September 2, 2016

VIA EDGAR AND OVERNIGHT DELIVERY

John Reynolds

Assistant Director

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

Re: | Thompson Creek Metals Company Inc. |

| Preliminary Proxy Statement on Schedule 14A |

| Filed August 17, 2016 |

| Response Dated August 17, 2016 |

| File No. 001-33783 |

Dear Mr. Reynolds:

On behalf of Thompson Creek Metals Company Inc. (“Thompson Creek”), we hereby submit this response to the comment set forth in the comment letter of the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission dated August 30, 2016 relating to the above-referenced Preliminary Proxy Statement on Schedule 14A. For convenience, the Staff’s comment is set forth herein, followed by our response.

Schedule 14A filed August 17, 2016

5) Pro forma assumptions and adjustments, page 146

1. We note your response to comment 8. It is unclear how netting the streaming arrangement obligation in property, plant and equipment is appropriate. Please address the following:

· Tell us why the streaming arrangement does not qualify as a liability assumed by you in your application of the acquisition method under IFRS 3. In doing so tell us how you considered the contractual obligation for Thompson Creek Metals to repay Royal Gold the remaining deposit of $653.5 million, as of December 31, 2015, in the event of default or any remaining balance at the end of the term.

· Provide a more fulsome analysis supporting your conclusion that cites the specific paragraphs of the authoritative literature used to reach your conclusion.

Response: Centerra Gold, Inc. (“Centerra”) advises us as follows in response to the Staff’s comment:

Centerra has been unable to identify any specific guidance under IFRS for the issuance and acquisition of existing metal streaming arrangements. Accordingly, Centerra management considered guidance issued by CPA Canada in respect of the accounting for metal streaming arrangements.(1) Under IFRS, the accounting for streaming arrangements is subject to significant judgment based on the assessment of all of the specific facts and circumstances. As set forth below, Centerra management has determined that the streaming arrangement does not meet the definition of a financial liability and is therefore out of scope of IAS 39 and substantive based accounting should be applied. Accordingly, they have concluded that the purchase accounting should consider the streaming arrangement net, in the manner of a partial sale of mineral interests. Given the lack of specific guidance, Centerra also considered existing practice within the mining industry.

Consideration of Recording a Streaming Arrangement Financial Liability

In accordance with the acquisition method outlined in IFRS 3 — Business Combinations (“IFRS 3”), Centerra must determine whether the streaming arrangement qualifies as a liability assumed as part of the transaction. IAS 32.11 defines a financial liability, in part, as any liability that isa contractual obligation to (i) deliver cash or another financial asset to another entity; or (ii) exchange financial assets or financial liabilities with another entity under conditions that are potentially unfavorable to the entity. The Implementation Guidance to IAS 39, paragraph B.1 provides that gold bullion is a commodity and not a financial asset. Centerra also believes that none of the terms of the streaming arrangement are potentially unfavorable. As a result, the streaming arrangement is not in scope of IAS 39, and the accounting model must be determined based on the substance of the arrangement. As part of this analysis, Centerra management considered the contractual obligation for Thompson Creek to pay Royal Gold in the event of default or any remaining balance at the end of the term.

Centerra management first considered whether the streaming arrangement met the definition of a financial liability. Centerra management utilized the guidance on financial liabilities outlined in IAS 32 — Financial Instruments: Presentation (“IAS 32”) and IAS 39 — Financial Instruments: Recognition and Measurement (“IAS 39”).

Contracts to buy non-financial items that are in the scope of IAS 39 are accounted for based on the requirements of that standard. Contracts that are outside the scope of IAS 39 are accounted for based on their economic substance. Determining the appropriate accounting approach is not an accounting policy choice but rather an assessment of the specific facts and circumstances and application of the applicable IFRS based on those facts and circumstances.

(1) CPA Canada Viewpoints — Accounting For Precious Metal Streaming Arrangements By The Producer: https://www.cpacanada.ca/~/media/site/business-and-accounting-resources/docs/viewpoints%20%20accounting%20for%20precious%20metal%20streaming%20arrangements%20by%20the%20producer.pdf

2

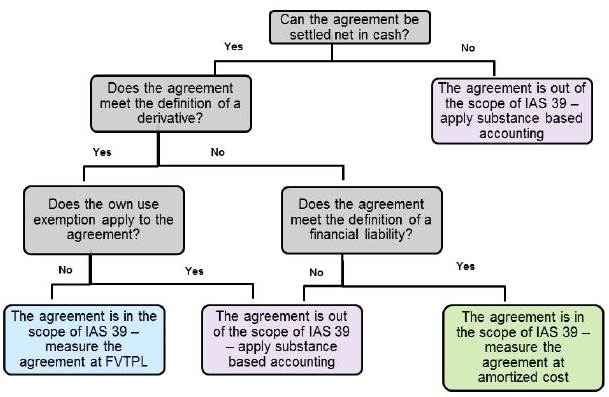

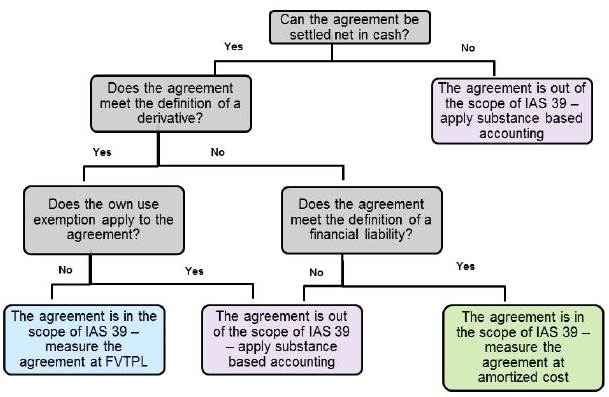

Below is a decision tree (sourced from the publication “PwC In Depth, Alternative Financing for Extractive Industries”) to illustrate the method by which an entity determines whether a streaming arrangement is within the scope of IAS 39 (applying the guidance in IAS 39.5 -7) and the resulting accounting treatment:

Consideration 1 - Centerra management concluded that the agreement can be settled net in cash. IAS 39.6 describes various ways in which a commodity contract is considered to be capable of being settled net in cash, including when the non-financial item/commodity is “readily convertible to cash.” Actively traded commodities such as gold and copper are normally considered readily convertible to cash due to the existence of an active market, among other factors, and as such, the streaming arrangement can be settled net in cash in accordance with IAS 39.

Consideration 2 - Centerra management must determine whether the streaming arrangement meets the definition of a derivative instrument. As outlined in the response to comment 8 to the Staff’s August 9, 2016 comment letter, the contract does not meet the definition of a derivative in its entirety.

Consideration 3 - Centerra management must determine whether the streaming arrangement meets the definition of a financial liability.

3

IAS 32.11 defines a financial liability, in part(2), as follows:

A financial liability is any liability that is:

(a) a contractual obligation:

(i) to deliver cash or another financial asset to another entity; or

(ii) to exchange financial assets or financial liabilities with another entity under conditions that are potentially unfavourable to the entity; ….

The Implementation Guidance to IAS 39 paragraph B.1 asks the following question:

Is gold bullion a financial instrument (like cash) or is it a commodity?

It is a commodity. Although bullion is highly liquid, there is no contractual right to receive cash or another financial asset inherent in bullion.

Therefore, the obligation to deliver Royal Gold’s share of the underlying gold to Royal Gold under the streaming arrangement is not equivalent to a requirement “to deliver cash or another financial asset” as noted in part (a)(i) of the financial liability definition(3). This would also apply to copper.

As part of the assessment, Centerra management also considered whether the potential repayment of any remaining balance in the event of default or at the end of the term are considered to be non-substantive clauses and therefore not unavoidable obligations.

Centerra management has concluded that the contingent cash payment at the end of the term of the streaming arrangement, should the remaining deposit not be settled in accordance with the terms of the arrangement, is not a “contractual obligation” to pay cash as it will only be required if there is insufficient production from Mount Milligan and/or a substantial decrease in the price of gold. Centerra management obtained reasonable assurance from its due diligence analysis that the remaining deposit will be settled during the expected life of the mine. If, in Centerra management’s view, there was a reasonable risk of the deposit not being settled during the mine’s life, Centerra is unlikely to have entered into the proposed transaction. The current estimate of the life of the mine is to 2036, while the initial term of the streaming arrangement extends until 2060. Centerra management’s analysis anticipates that the deposit will be settled before the end of Mount Milligan’s mine life.

While the market prices of gold and copper are not within the control of Centerra, it is Centerra management’s view that the potential repayment at the end of the term of the streaming arrangement is not substantive due to the substantial time period before payment would be required, the existence of proven and probable reserves and the estimate of repayment during the current life

(2) The remainder of the definition deals with contracts that will or may be settled in an entity’s own equity instruments and is not applicable to this analysis.

(3) While Centerra management have concluded in consideration #1 that gold and copper are “readily convertible to cash”, that does not mean that these commodities actually are cash or another financial asset, as required by criterion (a)(i) in the definition of a financial liability.

4

of mine. In summary, Centerra management believes that the likelihood of cash payment at the end of the term is remote.

Regarding the early repayment of the deposit to Royal Gold in the event of default, as outlined in the streaming arrangement, Centerra management has concluded that the risk is remote or within the control of Centerra, for many of the same reasons as noted in the paragraph above.

Centerra management has concluded that repayments of any remaining balance in the event of default or at the end of the term are considered to be non-substantive clauses that are also within the control of Centerra and therefore not unavoidable obligations which should be recognized in purchase accounting.

Centerra management has determined that the streaming arrangement does not meet the definition of a financial liability and is therefore out of scope of IAS 39 and substantive based accounting should be applied.

Substance of the Arrangement and Presentation of the Streaming Arrangement

To determine the substance of the streaming arrangement, Centerra management is required to conclude as to whether such arrangement is consistent with the sale of a mineral interest or a financing arrangement. This substance-based assessment is critical as the accounting result for a mineral interest differs significantly from that of a financing arrangement. Some of the key differences from Centerra’s perspective are noted below:

| | Mineral interest | | Financing arrangement

(IAS 39.47) |

Host contract/funds received | | Netted against the cost of the PP&E

(IAS 16.6 — PPE “….fair value of the other consideration given to acquire an asset”) | | Classified as a liability on the Balance Sheet and measured at amortized cost |

As outlined in the response to comment 8 to the Staff’s August 9, 2016 comment letter, Centerra management concluded that the streaming arrangement is consistent with the sale of a mineral interest, rather than sale/delivery of a fixed amount of commodity or a financing arrangement, as Royal Gold is predominantly exposed to the risks that would be indicative of an interest in a mineral property (the Mount Milligan mine). The economic substance of the streaming arrangement is that a portion of the mineral property was sold and Centerra is obligated to deliver to Royal Gold its portion as it is produced from the mineral property.

5

Purchase Accounting Considerations

Due to the substance of the streaming arrangement, Centerra management has concluded that it is appropriate to present the fair value of the mining property net of the fair value of the streaming arrangement as part of the application of acquisition accounting under IFRS 3, similar to the accounting for a net smelter return or a farm-out arrangement. Certain criteria considered in making this determination included: development and production risk, price risk, volume risk and fixed or variable return. While there are some mixed indicators, which is very common in such complex arrangements, the balance of the indicators support that the streaming arrangement is primarily an acquisition of a mineral interest by Royal Gold based on the economic substance of the arrangement. Such treatment would be consistent with several other IFRS reporters in the mining industry that are also SEC registrants.(4) Centerra management is unaware of other IFRS reporting issuers who have assumed metal streaming arrangements in connection with a business combination and have recognized deferred revenue. Management would note that, while IFRS 3 is largely consistent with US GAAP accounting for business combinations, there are GAAP differences in application specific to net measurement/presentation. For example, in-place leases acquired in a business combination are presented net of an income producing property under IFRS but are normally shown gross under US GAAP.

In conclusion, Centerra management has determined that in regards to the streaming arrangement, in accordance with the acquisition method of IFRS 3, recording a liability is not required and reflecting the fair value of the mining interest net of the streaming arrangement is appropriate.

* * * *

If we can facilitate the Staff’s review, or if the Staff has any questions on any of the information set forth herein, please telephone me at (303) 291-2362. Thank you again for your time and consideration.

| Respectfully submitted, |

| |

| By: | /s/ Jason Day |

| | Jason Day |

cc: Anne DeMarco (Thompson Creek Metals Company Inc.)

(4) Refer to the following financial statements as an example: Primero Mining Corp. (2015 Annual Financial Statements) and Eldorado Gold Corp. (2013 Annual Financial Statements).

6