UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant [X] Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [X] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to §240.14a-12 |

ALPS ETF TRUST

(Exact Name of Registrant as Specified in Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

| [ ] | Fee paid previously with preliminary materials: |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

ALPS ETF TRUST

| Alerian Energy Infrastructure ETF | Buzz US Sentiment Leaders ETF |

| Alerian MLP ETF | Cohen & Steers Global Realty Majors ETF |

| ALPS Disruptive Technologies ETF | RiverFront Dynamic Core Income ETF |

| ALPS Emerging Sector Dividend Dogs ETF | RiverFront Dynamic Unconstrained Income ETF |

| ALPS Equal Sector Weight ETF | RiverFront Dynamic US Dividend Advantage ETF |

| ALPS International Sector Dividend Dogs ETF | RiverFront Dynamic US Flex-Cap ETF |

| ALPS Medical Breakthroughs ETF | RiverFront Strategic Income Fund |

| ALPS Sector Dividend Dogs ETF | Sprott Gold Miners ETF |

| ALPS | Dorsey Wright Sector Momentum ETF | Sprott Junior Gold Miners ETF |

| Barron’s 400SM ETF | Workplace Equality Portfolio |

(each a “Fund” and together, the “Funds”)

April , 2018

Dear Shareholders:

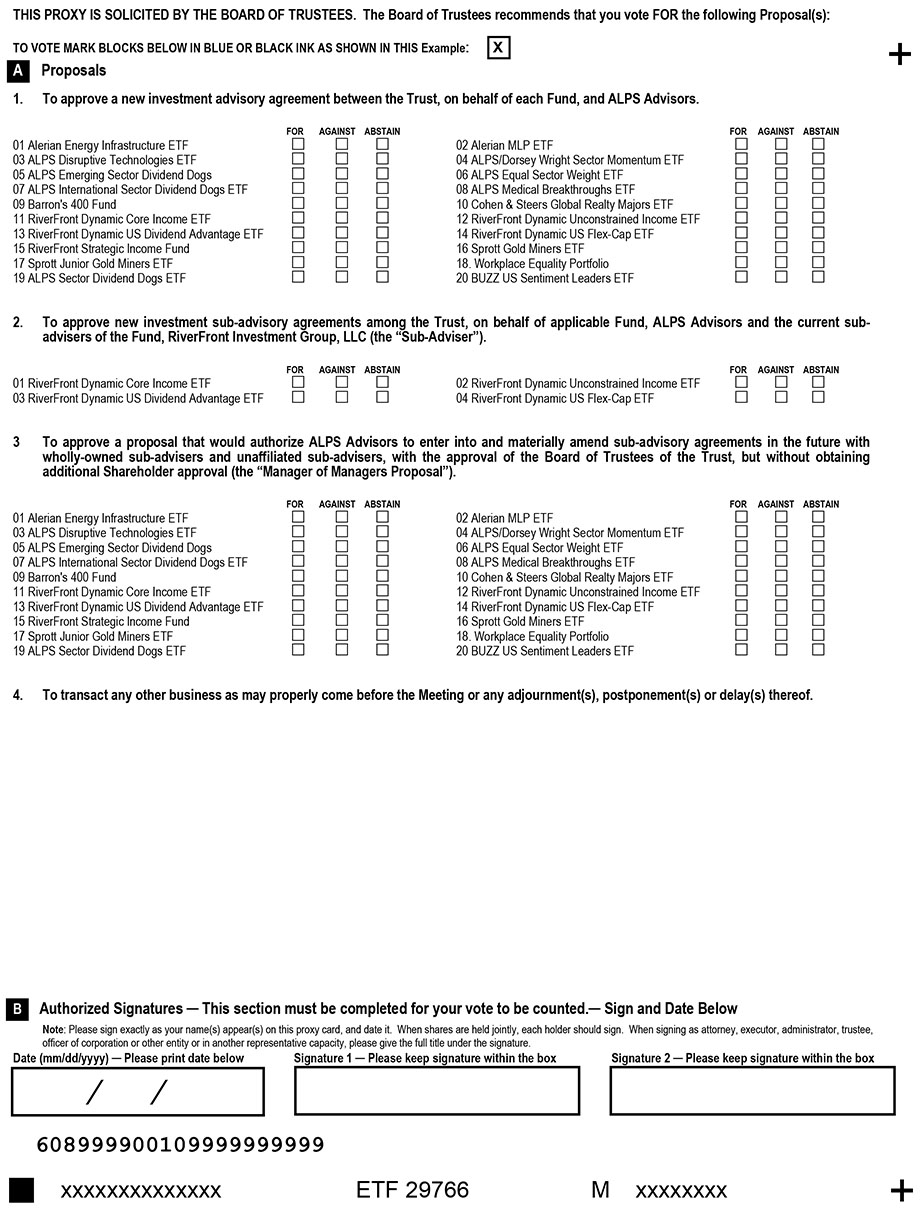

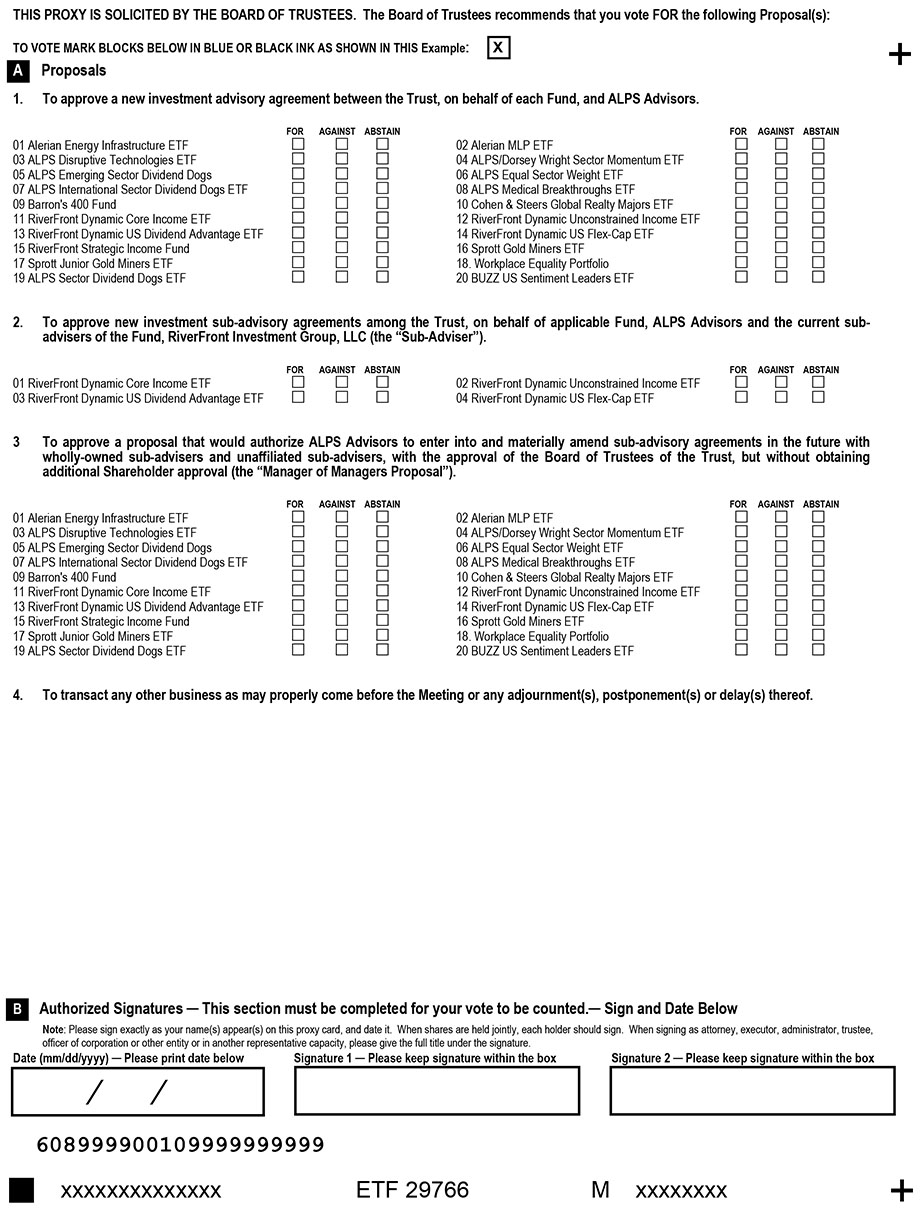

The enclosed Proxy Statement discusses three proposals to be voted upon by shareholders (the “Shareholders”) of the above-named Funds, each a series of ALPS ETF Trust (the “Trust”). Please review the Proxy Statement and cast your vote on each of the proposals. After consideration of each of the proposals, the Board of Trustees of the Trust (the “Board of Trustees”) has unanimously approved each proposal.The Board of Trustees recommends that you vote FOR each proposal.

Under an investment advisory agreement between the Trust, on behalf of each Fund, and ALPS Advisors, Inc. (“ALPS Advisors”), ALPS Advisors serves as each Fund’s investment adviser and is responsible for each Fund’s overall investment strategy and its implementation. ALPS Advisors is an indirect wholly owned subsidiary of DST Systems, Inc. (“DST”), a publicly traded company listed on the New York Stock Exchange that provides sophisticated information processing and computer software products and services to support the mutual fund, investment management, brokerage, insurance and healthcare industries.

As discussed in more detail in the enclosed Proxy Statement, on January 11, 2018, DST entered into an agreement and plan of merger (the “Transaction Agreement”) with SS&C Technologies Holdings, Inc. (“SS&C”), a publicly traded company listed on the NASDAQ Global Select Market and a leading provider of mission-critical, sophisticated software products and software-enabled services that allow financial services providers to automate complex business processes and effectively manage their information processing requirements, and Diamond Merger Sub, Inc., a Delaware corporation and an indirect wholly owned subsidiary of SS&C (“Merger Sub”), pursuant to which Merger Sub will merge with and into DST (the “Transaction”), with DST surviving as an indirect wholly owned subsidiary of SS&C. Completion of the Transaction is subject to a number of conditions. DST and SS&C currently expect to complete the Transaction before the end of the second quarter of 2018.

The Transaction, if consummated, will constitute a change of control of ALPS Advisors. To provide for continuity in the operation of the Funds, you are being asked to approve (1) a new advisory agreement between the Trust, on behalf of each Fund, and ALPS Advisors and (2) with respect to certain Funds, a new sub-advisory agreement among the Trust, on behalf of each applicable Fund, ALPS Advisors and the sub-adviser who currently sub-advises the applicable Fund’s assets, Riverfront Investment Group, LLC (the “Sub-Adviser”).

Under these new agreements, ALPS Advisors and the Sub-Adviser, as applicable, will provide investment advisory services to each Fund on the same terms and for the same fees that are currently in effect. None of the Funds’ investment objectives will change as a result of the Transaction. The senior personnel and the investment advisory personnel of ALPS Advisors are not expected to change. The investment advisory personnel of the Sub-Adviser who currently manage the sub-advised Funds are expected to continue to do so after the closing of the Transaction (the "Closing"). In addition, the Board of Trustees will continue in office after the Closing.

The Transaction and each proposal are discussed in detail in the enclosed Proxy Statement. The Transaction will NOT change the names of the Funds, alter the number of shares you own of your Fund, or cause a change to the advisory fees charged to your Fund.

In addition, the Board of Trustees is asking you to approve a proposal to authorize ALPS Advisors to enter into and materially amend sub-advisory agreements for the Funds, as applicable, with wholly-owned sub-advisers and unaffiliated sub-advisers, with the approval of the Board of Trustees, but without obtaining additional Shareholder approval, subject to receipt by the Trust and ALPS Advisors of exemptive relief from the Securities and Exchange Commission that provides ALPS Advisors such flexibility.

The Board of Trustees recommends that you vote FOR each proposal.

Your vote is important no matter how many shares you own. The proxy documents explain the proposals in detail, and we encourage you to review them. Voting your shares early will avoid costly follow-up mail and telephone solicitation. After reviewing the enclosed materials, please complete, sign and date your proxy card(s) and mail it promptly in the enclosed return envelope, or help save time and postage costs by calling the toll-free number and following the instructions. You may also vote via the Internet by logging on to the website indicated on your proxy card and following the instructions that will appear. If we do not hear from you, our proxy solicitor, Computershare Fund Services (“Computershare”), may contact you. This will ensure that your vote is counted even if you cannot attend the special meeting in person. If you have any questions about the proposals or the voting instructions, please call Computershare at (866) 875-8613.

Very truly yours,

[Signature]

Edmund J. Burke

Trustee and President

ALPS ETF TRUST

| Alerian Energy Infrastructure ETF | Buzz US Sentiment Leaders ETF |

| Alerian MLP ETF | Cohen & Steers Global Realty Majors ETF |

| ALPS Disruptive Technologies ETF | RiverFront Dynamic Core Income ETF |

| ALPS Emerging Sector Dividend Dogs ETF | RiverFront Dynamic Unconstrained Income ETF |

| ALPS Equal Sector Weight ETF | RiverFront Dynamic US Dividend Advantage ETF |

| ALPS International Sector Dividend Dogs ETF | RiverFront Dynamic US Flex-Cap ETF |

| ALPS Medical Breakthroughs ETF | RiverFront Strategic Income Fund |

| ALPS Sector Dividend Dogs ETF | Sprott Gold Miners ETF |

| ALPS | Dorsey Wright Sector Momentum ETF | Sprott Junior Gold Miners ETF |

| Barron’s 400SM ETF | Workplace Equality Portfolio |

(each a “Fund” and together, the “Funds”)

NOTICE OF A SPECIAL MEETING OF SHAREHOLDERS

To be Held On

May 31, 2018

1290 Broadway, Suite 1100

Denver, Colorado 80203

(303) 623-2577

To Shareholders of the Funds:

Notice is hereby given that a special meeting (the “Meeting”) of shareholders (the “Shareholders”) of the Funds, each a series of ALPS ETF Trust, a Delaware statutory trust (the “Trust”), will be held in the offices of ALPS Advisors, Inc. (“ALPS Advisors”), 1290 Broadway, Suite 1100, Denver, Colorado, on May 31, 2018 at 8:00 a.m. (Mountain time). At the Meeting, Shareholders will be asked to vote on the following proposals with respect to each Fund in which they own shares:

| Proposal | Applicable Funds |

| 1. To approve a new investment advisory agreement between the Trust, on behalf of each Fund, and ALPS Advisors. | All Funds |

| 2. To approve a new sub-advisory agreement among the Trust, on behalf of each applicable Fund, ALPS Advisors and the current sub-adviser of the Fund, RiverFront Investment Group, LLC (the “Sub-Adviser”). | RiverFront Dynamic Core Income ETF

RiverFront Dynamic Unconstrained Income ETF

RiverFront Dynamic US Dividend Advantage ETF

RiverFront Dynamic US Flex-Cap ETF |

| 3. To approve a proposal that would authorize ALPS Advisors to enter into and materially amend sub-advisory agreements in the future with wholly-owned sub-advisers and unaffiliated sub-advisers, with the approval of the Board of Trustees of the Trust, but without obtaining additional Shareholder approval (the “Manager of Managers Proposal”). | All Funds |

| 4. To transact any other business as may properly come before the Meeting or any adjournment(s), postponement(s) or delay(s) thereof. | All Funds |

The Board of Trustees recommends that you vote FOR each of the proposals.

You are entitled to vote at the Meeting, or any adjournment(s), postponement(s) or delay(s) thereto, if you owned shares of one or more of the Funds at the close of business on April 2, 2018 (the “Record Date”). Proxies or voting instructions may be revoked at any time before they are exercised by executing and submitting a revised proxy, by giving written notice of revocation to the relevant Fund or by voting in person at the Meeting (merely attending the Meeting, however, will not revoke any previously submitted proxy).

YOUR VOTE IS IMPORTANT – PLEASE COMPLETE AND RETURN YOUR PROXY PROMPTLY.

You are cordially invited to attend the Meeting. If you attend the Meeting, you may vote your shares in person. However, we urge you, whether or not you expect to attend the Meeting in person, to complete, date, sign and return the enclosed proxy card(s) in the enclosed postage-paid envelope or vote by telephone or through the Internet. We ask your cooperation in voting your proxy promptly.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting to Be Held on May 31, 2018

The Proxy Statement is available on the internet at [ ].

By order of the Board of Trustees of the Trust, on behalf of the Funds.

[Signature]

Andrea E. Kuchli

Secretary

ALPS ETF Trust

[•], 2018

IMPORTANT INFORMATION TO HELP YOU UNDERSTAND AND VOTE ON THE PROPOSALS

While we strongly encourage you to read the full text of the enclosed Proxy Statement, we are also providing you with a brief overview of the subject of the Shareholder vote. Your vote is important.

QUESTIONS AND ANSWERS

| Q. | What is happening with respect to the Transaction? |

| A. | ALPS Advisors, Inc. (“ALPS Advisors”) serves as each Fund’s investment adviser and is responsible for each Fund’s overall investment strategy and its implementation. ALPS Advisors is an indirect wholly owned subsidiary of DST Systems, Inc. (“DST”), a publicly traded company listed on the New York Stock Exchange that provides sophisticated information processing and computer software products and services to support the mutual fund, investment management, brokerage, insurance and healthcare industries. |

On January 11, 2018, DST entered into an agreement and plan of merger (the “Transaction Agreement”) with SS&C Technologies Holdings, Inc. (“SS&C”), a publicly traded company listed on the NASDAQ Global Select Market and a leading provider of mission-critical, sophisticated software products and software-enabled services that allow financial services providers to automate complex business processes and effectively manage their information processing requirements, and Diamond Merger Sub, Inc., a Delaware corporation and an indirect wholly owned subsidiary of SS&C (“Merger Sub”), pursuant to which Merger Sub will merge with and into DST (the “Transaction”), with DST surviving as an indirect wholly owned subsidiary of SS&C. Completion of the Transaction is subject to a number of conditions. DST and SS&C currently expect to complete the Transaction before the end of the second quarter of 2018.

The Transaction, if consummated, will constitute a change of control of ALPS Advisors, which may be deemed to result in an “assignment” of the existing investment advisory agreements between the Trust, on behalf of each Fund, and ALPS Advisors (each an “Existing Advisory Agreement”) and with respect to RiverFront Dynamic Core Income ETF, RiverFront Dynamic Unconstrained Income ETF, RiverFront Dynamic US Dividend Advantage ETF and RiverFront Dynamic US Flex-Cap ETF (collectively, the “Sub-Advised Funds”), the existing sub-advisory agreement among the Trust, on behalf of each applicable Sub-Advised Fund, ALPS Advisors and the sub-adviser who currently sub-advises the Sub-Advised Funds, RiverFront Investment Group, LLC (the “Sub-Adviser”) (the “Existing Sub-Advisory Agreement”), resulting in the automatic termination of the Existing Advisory Agreements and Existing Sub-Advisory Agreement in accordance with their terms, pursuant to the Investment Company Act of 1940, as amended (the “1940 Act”). It is intended that, after the closing of the Transaction (the “Closing”), ALPS Advisors will continue to be the investment adviser to the Funds and the Sub-Adviser will continue to manage the Sub-Advised Funds’ assets as sub-adviser. Therefore, ALPS Advisors has recommended, and the Board of Trustees (the “Board,” the “Board of Trustees,” or the “Trustees”) of ALPS ETF Trust (the “Trust”) has approved, a new investment advisory agreement between the Trust, on behalf of each Fund, and ALPS Advisors (the “New Advisory Agreement”) and a new sub-advisory agreement among the Trust, on behalf of each Sub-Advised Fund, ALPS Advisors and the Sub-Adviser (the “New Sub-Advisory Agreement”). The New Advisory Agreement will have substantially the same terms as each Existing Advisory Agreement, but for the combination of the agreements into a single agreement and a new commencement date. The New Sub-Advisory Agreement will have the same terms as the Existing Sub-Advisory Agreement, but for a new commencement date.

The senior personnel and the investment advisory personnel of ALPS Advisors are not expected to change and the investment advisory personnel of the Sub-Adviser who currently manage the Sub-Advised Funds are expected to continue to do so after the Closing. In addition, the Board of Trustees will continue in office after the Closing. However, there can be no assurance that any particular employee of ALPS Advisors or of the Sub-Adviser will choose to remain employed by the respective firm before or after the Closing.

In order for ALPS Advisors and the Sub-Adviser to continue to provide advisory services to the Funds following the Closing, and for reasons described in greater detail in this proxy statement, the Board of Trustees recommends that Shareholders of the Funds approve the New Advisory Agreement and the New Sub-Advisory Agreement, as applicable.

The Proxy Statement provides additional information about ALPS Advisors, the Sub-Adviser and the proposals. If Shareholders of a Fund approve the New Advisory Agreement and, as applicable, New Sub-Advisory Agreement, the effectiveness of such agreements is contingent upon the Closing occurring (and the effectiveness of the New Sub-Advisory Agreement for a Fund is contingent upon the New-Advisory Agreement being approved for that Fund). The New Advisory Agreement and, as applicable, New Sub-Advisory Agreement will become effective for each Fund upon the later of the Closing or approval of such agreements by Shareholders of such Fund. If the Transaction is not consummated, the New Advisory Agreement and New Sub-Advisory Agreement will not become effective, and the Existing Advisory Agreements and the Existing Sub-Advisory Agreement will remain in effect according to their terms.

The Board of Trustees recommends that you voteFOR the proposals to approve the New Advisory Agreement and, as applicable, New Sub-Advisory Agreement.

| Q. | Why am I being asked to vote on the New Advisory Agreement and New Sub-Advisory Agreement? |

| A. | As described above, completion of the Transaction may be deemed to result in an “assignment” of your Fund’s Existing Advisory Agreement and, as applicable, Existing Sub-Advisory Agreement, resulting in the automatic termination of each agreement. The 1940 Act requires that a new advisory agreement (other than an interim advisory agreement, as described below) be approved by the board of trustees and shareholders of a fund in order for it to become effective. To ensure that the operation of your Fund can continue without any interruption and that ALPS Advisors and, with respect to the Sub-Advised Funds, the Sub-Adviser, can provide your Fund with the same services that are currently being provided to your Fund, the Board of Trustees recommends that you approve the New Advisory Agreement and, with respect to the Sub-Advised Funds, the New Sub-Advisory Agreement for your Fund. |

| Q. | How will the Transaction affect me as a Fund Shareholder? |

| A. | Your Fund and its investment objective(s) and strategies will not change as a result of the completion of the Transaction, and you will still own the same number of shares of the same Fund. The terms of the New Advisory Agreement are substantially same as the Existing Advisory Agreements, but for the combination of the Existing Advisory Agreements into a single agreement and the new commencement date. The terms of the New Sub-Advisory Agreement are the same as the Existing Sub-Advisory Agreement, but for the new commencement date. If approved by Shareholders, the New Advisory Agreement and New Sub-Advisory Agreement will have an initial two-year term and will be subject to annual renewal thereafter. The advisory fee rates charged to your Fund under the New Advisory Agreement and the New Sub-Advisory Agreement are the same as under your Fund’s Existing Advisory Agreement and Existing Sub-Advisory Agreement. The senior personnel and the investment advisory personnel of ALPS Advisors are not expected to change after the Closing. The Sub-Adviser is expected to continue to sub-advise the Sub-Advised Funds after the Closing and the investment advisory personnel of the Sub-Adviser who currently manage the Sub-Advised Funds are expected to continue to do so after the Closing. In addition, the Board of Trustees will continue in office after the Closing. However, there can be no assurance that any particular employee of ALPS Advisors or of the Sub-Adviser will choose to remain employed by the respective firm before or after the Closing. |

| Q. | Will any Fund’s name change? |

| A. | No. No Fund’s name will change as a result of the Transaction. |

| Q. | Will there be any Sub-Adviser changes? |

| A. | No. The Sub-Adviser is expected to continue to sub-advise the Sub-Advised Funds after the Closing pursuant to the same investment objective and strategies currently in place. |

| Q. | Will the fee rates payable under the New Advisory Agreement and, as applicable, New Sub-Advisory Agreement increase as a result of the Transaction? |

| A. | No. The proposals to approve the New Advisory Agreement and New Sub-Advisory Agreement do not seek any increase in fee rates. |

| Q. | What will happen if the Closing occurs before Shareholders of a Fund approve the New Advisory Agreement and/or New Sub-Advisory Agreement? |

| A. | Pursuant to the Transaction Agreement, DST has agreed to use reasonable best efforts to obtain approval of new investment management agreements for the registered investment companies advised by ALPS Advisors, including the Funds, by the boards and shareholders of such registered investment companies; however, obtaining such approvals is not a condition of the Closing. The Closing may occur prior to the Meeting. In the event Shareholders of a Fund have not approved the New Advisory Agreement and, as applicable, New Sub-Advisory Agreement prior to the Closing, ALPS Advisors and, with respect to the Sub-Advised Funds, the Sub-Adviser will continue to provide advisory services to each Fund under an interim investment advisory agreement and an interim sub-advisory agreement that have been approved by the Board of Trustees, but must place their compensation for their services during this interim period in escrow, pending Shareholder approval of the New Advisory Agreement and New Sub-Advisory Agreement. These interim advisory and sub-advisory agreements allow ALPS Advisors and, with respect to the Sub-Advised Funds, the Sub-Adviser to continue to provide advisory services to each Fund for up to 150 days following the Closing while the Fund seeks Shareholder approval of the New Advisory Agreement and, as applicable, New Sub-Advisory Agreement. Accordingly, the Board of Trustees urges you to vote without delay in order to avoid potential disruption to your Fund that could occur if Shareholder approval is not obtained in that time and ALPS Advisors and the Sub-Adviser, as applicable, are unable to continue to provide advisory services to your Fund. |

| Q. | Will my Fund pay for this proxy solicitation or for the costs of the Transaction? |

| A. | No. The Funds will not bear these costs. ALPS Advisors or its affiliates has agreed to bear any such costs that would otherwise be borne by the Funds. |

| Q: | Why am I being asked to vote on the Manager of Managers Proposal? |

| A: | ALPS Advisors and the Trust have applied for exemptive relief from the Securities and Exchange Commission (“SEC”) that, if granted, would provide ALPS Advisors the flexibility to enter into and materially amend sub-advisory agreements in the future with wholly-owned sub-advisers and unaffiliated sub-advisers, with the approval of the Board of Trustees, but without the costs and delays associated with holding a Shareholder meeting. This is referred to as “Manager of Managers” relief. However, in order to utilize the relief, Shareholders of a Fund must approve its use for their Fund. If the Manager of Managers Proposal is approved by Shareholders, the effectiveness of such proposal is conditioned upon the receipt of the requested exemptive order. There can be no assurance that the requested exemptive order will be granted. There are no proposed changes to any Fund’s existing sub-advisory arrangement at this time. If Shareholders approve the Manager of Managers Proposal and the SEC issues the requested exemptive order, in the future if ALPS Advisors and/or the Board determines that resources of a sub-adviser, or different sub-adviser, would be beneficial for a Fund, your approval of the Manager of Managers Proposal would allow ALPS Advisors to engage that sub-adviser without incurring the costs related to a Shareholder meeting and proxy solicitation. Any appointment of such a sub-adviser is subject to Board approval and you would receive notification of each such engagement. |

| Q. | Why are you sending me this information? |

| A. | You are receiving these proxy materials because you own shares in one or more of the Funds and have the right to vote on these very important proposals concerning your investment. |

| Q. | How does the Board of Trustees recommend that I vote? |

| A. | The Board of Trustees recommends that you voteFOR each of the proposals. |

| Q. | Who is entitled to vote? |

| A. | If you owned shares of a Fund as of the close of business on April 2, 2018 (the “Record Date”), you are entitled to vote. |

| Q. | How do I vote my shares? |

| A. | For your convenience, there are several ways you can vote: |

| By Mail: | Vote, sign and return the enclosed proxy card(s) in the enclosed self-addressed, postage-paid envelope; |

| By Telephone: | Call the number printed on the enclosed proxy card(s); |

| By Internet: | Access the website address printed on the enclosed proxy card(s); or |

| In Person: | Attend the Meeting as described in the Proxy Statement. |

| Q. | Why might there be more than one proxy card enclosed? |

| A. | If you own shares of multiple Funds, you will receive a separate proxy card for each applicable Fund. You will be allowed to vote your shares of a Fund only with respect to the approval of the New Advisory Agreement for the Fund and, as applicable, the New Sub-Advisory Agreement for that Fund, and also approval of the Manager of Managers Proposal for that Fund. |

| Q. | What vote is required to approve each proposal? |

| A. | Approval of each proposal requires the affirmative vote of a “majority of the outstanding voting securities” of each Fund, which, under the 1940 Act, means an affirmative vote of the lesser of (a) 67% or more of the shares of a Fund present at the Meeting or represented by proxy if the holders of more than 50% of the outstanding shares are present or represented by proxy, or (b) more than 50% of the outstanding shares. |

| Q. | What happens if I sign and return my proxy card but do not mark my vote? |

| A. | Your proxy will be voted FOR each proposal. |

| A. | You may revoke your proxy at any time before it is exercised by giving notice of your revocation to your Fund in writing, or by the execution and delivery of a later-dated proxy. You may also revoke your proxy by attending the Meeting, requesting the return of your proxy and voting in person (merely attending the Meeting, however, will not revoke any previously submitted proxy). |

| Q. | How can I obtain a copy of a Fund’s annual report? |

| A. | If you would like to receive a copy of the latest annual report for any Fund, please call 1-866-759-5679, or write to the Fund, ALPS ETF Trust, 1290 Broadway, Suite 1100, Denver CO 80203. If a Fund has issued an annual report, the report will be furnished free of charge. |

| Q. | Whom should I call for additional information about this Proxy Statement? |

| A. | If you need any assistance, or have any questions regarding the proposals or how to vote your shares, please call the Funds’ proxy solicitor, Computershare Fund Services at (866) 875-8613. |

INSTRUCTIONS FOR SIGNING PROXY CARDS

The following general rules for signing proxy cards may be of assistance to you and may avoid any delay involved in validating your vote if you fail to sign your proxy card(s) properly.

| 1. | Individual Account: Sign your name exactly as it appears in the registration on the proxy card. |

| 2. | Joint Account: Either party may sign, but the name of the party signing should conform exactly to the name shown in the registration on the proxy card. |

| 3. | All Other Accounts: The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration. For example: |

| Registration | | Valid Signature |

| Corporate Account | | |

| (1) ABC Corp. | | ABC Corp. |

| (2) ABC Corp. | | John Doe, Treasurer |

| (3) ABC Corp. c/o John Doe, Treasurer | | John Doe |

| (4) ABC Corp. Profit Sharing Plan | | John Doe, Trustee |

| | | |

| Trust Account | | |

| (1) ABC Trust | | Jane B. Doe, Trustee |

| (2) Jane B. Doe, Trustee u/t/d 12/28/78 | | Jane B. Doe |

| | | |

| Custodial or Estate Account | | |

| (1) John B. Smith, Cust. f/b/o John B. Smith, Jr. UGMA | | John B. Smith |

| (2) Estate of John B. Smith | | John B. Smith, Jr., Executor |

ALPS ETF TRUST

| Alerian Energy Infrastructure ETF | Buzz US Sentiment Leaders ETF |

| Alerian MLP ETF | Cohen & Steers Global Realty Majors ETF |

| ALPS Disruptive Technologies ETF | RiverFront Dynamic Core Income ETF |

| ALPS Emerging Sector Dividend Dogs ETF | RiverFront Dynamic Unconstrained Income ETF |

| ALPS Equal Sector Weight ETF | RiverFront Dynamic US Dividend Advantage ETF |

| ALPS International Sector Dividend Dogs ETF | RiverFront Dynamic US Flex-Cap ETF |

| ALPS Medical Breakthroughs ETF | RiverFront Strategic Income Fund |

| ALPS Sector Dividend Dogs ETF | Sprott Gold Miners ETF |

| ALPS | Dorsey Wright Sector Momentum ETF | Sprott Junior Gold Miners ETF |

| Barron’s 400SM ETF | Workplace Equality Portfolio |

(each a “Fund” and together, the “Funds”)

1290 Broadway, Suite 1100

Denver, Colorado 80203

PROXY STATEMENT

FOR THE SPECIAL MEETING OF SHAREHOLDERS

to be held on May 31, 2018

This Proxy Statement is furnished in connection with the solicitation of proxies on behalf of the Board of Trustees of ALPS ETF Trust (the “Board” or the “Board of Trustees”), a Delaware statutory trust (the “Trust”), on behalf of the Funds, to be used at the special meeting of shareholders (the “Shareholders”) of the Funds to be held in the offices of ALPS Advisors, Inc. (“ALPS Advisors”), 1290 Broadway, Suite 1100, Denver, Colorado on May 31, 2018, at 8:00 a.m. (Mountain time) and at any adjournment(s), postponement(s) or delay(s) thereof (such meeting and any adjournment(s), postponement(s) or delay(s) being referred to as the “Meeting”).

The solicitation of proxies for use at the Meeting is being made primarily by the Funds by the mailing on or about [ ], 2018 of the Notice of Special Meeting of Shareholders, this Proxy Statement and the accompanying proxy card(s). Supplementary solicitations may be made by mail, telephone or personal interview by officers and Trustees of the Trust and officers, employees and agents of the Funds’ investment adviser, ALPS Advisors, and/or its affiliates and by Computershare Fund Services (“Computershare”), the firm that has been engaged to assist in the solicitation of proxies. Authorization to execute proxies may be obtained from Shareholders through instructions transmitted by telephone, facsimile or other electronic means.

At the Meeting, Shareholders of each Fund will be asked to the vote on the following proposals with respect to each Fund in which they own shares:

| Proposal | Applicable Funds |

| 1. To approve a new investment advisory agreement between the Trust, on behalf of each Fund, and ALPS Advisors. | All Funds |

| 2. To approve a new sub-advisory agreement among the Trust, on behalf of each applicable Fund, ALPS Advisors and the current sub-adviser of the Fund, RiverFront Investment Group, LLC (the “Sub-Adviser”). | RiverFront Dynamic Core Income ETF

RiverFront Dynamic Unconstrained Income ETF

RiverFront Dynamic US Dividend Advantage ETF

RiverFront Dynamic US Flex-Cap ETF |

| 3. To approve a proposal that would authorize ALPS Advisors to enter into and materially amend sub-advisory agreements in the future with wholly-owned sub-advisers and unaffiliated sub-advisers, with the approval of the Board of Trustees of the Trust, but without obtaining additional Shareholder approval (the “Manager of Managers Proposal”). | All Funds |

| 4. To transact any other business as may properly come before the Meeting or any adjournment(s), postponement(s) or delay(s) thereof. | All Funds |

The Board of Trustees has set the close of business on April 2, 2018 as the record date (the “Record Date”) for the Meeting, and only Shareholders of record on the Record Date will be entitled to vote on these proposals at the Meeting. The number of outstanding shares of each Fund, as of the close of business on the Record Date, is set forth inAppendix A to this Proxy Statement. Additional information regarding outstanding shares and voting your proxy is included at the end of this Proxy Statement in the sections titled “General Information” and “Voting Information.”

Copies of the Funds’ annual reports have previously been mailed to Shareholders, except with respect to the ALPS Disruptive Technologies ETF, which commenced operations on December 29, 2017. This Proxy Statement should be read in conjunction with the annual reports. To request a copy of the Proxy Statement or a report, please call (866) 875-8613 (for proxy materials) or 1-866-759-5679 (for reports), write to the Fund at ALPS ETF Trust, 1290 Broadway, Suite 1100, Denver CO 80203, or visit the Fund’s website at www.alpsfunds.com. You may also call for information on how to obtain directions to be able to attend the Meeting in person.

TABLE OF CONTENTS

| GENERAL OVERVIEW | 1 |

| The Transaction | 1 |

| About SS&C | 1 |

| Post-Transaction Structure and Operations | 1 |

| PROPOSAL 1: APPROVAL OF THE NEW ADVISORY AGREEMENT | 3 |

| Background | 3 |

| The Proposal | 3 |

| Board Approval and Recommendation | 3 |

| Description of the Existing Advisory Agreements and the New Advisory Agreement | 3 |

| Interim Advisory Agreement | 4 |

| Affiliated Service Providers, Affiliated Brokerage and Other Fees | 5 |

| Information About ALPS Advisors and its Affiliates | 5 |

| Required Vote | 6 |

| PROPOSAL 2: APPROVAL OF THE NEW SUB-ADVISORY AGREEMENT | 7 |

| Background | 7 |

| The Proposal | 7 |

| Board Approval and Recommendation | 7 |

| Description of the Existing Sub-Advisory Agreement and the New Sub-Advisory Agreement | 7 |

| Interim Sub-Advisory Agreements | 9 |

| Affiliated Service Providers, Affiliated Brokerage and Other Fees | 9 |

| Information About the Sub-Adviser | 9 |

| Required Vote | 10 |

| BOARD CONSIDERATIONS | 11 |

| Summary of Board Meetings and Considerations | 11 |

| Approval of Continuance of Existing Advisory Agreements and Existing Sub-Advisory Agreement | 11 |

| Approval of the New Advisory Agreement and the New Sub-Advisory Agreement | 15 |

| Approval of Interim Advisory Agreements and Interim Sub-Advisory Agreements | 15 |

| PROPOSAL 3: APPROVAL OF MANAGER OF MANAGERS PROPOSAL | 16 |

| The Manager of Managers Proposal | 16 |

| Board Considerations | 16 |

| Required Vote | 17 |

| GENERAL INFORMATION | 18 |

| Ownership of Shares | 18 |

| Other Information | 18 |

| Payment of Solicitation Expenses | 18 |

| Delivery of Proxy Statement | 18 |

| Other Business | 18 |

| Submission of Certain Shareholder Proposals | 19 |

| Reports to Shareholders and Financial Statements | 19 |

| VOTING INFORMATION | 20 |

| Voting Rights | 20 |

| Attending the Meeting | 20 |

| Quorum; Adjournment | 21 |

| Required Vote | 21 |

| APPENDIX LIST | 22 |

| Appendix A – Shares Outstanding | A-1 |

| Appendix B – Dates Relating to Existing Advisory Agreements | B-1 |

| Appendix C – Advisory Fee Rates | C-1 |

| Appendix D – Advisory Fees and Other Fees Paid | D-1 |

| Appendix E – Information Regarding Officers and Directors of ALPS Advisors | E-1 |

| Appendix F – Dates Relating to Existing Sub-Advisory Agreement | F-1 |

| Appendix G – Sub-Advisory Fee Rates | G-1 |

| Appendix H – Sub-Advisory Fees and Other Fees Paid | H-1 |

| Appendix I – Information About the Sub-Adviser | I-1 |

| Appendix J – Comparable Funds | J-1 |

| Appendix K – Principal Holders | K-1 |

| Appendix L – Form of the New Advisory Agreement | L-1 |

| Appendix M – Form of the New Sub-Advisory Agreement | M-1 |

The Transaction

ALPS Advisors serves as each Fund’s investment adviser and is responsible for each Fund’s overall investment strategy and its implementation. ALPS Advisors is an indirect wholly owned subsidiary of DST Systems, Inc. (“DST”), a publicly traded company listed on the New York Stock Exchange that provides sophisticated information processing and computer software products and services to support the mutual fund, investment management, brokerage, insurance and healthcare industries.

On January 11, 2018, DST entered into an agreement and plan of merger (the “Transaction Agreement”) with SS&C Technologies Holdings, Inc. (“SS&C”) and Diamond Merger Sub, Inc., a Delaware corporation and an indirect wholly owned subsidiary of SS&C (“Merger Sub”), pursuant to which Merger Sub will merge with and into DST (the “Transaction”), with DST surviving as an indirect wholly owned subsidiary of SS&C. If the Transaction is completed, DST common stockholders will receive cash consideration for their shares of common stock of DST.

Consummation of the Transaction is subject to certain customary conditions, including, without limitation, (i) the approval by the affirmative vote of the holders of a majority of the outstanding shares of common stock of DST entitled to vote at the DST stockholders meeting to approve the Transaction; (ii) the receipt of approvals, or the expiration or termination of waiting periods under, certain regulatory laws or from certain regulatory authorities (including the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, approval under the competition law of Ireland and approvals of the Financial Industry Regulatory Authority, the United Kingdom’s Financial Conduct Authority, the Central Bank of Ireland and Luxembourg’s Commission de Surveillance du Secteur Financier); and (iii) the absence of any judgment, order, injunction, ruling or decree, preliminary, temporary or permanent, or other legal restraint or prohibition and no action, proceeding, binding order or determination by any governmental entity, preventing or otherwise making illegal the consummation of the Transaction. Pursuant to the Transaction Agreement, DST has agreed to use reasonable best efforts to obtain approval of new investment management agreements for the registered investment companies advised by ALPS Advisors, including the Funds, by the boards and shareholders of such registered investment companies; however, obtaining such approvals is not a condition of the completion of the Transaction. Although there is no assurance that the Transaction will be completed, DST and SS&C currently expect to complete the Transaction before the end of the second quarter of 2018.

About SS&C

SS&C is a leading provider of mission-critical, sophisticated software products and software-enabled services that allow financial services providers to automate complex business processes and effectively manage their information processing requirements.

SS&C’s portfolio of software products and rapidly deployable software-enabled services allows SS&C’s clients to automate and integrate front-office functions such as trading and modeling, middle-office functions such as portfolio management and reporting, and back-office functions such as accounting, performance measurement, reconciliation, reporting, processing and clearing. SS&C’s solutions enable their clients to focus on core operations, better monitor and manage investment performance and risk, improve operating efficiency and reduce operating costs.

SS&C’s principal executive offices are located at 80 Lamberton Road, Windsor, CT 06095.

SS&C was incorporated in Delaware in July 2005, as the successor to a corporation originally formed in Connecticut in March 1986. SS&C’s common stock trades on The NASDAQ Global Select Market, under the symbol “SSNC.”

Post-Transaction Structure and Operations

It is intended that, after the closing of the Transaction (the “Closing”), ALPS Advisors will continue to be the investment adviser to the Funds and, with respect to the Sub-Advised Funds, the Sub-Adviser will continue to sub-advise the Sub-Advised Funds. The senior personnel and investment advisory personnel of ALPS Advisors are not expected to change and the investment advisory personnel of the Sub-Adviser who currently manage the Sub-Advised Funds are expected to continue to do so after the Closing. However, there can be no assurance that any particular employee of ALPS Advisors or of the Sub-Adviser will choose to remain employed by the respective firm before or after the Closing. While the operations of ALPS Advisors are expected to continue with minimal change following the Closing, ALPS Advisors expects to benefit indirectly from the financial strength and information technology infrastructure of the merged organization.

The Board of Trustees and ALPS Advisors currently do not anticipate any changes to the organization and structure of the Funds. Your Fund and its investment objective and strategies will not change as a result of the completion of the Transaction, and you will still own the same number of shares of the same Fund. No Fund’s name will change as a result of the Transaction. The Board of Trustees will continue in office after the Closing and will continue to make decisions regarding the independent registered public accounting firm, custodian, administrator, distributor and transfer agent of the Funds. The Board of Trustees and ALPS Advisors are not proposing any changes to these existing service providers at this time.

PROPOSAL 1: APPROVAL OF THE NEW ADVISORY AGREEMENT (All Funds) |

Background

ALPS Advisors currently serves as investment adviser to each Fund pursuant to investment advisory agreements between the Trust, on behalf of each Fund, and ALPS Advisors (each an “Existing Advisory Agreement” and, collectively, the “Existing Advisory Agreements”). The date of each Fund’s Existing Advisory Agreement and the date on which it was last approved by Shareholders and approved for continuance by the Board are provided onAppendix B to this Proxy Statement.

As required by the Investment Company Act of 1940, as amended (the “1940 Act”), each Fund’s Existing Advisory Agreement provides for its automatic termination in the event of an assignment. Upon the Closing, DST will be acquired by SS&C and, as a result, ALPS Advisors will indirectly undergo a change in control. This change in control may be deemed an “assignment” of each Fund’s Existing Advisory Agreement which would cause the termination of each Existing Advisory Agreement. The 1940 Act requires that a new advisory agreement be approved by the board of trustees and shareholders of a fund in order for it to become effective.

The Proposal

With respect to each Fund, Shareholders of the Fund are being asked to approve a new investment advisory agreement between the Trust, on behalf of the Fund, and ALPS Advisors (the “New Advisory Agreement”). As described above, each Fund’s Existing Advisory Agreement will automatically terminate upon the Closing. Therefore, approval of the New Advisory Agreement is sought so that the operation of each Fund can continue without interruption. If approved by Shareholders of a Fund, the New Advisory Agreement will become effective for that Fund upon the later of the date of such approval or the Closing. If the Transaction is not completed for any reason, the Existing Advisory Agreements will continue in effect.

Board Approval and Recommendation

On March 5, 2018, the Board of Trustees, including the Trustees who are not “interested persons” of the Funds, ALPS Advisors and the Sub-Adviser within the meaning of the 1940 Act (the “Independent Trustees”), unanimously approved the New Advisory Agreement for each Fund and unanimously recommended that Shareholders of each Fund approve the New Advisory Agreement. A summary of the Board’s considerations is provided below in the section titled “Board Considerations.”

Description of the Existing Advisory Agreements and the New Advisory Agreement

The form of the New Advisory Agreement is set forth inAppendix L to this Proxy Statement.

Currently, each Fund has a separate Existing Advisory Agreement. After the Closing, however, if approved by Shareholders, ALPS Advisors will provide investment advisory services to the Funds pursuant to a single consolidated advisory agreement, the New Advisory Agreement. The terms of the New Advisory Agreement are substantially the same as the terms of each Existing Advisory Agreement, but for the combination of the agreements into a single agreement and the new commencement date. The advisory fee rates under the New Advisory Agreement with respect to each Fund are the same as the fee rates under each Fund’s Existing Advisory Agreement. ALPS Advisors has advised the Board of Trustees that it does not anticipate that the Transaction will result in any reduction in the quality of services now provided to the Funds or have any adverse effect on the ability of ALPS Advisors to fulfill its obligations to the Funds.

The following discussion describes both the Existing Advisory Agreements and the New Advisory Agreement. The next several paragraphs briefly summarize some important provisions of the Existing Advisory Agreements and the New Advisory Agreement, but for a more complete understanding of the agreements you should read the form of the New Advisory Agreement contained inAppendix L.

Services Provided by ALPS Advisors.The New Advisory Agreement requires ALPS Advisors to provide general management services to each Fund and to assume overall supervisory responsibility for the general management and investment of each Fund’s assets, subject to the review and approval of the Board of Trustees. ALPS Advisors is responsible for setting each Fund’s investment program and strategies, revising the programs, as necessary, and monitoring and reporting periodically to the Board of Trustees concerning the implementation of the programs.

Fees. Under the New Advisory Agreement, each Fund pays ALPS Advisors an investment advisory fee. Each Fund’s investment advisory fee rate under the New Advisory Agreement is identical to the investment advisory fee rate under each Fund’s Existing Advisory Agreement.

Appendix C to this Proxy Statement shows:

| • | the advisory fee rates for each Fund under both the Existing Advisory Agreements and the New Advisory Agreement; and |

| • | whether ALPS Advisors has waived, reduced or otherwise agreed to reduce its compensation for any Fund under any applicable contract. |

Appendix D to this Proxy Statement shows:

| • | the amount of ALPS Advisors’ advisory fee and the amount of any other payments by a Fund to ALPS Advisors, or any of its affiliated persons or an affiliated person of such person, during the Fund’s most recently completed fiscal year. |

Term. The New Advisory Agreement provides that it will continue in effect for an initial period beginning on the date of its effectiveness and ending on the second anniversary of that date. After that, it will continue in effect from year to year as long as the continuation is approved at least annually (i) by the Fund’s Board of Trustees, including a majority of the Board’s Independent Trustees; or (ii) by vote of a majority of the outstanding voting securities of the Fund.

Termination. The New Advisory Agreement may be terminated with respect to a Fund without penalty by vote of the Board of Trustees, including a majority of the Board’s Independent Trustees, or by vote of a majority of the outstanding voting securities of the Fund, on 60 days’ written notice to ALPS Advisors, or by ALPS Advisors upon 60 days’ written notice to the Fund, and terminates automatically in the event of its “assignment” as defined in the 1940 Act. The 1940 Act defines “assignment” to include, in general, transactions in which a significant change in the ownership of an investment adviser or its parent company occurs.

Liability of ALPS Advisors. The New Advisory Agreement provides that ALPS Advisors will not be liable to the Fund or its Shareholders for any error of judgment or mistake of law or for any loss suffered by the Trust or the Fund in connection with the matters to which the agreement relates, except a loss resulting from willful misfeasance, bad faith or gross negligence on its part in the performance of its duties or from reckless disregard by ALPS Advisors of its obligations and duties under the agreement, or a loss resulting from a breach of fiduciary duty with respect to receipt of compensation for services (in which case any award of damages shall be limited to the period and amount set forth in Section 36(b)(3) of the 1940 Act).

Differences between the Existing Advisory Agreements and the New Advisory Agreement.The New Advisory Agreement is substantially the same as each Existing Advisory Agreement, but for the combination of the agreements into a single agreement and the new commencement date.

Interim Advisory Agreement

Pursuant to the Transaction Agreement, DST has agreed to use reasonable best efforts to obtain approval of new investment management agreements for the registered investment companies advised by ALPS Advisors, including the Funds, by the boards and shareholders of such registered investment companies; however, obtaining such approvals is not a condition of the Closing. The Closing may occur prior to the Meeting. In the event Shareholders of a Fund have not approved the New Advisory Agreement prior to the Closing, an interim investment advisory agreement between the Trust, on behalf of such Fund, and ALPS Advisors (each an “Interim Advisory Agreement” and, collectively, the “Interim Advisory Agreements”) will take effect upon the Closing. On March 5, 2018, the Board of Trustees, including the Independent Trustees, unanimously approved the Interim Advisory Agreement for each Fund in order to assure continuity of investment advisory services to the Funds after the Closing.

The terms of each Interim Advisory Agreement with respect to each Fund are substantially identical to those of the corresponding Existing Advisory Agreement and the New Advisory Agreement, except for the duration, termination and escrow provisions described below. The Interim Advisory Agreement will continue in effect for a term ending on the earlier of 150 days from the Closing (the “150-day period”) or when Shareholders of the Fund approve the New Advisory Agreement. Pursuant to Rule 15a-4 under the 1940 Act, compensation earned by ALPS Advisors under an Interim Advisory Agreement will be held in an interest-bearing escrow account. If Shareholders of a Fund approve the New Advisory Agreement prior to the end of the 150-day period, the amount held in the escrow account under the Interim Advisory Agreement will be paid to ALPS Advisors. If Shareholders of a Fund do not approve the New Advisory Agreement prior to the end of the 150-day period, the Board will take such action as it deems to be in the best interests of the Fund, and ALPS Advisors will be paid the lesser of its costs incurred in performing its services under the Interim Advisory Agreement or the total amount in the escrow account, plus interest earned. The Interim Advisory Agreements may be terminated by the Trust on ten days written notice to ALPS Advisors.

Affiliated Service Providers, Affiliated Brokerage and Other Fees

ALPS Fund Services, Inc. (“ALPS Fund Services”), an affiliate of ALPS Advisors, serves as each Fund’s administrator and provides fund accounting and administrative services under a separate Fund Accounting and Administration Agreement. ALPS Fund Services receives a fee, accrued daily and paid monthly by ALPS Advisors from the investment advisory fee.

ALPS Portfolio Solutions Distributor, Inc. (“ALPS Distributor”), an affiliate of ALPS Advisors, acts as the distributor of each Fund’s shares pursuant to a separate Distribution Agreement.

During each Fund’s most recently completed fiscal year, no Fund made any payments to ALPS Advisors or any affiliated person of ALPS Advisors for services provided to the Fund except as set forth on Appendix D to this Proxy Statement.

No Fund paid brokerage commissions within the last fiscal year to (i) any broker that is an affiliated person of such Fund or an affiliated person of such person, or (ii) any broker an affiliated person of which is an affiliated person of such Fund, ALPS Advisors or, with respect to the Sub-Advised Funds, the Sub-Adviser.

Information About ALPS Advisors and its Affiliates

ALPS Advisors is a subsidiary of ALPS Holdings, Inc. (“ALPS”). ALPS, located at 1290 Broadway, Suite 1100, Denver, Colorado 80203, was founded in 1985 as a provider of fund administration and fund distribution services. Since then, ALPS has added additional services, including fund accounting, transfer agency, shareholder services, active distribution, legal, tax and compliance services. ALPS conducts its business through its wholly owned subsidiaries, including:

| • | ALPS Advisors, which is registered with the Securities and Exchange Commission (“SEC”) as an investment adviser and commenced business operations in December 2006 upon the acquisition of an existing investment advisory operation; |

| • | ALPS Fund Services, an administrator and SEC-registered transfer agent; and |

| • | ALPS Portfolio Solutions Distributor, Inc. and ALPS Distributors, Inc., each a FINRA-registered broker-dealer, currently registered in all 50 states. |

As of December 31, 2017, ALPS Advisors had approximately $18.4 billion of assets under management and ALPS and its affiliates provided fund administration services to funds with assets in excess of $225 billion and distribution services to funds with assets of more than $158 billion.

Information regarding the principal executive officer, directors and certain other officers of ALPS Advisors and its affiliates and certain other information is attached inAppendix E to this Proxy Statement.

ALPS Advisors serves as investment adviser to certain funds that have investment objectives similar to those of the Funds, as set forth inAppendix J to this Proxy Statement.

Required Vote

Shareholders of each Fund will vote separately. For each Fund, the presence in person or by proxy of thirty percent (30%) of a Fund’s shares that are entitled to vote constitutes a quorum with respect to such Fund.

Approval of the New Advisory Agreement with respect to a Fund requires the affirmative vote of a “majority of the outstanding voting securities” of such Fund, which, under the 1940 Act, means the affirmative vote of the lesser of (a) 67% or more of the shares of the Fund present at the Meeting or represented by proxy if the holders of more than 50% of the outstanding shares are present or represented by proxy, or (b) more than 50% of the outstanding shares.

THE BOARD OF TRUSTEES RECOMMENDS THAT SHAREHOLDERS OF EACH FUND VOTE “FOR” PROPOSAL 1.

PROPOSAL 2: APPROVAL OF THE NEW SUB-ADVISORY AGREEMENT (Sub-Advised Funds only) |

Background

RiverFront Investment Group, LLC currently serves as investment sub-adviser to each Sub-Advised Fund pursuant to sub-advisory agreements among the Trust, on behalf of each Sub-Advised Fund, ALPS Advisors and the Sub-Adviser (the “Existing Sub-Advisory Agreement”).

The date of the Existing Sub-Advisory Agreement with respect to each Fund and the date on which it was last approved by Shareholders and approved for continuance by the Board are provided onAppendix F to this Proxy Statement.

As required by the 1940 Act, the Existing Sub-Advisory Agreement provides for its automatic termination in the event of an assignment. In addition, the Existing Sub-Advisory Agreement provides for its automatic termination upon termination of the Fund’s Existing Advisory Agreement. As a result, upon the Closing, the Existing Sub-Advisory Agreement will terminate. The 1940 Act requires that a new sub-advisory agreement be approved by the board of trustees and shareholders of a fund in order for it to become effective.

The Proposal

Shareholders of each Sub-Advised Fund are being asked to approve a new sub-advisory agreement among the Trust, on behalf of such Sub-Advised Fund, ALPS Advisors and the Sub-Adviser (the “New Sub-Advisory Agreement”). As described above, the Existing Sub-Advisory Agreement will automatically terminate upon the Closing. Therefore, approval of the New Sub-Advisory Agreement is sought so that the operation of each Sub-Advised Fund can continue without interruption. If approved by Shareholders of a Sub-Advised Fund, the New Sub-Advisory Agreement will be effective for that Sub-Advised Fund upon the later of the Closing or the date of approval of the New Advisory Agreement and New Sub-Advisory Agreement. If the Transaction is not completed for any reason, the Existing Sub-Advisory Agreement will continue in effect.

Board Approval and Recommendation

On March 5, 2018, the Board of Trustees, including a majority of the Independent Trustees, unanimously approved the New Sub-Advisory Agreement for each Sub-Advised Fund and unanimously recommended that Shareholders of each Sub-Advised Fund approve the applicable New Sub-Advisory Agreement. A summary of the Board’s considerations is provided below in the section titled “Board Considerations.”

Description of the Existing Sub-Advisory Agreement and the New Sub-Advisory Agreement

The form of the New Sub-Advisory Agreement is set forth inAppendix M to this Proxy Statement.

The terms of the New Sub-Advisory Agreement are the same as the terms of the Existing Sub-Advisory Agreement, but for the new commencement date. The sub-advisory fee rates under the New Sub-Advisory Agreement with respect to each Fund are the same as the fee rates for those services under the Existing Sub-Advisory Agreement. ALPS Advisors and the Sub-Adviser have advised the Board of Trustees that they do not anticipate that the Transaction will result in any reduction in the quality of services now provided to the Sub-Advised Funds or have any adverse effect on the ability of the Sub-Adviser to fulfill its obligations under the New Sub-Advisory Agreement.

The following discussion describes both the Existing Sub-Advisory Agreement and the New Sub-Advisory Agreement. The next several paragraphs briefly summarize some important provisions of the Existing Sub-Advisory Agreement and the New Sub-Advisory Agreement, but for a more complete understanding of the agreements you should read the form of the New Sub-Advisory Agreement contained inAppendix M.

Services Provided by the Sub-Adviser. ALPS Advisors has delegated daily management of each Sub-Advised Fund’s assets to the Sub-Adviser. The New Sub-Advisory Agreement essentially provides that the Sub-Adviser is engaged to manage the investments of each Sub-Advised Fund in accordance with such Sub-Advised Fund’s investment objective, policies and limitations and investment guidelines established by ALPS Advisors and the Board of Trustees.

Fees.Under the New Sub-Advisory Agreement, ALPS Advisors pays a sub-advisory fee to the Sub-Adviser. Each Sub-Advised Fund’s sub-advisory fee rate under its New Sub-Advisory Agreement is identical to the sub-advisory fee rate under the Existing Sub-Advisory Agreement. The sub-advisory fee is paid by ALPS Advisors, and not the Sub-Advised Fund.

Appendix G to this Proxy Statement shows:

| • | the sub-advisory fee rates for each Sub-Advised Fund under both the Existing Sub-Advisory Agreement and the New Sub-Advisory Agreement; and |

| • | whether the Sub-Adviser has waived, reduced or otherwise agreed to reduce its compensation for any Sub-Advised Fund under any applicable contract. |

Appendix H to this Proxy Statement shows:

| • | the aggregate amount of the Sub-Adviser’s fee and the amount of any other payments by a Sub-Advised Fund to the Sub-Adviser, or any of its affiliated persons or affiliated person of such person, during the Sub-Advised Fund’s most recently completed fiscal year. |

Term. The New Sub-Advisory Agreement provides that it will continue in effect for an initial period beginning on the effective date thereof and ending on the second anniversary of that date. After that, the New Sub-Advisory Agreement will continue in effect from year to year as long as the continuation is approved at least annually (i) by the Board of Trustees, including a majority of Independent Trustees; or (ii) by vote of a majority of the outstanding voting securities of the Sub-Advised Fund.

Termination. The New Sub-Advisory Agreement may be terminated with respect to a Sub-Advised Fund at any time, without the payment of any penalty, by a vote of the majority of the Board of Trustees, by vote of a majority of the outstanding voting securities of the Sub-Advised Fund, or ALPS Advisors on 60 days’ prior written notice to the Sub-Adviser and ALPS Advisors, as appropriate. In addition, the Sub-Adviser may terminate the agreement upon 60 days’ written notice to ALPS Advisors. It is anticipated that the New Sub-Advisory Agreement will automatically terminate, without the payment of any penalty, in the event of its assignment or in the event the New Advisory Agreement with ALPS Advisors is assigned (in each case, as "assignment" is defined in the 1940 Act) or terminates for any other reason. The 1940 Act defines “assignment” to include, in general, transactions in which a significant change in the ownership of an investment adviser or its parent company occurs. The New Sub-Advisory Agreement will also terminate upon written notice to the other party that the other party is in material breach of the agreement, unless the other party in material breach of the agreement cures such breach to the reasonable satisfaction of the party alleging the breach within 30 days after written notice.

Liability of the Sub-Adviser. The New Sub-Advisory Agreement provides that, except as may otherwise be provided by the 1940 Act or any other federal securities law, in the absence of willful misconduct, bad faith or gross negligence, neither the Sub-Adviser nor any of its officers, affiliates, employees or consultants (its “Affiliates”) shall be liable for any losses, claims, damages, liabilities or litigation (including reasonable legal and other expenses) incurred or suffered by ALPS Advisors, the Sub-Advised Fund or the Trust as a result of any error of judgment or for any action or inaction taken in good faith by the Sub-Adviser or its Affiliates with respect to the Sub-Advised Fund.

Differences between the Existing and the New Sub-Advisory Agreement. The New Sub-Advisory Agreement is the same as the Existing Sub-Advisory Agreement, but for the new commencement date.

Interim Sub-Advisory Agreements

Pursuant to the Transaction Agreement, DST has agreed to use reasonable best efforts to obtain approval of new investment management agreements for the registered investment companies advised by ALPS Advisors, including the Sub-Advised Funds, by the boards and shareholders of such registered investment companies; however, obtaining such approvals is not a condition of the Closing. The Closing may occur prior to the Meeting. In the event Shareholders of a Sub-Advised Fund have not approved the New Advisory Agreement and/or the New Sub-Advisory Agreement prior to the Closing, an interim sub-advisory agreement among the Trust, on behalf of such Sub-Advised Fund, ALPS Advisors and the Sub-Adviser (each an “Interim Sub-Advisory Agreement” and, collectively, the “Interim Sub-Advisory Agreements”) will take effect upon the Closing. On March 5, 2018, the Board of Trustees, including the Independent Trustees, unanimously approved the Interim Sub-Advisory Agreement for each Sub-Advised Fund in order to assure continuity of investment advisory services to the Sub-Advised Funds after the Closing.

The terms of the Interim Sub-Advisory Agreement with respect to each Sub-Advised Fund are substantially identical to those of the Existing Sub-Advisory Agreement and New Sub-Advisory Agreement, except for the term and escrow provisions described below. The Interim Sub-Advisory Agreement will continue in effect for a term ending on the earlier of 150 days from the Closing (the “150-day period”) or when Shareholders of the Sub-Advised Fund approve the New Advisory Agreement and the New Sub-Advisory Agreement. Pursuant to Rule 15a-4 under the 1940 Act, compensation earned by the Sub-Adviser under an Interim Sub-Advisory Agreement will be held in an interest-bearing escrow account. If Shareholders of a Sub-Advised Fund approve the New Advisory Agreement and the New Sub-Advisory Agreement prior to the end of the 150-day period, the amount held in the escrow account under the Interim Sub-Advisory Agreement will be paid to the Sub-Adviser. If Shareholders of a Sub-Advised Fund do not approve the New Advisory Agreement and the New Sub-Advisory Agreement prior to the end of the 150-day period, the Board will take such action as it deems to be in the best interests of the Sub-Advised Fund, and the Sub-Adviser will be paid the lesser of its costs incurred in performing its services under the Interim Sub-Advisory Agreement or the total amount in the escrow account, plus interest earned.

Affiliated Service Providers, Affiliated Brokerage and Other Fees

During each Sub-Advised Fund’s most recently completed fiscal year, no Sub-Advised Fund made any material payments to the Sub-Adviser or any affiliated person of the Sub-Adviser for services provided to the Sub-Advised Fund except as set forth onAppendix H to this Proxy Statement.

No Sub-Advised Fund paid brokerage commissions within the last fiscal year to (i) any broker that is an affiliated person of such Sub-Advised Fund or an affiliated person of such person, or (ii) any broker an affiliated person of which is an affiliated person of such Sub-Advised Fund, ALPS Advisors or the Sub-Adviser.

Information about the Sub-Adviser

RiverFront Investment Group, LLC, established in April 2008 by the former Chief Investment Officer, Chief Investment Strategist and Chief Equity Strategist at Wachovia Securities, is located at 1214 East Cary St., Richmond, Virginia 23219. The Sub-Adviser is majority-owned by its employees but is affiliated with Baird Financial Corporation as a result of its minority equity interests and representation on the Sub-Adviser’s board of directors. The Sub-Adviser is an investment adviser registered with the SEC under the Investment Advisers Act of 1940, as amended. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). The Sub-Adviser also serves as sub-advisor to a series of mutual funds and ETFs. As of December 31, 2017, the Sub-Adviser had approximately $7.5 billion in assets under advisement (discretionary and nondiscretionary).

Certain information about the Sub-Adviser and information regarding the principal executive officer, directors and certain other officers of the Sub-Adviser and its affiliates and certain other information is attached inAppendix I to this Proxy Statement.

Required Vote

Shareholders of each Sub-Advised Fund will vote separately. For each Sub-Advised Fund, the presence in person or by proxy of thirty percent (30%) of a Sub-Advised Fund’s shares that are entitled to vote constitutes a quorum with respect to such Sub-Advised Fund.

Approval of the New Sub-Advisory Agreement with respect to a Sub-Advised Fund requires the affirmative vote of a “majority of the outstanding voting securities” of such Sub-Advised Fund, which, under the 1940 Act, means the affirmative vote of the lesser of (a) 67% or more of the shares of the Sub-Advised Fund present at the Meeting or represented by proxy if the holders of more than 50% of the outstanding shares are present or represented by proxy, or (b) more than 50% of the outstanding shares.

THE BOARD OF TRUSTEES RECOMMENDS THAT SHAREHOLDERS OF EACH SUB-ADVISED FUND VOTE “FOR” PROPOSAL 2.

Summary of Board Meetings and Considerations

The Board, including the Independent Trustees, met in person on March 5, 2018 to evaluate, among other things, the Transaction, ALPS Advisors and the Sub-Adviser and to determine whether to approve the New Advisory Agreement and the New Sub-Advisory Agreement, as applicable, and recommend approval to Shareholders. The Independent Trustees also met separately to consider the foregoing. At the Board meeting and throughout the process of considering the Transaction, the Board, including the Independent Trustees, was advised by counsel to the Independent Trustees and counsel to the Trust.

In their consideration of the approval of the New Advisory Agreement and New Sub-Advisory Agreement, the Board, counsel to the Independent Trustees and counsel to the Trust requested certain materials from ALPS Advisors, DST, SS&C and the Sub-Adviser and reviewed their responses thereto. The Board communicated with senior representatives of ALPS Advisors and the Sub-Adviser regarding their personnel, operations and financial condition. The Board also reviewed the terms of the Transaction and considered its possible effects on the Funds and their Shareholders. In this regard, the Trustees spoke with representatives of ALPS Advisors during the Board meeting and, with respect to the Independent Trustees, in private sessions to discuss the anticipated effects of the Transaction.

During these meetings, the representatives of ALPS Advisors indicated their belief that the Transaction would not adversely affect (i) the continued operation of the Funds; (ii) the capabilities of the senior personnel and investment advisory personnel of ALPS Advisors who currently manage the Funds to continue to provide these and other services to the Funds at the current levels; or (iii) the capabilities of the Sub-Adviser to continue to provide the same level of sub-advisory services to the Sub-Advised Funds. ALPS Advisors recommended that the Board approve the New Advisory Agreement and New Sub-Advisory Agreement and that the Board recommend that Shareholders approve the New Advisory Agreement and New Sub-Advisory Agreement.

Approval of the New Advisory Agreement and New Sub-Advisory Agreement

In determining whether to approve the New Advisory Agreement and, as applicable, New Sub-Advisory Agreement for each Fund, and whether to recommend approval to Shareholders, the Board received information and made inquiries into all matters as it deemed appropriate. The Board reviewed and analyzed various factors it deemed relevant, including the following factors, among others, none of which by itself was considered dispositive:

| • | the terms of the New Advisory Agreement, including the fees payable to ALPS Advisors by the Funds, are substantially same as the Existing Advisory Agreements, but for the combination of the agreements into a single agreement and the new commencement dates; |

| • | the terms of the New Sub-Advisory Agreement, including the fees payable by ALPS Advisors to the Sub-Adviser, are the same as the Existing Sub-Advisory Agreements, but for the new commencement dates; |

| • | assurances from ALPS Advisors and SS&C that the manner in which the Funds’ assets are managed will not change as a result of the Transaction, that the same people who currently manage the Funds’ assets are expected to continue to do so after the Closing, and that there is not expected to be any diminution in the nature, quality and extent of the services provided to the Funds by ALPS Advisors and the Sub-Adviser; |

| • | the favorable history, reputation, qualification and background of SS&C; |

| • | ALPS Advisors’ and DST’s financial condition; |

| • | SS&C’s financial condition; |

| • | that while the operations of ALPS Advisors are expected to continue with minimal or no change following the Closing, ALPS Advisors expects to benefit indirectly from the financial strength and information technology infrastructure of the merged organization; |

| • | the potential adverse effects on the Funds, in the event the Transaction is completed and the New Advisory Agreement and New Sub-Advisory Agreement are not approved; |

| • | the fact that Shareholders of the Funds will not bear any costs in connection with the Transaction, inasmuch as ALPS Advisors or its affiliates has committed to pay the expenses of the Funds in connection with the Transaction, including all expenses in connection with the solicitation of proxies; and |

| • | that SS&C is aware of the terms of Section 15(f) of the 1940 Act, and that although the Transaction Agreement does not contain a specific covenant in that regard due to the small size of ALPS Advisors’ business relative to the Transaction as represented by ALPS Advisors, SS&C does not intend to impose, and has committed to the Board to use commercially reasonable efforts not to impose, any unfair burden on the Funds as a result of the Transaction. |

New Advisory Agreement

In evaluating the New Advisory Agreement with respect to each of the following Funds, Alerian MLP ETF (“AMLP”), ALPS Equal Sector Weight ETF (“EQL”), Cohen & Steers Global Realty Majors ETF (“GRI”), ALPS Sector Dividend Dogs ETF (“SDOG”), Barons 400 ETF (“BFOR”), ALPS International Sector Dividend Dogs ETF (“IDOG”), RiverFront Strategic Income Fund (“RIGS”), Alerian Energy Infrastructure ETF (“ENFR”), Workplace Equality Portfolio (“EQLT”), ALPS Emerging Sector Dividend Dogs ETF (“EDOG”), ALPS Medical Breakthroughs ETF (“SBIO”), Sprott Gold Miners ETF (“SGDM”), Sprott Junior Gold Miners ETF (“SGDJ”), RiverFront Dynamic Unconstrained Income ETF (“RFUN”), RiverFront Dynamic Core Income ETF (“RFCI”), RiverFront Dynamic US Dividend Advantage ETF (“RFDA”), RiverFront Dynamic US Flex-Cap ETF (“RFFC”), BUZZ US Sentiment Leaders ETF (“BUZ”), ALPS/Dorsey Wright Sector Momentum ETF (“SWIN”) and ALPS Disruptive Technologies ETF (“DTEC”) (each a “Fund” and collectively “the Funds”), the Board considered various factors, including (i) the nature, extent and quality of the services to be provided by ALPS Advisors with respect to the applicable Fund under the New Advisory Agreement; (ii) the advisory fees and other expenses paid by the Fund compared to those of similar funds managed by other investment advisers; (iii) the costs of the services provided to the Fund by ALPS Advisors and the profits realized by ALPS Advisors and its affiliates from its relationship to the Fund; (iv) the extent to which economies of scale have been or would be realized if and as the assets of the Fund grow and whether fees reflect the economies of scale for the benefit of shareholders; and (v) any additional benefits and other considerations.

With respect to the nature, extent and quality of the services to be provided by ALPS Advisors under the New Advisory Agreement, the Board considered and reviewed information concerning the services provided under the Existing Advisory Agreements, the investment parameters of the index of each Fund (except RIGS, RFUN, RFCI, RFDA and RFFC, together, the “Sub-Advised Funds” which are actively managed ETFs), financial information regarding ALPS Advisors and its parent company, information describing ALPS Advisors’ current organization and the background and experience of the persons responsible for the day-to-day management of the Funds.

The Board reviewed information on the performance of each Fund and its applicable benchmark, and with respect to the Sub-Advised Funds, the Broadridge performance group. The Board also evaluated the correlation and tracking error between each underlying index and its corresponding Fund’s performance except for the Sub-Advised Funds, which are actively managed ETFs. Based on their review, the Board found that the nature and extent of services to be provided to each Fund under the New Advisory Agreement was appropriate and that the quality was satisfactory.

The Board noted that the advisory fees for each Fund were unitary fees pursuant to which ALPS Advisors assumes all expenses of the Funds (including the cost of transfer agency, custody, fund administration, legal, audit and other services) other than the payments under the New Advisory Agreement, brokerage expenses, taxes, interest, litigation expenses and other extraordinary expenses.

With respect to advisory fee rates, the Board noted the following:

AMLP, SDOG, BFOR, ENFR, EQLT, EDOG, IDOG, GRI, SBIO, RFFC and BUZ

The net advisory fee rate for each of these Funds is higher than the median of its Broadridge expense group. The Funds’ respective expense ratios, however, are (i) in the case of IDOG, SBIO, and RFFC, below the median of their respective Broadridge expense group; (ii) in the case of GRI, at the median of its Broadridge expense group; (iii) in the case of EDOG and SDOG, slightly above the median of their respective Broadridge expense group and (iv) for all other Funds, their expense ratios are higher than the medians of their respective Broadridge expense group.

With respect to AMLP, the Board took into account, among other things, supplemental information provided by ALPS Advisors showing AMLP’s total expenses were in line with the total expenses of peer groups deemed by ALPS Advisors to be more comparable, including peer groups comprised of (i) the master limited partnership (“MLP”) asset class as a whole and (ii) exchange-traded products focused solely on MLP investments. The Board also considered the additional costs and expenses incurred by ALPS Advisors in managing and administering the Fund and that AMLP’s investment advisory fee schedule included breakpoints.

With respect to AMLP and ENFR, the Board took into account, among other things, the brand recognition of the Funds’ index provider and the fees charged by the index provider for licensing its indexes.

With respect to BFOR, the Board took into account, among other things, the unique features and performance of the Fund’s underlying index and the costs and benefits of linkage to the Barron’s name.