As filed with the Securities and Exchange Commission on April 8, 2022

File No. 333-263500

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-14

| |

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | |

| | | |

| | Pre-Effective Amendment No. 1 | X |

| | | |

| | Post-Effective Amendment No. | [ ] |

ALPS ETF Trust

(Exact name of Registrant as Specified in Charter)

1290 Broadway

Suite 1000

Denver, Colorado 80203

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including area code:

(303) 623-2577

Brendan Hamill, Esq.

ALPS Fund Services, Inc. 1290 Broadway Suite 1000 Denver, Colorado 80203 | Adam T. Teufel, Esq. Dechert LLP 1900 K Street, N.W. Washington, D.C. 20006 |

| (Name and Address of Agent for Service) |

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until such date as the Commission, acting pursuant to said Section 8(a), may determine that the Registration Statement shall become effective.

No filing fee is required because an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended.

Title of Securities Being Registered: ALPS | O’Shares U.S. Quality Dividend ETF, ALPS | O’Shares U.S. Small-Cap Quality Dividend ETF, ALPS | O’Shares Global Internet Giants ETF, ALPS | O’Shares Europe Quality Dividend ETF.

OSI ETF TRUST

O’Shares U.S. Quality Dividend ETF

O’Shares U.S. Small-Cap Quality Dividend ETF

O’Shares Global Internet Giants ETF

O’Shares Europe Quality Dividend ETF

75 State Street, Suite 100

Boston, Massachusetts 02109

(617) 855-7670

April 13, 2022

Dear Shareholder:

On behalf of the Board of Trustees of OSI ETF Trust (the “OSI ETF Board”), I am pleased to invite you to a special meeting of shareholders of the O’Shares U.S. Quality Dividend ETF, O’Shares U.S. Small-Cap Quality Dividend ETF, O’Shares Global Internet Giants ETF, and O’Shares Europe Quality Dividend ETF, each a series of OSI ETF Trust (each, an “OSI ETF” and, collectively, the “OSI ETFs”), to ask you to vote on important proposals. The special meeting will be held virtually on May 18, 2022 at 11:00 a.m. Eastern time (with any adjournments or postponements thereof, the “Meeting”).

At the Meeting, shareholders of each OSI ETF will be asked to vote on:

| (i) | an Agreement and Plan of Reorganization providing for the reorganization of each OSI ETF with and into its corresponding series of ALPS ETF Trust that was newly created specifically for such reorganization (the “Proposal”); and |

| (ii) | such other business as may properly come before the Meeting. |

After careful consideration, the OSI ETF Board unanimously approved the Agreement and Plan of Reorganization and authorized the solicitation of proxies on the Proposal. The OSI ETF Board recommends that you vote FOR the Proposal. On behalf of the OSI ETF Board, I ask you to review the Proposal and vote. For more information about the Proposal requiring your vote, please refer to the accompanying Proxy Statement/Prospectus.

No matter how many shares you own, your timely vote is important. We hope you will respond today to ensure your shares will be represented at the Meeting. You may use one of the methods below by following the information on your proxy card:

| | • | by touch-tone telephone; |

| | • | by internet; |

| | • | by returning the enclosed proxy card in the postage paid envelope; or |

| | • | by participating in and voting at the Meeting on the internet by virtual means. |

Thank you in advance for your participation in this important event.

If you have any questions regarding the Proxy Statement/Prospectus, please call 1-800-622-1569.

| | Sincerely, |

| | |

| | /s/ Connor O’Brien |

| | Connor O’Brien |

| | Trustee |

| | OSI ETF Trust |

OSI ETF TRUST

75 State Street, Suite 100

Boston, Massachusetts 02109

(617) 855-7670

NOTICE OF A SPECIAL MEETING OF SHAREHOLDERS

To be held on May 18, 2022

Dear Shareholders:

Notice is hereby given that a special meeting of shareholders of O’Shares U.S. Quality Dividend ETF, O’Shares U.S. Small-Cap Quality Dividend ETF, O’Shares Global Internet Giants ETF, and O’Shares Europe Quality Dividend ETF, each a series of OSI ETF Trust (each, an “OSI ETF” or “Target Fund” and, collectively, the “OSI ETFs” or the “Target Funds”), which will be held virtually on May 18, 2022 at 11:00 a.m. Eastern time (with any adjournments or postponements thereof, the “Meeting”).

The purpose of the Meeting is for shareholders of each OSI ETF to consider and act upon the following proposal for each of the OSI ETFs (the “Proposal”).

| | 1. | To approve an Agreement and Plan of Reorganization providing for: |

| | 1(a). | The reorganization of O’Shares U.S. Quality Dividend ETF into ALPS | O’Shares U.S. Quality Dividend ETF; |

| | 1(b). | The reorganization of O’Shares U.S. Small-Cap Quality Dividend ETF into ALPS | O’Shares U.S. Small-Cap Quality Dividend ETF; |

| | 1(c). | The reorganization of O’Shares Global Internet Giants ETF into ALPS | O’Shares Global Internet Giants ETF; and |

| | 1(d). | The reorganization of O’Shares Europe Quality Dividend ETF into ALPS | O’Shares Europe Quality Dividend ETF (each, a “Reorganization”). |

| | 2. | To transact such other business as may properly come before the Meeting. |

Each Reorganization provides for the acquisition of the assets and assumption of the liabilities of the Target Fund by its corresponding series of ALPS ETF Trust, as listed above (each, an “Acquiring Fund” and, collectively, the “Acquiring Funds”), in exchange for shares of the Acquiring Fund (except with respect to cash received in lieu of fractional shares, if any), followed by the complete liquidation of the Target Fund. If a Reorganization takes place, shareholders of each OSI ETF will become shareholders of the corresponding Acquiring Fund.

Shareholders of each OSI ETF will vote separately on the Proposal as it relates to the OSI ETF. The Proposal will be effected for an OSI ETF only if approved by shareholders of such OSI ETF. Approval of the Proposal by shareholders of an OSI ETF is not contingent on the approval of the Proposal by shareholders of any other OSI ETF. The accompanying Proxy Statement/Prospectus describes the Proposal in more detail and provides certain comparative information pertaining to each Target Fund and its corresponding Acquiring Fund for your evaluation.

Due to the public health impact of the coronavirus pandemic (COVID-19), and to support the health and well-being of our shareholders, the Meeting will be held in a virtual-only format via a web-based portal. To participate in and/or vote at the Meeting, shareholders of the Target Funds must submit the necessary credentials and use the conference line number provided to them by AST Fund Solutions, LLC (“AST”) as described further below. Shareholders may vote during the Meeting by following the instructions available on the Meeting website during the Meeting. Shareholders will not be able to attend the Meeting in person.

If, as of March 24, 2022, you were a shareholder of a Target Fund and wish to participate in and vote at the Meeting, please register by sending an email to attendameeting@astfinancial.com and provide your full name and address in order to receive the virtual meeting access information and use “OSI ETF Virtual Meeting” in the email subject line. AST will email you back with your credentials to attend and instructions to vote at the Meeting. However, for administrative and tabulation efficiency we are encouraging all shareholders to vote their shares prior to the Meeting. All requests to participate in and/or vote at the Meeting must be received by AST no later than 12:00 p.m. Eastern time on May 17, 2022.

If, as of March 24, 2022, you held Target Fund shares through an intermediary (such as a broker-dealer) and wish to participate in and vote at the Meeting, you will need to obtain a legal proxy from your intermediary reflecting the Target Fund’s name, the number of Target Fund shares held and your name and email address. You may forward an email from your intermediary containing the legal proxy or attach an image of the legal proxy to an email and send it to AST at attendameeting@astfinancial.com with “Legal Proxy” in the subject line. You will then be provided with credentials to participate in the Meeting, as well as a unique control number to vote your shares. If you would like to participate in, but NOT vote at, the Meeting, please send an email to AST at attendameeting@astfinancial.com with proof of ownership of Target Fund shares. A statement, letter or the Vote Instruction Form from your intermediary will be sufficient proof of ownership. You will then be provided credentials to participate in the Meeting. All requests to participate in and/or vote at the Meeting must be received by AST no later than 12:00 p.m. Eastern time on May 17, 2022.

Please contact AST at attendameeting@astfinancial.com with any questions regarding access to the Meeting, and an AST representative will contact you to answer your questions. Whether or not you plan to participate in the Meeting, we urge you to vote and submit your vote in advance of the Meeting.

Whether or not you plan to attend the Meeting, your vote is needed. Attendance at the Meeting will be limited to shareholders of the Target Funds as of the close of business on March 24, 2022. You are entitled to receive notice of, and to vote at, the Meeting and any adjournment of the Meeting, even if you no longer hold shares of a Target Fund. Your vote is important no matter how many shares you own.

Voting is quick and easy. Everything you need is enclosed. You may vote by completing and returning your proxy card in the enclosed postage-paid return envelope, by calling the toll-free telephone number listed on the enclosed proxy card, or by visiting the Internet website listed on the enclosed proxy card. You may receive more than one set of proxy materials if you hold shares in more than one account. Please be sure to vote each proxy card you receive. If we do not hear from you, our proxy solicitor, AST, may contact you. This will ensure that your vote is counted even if you cannot or do not wish to attend the Meeting. If you have any questions about the Proposals or how to vote, you may call AST at 1-800-622-1569 and a representative will assist you.

If you have any questions regarding the enclosed Proxy Statement/Prospectus or need assistance in voting your shares, please contact AST at 1-800-622-1569 Monday through Friday from 9:00 a.m. to 10:00 p.m. Eastern time and Saturday 10:00 a.m. to 6:00 p.m. Eastern Time.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Shareholders to Be Held on May 18, 2022. This Notice of Special Meeting of Shareholders, the Proxy Statement/Prospectus and the form of proxy card(s) are available on the Internet at https://vote.proxyonline.com/oshares/docs/proxy.pdf. On this website, you will be able to access the Notice of Special Meeting of Shareholders, the Proxy Statement/Prospectus, the form of proxy card(s) and any amendments or supplements to the foregoing material that are required to be furnished to shareholders.

After careful consideration and upon recommendation of O’Shares Investment Advisers, LLC, the OSI ETF Board recommends that you cast your vote FOR the Proposal, as described in the accompanying Proxy Statement/Prospectus, as the Proposal relates to the OSI ETF(s) that you own.

| | By Order of the Board of Trustees of OSI ETF Trust |

| | |

| | /s/ Connor O’Brien |

| | Connor O’Brien |

| | Trustee |

| | OSI ETF Trust |

| | April 13, 2022 |

QUESTIONS AND ANSWERS RELATING TO THE PROPOSAL

The following is a summary of certain information contained elsewhere in this Proxy Statement/Prospectus. Shareholders should read the entire Proxy Statement/Prospectus carefully.

This combined Proxy Statement/Prospectus contains information that shareholders of O’Shares U.S. Quality Dividend ETF, O’Shares U.S. Small-Cap Quality Dividend ETF, O’Shares Global Internet Giants ETF, and O’Shares Europe Quality Dividend ETF (each, an “OSI ETF” or “Target Fund” and, collectively, the “OSI ETFs” or “Target Funds”), each a series of OSI ETF Trust, should know before voting on the proposed Agreement and Plan of Reorganization providing for the reorganization of each Target Fund with and into its corresponding Acquiring Fund (as defined below), which is described in more detail herein.

This document is both a Proxy Statement for each of the Target Funds and a Prospectus for each of ALPS | O’Shares U.S. Quality Dividend ETF, ALPS | O’Shares U.S. Small-Cap Quality Dividend ETF, ALPS | O’Shares Global Internet Giants ETF, ALPS | O’Shares Europe Quality Dividend ETF (each, an “Acquiring Fund” and, collectively, the “Acquiring Funds”), each a newly created series of ALPS ETF Trust that was created specifically for the purpose of acquiring the assets and assuming the liabilities of its corresponding Target Fund.

The Target Funds and the Acquiring Funds are referred to collectively as the “Funds” and individually as a “Fund.”

Why is the Meeting being held, and what is being proposed?

On February 23, 2022 the Board of Trustees of OSI ETF Trust (the “OSI ETF Board”) approved an Agreement and Plan of Reorganization (the “Reorganization Agreement”) with ALPS ETF Trust to reorganize each Target Fund with and into its corresponding Acquiring Fund (each, a “Reorganization” and, collectively, the “Reorganizations”), subject to approval by shareholders of each Target Fund. Accordingly, at the special meeting of shareholders to be held on May 18, 2022 (with any postponements or adjournments thereof, the “Meeting”), shareholders of each Target Fund will be asked to consider and approve the Reorganization Agreement that provides for:

| | THE ACQUISITION OF THE ASSETS OF: | BY AND IN EXCHANGE FOR SHARES OF: |

| 1(a) | O’Shares U.S. Quality

Dividend ETF | ALPS | O’Shares U.S. Quality Dividend ETF |

| 1(b) | O’Shares U.S. Small-Cap Quality Dividend ETF | ALPS | O’Shares U.S. Small-Cap Quality Dividend ETF |

| 1(c) | O’Shares Global Internet

Giants ETF | ALPS | O’Shares Global Internet Giants ETF |

| 1(d) | O’Shares Europe Quality

Dividend ETF | ALPS | O’Shares Europe Quality Dividend ETF |

| | (each a series of OSI ETF Trust) 75 State Street Suite 100 Boston, Massachusetts 02109 | (each a series of ALPS ETF Trust) 1290 Broadway Suite 1000 Denver, Colorado 80203 |

(each an open-end management investment company)

Any shareholder who owned shares of a Target Fund as of the close of business on March 24, 2022 (the “Record Date”) will receive notice of the Meeting and will be entitled to vote on the Reorganization Agreement related to such Target Fund at the Meeting. The Reorganization Agreement as it relates to each Target Fund requires approval by shareholders of the Target Fund, and, if approved, the Reorganizations are expected to close on or about May 20, 2022 or such other date as the parties may agree (the “Closing Date”). If a Reorganization is approved by shareholders of a Target Fund, shareholders of the Target Fund will become shareholders of the corresponding Acquiring Fund and the applicable Target Fund will be liquidated. The Board of Trustees of ALPS ETF Trust also approved the Reorganization Agreement.

What is this document and why did you send it to me?

This booklet includes the Proxy Statement/Prospectus and a proxy card or cards. This Proxy Statement/Prospectus is being provided to you by OSI ETF Trust in connection with the solicitation of proxies to vote to approve the Proposal as described in the Proxy Statement/Prospectus. The Proxy Statement/Prospectus concisely sets forth the information about the Proposal that an investor ought to know before voting. Shareholders should consider retaining the Proxy Statement/Prospectus for future reference.

Because you, as a shareholder of one or more Target Funds, are being asked to approve the Reorganization Agreement that will result in a transaction in which you would ultimately hold shares of the corresponding Acquiring Fund(s), this Proxy Statement also serves as a Prospectus for the Acquiring Funds.

It is anticipated that this Proxy Statement/Prospectus will be first mailed to shareholders on or about April 13, 2022.

Who will bear the costs associated with the Meeting?

ALPS Advisors, Inc. (“ALPS Advisors”) and O’Shares Investment Advisers, LLC (“O’Shares”), or their respective affiliates, will bear all costs associated with the Meeting, including, but not limited to, proxy and proxy solicitation costs, printing costs, board fees relating to any special board meetings and legal fees, regardless of whether the Reorganizations are consummated. The Acquiring Funds, the Target Funds and their respective shareholders will not bear any costs associated with the Meeting.

What is the OSI ETF Board’s recommendation?

After careful consideration and upon recommendation of O’Shares, the OSI ETF Board recommends that shareholders of the Target Funds vote for the Proposal, as described in the Proxy Statement/Prospectus.

For a discussion of the considerations of the OSI ETF Board in evaluating this matter, please see the section entitled “Board Considerations.”

What happens if the Proposal is not approved with respect to a Target Fund?

Shareholders of each Target Fund will vote separately on the Proposal as it relates to that Target Fund. If the shareholders of a Target Fund do not approve the Reorganization, then the Reorganization will not be implemented with respect to that Target Fund. In such case, the OSI ETF Board will consider what further actions to take with respect to each Target Fund whose shareholders did not approve the Reorganization.

How will the Reorganizations work?

The Reorganization Agreement provides for: (i) the transfer of all of the assets of each Target Fund to its corresponding Acquiring Fund in exchange for shares of the Acquiring Fund; (ii) the assumption by each Acquiring Fund of the liabilities of its corresponding Target Fund; (iii) the distribution of shares of each Acquiring Fund to its corresponding Target Fund (except with respect to cash received in lieu of fractional shares, if any); and (iv) the subsequent termination, dissolution and complete liquidation of each Target Fund.

If shareholders of a Target Fund approve the Reorganization as it relates to the Target Fund, each owner of shares of such Target Fund would receive shares of such Target Fund’s corresponding Acquiring Fund. If approved, the Reorganizations are expected to be consummated on the Closing Date and each shareholder of a Target Fund will hold, immediately after the close of the Reorganization, shares of the corresponding Acquiring Fund (plus cash in lieu of fractional shares, if any) having an aggregate net asset value equal to the aggregate net asset value of the shares of the Target Fund held by that shareholder as of the close of business on the Closing Date.

What is the purpose of and rationale for the Reorganizations?

On January 4, 2022, O’Shares announced that it has agreed to a strategic transaction with ALPS Advisors having assets under management (AUM) exceeding $8.6 billion in ETFs and total AUM exceeding $17.6 billion. The agreement provides for long-term collaboration between O’Shares and ALPS Advisors. The strategic transaction, which is to be effected through the Reorganizations, is expected to enhance the distribution and growth of the Funds, as ALPS Advisors is a larger ETF organization with greater distribution resources. The Reorganizations are expected to benefit both existing investors in the Target Funds and future investors in the Acquiring Funds. O’Shares will provide the Acquiring Funds use of the Target Funds’ current underlying indexes under license agreements with ALPS Advisors, and O’Shares will provide continued marketing support of the Acquiring Funds following the Reorganizations.

How will the Reorganizations affect me?

If Target Fund shareholders approve the Reorganizations, you will become a shareholder of the Acquiring Fund(s) corresponding to the Target Fund(s) that you own. It is important to note that following the Reorganizations, shareholders of each Target Fund would be subject to the actual fees and expenses of the corresponding Acquiring Fund.

The following table outlines the service providers for the Target Funds and the comparable service providers for the Acquiring Funds.

| | | Target Funds | | Acquiring Funds | |

| Investment Adviser | | O’Shares | | ALPS Advisors | |

| Sub-Adviser | | Vident Investment Advisory, LLC | | None | |

| Index Provider | | O’Shares | | O’Shares | |

| Distributor | | Foreside Fund Services, LLC | | ALPS Portfolio Solutions Distributor, Inc. | |

| Administrator | | J.P. Morgan Chase Bank, N.A. | | ALPS Fund Services, Inc. | |

| Custodian/Transfer Agent | | J.P. Morgan Chase Bank, N.A. | | State Street Bank & Trust Co. | |

| Independent Registered Public Accounting Firm | | BBD, LLP | | BBD, LLP | |

| Legal Counsel | | Stradley Ronon Stevens & Young LLP | | Dechert LLP | |

Are there any significant differences between the investment objectives and strategies of each Target Fund and its corresponding Acquiring Fund?

No. The investment objective of each Target Fund and its corresponding Acquiring Fund are identical, and the investment strategies and policies of each Target Fund and its corresponding Acquiring Fund are not materially different, although there may be differences in how they are described in their respective prospectuses. The principal investment risks of the Target Funds and their corresponding Acquiring Funds are not materially different, although there may be differences in how they are described in their respective prospectuses. Further information comparing the investment objectives, strategies, policies, and risks is included in this Proxy Statement/Prospectus.

Will the portfolio managers of my fund change as a result of the Reorganizations?

Yes. The Target Funds are advised by O’Shares and sub-advised by Vident Investment Advisory, LLC (“Vident”). The Acquiring Funds are advised by ALPS Advisors. Currently, personnel employed by Vident are responsible for the day-to-day portfolio management of each Target Fund. Following the completion of the Reorganizations, the portfolio management teams of the Target Funds will change. Personnel employed by ALPS Advisors will be responsible for the day-to-day management of the Acquiring Funds. Vident will not provide sub-advisory services for the Acquiring Funds.

Would the Reorganizations result in higher management fees or operating expenses for current Target Fund shareholders?

No. Each Acquiring Fund will enter into a “unitary fee” arrangement with ALPS Advisors that is not materially different in structure to the fee arrangements the corresponding Target Fund has entered into with O’Shares. Under the fee arrangements for the Target Funds (the “O’Shares Fee Arrangements”), O’Shares bears all of the ordinary operating expenses of the Target Funds, subject to certain exceptions. Similarly, under the fee arrangements for the Acquiring Funds (the “ALPS Fee Arrangements”), ALPS Advisors bears all of the ordinary operating expenses of the Acquiring Funds, subject to certain exceptions.

ALPS | O’Shares Global Internet Giants ETF and ALPS | O’Shares Europe Quality Dividend ETF will have the same management fee as their corresponding Target Funds. Therefore, ALPS | O’Shares Global Internet Giants ETF and ALPS | O’Shares Europe Quality Dividend ETF are expected to have the same total annual fund operating expense ratios as their corresponding Target Funds.

ALPS | O’Shares U.S. Quality Dividend ETF and ALPS | O’Shares U.S. Small-Cap Quality Dividend ETF will adopt breakpoint fee structures that differ from the fee structures of their corresponding Target Funds, which may benefit shareholders if an Acquiring Fund’s assets increase above certain thresholds thereby resulting in a lower management fee relative to the corresponding Target Fund. Pursuant to these breakpoint fee structures, shareholders of ALPS | O’Shares U.S. Quality Dividend ETF and ALPS | O’Shares U.S. Small-Cap Quality Dividend ETF would pay the same management fee as their corresponding Target Fund until such time as the average daily net assets of the Acquiring Fund increase to reach certain thresholds. Once the average daily net assets of an Acquiring Fund increase to reach the specified thresholds, shareholders of the applicable ALPS | O’Shares U.S. Quality Dividend ETF or ALPS | O’Shares U.S. Small-Cap Quality Dividend ETF would pay lower management fees than their corresponding Target Fund. Accordingly, ALPS | O’Shares U.S. Quality Dividend ETF and ALPS | O’Shares U.S. Small-Cap Quality Dividend ETF are expected to have the same, or possibly lower, total annual fund operating expense ratios as their corresponding Target Funds.

Pro forma fee, expense, and financial information is included in this Proxy Statement/Prospectus in the description of each Proposal.

Who will bear the costs associated with the Reorganizations?

ALPS Advisors and O’Shares, or their respective affiliates, will bear all costs associated with the Reorganizations (exclusive of brokerage commissions and other transaction costs incurred by a Fund, which will be borne by such Fund and, if any, are expected by ALPS Advisors and O’Shares to be immaterial), regardless of whether the Reorganizations are consummated. The Acquiring Funds, the Target Funds and their respective shareholders will not bear any other direct costs arising in connection with the transactions contemplated by the Reorganization Agreement. Shareholders will continue to pay transaction costs associated with normal Target Fund operations, including brokerage or trading expenses, if any.

Are the Reorganizations expected to create a taxable event?

It is anticipated that each Reorganization will qualify for federal income tax purposes as a tax-free reorganization under Section 368(a) of the Internal Revenue Code of 1986, as amended, and each Fund will receive a tax opinion to that effect. Accordingly, pursuant to this treatment, none of the Target Funds, the Acquiring Funds, or their respective shareholders are expected to recognize any gain or loss for federal income tax purposes (except with respect to cash received in lieu of fractional shares, if any) from the transactions contemplated by the Reorganization Agreements. You may wish to consult your own tax adviser regarding the tax consequences of the Reorganizations in light of your individual circumstances.

Will my cost basis or holding period change as a result of the Reorganizations?

No, your total cost basis and holding period are not expected to change as a result of the Reorganizations (except as adjusted for amounts allocable to cash received in lieu of any fractional shares).

Will the Reorganization affect my ability to buy and sell shares?

No. You may continue to make additional purchases or sales of the Target Funds’ shares. Any purchase or sales of Fund shares after the Reorganizations will be purchases or sales of the applicable Acquiring Fund. If the Reorganizations are approved, your Target Fund shares will automatically be converted to corresponding Acquiring Fund shares. You will receive confirmation of this transaction following the Reorganizations.

How many votes am I entitled to cast?

You are entitled to one vote for each Target Fund share held in your name or on your behalf on the Record Date. Shareholders of record of the Target Funds at the close of business on the Record Date will receive notice of and be asked to vote on the Reorganization Agreement that corresponds to such Target Fund shares held.

If I vote my proxy now as requested, can I change my vote later?

You may revoke a proxy once it is given. If you desire to revoke a proxy, you must submit a subsequent, duly executed and later-dated proxy or a written notice of revocation to AST Fund Solutions, at 55 Challenger Road, Suite 200, Ridgefield Park, NJ 07660. Notice of revocation must be received prior to 12:00 p.m. Eastern time on May 16, 2022. You may also give written notice of revocation at the Meeting. Even if you plan to attend the Meeting, we ask that you return the enclosed proxy card or vote by telephone or the Internet. This will help us to ensure that an adequate number of shares are present at the Meeting for consideration of the Reorganizations. All properly executed proxies received in time for the Meeting will be voted as specified in the proxy, or, if no specification is made, FOR the Proposal.

What is the required vote to approve the Reorganizations?

Approval of each Reorganization will require the affirmative vote of a “majority of the outstanding voting securities” for each Target Fund within the meaning of the Investment Company Act of 1940, as amended. This means the lesser of (1) 67% or more of the Target Fund shares present at the Meeting if the holders of more than 50% of the outstanding Target Fund shares are present or represented by proxy, or (2) more than 50% of the outstanding shares of the Target Fund.

How do I vote?

You can vote in one of four ways:

| | ● | By telephone (call the toll free number listed on your proxy card or cards); |

| | ● | By Internet (log on to the website listed on your proxy card or cards); |

| | ● | By mail (using the enclosed postage prepaid envelope); or |

| | ● | In person at the shareholder meeting scheduled to occur virtually on May 18, 2022, at 11:00 a.m. Eastern time. |

If, as of March 24, 2022, you were a shareholder of a Target Fund and wish to participate in and vote at the Meeting, please register by sending an email to attendameeting@astfinancial.com and provide your full name and address in order to receive the virtual meeting access information and use “OSI ETF Virtual Meeting” in the email subject line. AST will email you back with your credentials to attend and instructions to vote at the Meeting. However, for administrative and tabulation efficiency we are encouraging all shareholders to vote their shares prior to the Meeting. All requests to participate in and/or vote at the Meeting must be received by AST no later than 12:00 p.m. Eastern time on May 17, 2022.

We encourage you to vote as soon as possible so we can reach the needed quorum for the vote and avoid the cost of additional solicitation efforts. Please refer to the enclosed proxy card(s) for instructions for voting by telephone, Internet or mail.

Whom should I call if I have questions?

If you have questions about the Proposal described in the Proxy Statement/Prospectus, please call AST, the proxy solicitor, toll free at 1-800-622-1569. If you have any questions about voting procedures, please call the number listed on your proxy card(s). Representatives will be available Monday through Friday from 9:00 a.m. to 10:00 p.m. Eastern time and Saturday 10:00 a.m. to 6:00 p.m. Eastern Time.

COMBINED PROXY STATEMENT/PROSPECTUS

APRIL 13, 2022

| PROXY STATEMENT OF | | PROSPECTUS OF |

| | | |

| OSI ETF TRUST | | ALPS ETF TRUST |

| | | |

O’Shares U.S. Quality Dividend ETF O’Shares U.S. Small-Cap Quality Dividend ETF O’Shares Global Internet Giants ETF O’Shares Europe Quality Dividend ETF | AND | ALPS | O’Shares U.S. Quality Dividend ETF ALPS | O’Shares U.S. Small-Cap Quality Dividend ETF ALPS | O’Shares Global Internet Giants ETF ALPS | O’Shares Europe Quality Dividend ETF |

| | | |

75 State Street, Suite 100 Boston, Massachusetts 02109 (617) 855-7670 https://oshares.com | | 1290 Broadway, Suite 1000 Denver, Colorado 80203 (303) 623-2577 https://www.alpsfunds.com |

PROXY STATEMENT/PROSPECTUS

Special Meeting of Shareholders

To be held on May 18, 2022

This Proxy Statement/Prospectus, dated April 13, 2022, is being furnished to shareholders of O’Shares U.S. Quality Dividend ETF, O’Shares U.S. Small-Cap Quality Dividend ETF, O’Shares Global Internet Giants ETF, and O’Shares Europe Quality Dividend ETF, each a series of OSI ETF Trust (each, an “OSI ETF” or “Target Fund” and, collectively, the “OSI ETFs” or “Target Funds”), in connection with the solicitation by the Board of Trustees of OSI ETF Trust of proxies to be used at a special meeting of the Target Funds, which will be held virtually on May 18, 2022, at 11:00 a.m. Eastern time (with any adjournments or postponements thereof, the “Meeting”).

You will not be able to attend the Meeting in person. All references herein to attending the Meeting or voting "in person" mean in person by means of virtual format rather than by physical presence.

At the Meeting, shareholders of each Target Fund will be asked to consider and vote separately on the following proposal (the “Proposal”):

| | 1. | To approve an Agreement and Plan of Reorganization providing for: |

| | 1(a). | The reorganization of O’Shares U.S. Quality Dividend ETF into ALPS | O’Shares U.S. Quality Dividend ETF; |

| | 1(b). | The reorganization of O’Shares U.S. Small-Cap Quality Dividend ETF into ALPS | O’Shares U.S. Small-Cap Quality Dividend ETF; |

| | 1(c). | The reorganization of O’Shares Global Internet Giants ETF into ALPS | O’Shares Global Internet Giants ETF; and |

| | 1(d). | The reorganization of O’Shares Europe Quality Dividend ETF into ALPS | O’Shares Europe Quality Dividend ETF (each, a “Reorganization”). |

| | 2. | To transact such other business as may properly come before the Meeting. |

This Proxy Statement/Prospectus explains concisely what you should know before voting on the matters described herein or investing in the ALPS | O’Shares U.S. Quality Dividend ETF, ALPS | O’Shares U.S. Small-Cap Quality Dividend ETF, ALPS | O’Shares Global Internet Giants ETF, and ALPS | O’Shares Europe Quality Dividend ETF (each, an “Acquiring Fund” and, collectively, the “Acquiring Funds”). Please read it carefully and keep it for future reference.

After careful consideration, and upon recommendation of O’Shares, the Board of Trustees of OSI ETF Trust recommends that you cast your vote FOR the Proposal, as described in this Proxy Statement/Prospectus, as it relates to the Target Fund(s) that you own.

The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

TO OBTAIN MORE INFORMATION

To obtain more information on the Target Funds or the Acquiring Funds (each, a “Fund” and, collectively, the “Funds”), please write or call or visit www.alpsfunds.com for a free copy of the current prospectus, statement of additional information, annual/semi-annual shareholder reports (for the Target Funds) or other information.

| | Target Funds OSI ETF Trust c/o Foreside Fund Services, LLC Three Canal Plaza Portland, Maine 04101 855-637-5383 | Acquiring Funds ALPS ETF Trust c/o ALPS Portfolio Solutions Distributor, Inc.

1290 Broadway

Suite 1000

Denver, Colorado 80203

866-759-5679 |

The following documents containing additional information about the Funds, each having been filed with the U.S. Securities and Exchange Commission (“SEC”), are incorporated by reference into this Proxy Statement/Prospectus:

| | ● | The Prospectus of the Target Funds, dated October 31, 2021, as supplemented (Accession Number 0001387131-21-010490); |

| | ● | The Prospectus of the Acquiring Funds, dated April 7, 2022 (Accession Number 0001398344-22-007108); |

| | ● | The Statement of Additional Information of the Target Funds, dated October 31, 2021 (Accession Number 0001387131-21-010490); |

| | ● | The Statement of Additional Information of the Acquiring Funds, dated April 7, 2022 (Accession Number 0001398344-22-007108); |

| | ● | The Statement of Additional Information dated April 13, 2022 related to this Proxy Statement/Prospectus; |

| | ● | The Annual Report to shareholders of the Target Funds for the fiscal year ended June 30, 2021 (Accession Number 0001387131-21-009207); and |

| | ● | The Semi-Annual Report to shareholders of the Target Funds for the fiscal period ended December 31, 2021 (Accession Number 0001387131-22-002861). |

The Funds are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended (“1940 Act”), and the rules, regulations and exemptive orders, thereunder, and in accordance therewith, file reports and other information including proxy materials with the SEC.

You also may view or obtain these documents from the SEC:

| In Person: | U.S. Securities and Exchange Commission Public Reference Section 100 F Street, N.E. Washington, D.C. 20549 (202) 551-8090 |

| | |

| By Mail: | U.S. Securities and Exchange Commission Public Reference Section 100 F Street, N.E. Washington, D.C. 20549 (Duplication Fee Required) |

| | |

| By Email: | publicinfo@sec.gov (Duplication Fee Required) |

| | |

| By Internet: | www.sec.gov |

The Board of Trustees of OSI ETF Trust knows of no business other than that discussed above that will be presented for consideration at the Meeting. If any other matter is properly presented, it is the intention of the persons named in the enclosed proxy card(s) to vote in accordance with their best judgment.

No person has been authorized to give any information or make any representation not contained in this Proxy Statement/Prospectus and, if so given or made, such information or representation must not be relied upon as having been authorized. This Proxy Statement/Prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which, or to any person to whom, it is unlawful to make such offer or solicitation.

TABLE OF CONTENTS

| PROPOSAL — APPROVAL OF THE REORGANIZATION AGREEMENT | 1 |

| | Proposal 1(a) | Approval of the Reorganization Agreement providing for the Reorganization of O’Shares U.S. Quality Dividend ETF into ALPS | O’Shares U.S. Quality Dividend ETF | 3 |

| | Proposal 1(b) | Approval of the Reorganization Agreement providing for the Reorganization of O’Shares U.S. Small-Cap Quality Dividend ETF into ALPS | O’Shares U.S. Small-Cap Quality Dividend ETF | 11 |

| | Proposal 1(c) | Approval of the Reorganization Agreement providing for the Reorganization of O’Shares Global Internet Giants ETF into ALPS | O’Shares Global Internet Giants ETF | 19 |

| | Proposal 1(d) | Approval of the Reorganization Agreement providing for the Reorganization of O’Shares Europe Quality Dividend ETF into ALPS | O’Shares Europe Quality Dividend ETF | 28 |

| Additional Information Regarding the Proposal | 36 |

| GENERAL INFORMATION ABOUT THE PROXY STATEMENT/PROSPECTUS | 45 |

| APPENDIX A - FORM OF AGREEMENT AND PLAN OF REORGANIZATION | A-1 |

| APPENDIX B - ADDITIONAL INFORMATION ABOUT THE ACQUIRING FUNDS | B-1 |

| APPENDIX C - SERVICE PROVIDERS | C-1 |

| APPENDIX D - PRINCIPAL RISKS FOR THE TARGET FUNDS | D-1 |

| APPENDIX E - SECURITY OWNERSHIP OF CERTAIN BENEFICIAL AND RECORD OWNERS | E-1 |

| APPENDIX F - INVESTMENT RESTRICTIONS | F-1 |

| PART B - ALPS ETF TRUST STATEMENT OF ADDITIONAL INFORMATION | 1 |

| PART C - OTHER INFORMATION | 1 |

PROPOSAL — APPROVAL OF THE REORGANIZATION AGREEMENT

Background

The Target Funds are series of OSI ETF Trust, a Delaware statutory trust. O’Shares Investment Advisers, LLC (“O’Shares”) is the investment adviser to each Target Fund and Vident Investment Advisory, LLC (“Vident”) is the sub-adviser to each Target Fund. The Acquiring Funds are series of ALPS ETF Trust, a Delaware statutory trust. ALPS Advisors, Inc. (“ALPS Advisors”) is the investment adviser to each Acquiring Fund. Each Acquiring Fund is a newly created series of ALPS ETF Trust that was created specifically for the purpose of acquiring the assets and assuming the liabilities of its corresponding Target Fund. The Acquiring Funds will not commence operations until the date the applicable Reorganization is effected.

As further discussed below, each Acquiring Fund has an identical investment objective as its corresponding Target Fund and will operate pursuant to investment strategies and policies and be subject to principal investment risks that are not materially different from its corresponding Target Fund. The portfolio management team for the Acquiring Funds is different than the portfolio management team for the Target Funds. Personnel employed by ALPS Advisors will be responsible for the day-to-day management of the Acquiring Funds. Each Acquiring Fund will track the same underlying index as its corresponding Target Fund.

It is anticipated that, upon the closing of each Reorganization, the total annual fund operating expenses of an Acquiring Fund will be equal to those of its corresponding Target Fund.

The Board of Trustees of OSI ETF Trust (“OSI ETF Board”) considered and approved, and recommends that shareholders of the Target Funds approve (i.e., vote FOR), the Reorganizations. The 1940 Act requires that each Reorganization be approved by a “vote of a majority of the outstanding voting securities” (as defined in the 1940 Act) of each applicable Target Fund for the Reorganization to be effected.

The Reorganizations

The OSI ETF Board, including the trustees who are not “interested persons” (as that term is defined in Section 2(a)(19) the 1940 Act) of OSI ETF Trust (“OSI ETF Independent Trustees”), has unanimously approved each Reorganization and recommends that shareholders vote FOR the Proposal. Subject to approval by shareholders of the applicable Target Fund, the Agreement and Plan of Reorganization (“Reorganization Agreement”) provides for:

| ● | the transfer of all of the assets of each Target Fund to its corresponding Acquiring Fund in exchange for shares of the Acquiring Fund; |

| ● | the assumption by each Acquiring Fund of the liabilities of its corresponding Target Fund; |

| ● | the distribution of shares of each Acquiring Fund to the shareholders of its corresponding Target Fund (except with respect to cash received in lieu of fractional shares, if any); and |

| ● | the complete liquidation of each Target Fund. |

If shareholders of a Target Fund approve a Reorganization, it is currently expected to take place on or about May 20, 2022.

You will not incur fees or charges of any kind in connection with a Reorganization (i.e., front-end sales charges, contingent deferred sales charges or exchange or redemption fees).

Tax Considerations

Each Reorganization is expected to qualify as tax-free for U.S. federal income tax purposes. Accordingly, it is expected that Target Fund shareholders will not, and each Target Fund generally will not, recognize any gain or loss as a result of a Reorganization for U.S. federal income tax purposes (except with respect to cash received in lieu of fractional shares, if any). Each Target Fund anticipates receiving a legal opinion as to this and other expected U.S. federal income tax consequences of the Reorganization. It is possible that the Internal Revenue Service (“IRS”) or a court could disagree with this legal opinion and determine that a Reorganization does not qualify as a tax-free reorganization, and is thus taxable and the Target Funds and Target Fund shareholders, if any, would recognize gain or loss on the Reorganization. The Target Funds will be the accounting survivors of the Reorganizations.

Reasons for the Reorganizations

On January 4, 2022, O’Shares announced that it has agreed to a strategic transaction with ALPS Advisors having assets under management (AUM) exceeding $8.6 billion in ETFs and total AUM exceeding $17.6 billion. The agreement provides for long-term collaboration between O’Shares and ALPS Advisors. The strategic transaction, which is to be effected through the Reorganizations, is expected to enhance the distribution and growth of the Funds, as ALPS Advisors is a larger ETF organization with greater distribution resources. The Reorganizations are expected to benefit both existing investors in the Target Funds and future investors in the Acquiring Funds. O’Shares will provide the Acquiring Funds use of the Target Funds’ current underlying indexes under license agreements with ALPS Advisors, and O’Shares will provide continued marketing support of the Acquiring Funds following the Reorganizations.

Board Considerations

The OSI ETF Board considered the Reorganizations at a meeting held on February 15, 2022 and reconvened on February 23, 2022 (the “February Meeting”). In advance of the February Meeting, the OSI ETF Board received, among other materials, ALPS Advisors’ responses to questions posed by the OSI ETF Board in performing due diligence on the Acquiring Funds, ALPS Advisors and other proposed service providers to the Acquiring Funds, a detailed summary of the terms of the purchase agreement between O’Shares, ALPS Advisors, and their respective affiliates related to the strategic transaction between such entities (the “Transaction”), and a draft of the Acquiring Funds’ registration statement. In connection with the February Meeting, the OSI ETF Board met with representatives of O’Shares, ALPS Advisors and the ALPS ETF Board to discuss the Reorganizations. Throughout the process, the OSI ETF Board was advised by experienced counsel that is independent of O’Shares, ALPS Advisors and their affiliates.

Based in part upon the recommendation of O’Shares, the OSI ETF Board’s evaluation of the relevant information provided by O’Shares and ALPS Advisors, discussions with representatives of O’Shares, ALPS Advisors and the ALPS ETF Board, and in light of its fiduciary duties under federal and state law, the OSI ETF Board, including all of the trustees who are not “interested persons” of the OSI ETF Trust under the 1940 Act, determined with respect to each Target Fund, that the Reorganization would be in the best interests of the Target Fund and that the interests of Target Fund shareholders would not be diluted as a result of the Reorganization. In determining to approve the Reorganization Agreement, and to recommend that shareholders of each Target Fund approve the Reorganization Agreement, the OSI ETF Board received information and made inquiries into all matters it deemed appropriate. The OSI ETF Board reviewed and analyzed various factors it deemed relevant, including the following factors, among others, none of which by itself was considered dispositive:

The Terms and Conditions of the Reorganizations. The OSI ETF Board considered: (i) the terms of the Reorganization Agreement, and, in particular, that the transfer of assets of each Target Fund would be in exchange for shares of the corresponding Acquiring Fund and the Acquiring Fund’s assumption of all liabilities in the Target Fund; (ii) that no sales charges would be imposed in connection with the Reorganizations; and (iii) that pursuant to the Reorganization Agreement, shareholders of each Target Fund would receive the same number of shares of the corresponding Acquiring Fund with the same aggregate NAV as the shares of the Target Fund they owned immediately prior to the Reorganization (except with respect to cash received in lieu of fractional shares, if any). As a result, the OSI ETF Board noted that the interests of Target Fund shareholders would not be diluted as a result of the Reorganizations. The OSI ETF Board also considered that the Reorganizations would be submitted to the Target Funds’ shareholders for approval.

Investment Objectives, Policies and Limitations. The OSI ETF Board considered that each Acquiring Fund would be managed in accordance with the same investment objective, and subject to substantially the same investment strategies, policies, and limitations, as the corresponding Target Fund immediately prior to its Reorganization. The OSI ETF Board considered that O’Shares, which provides and maintains the Target Funds’ underlying indices, is expected to provide and maintain the same underlying indices for the Acquiring Funds after the Reorganizations. In addition, the OSI ETF Board considered that each Acquiring Fund will have the same ticker symbol and trade on the same exchange as its corresponding Target Fund.

Change in Investment Adviser, Portfolio Management and Board. The OSI ETF Board considered that while O’Shares and Vident served as investment adviser and sub-adviser, respectively, of the Target Funds, ALPS Advisors would serve as the investment adviser of the Acquiring Funds with no sub-adviser. The OSI ETF Board considered representations from O’Shares and ALPS Advisors that ALPS Advisors and the proposed portfolio managers of ALPS Advisors have sufficient experience and capacity to service the Acquiring Funds at a level consistent with what is currently provided to the Target Funds, and that there would be no need for a sub-adviser. The OSI ETF Board also considered and evaluated the qualifications and experience of the ALPS ETF Board, including meeting with representatives of the ALPS ETF Board.

Potential Conflicts of Interest. The OSI ETF Board considered that O’Shares faced certain conflicts of interest in recommending OSI ETF Board approval of the Reorganizations, including that O’Shares would be compensated upon the successful completion of the Transaction, pursuant to the terms of the purchase agreement. Additionally, the OSI ETF Board considered other financial benefits that O’Shares would receive from approval of the Reorganizations, including acting as the index provider to the Acquiring Funds and providing continued marketing support. The OSI ETF Board further considered that the purchase agreement provided that the Reorganizations would meet the requirements of Section 15(f) of the 1940 Act, including that no “unfair burden” (as defined therein) would be imposed on the Funds, and that at least 75% of the ALPS ETF Board would be independent of both ALPS and O’Shares for a period of three years after completion of the Reorganizations.

Relative Expense Ratios. The OSI ETF Board reviewed information regarding the comparative expense ratios of the Target Funds and the Acquiring Funds. The OSI ETF Board considered the fact that the management fee and total annual fund operating expenses of each Acquiring Fund are expected to be the same as the management fee and total annual fund operating expenses of each corresponding Target Fund after its Reorganization. The OSI ETF Board considered that under the unified fee structure for the Target Funds and the unified fee structure of the Acquiring Funds, O’Shares does bear, and ALPS Advisors would bear, the ordinary operating expenses of the Funds. The OSI ETF Board also considered that ALPS Advisors would be implementing breakpoints for certain Acquiring Funds.

Distribution and Shareholder Servicing. The OSI ETF Board considered the distribution capabilities of ALPS Advisors and its affiliates and their commitment to distributing the Acquiring Funds. The OSI ETF Board considered ALPS Advisors’ representation that the Reorganizations would provide the Target Funds with the potential for accelerated asset growth as the Reorganizations may provide an opportunity for the Acquiring Funds to become investment options on additional distribution platforms. The OSI ETF Board considered that such asset growth may result in greater trading volumes and narrower bid-ask spreads in the Acquiring Funds’ shares than the Target Funds’ shares experience, and the potential for additional breakpoints should circumstances warrant, which would benefit shareholders. The OSI ETF Board recognized that the Acquiring Funds’ shares would be distributed by ALPS Portfolio Solutions Distributor, Inc. The OSI ETF Board further considered that each Target Fund has adopted a 12b-1 Plan pursuant to Rule 12b-1 under the 1940 Act, and that, the ALPS ETF Trust has not adopted a 12b-1 Plan and would not adopt one for the Acquiring Funds. The OSI ETF Board further considered that no Rule 12b-1 fees have ever been paid by any Target Funds and there were no plans to impose such fees.

Alternative to the Reorganizations. The OSI ETF Board considered various alternatives to the Reorganizations, including the potential for the Target Funds to continue to operate as O’Shares-sponsored series of the OSI ETF Trust. The OSI ETF Board recognized O’Shares’ determination that becoming series of ALPS ETF Trust was the best alternative to improve the distribution for the Funds, which would only provide potential benefits for Fund shareholders if the Reorganizations were completed.

The Experience, Expertise and Fiduciary Duties of ALPS Advisors. The OSI ETF Board considered that ALPS Advisors is a registered investment adviser and is an indirect wholly owned subsidiary of SS&C Technologies Holdings, Inc. ALPS Advisors commenced business operations in 2006 and currently serves as investment adviser to all of the series of the ALPS ETF Trust, other mutual funds, closed-end funds and variable insurance trusts, as well as sub-adviser of two registered investment companies. As of December 31, 2021, ALPS Advisors had over $17.3 billion assets under management.

Tax Consequences. The OSI ETF Board considered that the Reorganizations are expected to be free from adverse federal income tax consequences for each Target Fund, each Target Fund’s shareholders, and each Acquiring Fund and that a tax opinion to these effects from Dechert LLP would be delivered in connection with Reorganizations.

Expenses Relating to Reorganizations. The OSI ETF Board considered that O’Shares and ALPS Advisors would pay the fees and expenses related to the Reorganizations, including the costs associated with the drafting, printing, and mailing of the Proxy Statement/Prospectus, the solicitation of proxies, the special meeting of shareholders to approve the Reorganizations, and tail insurance for the OSI ETF Trust’s officers and trustees. In this respect, the OSI ETF Board considered that the Target Funds and their shareholders would not incur any expenses in connection with the Reorganizations.

Other Potential Benefits of the Reorganizations. With respect to each Target Fund, the OSI ETF Board concluded that the Reorganization would be in the best interests of the Target Fund and that the Target Fund’s shareholders would not be diluted as a result of the Reorganization. These determinations were made on the basis of the business judgment of the OSI ETF Board after consideration of all of the factors taken as a whole, though individual members of the OSI ETF Board may have placed different weight on various factors and assigned different degrees of materiality to various conclusions.

Shareholders of the Target Funds also may wish to take these factors into consideration when determining whether to vote FOR each Reorganization.

OSI ETF Board Recommendation

After careful consideration, the OSI ETF Board recommends that you vote FOR each Reorganization.

The following is a comparison of certain features of each Target Fund and its corresponding Acquiring Fund, including, among other things, each Fund’s investment objective, fees and expenses, principal investment strategies, principal risks and performance.

Proposal 1(a) Approval of the Reorganization Agreement providing for the Reorganization of O’Shares U.S. Quality Dividend ETF into ALPS | O’Shares U.S. Quality Dividend ETF

Comparison of Investment Objectives

As shown in the chart that follows, O’Shares U.S. Quality Dividend ETF and ALPS | O’Shares U.S. Quality Dividend ETF have identical investment objectives.

| | | Target Fund | | Acquiring Fund |

| Investment Objective | | The Fund seeks to track the performance (before fees and expenses) of the O’Shares U.S. Quality Dividend Index. | | The Fund seeks to track the performance (before fees and expenses) of the O’Shares U.S. Quality Dividend Index. |

Each Fund’s investment objective may be changed by a vote of its board of trustees, without shareholder approval. Each Fund has adopted a policy that requires the Fund to provide shareholders with at least 60 days’ notice before changing the Fund’s investment objective.

Comparison of Fees and Expenses

The following tables describe the fees and expenses that you may pay if you buy and hold shares of the Funds. The annual fund operating expense ratio for the Target Fund is based on the fees and expenses incurred by the Target Fund during its fiscal year ended June 30, 2021. Pro forma fees and expenses of the Acquiring Fund are the estimated and hypothetical fees and expenses of the ALPS | O’Shares U.S. Quality Dividend ETF after giving effect to the Reorganization.

Shares of each Fund are not subject to sales charges, redemption fees or exchange fees.

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| | | Target Fund | | Acquiring Fund Pro Forma |

| Management Fees | | 0.48% | | 0.48% |

| Distribution and/or Service (12b-1) Fees | | 0.00% | | 0.00% |

| Other Expenses | | 0.00% | | 0.00% |

| Total Annual Fund Operating Expenses | | 0.48% | | 0.48% |

Expense Example

The following example is intended to help you compare the cost of investing in the Target Fund and the Acquiring Fund with the costs of investing in other funds. The example assumes that you invest $10,000 in each Fund for the time periods indicated and then hold or redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that each Fund’s operating expenses remain the same each year.

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

| Target Fund | | $49 | | $154 | | $269 | | $604 |

| Acquiring Fund (Pro Forma) | | $49 | | $154 | | $269 | | $604 |

Comparison of Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when a Fund’s shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect each Fund’s performance. During the most recent fiscal year ended June 30, 2021, the Target Fund’s portfolio turnover rate was 26% of the average value of its portfolio. Because the Acquiring Fund is newly organized, there is no portfolio turnover to report.

Comparison of Principal Investment Strategies

There are no material differences between the principal investment strategies of the Funds, though the Funds may use different terminology to describe their investment strategies. Each Fund seeks investment results that replicate as closely as possible, before fees and expenses, the performance of the O’Shares U.S. Quality Dividend Index (the “Underlying Index”). The Underlying Index is designed to measure the performance of publicly-listed large-capitalization and mid-capitalization dividend-paying issuers in the United States that meet certain market capitalization, liquidity, high quality, low volatility and dividend yield thresholds, as determined by O’Shares Investment Advisers, LLC (the “Index Provider”). The high quality and low volatility requirements are designed to reduce exposure to high dividend equities that have experienced large price declines.

The constituents of the Underlying Index are selected from the S-Network US Equity Large-Cap 500 Index. As of June 30, 2021, the Underlying Index consisted of 100 securities.

The Underlying Index is constructed using a proprietary, rules-based methodology designed to select equity securities from the S-Network US Equity Large-Cap 500 Index that have exposure to the following four factors: 1) quality, 2) low volatility, 3) dividend yield and 4) dividend quality. The “quality” factor is calculated by combining measures of profitability and leverage with the objective of identifying companies with strong profitability and balance sheets. The “low volatility” factor measures the risk of price moves for a security with the objective of reducing allocations to riskier companies. The “dividend yield” factor measures the income generated by an investment with the objective of identifying companies with higher dividend yields. The “dividend quality” factor measures the income available to a company to pay dividends to common shareholders together with the growth of a company’s dividends over time, with the objective of identifying companies with less risk of dividend cuts or suspensions.

Each company in the S-Network US Equity Large-Cap 500 Index is weighted based on: (i) the company’s market capitalization weight in the S-Network US Equity Large-Cap 500 Index, as adjusted by (ii) the quality, low volatility, dividend yield and dividend quality factors, with the quality and low volatility factors receiving greater emphasis. The inclusion of each company is then subject to certain constraints (e.g., diversification, capacity and sector) prior to adjusting the final weights in the Underlying Index. The diversification constraint limits maximum position weights. All stocks included in the S-Network US Equity Large-Cap 500 Index are screened for free float (the number of shares readily available for purchase on the open market) and average daily trading volume. The sector constraints limit sector deviations. The Underlying Index is rebalanced quarterly and reconstituted annually. Individual index constituent weights are capped at 5% at each quarterly rebalance to avoid overexposure to any single security. The Underlying Index’s investable universe includes companies from the following GICS sectors within the S-Network US Equity Large-Cap 500 Index: Communication Services, Consumer Discretionary, Consumer Staples, Financials, Health Care, Industrials, Information Technology, and Utilities.

Each Fund may use either a replication strategy or representative sampling strategy in seeking to track the performance of the Underlying Index. Under a replication strategy, each Fund intends to replicate the constituent securities of the Underlying Index as closely as possible. Under a representative sampling strategy, each Fund would invest in what it believes to be a representative sample of the component securities of the Underlying Index. Each Fund may use a representative sampling strategy when a replication strategy might be detrimental to shareholders, such as when there are practical difficulties or substantial costs involved in compiling a portfolio of securities to follow the Underlying Index (e.g., where the Underlying Index contains component securities too numerous to efficiently purchase or sell); or, in certain instances, when a component security of the Underlying Index becomes temporarily illiquid, unavailable or less liquid. Each Fund may also use a representative sampling strategy to exclude less liquid component securities contained in the Underlying Index from the Fund’s portfolio in order to create a more tradable portfolio and improve arbitrage opportunities. To the extent a Fund uses a representative sampling strategy, it may not track the Underlying Index with the same degree of accuracy as would an investment vehicle replicating the entire index.

Under normal market conditions, each Fund will invest at least 80% of its total assets in the components of the Underlying Index. To the extent that the Underlying Index concentrates (i.e., holds 25% or more of its net assets) in the securities of a particular industry or group of industries, each Fund is expected to concentrate to approximately the same extent.

Each Fund may invest up to 20% of its total assets in investments not included in the Underlying Index, but which the Fund’s adviser (or sub-adviser in the case of the Target Fund) believes will help the Fund track the Underlying Index. For example, there may be instances in which the Fund’s adviser (or sub-adviser in the case of the Target Fund) may choose to purchase or sell investments, including exchange-traded funds (“ETFs”) and other investment company securities, and cash and cash equivalents, as substitutes for one or more Underlying Index components or in anticipation of changes in the Underlying Index’s components.

Comparison of Principal Investment Risks

There are no material differences between the principal risks associated with an investment in the Target Fund and the principal risks associated with an investment in the Acquiring Fund. Although the principal investment risks are not materially different, each Fund uses different terminology to describe the principal risks applicable to such Fund’s principal investment strategy. The principal investment risks for the Acquiring Fund are summarized below. For the principal risks associated with an investment in the Target Fund, please consult Appendix D.

Market Risk. Economies and financial markets throughout the world are becoming increasingly interconnected, which increases the likelihood that events or conditions in one country or region will adversely impact markets or issuers in other countries or regions. The values of equity securities, such as common stocks and preferred stock, may decline due to general market conditions that are not specifically related to a particular company, such as real or perceived adverse economic, political and social conditions, inflation (or expectations for inflation), deflation (or expectations for deflation), changes in the general outlook for corporate earnings, global demand for particular products or resources, market instability, debt crises and downgrades, embargoes, tariffs, sanctions and other trade barriers, regulatory events, other governmental trade or market control programs and related geopolitical events, changes in interest or currency rates or adverse investor sentiment generally. Equity securities generally have greater price volatility than fixed-income securities. In addition, the value of the Acquiring Fund’s investments may be negatively affected by the occurrence of global events such as war, terrorism, environmental disasters, natural disasters or events, country instability, and infectious disease epidemics or pandemics.

Multifactor Risk. The Underlying Index, and thus the Acquiring Fund, seeks to achieve specific factor exposures identified in the Acquiring Fund’s principal investment strategies. There can be no assurance that targeting exposure to such factors will enhance the Acquiring Fund’s performance over time, and targeting exposure to certain factors may detract from performance in some market environments. There is no guarantee the Index Provider’s methodology will be successful in creating an index that achieves the specific factor exposures identified in the Acquiring Fund’s principal investment strategies.

Quality Stocks Risk. This style of investing is subject to the risk that the past performance of these companies does not continue or that the returns on “quality” equity securities are less than returns on other styles of investing or the overall stock market. In addition, there may be periods when quality investing is out of favor and during which the investment performance of a fund using a quality strategy may suffer.

Dividend-Paying Stock Risk. The Acquiring Fund’s emphasis on dividend-paying stocks involves the risk that such stocks may fall out of favor with investors and underperform the market. Also, a company may reduce or eliminate its dividend. An issuer of a security may also be unable or unwilling to make dividend payments when due and the related risk that the value of a security may decline because of concerns about the issuer’s ability to make such payments.

Volatility Risk. There is a risk that the present and future volatility of a security, relative to the S-Network US Equity Large-Cap 500 Index, will not be the same as it historically has been and thus that the Underlying Index will not be exposed to the less volatile securities in the S-Network US Equity Large-Cap 500 Index. Volatile stocks are subject to sharp swings in value.

Index Management Risk. Unlike many investment companies, the Acquiring Fund is not “actively” managed. Therefore, it would not necessarily sell a security because the security’s issuer was in financial trouble unless that security is removed from the Underlying Index.

Sampling Risk. To the extent the Acquiring Fund uses a representative sampling approach, it will hold a smaller number of securities than are in the Underlying Index. As a result, an adverse development respecting a security held by the Acquiring Fund could result in a greater decline in NAV than would be the case if the Acquiring Fund held all of the securities in the Underlying Index. Conversely, a positive development relating to a security in the Underlying Index that is not held by the Acquiring Fund could cause the Acquiring Fund to underperform the Underlying Index. To the extent the assets in the Acquiring Fund are smaller, these risks will be greater.

Tracking Error Risk. Tracking error is the divergence of the Acquiring Fund’s performance from that of the Underlying Index. Tracking error may occur due to, among other things, fees and expenses paid by the Acquiring Fund, including the cost of buying and selling securities that are not reflected in the Underlying Index. If the Acquiring Fund is small, it may experience greater tracking error. If the Acquiring Fund is not fully invested, holding cash balances may prevent it from tracking the Underlying Index. In addition, the Acquiring Fund’s NAV may deviate from the Underlying Index if the Acquiring Fund fair values a portfolio security at a price other than the price used by the Underlying Index for that security. To the extent the Acquiring Fund uses a representative sampling strategy to track the Underlying Index, such a strategy may produce greater tracking error than if the Acquiring Fund employed a full replication strategy.

Concentration Risk. To the extent that the Underlying Index is concentrated in a particular industry or group of industries, the Acquiring Fund is also expected to be concentrated in that industry or group of industries, which may subject the Acquiring Fund to a greater loss as a result of adverse economic, business or other developments affecting that industry or group of industries.

Sector Risk. To the extent the Underlying Index, and thereby the Acquiring Fund, emphasizes, from time to time, investments in a particular sector, the Acquiring Fund is subject to a greater degree to the risks particular to that sector. Market conditions, interest rates, and economic, regulatory, or financial developments could significantly affect all the securities in a single sector. If the Acquiring Fund invests in a few sectors, it may have increased exposure to the price movements of those sectors.

Mid-, and Large Capitalization Company Risk. Investing in securities of medium capitalization companies involves greater risk than customarily is associated with investing in larger, more established companies. Medium-capitalization companies’ securities may be more volatile and less liquid than those of more established companies. These securities may have returns that vary, sometimes significantly, from the overall securities market. Often medium capitalization companies and the industries in which they focus are still evolving and, as a result, they may be more sensitive to changing market conditions. The large capitalization companies in which the Acquiring Fund invests may underperform other segments of the equity market or the equity market as a whole.

Investment Risk. An investment in the Acquiring Fund is subject to investment risk including the possible loss of the entire principal amount that you invest.

Liquidity Risk. Liquidity risk exists when particular investments are difficult to purchase or sell. Such securities may become illiquid under adverse market or economic conditions and/or due to specific adverse changes in the condition of a particular issuer. If the Acquiring Fund invests in illiquid securities or securities that become illiquid, Acquiring Fund returns may be reduced because the Acquiring Fund may be unable to sell the illiquid securities at an advantageous time or price.

Cash and Cash Equivalents Risk. Holding cash or cash equivalents, even strategically, may lead to missed investment opportunities. This is particularly true when the market for other investments in which the Acquiring Fund may invest is rapidly rising.

Issuer-Specific Risk. The value of an individual security or particular type of security can be more volatile than the market as a whole and can perform differently from the value of the market as a whole.

Fluctuation of Net Asset Value. The net asset value (“NAV”) of the Acquiring Fund’s shares will generally fluctuate with changes in the market value of the Acquiring Fund’s holdings. The market prices of the shares will generally fluctuate in accordance with changes in NAV as well as the relative supply of and demand for the shares on the CBOE BZX Exchange, Inc. (the “Exchange”). ALPS Advisors cannot predict whether the shares will trade below, at or above their NAV.

Comparison of Fundamental Investment Restrictions

The fundamental investment restrictions of the Funds, meaning those policies that may not be changed without shareholder approval, are substantively similar. Although each Fund describes its fundamental investment restrictions differently in some respects, these differences do not reflect a material difference between how each Fund is (or will be) managed. See Appendix F for the fundamental investment restrictions of the Funds.

Comparison of Non-Fundamental Investment Restrictions

Each Fund’s investment objective is a non-fundamental policy. In addition, each Fund has a substantially similar non-fundamental policy to normally invest at least 80% of its total assets in component securities that comprise its Underlying Index, and, as applicable, depositary receipts based on the securities in its Underlying Index. Unlike the Acquiring Fund, the Target Fund has a policy to provide shareholders with at least 60 days notice prior to changing its 80% policy, although, as noted above, each Fund has adopted a policy that requires the Fund to provide shareholders with at least 60 days’ notice before changing the Fund’s investment objective. The Target Fund does not have any additional non-fundamental policies or investment limitations. The Acquiring Fund’s additional non-fundamental investment restrictions are shown in Appendix F. The Acquiring Fund’s non-fundamental investment restrictions are not expected to result in any material difference between how each Fund is managed. Non-fundamental investment restrictions may be changed without shareholder approval.

Comparison of Performance

No performance information is included for the Acquiring Fund because the Acquiring Fund has not yet commenced investment operations. The Acquiring Fund will assume the performance history of the Target Fund at the closing of the Reorganization. Performance information for the Target Fund is presented below.

The Target Fund adopted the historical performance of the O’Shares FTSE U.S. Quality Dividend ETF, a series of FQF Trust (the “U.S. Quality Dividend Predecessor Fund”), as the result of a reorganization in which the Target Fund acquired all of the assets, subject to liabilities, of the U.S. Quality Dividend Predecessor Fund on June 28, 2018. The returns presented for the Target Fund for periods prior to June 28, 2018 reflect the performance of the U.S. Quality Dividend Predecessor Fund. At the time of the reorganization, the investment objectives of the U.S. Quality Dividend Predecessor Fund and the Target Fund were identical and the investment strategies of the U.S. Quality Dividend Predecessor Fund and the Target Fund were substantially the same.

Effective June 1, 2020, the Target Fund’s underlying index was changed to the O’Shares U.S. Quality Dividend Index (the “Underlying Index”) from the FTSE USA Qual/Vol/Yield Factor 5% Capped Index (the “Former Index”). Thus, Target Fund performance shown below through May 31, 2020 reflects the Target Fund seeking to track the performance of the Former Index, and Target Fund performance shown below beginning June 1, 2020 reflects the Target Fund seeking to track the performance of the Underlying Index. In addition, the Underlying Index performance shown below reflects the blended performance of the Former Index through May 31, 2020 and the Underlying Index thereafter.

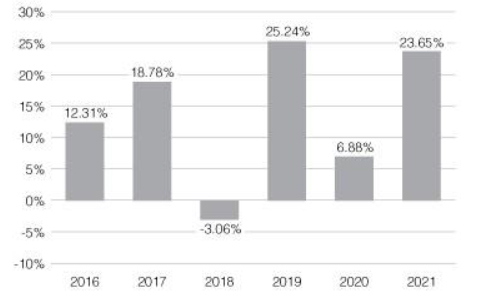

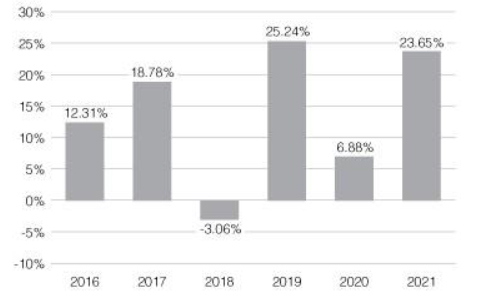

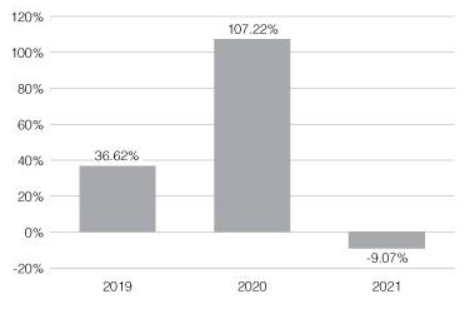

The bar chart and table that follow show how the Fund has performed on a calendar year basis and provide an indication of the risks of investing in the Fund by showing the changes in the performance from year to year and how the Fund’s average annual returns compare against the Target Index and a broad based securities market index. Past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. For current performance information, please visit the Fund’s website at www.oshares.com.

For the periods shown in the bar chart above:

| Best Quarter | June 30, 2020 | 15.16% |

| Worst Quarter | March 31, 2020 | (20.34)% |

The year-to-date return as of the calendar quarter ended March 31, 2022 is -5.14%.

Average Annual Total Returns (for the periods ended December 31, 2021) | One Year | Five Years | Since Inception (July 14, 2015) |

| Before Taxes | 23.65% | 13.77% | 12.71% |

| After Taxes on Distributions | 23.15% | 13.14% | 12.08% |

| After Taxes on Distributions and Sale of Shares | 14.30% | 10.90% | 10.15% |