Exhibit 99.2 Earnings Presentation NASDAQ: OCSL First Quarter 2025

Forward Looking Statements & Legal Disclosures Some of the statements in this presentation constitute forward-looking statements because they relate to future events or our future performance or financial condition. The forward-looking statements contained in this presentation may include statements as to: our future operating results and distribution projections; the ability of Oaktree Fund Advisors, LLC (together with its affiliates, “Oaktree”) to implement Oaktree’s future plans with respect to our business; the ability of Oaktree and its affiliates to attract and retain highly talented professionals; our business prospects and the prospects of our portfolio companies; the impact of the investments that we expect to make; the ability of our portfolio companies to achieve their objectives; our expected financings and investments and additional leverage we may seek to incur in the future; the adequacy of our cash resources and working capital; the timing of cash flows, if any, from the operations of our portfolio companies; the cost or potential outcome of any litigation to which we may be a party; and the impact of current global economic conditions, including those caused by inflation, an elevated (but decreasing) interest rate environment and geopolitical risks on all of the foregoing. In addition, words such as “anticipate,” “believe,” “expect,” “seek,” “plan,” “should,” “estimate,” “project” and “intend” indicate forward-looking statements, although not all forward-looking statements include these words. The forward- looking statements contained in this presentation involve risks and uncertainties. Our actual results could differ materially from those implied or expressed in the forward-looking statements for any reason, including the factors set forth in “Risk Factors” and elsewhere in our annual report on Form 10-K for the fiscal year ended September 30, 2024 and our quarterly report on Form 10-Q for the quarter ended December 31, 2024. Other factors that could cause actual results to differ materially include: changes in the economy, financial markets and political environment, including the impacts of inflation and elevated interest rates; risks associated with possible disruption in our operations or the economy generally due to terrorism, war or other geopolitical conflict, natural disasters, pandemics or cybersecurity incidents; future changes in laws or regulations (including the interpretation of these laws and regulations by regulatory authorities); conditions in our operating areas, particularly with respect to business development companies or regulated investment companies; and other considerations disclosed from time to time in our publicly disseminated documents and filings. We have based the forward-looking statements included in this presentation on information available to us on the date of this presentation, and we assume no obligation to update any such forward-looking statements. Although we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, you are advised to consult any additional disclosures that we may make directly to you or through reports that we in the future may file with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. Calculation of Assets Under Management References to total assets under management or AUM represent assets managed by Oaktree and a proportionate amount of the AUM reported by DoubleLine Capital LP ( DoubleLine Capital ), in which Oaktree owns a 20% minority interest. Oaktree's methodology for calculating AUM includes (i) the net asset value (“NAV”) of assets managed directly by Oaktree, (ii) the leverage on which management fees are charged, (iii) undrawn capital that Oaktree is entitled to call from investors in Oaktree funds pursuant to their capital commitments, (iv) for collateralized loan obligation vehicles ( CLOs ), the aggregate par value of collateral assets and principal cash, (v) for publicly-traded business development companies, gross assets (including assets acquired with leverage), net of cash, and (vi) Oaktree's pro rata portion (20%) of the AUM reported by DoubleLine Capital. This calculation of AUM is not based on the definitions of AUM that may be set forth in agreements governing the investment funds, vehicles or accounts managed and is not calculated pursuant to regulatory definitions. Unless otherwise indicated, data provided herein are dated as of December 31, 2024. First Quarter 2025 Investor Presentation NASDAQ: OCSL

Strategic Actions In Support of OCSL • On February 3, Oaktree purchased $100 million of newly issued shares of OCSL common stock at a price of $17.63/share equal to net asset value per share on January 31, 2025 • This transaction represented a 10% premium to the closing stock price on January 31, 2025, and resulted in a nearly Equity Raise 7% increase in net assets • The equity raise (coupled with additional leverage) will increase dry powder for deployment, enabling growth and further diversification of the portfolio • Oaktree instituted an incentive fee cap (i.e., a total return hurdle) which resulted in a waiver of $6.4 million of Part I incentive fees during the quarter New Incentive • This new arrangement includes a lookback provision that commences October 1, 2024, building to a rolling 12 Fee Cap quarter lookback by the Company's 2027 fiscal year-end • Although we have voluntarily waived fees in previous quarters, this formalizes our process and provides clarity Oaktree remains committed to the long-term growth and success of OCSL 2

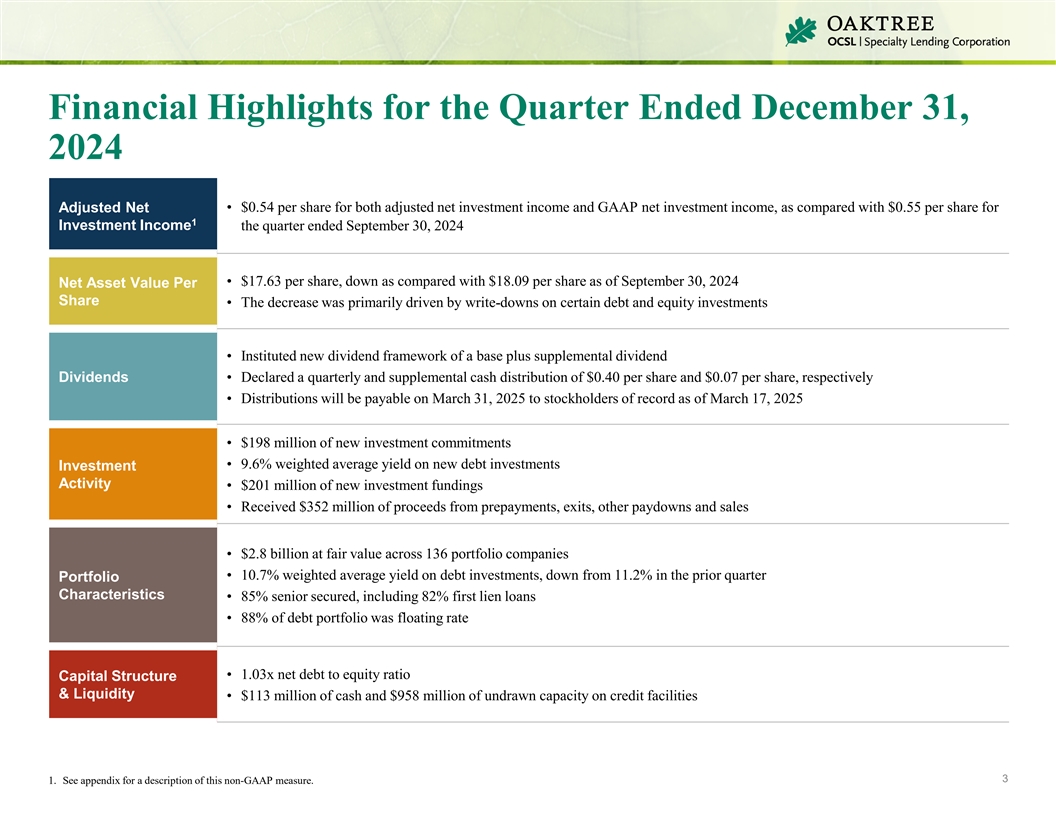

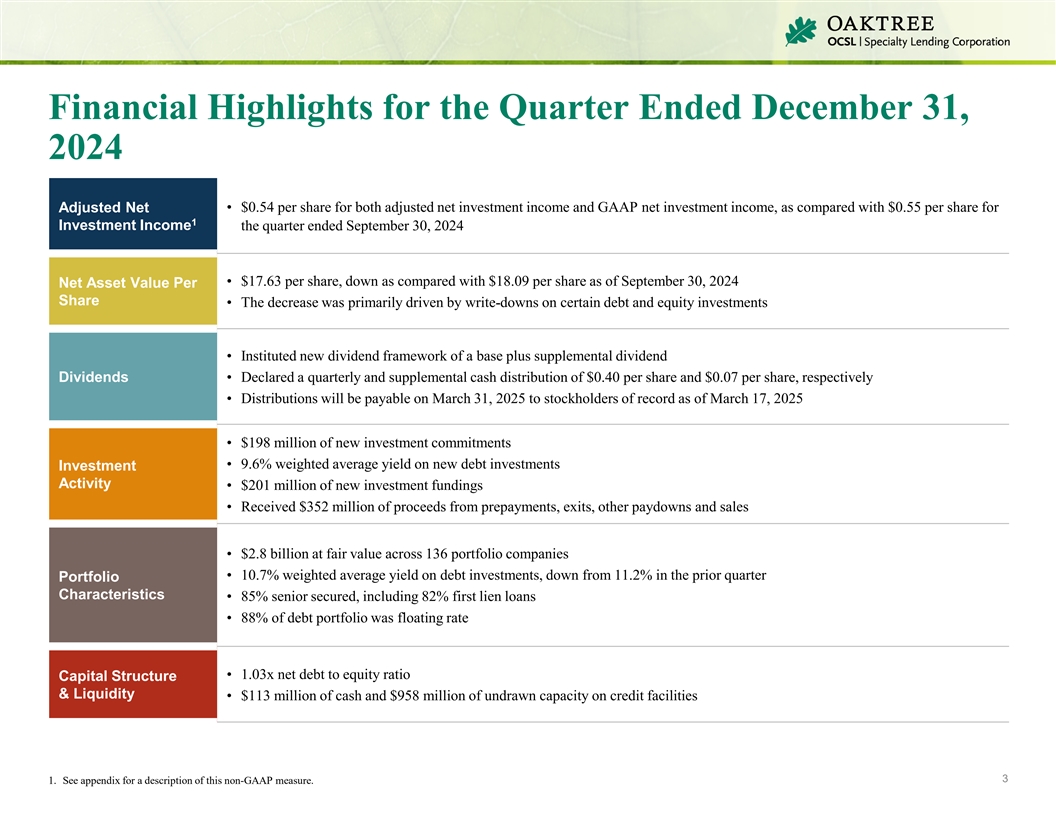

Financial Highlights for the Quarter Ended December 31, 2024 • $0.54 per share for both adjusted net investment income and GAAP net investment income, as compared with $0.55 per share for Adjusted Net 1 Investment Income the quarter ended September 30, 2024 • $17.63 per share, down as compared with $18.09 per share as of September 30, 2024 Net Asset Value Per Share • The decrease was primarily driven by write-downs on certain debt and equity investments • Instituted new dividend framework of a base plus supplemental dividend Dividends • Declared a quarterly and supplemental cash distribution of $0.40 per share and $0.07 per share, respectively • Distributions will be payable on March 31, 2025 to stockholders of record as of March 17, 2025 • $198 million of new investment commitments • 9.6% weighted average yield on new debt investments Investment Activity • $201 million of new investment fundings • Received $352 million of proceeds from prepayments, exits, other paydowns and sales • $2.8 billion at fair value across 136 portfolio companies • 10.7% weighted average yield on debt investments, down from 11.2% in the prior quarter Portfolio Characteristics • 85% senior secured, including 82% first lien loans • 88% of debt portfolio was floating rate • 1.03x net debt to equity ratio Capital Structure & Liquidity • $113 million of cash and $958 million of undrawn capacity on credit facilities 3 1. See appendix for a description of this non-GAAP measure.

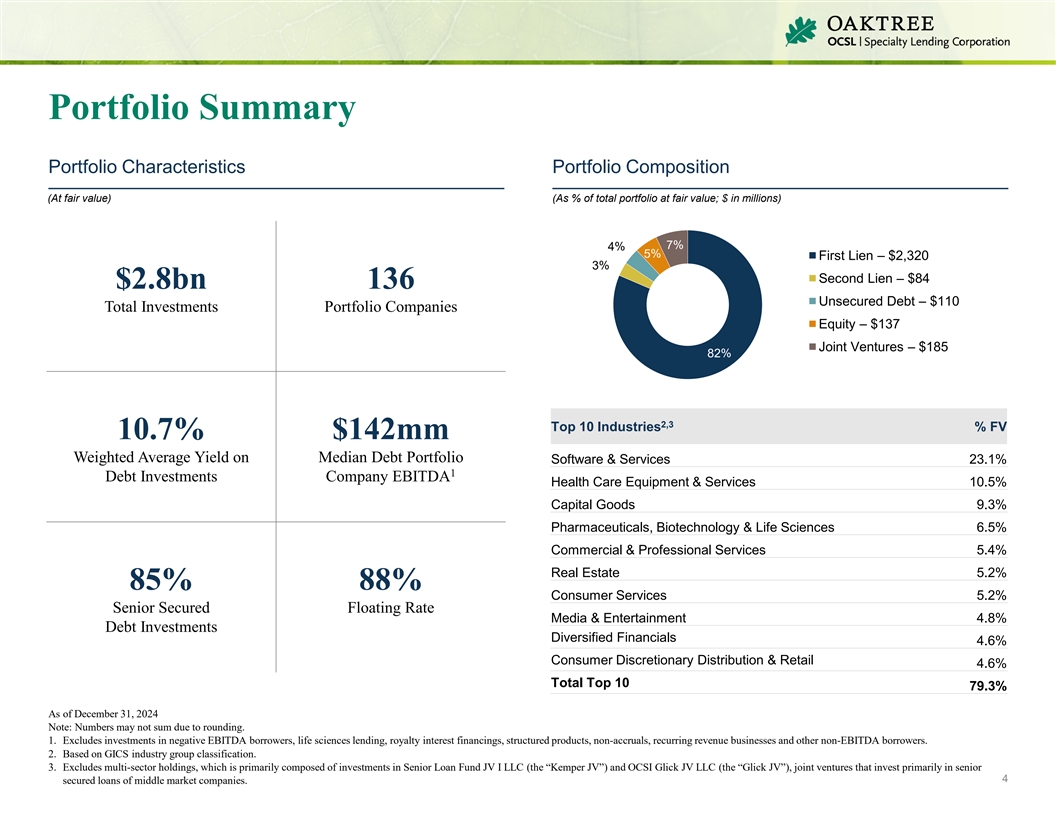

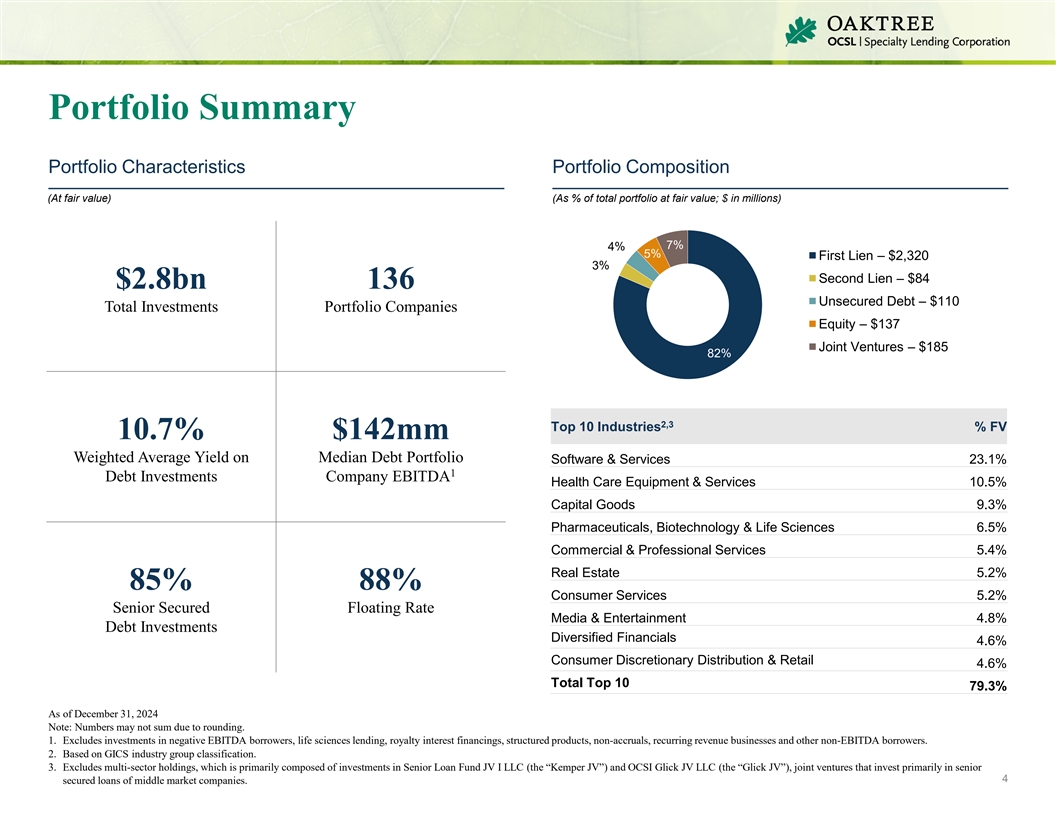

Portfolio Summary Portfolio Characteristics Portfolio Composition (At fair value) (As % of total portfolio at fair value; $ in millions) 7% 4% 5% First Lien – $2,320 3% Second Lien – $84 $2.8bn 136 Unsecured Debt – $110 Total Investments Portfolio Companies Equity – $137 Joint Ventures – $185 82% 2,3 Top 10 Industries % FV 10.7% $142mm Weighted Average Yield on Median Debt Portfolio Software & Services 23.1% 1 Debt Investments Company EBITDA Health Care Equipment & Services 10.5% Capital Goods 9.3% Pharmaceuticals, Biotechnology & Life Sciences 6.5% Commercial & Professional Services 5.4% Real Estate 5.2% 85% 88% Consumer Services 5.2% Senior Secured Floating Rate Media & Entertainment 4.8% Debt Investments Diversified Financials 4.6% Consumer Discretionary Distribution & Retail 4.6% Total Top 10 79.3% As of December 31, 2024 Note: Numbers may not sum due to rounding. 1. Excludes investments in negative EBITDA borrowers, life sciences lending, royalty interest financings, structured products, non-accruals, recurring revenue businesses and other non-EBITDA borrowers. 2. Based on GICS industry group classification. 3. Excludes multi-sector holdings, which is primarily composed of investments in Senior Loan Fund JV I LLC (the “Kemper JV”) and OCSI Glick JV LLC (the “Glick JV”), joint ventures that invest primarily in senior 4 secured loans of middle market companies.

Investment Activity New Investment Highlights Historical Funded Originations and Exits ($ in millions) $377 $400 $352 $338 $323 $293 ($ in millions) $300 Total New $233 $201 Commitments $185 $200 $198 5 new borrowers $100 Existing Borrowers $0 $50 3/31/24 6/30/24 9/30/24 12/31/24 1 2 New Funded Investments Investment Exits 9.6% Seniority Breakdown weighted average yield on new debt commitments (As % of new investment commitments; $ in millions) New Borrowers $148 100% First Lien - $198mm also held by other Oaktree funds Second Lien - $0mm Subordinated Debt - $0mm 100% As of December 31, 2024 Note: Numbers rounded to the nearest million or percentage point and may not sum as a result. 1. New funded investments includes drawdowns on existing delayed draw and revolver commitments. 5 2. Investment exits includes proceeds from prepayments, exits, other paydowns and sales.

Investment Activity (continued) New Investment Commitment Detail ($ in millions) Security Type Market Investment Unsecured Private Primary Secondary Avg. Secondary Fiscal Quarter Number of Deals First LienSecond Lien Commitments & Other Placement (Public) (Public) Purchase Price 1Q2021 $286 21 $196 $90 -- $181 $84 $22 93% 2Q2021 $318 20 $253 $44 $21 $245 $63 $10 93% 3Q2021 $178 10 $141 $25 $12 $104 $70 $5 97% 4Q2021 $385 20 $350 $13 $23 $304 $79 $2 100% 1Q2022 $300 21 $220 $77 $2 $227 $73 -- N/A 2Q2022 $228 25 $163 $17 $48 $162 $26 $40 96% 3Q2022 $132 28 $100 $6 $25 $63 $5 $63 91% 4Q2022 $97 11 $65 -- $32 $71 $22 $4 92% 1Q2023 $250 25 $214 $10 $26 $188 $49 $14 82% 2Q2023 $124 9 $124 -- -- $118 $5 $1 81% 3Q2023 $251 10 $227 $24 $0.2 $224 $20 $7 85% 4Q2023 $87 6 $87 -- -- $76 $12 -- N/A 1Q2024 $370 24 $354 -- $16 $302 -- $68 90% 2Q2024 $396 35 $364 -- $32 $205 $99 $92 98% 3Q2024 $339 20 $302 $3 $34 $256 $58 $24 97% 4Q2024 $259 19 $252 $5 $2 $227 $32 -- N/A 1Q2025 $198 13 $198 -- -- $198 -- -- N/A 6 Note: Numbers may not sum due to rounding. Excludes any positions originated, purchased and sold within the same quarter and the assets acquired in the OSI2 Merger.

Financial Highlights As of ($ and number of shares in thousands, except per share amounts) 12/31/2024 9/30/2024 6/30/2024 3/31/2024 12/31/2023 GAAP Net Investment Income per Share $0.54 $0.55 $0.54 $0.52 $0.57 1 Adjusted Net Investment Income per Share $0.54 $0.55 $0.55 $0.56 $0.57 Net Realized and Unrealized Gains (Losses), Net of Taxes per Share -$0.45 -$0.10 -$0.53 -$0.40 -$0.43 1 Adjusted Net Realized and Unrealized Gains (Losses), Net of Taxes per Share -$0.45 -$0.10 -$0.54 -$0.44 -$0.42 Earnings (Loss) per Share $0.09 $0.45 $0.01 $0.12 $0.14 1 Adjusted Earnings (Loss) per Share $0.09 $0.45 $0.01 $0.12 $0.15 Quarterly Distributions per Share $0.40 $0.55 $0.55 $0.55 $0.55 Quarterly Supplemental Distributions per Share $0.07 -- -- -- -- Total Quarterly Distributions per Share $0.47 $0.55 $0.55 $0.55 $0.55 Special Distributions per Share -- -- -- -- $0.07 NAV per Share $17.63 $18.09 $18.19 $18.72 $19.14 Weighted Average Shares Outstanding 82,245 82,245 81,830 79,763 77,840 Shares Outstanding, End of Period 82,245 82,245 82,245 81,396 78,965 Investment Portfolio (at Fair Value) $2,835,294 $3,021,279 $3,121,703 $3,047,445 $3,018,552 Cash and Cash Equivalents $112,913 $63,966 $96,321 $125,031 $112,369 Total Assets $3,083,792 $3,198,341 $3,322,181 $3,297,939 $3,266,195 2 Total Debt Outstanding $1,577,795 $1,638,693 $1,679,164 $1,635,642 $1,622,717 Net Assets $1,449,815 $1,487,811 $1,496,133 $1,524,099 $1,511,651 Total Debt to Equity Ratio 1.11x 1.12x 1.16x 1.10x 1.10x Net Debt to Equity Ratio 1.03x 1.07x 1.10x 1.02x 1.02x 3 Weighted Average Interest Rate on Debt Outstanding 6.2% 6.7% 7.0% 7.0% 7.0% 1. See appendix for a description of the non-GAAP measures as necessary. 2. Net of unamortized financing costs. 7 I n 3. Includes effect of the interest rate swap agreements the Company entered into in connection with the issuance of the 2027 Notes and the 2029 Notes. v e s t o r P r e s e n ta

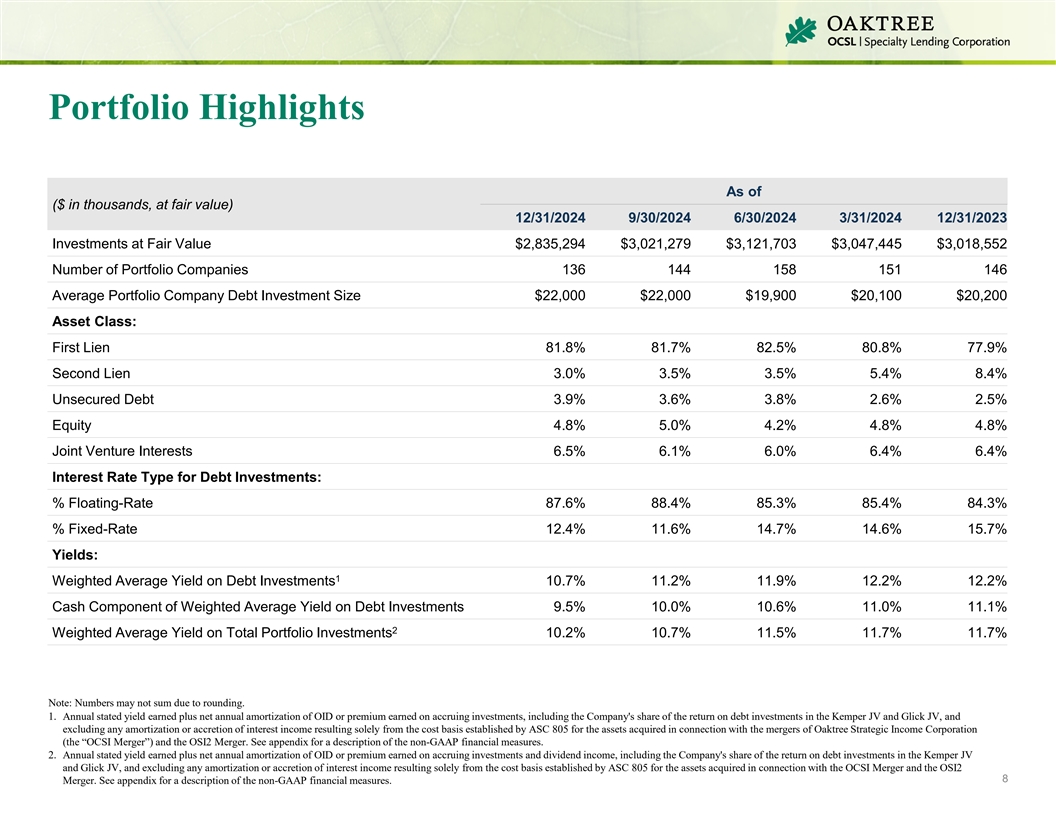

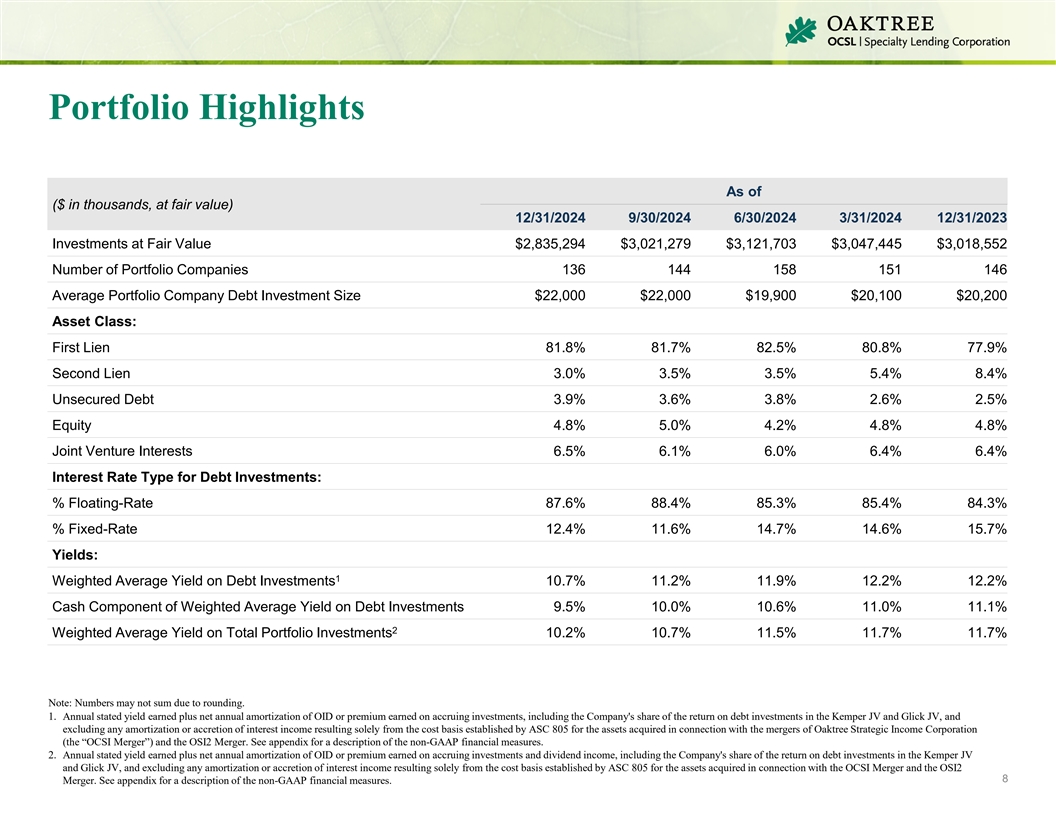

Portfolio Highlights As of ($ in thousands, at fair value) 12/31/2024 9/30/2024 6/30/2024 3/31/2024 12/31/2023 Investments at Fair Value $2,835,294 $3,021,279 $3,121,703 $3,047,445 $3,018,552 Number of Portfolio Companies 136 144 158 151 146 Average Portfolio Company Debt Investment Size $22,000 $22,000 $19,900 $20,100 $20,200 Asset Class: First Lien 81.8% 81.7% 82.5% 80.8% 77.9% Second Lien 3.0% 3.5% 3.5% 5.4% 8.4% Unsecured Debt 3.9% 3.6% 3.8% 2.6% 2.5% Equity 4.8% 5.0% 4.2% 4.8% 4.8% Joint Venture Interests 6.5% 6.1% 6.0% 6.4% 6.4% Interest Rate Type for Debt Investments: % Floating-Rate 87.6% 88.4% 85.3% 85.4% 84.3% % Fixed-Rate 12.4% 11.6% 14.7% 14.6% 15.7% Yields: 1 Weighted Average Yield on Debt Investments 10.7% 11.2% 11.9% 12.2% 12.2% Cash Component of Weighted Average Yield on Debt Investments 9.5% 10.0% 10.6% 11.0% 11.1% 2 Weighted Average Yield on Total Portfolio Investments 10.2% 10.7% 11.5% 11.7% 11.7% Note: Numbers may not sum due to rounding. 1. Annual stated yield earned plus net annual amortization of OID or premium earned on accruing investments, including the Company's share of the return on debt investments in the Kemper JV and Glick JV, and excluding any amortization or accretion of interest income resulting solely from the cost basis established by ASC 805 for the assets acquired in connection with the mergers of Oaktree Strategic Income Corporation (the “OCSI Merger”) and the OSI2 Merger. See appendix for a description of the non-GAAP financial measures. 2. Annual stated yield earned plus net annual amortization of OID or premium earned on accruing investments and dividend income, including the Company's share of the return on debt investments in the Kemper JV and Glick JV, and excluding any amortization or accretion of interest income resulting solely from the cost basis established by ASC 805 for the assets acquired in connection with the OCSI Merger and the OSI2 8 Merger. See appendix for a description of the non-GAAP financial measures.

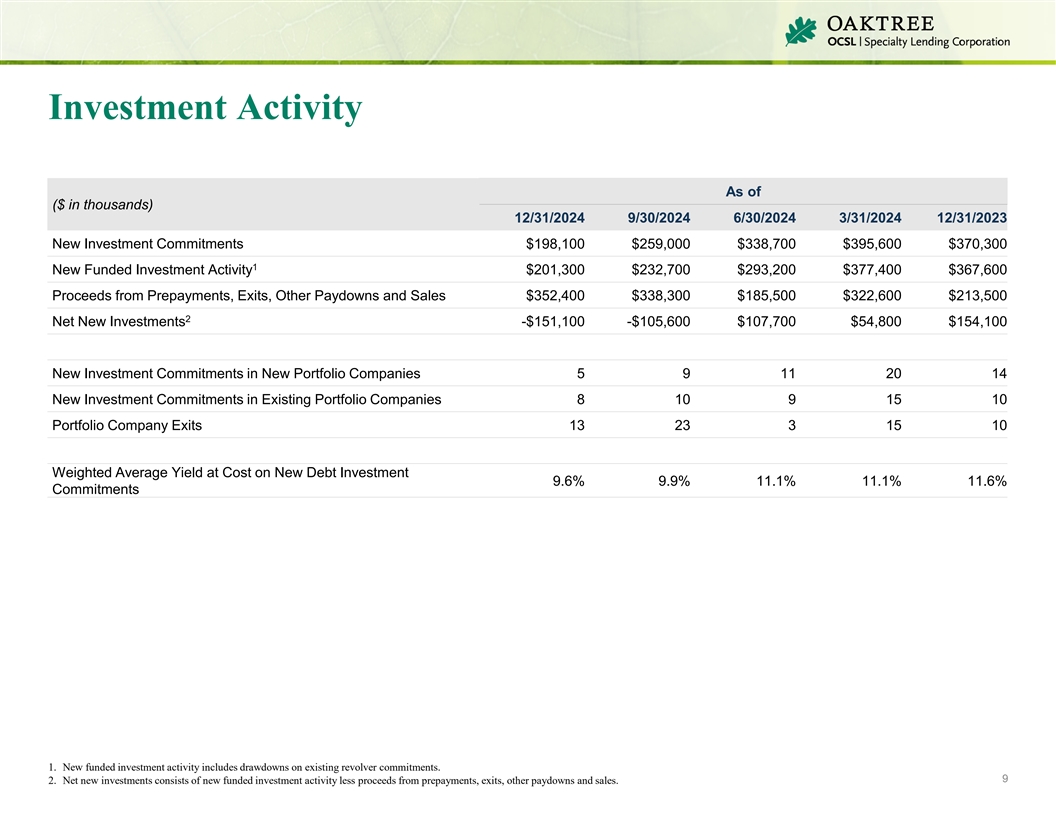

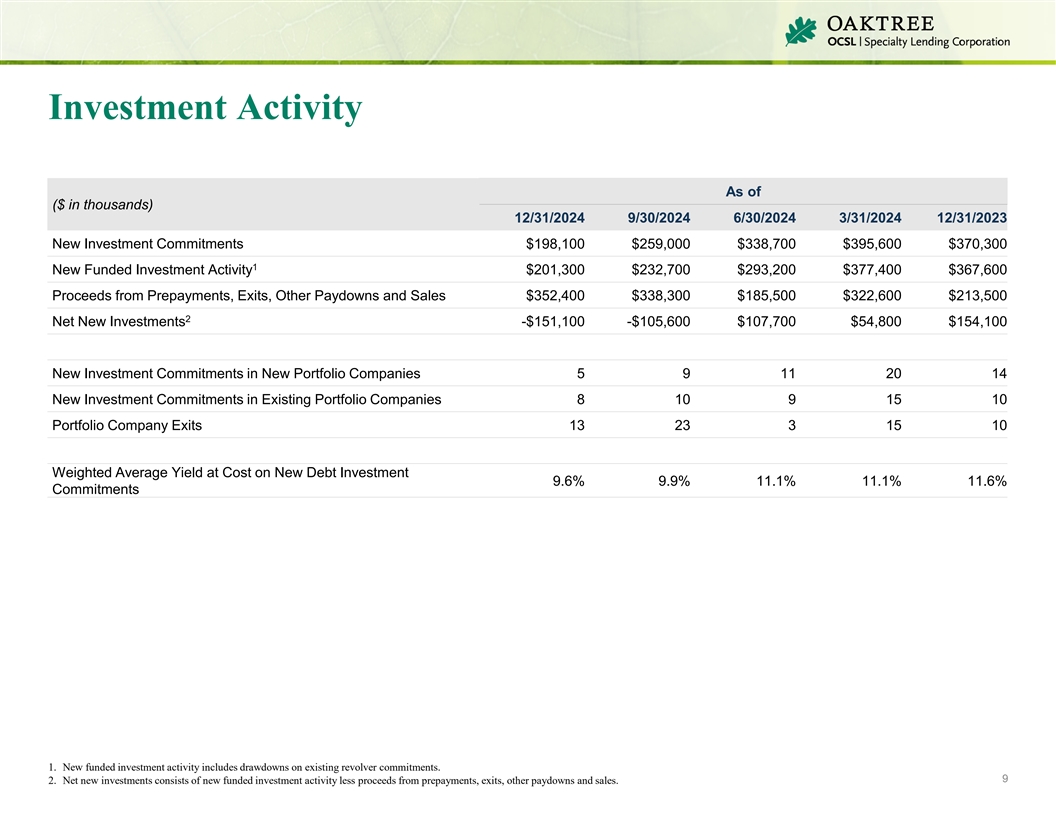

Investment Activity As of ($ in thousands) 12/31/2024 9/30/2024 6/30/2024 3/31/2024 12/31/2023 New Investment Commitments $198,100 $259,000 $338,700 $395,600 $370,300 1 New Funded Investment Activity $201,300 $232,700 $293,200 $377,400 $367,600 Proceeds from Prepayments, Exits, Other Paydowns and Sales $352,400 $338,300 $185,500 $322,600 $213,500 2 Net New Investments -$151,100 -$105,600 $107,700 $54,800 $154,100 New Investment Commitments in New Portfolio Companies 5 9 11 20 14 New Investment Commitments in Existing Portfolio Companies 8 10 9 15 10 Portfolio Company Exits 13 23 3 15 10 Weighted Average Yield at Cost on New Debt Investment 9.6% 9.9% 11.1% 11.1% 11.6% Commitments 1. New funded investment activity includes drawdowns on existing revolver commitments. 9 2. Net new investments consists of new funded investment activity less proceeds from prepayments, exits, other paydowns and sales. I n v e s t o r P r e s e n ta

Net Asset Value Per Share Bridge $21.00 Adjusted Net Realized and Unrealized Adjusted NII Gains (Losses), Net of Taxes $0.54 -$0.45 $20.00 $19.00 $0.01 $0.41 -$0.55 -$0.04 -$0.00 $0.54 $18.00 $17.00 $18.09 $16.00 $17.63 $15.00 $14.00 9/30/24 NAV GAAP Net Interest Income Net Unrealized Net Realized Net Realized & Quarterly 12/31/24 NAV 1 Investment Accretion Appreciation / Gain / (Loss) Unrealized Loss Distribution 1 Income Related to (Depreciation) Related to Merger Merger Accounting Accounting Adjustments Adjustments Note: Numbers may not sum due to rounding. Net asset value per share amounts are based on the shares outstanding at each respective quarter end. Net investment income per share, net unrealized appreciation / (depreciation), and net realized gain / (loss) are based on the weighted average number of shares outstanding for the period. Numbers may not sum due to rounding. See appendix for a description of the non-GAAP measures. 10 1. Excludes reclassifications of net unrealized appreciation / (depreciation) to net realized gains / (losses) as a result of investments exited during the quarter. I n v e s t o r P r e s e n a t

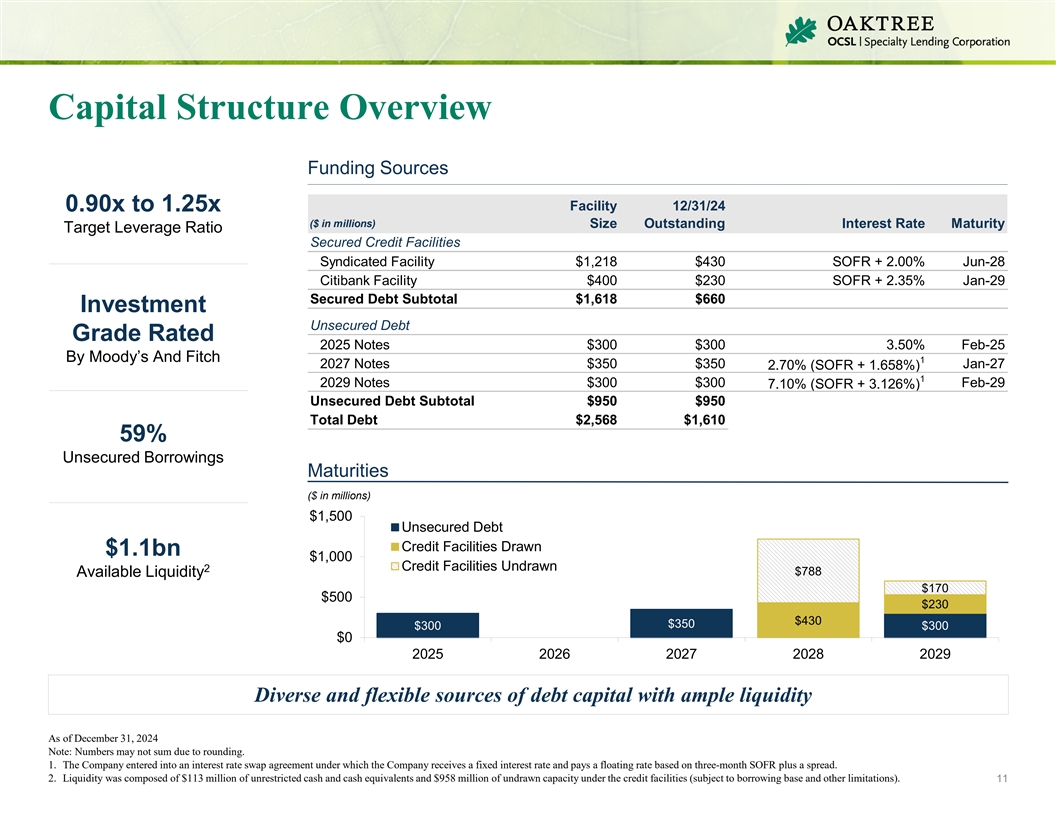

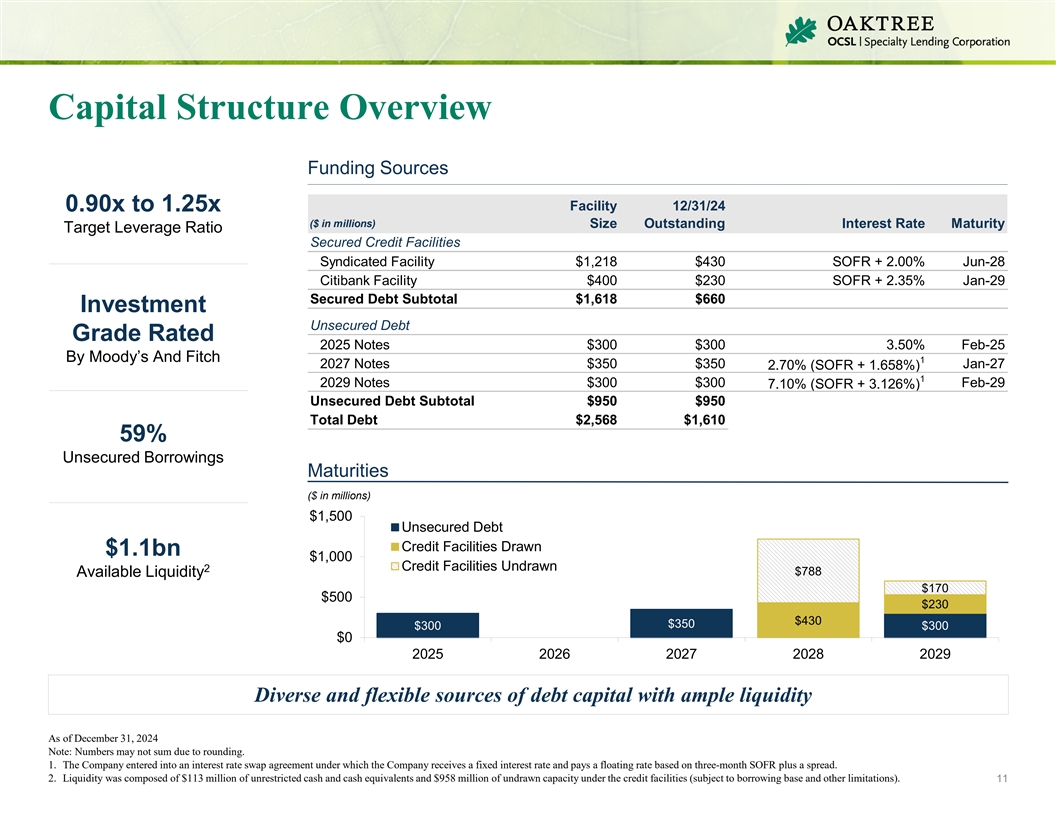

Capital Structure Overview Funding Sources Facility 12/31/24 0.90x to 1.25x ($ in millions) Size Outstanding Interest Rate Maturity Target Leverage Ratio Secured Credit Facilities Syndicated Facility $1,218 $430 SOFR + 2.00% Jun-28 Citibank Facility $400 $230 SOFR + 2.35% Jan-29 Secured Debt Subtotal $1,618 $660 Investment Unsecured Debt Grade Rated 2025 Notes $300 $300 3.50% Feb-25 By Moody’s And Fitch 1 2027 Notes $350 $350 Jan-27 2.70% (SOFR + 1.658%) 1 2029 Notes $300 $300 Feb-29 7.10% (SOFR + 3.126%) Unsecured Debt Subtotal $950 $950 Total Debt $2,568 $1,610 59% Unsecured Borrowings Maturities ($ in millions) $1,500 Unsecured Debt Credit Facilities Drawn $1.1bn $1,000 Credit Facilities Undrawn 2 $788 Available Liquidity $170 $500 $230 $430 $350 $300 $300 $0 2025 2026 2027 2028 2029 Diverse and flexible sources of debt capital with ample liquidity As of December 31, 2024 Note: Numbers may not sum due to rounding. 1. The Company entered into an interest rate swap agreement under which the Company receives a fixed interest rate and pays a floating rate based on three-month SOFR plus a spread. 2. Liquidity was composed of $113 million of unrestricted cash and cash equivalents and $958 million of undrawn capacity under the credit facilities (subject to borrowing base and other limitations). 11

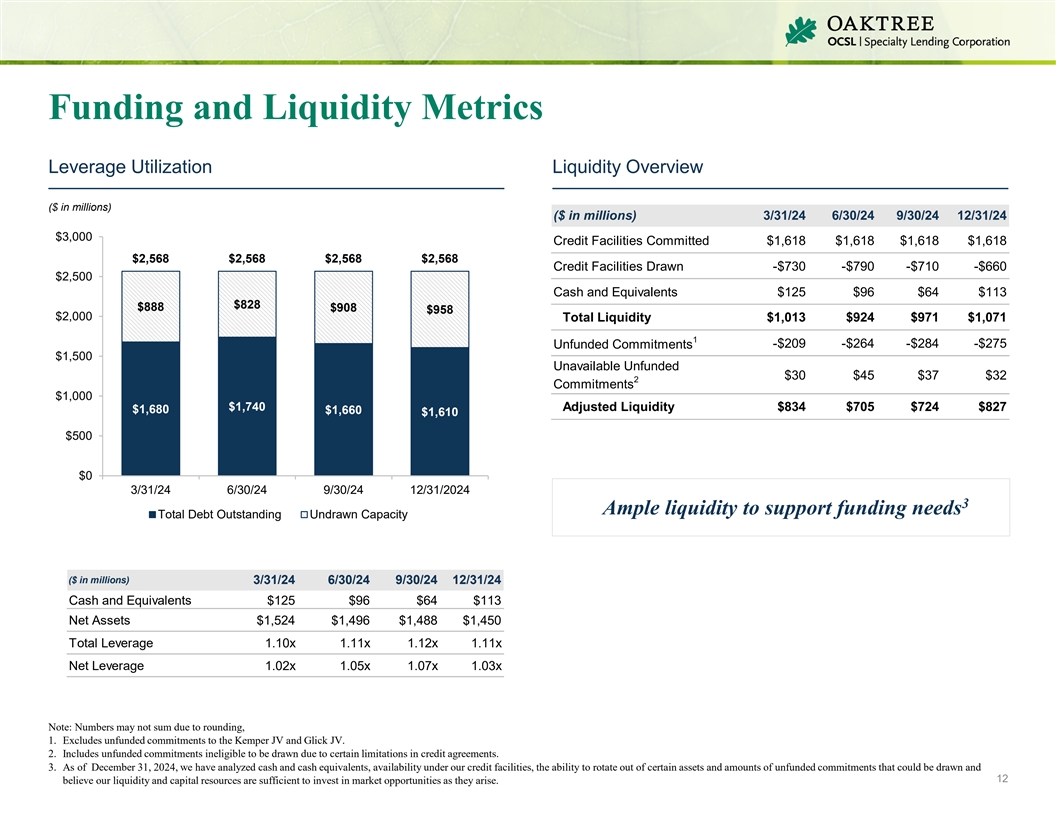

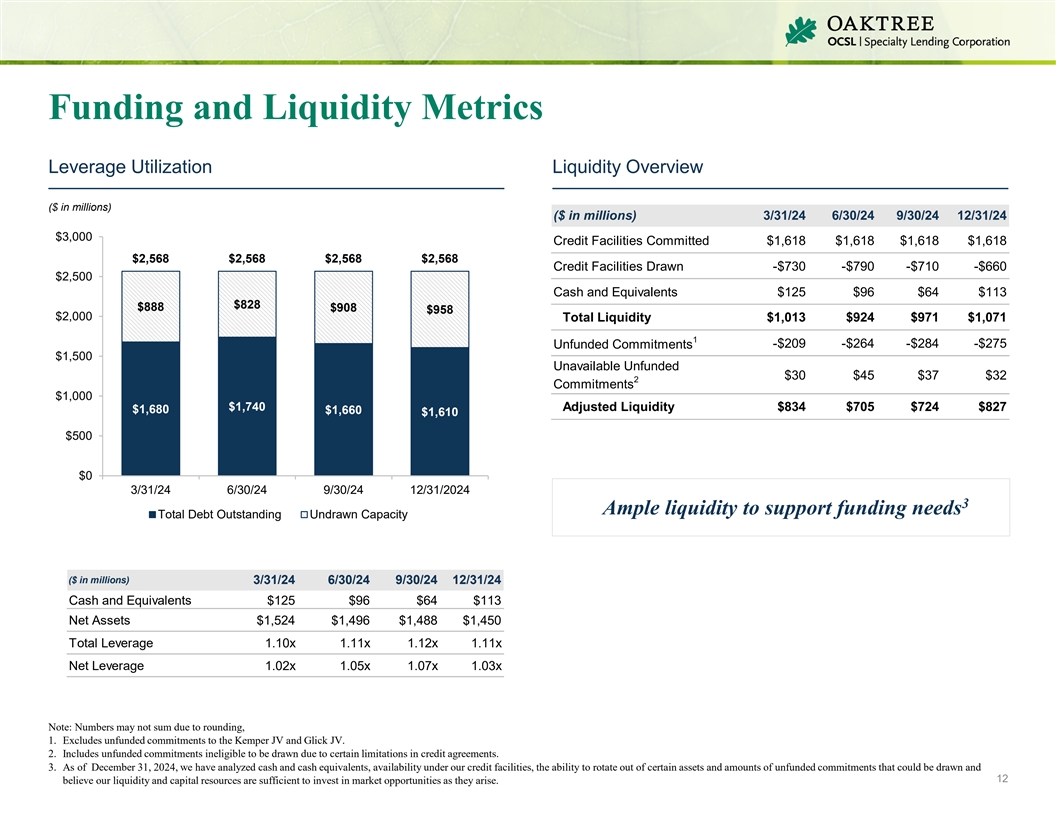

Funding and Liquidity Metrics Leverage Utilization Liquidity Overview ($ in millions) ($ in millions) 3/31/24 6/30/24 9/30/24 12/31/24 $3,000 Credit Facilities Committed $1,618 $1,618 $1,618 $1,618 $2,568 $2,568 $2,568 $2,568 Credit Facilities Drawn -$730 -$790 -$710 -$660 $2,500 Cash and Equivalents $125 $96 $64 $113 $828 $888 $908 $958 $2,000 Total Liquidity $1,013 $924 $971 $1,071 1 -$209 -$264 -$284 -$275 Unfunded Commitments $1,500 Unavailable Unfunded $30 $45 $37 $32 2 Commitments 2 $1,000 $1,740 Adjusted Liquidity $834 $705 $724 $827 $1,680 $1,660 $1,610 $500 $0 3/31/24 6/30/24 9/30/24 12/31/2024 3 Ample liquidity to support funding needs Total Debt Outstanding Undrawn Capacity ($ in millions) 3/31/24 6/30/24 9/30/24 12/31/24 Cash and Equivalents $125 $96 $64 $113 Net Assets $1,524 $1,496 $1,488 $1,450 Total Leverage 1.10x 1.11x 1.12x 1.11x Net Leverage 1.02x 1.05x 1.07x 1.03x Note: Numbers may not sum due to rounding, 1. Excludes unfunded commitments to the Kemper JV and Glick JV. 2. Includes unfunded commitments ineligible to be drawn due to certain limitations in credit agreements. 3. As of December 31, 2024, we have analyzed cash and cash equivalents, availability under our credit facilities, the ability to rotate out of certain assets and amounts of unfunded commitments that could be drawn and 12 believe our liquidity and capital resources are sufficient to invest in market opportunities as they arise.

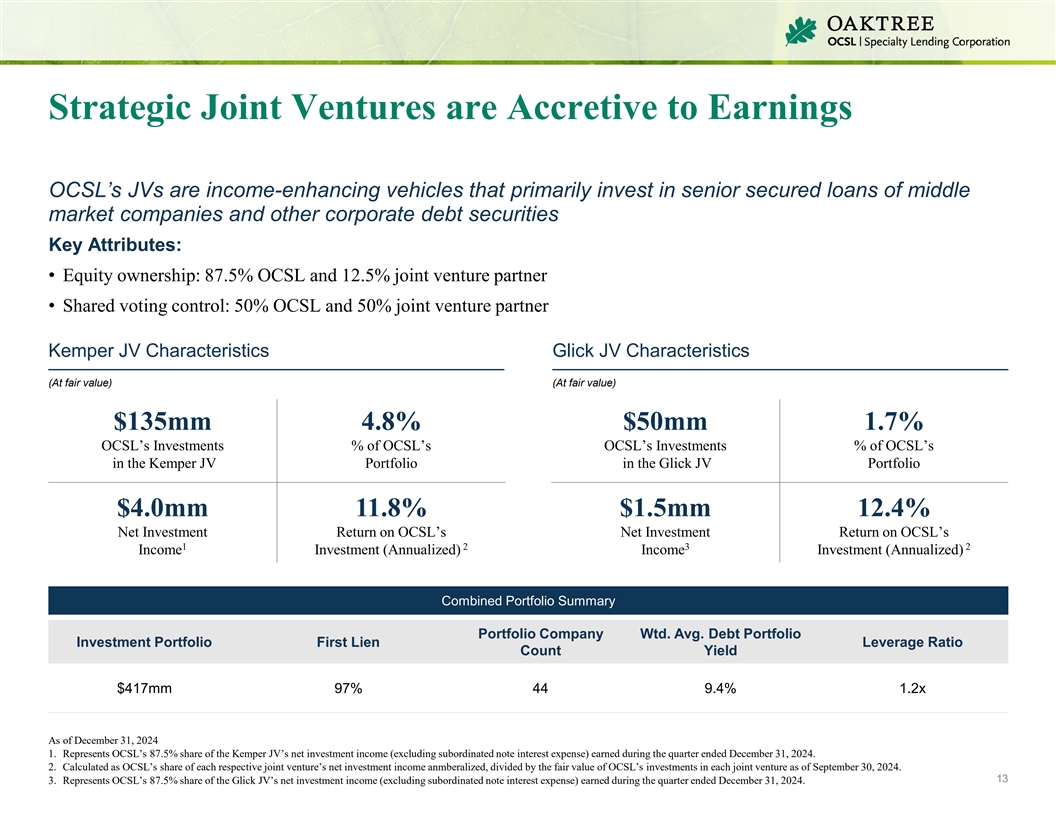

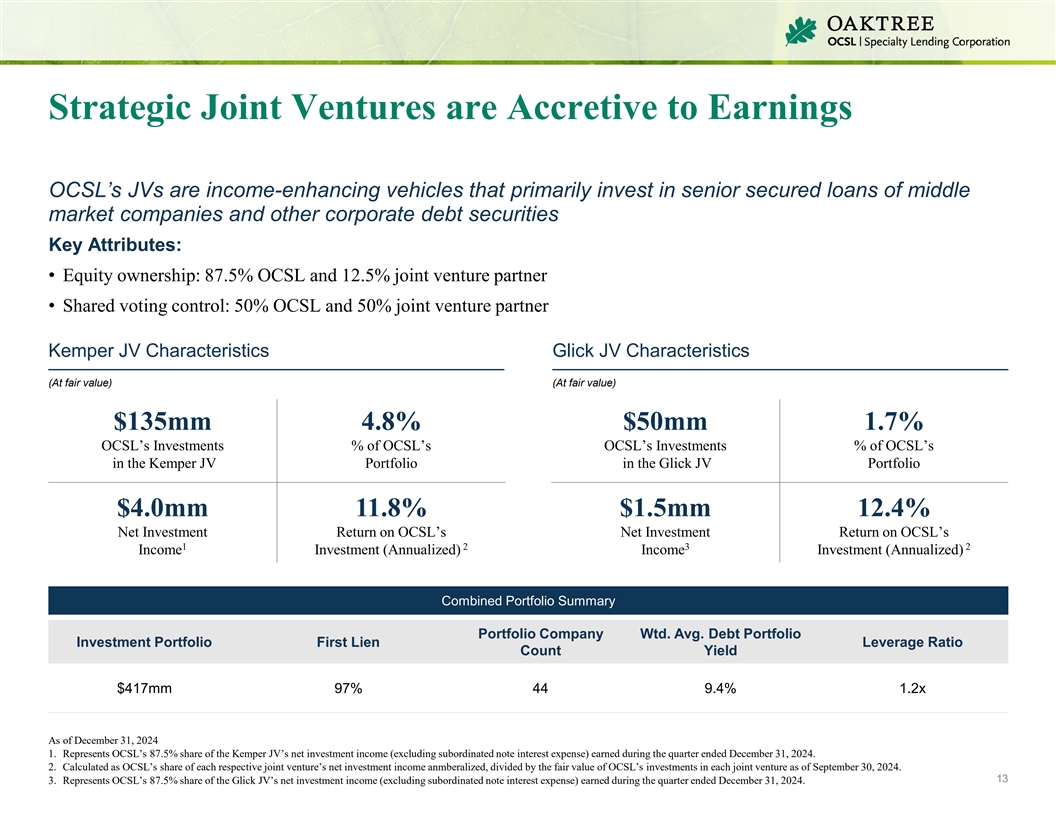

Strategic Joint Ventures are Accretive to Earnings OCSL’s JVs are income-enhancing vehicles that primarily invest in senior secured loans of middle market companies and other corporate debt securities Key Attributes: • Equity ownership: 87.5% OCSL and 12.5% joint venture partner • Shared voting control: 50% OCSL and 50% joint venture partner Kemper JV Characteristics Glick JV Characteristics (At fair value) (At fair value) $135mm 4.8% $50mm 1.7% OCSL’s Investments % of OCSL’s OCSL’s Investments % of OCSL’s in the Kemper JV Portfolio in the Glick JV Portfolio $4.0mm 11.8% $1.5mm 12.4% Net Investment Return on OCSL’s Net Investment Return on OCSL’s 1 2 3 2 Income Investment (Annualized) Income Investment (Annualized) Combined Portfolio Summary Portfolio Company Wtd. Avg. Debt Portfolio Investment Portfolio First Lien Leverage Ratio Count Yield $417mm 97% 44 9.4% 1.2x As of December 31, 2024 1. Represents OCSL’s 87.5% share of the Kemper JV’s net investment income (excluding subordinated note interest expense) earned during the quarter ended December 31, 2024. 2. Calculated as OCSL’s share of each respective joint venture’s net investment income anmberalized, divided by the fair value of OCSL’s investments in each joint venture as of September 30, 2024. 13 3. Represents OCSL’s 87.5% share of the Glick JV’s net investment income (excluding subordinated note interest expense) earned during the quarter ended December 31, 2024.

Appendix

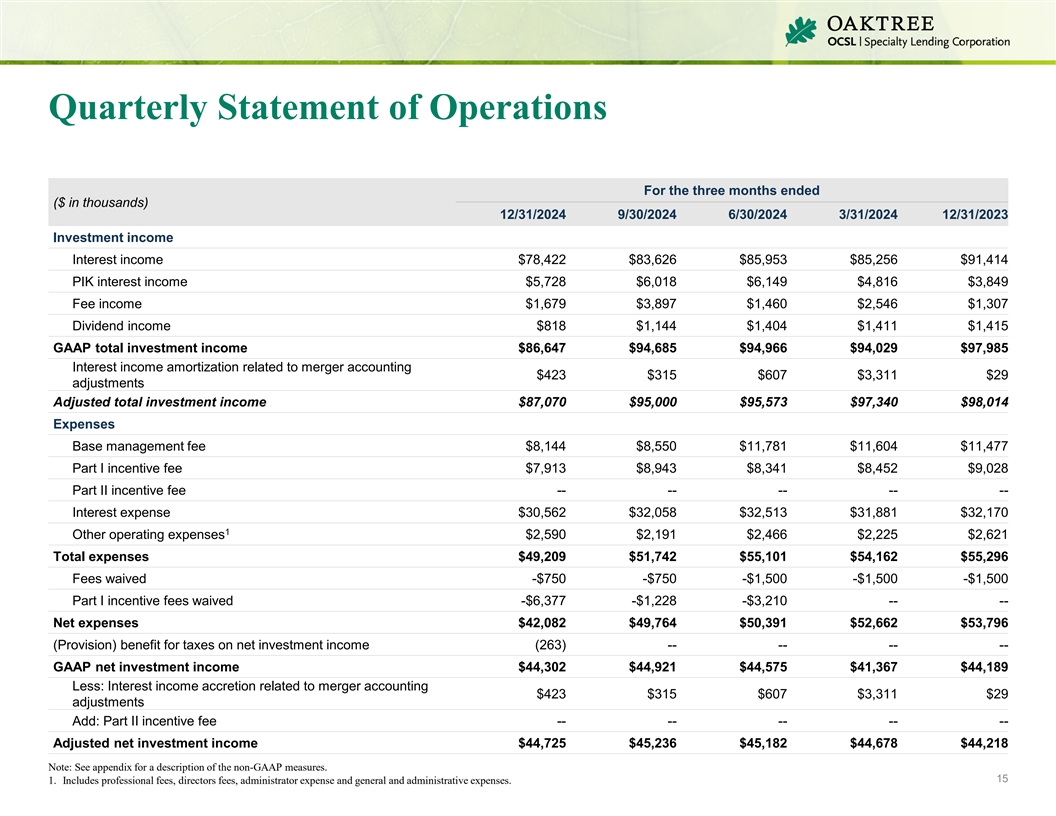

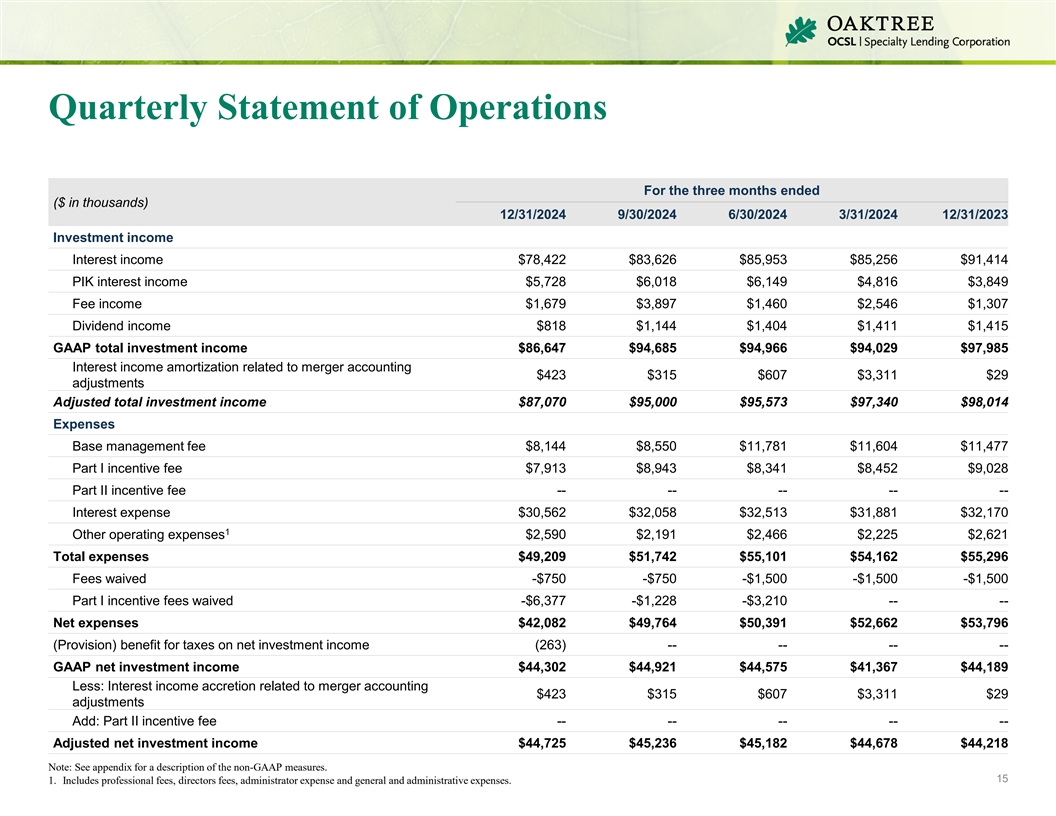

Quarterly Statement of Operations For the three months ended ($ in thousands) 12/31/2024 9/30/2024 6/30/2024 3/31/2024 12/31/2023 Investment income Interest income $78,422 $83,626 $85,953 $85,256 $91,414 PIK interest income $5,728 $6,018 $6,149 $4,816 $3,849 Fee income $1,679 $3,897 $1,460 $2,546 $1,307 Dividend income $818 $1,144 $1,404 $1,411 $1,415 GAAP total investment income $86,647 $94,685 $94,966 $94,029 $97,985 Interest income amortization related to merger accounting $423 $315 $607 $3,311 $29 adjustments Adjusted total investment income $87,070 $95,000 $95,573 $97,340 $98,014 Expenses Base management fee $8,144 $8,550 $11,781 $11,604 $11,477 Part I incentive fee $7,913 $8,943 $8,341 $8,452 $9,028 Part II incentive fee -- -- -- -- -- Interest expense $30,562 $32,058 $32,513 $31,881 $32,170 1 Other operating expenses $2,590 $2,191 $2,466 $2,225 $2,621 Total expenses $49,209 $51,742 $55,101 $54,162 $55,296 Fees waived -$750 -$750 -$1,500 -$1,500 -$1,500 Part I incentive fees waived -$6,377 -$1,228 -$3,210 -- -- Net expenses $42,082 $49,764 $50,391 $52,662 $53,796 (Provision) benefit for taxes on net investment income (263) -- -- -- -- GAAP net investment income $44,302 $44,921 $44,575 $41,367 $44,189 Less: Interest income accretion related to merger accounting $423 $315 $607 $3,311 $29 adjustments Add: Part II incentive fee -- -- -- -- -- Adjusted net investment income $44,725 $45,236 $45,182 $44,678 $44,218 Note: See appendix for a description of the non-GAAP measures. 15 1. Includes professional fees, directors fees, administrator expense and general and administrative expenses. I n v e s t o r P r e s e n a t

Quarterly Statement of Operations (continued) For the three months ended ($ in thousands, except per share amounts) 12/31/2024 9/30/2024 6/30/2024 3/31/2024 12/31/2023 Net realized and unrealized gains (losses) Net unrealized appreciation (depreciation) -$19,614 $43,179 $26,199 -$25,252 -$25,025 Net realized gains (losses) -$17,310 -$51,848 -$69,452 -$6,603 -$8,453 (Provision) benefit for taxes on realized and unrealized gains (losses) -$139 $661 -$202 -$175 -$176 GAAP net realized and unrealized gains (losses), net of taxes -$37,063 -$8,008 -$43,455 -$32,030 -$33,654 Net realized and unrealized losses (gains) related to merger accounting -$61 -$314 -$600 -$3,314 $796 adjustments Adjusted net realized and unrealized gains (losses), net of taxes -$37,124 -$8,322 -$44,055 -$35,344 -$32,858 GAAP net increase (decrease) in net assets resulting from operations $7,239 $36,913 $1,120 $9,337 $10,535 Interest income amortization (accretion) related to merger accounting adjustments $423 $315 $607 $3,311 $29 Net realized and unrealized losses (gains) related to merger accounting -$61 -$314 -$600 -$3,314 $796 adjustments Adjusted earnings (loss) $7,601 $36,914 $1,127 $9,334 $11,360 Per share data: GAAP total investment income $1.05 $1.15 $1.16 $1.18 $1.26 Adjusted total investment income $1.06 $1.16 $1.17 $1.22 $1.26 GAAP net investment income $0.54 $0.55 $0.54 $0.52 $0.57 Adjusted net investment income $0.54 $0.55 $0.55 $0.56 $0.57 GAAP net realized and unrealized gains (losses), net of taxes -$0.45 -$0.10 -$0.53 -$0.40 -$0.43 Adjusted net realized and unrealized gains (losses), net of taxes -$0.45 -$0.10 -$0.54 -$0.44 -$0.42 GAAP net increase/decrease in net assets resulting from operations $0.09 $0.45 $0.01 $0.12 $0.14 Adjusted earnings (loss) $0.09 $0.45 $0.01 $0.12 $0.15 Weighted average common shares outstanding 82,245 82,245 81,830 79,763 77,840 Shares outstanding, end of period 82,245 82,245 82,245 81,396 78,965 16 I n v e s t o r P r e s e n a t

Non-GAAP Disclosures The OCSI Merger and the OSI2 Merger (the “Mergers”) were accounted for as asset acquisitions in accordance with the asset acquisition method of accounting as detailed in ASC 805-50, Business Combinations—Related Issues ( ASC 805 ). The consideration paid to each of the stockholders of OCSI and OSI2 were allocated to the individual assets acquired and liabilities assumed based on the relative fair values of the net identifiable assets acquired other than non-qualifying assets, which established a new cost basis for the acquired investments under ASC 805 that, in aggregate, was different than the historical cost basis of the acquired investments prior to the OCSI Merger or OSI2 Merger, as applicable. Additionally, immediately following the completion of the Mergers, the acquired investments were marked to their respective fair values under ASC 820, Fair Value Measurements, which resulted in unrealized appreciation / depreciation. The new cost basis established by ASC 805 on debt investments acquired will accrete / amortize over the life of each respective debt investment through interest income, with a corresponding adjustment recorded to unrealized appreciation / depreciation on such investment acquired through its ultimate disposition. The new cost basis established by ASC 805 on equity investments acquired will not accrete / amortize over the life of such investments through interest income and, assuming no subsequent change to the fair value of the equity investments acquired and disposition of such equity investments at fair value, the Company will recognize a realized gain / loss with a corresponding reversal of the unrealized appreciation / depreciation on disposition of such equity investments acquired. The Company’s management uses the non-GAAP financial measures described above internally to analyze and evaluate financial results and performance and to compare its financial results with those of other business development companies that have not adjusted the cost basis of certain investments pursuant to ASC 805. The Company’s management believes Adjusted Total Investment Income , Adjusted Total Investment Income Per Share , Adjusted Net Investment Income and Adjusted Net Investment Income Per Share are useful to investors as an additional tool to evaluate ongoing results and trends for the Company without giving effect to the accretion income resulting from the new cost basis of the investments acquired in the Mergers because these amounts do not impact the fees payable to Oaktree under its second amended and restated investment advisory agreement (the “A&R Advisory Agreement”), and specifically as its relates to Adjusted Net Investment Income and Adjusted Net Investment Income Per Share , without giving effect to Part II incentive fees. In addition, the Company’s management believes that “Adjusted Net Realized and Unrealized Gains (Losses), Net of Taxes”, “Adjusted Net Realized and Unrealized Gains (Losses), Net of Taxes Per Share”, “Adjusted Earnings (Loss)” and “Adjusted Earnings (Loss) Per Share” are useful to investors as they exclude the non-cash income/gain resulting from the Mergers and used by management to evaluate the economic earnings of its investment portfolio. Moreover, these metrics align the Company's key financial measures with the calculation of incentive fees payable to Oaktree under with the A&R Advisory Agreement (i.e., excluding amounts resulting solely from the lower cost basis of the acquired investments established by ASC 805 that would have been to the benefit of Oaktree absent such exclusion). 17 I n v e s t o r P r e s e n a t

oaktreespecialtylending.com