Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS 2

TABLE OF CONTENTS

Table of Contents

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. 1)

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

ý | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

o | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| THOMPSON CREEK METALS COMPANY INC. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

o | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: Common Shares, no par value, of Thompson Creek Metals Company Inc. | |||

| (2) | Aggregate number of securities to which transaction applies: As of July 8, 2016, 228,545,893 Common Shares (giving effect to all outstanding Common Shares and all Common Shares issuable upon the exercise of outstanding stock options and the settlement of all outstanding restricted share unit and performance share unit awards). | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): The filing fee was calculated based on the value of the transaction, which was computed by adding the sum of (i) 222,782,042 outstanding Common Shares, (ii) 1,142,005 Common Shares subject to issuance pursuant to outstanding stock options, (iii) 1,437,095 Common Shares subject to issuance upon settlement of outstanding restricted share unit awards and (iv) 3,184,751 Common Shares subject to issuance upon settlement of outstanding performance share unit awards, with such sum multiplied by $0.55 per Common Share, the last sale report on the OTCQX on July 8, 2016. In accordance with Section 14(a) of the Securities Exchange Act of 1934, as amended, the filing fee was determined at the rate of $100.7 per million. | |||

| (4) | Proposed maximum aggregate value of transaction: $125,700,241.15 | |||

| (5) | Total fee paid: $12,658.02 | |||

ý | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

ARRANGEMENT PROPOSAL—YOUR VOTE IS VERY IMPORTANT

[ · ], 2016

Dear Shareholders of Thompson Creek Metals Company Inc.:

On July 5, 2016, Thompson Creek Metals Company Inc. ("Thompson Creek") and Centerra Gold Inc. ("Centerra") entered into an arrangement agreement that provides for Thompson Creek to become a wholly-owned subsidiary of Centerra (the "Arrangement Agreement"). At the Special Meeting (as defined below), you will be asked to approve a special resolution (the "Arrangement Resolution") adopting a statutory plan of arrangement under Section 288 of theBusiness Corporations Act (British Columbia), as amended (the "BCBCA") involving the acquisition by Centerra of all of the outstanding common shares of Thompson Creek (the "Arrangement"). In connection with the completion of the Arrangement, Centerra has agreed to contribute to Thompson Creek the amount of cash necessary to redeem, or otherwise satisfy and discharge, all of Thompson Creek's outstanding secured and unsecured notes in accordance with the terms of their indentures. A special committee of independent directors (the "Special Committee") and Thompson Creek's board of directors (the "Thompson Creek Board") have each determined that the Arrangement is fair to Thompson Creek shareholders, and in the best interests of Thompson Creek, and the Thompson Creek Board has recommended that shareholders vote in favor of the Arrangement Resolution adopting the plan of arrangement and approving the Arrangement Agreement and the transactions contemplated thereby.

If the Arrangement becomes effective, each outstanding Thompson Creek common share, other than shares held by a shareholder duly and validly exercising dissent rights, will be transferred to Centerra in exchange for 0.0988 of a Centerra common share. Immediately following completion of the Arrangement, it is expected that Thompson Creek shareholders will own approximately 8% of the outstanding Centerra common shares. The common shares of Thompson Creek are traded on the Toronto Stock Exchange under the symbol "TCM" and on the OTCQX market under the symbol "TCPTF." The common shares of Centerra are traded on the Toronto Stock Exchange under the symbol "CG." Shareholders are encouraged to review current market prices.

Thompson Creek is holding a special meeting of the shareholders on [ · ], 2016 at [ · ].m. local time, at our corporate headquarters located at 26 West Dry Creek Circle, Second Floor, Littleton, Colorado 80120 (the "Special Meeting"), to obtain your vote to: (1) approve the Arrangement Resolution adopting the Arrangement, the Arrangement Agreement and the transactions contemplated thereby; and (2) approve, solely on an advisory (non-binding) basis, the compensation payments made by Thompson Creek to its named executive officers in connection with the Arrangement. Your vote is very important. For the Arrangement to become effective, the Arrangement Resolution must be approved by at least two-thirds of the votes cast on the Arrangement Resolution by the holders of Thompson Creek common shares present in person or by proxy at the Special Meeting. The Arrangement also requires the approval of the Supreme Court of British Columbia.

Highlights of the Arrangement include:

- •

- The exchange ratio implies a 32% premium to Thompson Creek common shares based on the closing price of Thompson Creek common shares on the Toronto Stock Exchange on July 4, 2016;

- •

- Provides a comprehensive solution for Thompson Creek's capital structure and delivers a premium exchange ratio to Thompson Creek shareholders while maintaining meaningful equity participation in a combined company with a strong balance sheet;

- •

- Centerra is paying off approximately $889 million of Thompson Creek's debt (which amount includes applicable call premiums and estimated accrued interest) that would have otherwise negatively impacted the future of Thompson Creek and its shareholders; and

- •

- The combined company is expected to provide Thompson Creek shareholders with exposure to a large, long-life reserve base through Mount Milligan Mine, Centerra's world-class Kumtor Mine, Centerra's pipeline of exploration and development properties and Centerra's peer-leading dividend policy.

The Thompson Creek Board recommends that Thompson Creek shareholders vote "FOR" the Arrangement Resolution and "FOR" the advisory resolution to approve the compensation payments made by Thompson Creek to its named executive officers in connection with the Arrangement.

On behalf of the Thompson Creek Board, I invite you to attend the Special Meeting. Your vote is very important. Whether or not you plan to attend the Special Meeting, we hope you will vote as soon as possible. For specific instructions on how to vote your shares, please refer to the section entitled "Questions and Answers About the Arrangement and the Special Meeting" beginning on page 1 of the proxy statement and management information circular.

This document is a proxy statement and management information circular of Thompson Creek for use in soliciting proxies for the Special Meeting. This document answers questions about the Arrangement and the Special Meeting and includes a summary description of the Arrangement.We urge you to review this entire document carefully. In particular, you should also consider the matters discussed under "Risk Factors" beginning on page 23 of the proxy statement and management information circular.

We are very excited about the opportunities offered by the Arrangement, and we thank you for your consideration and ongoing support.

| By Order of the Board of Directors, | ||

JACQUES PERRON President and Chief Executive Officer |

The accompanying proxy statement and management information circular is dated [ · ], 2016 and is first being mailed to the shareholders of Thompson Creek on or about [ · ], 2016.

Thompson Creek files annual, quarterly and other reports, proxy statements and other information with the U.S. Securities and Exchange Commission ("SEC") and with Canadian provincial securities regulatory authorities. This proxy statement and management information circular (together referred to herein as the "proxy statement") incorporates by reference important business and financial information about Thompson Creek from documents that are not included in or delivered with this proxy statement. For a listing of the documents incorporated by reference into this proxy statement, see "Where You Can Find Additional Information" below. You can obtain copies of the documents incorporated by reference into this proxy statement, without charge, from the SEC's website at www.sec.gov, or the Canadian System for Electronic Document Analysis and Retrieval ("SEDAR"), the Canadian equivalent of the SEC's EDGAR system, at www.sedar.com.

Centerra files reports, statements and other information with Canadian provincial and territorial securities regulatory authorities. Centerra's filings are electronically available to the public under Centerra's profile on SEDAR, at www.sedar.com. For the purposes of Canadian securities laws, this proxy statement incorporates by reference certain documents of Centerra filed on SEDAR. For a listing of such documents, see "Where You Can Find Additional Information" below. Such documents are not incorporated by reference in this proxy statement for U.S. purposes; however, the filings Centerra makes on SEDAR are available free of charge to any person at www.sedar.com.

You can also request copies of documents incorporated by reference into this proxy statement (excluding all exhibits, unless an exhibit has specifically been incorporated by reference into this proxy statement) or otherwise listed under "Where You Can Find Additional Information," without charge, by requesting them in writing or by telephone from the appropriate company at the following address and telephone number:

| Thompson Creek Metals Company Inc. 26 Dry Creek Circle, Suite 810 Littleton, Colorado 80120 Attention: Investor Relations Telephone: (303) 762-3526 | Centerra Gold Inc. 1 University Avenue, Suite 1500 Toronto, Ontario M5J 2P1 Attention: Investor Relations Telephone: (416) 204-1953 |

In addition, if you have questions about the Arrangement Agreement, the Arrangement and related transactions, or the Special Meeting, or if you need to obtain copies of this proxy statement, proxy cards or any documents incorporated by reference in this proxy statement (excluding all exhibits, unless an exhibit has specifically been incorporated by reference into this proxy statement) or otherwise listed under "Where You Can Find Additional Information," you may contact Thompson Creek's proxy solicitor, at the address and contact information listed below. You will not be charged for any of the documents you request.

![]()

The Exchange Tower

130 King Street West, Suite 2950, P.O. Box 361

Toronto, Ontario

M5X 1E2

www.kingsdaleshareholder.com

North American Toll Free: 1-866-581-1479

Email: contactus@kingsdaleshareholder.com

Outside North America Call Collect: 1-416-867-2272

Toll Free Facsimile: 1-866-545-5580

Facsimile: 416-867-2271

If you would like to request documents, please do so by[ · ], 2016 (which is five business days before the date of the Special Meeting) in order to receive them before the Special Meeting.

Centerra has supplied all information contained in this proxy statement relating to Centerra, and Thompson Creek has supplied all information contained in this proxy statement relating to Thompson Creek.

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To the Shareholders of Thompson Creek Metals Company Inc.:

Notice is hereby given that, pursuant to an order (the "Interim Order") of the Supreme Court of British Columbia (the "Court") a special meeting of the shareholders (the "Special Meeting") of Thompson Creek Metals Company Inc. ("Thompson Creek") will be held on [ · ], 2016 at our corporate headquarters located at 26 West Dry Creek Circle, Second Floor, Littleton, Colorado 80120, at [ · ].m., local time, for the following purposes:

(1) Arrangement Resolution. To consider, pursuant to the Interim Order, and if deemed advisable, to pass, with or without variation, a special resolution (the "Arrangement Resolution"), the full text of which is set forth inAnnex B to the accompanying proxy statement and management information circular, approving an arrangement (the "Arrangement") pursuant to Division 5 of Part 9 of theBusiness Corporations Act (British Columbia) (the "BCBCA"), all as more particularly described in the accompanying proxy statement and management information circular;

(2) Named Executive Officer Arrangement-Related Compensation Proposal. To consider, solely on an advisory (non-binding) basis, the agreements or understandings between Thompson Creek's named executive officers and Thompson Creek and the related compensation that will or may be paid to its named executive officers in connection with the Arrangement, as disclosed pursuant to Item 402(t) of Regulation S-K in the "Golden Parachute Compensation" table and the related narrative disclosures in the section of the accompanying proxy statement and management information circular entitled "Interests of Directors and Executive Officers in the Arrangement—Quantification of Potential Payments to the Named Executive Officers in Connection with the Arrangement"; and

(3) Other Business. To transact such other business as may properly come before the Special Meeting or any adjournment or postponement thereof.

Specific details about the matters to be put before the Special Meeting are set forth in the accompanying proxy statement and management information circular.

Only shareholders of record as of the close of business on August 8, 2016 are entitled to notice of and to vote at the Special Meeting or at any adjournment or postponement thereof.

Thompson Creek shareholders may attend the Special Meeting in person or by proxy. Thompson Creek shareholders who are unable to attend the Special Meeting or any adjournment or postponement thereof in person are requested to date, sign and return the accompanying form of proxy for use at the Special Meeting or any adjournment or postponement thereof. To be effective, the form of proxy must be received by TSX Trust Company (according to the instructions on the proxy card), not later than [ · ].m. local time, on [ · ], 2016, or not later than 48 hours (other than Saturday, Sunday or holidays) prior to the time set for any adjournment or postponement of the Special Meeting. The deadline for the deposit of proxies may be waived or extended by the Chair of the Special Meeting at his or her sole discretion without notice.

Thompson Creek shareholders who are planning to return the form of proxy are encouraged to review the accompanying proxy statement and management information circular carefully before submitting the accompanying proxy card.

Approval of the Arrangement Resolution authorizing and adopting the Arrangement, the plan of arrangement, the Arrangement Agreement and the transactions contemplated thereby by the Thompson Creek shareholders is a condition to the completion of the Arrangement and requires the affirmative approval of two-thirds of the votes cast by the holders of Thompson Creek's common shares present in person or by proxy at the Special Meeting. Therefore, your vote is very important.

Pursuant to the Interim Order, registered Thompson Creek shareholders have been granted the right to dissent in respect of the Arrangement Resolution. If the Arrangement becomes effective, a registered Thompson Creek shareholder who dissents in respect of the Arrangement Resolution is entitled to be paid the fair value of such dissenting Thompson Creek shareholder's common shares in accordance with the provisions of Section 238 of the BCBCA as modified by the plan of arrangement and the Interim Order, provided that such shareholder has delivered a written notice of dissent to the Arrangement Resolution to Thompson Creek, c/o Cassels Brock & Blackwell LLP, Suite 2100, Scotia Plaza, 40 King Street West, Toronto, Ontario, Canada M5H 3C2, Attention: Paul M. Stein, no later than 5:00 p.m., Eastern time, on [ · ], 2016 (or, if the Special Meeting is adjourned or postponed, 5:00 p.m., Eastern time, on the day that is two business days before the time of the postponed or adjourned Special Meeting) and has otherwise complied strictly with the dissent procedures described in the accompanying proxy statement, including the relevant provisions of Division 2 of Part 8 of the BCBCA, as modified by the plan of arrangement and the Interim Order. Beneficial owners of Thompson Creek common shares that are registered in the name of a broker, bank, custodian, nominee or other intermediary who wish to dissent should be aware that only registered owners of Thompson Creek common shares are entitled to dissent. A dissenting holder of Thompson Creek common shares may only dissent with respect to all Thompson Creek common shares held on behalf of any one beneficial owner and registered in the name of such dissenting Thompson Creek shareholder. Accordingly, a non-registered holder of Thompson Creek common shares who desires to exercise the right of dissent must make arrangements for the Thompson Creek common shares beneficially owned by such holder to be registered in the holder's name prior to the time the written notice of dissent to the Arrangement Resolution is required to be received by Thompson Creek or, alternatively, make arrangements for the registered holder of such Thompson Creek common shares to dissent on the holder's behalf. It is recommended that you seek independent legal advice if you wish to exercise your right of dissent.

Failure to strictly comply with the relevant provisions of Division 2 of Part 8 of the BCBCA as modified by the plan of arrangement and the Interim Order may result in the loss of any right to dissent.

| By Order of the Board of Directors, | ||

| ||

| JACQUES PERRON President and Chief Executive Officer |

[ · ], 2016

PLEASE VOTE ON THE ENCLOSED PROXY CARD NOW EVEN IF YOU PLAN TO ATTEND THE SPECIAL MEETING. YOU CAN VOTE BY SIGNING, DATING AND RETURNING YOUR PROXY CARD BY MAIL IN THE ENCLOSED RETURN ENVELOPE, WHICH REQUIRES NO ADDITIONAL POSTAGE IF MAILED IN THE UNITED STATES OR CANADA, OR BY FACSIMILE OR INTERNET BY FOLLOWING THE INSTRUCTIONS ON THE PROXY CARD. IF YOU DO ATTEND THE SPECIAL MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE IN PERSON IF YOU ARE A REGISTERED SHAREHOLDER OR HAVE A LEGAL PROXY FROM A REGISTERED SHAREHOLDER.

If you are the beneficial owner of Thompson Creek common shares held by a broker, bank, custodian, nominee or other intermediary and you wish to vote in person at the Special Meeting, you must bring to the Special Meeting a proxy from the broker, bank, custodian, nominee or other intermediary that holds your Thompson Creek common shares authorizing you to vote in person at the Special Meeting. Please also bring to the Special Meeting your account statement evidencing your beneficial ownership of Thompson Creek's common shares as of the record date. All shareholders should also bring photo identification.

The accompanying proxy statement and management information circular provides a detailed description of the plan of arrangement, the Arrangement Agreement, the Arrangement and related agreements and transactions. We urge you to read the accompanying proxy statement and management information circular, including any documents incorporated by reference into the accompanying proxy statement and management information circular and its annexes carefully and in their entirety. If you have any questions concerning the Arrangement Resolution, the other proposals or the accompanying proxy statement and management information circular, would like additional copies of the accompanying proxy statement and management information circular or need help voting your shares, please contact Thompson Creek's proxy solicitor at the contact information listed below:

![]()

The Exchange Tower

130 King Street West, Suite 2950, P.O. Box 361

Toronto, Ontario

M5X 1E2

www.kingsdaleshareholder.com

North American Toll Free: 1-866-581-1479

Email: contactus@kingsdaleshareholder.com

Outside North America Call Collect: 1-416-867-2272

Toll Free Facsimile: 1-866-545-5580

Facsimile: 416-867-2271

CURRENCY AND EXCHANGE RATE DATA

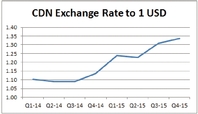

This proxy statement contains references to United States dollars and Canadian dollars. All dollar amounts referenced, unless otherwise indicated, are expressed in United States dollars and Canadian dollars are referred to as "Canadian dollars" or "C$". The following table reflects the high, low and average rates of exchange in Canadian dollars for one United States dollar for the periods noted, based on the Bank of Canada noon spot rate of exchange.

| | Fiscal Year Ended | Six Months Ended | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | December 31, 2015 | December 31, 2014 | June 30, 2016 | June 30, 2015 | |||||||||

High | 0.8527 | 0.9422 | 0.7972 | 0.8527 | |||||||||

Low | 0.7148 | 0.8589 | 0.6854 | 0.7811 | |||||||||

Average | 0.7820 | 0.9054 | 0.7518 | 0.8095 | |||||||||

On [ · ], 2016, the noon buying rate as reported by the Bank of Canada was $1.00 = C$[ · ] or C$1.00 = $[ · ].

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this proxy statement (including information incorporated by reference) are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and "forward-looking information" within applicable Canadian securities legislation (collectively, "forward-looking statements"), and are intended to be covered by the safe harbors provided by these regulations. All statements other than statements of historical fact set forth herein or incorporated herein by reference are forward-looking statements. These forward-looking statements may, in some cases, be identified by the use of terms such as "believe," "project," "expect," "anticipate," "estimate," "intend," "strategy," "future," "opportunity," "plan," "may," "should," "will," "would," "will be," "will continue," "will likely result," and similar expressions. Such forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, such statements. These risks and uncertainties include, but are not limited to:

- •

- the ability to obtain Thompson Creek shareholder and Court approval of the Arrangement;

- •

- the ability to complete the Arrangement on the anticipated terms and timetable;

- •

- Centerra's and Thompson Creek's ability to integrate successfully after the Arrangement and achieve anticipated benefits from the Arrangement;

- •

- the possibility that various closing conditions for the Arrangement may not be satisfied or waived;

- •

- risks relating to any unforeseen liabilities, costs or expenses of Centerra or Thompson Creek;

- •

- the other risks described in Item 1A. "Risk Factors" in Thompson Creek's Annual Report on Form 10-K for the year ended December 31, 2015 and Item 1A. "Risk Factors" in Thompson Creek's Quarterly Report on Form 10-Q for the quarter ended June 30, 2016, which are incorporated by reference in this proxy statement in the section entitled "Risk Factors" below and in the section entitled "Risk Factors—Risks Related to Centerra."

Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. You should not place undue reliance on these forward-looking statements. Neither Thompson Creek nor Centerra undertakes any obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities laws.

SCIENTIFIC AND TECHNICAL INFORMATION

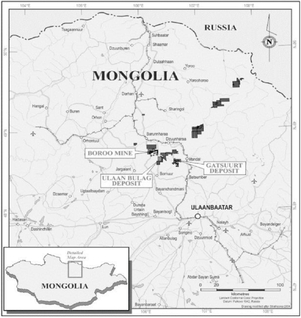

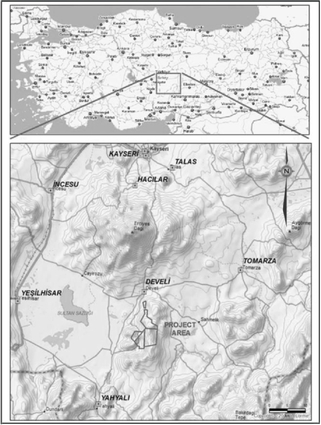

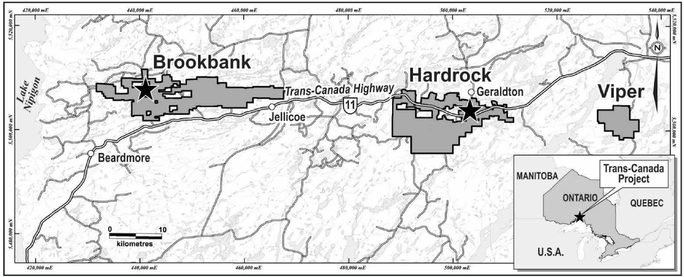

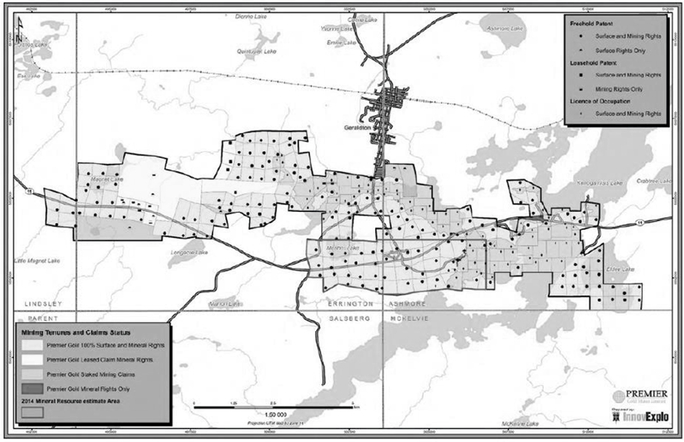

The scientific and technical information with respect to Centerra's Kumtor, Boroo, Öksüt, Gatsuurt and Greenstone projects contained in and, for Canadian securities law purposes, incorporated by reference herein is based on the Centerra Technical Reports (as defined herein). The scientific and technical information of Centerra contained in and, for Canadian securities law purposes, incorporated by reference herein has been updated with current information where applicable. The full text of the Centerra Technical Reports has been filed with Canadian provincial and territorial securities regulatory authorities pursuant to National Instrument 43-101—Standards of Disclosure for Mineral Projects ("NI 43-101") and are available for review under Centerra's profile on SEDAR at www.sedar.com.

Centerra's and Thompson Creek's proven and probable reserve estimates contained herein and the documents incorporated by reference herein, as applicable, are as of December 31, 2015, except where otherwise stated.

Gordon D. Reid, P.Eng., an employee of Centerra, has reviewed and approved the scientific and technical information in respect of Centerra contained in or incorporated by reference herein. Robert Clifford, an employee of Thompson Creek, has reviewed and approved the scientific and technical information in respect of Thompson Creek contained in or incorporated by reference herein. Each of Mr. Reid and Mr. Clifford is considered, by virtue of their education, experience and professional association, to be a "qualified person" for purposes of NI 43-101. Mr. Reid is not independent of Centerra within the meaning of NI 43-101. Mr. Clifford is not independent of Thompson Creek within the meaning of NI 43-101.

CAUTIONARY NOTICE TO U.S. SHAREHOLDERS

Reserve and Resource Estimates

The disclosure in this document and, for Canadian securities law purposes, the documents incorporated by reference herein use mineral resource classification terms that comply with reporting standards in Canada, and certain mineral resource estimates are made in accordance with NI 43-101. NI 43-101 is a rule developed by the Canadian Securities Administrators ("CSA") that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all mineral reserve and resource estimates of Centerra contained herein and, for Canadian securities law purposes, the documents incorporated by reference herein have been prepared in accordance with NI 43-101. These standards differ significantly from the mineral reserve disclosure requirements of the SEC as stated in Industry Guide 7. Consequently, mineral reserve and resource information contained herein is not comparable to similar information that would generally be disclosed by U.S. companies in accordance with the rules of the SEC.

In particular, the SEC's Industry Guide 7 applies different standards in order to classify mineralization as a reserve. As a result, the definitions of proven and probable reserves used in NI 43-101 differ from the definitions in SEC Industry Guide 7. Under SEC standards, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Among other things, all necessary permits would be required to be in hand or issuance imminent in order to classify mineralized material as reserves under the SEC standards. Accordingly, mineral reserve estimates contained herein may not qualify as "reserves" under SEC standards.

In addition, this proxy statement and, for Canadian securities law purposes, the documents incorporated by reference herein use the terms "mineral resources," "indicated mineral resources" and "inferred mineral resources" as permitted by the reporting standards in Canada. The SEC's Industry Guide 7 does not recognize mineral resources and U.S. companies are generally not permitted to disclose resources in documents they file with the SEC. Thompson Creek shareholders are specifically cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into SEC defined mineral reserves. Further, "inferred mineral resources" have a great amount of uncertainty as to their existence and as to whether they can be mined legally or

economically. Therefore, Thompson Creek shareholders are also cautioned not to assume that all or any part of an inferred resource exists. In accordance with Canadian rules, estimates of "inferred mineral resources" cannot form the basis of feasibility or pre-feasibility studies. It cannot be assumed that all or any part of "mineral resources," "measured mineral resources," "indicated mineral resources" or "inferred mineral resources" will ever be upgraded to a higher category. Thompson Creek shareholders are cautioned not to assume that any part of the reported "mineral resources," "measured mineral resources," "indicated mineral resources" or "inferred mineral resources" herein is economically or legally mineable. In addition, the definitions of "proven mineral reserves" and "probable mineral reserves" under reporting standards in Canada differ in certain respects from the standards of the SEC. For the above reasons, information contained herein that describes mineral reserve and resource estimates is not comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC.

| | Page | |

|---|---|---|

QUESTIONS AND ANSWERS ABOUT THE ARRANGEMENT AND THE SPECIAL MEETING | 1 | |

SUMMARY | 11 | |

Information about Centerra and Thompson Creek | 11 | |

Risk Factors | 12 | |

The Arrangement and the Arrangement Agreement | 12 | |

Special Meeting of Thompson Creek Shareholders | 12 | |

What Thompson Creek Shareholders will Receive in the Arrangement | 13 | |

Treatment of Equity Awards | 13 | |

Recommendation of the Special Committee and the Thompson Creek Board of Directors | 14 | |

Opinion of BMO Capital Markets | 14 | |

Ownership of Centerra after the Arrangement | 14 | |

The Arrangement Requires the Approval of the Court | 14 | |

Interests of Directors and Executive Officers in the Arrangement | 15 | |

Dissent Rights Available | 15 | |

Completion of the Arrangement is Subject to Certain Conditions | 16 | |

No Solicitation by Thompson Creek | 18 | |

Termination of the Arrangement Agreement | 19 | |

Termination Fee Payable by Thompson Creek | 20 | |

Material U.S. Federal Income Tax Considerations | 21 | |

Material Canadian Federal Income Tax Considerations | 22 | |

Accounting Treatment | 22 | |

Rights of Thompson Creek Shareholders Will Change as a Result of the Arrangement | 22 | |

RISK FACTORS | 23 | |

Risks Related to the Arrangement | 23 | |

Risks Related to Centerra | 28 | |

THE COMPANIES | 49 | |

Centerra | 49 | |

Thompson Creek | 49 | |

SPECIAL MEETING OF SHAREHOLDERS OF THOMPSON CREEK | 50 | |

General | 50 | |

Date, Time and Place of the Special Meeting | 50 | |

Matters to be Considered at the Special Meeting | 50 | |

Recommendation of the Thompson Creek Board of Directors | 51 | |

Record Date and Outstanding Shares | 51 | |

Quorum | 51 | |

Required Vote | 51 | |

Voting by Thompson Creek's Directors and Executive Officers | 52 | |

Voting by Proxy or in Person | 52 | |

Revocability of Proxies and Changing Your Vote | 53 | |

Abstentions and Unvoted Shares | 53 | |

Failure to Vote | 54 | |

Inspector of Election; Tabulation of Vote | 54 | |

Solicitation of Proxies | 54 | |

Householding | 55 | |

Adjournment | 55 | |

THE ARRANGEMENT | 56 | |

Background to the Arrangement | 56 |

i

| | Page | |

|---|---|---|

Recommendation of the Thompson Creek Board of Directors | 65 | |

Reasons for the Arrangement | 65 | |

Opinion of BMO Capital Markets | 68 | |

Certain Unaudited Prospective Financial Information of Thompson Creek | 78 | |

Principal Steps to the Arrangement | 80 | |

Treatment of Thompson Creek Options | 81 | |

Treatment of Thompson Creek PSUs | 82 | |

Treatment of Thompson Creek RSUs | 82 | |

Approval of Arrangement Resolution | 82 | |

Completion of the Arrangement | 82 | |

Procedure for Exchange of Thompson Creek Common Shares | 82 | |

Mail Services Interruption | 84 | |

No Fractional Shares to be Issued | 85 | |

Withholding Rights | 85 | |

Treatment of Dividends | 85 | |

Cancellation of Rights after Six Years | 85 | |

Effects of the Arrangement on Thompson Creek Shareholders' Rights | 86 | |

Court Approval of the Arrangement | 86 | |

Regulatory Law Matters and Securities Law Matters | 87 | |

U.S. Securities Law Matters | 90 | |

Canadian Securities Law Matters | 90 | |

Fees and Expenses | 92 | |

Delisting and Deregistration of Thompson Creek Common Shares | 92 | |

INTERESTS OF DIRECTORS AND EXECUTIVE OFFICERS IN THE ARRANGEMENT | 93 | |

Treatment of Equity-Based Awards | 93 | |

Outstanding Equity Awards Held by Executive Officers and Directors | 94 | |

Employment Agreements | 94 | |

Cash-Based Incentive Plan | 95 | |

Quantification of Potential Payments to the Named Executive Officers in Connection with the Arrangement | 96 | |

Director and Officer Indemnification/Voting Agreements | 98 | |

Thompson Creek Officers and Directors Post-Closing of the Arrangement | 98 | |

THE ARRANGEMENT AGREEMENT | 99 | |

Effective Date and Conditions of Arrangement | 99 | |

Other Covenants | 110 | |

Dissent Rights | 111 | |

Other Agreements in Connection with the Arrangement Agreement | 114 | |

MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS | 116 | |

MATERIAL CANADIAN FEDERAL INCOME TAX CONSIDERATIONS | 121 | |

Holders Resident in Canada | 121 | |

Holders Not Resident in Canada | 125 | |

ADVISORY VOTE REGARDING ARRANGEMENT-RELATED COMPENSATION FOR THOMPSON CREEK NAMED EXECUTIVE OFFICERS | 128 | |

SELECTED HISTORICAL CONSOLIDATED FINANCIAL DATA OF THOMPSON CREEK | 129 | |

SELECTED HISTORICAL CONSOLIDATED FINANCIAL DATA OF CENTERRA | 131 | |

COMPARATIVE PER SHARE DATA | 132 | |

COMPARATIVE PER SHARE MARKET PRICE AND DIVIDEND INFORMATION | 133 | |

UNAUDITED PRO FORMA COMBINED FINANCIAL INFORMATION | 138 | |

ADDITIONAL INFORMATION ABOUT CENTERRA | 150 | |

Cautionary Statement | 150 |

ii

| | Page | |

|---|---|---|

Non-IFRS Financial Measures | 150 | |

Corporate Structure | 152 | |

Business of Centerra | 154 | |

Recent Developments | 163 | |

Centerra's Properties | 165 | |

Legal Proceedings | 230 | |

MD&A | 240 | |

Consolidation Capitalization | 240 | |

Directors and Senior Executive Officers | 241 | |

Interests of Experts | 245 | |

AUDITORS AND TRANSFER AGENT | 247 | |

DESCRIPTION OF CENTERRA CAPITAL STOCK | 248 | |

COMPARISON OF SHAREHOLDER RIGHTS | 250 | |

SECURITY OWNERSHIP OF THOMPSON CREEK | 264 | |

SECURITY OWNERSHIP OF CENTERRA | 266 | |

ADDITIONAL INFORMATION ABOUT THE COMBINED COMPANY | 268 | |

FUTURE SHAREHOLDER PROPOSALS | 269 | |

WHERE YOU CAN FIND ADDITIONAL INFORMATION | 270 | |

GLOSSARY OF TERMS | 272 | |

FINANCIAL STATEMENTS OF CENTERRA | FS-1 | |

ANNEX A—Arrangment Agreement | A-1 | |

ANNEX B—Form of Arrangement Resolution | B-1 | |

ANNEX C—Opinion of BMO Capital Markets | C-1 | |

ANNEX D—Division 2 of Part 8 of the Business Corporations Act (British Columbia) | D-1 | |

ANNEX E—Interim Order | E-1 | |

ANNEX F—Notice of Petition | F-1 | |

ANNEX G—Centerra Gold Inc. Management's Discussion and Analysis for the year ended December 31, 2015 | G-1 | |

ANNEX H—Centerra Gold Inc. Management's Discussion and Analysis for the quarter ended June 30, 2016 | H-1 |

iii

QUESTIONS AND ANSWERS ABOUT THE ARRANGEMENT AND THE SPECIAL MEETING

Unless stated otherwise or unless the context otherwise requires, all references in this proxy statement to "Thompson Creek," "we," "our" and "us" are to Thompson Creek Metals Company Inc., a British Columbia corporation, all references to "Centerra" are to Centerra Gold Inc., a corporation existing under the laws of Canada, all references to the "Special Meeting" are to the special meeting of shareholders of Thompson Creek on [ · ], 2016 at [ · ].m. local time, at our corporate headquarters located at 26 West Dry Creek Circle, Second Floor, Littleton, Colorado 80120, all references to the "Arrangement Agreement" are to the Arrangement Agreement, dated July 5, 2016, as it may be amended from time to time, by and between Thompson Creek and Centerra, a copy of which is attached asAnnex A to this proxy statement, all references to the "Arrangement Resolution" are to the form of arrangement resolution, a copy of which is attached asAnnex B to this proxy statement, all references to the "Arrangement" are to the statutory plan of arrangement under Section 288 of the Business Corporations Act (British Columbia)("BCBCA") involving the acquisition by Centerra of all of the outstanding common shares of Thompson Creek, a copy of which is attached as Schedule A to the Arrangement Agreement attached asAnnex A to this proxy statement, all references to the "Court" are to the Supreme Court of British Columbia, all references to the "Interim Order" are to the interim order of the Court, a copy of which is attached asAnnex E to this proxy statement and all references to the "Final Order" are to a final order of the Court approving the Arrangement. Capitalized terms used but not defined in other sections of this proxy statement have the meaning set forth in the "Glossary of Terms" beginning on page 272 of this proxy statement.

The following are some questions that you, as a shareholder of Thompson Creek, may have regarding the Arrangement and the Special Meeting, and brief answers to those questions. You are urged to read carefully this proxy statement and the other documents incorporated by reference and referred to in this proxy statement in their entirety because this section may not provide all of the information that is important to you with respect to the Arrangement and the Special Meeting. Additional important information is contained in the annexes to, and the documents incorporated by reference into, this proxy statement.

- Q:

- Why am I receiving this document?

- A:

- Centerra and Thompson Creek have agreed to the Arrangement, pursuant to which Centerra will acquire all of the outstanding common shares, no par value, of Thompson Creek (the "Thompson Creek common shares"), with Thompson Creek becoming a wholly-owned subsidiary of Centerra. In order to complete the Arrangement, Thompson Creek shareholders must approve the Arrangement Resolution, and Thompson Creek is holding the Special Meeting of shareholders to obtain such shareholder approval. Pursuant to the Arrangement, Centerra will issue common shares of Centerra ("Centerra common shares") to the holders of Thompson Creek common shares in exchange for their Thompson Creek common shares in accordance with the Exchange Ratio (as defined below). In connection with the completion of the Arrangement, Centerra has agreed to contribute to Thompson Creek the amount of cash necessary to redeem, or otherwise satisfy and discharge, all of Thompson Creek's outstanding secured and unsecured notes in accordance with the terms of the respective note indentures.

This document is being delivered to you as a proxy statement and management information circular of Thompson Creek (together referred to herein as the "proxy statement") in connection with the Arrangement. It is the proxy statement by which Thompson Creek's board of directors (the "Thompson Creek Board") is soliciting proxies from you to vote to approve the Arrangement Resolution at the Special Meeting or at any adjournment or postponement of the Special Meeting.

1

- Q:

- What will happen in the Arrangement?

- A:

- Pursuant to the Arrangement, Thompson Creek will be acquired by Centerra and become a wholly-owned subsidiary of Centerra.

- Q:

- What will I receive in the Arrangement?

- A:

- If the Arrangement is completed, each of your Thompson Creek common shares will be transferred to Centerra in exchange for 0.0988 of a Centerra common share (the "Exchange Ratio"). The number of Centerra common shares to be issued to a Thompson Creek shareholder shall be rounded down to the next whole number of Centerra common shares and no Thompson Creek shareholder will be entitled to any compensation, including cash compensation, in respect of any fractional Centerra common shares. The Centerra common shares to be received based on the Exchange Ratio pursuant to the Arrangement is referred to as the "Arrangement Consideration". Based on the closing price of C$8.02 for Centerra common shares on the Toronto Stock Exchange ("TSX") on July 4, 2016, the last trading day before the public announcement of the Arrangement Agreement, the Arrangement Consideration represented a value to Thompson Creek shareholders of C$0.79 per share, a 32% premium to the closing price for Thompson Creek's common shares on July 4, 2016 on the TSX. The Exchange Ratio for the Arrangement will not be adjusted for subsequent changes in market prices of the Centerra common shares or the Thompson Creek common shares.

The market price of Centerra common shares will fluctuate prior to the Arrangement, and the market price of Centerra common shares when received by Thompson Creek shareholders after the Arrangement is completed could be greater or less than the current market price of Centerra common shares. See "Risk Factors" beginning on page 23 of this proxy statement.

- Q:

- Will I be able to freely trade the Centerra common shares received as a result of the Arrangement?

- A

- Yes. If you are a U.S. holder, you will receive freely tradable Centerra common shares as a result of the Arrangement if you are not an affiliate of Centerra and have not been an affiliate of Centerra within 90 days of the closing of the Arrangement, although the Centerra common shares issued as consideration to Thompson Creek shareholders pursuant to the Arrangement will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"). Instead, they will be issued pursuant to the exemption from the registration requirements of the U.S. Securities Act provided under Section 3(a)(10) thereof (the "Section 3(a)(10) exemption") and comparable provisions under U.S. state securities laws. See "The Arrangement—U.S. Securities Law Matters" beginning on page 90 of this proxy statement.

For Canadian holders, the distribution of Centerra common shares as consideration to Thompson Creek shareholders pursuant to the Arrangement is being made pursuant to exemptions from the prospectus and dealer requirements under applicable Canadian securities laws. While the resale of Centerra common shares issued as consideration to Thompson Creek shareholders is subject to restrictions under the securities laws of certain Canadian provinces and territories, Thompson Creek shareholders in such provinces and territories generally will be able to rely on statutory exemptions from such resale restrictions.

In addition, if Centerra ceases to be a reporting issuer in the provinces and territories of Canada following completion of the Arrangement, a trade of Centerra common shares issued to a shareholder of Thompson Creek in Canada pursuant to the Arrangement will be subject to resale restrictions unless certain conditions are satisfied. See "The Arrangement—Canadian Securities Law Matters" beginning on page 90 of this proxy statement.

2

- Q:

- What happens if the Arrangement is not completed?

- A:

- If the Arrangement Resolution is not approved by Thompson Creek shareholders or if the Arrangement is not completed for any other reason, including if the Court does not approve the Arrangement, Thompson Creek shareholders will not receive any payment for their Thompson Creek common shares. Instead, Thompson Creek will remain an independent public company and the Thompson Creek common shares will continue to be listed on the TSX and quoted on the OTCQX. If the Arrangement Agreement is terminated under certain specified circumstances, Thompson Creek may be required to pay Centerra a termination fee of $35 million (the "Termination Fee"). See "The Arrangement Agreement—Termination Fee" beginning on page 109 of this proxy statement.

See also the risk factor entitled "The Arrangement Agreement limits Thompson Creek's ability to pursue alternatives to the Arrangement, including if the Arrangement is not completed" in "Risk Factors" below.

- Q:

- What am I being asked to vote on?

- A:

- Thompson Creek shareholders are being asked to vote on the proposal to approve (i) the Arrangement Resolution and (ii) on an advisory basis, the compensation payments made by Thompson Creek to its named executive officers in connection with the Arrangement.

The approval of the Arrangement Resolution by Thompson Creek shareholders is a condition to the obligations of Thompson Creek and Centerra to complete the Arrangement.

- Q:

- Does the Thompson Creek Board recommend that shareholders approve the Arrangement Resolution?

- A:

- Yes. A special committee of the Thompson Creek Board (the "Special Committee") and the Thompson Creek Board have each approved the Arrangement and the Arrangement Agreement, including the Arrangement Resolution, and determined that the Arrangement is fair to Thompson Creek shareholders and in the best interests of Thompson Creek. Therefore, the Thompson Creek Board recommends that you vote "FOR" the Arrangement Resolution at the Special Meeting. See "The Arrangement—Reasons for the Arrangement" and "Recommendation of the Thompson Creek Board of Directors" beginning on page 65 of this proxy statement.

- Q:

- Why is the Thompson Creek Board making this recommendation?

- A:

- In reaching its conclusion that the Arrangement is fair to Thompson Creek shareholders and that the Arrangement is in the best interests of Thompson Creek, the Thompson Creek Board considered and relied upon a number of factors, including those described under the headings "The Arrangement—Reasons for the Arrangement" and "The Arrangement—Opinion of BMO Capital Markets" beginning on pages 65 and 68 of this proxy statement.

- Q:

- What shareholder vote is required for the approval of the Arrangement Resolution?

- A:

- The vote requirement to approve the Arrangement Resolution is the affirmative approval of two-thirds of the votes cast by holders of Thompson Creek common shares present in person or by proxy at the Special Meeting.

3

- Q:

- What shareholder vote is required for the approval of, on an advisory basis, the compensation payments made by Thompson Creek to its named executive officers in connection with the Arrangement?

- A:

- The vote requirement to approve, on an advisory basis, the compensation payments made by Thompson Creek to its named executive officers in connection with the Arrangement is the affirmative approval of a majority of the votes cast by holders of Thompson Creek common shares present in person or by proxy at the Special Meeting.

- Q:

- What constitutes a quorum for the Special Meeting?

- A:

- The quorum for the transaction of business at the Special Meeting is two persons, present in person, each being a Thompson Creek shareholder entitled to vote at the Special Meeting or a duly appointed proxy for a Thompson Creek shareholder so entitled, representing at least 25% of the Thompson Creek common shares entitled to vote at the Special Meeting.

- Q:

- When is this proxy statement being mailed?

- A:

- This proxy statement and the proxy card are first being sent to Thompson Creek shareholders on or about [ · ], 2016.

- Q:

- Who is entitled to vote at the Special Meeting?

- A:

- All holders of Thompson Creek common shares who held shares at the close of business on August 8, 2016, the record date for the Special Meeting (the "Record Date"), are entitled to receive notice of and to vote at the Special Meeting. As of the close of business on the Record Date, there were 222,782,042 Thompson Creek common shares outstanding and entitled to vote at the Special Meeting. Each Thompson Creek common share is entitled to one vote.

- Q:

- When and where is the Special Meeting?

- A:

- The Special Meeting will be held at our corporate headquarters located at 26 West Dry Creek Circle, Second Floor, Littleton, Colorado 80120, on [ · ], 2016 at [ · ].m., local time.

- Q:

- How do I vote my shares at the Special Meeting?

- A:

- If you are entitled to vote at the Special Meeting and hold your shares in your own name, you can submit a proxy or vote in person by completing a ballot at the Special Meeting. However, Thompson Creek encourages you to submit a proxy before the Special Meeting even if you plan to attend the Special Meeting. A proxy is a legal designation of another person to vote your Thompson Creek common shares on your behalf. If you hold shares in your own name, you may submit a proxy for your shares by:

- •

- filling out, signing and dating the enclosed proxy card and mailing it in the prepaid envelope included with these proxy materials;

- •

- by faxing the signed proxy card pursuant to the instructions set forth in the proxy card; or

- •

- accessing the Internet website specified on the enclosed proxy card and following the instructions provided to you.

When a Thompson Creek shareholder submits a proxy through the Internet, his, her or its proxy is recorded immediately. If you submit a proxy through the Internet website, please do not return your proxy card by mail.

4

If a Thompson Creek shareholder executes a proxy card without giving instructions, the Thompson Creek common shares represented by that proxy card will be voted "FOR" approval of the Arrangement Resolution and "FOR" the approval of, on an advisory basis, the compensation payments made by Thompson Creek to its named executive officers in connection with the Arrangement.

Please submit your proxy through the Internet, by mail or by facsimile, whether or not you plan to attend the Special Meeting in person. Proxies must be received by [ · ].m., [ · ], on [ · ], 2016.

- Q:

- What is the difference between holding shares as a registered shareholder and as a beneficial owner of shares held in "street name"?

- A:

- Most of Thompson Creek's shareholders hold their shares through a broker, bank, custodian, nominee or other intermediary rather than directly in their own names. As summarized below, there are some distinctions between registered shareholders and beneficial owners:

- •

- Registered Shareholders—If your shares are registered directly in your name with Thompson Creek's transfer agent, you are considered, with respect to those shares, to be the "registered shareholder." As the registered shareholder, you have the right to grant your voting proxy directly to Thompson Creek or to a third party, or to vote in person at the Special Meeting.

- •

- Beneficial Owner—If your shares are held in "street name" by a broker, bank, custodian, nominee, or other intermediary, you are considered the "beneficial owner" of those shares. As the beneficial owner of those shares, you have the right to direct your broker, bank, custodian, nominee or other intermediary how to vote and you also are invited to attend the Special Meeting. However, because a beneficial owner is not the registered shareholder, you will not be entitled to vote your beneficially-owned shares in person at the Special Meeting unless you obtain a "legal proxy" from the broker, bank, custodian, nominee or other intermediary that holds your shares, giving you the right to vote the shares at the Special Meeting.

If you do not provide voting instructions to your broker, bank, custodian, nominee or other intermediary, your shares may not be voted on the Arrangement Resolution, since it is not considered a routine matter. If your shares are not voted by your broker, bank, custodian, nominee or other intermediary, this is referred to in this proxy statement, and in general, as a "broker non-vote". Broker non-votes will have no effect on the outcome of the proposal to approve the Arrangement Resolution or any other proposals at the Special Meeting.

If you hold shares through a broker or other nominee and wish to vote your shares in person at the Special Meeting, you must obtain a proxy from your broker, bank custodian, nominee or other intermediary and present it to the inspector of election with your ballot when you vote at the Special Meeting.

- Q:

- How will my shares be represented at the Special Meeting?

- A:

- If you submit your proxy through the Internet or by signing and returning your proxy card, the officers named in your proxy card will vote your shares in the manner you requested if you correctly submitted your proxy. If you sign your proxy card and return it without indicating how you would like to vote your shares, your proxy will be voted as the Thompson Creek Board recommends, which is "FOR" all proposals detailed herein, including the Arrangement Resolution.

If any amendments or variations to the proposals identified in the accompanying notice of meeting are proposed at the Special Meeting or if any other matters properly come before the Special Meeting, the enclosed proxy card confers authority to vote on such amendments or variations according to the discretion of the person voting the proxy at the Special Meeting.

5

- Q:

- Who may attend the Special Meeting?

- A:

- You are entitled to attend the Special Meeting only if you were a Thompson Creek shareholder as of the close of business on the Record Date or if you hold a valid proxy for the Special Meeting. You must present photo identification for admittance. If you are a registered shareholder, your name will be verified against the list of shareholders of record or plan participants on the Record Date prior to your admission to the Special Meeting. If you are not a registered shareholder but hold your shares through a broker, trustee or nominee, you must provide proof of beneficial ownership on the Record Date, such as your most recent account statement prior to the Record Date or other similar evidence of ownership.

If you do not provide photo identification or comply with the other procedures outlined above, you will not be admitted to the Special Meeting.

The Special Meeting will begin promptly at [ · ] [ · ].m., local time. Please allow sufficient time for check-in procedures.

- Q:

- Is my vote important?

- A:

- Yes, your vote is very important. If you do not submit a proxy or vote in person at the Special Meeting, it will be more difficult for Thompson Creek to obtain the necessary quorum to hold the Special Meeting. If you are the beneficial owner of shares held in "street name" by a broker, bank, custodian, nominee or other intermediary, your broker, bank, custodian, nominee or other intermediary may not be able to cast a vote on the approval of the Arrangement Resolution without instructions from you. Broker non-votes and shares not voted or in attendance at the Special Meeting will have no effect on the outcome of the proposal to approve the Arrangement Resolution or any other proposal at the Special Meeting. The Thompson Creek Board recommends that you vote"FOR" all proposals detailed herein, including the Arrangement Resolution.

- Q:

- Can I revoke my proxy or change my voting instructions?

- A:

- Yes. If you are the registered shareholder, you may change your vote by submitting a new proxy bearing a later date (which automatically revokes the earlier proxy), by providing a written notice to Thompson Creek at our principal office that you wish to revoke a proxy that has already been submitted at any time up to and including the last business day preceding the day of the Special Meeting, or by notifying the Chair of the Special Meeting on the day of the Special Meeting that you wish to revoke a proxy that has already been submitted.

If you are the beneficial owner of shares held in "street name" by a broker, bank, custodian, nominee or other intermediary, you may change your vote by submitting new voting instructions to your broker, bank, custodian, nominee or other intermediary according to the instructions provided by your broker, bank, custodian, nominee or other intermediary or, if you have obtained a legal proxy from your broker, bank, custodian, nominee or other intermediary giving you the right to vote your shares, by attending and voting in person at the Special Meeting.

- Q:

- What happens if I sell my shares after the Record Date but before the Special Meeting?

- A:

- The Record Date for the Special Meeting is earlier than the date of the Special Meeting and the date that the Arrangement is expected to be completed. If you sell or otherwise transfer your Thompson Creek common shares after the Record Date but before the date of the Special Meeting, you will retain your right to vote at the Special Meeting. However, you will not have the right to receive the consideration to be received by Thompson Creek's shareholders under the Arrangement. In order to receive the Centerra common shares in exchange for your Thompson

6

Creek common shares, you must hold your Thompson Creek common shares through completion of the Arrangement.

- Q:

- What do I do if I receive more than one set of voting materials?

- A:

- You may receive more than one set of voting materials for the Special Meeting, including multiple copies of this proxy statement, proxy cards and/or voting instruction forms. This can occur if you hold your Thompson Creek common shares in more than one brokerage account, if you hold shares directly as a registered shareholder and also are the beneficial owner of shares held in "street name" through a broker, bank, custodian, nominee or other intermediary, and in certain other circumstances. If you receive more than one set of voting materials, each should be voted and/or returned separately in order to ensure that all of your Thompson Creek common shares are voted.

- Q:

- Am I entitled to dissent rights?

- A:

- Yes. Pursuant to the Interim Order, Thompson Creek registered shareholders are entitled to dissent rights but only if they follow the relevant provisions of Division 2 of Part 8 of the BCBCA, as modified by the Plan of Arrangement and the Interim Order. Beneficial owners of Thompson Creek common shares that are registered in the name of a broker, bank, custodian, nominee or other intermediary who wish to dissent should be aware that only registered shareholders of Thompson Creek are entitled to dissent. If you wish to exercise dissent rights, you should review the requirements summarized in this proxy statement carefully and consult with legal counsel. See "The Arrangement Agreement—Dissent Rights" beginning on page 111 of this proxy statement.

- Q:

- What will happen to Thompson Creek's outstanding notes in connection with the Arrangement?

- A:

- In connection with the completion of the Arrangement, Centerra has agreed to contribute to Thompson Creek the amount of cash necessary to redeem, or otherwise satisfy and discharge, all of Thompson Creek's outstanding 9.75% senior secured notes due 2017, 7.375% senior unsecured notes due 2018 and 12.5% senior unsecured notes due 2019 (collectively, the "Notes").

Concurrent with the announcement of the Arrangement Agreement, Centerra announced a bought deal prospectus offering of subscription receipts, with gross proceeds to Centerra of approximately C$195 million, which closed on July 20, 2016 (the "Centerra Equity Financing") and a committed $325 million senior secured revolving and term loan facility (the "Centerra Debt Financing"). Upon closing of the Arrangement, the net proceeds of the Centerra Equity Financing will be released from escrow to Centerra.

The proceeds of the Centerra Equity Financing, the Centerra Debt Financing and available cash on hand will be used to fund the redemption, or satisfaction and discharge, of the Notes and other expenses incurred in connection with the Arrangement.

- Q:

- Is completion of the Arrangement subject to any conditions?

- A:

- Yes. The Arrangement requires the approval of Thompson Creek shareholders, the issuance of the Final Order by the Court, certain other regulatory approvals, and satisfaction, or to the extent permitted by applicable law, waiver of the other conditions specified in the Arrangement Agreement.

- Q:

- What happens if Centerra is not able to complete the financing for the Arrangement?

- A:

- Each of Centerra and Thompson Creek have the right to terminate the Arrangement Agreement if either the Centerra Equity Financing or the Centerra Debt Financing is terminated. The Centerra

7

Equity Financing closed on July 20, 2016 and the net proceeds of the Centerra Equity Financing are held in escrow subject to closing of the Arrangement.

- Q:

- When do you expect to complete the Arrangement?

- A:

- Thompson Creek and Centerra are working towards completing the Arrangement promptly. Thompson Creek and Centerra currently expect to complete the Arrangement not later than October 31, 2016, subject to approval of the Arrangement Resolution by the requisite vote of Thompson Creek shareholders, approval from the Court and satisfaction of other closing conditions specified in the Arrangement Agreement and summarized in "The Arrangement Agreement—Effective Date and Conditions of Arrangement" beginning on page 99 of this proxy statement. However, no assurance can be given as to when, or if, the Arrangement will occur.

- Q:

- What are the U.S. federal income tax consequences of the Arrangement to Thompson Creek shareholders?

- A:

- The Arrangement is intended to qualify, for U.S. federal income tax purposes, as a tax-free "reorganization" within the meaning of Section 368(a)(1)(B) of the Internal Revenue Code of 1986, as amended (the "U.S. Tax Code"). If the Arrangement qualifies as a reorganization, no gain or loss generally would be recognized by Thompson Creek shareholders for U.S. federal income tax purposes. However, neither Thompson Creek nor Centerra has requested, or intends to request a ruling from the Internal Revenue Service (the "IRS") or an opinion of counsel with respect to whether the Arrangement will qualify as a reorganization. Thompson Creek shareholders should review the discussion under "Material U.S. Federal Income Tax Considerations" beginning on page 116 of this proxy statement and are urged to consult their tax advisors as to whether the Arrangement will qualify as a reorganization on the effective date.

- Q:

- What are the Canadian federal income tax consequences of the Arrangement to Thompson Creek shareholders?

A Canadian resident holder that disposes of Thompson Creek common shares in exchange for Centerra common shares pursuant to the Arrangement will be deemed to have disposed of the Thompson Creek common shares for proceeds of disposition equal to the holder's adjusted cost base of Centerra common shares immediately before the exchange and will be deemed to acquire the Centerra common shares at a cost equal to such adjusted cost base, resulting in the deferral of any accrued capital gain on the Thompson Creek common shares. This deferral will not apply where the holder has, in the holder's income tax return for the year in which the exchange occurs, included in computing income any portion of the capital gain (or capital loss) arising on the exchange otherwise determined.

If a holder elects to include in income for the year the exchange occurs any portion of the gain (or loss) otherwise arising, such capital gain (or capital loss) will be equal to the amount by which the fair market value of the Centerra common shares received on the exchange of Thompson Creek common shares (determined at the time of the exchange) exceeds (or is less than) the aggregate of the adjusted cost base to the holder of such Thompson Creek common shares, determined immediately before the exchange, and any reasonable costs of disposition.

A non-resident holder who disposes or is deemed to dispose of Thompson Creek common shares in exchange for Centerra common shares pursuant to the Arrangement will generally be deemed to have disposed of the Thompson Creek common shares for proceeds of disposition equal to the non-resident holder's adjusted cost base of the Thompson Creek common shares immediately before the exchange. Thompson Creek shareholders should review the discussion under "Material Canadian Federal Income Tax Considerations" beginning on page 121 of this proxy statement and

8

are urged to consult their tax advisor regarding the tax consequences of the Arrangement based on their particular circumstances.

- Q:

- What do I need to do now?

- A:

- Carefully read and consider the information contained in and incorporated by reference into this proxy statement, including its annexes. Then, please vote your Thompson Creek common shares, which you may do by:

- •

- completing, dating, signing and returning the enclosed proxy card in the accompanying postage-paid envelope;

- •

- submitting your proxy via the Internet by following the instructions included on your proxy card; or

- •

- attending the Special Meeting and voting by ballot in person.

If you hold shares through a broker, bank, custodian, nominee or other intermediary, please instruct your broker, bank, custodian, nominee or other intermediary to vote your shares by following the instructions that the broker, bank, custodian, nominee or other intermediary provides to you with these materials.

- Q:

- Should I send in my share certificates now?

- A:

- No. Thompson Creek shareholders should not send in their share certificates at this time.

- Q:

- When and how do I send in my share certificates?

- A:

- On or around the date on which the Arrangement is completed, Centerra will send out a letter of transmittal and detailed instructions to all registered shareholders of Thompson Creek as of the effective date of the Arrangement. After receiving those materials, Thompson Creek shareholders may surrender the certificates representing their Thompson Creek common shares in exchange for certificates representing the number of Centerra common shares to which they are entitled under the Arrangement by properly completing and returning the letter of transmittal in accordance with the instructions contained therein and all other documents required thereby.

- Q:

- Why am I being asked to approve, on a non-binding, advisory basis, the compensation payments that will or may be paid by Thompson Creek to its named executive officers in connection with the Arrangement?

- A:

- The SEC has adopted rules that require Thompson Creek to seek a non-binding, advisory vote on the compensation payments that will or may be paid by Thompson Creek to its named executive officers in connection with the Arrangement.

- Q:

- What happens if the named executive officer arrangement-related compensation proposal is not approved?

- A:

- Approval of this proposal is not a condition to the completion of the Arrangement, and as an advisory vote, the result will not be binding on Thompson Creek, the Thompson Creek Board or Centerra. Further, the underlying plans and arrangements are contractual in nature and not, by their terms, subject to shareholder approval. Accordingly, regardless of the outcome of the advisory vote, if the Arrangement is consummated, Thompson Creek's named executive officers will be eligible to receive the compensation that is based on or otherwise relates to the Arrangement in accordance with the terms and conditions applicable to those payments.

9

- Q:

- How will Thompson Creek's directors and executive officers vote on the proposal to approve the Arrangement Resolution?

- A:

- The directors and executive officers of Thompson Creek have informed Thompson Creek that as of the date of this proxy statement, they intend to vote their Thompson Creek common shares in favor of the Arrangement Resolution. In addition, concurrently, and in connection with entering into the Arrangement Agreement, certain of Thompson Creek's directors and executive officers entered into voting and support agreements with Centerra pursuant to which, subject to the conditions set forth therein, such directors and executive officers agree, among other things, (i) to vote all Thompson Creek common shares beneficially owned or controlled by them in favor of the approval and adoption of the Arrangement and the transactions contemplated thereby and (ii) to support actions necessary to consummate the Arrangement.

As of the Record Date for the Special Meeting, the directors and executive officers of Thompson Creek have the right to vote, in the aggregate, 1,380,196 Thompson Creek common shares, representing less than 1% of the issued and outstanding Thompson Creek common shares entitled to vote at the Special Meeting.

- Q:

- Do any of Thompson Creek's directors or executive officers have interests in the Arrangement that may differ from or be in addition to my interests as a shareholder?

- A:

- Yes. In considering the recommendation of the Special Committee and the Thompson Creek Board with respect to the Arrangement, you should be aware that Thompson Creek's directors and executive officers may have interests in the Arrangement that are different from, or in addition to, the interests of Thompson Creek shareholders. These interests may create potential conflicts of interest. The Special Committee and the Thompson Creek Board were aware of those interests and considered them, among other matters, in approving the Arrangement Agreement, the Arrangement, and the transactions contemplated by the Arrangement Agreement. See the section entitled "Interests of Directors and Executive Officers in the Arrangement" beginning on page 93 of this proxy statement.

- Q:

- Does Centerra require shareholder approval to complete the Arrangement?

- A:

- No, Centerra is not required to obtain the approval of Centerra shareholders to complete the Arrangement or for the issuance of Centerra common shares in exchange for the Thompson Creek common shares.

- Q:

- Where can I find more information about Thompson Creek, Centerra and the transactions contemplated by the Arrangement Agreement?

- A:

- You can find out more information about Thompson Creek, Centerra and the transactions contemplated by the Arrangement Agreement by reading this proxy statement and, with respect to Thompson Creek and Centerra, from various sources described in the section entitled "Where You Can Find Additional Information" beginning on page 270 of this proxy statement.

- Q:

- Whom should I call with questions?

- A:

- Thompson Creek shareholders should contact Kingsdale Shareholder Services, Thompson Creek's proxy solicitor, toll-free at 1-866-581-1479 or 416-867-2272 (collect call) or by email at contactus@kingsdaleshareholder.com with any questions about the Arrangement or the Special Meeting, or to obtain additional copies of this proxy statement, proxy cards or voting instruction forms.

10

This summary highlights selected information from this proxy statement. It may not contain all of the information that is important to you. You are urged to read carefully the entire proxy statement and the other documents referred to or incorporated by reference in this proxy statement in order to fully understand the Arrangement Agreement and the Arrangement. See "Where You Can Find Additional Information" beginning on page 270 of this proxy statement. Each item in this summary refers to the page of this proxy statement on which that subject is discussed in more detail.

Information about Centerra and Thompson Creek (see page 49)

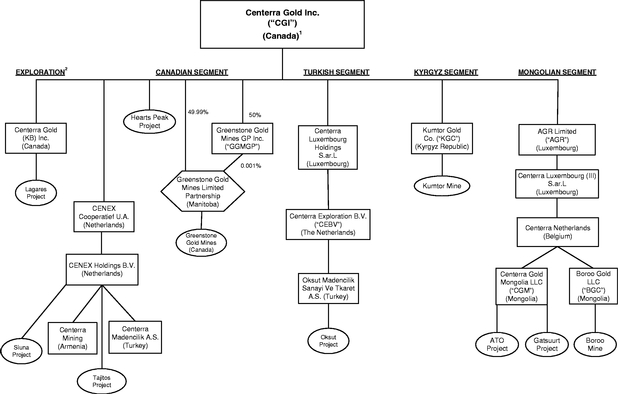

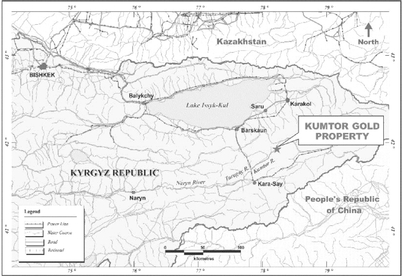

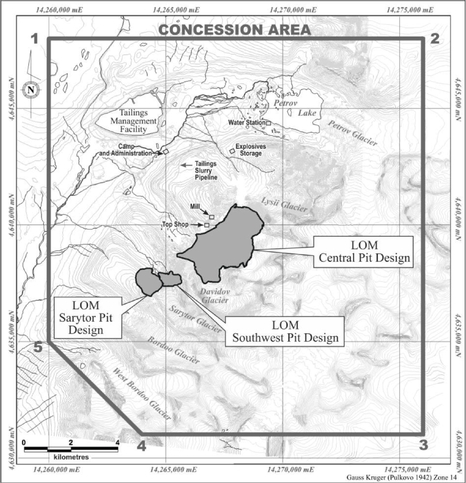

Centerra

Centerra is a Canadian-based gold mining company engaged in operating, developing, acquiring and exploring gold properties in Asia, North America and other markets worldwide. Centerra is the largest Western-based gold producer in Central Asia with one operating gold mine, located in the Kyrgyz Republic. In 2015, Centerra produced 536,920 ounces of gold from its operations. Centerra was incorporated under theCanada Business Corporations Act (the "CBCA") in November 2002 under the name 4122216 Canada Limited. Centerra changed its name in December 2002 to Kumtor Mountain Holdings Corporation and in December 2003 to Centerra Gold Inc.

The Centerra common shares are listed under the symbol "CG" on the TSX. Centerra's principal executive offices are located at 1 University Avenue, Suite 1500, Toronto, Ontario, Canada M5J 2P1, its telephone is (416) 204-1953 and its website is www.centerragold.com. The information contained in, or that can be accessed through, Centerra's website is not incorporated by reference in this proxy statement and you should not consider information contained on Centerra's website as part of this proxy statement. For additional information about Centerra, see "Additional Information about Centerra" and "Where You Can Find Additional Information" below in this proxy statement.

Thompson Creek

Thompson Creek, a corporation continued under the BCBCA, is a North American mining company engaged in the full mining cycle, which includes acquisition, exploration, development and operation of mineral properties. Thompson Creek's principal operating property is its 100%-owned Mount Milligan Mine, an open-pit copper and gold mine and concentrator in British Columbia, Canada. Thompson Creek's molybdenum assets consist of its 100%-owned Thompson Creek Mine, an open-pit molybdenum mine and concentrator in Idaho, its 75% joint venture interest in the Endako Mine, an open-pit molybdenum mine, concentrator and roaster in British Columbia, Canada, both of which have been placed on care and maintenance, and its Langeloth Metallurgical Facility in Pennsylvania. Thompson Creek's development and exploration projects include the Berg and IKE properties, both copper, molybdenum and silver exploration properties located in British Columbia, Canada.

The Thompson Creek common shares are listed under the symbol "TCM" on the TSX and under the symbol "TCPTF" on the OTCQX. Thompson Creek's principal executive offices are located at 26 West Dry Creek Circle, Suite 810, Littleton, Colorado 80120, its telephone is (303) 761-8801 and its website is www.thompsoncreekmetals.com. The information contained in, or that can be accessed through, Thompson Creek's website is not incorporated by reference in this proxy statement and you should not consider information contained on Thompson Creek's website as part of this proxy statement. For additional information about Thompson Creek, see "Where You Can Find Additional Information" below in this proxy statement.

11

You should read and carefully consider the risk factors set forth in the section entitled "Risk Factors" below in this proxy statement. You also should read and carefully consider the risk factors contained in the documents that are incorporated by reference into this proxy statement.

The Arrangement and the Arrangement Agreement (see pages 56 and 99, respectively)

Centerra and Thompson Creek entered into the Arrangement Agreement on July 5, 2016. Subject to the terms and conditions of the Arrangement Agreement and in accordance with the BCBCA, Centerra will acquire all of the outstanding Thompson Creek common shares in exchange for Centerra common shares. Upon completion of the transactions contemplated under the Plan of Arrangement and the Arrangement Agreement, which are referred to in this proxy statement as the Arrangement, Thompson Creek will be a wholly-owned subsidiary of Centerra, and Thompson Creek common shares will no longer be publicly traded.

A copy of the Arrangement Agreement is attached asAnnex A to this proxy statement.You should read the Arrangement Agreement carefully and in its entirety because it is the legal document that governs the Arrangement.

Special Meeting of Thompson Creek Shareholders (see page 50)