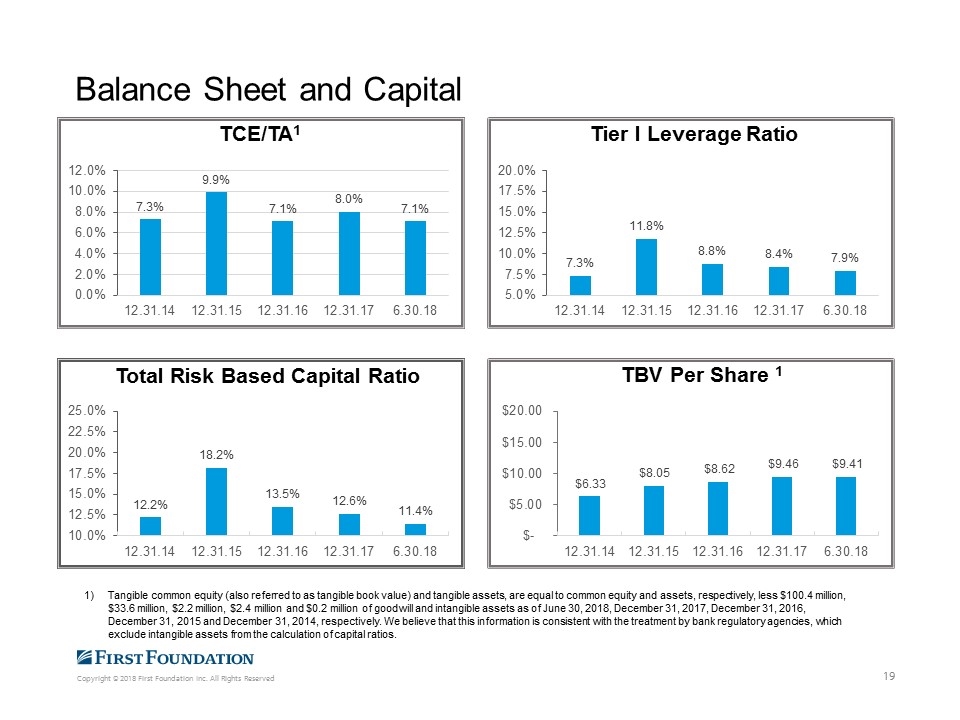

Balance Sheet and Capital Tangible common equity (also referred to as tangible book value) and tangible assets, are equal to common equity and assets, respectively, less $100.4 million, $33.6 million, $2.2 million, $2.4 million and $0.2 million of goodwill and intangible assets as of June 30, 2018, December 31, 2017, December 31, 2016, December 31, 2015 and December 31, 2014, respectively. We believe that this information is consistent with the treatment by bank regulatory agencies, which exclude intangible assets from the calculation of capital ratios.