Second Quarter Fiscal Year 2020 Earnings Presentation May 7, 2020 Nasdaq: OCSL Exhibit 99.2

Forward Looking Statements Some of the statements in this presentation constitute forward-looking statements because they relate to future events or our future performance or financial condition. The forward-looking statements contained in this presentation may include statements as to: our future operating results and distribution projections; the ability of Oaktree Fund Advisors, LLC (“Oaktree”) to reposition our portfolio and to implement Oaktree’s future plans with respect to our business; the ability of Oaktree to attract and retain highly talented professionals; our business prospects and the prospects of our portfolio companies; the impact of the investments that we expect to make; the ability of our portfolio companies to achieve their objectives; our expected financings and investments and additional leverage we may seek to incur in the future; the adequacy of our cash resources and working capital; the timing of cash flows, if any, from the operations of our portfolio companies; and the cost or potential outcome of any litigation to which we may be a party. In addition, words such as “anticipate,” “believe,” “expect,” “seek,” “plan,” “should,” “estimate,” “project” and “intend” indicate forward-looking statements, although not all forward-looking statements include these words. The forward-looking statements contained in this presentation involve risks and uncertainties. Our actual results could differ materially from those implied or expressed in the forward-looking statements for any reason, including the factors set forth in “Risk Factors” and elsewhere in our annual report on Form 10-K for the fiscal year ended September 30, 2019 and our quarterly report on Form 10-Q for the quarter ended March 31, 2020. Other factors that could cause actual results to differ materially include: changes or potential disruptions in our operations, the economy, financial markets or political environment; risks associated with possible disruption in our operations or the economy generally due to terrorism, natural disasters or the COVID-19 pandemic; future changes in laws or regulations (including the interpretation of these laws and regulations by regulatory authorities) and conditions in our operating areas, particularly with respect to business development companies or regulated investment companies; general considerations associated with the COVID-19 pandemic; and other considerations that may be disclosed from time to time in our publicly disseminated documents and filings. We have based the forward-looking statements included in this presentation on information available to us on the date of this presentation, and we assume no obligation to update any such forward-looking statements. Although we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, you are advised to consult any additional disclosures that we may make directly to you or through reports that we in the future may file with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. Unless otherwise indicated, data provided herein are dated as of March 31, 2020.

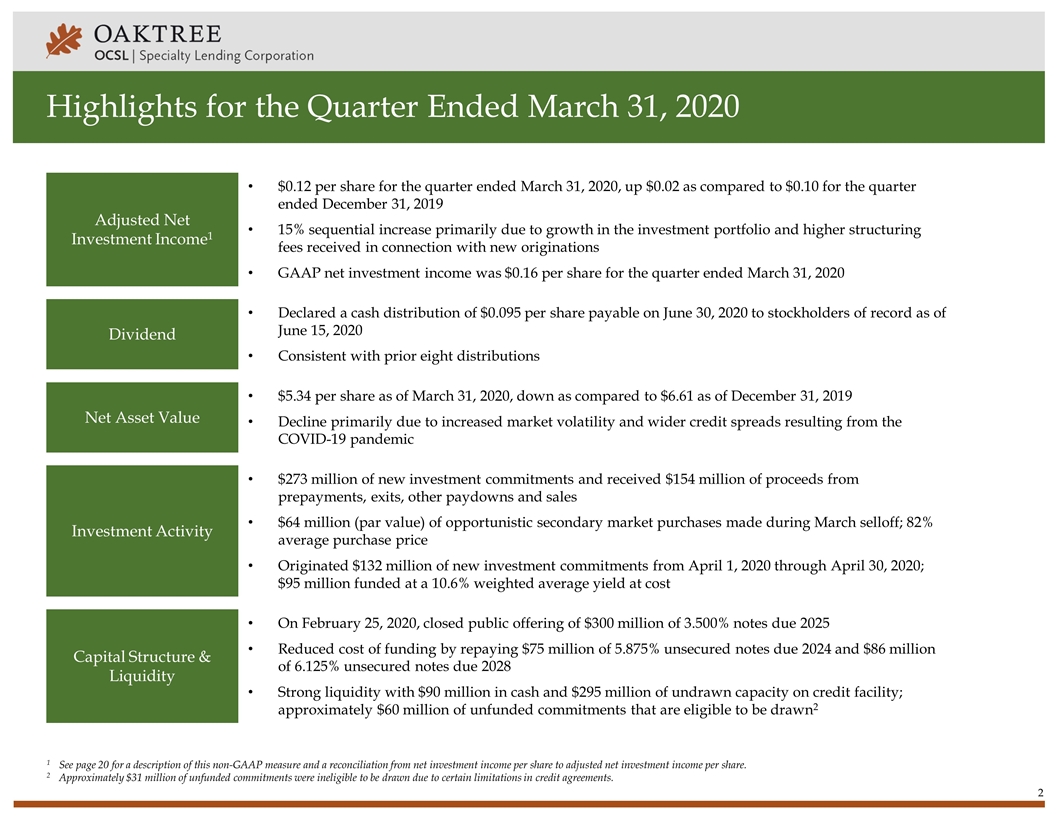

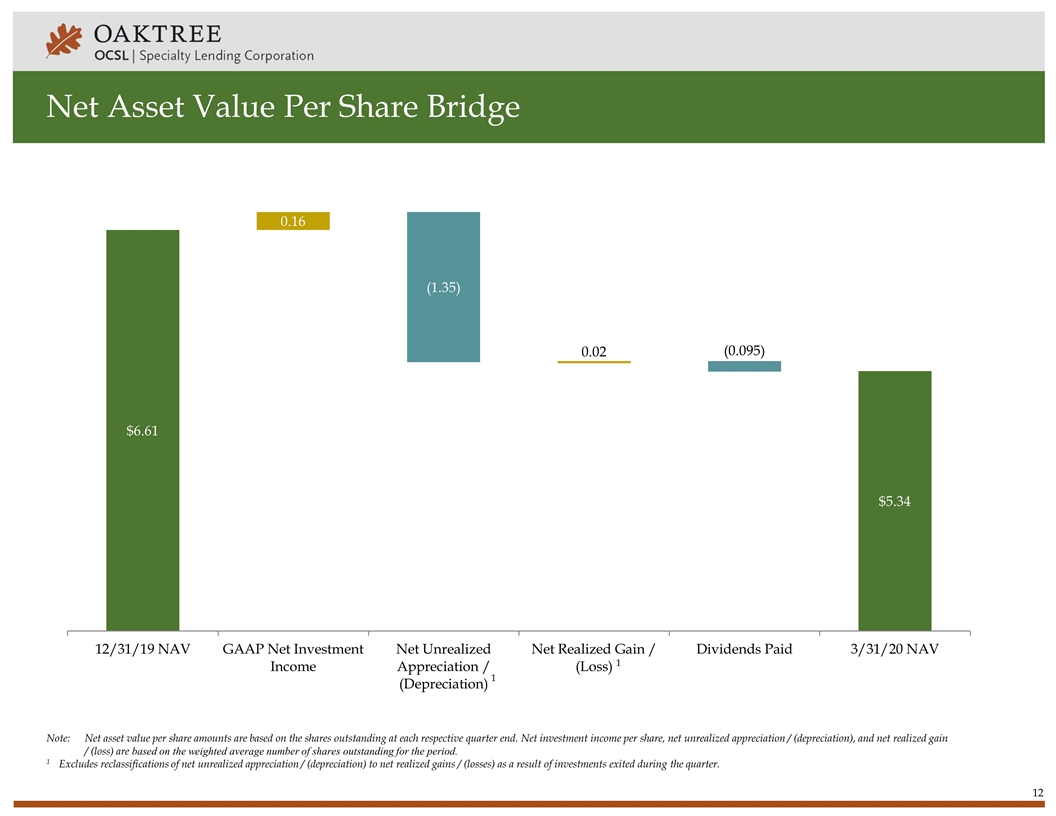

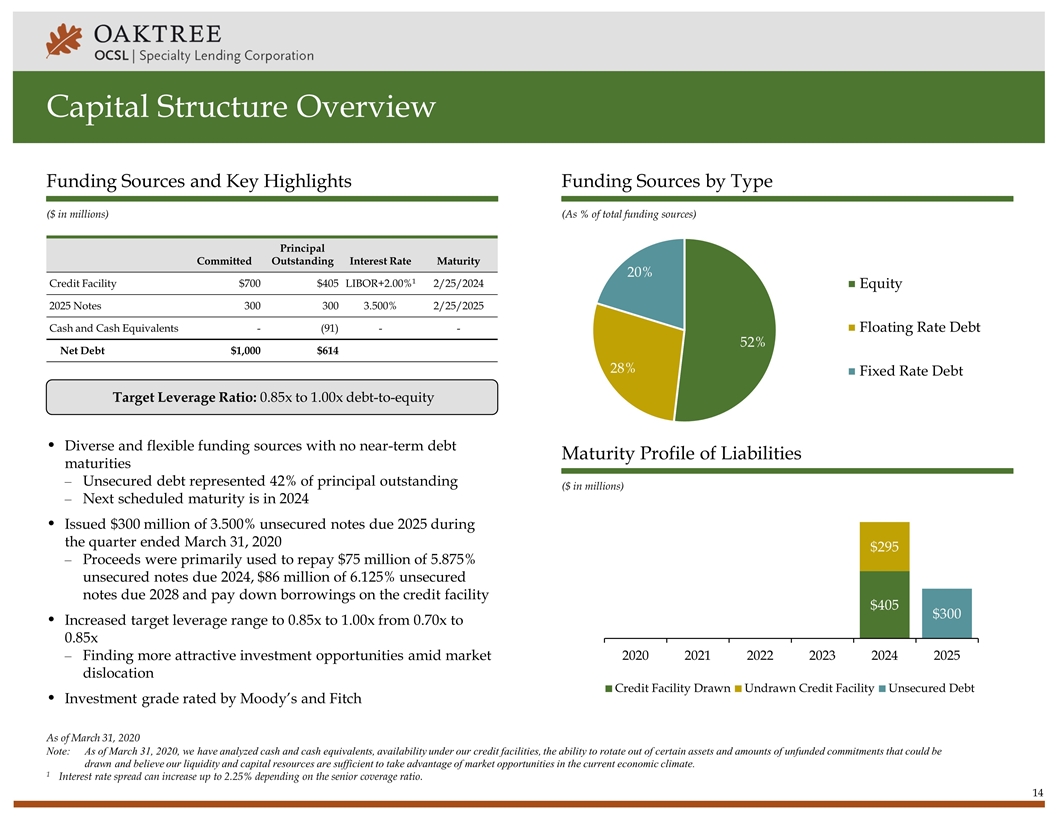

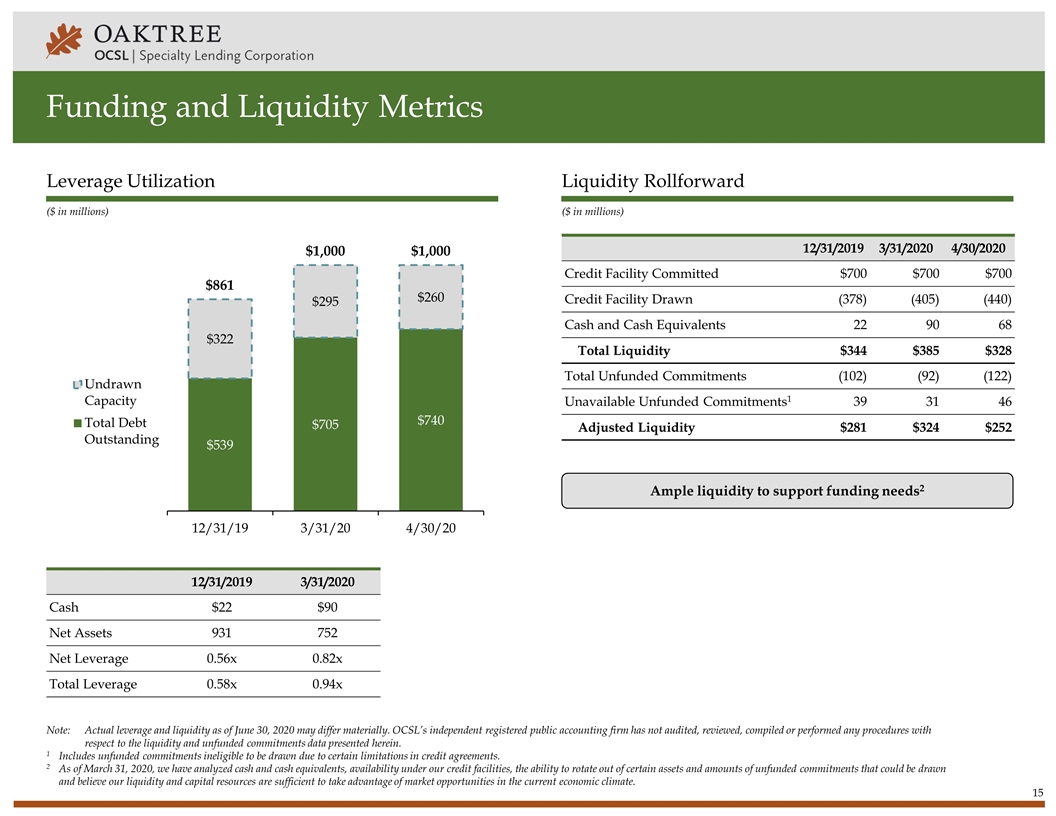

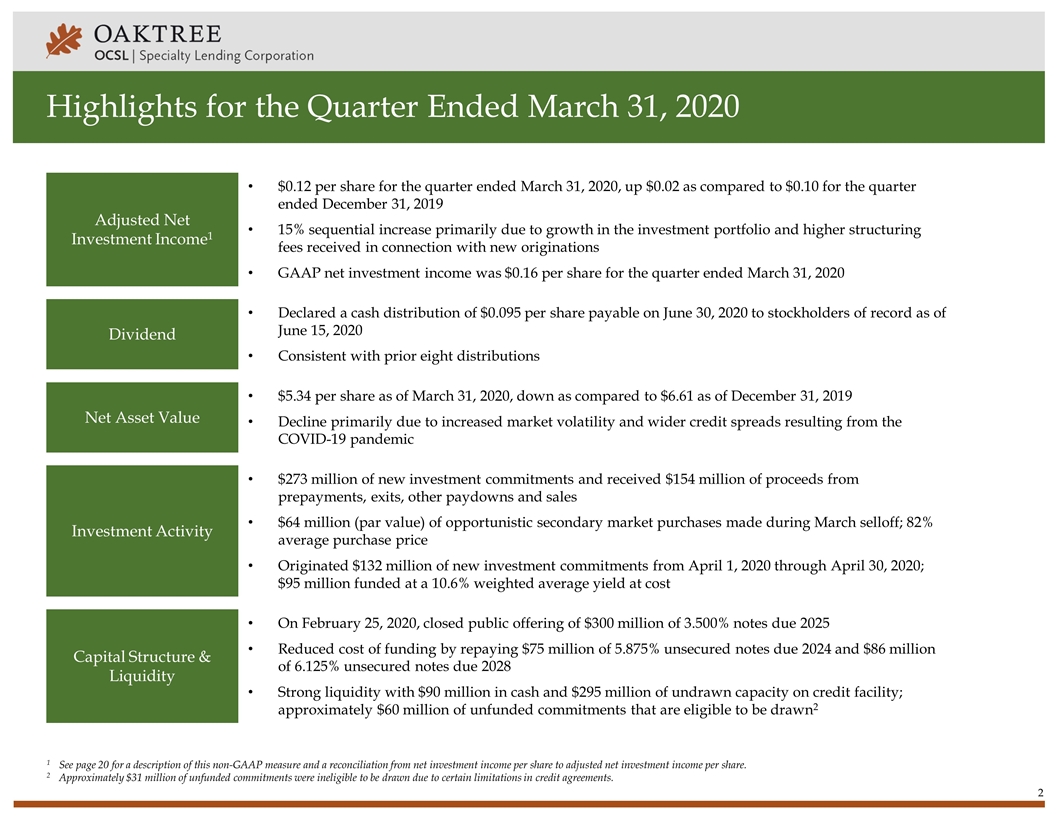

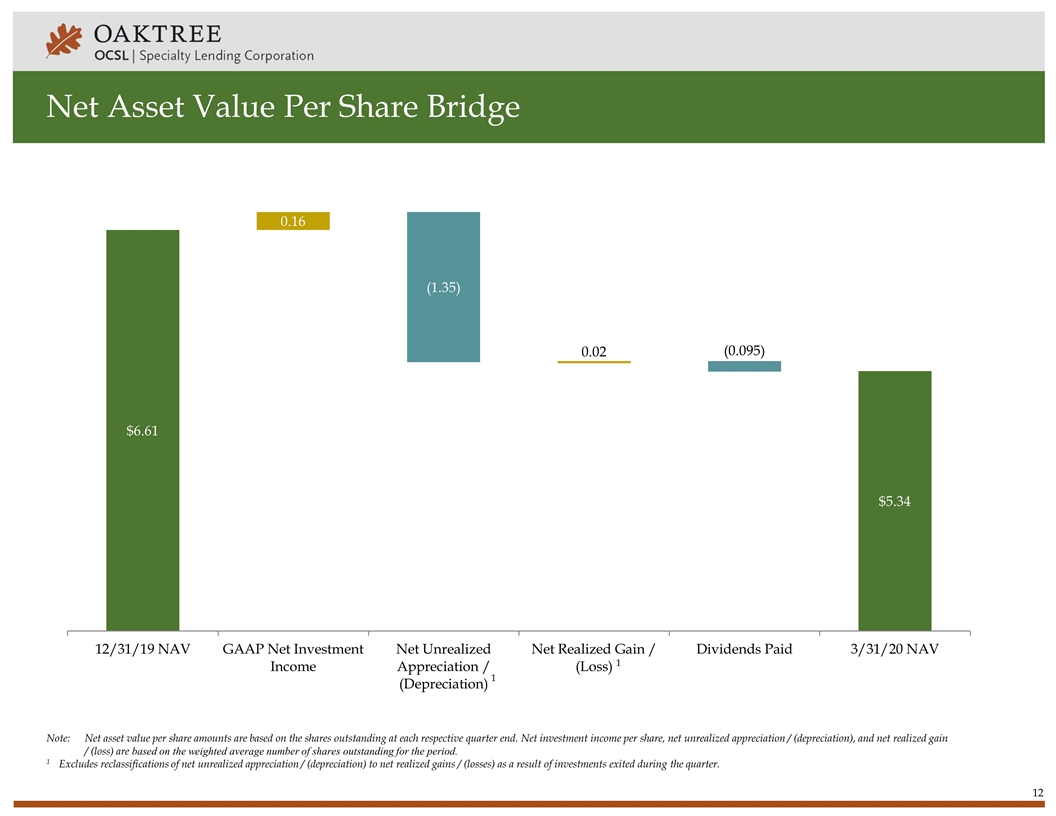

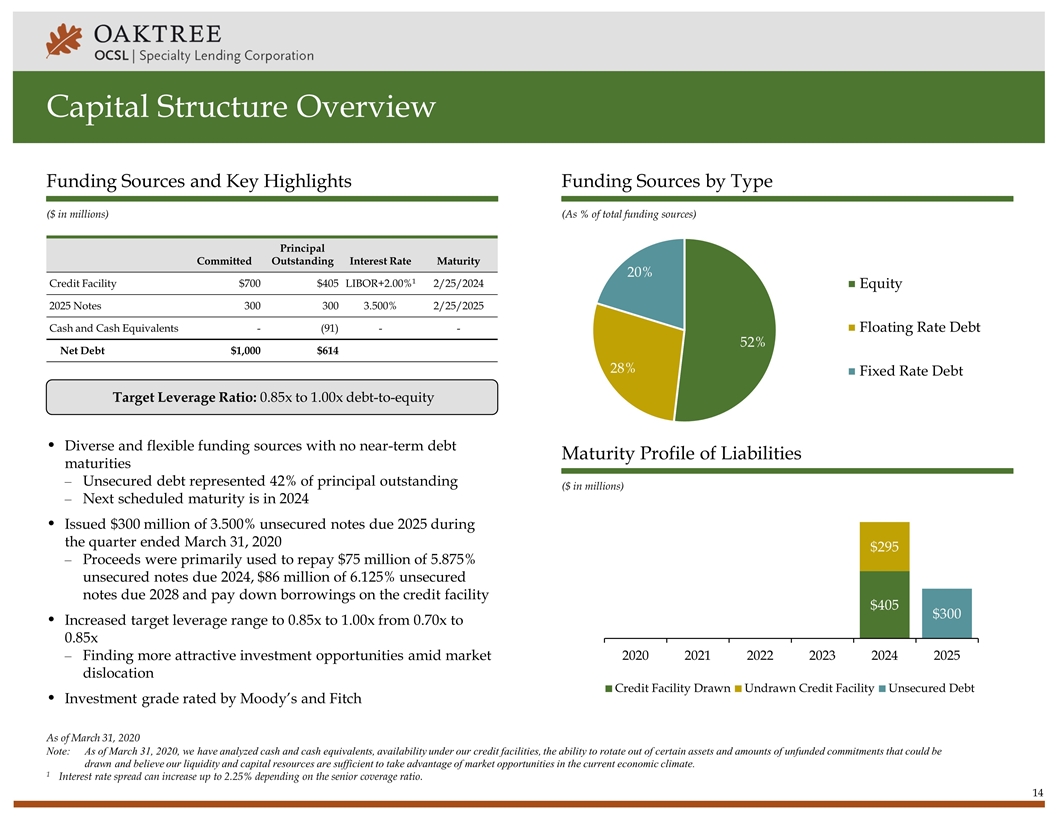

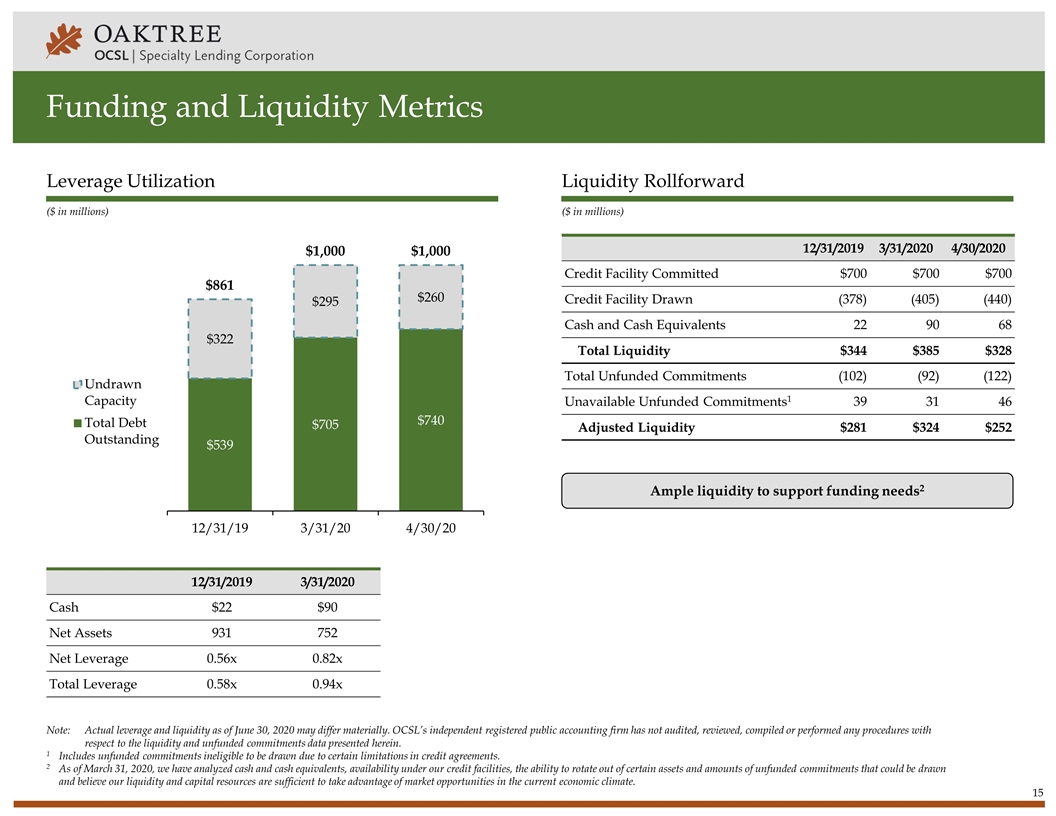

Highlights for the Quarter Ended March 31, 2020 Adjusted Net Investment Income1 $0.12 per share for the quarter ended March 31, 2020, up $0.02 as compared to $0.10 for the quarter ended December 31, 2019 15% sequential increase primarily due to growth in the investment portfolio and higher structuring fees received in connection with new originations GAAP net investment income was $0.16 per share for the quarter ended March 31, 2020 Dividend Declared a cash distribution of $0.095 per share payable on June 30, 2020 to stockholders of record as of June 15, 2020 Consistent with prior eight distributions Net Asset Value $5.34 per share as of March 31, 2020, down as compared to $6.61 as of December 31, 2019 Decline primarily due to increased market volatility and wider credit spreads resulting from the COVID-19 pandemic Investment Activity $273 million of new investment commitments and received $154 million of proceeds from prepayments, exits, other paydowns and sales $64 million (par value) of opportunistic secondary market purchases made during March selloff; 82% average purchase price Originated $132 million of new investment commitments from April 1, 2020 through April 30, 2020; $95 million funded at a 10.6% weighted average yield at cost Capital Structure & Liquidity On February 25, 2020, closed public offering of $300 million of 3.500% notes due 2025 Reduced cost of funding by repaying $75 million of 5.875% unsecured notes due 2024 and $86 million of 6.125% unsecured notes due 2028 Strong liquidity with $90 million in cash and $295 million of undrawn capacity on credit facility; approximately $60 million of unfunded commitments that are eligible to be drawn2 1See page 20 for a description of this non-GAAP measure and a reconciliation from net investment income per share to adjusted net investment income per share. 2Approximately $31 million of unfunded commitments were ineligible to be drawn due to certain limitations in credit agreements.

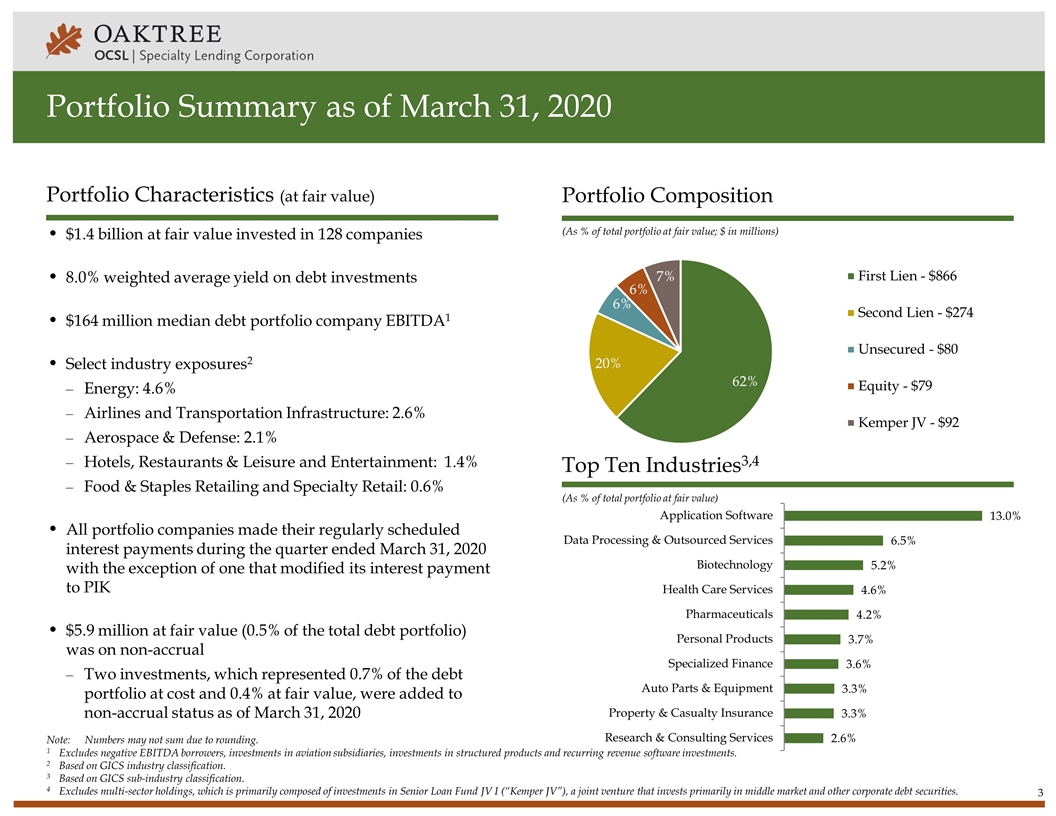

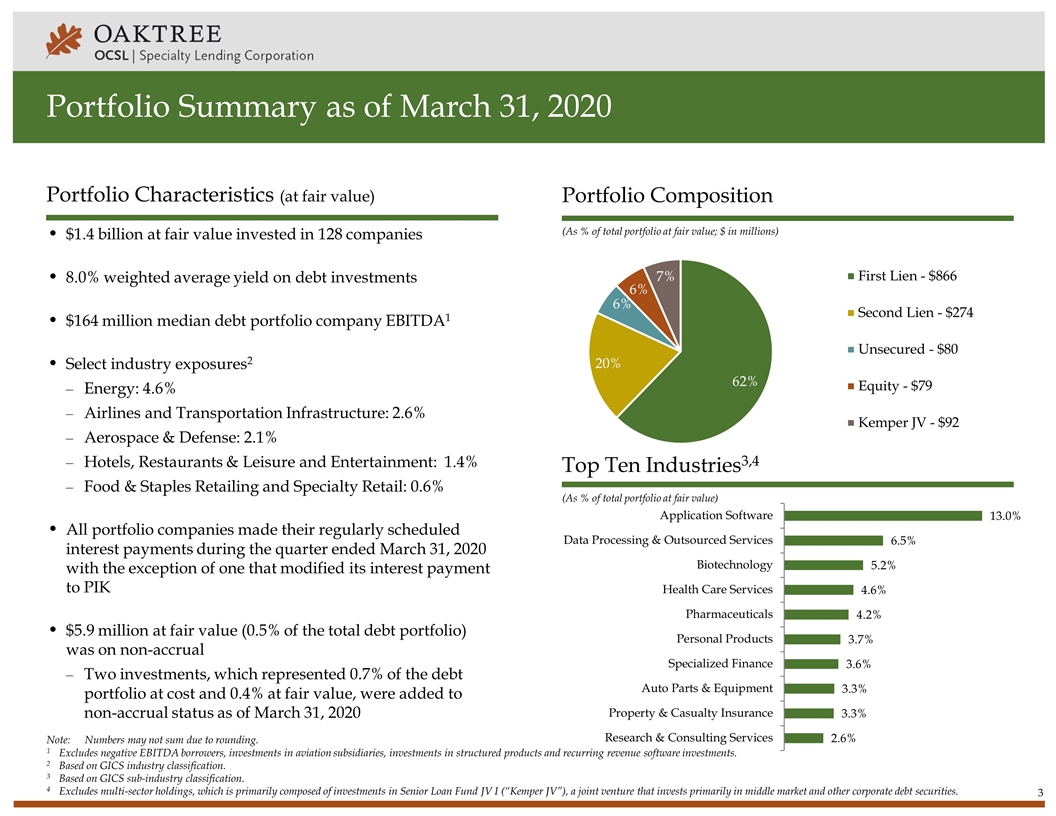

Portfolio Summary as of March 31, 2020 (As % of total portfolio at fair value; $ in millions) (As % of total portfolio at fair value) Portfolio Composition Top Ten Industries3,4 Portfolio Characteristics (at fair value) Note:Numbers may not sum due to rounding. 1Excludes negative EBITDA borrowers, investments in aviation subsidiaries, investments in structured products and recurring revenue software investments. 2Based on GICS industry classification. 3Based on GICS sub-industry classification. 4Excludes multi-sector holdings, which is primarily composed of investments in Senior Loan Fund JV I (“Kemper JV”), a joint venture that invests primarily in middle market and other corporate debt securities. $1.4 billion at fair value invested in 128 companies 8.0% weighted average yield on debt investments $164 million median debt portfolio company EBITDA1 Select industry exposures2 Energy: 4.6% Airlines and Transportation Infrastructure: 2.6% Aerospace & Defense: 2.1% Hotels, Restaurants & Leisure and Entertainment: 1.4% Food & Staples Retailing and Specialty Retail: 0.6% All portfolio companies made their regularly scheduled interest payments during the quarter ended March 31, 2020 with the exception of one that modified its interest payment to PIK $5.9 million at fair value (0.5% of the total debt portfolio) was on non-accrual Two investments, which represented 0.7% of the debt portfolio at cost and 0.4% at fair value, were added to non-accrual status as of March 31, 2020

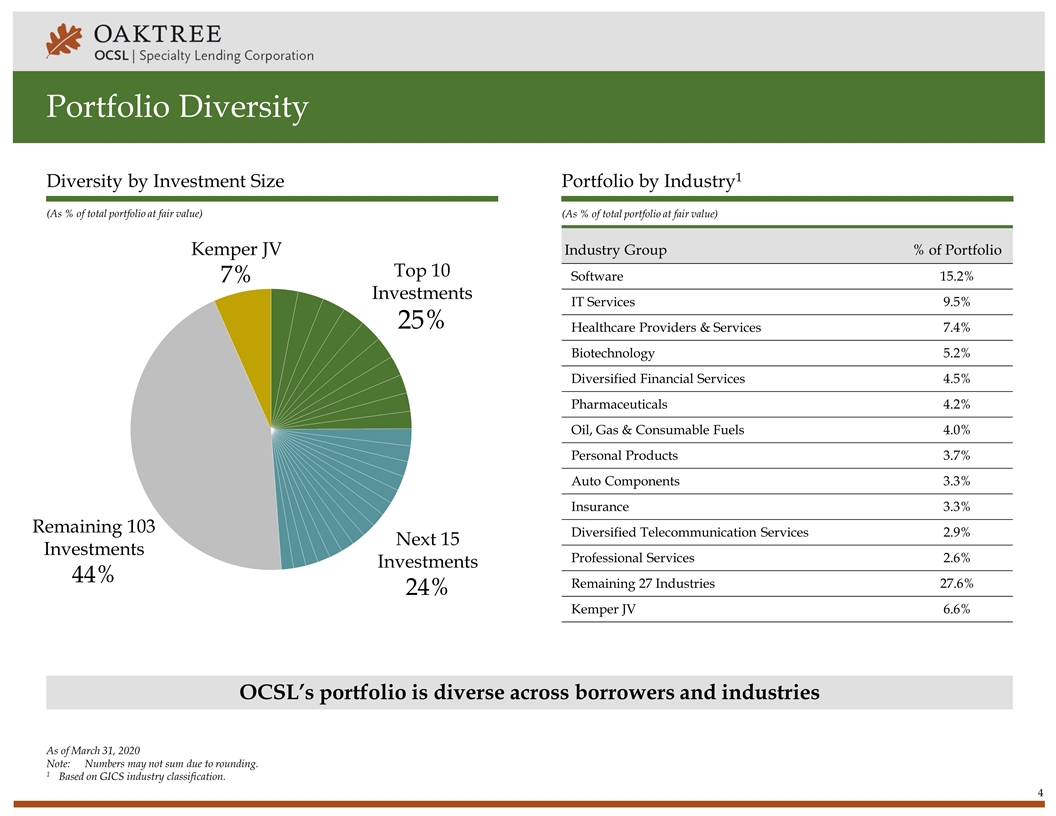

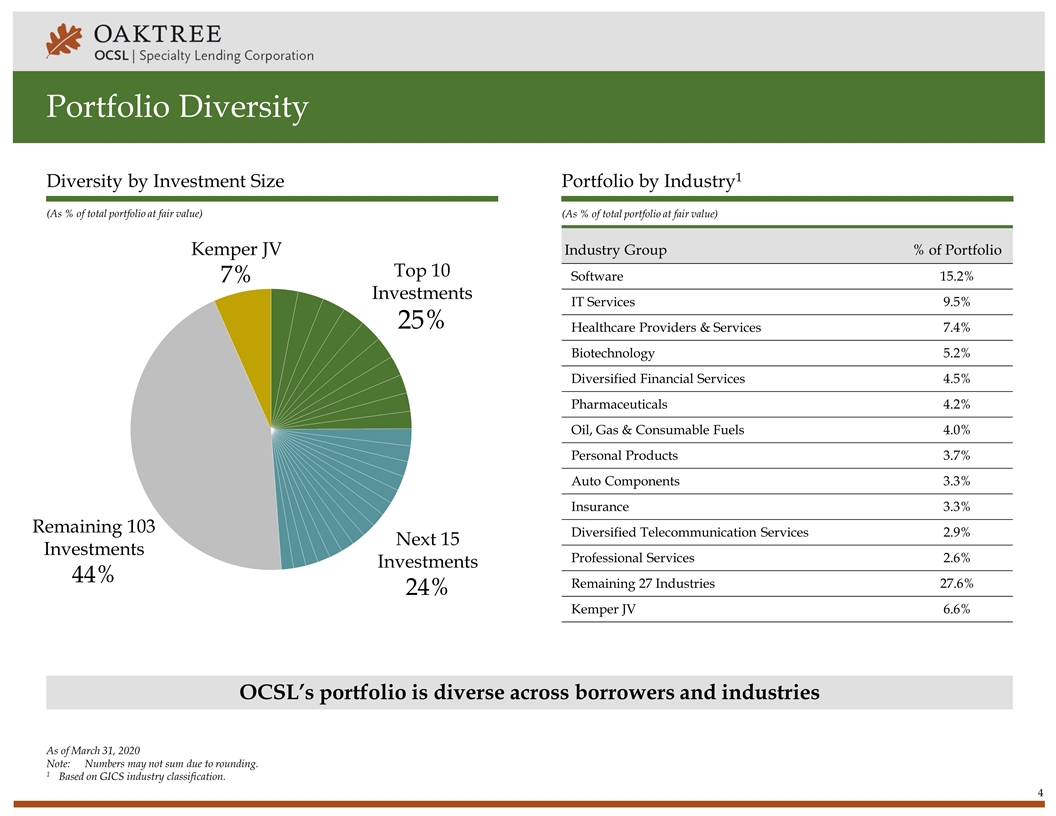

Portfolio Diversity OCSL’s portfolio is diverse across borrowers and industries (As % of total portfolio at fair value) Portfolio by Industry1 Diversity by Investment Size Top 10 Investments 25% Next 15 Investments 24% Remaining 103 Investments 44% Kemper JV 7% As of March 31, 2020 Note:Numbers may not sum due to rounding. 1 Based on GICS industry classification. Industry Group % of Portfolio Software 15.2% IT Services 9.5% Healthcare Providers & Services 7.4% Biotechnology 5.2% Diversified Financial Services 4.5% Pharmaceuticals 4.2% Oil, Gas & Consumable Fuels 4.0% Personal Products 3.7% Auto Components 3.3% Insurance 3.3% Diversified Telecommunication Services 2.9% Professional Services 2.6% Remaining 27 Industries 27.6% Kemper JV 6.6% (As % of total portfolio at fair value)

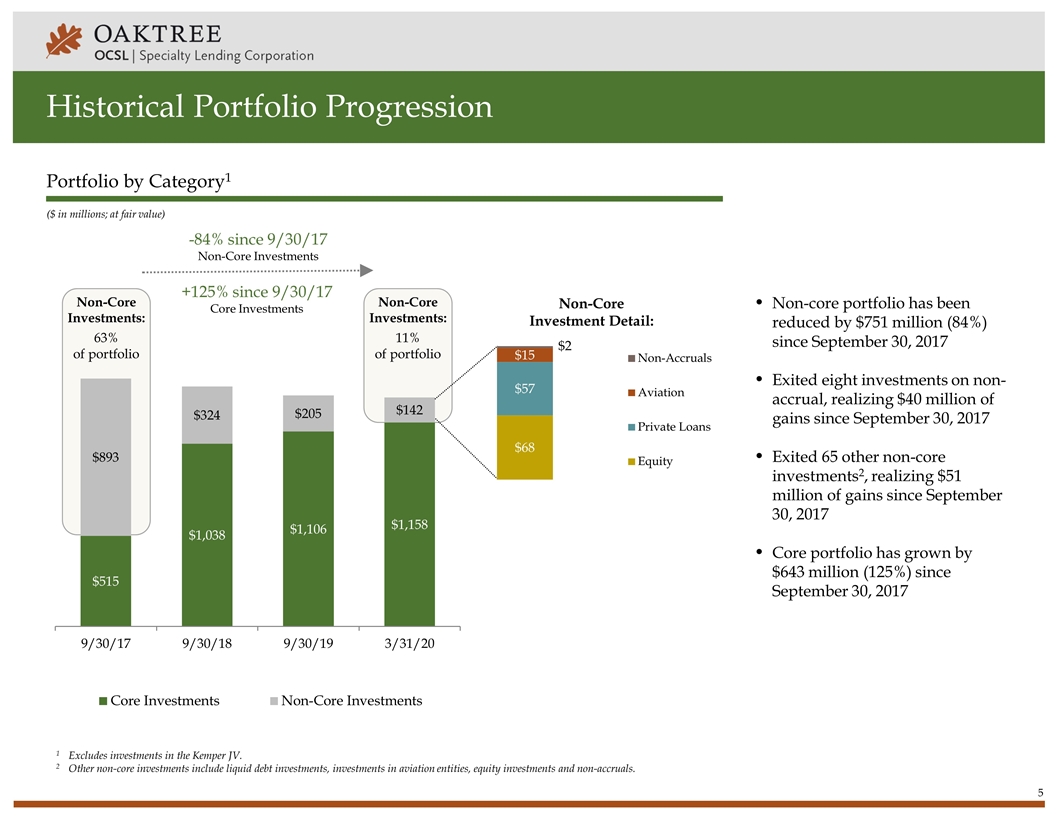

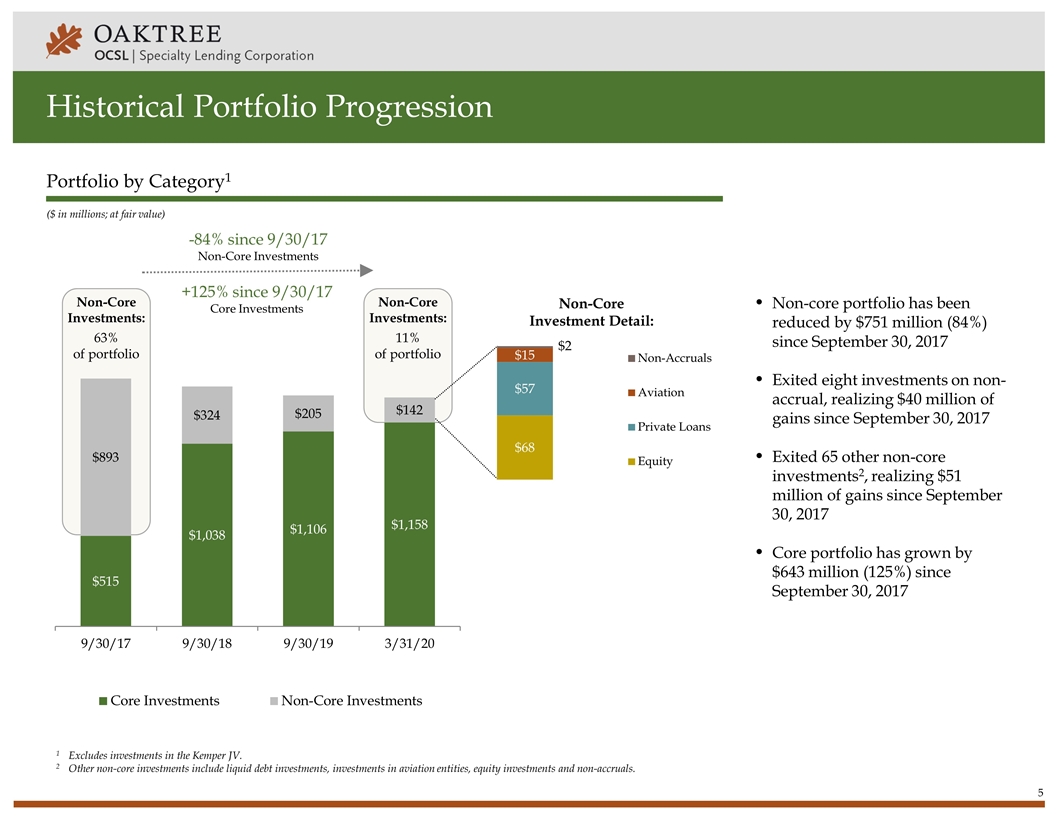

Non-Core Investments: 11% of portfolio Non-Core Investments: 63% of portfolio Historical Portfolio Progression ($ in millions; at fair value) Portfolio by Category1 -84% since 9/30/17 Non-Core Investments 1Excludes investments in the Kemper JV. 2Other non-core investments include liquid debt investments, investments in aviation entities, equity investments and non-accruals. +125% since 9/30/17 Core Investments Non-Core Investment Detail: Non-core portfolio has been reduced by $751 million (84%) since September 30, 2017 Exited eight investments on non-accrual, realizing $40 million of gains since September 30, 2017 Exited 65 other non-core investments2, realizing $51 million of gains since September 30, 2017 Core portfolio has grown by $643 million (125%) since September 30, 2017

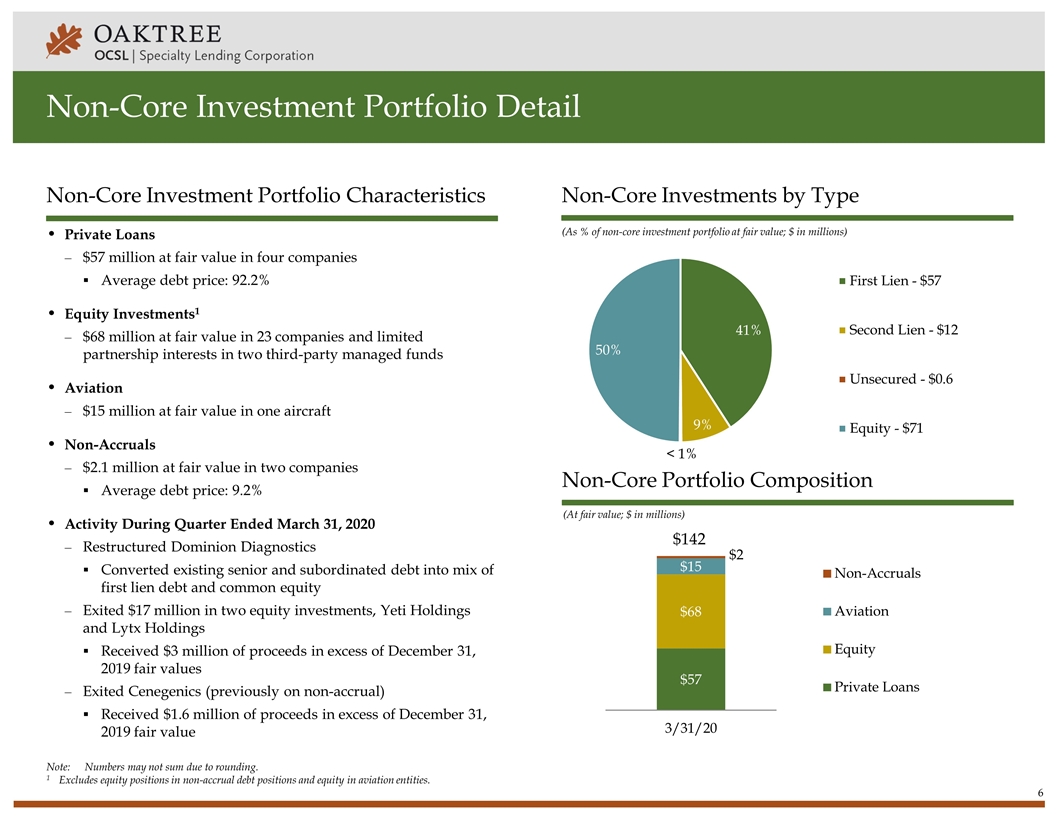

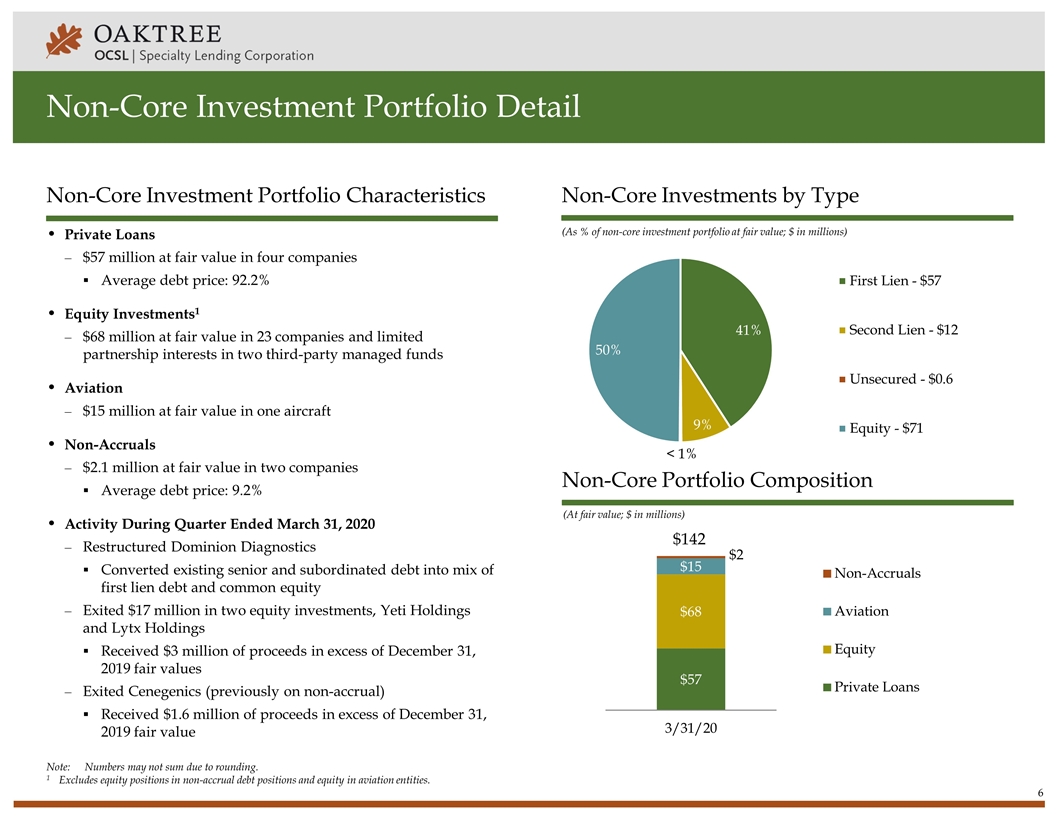

Note:Numbers may not sum due to rounding. 1Excludes equity positions in non-accrual debt positions and equity in aviation entities. Non-Core Investment Portfolio Detail Non-Core Investment Portfolio Characteristics Private Loans $57 million at fair value in four companies Average debt price: 92.2% Equity Investments1 $68 million at fair value in 23 companies and limited partnership interests in two third-party managed funds Aviation $15 million at fair value in one aircraft Non-Accruals $2.1 million at fair value in two companies Average debt price: 9.2% Activity During Quarter Ended March 31, 2020 Restructured Dominion Diagnostics Converted existing senior and subordinated debt into mix of first lien debt and common equity Exited $17 million in two equity investments, Yeti Holdings and Lytx Holdings Received $3 million of proceeds in excess of December 31, 2019 fair values Exited Cenegenics (previously on non-accrual) Received $1.6 million of proceeds in excess of December 31, 2019 fair value (As % of non-core investment portfolio at fair value; $ in millions) Non-Core Investments by Type (At fair value; $ in millions) Non-Core Portfolio Composition $142 < 1%

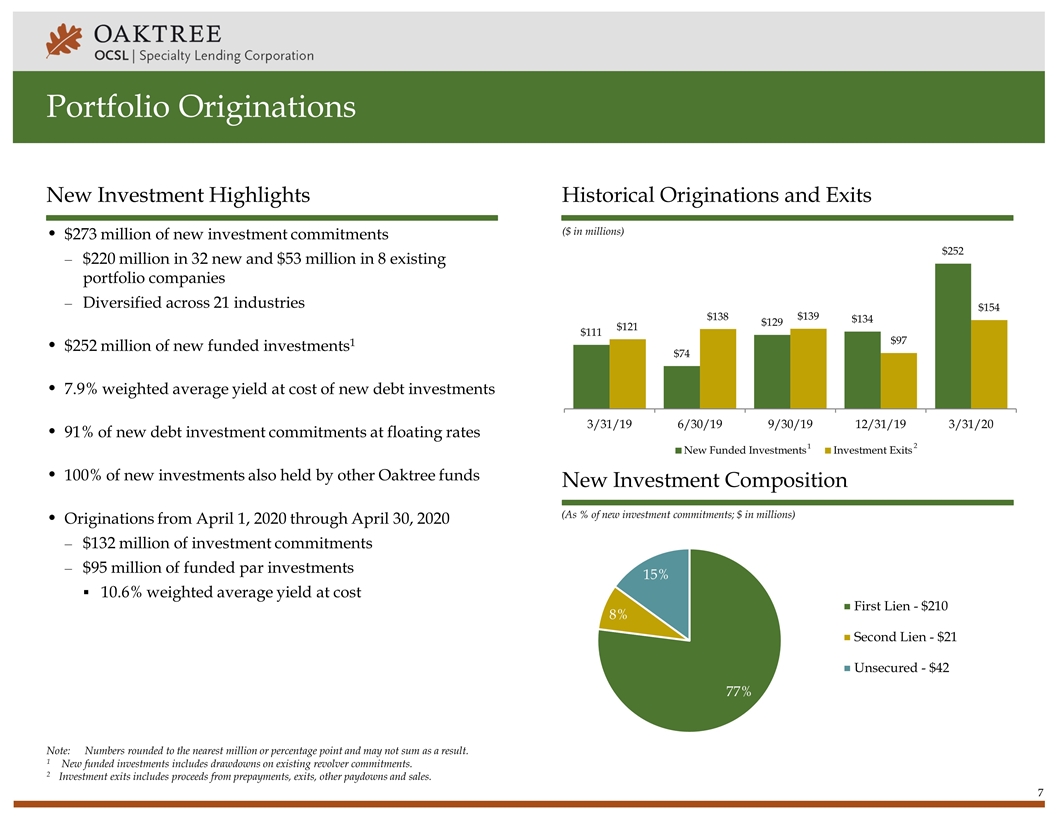

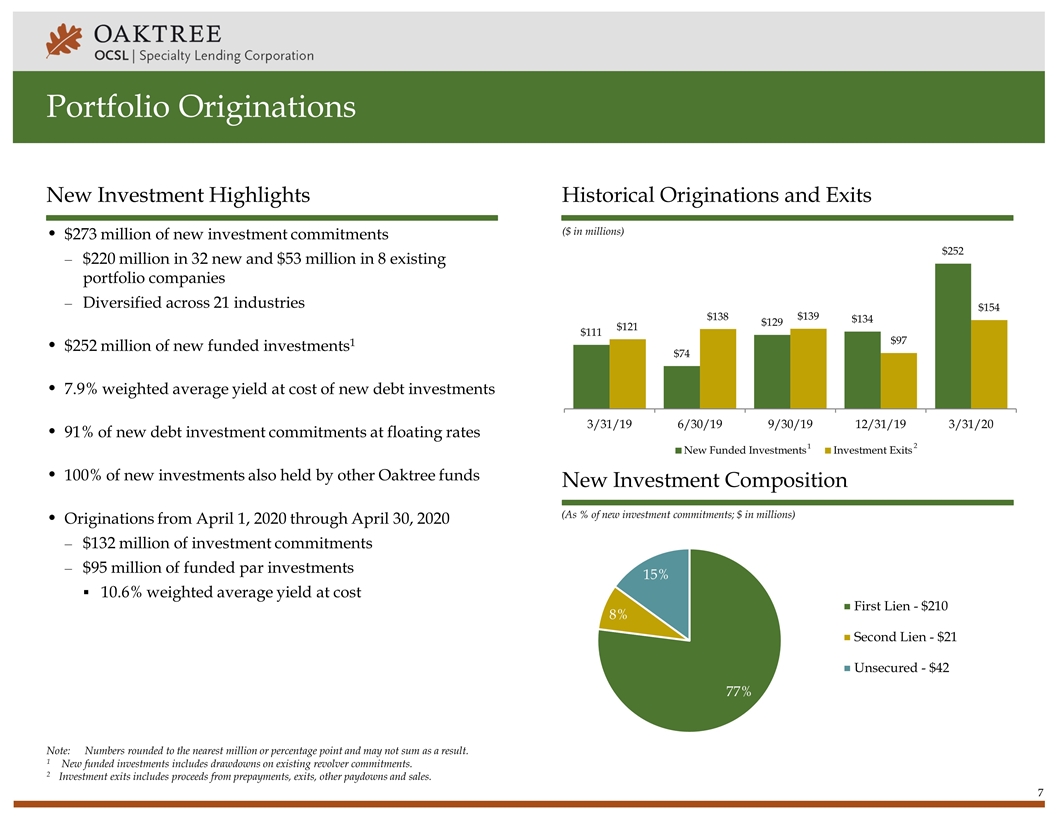

Portfolio Originations $273 million of new investment commitments $220 million in 32 new and $53 million in 8 existing portfolio companies Diversified across 21 industries $252 million of new funded investments1 7.9% weighted average yield at cost of new debt investments 91% of new debt investment commitments at floating rates 100% of new investments also held by other Oaktree funds Originations from April 1, 2020 through April 30, 2020 $132 million of investment commitments $95 million of funded par investments 10.6% weighted average yield at cost New Investment Highlights (As % of new investment commitments; $ in millions) New Investment Composition ($ in millions) Historical Originations and Exits Note:Numbers rounded to the nearest million or percentage point and may not sum as a result. 1 New funded investments includes drawdowns on existing revolver commitments. 2Investment exits includes proceeds from prepayments, exits, other paydowns and sales. 1 2

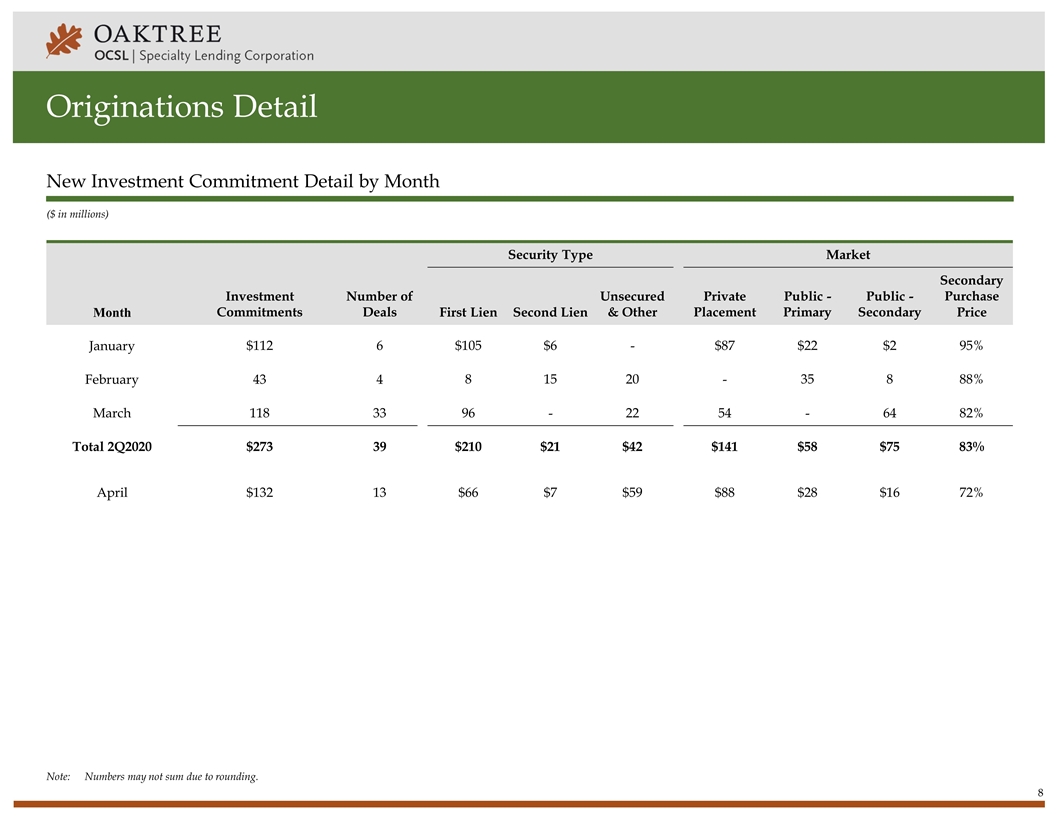

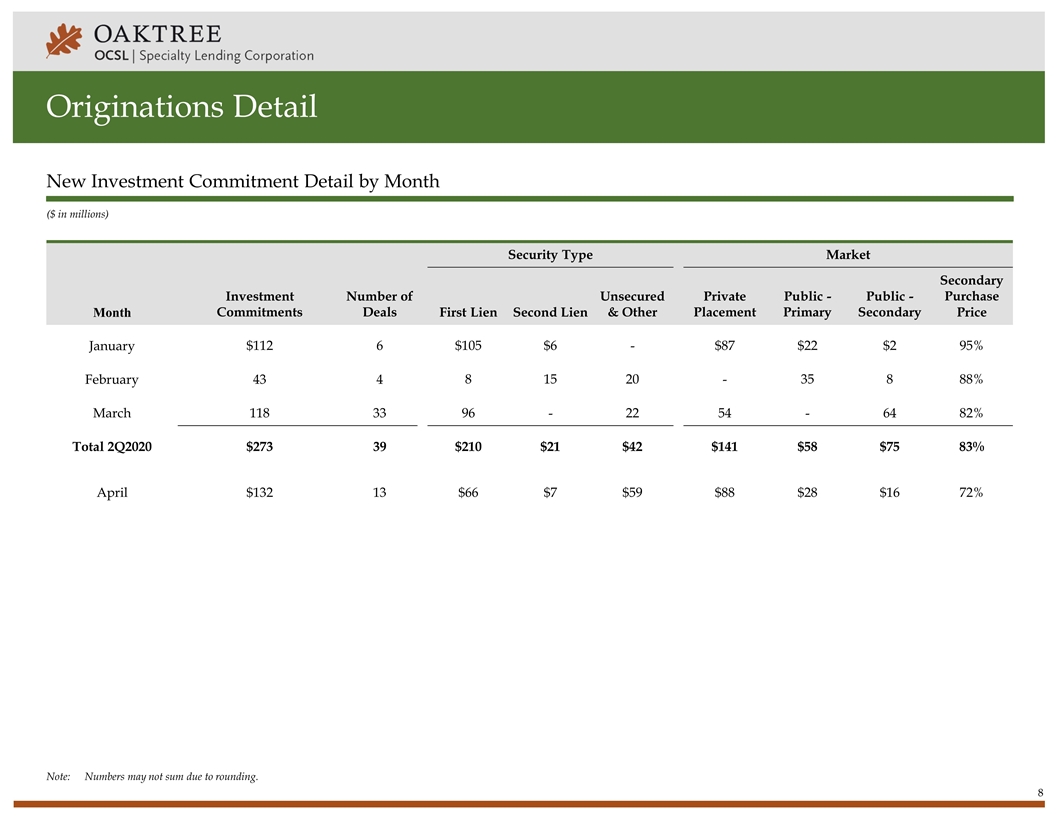

Originations Detail ($ in millions) New Investment Commitment Detail by Month Security Type Market Month Investment Commitments Number of Deals First Lien Second Lien Unsecured & Other Private Placement Public - Primary Public - Secondary Secondary Purchase Price January $112 6 $105 $6 - $87 $22 $2 95% February 43 4 8 15 20 - 35 8 88% March 118 33 96 - 22 54 - 64 82% Total 2Q2020 $273 39 $210 $21 $42 $141 $58 $75 83% April $132 13 $66 $7 $59 $88 $28 $16 72% Note:Numbers may not sum due to rounding.

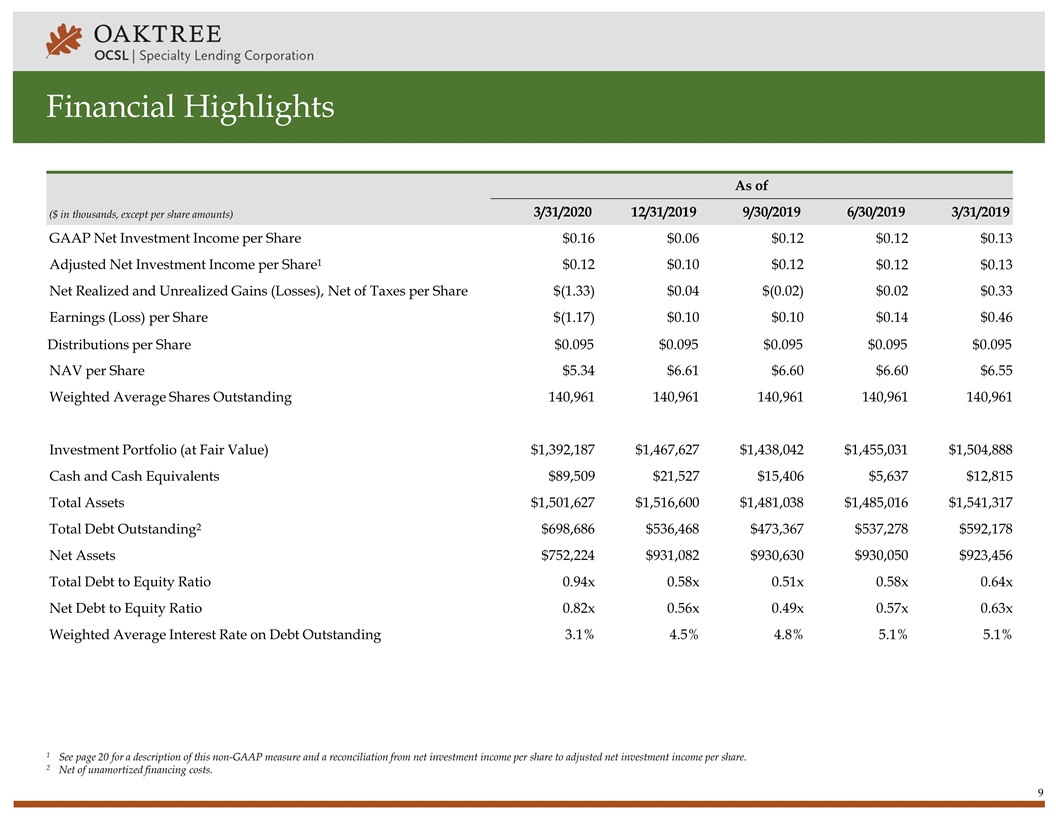

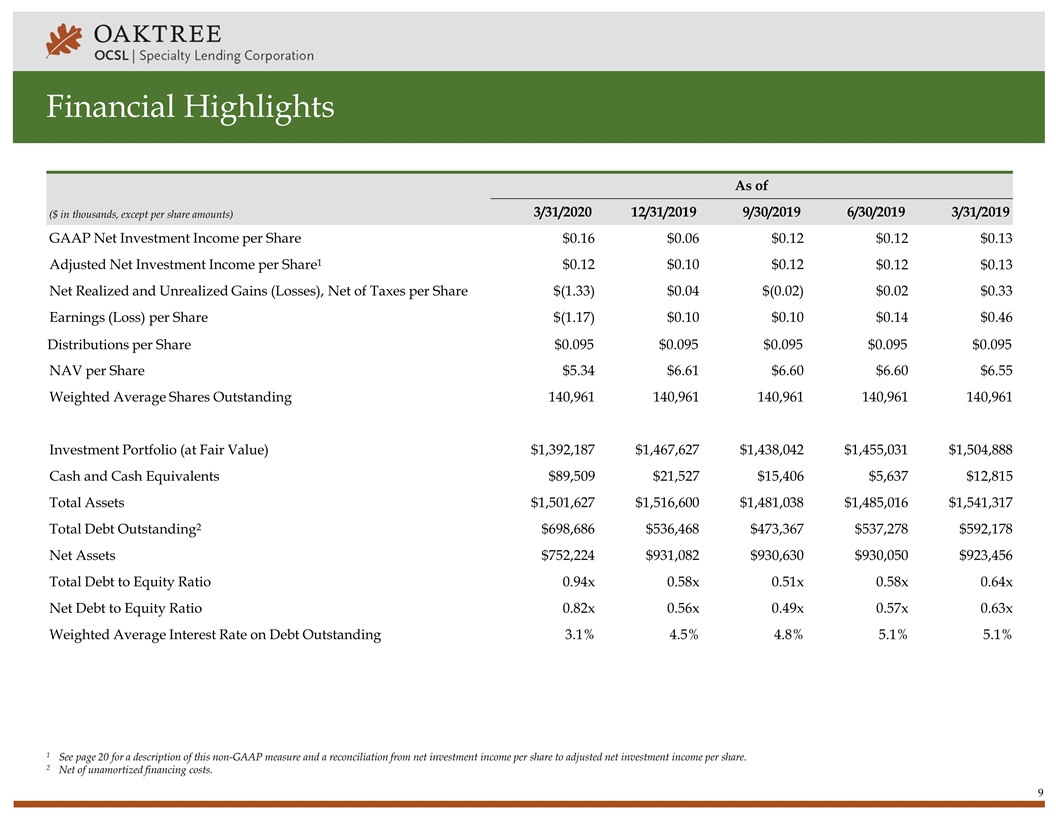

Financial Highlights 1See page 20 for a description of this non-GAAP measure and a reconciliation from net investment income per share to adjusted net investment income per share. 2Net of unamortized financing costs. ($ in thousands, except per share amounts) As of 3/31/2020 12/31/2019 9/30/2019 6/30/2019 3/31/2019 GAAP Net Investment Income per Share $0.16 $0.06 $0.12 $0.12 $0.13 Adjusted Net Investment Income per Share1 $0.12 $0.10 $0.12 $0.12 $0.13 Net Realized and Unrealized Gains (Losses), Net of Taxes per Share $(1.33) $0.04 $(0.02) $0.02 $0.33 Earnings (Loss) per Share $(1.17) $0.10 $0.10 $0.14 $0.46 Distributions per Share $0.095 $0.095 $0.095 $0.095 $0.095 NAV per Share $5.34 $6.61 $6.60 $6.60 $6.55 Weighted Average Shares Outstanding 140,961 140,961 140,961 140,961 140,961 Investment Portfolio (at Fair Value) $1,392,187 $1,467,627 $1,438,042 $1,455,031 $1,504,888 Cash and Cash Equivalents $89,509 $21,527 $15,406 $5,637 $12,815 Total Assets $1,501,627 $1,516,600 $1,481,038 $1,485,016 $1,541,317 Total Debt Outstanding2 $698,686 $536,468 $473,367 $537,278 $592,178 Net Assets $752,224 $931,082 $930,630 $930,050 $923,456 Total Debt to Equity Ratio 0.94x 0.58x 0.51x 0.58x 0.64x Net Debt to Equity Ratio 0.82x 0.56x 0.49x 0.57x 0.63x Weighted Average Interest Rate on Debt Outstanding 3.1% 4.5% 4.8% 5.1% 5.1%

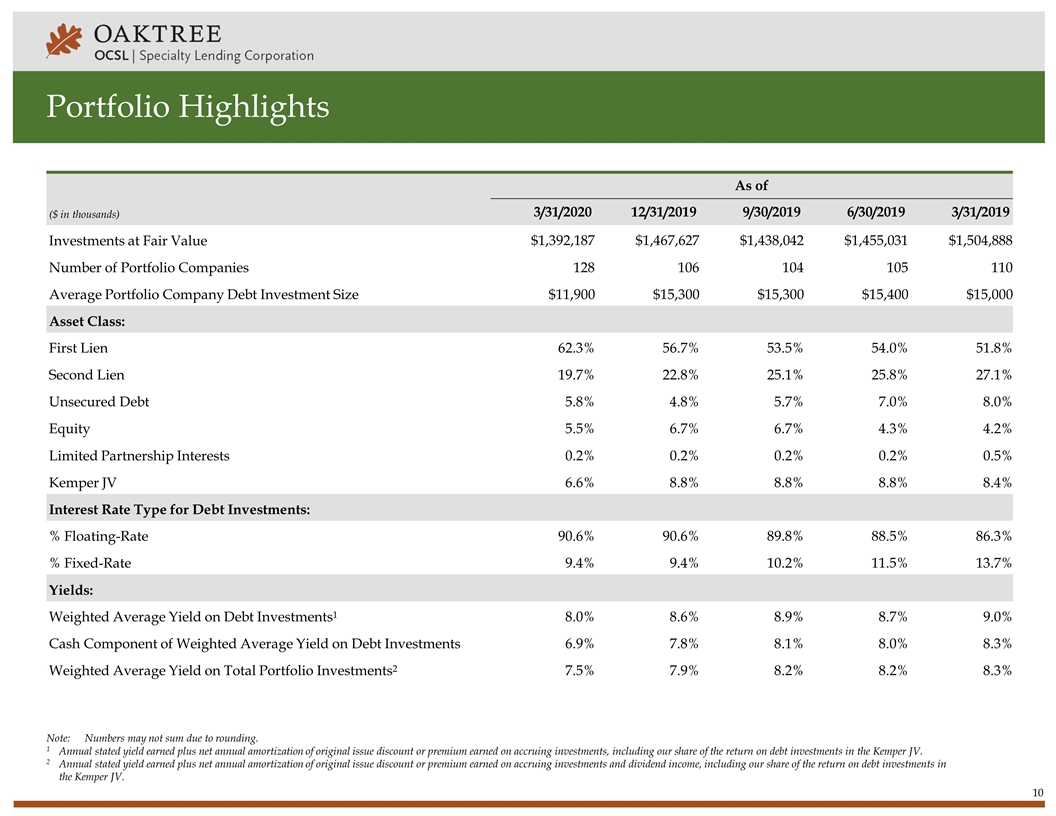

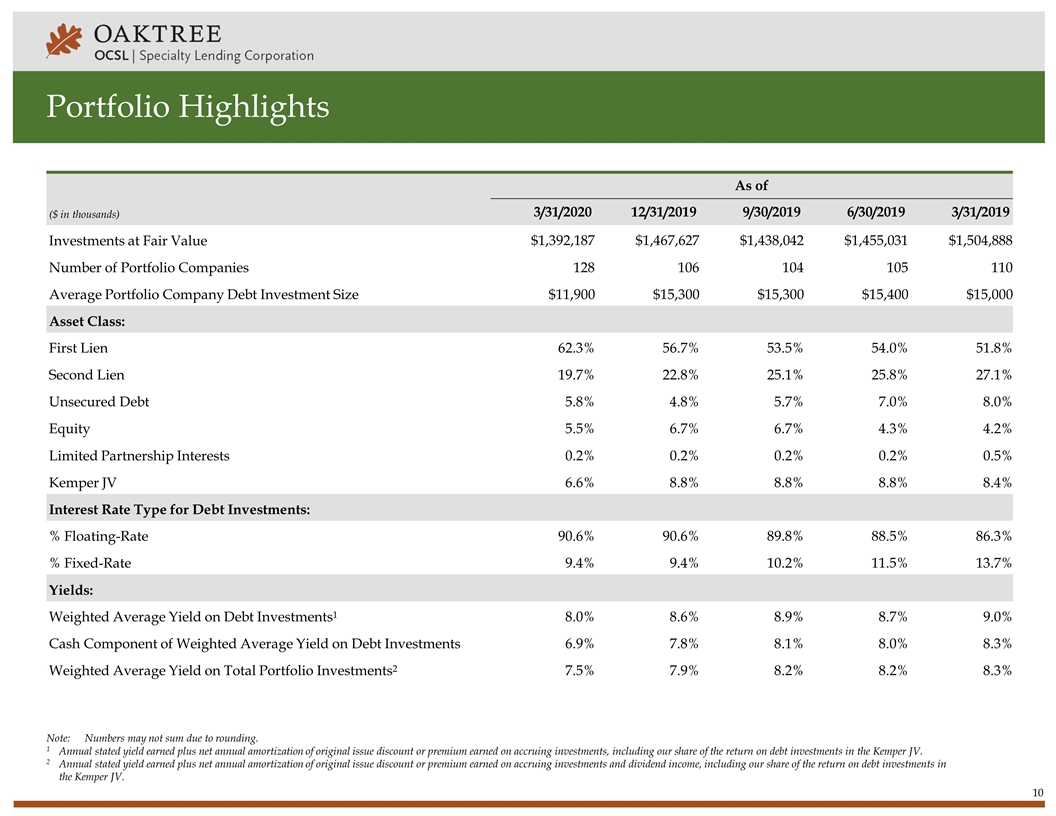

Portfolio Highlights ($ in thousands) As of 3/31/2020 12/31/2019 9/30/2019 6/30/2019 3/31/2019 Investments at Fair Value $1,392,187 $1,467,627 $1,438,042 $1,455,031 $1,504,888 Number of Portfolio Companies 128 106 104 105 110 Average Portfolio Company Debt Investment Size $11,900 $15,300 $15,300 $15,400 $15,000 Asset Class: First Lien 62.3% 56.7% 53.5% 54.0% 51.8% Second Lien 19.7% 22.8% 25.1% 25.8% 27.1% Unsecured Debt 5.8% 4.8% 5.7% 7.0% 8.0% Equity 5.5% 6.7% 6.7% 4.3% 4.2% Limited Partnership Interests 0.2% 0.2% 0.2% 0.2% 0.5% Kemper JV 6.6% 8.8% 8.8% 8.8% 8.4% Interest Rate Type for Debt Investments: % Floating-Rate 90.6% 90.6% 89.8% 88.5% 86.3% % Fixed-Rate 9.4% 9.4% 10.2% 11.5% 13.7% Yields: Weighted Average Yield on Debt Investments1 8.0% 8.6% 8.9% 8.7% 9.0% Cash Component of Weighted Average Yield on Debt Investments 6.9% 7.8% 8.1% 8.0% 8.3% Weighted Average Yield on Total Portfolio Investments2 7.5% 7.9% 8.2% 8.2% 8.3% Note:Numbers may not sum due to rounding. 1Annual stated yield earned plus net annual amortization of original issue discount or premium earned on accruing investments, including our share of the return on debt investments in the Kemper JV. 2Annual stated yield earned plus net annual amortization of original issue discount or premium earned on accruing investments and dividend income, including our share of the return on debt investments in the Kemper JV.

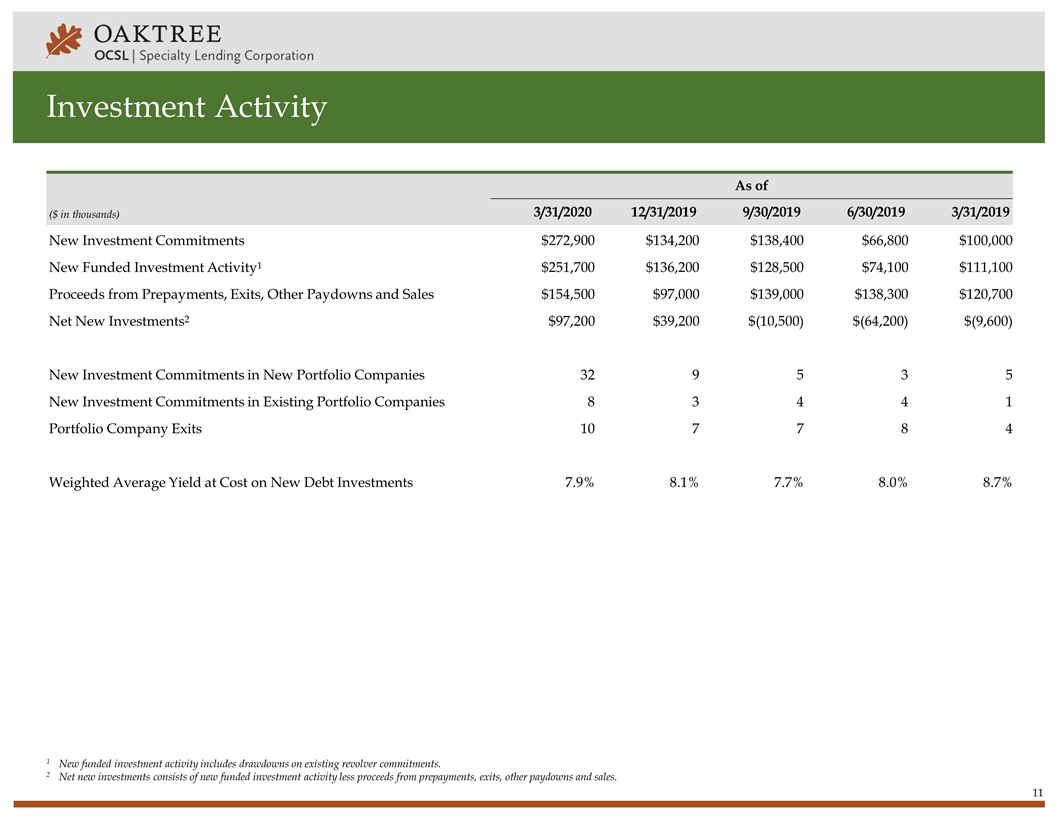

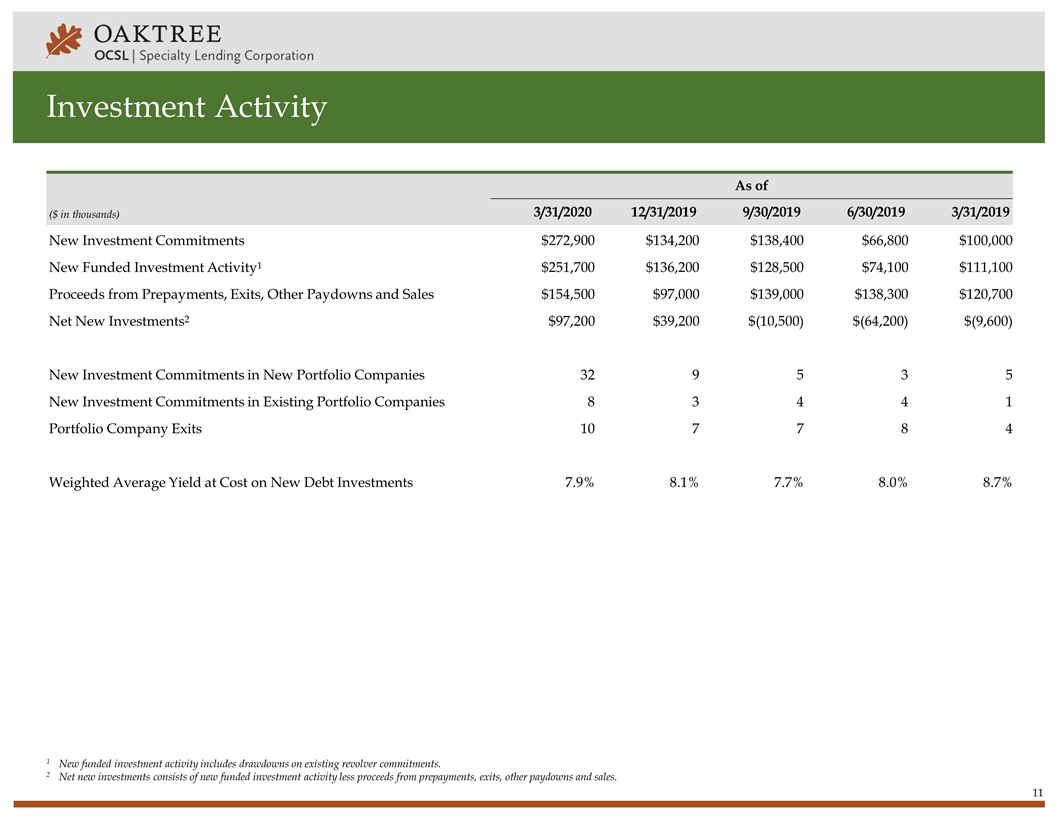

Investment Activity ($ in thousands) As of 3/31/2020 12/31/2019 9/30/2019 6/30/2019 3/31/2019 New Investment Commitments $272,900 $134,200 $138,400 $66,800 $100,000 New Funded Investment Activity1 $251,700 $136,200 $128,500 $74,100 $111,100 Proceeds from Prepayments, Exits, Other Paydowns and Sales $154,500 $97,000 $139,000 $138,300 $120,700 Net New Investments2 $97,200 $39,200 $(10,500) $(64,200) $(9,600) New Investment Commitments in New Portfolio Companies 32 9 5 3 5 New Investment Commitments in Existing Portfolio Companies 8 3 4 4 1 Portfolio Company Exits 10 7 7 8 4 Weighted Average Yield at Cost on New Debt Investments 7.9% 8.1% 7.7% 8.0% 8.7% 1New funded investment activity includes drawdowns on existing revolver commitments. 2Net new investments consists of new funded investment activity less proceeds from prepayments, exits, other paydowns and sales.

Net Asset Value Per Share Bridge Note:Net asset value per share amounts are based on the shares outstanding at each respective quarter end. Net investment income per share, net unrealized appreciation / (depreciation), and net realized gain / (loss) are based on the weighted average number of shares outstanding for the period. 1Excludes reclassifications of net unrealized appreciation / (depreciation) to net realized gains / (losses) as a result of investments exited during the quarter. 1 1

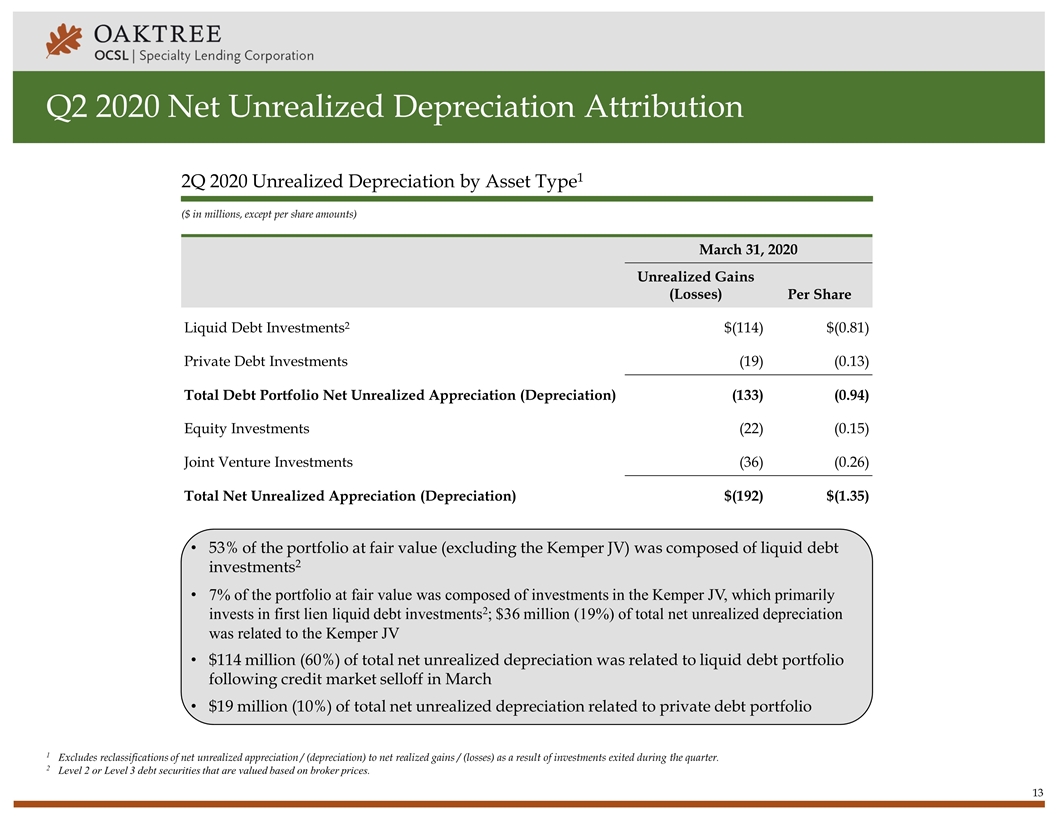

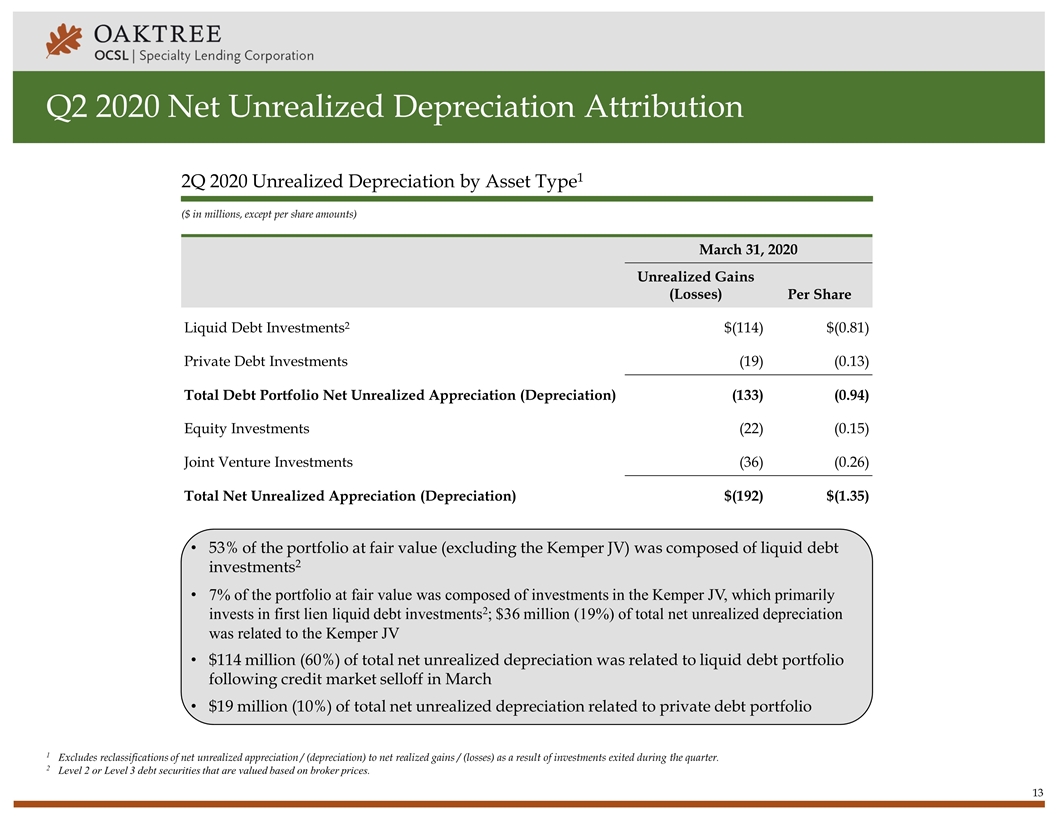

Q2 2020 Net Unrealized Depreciation Attribution ($ in millions, except per share amounts) 2Q 2020 Unrealized Depreciation by Asset Type1 March 31, 2020 Unrealized Gains (Losses) Per Share Liquid Debt Investments2 $(114) $(0.81) Private Debt Investments (19) (0.13) Total Debt Portfolio Net Unrealized Appreciation (Depreciation) (133) (0.94) Equity Investments (22) (0.15) Joint Venture Investments (36) (0.26) Total Net Unrealized Appreciation (Depreciation) $(192) $(1.35) 1Excludes reclassifications of net unrealized appreciation / (depreciation) to net realized gains / (losses) as a result of investments exited during the quarter. 2Level 2 or Level 3 debt securities that are valued based on broker prices. 53% of the portfolio at fair value (excluding the Kemper JV) was composed of liquid debt investments2 7% of the portfolio at fair value was composed of investments in the Kemper JV, which primarily invests in first lien liquid debt investments2; $36 million (19%) of total net unrealized depreciation was related to the Kemper JV $114 million (60%) of total net unrealized depreciation was related to liquid debt portfolio following credit market selloff in March $19 million (10%) of total net unrealized depreciation related to private debt portfolio

Capital Structure Overview ($ in millions) (As % of total funding sources) ($ in millions) Funding Sources and Key Highlights Funding Sources by Type Maturity Profile of Liabilities Committed Principal Outstanding Interest Rate Maturity Credit Facility $700 $405 LIBOR+2.00%1 2/25/2024 2025 Notes 300 300 3.500% 2/25/2025 Cash and Cash Equivalents - (91) - - Net Debt $1,000 $614 As of March 31, 2020 Note:As of March 31, 2020, we have analyzed cash and cash equivalents, availability under our credit facilities, the ability to rotate out of certain assets and amounts of unfunded commitments that could be drawn and believe our liquidity and capital resources are sufficient to take advantage of market opportunities in the current economic climate. 1Interest rate spread can increase up to 2.25% depending on the senior coverage ratio. Target Leverage Ratio: 0.85x to 1.00x debt-to-equity Diverse and flexible funding sources with no near-term debt maturities Unsecured debt represented 42% of principal outstanding Next scheduled maturity is in 2024 Issued $300 million of 3.500% unsecured notes due 2025 during the quarter ended March 31, 2020 Proceeds were primarily used to repay $75 million of 5.875% unsecured notes due 2024, $86 million of 6.125% unsecured notes due 2028 and pay down borrowings on the credit facility Increased target leverage range to 0.85x to 1.00x from 0.70x to 0.85x Finding more attractive investment opportunities amid market dislocation Investment grade rated by Moody’s and Fitch

Funding and Liquidity Metrics Leverage Utilization Liquidity Rollforward Note:Actual leverage and liquidity as of June 30, 2020 may differ materially. OCSL’s independent registered public accounting firm has not audited, reviewed, compiled or performed any procedures with respect to the liquidity and unfunded commitments data presented herein. 1Includes unfunded commitments ineligible to be drawn due to certain limitations in credit agreements. 2As of March 31, 2020, we have analyzed cash and cash equivalents, availability under our credit facilities, the ability to rotate out of certain assets and amounts of unfunded commitments that could be drawn and believe our liquidity and capital resources are sufficient to take advantage of market opportunities in the current economic climate. 12/31/2019 3/31/2020 4/30/2020 Credit Facility Committed $700 $700 $700 Credit Facility Drawn (378) (405) (440) Cash and Cash Equivalents 22 90 68 Total Liquidity $344 $385 $328 Total Unfunded Commitments (102) (92) (122) Unavailable Unfunded Commitments1 39 31 46 Adjusted Liquidity $281 $324 $252 ($ in millions) 12/31/2019 3/31/2020 Cash $22 $90 Net Assets 931 752 Net Leverage 0.56x 0.82x Total Leverage 0.58x 0.94x ($ in millions) Ample liquidity to support funding needs2

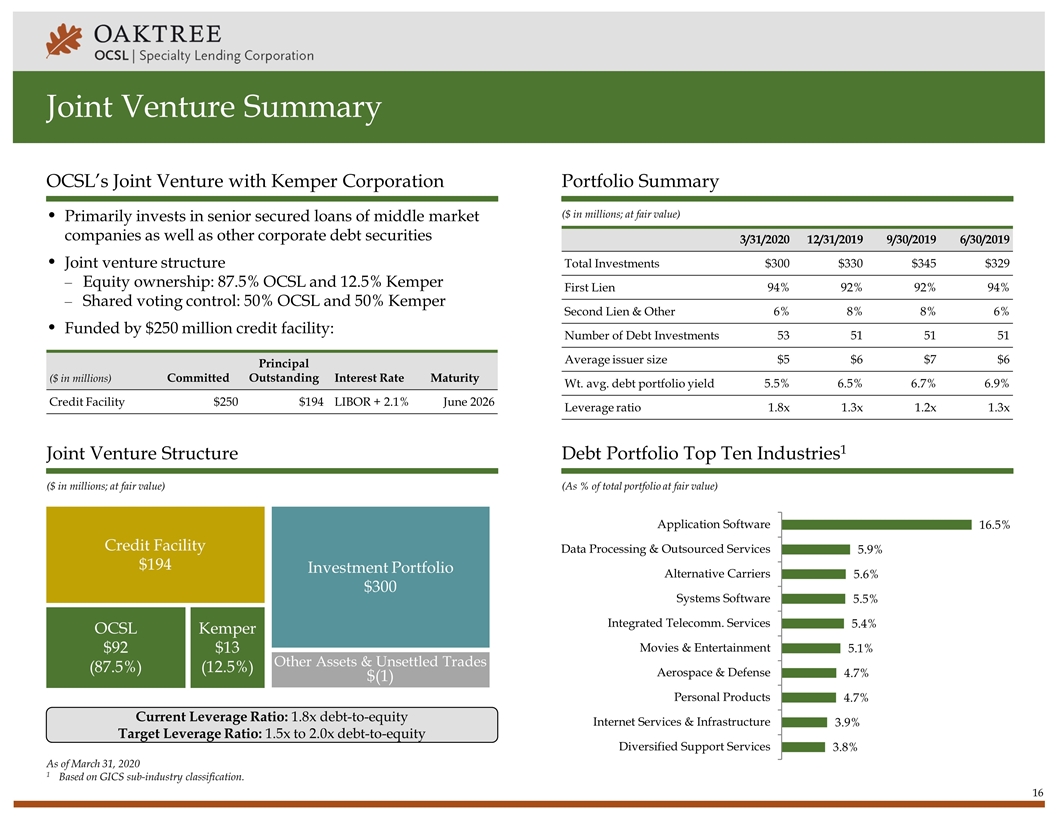

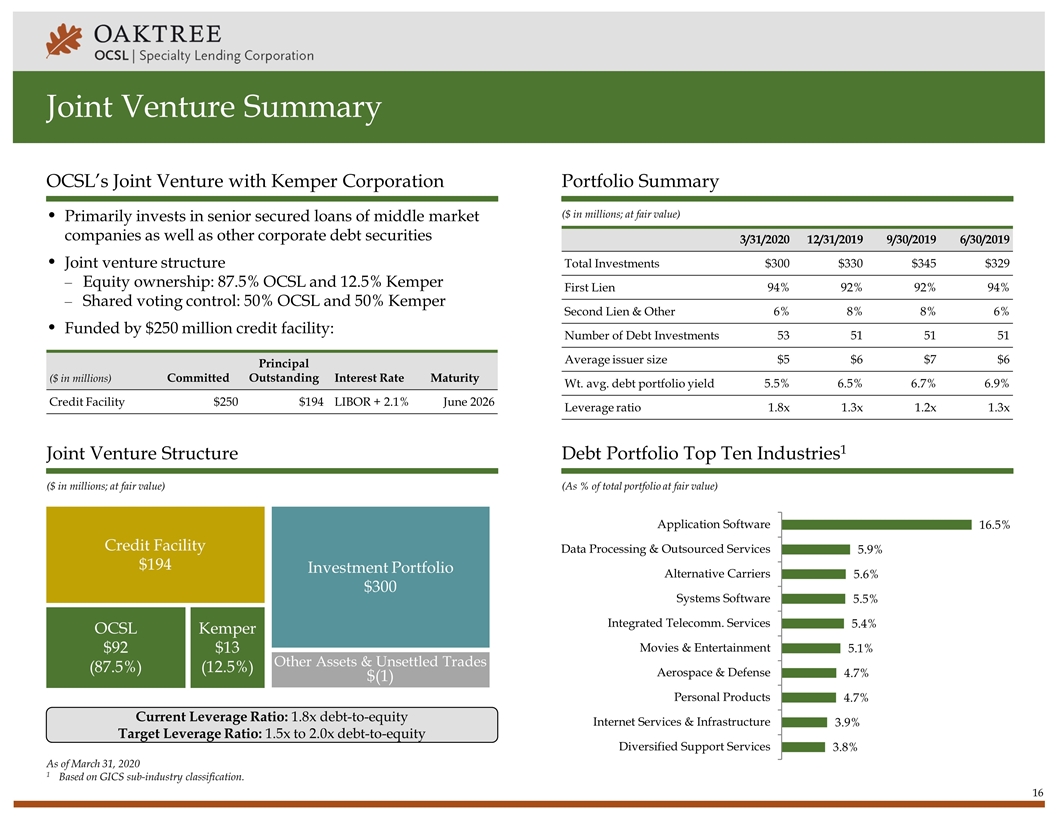

Joint Venture Summary ($ in millions; at fair value) ($ in millions; at fair value) (As % of total portfolio at fair value) OCSL’s Joint Venture with Kemper Corporation Portfolio Summary Joint Venture Structure Debt Portfolio Top Ten Industries1 As of March 31, 2020 1Based on GICS sub-industry classification. Primarily invests in senior secured loans of middle market companies as well as other corporate debt securities Joint venture structure Equity ownership: 87.5% OCSL and 12.5% Kemper Shared voting control: 50% OCSL and 50% Kemper Funded by $250 million credit facility: 3/31/2020 12/31/2019 9/30/2019 6/30/2019 Total Investments $300 $330 $345 $329 First Lien 94% 92% 92% 94% Second Lien & Other 6% 8% 8% 6% Number of Debt Investments 53 51 51 51 Average issuer size $5 $6 $7 $6 Wt. avg. debt portfolio yield 5.5% 6.5% 6.7% 6.9% Leverage ratio 1.8x 1.3x 1.2x 1.3x Credit Facility $194 Investment Portfolio $300 OCSL $92 (87.5%) Other Assets & Unsettled Trades $(1) Kemper $13 (12.5%) ($ in millions) Committed Principal Outstanding Interest Rate Maturity Credit Facility $250 $194 LIBOR + 2.1% June 2026 Current Leverage Ratio: 1.8x debt-to-equity Target Leverage Ratio: 1.5x to 2.0x debt-to-equity

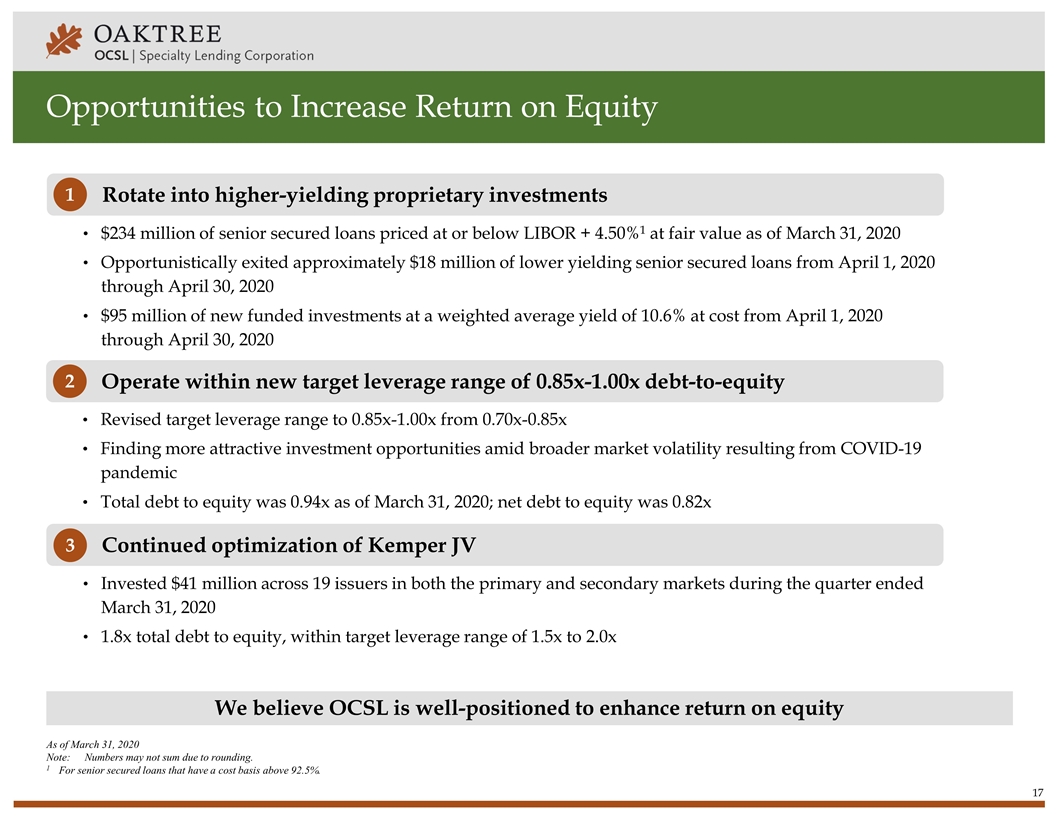

Rotate into higher-yielding proprietary investments Opportunities to Increase Return on Equity As of March 31, 2020 Note:Numbers may not sum due to rounding. 1For senior secured loans that have a cost basis above 92.5%. 1 Operate within new target leverage range of 0.85x-1.00x debt-to-equity 2 Continued optimization of Kemper JV 3 $234 million of senior secured loans priced at or below LIBOR + 4.50%1 at fair value as of March 31, 2020 Opportunistically exited approximately $18 million of lower yielding senior secured loans from April 1, 2020 through April 30, 2020 $95 million of new funded investments at a weighted average yield of 10.6% at cost from April 1, 2020 through April 30, 2020 Revised target leverage range to 0.85x-1.00x from 0.70x-0.85x Finding more attractive investment opportunities amid broader market volatility resulting from COVID-19 pandemic Total debt to equity was 0.94x as of March 31, 2020; net debt to equity was 0.82x Invested $41 million across 19 issuers in both the primary and secondary markets during the quarter ended March 31, 2020 1.8x total debt to equity, within target leverage range of 1.5x to 2.0x We believe OCSL is well-positioned to enhance return on equity

Appendix

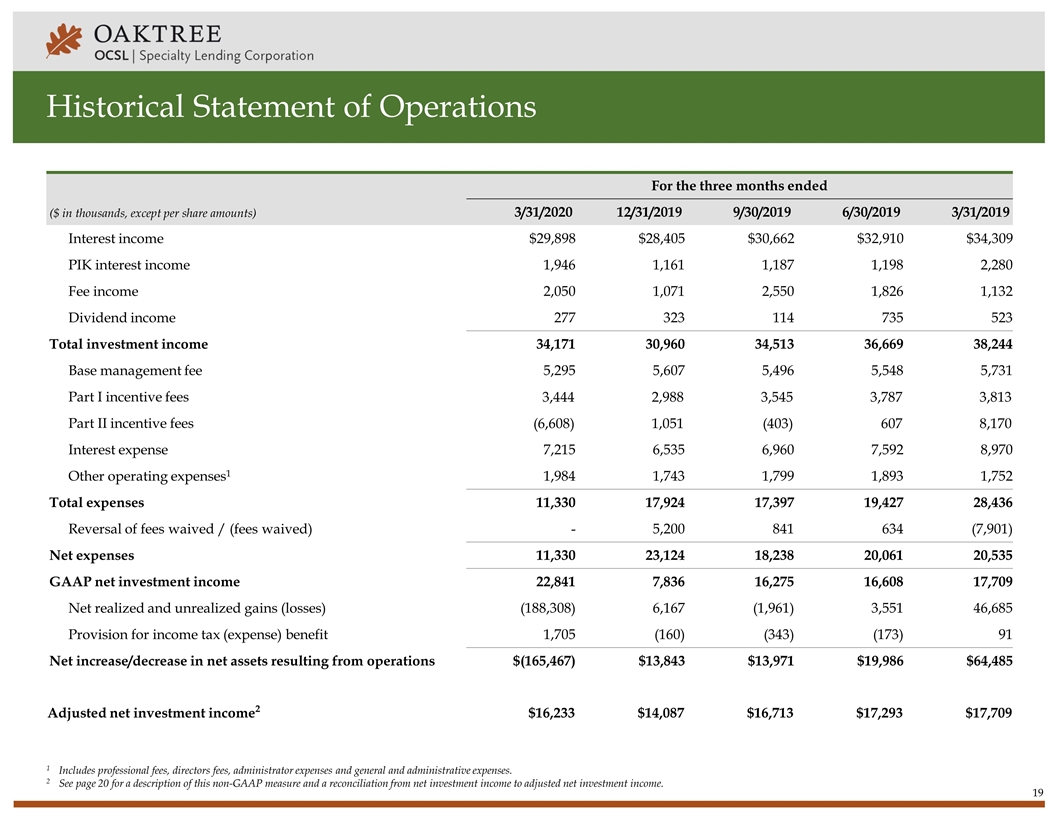

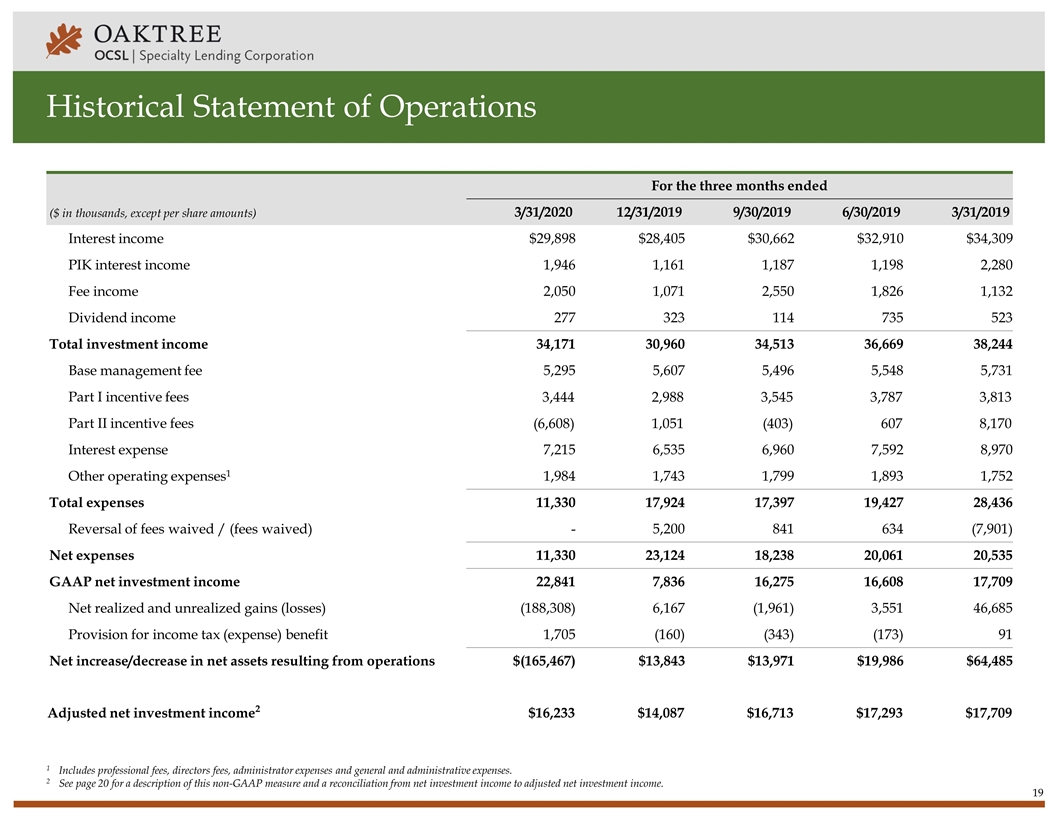

Historical Statement of Operations ($ in thousands, except per share amounts) For the three months ended 3/31/2020 12/31/2019 9/30/2019 6/30/2019 3/31/2019 Interest income $29,898 $28,405 $30,662 $32,910 $34,309 PIK interest income 1,946 1,161 1,187 1,198 2,280 Fee income 2,050 1,071 2,550 1,826 1,132 Dividend income 277 323 114 735 523 Total investment income 34,171 30,960 34,513 36,669 38,244 Base management fee 5,295 5,607 5,496 5,548 5,731 Part I incentive fees 3,444 2,988 3,545 3,787 3,813 Part II incentive fees (6,608) 1,051 (403) 607 8,170 Interest expense 7,215 6,535 6,960 7,592 8,970 Other operating expenses1 1,984 1,743 1,799 1,893 1,752 Total expenses 11,330 17,924 17,397 19,427 28,436 Reversal of fees waived / (fees waived) - 5,200 841 634 (7,901) Net expenses 11,330 23,124 18,238 20,061 20,535 GAAP net investment income 22,841 7,836 16,275 16,608 17,709 Net realized and unrealized gains (losses) (188,308) 6,167 (1,961) 3,551 46,685 Provision for income tax (expense) benefit 1,705 (160) (343) (173) 91 Net increase/decrease in net assets resulting from operations $(165,467) $13,843 $13,971 $19,986 $64,485 Adjusted net investment income2 $16,233 $14,087 $16,713 $17,293 $17,709 1Includes professional fees, directors fees, administrator expenses and general and administrative expenses. 2See page 20 for a description of this non-GAAP measure and a reconciliation from net investment income to adjusted net investment income.

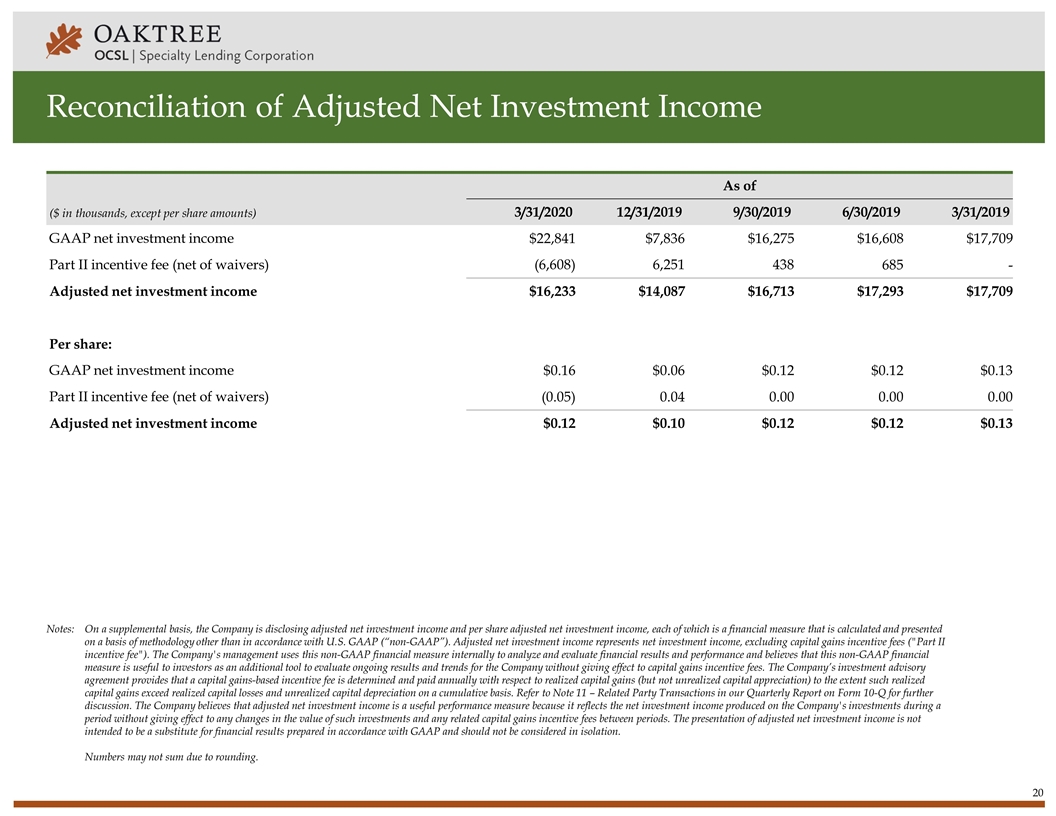

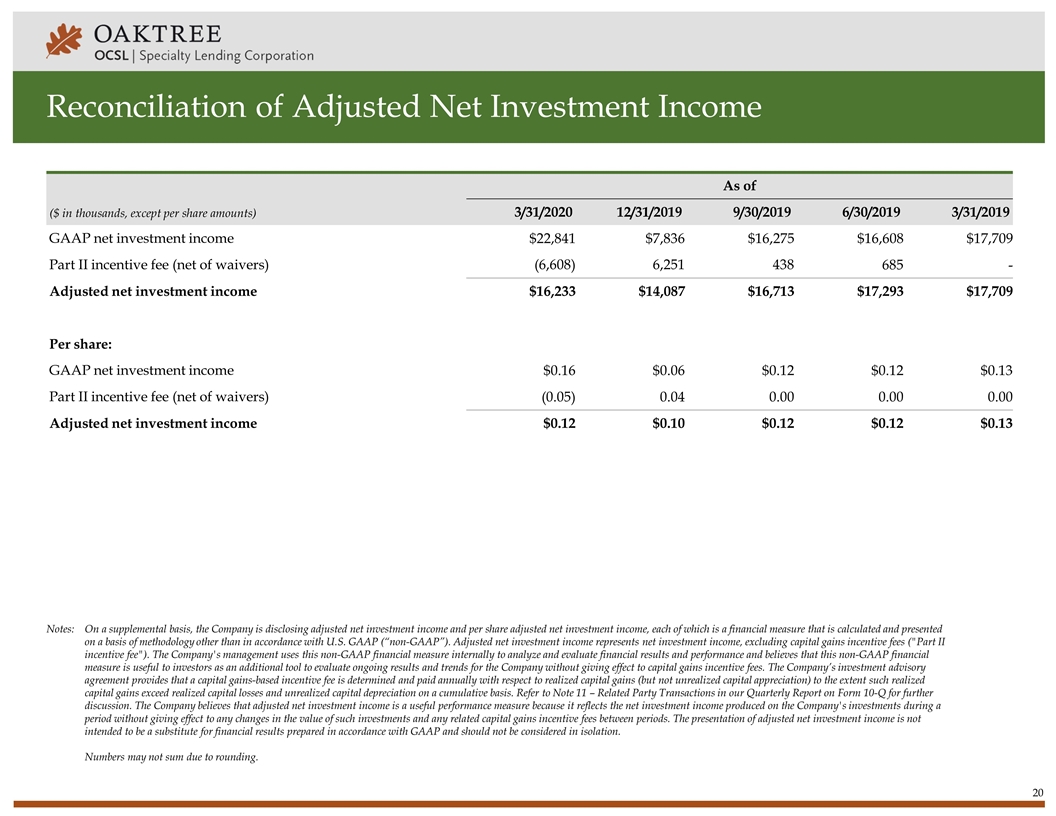

Reconciliation of Adjusted Net Investment Income ($ in thousands, except per share amounts) As of 3/31/2020 12/31/2019 9/30/2019 6/30/2019 3/31/2019 GAAP net investment income $22,841 $7,836 $16,275 $16,608 $17,709 Part II incentive fee (net of waivers) (6,608) 6,251 438 685 - Adjusted net investment income $16,233 $14,087 $16,713 $17,293 $17,709 Per share: GAAP net investment income $0.16 $0.06 $0.12 $0.12 $0.13 Part II incentive fee (net of waivers) (0.05) 0.04 0.00 0.00 0.00 Adjusted net investment income $0.12 $0.10 $0.12 $0.12 $0.13 Notes: On a supplemental basis, the Company is disclosing adjusted net investment income and per share adjusted net investment income, each of which is a financial measure that is calculated and presented on a basis of methodology other than in accordance with U.S. GAAP (“non-GAAP”). Adjusted net investment income represents net investment income, excluding capital gains incentive fees ("Part II incentive fee"). The Company's management uses this non-GAAP financial measure internally to analyze and evaluate financial results and performance and believes that this non-GAAP financial measure is useful to investors as an additional tool to evaluate ongoing results and trends for the Company without giving effect to capital gains incentive fees. The Company’s investment advisory agreement provides that a capital gains-based incentive fee is determined and paid annually with respect to realized capital gains (but not unrealized capital appreciation) to the extent such realized capital gains exceed realized capital losses and unrealized capital depreciation on a cumulative basis. Refer to Note 11 – Related Party Transactions in our Quarterly Report on Form 10-Q for further discussion. The Company believes that adjusted net investment income is a useful performance measure because it reflects the net investment income produced on the Company's investments during a period without giving effect to any changes in the value of such investments and any related capital gains incentive fees between periods. The presentation of adjusted net investment income is not intended to be a substitute for financial results prepared in accordance with GAAP and should not be considered in isolation. Numbers may not sum due to rounding.

Contact: Michael Mosticchio, Investor Relations ocsl-ir@oaktreecapital.com