client logo here Supplemental Investor Information November 7th, 2019 0

Note Regarding Financial Information On September 10, 2019, EchoStar Corporation (“EchoStar”) transferred to DISH Network Corporation (“DISH”) the portion of its business that manages, markets and provides (i) broadcast satellite services primarily to DISH and its subsidiaries (“DISH Network”), and Dish Mexico, S. de R.L. de C.V. and its subsidiaries and (ii) telemetry, tracking and control services to satellites owned by DISH Network and a portion of EchoStar’s other businesses, and certain related assets and business operations (the “BSS Transaction”). The BSS Transaction was structured in a manner intended to be tax-free to EchoStar and its shareholders for U.S. federal income tax purposes. Following consummation of the BSS Transaction, EchoStar no longer operates its former BSS business and, as a result, beginning in the third quarter of 2019, the operating results of EchoStar’s former BSS business will be presented as discontinued operations in EchoStar’s condensed consolidated financial statements. The following preliminary unaudited financial information for EchoStar for the quarters ending March 31, June 30, September 30 and December 31, 2018 and March 31, June 30 and September 30, 2019 reflect these changes for the periods presented. The preliminary unaudited financial information is presented based on information currently available and is intended for information purposes only. In addition, the unaudited financial information is not necessarily indicative of EchoStar’s future financial condition or results of operations. The preliminary unaudited financial information should be read in conjunction with the audited consolidated financial statements and accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in EchoStar’s Annual Report on Form 10-K/A for the year ended December 31, 2018 and the unaudited consolidated financial statements and accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in EchoStar’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2019. The pro forma adjustments are based on available information and assumptions that EchoStar’s management believes are reasonable, factually supportable, reflect the impacts of events directly attributable to the BSS Transaction and for purposes of the statements of operations, are expected to have a continuing impact on EchoStar. The pro forma adjustments do not reflect future events that may occur after the BSS Transaction. 1

Post BSS Transaction – Continuing Ops ($000) Q1-18 Q2-18 Q3-18 Q4-18 Q1-19 Q2-19 Q3-19 Revenue: Services and other revenue - Dish Network $ 21,719 $ 18,637 $ 17,054 $ 16,055 $ 15,062 $ 14,238 $ 13,232 Services and other revenue - other 349,167 369,570 382,374 382,653 387,606 388,548 393,305 Equipment revenue 42,946 50,342 56,846 55,275 51,714 57,645 65,725 Total revenue 413,832 438,549 456,274 453,983 454,382 460,431 472,262 Costs and expenses: Cost of sales - services and other 138,490 140,842 142,290 142,285 143,347 142,680 143,842 Cost of sales - equipment 39,071 41,865 46,318 49,345 45,007 46,549 51,188 Selling, general and administrative expenses 103,333 103,167 107,540 122,372 112,186 149,290 122,676 Research and development expenses 7,138 6,646 6,544 7,242 6,887 6,388 6,136 Deprecation and amortization 110,269 113,143 115,325 118,379 118,978 120,267 122,374 Impairments - - - 65,220 - - - Total costs and expenses 398,301 405,663 418,017 504,843 426,405 465,174 446,216 Operating Income 15,531 32,886 38,257 (50,860) 27,977 (4,743) 26,046 Other income (expense): Interest income 15,635 19,253 21,349 24,038 24,429 23,213 17,175 Interest expense, net of amounts capitalized (55,055) (54,105) (54,878) (55,250) (53,199) (53,749) (49,865) Gains (losses) on investments, net (36,663) 65,396 2,873 (44,227) 6,937 12,855 8,295 Equity in earnings (losses) of unconsolidated affiliates, net (1,009) (2,058) 416 (3,303) (6,354) (4,754) (3,209) Other, net 204 (336) (3,249) (954) (1,201) 1,760 (16,587) Total other income (expense), net (76,888) 28,150 (33,489) (79,696) (29,388) (20,675) (44,191) Income (loss) from continuing operations before income taxes (61,357) 61,036 4,768 (130,556) (1,411) (25,418) (18,145) Income tax provision, net 4,574 (4,886) (7,963) (5,438) (2,899) (4,692) (5,016) Net income (loss) from continuing operations (56,783) 56,150 (3,195) (135,994) (4,310) (30,110) (23,161) Net income (loss) from discontinued operations 35,612 21,534 19,697 12,282 19,319 25,049 2,055 Net income (loss) (21,171) 77,684 16,502 (123,712) 15,009 (5,061) (21,106) Less: Net income attributable to noncontrolling interests 380 462 450 550 806 632 (2,797) Net income (loss) attributable to EchoStar Corporate common stock $ (21,551) $ 77,222 $ 16,052 $ (124,262) $ 14,203 $ (5,693) $ (18,309) EBITDA $ 87,952 $ 208,569 $ 153,172 $ 18,485 $ 145,531 $ 124,753 $ 139,716 Adjusted EBITDA $ 124,406 $ 145,291 $ 154,364 $ 127,970 $ 139,754 $ 134,649 $ 148,339 2

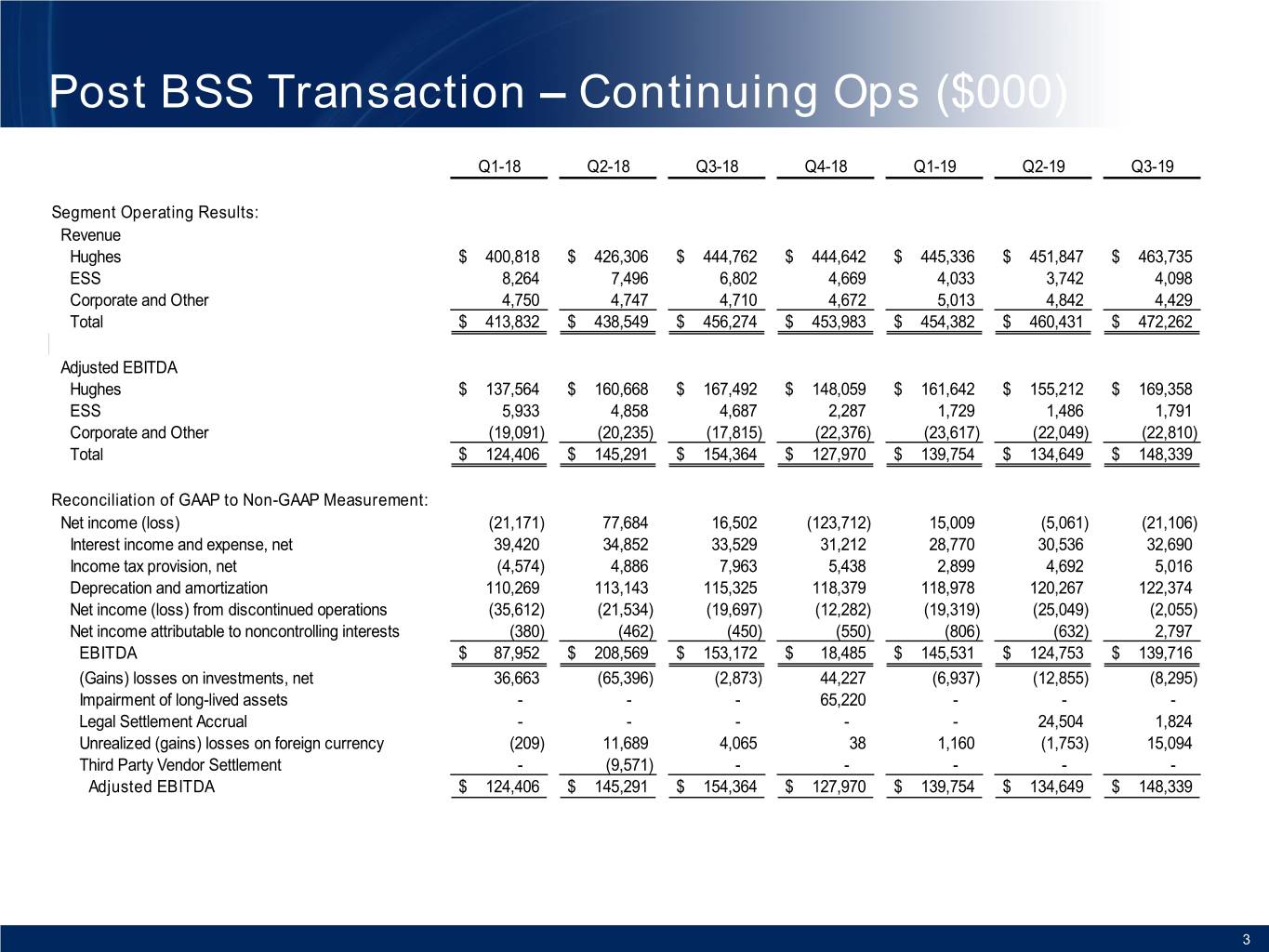

Post BSS Transaction – Continuing Ops ($000) Q1-18 Q2-18 Q3-18 Q4-18 Q1-19 Q2-19 Q3-19 Segment Operating Results: Revenue Hughes $ 400,818 $ 426,306 $ 444,762 $ 444,642 $ 445,336 $ 451,847 $ 463,735 ESS 8,264 7,496 6,802 4,669 4,033 3,742 4,098 Corporate and Other 4,750 4,747 4,710 4,672 5,013 4,842 4,429 Total $ 413,832 $ 438,549 $ 456,274 $ 453,983 $ 454,382 $ 460,431 $ 472,262 Adjusted EBITDA Hughes $ 137,564 $ 160,668 $ 167,492 $ 148,059 $ 161,642 $ 155,212 $ 169,358 ESS 5,933 4,858 4,687 2,287 1,729 1,486 1,791 Corporate and Other (19,091) (20,235) (17,815) (22,376) (23,617) (22,049) (22,810) Total $ 124,406 $ 145,291 $ 154,364 $ 127,970 $ 139,754 $ 134,649 $ 148,339 Reconciliation of GAAP to Non-GAAP Measurement: Net income (loss) (21,171) 77,684 16,502 (123,712) 15,009 (5,061) (21,106) Interest income and expense, net 39,420 34,852 33,529 31,212 28,770 30,536 32,690 Income tax provision, net (4,574) 4,886 7,963 5,438 2,899 4,692 5,016 Deprecation and amortization 110,269 113,143 115,325 118,379 118,978 120,267 122,374 Net income (loss) from discontinued operations (35,612) (21,534) (19,697) (12,282) (19,319) (25,049) (2,055) Net income attributable to noncontrolling interests (380) (462) (450) (550) (806) (632) 2,797 EBITDA $ 87,952 $ 208,569 $ 153,172 $ 18,485 $ 145,531 $ 124,753 $ 139,716 (Gains) losses on investments, net 36,663 (65,396) (2,873) 44,227 (6,937) (12,855) (8,295) Impairment of long-lived assets - - - 65,220 - - - Legal Settlement Accrual - - - - - 24,504 1,824 Unrealized (gains) losses on foreign currency (209) 11,689 4,065 38 1,160 (1,753) 15,094 Third Party Vendor Settlement - (9,571) - - - - - Adjusted EBITDA $ 124,406 $ 145,291 $ 154,364 $ 127,970 $ 139,754 $ 134,649 $ 148,339 3

Note on Use of Non-GAAP Financial Measures EBITDA is defined as “Net income (loss)” excluding “Interest income and expense, net”, “Income tax provision, net”, “Depreciation and amortization,” “Net income (loss) from discontinued operations,” and “Net income (loss) attributable to noncontrolling interests.” Adjusted EBITDA is defined as EBITDA excluding “Gains and losses on investments, net,” unrealized gains (losses) on foreign currency, and other non-recurring or non-operational items. EBITDA and Adjusted EBITDA are not measures determined in accordance with US GAAP. EBITDA and Adjusted EBITDA are reconciled to “Net income (loss)” in the table above and should not be considered in isolation or as a substitute for operating income, net income or any other measure determined in accordance with US GAAP. Our management uses EBITDA and Adjusted EBITDA as measures of our operating efficiency and overall financial performance for benchmarking against our peers and competitors. Management believes that these non-GAAP measures provide meaningful supplemental information regarding the underlying operating performance of our business and are appropriate to enhance an overall understanding of our financial performance. Management also believes that EBITDA and Adjusted EBITDA are useful to investors because they are frequently used by securities analysts, investors, and other interested parties to evaluate the performance of companies in our industry. 4