| 1900 K Street, NW

Washington, DC 20006-1110 +1 202 261 3300 Main +1 202 261 3333 Fax www.dechert.com |

| | Adam T. Teufel adam.teufel@dechert.com +1 202 261 3464 Direct +1 202 261 3164 Fax |

| | |

VIA EMAIL and EDGAR

August 24, 2021

Securities and Exchange Commission

100 F Street, NE

Washington, D.C. 20549

Attention: David Orlic, Division of Investment Management

| RE: | ALPS ETF Trust (the “Registrant”)

File Nos. 333-148826, 811-22175 |

Dear Mr. Orlic:

Set forth in the numbered paragraphs below are the Staff’s comments provided telephonically on August 3, 2021 to Registrant’s Post-Effective Amendment No. 308 filed on June 17, 2021 (“PEA 308”), which included a prospectus and statement of additional information pertaining to the ALPS Global Travel Beneficiaries ETF (the “Fund”), accompanied by the Registrant’s responses to each comment. Capitalized terms not otherwise defined herein shall have the meanings given to them in PEA 308.

| 1. | Staff Comment: Please provide a draft response and completed fee table five (5) business days prior to effectiveness. Please note that the Staff requests that all names issues be resolved prior to effectiveness. |

Registrant’s Response: Comment acknowledged. Please find the completed fee table attached as Exhibit A.

| 2. | Staff Comment: Under principal investment strategies, please be more specific as to what “Ancillary Beneficiaries” means or the types of companies are included in this Segment. |

Registrant’s Response: The Trust will revise the disclosure accordingly.

| 3. | Staff Comment: We note that the fund has an investment strategy to track an index with significant exposure to non-U.S. companies in emerging and frontier markets. Please provide disclosure with respect to the following risks (and any related risks) associated with this investment strategy, or explain to us why such disclosure would not be appropriate: |

1) the potential for errors in index data, index computation and/or index construction if information on non-U.S. companies is unreliable or outdated, or if less information about the non-U.S. companies is publicly available due to differences in regulatory, accounting, auditing and financial recordkeeping standards;

2) the potential significance of such errors on the fund’s performance;

3) limitations on the fund adviser’s ability to oversee the index provider’s due diligence process over index data prior to its use in index computation, construction, and/or rebalancing; and

4) the rights and remedies associated with investments in a fund that tracks an index comprised of foreign securities may be different than a fund that tracks an index of domestic securities.

Registrant’s Response: The Trust believes that the first and second points above are addressed in the “Foreign Securities Risk” and “Emerging Markets Risk” disclosure. The Trust will revise this disclosure to address the fourth point. The Trust notes that the disclosure requested in the third point is addressed in “Quantitative and Qualitative Methodology Risk”.

| 4. | Staff Comment: Please expressly describe how the Fund will invest its assets in investments that are economically tied to a number of countries around the world. (Citation: Names Rule Adopting Release 2001, footnote 42). |

Registrant’s Response: The Trust will revise the disclosure in its “Principal Investment Strategies” section to further describe how the Fund invests consistent with the connotation that “global” means diversification among investments in a number of different countries throughout the world. The Fund will have country exposure, including non-US country exposure, approximately to the same extent as the Fund’s Underlying Index.

The Trust believes that its disclosure, as revised, effectively describes how the Fund will invest its assets in investments that are tied economically to a number of countries throughout the world and that the Fund’s investments are consistent with footnote 42 to Investment Company Act Release No. 24828.

| 5. | Staff Comment: The Staff references the following statement from the Principal Investment Strategies section: “All equity securities meeting the above criteria are selected for inclusion in the Index Universe. From the Index Universe, the Underlying Index methodology selects and weights twenty stocks in each Segment according to proprietary quantitative and qualitative factors” (emphasis added). |

We note that the language “proprietary quantitative and qualitative factors” might indicate too much discretion on the part of the Index Provider. Please provide the Underlying Index white paper and a list of companies currently in the Underlying Index. Please also confirm that the Index Provider does not show back tested performance.

Registrant’s Response: The Trust notes that the phrase “proprietary quantitative and qualitative factors” is meant to connote that the index methodology was developed by the Index Provider and is language commonly used in prospectus disclosure. The Trust undertakes to provide a copy of the rule book separately via email.

The Trust has included, as Exhibit B, the list of companies that comprised the Underlying Index as of August 13, 2021, as well as their respective sectors and weights.

Neither the Fund nor the Adviser uses back tested performance for the Fund’s Underlying Index, but the Trust cannot confirm what the Index Provider uses in its materials.

| 6. | Staff Comment: Please advise why there is no concentration or passive index risk as a principal investment risk. |

Registrant’s Response: The Trust notes that passive index risk is addressed in “Index Management Risk.” With respect to concentration risk, the Trust will add risks specific to those sectors or industries in which the Fund is expected to invest more than 25% of its assets based on the Underlying Index’s current constituents. For a list of the Underlying Index’s current allocation to particular sectors and industries, please see Exhibit C.

| 7. | Staff Comment: We note there is a reference to biological outbreak in the Travel Industry Risk. Given the impact of COVID-19 on the travel industry in the past few years, please add a specific COVID-19 risk disclosure in summary risk section. |

Registrant’s Response: The Trust has added the following to the “Travel Industry Risk” as a second paragraph:

For example, the outbreak of COVID-19, a novel coronavirus disease, has negatively affected travel throughout the world, including those companies in which the Fund invests. The effects of this pandemic to public health and business and market conditions may continue to have a significant negative impact on the performance of the Fund’s investments. The full impact of the COVID-19 pandemic, or other future epidemics or pandemics, is currently unknown.

| 8. | Staff Comment: We note there is a Small-, Mid- and Large-Capitalization Company Risk. Please discuss market cap size in principal investment strategy section above. |

Registrant’s Response: The Fund will update its principal investment strategy section to note that the index components are subject to a minimum market capitalization of $100 million.

| 9. | Staff Comment: We note there is an Underlying Segment Risk. Please add more specificity as to what those risks are. |

Registrant’s Response: The Trust has added additional disclosure regarding risks applicable to the following segments: Airlines & Airport Services; Hotels, Casinos, Cruise Lines; Booking & Rental Agencies.

| 10. | Staff Comment: We note there is an Underlying Index Construction Risk. Please disclose whether the Index Provider is affiliated with the Adviser. |

Registrant’s Response: The Trust notes that there is no “Underlying Index Construction Risk” in the prospectus; there is an “Underlying Index Construction” section (to which the staff refers below) that describes the index methodology. The Trust has added a sentence in this section noting that the Index Provider is not affiliated with the Adviser.

| 11. | Staff Comment: We reference the following sentence in the “Underlying Index Construction” section in Item 9: “In order to be eligible for inclusion in the Underlying Index’s Index Universe, a company’s stock must be traded on one or more major global securities exchanges and is principally engaged (emphasis added) in or derives significant revenue from one of the Segments.” The term “principally engaged in” is used in other sections as well, including the 80% test. Please delete or define “principally engaged in.” We note that the revenue test is what we consider necessary for names rule purposes. |

Registrant’s Response: The Trust notes that the 80% test described in the Prospectus is with respect to the Fund’s investment in the component securities of the Underlying Index; not with respect to any particular type of investment.

The Trust does not believe that Rule 35d-1 under the 1940 Act (the “Names Rule”) applies to the use of the term “travel beneficiaries” in the Fund’s name. In the release adopting the Names Rule (the “Adopting Release”) and the companion Staff guidance titled “Frequently Asked Questions about Rule 35d-1 (Investment Company Names),” the SEC Staff distinguished terms that suggest an investment objective or strategy, rather than a type of investment, and noted that such terms do not require adoption of an 80% policy pursuant to the Names Rule. With respect to the term “travel beneficiaries” in the Fund’s name, the Trust believes that it does not suggest a particular type of investment, because companies in a wide range of industries may benefit from travel, as identified by the Index Provider’s index methodology described in the Prospectus.

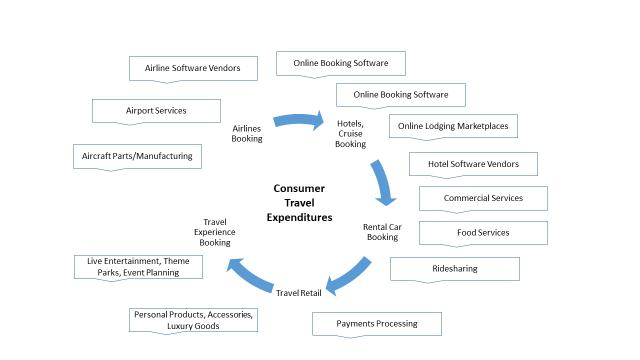

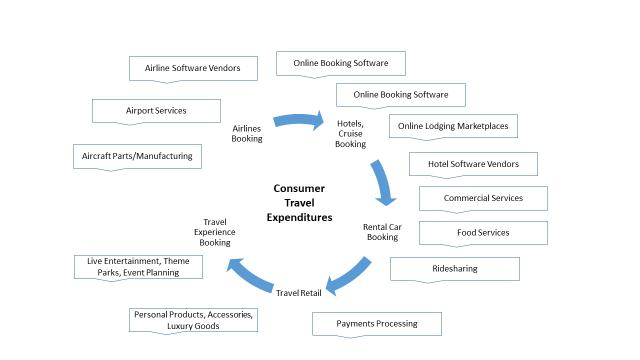

We refer to the graphic below as an illustration of this concept.

In this illustration, the inside circle represents traditional “travel” companies, and the outside circle are potential travel beneficiaries. For instance, data indicates that cosmetics companies benefit from airport sales when travel activity rises. Other examples include software providers for online travel companies and hotels, food services companies and aircraft manufacturers, which are captured in the Underlying Index methodology.

Accordingly, “travel beneficiaries” in the Fund’s name describes the investment strategy and philosophy utilized by the Underlying Index methodology in accordance with which the Fund will invest. The Trust therefore respectfully declines to define the requested terms because we believe that the Names Rule does not apply to the Fund.

| 12. | Staff Comment: We reference the following sentence in the “Underlying Index Construction” section in Item 9: “The Underlying Index defines significant revenue from one of the Segments as: (1) revenues representing more than 20% of the company’s total revenues and such revenues are independently reported in the company’s financial reports, (2) applicable revenues are likely to have a material impact on the company’s overall share price performance, or (3) the company’s applicable business is likely to have a significant impact on the sector as a whole.” Prong 2 and 3 are not criteria that the Staff has found acceptable for Names Rule purposes. In addition, for Names Rule purposes, in prong 1, 20% revenue for Prong 1 is too low. The Staff has typically viewed 50% as more appropriate. We think this information should appear in the Summary section. |

Registrant’s Response: As noted in the response above, the Trust respectfully declines to make these changes because we do not believe the Names Rule applies on account of the Fund’s investment strategy.

| 13. | Staff Comment: We reference the following sentence in the “Underlying Index Construction” section in Item 9: “From the Index Universe, the Underlying Index methodology selects and weights twenty stocks in each Segment according to proprietary quantitative and qualitative factors (emphasis added).” Please disclose the actual weighting method. |

Registrant’s Response: Comment acknowledged. The following disclosure will be added to the “Underlying Index Construction” section:

From among stocks that meet the above requirements, Underlying Index constituents are selected by ranking of their quality- and growth-modified float market capitalizations using the following steps:

| 1) | Calculate the company’s quality score (“Quality Score”) |

| a. | Calculate the ratio of free cash flow to revenue for each of the last five years |

| b. | Calculate the arithmetic average of the five values from (a) |

| c. | Calculate the z-score of (b) relative to the other companies’ averages |

| d. | Calculate the s-score of the z-score from (c) — i.e., the cumulative probability of the z-score, assuming a normal distribution |

| e. | In cases of missing or erroneous data, set the s-score to zero |

| 2) | Calculate the company’s growth score (“Growth Score”) |

| a. | Calculate the future short-term growth in earnings per share |

| b. | Subtract the one-year-prior earnings per share (“EPS”) from the one-year-forward EPS estimate |

| c. | Divide the difference from (b) by the absolute value of the one-year-prior EPS |

| d. | Calculate the z-score of (c) relative to the other companies’ values |

| e. | Calculate the s-score of the z-score from (d) |

| f. | In cases of missing or erroneous data, set the s-score to zero |

| 3) | Calculate the company’s Quality/Growth Score: |

| 4) | Modify the stock’s float-adjusted market capitalization by multiplying by its Quality/Growth Score |

| 5) | Select for inclusion in the Underlying Index the top 20 eligible stocks in each segment by modified float market capitalization from (4) |

The selected constituents are weighted as follows:

| 1) | Calculate a new quality- and growth-modified float market capitalization for each constituent using its Quality/Growth Score from the selection process together with its float-adjusted market capitalization as of the close of trading on the day prior to the second Friday of the rebalancing month (the “Weight Date”). |

| 2) | Calculate interim within-region weights for all the constituents within each of four regions — US & Canada, Europe, Pacific (ex-Canada), and Emerging — based on the constituents’ new modified float market caps from (1) |

| 3) | Set each region’s total weight to the corresponding region’s weight in the SNG5500 Index, with Canada shifted from the SNG5500 Index’s Pacific region to form the “US & Canada” region |

| 4) | Limit the individual constituents’ Underlying Index weights to a maximum of 4.5% and a minimum of 0.25% |

| 5) | Redistribute any excess weight from (4) proportionally within the region(s) of the stocks whose weights were limited |

The constituents in the Underlying Index will be selected based on prices as of the close of trading on the Weight Date.

| 14. | Staff Comment: We reference “Market Risk” in Additional Information About the Fund’s Principal Investment Risks. Please be more specific as to how COVID-19 affects travel. |

Registrant’s Response: The Trust specifically revised the “Travel Industry Risk”, as noted above in Response 7, to address COVID-19 with respect to travel.

| 15. | Staff Comment: We reference the following statement in the Secondary Investment Strategies section: “The Fund seeks to track the Underlying Index, which itself may be concentrated in certain industries or sectors. As a result, the Fund may also be concentrated to the extent the Underlying Index is so concentrated. (emphasis added).” Please change “may” to “will/will be” in the second sentence and disclose whether the Index is currently concentrated. Please also disclose the industry currently concentrated in (e.g. travel). |

Registrant’s Response: The Trust acknowledges your comment and has made the requested changes.

| 16. | Staff Comment: Please disclose that, where all or a portion of the ETF’s underlying securities trade in a market that is closed when the market in which the ETF’s shares are listed and trading in that market is open, there may be changes between the last quote from its closed foreign market and the value of such security during the ETF’s domestic trading day. In addition, please note that this in turn could lead to differences between the market price of the ETF’s shares and the underlying value of those shares. |

Registrant’s Response: The Trust submits that this information is disclosed in the “HOW TO BUY AND SELL SHARES – Pricing Fund Shares” section of the Fund’s prospectus. The Trust has added further disclosure with respect to the staff’s additional point.

| 17. | Staff Comment: Please confirm whether securities underlying the ETF are traded outside of a collateralized settlement system. If so, please disclose that there are a limited number of financial institutions that may act as authorized participants that post collateral for certain trades on an agency basis (i.e., on behalf of other market participants). Please also disclose that, to the extent that those authorized participants exit the business or are unable to process creation and/or redemption orders and no other authorized participant is able to step forward to do so, there may be a significantly diminished trading market for the ETF’s shares. In addition, please note that this could in turn lead to differences between the market price of the ETF’s shares and the underlying value of those shares. |

Registrant’s Response: The Trust respectfully submits that the requested risk disclosure is addressed in the “Authorized Participant Concentration Risk” in the “ADDITIONAL RISK CONSIDERATIONS” section of the Fund’s prospectus.

| 18. | Staff Comment: Please file the license agreement related to the Index as an exhibit. |

Registrant’s Response: The Trust respectfully declines to file the index license agreement because the Trust is not a party to the agreement.

* * *

If you have any questions or further comments, please contact me at 202.261.3464.

| | | |

| | Sincerely, | |

| | | |

| | /s/ Adam Teufel | |

| | Adam Teufel | |

Exhibit A

FEES AND EXPENSES OF THE FUND

This table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund (“Shares”). Investors purchasing or selling Shares in the secondary market may be subject to fees and expenses (including customary brokerage commissions) charged by their broker and other fees to financial intermediaries. These fees and expenses are not included in the expense example below.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| Management Fees | 0.65% |

| Other Expenses(1) | 0% |

| Total Annual Fund Operating Expenses | 0.65% |

| (1) | Other Expenses are estimated for the current fiscal year |

Example

The following example is intended to help you compare the cost of investing in the Fund with the costs of investing in other funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then hold or redeem all of your Shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same each year.

| | One

Year | Three

Years |

| Although your actual costs may be higher or lower, based on these assumptions your costs would be: | $66 | $208 |

Exhibit B

| Row Labels | Sum of INDEX WEIGHT |

| Communication Services | 6.28% |

| Liberty Tripadvisor Holdings Inc | 0.23% |

| Live Nation Entertainment Inc | 0.84% |

| TripAdvisor Inc | 0.23% |

| Walt Disney Co | 4.98% |

| Consumer Discretionary | 41.51% |

| Airbnb Inc | 1.95% |

| Booking Holdings Inc | 4.61% |

| Boyd Gaming Corp | 0.66% |

| Caesars Entertainment Inc | 1.74% |

| Carnival Corp | 0.61% |

| Dufry AG | 0.21% |

| Expedia Group Inc | 1.51% |

| Flight Centre Travel Group Ltd | 0.26% |

| Galaxy Entertainment Group Ltd | 2.22% |

| Hilton Worldwide Holdings Inc | 3.70% |

| Huazhu Group Ltd | 1.42% |

| InterContinental Hotels Group PLC | 0.80% |

| Kering SA | 5.03% |

| Las Vegas Sands Corp | 2.12% |

| Marriott International Inc | 3.99% |

| Marriott Vacations Worldwide Corp | 0.54% |

| MGM Resorts International | 1.38% |

| Moncler SpA | 1.11% |

| Penn National Gaming Inc | 1.13% |

| Royal Caribbean Group | 0.51% |

| Thule Group AB | 0.43% |

| Tongcheng-Elong Holdings Ltd | 0.25% |

| Trainline PLC | 0.38% |

| Travel + Leisure Co | 0.53% |

| Trip.com Group Ltd | 1.65% |

| Vail Resorts Inc | 1.40% |

| Wyndham Hotels & Resorts Inc | 0.69% |

| Wynn Resorts Ltd | 0.67% |

| Consumer Staples | 15.43% |

| Estee Lauder Companies Inc | 5.32% |

| L'Oreal SA | 4.97% |

| Premium Brands Holdings Corp | 0.27% |

| Sanderson Farms Inc | 0.32% |

| Shiseido Co Ltd | 4.55% |

| Financials | 4.98% |

| American Express Co | 4.98% |

| Industrials | 27.55% |

| Aena SME SA | 1.19% |

| Air Canada | 0.22% |

| Airports of Thailand PCL | 0.76% |

| Alaska Air Group Inc | 0.67% |

| Allegiant Travel Co | 0.25% |

| American Airlines Group Inc | 0.90% |

| ANA Holdings Inc | 1.54% |

| Auckland International Airport Ltd | 1.01% |

| Avis Budget Group Inc | 0.29% |

| Beijing Capital International Airport Co Ltd | 0.22% |

| China Southern Airlines Co Ltd | 0.26% |

| Cintas Corp | 3.63% |

| Dassault Aviation SA | 0.25% |

| Delta Air Lines Inc | 2.21% |

| Elis SA | 0.27% |

| Grupo Aeroportuario del Pacifico SAB de CV | 0.36% |

| HyreCar Inc | 0.14% |

| International Consolidated Airlines Group SA | 0.29% |

| Japan Airlines Co Ltd | 1.26% |

| JetBlue Airways Corp | 0.22% |

| Korean Air Lines Co Ltd | 0.80% |

| Localiza Rent a Car SA | 0.66% |

| Lyft Inc | 0.26% |

| Qantas Airways Ltd | 0.95% |

| Ryanair Holdings PLC | 0.67% |

| Sixt SE | 0.26% |

| Southwest Airlines Co | 3.06% |

| Textron Inc | 1.64% |

| Uber Technologies Inc | 2.11% |

| United Airlines Holdings Inc | 1.20% |

| Information Technology | 3.48% |

| Agilysys Inc | 0.28% |

| Amadeus IT Group SA | 2.52% |

| Pros Holdings Inc | 0.23% |

| Sabre Corp | 0.21% |

| Shift4 Payments Inc | 0.24% |

| Real Estate | 0.77% |

| Host Hotels & Resorts Inc | 0.77% |

| (blank) | |

| (blank) | |

| Grand Total | 100.00% |

Exhibit C

| Industry | INDEX WEIGHT | Sector | INDEX WEIGHT |

| Aerospace & Defense | 1.90% | Communication Services | 6.28% |

| Airlines | 14.52% | Consumer Discretionary | 41.51% |

| Commercial Services & Supplies | 3.90% | Consumer Staples | 15.43% |

| Consumer Finance | 4.98% | Financials | 4.98% |

| Entertainment | 5.82% | Industrials | 27.55% |

| Equity Real Estate Investment | 0.77% | Information Technology | 3.48% |

| Food Products | 0.59% | Real Estate | 0.77% |

| Hotels, Restaurants & Leisure | 34.73% | Grand Total | 100.00% |

| Interactive Media & Services | 0.46% | | |

| IT Services | 2.96% | | |

| Leisure Products | 0.43% | | |

| Personal Products | 14.84% | | |

| Road & Rail | 3.70% | | |

| Software | 0.52% | | |

| Specialty Retail | 0.21% | | |

| Textiles, Apparel & Luxury Goo | 6.13% | | |

| Transportation Infrastructure | 3.54% | | |

| Grand Total | 100.00% | | |