BBV VIETNAM S.E.A. ACQUISITION CORP.

61 Hue Lane

Hai Ba Trung District

Hanoi, Vietnam

PROXY STATEMENT

To the Stockholders of BBV Vietnam S.E.A. Acquisition Corp.:

You are cordially invited to attend the Special Meeting of Stockholders of BBV Vietnam S.E.A. Acquisition Corp. (the “Company”, “BBV”, “we”, “us” or “our”) at 10:00 a.m. Eastern time on April 14, 2010 at the offices of Ellenoff Grossman & Schole LLP, 150 East 42nd Street, 11th Floor, New York, New York, 10017.

At the Special Meeting of Company stockholders, Company stockholders will be asked to consider and vote on the following proposals:

(i) to approve the merger of Pharmanite, Inc. (“Pharmanite”), a recently-formed Delaware corporation and wholly-owned subsidiary of Migami, Inc., a Nevada corporation (“Migami”), with BBV Sub, Inc., a recently-formed Delaware corporation and wholly-owned subsidiary of the Company (“BBV Sub”), with Pharmanite surviving as a wholly-owned subsidiary of the Company, as a result of which Migami will transfer all of the outstanding capital stock of Pharmanite to the Company in exchange for 9,706,250 newly issued shares of the Company’s common stock (the “Transaction”), pursuant to the terms of a Merger Agreement and Plan of Reorganization, dated February 27, 2010, by and among the Company, BBV Sub, Migami and Pharmanite (the “Merger Agreement”), and the transactions contemplated thereby (the “Merger Proposal”);

(ii) to approve an amendment to the Company’s amended and restated articles of incorporation to change the name of the Company to “Pharmanite Holdings, Inc.” (the “Name Change Proposal”);

(iii) to approve an amendment to the Company’s amended and restated articles of incorporation to increase the authorized capital of the Company from 51,000,000 shares, consisting of 50,000,000 shares of common stock, par value $0.0001 per share (the “Common Stock”), and 1,000,000 shares of preferred stock, par value $0.0001 per share (the “Preferred Stock”), to 101,000,000 shares, consisting of 100,000,000 shares of Common Stock and 1,000,000 shares of Preferred Stock (the “Increase in Authorized Proposal”); and

(iv) to approve separately certain amendments to the Company’s amended and restated articles of incorporation to eliminate certain special purpose acquisition company provisions therein (collectively, the “Elimination Proposals”).

Each of these proposals is more fully described in the accompanying proxy statement.

Enclosed please find notices of the Special Meeting and a proxy statement containing detailed information concerning the Merger Agreement and the transactions contemplated thereby, and the proposed amendments to the amended and restated articles of incorporation. Whether or not you plan to attend the Special Meeting, we urge you to read this material carefully.

After careful consideration, the board of directors of the Company recommends that stockholders vote or give instruction to vote “FOR” the approval of the Merger Proposal and the other proposals to be presented at the Special Meeting of Stockholders.

Please be aware that if the Merger Proposal is approved and the Transaction is completed, each holder of shares purchased in the Company’s initial public offering or in the aftermarket who votes such shares “AGAINST” the Transaction may, in connection with casting such vote, elect to redeem those shares for cash.

Your vote is important. Whether or not you plan to attend the Special Meeting of Stockholders, please sign, date and return the enclosed proxy card as soon as possible in the envelope provided. A signed proxy card that is returned without an indication of how to vote on a particular matter will be voted “FOR” each such proposal presented at the Special Meeting of Stockholders.

We look forward to seeing you at the Special Meeting.

| | Sincerely, |

| | |

| | /s/ Eric M. Zachs |

| | |

| | Eric M. Zachs |

| | President |

March 29, 2010

Neither the Securities and Exchange Commission nor any state regulatory agency has approved or disapproved of the Transaction, passed upon the merits or fairness of the Transaction or passed upon the adequacy or accuracy of the disclosure in the attached proxy statement. Any representation to the contrary is a criminal offense.

BBV VIETNAM S.EA. ACQUISITION CORP.

61 Hue Lane

Hai Ba Trung District

Hanoi, Vietnam

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 14, 2010

To the Stockholders of BBV Vietnam S.E.A. Acquisition Corp.:

NOTICE IS HEREBY GIVEN that the Special Meeting of Stockholders (the “Special Meeting of Stockholders”) of BBV Vietnam S.E.A. Acquisition Corp. (the “Company”, “BBV”, “we”, “us”, “our” or similar terminology), a company organized under the laws of the Republic of the Marshall Islands, will be held at 10:00 a.m. New York time, on April 14, 2010 at the offices of Ellenoff Grossman & Schole LLP at 150 East 42nd Street, 11th Floor, New York, New York 10017. You are cordially invited to attend the Special Meeting of Stockholders, at which meeting stockholders will be asked to consider and vote upon the following proposals, which are more fully described in the accompanying proxy statement:

(1) The Merger Proposal — to consider and vote upon a proposal to approve the merger of Pharmanite, Inc. (“Pharmanite”), a recently-formed Delaware corporation and wholly-owned subsidiary of Migami, Inc., a Nevada corporation (“Migami”), with BBV Sub, Inc., a recently-formed Delaware corporation and wholly-owned subsidiary of the Company (“BBV Sub”), with Pharmanite surviving as a wholly-owned subsidiary of the Company, as a result of which Migami will transfer all of the outstanding capital stock of Pharmanite to the Company in exchange for 9,706,250 newly issued shares of the Company’s common stock (the “Transaction”), pursuant to the terms of a Merger Agreement and Plan of Reorganization, dated February 27, 2010, by and among the Company, BBV Sub, Migami and Pharmanite (the “Merger Agreement”), and the transactions contemplated thereby, including the transfer by Migami of all of its assets and liabilities to Pharmanite immediately prior to the closing of the Transaction (“Proposal 1”or the “Merger Proposal”);

(2) The Name Change Proposal — to consider and vote upon a proposal to adopt an amendment to the Company’s amended and restated articles of incorporation to change the Company’s corporate name to “Pharmanite Holdings, Inc.” (“Proposal 2” or the “Name Change Proposal”);

(3) The Increase in Authorized Proposal — to consider and vote upon a proposal to adopt an amendment to the Company’s amended and restated articles of incorporation to increase the authorized capital stock of BBV from 51,000,000 shares consisting of 50,000,000 shares of common stock, par value $0.0001 per share (the “Common Stock”), and 1,000,000 shares of preferred stock, par value $0.0001 per share (the “Preferred Stock”), to 101,000,000 shares, consisting of 100,000,000 shares of Common Stock and 1,000,000 shares of Preferred Stock, with a portion of such shares being issued to the stockholders of Migami in connection with the Transaction (“Proposal 3” or the “Increase in Authorized Proposal”);

(4) The Elimination Proposals — to consider and vote upon the following separate proposals to amend the Company’s amended and restated articles of incorporation to eliminate certain special purpose acquisition company provisions: (i) to remove the provisions related to the Company’s status as a blank check company, including, among other things, the classification of the board of directors and (ii) to make the Company’s corporate existence, which currently terminates on February 13, 2011, perpetual (collectively “Proposal 4” or the “Elimination Proposals”); and

(5) to conduct such other business as may properly come before the Special Meeting of Stockholders or any adjournment or postponement thereof.

These proposals are described in the attached proxy statement which the Company urges you to read in its entirety before voting.

The board of directors has fixed the close of business on February 19, 2010 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of and to vote at the Special Meeting of Stockholders and at any adjournment thereof. As of the Record Date, there were 5,237,684 shares of Common Stock issued and outstanding and entitled to vote at the Special Meeting of Stockholders.

Each Company stockholder as of the Record Date that holds shares of Common Stock (“IPO Shares”) issued in the Company’s initial public offering (the “IPO”) that votes against the Merger Proposal may elect that the Company redeem such stockholder’s shares into cash equal to a pro rata portion of the funds held in the Company’s trust account into which a substantial portion of the net proceeds of the IPO were deposited. These shares will be redeemed into cash only if the Transaction is consummated.

On February 8, 2010, the Company entered into definitive stock purchase agreements (the “Stock Purchase Agreements”) with certain investors (the “Investors”) pursuant to which the Investors purchased an aggregate of 3,682,689 IPO Shares (the “Extension Shares”) through independent, privately negotiated transactions with third parties, representing approximately 71% of the total IPO Shares. The purchases occurred prior to the Company’s special meeting of stockholders held on February 12, 2010 (the “Extension Meeting”) for the purpose of voting upon a proposal to extend the date on or prior to which the Company must consummate its initial business combination from February 13, 2010 until February 13, 2011 (the “Extension Proposal”). Stockholders of the Company approved the Extension Proposal at the Extension Meeting and stockholders representing 23.79% of the IPO Shares (or 1,231,066 IPO Shares) sought redemption of their shares into a pro rata portion of the trust account.

Pursuant to the Stock Purchase Agreements, the Company agreed to purchase the Extension Shares from the Investors using proceeds from the trust account in an amount not to exceed the per share amount then held in trust, upon certain terms and conditions. Further, the Investors agreed to irrevocably grant each of John Park, Migami’s chief executive officer, and Eric Zachs, our President, proxies to vote the Extension Shares at the Extension Meeting and at the Special Meeting of Stockholders. As a result of the Company’s agreement with the Investors to consummate the closing of the Stock Purchase Agreements no later than April 19, 2010, the board of directors may be required to liquidate the Company in the event the Transaction is not consummated by such date if it is required to use the proceeds from the trust account to satisfy its obligations under the Stock Purchase Agreements. In the event the Company is able to obtain funds or otherwise satisfy its obligations under the Stock Purchase Agreements from other sources, the board of directors may determine to continue the Company’s corporate existence until February 13, 2011, even if the Merger Proposal is not approved.

Under the Company’s amended and restated articles of incorporation, approval of the Merger Proposal requires: (i) the affirmative vote of a majority of the shares of the Common Stock voted at the Special Meeting of Stockholders, assuming a quorum is established; and (ii) that less than 30% of the IPO shares vote against the Merger Proposal (such percentage inclusive of stockholders representing 23.79% of the IPO Shares who already voted against the Extension Proposal and exercised their redemption rights at the Extension Meeting). Taking into account the redemption of the 1,231,066 IPO Shares in connection with the Extension Meeting, the Investors currently own approximately 93% of the IPO Shares outstanding as of the Record Date. The Investors have given John Park and Eric Zachs proxies to vote such shares, assuming satisfaction by BBV and Migami of certain conditions. Messrs. Park and Zachs have indicated their intention to vote such shares in favor of the Merger Proposal. Accordingly, it is expected there will be (i) an affirmative vote of the majority of the Common Stock in favor of the Merger Proposal and (ii) less than 30% of the IPO Shares voting, in the aggregate, against the Extension Proposal and the Merger Proposal. The affirmative vote of a majority of the shares of the Common Stock issued and outstanding as of the Record Date is required to approve the Name Change Proposal, the Increase in Authorized Proposal and each of the Elimination Proposals.

Each of the Name Change Proposal, the Increase in Authorized Proposal and the Elimination Proposals are conditioned upon the approval of the Merger Proposal, and in the event the Merger Proposal does not receive the necessary vote to approve such proposal, then the Company will not complete any of the items identified in any of the proposals. If the Merger Proposal is approved but one or more of the Name Change Proposal, the Increase in Authorized Proposal or the Elimination Proposals are not approved, we may still consummate the Transaction if the Company and Migami waive these conditions.

The Company will not transact any other business at the Special Meeting of Stockholders, except for business properly brought before the Special Meeting of Stockholders, or any adjournment or postponement thereof, by the board of directors.

The Company’s founders, initial shareholders, directors, executive officers and their affiliates presently own an aggregate of 1,293,750 shares of Common Stock which they purchased prior to the IPO, or approximately 24.7% of the outstanding shares of the Company (after giving effect to the redemption of 23.79% of the IPO Shares in connection with the Extension Meeting). They have agreed to vote all such shares in accordance with the majority of the IPO Shares with respect to the Merger Proposal. However, any shares they purchased or may purchase in the open market will be voted in favor of all of the proposals set forth herein.

If the Merger Proposal is not approved and the Company is unable to complete a business combination or similar agreement by February 13, 2011 (or April 19, 2010 as set forth above), the Company will have to commence the winding up, dissolution and liquidation of the Company, including the liquidation of the trust account and distribution of the trust proceeds, in accordance with the terms of the Company’s amended and restated articles of incorporation, the agreement with respect to the trust and the corporate law of the Republic of the Marshall Islands.

On February 13, 2008, BBV consummated its initial public offering (the “IPO”) of 4,500,000 units consisting of one share of common stock, par value $0.0001 per share (the “Common Stock”) and one warrant to purchase one share of Common Stock (the “Warrants” and collectively with the Common Stock as originally issued in the IPO, the “Units”) and the concurrent sale of 675,000 Units in connection with the exercise by the underwriters of their over-allotment option. Ladenburg Thalmann & Co. Inc. and Chardan Capital Markets, LLC acted as joint bookrunning managers of the IPO and as the joint representatives of the underwriters of the IPO. Ladenburg, Chardan and other underwriters and advisors of the Company may provide assistance to the Company and its directors and executive officers, and may be deemed to be participants in the solicitation of proxies. A total of $1,449,000 of the underwriters’ discounts and commissions relating to the Company’s IPO was deferred pending stockholder approval of the Company’s initial business combination and all or a portion of such amount will be released to the underwriters upon consummation of the business combination. If the business combination is not consummated and the Company is required to be liquidated, the underwriters will not receive any such fees. Stockholders are therefore advised that the underwriters have a financial interest in the successful outcome of the proxy solicitation.

If you return your proxy card without an indication of how you wish to vote, your shares will be voted IN FAVOR of each of the proposals and you will not be eligible to have your shares redeemed into a pro rata portion of BBV’s trust account.

In order to properly exercise your redemption rights, you must (i) vote against the Merger Proposal and demand that BBV redeem your shares for cash from the trust account no later than the close of the vote on the Merger Proposal, and (ii) tender your shares to BBV’s stock transfer agent prior to the Special Meeting of Stockholders. You may tender your stock by either delivering your stock certificate to the transfer agent or by delivering your shares electronically using the Depository Trust Company’s DWAC (Deposit Withdrawal at Custodian) system. If the Transaction is not completed, these tendered shares will not be redeemed for cash and you will continue to own your shares. If you hold the shares in street name, you will need to instruct the account executive at your bank or broker to withdraw the shares from your account in order to exercise your redemption rights. See “Special Meeting of BBV Stockholders — Redemption Rights” for more specific instructions.

We may amend or supplement the enclosed proxy statement from time to time by filing amendments or supplements as required.

YOU SHOULD CAREFULLY CONSIDER THE MATTERS DISCUSSED UNDER THE HEADING “RISK FACTORS” BEGINNING ON PAGE 47 OF THE ACCOMPANYING PROXY STATEMENT BEFORE VOTING IN CONNECTION WITH THE TRANSACTION SINCE, UPON THE CLOSING OF THE TRANSACTION, THE OPERATIONS AND ASSETS OF THE COMPANY WILL LARGELY BE THOSE OF MIGAMI.

If you give a proxy, you may revoke it at any time before it is exercised by doing any one of the following: (i) you may send another proxy card with a later date; (ii) you may notify Eric Zachs, in writing, before the Special Meeting of Stockholders that you have revoked your proxy; or (iii) you may attend the Special Meeting of Stockholders, revoke your proxy and vote in person, as indicated above.

No appraisal rights are available under the Marshall Islands Business Corporations Act, or BCA, to the stockholders of BBV in connection with the proposals. Any holder of IPO Shares who votes against the Merger Proposal may, at the same time, demand that BBV redeem his shares into a pro rata portion of the trust account.

We are soliciting the proxy on behalf of the board of directors, and we will pay all costs of preparing, assembling and mailing the proxy materials. In addition to mailing out proxy materials, the Company’s officers may solicit proxies by telephone or fax, without receiving any additional compensation for their services. We will publicly file all such written soliciting materials, including scripts and outlines used to solicit proxies by telephone, with the SEC. We have requested brokers, banks and other fiduciaries to forward proxy materials to the beneficial owners of our stock. We have also retained the proxy soliciting firm of Advantage Proxy to solicit proxies on our behalf. If you have any questions or need assistance in voting your shares, please contact Advantage Proxy toll free at (877) 870-8565.

Your vote is important. Please sign, date and return your proxy card as soon as possible to make sure that your shares are represented at the Special Meeting of Stockholders. If you are a stockholder of record of the Common Stock, you may also cast your vote in person at the Special Meeting of Stockholders. If your shares are held in an account at a brokerage firm or bank, you must instruct your broker or bank on how to vote your shares.

The board of directors recommends that you vote or give instruction to vote “FOR” all of the proposals, all as described in the accompanying proxy statement.

This proxy statement is dated March 29, 2010 and is first being mailed to stockholders on or about March 29, 2010.

| | BY ORDER OF THE BOARD OF DIRECTORS, |

| | |

| | /s/ Eric M. Zachs |

| | |

| | Eric M. Zachs |

| | President |

March 29, 2010

PROXY STATEMENT FOR SPECIAL MEETING

OF STOCKHOLDERS OF

BBV VIETNAM S.E.A. ACQUISITION CORP.

We are pleased to announce that the board of directors of each of BBV Vietnam S.E.A. Acquisition Corp. (the “Company”, “BBV”, “we”, “us”, or “our”) and Migami, Inc., a Nevada corporation (“Migami”), has agreed to the merger of Pharmanite, Inc. (“Pharmanite”), a recently-formed Delaware corporation and wholly-owned subsidiary of Migami, with BBV Sub, Inc., a recently-formed Delaware corporation and wholly-owned subsidiary of the Company (“BBV Sub”), with Pharmanite surviving as a wholly-owned subsidiary of the Company, as a result of which Migami will transfer all of the outstanding capital stock of Pharmanite to the Company in exchange for 9,706,250 newly issued shares of the Company’s common stock (the “Transaction”).

We are a special purpose acquisition company organized under the laws of the Republic of the Marshall Islands on August 8, 2007. We were formed for the purpose of acquiring, or acquiring control of, one or more operating businesses having their primary operations in Asia through a merger, capital stock exchange, asset acquisition, stock purchase or other similar business combination, or contractual arrangements. For more information about us, see the section entitled “Business of BBV” beginning on page 119. On February 25, 2010, we formed BBV Sub as our wholly-owned subsidiary to effectuate the merger with Pharmanite.

Migami was formed in February 1986 under the name Covington Capital Corporation and formed Pharmanite as its wholly-owned subsidiary on December 1, 2009. Migami purchases licensing rights from U.S. and European-based pharmaceutical and cosmetics companies, sublicenses these rights to Asian pharmaceutical and cosmetics companies and distributes the pharmaceutical products in Asia and the cosmetic products worldwide. For more information about Migami, see the sections entitled “Selected Unaudited Pro Forma Financial Information,” “Business of Migami,” and “Migami’s Management’s Discussion and Analysis of Financial Condition and Results of Operations” beginning on pages 42, 119 and 132, respectively. Also see Migami’s financial statements included herein.

Summary of the Material Terms

| | · | Immediately prior to the closing of the Merger Agreement, Migami and Pharmanite will enter into a Contribution Agreement, pursuant to which Migami will transfer to Pharmanite, and Pharmanite will assume, all of the assets and liabilities of Migami immediately prior to the closing of the Transaction (the “Migami Contribution”). The transferred assets will include, without limitation, Migami’s cash, accounts receivable, intellectual property, equipment and its ownership interest in all of Migami’s subsidiaries and joint ventures. Subsequent to the Migami Contribution, Pharmanite will own all of Migami’s former assets and liabilities and Migami’s sole asset will be its ownership of 100% of the outstanding shares of common stock of Pharmanite. |

| | · | On December 7, 2009, BBV entered into an option agreement (“Option Agreement”) with the founders of BBV (the “BBV Founders”) and Vision Fair Limited, a Hong Kong company and affiliate of Migami (“Vision Fair”). Pursuant to the Option Agreement, the BBV Founders granted Vision Fair a call option to purchase an aggregate of 293,750 shares of Common Stock (the “Option Shares”) of the 1,293,750 shares of Common Stock issued to the BBV Founders immediately prior to the IPO (the “Founder Shares”) and all of the 1,873,684 warrants purchased in a private placement by the BBV Founders in connection with the IPO (the “Founder Warrants”), and Vision Fair granted the BBV Founders a put option to require Vision Fair to purchase all of the Option Shares and Founder Warrants. Vision Fair agreed to pay $3,250,000 (the “Purchase Price”) to the BBV Founders in connection with the Option Agreement, comprised of: (i) a $100,000 deposit paid upon execution of the Option Agreement, (ii) a $3,000,000 payment to be deposited in an escrow account by December 9, 2009 and (iii) a $150,000 payment due on the earlier of the first business day following the consummation of the Transaction or February 9, 2009 (regardless of whether the Transaction is consummated). In connection with the Option Agreement, John Park executed a $250,000 promissory note in his personal capacity (the “Note”), payable to the BBV Founders in the event Vision Fair defaulted on its obligations under the Option Agreement. On December 9, 2009, BBV and Vision Fair entered into a side letter agreement (the “Side Letter”) pursuant to which the Purchase Price was increased by $50,000 for each day after December 9, 2009 in which the $3,000,000 portion of the Purchase Price was not deposited into the escrow account. The parties are negotiating a revision to the terms of these arrangements and we will file a Foreign Report on Form 6-K with the revised terms once the terms are finalized. |

On February 27, 2010, in connection with the execution of the Merger Agreement, Migami and the BBV Founders entered into a payment guarantee pursuant to which Migami unconditionally guaranteed the amounts owed by Vision Fair to the BBV Founders under the Option Agreement and the Side Letter, in an amount up to $3,500,000 (“Payment Guarantee”). The Payment Guarantee provided that the parties instruct their affiliates to enter into an amended and restated Option Agreement providing for an increase in the Purchase Price to $3,500,000 and a full general release by all parties of all claims under the Option Agreement and the Side Letter. The Payment Guarantee immediately terminates upon the parties entering into an amended and restated Option Agreement. The parties are negotiating a revision to the terms of these arrangements and we will file a Foreign Report on Form 6-K with the revised terms once the terms are finalized.

| | · | At a special meeting of BBV’s stockholders held on February 12, 2010 (the “Extension Meeting”), stockholders of the Company approved a proposal to extend the time on or before which the Company must consummate its initial business combination from February 13, 2010 to February 13, 2011 (the “Extension Proposal”). Prior to the Extension Meeting, the Company entered into definitive stock purchase agreements (the “Stock Purchase Agreements”) with certain investors (“Investors”) pursuant to which the Investors purchased an aggregate of 3,682,689 IPO Shares (“Extension Shares”) from third parties prior to the Extension Meeting through independent, privately negotiated transactions. Pursuant to the Stock Purchase Agreements, the Company agreed to purchase the Extension Shares from the Investors using proceeds from the trust account in an amount not to exceed the per share amount then held in trust, upon certain terms and conditions. At the Extension Meeting, stockholders representing 23.79% of the common stock issued to public stockholders in connection with the IPO (the “IPO Shares”), or 1,231,066 IPO Shares, sought redemption of their shares into a pro rata portion of the trust account. As a result of the Company’s agreement with the Investors, the board of directors may be required to liquidate the Company in the event the Transaction is not consummated by April 19, 2010 but only if it is required to use proceeds from the trust account to satisfy its obligations under the Stock Purchase Agreements. In the event the Company is able to obtain funds or otherwise satisfy its obligations under the Stock Purchase Agreements from other sources, the board of directors may determine to continue the Company’s corporate existence until February 13, 2011, even if the Merger Proposal is not approved. Subsequent to the redemption of the 1,231,066 IPO Shares in connection with the Extension Meeting, the Investors currently own approximately 93% of the IPO Shares outstanding as of the Record Date. The Investors have given John Park and Eric Zachs proxies to vote such shares, assuming satisfaction by BBV and Migami of certain conditions. Messrs. Park and Zachs have indicated their intention to vote such shares in favor of the Merger Proposal. Accordingly, it is expected there will be (i) an affirmative vote of the majority of the Common Stock in favor of the Merger Proposal and (ii) less than 30% of the IPO Shares, voting, in the aggregate, against the Extension Proposal and the Merger Proposal. |

| | · | On February 27, 2010, BBV, BBV Sub, Migami and Pharmanite entered into a Merger Agreement and Plan of Reorganization (the “Merger Agreement”) pursuant to which Pharmanite will merge with BBV, with Pharmanite surviving as a wholly-owned subsidiary of the Company, as a result of which Migami will transfer all of the outstanding capital stock of Pharmanite to the Company in exchange for 9,706,250 newly issued shares (the “Transaction Consideration”) of Common Stock (the “Transaction”). As a result of the Transaction, Pharmanite will become a wholly-owned subsidiary of BBV and Migami will own approximately 88% of the outstanding shares of BBV (or approximately 54% on a fully diluted basis), assuming 100% redemption of our IPO Shares. The aggregate value of the Transaction Consideration is approximately $77.6 million. For additional information regarding the Merger Agreement and the Transaction Consideration, see the section entitled “The Merger Agreement” beginning on page 96. |

| | · | At the Special Meeting of Stockholders, stockholders of BBV will be asked, among other things, to approve the Transaction and other key matters, including the renaming of BBV to “Pharmanite Holdings, Inc.” and certain other charter amendments. For more information about the Special Meeting of Stockholders, see the section entitled “Special Meeting of Stockholders” beginning on page 67. |

| | · | As of February 19, 2010, the record date for the special meeting, the BBV Founders beneficially owned 1,293,750 shares of Common Stock, or approximately 24.7% of the outstanding shares of Common Stock (after giving effect to the redemption of 23.79% of the IPO Shares in connection with the Extension Meeting), which they purchased prior to the IPO. The BBV Founders agreed to vote all such shares in accordance with the majority of the IPO Shares with respect to the Merger Proposal. |

The Company and Migami intend to consummate the Transaction as promptly as practicable after the Special Meeting of Stockholders, provided that:

| | · | the Company’s stockholders have approved and adopted the Merger Proposal; |

| | · | the Company’s stockholders have approved and adopted amendments to the Company’s amended and restated articles of incorporation to: (i) change the name of the Company to “Pharmanite Holdings, Inc.” (the “Name Change Proposal”); (ii) authorize an increase in the authorized number of shares of Common Stock, a portion of which will be issued to the stockholders of Migami in connection with the Transaction (the “Increase in Authorized Proposal”); and (iii) eliminate certain special purpose acquisition company-related provisions (collectively the “Elimination Proposals”); |

| | · | holders of less than 30% of the IPO Shares, in the aggregate, vote against, and exercise their redemption rights in connection with, the Extension Proposal and the Merger Proposal and demand redemption of their shares into a pro rata portion of the trust account; and |

| | · | the other conditions specified in the Merger Agreement have been satisfied or waived. |

See the description of the Merger Agreement in the section entitled “The Merger Agreement” beginning on page 96. The Merger Agreement is included as Annex I to this proxy statement. We encourage you to read the Merger Agreement in its entirety. The amendments to the Company’s amended and restated articles of incorporation described above will be effected by the adoption of a Second Amended and Restated Articles of Incorporation of the Company, which is included as Annex II to this proxy statement.

The Company may proceed with the Transaction if holders of a majority in interest of the Common Stock vote in favor of the Merger Proposal and holders of less than 30% of the IPO Shares, in the aggregate, vote against, and exercise their redemption rights in connection with, the Extension Proposal and the Merger Proposal and demand redemption of their IPO Shares into a pro rata portion of the trust account. Taking into account the redemption of the 1,231,066 IPO Shares in connection with the Extension Meeting, the Investors currently own approximately 93% of the IPO Shares outstanding as of the Record Date. The Investors have given John Park and Eric Zachs proxies to vote such shares, assuming satisfaction by BBV and Migami of certain conditions. Messrs. Park and Zachs have indicated their intention to vote such shares in favor of the Merger Proposal. Accordingly, it is expected there will be an affirmative vote of a majority interest of the Common Stock in favor of the Merger Proposal and that less than 30% of the IPO Shares will be voted, in the aggregate, against the Extension Proposal and the Merger Proposal.

Additionally, in order for the funds held in the trust account to be released to the Company, the Company must complete a business combination having a fair market value equal to at least 80% of the trust account balance (excluding deferred underwriting discounts and commissions) at the time of such business combination. The Company has received an opinion from an investment bank that the fair market value of Migami was equal to at least 80% of the trust account balance (excluding deferred underwriting discount and commissions) at the time of the Transaction.

Our Units, Common Stock and Warrants are quoted on the OTC Bulletin Board under the symbols “BBVUF,” “BBVVF” and “BBVWF,” respectively. On March 25, 2010, our Units, Common Stock and Warrants had a closing price of $8.50, $7.75 and $0.27, respectively. The Company intends to apply to have the Common Stock listed on the NASDAQ Global Market or the NASDAQ Capital Market as soon as it satisfies the relevant listing requirements, including a requirement to have a specified minimum number of shareholders. The Company does not expect to be eligible for listing as of the closing of the Transaction and as a result will likely continue to be listed on the OTC Bulletin Board. Following the consummation of the Transaction, the Units will be separated into their components, one share of Common Stock and one Warrant and will cease trading.

This proxy statement provides you with detailed information about the Transaction, the proposed amendments to the amended and restated articles of incorporation and the Special Meeting of Stockholders. We encourage you to carefully read this entire document and the documents incorporated by reference, including the Merger Agreement and the form of the Second Amended and Restated Articles of Incorporation, each of which are attached hereto as Annexes I and II, respectively. YOU SHOULD ALSO CAREFULLY CONSIDER THE RISK FACTORS BEGINNING ON PAGE 47.

To obtain timely delivery of requested materials, stockholders must request the information no later than five days before the date they submit their proxies or attend the Special Meeting of the Stockholders, respectively. The latest date to request the information to be received timely is April 7, 2010.

We are soliciting the enclosed proxy card (or cards) on behalf of the board of directors of BBV, and we will pay all costs of preparing, assembling and mailing the proxy materials. In addition to mailing out proxy materials, our officers may solicit proxies by telephone or fax, without receiving any additional compensation for their services. We have requested brokers, banks and other fiduciaries to forward proxy materials to the beneficial owners of our stock. We have also retained the proxy soliciting firm of Advantage Proxy to solicit proxies on our behalf.

Neither the Securities and Exchange Commission nor any state securities commission has determined if the attached proxy statement is truthful or complete. Any representation to the contrary is a criminal offense.

| | | Page |

| QUESTIONS AND ANSWERS ABOUT THE PROPOSALS | | 11 |

| SUMMARY | | 23 |

| Information About the Companies | | 23 |

| The Merger Proposal | | 25 |

| The Name Change Proposal | | 33 |

| The Increase in Authorized Proposal | | 33 |

| The Elimination Proposals | | 33 |

| The Special Meeting of Stockholders | | 34 |

| Recommendation to BBV Stockholders | | 36 |

| SELECTED HISTORICAL FINANCIAL INFORMATION | | 37 |

| SELECTED UNAUDITED PRO FORMA FINANCIAL INFORMATION | | 42 |

| RISK FACTORS | | 47 |

| Risks Related to Migami’s Business and Operations | | 47 |

| Risks Related to BBV and the Transaction | | 55 |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | | 65 |

| SPECIAL MEETING OF BBV STOCKHOLDERS | | 67 |

| General | | 67 |

| Date, Time and Place | | 67 |

| Purpose of the BBV Special Meeting of Stockholders | | 67 |

| Recommendation of BBV Board of Directors to BBV Stockholders | | 67 |

| Record Date; Who is Entitled to Vote | | 68 |

| Quorum and Required Vote of BBV Stockholders | | 68 |

| Abstentions and Broker Non-Votes | | 68 |

| Voting Your Shares of Common Stock | | 69 |

| Revoking Your Proxy | | 69 |

| No Additional Matters May Be Presented at the Special Meeting | | 69 |

| Who Can Answer Your Questions About Voting Your Shares of Common Stock | | 69 |

| Redemption Rights | | 70 |

| Appraisal Rights | | 70 |

| Proxy Solicitation Costs | | 70 |

| Founder Shares and Founder Warrants | | 71 |

| PROPOSALS TO BE CONSIDERED BY BBV STOCKHOLDERS | | 72 |

| PROPOSAL 1 — THE MERGER PROPOSAL | | 72 |

| General Description of the Transaction | | 72 |

| Background of the Transaction | | 72 |

| Interest of BBV Stockholders in the Transaction | | 75 |

| Interests of BBV’s Directors and Officers and Others in the Transaction | | 75 |

| BBV’s Board of Directors’ Reasons for the Approval of the Transaction | | 76 |

| Potential Negative Factors | | 77 |

| THE VALUATION OPINION | | 78 |

| Opinion of Caris & Company | | 78 |

| TAXATION | | 86 |

| Republic of Marshall Islands (“Marshall Islands”) Tax Consequences | | 86 |

| U.S. Federal Income Tax Consequences | | 86 |

| Tax Status of the Company After the Transaction | | 88 |

| Tax Consequences of the Transaction | | 88 |

| Tax Consequences to U.S. Holders of Common Stock and Warrants | | 89 |

| Tax Consequences to Non-U.S. Holders of Common Stock and Warrants | | 93 |

| Backup Withholding and Information Reporting | | 93 |

| Contact Information for BBV | | 94 |

| Contact Information for Migami | | 94 |

| Required Vote | | 94 |

| Recommendation | | 95 |

| THE MERGER AGREEMENT | | 96 |

| Structure of the Transaction; Consideration to be Paid | | 96 |

| Closing of the Transaction | | 96 |

| Conditions to the Closing of the Transaction | | 96 |

| Termination | | 98 |

| Effect of Termination | | 99 |

| Fees and Expenses | | 99 |

| Management of the Combined Company Following the Transaction | | 99 |

| Representations and Warranties of BBV and Migami in the Merger Agreement | | 99 |

| Materiality and Material Adverse Effect | | 100 |

| Covenants of the Parties | | 100 |

| Indemnification | | 100 |

| Lock Up Agreement; Tag Along | | 100 |

| Trust Account Waiver | | 100 |

| Access to Information | | 101 |

| Public Announcements | | 101 |

| Name; Headquarters | | 101 |

| PROPOSAL 2 — THE NAME CHANGE PROPOSAL | | 102 |

| Reasons for the Amendment | | 102 |

| Required Vote | | 102 |

| Recommendation | | 102 |

| PROPOSAL 3 — THE INCREASE IN AUTHORIZED PROPOSAL | | 103 |

| Principal Effects of the Increase in Authorized Capital | | 103 |

| Capitalization | | 104 |

| Required Vote | | 104 |

| Recommendation | | 104 |

| PROPOSAL 4 — THE ELIMINATION PROPOSALS | | 105 |

| Required Vote | | 105 |

| Recommendation | | 105 |

| BUSINESS OF BBV | | 106 |

| BBV’s OPERATING AND FINANCIAL REVIEW AND PROSPECTS | | 114 |

| Operating Results | | 114 |

| Liquidity and Capital Resources | | 114 |

| Trend Information. | | 115 |

| Off-Balance Sheet Arrangements | | 115 |

| Contractual Obligations | | 115 |

| MANAGEMENT OF BBV | | 116 |

| BUSINESS OF MIGAMI | | 119 |

| Overview | | 119 |

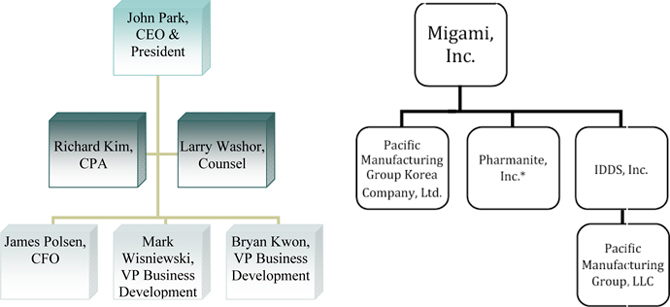

| Corporate Structure | | 120 |

| Business Strategy | | 122 |

| Supply Side Partners | | 122 |

| Sell Side Partners and Clients | | 123 |

| Drug Delivery Systems Overview | | 123 |

| Migami’s Licensed Products | | 124 |

| Patents and Proprietary Rights | | 125 |

| Geography | | 126 |

| Manufacturing | | 126 |

| Sales, Marketing and Distribution | | 126 |

| Raw Materials and Suppliers | | 126 |

| Competition | | 126 |

| Research and Development | | 127 |

| Government Regulation | | 127 |

| Recent developments | | 130 |

| Insurance | | 130 |

| Environmental Regulation | | 130 |

| Employees | | 130 |

| Legal Proceedings | | 131 |

| Property | | 130 |

| MIGAMI’S MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | 132 |

| Key Financial Results Metrics | | 133 |

| Factors affecting comparability | | 134 |

| Critical Accounting Policies and Estimates | | 135 |

| Manufacturing revenue | | 135 |

| MANAGEMENT FOLLOWING THE TRANSACTION | | 137 |

| Executive Compensation | | 138 |

| BENEFICIAL OWNERSHIP OF BBV SECURITIES | | 140 |

| BENEFICIAL OWNERSHIP FOLLOWING CONSUMMATION OF THE TRANSACTION | | 145 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | | 146 |

| DESCRIPTION OF SECURITIES | | 150 |

| General | | 150 |

| Common Stock | | 150 |

| Preferred Stock | | 150 |

| Warrants | | 150 |

| Units | | 150 |

| Transfer Agent | | 150 |

| PRICE RANGE OF SECURITIES AND DIVIDENDS | | 151 |

| BBV | | 151 |

| Migami | | 151 |

| APPRAISAL RIGHTS | | 152 |

| STOCKHOLDER PROPOSALS | | 152 |

| WHERE YOU CAN FIND ADDITIONAL INFORMATION | | 152 |

| FINANCIAL STATEMENTS | | F-1 |

| ANNEXES | | |

| | | |

| Annex I | | Merger Agreement and Plan of Reorganization dated February 27, 2010 |

| Annex II | | Second Amended and Restated Certificate of Incorporation of BBV |

| Annex III | | Opinion of Caris & Company, Inc. |

| Annex IV | | Form of Proxy Card |

QUESTIONS AND ANSWERS ABOUT THE PROPOSALS

Q. Why am I receiving this proxy statement?

A. BBV and Migami have agreed to a business combination pursuant to the terms of the Merger Agreement that is described in this proxy statement, a copy of which is attached to this proxy statement as Annex I. You are encouraged to read the Merger Agreement in its entirety.

BBV’s stockholders are being asked to consider and vote upon a proposal to approve the Merger Agreement and the transactions contemplated thereby. Stockholders are also being asked to consider and vote upon: (i) the Name Change Proposal, (ii) the Increase in Authorized Proposal and (iii) the Elimination Proposals.

This proxy statement contains important information about the Transaction and we recommend that you review it carefully.

Q. What is being voted on?

A. Stockholders are being asked to vote on the following four proposals:

The Merger Proposal. The first stockholder proposal, referred to herein as the Merger Proposal, is to approve the Transaction, which is the merger of Pharmanite with BBV Sub, with Pharmanite surviving as a wholly-owned subsidiary of BBV, pursuant to the terms of the Merger Agreement.

The Name Change Proposal. The second stockholder proposal, referred to herein as the Name Change Proposal, is to approve an amendment to BBV’s amended and restated articles of incorporation to change BBV’s corporate name to “Pharmanite Holdings, Inc.” The effectiveness of this proposal is conditioned upon approval of the Merger Proposal and will only be presented at the Special Meeting of Stockholders if the Merger Proposal is approved.

The Increase in Authorized Proposal. The third stockholder proposal, referred to herein as the Increase in Authorized Proposal, is to approve an amendment to BBV’s amended and restated articles of incorporation to increase the authorized capital stock from 51,000,000 shares, consisting of 50,000,000 shares of Common Stock and 1,000,000 shares of Preferred Stock, to 101,000,000 shares, consisting of 100,000,000 shares of Common Stock and 1,000,000 shares of Preferred Stock. The effectiveness of this proposal is conditioned upon approval of the Merger Proposal and will only be presented at the Special Meeting of Stockholders if the Merger Proposal is approved.

The Elimination Proposals. The fourth stockholder proposal, collectively referred to herein as the Elimination Proposals, is two separate proposals to approve an amendment to BBV’s amended and restated articles of incorporation to eliminate certain special purpose acquisition company provisions. The effectiveness of this proposal is conditioned upon approval of the Merger Proposal and will only be presented at the Special Meeting of Stockholders if the Merger Proposal is approved.

The amendments to the Company’s amended and restated articles of incorporation, which would be made if the Merger Proposal, the Name Change Proposal, the Increase in Authorized Proposal and the Elimination Proposals are approved, will be effected by the adoption and filing of the Second Amended and Restated Articles of Incorporation, which is included as Annex II to this proxy statement and which you are encouraged to read in its entirety.

Q. Are the proposals conditioned on one another?

A. Yes. The effectiveness of the Name Change Proposal, the Increase in Authorized Proposal and the Elimination Proposals are conditioned upon approval of the Merger Proposal, and will only be presented at the Special Meeting of Stockholders if the Merger Proposal is approved. In addition, the Transaction is conditioned upon the approval of the Elimination Proposals.

Q. Why isn’t BBV required to wind up its affairs and liquidate since it did not complete a business combination prior to February 13, 2010?

A. BBV’s amended and restated articles of incorporation provides that BBV shall wind up its affairs and liquidate if it has not completed a business combination by February 13, 2010. However, the amended and restated articles of incorporation also provides that BBV may extend the time period within which to complete the initial business combination to 36 months (from 24 months) in certain instances if such extension is approved by a majority of the shares voted at a special meeting of stockholders and less than 30% of the IPO Shares are voted against such extension and exercise their redemption rights with respect to such shares. BBV held the Extension Meeting on February 12, 2010 where BBV’s stockholders approved the Extension Proposal, with 23.79% of the IPO Shares (or 1,231,066 IPO Shares) voting against the Extension Proposal and seeking redemption for such shares.

Q. What are the terms of the agreements with the Investors?

A. On February 8, 2010, the Company entered into the Stock Purchase Agreements with the Investors pursuant to which the Investors purchased the Extension Shares through independent, privately negotiated transactions with third parties. Pursuant to the Stock Purchase Agreements, the Company agreed to purchase the Extension Shares from the Investors on certain terms and conditions and the Investors agreed to irrevocably grant each of John Park and Eric Zachs proxies to vote the Extension Shares at the Extension Meeting and at the Special Meeting of Stockholders.

Pursuant to the Stock Purchase Agreements, the Company agreed to repurchase the Extension Shares from the Investors not later than March 15, 2010. Migami extended such date by depositing $22,096 for each day beyond March 15, 2010 for which extension is requested. As a result of BBV’s agreement with the Investors to consummate the closing of the Stock Purchase Agreements no later than April 19, 2010, the board of directors may be required to liquidate the Company in the event the Transaction is not consummated by April 19, 2010 if it is required to use proceeds from the trust account to satisfy its obligations under the Stock Purchase Agreements. In the event BBV is able to obtain funds or otherwise satisfy its obligations under the Stock Purchase Agreements from other sources, the board of directors may determine to continue BBV’s corporate existence until February 13, 2011, even if the Merger Proposal is not approved.

In the event the Transaction is consummated, the Company will repurchase the Extension Shares from the Investors for a price equal to the aggregate purchase price paid by the Investors to acquire the Extension Shares plus an additional amount equal to 2.25% of the aggregate purchase price for each 30 day period the Extension Shares are held (prorated to reflect the actual numbers of days the Extension Shares are held). As additional consideration, Migami paid the Investors $170,000 in cash and issued restricted shares of its common stock to the Investors (based on their pro rata purchases) in an amount which would entitle the Investors to receive 275,000 shares of Common Stock as part of the Transaction Consideration. Additionally, (i) because the Transaction was not consummated within 30 days of the purchase of the Extension Shares, Migami will issue restricted shares of its common stock to the Investors (based on their pro rata purchases) in an amount which would entitle the Investors to receive an additional 225,000 shares of Common Stock as part of the Transaction Consideration, (ii) if the Transaction is not consummated within 60 days of the purchase of the Extension Shares, Migami will issue 6,667 restricted shares of its common stock to the Investors (based on their pro rata purchases) for each day beyond the 61st day from the date of purchase the Transaction is not consummated, to be divided pro rata among the Investors, and (iii) cash in the aggregate amount of $22,096 per day for each day beyond March 15, 2010 in which the Transaction is not consummated, which amount shall be divided pro rata among the Investors (collectively, the “Fees”).

As a result of certain payment defaults pursuant to the Stock Purchase Agreements, Migami has paid cash penalties to the Investors in the amount of $100,000 and has issued restricted shares of its common stock to the Investors in an amount which would entitle the Investors to receive an additional 375,000 shares of Common Stock as part of the Transaction Consideration (collectively, the “Penalties”).

Migami expects to enter into an agreement with the Investors which will provide that in consideration for the Investors’ waiver of further defaults relating to late payments under the Stock Purchase Agreements and Escrow Agreement and their agreement to hold in escrow documents which would terminate the corporate existence of BBV and require the distribution of all funds from the trust account (the “Waiver”), Migami will: (i) deliver a number of Migami shares equivalent to 350,000 post-Transaction shares of Common Stock by March 31, 2010, (ii) pay $250,000 in cash by April 1, 2010 (as a partial interest payment under the Stock Purchase Agreements), (iii) provide by April 8, 2010 (a) a secured promissory note in an amount equal to the remaining interest due under the Stock Purchase Agreements less $250,000 and recalculated as of the date of repurchase of the Investors’ shares by BBV or a third party which shall be pre-payable without penalty, contain reasonable and customary events of default and will be mandatorily repayable out of fifty percent (50%) of all income earned by Migami, (b) a form of security agreement acceptable to the Investors and (c) file in Nevada and other jurisdictions as requested by the Investors UCC financing statements evidencing the security interest of the Investors. If the Waiver is not entered into or if Migami does not comply with any of the foregoing conditions of the Waiver in a timely manner, the Investors may deliver the termination documents to BBV’s transfer agent and terminate BBV’s corporate existence.

In consideration for the Fees, Penalties and Waiver, and provided the Special Meeting of Stockholders occurs on or before April 19, 2010, the Investors agreed to irrevocably grant each of John Park and Eric Zachs proxies to vote the Extension Shares at the Special Meeting of Stockholders. Additionally, each of John Park and Migami agreed to indemnify the Investors in the event the aggregate purchase price paid for the Extension Shares and the Fees are not fully paid to the Investors.

Q. Why is BBV proposing the Transaction?

A. BBV was formed for the purpose of acquiring, or acquiring control of, one or more operating businesses having their primary operations in Asia, through a merger, capital stock exchange, asset acquisition, stock purchase or other similar business combination, or contractual arrangements, whose fair market value is at least equal to 80% of the net assets of BBV at the time of the transaction.

BBV consummated its IPO on February 13, 2008, raising net proceeds of approximately $41,400,000 (which includes the proceeds of the private placement of the Founder Warrants), which was placed in a trust account immediately following the IPO and, in accordance with BBV’s amended and restated articles of incorporation, will be released upon the consummation of a business combination. As of March 26, 2010, after payments of approximately $9.8 million to stockholders who exercised their redemption rights in connection with the Extension Meeting, approximately $31.6 million was held on deposit in the trust account.

No cash consideration is being paid in connection with the Transaction. BBV intends to use the funds held in the trust account to pay: (i) transaction fees and expenses, tax obligations, deferred underwriting discounts and commissions, (ii) the Investors who purchased IPO Shares in connection with the Extension Meeting and (iii) stockholders who properly exercise their redemption rights and the balance, if any, for general corporate purposes following the consummation of the Transaction. Although the deferred underwriting discounts and commissions payable is subject to negotiation between the parties, BBV estimates that subsequent to the consummation of the Transaction, there will not be any funds remaining in the trust account.

Q. What is Migami?

A. Migami purchases licensing rights from U.S. and European based pharmaceutical and cosmetics companies, sublicenses these rights to Asian pharmaceutical and cosmetics companies and distributes the pharmaceutical products in Asia and the cosmetic products worldwide. As a result, BBV believes the Transaction will provide BBV stockholders with an opportunity to participate in a company with significant growth potential. See the section entitled “The Merger Proposal — BBV’s Board of Directors’ Reasons for the Approval of the Transaction.”

Q. What is Pharmanite?

A. Migami formed Pharmanite as its wholly-owned subsidiary on December 1, 2009. Immediately prior to the closing of Merger Agreement, Migami and Pharmanite will enter into a Contribution Agreement, pursuant to which Migami will transfer to Pharmanite, and Pharmanite will assume, all of the assets and liabilities of Migami immediately prior to the closing of the Transaction (the “Migami Contribution”). The transferred assets will include, without limitation, Migami’s cash, accounts receivable, intellectual property, equipment and its ownership interest in all of Migami’s subsidiaries and joint ventures. Subsequent to the Migami Contribution, Pharmanite will own all of Migami’s former assets and liabilities and Migami’s sole asset will be its ownership of 100% of the outstanding shares of common stock of Pharmanite.

Q. What other agreements (other than the Merger Agreement) were entered into between BBV, Migami and their respective affiliates?

A. On December 7, 2009, BBV entered into the Option Agreement with the BBV Founders and Vision Fair. Pursuant to the Option Agreement, the BBV Founders granted Vision Fair a call option to purchase an aggregate of 293,750 Founder Shares (the “Option Shares”) and all of the Founder Warrants, and Vision Fair granted the BBV Founders a put option to require Vision Fair to purchase all of the Option Shares and Founder Warrants. Vision Fair agreed to pay $3,250,000 to the BBV Founders in connection with the Option Agreement. In connection with the Option Agreement, John Park, Migami’s chief executive officer, executed a $250,000 promissory note in his personal capacity payable to the BBV Founders in the event Vision Fair defaulted on its obligations under the Option Agreement. On December 9, 2009, BBV and Vision Fair entered into the Side Letter pursuant to which the Purchase Price was increased by $50,000 for each day after December 9, 2009 in which the $3,000,000 portion of the Purchase Price was not deposited into the escrow account.

On February 27, 2010, in connection with the execution of the Merger Agreement, Migami and the BBV Founders entered into a Payment Guarantee pursuant to which Migami unconditionally guaranteed the amounts owed by Vision Fair to the BBV Founders under the Option Agreement and the Side Letter, in an amount up to $3,500,000. The Payment Guarantee provided that the parties instruct their affiliates to enter into an amended and restated Option Agreement providing for an increase in the Purchase Price to $3,500,000 and a full general release by all parties of all claims under the Option Agreement and the Side Letter. The Payment Guarantee immediately terminates upon the parties entering into an amended and restated Option Agreement.

The parties are negotiating a revision to the terms of these arrangements and we will file a Foreign Report on Form 6-K with the revised terms once the terms are finalized.

Q. Do BBV stockholders have redemption rights?

A. Yes. Any holder of IPO Shares who votes those shares against the business combination and properly demands redemption of its IPO Shares will be entitled to redeem their IPO Shares for cash if the Merger Proposal is approved and the Transaction is completed. The per-share redemption price will equal the amount in BBV’s trust account, inclusive of any interest not otherwise payable to the Company, as of two business days before the consummation of the business combination, less taxes payable, divided by the number of outstanding IPO Shares, which, as of March 29, 2010, was approximately $8.00 per share. If the business combination is not approved and completed, then no redemption rights will be available.

Q. If I have redemption rights, how do I properly demand redemption of my IPO Shares?

A. To properly demand redemption of your IPO Shares, you must:

(1) vote your IPO Shares, in person or by proxy, “AGAINST” the business combination;

(2) affirmatively request redemption of your IPO Shares by marking the appropriate box on your proxy card, voting information card, or ballot; and

(3) deliver, or instruct your bank or broker to deliver, your IPO Shares to BBV’s transfer agent before the Special Meeting of Stockholders.

Stockholders holding IPO Shares who abstain or do not vote their IPO Shares against the Merger Proposal will forfeit their right to redeem those shares if the Transaction is consummated.

Q. Why is BBV proposing the Name Change Proposal?

A. The adoption of the Name Change Proposal is being proposed because the board of directors of BBV deems it beneficial for the combined company going forward following the Transaction to have a corporate name that properly reflects the business of the combined company.

Q. Why is BBV proposing the Increase in Authorized Proposal?

A. The Increase in Authorized Proposal is being proposed by the board of directors of BBV in order to increase the authorized capital of the Company for future operations. The Company’s current authorized capital is 51,000,000 shares, consisting of 50,000,000 shares of Common Stock and 1,000,000 shares of Preferred Stock. As of February 19, 2010, there were 5,237,684 issued and outstanding shares of Common Stock and 7,048,684 shares of Common Stock reserved for issuance pursuant to BBV’s warrants (the “Warrants”) issued to public securityholders as part of the units (the “Units”) consisting of one share of Common Stock and one Warrant to purchase one share of Common Stock originally issued in connection with BBV’s IPO. In connection with the Transaction, BBV will issue 9,706,250 shares of Common Stock in exchange for all of the outstanding capital stock of Pharmanite. BBV believes the availability of additional shares will provide it with the flexibility to meet business needs as they arise, take advantage of favorable opportunities, and respond to a changing corporate environment.

Q. Why is BBV proposing the Elimination Proposals?

A. The adoption of the Elimination Proposals are being proposed because the board of directors of BBV deems it beneficial for the combined company going forward not to be governed by the special purpose acquisition company requirements under which BBV currently operates. Such requirements include: (i) placing offering proceeds in a trust account; (ii) requiring stockholder vote of business combinations (even if such vote is not required under applicable law); and (iii) having a set termination date for corporate existence. In addition, the board of directors deems it beneficial to have one class of directors rather than the current three classes of directors.

Q. What is a quorum?

A. A quorum is the number of shares of Common Stock that must be represented, in person or by proxy, for business to be transacted at the Special Meeting of Stockholders. Abstentions and broker non-votes are counted for purposes of determining the presence of a quorum. A majority of the total number of shares of our Common Stock outstanding and entitled to vote as of the Record Date must be represented either in person or by proxy, to transact business at the Special Meeting of Stockholders.

Q. What vote is required to approve the Merger Proposal and the other proposals presented at the Special Meeting of Stockholders?

A. The approval of the Merger Proposal requires (1) the affirmative vote of the majority of the shares of Common Stock voted at the Special Meeting of Stockholders, assuming a quorum is established, and (2) that less than an aggregate of 30% of the IPO Shares are voted against the Merger Proposal and the Extension Proposal and requested to be redeemed by the holders thereof. Subsequent to the redemption of the 1,231,066 IPO Shares in connection with the Extension Meeting, the Investors currently own approximately 93% of the IPO Shares outstanding as of the Record Date. The Investors have given John Park and Eric Zachs proxies to vote such shares, assuming satisfaction by BBV and Migami of certain conditions. Messrs. Park and Zachs have indicated their intention to vote such shares in favor of the Merger Proposal. Accordingly, it is expected there will be an affirmative vote of a majority in interest of the Common Stock in favor of the Merger Proposal and that less than 30% of the IPO Shares will be voted, in the aggregate, against the Extension Proposal and the Merger Proposal.

The approval of the Name Change Proposal, the Increase in Authorized Proposal and each of the Elimination Proposals will each require the affirmative vote of a majority of the shares of the Common Stock issued and outstanding as of the Record Date. Broker non-votes or abstentions will have the same effect as a vote “AGAINST” the Merger Proposal, the Name Change Proposal, the Increase in Authorized Proposal and each of the Elimination Proposals. The failure to vote on the Name Change Proposal, the Increase in Authorized Proposal, and the Elimination Proposals will have the same effect as a vote “AGAINST” those proposals. The failure to vote on the Merger Proposal will neither be counted as “FOR” nor “AGAINST” the Merger Proposal.

Q. What happens if I vote against the Merger Proposal?

A. If you are a holder of IPO Shares, you have the right to vote your shares against the Merger Proposal. You can also vote against the Merger Proposal and demand BBV redeem your shares for a pro rata portion of the trust account in which a substantial portion of the net proceeds of BBV’s IPO are held. These rights to vote against the Merger Proposal and demand redemption of the IPO Shares are sometimes referred to herein as “redemption rights”. If the Merger Proposal is not approved and BBV does not consummate an initial business combination by February 13, 2011 (or such date as BBV may determine), BBV will liquidate and the Warrants will expire worthless.

Q: If the Merger Proposal is not approved, will BBV pursue other possible transactions?

A. Possibly, but not likely. The agreement with the Investors requires BBV to purchase all shares of Common Stock owned by the Investors not later than April 19, 2010, using proceeds from the trust account in an amount not to exceed the per share amount then held in trust. In such event, BBV’s board of directors may be required to liquidate the Company in the event the Transaction is not consummated by April 19, 2010. However, if the obligations of BBV can be satisfied without using any of the amounts in the trust account, BBV may determine to continue its corporate existence and seek another business combination or perhaps a different form of business combination with Migami and Pharmanite based on the facts and circumstances at such time.

Q. What happens if the Transaction is not consummated or is terminated?

A. If BBV is unable to complete the Transaction by April 19, 2010, and is required to satisfy its obligations to the Investors using proceeds from the trust account, it will dissolve and liquidate and the Warrants will expire worthless. In the event BBV is able to obtain funds or otherwise satisfy its obligations under the Stock Purchase Agreements from other sources, BBV may determine to continue its corporate existence until February 13, 2011 and seek another business combination or perhaps a different form of business combination with Migami and Pharmanite based on the facts and circumstances at such time.

Q. How do I exercise my redemption rights?

A. If you are a holder of IPO Shares and wish to exercise your redemption rights, you must do all of the following:

(i) deliver your IPO Shares to BBV’s transfer agent physically or electronically using Depository Trust Company’s DWAC (Deposit Withdrawal at Custodian) System prior to the Special Meeting of Stockholders,

(ii) vote against the Merger Proposal, and

(iii) demand that BBV redeem your IPO Shares into cash.

The Transaction must have been approved and consummated for stockholders to receive the redemption amount of approximately $8.00 per share of Common Stock.

Any action that does not include an affirmative vote against the Merger Proposal will prevent you from exercising your redemption rights. Your vote on any proposal other than the Merger Proposal will have no impact on your redemption rights.

You may exercise your redemption rights either by checking the box on the included proxy card or by submitting your request in writing to Mark Zimkind of Continental Stock Transfer & Trust Company, BBV’s transfer agent, at the address listed at the end of this section.

If you: (i) initially vote for the Merger Proposal but then wish to vote against it, (ii) initially vote against the Merger Proposal and wish to exercise your redemption rights but do not check the box on the proxy card providing for the exercise of your redemption rights or do not send a written request to BBV’s transfer agent to exercise your redemption rights, or (iii) initially vote against the Merger Proposal but later wish to vote for it, you may request BBV to send you another proxy card on which you may indicate your intended vote. You may make such request by contacting BBV at the phone number or address listed at the end of this section but you must do so by April 7, 2010.

Any request for redemption, once made, may be withdrawn at any time up to the closing of the vote taken with respect to the Merger Proposal. If you delivered your shares for redemption to BBV’s transfer agent and decide prior to the closing of the vote not to elect redemption, you may request that BBV’s transfer agent return the shares to you (physically or electronically). You may make such request by contacting BBV’s transfer agent at the phone number or address listed at the end of this “Questions and Answers” section.

Any corrected or changed proxy card must be received by BBV’s corporate secretary (the “Secretary”) prior to the Special Meeting of Stockholders. No demand for redemption will be honored unless the holder’s stock certificate has been delivered (either physically or electronically) to the transfer agent prior to the Special Meeting of Stockholders.

Q. What will Migami receive in the Transaction?

A. At the closing of the Transaction, Migami will receive 9,706,250 shares of Common Stock (collectively, the “Transaction Consideration”). No less than twelve months subsequent to the closing of the Transaction, BBV may, but is under no obligation to, file a registration statement with the SEC covering the Transaction Consideration.

Q: What possible adjustments might be made to the Transaction Consideration to be received by Migami?

A. The Transaction Consideration will be adjusted if the Common Stock is reclassified, recapitalized, split-up, combined, divided or exchanged into another form or security, so that Migami would receive the same economic effect as is currently contemplated by the Merger Agreement.

Q. Do I have appraisal rights if I object to the Transaction?

A. No appraisal rights are available under the laws of the Republic of the Marshall Islands to stockholders of BBV in connection with the proposals. Any stockholder of BBV holding IPO Shares who votes against the Merger Proposal may, at the same time, demand that BBV redeem his shares for a pro rata portion of the trust account. The only rights for those stockholders who wish to receive cash for their shares is to vote against the Merger Proposal and simultaneously demand redemption of their shares from the trust account.

Q. What happens to the funds deposited in the trust account after consummation of the Transaction?

A. Assuming approval of the Merger Proposal, at the closing of the Transaction, the funds in the trust account will be released to pay (i) transaction fees and expenses, tax obligations, deferred underwriting discounts and commissions, (ii) the Investors who purchased IPO Shares in connection with the Extension Meeting, (iii) stockholders who properly exercise their redemption rights and (iv) the balance, if any, for general corporate purposes following the consummation of the Transaction. Although the deferred underwriting discounts and commissions is subject to negotiation between the parties, BBV estimates that subsequent to the consummation of the Transaction, there will not be any funds remaining in the trust account.

Q. Since BBV’s IPO prospectus did not disclose that BBV might use funds in its trust account in order to secure stockholder approval of the Merger Proposal or that BBV may enter into a business combination with an entity whose primary operations are not in Asia, what are my legal rights?

A. You should be aware that because BBV’s IPO prospectus did not disclose that funds in BBV’s trust account might be used, directly or indirectly, to purchase the Company’s securities in order to secure approval of BBV’s stockholders for the Merger Proposal or that BBV may enter into a business combination with an entity whose primary operations are not in Asia, each holder of IPO Shares at the time of the Transaction who purchased such shares in the IPO may bring securities law claims against BBV for rescission (under which a winning claimant has the right to receive the total amount paid for his or her securities pursuant to an allegedly deficient prospectus, plus interest and less any income earned on the securities, in exchange for surrender of the securities) or damages (compensation for loss on an investment caused by alleged material misrepresentations or omissions in the sale of a security). Such claims may entitle stockholders asserting them to up to $8.00 per share, based on the initial offering price of the IPO Units, less any amount received from the sale of the IPO Units or the shares or Warrants comprising such IPO Units, plus interest from the date of the IPO (which, in the case of holders of IPO Shares, may be more than the pro rata share of the trust account to which they are entitled on redemption or liquidation). Such claims could further diminish the amount of funds available following the Transaction for working capital and general corporate purposes. See the section entitled “Summary — Rescission Rights.”

Q. When do you expect the Transaction to be completed?

A. It is currently anticipated the Transaction will be consummated promptly following the Special Meeting of the Stockholders. For a description of the conditions precedent to the completion of the Transaction, see the section entitled “The Merger Agreement — Conditions to the Closing of the Transaction.”

Q. How is management of BBV voting?

A. The BBV Founders own an aggregate of 1,293,750 shares of Common Stock, or approximately 24.7% of the outstanding shares of the Company (after giving effect to the redemption of 23.79% of the IPO Shares in connection with the Extension Meeting), which they purchased prior to the IPO. The BBV Founders have agreed to vote all of these shares in accordance with the vote of the majority of the IPO Shares with respect to the Merger Proposal.

Q. Will I receive anything in the Transaction?

A. If you are a stockholder and the Transaction is consummated and you did not elect redemption, you will continue to hold the Common Stock you currently own. If you are a stockholder and the Transaction is consummated but you have voted your shares against the Merger Proposal and have elected redemption, and you timely deliver your stock certificate for redemption, your shares of Common Stock will be cancelled and you will receive cash equal to a pro rata portion of the trust account, which as of March 29, 2010, was equal to approximately $8.00 per share. Only stockholders who vote their shares against the Merger Proposal, have elected redemption and have properly tendered their shares for redemption will be entitled to a pro rata portion of the trust account.

Q. What do I need to do now?

A. BBV urges you to carefully read and consider the information contained in this proxy statement, including the exhibits and annexes, and to consider how the Transaction will affect you as a stockholder of BBV. You should then vote as soon as possible in accordance with the instructions provided in this proxy statement and on the enclosed proxy card (or cards).

Q. How do I vote?

A. If you are a holder of record of Common Stock on the Record Date (February 19, 2010), you may vote with respect to the applicable proposals in person at the Special Meeting of Stockholders or by submitting a proxy for the Special Meeting of Stockholders. You may submit your proxy by completing, signing, dating and returning the enclosed proxy card in the accompanying pre-addressed postage paid envelope.

If you hold your shares of Common Stock in “street name,” which means your shares are held of record by a broker, bank or nominee, you should contact your broker to ensure that votes related to the Common Stock you beneficially own are properly counted. In this regard, you must provide the record holder of your Common Stock with instructions on how to vote. If you wish to attend the the Special Meeting of Stockholders and vote in person, you must obtain a proxy from your broker, bank or nominee.

Q. What will happen if I abstain from voting or fail to vote at the Special Meeting of Stockholders?

A. BBV will count a properly executed proxy marked “ABSTAIN” presented at the Special Meeting of Stockholders, as present for purposes of determining whether a quorum is present.

For purposes of approval, an abstention on the Merger Proposal will have the same effect as a vote “AGAINST” the proposal, provided a quorum is present, but will not have the effect of electing a redemption of your IPO Shares into a pro rata portion of BBV’s trust account. In order for a stockholder to properly elect redemption of his or her IPO Shares, he or she must cast a vote against the Merger Proposal, make an election on the proxy card to redeem such IPO Shares and deliver his or her shares for redemption pursuant to the procedures set forth herein. Only stockholders who vote their shares against the Merger Proposal, have elected redemption and delivered their shares will be entitled to a pro rata portion of the trust account.

An abstention from voting on the Name Change Proposal, the Increase in Authorized Proposal, or any of the Elimination Proposals will have the same effect as a vote “AGAINST” such proposals.

Q. What will happen if I sign and return my proxy card without indicating how I wish to vote?

A. Signed and dated proxies received by BBV without an indication of how the stockholder intends to vote on a proposal will be voted “FOR” each proposal presented to stockholders. Stockholders will not be entitled to exercise their redemption rights if such stockholders return proxy cards to BBV without an indication of how they desire to vote with respect to the Merger Proposal or, for stockholders holding their shares in street name, if such stockholders fail to provide voting instructions to their brokers.

Q. If I am not going to attend the Special Meeting of Stockholders in person, should I return my proxy card?