Exhibit (a)(5)(G)

Rosemary M. Rivas (State Bar No. 209147)

Email: rrivas@zlk.com

LEVI & KORSINSKY, LLP

44 Montgomery Street, Suite 650

San Francisco, California 94104

Telephone: (415) 291-2420

Facsimile: (415) 484-1294

Donald J. Enright (to be admittedpro hac vice)

Email: denright@zlk.com

LEVI & KORSINSKY, LLP

1101 30th Street NW, Suite 115

Washington, DC 20007

Tel: (202) 524-4290

Fax: (202) 337-1567

Attorneys for Plaintiff David Feuerborn

UNITED STATES DISTRICT COURT

FOR THE NORTHERN DISTRICT OF CALIFORNIA

| | |

| DAVID FEUERBORN, an individual, | | Case No. 3:18-cv-00197 |

| | |

| Plaintiff, | | COMPLAINT FOR VIOLATION OF THE |

| | | FEDERAL SECURITIES LAWS |

| v. | | |

| | |

| YUME, INC., PAUL PORRINI, MITCHELL | | JURY TRIAL DEMANDED |

| HABIB, ADRIEL LARES, ELIAS NADER, | | |

| CHRISTOPHER PAISLEY, ERIC SINGER, | | |

| JOHN MUTCH, BRIAN KELLEY, STEVE | | |

| DOMENIK, RHYTHMONE, PLC, and | | |

| REDWOOD MERGER SUB I, INC., | | |

| | |

| Defendants. | | |

Plaintiff David Feuerborn (“Plaintiff”), by his undersigned attorneys, alleges the following on information and belief, except as to the allegations specifically pertaining to Plaintiff, which are based on personal knowledge.

NATURE AND SUMMARY OF THE ACTION

1. Plaintiff brings this action as a public stockholder of YuMe, Inc. (“YuMe” or the “Company”) against the members of YuMe’s Board of Directors (the “Board” or the “Individual Defendants”) and YuMe for their violations of Section 14(d)(4) and Rule 14D-9 promulgated thereunder by the U.S. Securities and Exchange Commission (the “SEC”), and 20(a), arising out of their attempt to sell the Company to RhythmOne, PLC (“RhythmOne”).

| | | | |

| | | 1 | | Case No. 3:18-cv-00197 |

| COMPLAINT FOR VIOLATION OF THE FEDERAL SECURITIES LAWS |

2. On September 5, 2017, the Company announced that it had entered into a definitive agreement (the “Merger Agreement”) by which RhythmOne would acquire YuMe through an exchange offer, with each share of YuMe common stock exchangeable for (i) $1.70 in cash; and (ii) 7.325 shares of RhythmOne (the “Exchange Offer”), with an implied value of $5.20 per share of YuMe common stock (the “Proposed Transaction”). The Proposed Transaction has an equity value of approximately $185 million.

3. On December 26, 2017, RhythmOne and the Company filed a materially misleading and incomplete Form F-4 Registration Statement (the “Registration Statement”) with the SEC. On January 4, 2018, the Company filed a Schedule 14D-9 (the “Recommendation Statement”) in connection with the Exchange Offer. The Recommendation Statement solicits the approval of the the Proposed Transaction to YuMe stockholders through a materially misleading and incomplete recitation of the financial projections of RhythmOne, and the financial analysis performed by the Company’s financial advisor, Deutsche Bank Securities, Inc. (“Deutsche Bank”). The Exchange Offer commenced on January 4, 2018, and expires on February 1, 2018 at one minute following 11:59 P.M. Pacific time.

4. Without additional information, the Recommendation Statement is materially misleading in violation of federal securities laws.

5. By unanimously approving the Proposed Transaction and authorizing the issuance of the Recommendation Statement, the Individual Defendants (defined below) participated in the solicitation even though they knew, or should have known, that the Recommendation Statement was materially false and/or misleading. The Recommendation Statement is an essential link in accomplishing, and receiving stockholder approval for, the Proposed Transaction.

6. For these reasons and as set forth in detail herein, Plaintiff seeks to enjoin Defendants (collectively identified below) from completing the Exchange Offer unless and until the material information discussed below is disclosed to the holders of YuMe common stock or, in the event the Proposed Transaction is consummated, to recover damages resulting from the Defendants’ violations of the Exchange Act.

| | | | |

| | | 2 | | Case No. 3:18-cv-00197 |

| COMPLAINT FOR VIOLATION OF THE FEDERAL SECURITIES LAWS |

JURISDICTION AND VENUE

7. This Court has subject matter jurisdiction under 28 U.S.C. §§ 1331-32, pursuant to 15 U.S.C. § 78aa (federal question jurisdiction), as Plaintiff alleges violations of Sections 14(d)(4), and 20(a) of the Exchange Act of 1934 (“Exchange Act”), and Rule 14d-9 promulgated thereunder.

8. The Court has personal jurisdiction over all of the defendants because each is either a corporation that conducts business in and maintains operations in this District, or is an individual who is either present in this District for jurisdictional purposes or has sufficient minimum contacts with this District so as to render the exercise of jurisdiction by this Court permissible under traditional notions of fair play and substantial justice.

9. Venue is proper in this District under Section 27 of the Exchange Act, 15 U.S.C. § 78aa, as well as pursuant to 28 U.S.C. § 1391, because: (i) the conduct at issue took place and had an effect in this District; (ii) YuMe maintains its principal place of business in this District and each of the Individual Defendants, and Company officers or directors, either resides in this District or has extensive contacts within this District; (iii) a substantial portion of the transactions and wrongs complained of herein, occurred in this District; (iv) most of the relevant documents pertaining to Plaintiff’s claims are stored (electronically and otherwise), and evidence exists, in this District; and (v) Defendants have received substantial compensation in this District by doing business here and engaging in numerous activities that had an effect in this District.

THE PARTIES

10. Plaintiff is, and has been at all times relevant hereto, a stockholder of YuMe.

11. Defendant YuMe is a Delaware corporation with its headquarters located at 1204 Middlefield Road, Redwood City, California, 94063. YuMe common stock trades on the New York Stock Exchange under the ticker symbol “YUME.”

12. Defendant Mitchell Habib (“Habib”) has served as a director of the Company since June 2013.

13. Defendant Adriel Lares (“Lares”) has served as a director since June 2013.

14. Defendant Elias Nader (“Nader”) has served as a director of the Company since May 2016.

| | | | |

| | | 3 | | Case No. 3:18-cv-00197 |

| COMPLAINT FOR VIOLATION OF THE FEDERAL SECURITIES LAWS |

15. Defendant Christopher Paisley (“Paisley”) has served as a director of the Company since November 2012.

16. Defendant Eric Singer (“Singer”) has served as a director and the Chairman of the Board since May 2016.

17. Defendant John Mutch (“Mutch”) has served as a director of the Company since 2017.

18. Defendant Brian Kelley (“Kelley”) has served as a director of the Company since 2017

19. Defendant Steve Domenik (“Domenik”) has served as a director of the Company since 2017.

20. Defendant Paul Porrini (“Porrini”) has served as President and Chief Executive Officer of the Company since November 2016.

21. Defendants Habib, Lares, Nader, Paisley, Singer, Mutch, Kelley, Domenik, and Porrini are collectively referred to herein as the “Individual Defendants,” and the Individual Defendants are sometimes collectively referred to herein as the “Board.”

22. Defendant RhythmOne is a public limited company incorporated and registered in England and Wales. RhythmOne is a digital media company that connects online audiences with brands through premium content across devices. RhythmOne is named as a defendant for the purpose of obtaining the relief sought by Plaintiff.

23. Defendant Redwood Merger Sub I, Inc. (“Merger Sub”) is a Delaware corporation and wholly-owned subsidiary of RhythmOne, formed for the purpose of effecting the Proposed Transaction. Merger Sub is named as a defendant for the purpose of obtaining the relief sought by Plaintiff.

SUBSTANTIVE ALLEGATIONS

Background of the Company

24. YuMe is an independent provider of multiscreen video advertising technology, connecting brand advertisers, digital media property owners, and consumers of video content across a range of Internet-connected devices. The Company’s software is used by digital media properties to monetize professionally-produced content and applications.

| | | | |

| | | 4 | | Case No. 3:18-cv-00197 |

| COMPLAINT FOR VIOLATION OF THE FEDERAL SECURITIES LAWS |

25. In a press release dated September 5, 2017, the Company announced that it had entered into the Merger Agreement with RhythmOne, pursuant to which the Company will be acquired by RhythmOne and stockholders will receive $1.70 in cash and 7.325 shares of RhythmOne common stock for each share of YuMe common stock. This represents a total equity value of approximately $185 million.

26. In relevant part, the press release reads:

San Francisco, USA – September 5, 2017 — RhythmOne plc (LSE AIM:RTHM) today announced that that it has entered into a definitive agreement with YuMe, Inc. (NYSE: YUME) to acquire all its issued and to be issued share capital for a total consideration of approximately US $185M based on current exchange rates. The transaction is expected to close by Q1 2018.

The combination of YuMe and RhythmOne will bring together demand side and supply-side strengths in the fast growing segments of mobile, video, connected TV (“CTV”) and programmatic trading. The combined marketplace is anticipated to be a top five comScore ranked marketplace that will facilitate seamless, transparent connections between thousands of advertisers and a massive supply of brand-safe inventory. The RhythmOne platform is purpose-built to meet a broad range of campaign objectives, providing turnkey solutions for both brand and performance campaigns. Furthermore, the platform will provide advertisers with a credible, scaled and independent alternative to entrenched players.

“Acquiring YuMe accelerates RhythmOne’s strategy to build a unified programmatic platform with unique audiences of differentiated quality at scale,” said Ted Hastings, CEO, RhythmOne. “Through YuMe, RhythmOne gains access to premium video supply including emerging, high-value connected TV inventory, unique customer insights, cross-screen targeting technology and established demand relationships. We believe this combination will give RhythmOne the resources, relationships and talent to drive value for its shareholders, and true a return on investment.”

“The future of brand advertising is connected; connecting buyers to premium inventory, connecting screens to deliver unified cross-screen campaigns, connecting campaigns to brand objectives and most importantly, connecting the best technologies to each other to deliver a sum that is greater than its parts,” said Paul Porrini, CEO, YuMe. “We are proud of the business we have built at YuMe, and our success in delivering innovative technologies that have helped our clients achieve their marketing goals. Together, RhythmOne and YuMe have an opportunity to transform digital advertising with an adaptive platform that connects premium demand and supply with efficiency and performance at its core.”

“The combined company will have a strong financial profile providing a solid, scalable foundation upon which to accelerate growth and profitability,” said Eric Singer, chairman of YuMe. “After a comprehensive review of strategic alternatives, the YuMe board concluded that the combination with RhythmOne is in the best interest of all stockholders. This combination will provide immediate scale and will allow us to build upon the significant financial improvements underway in both companies. I look forward to serving the stockholders as chairman of the combined company upon closing and to guiding the team in realizing the combined company’s mission.”

| | | | |

| | | 5 | | Case No. 3:18-cv-00197 |

| COMPLAINT FOR VIOLATION OF THE FEDERAL SECURITIES LAWS |

Strategic Rationale

A demand leader paired with a supply leader. YuMe’s strengths lie in demand-side software and services used by brands, agencies and trading platforms, a robust, first-party data management and targeting platform and global programmatic capabilities. RhythmOne’s strengths are primarily focused on the supply-side as well as programmatic platform capabilities represented by its multi-channel, multi-format ad exchange, whereby advertisers and agencies can reach targeted, engaged audiences at scale. YuMe’s strong relationships with agencies and brands and its demand side platform complement RhythmOne’s robust, unified programmatic platform.

The benefits of scale. According to eMarketer, for the first time in 2016, digital advertising spend outpaced that of television. Advertisers want the value and scale from digital that they previously experienced with television. RhythmOne’s acquisition of YuMe will create a combined organization with one of the largest cross-device supply footprints in the industry. By adding comScore data from the two companies, the combined entity would reach ~220M unique visitors per month. Rather than dealing with a patchwork of boutique providers, advertisers will be able to go to a single source to meet their advertising objectives.

Comprehensive data insights. YuMe has built a robust, first-party data management and targeting platform that provides unique insights for brand advertising campaigns. RhythmOne’s analytics, data management platform and top-ranked brand safety technology provide transparency and drive results for performance-based campaigns. The unified, proprietary data set, augmented by machine-learning algorithms, will enable the combined company to successfully deliver against a broad range of advertising objectives. The data will also offer significant insight for publishers looking to derive additional value from their audiences.

Talent. RhythmOne and YuMe have two experienced, tenured teams that are clearly aligned within the vision for the combined company. These teams will directly benefit from operating a broader platform with greater revenue scale on a significantly stronger financial foundation.

Accretive. RhythmOne anticipates the transaction to be accretive in the first full year of ownership and believes that the acquisition represents an attractive opportunity to achieve savings of approximately US$10-12M per annum (before tax) across the combined businesses from functional redundancies, duplicative vendor relationships and public company costs. Furthermore, increased scale is likely to improve gross margin as a result of operating leverage and there may also be potential for revenue synergies.

Management

RhythmOne’s CEO Ted Hastings will continue in his role as President and CEO of the combined company. Additionally, YuMe will appoint two directors to the newly constituted board of directors, one of whom will be Eric Singer, who will become the Chairman of the Board.

| | | | |

| | | 6 | | Case No. 3:18-cv-00197 |

| COMPLAINT FOR VIOLATION OF THE FEDERAL SECURITIES LAWS |

Transaction details

Under the terms of the agreement, YuMe shareholders will receive $1.70per share in cash and 7.325 shares in RhythmOne stock which equates to a total consideration of $185M.

YuMe’s directors and officers and stockholders owning more than 10% of YuMe, and each of their respective affiliates, who among them hold approximately 31.6% of the issued YuMe shares, have signed tender and support agreements consenting to tender their share and not to offer, sell, grant any option to purchase or otherwise dispose of any RhythmOne shares received by them for a period of six months from closing of the transaction.

The acquisition is conditional on YuMe stockholders tendering at least a majority of the issued and outstanding YuMe shares. The acquisition is also subject to other conditions customary for transactions of this nature and requires clearance by the relevant competition authority, including the expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976. RhythmOne will register the shares offered to YuMe stockholders with the US Securities and Exchange Commission.

The boards of directors of RhythmOne and YuMe have each unanimously approved the acquisition. The transaction is expected to close by the first quarter of 2018.

The Recommendation Statement Materially Misleads Stockholders By Omission

27. Defendants filed the Recommendation Statement with the SEC in connection with the Proposed Transaction. The Recommendation Statement omits material information with respect to RhythmOne’s financial projections relied upon by the Company’s financial advisor, Deutsche Bank, as well as the financial analyses performed by Deutsche Bank underlying its fairness opinion. This omitted information renders the Recommendation Statement materially misleading. If disclosed, the omitted information would significantly alter the total mix of information available to YuMe’s stockholders.

28. First, the Recommendation Statement omits all projections for RhythmOne despite the use of these projections by Deutsche Bank in performing a discounted cash flow analysis to determine the value of RhythmOne common stock. The Recommendation Statement states that “Deutsche Bank performed a discounted cash flow analysis to determine a range of implied net present values per RhythmOne Share. Deutsche Bank applied discount rates ranging from 12.0% to 15.8% to estimates of the future unlevered free cash flows of RhythmOne for the calendar years 2017 through 2021.” But despite performing this analysis and relying on the projected unlevered free cash flows, the Recommendation Statement omits these projections.

| | | | |

| | | 7 | | Case No. 3:18-cv-00197 |

| COMPLAINT FOR VIOLATION OF THE FEDERAL SECURITIES LAWS |

29. This information is particularly crucial where a significant portion of the consideration offered to YuMe stockholders comes in the form of RhythmOne common stock, and their continued interest in the combined company relies on the cash flows of RhythmOne.

30. The Recommendation Statement also omits material information regarding Deutsche Bank’s valuation analyses.

31. With respect to theDiscounted Cash Flow Analysis of YuMe, for example, the Recommendation Statement omits (i) the inputs and assumptions underlying the calculation of the discount rate range of 12.0% to 15.8% used for YuMe; (ii) the range of estimated terminal values for YuMe at the end of 2021; (iii) the range of implied enterprise values for YuMe as of September 1, 2017; (iv) YuMe’s stock based compensation expense; (v) YuMe’s cash taxes; (vi) YuMe’s capital expenditures; (vii) YuMe’s change in net working capital; (viii) the inputs and assumptions underlying the calculation of the range of perpetuity growth rates of 3.0% to 5.0% used for YuMe; and (ix) YuMe’s cash (net of debt).

32. Similarly, with respect to theDiscounted Cash Flow Analysis of RhythmOne, the Recommendation Statement omits (i) the inputs and assumptions underlying the calculation of the discount rate range of 12.0% to 15.8% used for RhythmOne; (ii) RhythmOne’s unlevered free cashflows for the calendar years 2017 through 2021; (iii) the range of estimated terminal values for RhythmOne at the end of 2021; (iv) the range of implied enterprise values for RhythmOne as of September 1, 2017; (v) RhythmOne’s Adjusted EBITDA; (vi) RhythmOne’s stock based compensation expense; (vii) RhythmOne’s cash taxes; (viii) RhythmOne’s capital expenditures; (ix) RhythmOne’s change in net working capital; (x) the inputs and assumptions underlying the calculation of the range of perpetuity growth rates of 3.0% to 5.0% used for RhythmOne; and (xi) RhythmOne’s cash (net of debt).

33. With respect to theSelected Public Companies Analysis andSelected Transactions Analysis, the Recommendation Statement omits the Equity Value/Last-Twelve-Month Adjusted EBITDA multiples for four of the nine selected companies and two of the nine selected transactions because those companies had either negative multiples or multiples above 15.0x, and according to Deutsche Bank, were therefore “not meaningful.” These omissions leave YuMe stockholders

| | | | |

| | | 8 | | Case No. 3:18-cv-00197 |

| COMPLAINT FOR VIOLATION OF THE FEDERAL SECURITIES LAWS |

ignorant of whether these selectively-omitted multiples would have increased or decreased the implied fairness of the consideration offered by RhythmOne. While Deutsche Bank may not have used these multiples in its calculations, it selected the transactions and companies as comparable and must provide the assumptions underlying the omission of these “not meaningful” multiples as well as the multiples themselves.

34. These omissions of material fact represent selective disclosures made by Defendants in the Recommendation Statement that significantly alter the total mix of information that Defendants used to market the Proposed Transaction. Defendants have misled investors into believing the Proposed Transaction is fair while refusing to disclose the full picture provided to the Board by its financial advisor.

35. Accordingly, Plaintiff seeks injunctive and other equitable relief to prevent the irreparable injury that Company stockholders will continue to suffer absent judicial intervention

CLAIMS FOR RELIEF

COUNT I

Claims Against All Defendants for Violations of Section 14(d)(4) of the

Securities Exchange Act of 1934 and SEC Rule 14d-9 (17 C.F.R. § 240.14d-9)

36. Plaintiff incorporates each and every allegation set forth above as if fully set forth herein.

37. Defendants have caused the Recommendation Statement to be issued with the intention of soliciting stockholder support of the Proposed Transaction.

38. Section 14(d)(4) of the Exchange Act and SEC Rule 14d-9 promulgated thereunder require full and complete disclosure in connection with tender offers.

39. The Recommendation Statement violates Section 14(d)(4) and Rule 14d-9 because it omits material facts, including those set forth above, which render the Recommendation Statement false and/or misleading.

40. Defendants knowingly or with deliberate recklessness omitted the material information identified above from the Recommendation Statement, causing certain statements therein to be materially incomplete and therefore misleading. Indeed, while Defendants undoubtedly had access to and/or reviewed the omitted material information in connection with approving the Proposed Transaction, they allowed it to be omitted from the Recommendation Statement, rendering certain portions of the Recommendation Statement materially incomplete and therefore misleading.

| | | | |

| | | 9 | | Case No. 3:18-cv-00197 |

| COMPLAINT FOR VIOLATION OF THE FEDERAL SECURITIES LAWS |

41. The misrepresentations and omissions in the Recommendation Statement are material to Plaintiff, and Plaintiff will be deprived of his entitlement to make a fully informed decision if such misrepresentations and omissions are not corrected prior to the expiration of the tender offer.

42. The omissions and incomplete and misleading statements in the Recommendation Statement are material in that a reasonable stockholder would consider them important in deciding whether to tender their shares or seek appraisal. In addition, a reasonable investor would view the information identified above which has been omitted from the Recommendation Statement as altering the “total mix” of information made available to stockholders.

COUNT II

Against the Individual Defendants for

Violations of Section 20(a) of the 1934 Act

43. Plaintiff repeats and realleges the preceding allegations as if fully set forth herein.

44. The Individual Defendants acted as controlling persons of YuMe within the meaning of Section 20(a) of the Exchange Act as alleged herein. By virtue of their positions as officers and/or directors of YuMe and participation in and/or awareness of the Company’s operations and/or intimate knowledge of the false statements contained in the Recommendation Statement, they had the power to influence and control and did influence and control, directly or indirectly, the decision making of the Company, including the content and dissemination of the various statements that Plaintiff contends are false and misleading.

45. Each of the Individual Defendants was provided with or had unlimited access to copies of the Recommendation Statement alleged by Plaintiff to be misleading prior to and/or shortly after these statements were issued and had the ability to prevent the issuance of the statements or cause them to be corrected.

| | | | |

| | | 10 | | Case No. 3:18-cv-00197 |

| COMPLAINT FOR VIOLATION OF THE FEDERAL SECURITIES LAWS |

46. In particular, each of the Individual Defendants had direct and supervisory involvement in the day-to-day operations of the Company, and, therefore, is presumed to have had the power to control and influence the particular transactions giving rise to the violations as alleged herein, and exercised the same. The Recommendation Statement contains the unanimous recommendation of the Individual Defendants to approve the Proposed Transaction. They were thus directly involved in the making of the Recommendation Statement.

47. By virtue of the foregoing, the Individual Defendants violated Section 20(a) of the Exchange Act.

48. As set forth above, the Individual Defendants had the ability to exercise control over and did control a person or persons who have each violated Section 14(d) of the Exchange Act and Rule 14d-9, by their acts and omissions as alleged herein. By virtue of their positions as controlling persons, these defendants are liable pursuant to Section 20(a) of the Exchange Act. As a direct and proximate result of Defendants’ conduct, Plaintiff is threatened with irreparable harm.

PRAYER FOR RELIEF

WHEREFORE, Plaintiff demands judgment against Defendants jointly and severally, as follows:

(A) declaring that the Recommendation Statement is materially false or misleading;

(B) enjoining, preliminarily and permanently, the Proposed Transaction;

(C) in the event that the transaction is consummated before the entry of this Court’s final judgment, rescinding it or awarding Plaintiff rescissory damages;

(D) directing that Defendants account to Plaintiff for all damages caused by them and account for all profits and any special benefits obtained as a result of their violations of the Exchange Act; (E) awarding Plaintiff the costs of this action, including a reasonable allowance for the fees and expenses of Plaintiff’s attorneys and experts; and

(F) granting Plaintiff such further relief as the Court deems just and proper.

| | | | |

| | | 11 | | Case No. 3:18-cv-00197 |

| COMPLAINT FOR VIOLATION OF THE FEDERAL SECURITIES LAWS |

JURY DEMAND

Plaintiff demands a trial by jury.

| | |

| Dated: January 9, 2018 | | LEVI & KORSINSKY, LLP |

| |

| | By:/s/Rosemary M. Rivas |

| | Rosemary M. Rivas |

| | 44 Montgomery Street, Suite 650 |

| | San Francisco, CA 94104 |

| | Telephone: (415) 291-2420 |

| | Facsimile: (415) 484-1294 |

| |

| | Donald J. Enright (to be admittedpro hac vice) |

| | LEVI & KORSINSKY, LLP |

| | 1101 30th Street NW, Suite 115 |

| | Washington, DC 20007 |

| | Tel: (202) 524-4290 |

| | Fax: (202) 337-1567 |

| |

| | Attorneys for Plaintiff David Feuerborn |

| | | | |

| | | 12 | | Case No. 3:18-cv-00197 |

| COMPLAINT FOR VIOLATION OF THE FEDERAL SECURITIES LAWS |

CERTIFICATION OF PLAINTIFF PURSUANT TO FEDERAL SECURITIES LAWS

I, David Feuerborn , declare as to the claims asserted under the federal securities laws, as follows:

1. I have reviewed the Complaint and authorized its filing.

2. I did not purchase the securities that are the subject of this Complaint at the direction of Plaintiffs’ counsel or in order to participate in this litigation.

3. I am willing to serve as a representative party on behalf of the Class, including providing testimony at deposition and trial, if necessary.

4. I currently hold shares of YuMe Inc. My purchase history is as follows:

| | | | | | | | | | |

Purchase Date | | Stock Symbol | | Shares Transacted | | | Price Per Share | |

8/31/17 | | YUME | | | 168 | | | | 5.405 | |

5. During the three years prior to the date of this Certification, I have not participated nor have I sought to participate, as a representative in any class action suit in the United States District Courts under the federal securities laws.

6. I have not received, been promised or offered, and will not accept, any form of compensation, directly or indirectly, for prosecuting or serving as a representative party in this class action, except for: (i) such damages or other relief as the Court may award to me as my pro rata share of any recovery or judgment; (ii) such reasonable fees, costs or other payments as the Court expressly approves to be paid to or on behalf of me; or (iii) reimbursement, paid by my attorneys, of actual or reasonable out-of-pocket expenditures incurred directly in connection with the prosecution of this action.

I declare, under penalty of perjury, that the foregoing is true and correct. Executed this January 9, 2018, at Norman, OK.

Name: David Feuerborn

Signed:

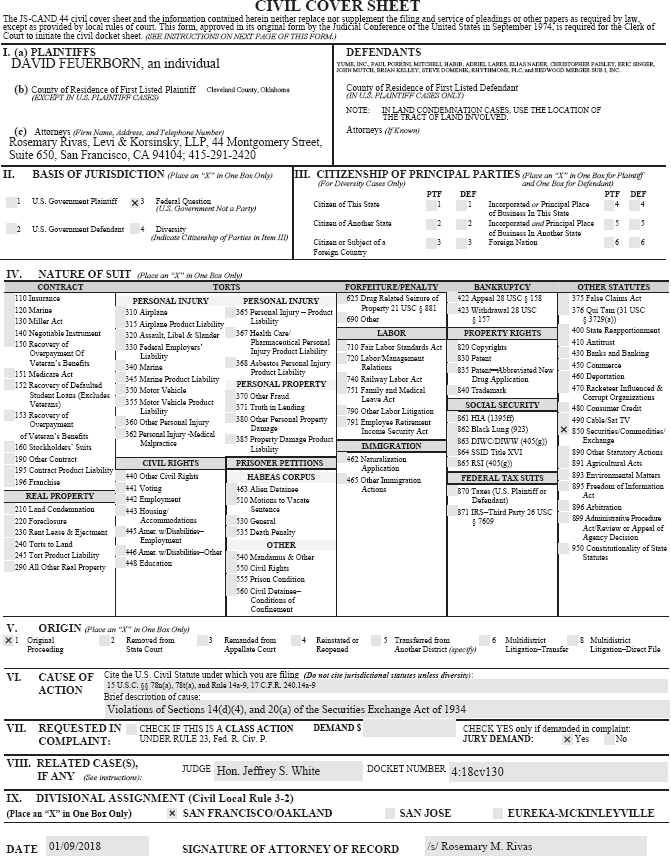

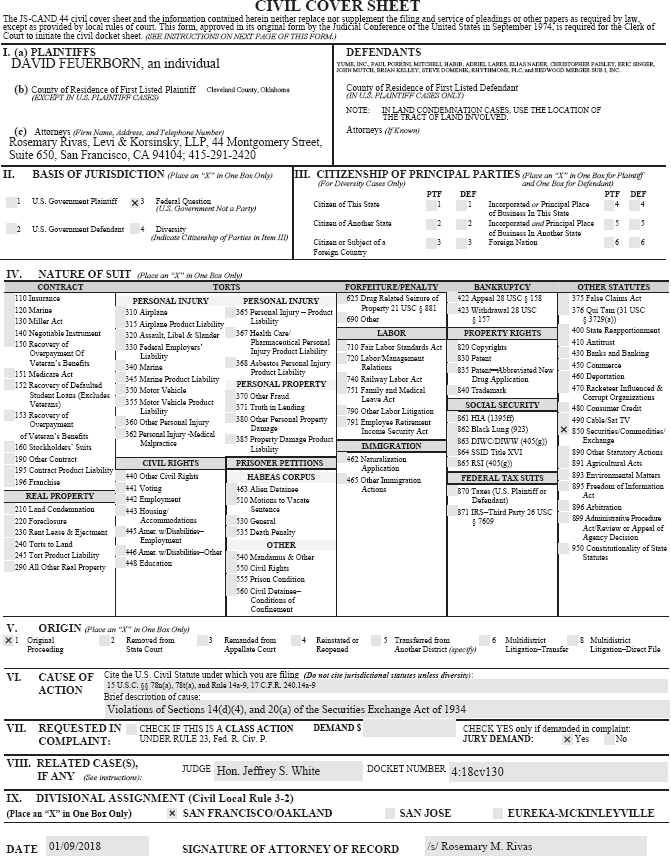

JS-CAND 44 (Rev. 06/17) CIVIL COVER SHEET The JS-CAND 44 civil cover sheet and the information contained herein neither replace nor supplement the filing and service of pleadings or other papers as required by law, except as provided by local rules of court. This form, approved in its original form by the Judicial Conference of the United States in September 1974, is required for the Clerk of Court to initiate the civil docket sheet. (SEE INSTRUCTIONS ON NEXT PAGE OF THIS FORM.) I. (a) PLAINTIFFS DEFENDANTS DAVID FEUERBORN, an individual YUME, INC., PAUL PORRINI, MITCHELL HABIB, ADRIEL LARES, ELIAS NADER, CHRISTOPHER PAISLEY, ERIC SINGER, JOHN MUTCH, BRIAN KELLEY, STEVE DOMENIK, RHYTHMONE, PLC, and REDWOOD MERGER SUB I, INC. (b) County of Residence of First Listed Plaintiff Cleveland County, Oklahoma County of Residence of First Listed Defendant (EXCEPT IN U.S. PLAINTIFF CASES) (IN U.S. PLAINTIFF CASES ONLY) NOTE: IN LAND CONDEMNATION CASES, USE THE LOCATION OF THE TRACT OF LAND INVOLVED. (c) Attorneys (Firm Name, Address, and Telephone Number) Attorneys (If Known) Rosemary Rivas, Levi & Korsinsky, LLP, 44 Montgomery Street, Suite 650, San Francisco, CA 94104; 415-291-2420 II. BASIS OF JURISDICTION (Place an “X” in One Box Only) III. CITIZENSHIP OF PRINCIPAL PARTIES (Place an “X” in One Box for Plaintiff (For Diversity Cases Only) and One Box for Defendant) PTF DEF PTF DEF 1 U.S. Government Plaintiff 3 Federal Question Citizen of This State 1 1 Incorporated or Principal Place 4 4 (U.S. Government Not a Party) of Business In This State Citizen of Another State 2 2 Incorporated and Principal Place 5 5 2 U.S. Government Defendant 4 Diversity of Business In Another State (Indicate Citizenship of Parties in Item III) Citizen or Subject of a 3 3 Foreign Nation 6 6 Foreign Country IV. NATURE OF SUIT(Place an “X” in One Box Only) CONTRACT TORTS FORFEITURE/PENALTY BANKRUPTCY OTHER STATUTES 110 Insurance PERSONAL INJURY PERSONAL INJURY 625 Drug Related Seizure of 422 Appeal 28 USC § 158 375 False Claims Act 120 Marine 310 Airplane 365 Personal Injury – Product Property 21 USC § 881 423 Withdrawal 28 USC 376 Qui Tam (31 USC 130 Miller Act 315 Airplane Product Liability Liability 690 Other § 157 § 3729(a)) 140 Negotiable Instrument 320 Assault, Libel & Slander 367 Health Care/ LABOR PROPERTY RIGHTS 400 State Reapportionment 150 Recovery of 330 Federal Employers’ Pharmaceutical Personal 710 Fair Labor Standards Act 820 Copyrights 410 Antitrust Overpayment Of Liability Injury Product Liability 720 430 Banks and Banking Labor/Management 830 Patent Veteran’s Benefits 340 Marine 368 Asbestos Personal Injury Relations 450 Commerce 151 Medicare Act 345 Marine Product Liability Product Liability 740 Railway Labor Act 835 PatentņAbbreviated Drug Application New 460 Deportation 152 Recovery of Defaulted 350 Motor Vehicle PERSONAL PROPERTY 751 Family and Medical 840 Trademark 470 Racketeer Influenced & Student Loans (Excludes 370 Other Fraud Corrupt Organizations Veterans) 355 Motor Vehicle Product 371 Truth in Lending Leave Act SOCIAL SECURITY Liability 790 Other Labor Litigation 480 Consumer Credit 153 Recovery of 380 Other Personal Property 861 HIA (1395ff) 490 Cable/Sat TV Overpayment 360 Other Personal Injury 791 Employee Retirement of Veteran’s Benefits 362 Personal Injury -Medical Damage Income Security Act 862 Black Lung (923) 850 Securities/Commodities/ Malpractice 385 Property Damage Product 863 DIWC/DIWW (405(g)) Exchange 160 Stockholders’ Suits Liability IMMIGRATION 864 SSID Title XVI 890 Other Statutory Actions 190 Other Contract CIVIL RIGHTS PRISONER PETITIONS 462 Naturalization 865 RSI (405(g)) 891 Agricultural Acts 195 Contract Product Liability Application 196 Franchise 440 Other Civil Rights HABEAS CORPUS 465 Other Immigration FEDERAL TAX SUITS 893 Environmental Matters 441 Voting 463 Alien Detainee Actions 870 Taxes (U.S. Plaintiff or 895 Freedom of Information REAL PROPERTY Act 442 Employment 510 Motions to Vacate Defendant) 210 Land Condemnation 443 Housing/ Sentence 871 IRS–Third Party 26 USC 896 Arbitration 220 Foreclosure Accommodations 530 General § 7609 899 Administrative Procedure 230 Rent Lease & Ejectment 445 Amer. w/Disabilities– 535 Death Penalty Act/Review or Appeal of Employment Agency Decision 240 Torts to Land OTHER 950 Constitutionality of State 245 Tort Product Liability 446 Amer. w/Disabilities–Other 540 Mandamus & Other Statutes 290 All Other Real Property 448 Education 550 Civil Rights 555 Prison Condition 560 Civil Detainee– Conditions of Confinement V. ORIGIN (Place an “X” in One Box Only) 1 Original 2 Removed from 3 Remanded from 4 Reinstated or 5 Transferred from 6 Multidistrict 8 Multidistrict Proceeding State Court Appellate Court Reopened Another District (specify) Litigation–Transfer Litigation–Direct File VI. CAUSE OF Cite the U.S. Civil Statute under which you are filing (Do not cite jurisdictional statutes unless diversity): ACTION 15 U.S.C. §§ 78n(a), 78t(a), and Rule 14a-9, 17 C.F.R. 240.14a-9 Brief description of cause: Violations of Sections 14(d)(4), and 20(a) of the Securities Exchange Act of 1934 VII. REQUESTED IN CHECK IF THIS IS A CLASS ACTION DEMAND $ CHECK YES only if demanded in complaint: COMPLAINT: UNDER RULE 23, Fed. R. Civ. P. JURY DEMAND: Yes No VIII. RELATED CASE(S), IF ANY (See instructions): JUDGE Hon. Jeffrey S. White DOCKET NUMBER 4:18cv130 IX. DIVISIONAL ASSIGNMENT (Civil Local Rule 3-2) (Place an “X” in One Box Only) SAN FRANCISCO/OAKLAND SAN JOSE EUREKA-MCKINLEYVILLE DATE 01/09/2018 SIGNATURE OF ATTORNEY OF RECORD /s/RosemaryM.Rivas

INSTRUCTIONS FOR ATTORNEYS COMPLETING CIVIL COVER SHEET FORM JS-CAND 44

Authority For Civil Cover Sheet. The JS-CAND 44 civil cover sheet and the information contained herein neither replaces nor supplements the filings and service of pleading or other papers as required by law, except as provided by local rules of court. This form, approved in its original form by the Judicial Conference of the United States in September 1974, is required for the Clerk of Court to initiate the civil docket sheet. Consequently, a civil cover sheet is submitted to the Clerk of Court for each civil complaint filed. The attorney filing a case should complete the form as follows:

| | I.a) | Plaintiffs-Defendants. Enter names (last, first, middle initial) of plaintiff and defendant. If the plaintiff or defendant is a government agency, use only the full name or standard abbreviations. If the plaintiff or defendant is an official within a government agency, identify first the agency and then the official, giving both name and title. |

| | b) | County of Residence. For each civil case filed, except U.S. plaintiff cases, enter the name of the county where the first listed plaintiff resides at the time of filing. In U.S. plaintiff cases, enter the name of the county in which the first listed defendant resides at the time of filing. (NOTE: In land condemnation cases, the county of residence of the “defendant” is the location of the tract of land involved.) |

| | c) | Attorneys. Enter the firm name, address, telephone number, and attorney of record. If there are several attorneys, list them on an attachment, noting in this section “(see attachment).” |

| | II. | Jurisdiction. The basis of jurisdiction is set forth under Federal Rule of Civil Procedure 8(a), which requires that jurisdictions be shown in pleadings. Place an “X” in one of the boxes. If there is more than one basis of jurisdiction, precedence is given in the order shown below. |

| | (1) | United States plaintiff. Jurisdiction based on 28 USC §§ 1345 and 1348. Suits by agencies and officers of the United States are included here. |

| | (2) | United States defendant. When the plaintiff is suing the United States, its officers or agencies, place an “X” in this box. |

| | (3) | Federal question. This refers to suits under 28 USC § 1331, where jurisdiction arises under the Constitution of the United States, an amendment to the Constitution, an act of Congress or a treaty of the United States. In cases where the U.S. is a party, the U.S. plaintiff or defendant code takes precedence, and box 1 or 2 should be marked. |

| | (4) | Diversity of citizenship. This refers to suits under 28 USC § 1332, where parties are citizens of different states. When Box 4 is checked, the citizenship of the different parties must be checked.(See Section III below; NOTE: federal question actions take precedence over diversity cases.) |

| | III. | Residence (citizenship) of Principal Parties. This section of the JS-CAND 44 is to be completed if diversity of citizenship was indicated above. Mark this section for each principal party. |

| | IV. | Nature of Suit. Place an “X” in the appropriate box. If the nature of suit cannot be determined, be sure the cause of action, in Section VI below, is sufficient to enable the deputy clerk or the statistical clerk(s) in the Administrative Office to determine the nature of suit. If the cause fits more than one nature of suit, select the most definitive. |

| | V. | Origin. Place an “X” in one of the six boxes. |

| | (1) | Original Proceedings. Cases originating in the United States district courts. |

| | (2) | Removed from State Court. Proceedings initiated in state courts may be removed to the district courts under Title 28 USC § 1441. When the petition for removal is granted, check this box. |

| | (3) | Remanded from Appellate Court. Check this box for cases remanded to the district court for further action. Use the date of remand as the filing date. |

| | (4) | Reinstated or Reopened. Check this box for cases reinstated or reopened in the district court. Use the reopening date as the filing date. |

| | (5) | Transferred from Another District. For cases transferred under Title 28 USC § 1404(a). Do not use this for within district transfers or multidistrict litigation transfers. |

| | (6) | Multidistrict Litigation Transfer. Check this box when a multidistrict case is transferred into the district under authority of Title 28 USC § 1407. When this box is checked, do not check (5) above. |

| | (8) | Multidistrict Litigation Direct File. Check this box when a multidistrict litigation case is filed in the same district as the Master MDL docket. |

Please note that there is no Origin Code 7. Origin Code 7 was used for historical records and is no longer relevant due to changes in statute.

| | VI. | Cause of Action. Report the civil statute directly related to the cause of action and give a brief description of the cause.Do not cite jurisdictional statutes unless diversity.Example: U.S. Civil Statute: 47 USC § 553.Brief Description: Unauthorized reception of cable service. |

| | VII. | Requested in Complaint.Class Action. Place an “X” in this box if you are filing a class action under Federal Rule of Civil Procedure 23. |

Demand. In this space enter the actual dollar amount being demanded or indicate other demand, such as a preliminary injunction.

Jury Demand. Check the appropriate box to indicate whether or not a jury is being demanded.

| | VIII. | Related Cases. This section of the JS-CAND 44 is used to identify related pending cases, if any. If there are related pending cases, insert the docket numbers and the corresponding judge names for such cases. |

| | IX. | Divisional Assignment. If the Nature of Suit is under Property Rights or Prisoner Petitions or the matter is a Securities Class Action, leave this section blank. For all other cases, identify the divisional venue according to Civil Local Rule 3-2: “the county in which a substantial part of the events or omissions which give rise to the claim occurred or in which a substantial part of the property that is the subject of the action is situated. |

Date and Attorney Signature. Date and sign the civil cover sheet.