Filed by RhythmOne plc

This communication is filed pursuant to Rule 425 under the United States Securities Act of 1933

and deemed filed pursuant to Rule 14d-2 of the Securities Exchange Act of 1934

Subject Company: YuMe, Inc.

Subject Company’s Commission File Number: 001-36039

Date: December 4, 2017

RHYTHMONE PLC DECEMBER 2017

Safe Harbor & Copyright StatementsFORWARD--?LOOKING STATEMENTS This announcement contains (or may contain) certainforward--?looking statements with respect to certain of RhythmOne’s plans and its current goals and expectations relating to its future financial condition and performance and which involve a number of risks and uncertainties. RhythmOne cautions readers that noforward--?looking statement is a guarantee of future performance and that actual results could differ materially from those contained in theforward--?looking statements. Theseforward--?looking statements can be identified by the fact that they do not relate only to historical or current facts.Forward--?looking statements sometimes use words such as ‘aim’, ‘anticipate’, ‘target’, ‘expect’, ‘estimate’, ‘intend’, ‘plan’, ‘goal’, ‘believe’, or other words of similar meaning. Examples offorward--?looking statements include, among others, statements regarding RhythmOne’s future financial position, income growth, impairment charges, business strategy, projected levels of growth in its markets, projected costs, estimates of capital expenditure, and plans and objectives for future operations of RhythmOne and other statements that are not historical fact. By their nature,forward--?looking statements involve risk and uncertainty because they relate to future events and circumstances, including, but not limited to, UK domestic and global economic and business conditions, the effects of continued volatility in credit markets,market--?related risks such as changes in interest rates and exchange rates, the policies and actions of governmental and regulatory authorities, changes in legislation, the further development of standards and interpretations under International Financial Reporting Standards (“IFRS”) applicable to past, current and future periods, evolving practices with regard to the interpretation and application of standards under IFRS, the outcome of pending and future litigation, the success of future acquisitions and other strategic transactions and the impact of competition--? a number of which factors are beyond RhythmOne’s control. As a result, RhythmOne’s actual future results may differ materially from the plans, goals, and expectations set forth in RhythmOne’sforward--?looking statements. Anyforward--?looking statements made herein by or on behalf of RhythmOne speak only as of the date they are made. Except as required by the FCA, AIM or applicable law, RhythmOne expressly disclaims any obligation or undertaking to release publicly any updates or revisions to anyforward--?looking statements contained in this announcement to reflect any changes in RhythmOne expectations with regard thereto or any changes in events, conditions or circumstances on which any such statement is based. Neither the content of the Company’s website (or any other website) nor the content of any website accessible from hyperlinks on the Company’s website (or any other website) is incorporated into, or forms part of, this announcement. COPYRIGHT STATEMENT © 2017 RhythmOne, LLC. All rights reserved. All materials contained herein are the property of RhythmOne, LLC. and may only be used, copied or distributed with the express written permission of RhythmOne, LLC. Other products and companies referred to herein are the trademarks or registered trademarks of their respective companies or mark holders.

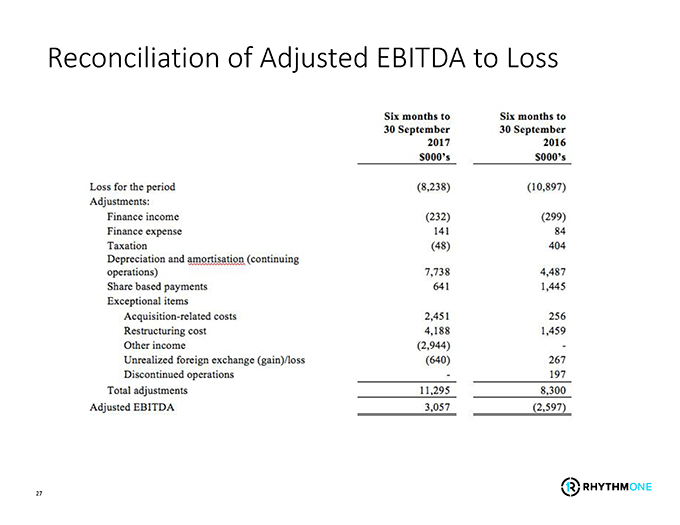

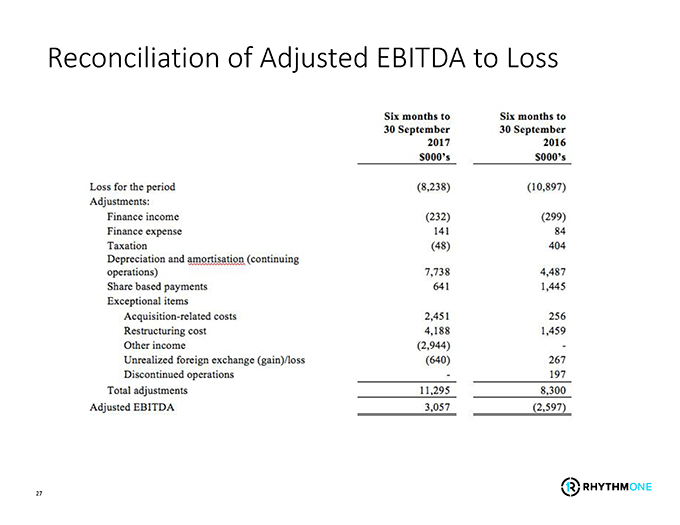

Adjusted EBITDA To provide investors with additional information regarding RhythmOne’s financial results, RhythmOne has presented, within this earnings presentation, Adjusted EBITDA, a measure that is not defined by IFRS. RhythmOne has defined Adjusted EBITDA below. Provided in Appendix A is a reconciliation of Adjusted EBITDA to loss for the Period, the most directly comparable IFRS financial measure. RhythmOne defines Adjusted EBITDA as loss for the Period, adjusted to exclude finance income and expense, taxation, depreciation and amortization, share based payments and exceptional items in continuing operations and in discontinued operations, which include goodwill impairment, change in intangible assets’ lives,acquisition--?related costs, and restructuring, severance costs, other income and unrealized foreign exchange gain and loss. RhythmOne adjusts Adjusted EBITDA foracquisition--?related costs because the size, number and type of transactions have varied meaningfully over time.Acquisition--?related costs resulting directly from merger and acquisition activities such as legal, due diligence and integration costs are not factored into management’s evaluation of potential acquisitions or its performance after completion of acquisitions, because they are not related to RhythmOne’s core operating performance, and the frequency and amount of such charges vary significantly based on the size and timing of the acquisitions and the maturities of the businesses being acquired. In addition, RhythmOne’s management believes that the adjustments of items such asacquisition--?related costs and amortization of intangible assets more closely correlate with the sustainability of RhythmOne’s operating performance. RhythmOne’s management believes that Adjusted EBITDA provides useful information to investors in understanding and evaluating the operating results of RhythmOne in the same manner as management and the RhythmOne board of directors because it excludes the impact of exceptional items in profit from operations, which have less bearing on the routine operating activities of RhythmOne, thereby enhancing users’ understanding of the underlying business performance. RhythmOne’s management also believes that Adjusted EBITDA provides information that enables investors to better compare RhythmOne’s business performance across periods. Thisnon--?IFRS measure is not necessarily comparable to similarly titled measures of other companies, and Adjusted EBITDA should not be viewed as a substitute for, or superior to, loss for the period prepared in accordance with IFRS as a measure of RhythmOne’s profitability or liquidity. Some of the limitations of Adjusted EBITDA are: • Although depreciation and amortization arenon--?cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements; • Adjusted EBITDA does not reflect changes in, or cash requirements for, RhythmOne’s working capital needs; • Adjusted EBITDA does not consider the potentially dilutive impact ofequity--?based compensation; • Adjusted EBITDA does not reflect tax payments that may represent a reduction in cash available to RhythmOne; and • Other companies, including companies in RhythmOne’s industry, may calculate Adjusted EBITDA differently, which reduces its usefulness as a comparative measure. Users of this financial information should consider the types of events and transactions for which adjustments have been made.

Additional Information and Where to Find It ADDITIONAL INFORMATION AND WHERE TO FIND IT The exchange offer for the outstanding shares of YuMe, Inc. (“YuMe”) stock has not yet commenced. This announcement is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares, nor is it a substitute for any materials that RhythmOne and its offering subsidiary, Redwood Merger Sub 1, Inc. (“Purchaser”), will file with the SEC. RhythmOne and Purchaser plan to file a tender offer statement on Schedule TO, together with other related exchange offer documents, including a letter of transmittal, in connection with the offer; YuMe plans to file a Recommendation Statement on Schedule14D--?9 in connection with the offer; and RhythmOne plans to file a registration statement on FormF--?4 that will serve as a prospectus for RhythmOne shares to be issued as consideration in the offer and the mergers. These documents will contain important information about RhythmOne, YuMe, the offer and the mergers. YuMe stockholders are urged to read these documents carefully and in their entirety when they become available before making any decision regarding exchanging their shares. These documents will be made available to YuMe stockholders at no expense to them and will also be available for free at the SEC’s website at www.sec.gov. Additional copies may be obtained for free by contacting RhythmOne’s investor relations department at Edward Bridges, FTI Consulting, Inc., Tel: +44 (0)20 3727 1000, Email: rhythmone@fticonsulting.com or YuMe’s investor relations department at ir@yume.com or1--?650--?503--?7192. Such documents are not currently available. In addition to the SEC filings made in connection with the transaction, YuMe files annual, quarterly and current reports and other information with the SEC. You may read and copy any reports or other such filed information at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at1--?800--?SEC--?0330 for further information on the public reference room. YuMe’s filings with the SEC are also available to the public from commercialdocument--?retrieval services and at http://www.sec.gov. In addition to the SEC filings made in connection with the transaction, RhythmOne makes available annual reports and other information free of charge on its website at www.RhythmOne.com. Such information can also be obtained from RhythmOne using the contact information above.

OVERVIEW

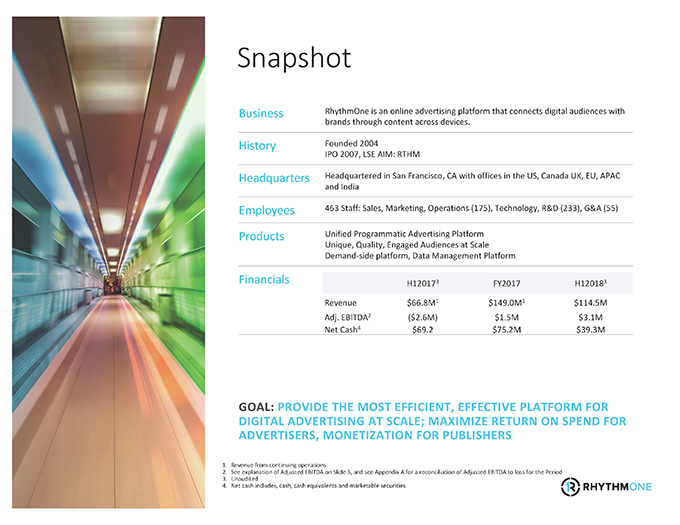

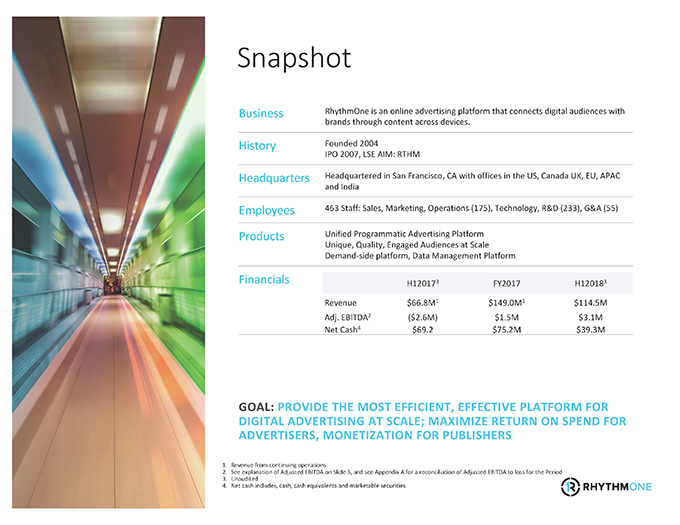

6 Business RhythmOne is an online advertising platform that connects digital audiences with brands through content across devices. History Founded 2004 IPO 2007, LSE AIM: RTHM Headquarters Headquartered in San Francisco, CA with offices in the US, Canada UK, EU, APAC and India Employees 463 Staff: Sales, Marketing, Operations (175), Technology, R&D (233), G&A (55) Products Unified Programmatic Advertising Platform Unique, Quality, Engaged Audiences at Scale Demand—?side platform, Data Management Platform Financials Snapshot GOAL: PROVIDE THE MOST EFFICIENT, EFFECTIVE PLATFORM FOR DIGITAL ADVERTISING AT SCALE; MAXIMIZE RETURN ON SPEND FOR ADVERTISERS, MONETIZATION FOR PUBLISHERS 1. Revenue from continuing operations 2. See explanation of Adjusted EBITDA on Slide 3, and see Appendix A for a reconciliation of Adjusted EBITDA to loss for the Period 3. Unaudited 4. Net cash includes, cash, cash equivalents and marketable securities H120173 FY2017 H120183 Revenue $66.8M1 $149.0M1 $114.5M Adj. EBITDA2 ($2.6M) $1.5M $3.1M Net Cash4 $69.2 $75.2M $39.3M

7 H12018 Overview DEMONSTRATED FINANCIAL PERFORMANCE Delivered against targets, progressive profitability WELL DEFINED REVENUE MODEL Revenue = Price x Fill Rate x Volume, known cost and growth drivers STRUCTURAL SECTOR OPPORTUNITY Opportunity to build a credible, enduring and necessary alternative to walled gardens CLASS—?LEADING TECHNOLOGY Unified programmatic platform for engaged audiences at scale UNIQUE CONSOLIDATION PLATFORM Technology, team and resources to lead industry consolidation in 2nd Coming of ad tech

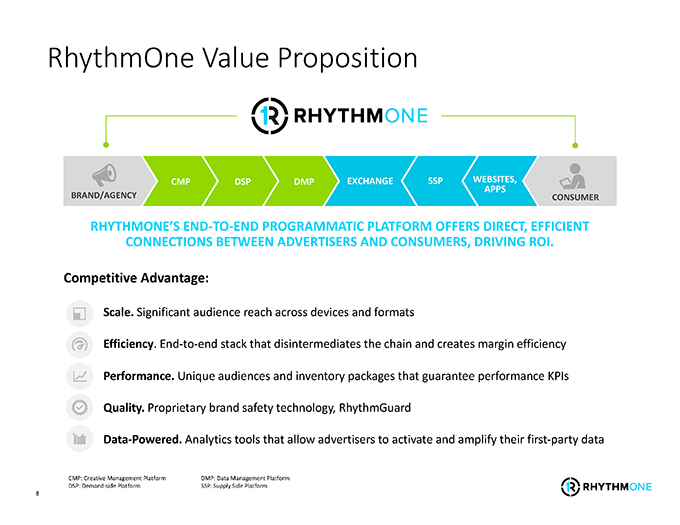

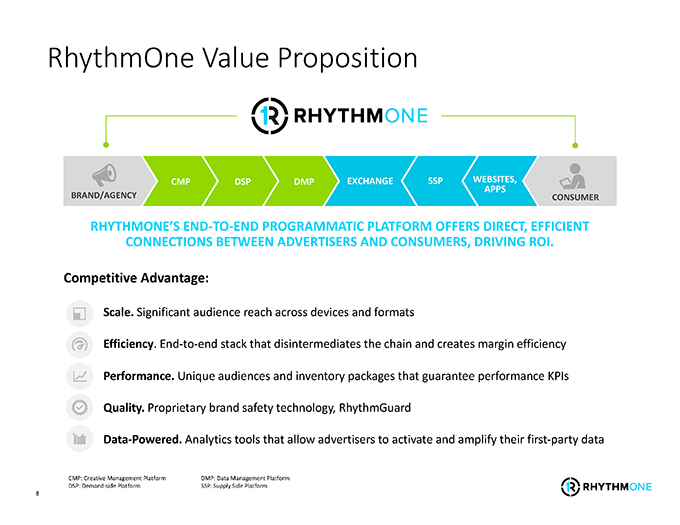

8 CMP: Creative Management Platform DSP: Demand—?side Platform DMP: Data Management Platform SSP: Supply Side Platform RhythmOne Value Proposition RHYTHMONE’S END—?TO—?END PROGRAMMATIC PLATFORM OFFERS DIRECT, EFFICIENT CONNECTIONS BETWEEN ADVERTISERS AND CONSUMERS, DRIVING ROI. DSP DMP EXCHANGE SSP WEBSITES, APPS CMP BRAND/AGENCY CONSUMER Competitive Advantage: Scale. Significant audience reach across devices and formats Efficiency. End—?to—?end stack that disintermediates the chain and creates margin efficiency Performance. Unique audiences and inventory packages that guarantee performance KPIs Quality. Proprietary brand safety technology, RhythmGuard Data—?Powered. Analytics tools that allow advertisers to activate and amplify their first—?party data

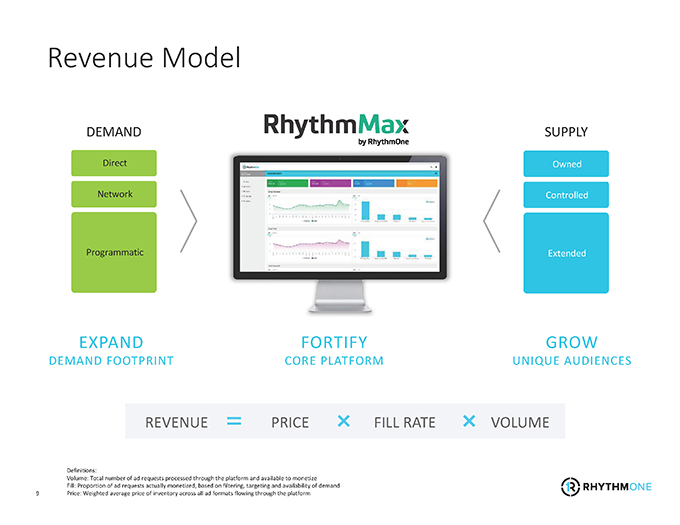

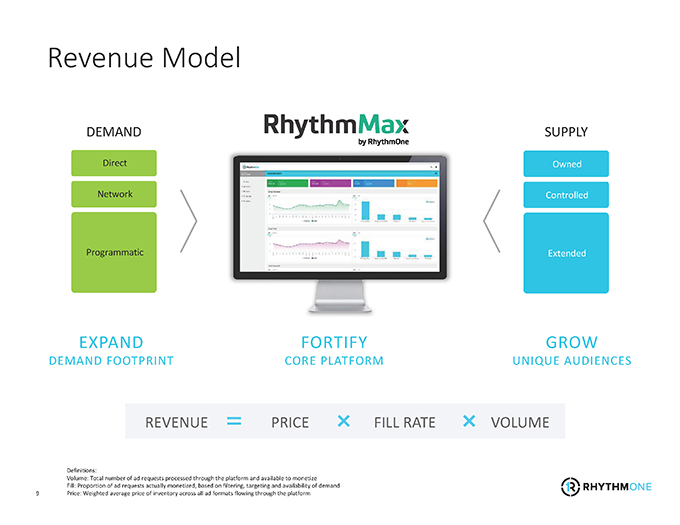

9 Revenue Model Definitions: Volume: Total number of ad requests processed through the platform and available to monetize Fill: Proportion of ad requests actually monetized, based on filtering, targeting and availability of demand Price: Weighted average price of inventory across all ad formats flowing through the platform REVENUE PRICE FILL RATE VOLUME SUPPLY Owned Extended Controlled DEMAND Direct Programmatic Network GROW UNIQUE AUDIENCES FORTIFY CORE PLATFORM EXPAND DEMAND FOOTPRINT

FINANCIALS

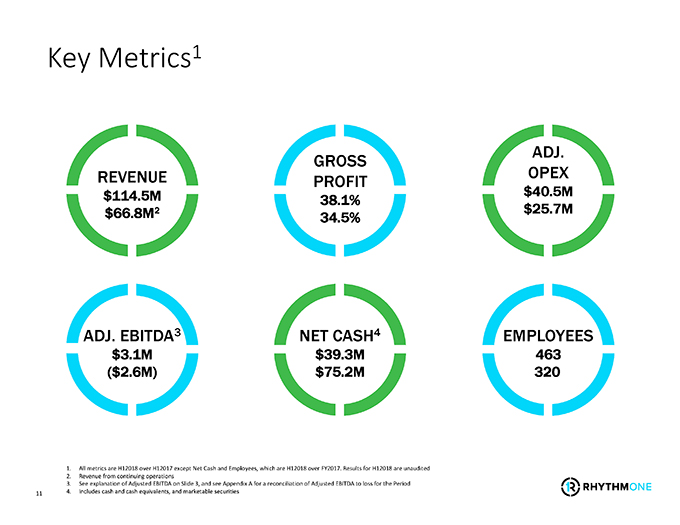

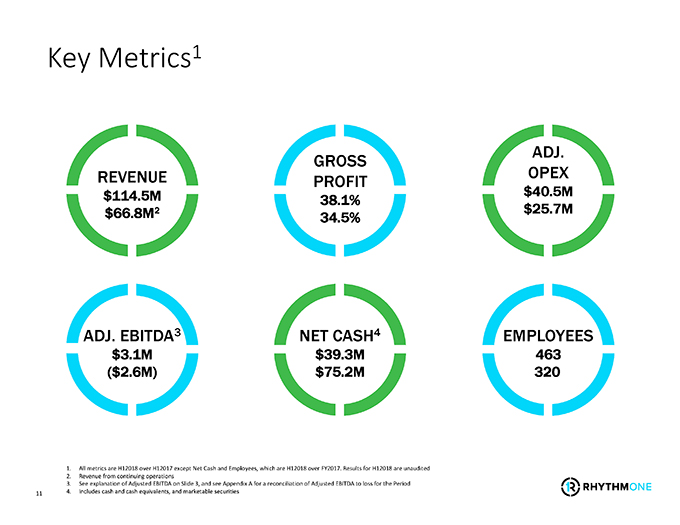

11 Key Metrics1 REVENUE $114.5M $66.8M2 ADJ. OPEX $40.5M $25.7M $73.4M NET CASH4 $39.3M $75.2M EMPLOYEES 463 320274 GROSS PROFIT 38.1% 34.5% ADJ. EBITDA3 $3.1M ($2.6M) 1. All metrics are H12018 over H12017 except Net Cash and Employees, which are H12018 over FY2017. Results for H12018 are unaudited 2. Revenue from continuing operations 3. See explanation of Adjusted EBITDA on Slide 3, and see Appendix A for a reconciliation of Adjusted EBITDA to loss for the Period 4. Includes cash and cash equivalents, and marketable securities

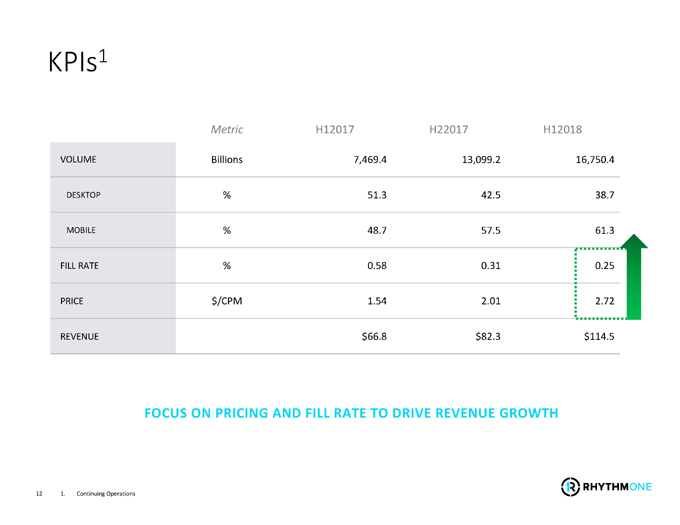

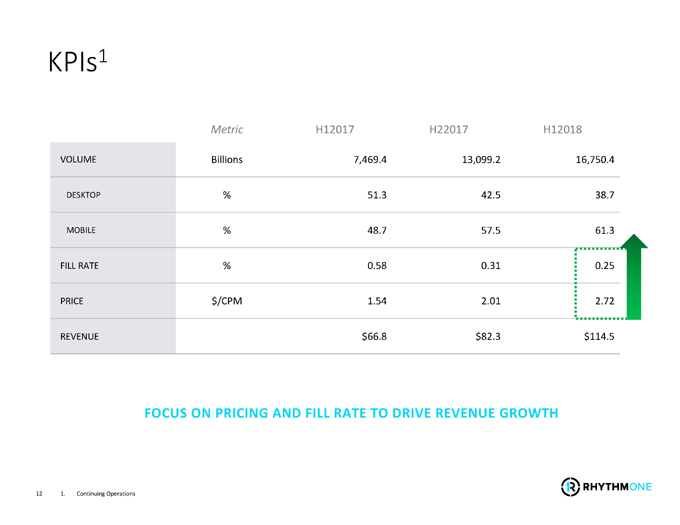

12 KPIs1 FOCUS ON PRICING AND FILL RATE TO DRIVE REVENUE GROWTH Metric H12017 H22017 H12018 VOLUME Billions 7,469.4 13,099.2 16,750.4 DESKTOP % 51.3 42.5 38.7 MOBILE % 48.7 57.5 61.3 FILL RATE % 0.58 0.31 0.25 PRICE $/CPM 1.54 2.01 2.72 REVENUE $66.8 $82.3 $114.5 1. Continuing Operations

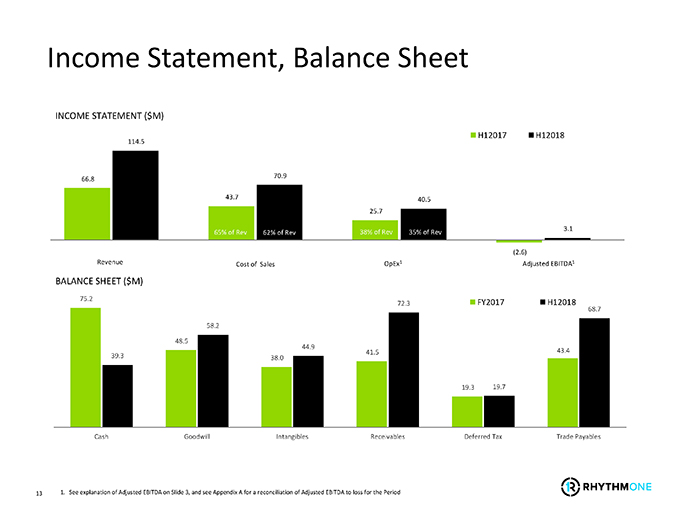

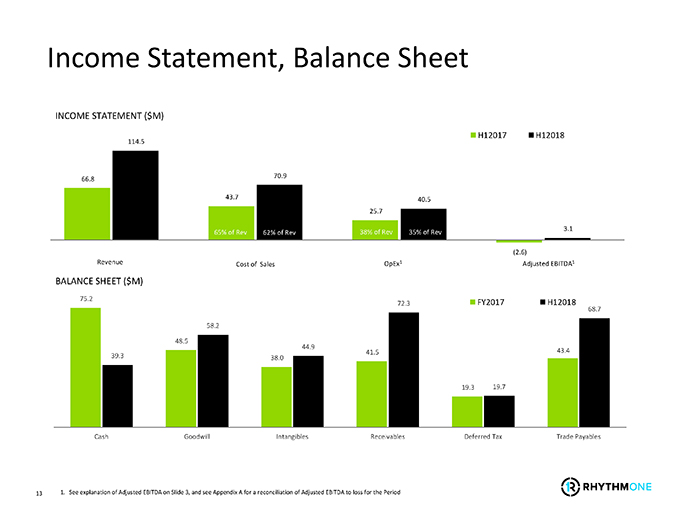

13 Income Statement, Balance Sheet INCOME STATEMENT ($M) 75.2 48.5 38.0 41.5 19.3 43.4 39.3 58.2 44.9 72.3 19.7 68.7 Cash Goodwill Intangibles Receivables Deferred Tax Trade Payables FY2017 H12018 BALANCE SHEET ($M) 66.8 43.7 25.7 (2.6) 114.5 70.9 40.5 3.1 H12017 H12018 Revenue Cost of Sales OpEx1 Adjusted EBITDA1 1. See explanation of Adjusted EBITDA on Slide 3, and see Appendix A for a reconciliation of Adjusted EBITDA to loss for the Period 65% of Rev 62% of Rev 38% of Rev 35% of Rev

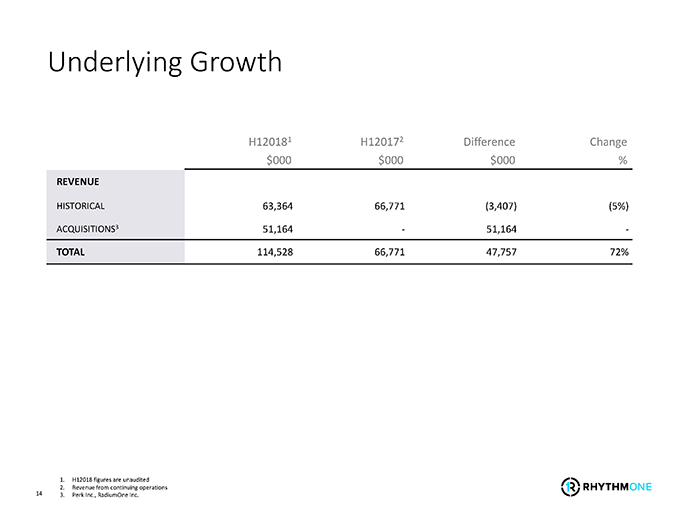

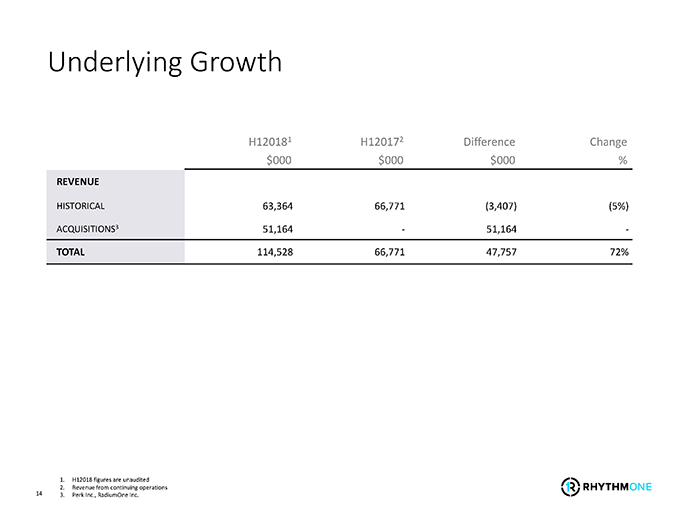

14 Underlying Growth H120181 H120172 Difference Change $000 $000 $000 % REVENUE HISTORICAL 63,364 66,771 (3,407) (5%) ACQUISITIONS3 51,164 —? 51,164 —? TOTAL 114,528 66,771 47,757 72% 1. H12018 figures are unaudited 2. Revenue from continuing operations 3. Perk Inc., RadiumOne Inc.

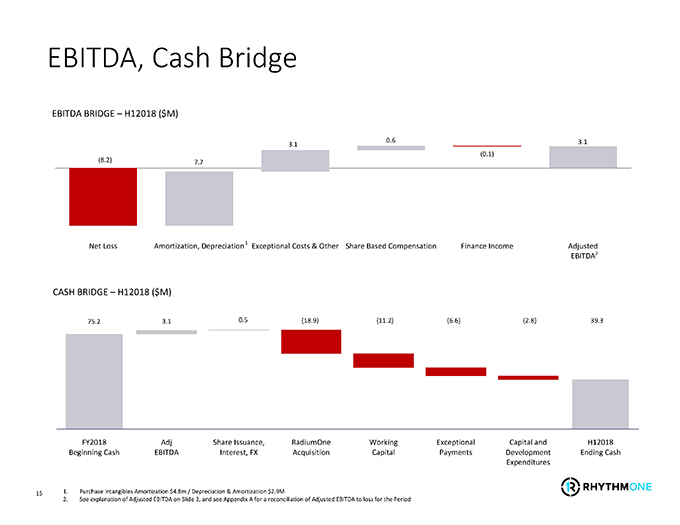

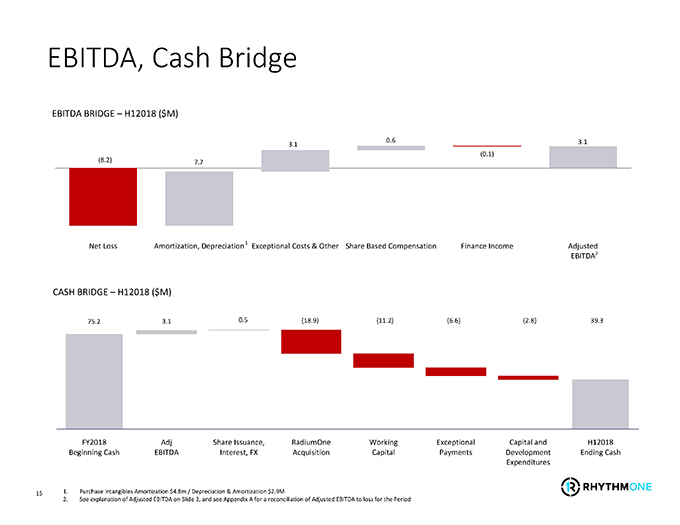

15 EBITDA, Cash Bridge EBITDA BRIDGE – H12018 ($M) Net Loss Amortization, Depreciation Exceptional Costs & Other Share Based Compensation Finance Income Adjusted EBITDA (8.2) 7.7 (0.1) 3.1 0.6 3.1 FY2018 Beginning Cash Adj EBITDA Share Issuance, Interest, FX RadiumOne Acquisition Working Capital Exceptional Payments Capital and Development Expenditures H12018 Ending Cash 75.2 3.1 0.5 (18.9) (11.2) (6.6) (2.8) 39.3 CASH BRIDGE – H12018 ($M) 1. Purchase Intangibles Amortization $4.8m / Depreciation & Amortization $2.9M 2. See explanation of Adjusted EBITDA on Slide 3, and see Appendix A for a reconciliation of Adjusted EBITDA to loss for the Period 1 2

PRODUCT & STRATEGY

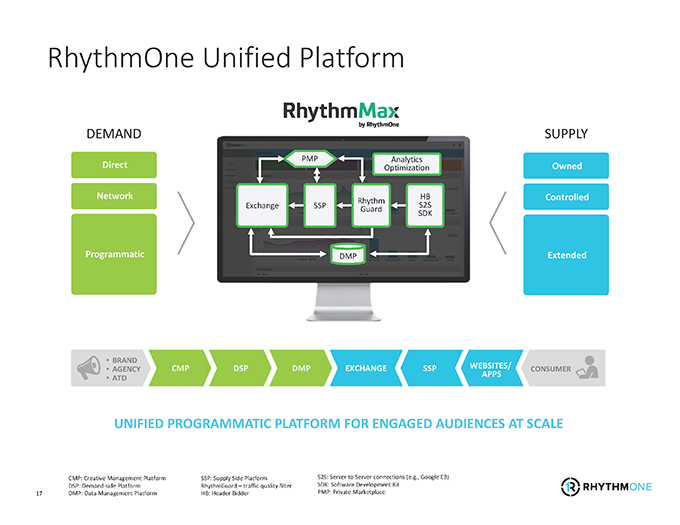

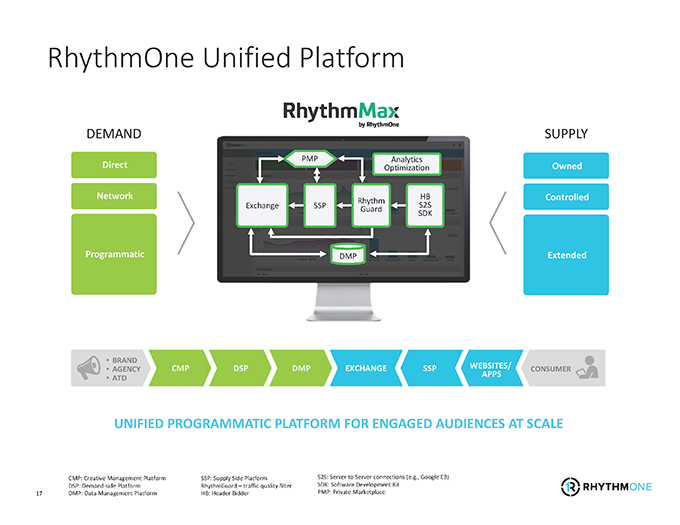

17 CMP: Creative Management Platform DSP: Demand—?side Platform DMP: Data Management Platform SSP: Supply Side Platform RhythmGuard – traffic quality filter HB: Header Bidder SUPPLY Owned Extended Controlled DEMAND Direct Programmatic Network RhythmOne Unified Platform UNIFIED PROGRAMMATIC PLATFORM FOR ENGAGED AUDIENCES AT SCALE DSP DMP EXCHANGE SSP WEBSITES/ CMP APPS CONSUMER • BRAND • AGENCY • ATD DMP Analytics Optimization PMP Rhythm Guard HB S2S SDK Exchange SSP S2S: Server to Server connections (e.g., Google EB) SDK: Software Development Kit PMP: Private Marketplace

18 Engaged Audiences at Scale OWNED All Media Perk Extended Preferred platform supply Controlled SDK/Tags Header Bidder Google EB RANK NETWORK/EXCHANGE UNIQUES REACH 1 Google Ad Network 200,949 91.1 2 Yahoo Audience Network 189,820 86.1 3 Conversant 174,226 79.0 4 RhythmOne 166,194 75.4 5 RadiumOne 162,089 73.5 RANKED US #4 Source for Rankings: comScore US Display Ad Ecosystem, Media Metrix, September, 2017

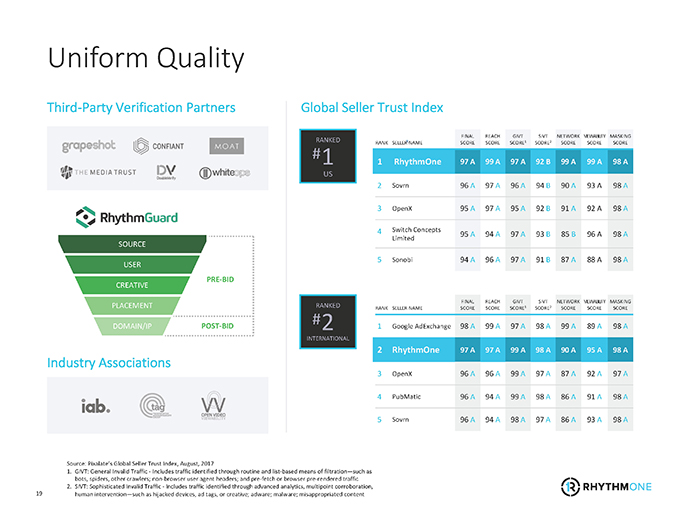

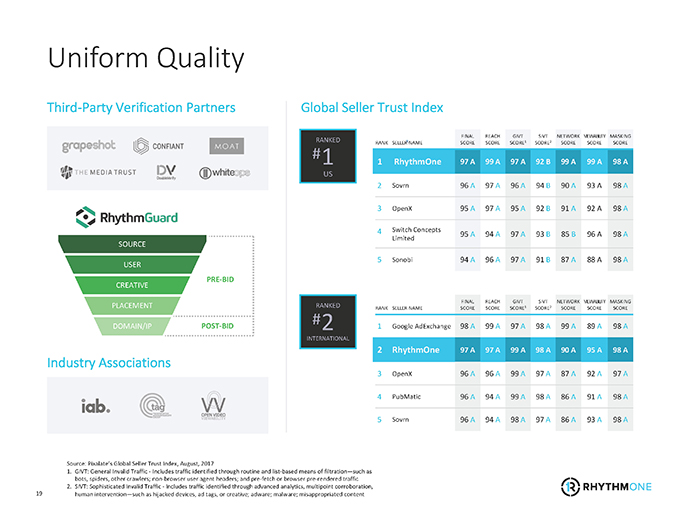

19 Uniform Quality Global Seller Trust Index Source: Pixalate’s Global Seller Trust Index, August, 2017 1. GIVT: General Invalid Traffic —? Includes traffic identified through routine and list—?based means of filtration—such as bots, spiders, other crawlers; non—?browser user agent headers; and pre—?fetch or browser pre—?rendered traffic 2. SIVT: Sophisticated Invalid Traffic —? Includes traffic identified through advanced analytics, multipoint corroboration, human intervention—such as hijacked devices, ad tags, or creative; adware; malware; misappropriated content RANK SELLER NAME FINAL SCORE REACH SCORE GIVT SCORE1 SIVT SCORE2 NETWORK SCORE VIEWABILITY SCORE MASKING SCORE 1 Google AdExchange 98 A 99 A 97 A 98 A 99 A 89 A 98 A 2 RhythmOne 97 A 97 A 99 A 98 A 90 A 95 A 98 A 3 OpenX 96 A 96 A 99 A 97 A 87 A 92 A 97 A 4 PubMatic 96 A 94 A 99 A 98 A 86 A 91 A 98 A 5 Sovrn 96 A 94 A 98 A 97 A 86 A 93 A 98 A RANK SELLER NAME FINAL SCORE REACH SCORE GIVT SCORE1 SIVT SCORE2 NETWORK SCORE VIEWABILITY SCORE MASKING SCORE 1 RhythmOne 97 A 99 A 97 A 92 B 99 A 99 A 98 A 2 Sovrn 96 A 97 A 96 A 94 B 90 A 93 A 98 A 3 OpenX 95 A 97 A 95 A 92 B 91 A 92 A 98 A 4 Switch Concepts Limited 95 A 94 A 97 A 93 B 85 B 96 A 98 A 5 Sonobi 94 A 96 A 97 A 91 B 87 A 88 A 98 A Industry Associations SOURCE USER CREATIVE PLACEMENT DOMAIN/IP PRE—?BID POST—?BID Third—?Party Verification Partners RANKED US #1 RANKED INTERNATIONAL #2

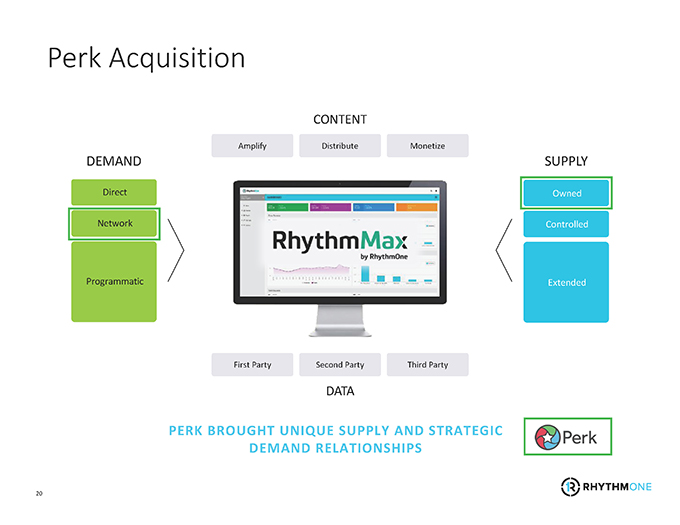

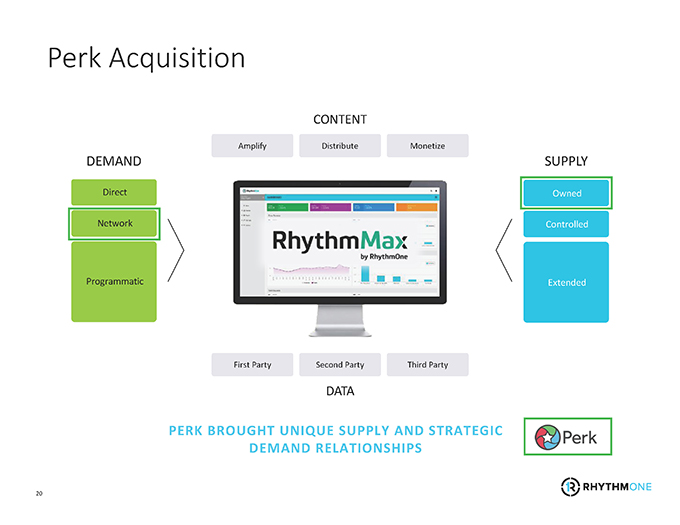

20 Perk Acquisition CONTENT DATA Amplify Distribute Monetize First Party Second Party Third Party SUPPLY Owned Extended Controlled DEMAND Direct Programmatic Network PERK BROUGHT UNIQUE SUPPLY AND STRATEGIC DEMAND RELATIONSHIPS

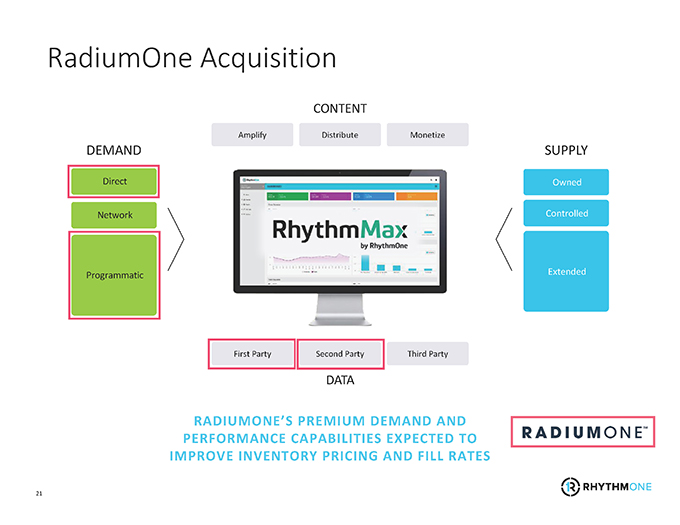

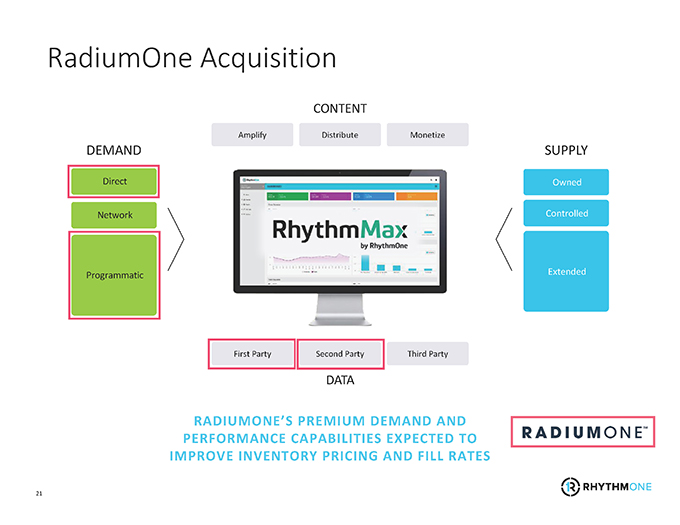

21 RadiumOne Acquisition SUPPLY Owned Extended Controlled DEMAND Direct Programmatic Network CONTENT DATA Amplify Distribute Monetize First Party Second Party Third Party RADIUMONE’S PREMIUM DEMAND AND PERFORMANCE CAPABILITIES EXPECTED TO IMPROVE INVENTORY PRICING AND FILL RATES

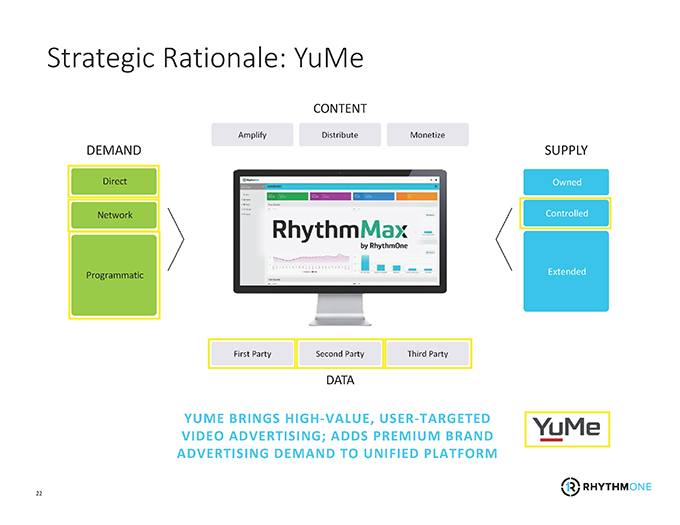

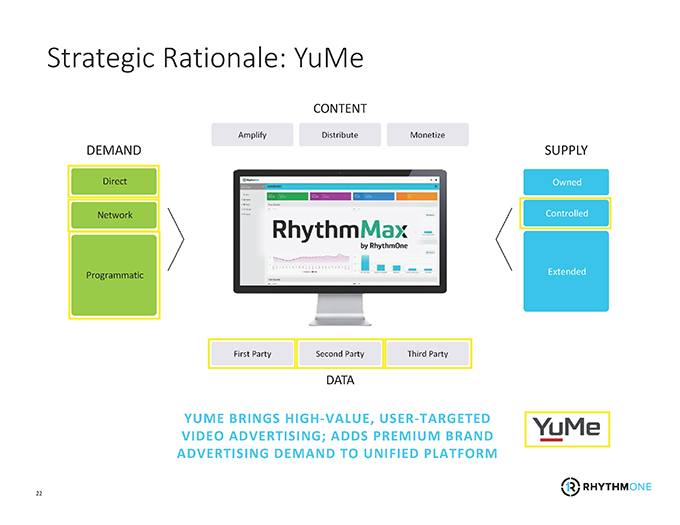

22 Strategic Rationale: YuMe SUPPLY Owned Extended Controlled DEMAND Direct Programmatic Network CONTENT DATA Amplify Distribute Monetize First Party Second Party Third Party YUME BRINGS HIGH—?VALUE, USER—?TARGETED VIDEO ADVERTISING; ADDS PREMIUM BRAND ADVERTISING DEMAND TO UNIFIED PLATFORM

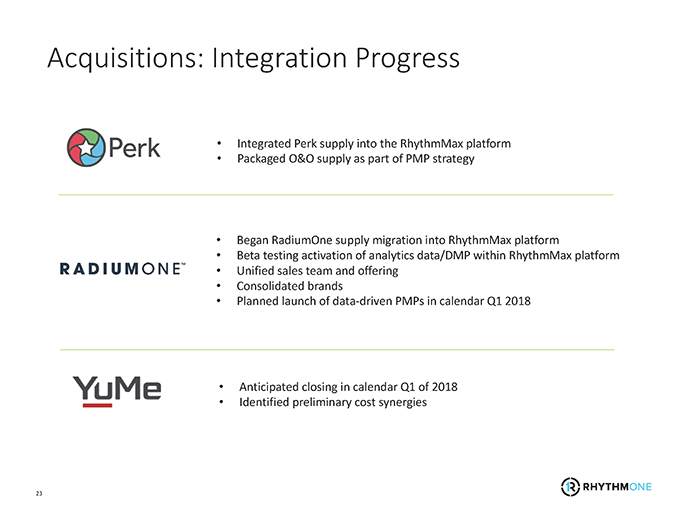

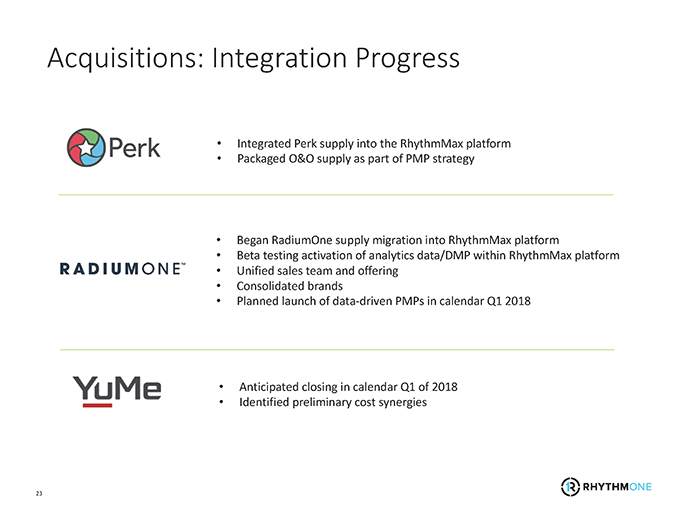

23 Acquisitions: Integration Progress • Integrated Perk supply into the RhythmMax platform • Packaged O&O supply as part of PMP strategy • Began RadiumOne supply migration into RhythmMax platform • Beta testing activation of analytics data/DMP within RhythmMax platform • Unified sales team and offering • Consolidated brands • Planned launch of data—?driven PMPs in calendar Q1 2018 • Anticipated closing in calendar Q1 of 2018 • Identified preliminary cost synergies

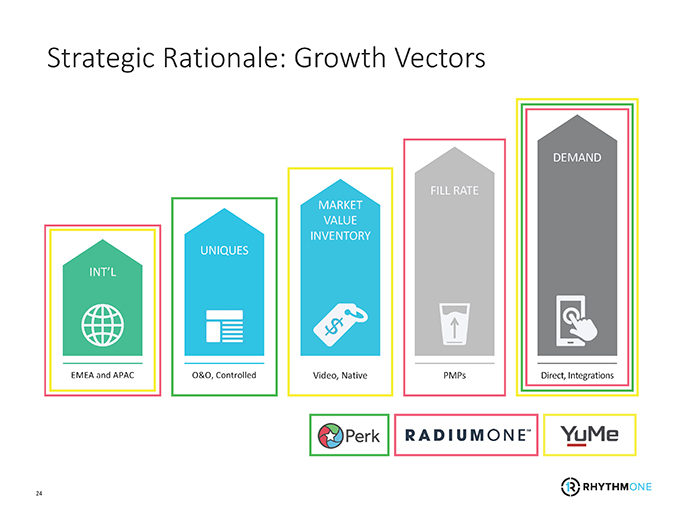

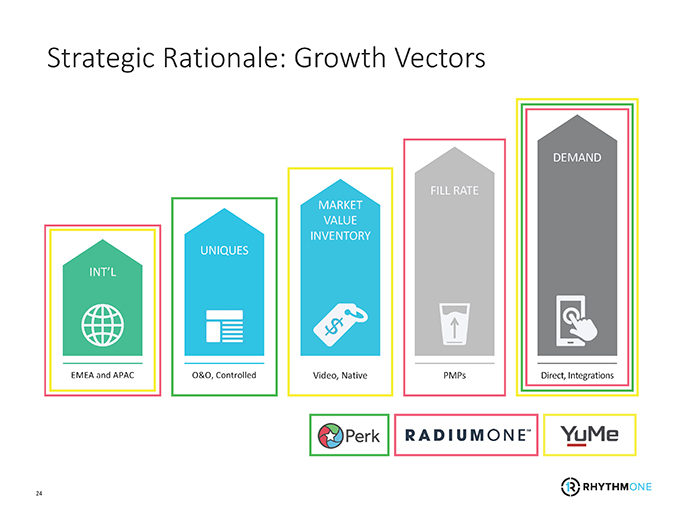

24 Strategic Rationale: Growth Vectors MARKET VALUE INVENTORY Video, Native FILL RATE PMPs DEMAND EMEA and APAC Direct, Integrations INT’L O&O, Controlled UNIQUES

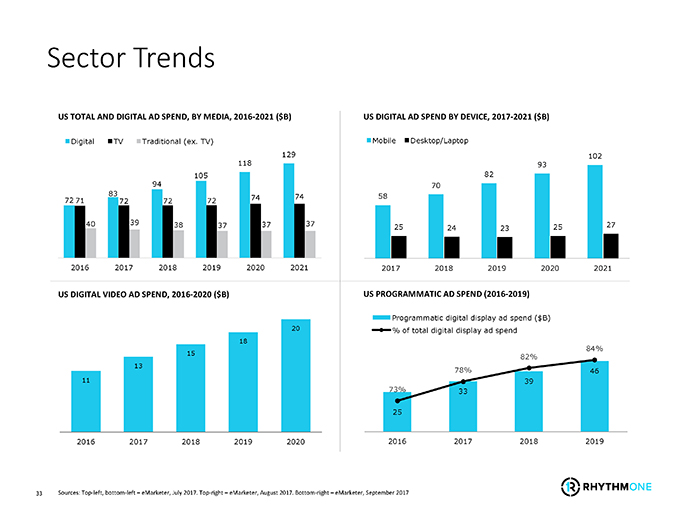

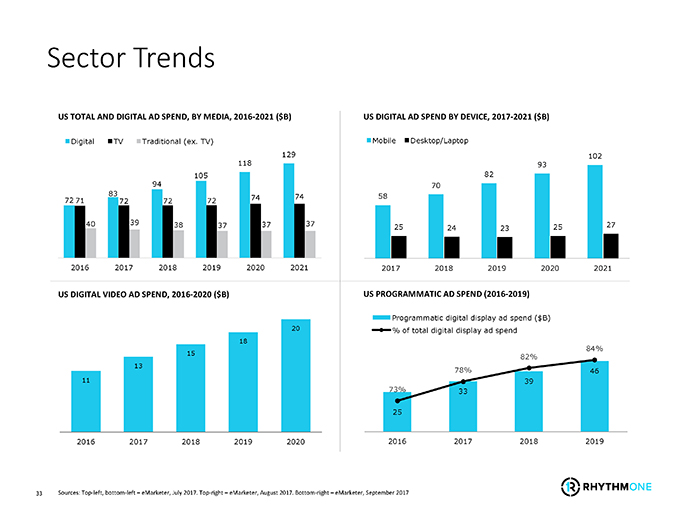

25 Conclusions • Connect audiences and brands through content across devices • Sector continues to evolve and is expected to grow to $129B/Yr1 over next 4 years • Focus on programmatic engine across channels and formats • Strong, well—?understood growth and cost drivers • Scale, scope and reach across the digital advertising supply chain • Platform to lead sector consolidation 14 1. eMarketer comparative estimates, August 2017

APPENDIX A

27 Reconciliation of Adjusted EBITDA to Loss Loss fo r the period Adjustments: Finance income Finance expense Taxation Depreciation and amortisation (continuing operations) Share based payments Exceptional items Acquisition-related costs Restructuring cost Other income Unrealized fo reign exchange (gain)lloss Discontinued operations Total adjustments Adjusted EBITDA Six months to 30 September 2017 SOOO’s (8,238) (232) 141 (48) 7,738 641 2,451 4, 188 (2,944) (640) 11,295 3,057 Six months to 30 September 2016 SOOO’s (I 0,897) (299) 84 404 4,487 1,445 256 1,459 267 197 8,300 (2,597) (~ RHYTHMONE

APPENDIX B

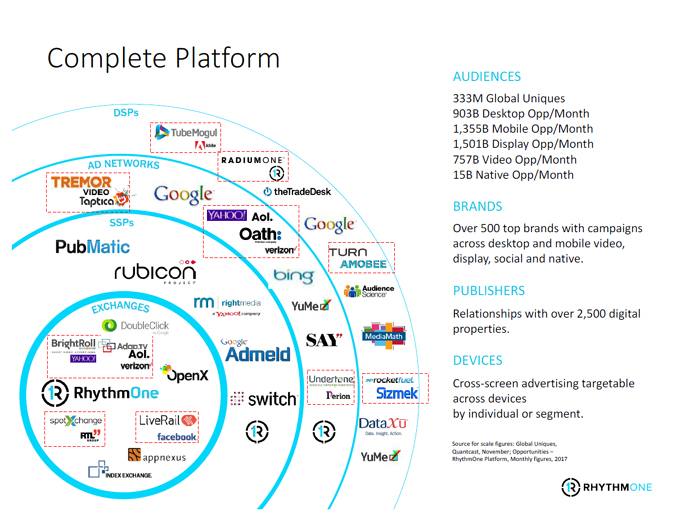

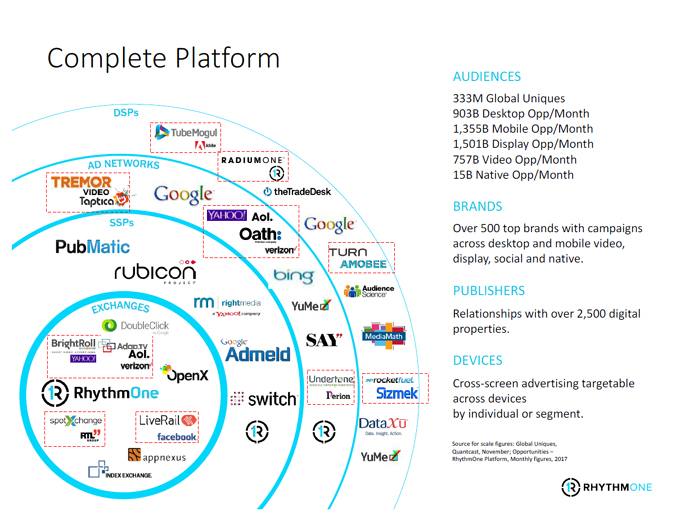

29 Complete Platform AUDIENCES 333M Global Uniques 903B Desktop Opp/Month 1,355B Mobile Opp/Month 1,501B Display Opp/Month 757B Video Opp/Month 15B Native Opp/Month BRANDS Over 500 top brands with campaigns across desktop and mobile video, display, social and native. PUBLISHERS Relationships with over 2,500 digital properties. DEVICES Cross—?screen advertising targetable across devices by individual or segment. Source for scale figures: Global Uniques, Quantcast, November; Opportunities – RhythmOne Platform, Monthly figures, 2017

30 Industry CONTENT BRAND DEVICE AUDIENCES CONNECT AUDIENCES AND BRANDS THROUGH DIGITAL CONTENT ACROSS DEVICES

31 AUDIENCES Ecosystem BRANDS AGENTS PUBLISHERS CONTENT DEVICES DEMAND SUPPLY

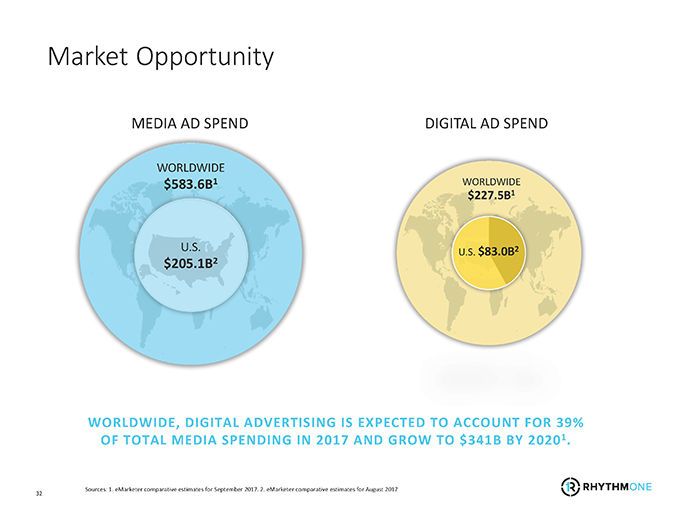

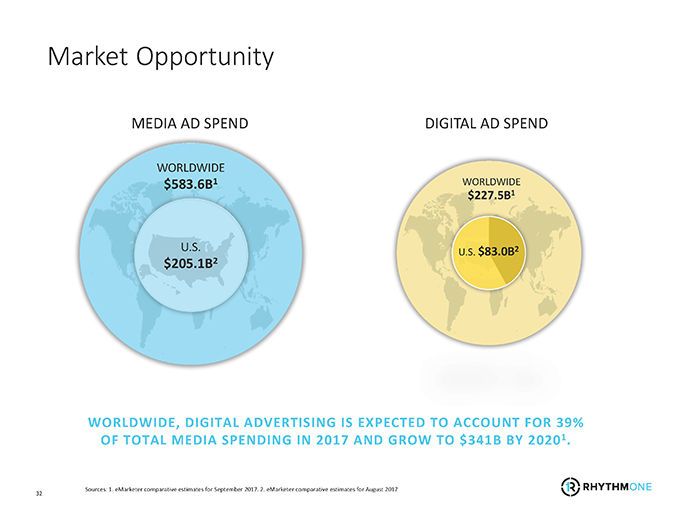

32 Market Opportunity MEDIA AD SPEND U.S. $205.1B2 WORLDWIDE $583.6B1 DIGITAL AD SPEND WORLDWIDE $227.5B1 U.S. $83.0B2 WORLDWIDE, DIGITAL ADVERTISING IS EXPECTED TO ACCOUNT FOR 39% OF TOTAL MEDIA SPENDING IN 2017 AND GROW TO $341B BY 20201. Sources: 1. eMarketer comparative estimates for September 2017. 2. eMarketer comparative estimates for August 2017

33 Sector Trends US DIGITAL VIDEO AD SPEND, 2016—?2020 ($B) 11 13 15 18 20 2016 2017 2018 2019 2020 US PROGRAMMATIC AD SPEND (2016—?2019) 25 33 39 46 73% 78% 82% 84% 65% 70% 75% 80% 85% 0 10 20 30 40 50 2016 2017 2018 2019 Programmatic digital display ad spend ($B) % of total digital display ad spend US TOTAL AND DIGITAL AD SPEND, BY MEDIA, 2016—?2021 ($B) 72 83 94 105 118 129 71 72 72 72 74 74 40 39 38 37 37 37 2016 2017 2018 2019 2020 2021 Digital TV Traditional (ex. TV) US DIGITAL AD SPEND BY DEVICE, 2017—?2021 ($B) 58 70 82 93 102 25 24 23 25 27 2017 2018 2019 2020 2021 Mobile Desktop/Laptop Sources: Top—?left, bottom—?left – eMarketer, July 2017. Top—?right – eMarketer, August 2017. Bottom—?right – eMarketer, September 2017