Exhibit B

| Acquisition of NovAtel 8 October 2007 |

| Key Transaction Highlights Combination Rationale Overview of NovAtel Overview of Transaction Review of Financial Impact Closing Remarks and Q&A - Jonathan Ladd, NovAtel - Ola Rollén Agenda 8 October 2007 |

| Forward-Looking Statements This PowerPoint presentation contains projections and other forward-looking statements regarding expected performance of Hexagon following completion of the acquisition, including statements related to Hexagon’s product and service offerings and the future of the precision global navigation satellite system markets. Statement regarding future events are based on the parties’ current expectations and are necessarily subject to associated risks related to, among other things, obtaining a sufficient number of tendered shares of common stock and regulatory approval of the merger, the potential impact on the business of NovAtel due to the uncertainty about the acquisition, the retention of employees of NovAtel and the ability of Hexagon to successfully integrate NovAtel and to achieve expected benefits. Actual results may differ materially from those in the projections or other forward-looking statements. For information regarding other related risks, please see the Hexagon’s Annual Report by going to Hexagon’s Investors Website at www.hexagon.se. Securities Law Disclosure The tender offer for the outstanding common stock of NovAtel has not yet commenced. This PowerPoint presentation is for informational purposes only and is not an offer to buy or the solicitation of an offer to sell any securities. The solicitation and the offer to buy shares of NovAtel common stock will be made only pursuant to an offer to purchase and related materials that Hexagon AB intends to file with the SEC on Schedule TO. NovAtel also intends to file a solicitation/recommendation statement on Schedule 14D-9 with respect to the offer. NovAtel stockholders and other investors should read these materials carefully because they contain important information, including the terms and conditions of the offer. NovAtel stockholders and other investors will be able to obtain copies of these materials without charge from the SEC through the SEC’s website at www.sec.gov. Stockholders and other investors are urged to read carefully those materials prior to making any decisions with respect to the offer. |

| Key Transaction Highlights Hexagon has agreed to acquire NovAtel, a leading provider of high precision GNSS technology components and sub-systems Transaction enhances Hexagon’s position in an attractive and rapidly growing market Offer is for USD 50 per share in cash, or an aggregate purchase price of roughly USD 390 million, net of NovAtel’s cash balance Transaction is attractive from a financial perspective to Hexagon’s shareholders and is expected to contribute to earnings as of consolidation date Transaction approved by NovAtel’s Board of Directors and has the full support of NovAtel’s senior management Transaction expected to close during Q4 2007, subject to customary conditions |

| Combination Rationale Transaction creates a leader in the rapidly growing market for high precision GNSS technology solutions Combining NovAtel’s technology with Hexagon’s access to new, fast growing, applications and software solutions is expected to produce meaningful strategic and financial benefits Hexagon has been integral to NovAtel’s OEM strategy, accounting for 23% of NovAtel’s revenues in 2006 In return, NovAtel has been a core supplier of GNSS technology to Hexagon, ensuring its products remain at the technological forefront A combination allows both parties to focus on delivering new high technology solutions to both the current core markets as well as new emerging markets for the GNSS technology |

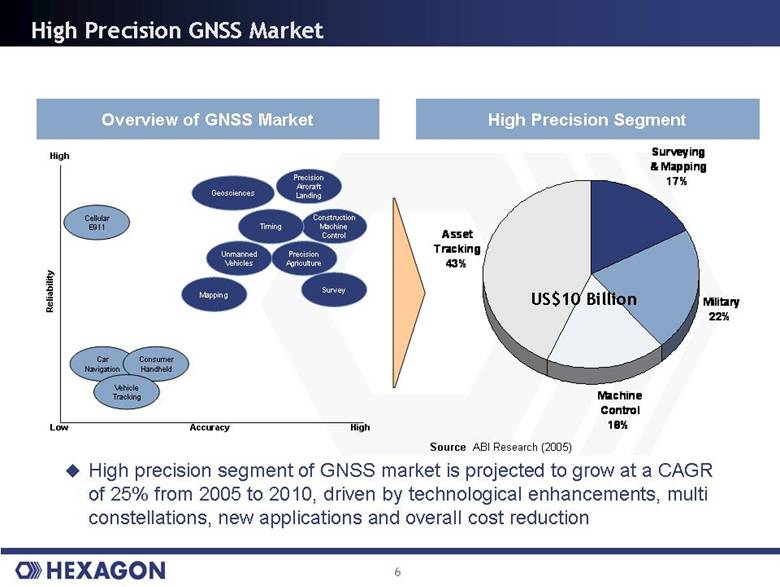

| High Precision GNSS Market Overview of GNSS Market High Precision Segment US$10 Billion Source ABI Research (2005) High precision segment of GNSS market is projected to grow at a CAGR of 25% from 2005 to 2010, driven by technological enhancements, multi constellations, new applications and overall cost reduction Car Navigation Consumer Handheld Vehicle Tracking Cellular E911 Precision Aircraft Landing Construction Machine Control Precision Agriculture Unmanned Vehicles Survey Mapping High Low High Accuracy Reliability Timing Geosciences Surveying & Mapping 17% Military 22% Machine Control 18% Asset Tracking 43% |

| The development of multi constellations - GNSS GPS – US system 1990-ies GLONASS – Russian system 2006 Galileo – European system 2010 Compass – Chinese system 2010 INRSS – Indian system 2012 Multi constellations will drive precision and speed opening up previously closed markets for GNSS applications |

| NovAtel Overview World leader in high-precision satellite positioning component technologies and sub-systems Key products include receivers, enclosures, antennas and firmware Used in range of applications, including surveying and mapping Proprietary and patented technology Founded in 1978 and publicly traded on NASDAQ since 1997 Based in Calgary, Canada with 300 employees |

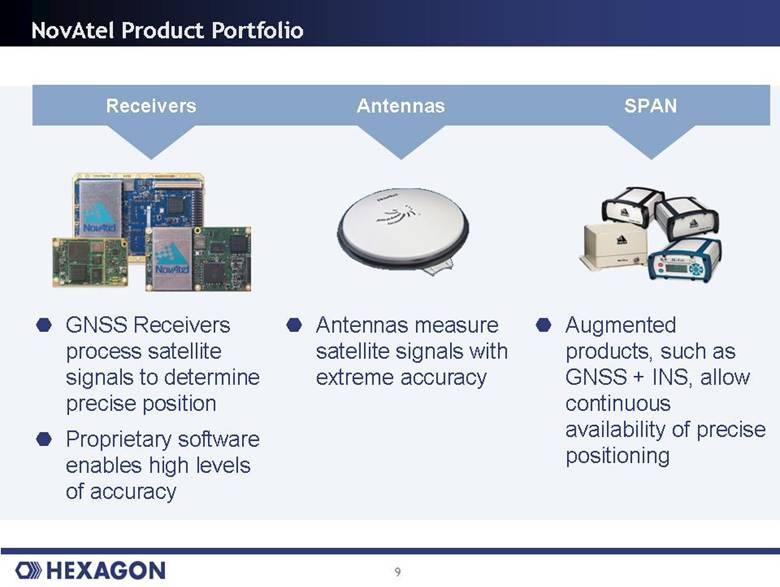

| NovAtel Product Portfolio GNSS Receivers process satellite signals to determine precise position Proprietary software enables high levels of accuracy Antennas measure satellite signals with extreme accuracy Augmented products, such as GNSS + INS, allow continuous availability of precise positioning SPAN Receivers Antennas |

| NovAtel Product Applications Special Applications (2) Aerospace and Defence Geomatics Systems 12% of revenue(1) 17% of revenue(1) 71% of revenue(1) Civil air traffic control Flight management systems Defence weapons training Surveying Mapping Geographic Information Systems (GIS) Precision agriculture Unmanned vehicles Port automation Commercial marine Emerging markets Machine control Asset tracking Others brought by Hexagon Based on 2006 revenue Includes sales to Leica Geosystems |

| NovAtel’s Strong Financial Performance 02-06 CAGR +24% Rapid Revenue Growth Revenue (C$ million) Net Income (C$ million) 02-06 CAGR +95% 33.1 38.7 53.9 63.3 77.6 0.0 30.0 60.0 90.0 2002 2003 2004 2005 2006 1.5 3.5 12.8 16.7 21.5 0.0 5.0 10.0 15.0 20.0 25.0 2002 2003 2004 2005 2006 and Strong Earnings Momentum |

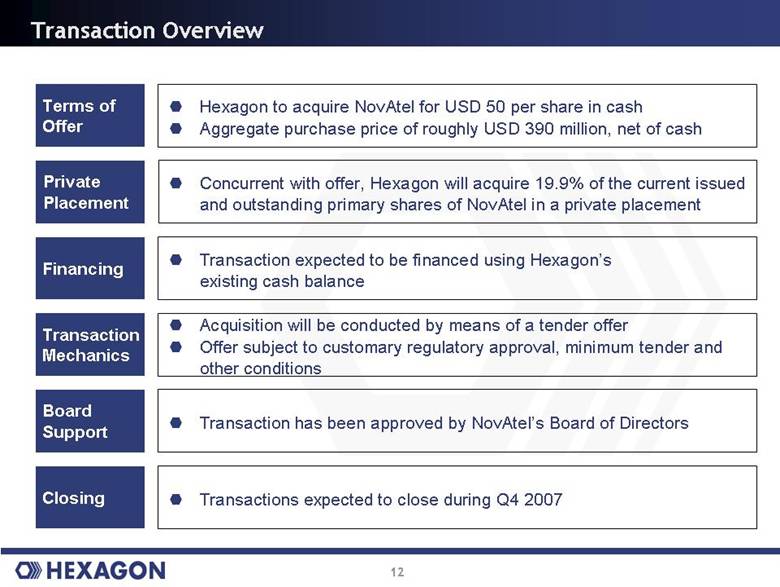

| Transaction Overview Terms of Offer Hexagon to acquire NovAtel for USD 50 per share in cash Aggregate purchase price of roughly USD 390 million, net of cash Financing Board Support Transaction Mechanics Closing Transaction expected to be financed using Hexagon’s existing cash balance Transaction has been approved by NovAtel’s Board of Directors Acquisition will be conducted by means of a tender offer Offer subject to customary regulatory approval, minimum tender and other conditions Transactions expected to close during Q4 2007 Private Placement Concurrent with offer, Hexagon will acquire 19.9% of the current issued and outstanding primary shares of NovAtel in a private placement |

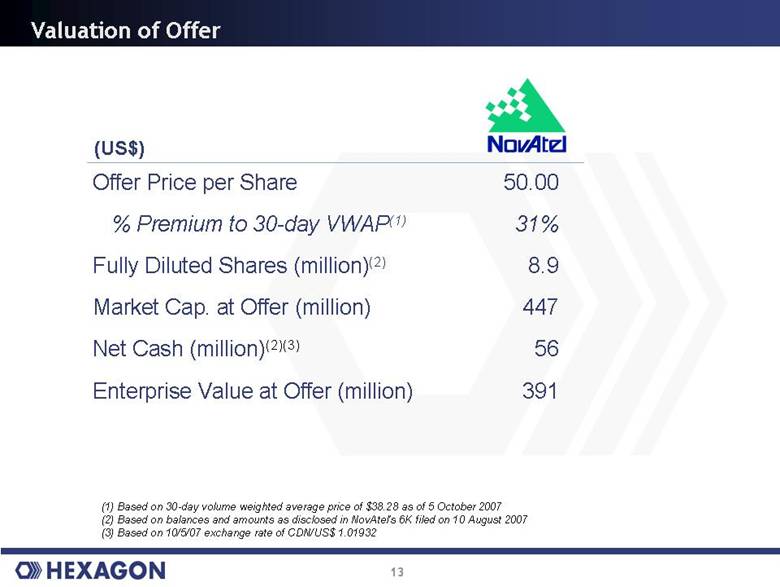

| Valuation of Offer Offer Price per Share 50.00 % Premium to 30-day VWAP(1) 31% Fully Diluted Shares (million)(2) 8.9 Market Cap. at Offer (million) 447 Net Cash (million)(2)(3) 56 Enterprise Value at Offer (million) 391 (US$) (1) Based on 30-day volume weighted average price of $38.28 as of 5 October 2007 (2) Based on balances and amounts as disclosed in NovAtel’s 6K filed on 10 August 2007 (3) Based on 10/5/07 exchange rate of CDN/US$ 1.01932 |

| Financial Impact to Hexagon (Assuming consolidation on 1 Jan 2008) Expected to enhance top line growth as well as EBIT margin Expected to drive Hexagon towards new, rapidly growing segments of the industry Expected to contribute to earnings as of consolidation date Strategic merits of transaction expected to deliver meaningful financial benefits over time Transaction expected to meet Hexagon’s internal acquisition targets |

|

|