As confidentially submitted to the Securities and Exchange Commission on November 1, 2013

This draft registration statement has not been publicly filed with the Securities and Exchange Commission

and all information herein remains strictly confidential.

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMS-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

RIMINI STREET, INC.

(Exact name of Registrant as specified in its charter)

| | | | |

| Nevada | | 7379 | | 20-3476468 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

3993 Howard Hughes Parkway, Suite 780

Las Vegas, NV 89169

(702) 839-9671

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Seth A. Ravin

Chief Executive Officer

Rimini Street, Inc.

3993 Howard Hughes Parkway, Suite 780

Las Vegas, NV 89169

(702) 839-9671

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | | | |

Page Mailliard Jon C. Avina Wilson Sonsini Goodrich & Rosati, P.C. 650 Page Mill Road Palo Alto, California 94304 (650) 493-9300 | | Daniel B. Winslow Senior Vice President and General Counsel Rimini Street, Inc. 6601 Koll Center Parkway, Suite 300 Pleasanton, CA 94566 (925) 485-9211 | | Nora L. Gibson Todd A. Hamblet Covington & Burling LLP One Front Street San Francisco, CA 94111-5356 (415) 591-6000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 (the “Securities Act”), check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Securities Exchange Act of 1934. (Check one). ¨

| | | | | | |

| Large accelerated filer¨ | | Accelerated filer¨ | | Non-accelerated filerx | | Smaller reporting company ¨ |

| | | |

| | (Do not check if a smaller reporting company) | | | | |

CALCULATION OF REGISTRATION FEE

| | | | |

|

| Title of Each Class of Securities to be Registered | | Proposed Maximum

Aggregate Offering Price(1)(2) | | Amount of Registration Fee |

Class A Common Stock, $0.001 par value | | $ | | $ |

|

|

| (1) | | Includes the aggregate offering price of additional shares that the underwriters have the option to purchase. |

| (2) | | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457 under the Securities Act of 1933. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission acting pursuant to said Section 8(a) may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

| | | | |

| PRELIMINARY PROSPECTUS | | Subject to Completion | | , 2013 |

Shares

Class A Common Stock

This is an initial public offering of our Class A common stock. No public market currently exists for our Class A common stock. We are offering all of the shares of Class A common stock offered by this prospectus. We expect the public offering price to be between $ and $ per share.

We have two classes of authorized common stock, Class A common stock and Class B common stock. The rights of the holders of our Class A common stock and our Class B common stock are identical, except with respect to voting and conversion. Each share of our Class A common stock is entitled to one vote per share. Each share of our Class B common stock is entitled to 15 votes per share and is convertible at any time into one share of Class A common stock. Following this offering, outstanding shares of our Class B common stock will represent approximately % of the voting power of our outstanding capital stock, and outstanding shares of our Class B common stock held by our founders will represent approximately % of the voting power of our outstanding capital stock.

Entities affiliated with Adams Street Partners, LLC, one of our existing stockholders, intend to enter into a stock purchase agreement with us pursuant to which they will purchase in a private placement to close immediately subsequent to the closing of this offering, shares of our Class A common stock at a price per share equal to the initial public offering price.

We intend to apply to list our Class A common stock on , under the symbol “ .”

We are an “emerging growth company,” as defined under the federal securities laws, and, as such, may elect to comply with certain reduced public company reporting requirements for future filings.

Investing in our Class A common stock involves a high degree of risk. Before buying any shares, you should carefully read the discussion of the risks of investing in our Class A common stock in “Risk Factors” beginning on page 15 of this prospectus.

Neither the Securities Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | | |

| | | Per Share | | Total |

| Public offering price | | $ | | $ |

| Underwriting discounts and commissions(1) | | $ | | $ |

| Proceeds, before expenses, to us | | $ | | $ |

| (1) | | See “Underwriting” for a description of the compensation payable to the underwriters. |

The underwriters may also purchase up to an additional shares of our Class A common stock at the public offering price, less the underwriting discounts and commissions payable by us, to cover over-allotments, if any, within 30 days from the date of this prospectus. If the underwriters exercise this option in full, the total underwriting discounts and commissions will be $ , and our total proceeds, after underwriting discounts and commissions payable by us but before expenses, will be $ .

The underwriters are offering our Class A common stock as set forth under “Underwriting.” Delivery of the shares will be made on or about , 2014.

| | | | |

| UBS Investment Bank | | Piper Jaffray | | JMP Securities |

| | |

| Needham & Company | | Cowen and Company |

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. Neither we nor any of the underwriters have authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus or any related free writing prospectus. We are offering to sell, and seeking offers to buy, shares of our Class A common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of its date, regardless of its time of delivery or of any sale of our Class A common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

Through and including , 2014 (25 days after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

For investors outside the United States: neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus outside of the United States.

i

Prospectus summary

This summary highlights information contained in greater detail elsewhere in this prospectus. This summary is not complete and does not contain all of the information you should consider in making your investment decision. You should read the entire prospectus carefully before making an investment in our Class A common stock. You should carefully consider, among other things, our consolidated financial statements and the related notes and the sections entitled “Risk factors” and “Management’s discussion and analysis of financial condition and results of operations” included elsewhere in this prospectus.

RIMINI STREET, INC.

Overview

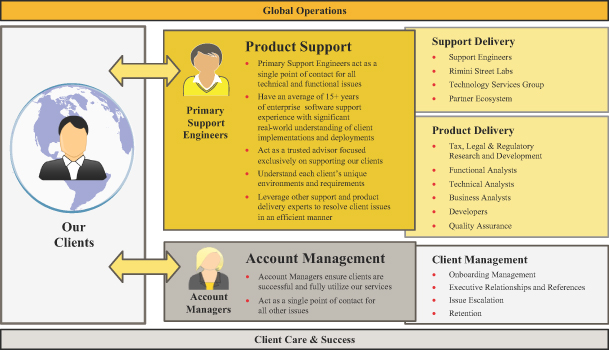

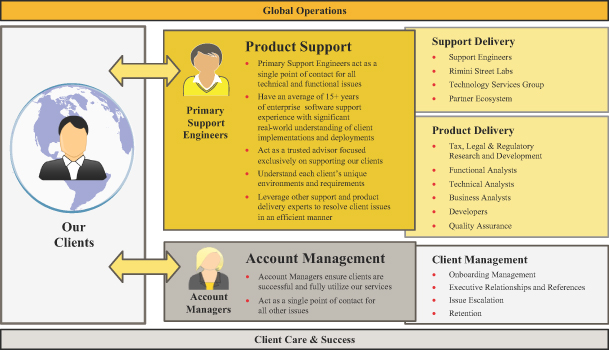

Rimini Street is the leading independent provider of enterprise software support. Our subscription-based services offer enterprise software licensees around the world a choice of maintenance and support programs with differentiated service and pricing compared to the maintenance and support services traditionally provided by enterprise software vendors for their software. Our maintenance and support services replace the vendor’s maintenance and support offering. Clients utilize our services to receive more responsive and comprehensive support, achieve substantial cost savings and extend the life of their existing software products. We believe our services enable our clients to improve productivity and compete more effectively by reallocating their IT budgets to new technology investments that provide greater strategic value. We achieved our leadership position through a commitment to exceptional client service and a focus on innovation that is manifested in our proprietary knowledge, software tools and processes.

The majority of enterprise software vendors license the rights for customers to use their software. Along with these software licenses, enterprise software vendors typically sell maintenance and support agreements, which generally include the right to receive product support services; software bug fixes; tax, legal and regulatory updates; software updates and new releases of the licensed products, in each case if and when made available. These maintenance and support agreements are typically purchased or renewed annually, and the annual support fees are approximately 20% of the total cost of the software license. Because enterprise software vendors have been the primary providers of these maintenance and support services, they have been able to control service levels and pricing, leaving licensees with little choice but to agree to the vendor terms or risk potential failure or tax, legal and regulatory non-compliance of mission-critical systems. As a result, the maintenance and support market has grown into one of the largest areas of global IT spend. According to the IDC report, Worldwide Software Maintenance 2012-2016 Forecast (doc # 235402, June 2012), total software maintenance revenue is expected to be $134 billion in 2013.

We believe the annual maintenance and support model as delivered by traditional enterprise software vendors such as Oracle Corporation and SAP AG is outdated and does not meet the needs of many enterprise software licensees. According to a 2010 study published by research firm Computer Economics, 58% of Oracle customers (out of 109 organizations surveyed) were dissatisfied with the cost of their software vendor support, and 42% were dissatisfied with the quality of their software vendor support. In addition to cost and quality dissatisfaction, customers of traditional software vendors are also burdened by the requirement that they implement costly upgrades to newer releases in order to continue receiving required maintenance and support services from the software vendor. Many of these licensees find that new releases of licensed products made available by the enterprise software vendors do

1

not provide incremental value. Dissatisfaction with the high cost, poor quality and limited scope of support provided by traditional enterprise software vendors has created a significant market opportunity for a better alternative.

We founded our company to redefine enterprise software support. We are focused exclusively on providing our clients with innovative, award-winning support services that deliver exceptional client results, coupled with significant savings in annual support fees and related costs. We provide our clients with 50% savings on their current annual support fees, enable them to avoid or defer costly, unwanted software upgrades and deliver a more comprehensive set of support services at no additional cost. Our average call response time for high priority client issues was less than five minutes during the 12 months ended June 30, 2013, which is significantly faster than the 30-minute response time that we guarantee in our Service Level Agreements. We currently provide our support services for nine products including Enterprise Resource Planning (ERP), Customer Relationship Management (CRM), industry-specific, business intelligence and database software provided by Oracle and SAP. We intend to expand our service offerings to support additional enterprise software products. In addition, we believe our expertise in software support will enable us to expand into two adjacent markets: support for Software-as-a-Service (SaaS) applications and outsourced support services. While basic support is typically bundled into SaaS subscription fees, we believe a market opportunity exists for independent premium support services to be sold to SaaS licensees. Evidence of this market opportunity can be found in the premium support services already being offered by certain SaaS vendors. In addition, we believe there are software vendors that are skilled at software development but lack expertise in support delivery and would consider leveraging our support expertise to provide a better support experience for their customers on an outsourced basis.

Over the past eight years, we have invested significant resources developing our proprietary knowledge, software tools and processes that have enabled our success. For example, since our inception, we have provided over 50,000 tax, legal and regulatory updates to our global client base. Our global tax, legal and regulatory compliance update service currently covers more than 70 countries and is based on a data capture and management process, software tools and ISO-certified processes that we believe provide us with a significant competitive advantage.

As of June 30, 2013, we supported more than 440 clients globally, including 46 of the Fortune 500 and 10 of the Fortune Global 100 across a broad range of industries. We define a client as a distinct entity, such as a company, an educational or government institution, or a business unit of a company, that purchases our services to support a specific product. For example, we count as two separate clients instances in which we provide support for two different products to the same entity. We market and sell our services through our direct sales force.

Our business has experienced rapid growth since it was founded in 2005. In addition, our subscription-based revenues provide a strong foundation for, and visibility into, future period results. We generated revenues of $20.6 million and $28.0 million for the six-month periods ended June 30, 2012 and 2013, respectively, representing a year-over-year increase of 36%, and revenues of $33.4 million and $43.6 million for the years ended December 31, 2011 and 2012, respectively, representing a year-over-year increase of 31%. We incurred net losses of $6.1 million and $4.0 million for the six-month periods ended June 30, 2012 and 2013, respectively, and net losses of $12.2 million and $9.9 million for the years ended December 31, 2011 and 2012, respectively.

2

OUR INDUSTRY

Enterprise software maintenance and support is one of the largest categories of overall global IT spending. As core ERP and CRM software platforms have become increasingly important in the operation of mission-critical business processes, licensees often view software maintenance and support subscriptions as a mandatory cost of doing business.

Maintenance and support services generally include the right to product support services; software bug fixes; tax, legal and regulatory updates; software updates and new releases if and when made available by the software vendor. Enterprise software vendors have historically been the primary providers of maintenance and support services, enabling these companies to control service levels and pricing. As a result of these historical market dynamics, the price of annual support fees has increased over time.

Software vendor support market challenges

We believe vendor support is based on an increasingly costly and outdated model that has not evolved to offer software licensees the responsiveness, quality, breadth of capabilities or value needed to support today’s mature enterprise software.

Poor service levels

We believe there is a high level of dissatisfaction with the traditional service customers receive from enterprise software vendors. The cost of downtime due to failure of mission-critical software applications can be significant, making the ability to rapidly correct problems a critical element of any support services offering. In many cases, however, traditional vendor support services are often handled by call center personnel who have either limited or no operational experience with the software, have little or no familiarity with the customer’s unique implementation and may not be well equipped to assist the customer in resolving its issue in a timely manner.

High cost of offering

Each year, customers typically spend approximately 20% of the total cost of the software license for maintenance and support provided by enterprise software vendors. Organizations incur additional costs installing, configuring, customizing, fixing, testing, upgrading and internally supporting software applications, which creates significant overhead and additional resource requirements.

Limited scope of support

The scope of standard annual vendor support programs is often limited. We believe from our experience with our clients that the majority of operational issues in today’s mature software deployments are related to customizations that a customer has made to its unique implementation of the software, which vendors do not typically support. Vendors typically only support the standard, unmodified source code originally delivered to the software licensee. Moreover, mature applications that are run over many years can require specialized performance tuning and interoperability support that are not typically provided by software vendors as part of their standard support programs.

Required deployment of upgrades to maintain support services

Full support of enterprise software is typically only provided by software vendors over a finite period of time. As a result, software licensees are often required to upgrade to new releases in order to continue

3

receiving full support under their standard maintenance contracts, even if those new releases may be costly to implement and provide no additional value to the customer.

Emergence of an independent enterprise software support services model

In response to the outdated enterprise software vendor support model and the evolving needs of enterprise software licensees, a new approach for delivering enterprise software support has emerged, focused on providing cost-effective, high-value services by trusted, independent providers.

OUR SOLUTION

We are the leading independent provider of enterprise software support and have spent the last eight years developing and fine-tuning a client support model based on proprietary knowledge, software tools and processes that enable us to provide an award-winning support alternative to enterprise software licensees. We believe our historical revenue growth, industry recognition and global client base demonstrate the value we provide to our clients and the market as a competitive offering. Key benefits of our services include:

Exceptional service experience

Our highly experienced team is dedicated to helping our clients efficiently resolve their mission-critical issues around the clock. We also provide our clients with guaranteed 30-minute call response time for high priority issues. We closely monitor our service delivery performance to ensure continued exceptional service.

Substantial cost savings

We offer our clients a 50% discount to the current annual support fees they would otherwise pay enterprise software vendors for their maintenance and support services. In addition to the substantial savings on maintenance fees, our services enable our clients to avoid or defer the high cost of unwanted upgrades and reduce the resources required for customization support.

Comprehensive software support capabilities

We provide our clients with a broader range of support services relative to traditional enterprise software vendor support. We provide full support for custom code as a part of our services at no additional charge, thereby reducing cost, risk and the potential for critical business disruption for our clients.

Global tax, legal and regulatory support

Organizations rely on enterprise software applications to ensure compliance with numerous legal, human resource and government tax and regulatory mandates. We currently deliver this support for over 70 countries and have the ability to provide this support for approximately 200 countries around the world.

Flexibility to avoid or defer unnecessary upgrades

Our services typically enable our clients to remain on their current software release without any required upgrades or migrations to new releases for at least 10 years after they first contract with us. By providing

4

support for software versions long after vendors stop providing full support, we allow our clients to extract more value from their existing software applications.

Shift client IT investment from maintenance to innovation

We enable our clients to redirect their IT investment from maintaining existing infrastructure and systems to new, innovative IT initiatives that drive significant business value.

COMPETITIVE STRENGTHS

We believe that we have a number of competitive advantages that will enable us to strengthen our position as the leading independent provider of enterprise software support. Our key competitive strengths include:

Focus on redefining enterprise software support

We are solely focused on delivering highly responsive, robust and value-driven enterprise software maintenance and support services. We believe our innovative services drive significant return on investment for our clients that is not achievable with traditional enterprise software vendor maintenance and support models.

Scalable business model

We have developed proprietary knowledge, software tools and processes in the design, development and delivery of our enterprise software support services. We have also designed an innovative support model that enables us to quickly and cost effectively scale to meet growing global demand in our existing product lines.

Large global client base

We believe that our proven ability to deliver value to an extensive list of clients across a broad range of industries validates our business model and provides us with important references for prospective clients.

Clear leadership position

We pioneered independent enterprise software support. We believe we have substantial thought leadership in our market through our extensive marketing efforts and promotion of the independent enterprise software support model, which enables us to bring new services to market more quickly, attract and retain high quality personnel and acquire new clients.

Highly experienced management team

Our senior management team pioneered independent enterprise software support services and has over 100 years of combined experience in the enterprise software maintenance and support industry.

Client-centric culture

We believe that our culture is a key element of our success. Our employees share a passion for delivering exceptional service to our clients. In addition, we believe that our culture has enabled us to attract and retain high quality professionals.

5

OUR GROWTH STRATEGY

The key elements of our growth strategy include:

Add new clients

We are making significant investments in sales and marketing and will continue our focus on aggressively acquiring new clients.

Expand internationally

We believe that there is a large opportunity to grow our international business.

Extend support to additional software products

We intend to extend our support service offerings to additional enterprise software products.

Further penetrate our existing client base

We intend to increase adoption of our services among our existing clients by selling additional support contracts for other software products within their organizations.

Expand independent enterprise software support markets

We believe our support expertise will enable us to expand into two adjacent markets: premium support for SaaS applications and outsourced support services for software vendors that are skilled at developing software but lack expertise in software support delivery.

SELECTED RISKS ASSOCIATED WITH OUR BUSINESS

Our business is subject to numerous risks described in the section entitled “Risk factors” and elsewhere in this prospectus. You should carefully consider these risks before making an investment. Some of these risks include:

| Ø | | We and our Chief Executive Officer are involved in litigation with Oracle and an adverse result in the litigation could result in a judgment requiring the payment of substantial damages and/or an injunction against certain of our business practices. |

| Ø | | The software products that we support that are part of our ongoing litigation with Oracle represent a significant portion of our current revenues. |

| Ø | | Our ongoing litigation with Oracle presents challenges for growing our business. |

| Ø | | Oracle has a history of litigation against companies offering alternative support programs for Oracle products, and Oracle could pursue additional litigation with us. Such additional litigation could be costly, distract our management team and reduce client interest and sales revenues. |

| Ø | | The market for our services is relatively undeveloped and may not grow. |

| Ø | | We have a history of losses and may not achieve profitability in the future. |

| Ø | | If we are unable to attract new clients or sell additional services to our existing clients, our revenue growth will be adversely affected. |

| Ø | | If our renewal rates decrease, or we do not accurately predict renewal rates, our future revenues and operating results may be harmed. |

6

| Ø | | We face significant competition from both enterprise software vendors and other companies offering independent enterprise software support services, as well as from software licensees that attempt to self support, which may harm our ability to add new clients, retain existing clients and grow our business. |

| Ø | | Our recent rapid growth may not be indicative of our future growth and, if we continue to grow rapidly, we may not be able to manage our growth effectively. |

| Ø | | We rely on our management team and other key employees, including our Chief Executive Officer, and the loss of one or more key employees could harm our business. |

| Ø | | The dual class structure of our common stock as provided for by our charter documents has the effect of concentrating voting control with those stockholders who held our stock prior to this offering, including our founders and our executive officers, employees and directors and their affiliates, and limiting your ability to influence corporate matters. |

CORPORATE INFORMATION

We were incorporated in the State of Nevada in September 2005. Unless expressly indicated or the context requires otherwise, the terms “Rimini,” “Rimini Street,” the “Company,” “we,” “us” and “our” in this prospectus refer to Rimini Street, Inc., and where appropriate, our wholly-owned subsidiaries. Our principal executive offices are located at 3993 Howard Hughes Parkway, Suite 780, Las Vegas, NV 89169, and our telephone number is (702) 839-9671. Our website address is www.riministreet.com. The information on, or that can be accessed through, our website is not part of this prospectus.

The Rimini Street design logo and the Rimini Street mark appearing in this prospectus are the property of Rimini Street, Inc. Trade names, trademarks and service marks of other companies appearing in this prospectus are the property of their respective holders. We have omitted the® and ��� designations, as applicable, for the trademarks used in this prospectus.

All share and per share information in this prospectus reflects the 15:1 stock split effective August 1, 2012.

We are an emerging growth company as defined in the Jumpstart Our Business Startups Act of 2012 (JOBS Act). We will remain an emerging growth company until the earliest to occur of: the last day of the fiscal year in which we have more than $1.0 billion in annual revenues; the date we qualify as a “large accelerated filer,” with at least $700 million of equity securities held by non-affiliates; the issuance, in any three-year period, by us of more than $1.0 billion in non-convertible debt securities; and the last day of the fiscal year ending after the fifth anniversary of our initial public offering.

7

The offering

Class A common stock offered by us | Shares |

Over-allotment option being offered by us | Shares |

Class A common stock to be outstanding after this offering | Shares |

Class B common stock to be outstanding after this offering | Shares |

Class A common stock sold by us in the concurrent private placement | Immediately subsequent to the closing of this offering, entities affiliated with Adams Street Partners, LLC (collectively, Adams Street Partners) will purchase from us in a private placement shares of our Class A common stock at a price per share equal to the initial public offering price. Based on an assumed initial public offering price of $ per share, which is the midpoint of the range set forth on the cover of this prospectus, this would equal $ million in additional proceeds to us. We will receive the full proceeds and will not pay any underwriting discounts or commissions with respect to the shares that are sold in the private placement. The sale of these shares to Adams Street Partners will not be registered in this offering and will be subject to a lock-up of 180 days. |

Total Class A and Class B common stock to be outstanding after this offering and the concurrent private placement | Shares |

Voting Rights | Shares of Class A common stock are entitled to one vote per share. |

| | Shares of Class B common stock are entitled to 15 votes per share. |

| | Holders of our Class A common stock and Class B common stock will generally vote together as a single class, unless otherwise required by our articles of incorporation or bylaws. Seth Ravin, our co-founder and Chief Executive Officer, and Thomas Shay, our co-founder and Chief Information Officer, and their affiliates, who after our initial public offering will hold more than % |

8

| | of the voting power of our outstanding capital stock, will have the ability to control the outcome of matters submitted to our stockholders for approval, including the election of our directors and the approval of any change in control transaction. See “Principal stockholders” and “Description of capital stock.” |

Use of Proceeds | The principal purposes of this offering and the concurrent private placement are to increase our capitalization and financial flexibility, create a public market for our stock and thereby enable access to the public equity markets by our employees and stockholders, obtain additional capital and increase our visibility in the marketplace. As of the date of this prospectus, we have no specific plans for the use of the net proceeds we receive from this offering and the concurrent private placement. However, we currently intend to use the net proceeds primarily for general corporate purposes, including working capital, sales and marketing activities, product development, general and administrative matters and capital expenditures to fund our growth and global expansion. We may also use a portion of the net proceeds for the acquisition of, or investment in, technologies, solutions or businesses that complement our business, although we have no present commitments or agreements to enter into any acquisitions or investments. See “Use of proceeds.” |

Directed Share Program | At our request, the underwriters have reserved up to 5% of the Class A common stock being offered by this prospectus for sale at the initial public offering price to our directors, officers, employees and other individuals associated with us and members of their families. The sales will be made by UBS Financial Services Inc., a selected dealer affiliated with UBS Securities LLC, an underwriter of this offering, through a directed share program. We do not know if these persons will choose to purchase all or any portion of these reserved shares, but any purchases they do make will reduce the number of shares available to the general public. Any reserved shares not so purchased will be offered by the underwriters to the general public on the same terms as the other shares of Class A common stock. Participants in the directed share program who purchase more than $1,000,000 of shares of Class A common stock |

9

| | shall be subject to a 25-day lock-up with respect to any shares sold to them pursuant to that program. Any shares sold in the directed share program to our directors or executive officers shall be subject to the lock-up agreements described under the caption “Underwriting.” |

The total number of shares of our Class A and Class B common stock to be outstanding after this offering and the concurrent private placement is based on no shares of our Class A common stock and 144,392,970 shares of our Class B common stock outstanding as of June 30, 2013, and excludes:

| Ø | | 45,082,650 shares of our Class B common stock issuable upon the exercise of options outstanding as of June 30, 2013, with a weighted-average exercise price of $0.2296 per share; |

| Ø | | 2,023,250 shares of our Class B common stock issuable upon the exercise of options granted after June 30, 2013 with an exercise price of $1.10 per share; and |

| Ø | | shares of our Class A common stock reserved for future issuance under our share-based compensation plans, consisting of 8,563,463 shares of our Class A common stock reserved for future issuance under our 2013 Equity Incentive Plan, shares of our Class A common stock reserved for future issuance under our 2014 Employee Stock Purchase Plan, which will become effective upon completion of this offering, and shares that become available under our 2013 Equity Incentive Plan and 2014 Employee Stock Purchase Plan, pursuant to provisions thereof that automatically increase the share reserves under the plans each year, as more fully described in “Executive compensation—Employee benefit and stock plans.” |

Except as otherwise indicated, all information in this prospectus assumes:

| Ø | | the effectiveness of our amended and restated articles of incorporation in connection with the completion of this offering; |

| Ø | | the effectiveness of our amended and restated articles of incorporation that implement the dual class structure; |

| Ø | | the automatic conversion of all outstanding shares of our convertible preferred stock into an aggregate of 44,045,460 shares of our Class B common stock immediately prior to the completion of this offering; |

| Ø | | no exercise of options outstanding as of June 30, 2013; and |

| Ø | | no exercise by the underwriters of their option to purchase up to an additional shares of our Class A common stock. |

10

Summary consolidated financial data

You should read the following summary consolidated financial data in conjunction with “Management’s discussion and analysis of financial condition and results of operations” and our consolidated financial statements and related notes, all included elsewhere in this prospectus. We derived the summary consolidated statements of comprehensive loss data for the years ended December 31, 2010, 2011 and 2012 from our audited consolidated financial statements appearing elsewhere in this prospectus. The summary consolidated statements of comprehensive loss data for the six months ended June 30, 2012 and 2013 and the selected consolidated balance sheet data as of June 30, 2013 are derived from our unaudited consolidated financial statements appearing elsewhere in this prospectus. The unaudited consolidated financial statements were prepared on a basis consistent with our audited financial statements and include, in our opinion, all adjustments, consisting of normal and recurring adjustments that we consider necessary for a fair presentation of our unaudited consolidated financial statements. Our historical results are not necessarily indicative of the results that may be expected in the future, and our results as of and for the six month period ended June 30, 2013 are not necessarily indicative of the results that may be expected for the year ended 2013.

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | | | Six Months Ended June 30,

(unaudited) | |

| | | 2010 | | | 2011 | | | 2012 | | | 2012 | | | 2013 | |

| | | (in thousands, except share and per share data) | |

Consolidated statements of comprehensive loss data: | | | | | | | | | | | | | | | | | | | | |

Revenues, net | | $ | 25,331 | | | $ | 33,376 | | | $ | 43,574 | | | $ | 20,613 | | | $ | 28,011 | |

Costs of revenues(1) | | | 18,015 | | | | 20,040 | | | | 24,216 | | | | 12,106 | | | | 13,681 | |

| | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 7,316 | | | | 13,336 | | | | 19,358 | | | | 8,507 | | | | 14,330 | |

| | | | | | | | | | | | | | | | | | | | |

Operating expenses:(1) | | | | | | | | | | | | | | | | | | | | |

Sales and marketing | | | 9,006 | | | | 11,465 | | | | 14,802 | | | | 7,249 | | | | 9,085 | |

General and administrative(2) | | | 8,533 | | | | 12,484 | | | | 13,568 | | | | 7,232 | | | | 8,604 | |

| | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 17,539 | | | | 23,949 | | | | 28,370 | | | | 14,481 | | | | 17,689 | |

| | | | | | | | | | | | | | | | | | | | |

Operating loss | | | (10,223 | ) | | | (10,613 | ) | | | (9,012 | ) | | | (5,974 | ) | | | (3,359 | ) |

Other income (expense): | | | | | | | | | | | | | | | | | | | | |

Change in fair value of warrant liability | | | 2,440 | | | | (1,179 | ) | | | — | | | | — | | | | — | |

Interest expense | | | (95 | ) | | | (281 | ) | | | (481 | ) | | | (229 | ) | | | (301 | ) |

Other income and expense | | | (94 | ) | | | (115 | ) | | | (28 | ) | | | 249 | | | | (133 | ) |

| | | | | | | | | | | | | | | | | | | | |

Loss before income taxes | | | (7,972 | ) | | | (12,188 | ) | | | (9,521 | ) | | | (5,954 | ) | | | (3,793 | ) |

Income taxes | | | 24 | | | | 40 | | | | 362 | | | | 194 | | | | 234 | |

| | | | | | | | | | | | | | | | | | | | |

Net loss | | $ | (7,996 | ) | | $ | (12,228 | ) | | $ | (9,883 | ) | | $ | (6,148 | ) | | $ | (4,027 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net loss per common share (basic and diluted) | | $ | (0.10 | ) | | $ | (0.13 | ) | | $ | (0.10 | ) | | $ | (0.06 | ) | | $ | (0.04 | ) |

| | | | | | | | | | | | | | | | | | | | |

Weighted average number of common shares outstanding, basic and diluted | | | 78,432 | | | | 92,274 | | | | 97,062 | | | | 96,258 | | | | 100,181 | |

| | | | | | | | | | | | | | | | | | | | |

Pro forma net loss per common share, basic and diluted (unaudited)(3) | | | | | | | | | | $ | (0.07 | ) | | | | | | $ | (0.03 | ) |

Weighted average number of pro forma common shares outstanding, basic and diluted (unaudited)(3) | | | | | | | | | | | 141,107 | | | | | | | | 144,226 | |

(footnotes on following page)

11

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended

December 31, | | | Six Months Ended June 30,

(unaudited) | |

| | | 2010 | | | 2011 | | | 2012 | | | 2012 | | | 2013 | |

| | | (in thousands) | |

(1) Costs and expenses include share-based compensation expense as follows: | | | | | | | | | | | | | | | | | | | | |

Costs of revenues | | $ | 334 | | | $ | 293 | | | $ | 308 | | | $ | 166 | | | $ | 158 | |

Operating expenses: | | | | | | | | | | | | | | | | | | | | |

Sales and marketing | | | 336 | | | | 400 | | | | 373 | | | | 187 | | | | 174 | |

General and administrative | | | 214 | | | | 434 | | | | 586 | | | | 294 | | | | 399 | |

(2) General and administrative expenses include legal expenses related to the Oracle lawsuit as follows: | | | | | | | | | | | | | | | | | | | | |

General and administrative | | | 3,694 | | | | 5,741 | | | | 3,468 | | | | 2,436 | | | | 757 | |

| (3) | | Please see Note 18 to the audited annual consolidated financial statements and Note 10 to the unaudited consolidated interim financial statements included elsewhere in this prospectus for an explanation of the calculation of the pro forma net loss per share and pro forma weighted average shares. |

Our consolidated balance sheet data as of June 30, 2013 is presented on:

| Ø | | an actual basis as derived from our unaudited consolidated balance sheet as of June 30, 2013; |

| Ø | | a pro forma basis, giving effect to the automatic conversion of all outstanding shares of our convertible preferred stock into 44,045,460 shares of our Class B common stock and the effectiveness of our amended and restated articles of incorporation as of immediately prior to the completion of this offering, as if such conversion had occurred and our amended and restated articles of incorporation had become effective on June 30, 2013; and |

| Ø | | a pro forma as adjusted basis, giving effect to (i) the pro forma adjustments, (ii) the sale of shares of our Class A common stock by us in this offering, based on an assumed initial public offering price of $ per share, the midpoint of the range reflected on the cover page of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us, and (iii) the sale of shares of Class A common stock to be purchased from us by Adams Street Partners in the concurrent private placement at an assumed offering price of $ per share, the midpoint of the range reflected on the cover page of this prospectus. |

The pro forma as adjusted information set forth in the table below is illustrative only and will be adjusted based on the actual initial public offering price and other terms of this offering determined at pricing.

| | | | | | | | | | | | |

| | | As of June 30, 2013 | |

| | | Actual | | | Pro Forma(1) | | | Pro Forma As

Adjusted(2) | |

| | | (in thousands) | |

Consolidated balance sheet data: | | | | |

Cash and cash equivalents | | $ | 20,068 | | | $ | 20,068 | | | $ | | |

Working capital | | | (30,798 | ) | | | (30,798 | ) | | | | |

Total assets | | | 34,943 | | | | 34,943 | | | | | |

Total deferred revenues | | | 45,857 | | | | 45,857 | | | | | |

Total liabilities | | | 69,395 | | | | 69,395 | | | | | |

Total stockholders’ equity (deficit) | | | (34,452 | ) | | | (34,452 | ) | | | | |

| (1) | | The pro forma column reflects the automatic conversion of all shares of our convertible preferred stock outstanding as of June 30, 2013 into 44,045,460 shares of our Class B common stock immediately prior to the closing of this offering. |

| (2) | | The pro forma as adjusted column reflects (i) the pro forma adjustments described immediately above, (ii) the sale of shares of our Class A common stock in this offering at an assumed initial public offering price of $ per share, the midpoint of the price range on the cover of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us and (iii) the sale of shares of Class A common stock to be purchased from us by Adams Street Partners in the concurrent private placement at an assumed offering price of $ per share, the midpoint of the range reflected on the cover page of this prospectus. Each $1.00 increase (decrease) in the assumed initial public offering price of $ per share, the midpoint of the price range reflected on the cover page of this prospectus, would increase (decrease) our cash and cash equivalents, working capital, total assets, and total stockholders’ equity by approximately $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

12

NON-GAAP FINANCIAL MEASURES

We monitor the following non-GAAP financial measures to help us evaluate growth trends in our business, establish related budgets, measure the effectiveness of our sales and marketing efforts, and assess operational efficiencies. In addition to our results determined under generally accepted accounting principles (GAAP), we believe these non-GAAP financial measures are useful in evaluating our operating performance.

We calculate non-GAAP operating loss and non-GAAP net loss, in each case by excluding stock-based compensation expenses and litigation expenses relating to our ongoing litigation with Oracle. We exclude stock-based compensation expense because it is non-cash in nature and excluding this expense provides meaningful supplemental information regarding our operational performance. In particular, because of varying available valuation methodologies, subjective assumptions and the variety of award types that companies can use under FASB ASC Topic 718, we believe that providing non-GAAP financial measures that exclude this expense allows investors the ability to make more meaningful comparisons between our operating results and those of other companies. We exclude litigation expenses relating to our ongoing litigation with Oracle because they are discrete charges that do not reflect our core business operating results.

These non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. There are limitations in using these non-GAAP financial measures because the non-GAAP financial measures are not prepared in accordance with GAAP, may be different from non-GAAP financial measures used by our competitors and exclude expenses that may have a material impact upon our financial results. Further, stock-based compensation and litigation expenses relating to our ongoing litigation with Oracle have been and will continue to be for the foreseeable future a significant recurring expense in our business.

These non-GAAP financial measures are meant to supplement and be viewed in conjunction with GAAP financial measures. We believe that these non-GAAP financial measures provide useful information about our operating results, enhance the overall understanding of past financial performance and future prospects and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making.

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | | | Six Months Ended

June 30, | |

| | | 2010 | | | 2011 | | | 2012 | | | 2012 | | | 2013 | |

| | | (in thousands) | |

Non-GAAP financial measures: | | | | | | | | | | | | | | | | | | | | |

Non-GAAP operating loss | | $ | (5,645 | ) | | $ | (3,745 | ) | | $ | (4,277 | ) | | $ | (2,891 | ) | | $ | (1,871 | ) |

Non-GAAP net loss | | | (3,418 | ) | | | (5,360 | ) | | | (5,148 | ) | | | (3,065 | ) | | | (2,539 | ) |

13

Set forth below is a reconciliation of the non-GAAP financial measures to the nearest measure calculated in accordance with GAAP:

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | | | Six Months Ended

June 30, | |

| | | 2010 | | | 2011 | | | 2012 | | | 2012 | | | 2013 | |

| | | (in thousands) | |

Operating loss | | $ | (10,223 | ) | | $ | (10,613 | ) | | $ | (9,012 | ) | | $ | (5,974 | ) | | $ | (3,359 | ) |

Add: stock-based compensation | | | 884 | | | | 1,127 | | | | 1,267 | | | | 647 | | | | 731 | |

Add: litigation expenses | | | 3,694 | | | | 5,741 | | | | 3,468 | | | | 2,436 | | | | 757 | |

| | | | | | | | | | | | | | | | | | | | |

Non-GAAP operating loss | | $ | (5,645 | ) | | $ | (3,745 | ) | | $ | (4,277 | ) | | $ | (2,891 | ) | | $ | (1,871 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net loss | | $ | (7,996 | ) | | $ | (12,228 | ) | | $ | (9,883 | ) | | $ | (6,148 | ) | | $ | (4,027 | ) |

Add: stock-based compensation | | | 884 | | | | 1,127 | | | | 1,267 | | | | 647 | | | | 731 | |

Add: litigation expenses | | | 3,694 | | | | 5,741 | | | | 3,468 | | | | 2,436 | | | | 757 | |

| | | | | | | | | | | | | | | | | | | | |

Non-GAAP net loss | | $ | (3,418 | ) | | $ | (5,360 | ) | | $ | (5,148 | ) | | $ | (3,065 | ) | | $ | (2,539 | ) |

| | | | | | | | | | | | | | | | | | | | |

14

Risk factors

Investing in our Class A common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus, including our consolidated financial statements and related notes, before deciding whether to purchase shares of our Class A common stock. If any of the following risks are realized, our business, financial condition, operating results and prospects could be materially and adversely affected. In that event, the price of our Class A common stock could decline, and you could lose part or all of your investment.

RISKS RELATED TO OUR BUSINESS AND INDUSTRY

We and our Chief Executive Officer are involved in litigation with Oracle and an adverse result in the litigation could result in a judgment requiring the payment of substantial damages and/or an injunction against certain of our business practices.

In January 2010, certain subsidiaries of Oracle Corporation filed a lawsuit against us and our Chief Executive Officer, Seth Ravin, in the United States District Court for the District of Nevada, alleging that certain of our processes violate Oracle’s license agreements and that we have committed acts of copyright infringement and violated other federal and state laws. Oracle alleged that its license agreements restrict licensees’ rights to provide third parties with copies of Oracle software and restrict where a customer physically may install the software. Oracle alleges that, in the course of providing our services, we violated such license agreements and illegally downloaded software and support materials without authorization. Oracle further alleges that we damaged its computer systems in the course of downloading materials for our clients. Oracle filed a second amended complaint in June 2011.

Specifically, Oracle’s operative complaint asserts the following causes of action: copyright infringement; violations of the federal Computer Fraud and Abuse Act, California’s Computer Data Access and Fraud Act, and Section 205.4765 of the Nevada Revised Statutes (unlawful acts against computers); breach of contract; inducing breach of contract; intentional interference with prospective economic advantage; unfair competition; trespass to chattels; unjust enrichment/restitution; unfair practices; and a demand for an accounting. Oracle’s complaint seeks a preliminary and permanent injunction prohibiting us from copying, distributing, using, or creating derivative works based on Oracle software and support materials except as allowed by express license from Oracle, as well as from using any software tool to access Oracle software. Oracle’s complaint also seeks to prohibit us from facilitating access to, use of, or downloading of Oracle software or support materials for any customer without a current, valid software and support license entitling the customer to have and use those materials, and from copying, distributing, or using software and support materials obtained through or for one customer to support a different customer. Oracle also seeks damages, trebling of those damages, punitive damages, restitution and disgorgement of all alleged ill-gotten gains and imposition of a constructive trust for Oracle’s benefit consisting of all revenues received by us through the challenged conduct.

In March 2010, we filed an answer to Oracle’s initial complaint, generally denying Oracle’s allegations. We also filed counterclaims against Oracle for defamation, trade libel and business disparagement, copyright misuse and unfair competition.

The parties conducted extensive fact and expert discovery from 2010 through mid-2012. The Court dismissed our counterclaim for copyright misuse in October 2010. Oracle amended its complaint in June 2011 to add allegations that we infringe Oracle’s copyrights in its database software. We filed an amended answer denying those allegations.

15

Risk factors

In March 2012, Oracle filed a motion seeking partial summary judgment as to its claim of infringement of eight of the copyrighted works asserted in Oracle’s complaint. It also sought summary judgment as to certain of our license defenses. In April 2012, we filed an opposition arguing that, as to our license defenses, there remain genuine issues of material fact that preclude summary judgment of liability. In May 2012, Oracle filed a reply.

In September 2012, Oracle filed a second motion for partial summary judgment as to its claim that we infringe additional copyrighted works covering Oracle’s Relational Management Database software. Oracle’s motion also seeks summary judgment as to certain of our defenses, as well as our two remaining counterclaims for defamation, trade libel and business disparagement and for unfair competition. We filed an opposition in October 2012, arguing that there are genuine issues of material fact as to our license defenses and counterclaims that preclude summary judgment. Oracle filed a reply later that month.

Both of Oracle’s motions for partial summary judgment remain pending, and the court could rule upon them at any time. Regardless of the outcomes of the summary judgment motions, it is likely that liability still will be unresolved for some claims and counterclaims. Additionally, to the extent either party were to prevail on any claims or counterclaims at trial, damages would need to be determined.

Should Oracle prevail on its claims, we could be required to pay substantial damages for our past business activities and/or enjoined from certain business practices. Any of these outcomes could result in a material adverse effect on our business. Should we prevail on our counterclaims, our recovery of damages may not fully offset the negative impact on our operations resulting from Oracle’s conduct. The pendency of the litigation alone could dissuade clients from purchasing our services. Our business has been and may continue to be materially harmed by this litigation. During the course of this litigation, we anticipate announcements of the court’s decisions in connection with hearings, motions, and other matters, as well as other interim developments related to the litigation. If securities analysts or investors regard these announcements as negative, the market price of our common stock may decline.

While we are vigorously defending the lawsuit, we are unable to predict the timing or outcome of Oracle’s claims or our counterclaims. In addition, we anticipate that a judgment entered in either party’s favor by the trial court is likely to be appealed.

Oracle claims economic damages under various theories in amounts well in excess of the total revenues generated by our operations to date, as well as punitive damages and attorneys’ fees. We are contesting Oracle’s measure of damages as well as liability. Oracle also is seeking an injunction prohibiting us from providing any support services for which we are found to be liable for infringement insofar as such services relate to Oracle products. Given the stage of this litigation, we are unable to predict the likelihood of success of Oracle’s claims or our counterclaims. No assurance is or can be given that we will prevail on any claims or counterclaims in the lawsuit.

Refer to the discussion under “Business—Legal proceedings” for more information related to this litigation.

The software products that we support that are part of our ongoing litigation with Oracle represent a significant portion of our current revenues.

Our litigation with Oracle relates to the support services we offer for Oracle’s PeopleSoft, J.D. Edwards and Siebel software products and Oracle’s Relational Database Management System. For the six months ended June 30, 2013, approximately 75% of our revenues were derived from the support services that

16

Risk factors

we provide for our clients using PeopleSoft, J.D. Edwards and Siebel software. Excluding revenues derived from services we provide for J.D. Edwards and Siebel software products, the percentage of revenues derived from services we provide for just PeopleSoft software was approximately 45% during this same period. Although we provide support services for additional Oracle product lines that are not subject to litigation and support services for software products provided by companies other than Oracle, our current revenues depend significantly on the product lines that are the subject of litigation. Should Oracle prevail on its motions for summary judgment or on its claims at trial, we could be required to change the way we provide support services to some of our clients, which could result in the loss of clients and revenues, and may also give rise to claims for compensation from our clients, any of which could have a material adverse effect on our business.

Our ongoing litigation with Oracle presents challenges for growing our business.

We have experienced challenges growing our business as a result of our ongoing litigation with Oracle. Many of our new and potential clients have expressed concerns regarding our ongoing litigation and, in some cases, have been subjected to subpoenas and depositions by Oracle in connection with the litigation. Certain of our clients may be subject to additional subpoenas and depositions. We have taken steps to minimize disruptions to our existing and potential clients regarding the litigation, but we continue to face challenges growing our business while the litigation remains outstanding. In certain cases, we have agreed to reimburse our clients for their legal fees incurred in connection with any litigation-related subpoenas and depositions or to provide indemnification or termination rights if any outcome of litigation results in our inability to continue providing any of the paid-for services. In addition, we believe the length of our sales cycle is longer than it otherwise would be due to customer diligence on possible effects of the Oracle litigation on our business. We cannot assure you that we will continue to overcome the challenges we face as a result of the litigation and continue to renew existing clients or secure new clients.

Oracle has a history of litigation against companies offering alternative support programs for Oracle products, and Oracle could pursue additional litigation with us.

Oracle has been active in litigating against companies that have offered competing maintenance and support services for their products. For example, in March 2007, Oracle filed a lawsuit against SAP and its wholly-owned subsidiary, TomorrowNow, Inc., and settled the case in 2012, subject to a pending appeal. In February 2012, Oracle filed suit against Service Key, Inc. and settled the case in October 2013. Oracle also filed suit against CedarCrestone Corporation in September 2012, and settled the case in August 2013. TomorrowNow and CedarCrestone offered maintenance and support for Oracle software products, and Service Key offered maintenance and support for Oracle technology products. Given Oracle’s history of litigation against companies offering alternative support programs for Oracle products, we can provide no assurance, regardless of the outcome of the current litigation with Oracle, that Oracle will not pursue additional litigation against us. Such additional litigation could be costly and distract our management team from running our business and reduce client interest and sales revenues.

The market for our services is relatively undeveloped and may not grow.

The market for independent enterprise software support is still relatively undeveloped, has not yet achieved widespread acceptance and may not grow quickly or at all. Our success will depend to a substantial extent on the willingness of companies to engage a third party such as us to provide software maintenance and support services for their enterprise software. Many companies are still reluctant to use a third party for these services, relying instead on maintenance and support services provided by the enterprise software vendor. Other companies have invested substantial personnel, infrastructure and financial resources in their own organizations with respect to maintenance and support of their enterprise

17

Risk factors

software products and may choose to self-support with their own internal resources instead of purchasing services from the software vendor or an independent provider like us. Companies may not engage us for other reasons, including concerns regarding our ongoing litigation with Oracle, that engaging with us could damage their relationships with their enterprise software vendor, or a concern that they could infringe third-party intellectual property rights or breach one or more software license agreements if they engage with us. New concerns or considerations may also emerge in the future. Particularly because our market is relatively undeveloped, we must address our potential clients’ concerns and explain the benefits of our approach in order to convince them of the benefits of our services. If companies are not sufficiently convinced that we can address their concerns and that the benefits of our services are compelling, then the market for our services may not develop as we anticipate and our business will not grow.

We have a history of losses and may not achieve profitability in the future.

We incurred net losses of $12.2 million, $9.9 million, $6.1 million and $4.0 million in 2011, 2012 and for the six months ended June 30, 2012 and 2013, respectively. As of June 30, 2013, we had an accumulated deficit of $55.4 million. We will need to generate and sustain increased revenue levels in future periods in order to become profitable, and, even if we do, we may not be able to maintain or increase our level of profitability. We intend to continue to expend significant funds to expand our sales operations, enhance our service offerings, meet the increased compliance requirements associated with our transition to and operation as a public company and expand into new markets. Our efforts to grow our business may be more costly than we expect, and we may not be able to increase our revenues enough to offset our higher operating expenses. We may incur significant losses in the future for a number of reasons, including, as a result of our ongoing litigation with Oracle, other risks described in this prospectus, unforeseen expenses, difficulties, complications and delays and other unknown events. If we are unable to achieve and sustain profitability, the market price of our Class A common stock may significantly decrease.

If we are unable to attract new clients or sell additional services to our existing clients, our revenue growth will be adversely affected.

To increase our revenues, we must add new clients, encourage existing clients to renew their software maintenance and support services agreements on terms favorable to us and sell additional services to existing clients. As competitors introduce lower-cost and/or differentiated services that are perceived to compete with ours, or as enterprise software vendors introduce competitive pricing, additional support services or other strategies to compete with us, our ability to sell to new clients and renew agreements with existing clients based on pricing, service levels, technology and functionality could be impaired. As a result, we may be unable to renew our agreements with existing clients or attract new clients or new business from existing clients on terms that would be favorable or comparable to prior periods, which could have an adverse effect on our revenues and growth. In addition, certain of our existing clients may choose to upgrade to a new or different version of enterprise software, and such clients’ license agreements with the enterprise software vendor will typically include a one-year mandatory maintenance and support services agreement. In that case, it is unlikely that these clients would renew their maintenance and support services agreements with us, at least during the early term of the license agreement.

If our retention rates decrease, or we do not accurately predict retention rates, our future revenues and operating results may be harmed.

Our clients have no obligation to renew their agreements with us after the expiration of the initialnon-cancellable term, which ranges from one to three or more years. In addition, the majority of our multi-year client contracts are not pre-paid. We may not accurately predict retention rates for our clients. Our

18

Risk factors

retention rates may decline or fluctuate as a result of a number of factors, including our clients’ decision to upgrade to a new version of their enterprise software that they will have to purchase from an enterprise software vendor, our clients’ decision to move to a cloud-based solution instead of traditional enterprise software, client satisfaction with our services, the acquisition of our clients by other companies, and our clients going out of business. If our clients do not renew their agreements for our services or if our clients decrease the amount they spend with us, our revenues will decline and our business will suffer.

We face significant competition from both enterprise software vendors and other companies offering independent enterprise software support services, as well as from software licensees that attempt to self support, which may harm our ability to add new clients, retain existing clients and grow our business.

We face intense competition from enterprise software vendors such as Oracle and SAP who provide software maintenance and support services for their own products. Enterprise software vendors have offered discounts to companies to whom we have marketed our services. In addition, our current and potential competitors and enterprise software vendors may develop and market new technologies that render our existing or future services less competitive or obsolete. Competition could significantly impede our ability to sell our services on terms favorable to us and we may need to decrease the prices for our services in order to remain competitive. If we are unable to maintain our current pricing due to competitive pressures, our margins will be reduced and our operating results will be negatively affected.

There are also several smaller vendors in the independent enterprise software support services market with whom we compete. We expect competition to continue to increase in the future, which could harm our ability to increase sales, maintain or increase renewals and maintain our prices.

Our current and potential competitors may have significantly more financial, technical and other resources than we have, may be able to devote greater resources to the development, promotion, sale and support of their products and services, have more extensive customer bases and broader customer relationships than we have and may have longer operating histories and greater name recognition than we have. As a result, these competitors may be better able to respond quickly to new technologies and provide faster support services. In addition, certain independent enterprise software support organizations may have or develop more cooperative relationships with enterprise software vendors, which may allow them to compete more effectively over the long term. Enterprise software vendors may also offer maintenance and support services at reduced or no additional cost to their customers. In addition, enterprise software vendors may take other actions in an attempt to maintain their support service business, including changing the terms of their license agreements, their terms of service to limit independent enterprise software maintenance and support services or to increase the length of their required maintenance contracts, the functionality of their products, or their pricing terms. For example, various support policies of Oracle and SAP may include clauses that could penalize customers that choose to use independent enterprise software maintenance and support vendors or that, following a departure from the software vendor, seek to return to the software vendor to purchase new licenses or services. To the extent any of our competitors have existing relationships with potential clients for enterprise software products and maintenance and support services, those potential clients may be unwilling to purchase our services because of those existing relationships. If we are unable to compete with such companies, the demand for our services could substantially decline.

Our recent rapid growth may not be indicative of our future growth and if we continue to grow rapidly, we may not be able to manage our growth effectively.

Our revenues grew from $20.6 million for the six months ended June 30, 2012 to $28.0 million for the six months ended June 30, 2013, representing a year-over-year increase of 36%. We expect that, in the

19

Risk factors

future, as our revenues increase to higher levels, our revenue growth rate will decline. We believe growth of our revenues depends on a number of factors, including our ability to:

| Ø | | price our services effectively so that we are able to attract and retain clients without compromising our profitability; |

| Ø | | attract new clients, increase our existing clients’ use of our services and provide our clients with excellent support services; |

| Ø | | introduce our services to new geographic markets; |

| Ø | | satisfactorily conclude the Oracle litigation; and |

| Ø | | increase awareness of our company and services on a global basis. |

We may not successfully accomplish all or any of these objectives. We plan to continue our investment in future growth. We expect to continue to expend substantial financial and other resources on, among others:

| Ø | | sales and marketing efforts; |

| Ø | | expanding in new geographical areas; |

| Ø | | growing our product support capabilities; and |

| Ø | | general administration, including legal and accounting expenses related to being a public company. |

In addition, our historical rapid growth has placed and may continue to place significant demands on our management and our operational and financial resources. Our organizational structure is becoming more complex as we add additional staff, and we will need to improve our operational, financial and management controls, as well as our reporting systems and procedures. We will require significant capital expenditures and the allocation of valuable management resources to grow and change in these areas without undermining our corporate culture of rapid innovation, teamwork and attention to client service that has been central to our growth so far.

Our business may suffer if it is alleged or determined that our technology infringes the intellectual property rights of others.

The software industry is characterized by the existence of a large number of patents, copyrights, trademarks, trade secrets and other intellectual and proprietary rights. Companies in the software industry are often required to defend against litigation claims based on allegations of infringement or other violations of intellectual property rights. Many of our competitors and other industry participants have been issued patents and/or have filed patent applications and may assert patent or other intellectual property rights within the industry. From time to time, we may receive threatening letters or notices or may be the subject of claims that our services and underlying technology infringe or violate the intellectual property rights of others. For example, as described further under “Business—Legal proceedings,” we are in litigation with Oracle relating in part to alleged copyright infringement. Responding to such claims, regardless of their merit, can be time consuming, costly to defend in litigation, divert management’s attention and resources, damage our reputation and brand, and cause us to incur significant expenses. Our services may not be able to withstand any or all third-party claims or rights against their use. Claims of intellectual property infringement might require us to redesign our processes, delay product deliverables, enter into costly settlements or license agreements or pay costly damage awards, or face a temporary or permanent injunction prohibiting us from marketing, selling or performing our services. If we cannot or do not license the infringed technology on reasonable terms or

20

Risk factors

at all, or substitute similar technology from another source, our revenues and operating results could be adversely impacted. In addition, regardless of the outcome of our ongoing litigation with Oracle, other enterprise software vendors may pursue similar litigation against us, or Oracle may pursue other claims against us relating to current or past business practices. The occurrence of any of these events could have a material adverse effect on our business. Furthermore, in some cases, we have provisions in our agreements with our clients whereby we indemnify our customers in the event that Oracle is successful in its litigation against us and we are no longer able to provide service to these clients. In some cases, our clients have the right to terminate their agreements and claim refunds or liquidated damages up to the amount paid to us for services if we are unable to provide our services due to infringement of the rights of third parties, including if we are unable to provide services due to our litigation with Oracle. In addition, if any judgments or awards are entered against us, or if we enter into any settlement arrangements with respect to any litigation or arbitration, and the aggregate amount of any such judgments, awards, or agreements exceeds $50,000, we would be in default of an existing agreement we have with Bridge Bank National Association for a revolving line of credit and note payable, in which case the lender could demand accelerated repayment of principal and accrued interest.

We rely on our management team and other key employees, including our Chief Executive Officer, and the loss of one or more key employees could harm our business.