MAY 2019 Investor Presentation Exhibit 99.1

This presentation and the accompanying oral commentary contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements express our current assumptions, beliefs, plans and expectations about our future financial performance and achievements and are necessarily based on current information available to us. Forward-looking statements include all statements that are not statements of historical facts and can be identified by words such as “anticipates,” “believes,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts, “projects,” “should,” “could,” “will,” “would” or similar expressions and the negatives of those expressions. In particular, forward-looking statements contained in this presentation and the accompanying oral commentary relate to, among other things, our future or assumed financial condition, results of operations, strategic plans and objectives, competitive position and potential growth opportunities. The realization of our future financial performance and the achievement of our plans and objectives, including the achievement of our strategic plans and the realization of our potential growth opportunities, as set forth in the forward-looking statements contained in this presentation and the accompanying oral commentary, are subject to substantial known and unknown risks and uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements contained in this presentation or expressed in the accompanying oral commentary. For a discussion of some of these risks, please see the section entitled "Risk Factors" in our 2018 Annual Report on Form 10-K filed with the SEC on March 1, 2019, and in the other documents we file with the SEC from time to time. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons our actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available to us in the future. Safe Harbor Statement

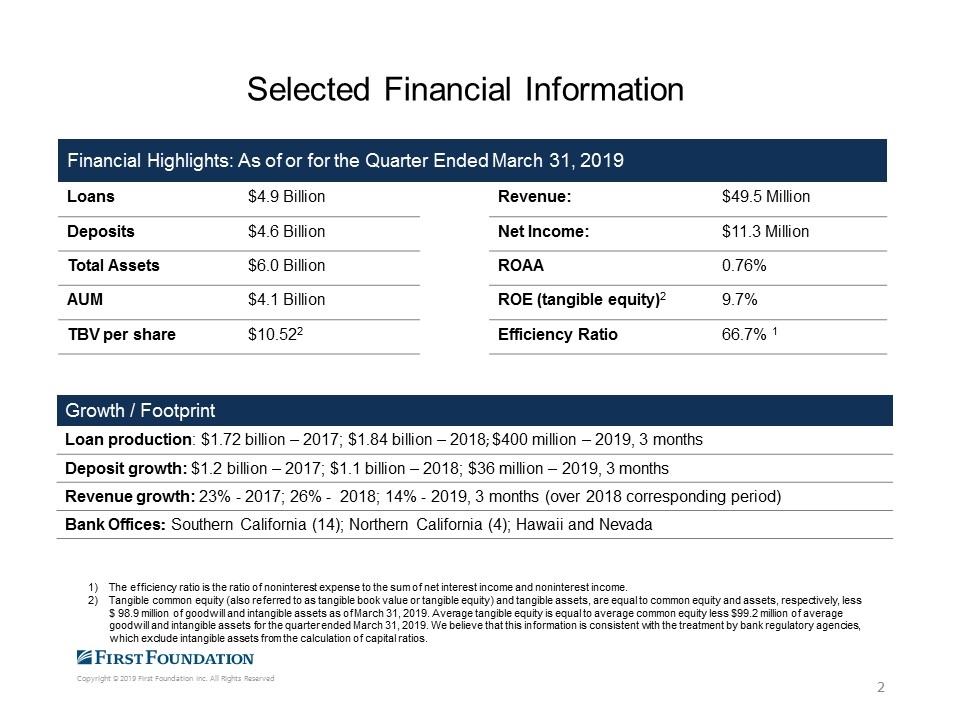

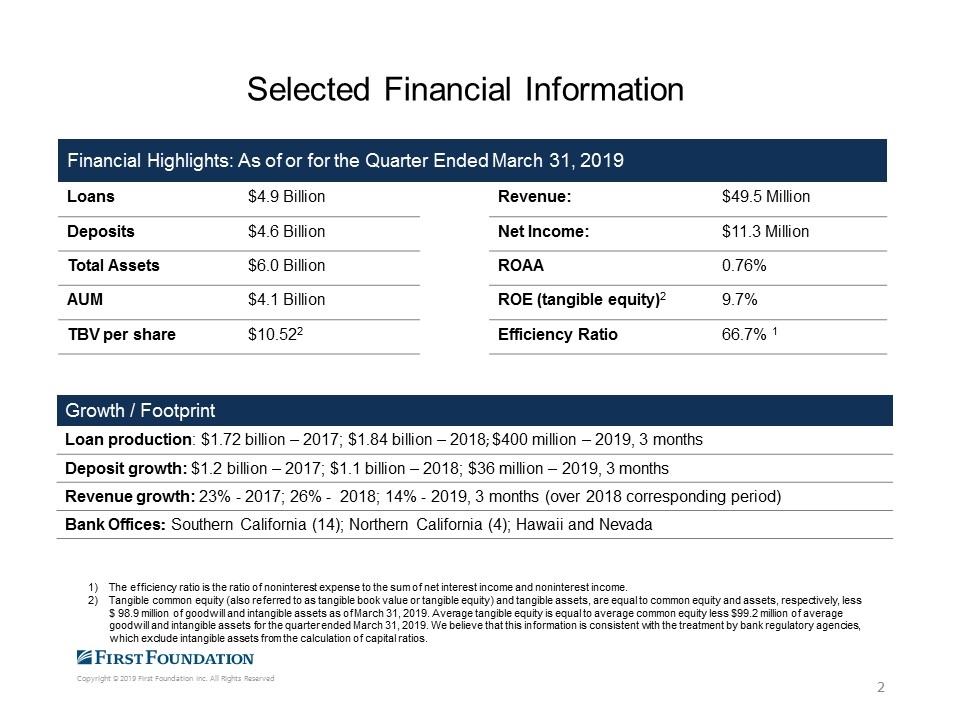

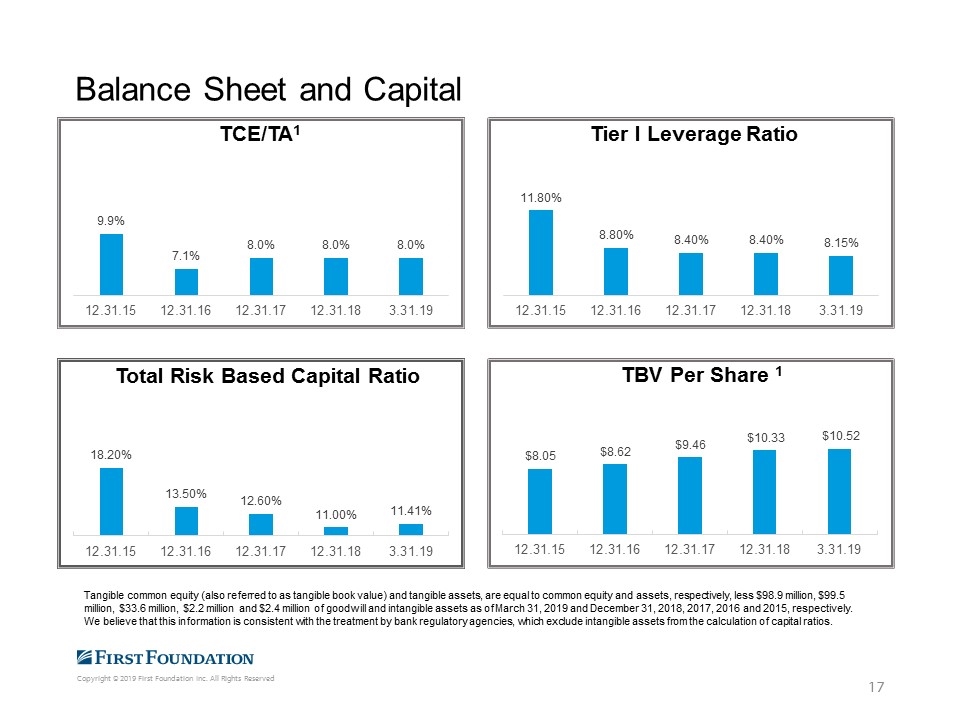

Selected Financial Information Financial Highlights: As of or for the Quarter Ended March 31, 2019 Loans $4.9 Billion Revenue: $49.5 Million Deposits $4.6 Billion Net Income: $11.3 Million Total Assets $6.0 Billion ROAA 0.76% AUM $4.1 Billion ROE (tangible equity)2 9.7% TBV per share $10.522 Efficiency Ratio 66.7% 1 Growth / Footprint Loan production: $1.72 billion – 2017; $1.84 billion – 2018; $400 million – 2019, 3 months Deposit growth: $1.2 billion – 2017; $1.1 billion – 2018; $36 million – 2019, 3 months Revenue growth: 23% - 2017; 26% - 2018; 14% - 2019, 3 months (over 2018 corresponding period) Bank Offices: Southern California (14); Northern California (4); Hawaii and Nevada The efficiency ratio is the ratio of noninterest expense to the sum of net interest income and noninterest income. Tangible common equity (also referred to as tangible book value or tangible equity) and tangible assets, are equal to common equity and assets, respectively, less $ 98.9 million of goodwill and intangible assets as of March 31, 2019. Average tangible equity is equal to average common equity less $99.2 million of average goodwill and intangible assets for the quarter ended March 31, 2019. We believe that this information is consistent with the treatment by bank regulatory agencies, which exclude intangible assets from the calculation of capital ratios.

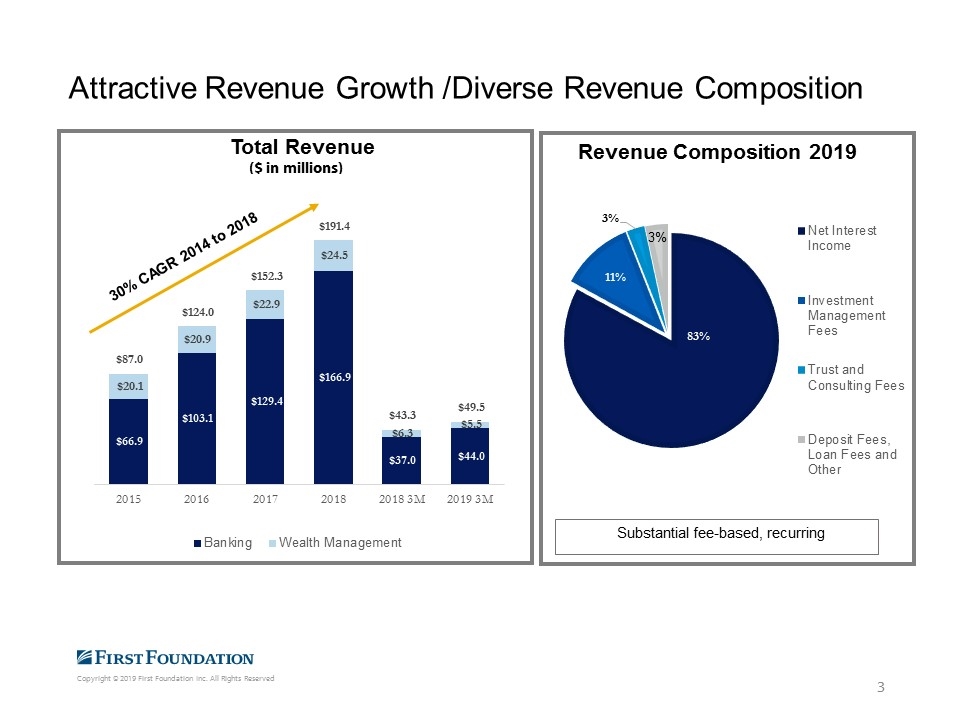

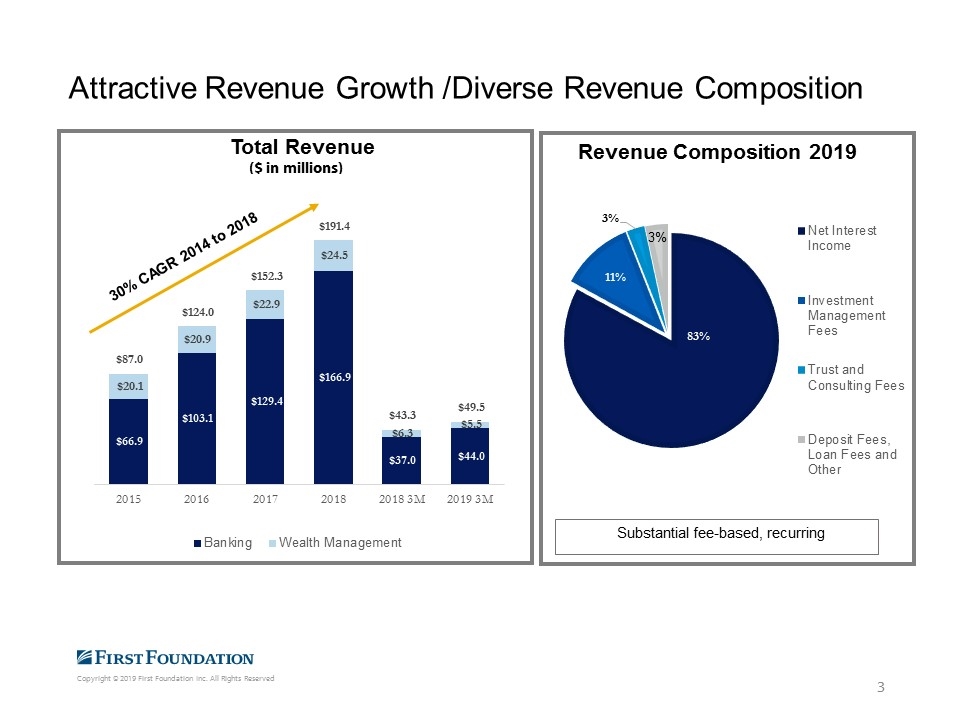

Attractive Revenue Growth /Diverse Revenue Composition

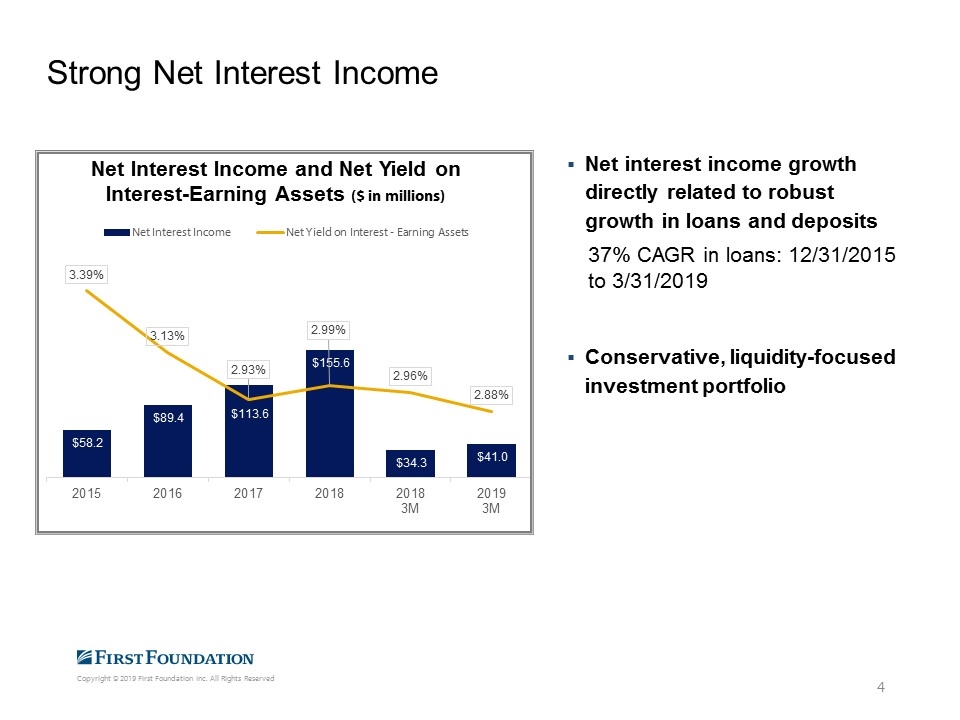

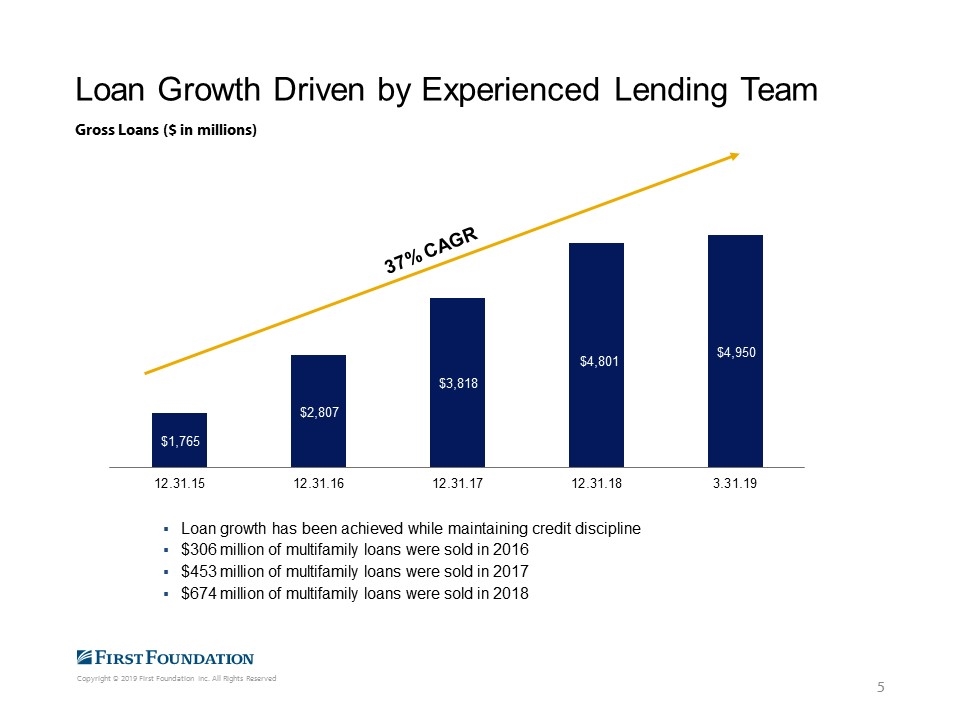

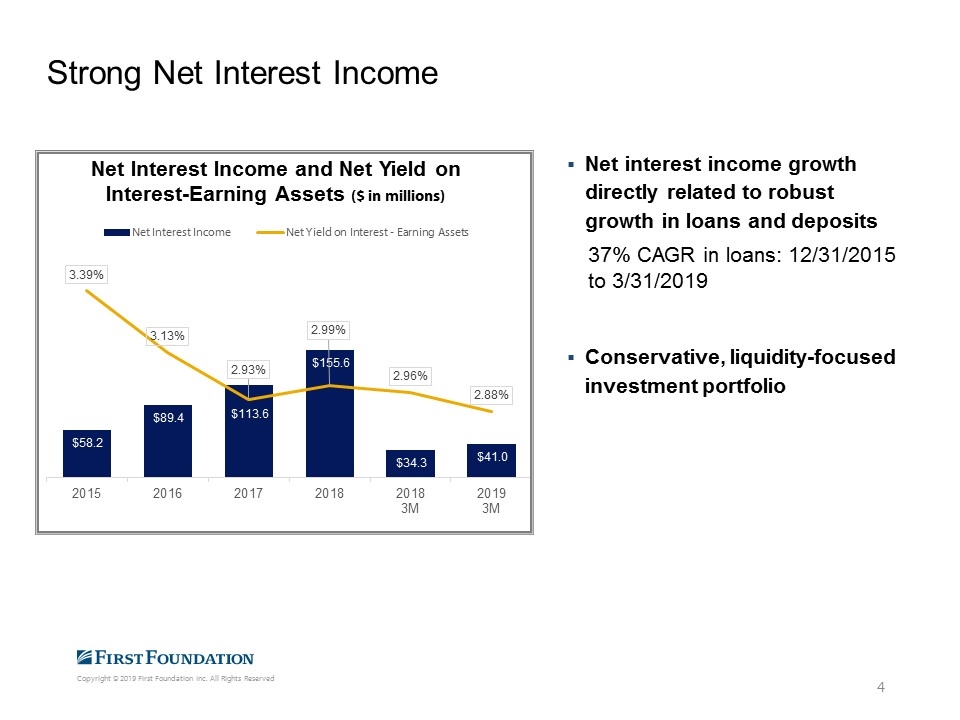

Net interest income growth directly related to robust growth in loans and deposits 37% CAGR in loans: 12/31/2015 to 3/31/2019 Conservative, liquidity-focused investment portfolio Strong Net Interest Income

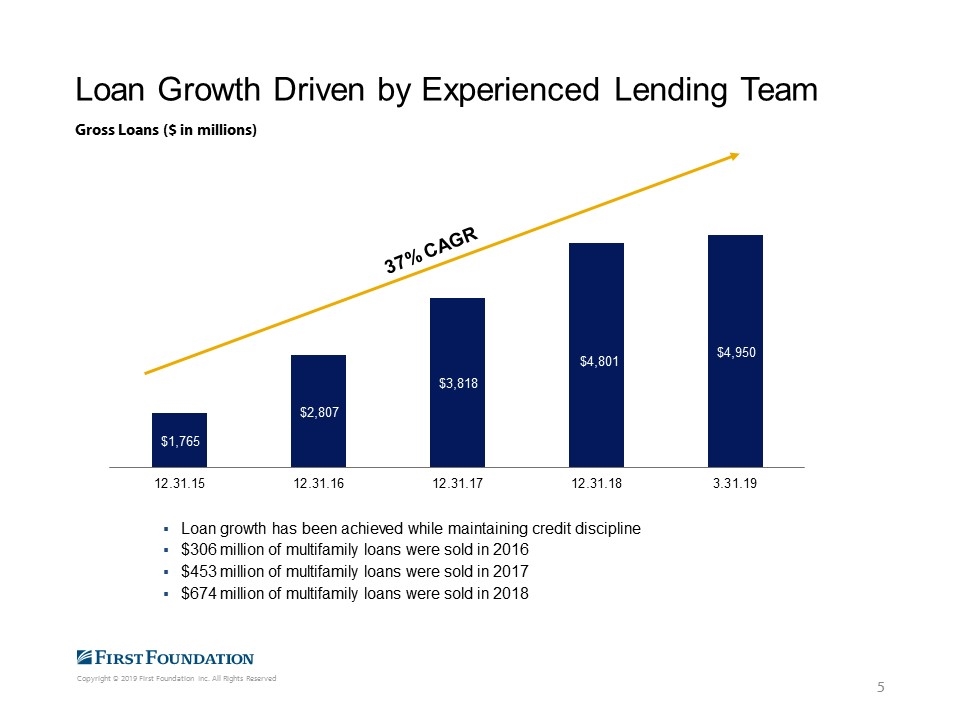

Loan growth has been achieved while maintaining credit discipline $306 million of multifamily loans were sold in 2016 $453 million of multifamily loans were sold in 2017 $674 million of multifamily loans were sold in 2018 Loan Growth Driven by Experienced Lending Team Gross Loans ($ in millions)

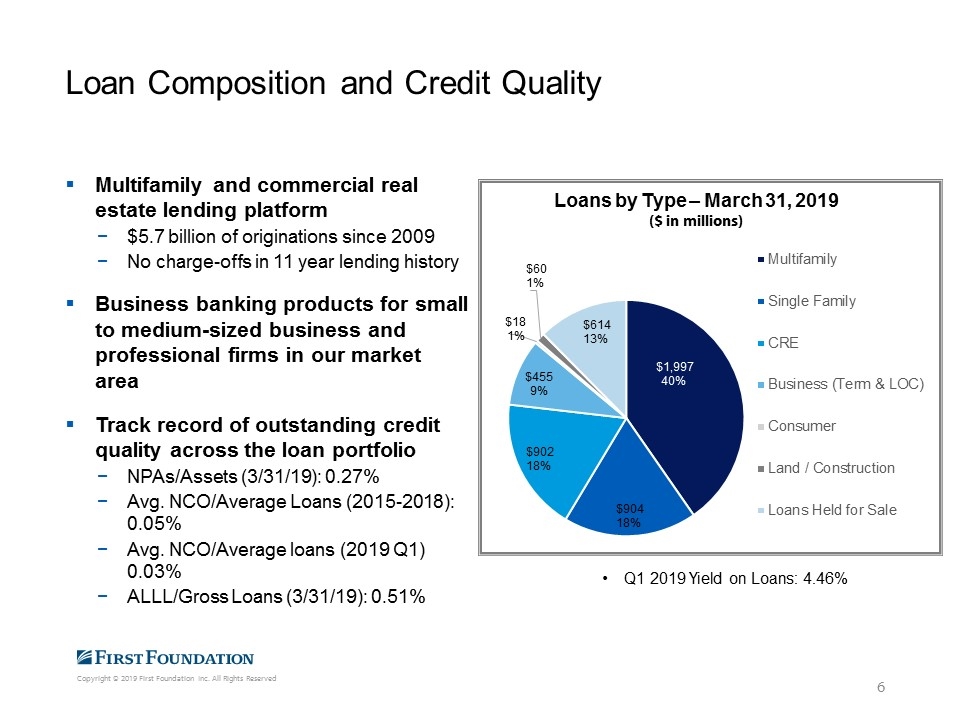

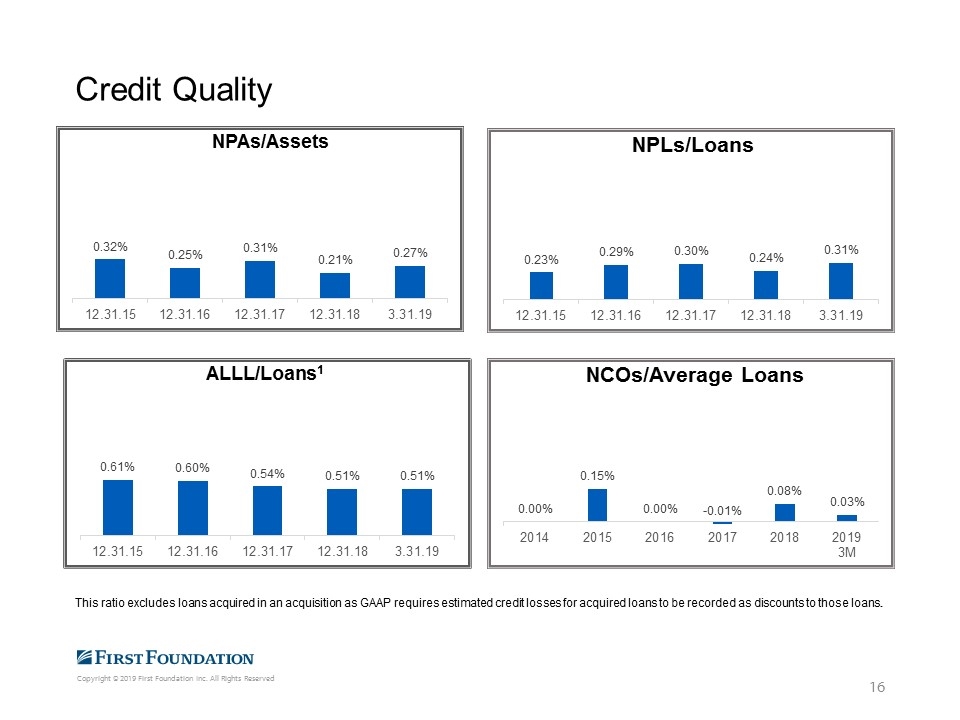

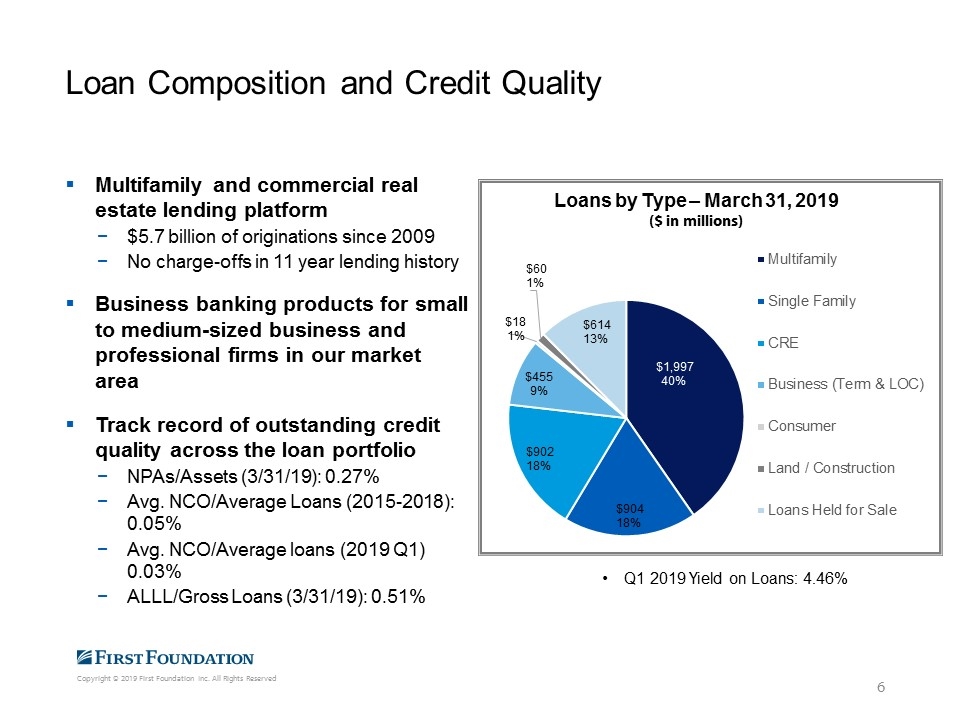

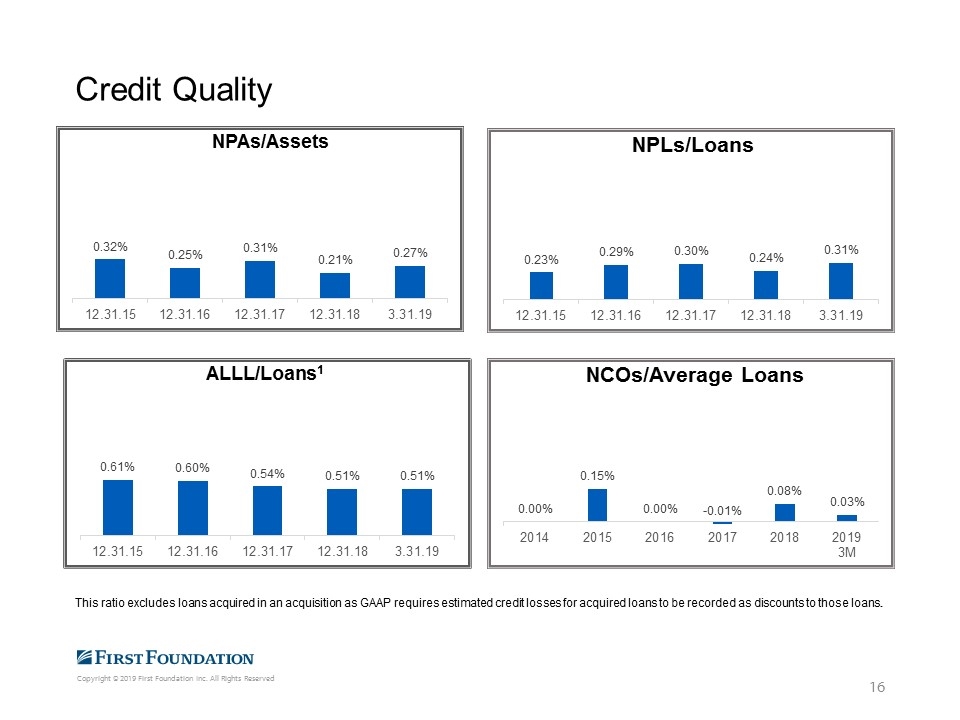

Multifamily and commercial real estate lending platform $5.7 billion of originations since 2009 No charge-offs in 11 year lending history Business banking products for small to medium-sized business and professional firms in our market area Track record of outstanding credit quality across the loan portfolio NPAs/Assets (3/31/19): 0.27% Avg. NCO/Average Loans (2015-2018): 0.05% Avg. NCO/Average loans (2019 Q1) 0.03% ALLL/Gross Loans (3/31/19): 0.51% Loan Composition and Credit Quality Q1 2019 Yield on Loans: 4.46%

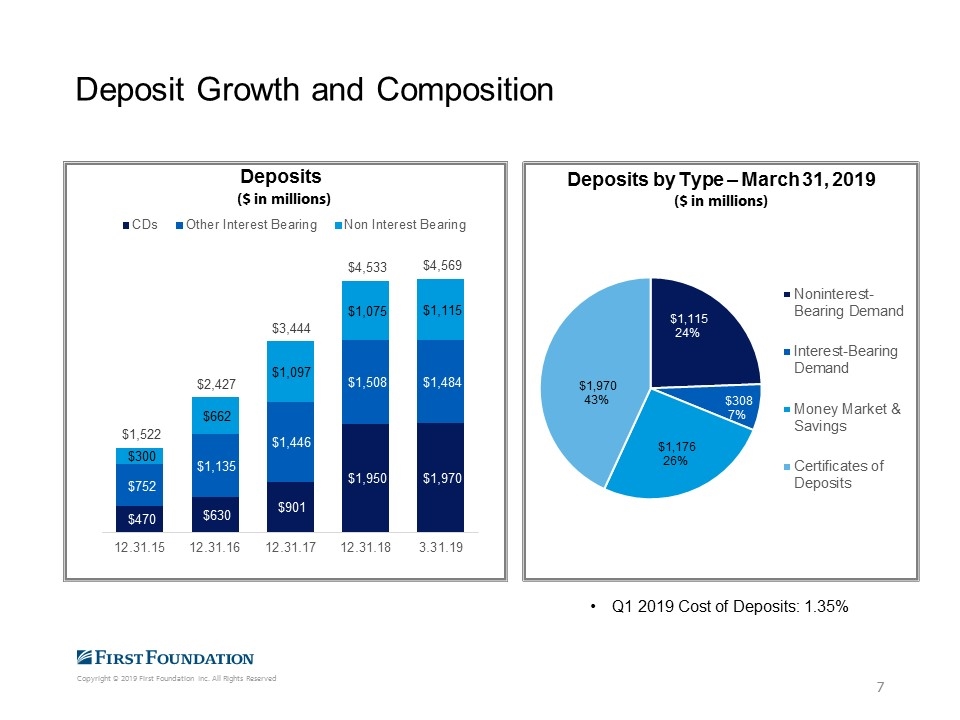

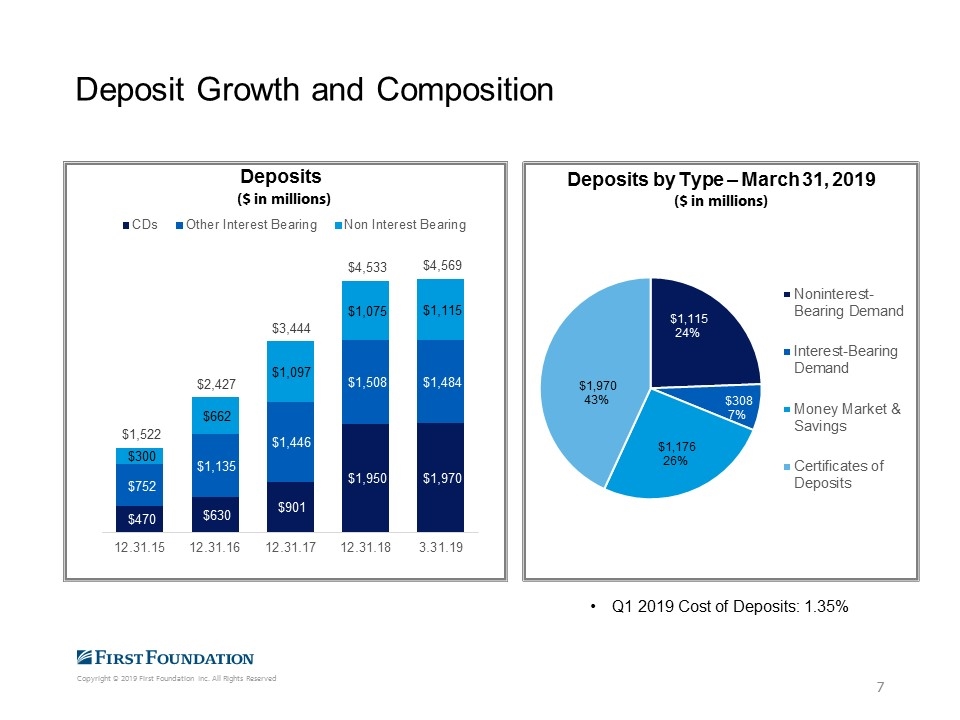

Deposit Growth and Composition Q1 2019 Cost of Deposits: 1.35%

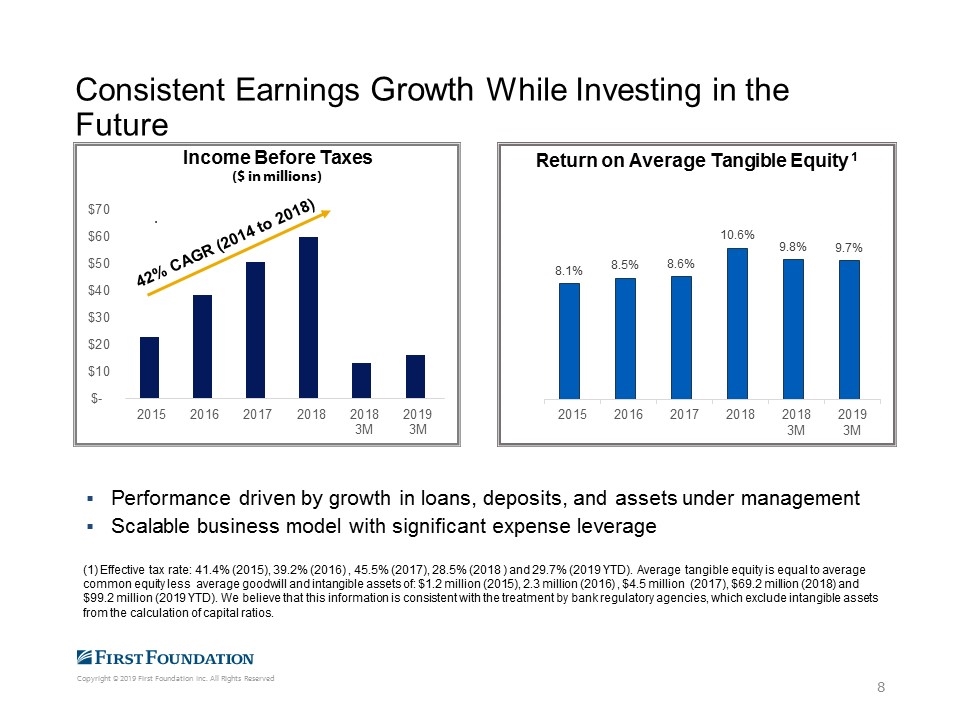

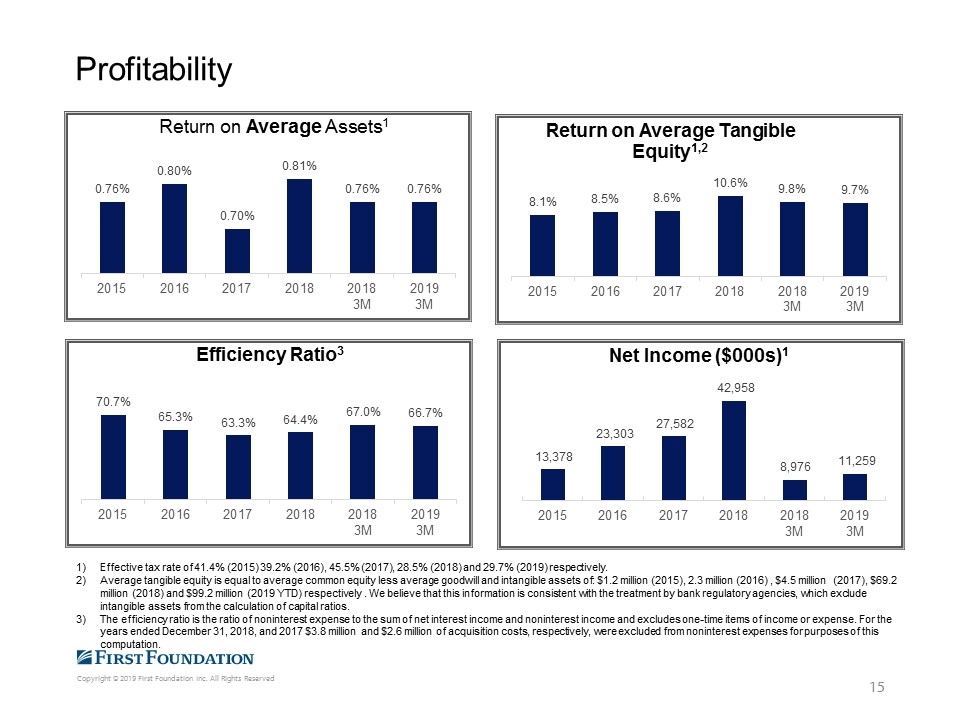

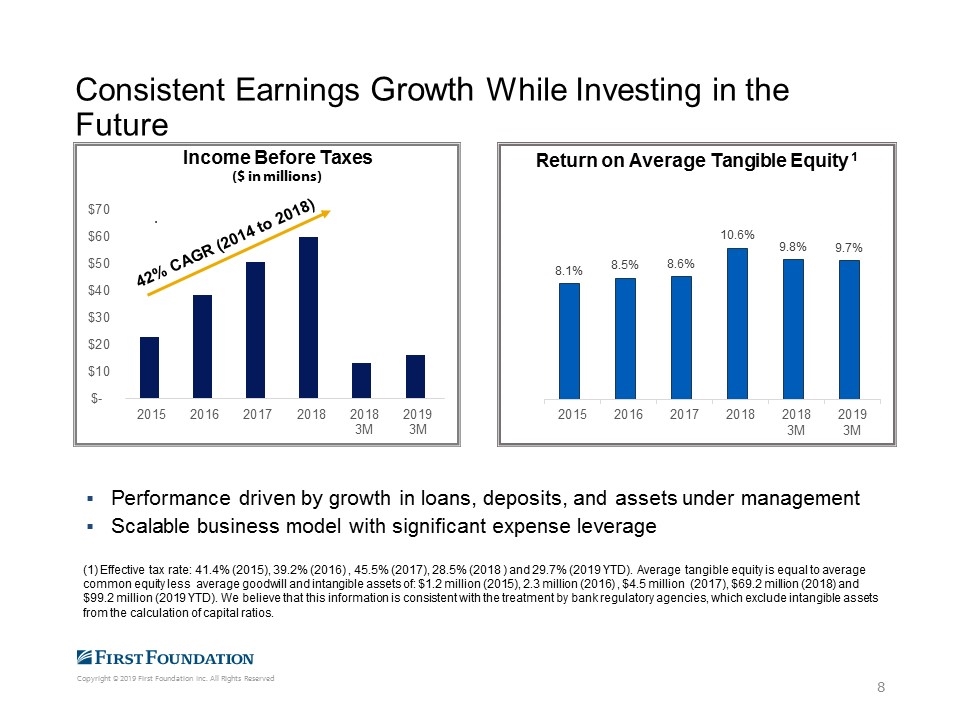

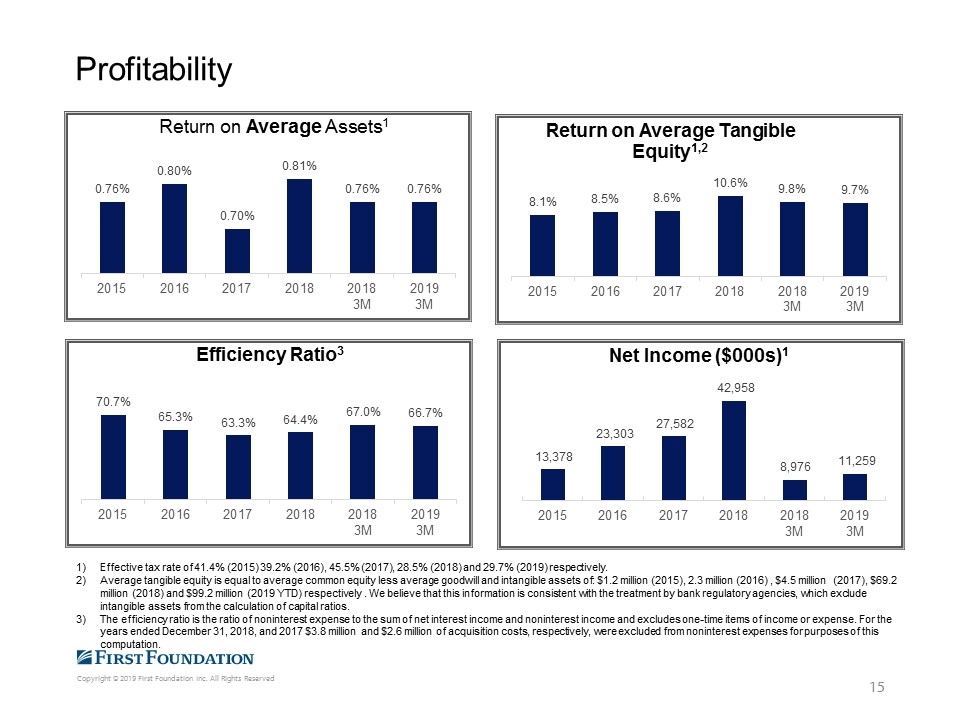

Consistent Earnings Growth While Investing in the Future Performance driven by growth in loans, deposits, and assets under management Scalable business model with significant expense leverage (1) Effective tax rate: 41.4% (2015), 39.2% (2016) , 45.5% (2017), 28.5% (2018 ) and 29.7% (2019 YTD). Average tangible equity is equal to average common equity less average goodwill and intangible assets of: $1.2 million (2015), 2.3 million (2016) , $4.5 million (2017), $69.2 million (2018) and $99.2 million (2019 YTD). We believe that this information is consistent with the treatment by bank regulatory agencies, which exclude intangible assets from the calculation of capital ratios.

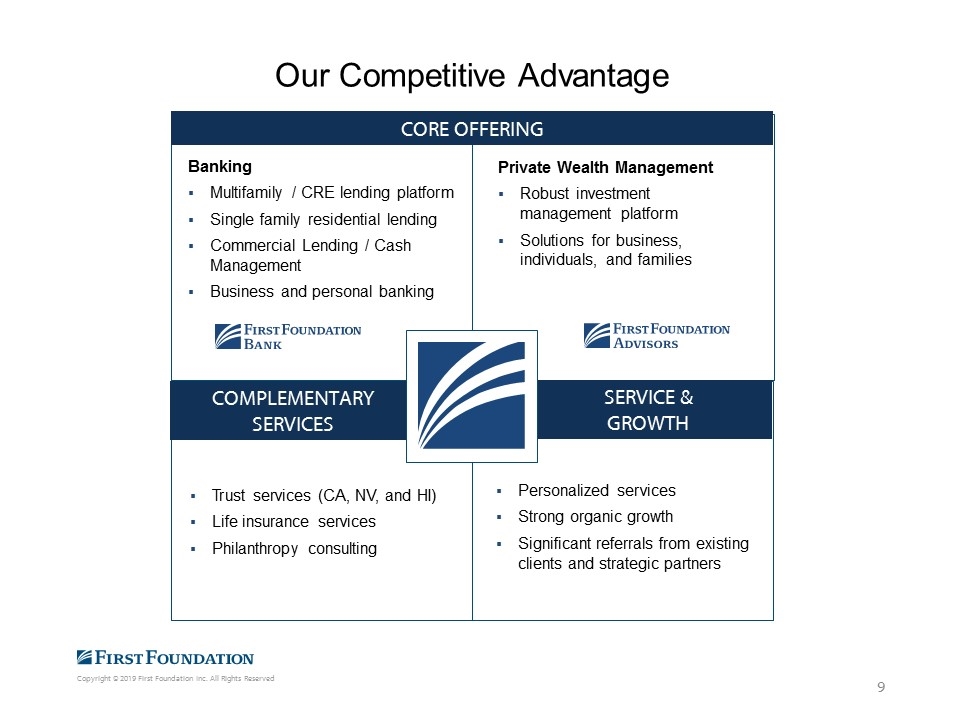

Our Competitive Advantage Personalized services Strong organic growth Significant referrals from existing clients and strategic partners Private Wealth Management Robust investment management platform Solutions for business, individuals, and families Trust services (CA, NV, and HI) Life insurance services Philanthropy consulting Banking Multifamily / CRE lending platform Single family residential lending Commercial Lending / Cash Management Business and personal banking Core Offering Complementary Services Service & Growth

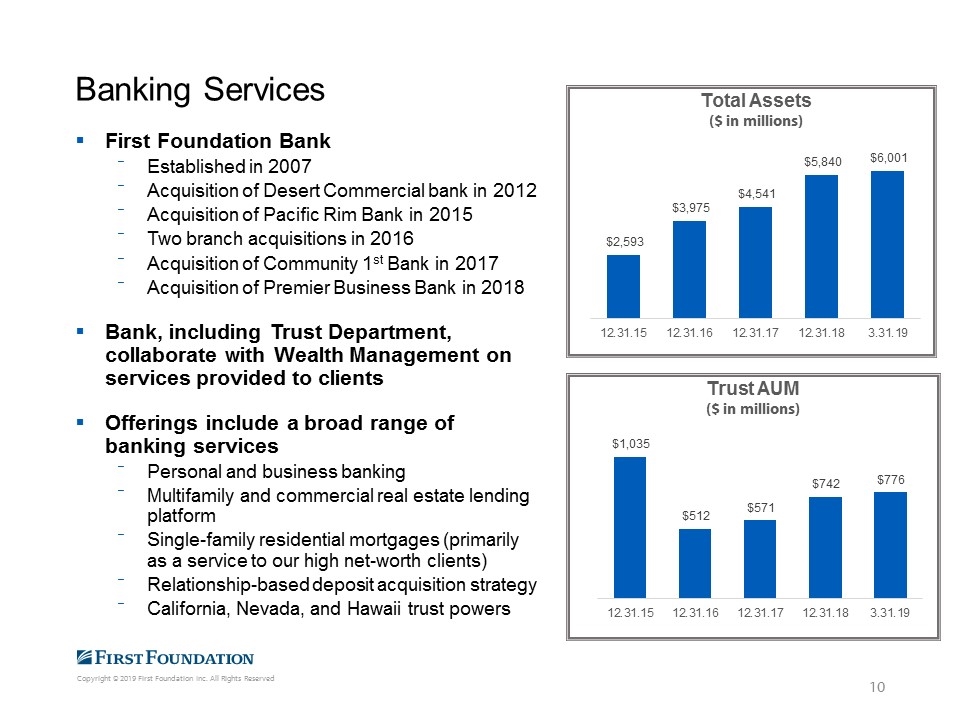

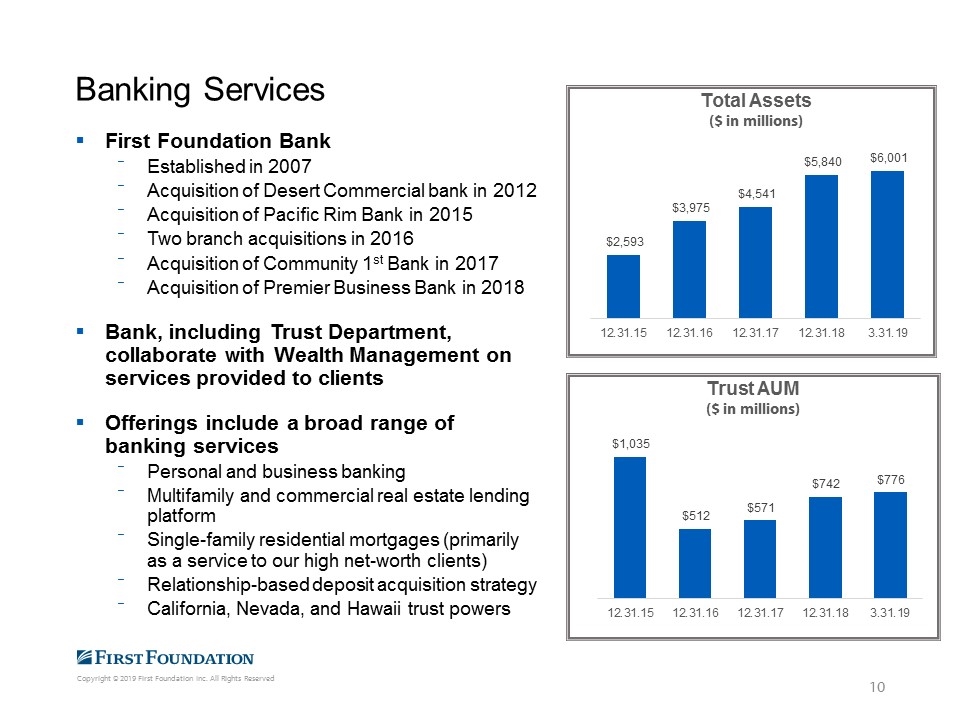

First Foundation Bank Established in 2007 Acquisition of Desert Commercial bank in 2012 Acquisition of Pacific Rim Bank in 2015 Two branch acquisitions in 2016 Acquisition of Community 1st Bank in 2017 Acquisition of Premier Business Bank in 2018 Bank, including Trust Department, collaborate with Wealth Management on services provided to clients Offerings include a broad range of banking services Personal and business banking Multifamily and commercial real estate lending platform Single-family residential mortgages (primarily as a service to our high net-worth clients) Relationship-based deposit acquisition strategy California, Nevada, and Hawaii trust powers Banking Services

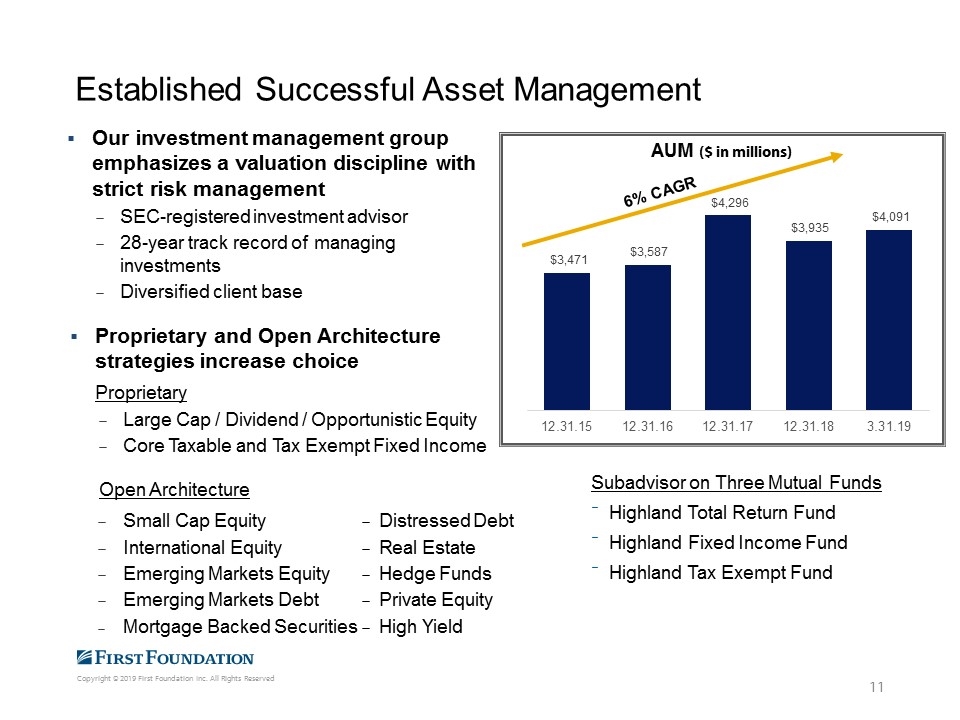

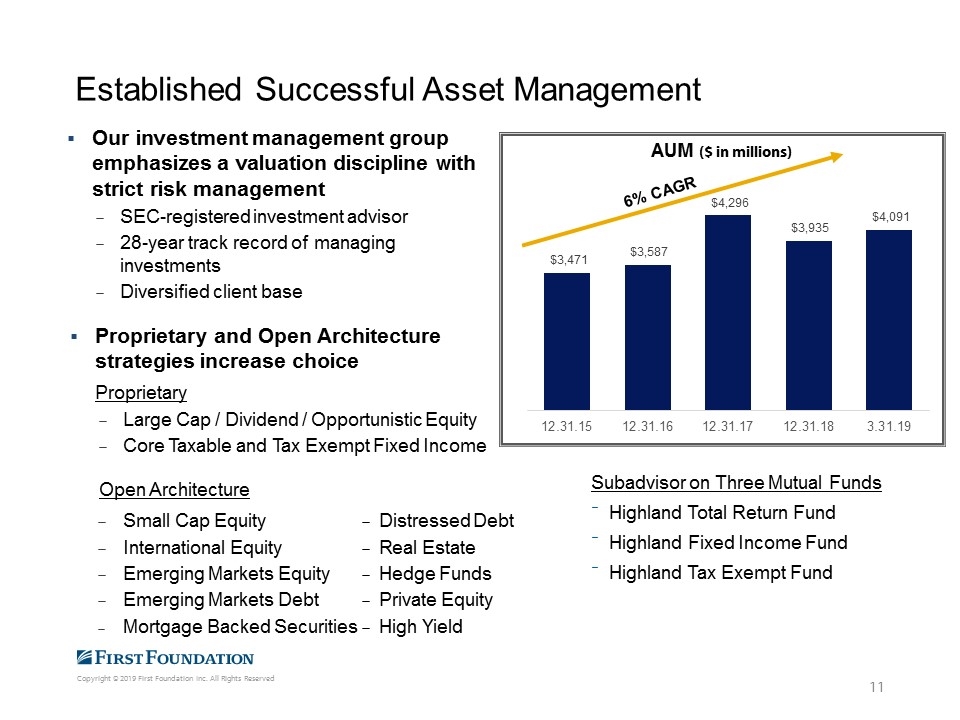

Established Successful Asset Management Subadvisor on Three Mutual Funds Highland Total Return Fund Highland Fixed Income Fund Highland Tax Exempt Fund 6% CAGR Our investment management group emphasizes a valuation discipline with strict risk management SEC-registered investment advisor 28-year track record of managing investments Diversified client base Proprietary and Open Architecture strategies increase choice Proprietary Large Cap / Dividend / Opportunistic Equity Core Taxable and Tax Exempt Fixed Income Small Cap Equity International Equity Emerging Markets Equity Emerging Markets Debt Mortgage Backed Securities Open Architecture Distressed Debt Real Estate Hedge Funds Private Equity High Yield

Grow and diversify our funding sources Maintain our top of class multifamily lending platform Grow our commercial lending activities Making opportunistic acquisitions Leveraging existing infrastructure to maximize economies of scale Cross-promoting our services among our banking and wealth management clients Strategic Activities

Why Invest in First Foundation Experienced Management Team with Demonstrated Ability to Provide Returns Well-Positioned in Strategic Markets with Attractive Demographics Strong Credit Culture Broad Range of Financial Products in Banking and Wealth Management Diverse Revenue Base Significant Insider Ownership – Incentives Aligned with Shareholders

Appendix

Effective tax rate of 41.4% (2015) 39.2% (2016), 45.5% (2017), 28.5% (2018) and 29.7% (2019) respectively. Average tangible equity is equal to average common equity less average goodwill and intangible assets of: $1.2 million (2015), 2.3 million (2016) , $4.5 million (2017), $69.2 million (2018) and $99.2 million (2019 YTD) respectively . We believe that this information is consistent with the treatment by bank regulatory agencies, which exclude intangible assets from the calculation of capital ratios. The efficiency ratio is the ratio of noninterest expense to the sum of net interest income and noninterest income and excludes one-time items of income or expense. For the years ended December 31, 2018, and 2017 $3.8 million and $2.6 million of acquisition costs, respectively, were excluded from noninterest expenses for purposes of this computation. Profitability

This ratio excludes loans acquired in an acquisition as GAAP requires estimated credit losses for acquired loans to be recorded as discounts to those loans. Credit Quality

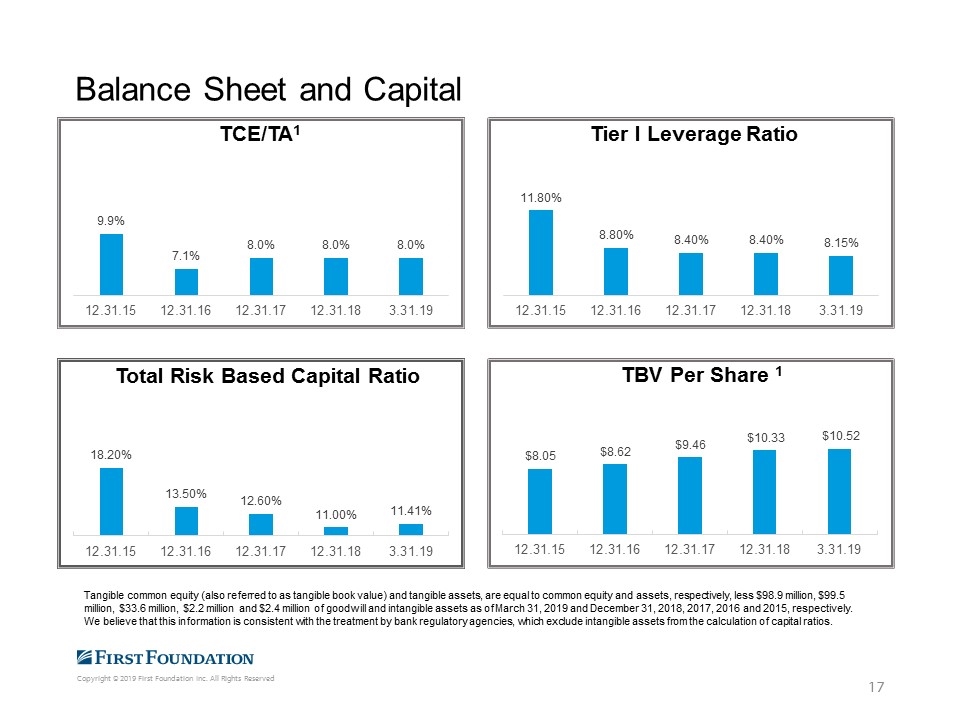

Balance Sheet and Capital Tangible common equity (also referred to as tangible book value) and tangible assets, are equal to common equity and assets, respectively, less $98.9 million, $99.5 million, $33.6 million, $2.2 million and $2.4 million of goodwill and intangible assets as of March 31, 2019 and December 31, 2018, 2017, 2016 and 2015, respectively. We believe that this information is consistent with the treatment by bank regulatory agencies, which exclude intangible assets from the calculation of capital ratios.