As filed with the Securities and Exchange Commission on April 24, 2009

Registration No. 333-146705

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 2

ON

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

OCTAVIAN GLOBAL TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 6531 | 01-895182 |

(State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Number) | (I.R.S. Employer Identification No.) |

| | | |

1-3 Bury Street Guildford Surrey, GU2 4AW

United Kingdom

(Address, Including Zip Code and Telephone Number,

Including Area Code, of Registrant's Principal Executive Offices)

With copies of all correspondence to:

Robert F. Charron, Esq.

Feldman Weinstein & Smith LLP

420 Lexington Avenue, Suite 2620

New York, NY 10170

(212) 869-7000

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One):

Large Accelerated filer ¨ | Accelerated filer ¨ |

Non-accelerated filer (Do not check if a smaller reporting company) ¨ | Smaller reporting company þ |

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered | | Amount of shares to be registered (1) | | | Proposed maximum offering price per share(2) | | | Proposed maximum aggregate offering price(3) | | | Amount of registration fee(3)(4) | |

| Common Stock, par value $.001 per share | | | 747, 414 | | | $ | .050174 | | | $ | 37,500 | | | $ | 1.15 | |

| (1) | Reflects the previous registered amount of 3,750,000 shares, adjusted for the 1-for-5.0174 reverse stock split that we effected on January 7, 2009 (the “Reverse Stock Split”). The total number of shares outstanding is nominally greater than the amount calculated through the Reverse Stock Split due to rounding errors. |

| | |

| (2) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457 of the Securities Act of 1933, as amended (the “Securities Act”). The initial proposed maximum offering price of $.01 per share has been adjusted to reflect the Reverse Stock Split. |

| (3) | Estimated solely for the purpose of computing the registration fee in accordance with Rule 457 of the Securities Act. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Explanatory Note: Pursuant to the transition provisions in Release 33-8876, this registration statement, which was originally filed on Form SB-2, now reflects the disclosure format and content of Form S-1.

The information in this prospectus is not complete and may be changed. The selling shareholders may not sell these securities until the post-effective amendment to the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus

Dated April 24, 2009

747,414 SHARES OF COMMON STOCK

OCTAVIAN GLOBAL TECHNOLOGIES, INC.

This is a public offering of common stock, which we refer to as our “Common Stock”. The persons listed in this prospectus under "Selling Shareholders" may offer and sell from time to time up to an aggregate of 747,414 shares of our Common Stock. We will not receive any proceeds from the sale of the Common Stock by the Selling Shareholders.

Our Common Stock is listed on the Over-the-Counter Bulletin Board under the symbol “OCTV”. As of April 22, 2009, there have been only minimal sales of our Common Stock on the Bulletin Board.

We will bear the costs and expenses of registering the Common Stock by the Selling Shareholders. Selling commissions, brokerage fees, and applicable transfer taxes are payable by the Selling Shareholders.

Investing in our Common Stock involves risk. See “Risk Factors” beginning on page 6.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is _________ ___, 2009

TABLE OF CONTENTS

| | | Page | |

| | | | |

| Prospectus Summary | | | 1 | |

| | | | | |

| Risk Factors | | | 6 | |

| | | | | |

| A Note About Forward-Looking Statements | | | 19 | |

| | | | | |

| Use of Proceeds | | | 20 | |

| | | | | |

| Selling Shareholders | | | 21 | |

| | | | | |

Plan of Distribution | | | 22 | |

| | | | | |

| Market for Common Equity and Related Shareholder Matters | | | 22 | |

| | | | | |

| Business | | | 23 | |

| | | | | |

| Management’s Discussion and Analysis and Results of Operations | | | 41 | |

| | | | | |

| Management | | | 53 | |

| | | | | |

| Executive Compensation | | | 55 | |

| | | | | |

| Certain Relationships and Related Transactions | | | 57 | |

| | | | | |

| Principal Shareholders | | | 60 | |

| | | | | |

| Description of Securities | | | 61 | |

| | | | | |

| Legal Matters | | | 65 | |

| | | | | |

| Experts | | | 65 | |

| | | | | |

| Where You Can Find More Information | | | 65 | |

| | | | | |

| Financial Statements | | | F-1 | |

| | | | | |

| Part II: Information not Required in the Prospectus | | | II-1 | |

| | | | | |

| Signatures | | | II-6 | |

| | | | | |

| Exhibit Index | | | II-7 | |

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with information different from that contained in this prospectus. The information contained in this prospectus is complete and accurate only as of the date on the front cover page of this prospectus, regardless of the time of delivery of this prospectus or the sale of any Common Stock or warrants. The prospectus is not an offer to sell, nor is it an offer to buy, our Common Stock in any jurisdiction in which the offer or sale is not permitted.

We have not taken any action to permit a public offering of our shares of Common Stock outside of the United States or to permit the possession or distribution of this prospectus outside of the United States. Persons outside of the United States who came into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of the shares of Common Stock and the distribution of this prospectus outside of the United States.

Unless we otherwise indicate or unless the context requires otherwise, any reference in this prospectus to:

| | · | Numbers of shares of Common Stock reflect a 1-for-5.0174 reverse split of our shares of Common Stock effective on January 7, 2009 (the “Reverse Stock Split”) |

| | · | “Octavian” refers, prior to the Share Exchange and Related Transactions (both as hereinafter defined), to the business of Octavian International Limited, a corporation organized under the laws of England and Wales and currently our wholly-owned subsidiary, and its subsidiaries and, from and after the Share Exchange and Related Transactions, the business of Octavian Global Technologies, Inc. and that of its subsidiaries; |

| | · | “House Fly” refers to the business of House Fly Rentals, Inc. prior to the Share Exchange and Related Transactions; |

| | · | “Common Stock” refers collectively to, before the Share Exchange and Related Transactions, House Fly common stock, and, from and after the Share Exchange and Related Transactions, Octavian common stock; and |

| | · | The “Share Exchange and Related Transactions” refers to the transactions by which the Company repurchased from Robert McCall, (House Fly’s prior President, Chief Executive Officer, Chief Financial Officer, Secretary, Treasurer and a member of the Board of Directors) an aggregate of 3,000,000 shares of Common Stock (597,919 shares of Common Stock if adjusted for the Reverse Stock Split), which represented 44.4 percent of the Company’s shares of Common Stock then issued and outstanding, for an aggregate purchase price of US$300,000 (the “Repurchase”); the holders of all of the issued and outstanding securities of Octavian International Limited contributed all of their securities of Octavian International Limited to House Fly in exchange for House Fly’s issuance to them of certain securities of House Fly (the “Share Exchange”); a newly created Nevada corporation called Octavian Global Technologies, Inc., which had no operations or assets and was 100 percent owned by House Fly merged into House Fly, resulting in House Fly changing its name to “Octavian Global Technologies, Inc.” (the “Subsidiary Merger and Name Change”); Octavian Global Technologies, Inc. entered into a Securities Purchase Agreement (the “Purchase Agreement”) with certain accredited investors and closed a private placement offering pursuant to which it raised gross proceeds of $13 million and, among other things, issued and sold ten percent discount convertible debentures (“Debentures”) with an aggregate principal amount of US$14,285,700 convertible into shares of the Company’s Common Stock (“Conversion Shares”) at an initial conversion price of US$3.10, subject to adjustment other than with respect to the Reverse Stock Split (the “Private Placement”); and Octavian Global Technologies, Inc. effected the Reverse Stock Split. |

INDUSTRY AND MARKET DATA

In this prospectus, we rely on and refer to information and statistics regarding the gaming industry. We obtained this data from independent publications or other publicly available information. Independent publications generally indicate that the information contained therein was obtained from sources believed to be reliable but do not guarantee the accuracy and completeness of such information. Although we believe these sources are reliable, we have not independently verified this information. We do not guarantee the accuracy and completeness of this information.

PROSPECTUS SUMMARY

This summary highlights selected information contained in greater detail elsewhere in this prospectus. This summary may not contain all of the information that you should consider before investing in our Common Stock. You should carefully read the entire prospectus, including the “Risk Factors,” the financial statements and the exhibits to the registration statement of which this prospectus is a part before making an investment decision. Unless otherwise specified, references to “we”, “us”, “our”, or our “company” or “Octavian” refer to the company after the Share Exchange and Related Transactions. All share amounts relating to our Common Stock contained in this prospectus give effect to a 1-for-5.0174 reverse split of our shares of Common Stock, effective on January 7, 2009 (the “Reverse Stock Split”).

On October 30, 2008, Octavian International Limited and House Fly Rentals, Inc. entered into the Share Exchange and Related Transactions. The company was renamed “Octavian Global Technologies, Inc.”

Our Business

Octavian is a global provider of a full end-to-end suite of gaming systems and products. Our solutions include full life-cycle gaming support and system solutions; design, manufacture and marketing of computerized games, products for the lottery industry; and resale of third-party products.

Our primary market focus is emerging, fast growing markets. We offer flexible, tailored, technical and operational support and solutions which, we believe, enable our customers to efficiently scale their operations over multiple locations.

Our solutions are organized into four core solution areas:

| | OctaSystems Our OctaSystems business sector is comprised of two main products, our casino management systems and our downloadable games systems. |

Casino Management Systems

Our casino management systems provide both local and centralized global solutions by linking electronic gaming machines either within a single casino or globally over multiple venues, to a central data center in order to manage, control and monitor gaming machines and tables worldwide.

Our current system solutions include:

Octavian End to End Casino Management Systems

Our most comprehensive system offering is our Octavian e2e GMS (“Octavian e2e”). Octavian e2e is our complete end to end system and covers and links together slot machines, gaming tables, the cash desk, player registration, reception, security, loyalty systems and marketing.

We offer our casino management systems in a variety of different ways and levels, from our comprehensive, fully automated, end to end system, Octavian e2e GMS, to our entry level, low cost end to end system, Octavian EasyStart. Within our end to end systems clients can purchase individual modules that address specific needs or requirements of an operator, such as our slot machine management system, ACP, our casino reception and marketing system, Octavian GateManager™, and our cash desk management system, Octavian CashManager™.

Octavian Modular Casino Management Systems

ACP (Accounting, Control and Progressive) Slots Management System

Octavian ACP – Our primary casino management systems for slot machines is Octavian ACP which we believe is a secure, highly flexible and reliable system with the capability to link machines from virtually all manufacturers, in multiple locations globally.

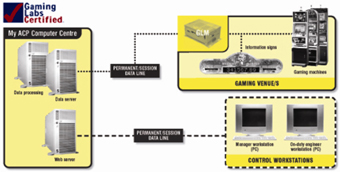

My ACP Slots Management System – Our “My ACP” is a variation on our Octavian ACP system but is for an in-house casino management system where operators maintain their own central server, software, database and technical center on their own premises, managed by their IT personnel.

Downloadable Games Systems

Symphony™ is our adaptable, scalable and cost-effective downloadable game system that meets the broadest range of gaming needs. We offer two versions of Symphony™: Symphony™ DE and Symphony™ LE.

| | OctaGames | |

| | Octavian creates and supplies games and other integrated on-screen content that we believe provides a more exciting and satisfying customer experience. |

We have a portfolio of over 80 games sold globally. We believe our OctaGames business has developed a reputation for developing games that are especially popular in emerging markets and known for their advanced graphics and attractive user interfaces. We support a wide variety of games which are tailored for electronic gaming machines (“EGMs”) and amusement with prizes machines (“AWPs”).

| | OctaLotto | |

| | | | |

| | Octavian develops systems and game content and provides complete end-to-end lottery solutions, from consulting and set-up, through systems implementation and supplier management, to marketing, training and ongoing support. | |

Our Symphony™ LE platform has been developed to provide lottery systems and solutions, including Video Lottery Terminals (“VLTs”) and downloadable games for state and local lotteries, especially in emerging markets. We are currently planning to roll out this platform across multiple African countries.

Key benefits include:

| · | A one-stop turnkey solution for existing and prospective lottery operators; | |

| · | Innovative systems solutions to enable traditional lottery operators to sell tickets via networked gaming machines/VLTs; |

| · | Related lottery products including traditional online games, mobile gaming, VLT machines and scratch cards; |

| · | Ability to provide wireless, mobile and Internet gaming products; and |

| · | Discrete services such as business and technology advice, training and mentoring, supplier management and ongoing lottery business development. |

| | OctaSupplies | |

| | | | |

| | Octavian supplies casino and amusement equipment through which game content and related services are delivered to customers. |

We offer a full range of products from the world’s leading manufacturers, including gaming machines and other innovative attractions and peripherals. The purchase of new devices in certain international markets is often costly, and where appropriate, we incur costs to recondition used devices for resale. We also sell used equipment on an “as is” basis.

We offer products from the following third party suppliers:

| | · | Austrian Gaming Industries (a/k/a Novomatic): We have distributed gaming products for AGI (a/k/a Novomatic) since 2001. The products we have distributed for AGI include Gaminator®, Multi-Gaminator® and Super-V+ Gaminator® (each of which is a multi-game solution that provides a choice of video games to the player). Distribution of AGI’s products have been targeted to selected markets, including substantially all countries in Latin America, other than Chile, Peru and Uruguay and the Commonwealth of Independent States (“CIS”), which includes Armenia, Azerbaijan, Belarus, Georgia, Kazakhstan, Kyrgyzstan, Moldova, Tajikistan, Turkmenistan, Uzbekistan and Ukraine. |

| | · | International Game Technology (IGT): We have distributed gaming products for International Game Technology (“IGT”) since 2005. The products we have distributed for IGT include gaming machines (including slot machines and other video gaming terminals) in Russia and IGT EZ Pay® to selected markets across Europe, North Africa and the CIS. Distribution of IGT EZ Pay® is on a non-exclusive basis and covers Europe, Egypt, Morocco, Tunisia, Lebanon, Palestine, Israel, Russia, Belarus, Kazakhstan and Turkmenistan through October 2010. Typical distribution terms with IGT require us to purchase the software, components and parts at a fixed discount and to offer maintenance agreements at a fixed discount. |

Markets

We market our products and services in legalized gaming jurisdictions around the world, which offer various opportunities and challenges.

Russia and the CIS Countries

We commenced our operations in Russia and the CIS countries in 2001. We provided our ACP system and all technical support to one of the first major gaming operators in Russia and the CIS countries. We expanded our presence in the market by providing services to other gaming operators. We also expanded our product and service offerings to include the distribution of third-party products and our proprietary games. We currently have two offices in Russia: our Moscow office focuses on our OctaSupplies business line, while our St. Petersburg office focuses on our OctaSystems, OctaGames, and OctaLotto business lines, research and development, and the operation of one of our global data centers.

Historically, Russia and the CIS countries has been our most significant market, representing 73.1% of our revenues in 2007 and 75.9% of our revenues in 2008. On December 29, 2006, the Russian government enacted legislation (No. 244FZ) that immediately restricted the number and the size of sites that can offer slot-machine operations. In addition, casinos will be limited to four geographic zones after July 1, 2009, and only gaming operators meeting certain specified revenue and assets thresholds would be permitted to operate casinos in these regions. This legislation effectively capped the market and caused a number of gaming suppliers to exit the marketplace. The legislation resulted in a reduction in our revenues from business in Russia and the CIS countries of approximately US$37.0 million (or 68 percent), from US$54.4 million in 2006 to US$17.2 million in 2007. In 2008, our revenues in Russia and the CIS countries increased to $30 million. We believe that our well-established relationships with operators in Russia and the reduction of the number of competitors in Russia places us in a favorable position to serve the remaining Russian gaming industry in the event the Russian legislature passes legislation that permits country-wide gaming to continue. Such an extension would require operators to re-invest in new equipment, providing an opportunity for future growth.

The 2007 legislation did not restrict lottery operations, resulting in the decision of certain slot-machine operators to transfer some of their operations from slot machines to lottery machines. Octavian has been able to capitalize on this new market through our OctaLotto business line. We currently supply video lottery terminals and other lottery systems to several markets in Russia and anticipate continued growth in this area.

Europe

Octavian currently does most of its business in Europe in Romania, Italy and Germany. Our European operations represented approximately 7.0% of our revenues in 2008, compared to 2.7% of our revenues in 2007.

Latin America and the Caribbean

We have a facility in each of Bogotá, Colombia and Buenos Aires, Argentina. Each of these locations hosts a global ACP data center, and we also conduct software research and development at our Buenos Aires location. Our Latin America and Caribbean operations encompass Brazil, Mexico, Argentina, Venezuela, Chile, Colombia, Peru, Puerto Rico, Ecuador, Guatemala, the Dominican Republic, Costa Rica, Trinidad, Tobago, Uruguay, El Salvador, Panama, Bolivia, Jamaica, Honduras, Paraguay, the Bahamas, Nicaragua, Haiti, Barbados, Suriname, Belize, Antigua, Barbuda and Saint Lucia. These operations contributed 17.1% of our revenues in 2008 and 24.2% of our revenues in 2007. We currently operate our Caribbean operations out of our office in Bogotá, Colombia. We derive our revenue in this region from our OctaSystems, OctaGames, and OctaSupplies business groups and also expect to deliver our OctaLotto services in this region in the near future.

Africa

In Rwanda we have an exclusive license from the Rwandan regulatory body to administer and operate Rwanda’s lottery through 2019. We will distribute lottery terminals, establish a distribution network, administer control procedures for the collection of receipts and payment of jackpots and market Rwanda’s lottery system, on an exclusive basis, throughout the term of the license. Additionally, we have an exclusive license from the Rwandan regulatory body to operate gaming machines, sports betting and horse racing in Rwanda through 2014, which includes the right to extend through 2019.

We are working with local operators to distribute 500 refurbished slot and similar machines in two African countries. We will receive payment equal to a percentage of the sales price of the machines along with a percentage of the profits made by the operators through 2013.

To date, the lottery and gaming markets in Africa are in the early stages of development and there can be no assurances that viable markets will ever evolve.

Asia Pacific

We currently have no operations in Asia, other than one Octavian GateManager™ and one Octavian CashManager™ installed in Sri Lanka, and have therefore generated only nominal revenues in this region to date. However, we anticipate growing demand in this region, both new and replacement, for machines, parts, games and systems.

Our Strategy

Our current focus is to grow our proprietary systems and games business and reduce our reliance on offering third party products. We are currently executing the following initiatives to drive further expansion and profitability:

| | · | Expand our Operations Outside Russia; |

| | · | Increase Proportion of Recurring Revenues and Long-Term Contracts; |

| | · | Increase Focus on Casino Management Systems; |

| | · | Continue to Establish Long-Term Relationships with Casino and AWP Operators; |

| | · | Expand Portfolio of Service Offerings; |

| | · | Continue Focus on Emerging Market Opportunities; |

| | · | Consolidate the Octavian Brand Name; and |

| | · | Expand Through Strategic Acquisitions. |

The Offering

All references herein to our shares of Common Stock give effect to a 1-for-5.0174 reverse split of our shares of Common Stock, effective on January 7, 2009 (the “Reverse Stock Split”).

| Common Stock offered by the selling shareholders | | Up to 747,414 shares of our Common Stock. |

| | | |

| Shares of Common Stock outstanding as of the date of this prospectus | | 8,016,408 shares of Common Stock |

| | | |

| Use of Proceeds | | We will not receive any of the proceeds from the sale of shares by the selling shareholders. See “Use of Proceeds” beginning on page 20. |

| | | |

| Voting Rights | | Each share of our Common Stock entitles its holder to one vote per share. |

| | | |

| Dividend Policy | | We do not expect to pay dividends on our shares of Common Stock for the foreseeable future. See “Dividends and Dividend Policy” beginning on page 23. |

| | | |

| Risk Factors | | For a discussion of factors you should consider before buying shares of our Common Stock, see “Risk Factors” beginning on page 6. |

| | | |

| Offering Price | | The offering price of the Common Stock is $0.050174 per share, adjusted to reflect the Reverse Stock Split, if and until a market develops for the trading of our shares of Common Stock, upon which the offering price shall thereafter be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling shareholders. |

| | | |

| Over-the-Counter Bulletin Board symbol | | OCTV |

Summary Financial Information

The following tables set forth the summary financial information for the Company. You should read this information together with the financial statements and the notes thereto appearing elsewhere in this prospectus and the information under “Management’s Discussion and Analysis and Results of Operations.”

Summary Financial Information

| Consolidated Statements of Income | | Year Ended December 31, 2008 | | | Year Ended December 31, 2007 | |

| | | | | | | |

| Revenues | | $ | 39,627,067 | | | $ | 23,538,458 | |

| Operating expenses | | $ | (17,686,931 | ) | | $ | (26,515,456 | ) |

| Net profit/(loss) from operations | | $ | (6,303,995 | ) | | $ | (20,216,582 | ) |

| Net profit/(loss) before taxes , minority interest and earnings from affiliate | | $ | (10,396,390 | ) | | $ | (20,530,005 | ) |

| Profit/(Loss) per share - basic and diluted | | $ | (10,783,753 | ) | | $ | (18,946.46 | ) |

| Weighted average shares outstanding basic and diluted | | | 4,008,388 | | | | 3,294,050 | |

| Balance Sheet Data | | At December 31, 2008 | | | At December 31, 2007 | |

| | | | | | | |

| Cash and cash equivalents | | $ | 2,829,641 | | | $ | 2,437,646 | |

| Total current assets | | $ | 14,574,736 | | | $ | 15,196,714 | |

| Property and equipment, net | | $ | 1,386,246 | | | $ | 692,284 | |

| Intangible assets, net | | $ | 2,759,572 | | | $ | 1,819,142 | |

| Total assets | | $ | 18,946,648 | | | $ | 17,793,649 | |

| Total liabilities | | $ | (33,590,182 | ) | | $ | (32,412,443 | ) |

| Minority interest in subsidiaries | | $ | (36,798 | ) | | $ | (30,522 | ) |

| Total stockholders' deficit | | $ | (14,680,332 | ) | | $ | (14,649,316 | ) |

RISK FACTORS

Investing in our Common Stock involves a high degree of risk. Prospective investors should carefully consider the risks described below, together with all of the other information included or referred to in this prospectus, before purchasing shares of our Common Stock. There are numerous and varied risks, known and unknown, that may prevent us from achieving our goals. If any of these risks actually occurs, our business, financial condition or results of operations may be materially adversely affected. In such case, the trading price of our Common Stock could decline, and investors in our Common Stock could lose all or part of their investment. Whenever the terms “our,” “we” and the “Company” are used in this Risk Factors section, they refer to one or more of the following: Octavian Global; Octavian International and all other direct and indirect subsidiaries of Octavian International identified in this prospectus.

Risks Related to Our Business

Substantially all of our intellectual property has been pledged as security for outstanding indebtedness.

We are a non-exclusive distributor for Austrian Gaming Industries GmbH (“AGI”). AGI is one of our largest suppliers and prior to completion of the Share Exchange, we had outstanding accounts payable of €18,756,207 (US$23,979,811 based on the October 30, 2008 Exchange Rate of €1=US$1.2785) owed to AGI. Pursuant to certain agreements we entered into with AGI immediately prior to the Share Exchange, AGI, in addition to agreeing to take such other actions as described in greater detail in Recent Developments – Agreements with AGI of our Business Section on page 39, restructured a portion of the accounts payable into the AGI Loan, secured by a security interest in the IP Rights. The amounts owed to AGI that are secured by the IP Rights, which as of October 30, 2008 totaled €8 million (US$10,228,000 based on the October 30, 2008 Exchange Rate of €1=US$1.2785), are due and payable October 31, 2012. As of April 22, 2009, one payment to AGI is overdue. In the event that we are unable to pay the principal and interest owed under the AGI Loan, the intellectual property constituting the IP Rights would be subject to transfer to AGI following a 30-day rectification period for a non-payment default. (For a more detailed description of the agreements with AGI and the IP Rights, please see the section titled “Recent Developments – Agreements with AGI,” beginning on page 39).

A loss of the IP Rights would substantially harm our OctaSystems and OctaGames businesses and could render us unable to provide our systems solutions in the ordinary course if the IP Rights were sold or otherwise transferred to a third party and/or we were no longer permitted to use and incorporate the intellectual property constituting the IP Rights in our products and services.

We face intense competition, and our results of operations will be adversely affected if we fail to compete successfully.

We compete with a number of developers, manufacturers and distributors of similar products and technologies. Because of the high initial costs of installing a computerized monitoring system, customers for such systems generally do not change suppliers once they have installed a system. This may make it difficult for us to attract customers who have existing computerized monitoring systems.

Some of our competitors have greater name recognition, larger customer bases and significantly greater financial, technical, marketing, public relations, sales, distribution and other resources. Our larger competitors may have more resources to devote to research and development and may be able to obtain regulatory approval more efficiently and effectively.

There can be no assurance that our new game themes, products or systems will achieve market acceptance, or that we will be able to compete effectively with these companies. Our ability to remain competitive will depend in part on our ability to:

| | · | Enhance and improve the responsiveness, functionality and other features of the products and services that we offer and plan to offer; |

| | · | Continue to develop our technical expertise; |

| | · | Develop and introduce new services, applications and technologies to meet changing customer needs and preferences; and |

| | · | Integrate the new technologies with existing systems. |

If our competitors continue to develop new game themes and technologically innovative products and systems, and we fail to keep pace, our business could be adversely affected. Competition may result in price reductions, fewer customer orders and reduced gross margins. We may be unsuccessful in our attempts to compete, and competitive pressures may harm our business. In addition, increased competition could cause our sales cycle to lengthen as potential new customers take more time to evaluate competing technologies or delay their purchasing decisions in order to determine which technologies are able to develop mass appeal.

Our success in the gaming and lottery industries depends in large part on our ability to develop innovative products and systems. If we fail to keep pace with rapid innovations in product design and deployment, or if we are unable to quickly adapt our development processes to release innovative products or systems, our business could be negatively impacted.

If we are unable to respond to regulatory or industry standards effectively, or if we are unable to develop and integrate new technologies effectively, our growth and the development of our products and services could be delayed or limited. Our success is heavily dependent on our ability to develop new products and systems that are attractive not only to our customers, namely slot machine and table operators, other gaming enterprises and lottery authorities, but also to their customers, the end players. The demands of our customers and the tastes of their customers are continuously changing. Therefore, our future success depends upon our ability to continue to design and market technologically sophisticated products that meet our customers’ needs, including ease of use and adaptability but that are also unique and entertaining such that they achieve high levels of player appeal and sustainability as well. The success of our business will depend on our ability to develop and integrate new technologies effectively and address the increasingly sophisticated technological needs of our customers in a timely and cost-effective manner.

Our future success and our ability to remain competitive will depend in part on our ability to enhance and improve the responsiveness, functionality and features of our products and services in accordance with regulatory or industry standards in a timely and cost-effective manner. If we are unable to influence these standards or respond to such standards effectively, our growth and the development of certain products and services could be delayed or limited.

Because our revenue growth is partially dependent on the earning power and life span of our games and newer game themes tend to have a shorter life span than more traditional game themes, we face pressure to design and deploy new and successful game themes to maintain our revenue stream and remain competitive. While we feel we have been successful at developing new and innovative products, our ability to do so could be adversely affected by:

| | · | A decline in the popularity of our gaming and lottery products with players; |

| | · | A decision by our customers or the gaming and lottery industries in general to cut back on purchases of new games or systems in anticipation of newer technologies; |

| | · | An inability to introduce new games, services or casino management and lottery systems on schedule as a result of delays in connection with regulatory product approval in the applicable jurisdictions, or otherwise; |

| | · | An increase in the popularity of competitors' games and systems; and |

| | · | A decline in consumer acceptance of our newest innovations. |

We cannot assure that we will be successful in responding to these technological and industry challenges in a timely and cost-effective manner. If we are unable to develop or integrate new technologies effectively or to respond to these changing needs, our margins could decrease and our release of new products and services and our deployment of new technology could be adversely affected.

We rely on highly skilled personnel and, if we are unable to retain or motivate key personnel or hire qualified personnel, we may not be able to maintain our operations or grow effectively.

We are highly dependent on certain key members of our executive management team and technical staff, including, in particular, Harmen Brenninkmeijer, our Chief Executive Officer. We depend on the experience of our key personnel to execute our business strategy. Accordingly, the retention of key members of our executive management team and technical staff is particularly important to our future success. The departure or other loss of any such member of our executive management team or technical staff could harm our ability to effectively market our products. In addition, if we cannot find suitable replacements for such persons in a timely manner, it could have a material adverse effect on our business. We have entered into an employment agreement with Mr. Harmen Brenninkmeijer which expires on December 31, 2013, unless renewed.

Our success also will depend in large part on our ability to continue to attract, retain and motivate qualified highly skilled scientific and technical personnel. Competition for certain employees, particularly development engineers, is intense. We may be unable to continue to attract and retain sufficient numbers of highly skilled employees. If we are unable to attract and retain additional qualified and highly skilled employees, our business, financial condition and results of operations may be adversely affected.

Our success will depend on the continued reliability and performance of third-party manufacturers and suppliers for whom we distribute. Loss of a material supplier could have a material adverse effect on our ability to perform effectively under some contracts and service our customer base effectively.

We currently are a distributor of third-party gaming machines. Historically, the majority of our revenues have come from these sales, the majority of which has been sourced through a single manufacturer, AGI, during 2007 and 2008. In addition, we are materially dependent on a limited number of third parties to produce systems or assemblies necessary for us to produce our products. While we strive to have alternate suppliers provide us with many of our products, a loss of one or more of such suppliers could have a material adverse effect on our ability to operate effectively. An inability to contract with third-party manufacturers and suppliers to provide a sufficient supply of quality products on acceptable terms and on a timely basis could negatively impact our relationships with existing customers and cause us to lose revenue-generating opportunities with current and potential customers. Additionally, if we are unable to replace any of these manufacturers or suppliers promptly and on terms that are equal or not significantly less favorable, this could have a material adverse effect on our business and financial condition.

We could experience manufacturing interruptions, delays, or inefficiencies of our hardware products if we are unable to timely replace short-term supplier agreements or supplier agreements terminated on short-term notice.

Generally, we maintain short-term supplier agreements and supplier agreements that can be terminated on short-term notice. If the supply of a critical hardware product or component is delayed or curtailed due to a cancellation or termination of one of our supplier agreements, we may not be able to ship the related product in desired quantities and in a timely manner. We believe that there are enough alternative suppliers that a cancellation of one of our supplier agreements will not have a material adverse effect on our operations. However, even where multiple sources of supply are available, qualification of the alternative suppliers, and establishment of reliable supplies, could result in delays and a possible loss of sales, which could harm operating results.

We are dependent on certain major customers, and the loss of one of these customers would significantly affect our business and financial results.

Our business to date has been dependent on major contracts from a limited number of customers. Gaming systems and lottery contracts are generally several years in length but may have varying durations. Some contracts contain cancellation clauses enabling either party to cancel the contract. In addition, after a contract period expires, the customer generally can re-open the contract for competitive bidding. If we fail to obtain additional contracts or if we lose any existing contracts due to cancellation or a competitive bidding situation, we may fail to realize a significant portion of revenues, which would adversely affect our business and financial results.

Customers may fail to pay us, negatively impacting our financial position. We are especially susceptible to this risk in the emerging markets in which we operate.

Customer financing is becoming an increasingly prevalent component of the sales process and therefore increases business risk of non-payment, especially in emerging markets. We maintain material accounts receivable balances with customers that, if we fail to collect on, could have a significant impact on our liquidity. These customer financing arrangements also delay our receipt of cash and can negatively impact our ability to enforce our rights upon default. In addition, if the national currency in markets in which we do business suffers significant depreciation, our customers may be unable to pay us, or we may receive significantly less than the amount owed to us.

If our products or technologies contain defects, our reputation could be harmed and our results of operations may be adversely affected.

Our products are highly complex and sophisticated and, from time to time, may contain design defects that are difficult to detect and correct. There can be no assurance that errors will not be found in new products after commencement of commercial shipments or, if discovered, that we will be able to correct such errors in a timely manner or at all. The occurrence of errors and failures in our products could result in loss of or delay in market acceptance of our products and correcting such errors and failures in our products could require us to expend significant amounts of capital. Our products are integrated into our customers’ networks and equipment and any defects could result in financial losses for our customers. The sale and support of these products may entail the risk of product liability or warranty claims based on damage to such networks and equipment. In addition, the failure of our products to perform to customer expectations could give rise to warranty claims. The consequences of such errors, failures and claims could have a material adverse effect on our business, results of operations and financial condition.

If customers in our industry reject the use of our technology or if our strategic decisions are not in sync with needs of our customers, the deployment of our technology may be delayed, and we may be unable to achieve revenue growth.

Customers in the gaming and lottery industries may delay or reject initiatives that relate to the deployment of our technology in various markets. Such a development would make the achievement of our business objectives in the affected markets difficult or impossible.

Our intellectual property protections may be insufficient to properly safeguard our technology. Expenses incurred with respect to monitoring, protecting and defending our intellectual property rights could adversely affect our business.

Effective protection of intellectual property rights may be unavailable or limited. To protect our intellectual property investments, we rely on a combination of patent, copyright, trademark and trade secret rights, confidentiality procedures and licensing arrangements.

Monitoring infringement and misappropriation of intellectual property can be difficult and expensive and we may not be able to detect infringement or misappropriation of our proprietary rights. In addition, in the event we detect infringement or misappropriation, we may incur significant litigation expenses protecting our intellectual property, which would reduce our ability to fund product initiatives. These expenses could have an adverse effect on our future cash flows and results of operations.

The gaming and lottery industries are constantly employing new technologies in both new and existing markets. Regulations that protect intellectual property generally are established on a country-by-country basis. We rely on a combination of patent and other technical security measures to protect our products and continue to apply for patents protecting such technologies. Notwithstanding these safeguards, we cannot assure that the protection of our proprietary rights will be adequate, or that our competitors will not independently develop similar technologies, duplicate our services or design around any of our patents or other intellectual property rights. Unlicensed copying and use of our intellectual property or illegal infringements of such intellectual property rights represent potential losses of revenue to us.

Furthermore, others may independently develop products similar or superior to ours without infringing on our intellectual property rights. It also is possible that others will independently develop the same or similar technologies or otherwise obtain access to the unpatented technologies upon which we rely for future growth and revenues. Failure to meaningfully protect our trade secrets, know-how or other proprietary information could adversely affect our future growth and revenues.

As part of our confidentiality procedures, we generally enter into non-disclosure agreements with our employees, directors, consultants and corporate partners, and we attempt to control access to and distribution of our technologies, documentation and other proprietary information. Despite these procedures, third parties may copy or otherwise obtain and make unauthorized use of our technologies or other proprietary information or independently develop similar technologies or information. The steps that we have taken to prevent misappropriation of our technologies or other proprietary information may not prevent their misappropriation, particularly outside the United States where laws or law enforcement practices may not protect our proprietary rights as fully as in the United States. We also may be subject to claims of moral rights from employees and developers.

We may be subject to claims of intellectual property infringement or invalidity.

As more companies engage in business activities relating to gaming and lottery technologies and develop corresponding intellectual property rights, it is increasingly likely that claims may arise which assert that some of our products or services infringe upon other parties’ intellectual property rights. These claims could subject us to costly litigation, divert management resources and result in the invalidation of our intellectual property rights. If we are found to infringe on the rights of others, we could be required to pay significant damages, cease production of infringing products, terminate our use of infringing technologies, develop non-infringing technologies or purchase a license to use the intellectual property in question from the owner. In these circumstances, continued use of technologies may require that we acquire such licenses to the intellectual property that is the subject of the alleged infringement. We might not be able to obtain these licenses on commercially reasonable terms or at all. Our use of protected technologies may result in liability that threatens our continuing operation.

The gaming and lottery industries are characterized by the rapid development of new technologies, which requires us to continuously introduce new products, as well as to expand into new markets that may be created. Therefore, our success depends in part on our ability to continually adapt our products and systems to incorporate new technologies and to expand into markets that may be created by new technologies. However, to the extent technologies are protected by the intellectual property rights of others, including our competitors, we may be prevented from introducing new products similar to these technologies or expanding into new markets. If the intellectual property rights of others prevent us from taking advantage of innovative technologies, our financial condition, operating results or prospects may be harmed.

Our future growth will depend on intellectual property provided by third parties, and such intellectual property may be subject to infringement claims and other litigation, which could adversely affect our business.

Our suppliers own the patent rights and other intellectual property rights in some of the products that we distribute. We rely on the ability of these suppliers to maintain and successfully enforce our rights to their technology. If our suppliers’ patents and other intellectual property rights are successfully challenged, invalidated or otherwise eliminated or diminished, we may lose the exclusive rights to such technology, and our competitive advantage in the industry could be adversely affected.

We face risks associated with our suppliers’ patent positions, including the potential and sometimes actual need from time to time to engage in significant legal proceedings to enforce their patents, the possibility that the validity or enforceability of patents may be denied and the possibility that third parties will be able to compete against us without infringing patents. In addition, budgetary concerns may cause us and/or our suppliers not to litigate against known infringers of patent rights, or may cause us or our suppliers not to file for patents or pursue patent protection in all jurisdictions where they may have value. If certain governmental entities infringe on our suppliers’ intellectual property rights, they may enjoy sovereign immunity from such claims. Failure to reliably enforce patent rights against infringers may make competition within the industry more difficult.

Our gaming systems, particularly our casino management system networks, may experience losses due to technical difficulties or fraudulent activities.

Our business relies on information technologies, both in-house and at customer and vendor locations. In addition, many of the systems we sell manage private personal information and protect information and locations involved in sensitive industry functions. Our success depends on our ability to avoid, detect, replicate and correct software and hardware errors and fraudulent manipulation of our products and systems. The protective measures that we use in these systems may not prevent security breaches, and failure to prevent security breaches may disrupt business and damage our reputation. A party who is able to circumvent security measures used in these systems could misappropriate sensitive or proprietary information, gain access to sensitive locations or materials, cause interruptions or otherwise damage products and services. To the extent any of our gaming machines or software experience errors or fraudulent manipulation, our customers may replace our products and services with those of our competitors. If unintended parties obtain sensitive data and information or otherwise sabotage our customers, we may receive negative publicity, incur liability to customers or lose the confidence of customers, any of which may cause the termination or modification of our contracts. In addition, the occurrence of errors in, or fraudulent manipulation of, our gaming machines or software may give rise to claims for lost revenues and related litigation by our customers and may subject us to investigation or other action by gaming regulatory authorities including suspension or revocation of our gaming licenses or disciplinary action. Further, our insurance coverage may be insufficient to cover losses and liabilities that may result from such events.

Additionally, in the event of such issues with our gaming machines or software, substantial engineering and marketing resources may be diverted from other areas to rectify the problem. In addition, we may be required to expend significant capital and other resources to protect us against the threat of security breaches or to alleviate problems caused by these breaches. Such protection or remedial measures may not be available at a reasonable price or at all, or may not be entirely effective if commenced.

Network disruptions could affect the performance of our services.

Our operations rely to a significant degree on the efficient and uninterrupted operation of complex technology systems and networks, which in some cases are integrated with those of third parties. Our hosted technology systems are potentially vulnerable to damage or interruption from a variety of sources including fire, earthquake, power loss, telecommunications or computer systems failure, human error, terrorist acts, war or other events. Although we pursue various measures to manage the risks related to network disruptions, there can be no assurances that these measures will be adequate or that the redundancies built into our systems and network operations will work as planned in the event of a disaster. Any outage in a network or system or other unanticipated problem that leads to an interruption or disruption of our service could have a material adverse effect on our operations, sales and operating results.

If our products or technologies currently in development do not achieve commercial success, our future revenue and business prospects could be adversely affected.

While we are pursuing and will continue to pursue product and technological development opportunities, there can be no assurance that such products or technologies will come to fruition or become successful. Furthermore, while a number of those products and technologies are being tested, we cannot provide any definite date by which they will be commercially viable and available, if at all. We may experience operational problems with such products after commercial introduction that could delay or prevent us from generating revenue or operating profits. Future operational problems could increase our costs, delay our plans or adversely affect our reputation or our sales of other products which, in turn, could materially adversely affect our success. We cannot predict which of the many possible future products or technologies currently in development will meet evolving industry standards and consumer demands. We cannot assure you that we will be able to adapt to technological changes or offer products on a timely basis or establish or maintain a competitive position.

Current borrowings, as well as potential future financings, may substantially increase our current indebtedness.

No assurance can be given that we will be able to generate the cash flows necessary to permit us to meet our fixed charges and payment obligations with respect to our debt, including payments pursuant to the AGI Loan. We could be required to incur additional indebtedness to meet these fixed charges and payment obligations. Any increased indebtedness may, among other things:

| | · | Adversely affect our ability to expand our business, market our products and make investments and capital expenditures; |

| | · | Adversely affect the cost and availability of funds from commercial lenders, debt financing transactions and other sources; and |

| | · | Create competitive disadvantages compared to other companies with lower debt levels. |

Any inability to service our fixed charges and payment obligations, or the incurrence of additional debt, would have an adverse effect on our cash flows, results of operations and business generally.

An inability to maintain sufficient liquidity could negatively affect expected levels of operations and new product development.

Future revenue may not be sufficient to meet operating, product development and other cash flow requirements. Sufficient funds to service our debt and maintain new product development efforts and expected levels of operations may not be available, and additional capital, if and when needed by us, may not be available on terms acceptable to us. If we cannot obtain sufficient capital on acceptable terms when needed, we may not be able to carry out our planned product development efforts and level of operations, which could harm our business.

We may not be able to continue operating as a going concern.

In their report in connection with our financial statements as of December 31, 2008, and for the fiscal year then ended, our auditors included an explanatory paragraph stating that, because we had incurred net losses of US$12,297,830 and accumulated a deficit of $27,256,985 as of December 31, 2008, there is substantial doubt about our ability to continue as a going concern.

If our revenues and gross profit do not increase, we will continue to incur significant losses and will not become profitable. Further, even if we are able to raise additional financing for our operational and financing needs, we also intend to expand our business, which will result in increased expenses related to sales and marketing, research and development, cost of revenues and general and administrative costs. We cannot assure you that our revenues will grow at the same pace as our expenses or at all. Additionally, we may encounter unforeseen difficulties and complications that require additional unexpected expenditures. Our losses may increase in future periods, and there can be no assurance that we ever will achieve positive cash flows from operating activities or reach profitability.

Our financial results vary from quarter to quarter, which could negatively impact our business.

Various factors affect our quarterly operating results, some of which are not within our control. These factors include, among others:

| | · | The financial strength of the gaming industry; |

| | · | Consumers’ willingness to spend money on leisure activities; |

| | · | The timing and introduction of new products and services; |

| | · | The mix of products and services sold; |

| | · | The timing of significant orders from and shipments to customers; |

| | · | Our product and service pricing and discounts; |

| | · | The timing of acquisitions of other companies and businesses or dispositions; and |

| | · | The general economic conditions. |

These and other factors are likely to cause our financial results to fluctuate from quarter to quarter. Based on the foregoing, we believe that quarter-to-quarter comparisons of our results of operations may not be meaningful.

Our sales often reflect a limited number of large transactions, which may not recur on an annual basis. Consequently, revenues and operating results can vary substantially from period to period as a result of the timing of revenue recognition. Our business also could be impacted by natural or man-made disasters. We have taken steps to have disaster recovery plans in place, but such an event could have a significant impact on our business.

Certain market risks may affect our business, results of operations and prospects.

In the normal course of our business, we are routinely subjected to a variety of market risks, examples of which include, but are not limited to, interest rate movements, collectability of receivables and recoverability of residual values on leased assets. Further, some of our customers may experience financial difficulties or may otherwise not pay accounts receivable when due, resulting in increased write-offs. Although we do not anticipate any material losses in these risk areas, no assurances can be made that material losses will not be incurred in these areas in the future.

Demand for our products could be adversely affected by changes in player and operator preferences.

As a supplier of gaming machines, we must offer themes and products that appeal to gaming operators and players. If we are unable to anticipate or timely react to any significant changes in player preferences, such as a negative change in the trend of acceptance of our newest systems innovations or jackpot fatigue (declining play levels on smaller jackpots), the demand for our gaming products could decline. Further, our products could suffer a loss of floor space to table games and operators may reduce revenue sharing arrangements, each of which would harm our sales and financial results. In addition, general changes in consumer behavior, such as reduced travel activity and redirection of entertainment dollars to other venues, could result in reduced demand for our products.

We are exposed to currency risk from our operations in various countries.

A substantial portion of our revenues are now, and may continue to be, realized in several currencies. A significant portion of our operating and manufacturing expenses are paid in various currencies other than U.S. dollars. Fluctuations in the exchange rate between these currencies may have a material effect on our results of operations. In particular, we may be adversely affected by a significant weakening of the U.S. dollar against the Euro. If the rates of exchange move in adverse directions, this could reduce our liquidity, profits and ability to reinvest in future development. To date, we have not engaged in any hedging transactions but may engage in such transactions in the future to reduce our exposure to currency fluctuations.

We may need to hire additional employees or contract labor in the future in order to take advantage of new business opportunities arising from increased demand, which could impede our ability to achieve or sustain profitability.

Although there can be no assurance, we believe that the gaming market will demonstrate increased demand in future periods. Our current staffing levels could affect our ability to respond to increased demand for our services. In addition, to meet any increased demand and take advantage of new business opportunities in the future, we may need to increase our workforce through additional employees or contract labor, which would increase our costs. If we experience such an increase in costs, we may not succeed in achieving or sustaining profitability.

Our insurance coverage may be inadequate.

We maintain third-party insurance coverage against various liability risks and risks of property loss. While we believe that these arrangements are an effective way to insure against liability and property damage risks, the potential liabilities associated with those risks or other events could exceed the coverage provided by such arrangements.

Interpretations and policies regarding revenue recognition could cause us to defer recognition of revenue or recognize lower revenue and profits.

As our transactions increase in complexity with the sale of multi-element products and services, negotiation of mutually acceptable terms and conditions can extend the sales cycle and, in certain situations, may require us to defer recognition of revenue. We believe that we are in compliance with U.S. Generally Accepted Accounting Principles (“U.S. GAAP”); however these future, more complex, multi-product, multi-year transactions may require additional accounting analysis to account for them accurately, which could lead to unanticipated changes in our current revenue accounting practices and may contain terms affecting the timing of revenue recognition.

New products require regulatory approval and may be subject to complex revenue recognition standards, which could materially affect our financial results.

As we introduce new products and transactions become increasingly complex, additional analysis and judgment is required to account for them and to recognize revenues in accordance with U.S. GAAP. These transactions may include multi-element arrangements and/or software components. As our products and transactions change, applicable accounting principles or regulatory product approval delays could change the timing of revenue recognition and could adversely affect our financial results for any given period.

Our ability to bid on new contracts is dependent upon our ability to fund required up-front capital expenditures through our cash from operations or through financings.

Our contracts generally require significant up-front capital expenditures. Historically, we have funded these up-front costs through cash flows generated from operations and available cash on hand. Our ability to continue to procure new contracts will depend on, among other things, our liquidity level and our ability to obtain additional financing at commercially acceptable terms to finance the initial up-front costs. If we do not have adequate liquidity or are unable to obtain financing for these up-front costs on favorable terms or at all, we may not be able to bid on certain contracts, which could restrict our ability to grow and have a material adverse effect on our results of operations.

Our revenues fluctuate due to seasonal, weather and other variations and you should not rely upon our periodic operating results as indications of future performance.

Our revenues are subject to seasonal and weather variations. Revenues usually reflect a limited number of large transactions, which may not recur on an annual basis. Consequently, revenues and operating results can vary substantially from period to period as a result of the timing of revenue recognition for major equipment sales and software license revenue. Our business could also be impacted by natural or man-made disasters such as Hurricane Katrina or the terrorist attack in New York on September 11, 2001. We have taken steps to have disaster recovery plans in place but there can be no assurance that such an event would not have a significant impact on our business.

We are dependent on the success and growth of our customers.

Our success depends on our customers buying our products to expand their existing operations, replace existing gaming machines or equip a new casino. Any slow down in the replacement cycle or delays in expansions or new openings may negatively impact our operations.

Casino operators in the gaming industry are undergoing a period of consolidation. The result of this trend is that a smaller number of companies control a larger percentage of our current and potential customer base. Because a significant portion of our sales come from repeat customers, to the extent one of our customers is sold to or merges with an entity that utilizes more of one of our competitors’ products and services, or that reduces spending on our products, our business could be negatively impacted. Additionally, to the extent the new owner allocates capital to expenditures other than gaming machines, such as hotel furnishings, restaurants and other improvements, or generally reduces expenditures, our business could be negatively impacted.

A substantial portion of our debt is subject to variable interest rates; rising interest rates could negatively impact our business.

Our borrowings from AGI bear interest at a variable rate. In addition, we may incur other variable rate indebtedness in the future. Carrying indebtedness subject to variable interest rates makes us more vulnerable to economic and industry downturns and reduces our flexibility in responding to changing business and economic conditions. Increases in interest rates on this indebtedness would increase our interest expense, which could adversely affect our cash flows and our ability to service our debt as well as our ability to grow the business.

We have limited financial resources which may be inadequate to meet our future financing needs.

Our business is a capital intensive business, and our financial resources are substantially smaller than the financial resources of our principal competitors. To continue our operations according to our business plan we will require additional equity or debt financing. There can be no assurance that we will be able to obtain the additional financial resources required to successfully compete on favorable commercial terms or at all. Failure to obtain such financing could result in the delay or abandonment of some or all of our plans for development and expansion, which could have a material adverse effect on our operating results and financial condition.

Our international operations subject us to additional risks and regulations, including the Foreign Corrupt Practices Act.

We have international operations in many foreign countries, including in Russia, Colombia and Rwanda. These activities are subject to risks inherent in operating in these countries, including government regulation, licensing requirements, currency restrictions and other restraints, burdensome taxes, risks of expropriation, threats to employees, political instability and terrorist activities, including extortion, and risks of action by U.S. and foreign governmental entities in relation to us. Should such circumstances occur, we might need to curtail, cease or alter our activities in a particular region or country. Our ability to deal with these issues may be affected by applicable U.S. laws and, in particular, potential conflicts between the requirements of U.S. law and the need to protect our employees and assets.

In addition, we are required to comply with the United States Foreign Corrupt Practices Act, which prohibits United States companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some of our competitors, are not subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in the countries in which we operate, including in Russia and Colombia. If our competitors engage in these practices they may receive preferential treatment from personnel of some companies, giving our competitors an advantage in securing business or from government officials who might give them priority in obtaining new licenses, which would put us at a disadvantage. Although we inform our personnel that such practices are illegal, there can be no assurance that our employees or other agents will not engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties.

Our prior association with PacificNet could expose us to claims or litigation.

On December 7, 2007, we entered into an agreement with PacificNet, Inc. relating to our becoming an indirect wholly-owned subsidiary of PacificNet. On May 14, 2008, this agreement and all rights and obligations of the parties thereunder were terminated. As a result, we no longer were an indirect subsidiary of PacificNet. We believe that PacificNet recently has experienced a significant downturn in its financial position, and it is possible that its financial difficulties could expose us to claims or litigation, due to our previous relationship with PacificNet. If we are named in any claims or litigation involving PacificNet, we may incur significant expenses defending or litigating such claims. These expenses could have an adverse effect on our future cash flows and results of operations. In addition, our obligations under our agreements with PacificNet are unclear and open to interpretation, which could lead to litigation if we and PacificNet differ on the interpretation of certain terms in the agreements.

We became public by means of a “reverse merger” transaction, and, as a result, we are subject to the risks associated with the prior activities of the public company.

Additional risks may exist because we became public through a “reverse merger” transaction which was effected through the Share Exchange. Prior to the Share Exchange on October 30, 2008, House Fly Rentals, Inc., our predecessor, was a development stage company with nominal assets and operations. We may require the cooperation or assistance of persons or organizations, such as auditors, previously associated with House Fly in connection with future matters that could be costly or difficult to secure. Although we performed a due diligence review of House Fly, we still may be exposed to undisclosed liabilities resulting from its prior operations and we could incur losses, damages or other costs as a result. In connection with the Share Exchange, claims may not be brought against such shareholders after six months from the closing of the Share Exchange. Therefore, any liabilities associated with the prior operations, capitalization or ownership of securities of our company by the shareholders of House Fly may be borne by our current shareholders.

Our business experiences variability in gross margins.

Our business experiences variability in gross margins on contracts due to numerous factors, including, among other things, the following:

| | · | Delays in project implementation; |

| | · | Failure to achieve add-on sales to existing customers; |

| | · | Changes in governmental regulation; |

| | · | Changes in user specifications; |

| | · | Level of commodity versus proprietary components applicable to customer system specifications; |

| | · | Whether contracts have been extended or renewed and the amount of remuneration associated with such extensions or renewals; |

| | · | Price competition in competitive bids, contract renewals and contract extensions; |

| | · | Variations in costs of materials and manufacturing; |

| | · | Variations in levels of efficiency of our workforce in delivering, implementing and servicing contracts; |

| | · | Seasonality of issuance volumes; |

| | · | Sales mix related to adoption of new products compared to sales of current products; |

| | · | Strategic decisions on new business; |

| | · | Depreciation and amortization of capitalized project costs related to new or upgraded programs; and |

| | · | Variability in the extent to which we are able to allocate personnel expenses to capital projects and thereby amortize such costs over the life of the relevant contract, rather than expensing such costs in the quarter in which they are incurred. |

As a result of the occurrence of one or more of the foregoing, we can expect that there will be fluctuations in our future operating results.

Unfavorable political developments, weak foreign economies, and other foreign risks may negatively impact our financial condition and results of operations.

Our business is dependent on international markets for the majority of our revenues. We expect that receivables with respect to sales outside of the United States will continue to account for a large portion of our total revenues. As a result, our business in these markets is subject to a variety of risks, including:

| | · | Social, political and economic instability; |

| | · | Additional costs of compliance; |

| | · | Tariffs and other trade barriers; |

| | · | Recessions in foreign economies; |

| | · | Expropriation, nationalization and limitation on repatriation of earnings; |

| | · | Fluctuations in foreign exchange rates; |

| | · | Adverse changes in the creditworthiness of parties with whom we have significant receivables; |

| | · | Reduced protection of intellectual property rights in some countries; |

| | · | Longer receivables collection periods and greater difficulty in collecting accounts receivable; |

| | · | Difficulties in managing foreign operations; |

| | · | Unexpected changes in regulatory requirements; |

| | · | Ability to finance foreign operations; |

| | · | Changes in consumer tastes and trends; and |

| | · | Acts of war or terrorism. |

Any of these international developments, or others, could adversely affect our financial condition and results of operations.

Future acquisitions could prove difficult to integrate, disrupt our business, dilute shareholder value and strain our resources.

As part of our business strategy, we intend to acquire businesses, services and technologies that we believe could complement or expand our business, augment our market coverage, enhance our technical capabilities, provide us with valuable customer contacts or otherwise offer growth opportunities. If we fail to achieve the anticipated benefits of any acquisitions we complete, our business, operating results, financial condition and prospects may be impaired. Acquisitions and investments involve numerous risks, including:

| | · | Difficulties in integrating operations, technologies, services, accounting and personnel; |

| | · | Difficulties in supporting and transitioning customers of our acquired companies to our technology platforms and business processes; |

| | · | Diversion of financial and management resources from existing operations; |

| | · | Difficulties in obtaining regulatory approval for technologies and products of acquired companies; |

| | · | Potential loss of key employees; |