UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A-2

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 27, 2009

TECHMEDIA ADVERTISING, INC.

(Exact name of registrant as specified in its charter)

Commission File Number 000-52945

| Nevada | | 98-0540833 |

(State or other jurisdiction of incorporation) | | (I.R.S. Employer Identification No.) |

c/o 62 Upper Cross Street, #04-01

Singapore 058353

(Address of principal executive offices, including Zip Code)

Registrant’s telephone number, including area code: 011-65-65323001

N/A

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.01. Completion of Acquisition or Disposition of Assets

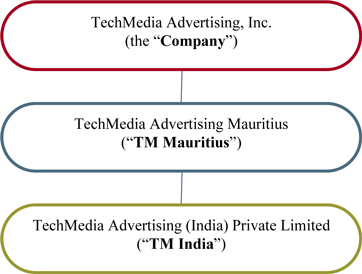

On July 27, 2009, TechMedia Advertising, Inc. (the “Company”) entered into a share exchange agreement (the “Exchange Agreement”) with TechMedia Advertising Mauritius (“TM Mauritius”), a company organized under the laws of Mauritius, and all the shareholders of TM Mauritius (the “Vendors”), whereby the Company agreed to acquire all of the issued and outstanding shares in the capital of TM Mauritius from the Vendors in exchange for the issuance of 24,000,000 shares of Common Stock of the Company to the Vendors on a pro rata basis in accordance with each Vendor’s percentage ownership in TM Mauritius.

TM Mauritius is the sole beneficial owner of TechMedia Advertising (India) Private Limited, a company organized under the laws of India (“TM India”), which is engaged in the development stages of selling outdoor advertising on billboards and digital signs in India located in high traffic locations, which locations range from transportation vehicles, commercial buildings, supermarkets and restaurants, by partnering with media space owners.

On August 6, 2009, the Exchange Agreement closed and as a result, TM Mauritius became a wholly owned subsidiary of the Company. As a result of the closing of the Exchange Agreement, the Vendors collectively own 24,000,000 shares of Common Stock of the Company as follows: 9,600,000 shares of Common Stock are owned by OneMedia Limited (21.4% of the issued and outstanding); 7,200,000 shares of Common Stock of the Company are owned by Ternes Capital Ltd. (16.0% of the issued and outstanding); and 7,200,000 shares of Common Stock of the Company are owned by Johnny Lian Tian Yong (16.0% of the issued and outstanding), which constitutes in aggregate 53.4% of the issued and outstanding shares of Common Stock of the Company. These figures are based on 44,919,000 shares of Common Stock of the Company outstanding as at August 6, 2009.

The foregoing description of the Exchange Agreement does not purport to be complete and is qualified in its entirety by reference to the Exchange Agreement, which was filed as Exhibit 10.1 to the initial Form 8-K on July 31, 2009, and is incorporated herein by reference.

As of August 6, 2009, and in accordance with the Exchange Agreement, Mr. Alan Goh, our current President, CEO, CFO, Secretary and Treasurer and a director, resigned as the Company’s President, CEO, CFO and Treasurer (remaining as our Secretary and a director) and appointed Mr. Johnny Lian Tian Yong as the President, CEO, Chairman and a director of the Company, Mr. Ratner Vellu as a director of the Company and Mr. William Goh Han Tiang as the Treasurer and a director of the Company. The appointments of Messrs. Johnny Lian Tian Yong, Ratner Vellu and William Goh Han Tiang as directors of the Company became effective on August 14, 2009, which was 10 days after a Schedule 14F-1 Information Statement was filed with the Securities and Exchange Commission and transmitted to all holders of record of securities of the Company who would be entitled to vote at a meeting for election of directors.

Concurrently with the closing of the Exchange Agreement, by a letter agreement entered into on July 30, 2009 (the “Letter Agreement”), between the Company and Alan Goh, the Company’s current Secretary and director, Mr. Alan Goh cancelled 24,000,000 shares of the 26,400,000 shares of common stock of the Company registered in his name. Therefore, Mr. Alan Goh now only has 2,400,000 shares of Common Stock of the Company registered in his name.

The foregoing description of the Letter Agreement does not purport to be complete and is qualified in its entirety by reference to the Letter Agreement, which was filed as Exhibit 10.2 to the initial Form 8-K on July 31, 2009, and is incorporated herein by reference.

The table below illustrates the corporate structure of the Company as a result of the completion of the Exchange Agreement:

TM Mauritius

TM Mauritius was incorporated pursuant to the laws of Maruitius on March 11, 2009. As a result of the closing of the Exchange Agreement, the Company is the sole shareholder of TM Mauritius. The directors of TM Mauritius are Messrs, Ratner Vellu, William Goh, Malcolm Moller and Gilbert Noel. On June 22, 2009, TM Mauritius acquired sole beneficial ownership of TM India in exchange for the issuance of 4 ordinary shares having a par value of US$1.00 per share in the capital of TM Mauritius.

TM India

TM India was incorporated pursuant to the laws of India on December 27, 2007. The directors of TM India are Mrs. Rohini Rajakumar and Messrs. S. Rajakumar Veeraswamy and William Goh. Since its incorporation, TM India has been involved in investigating, researching and establishing relationships in the media industry in India.

Business of the Company

The business of the Company will be conducted through its subsidiary, TM Mauritius, which intends to conduct its business through a new joint venture company in India as well as through TM India.

TM Mauritius received an assignment of TechMedia Advertising Singapore Pte. Ltd.’s rights and obligations under the Summary of Terms of Investment with respect to a joint venture arrangement for operating the business of installing, commissioning, maintaining and commercializing mobile digital advertising platforms in public commuter transports such as buses and trains in India (the “JV Business”), which was entered into between TechMedia Advertising Singapore Pte. Ltd., a company incorporated under the laws of Singapore, and Peacock Media Ltd., a company incorporated under the laws of India, on December 19, 2008. A copy of the Summary of Terms of Investment between TechMedia Advertising Singapore Pte. Ltd. and Peacock Media Ltd. was filed as Exhibit 10.3 to the Form 8-K/A-1 on August 12, 2009, and is incorporated herein by reference. In addition, a copy of the assignment from TechMedia Advertising Singapore Pte. Ltd. to TM Mauritius was filed as Exhibit 10.4 to the Form 8-K/A-1 on August 12, 2009, and is incorporated herein by reference.

TM Mauritius intends to enter into a formal joint venture agreement with Peacock Media Ltd. (“Peacock”) in the near future to formalize the arrangement under the Summary of Terms of Investment discussed above which will include among other things the following terms:

| | · | an India company will be established to act as the joint venture company (the “JV”); |

| | · | the JV will be owned 85% by TM Mauritius and 15% by Peacock; |

| | · | two directors of the JV shall be a nominee from Peacock and three directors of the JV shall be nominees from TM Mauritius; |

| | · | Peacock will contribute its exclusive media rights licenses granted to it by the Government of Tamil Nadu for buses and the Indian Railway for trains, relating to the JV Business, which currently covers more than 10,000 buses and more than 30 railway trains; |

| | · | Peacock will fully equip the buses and trains with the required hardware and software and ensure the same is in proper working order in order to support JV Business; |

| | · | Peacock will provide access to all of Peacock’s current and future advertising clients to market the JV Business; |

| | · | TM Mauritius will manage the JV Business; |

| | · | TM Mauritius will reimburse Peacock for the costs associated with fully equipping the buses and trains after TM Mauritius certifies the proper equipping of the buses and trains by Peacock; |

| | · | TM Mauritius will supply the necessary funding to the JV for operations and other working capital purposes. |

| | · | Any profits generated from the sale of advertising space from the JV Business will be split 85% for TM Mauritius and 15% for Peacock. |

Item 3.02 Unregistered Sales of Equity Securities and Use of Proceeds

The information set forth above under “Item 2.01 Completion of Acquisition or Disposition of Assets” is incorporated herein by reference.

Item 5.01 Changes in Control of Registrant

The information set forth above under “Item 2.01 Completion of Acquisition or Disposition of Assets” is incorporated herein by reference.

Item 5.02 Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Offices

The information set forth above under “Item 2.01 Completion of Acquisition or Disposition of Assets” is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

Financial Statements

The following financial statements are included in this Form 8-K/A-2.

Audited Financial Statements of TM India as of March 31, 2009 and 2008 – prepared in accordance with US GAAP

Report of Registered Independent Auditor

Balance Sheets as of March 31, 2009 and 2008

Statements of Operations and Comprehensive (Loss) for the year ended March 31, 2009, the Period Ended March 31, 2008, and Cumulative from Inception

Statement of Shareholders’ Equity (Deficit) for the periods from Inception through March 31, 2009

Statements of Cash Flows for the year ended March 31, 2009, the Period Ended March 31, 2008, and Cumulative from Inception

Notes to Financial Statements March 31, 2009, and 2008

Audited Financial Statements of TM Mauritius as of March 31, 2009 – prepared in accordance with US GAAP

Report of Registered Independent Auditor

Balance Sheet as of March 31, 2009

Statements of Operations for the Period Ended March 31, 2009

Statement of Shareholders’ (Deficit) for the period from Inception through March 31, 2009

Statements of Cash Flows for the Period Ended March 31, 2009, and Cumulative from Inception

Notes to the Financial Statements March 31, 2009

Unaudited Financial Statements of TM Mauritius as of June 30, 2009 – prepared in accordance with US GAAP

Consolidated Balance Sheet as of June 30, 2009, and March 31, 2009

Consolidated Statements of Operations and Comprehensive (Loss) for the three months ended June 30, 2009 and Cumulative from Inception

Consolidated Statements of Cash Flows for the three months ended June 30, 2009 and Cumulative from Inception.

Notes to Consolidated Financial Statements June 30, 2009

Unaudited Pro Forma Consolidated Financial Information

Unaudited Pro Forma Consolidated Financial Information and Explanatory Notes – As of July 31, 2009, and the Year Ended July 31, 2009

(d) Exhibits

| | | |

| Exhibit No. | | Description of Exhibit |

| | | |

| 10.1* | | Share Exchange Agreement, dated July 27, 2009, among the Company, TM Mauritius and all the shareholders of TM Mauritius. |

| | | |

| 10.2* | | Letter Agreement, dated July 30, 2009, among Mr. Alan Goh and the Company. |

| | | |

| 10.3** | | Summary of Terms of Investment among TechMedia Advertising Singapore Pte. Ltd. and Peacock Media Ltd., dated December 19, 2008. |

| | | |

| 10.4** | | Assignment from TechMedia Advertising Singapore Pte. Ltd. to TechMedia Advertising Mauritius, dated June 15, 2009. |

| | | |

| 23.1 | | Consent of Davis Accounting Group P.C., CPA’s and Accountants, dated October 20, 2009 for TM India. |

| | | |

| 23.2 | | Consent of Davis Accounting Group P.C., CPA’s and Accountants, dated October 20, 2009 for TM Mauritius. |

| | | |

| 99.1* | | News release dated July 31, 2009. |

| | | |

| 99.2** | | News release dated August 7, 2009. |

* Previously filed on Form 8-K on July 31, 2009 and incorporated herein by reference.

** Previously filed on Form 8-K/A-1 on August 12, 2009 and incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| TechMedia Advertising, Inc. |

| | |

| By: | |

| Name: | Johnny Lian |

| Title: | President and Director |

TECHMEDIA ADVERTISING (INDIA) PRIVATE LIMITED

(A DEVELOPMENT STAGE COMPANY)

INDEX TO FINANCIAL STATEMENTS

MARCH 31, 2009, AND 2008

| F-2 |

| | |

| Financial Statements- | |

| | |

| Balance Sheets as of March 31, 2009, and 2008 | F-3 |

| | |

| Statements of Operations and Comprehensive (Loss) for the Year Ended | |

| March 31, 2009, the Period Ended March 31, 2008, and Cumulative from Inception | F-4 |

| | |

| Statement of Stockholders’ Equity (Deficit) for the Periods from | |

| from Inception through March 31, 2009 | F-5 |

| | |

| Statements of Cash Flows for the Year Ended March 31, 2009, the | |

| Period Ended March 31, 2008, and Cumulative from Inception | F-6 |

| | |

| Notes to Financial Statements March 31, 2009, and 2008 | F-7 |

REPORT OF REGISTERED INDEPENDENT AUDITORS

To the Board of Directors and Stockholders

of TechMedia Advertising (India) Private Limited:

We have audited the accompanying balance sheets of TechMedia Advertising (India) Private Limited (an India corporation in the development stage) as of March 31, 2009, and 2008, and the related statements of operations and comprehensive (loss), stockholders’ equity (deficit), and cash flows for the periods then ended, and from inception (December 27, 2007) through March 31, 2009. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States of America). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of TechMedia Advertising (India) Private Limited as of March 31, 2009, and 2008, and the results of its operations and its cash flows for the periods then ended, and from inception (December 27, 2007) through March 31, 2009, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company is in the development stage, and has not established any source of revenue to cover its operating costs. As such, it has incurred an operating loss since inception. Further, as of March 31, 2009, and 2008, the cash resources of the Company were insufficient to meet its planned business objectives. These and other factors raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plan regarding these matters is also described in Note 2 to the financial statements. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Respectfully submitted,

/S/ Davis Accounting Group P.C.

Cedar City, Utah,

September 15, 2009.

TECHMEDIA ADVERTISING (INDIA) PRIVATE LIMITED

(A DEVELOPMENT STAGE COMPANY)

BALANCE SHEETS

AS OF MARCH 31, 2009, AND 2008

| | | 2009 | | | 2008 | |

| ASSETS | | | | | | |

| Current Assets: | | | | | | |

| Cash and cash equivalents | | $ | 117 | | | $ | 151 | |

| Total current assets | | | 117 | | | | 151 | |

| Total Assets | | $ | 117 | | | $ | 151 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | | | | | | | | |

| Current Liabilities: | | | | | | | | |

| Accrued liabilities | | $ | 1,594 | | | $ | - | |

| Total current liabilities | | | 1,594 | | | | - | |

| Total liabilities | | | 1,594 | | | | - | |

| Commitments and Contingencies | | | | | | | | |

| Stockholders' Equity (Deficit) | | | | | | | | |

| Common stock, par value $2.537 per share, 1,000 shares authorized; 1,000 shares issued and outstanding in 2009 and 2008, respectively | | | 2,537 | | | | 2,537 | |

| Accumulated other comprehensive income (loss) | | | 120 | | | | (52 | ) |

| (Deficit) accumulated during the development stage | | | (4,134 | ) | | | (2,334 | ) |

| Total stockholders' equity (deficit) | | | (1,477 | ) | | | 151 | |

| Total Liabilities and Stockholders' Equity (Deficit) | | $ | 117 | | | $ | 151 | |

The accompanying notes to financial statements are

an integral part of these balance sheets.

TECHMEDIA ADVERTISING (INDIA) PRIVATE LIMITED

(A DEVELOPMENT STAGE COMPANY)

STATEMENTS OF OPERATIONS AND COMPREHENSIVE (LOSS)

FOR THE YEAR ENDED MARCH 31 2009, THE PERIOD ENDED MARCH 31, 2008,

AND CUMULATIVE FROM INCEPTION (DECEMBER 27, 2007)

THROUGH MARCH 31, 2009

| | | Year Ended | | | Period Ended | | | | |

| | | March 31, | | | March 31, | | | Cumulative from | |

| | | 2009 | | | 2008 | | | Inception | |

| Revenues, net | | $ | - | | | $ | - | | | $ | - | |

| Cost of Revenues | | | - | | | | - | | | | - | |

| Gross Profit | | | - | | | | - | | | | - | |

| Expenses: | | | | | | | | | | | | |

| General and administrative | | | 1,800 | | | | 2,334 | | | | 4,134 | |

| Total operating expenses | | | 1,800 | | | | 2,334 | | | | 4,134 | |

| (Loss) from Continuing Operations | | | (1,800 | ) | | | (2,334 | ) | | | (4,134 | ) |

| Other Income (expense) | | | - | | | | - | | | | - | |

| Provision for Income Taxes | | | - | | | | - | | | | - | |

| Net (Loss) | | | (1,800 | ) | | | (2,334 | ) | | | (4,134 | ) |

| India foreign currency translation | | | 172 | | | | (52 | ) | | | 120 | |

| Total Comprehensive (Loss) | | $ | (1,628 | ) | | $ | (2,386 | ) | | $ | (4,014 | ) |

| (Loss) Per Common Share: | | | | | | | | | | | | |

| (Loss) per common share - Basic and Diluted | | $ | (1.80 | ) | | $ | (2.33 | ) | | | | |

Weighted Average Number of Common Shares Outstanding - Basic and Diluted | | | 1,000 | | | | 1,000 | | | | | |

The accompanying notes to financial statements are

an integral part of these statements.

TECHMEDIA ADVERTISING (INDIA) PRIVATE LIMITED

(A DEVELOPMENT STAGE COMPANY)

STATEMENT OF STOCKHOLDERS' EQUITY (DEFICIT)

FOR THE PERIOD FROM INCEPTION (DECEMBER 27, 2007)

THROUGH MARCH 31, 2009

| | | | | | | | | | | | (Deficit) | | | | |

| | | | | | | | | Accumulated | | | Accumulated | | | | |

| | | | | | | | | Other | | | During the | | | | |

| | | Common stock | | | Comprehensive | | | Development | | | | |

| Description | | Shares | | | Amount | | | Income (Loss) | | | Stage | | | Total | |

| | | | | | | | | | | | | | | | |

| Balance - December 27, 2007 | | | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| Common stock issued for cash | | | 1,000 | | | | 2,537 | | | | - | | | | - | | | | 2,537 | |

| India foreign currency translation | | | - | | | | - | | | | (52 | ) | | | - | | | | (52 | ) |

| Net (loss) for the period | | | - | | | | - | | | | - | | | | (2,334 | ) | | | (2,334 | ) |

| Balance -March 31, 2008 | | | 1,000 | | | $ | 2,537 | | | $ | (52 | ) | | $ | (2,334 | ) | | $ | 151 | |

| India foreign currency translation | | | - | | | | - | | | | 172 | | | | - | | | | 172 | |

| Net (loss) for the period | | | - | | | | - | | | | - | | | | (1,800 | ) | | | (1,800 | ) |

| Balance - March 31, 2009 | | | 1,000 | | | $ | 2,537 | | | $ | 120 | | | $ | (4,134 | ) | | $ | (1,477 | ) |

The accompanying notes to financial statements are

an integral part of this statement.

TECHMEDIA ADVERTISING (INDIA) PRIVATE LIMITED

(A DEVELOPMENT STAGE COMPANY)

STATEMENTS OF CASH FLOWS

FOR THE YEAR ENDED MARCH 31, 2009, THE PERIOD ENDED MARCH 31, 2008,

AND CUMULATIVE FROM INCEPTION (DECEMBER 27, 2007)

THROUGH MARCH 31, 2009

| | | Year Ended | | | Period Ended | | | Cumulative | |

| | | March 31, | | | March 31, | | | from | |

| | | 2009 | | | 2008 | | | Inception | |

| Operating Activities: | | | | | | | | | |

| Net (loss) | | $ | (1,800 | ) | | $ | (2,334 | ) | | $ | (4,134 | ) |

| Adjustments to reconcile net (loss) to net cash (used in) operating activities: | | | | | | | | | | | | |

| Changes in Current Assets and Liabilities- | | | | | | | | | | | | |

| Accrued liabilities | | | 1,594 | | | | - | | | | 1,594 | |

| Net Cash (Used in) Operating Activities | | | (206 | ) | | | (2,334 | ) | | | (2,540 | ) |

| Investing Activities: | | | | | | | | | | | | |

| Purchases of property and equipment | | | - | | | | - | | | | - | |

| Net Cash (Used in) Investing Activities | | | - | | | | - | | | | - | |

| Financing Activities: | | | | | | | | | | | | |

| Common stock issued for cash | | | - | | | | 2,537 | | | | 2,537 | |

| Net Cash Provided by Financing Activities | | | - | | | | 2,537 | | | | 2,537 | |

| Effect of Exchange Rate Changes on Cash | | | 172 | | | | (52 | ) | | | 120 | |

| Net Increase (Decrease) in Cash | | | (34 | ) | | | 151 | | | | 117 | |

| Cash - Beginning of Period | | | 151 | | | | - | | | | - | |

| Cash - End of Period | | $ | 117 | | | $ | 151 | | | $ | 117 | |

| Supplemental Disclosure of Cash Flow Information: | | | | | | | | | | | | |

| Cash paid during the period for: | | | | | | | | | | | | |

| Interest | | $ | - | | | $ | - | | | $ | - | |

| Income taxes | | $ | - | | | $ | - | | | $ | - | |

The accompanying notes to financial statements are

an integral part of these statements.

TECHMEDIA ADVERTISING (INDIA) PRIVATE LIMITED

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2009, AND 2008

| (1) | Basis of Presentation and Summary of Significant Accounting Policies |

Basis of Presentation and Organization

TechMedia Advertising (India) Private Limited (the “Company” or “TM India”) was incorporated under the laws of India on December 27, 2007, and is in the development stage. The business plan of the Company is the sale and delivery of outdoor advertising on billboards and digital signs in India located in high traffic locations, which locations range from transportation vehicles, commercial buildings, supermarkets, and restaurants, by forming partnerships with media space owners.

The accompanying financial statements of TM India were prepared from the accounts of the Company under the accrual basis of accounting.

Cash and Cash Equivalents

For purposes of reporting within the statements of cash flows, the Company considers all cash on hand, cash accounts not subject to withdrawal restrictions or penalties, and all highly liquid debt instruments purchased with a maturity of three months or less to be cash and cash equivalents.

Revenue Recognition

The Company is in the development stage and has yet to realize revenues from planned operations. Once the Company has commenced planned operations, it will recognize revenues when completion of recruiting services has occurred provided there is persuasive evidence of an agreement, acceptance has been approved by its customers, the fee is fixed or determinable based on the completion of stated terms and conditions, and collection of any related receivable is probable.

Lease Obligations

All noncancellable leases with an initial term greater than one year are categorized as either capital or operating leases. Assets recorded under capital leases are amortized according to the same methods employed for property and equipment or over the term of the related lease, if shorter.

Foreign Currency Translation

The Company accounts for foreign currency translation pursuant to SFAS No. 52, “Foreign Currency Translation” (“SFAS No. 52”). The Company’s functional currency is the India rupee (INR). Under SFAS No. 52, all assets and liabilities are translated into United States dollars using the current exchange rate at the end of each fiscal period. Revenues and expenses are translated using the average exchange rates prevailing throughout the respective periods. Translation adjustments are included in other comprehensive income (loss) for the period. Certain transactions of the Company are denominated in United States dollars or other currencies. Translation gains or losses related to such transactions are recognized for each reporting period in the related statement of operations and comprehensive income (loss).

TECHMEDIA ADVERTISING (INDIA) PRIVATE LIMITED

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2009, AND 2008

Loss per Common Share

Basic loss per share is computed by dividing the net loss attributable to the common stockholders by the weighted average number of shares of common stock outstanding during the period. Diluted loss per share is computed similar to basic loss per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive. There were no dilutive financial instruments issued or outstanding for the years ended March 31, 2009 and 2008.

Fair Value of Financial Instruments

The Company estimates the fair value of financial instruments using the available market information and valuation methods. Considerable judgment is required in estimating fair value. Accordingly, the estimates of fair value may not be indicative of the amounts the Company could realize in a current market exchange. As of March 31, 2009, and 2008, the carrying value of the Company’s financial instruments approximated fair value due to their short-term nature and maturity.

Comprehensive Income (Loss)

The Company has adopted Statement of Financial Accounting Standards (SFAS) No. 130, “Reporting Comprehensive Income.” Comprehensive income or loss includes net income or loss and all changes in equity during a period that arises from non-owner sources, such as foreign currency items and unrealized gains and losses on certain investments in equity securities.

Income Taxes

The Company accounts for income taxes pursuant to SFAS No. 109, “Accounting for Income Taxes” (“SFAS No. 109”). Under SFAS 109, deferred tax assets and liabilities are determined based on temporary differences between the bases of certain assets and liabilities for income tax and financial reporting purposes. The deferred tax assets and liabilities are classified according to the financial statement classification of the assets and liabilities generating the differences.

The Company maintains a valuation allowance with respect to deferred tax assets. The Company establishes a valuation allowance based upon the potential likelihood of realizing the deferred tax asset and taking into consideration the Company’s financial position and results of operations for the current period. Future realization of the deferred tax benefit depends on the existence of sufficient taxable income within the carryforward period under the Federal tax laws.

TECHMEDIA ADVERTISING (INDIA) PRIVATE LIMITED

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2009, AND 2008

Changes in circumstances, such as the Company generating taxable income, could cause a change in judgment about the realizability of the related deferred tax asset. Any change in the valuation allowance will be included in income in the year of the change in estimate.

Use of Estimates

The preparation of the Company’s consolidated financial statements in conformity with generally accepted accounting principles of United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Management makes its best estimate of the ultimate outcome for these items based on historical trends and other information available when the consolidated financial statements are prepared. Actual results could differ from those estimates.

| (2) | Development Stage Activities and Going Concern |

For the period from December 27, 2007, through March 31, 2009, TM India was organized and incorporated, and initiated its development stage activities by investigating, researching and establishing relationships in the media industry in India. The Company also intends to conduct additional capital formation activities through the issuance of debt and the completion of a business combination to further conduct its operations.

While management of the Company believes that the Company will be successful in its planned operating, capital formation, and business combination activities, there can be no assurance that it will be successful in the development of its planned advertising services such that it will generate sufficient revenues to earn a profit or sustain its operations.

The accompanying financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which contemplate continuation of the Company as a going concern. The Company has not established any source of revenue to cover its operating costs, and as such, has incurred an operating loss since inception. Further, as of March 31, 2009, and 2008, the cash resources of the Company were insufficient to meet its planned business objectives. These and other factors raise substantial doubt about the Company’s ability to continue as a going concern. The accompanying financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or liabilities that may result from the possible inability of the Company to continue as a going concern.

On December 27, 2007, the Company issued 1,000 shares of common stock, par value $2.537 per share, to two stockholders for proceeds of $2,537. As of March 31, 2009, and 2008, the Company had a total of 1,000 common shares issued and outstanding.

TECHMEDIA ADVERTISING (INDIA) PRIVATE LIMITED

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2009, AND 2008

On June 22, 2009, TechMedia Advertising Mauritius, a Mauritius corporation (“TM Mauritius”), acquired sole beneficial ownership of TM India as a wholly owned subsidiary through an exchange agreement whereby four ordinary shares of capital stock of TM Mauritius were exchanged for all of the 1,000 shares of issued capital stock of TM India. See Note 6 for additional information.

The provision (benefit) for income taxes for the periods ended March 31, 2009, and 2008, were as follows (assuming a 15 percent effective income tax rate):

| | | 2009 | | | 2008 | |

| | | | | | | |

| Current Tax Provision: | | | | | | |

| Federal and local- | | | | | | |

| Taxable income | | $ | - | | | $ | - | |

| Total current tax provision | | $ | - | | | $ | - | |

| | | | | | | | | |

| Deferred Tax Provision: | | | | | | | | |

| Federal and local- | | | | | | | | |

| Loss carryforwards | | $ | 270 | | | $ | 350 | |

| Change in valuation allowance | | | (270 | ) | | | (350 | ) |

| Total deffered tax provision | | $ | - | | | $ | - | |

The Company had deferred income tax assets as of March 31, 2009, and 2008, as follows:

| | | 2009 | | | 2008 | |

| | | | | | | |

| Loss Carryforwards | | $ | 620 | | | $ | 350 | |

| Less - Valuation allowance | | | (620 | ) | | | (350 | ) |

| Total net deferred tax assets | | $ | - | | | $ | - | |

The Company provided a valuation allowance equal to the deferred income tax assets for the years ended March 31, 2009, and 2008, because it is not presently known whether future taxable income will be sufficient to utilize the loss carryforwards.

As of March 31, 2009, and 2008, TM India had approximately $4,134 and $2,334, respectively, in tax loss carryforwards that can be utilized in future periods to offset taxable income. Such tax loss carryforwards will begin to expire in the year 2027.

TECHMEDIA ADVERTISING (INDIA) PRIVATE LIMITED

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2009, AND 2008

| (5) | Recent Accounting Pronouncements |

In March 2008, the FASB issued FASB Statement No. 161, “Disclosures about Derivative Instruments and Hedging Activities – an amendment of FASB Statement 133” (“SFAS No. 161”). SFAS No. 161 enhances required disclosures regarding derivatives and hedging activities, including enhanced disclosures regarding how: (a) an entity uses derivative instruments; (b) derivative instruments and related hedged items are accounted for under SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities”; and (c) derivative instruments and related hedged items affect an entity’s financial position, financial performance, and cash flows. Specifically, SFAS No. 161 requires:

| | – | disclosure of the objectives for using derivative instruments be disclosed in terms of underlying risk and accounting designation; |

| | | disclosure of the fair values of derivative instruments and their gains and losses in a tabular format; |

| | | disclosure of information about credit-risk-related contingent features; and |

| | | cross-reference from the derivative footnote to other footnotes in which derivative-related information is disclosed. |

SFAS No. 161 is effective for fiscal years and interim periods beginning after November 15, 2008. Earlier application is encouraged. The management of the Company does not expect the adoption of this pronouncement to have a material impact on its financial statements.

In May 2008, the FASB issued FASB Statement No. 162, “The Hierarchy of Generally Accepted Accounting Principles” (“SFAS No. 162”). SFAS No. 162 is intended to improve financial reporting by identifying a consistent framework, or hierarchy, for selecting accounting principles to be used in preparing financial statements that are presented in conformity with U.S. generally accepted accounting principles (“GAAP”) for nongovernmental entities.

Prior to the issuance of SFAS No. 162, GAAP hierarchy was defined in the American Institute of Certified Public Accountants (“AICPA”) Statement on Auditing Standards, “The Meaning of Present Fairly in Conformity with Generally Accept Accounting Principles” (“SAS No. 69”). SAS No. 69 has been criticized because it is directed to the auditor rather than the entity. SFAS No. 162 addresses these issues by establishing that the GAAP hierarchy should be directed to entities because it is the entity (not the auditor) that is responsible for selecting accounting principles for financial statements that are presented in conformity with GAAP.

The sources of accounting principles that are generally accepted are categorized in descending order as follows:

| a) | FASB Statements of Financial Accounting Standards and Interpretations, FASB Statement 133 Implementation Issues, FASB Staff Positions, and American Institute of Certified Public Accountants (AICPA) Accounting Research Bulletins and Accounting Principles Board Opinions that are not superseded by actions of the FASB. |

TECHMEDIA ADVERTISING (INDIA) PRIVATE LIMITED

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2009, AND 2008

| b) | FASB Technical Bulletins and, if cleared by the FASB, AICPA Industry Audit and Accounting Guides and Statements of Position. |

| c) | AICPA Accounting Standards Executive Committee Practice Bulletins that have been cleared by the FASB, consensus positions of the FASB Emerging Issues Task Force (EITF), and the Topics discussed in Appendix D of EITF Abstracts (EITF D-Topics). |

| d) | Implementation guides (Q&As) published by the FASB staff, AICPA Accounting Interpretations, AICPA Industry Audit and Accounting Guides and Statements of Position not cleared by the FASB, and practices that are widely recognized and prevalent either generally or in the industry. |

SFAS No. 162 is effective 60 days following the SEC’s approval of the Public Company Accounting Oversight Board amendment to its authoritative literature. It is only effective for nongovernmental entities; therefore, the GAAP hierarchy will remain in SAS No. 69 for state and local governmental entities and federal governmental entities. The management of the Company does not expect the adoption of this pronouncement to have a material impact on its financial statements.

In May 2008, the FASB issued FASB Statement No. 163, “Accounting for Financial Guarantee Insurance Contracts” (“SFAS No. 163”). SFAS No. 163 clarifies how FASB Statement No. 60, “Accounting and Reporting by Insurance Enterprises” (“SFAS No. 60”), applies to financial guarantee insurance contracts issued by insurance enterprises, including the recognition and measurement of premium revenue and claim liabilities. It also requires expanded disclosures about financial guarantee insurance contracts.

The accounting and disclosure requirements of SFAS No. 163 are intended to improve the comparability and quality of information provided to users of financial statements by creating consistency. Diversity exists in practice in accounting for financial guarantee insurance contracts by insurance enterprises under SFAS No. 60. That diversity results in inconsistencies in the recognition and measurement of claim liabilities because of differing views about when a loss has been incurred under FASB Statement No. 5, “Accounting for Contingencies” (“SFAS No. 5”). SFAS No. 163 requires that an insurance enterprise recognize a claim liability prior to an event of default when there is evidence that credit deterioration has occurred in an insured financial obligation. It also requires disclosure about (a) the risk-management activities used by an insurance enterprise to evaluate credit deterioration in its insured financial obligations and (b) the insurance enterprise’s surveillance or watch list.

SFAS No. 163 is effective for financial statements issued for fiscal years beginning after December 15, 2008, and all interim periods within those fiscal years, except for disclosures about the insurance enterprise’s risk-management activities. Disclosures about the insurance enterprise’s risk-management activities are effective the first period beginning after issuance of SFAS No. 163. Except for those disclosures, earlier application is not permitted. The management of the Company does not expect the adoption of this pronouncement to have material impact on its financial statements.

TECHMEDIA ADVERTISING (INDIA) PRIVATE LIMITED

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2009, AND 2008

On May 22, 2009, the FASB issued FASB Statement No. 164, “Not-for-Profit Entities: Mergers and Acquisitions” (“SFAS No. 164”). SFAS No. 164 is intended to improve the relevance, representational faithfulness, and comparability of the information that a not-for-profit entity provides in its financial reports about a combination with one or more other not-for-profit entities, businesses, or nonprofit activities. To accomplish that, this Statement establishes principles and requirements for how a not-for-profit entity:

| | a. | Determines whether a combination is a merger or an acquisition. |

| | b. | Applies the carryover method in accounting for a merger. |

| | c. | Applies the acquisition method in accounting for an acquisition, including determining which of the combining entities is the acquirer. |

| | d. | Determines what information to disclose to enable users of financial statements to evaluate the nature and financial effects of a merger or an acquisition. |

This Statement also improves the information a not-for-profit entity provides about goodwill and other intangible assets after an acquisition by amending FASB Statement No. 142, Goodwill and Other Intangible Assets, to make it fully applicable to not-for-profit entities.

SFAS No. 164 is effective for mergers occurring on or after December 15, 2009, and acquisitions for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2009. Early application is prohibited. The management of the Company does not expect the adoption of this pronouncement to have material impact on its financial statements.

On May 28, 2009, the FASB issued FASB Statement No. 165, “Subsequent Events” (“SFAS No. 165”). SFAS No. 165 establishes general standards of accounting for and disclosure of events that occur after the balance sheet date but before financial statements are issued or are available to be issued. Specifically, SFAS No. 165 provides:

| | 1. | The period after the balance sheet date during which management of a reporting entity should evaluate events or transactions that may occur for potential recognition or disclosure in the financial statements. |

| | 2. | The circumstances under which an entity should recognize events or transactions occurring after the balance sheet date in its financial statements. |

| | 3. | The disclosures that an entity should make about events or transactions that occurred after the balance sheet date. |

In accordance with this Statement, an entity should apply the requirements to interim or annual financial periods ending after June 15, 2009. The management of the Company does not expect the adoption of this pronouncement to have material impact on its financial statements.

On June 9, 2009, the FASB issued FASB Statement No. 166, “Accounting for Transfers of Financial Assets- an amendment of FASB Statement No., 140” (“SFAS No. 166”).

TECHMEDIA ADVERTISING (INDIA) PRIVATE LIMITED

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2009, AND 2008

SFAS No. 166 revises the derecognization provision of SFAS No. 140 “Accounting for Transfers and Servicing of Financial Assets and Extinguishment of Liabilities” and will require entities to provide more information about sales of securitized financial assets and similar transactions, particularly if the seller retains some risk with respect to the assets.

It also eliminates the concept of a "qualifying special-purpose entity."

This statement is effective for financial asset transfers occurring after the beginning of an entity's first fiscal year that begins after November 15, 2009. The management of the Company does not expect the adoption of this pronouncement to have a material impact on its financial statements.

In June 2009, the FASB issued SFAS No. 167 "Amendments to FASB Interpretation No. 46(R).” SFAS No. 167 amends certain requirements of FASB Interpretation No. 46(R), “Consolidation of Variable Interest Entities” to improve financial reporting by companies involved with variable interest entities and to provide additional disclosures about the involvement with variable interest entities and any significant changes in risk exposure due to that involvement. A reporting entity will be required to disclose how its involvement with a variable interest entity affects the reporting entity's financial statements.

This Statement shall be effective as of the beginning of each reporting entity’s first annual reporting period that begins after November 15, 2009. The management of the Company does not expect the adoption of this pronouncement to have a material impact on its financial statements.

In June 2009, the FASB issued SFAS No. 168, "The FASB Accounting Standards Codification and the Hierarchy of Generally Accepted Accounting Principles - a replacement of FASB Statement No. 162" ("SFAS No. 168"). SFAS No. 168 establishes the FASB Accounting Standards Codification (the "Codification") to become the single official source of authoritative, nongovernmental US generally accepted accounting principles (GAAP). The Codification did not change GAAP but reorganizes the literature.

SFAS No. 168 is effective for interim and annual periods ending after September 15, 2009. The management of the Company does not expect the adoption of this pronouncement to have a material impact on its financial statements.

On April 27, 2009, TM India and TechMedia Advertising, Inc., a Nevada corporation (“TM Inc.”), signed a loan agreement (the “Loan Agreement”) whereby TM Inc. agreed to loan to the Company up to $1,000,000 for the purpose of funding the company to equip buses in India under a joint venture business arrangement to be conducted in India between TM Mauritius and Peacock Media Ltd. Loan advances under the Loan Agreement carry an interest rate of 3 percent per annum, and all interest and principal outstanding are due and payable one year from the date of the Loan Agreement, unless a share exchange agreement is completed between TM Inc. and TM Mauritius, and TM Mauritius acquires TM India as a wholly owned subsidiary, at which time the total amount of principal and interest due will become an inter-corporate loan. Subsequent to March 31, 2009, the Company received a loan in the amount of $200,000 from TM Inc. See additional information below.

TECHMEDIA ADVERTISING (INDIA) PRIVATE LIMITED

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2009, AND 2008

On May 12, 2009, the Company entered into a lease agreement for office space in India with an unrelated third party. The lease term is 11 months from May 2009, through April 2010. The total cost of the lease during the lease term will be approximately $1,495.

On June 22, 2009, TM Mauritius acquired all of the assets (and assumed certain liabilities) of TM India. The purchase price paid by TM Mauritius was $0 through an exchange agreement whereby four ordinary shares of capital stock of TM Mauritius were exchanged for all of the 1,000 shares of issued capital stock of TM India. The value of the business combination was $220,620, less liabilities assumed of the same amount. The total purchase price of $0 was allocated as follows:

| Current assets | | $ | 209,744 | |

| Property | | | 4,159 | |

| Excess cost over net assets acquired | | | 6,717 | |

| Total assets acquired | | | 220,620 | |

| | | | | |

| Current liabilities assumed | | | 220,620 | |

| Purchase price | | $ | - | |

On July 27, 2009, TM Mauritius (including TM India as a wholly owned subsidiary of TM Mauritius) entered into a share exchange agreement (the “Exchange Agreement”) with TM Inc. and all of the shareholders of TM Mauritius (the “Sellers”), whereby TM Inc. acquired all of the issued and outstanding shares in the capital of TM Mauritius from the Sellers in exchange for the issuance of 24,000,000 shares of common stock of TM Inc. to the Sellers on a pro rata basis in accordance with each Seller’s percentage of ownership in TM Mauritius.

On August 6, 2009, a share exchange agreement between TM Inc. and TM Mauritius closed, and the amount of principal and interest due under the Loan Agreement, described above, became an inter-corporate loan.

TECHMEDIA ADVERTISING MAURITIUS

(A DEVELOPMENT STAGE COMPANY)

INDEX TO FINANCIAL STATEMENTS

MARCH 31, 2009

| Report of Registered Independent Auditors | | | F-17 | |

| | | | | |

| Financial Statements- | | | | |

| | | | | |

| Balance Sheet March 31, 2009 | | | F-18 | |

| | | | | |

| Statements of Operations for the Period Ended March 31, 2009, and cumulative from Inception through March 31, 2009 | | | F-19 | |

| | | | | |

| Statement of Stockholders’ (Deficit) for the Period from Inception through March 31, 2009 | | | F-20 | |

| | | | | |

| Statements of Cash Flows for the Period Ended March 31, 2009, and cumulative from Inception through March 31, 2009 | | | F-21 | |

| | | | | |

| Notes to Financial Statements March 31, 2009 | | | F-22 | |

REPORT OF REGISTERED INDEPENDENT AUDITORS

To the Board of Directors and Stockholders

of TechMedia Advertising Mauritius:

We have audited the accompanying balance sheet of TechMedia Advertising Mauritius (a Mauritius corporation in the development stage) as of March 31, 2009, and the related statements of operations, stockholders’ (deficit), and cash flows for the period then ended, and cumulative from inception (March 11, 2009) through March 31, 2009. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States of America). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of TechMedia Advertising Mauritius as of March 31, 2009, and the results of its operations and its cash flows for the period ended March 31, 2009, and cumulative from inception (March 11, 2009) through March 31, 2009, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company is in the development stage, and has not established any source of revenue to cover its operating costs. As such, it has incurred an operating loss since inception. Further, as of March 31, 2009, the cash resources of the Company were insufficient to meet its planned business objectives. These and other factors raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plan regarding these matters is also described in Note 2 to the financial statements. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Respectfully submitted,

/s/ Davis Accounting Group P.C.

Cedar City, Utah,

September 15, 2009.

TECHMEDIA ADVERTISING MAURITIUS

(A DEVELOPMENT STAGE COMPANY)

BALANCE SHEET (NOTE 2)

AS OF MARCH 31, 2009

| | | 2009 | |

| ASSETS |

| Current Assets: | | | |

| Accounts receivable - Other | | $ | 1,875 | |

| Total current assets | | | 1,875 | |

| Total Assets | | $ | 1,875 | |

| | | | | |

| LIABILITIES AND STOCKHOLDER'S ( DEFICIT) |

| Current Liabilities: | | | | |

| Accounts payable - Trade | | | 605 | |

| Loan - Related party | | | 8,497 | |

| Total current liabilities | | | 9,102 | |

| Total liabilities | | | 9,102 | |

| Commitments and Contingencies | | | | |

| Stockholders' (Deficit): | | | | |

| Common stock, par value $1 per share, three shares issued and outstanding in 2009 | | | 3 | |

| (Deficit) accumulated during the development stage | | | (7,230 | ) |

| Total stockholders' (deficit) | | | (7,227 | ) |

| Total Liabilities and Stockholders' (Deficit) | | $ | 1,875 | |

The accompanying notes to financial statements are

an integral part of this balance sheet.

TECHMEDIA ADVERTISING MAURITIUS

(A DEVELOPMENT STAGE COMPANY)

STATEMENTS OF OPERATIONS (NOTE 2)

FOR THE PERIOD ENDED MARCH 31 2009,

AND CUMULATIVE FROM INCEPTION (MARCH 11, 2009)

THROUGH MARCH 31, 2009

| | | Period Ended | | | Cumulative | |

| | | March 31, | | | From | |

| | | 2009 | | | Inception | |

| | | | | | | |

| Revenues, net | | $ | - | | | $ | - | |

| Cost of Revenues | | | - | | | | - | |

| Gross Profit | | | - | | | | - | |

| Expenses: | | | | | | | | |

| General and administrative | | | 7,230 | | | | 7,230 | |

| Total operating expenses | | | 7,230 | | | | 7,230 | |

| (Loss) from Operations | | | (7,230 | ) | | | (7,230 | ) |

| Other Income (Expense) | | | - | | | | - | |

| Provision for income taxes | | | - | | | | - | |

| Net (Loss) | | $ | (7,230 | ) | | $ | (7,230 | ) |

| (Loss) Per Common Share: | | | | | | | | |

| (Loss) per common share - Basic and Diluted | | $ | (2,410 | ) | | | | |

| Weighted Average Number of Common Shares Outstanding - Basic and Diluted | | | 3 | | | | | |

The accompanying notes to financial statements are

an integral part of these statements.

TECHMEDIA ADVERTISING MAURITIUS

(A DEVELOPMENT STAGE COMPANY)

STATEMENT OF STOCKHOLDERS' (DEFICIT) (NOTE 2)

FOR THE PERIOD FROM INCEPTION MARCH 11, 2009)

THROUGH MARCH 31, 2009

| | | | | | | | | (Deficit) | | | | |

| | | | | | | | | Accumulated | | | | |

| | | | | | | | | During the | | | | |

| | | Common Stock | | | Development | | | | |

| Description | | Shares | | | Amount | | | Stage | | | Total | |

| | | | | | | | | | | | | |

| Balance - March 11, 2009 | | | - | | | $ | - | | | $ | - | | | $ | - | |

| Common stock issued for cash | | | 3 | | | | 3 | | | | - | | | | 3 | |

| Net (loss) for the period | | | - | | | | - | | | | (7,230 | ) | | | (7,230 | ) |

| Balance -March 31, 2008 | | | 3 | | | $ | 3 | | | $ | (7,230 | ) | | $ | (7,227 | ) |

The accompanying notes to financial statements are

an integral part of this statement.

TECHMEDIA ADVERTISING MAURITUS

(A DEVELOPMENT STAGE COMPANY)

STATEMENTS OF CASH FLOWS

FOR THE PERIOD ENDED MARCH 31, 2009, AND

CUMULATIVE FROM INCEPTION (MARCH 11, 2009)

THROUGH MARCH 31, 2009

| | | Period Ended | | | Cumulative | |

| | | March 31, | | | From | |

| | | 2009 | | | Inception | |

| | | | | | | |

| Operating Activities: | | | | | | |

| Net (loss) | | $ | (7,230 | ) | | $ | (7,230 | ) |

| Adjustments to reconcile net (loss) to net cash (used in) operating activities: | | | | | | | | |

| Changes in Current Assets and Liabilities- | | | | | | | | |

| Accounts receivable - Other | | | (1,875 | ) | | | (1,875 | ) |

| Accounts payable - Trade | | | 605 | | | | 605 | |

| Net Cash (Used in) Operating Activities | | | (8,500 | ) | | | (8,500 | ) |

| Investing Activities: | | | | | | | | |

| Purchase of property and equipment | | | - | | | | - | |

| Net Cash (Used in) Investing Activities | | | - | | | | - | |

| Financing Activities: | | | | | | | | |

| Proceeds from loan - Related party | | | 8,497 | | | | 8,497 | |

| Proceeds from the issuance of common stock | | | 3 | | | | 3 | |

| Net Cash Provided by Financing Activities | | | 8,500 | | | | 8,500 | |

| Net Increase (Decrease) in Cash | | | - | | | | - | |

| Cash - Beginning of Period | | | - | | | | - | |

| Cash - End of Period | | $ | - | | | $ | - | |

| Supplemental Disclosure of Cash Flow Information: | | | | | | | | |

| Cash paid during the period for: | | | | | | | | |

| Interest | | $ | - | | | $ | - | |

| Income taxes | | $ | - | | | $ | - | |

The accompanying notes to financial statements are

an integral part of these statements.

TECHMEDIA ADVERTISING MAURITIUS

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2009

| (1) | Basis of Presentation and Summary of Significant Accounting Policies |

Basis of Presentation and Organization

TechMedia Advertising Mauritius (the “Company” or “TM Mauritius”) is a Mauritius corporation in the development stage. The Company was incorporated under the laws of Mauritius on March 11, 2009. The business plan of the Company is, by merger or acquisition, to enter into the streaming digital medial advertising business in India.

The accompanying financial statements of TechMedia Advertising Mauritius were prepared from the accounts of the Company under the accrual basis of accounting.

Cash and Cash Equivalents

For purposes of reporting within the statements of cash flows, the Company considers all cash on hand, cash accounts not subject to withdrawal restrictions or penalties, and all highly liquid debt instruments purchased with a maturity of three months or less to be cash and cash equivalents.

Revenue Recognition

The Company is in the development stage and has yet to realize revenues from planned operations. Once the Company has commenced planned operations, it will recognize revenues when completion of its advertising services has occurred provided there is persuasive evidence of an agreement, acceptance has been approved by its customers, the fee is fixed or determinable based on the completion of stated terms and conditions, and collection of any related receivable is probable.

Loss per Common Share

Basic loss per share is computed by dividing the net loss attributable to the common stockholders by the weighted average number of shares of common stock outstanding during the period. Diluted loss per share is computed similar to basic loss per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive. There were no dilutive financial instruments issued or outstanding for the period ended March 31, 2009

Fair Value of Financial Instruments

The Company estimates the fair value of financial instruments using the available market information and valuation methods. Considerable judgment is required in estimating fair value. Accordingly, the estimates of fair value may not be indicative of the amounts the Company could realize in a current market exchange. As of March 31, 2009, the carrying value of the Company’s financial instruments approximated fair value due to their short-term nature and maturity.

TECHMEDIA ADVERTISING MAURITIUS

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2009

Income Taxes

The Company accounts for income taxes pursuant to SFAS No. 109, “Accounting for Income Taxes” (“SFAS No. 109”). Under SFAS 109, deferred tax assets and liabilities are determined based on temporary differences between the bases of certain assets and liabilities for income tax and financial reporting purposes. The deferred tax assets and liabilities are classified according to the financial statement classification of the assets and liabilities generating the differences.

The Company maintains a valuation allowance with respect to deferred tax assets. The Company establishes a valuation allowance based upon the potential likelihood of realizing the deferred tax asset and taking into consideration the Company’s financial position and results of operations for the current period. Future realization of the deferred tax benefit depends on the existence of sufficient taxable income within the carryforward period under the Federal tax laws.

Changes in circumstances, such as the Company generating taxable income, could cause a change in judgment about the realizability of the related deferred tax asset. Any change in the valuation allowance will be included in income in the year of the change in estimate.

Use of Estimates

The preparation of the Company’s financial statements in conformity with generally accepted accounting principles of United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Management makes its best estimate of the ultimate outcome for these items based on historical trends and other information available when the financial statements are prepared. Actual results could differ from those estimates.

| (2) | Development Stage Activities and Going Concern |

For the period from March 11, 2009, through March 31, 2009, the Company was incorporated and organized, and a loan from an affiliated entity was completed to provide initial working capital and payment for common stock issued. The business plan of the Company is, by merger or acquisition, to enter into the streaming digital media advertising business in India.

TECHMEDIA ADVERTISING MAURITIUS

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2009

On June 15, 2009, TM Mauritius received an assignment from TechMedia Advertising Singapore Pte. Ltd., a Singapore corporation and related party entity (“TM Singapore”), of its rights and obligations under the Summary of Terms of Investment with respect to a joint venture arrangement for operating the business of installing, commissioning, maintaining and commercializing mobile digital advertising platforms in public commuter transports such as buses and trains in India (the “JV Business”), which was entered into between TM Singapore, and Peacock Media Ltd., a company incorporated under the laws of India, on December 19, 2008.

TM Mauritius also intends to enter into a formal joint venture agreement with Peacock Media Ltd. (“Peacock”) in the near future to formalize the arrangement under the Summary of Terms of Investment discussed above which will include among other things the following terms:

| · | an India company will be established to act as the joint venture company (the “JV”); |

| · | the JV will be owned 85 percent by TM Mauritius and 15 percent by Peacock; |

| · | one Director of the JV shall be a nominee from Peacock and three Directors of the JV shall be nominees from TM Mauritius; |

| · | Peacock will contribute its exclusive media rights licenses granted to it by the Government of Tamil Nadu for buses and the Indian Central Government for the Indian Railway for trains, relating to the JV Business, which currently covers more than 10,000 buses and more than 50 railway trains; |

| · | Peacock will fully equip the buses and trains with the required hardware and software and ensure the same is in proper working order in order to support JV Business; |

| · | Peacock will provide access to all of Peacock’s current and future advertising clients to market the JV Business; |

| · | TM Mauritius will manage the JV Business; |

| · | TM Mauritius will reimburse Peacock for the costs associated with fully equipping the buses and trains after TM Mauritius certifies the proper equipping of the buses and trains by Peacock; |

| · | TM Mauritius will supply the necessary funding to the JV for operations and other working capital purposes. |

| · | Any profits generated from the sale of advertising space from the JV Business will be divided 85 percent for TM Mauritius and 15 percent for Peacock. |

The Company also intends to conduct additional capital formation activities through the issuance of its common stock and to further conduct its operations.

While management of the Company believes that the Company will be successful in its planned operating and capital formation activities, there can be no assurance that it will be successful in the development of its planned advertising services such that it will generate sufficient revenues to earn a profit or sustain its operations.

TECHMEDIA ADVERTISING MAURITIUS

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2009

The accompanying financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which contemplate continuation of the Company as a going concern. The Company has not established any source of revenue to cover its operating costs, and as such, has incurred an operating loss since inception in the amount of $7,230. Further, as of March 31, 2009, the cash resources of the Company were insufficient to meet its planned business objectives. These and other factors raise substantial doubt about the Company’s ability to continue as a going concern. The accompanying financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or liabilities that may result from the possible inability of the Company to continue as a going concern.

On March 11, 2009, the company issued three original common shares of stock to Ternes Capital Limited with a par value of US$1.00 per share. Subsequent to March 31, 2009, an additional seven shares of common stock of the Company were issued to OneMedia Limited (four shares in connection with the acquisition of TM India as a wholly owned subsidiary), and Mr. Johnny Lian Tian Yong (three shares).

The provision (benefit) for income taxes for the period ended March 31, 2009, was as follows:

| | | 2009 | |

| Current Tax Provision: | | | |

| Federal and Local- | | $ | - | |

| Total current tax provision | | $ | - | |

| | | | | |

| Deferred Tax Provision: | | | | |

| Federal and Local- | | | | |

| Tax loss carryforwards | | $ | 1,085 | |

| Change in valuation allowance | | | (1,085 | ) |

| Total deferred tax provision | | $ | - | |

The Company had deferred income tax assets as of March 31, 2009, as follows:

| | | 2009 | |

| Tax loss carryforwards | | $ | 1,085 | |

| Less - Valuation allowance | | | (1,085 | ) |

| Total net deferred tax assets | | $ | - | |

The Company provided a valuation allowance equal to the deferred income tax assets for the period ended March 31, 2009, because it is not presently known whether future taxable income will be sufficient to utilize the loss carryforwards.

TECHMEDIA ADVERTISING MAURITIUS

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2009

As of March 31, 2009, TM Mauritius had approximately $7,230 in tax loss carryforwards that will expire in the year 2028.

During the period ended March 31, 2009, the Company received a loan from TM Singapore, a related party entity, for working capital purposes. As of March 31, 2009, the amount due on the loan was $8,497. The loan is unsecured, non-interest bearing, and has no terms for repayment.

| (6) | Recent Accounting Pronouncements |

On May 22, 2009, the FASB issued FASB Statement No. 164, “Not-for-Profit Entities: Mergers and Acquisitions” (“SFAS No. 164”). SFAS No. 164 is intended to improve the relevance, representational faithfulness, and comparability of the information that a not-for-profit entity provides in its financial reports about a combination with one or more other not-for-profit entities, businesses, or nonprofit activities. To accomplish that, this Statement establishes principles and requirements for how a not-for-profit entity:

| | a. | Determines whether a combination is a merger or an acquisition. |

| | b. | Applies the carryover method in accounting for a merger. |

| | c. | Applies the acquisition method in accounting for an acquisition, including determining which of the combining entities is the acquirer. |

| | d. | Determines what information to disclose to enable users of financial statements to evaluate the nature and financial effects of a merger or an acquisition. |

This Statement also improves the information a not-for-profit entity provides about goodwill and other intangible assets after an acquisition by amending FASB Statement No. 142, “Goodwill and Other Intangible Assets,” to make it fully applicable to not-for-profit entities.

SFAS No. 164 is effective for mergers occurring on or after December 15, 2009, and acquisitions for which the acquisitions date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2009. Early application is prohibited. The management of the Company does not expect the adoption of this pronouncement to have material impact on its financial statements.

On May 28, 2009, the FASB issued FASB Statement No. 165, “Subsequent Events” (“SFAS No. 165”). SFAS No. 165 establishes general standards of accounting for and disclosure of events that occur after the balance sheet date but before financial statements are issued or are available to be issued. Specifically, SFAS No. 165 provides:

TECHMEDIA ADVERTISING MAURITIUS

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2009

| | 1. | The period after the balance sheet date during which management of a reporting entity should evaluate events or transactions that may occur for potential recognition or disclosure in the financial statements. |

| | 2. | The circumstances under which an entity should recognize events or transactions occurring after the balance sheet date in its financial statements. |

| | 3. | The disclosures that an entity should make about events or transactions that occurred after the balance sheet date. |

In accordance with this Statement, an entity should apply the requirements to interim or annual financial periods ending after June 15, 2009. The management of the Company does not expect the adoption of this pronouncement to have material impact on its financial

In June 2009, the FASB issued FASB Statement No. 166, “Accounting for Transfers of Financial Assets- an amendment of FASB Statement No, 140” (“SFAS No. 166”). SFAS No. 166 is a revision to SFAS No. 140 “Accounting for Transfers and Servicing of Financial Assets and Extinguishment of Liabilities” and will require more information about transfers of financial assets, including securitization transactions, and where companies have continuing exposure to the risks related to transferred financial assets. It eliminates the concept of a “qualifying special-purpose entity,” changes the requirements for derecognizing financial assets, and requires additional disclosures.

This statement is effective for financial asset transfers occurring after the beginning of an entity's first fiscal year that begins after November 15, 2009. The management of the Company does not expect the adoption of this pronouncement to have a material impact on its financial statements.

In June 2009, the FASB issued SFAS Statement No. 167, "Amendments to FASB Interpretation No. 46(R)" (“SFAS No. 167”). SFAS No. 167 amends certain requirements of FASB Interpretation No. 46(R), “Consolidation of Variable Interest Entities” and changes how a company determines when an entity that is insufficiently capitalized or is not controlled through voting (or similar rights) should be consolidated. The determination of whether a company is required to consolidate an entity is based on, among other things, an entity’s purpose and design and a company’s ability to direct the activities of the entity that most significantly impact the entity’s economic performance.

This statement is effective as of the beginning of each reporting entity’s first annual reporting period that begins after November 15, 2009. The management of the Company does not expect the adoption of this pronouncement to have a material impact on its financial statements.

In June 2009, the FASB issued SFAS Statement No. 168, "The FASB Accounting Standards Codification and the Hierarchy of Generally Accepted Accounting Principles - a replacement of FASB Statement No. 162" ("SFAS No. 168"). SFAS No. 168 establishes the FASB Accounting Standards Codification (the "Codification") to become the single official source of authoritative, nongovernmental U.S. generally accepted accounting principles (“GAAP”). The Codification did not change GAAP but reorganizes the literature.

TECHMEDIA ADVERTISING MAURITIUS

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2009

SFAS No. 168 is effective for interim and annual periods ending after September 15, 2009. The management of the Company does not expect the adoption of this pronouncement to have a material impact on its financial statements.

On June 15, 2009, TM Mauritius received an assignment from TM Singapore of its rights and obligations under the Summary of Terms of Investment with respect to a joint venture arrangement for operating the business of installing, commissioning, maintaining and commercializing mobile digital advertising platforms (the “JV Business”) in public commuter transports such as buses and trains in India, which was entered into between TM Singapore, and Peacock, on December 19, 2008.

TM Mauritius also intends to enter into a formal joint venture agreement with Peacock in the near future to formalize the arrangement under the Summary of Terms of Investment discussed above which will include among other things the following terms:

| · | an India company will be established to act as the joint venture company (the “JV”); |

| · | the JV will be owned 85 percent by TM Mauritius and 15 percent by Peacock; |

| · | one Director of the JV shall be a nominee from Peacock and three Directors of the JV shall be nominees from TM Mauritius; |

| · | Peacock will contribute its exclusive media rights licenses granted to it by the Government of Tamil Nadu for buses and the Indian Central Government for the Indian Railway for trains, relating to the JV Business, which currently covers more than 10,000 buses and more than 50 railway trains; |

| · | Peacock will fully equip the buses and trains with the required hardware and software and ensure the same is in proper working order in order to support JV Business; |

| · | Peacock will provide access to all of Peacock’s current and future advertising clients to market the JV Business; |

| · | TM Mauritius will manage the JV Business; |

| · | TM Mauritius will reimburse Peacock for the costs associated with fully equipping the buses and trains after TM Mauritius certifies the proper equipping of the buses and trains by Peacock; |

| · | TM Mauritius will supply the necessary funding to the JV for operations and other working capital purposes. |

| · | Any profits generated from the sale of advertising space from the JV Business will be divided 85 percent for TM Mauritius and 15 percent for Peacock. |

TECHMEDIA ADVERTISING MAURITIUS

(A DEVELOPMENT STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2009

On June 22, 2009, TM Mauritius acquired sole beneficial ownership of TM India as a wholly owned subsidiary through an exchange agreement whereby four ordinary shares of capital stock of TM Mauritius were exchanged for all of the 1,000 shares of issued capital stock of TM India. The value of the business combination was $220,620, less liabilities assumed of the same amount. The total purchase price of $0 was allocated as follows:

| Current assets | | $ | 209,744 | |

| Property | | | 4,159 | |

| Excess cost over net assets acquired | | | 6,717 | |

| Total assets acquired | | | 220,620 | |

| | | | | |

| Current liabilities assumed | | | 220,620 | |

| Purchase price | | $ | - | |