UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): October 30, 2010

Aurum Explorations, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 000-53481 | 68-0681042 |

| (State or other jurisdiction of incorporation or organization) | (Commission File Number) | (IRS Employer Identification No.) |

Room 2102-03, 21/F, Kingsfield Centre

18-20 Shell Street, North Point, Hong Kong

(Address of principal executive offices)

Telephone – 852-2891-2111

Suite 903, Allied Kajima Building

138 Gloucester Road Wanchai, Hong Kong

(Former Address)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This report contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements include, among other things, statements relating to:

| · | the impact that a downturn or negative changes in the market for building materials may have on sales. |

| · | our ability to obtain additional capital in future years to fund our planned expansion. |

| · | economic, political, regulatory, legal and foreign exchange risks associated with our operations. |

| · | the loss of key members of our senior management and our qualified sales personnel. |

| · | our continued relationship with our single third-party manufacturer of our goods. |

Also, forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference and filed as exhibits to the report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

Use of Certain Defined Terms

Except where the context otherwise requires and for the purposes of this report only:

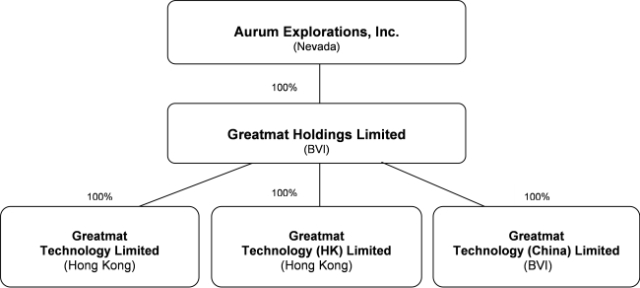

| · | the “Company,” “we,” “us,” and “our” refer to the combined business of (i) Aurum Explorations, Inc. or “Aurum,” a Nevada corporation, (ii) Greatmat Holdings Limited, or “Greatmat Holdings,” a BVI limited company and wholly-owned subsidiary of Aurum, (iii) Greatmat Technology Limited, or “Greatmat Limited,” a Hong Kong limited company and wholly-owned subsidiary of Greatmat Holdings, (iv) Greatmat Technology (HK) Limited, or “Greatmat Hong Kong,” a Hong Kong limited company and wholly-owned subsidiary of Greatmat Holdings, and (v) Greatmat Technology (China) Limited, or “Greatmat China,” a BVI limited company and wholly-owned subsidiary of Greatmat Holdings, as the case may be; |

| · | “BVI” refers to the British Virgin Islands; |

| · | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended; |

| · | “Hong Kong” refers to the Hong Kong Special Administrative Region of the People’s Republic of China and “Hong Kong dollars” and “HK$” refer to the legal currency of Hong Kong; |

- 2 - -

| · | “PRC,” “China,” and “Chinese,” refer to the People’s Republic of China (excluding Hong Kong and Taiwan); |

| · | “Renminbi” and “RMB” refer to the legal currency of China; |

| · | “Securities Act” refers to the Securities Act of 1933, as amended; and |

| · | “U.S. dollars,” “dollars” and “$” refer to the legal currency of the United States. |

In this current report we are relying on and we refer to information and statistics regarding the building materials industry and economy in East Asia and that we have obtained from various cited government and institute research publications. Much of this information is publicly available for free and has not been specifically prepared for us for use or incorporation in this current report on Form 8-K or otherwise. We have not independently verified such information, and you should not unduly rely upon it.

ITEM 1.01

ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On October 30, 2010, we entered into and closed a share exchange agreement, or the Share Exchange Agreement, with Greatmat Holdings Limited, a BVI company, or Greatmat Holdings, Chris Yun Sang SO, the sole shareholder of Greatmat Holdings, and Yau-sing TANG, our sole director and former sole officer and majority beneficial shareholder, pursuant to which we acquired 100% of the issued and outstanding capital stock of Greatmat Holdings in exchange for 36,560,700 shares of our Common Stock, which constituted 75.0% of our issued and outstanding capital stock as of and immediately after the consummation of the transactions contemplated by the Share Exchange Agreement.

The foregoing description of the terms of the Share Exchange Agreement is qualified in its entirety by reference to the provisions of the agreement filed as Exhibit 2.1 to this report, which are incorporated by reference herein.

ITEM 2.01

COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

On October 30, 2010, we completed an acquisition of Greatmat Holdings pursuant to the Share Exchange Agreement. The acquisition was a reverse acquisition in accordance with ASC 805-40 “Reverse Acquisitions”. The legal parent is Aurum Explorations, Inc. which was the accounting acquiree while the Greatmat group of companies was the accounting acquirer. There was no non-controlling interest after the acquisition. This transaction was accounted for as a recapitalization effected by a share exchange, wherein Greatmat Holdings is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of the acquired entity have been brought forward at their book value and no goodwill has been recognized.

As a result of the acquisition, our consolidated subsidiaries include Greatmat Holdings Limited, our wholly-owned subsidiary which is incorporated under the laws of the BVI, Greatmat Technology Limited, or Greatmat Limited, a wholly-owned subsidiary of Greatmat Holdings which is incorporated under the laws of Hong Kong, Greatmat Technology (HK) Limited, or Greatmat Hong Kong, a wholly-owned subsidiary of Greatmat Holdings which is incorporated under the laws of Hong Kong, and Greatmat Technology (China) Limited, or Greatmat China, a wholly-owned subsidiary of Greatmat Holdings which is incorporated under the laws of the BVI. Greatmat Limited, Greatmat Hong Kong and Greatmat China are sometimes collectively referred to herein as the “Operating Subsidiaries.”

- 3 - -

FORM 10 DISCLOSURE

As disclosed elsewhere in this report, on October 30, 2010, we acquired Greatmat Holdings in a reverse acquisition transaction. Item 2.01(f) of Form 8-K states that if the registrant was a shell company like we were immediately before the reverse acquisition transaction disclosed under Item 2.01, then the registrant must disclose the information that would be required if the registrant were filing a general form for registration of securities on Form 10 upon consummation of the transaction.

Accordingly, we are providing below the information that would be included in a Form 10 if we were to file a Form 10. Please note that the information provided below relates to the combined enterprises after the acquisition of Greatmat Holdings, except that information relating to periods prior to the date of the reverse acquisition only relate to Greatmat Holdings and its consolidated subsidiaries unless otherwise specifically indicated.

DESCRIPTION OF BUSINESS

Business Overview

Greatmat was established in May 2004 and is a leading innovative building material company that provides customers with customized designs, manufacturing solutions and technical advice for building projects. In particular, Greatmat is a supplier of high-quality engineered stone floor and wall surfaces to commercial construction projects in China, Hong Kong and elsewhere in Asia. Our principal business consists of the design, research and development and production of engineered stone for installation in construction projects. Our company headquarters and main sales office is located in Hong Kong.

Greatmat possesses a strong research and development team to help develop new solutions and innovative designs. We are often sought after by major property developers who want a unique material appearance for their flooring and exterior walls, typically in exclusive shopping centers around Asia. The Company designs, produces, sells and services all of its finished products. Project after project, the Company keeps coming up with unique finishing materials for ever-demanding property developers in Asia. After years in the building material industry, Greatmat has built a reputation in the region for having one of the highest quality standards in the field.

In 2005, Greatmat was awarded a grant from the Hong Kong Innovative Technology Fund for creating a new environmentally-friendly solution which could be applied to the walls, flooring and exterior of commercial buildings. In 2009, the Company was also awarded a Hong Kong Award for Environmental Excellence. Greatmat has successfully completed numerous signature projects in Hong Kong, Japan, Singapore and China for blue-chip clients such as Swire Properties, Sino Group, the Hong Kong Jockey Club, Sun Hung Kei Properties, Hang Lung Properties, and Shui On Properties, just to name a few. We maintain a website at http://www.greatmat.com, which is not incorporated into this Report.

- 4 - -

Greatmat Flooring on Display in Disneyland Hong Kong

Our Corporate History and Background

Aurum Explorations, Inc. was originally incorporated under the laws of the State of Nevada on April 27, 2007. Prior to our reverse acquisition of Greatmat Holdings, Aurum had originally intended to acquire exploration and development stage natural resource properties. The Company acquired the mineral rights to one property which subsequently reverted before the Company began mining operations. In July 2009, there was a change in control of Aurum. Thereafter, Aurum became dormant and began actively seeking a business combination through the acquisition of, or merger with, an operating business. From July 2009 until the present, Aurum was inactive and could be deemed to be a so-called “shell” company, whose only purpose at that time was to determine and implement a new business purpose.

As a result of our reverse acquisition of Greatmat Holdings, we are no longer a shell company and active business operations were revived.

Acquisition of Greatmat Holdings

On October 30, 2010, we completed a reverse acquisition transaction through a share exchange with Greatmat Holdings and its sole shareholder, whereby we acquired 100% of the issued and outstanding capital stock of Greatmat Holdings in exchange for 36,560,700 shares of our Common Stock, which constituted 75.0% of our issued and outstanding capital stock as of and immediately after the consummation of the reverse acquisition. As a result of the reverse acquisition, Greatmat Holdings became our wholly-owned subsidiary and the former shareholder of Greatmat Holdings became our controlling stockholder. The share exchange transaction with Greatmat Holdings and its shareholder, or Share Exchange, was treated as a reverse acquisition, with Greatmat Holdings as the acquirer and Aurum as the acquired party for accounting purposes. Unless the context suggests otherwise, when we refer in this report to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Greatmat Holdings and its consolidated subsidiaries.

- 5 - -

Immediately prior to the Share Exchange, the common stock of Greatmat Holdings was solely owned by Chris Yun Sang SO, the founder and chief executive officer of Greatmat.

Upon the closing of the reverse acquisition, Yau-sing TANG, Aurum’s sole director and officer, submitted a resignation letter pursuant to which he resigned from all offices that he held effective immediately and from his position as our director that will become effective on the tenth day following the mailing by us of an information statement, or the Information Statement, to our stockholders that complies with the requirements of Section 14f-1 of the Exchange Act. In addition, our board of directors on October 30, 2010 increased the size of our board of directors to three directors and appointed Chris Yun Sang SO, Carol Lai Ping HO and Rick Chun Wah TSE to fill the vacancies created by such resignation and increase in the size of the board, which appointments will become effective upon the effectiveness of the resignation of Yau-sing TANG on the tenth day following the mailing by us of the Information Statement to our stockholders. In addition, our sole executive officer Yau-sing TANG was replaced upon the closing of the reverse acquisition as indicated in more detail below.

As a result of our acquisition of Greatmat Holdings, we now own all of the issued and outstanding capital stock of Greatmat Holdings, which in turn owns all of the issued and outstanding capital stock of Greatmat Limited, Greatmat Hong Kong and Greatmat China, our operating subsidiaries.

Greatmat Limited was established in Hong Kong in September 2010. Greatmat Hong Kong was established in Hong Kong in May 2004. Greatmat China was established in the British Virgin Islands in December 2008. Greatmat Holdings was established in the British Virgin Islands in July 2010 to serve as an intermediate holding company. Greatmat Holdings currently owns 100% of Greatmat Limited, Greatmat Hong Kong and Greatmat China. Chris Yun Sang SO currently serves as the sole director of each of Greatmat Holdings, Greatmat Limited and Greatmat Hong Kong, and Greatmat Holdings currently serves as the sole director of Greatmat China.

Our Corporate Structure

All of our business operations are conducted through our Hong Kong and BVI subsidiaries. The chart below presents our corporate structure. We conduct business in China through Greatmat China, we conduct business in Hong Kong through Greatmat Hong Kong, and we conduct business in all other export markets through Greatmat Limited.

- 6 - -

Our Industry and Principal Markets:

The Chinese economy has grown by leaps and bounds since the PRC government introduced economic reforms in the late nineteen seventies. From the mid nineteen nineties onward, China became one of the fastest growing economies in the world. China’s GDP growth has since been the envy of the world and one of the main engines driving its growth is in the area of infrastructure, renovation and real estate development, as these sectors exceeded the growth rate of the general GDP by a substantial margin. Correspondingly, the growth in sales of building materials in China also outstripped GDP growth during the same period.

According to the Economic Times, China is projected to overtake the U.S. as the world’s largest construction market by 2018. In the next ten years, China’s construction market is projected to be worth about $2.4 trillion and represent 19.1% of global construction output. Despite India’s continued construction boom, China’s construction market is still projected to be three or four times larger than India’s at the end of the next decade.

At the current pace of growth, China will have 200 modern cities within the next decade. Cities, commercial buildings and shopping malls are all competing against each other largely on the basis of aesthetic appeal. The fact that many of these newly erected commercial structures are designed by foreign architects and interior designers has increased the demand for high-quality innovative materials with unique finishing looks. It is our aim to capture a larger portion of this high-end segment of the market.

At present, we are well positioned to capitalize on this growing demand. Over the past years, the Company has completed numerous high profile projects in Hong Kong and China. Because our main office is strategically situated in Hong Kong, the Company is in close contact with its core customers which are mainly the major Hong Kong and foreign property developers. The Company is also well situated to do business in other major markets in Asia and the Middle East.

- 7 - -

Greatmat Flooring Installed in the Hong Kong Coliseum

Our principal end-markets are high-end shopping malls, buildings and other commercial projects in China, Hong Kong and elsewhere in Asia. In the future, we hope to expand our markets to North America and worldwide. The Company believes that there are excellent growth opportunities for our business within China and the rest of Asia. Despite the economic downturn, it is also our belief that the USA could provide ample opportunities as well. The Company also believes there may be significant business opportunities in other closely related industry segments that it has not yet explored.

Engineered or reconstituted stone is just being introduced and accepted in the Chinese market. Real estate developers are always looking for high-end building materials which can enhance and distinguish the aesthetic appeal of their projects. However, budget is always a concern. This is where we can meet their need as we are able to provide high-end finishing materials at only half the price of some of our competitors, and with faster turnaround times. Furthermore, our customers are increasingly environmentally conscious and our products use recycled materials and can reduce the production of construction waste.

Traditionally, property developers would have only a limited number of choices for their wall or flooring surfaces. If a developer was big enough, perhaps it might be able to commission a manufacturer to produce something unique for them. But this was quite rare and very expensive and time consuming. Therefore, most developers typically choose building materials “off the rack” from a manufacturer’s showroom. Greatmat offers an innovative solution to its corporate clients who want that “special” building material for their signature project, yet at a reasonable cost. We believe that this is a rather revolutionary way of doing business in the building materials industry. Instead of bringing samples to show to the client, Greatmat simply asks the client what they would like to achieve in their flooring or wall design. Then Greatmat can come up with a solution to fulfill the client’s stated wish. We believe that this is one of the reasons why we have been so successful in pitching new projects. In addition, Greatmat keeps raising the bar for its competitors by setting higher and higher standards (even by U.S. standards) for the quality and features of its products. Greatmat also provides a ten year product warranty in writing for all of its products. We believe our novel approach to providing customized solutions for our clients is a win-win situation for both parties. And a major advantage of this model for Greatmat is that Greatmat is not required to hold any inventory of its products.

- 8 - -

A Greatmat Surface Making Use of Discarded Tires

Our Products

Greatmat has developed a new finishing building material by applying a newly modified chemical together with recycled materials such as glass, quartz and other materials. Greatmat has patented and trademarked this new finishing material as “Sani-Crete” stone.

Sani-Crete stone can be use for the exterior and interior of a new or renovated building structure, and can be applied to floors and walls. “Sani-Crete” stone is much stronger than ordinary finishing building materials and is suitable for heavy duty/high traffic area building projects, such as shopping malls, commercial buildings, residential towers and hospitals. Technical test data have shown that Sani-Crete stone products outperform natural stone for durability, hardness and waterproofing. Sani-Crete stone has the added benefit of being “anti-bacterial” and “anti-virus,” making it suitable even for scientific laboratories and hospitals.

Sani-Crete stone can be produced in virtually any color, graphic pattern, surface texture, size and thickness, and can duplicate the appearance of any kind of natural stone pattern, including stones that are no longer naturally available. Our products offer value-added attributes such as high wind velocity resistance and resistance to color fading. Since we can produce and apply all kinds of patterns such as corporate or brand logos onto patterned stone, we believe that there is a good opportunity for us to market our products to the high-end luxury brand market segment.

- 9 - -

Tactile Elements for the Benefit of the Visually Impaired

Graphical Elements Incorporated into a Greatmat Surface

- 10 - -

With a minimum thickness of only 5 millimeters, Sani-Crete stone is well-suited for flooring as well. This thinness provides a large advantage in connection with renovation work because the Sani-Crete surface will not damage most substrates, thereby eliminating the need for taking out the original substrate and creating additional construction waste. Sani-Crete stone can be laid directly on any kind of material surface, such as the ceramic tile, stone and so forth, which can prove to be economical, time-saving and efficient for the renovation process.

Sani-Crete is a co-epoxy based liquid chemical which can be mixed with other elements such as glass or quartz, or applied directly as a functional finishing decorative building material. Sani-Crete stone can be produced in tile form (known as the Sani-Crete Reconstituted Stone) or in liquid form and applied directly on a construction site to be a jointless finishing building material (known as the Sani-Crete H-Series). Sani-Crete stone can also be combined with other solid elements such as bamboo, gold, etc. to form new patterns.

Examples of Greatmat Products with Translucent Effect

Currently, the bulk of our manufactured products belong to the “Quartz” line collection. The Quartz line of products mixes fine quartz or marble with various recycled materials to produce sophisticated textures in various attractive colors. We are currently developing our new “Clone” and “Glow” lines, which may require substantial investments in the near future. We have begun to take orders for our Clone and Glow product lines and we expect to start production in 2011. Our Clone line of products reproduces the appearance of certain natural stones, but typically with a much lower cost and better performance than the original natural stone. Our Glow line of products literally glows by radiating light that they have absorbed and stored, creating a dramatic aesthetic effect as well as providing safety benefits. We are not aware of any other companies making products similar to our Clone and Glow lines in Asia.

- 11 - -

A Kitchen Counter Top Made from Sani-Crete

Our Third-Party Manufacturer

With a view to enhancing the efficiency of our operations, Greatmat has outsourced, and currently intends to continue to outsource, the manufacturing process for all of our products to our third-party manufacturer, Yunfu Changyi Stone Factory, a company located in the PRC. The third-party manufacturer is exclusively engaged in the manufacturing of Greatmat products based on specifications and designs received from Greatmat and does not itself engage in the marketing, sale and distribution of building material products or the production of building material products for anyone other than Greatmat. As a result, there is no competition between Greatmat and its third-party manufacturer with respect to Greatmat’s end-customers. In the interest of efficiency, the Company sometimes engages its third-party manufacturer to carry out research and development activities on its behalf.

The Company’s relationship with its third-party manufacturer is governed by an Exclusive Manufacturing Agreement dated June 30, 2004 between Greatmat Hong Kong and Yunfu, a copy of which is filed as Exhibit 10.1 to this report. Pursuant to the terms of the Exclusive Manufacturing Agreement, during the term of the agreement, the Company is required to use Yunfu exclusively to process its engineered stone, and Yunfu may only provide manufacturing and processing services for the Company’s products. The original term of the Exclusive Manufacturing Agreement ended on June 30, 2009, whereupon the agreement was automatically renewed for an indefinite period. As a result, there is currently no fixed term for the agreement and either party may terminate the agreement at any time. See the Risk Factor below “RISKS RELATED TO OUR BUSINESS—We rely on a single third-party manufacturer to manufacture our products.”

Pursuant to the terms of the Exclusive Manufacturing Agreement, Greatmat provides all of the machines, equipment and packaging, as well as designs and logos and certain specialized materials, to be used in production of its products to Yunfu. Yunfu provides the physical manufacturing facility, utilities and certain basic materials, as well as all of the labor in producing the engineered stone products, and is responsible for meeting the specifications for the products set forth in the work orders, while Greatmat provides management and technical support and retains the right to inspect the production process. Yunfu is responsible for meeting PRC legal requirements with respect to the facility and its workers. The processing fee to be paid by Greatmat to Yunfu is agreed to by both parties when the order is placed, with 30% of such fee payable upon placing the order and 70% due when the final products are inspected and approved. Greatmat is required to order a minimum amount of products from Yunfu each year or pay a sizable penalty. Greatmat has never failed to meet its minimum purchase requirements with Yunfu, nor does it expect any problem in meeting such requirements in the future.

- 12 - -

Our Production Process

Recycled elements, such as quartz, stone or glass are grinded into various sizes of fine powder. Dirt particles in the powder are then taken away by means of filtration while metallic material is removed using magnetic force. Different sizes of the powder are independently mixed to provide different batches of evenly-sized powdered material. They are then mixed together. Sani-Crete co-epoxy base liquid chemical is added and mixed with these powders. The resulting chemical mix will go through a process which includes high pressure compression, vacuum and machine vibration. The semi-finished product is taken out to dry for a few hours. The mold is then taken away and the semi-finished product will be left for 24 hours of cooling. The semi-finished product is then shaved to the requested thickness by a heavy-duty machine. Once the desired thickness is reached, the semi-finished product is polished. “Anti-dirt” coating is applied to the surface. Another layer of protective cover is then added to the surface. The product is then cut to the requested size. Once the final quality control check is done, the finished product is packed and shipped. Greatmat does not install the finished product in the construction project, but will provide developers with referrals to contractors able to install the finished products.

Quality control is an important part of our production process. Greatmat currently employs six employees in the quality control division. These employees are responsible for quality inspections throughout the production processes. All raw materials, semi-finished products and final products are subject to sampling and quality inspection in connection with each stage of processing.

Raw Materials

The main raw materials used in our production process are glass, quartz, and a special mix of adhesives. We purchase most of the raw materials from Chinese suppliers and the raw materials are generally in abundant supply and available from numerous sources. Many of our raw materials are recycled from otherwise unwanted waste materials. The price and availability of raw materials may vary from year to year due to market conditions and production capacities. We do not expect a lack of availability or significant price increases for our raw materials in the foreseeable future. We currently purchase adhesive material from Cathay Coating, a Taiwanese company, and quartz from Dak Wai, a Chinese company.

Energy is also a significant cost in our production. Any increase or material fluctuation in energy and fuel costs could have a material adverse effect on our business, financial condition and results of operations.

Customers

We have about 20 customers and they are all large property developers based in Hong Kong and China. Most of our customers are “blue chip” property developers headquartered in Hong Kong and almost all are publicly listed companies in Hong Kong. In fact, we currently are doing business with five of the six largest property developers in Hong Kong. Currently, our largest customer in terms of sales is Hang Lung Properties, which currently accounts for about 50% of our 2010 sales. Our next two largest customers are China Estate Holdings and Sino Group, which each account for about 20% of our sales.

Currently, about 65% of our sales are to projects in China, about 30% to Hong Kong, and about 5% to other parts of Asia. We are currently planning to increase the percentage of our sales to other parts of Asia in order to reduce our risk related to geographic concentration.

- 13 - -

Contract Pricing

Our work is performed under fixed-price contracts. It typically takes us between one to three months to perform one of our contracts. Under fixed-price contracts, we receive a fixed price. A disadvantage of fixed-price contracts is that we realize a profit only if we control our costs and prevent cost over-runs on the contracts, which can oftentimes be out of our control, such as cost of materials. An advantage of these contracts is that we can adjust the material and technology that we use in the project, as long as we satisfy the requirements of our customer, and there is a potential to benefit from lower costs of materials.

During 2009, we completed about 30 projects, large to small. Our two largest projects were worth approximately $3,300,000 and $800,000 and they accounted for about 62% and 15% of our sales, respectively, for the year ended December 31, 2009. We currently estimate that our three largest projects in 2010 will be worth about $6,500,000, $1,200,000 and $650,000 when completed.

Contract Backlog

As of October 2010, our total backlog of orders considered to be firm was approximately $7.5 million. This is comprised of three different projects; one is a large shopping complex by Hang Lung Properties in China and two are infrastructure projects by the Hong Kong government in Hong Kong.

We define backlog as the total anticipated revenue from projects already begun and upcoming projects for which contracts have been signed or awarded and pending signing. We view backlog as an important statistic in evaluating the level of sales activity and short-term sales trends in our business. However, as backlog is only one indicator, and is not an effective indicator of the ultimate profitability of our sales, we do not believe that backlog should be used as the sole indicator of our future earnings. There can be no assurance that the backlog at any point in time will translate into net revenue in any subsequent period.

Sales and Marketing

Sales

We have a marketing staff of five people, who market primarily to major property developers in Hong Kong. We also have one independent sales representative in China. We believe that we will be better able to satisfy the different needs of our clients by expanding the scope of our offerings in the future. We also believe that we will be better able to market our products abroad by establishing offices in other cities.

Sales managers lead our sales and marketing efforts through our domestic headquarters in Hong Kong. Our sales representatives attempt to maintain relationships with governments, developers, general contractors, architects, engineers, and other potential sources of business to determine potential new projects under consideration. Our sales efforts are further supported by our executive officers and engineering personnel, who have substantial experience in the design, engineering, fabrication, and installation of engineered stone surfaces.

We primarily compete for new project opportunities through our relationships and interaction with our active and prospective customer base, which we believe provides us with valuable current market information and sales opportunities. In addition, we are often contacted by governmental agencies in connection with public construction projects, and by large private-sector project owners and general contractors and engineering firms in connection with new building projects both in China and other countries, often at the recommendation of architects and engineers we have worked with in the past.

Marketing

Management believes that we have developed a reputation for innovative technology and quality in the market for specialty high-end finishing materials. Marketing efforts are geared towards advancing us as a brand of choice for building the world’s most modern and challenging projects. To better showcase our products to potential customers, we plan to exhibit at leading trade shows and exhibitions and are striving to improve our company website.

- 14 - -

Research and Development

Producers of construction materials face strong pressure to respond quickly to industry demands with new designs and product innovations that support rapidly changing technical demand and regulatory requirements. We devote a substantial amount of attention to the research and development of advanced engineered stone materials that meet the demands of project-specific needs while striving to lead the industry in value, materials and processes. We have sophisticated in-house R&D and testing facilities, a highly technical onsite team, and access to highly specialized market research, cooperation with leading research institutions, experienced management, and close relationships with leading materials experts. We currently expend about 5% of our sales on research and development. We bear the cost of our research and development ourselves.

Patents

We rely on a combination of trade secret and patent laws to protect our proprietary technology. We have made substantial investments in improving our manufacturing process which have enabled us to improve the properties of our products and facilitated our development of new products. The Company has received a patent from the Hong Kong government relating to the manufacture of a seamless inlay surface.

Trademarks

Our products are sold under the brands Greatmat and Sani-Crete, which are officially registered trademarks in Hong Kong. We believe that our trademarks are of considerable value to us as they allow our customers to differentiate our products from those of our competitors and allow us to reap the benefits of our marketing efforts. Although the enforceability of trademark rights in the PRC and elsewhere in Asia is somewhat more developed than with respect to patent rights, there is still some risk that we will not be able to stop infringement of such rights.

Employees

At October 30, 2010, we maintained nine full-time corporate staff employees stationed in Hong Kong. There are 120 full-time workers of Chinese nationality in our third-party manufacturer’s facility dedicated exclusively to producing our products, although they are technically not Greatmat’s employees. Our employees are not covered by collective bargaining agreements. We believe that our relationships with our employees are good.

Our Facilities and Property

We do not own or lease any of our production facilities, which are operated by our third-party manufacturer. We have leased our executive offices in Hong Kong under a two-year lease which expires in May 2011. The monthly rental and management fees due under the lease total about HK$18,607 (US$2,385). We are currently looking into alternative office leasing arrangements at the end of our current lease and do not believe that the termination of this lease should have an adverse effect on our business.

Competition

We believe that we are well positioned vis-à-vis our competitors based on our following competitive strengths:

| • | Well known reputation in our market for high quality work |

- 15 - -

| • | High efficiency and resulting low cost |

| • | Ability to expand our customer base in new markets within a relatively short time frame through referrals |

| • | Access to a large pool of engineering talent resulting in technical innovations and strong ability to market and commercialize our technical innovations |

| • | Continual improvement of our product development, product quality and customer service |

| • | Ability to produce higher value-added products |

| • | Ability to expand our production capacity in a relatively short time frame |

We are currently aware of about 30 manufacturers of quartz-based engineered stone in the world. Therefore, supplies are somewhat limited. We estimate that about 80% of these manufacturers target the low-end price-sensitive segment of the market and have little research and development capacity. Interest in this low-end segment of the market has been limited because of the perception that it is capital intensive and offers little potential for profit. Our principal competitors in the market for engineered stone products include mostly imported European manufacturers from Spain and Italy.

We view most of our competitors in the building materials market in Hong Kong and China basically to be trading firms which are inflexible in terms of their product offerings and cost. They obtain their showroom samples from their manufacturer and cannot modify them because their product is mass produced. In contrast, we are able to offer our customers customized solutions based on their specifications and particular needs.

Cyclicality

Our industry is affected by a variety of factors, including fluctuations in new shopping mall projects and volatility in the real estate market. We manage potential risks in the PRC’s volatile market environment by operating in different business segments and serving different customer bases. Operating in different business segments allows us to better cope with the cyclical nature of China’s building material industry. We believe that the combinations of our different business segments (which produce different products and serve different customers) will enabled us to reduce the disruptive effects of such downturns on our sales and operations. In addition, we also intend to expand to other Asian and North American markets in order to reduce our dependency on the China and Hong Kong markets.

Regulation

Because our exclusive third-party contract manufacturer is located in the PRC, our business may be deemed to be to some extent regulated by the national and local laws of the PRC. We believe that our conduct of our business materially complies with existing Hong Kong and PRC laws, rules and regulations.

General Regulation of Businesses

We believe that our third-party contract manufacturer is in material compliance with all applicable labor and safety laws and regulations in the PRC, including the PRC Labor Contract Law, the PRC Production Safety Law, the PRC Regulation for Insurance for Labor Injury, the PRC Unemployment Insurance Law, the PRC Provisional Insurance Measures for Maternity of Employees, PRC Interim Provisions on Registration of Social Insurance, PRC Interim Regulation on the Collection and Payment of Social Insurance Premiums and other related regulations, rules and provisions issued by the relevant governmental authorities from time to time, for their operations in the PRC.

- 16 - -

According to the PRC Labor Contract Law, employers are required to enter into labor contracts with their employees. They are required to pay no less than local minimum wages to their employees. They are also required to provide their employees with labor safety and sanitation conditions satisfying PRC government laws and regulations.

Environmental Matters

Our third-party manufacturer is subject to various pollution control regulations with respect to noise, water and air pollution and the disposal of waste and hazardous materials. They are also subject to periodic inspections by local environmental protection authorities. We are not currently subject to any pending actions alleging any violations of applicable environmental laws or regulations, nor have we been punished or reprimanded for violating any such laws or regulations. We aim to develop our business without compromising environmental protection.

Insurance

We have standard insurance coverage as required by Hong Kong law, including property coverage for our office premises and coverage for our employees in the case of work-related injury. We do not carry liability or business interruption coverage. Insurance companies in Hong Kong offer limited business insurance products. While business interruption insurance is available to a limited extent in Hong Kong, we have determined that the risks of interruption, cost of such insurance and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. As a result, we could face liability from the interruption of our business as summarized under “Risk Factors – Risks Related to Our Business – We do not carry business interruption or other insurance, so we have to bear losses ourselves.”

- 17 - -

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. You should read the section entitled “Special Notes Regarding Forward-Looking Statements” above for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this report.

RISKS RELATED TO OUR BUSINESS

We have a short operating history.

We were founded in 2004. We may not succeed in implementing our business plan successfully because of competition from domestic and foreign market entrants, failure of the market to accept our products, or other reasons. Therefore, you should not place undue reliance on our past performance as they may not be indicative of our future results.

Our senior management lacks experience managing a public company and complying with laws applicable to operating as a U.S. public company.

On October 30, 2010, Greatmat Holdings completed a transaction with Aurum, the result of which was for Greatmat Holdings to become wholly-owned subsidiaries of Aurum, a U.S. public company. At the same time, however, the management of Aurum resigned from its positions within Aurum, and the management of Greatmat became the management of our Company. While the previous management of Aurum had experience in managing a U.S. publicly traded company, the management of Greatmat did not. Prior to the completion of the Share Exchange, Greatmat was operated as a private company located in Hong Kong.

As a result of these transactions, our Company will become subject to laws, regulations and obligations that did not previously apply to it, and our senior management currently has limited experience in complying with such laws, regulations and obligations. For example, we will need to comply with the Nevada laws applicable to companies that are domiciled in that state. By contrast, such senior management is currently experienced in operating the business of Greatmat in compliance with Hong Kong law. Similarly, by virtue of these transactions we will be required to file quarterly and annual reports and to comply with U.S. securities and other laws, which may not have applied to our Company in the past. These obligations can be burdensome and complicated, and failure to comply with such obligations could have a material adverse effect on our company. In addition, we expect that the process of learning about such new obligations as a public company in the United States will require senior management to devote time and resources to such efforts that might otherwise be spent on the operation of the business of selling and producing engineered stone products.

We face risks related to general domestic and global economic conditions and to the current credit crisis.

Our current operating cash flows provide us with stable funding capacity. However, the current uncertainty arising out of domestic and global economic conditions, including the recent disruption in credit markets, poses a risk to the Asian economy, and may impact our ability to manage normal relationships with our customers, suppliers and creditors. If the current situation deteriorates significantly, our business could be materially negatively impacted, as demand for our products may decrease from a slow-down in the general economy, or supplier or customer disruptions may result from tighter credit markets.

- 18 - -

Our business is subject to the health of the PRC, Hong Kong and Asian economies and our growth may be inhibited by the inability of potential customers to fund purchases of our products.

Our products are dependent on the strength of the construction industry in China, Hong Kong and elsewhere in Asia, which could be adversely affected by an economic downturn.

In order to grow at the pace expected by management, we will require additional capital to support our long-term growth strategies. If we are unable to obtain additional capital in future years, we may be unable to proceed with our plans and we may be forced to curtail our operations.

We will require additional working capital to support our long-term growth strategies, which include increasing the number of projects we take on, establishing additional marketing and research facilities, developing additional product lines and engaging in increased promotion of our products and brands. Our working capital requirements and the cash flow provided by future operating activities, if any, may vary greatly from quarter to quarter, depending on the volume of business during the period. We may not be able to obtain adequate levels of additional financing, whether through equity financing, debt financing or other sources. Additional financings could result in significant dilution to our earnings per share or the issuance of securities with rights superior to our currently outstanding securities. In addition, we may grant registration rights to investors purchasing our equity or debt securities in the future. If we are unable to raise additional financing, we may be unable to implement our long-term growth strategies, develop or enhance our products and related brands, take advantage of future opportunities or respond to competitive pressures on a timely basis.

We depend on the leadership and services of Chris Yun Sang SO who is our founder and chief executive officer, and our business and growth prospects may be severely disrupted if we lose his services.

Our future success is dependent upon the continued service of Chris Yun Sang SO, our founder and chief executive officer. We rely on his industry expertise and experience in our business operations, and in particular, his business vision, management skills, and working relationships with our employees and customers. We do not have an employment agreement with Mr. So and he is under no obligation to remain with Greatmat. We do not maintain key-man life insurance for Mr. So. If he is unable or unwilling to continue in his present position or if he joins a competitor or forms a competing company, we may not be able to replace him easily or at all. As a result, our business and growth prospects may be severely disrupted if we lose his services.

If we are unable to attract and retain senior management and qualified technical, research and sales personnel, our operations, financial condition and prospects will be materially adversely affected.

Our future success depends in part on the contributions of our management team and key technical, research and sales personnel and our ability to attract and retain qualified new personnel. In particular, our success depends on the continuing employment of our Chief Executive Officer, Chris Yun Sang SO, our General Manager, Carol Lai Ping HO, and our Marketing Director, Rick Chun Wah TSE. We do not have employment agreements with any of our management personnel or employees. There is significant competition in our industry for qualified managerial, technical, research and sales personnel and we cannot assure you that we will be able to retain our key senior managerial, technical, research and sales personnel or that we will be able to attract, integrate and retain other such personnel that we may require in the future. If we are unable to attract and retain key personnel in the future, our business, operations, financial condition, results of operations and prospects could be materially adversely affected.

- 19 - -

We rely on a single third-party manufacturer to manufacture our products.

We depend on a single contract manufacturer to manufacture the products that we sell. Any significant problems at our third-party manufacturer’s production facility could impact our ability to deliver our products. If this contract manufacturer is unable to maintain adequate manufacturing and shipping capacity, it may be unable to provide us with timely delivery of products of acceptable quality. Our inability to meet our customers’ demand for our products could have a material adverse impact on our business, financial condition and results of operations. In addition, if the prices charged by this contractor increase for reasons such as increases in labor costs or currency fluctuations, our cost of manufacturing would increase, adversely affecting our results of operations. We also depend on third parties to transport and deliver our products. Due to the fact that we do not have any independent transportation or delivery capabilities of our own, if these third parties are unable to transport or deliver our products for any reason, or if they increase the price of their services, including as a result of increases in the cost of fuel, our operations and financial performance may be adversely affected.

We require our contract manufacturer to meet our standards in terms of product quality and other matters. Any failure by our contract manufacturer to meet these standards, to adhere to labor or other laws or to diverge from our mandated practices, and the potential negative publicity relating to any of these events, could harm our business and reputation.

Our agreement with our contract manufacturer is terminable at will by either party. To the extent we are unable to maintain or secure relationships with quality manufacturers, our business could be harmed.

The interests of our third-party manufacturer may diverge from ours, and we may not have the ability to make it act in a manner consistent with our best interests.

Our business relationship with our third-party manufacturer does not allow us to control its actions in the way that we could if we owned it. Although we are currently operating under an exclusive manufacturing agreement that prohibits them from competing with us, this agreement may be terminated at any time by either party. As a result, we may not be able to prevent our exclusive manufacturer from engaging in activities or pursuing strategic objectives that conflict with our interests or strategic objectives. Our ability to influence or control its business depends on the nature of our contractual relationship. We are not entitled to participate in the management of our exclusive manufacturer.

If we are unable to accurately estimate and control our contract costs and timelines, then we may incur losses on our contracts, which may result in decreases in our operating margins and in a significant reduction or elimination of our profits.

If we do not control our contract costs, we may be unable to maintain positive operating margins or experience operating losses. All of our sales are from fixed-price contracts. Under fixed-price contracts, we receive a fixed price. Consequently, we realize a profit on fixed-price contracts only if we control our costs and prevent cost over-runs on the contracts. If we are unable to estimate and control costs and/or project timelines, we may incur losses on our contracts, which may result in decreases in our operating margins and in a significant reduction or elimination of our profits.

We depend on a small number of customers for the vast majority of our sales. A reduction in business from any of these customers could cause a significant decline in our sales and profitability.

The large majority of our sales are generated from a small number of customers. Currently, our largest customer in terms of sales is Hang Lung Properties, which currently accounts for about 50% of our 2010 sales. Our next two largest customers are China Estate Holdings and Sino Group, which each account for about 20% of our sales. We expect that we will continue to depend upon a small number of customers for a significant majority of our sales for the foreseeable future. A reduction in business from any of these customers could cause a significant decline in our sales and profitability.

- 20 - -

Our operations rely on a continuous power supply and the ready availability of utilities and any shortages or interruptions could disrupt our operations and increase our expenses.

The manufacture of our products relies on a continuous and uninterrupted supply of electric power, water and natural gas, as well as waste and emission discharge facilities. Any shortage, interruption or discharge curtailment would significantly disrupt our operations and increase our expenses although we have backup generators or alternate sources of power to support our production in the event of a blackout. In addition, our insurance coverage does not extend to any damage resulting from interruption in our power supply. Any interruption in our ability to continue operations at our facilities could damage our reputation, harm our ability to retain existing customers or obtain new customers and could result in severe loss, any of which could have a material adverse affect on our business, financial condition and/or results of operations.

Increases in energy and fuel costs would have a material adverse effect on our business, financial conditions and results of operations.

Energy is a significant cost in our production. Any increase or material fluctuation in energy and fuel costs could have a material adverse effect on our business, financial condition and/or results of operations.

We may not be able to realize our expected production capacity increase to reap the full economic benefits of our increased sales.

If we fail to obtain our desired production output levels from our third-party manufacturer due to insufficient funding, technical difficulties, human or other resource constraints, or for whatever other reasons, we may not be able to attain our desired production capacity or obtain the intended economic benefits of our increased sales, such as economies of scales, in a full or timely manner, which may adversely affect our business, results of operations and/or financial conditions.

We may incur substantial costs as a result of warranty and product liability claims which could have an adverse effect on our results of operations.

The development, manufacture, sale and use of our products involve risks of warranty and product liability claims. We provide a ten-year warranty for all of our products. Warranty and product liability claims would not be covered by our insurance. Warranties of such an extended length pose a risk to us of unanticipated future expenses. In the past, we have corrected any problems with respect to our products by repairing or replacing the product in issue with minimal expense. Historically, we have not recorded any warranty expense as we have incurred minimal expense related to warranty claims. We may be required to record material expense in the future if actual costs for these warranties are different from our assumptions.

Insurance companies in Hong Kong offer limited business insurance products and offer business limited liability insurance. While business disruption insurance is available to a limited extent in Hong Kong, we have determined that the risks of disruption, cost of such insurance and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. As a result, we do not have any business liability, disruption or litigation insurance coverage for our operations in Hong Kong SAR, Macau SAR or the PRC. Any business disruption or litigation may result in our incurring substantial costs and the diversion of resources.

- 21 - -

Our quarterly operating results are likely to fluctuate, which may affect our stock price.

Our quarterly revenues, expenses, operating results and gross profit margins vary from quarter to quarter. As a result, our operating results may fall below the expectations of securities analysts and investors in some quarters, which could result in a decrease in the market price of our common stock. The reasons our quarterly results may fluctuate include:

| · | variations in profit margins attributable to different production contracts; |

| · | changes in the general competitive and economic conditions; |

| · | delays in, or uneven timing in the delivery of, customer orders; and |

| · | the introduction of new products by us or our competitors. |

Period to period comparisons of our results should not be relied on as indications of future performance.

Our limited ability to protect our intellectual property, and the possibility that our technology could inadvertently infringe technology owned by others, may adversely affect our ability to compete.

We rely on a combination of patents, trademarks and trade secret laws to protect the technological know-how and brands that comprise our intellectual property. A successful challenge to the ownership of our intellectual property could materially damage our business prospects. Our competitors may assert that our technologies or products infringe on their patents or proprietary rights. We may be required to obtain from others licenses that may not be available on commercially reasonable terms, if at all. Problems with intellectual property rights could increase the cost of our products or delay or preclude our new product development and commercialization. If infringement claims against us are deemed valid, we may not be able to obtain appropriate licenses on acceptable terms or at all. Litigation could be costly and time-consuming but may be necessary to protect our technology license positions or to defend against infringement claims.

Our business may be subject to seasonal and cyclical fluctuations in sales.

We may experience seasonal fluctuations in our revenue. Moreover, our revenues are usually slightly higher in the third and fourth quarters due to seasonal purchases.

RISKS RELATED TO DOING BUSINESS IN CHINA

Changes in China's political or economic situation could harm us and our operating results.

All of our business operations are currently conducted in Hong Kong, under the jurisdiction of the Hong Kong SAR, Macau SAR and PRC governments. All of our products are manufactured by our sole manufacturer in the PRC, and we sell the majority of our products to customers in the PRC. Accordingly, our results of operations, financial condition and prospects are subject to a significant degree to economic, political and legal developments in China. However, economic reforms adopted by the Chinese government have had a positive effect on the economic development of the country, but the government could change these economic reforms or any of the legal systems at any time. This could either benefit or damage our operations and profitability. Some of the things that could have this effect are:

| · | Level of government involvement in the economy; |

- 22 - -

| · | Control of foreign exchange; |

| · | Methods of allocating resources; |

| · | Balance of payments position; |

| · | International trade restrictions; and |

| · | International conflict. |

The Chinese economy differs from the economies of most countries belonging to the Organization for Economic Cooperation and Development, or OECD, in many ways. For example, state-owned enterprises still constitute a large portion of the Chinese economy and weak corporate governance and a lack of flexible currency exchange policy still prevail in China. As a result of these differences, we may not develop in the same way or at the same rate as might be expected if the Chinese economy was similar to those of the OECD member countries.

Payments from our customers in China are denominated in Hong Kong Dollars. The value of RMB and the Hong Kong Dollar against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in political and economic conditions. Although the exchange rate between RMB and the U.S. dollar has been effectively pegged by the People’s Bank of China since 1994, and the rate between the Hong Kong Dollar has been pegged to the U.S. dollar since 1983, there can be no assurance that these currencies will remain pegged to the U.S. dollar, especially in light of the significant international pressure on the Chinese government to permit the free floatation of the RMB, which would result in fluctuations in the exchange rate between the RMB and the U.S. dollar. In addition, a strengthening of the U.S. dollar against the Hong Kong Dollar, if it occurred, would adversely affect the value of your investment.

You may face difficulties in protecting your interests, and your ability to protect your rights through the U.S. federal courts may be limited because our subsidiaries are incorporated in non-U.S. jurisdictions, we conduct substantially all of our operations in Hong Kong, and all of our officers reside outside the United States.

Although we are incorporated in Nevada, we conduct substantially all of our operations through our wholly owned subsidiaries in Hong Kong. All of our officers reside outside the United States and some or all of the assets of those persons are located outside of the United States. As a result, it may be difficult or impossible for you to bring an action against us or against these individuals in Hong Kong in the event that you believe that your rights have been violated under U.S. securities laws or otherwise. Even if you are successful in bringing an action of this kind, the laws of Hong Kong may render you unable to enforce a judgment against our assets or the assets of our directors and officers.

The PRC government exerts substantial influence over the manner in which we must conduct our business activities.

The PRC government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to the construction industry, taxation, import and export tariffs, environmental regulations, land use rights, property and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

- 23 - -

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures.

Future inflation in China may inhibit our ability to conduct business in China.

In recent years, the Chinese economy has experienced periods of rapid expansion and highly fluctuating rates of inflation. During the past ten years, the rate of inflation in China has been as high as 20.7% and as low as -2.2%. These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products and our Company.

We may be exposed to liabilities under the Foreign Corrupt Practices Act and Chinese anti-corruption laws, and any determination that we violated these laws could have a material adverse effect on our business.

We are subject to the Foreign Corrupt Practice Act, or FCPA, and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers as defined by the statute, for the purpose of obtaining or retaining business. We have operations, agreements with third parties and we make many of our sales in China. PRC also strictly prohibits bribery of government officials. Our activities in China create the risk of unauthorized payments or offers of payments by the employees, consultants, sales agents or distributors of our Company, even though they may not always be subject to our control. It is our policy to implement safeguards to discourage these practices by our employees. However, our existing safeguards and any future improvements may prove to be less than effective, and the employees, consultants, sales agents or distributors of our Company may engage in conduct for which we might be held responsible. Violations of the FCPA or Chinese anti-corruption laws may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition. In addition, the U.S. government may seek to hold our Company liable for successor liability FCPA violations committed by companies in which we invest or that we acquire.

The outbreak of epidemics may have a material adverse effect on our business, financial condition and results of operations.

Certain areas of the PRC are susceptible to epidemics. An outbreak of any epidemics in the PRC, such as Severe Acute Respiratory Syndrome or avian flu, might result in material disruptions to the operations of the company or demand for its products, which in turn would adversely affect the Company’s results of operations and financial condition.

RISKS RELATED TO THE MARKET FOR OUR STOCK GENERALLY

Our common stock is quoted on the inter-dealer electronic quotation and trading system maintained by Pink OTC Markets Inc., which may have an unfavorable impact on our stock price and liquidity.

Our common stock is quoted on the inter-dealer electronic quotation and trading system maintained by Pink OTC Markets Inc. (the “Pink Sheets”), which is a significantly more limited market than established trading markets such as the New York Stock Exchange or NASDAQ. The quotation of our shares on the Pink Sheets may result in a less liquid market available for existing and potential shareholders to trade shares of our common stock, could depress the trading price of our common stock and could have a long-term adverse impact on our ability to raise capital in the future. We plan to list our common stock as soon as practicable. However, we cannot assure you that we will be able to meet the initial listing standards of any stock exchange, or that we will be able to maintain any such listing.

- 24 - -

We may be subject to penny stock regulations and restrictions and you may have difficulty selling shares of our common stock.

The SEC has adopted regulations which generally define so-called “penny stocks” to be an equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exemptions. Our common stock is a “penny stock” and is subject to Rule 15g-9 under the Exchange Act, or the Penny Stock Rule. This rule imposes additional sales practice requirements on broker-dealers that sell such securities to persons other than established customers and “accredited investors” (generally, individuals with a net worth in excess of $1,000,000 or annual incomes exceeding $200,000, or $300,000 together with their spouses). For transactions covered by Rule 15g-9, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser's written consent to the transaction prior to sale. As a result, this rule may affect the ability of broker-dealers to sell our securities and may affect the ability of purchasers to sell any of our securities in the secondary market, thus possibly making it more difficult for us to raise additional capital.

There can be no assurance that our common stock will qualify for exemption from the Penny Stock Rule. In any event, even if our common stock were exempt from the Penny Stock Rule, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the SEC the authority to restrict any person from participating in a distribution of penny stock, if the SEC finds that such a restriction would be in the public interest.

Provisions in our Articles of Incorporation and Bylaws or Nevada law might discourage, delay or prevent a change of control of us or changes in our management and, therefore depress the trading price of the common stock.

Nevada corporate law and our Articles of Incorporation and Bylaws contain provisions that could discourage, delay or prevent a change in control of our Company or changes in its management that our stockholders may deem advantageous. These provisions:

| · | deny holders of our common stock cumulative voting rights in the election of directors, meaning that stockholders owning a majority of our outstanding shares of common stock will be able to elect all of our directors; |

| · | require any stockholder wishing to properly bring a matter before a meeting of stockholders to comply with specified procedural and advance notice requirements; and |

| · | allow any vacancy on the board of directors, however the vacancy occurs, to be filled by the directors. |

- 25 - -

We do not intend to pay dividends for the foreseeable future.

Aurum has never paid any dividends to its shareholders. Prior to our reverse acquisition of Greatmat, Greatmat Hong Kong declared and paid an interim dividend of $115,385 to its shareholder at June 28, 2010. For the foreseeable future, Aurum intends to retain any further earnings to finance the development and expansion of our business, and we do not anticipate paying any cash dividends on our common stock. Accordingly, investors must be prepared to rely on sales of their common stock after price appreciation to earn an investment return, which may never occur. Investors seeking cash dividends should not purchase our common stock. Any determination to pay dividends in the future will be made at the discretion of our board of directors and will depend on our results of operations, financial condition, contractual restrictions, restrictions imposed by applicable law and other factors our board deems relevant.

Our controlling stockholder holds a significant percentage of our outstanding voting securities, which could hinder our ability to engage in significant corporate transactions without his approval.

Mr. Chris Yun Sang SO is the beneficial owner of approximately 75% of our outstanding voting securities. As a result, he possesses significant influence, giving him the ability, among other things, to elect a majority of our board of directors and to authorize or prevent proposed significant corporate transactions. His ownership and control may also have the effect of delaying or preventing a future change in control, impeding a merger, consolidation, takeover or other business combination or discourage a potential acquirer from making a tender offer.

If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud.

We are subject to reporting obligations under the U.S. securities laws. The Securities and Exchange Commission (“SEC”), as required by Section 404 of the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley Act”), adopted rules requiring every public company to include a management report on such company’s internal controls over financial reporting in its annual report, which contains management’s assessment of the effectiveness of the company’s internal controls over financial reporting. Our management may conclude that our internal controls over our financial reporting are not effective. Our reporting obligations as a public company will place a significant strain on our management, operational, and financial resources and systems for the foreseeable future. Effective internal controls, particularly those related to revenue recognition, are necessary for us to produce reliable financial reports and are important to help prevent fraud. As a result, our failure to achieve and maintain effective internal controls over financial reporting could result in the loss of investor confidence in the reliability of our financial statements, which in turn could harm our business and negatively impact the trading price of our stock. Furthermore, we anticipate that we will incur considerable costs and use significant management time and other resources in an effort to comply with Section 404 and other requirements of the Sarbanes-Oxley Act.

We will incur increased costs as a result of being a public company.

As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. In addition, the Sarbanes-Oxley Act, as well as new rules subsequently implemented by the SEC, have required changes in corporate governance practices of public companies. We expect these new rules and regulations to increase our legal, accounting and financial compliance costs and to make certain corporate activities more time-consuming and costly. In addition, we will incur additional costs associated with our public company reporting requirements. We are currently evaluating and monitoring developments with respect to these new rules, and we cannot predict or estimate the amount of additional costs we may incur, or the timing of such costs.

- 26 - -

The following discussion of our Company’s plan of operation, financial condition and results of operation should be read in conjunction with the consolidated financial statements and the notes thereto included in this Form 8-K.

Overview

Greatmat was established in May 2004 and is a leading innovative building material company that provides customers with customized designs, manufacturing solutions and technical advice for building projects. In particular, Greatmat is a supplier of high-quality engineered stone floor and wall surfaces to commercial construction projects in China, Hong Kong and elsewhere in Asia. Our principal business consists of the design, research and development and production of engineered stone for installation in construction projects. Our company headquarters and main sales office is located in Hong Kong.