June 11, 2012

U.S. Securities and Exchange Commission

Division of Corporate Finance

100 F Street, N.E.

Washington D.C. 20549

Attention: Loan Lauren P. Nguyen

| Re: | | Comment Letter dated June 4, 2012, regarding |

Del Frisco’s Restaurant Group, LLC’s Amendment No. 2

to Registration Statement on Form S-1 Filed May 18, 2012

(File No. 333-179141)

Dear Ms. Nguyen:

Del Frisco’s Restaurant Group, LLC (the “Company”, “we” or “our”) is in receipt of the above-captioned comment letter (the “Comment Letter”) regarding the Company’s Amendment No. 2 (“Amendment No. 2”) to the Registration Statement on Form S-1 (File No. 333-179141) originally filed with the Securities and Exchange Commission (the “Commission”) on January 24, 2012 (the “Registration Statement”). We have endeavored to respond fully to each of your comments and questions. For your convenience, this letter is formatted to reproduce your numbered comments in bold italicized text. We have filed Amendment No. 3 to the Registration Statement (“Amendment No. 3”) with the Commission today and have included with this letter a marked copy of Amendment No. 3. With this letter we have also supplementally provided you with a mock-up of the revised artwork included in Amendment No. 3.

General

| | 1. | | We note your response to our prior comment 4. It appears that you may not have compared your operating margin to all publicly traded full service restaurants. With a view towards revised disclosure, please explain to us how you selected the companies to which you are comparing yourself. |

We note the Staff’s comment and, in response thereto, have supplementally provided you with updated materials addressing the operating margins of a broader group of U.S. based publicly traded full-service restaurant companies. The updated materials now include two additional restaurants that were originally excluded because of their more limited size and location-base and lower revenues. We also previously excluded two companies that we considered to be more hybrid-service rather than full-service since they utilize a full-service labor model but fall into the limited-service category with respect to menu and price point. We did not consider these four companies as peers in preparing our initial analysis based on these differences; however we have added them to our updated analysis in order to provide a more comprehensive comparison. In addition, we note that we have higher operating margins than all four of these companies. Our conclusion based on our initial analysis that we have industry-

leading operating margins therefore remains unchanged. We also excluded and have continued to exclude three other U.S. based publicly traded full-service restaurant companies from our analysis, which are now referenced in the updated materials. We excluded these companies based on material differences between our business model and theirs. Specifically, we excluded one company that generated more than 50% of its revenues from entertainment and merchandise sales and two companies with a majority of franchise-operated restaurants. Finally, we excluded one OTC restaurant company that did not file 2011 results. We have revised the referenced disclosure on pages 3 and 70 of Amendment No. 3 to clarify the universe of U.S. based publicly traded full-service restaurant companies used in our comparison and to describe the companies that were excluded from this comparison.

| | 2. | | We note your response to our prior comment 5. Please revise to explain what you mean by “high AUVs.” We note from the materials you have provided that some of your restaurants appear to have typical AUVs for a full service restaurant. |

In response to the Staff’s comment, we have deleted the references to “high AUVs” from Amendment No. 3.

Prospectus Summary, page 1

Our Company, page 1

| | 3. | | Please explain what “excellent customer” service is or revise to remove the disclosure. If you mean to state that you provide service comparable to other high-end full service restaurants, please revise to clarify. |

In response to the Staff’s comment, we have revised the referenced disclosure on pages 1, 46, 68 and 75 of Amendment No. 3 to note “a positive customer experience.” We have also revised references to “outstanding customer service” on pages 3 and 70 of Amendment No. 3 to note “a positive customer experience.”

Multiple Top Performing Concepts, page 2

| | 4. | | We note your response to our prior comment 9. Please revise to provide context for your disclosure by clarifying that you believe that your Del Frisco’s New York restaurant was the highest grossing restaurant in the steakhouse industry in 2010 and 2011. We note that you cannot guarantee that your New York restaurant is currently the highest grossing restaurant in the steakhouse industry. |

In response to the Staff’s comment, we have revised the referenced disclosure as requested on pages 3 and 69 of Amendment No. 3.

Conflicts of Interest, page 5

| | 5. | | We note your response to our prior comment 12. Please revise to discuss the fact that you guarantee leases for affiliates of Lone Star Fund that are not controlled or managed by you, as discussed on page 22. |

2

In response to the Staff’s comment, we have revised the referenced disclosure as requested on page 6 of Amendment No. 3.

Capitalization, page 39

Consolidated Balance Sheets, page F-3

| | 6. | | We note your response to our prior comment 16 in which you indicate that once the offering proceeds are determinable, you will account for the $3.0 million one-time payment to Loan Star Fund as a reduction to your cash balance in the pro forma balance sheet. As we believe this payment is analogous to a dividend since it is being made to your principal stockholder, please revise to also reflect such payment as a reduction to retained earnings in the pro forma balance sheet. The pro forma balance sheet presented on page F-3 of your financial statements should be similarly revised. Note 14 to your financial statements should also be revised to explain the nature of the pro forma presentation for this one time termination payment being paid to Lone Star. Refer to the guidance in SAB Topic 1:B:3. |

We note the Staff’s comment and, in response thereto, acknowledge that once our estimated offering proceeds are determinable, we will account for the $3.0 million one-time payment to Lone Star Fund in the pro forma balance sheet that is presented alongside our historical balance sheet as of the latest period presented as not only a reduction to our cash balance, but also as a reduction to retained earnings, and that the pro forma balance sheet on page F-3 of our financial statements will be similarly revised. We will also revise Note 14 to our financial statements to explain the nature of the pro forma presentation for the one-time termination payment to Lone Star Fund.

Certain Relationships and Related Party Transactions, page 108

Termination of Asset Advisory Agreement, page 109

| | 7. | | Please revise to disclose the dollar value of the transition services agreement. Additionally, please disclose this agreement in the Conflicts of Interest section beginning on page 5. |

In response to the Staff’s comment, we have revised the referenced disclosure as requested on pages 6 and 109 of Amendment No. 3.

Note (2) Summary of Significant Accounting Policies

Segment Reporting, page F-13

| | 8. | | We note from your response to our prior comment 49 in your response letter dated April 16, 2012 that you believe it is appropriate to report the operations of your Del Frisco’s, Sullivan’s and Grill reporting units on an aggregated basis due to their similar economic characteristics as defined in ASC 280-10-50-11. We further note that you believe these operations are economically similar because Del Frisco’s and Sullivan’s have similar gross margins for the various periods presented in your financial statements and the Grill, although not yet operating for a complete fiscal year, is expected to have similar gross margins to these other operations. However, after further consideration of the information that you provided in response to our prior comment, it is unclear to us that the economic characteristics of your Del Frisco’s, Sullivan’s and Grill reporting units are sufficiently similar to provide for aggregation of these operations into a single reporting segment. In this regard, we cannot concur with your conclusion that based on the fact that gross margins or anticipated gross margins of your three reporting units are substantially similar, that they have similar economic characteristics and can therefore be aggregated into a single segment. The measure gross margin is not used or presented in any manner in the Company’s financial statements and therefore it does not appear to be an appropriate measure for analyzing the economic similarity of the Company’s reporting units or segments. In addition, throughout your filing, there is no discussion of gross margins. Instead, your analysis of operating performance focuses on operating income, the sole operating performance measure presented in the company’s statement of operations and restaurant-level EBITDA margins, and therefore, your specific facts and circumstances indicate that operating income or restaurant-level EBITDA are the measures used by the Company’s chief operating decision maker to assess the operating performance of your restaurant operations. Supplementally advise us of the operating income and restaurant-level EBITDA experienced for your three reporting units during the periods presented in your financial statements and explain in further detail why you believe they are economically similar. Please note that in the absence of economic similarity, we would expect you to revise your financial statements and MD&A to reflect the operations of Del Frisco’s, Sullivan’s and the Grill as separate reportable segments pursuant to ASC 280. If you continue to believe that aggregation is appropriate, please also provide us with the reports used by your chief operating decision maker for purposes of making decisions about allocating resources and assessing segment performance for the three fiscal years presented in your financial statements. |

We note the Staff’s comment and, in response thereto, respectfully submit that we continue to believe that it is appropriate to report the operations of our Del Frisco’s, Sullivan’s, and Grille operating segments, which we also refer to as our “concepts,” as one reportable segment as we consider that these operating segments meet the aggregation criteria under ASC 280-10-50-11.

In reaching our conclusion regarding aggregation, we focused on the qualitative aggregation criteria identified under ASC 280-10-50-11. These criteria, and the manner in which our concepts meet these criteria, are as follows:

3

| | • | The nature of the products and services: Each of our concepts operates in the full-service steakhouse industry and serves the same categories of food and beverages, including steaks, high-end wine and cocktails. |

| | • | The nature of the production processes: Each of our concepts has similar standard operating procedures, similar kitchen designs, and similar recipes for the food and drinks offered. Each location for each concept operates with the same staffing, labor positions and job titles that are overseen by common regional managers with responsibility for locations in all three concepts. Our training and education teams are cross-trained and work for, and provide support to each of our three concepts. The opening teams for new restaurant locations are not concept specific and are comprised of team members from multiple locations from all three concepts. |

| | • | The type or class of customer for their products and services:All of our restaurants operate in the upscale, full-service steakhouse industry and serve similar customers for largely similar upscale dining experiences. The methods used to market the restaurants are similar across all concepts. As all three concepts are in the upscale segment of our industry, our customers at all three concepts are characterized by similar demographic characteristics such as higher disposable incomes and live in metropolitan areas. |

| | • | The methods used to distribute their products or provide their services: Each of our concepts distributes its products through full-service restaurants. |

| | • | If applicable, the nature of the regulatory environment, for example, banking, insurance, or public utilities: Each of our concepts operates under identical regulatory requirements, including liquor licenses, health code requirements and other regulatory standards. Any variation in the regulatory environment is unique to a particular restaurant location and is exclusively the result of local variations in laws, rules, and regulations. |

The Company has a very flat management organization with a small senior management team that focuses on the overall Company and does not have a specific segment manager by concept. The CODM is the CEO of the Company. In his role as the CODM, the CEO manages two key investment decisions: (i) initial investment in a new location, and (ii) monitoring of the continuing operational and financial results of existing concepts and restaurants. The initial investment decision focuses on the expected volume that will be generated in the proposed market and the type of market so that the Company opens the proper concept based on the market demographics.

The Company’s concepts have differences in the average check which are driven primarily by the menu mix and products offered. However, the performance of each concept is significantly affected by the same factors – the cost of food and beverages and labor costs. Each concept is affected similarly by changes in market and economic factors. For example, each of our concepts has historically been similarly affected by a change in beef prices or changes in the labor markets, or by changes in the general economic environment. Accordingly, in monitoring the day-to-day results of existing restaurants, the CODM focuses on revenues and the related controllable costs, such as cost of sales and labor, and less on the fixed costs such as rent. Other

4

factors, such as restaurant-level EBITDA margin, are reported to the CODM, but are not focused on to the same extent for the purposes of evaluating the day-to-day results of operations. We use restaurant-level EBITDA as a secondary metric to evaluate the overall, aggregated, profitability of our restaurant operations. We also use Adjusted EBITDA to evaluate the overall profitability of the Company.

When evaluating if our operating segments can be aggregated into one reportable segment, we also considered the following quantitative metrics in evaluating economic similarity.

Revenues: Revenues for each of our concepts tend to be affected similarly by the same factors. For instance, during the recent economic downturns we saw similar declines in traffic and the average check amount across all of our concepts. Below is a summary of the quarterly comparable restaurant sales declines during 2009 for our Del Frisco’s and Sullivan’s concepts.

| | | | | | | | | | | | | | | | |

Comparable Restaurant Sales declines during 2009 economic downturn | |

| | | Q1, 2009 | | | Q2, 2009 | | | Q3, 2009 | | | Q4, 2009 | |

Del Frisco’s | | | (18.7%) | | | | (22.7%) | | | | (21.1%) | | | | (7.6%) | |

Sullivan’s | | | (18.8%) | | | | (25.0%) | | | | (20.2%) | | | | (15.6%) | |

Additionally, similar strategies for comparable restaurant sales growth are pursued across all concepts, principally through selective introduction of higher priced menu items and increases in pricing, as well as expanding and enhancing our private dining capacity.

Cost of Sales: Cost of sales, consisting of food and beverage costs, for our Del Frisco’s and Sullivan’s concepts for the last three years are as follows:

| | | | | | | | | | | | |

Cost of Sales as a Percentage of Revenue (Gross Margin: Sales less cost of sales) | |

| | | Fiscal Year Ended

December 29, 2009 | | | Fiscal Year Ended

December 28, 2010 | | | Fiscal Year Ended

December 27, 2011 | |

Del Frisco’s | | | 30.7% (69.3%) | | | | 30.0% (70.0%) | | | | 30.8% (69.2%) | |

Sullivan’s | | | 30.5% (69.5%) | | | | 30.5% (69.5%) | | | | 30.2% (69.8%) | |

Although the Grille concept has not been operating for a complete fiscal year, we anticipate that its cost of sales will be between 29.5% and 30.5%. In addition, each of our concepts, including the Grille, has beef costs that represent approximately one-third of their cost of sales. Our beef is provided by the same supplier to all concepts and changes in beef prices affect all of our concepts similarly.

We note that cost of sales, as a percentage of sales, are comparable for each concept. We believe that cost of sales for us is a proxy for gross margin as referenced in ASC 280. We also note that we have revised our MD&A disclosure on page [48] to identify cost of sales as a Performance Indicator in addition to its current inclusion as a key financial term. As cost of sales is the only true variable component of cost relative to the sales volume of a specific restaurant, it is the best metric to demonstrate the similar nature of our restaurants and concepts

5

as other metrics, such as restaurant level EBITDA, can vary significantly due to the ability to leverage fixed costs, such as utilities and occupancy costs, at higher sales volumes.

Despite the differences in the average check, or targeted average check, of each concept, and as demonstrated by the similar cost of sales percentages, the average check difference is driven primarily by the menu mix and products offered. While our Del Frisco’s concept has a higher average check, the underlying costs of sales for its menu offerings, such as USDA Prime beef and premium high-end wines, are also typically higher in cost than those at Sullivan’s and the Grille, ultimately resulting in a similar cost of sales percentage.

Labor Costs:Reflected in the table below are labor costs, a component of restaurant operating expenses, expressed as a percentage of sales for our Del Frisco’s and Sullivan’s concepts for the 2009, 2010, and 2011 fiscal years. These costs, which do have a fixed component impacted by sales volume, are also similar.

| | | | | | | | | | | | |

Labor Costs as a Percentage of Revenue | |

| | | Fiscal Year Ended

December 29, 2009 | | | Fiscal Year Ended

December 28, 2010 | | | Fiscal Year Ended

December 27, 2011 | |

Del Frisco’s | | | 23.9 | % | | | 23.3 | % | | | 23.2 | % |

Sullivan’s | | | 25.4 | % | | | 27.2 | % | | | 26.7 | % |

Although the Grille concept has not been operating for a complete fiscal year, we anticipate that its labor costs will be between 25.5% and 27.5%. We expect that over time, its labor costs will be consistent with the other concepts as it matures.

Labor costs, as well as other operating expenses including occupancy, have both a variable and fixed component that, when viewed as a percentage of sales, vary more as a result of sales volume of a specific restaurant location as opposed to a difference between concepts. It should also be noted that, in addition to the role that sales volume plays in contributing to fixed management costs included in labor costs, local and state laws concerning minimum wage and tip credits also impact labor costs. These factors create variation as a percentage of sales unrelated to any organic differences in the restaurants or concepts.

Reflected below is a table combining the costs of sales and labor costs as a percentage of revenue for our Del Frisco’s and Sullivan’s concepts for the 2009, 2010, and 2011 fiscal years. These combined costs, which do include the fixed component of labor costs impacted by sales volume, are also similar.

| | | | | | | | | | | | |

Combined Cost of Sales and Labor Costs as a Percentage of Revenue | |

| | | Fiscal Year Ended

December 29, 2009 | | | Fiscal Year Ended

December 28, 2010 | | | Fiscal Year Ended

December 27, 2011 | |

Del Frisco’s | | | 54.6 | % | | | 53.3 | % | | | 54.0 | % |

Sullivan’s | | | 55.9 | % | | | 57.7 | % | | | 56.9 | % |

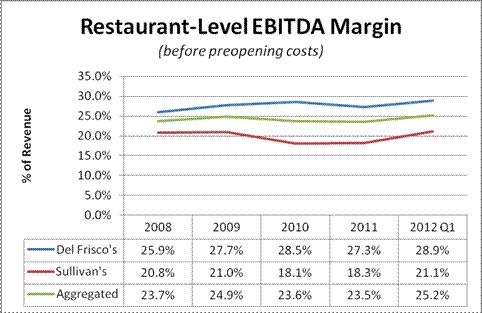

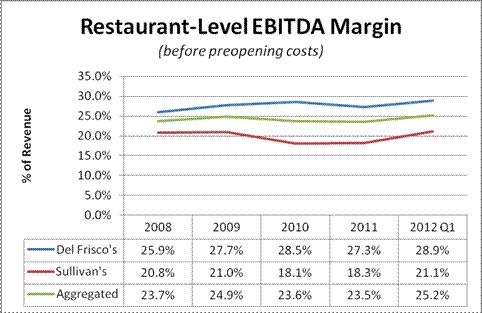

Restaurant-level EBITDA Margins: In our Registration Statement we also discuss restaurant-level EBITDA margins even though the CODM does not monitor this metric in day-to-day operations. We consider restaurant-level EBITDA margin helpful to an investor as it

6

provides a measure of operational results that incorporates fixed costs such as rent. However, as rent is not a controllable cost once a lease is signed, the CODM focuses on the variable costs aspect of the operations. Due to these fixed costs, restaurant-level EBITDA margin experiences increased variation based on the sales volume of the restaurant, which is evaluated by the CODM at the revenue level.

We have prepared the following analysis related to the restaurant-level EBITDA margin and noted that these margins vary between the concepts. However, changes in historical restaurant-level EBITDA margins for the concepts maintain a similar trend.

This similarity in trend, but difference in margin, is the result of the average sales volume differences per concept (i.e. average sales volume at Del Frisco’s is higher) and the ability of each concept to leverage the fixed costs and not as a result of fundamental economic differences between the steakhouse concepts. The aggregated trend and trends of the restaurant-level EBITDA margins by concept are similar and move in parallel as each concept is impacted by the same food costs, changes in labor costs and the overall changes in the economy in a similar manner.

In conclusion, as noted above, we believe that we meet the aggregation criteria as we operate similar concepts (full-service, upscale steakhouses) within the same sub-segment of the restaurant industry with the same customers, suppliers, and processes and that are similarly affected by changes in similar economic factors. The CODM focuses his day-to-day management on sales and the related controllable costs, which are variable costs such as cost of sales and labor which quantitatively have similar cost margins. All of these items are discussed in the MD&A of the Registration Statement, and we have included clarifications on page 48 to indicate the CODM’s use of these metrics as Performance Indicators for day-to-day management. While restaurant-level EBITDA is also discussed in the Registration Statement, as noted above, we consider it to be a secondary measure that is reviewed by the CODM. With that said our restaurant-level EBITDA margins do move in a consistent pattern between the concepts and is indicative of economic similarity. As the aggregated financial data is an appropriate representation of the trend of our segments’ operations and operating performance, we do not believe investors would get any additional value from the disaggregated data. As a result, we believe presenting one reportable segment is consistent with the principles of FASB ASC 280.

As requested, we have provided you supplementally with an example of our board report which, in addition to reports requested by our board of directors, includes certain reports used by the CODM for purposes of making decisions about allocating resources and assessing performance. The example that we have provided is consistent with the reports that are periodically provided to our board of directors and we have therefore provided only one example.

Note (10) Litigation, page F-23

| | 9. | | We note your response to our prior comment 22. Please note that absent a settlement agreement with the dissenting shareholders which clearly identifies the additional amounts paid as purchase price, we continue to believe that the additional amounts paid should not be reflected as an adjustment of the purchase price but rather as a legal settlement since such payments were made more than two years after the acquisition transaction, and in any event, significantly after the end of the allocation period provided for in SFAS No.141. Please revise your financial statements accordingly. |

We note the Staff’s comment, and in response thereto, respectfully submit that we have provided supplemental materials regarding the settlement and the amounts paid to the dissenting shareholders that we believe supports our position that the additional amounts paid should be reflected as an adjustment to the purchase price rather than as a legal settlement. As discussed with the Staff, we are preparing further supplemental materials regarding the accounting and operation of the promissory notes issued in the settlement.

7

Note 14. Subsequent Events, page F-25

| | 10. | | We note your response to our prior comment 24 and the revisions made on page F-15 but do not believe that your response or the related revisions adequately addressed our prior comment. As previously requested, please advise us and revise your disclosure to describe the significant assumptions used to determine that the fair value of the asset surrendered approximates its book value and therefore no gain or loss will be recorded on the exchange. |

In response to the Staff’s comment, we have revised the referenced disclosure in Note 3, Intangible Assets and Goodwill on page F-15 of Amendment No. 3 as requested to describe additional assumptions in the discounted cash flow method used to determine that the fair value of the asset surrendered approximates its book value.

Other

| | 11. | | We note your response to our prior comment 26. When the information becomes available, please disclose the number and expected terms of the options that the company plans to issue in connection with its planned public offering. |

We note the Staff’s comment and, in response thereto, advise that we intend to disclose the exact number of options to be granted in connection with the offering and the expected terms thereof in the Registration Statement prior to its effectiveness once the information becomes available.

| | 12. | | Please provide a currently dated consent from the independent registered public accountants in any future amendments to the registration statement. |

We note the Staff’s comment and, in response thereto, advise that we have filed a currently dated consent from our independent registered public accounting firm as Exhibit 23.1 to Amendment No. 3 as requested and will file currently dated consents with any future amendment to the Registration Statement the extent required.

We appreciate the opportunity to respond to your comments. If you have further comments or questions, we stand ready to respond as quickly as possible. If you wish to contact us directly you can reach me at (817) 601-4606.

Sincerely,

/s/ Thomas J. Pennison, Jr.

Thomas J. Pennison, Jr.

Chief Financial Officer

8

Peter W. Wardle

Colin J. Diamond

9