UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. 1)

Filed by the Registrant☒

Filed by a Party other than the Registrant☐

Check the appropriate box:

☒ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

YuMe, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

YUME, INC.

1204 Middlefield Road

Redwood City, California 94063

[●] [●], 2016

Dear Stockholder:

You are cordially invited to attend the YuMe, Inc. (the “Company”) Annual Meeting of Stockholders on[●],[●]2016 at[●] a.m., local time (the “Annual Meeting”). ●The Annual Meeting will be held at[●].

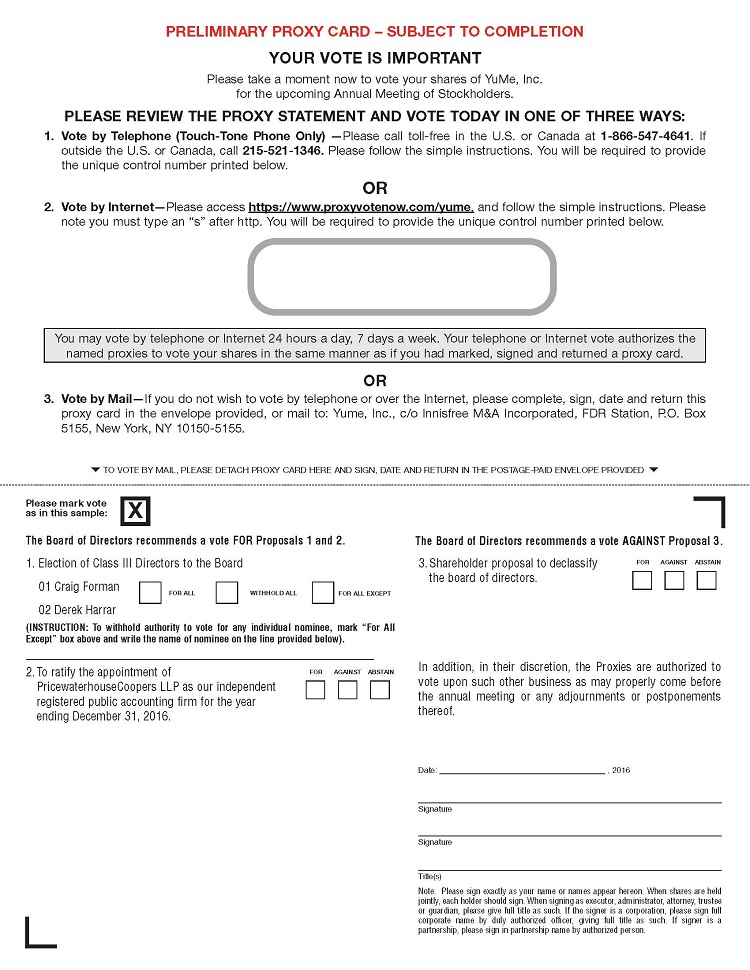

The formal notice of the Annual Meeting and the proxy statement, both of which accompany this letter, provide details regarding the business to be conducted at the Annual Meeting. Also included is aWHITE proxy card and postage-paid return envelope.WHITE proxy cards arebeing solicited on behalf of our Board of Directors.

Important information about the matters to be acted upon at the Annual Meeting is included in the notice and proxy statement.

Your vote will be especially important at the Annual Meeting. As you may have heard, VIEX Opportunities Fund, LP (together with its affiliates and related parties, “VIEX”) has provided notice of its intent to nominate a slate of two nominees for election as directors at the Annual Meeting in opposition to the nominees recommended by our Board of Directors.

After due consideration, the Board of Directors recommends that you vote FOR the election of all of the Board’s nominees, FOR the ratification of auditors, and AGAINST the shareholder proposal to declassify the Board of Directors.The Board of Directors urges you not to sign or return any gold proxy card sent to you by VIEX. If you have previously submitted a proxy card sent to you by VIEX, you can revoke that proxy and vote for the Board of Directors' nominees and on the other matters to be voted on at the Annual Meeting by using the enclosedWHITE proxy card.

All holders of record of outstanding shares of our common stock at the close of business on[●], 2016 are entitled to vote at the Annual Meeting.

Your shares cannot be voted unless you vote your proxy or attend theAnnual Meeting in person. Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted at the Annual Meeting. After reading the proxy statement, pleasevote as soon as possible by following the instructions included on yourWHITE proxy card to vote by Internet, by telephone or by mail.Mailing your completedWHITE proxy card or using the telephone or Internet voting systems will not prevent you from voting in person at the Annual Meeting if you are a stockholder of record and wish to do so.

If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor, Innisfree M&A Incorporated, toll free at (888) 750-5834. Banks and brokers may call collect at (212) 750-5833.

The Board of Directors and management look forward to seeing you at the Annual Meeting.

| Sincerely, |

| |

|  |

| |

| Jayant Kadambi |

| Chief Executive Officer |

PRELIMINARY COPY DATEDAPRIL 1, 2015

SUBJECT TO COMPLETION

YUME, INC.

1204 Middlefield Road

Redwood City, California, 94063

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On [●], 2016

The Annual Meeting of Stockholders ofYuMe, Inc., a Delaware corporation (the “Company”), will be held on[●], [●],2016at[●]a.m. local time at[●] (the “Annual Meeting”) for the following purposes:

| 1. | Toelect the two Class III director nominees named herein to hold office until the 2019 Annual Meeting of Stockholders and until their successors are duly elected and qualified. |

| 2. | To ratify the selection by the Audit Committee of the Board of Directors of the Company of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2016. |

| 3. | To vote on the advisory stockholder proposal to declassify the Board of Directors. |

| 4. | To conduct any other business properly brought before the Annual Meeting. |

These items of business are more fully described in the accompanying proxy statement.

The record date for the Annual Meeting is[●]. Only stockholders of record at the close of business on that date may vote at the Annual Meeting or any adjournment or postponement thereof. For ten days prior to the Annual Meeting, a complete list of the stockholders entitled to vote will be available during ordinary business hours at our headquarters for examination by any stockholder for any purpose relating to the Annual Meeting.

Please note thatVIEX Opportunities Fund, LP (together with its affiliates and related parties,“VIEX”)has notified us that it intends to propose two nominees for election as directors to the Board of Directors at the Annual Meeting in opposition to the nominees recommended by our Board of Directors. You may receive solicitation materials from VIEX, including proxy statements and proxy cards. We are not responsible for the accuracy of any information provided by or relating to VIEX or its nominees contained in solicitation materials filed or disseminated by or on behalf of VIEX or any other statements VIEX may make.

After careful consideration, the Board of Directors does not endorse the VIEX nominees and recommends that you vote on the WHITE proxy card or voting instruction form “FOR ALL” of the nominees proposed by the Board of Directors. The Board of Directors also urges you to vote “AGAINST” the VIEX proposal for a declassified board structure. The Board of Directors urges you not to sign or return any gold proxy card sent to you by VIEX. If you have previously submitted a proxy card sent to you by VIEX, you can revoke that proxy and vote for our Board of Directors' nominees and on the other matters to be voted on at the Annual Meeting by using the enclosed WHITE proxy card. Only the latest validly executed proxy that you submit will be counted.

| By Order of the Board of Directors |

| |

|  |

Redwood City, CA [●] [●], 2016 | Paul T. Porrini

Executive Vice President, General Counsel and Secretary |

This Notice and accompanying Proxy Statement will be distributed to stockholders beginning on or about [●], 2016.

YOUR VOTE IS IMPORTANT

All stockholders are cordially invited to attend the Annual Meeting in person. Whether or not you expect to attend the Annual Meeting, you are urged to submit theWHITE proxy card in the envelope provided to you, or to use the Internet or telephone method of voting described in yourWHITE proxy card so that your shares can be voted at the Annual Meeting in accordance with your instructions. For specific instructions on voting, please refer to the instructions on the proxy card or voting instruction form.

If you have questions or need assistance voting your shares please contact:

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, NY 10022

Stockholders in the U.S. and Canada please call toll-free: (888) 750-5834

Stockholders in other locations please call: + (412) 232-3651

Banks and Brokers may call collect: (212) 750-5833

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY

MATERIALS FOR THE ANNUAL MEETING TO BE HELD

ON[●],2016

The Company's Proxy Statement for the Annual Meeting and the Company's Annual Report on Form 10-K for the year ended December 31, 2015 are available atwww.yume.com.

TABLE OF CONTENTS

Item | Page |

| |

INFORMATION CONCERNING SOLICITATION AND VOTING | 8 |

| |

Questions and Answers About These Proxy Materials and Voting | 8 |

| | |

BACKGROUND TO POTENTIAL CONTESTED SOLICITATION | 14 |

| | |

PROPOSAL 1: ELECTION OF DIRECTORS | 16 |

| |

Number of Directors; Board Structure | 16 |

| |

Nominees | 16 |

| |

Directors Continuing in Office until the 2017 Annual Meeting of Stockholders | 18 |

| |

Directors Continuing in Office until the 2018 Annual Meeting of Stockholders | 18 |

| |

PROPOSAL 2: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 20 |

| |

Independent Registered Public Accounting Firm Fees | 20 |

| |

Pre-Approval Policies and Procedures | 20 |

| |

PROPOSAL 3: VIEX PROPOSAL RELATING TO BOARD DECLASSIFICATION | 22 |

| | |

Proposal Relating to Board Declassification | 22 |

| | |

Board of Directors Statement | 22 |

| | |

CORPORATE GOVERNANCE | 24 |

| |

Director Independence | 24 |

| |

Board Leadership Structure | 24 |

| |

Role of the Board in Risk Oversight | 25 |

| |

Executive Sessions of Independent Directors | 25 |

| |

Meetings of the Board | 25 |

| |

Information Regarding Committees of the Board | 25 |

| |

Communications with the Board; Attendance at Annual Stockholders’ Meeting | 28 |

| |

Codes of Conduct | 28 |

| |

Corporate Governance Guidelines | 29 |

| |

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS | 29 |

| |

EXECUTIVE OFFICERS WHO ARE NOT DIRECTORS | 29 |

| |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 30 |

| | |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 32 |

| |

EXECUTIVE COMPENSATION | 33 |

| |

2015 Summary Compensation Table | 35 |

| |

Outstanding Equity Awards at December 31, 2015 | 36 |

| |

Stock Options Exercises and Stock Vested During 2015 | 37 |

Equity Compensation Plan Information | 37 |

| |

Post-Employment Compensation | 38 |

| |

DIRECTOR COMPENSATION FOR YEAR ENDED DECEMBER 31, 2015 | 39 |

| |

TRANSACTIONS WITH RELATED PARTIES | 41 |

| |

ADDITIONAL INFORMATION | 42 |

| |

HOUSEHOLDING OF PROXY MATERIALS | 43 |

| |

OTHER MATTERS | 43 |

| |

ANNUAL REPORT ON FORM 10-K | 43 |

| | |

APPENDIX A | 44 |

YUME, INC.

1204 Middlefield Road

Redwood City, CALIFORNIA, 94063

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

To Be Held on[●], 2016

INFORMATION CONCERNING SOLICITATION AND VOTING

The Board of Directors (the “Board”) of YuMe, Inc.,is soliciting proxies for our Annual Meeting of Stockholders (the “Annual Meeting”) to be held on[●] , [●], 2016 at[●] a.m., local time, at[●].

The proxy materials, including this proxy statement,WHITE proxy card and our 2015 Annual Report on Form 10-K, are being distributed and made available on or about[●], 2016. This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. Please read it carefully.

In this proxy statement the terms “YuMe,” “the Company,” “we,” “us,” and “our” refer to YuMe, Inc.

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why am I being provided with these materials?

We have distributed these proxy materials to you beginning on or about[●], 2016 in connection with the solicitation by the Board of proxies to be voted at our Annual Meeting, and at any postponements or adjournments of the Annual Meeting. If at the close of business on[●] (the “Record Date”) you were a stockholder of record or held shares of the YuMe’s common stock through a broker, bank or other nominee, you are eligible to vote.

How do I attend theAnnual Meeting?

The Annual Meeting will be held on[●], [●],2016 at[●] a.m. local time at[●]. Information on how to vote in person at the Annual Meeting is discussed below.

What am I voting on?

There are three matters scheduled for a vote:

| 1. | Election of two Class III directors to the Board to serve until the 2019 Annual Meeting of Stockholders and until their successors are duly elected and qualified; |

| 2. | Ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2016; and |

| 3. | VIEX Proposal to declassify the Board. |

Have other candidates been nominated for election as directors at the Annual Meeting in opposition to the Board's nominees?

Yes. VIEX Opportunities Fund, LP (together with its affiliates and related parties, “VIEX”) has notified us that it intends to nominate two nominees for election to the Board at the Annual Meeting in opposition to the nominees recommended by the Board.The Board doesNOT endorse the VIEX nominees and recommends that you voteFOR ALL of the nominees proposed by the Board by using theWHITE proxy card accompanying this Proxy Statement. The Board urges you not to sign or return any gold proxy card sent to you by VIEX. If you have previously submitted a proxy card sent to you by VIEX, you can revoke that proxy and vote for the Board's nominees and on the other matters to be voted on at the Annual Meeting by using the enclosedWHITE proxy card. Only the latest validly executed proxy that you submit will be counted.

How does the Board recommend that I vote?

The Board recommends that you vote your shares on theWHITE proxy card as follows:

| | • | FORboth Class III director nominees named in this Proxy Statement to hold office until our 2019 Annual Meeting of Stockholders; |

| | • | FOR the ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2016; and |

| | • | AGAINST the VIEX advisory proposal to declassify the Board. |

Who can vote at theAnnual Meeting?

Only stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. On the Record Date, there were[●]shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If at the close of business on the Record Date your shares were registered directly in your name with our transfer agent, Continental Stock Transfer, then you are a stockholder of record. As a stockholder of record, you may vote in person at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to vote by telephone, via the Internet, or by signing, dating and returning the accompanyingWHITE proxy card to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank, or Other Nominee

If at the close of business on the Record Date your shares were held in an account at a brokerage firm, bank or other nominee rather than in your name, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by your broker, bank, or other nominee. The broker, bank, or other nominee holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting.

As a beneficial owner, you have the right to instruct your broker, bank, or other nominee on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy issued in your name from your broker, bank, or other nominee.

Given the contested nature of the election, your broker, bank, or other nominee will only be able to vote your shares with respect to any proposals at the Annual Meeting if you have instructed them how to vote. Your broker, bank, or other nominee has enclosed a voting instruction form for you to use to direct the broker, bank, or other nominee regarding how to vote your shares. Please instruct your broker, bank, or other nominee how to vote your shares using the voting instruction form you received from them. Please return your completedWHITE proxy card or voting instruction form to your broker, bank, or other nominee and contact the person responsible for your account so that your vote can be counted. If your broker, bank, or other nominee permits you to provide voting instructions by Internet or by telephone, you may vote that way as well.

Does my vote matter?

YES. Stockholder action is required to elect members of the Board, and to approve other important matters. Each share of common stock is entitled to one vote and every share voted has the same weight. In order for the Company to conduct business at the Annual Meeting, a quorum of stockholders (consisting of a majority of the issued and outstanding shares entitled to vote at the Annual Meeting, excluding treasury shares) must be represented at the Annual Meeting in person or by proxy. If a quorum is not obtained, the Company must postpone the Annual Meeting and solicit additional proxies. This is an expensive and time-consuming process that is not in the best interests of the Company or its stockholders. Since few stockholders can spend the time or money to attend stockholder meetings in person, voting by proxy is important to obtain a quorum and complete the stockholder vote. Your vote will be especially important at the Annual Meeting this year in light of VIEX’s notice to us that it intends to nominate two nominees for election as directors to the Board in opposition to the nominees recommended by our Board.

How do I vote?

You may vote by mail or follow any alternative voting procedure described on theWHITE proxy card. To use an alternative voting procedure, follow the instructions on eachWHITE proxy card that you receive. The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the Annual Meeting, vote by proxy using theWHITEproxy card, over the telephone, or on the Internet. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting and vote in person even if you have already voted by proxy.

| | ● | To vote in person, come to the Annual Meeting and we will give you a ballot when you arrive. |

| | ● | To vote using theWHITE proxy card sign and date the accompanyingWHITE proxy card and return it promptly in the pre-paid envelope provided. If you return your signedWHITE proxy card to us before the Annual Meeting, we will vote your shares as you direct. |

| | ● | To vote over the Internet or by telephone, follow the instructions included on yourWHITE proxy card. |

Beneficial Owner: Shares Registered in the Name of Broker, Bank or Other Agent

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a voting instruction form with these proxy materials from that organization rather than from YuMe. Simply complete and mail the voting instruction form to ensure that your vote is counted. Alternatively, you may vote by telephone or on the Internet as instructed by your broker, bank or other agent. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker, bank or other agent included with these proxy materials, or contact your broker, bank or other agent to request a proxy form.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you owned as of the close of business on the Record Date, which is[●].

What if another matter is properly brought before the Annual Meeting?

VIEX has notified us of its intent to propose a resolution at the Annual Meeting that, if approved, would ask the Board “to take steps to declassify the board.” This proposal is referred to as the “VIEX Proposal.” The Company knows of no other matters to be submitted to the stockholders at the Annual Meeting, other than the proposals referred to in this Proxy Statement and the possible submission of the VIEX Proposal.

The VIEX Proposal, if approved, would require that the Board take steps to declassify the Board such that, once fully declassified, all directors stand for election on an annual basis. The VIEX Proposal was not submitted under Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and VIEX did not seek to have the VIEX Proposal included in this Proxy Statement. Accordingly, the VIEX Proposal may be presented at the Annual Meeting but is not included in this Proxy Statement. If the VIEX Proposal is presented at the Annual Meeting, then to the extent permitted by applicable rules, the proxy holders will have, and intend to exercise, discretionary voting authority under Rule 14a-4(c) under the Exchange Act to vote AGAINST the VIEX Proposal. If any other matters properly come before the stockholders at the Annual Meeting, it is the intention of the persons named on the proxy to vote the shares represented thereby on such matters in accordance with their best judgment.The Board recommends you use the WHITE proxy card to vote AGAISNT the VIEX Proposal.

What if I return aWHITEproxy card or otherwise vote but do not make specific choices?

If you return a signed and datedWHITEproxy card or otherwise vote without marking voting selections, your shares will be voted “For” the election of the Board’s two nominees for director and “For” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2016. Additionally, if the VIEX Proposal (as discussed above) is presented at the Annual Meeting, if you have not made a voting selection for the VIEX Proposal, the proxy holders intend to vote “Against” the VIEX proposal. If any other matter is properly presented at the Annual Meeting, your proxy holder (one of the individuals named on your proxy card) will vote your shares using his best judgment.

Who is soliciting my proxy and paying for this proxy solicitation?

We will pay the entire cost of preparing, assembling, printing, mailing, and distributing these proxy materials. We will also bear the cost of soliciting proxies on behalf of the Board. We will provide copies of these proxy materials to banks, brokerage houses, fiduciaries, and custodians holding shares of our common stock beneficially owned by others in street name so that they may forward these proxy materials to the beneficial owners, and may reimburse these banks, brokerage houses and other agents for the cost of forwarding proxy materials.

We have retained the services of Innisfree M&A Incorporated (“Innisfree”), a professional proxy solicitation firm, to aid in the solicitation of proxies. Innisfree estimates that approximately 25 of its employees will assist in this proxy solicitation, which they may conduct by personal interview, mail, telephone, facsimile, email, other electronic channels of communication, or otherwise. We expect to pay Innisfree customary fees, estimated not to exceed approximately $185,000 in the aggregate, plus reasonable out-of-pocket expenses incurred in the process of soliciting proxies. Our aggregate expenses related to the solicitation, including those of Innisfree as well as for printing and mailing materials to our stockholders, in excess of those normally spent for an annual meeting of stockholders as a result of the potential proxy contest and excluding salaries and wages of our officers and regular employees, are expected to be approximately $[●]of which approximately $[●] has been spent to date. We have agreed to indemnify Innisfree against certain liabilities relating to or arising out of their engagement.

Solicitations may also be made by personal interview, mail, telephone, facsimile, email, other electronic channels of communication, our investor relations website, or otherwise by directors, officers, and other employees of YuMe, but such directors, officers, or other employees for these services will not receive additional compensation. Appendix A sets forth information relating to certain of our directors, officers, and employees who are considered “participants” in this proxy solicitation under SEC rules by reason of their position or because they may be soliciting proxies on our behalf.

What should I do if I receive a proxy card fromVIEX?

VIEX has notified us that it intends to nominate two nominees for election as directors to the Board at the Annual Meeting in opposition to the nominees recommended by the Board. VIEX has also notified us of its intent to put forth the VIEX Proposal. If VIEX proceeds with its alternative nominations and the VIEX Proposal, you may receive proxy solicitation materials from VIEX, including an opposition proxy statement and proxy card. YuMe is not responsible for the accuracy of any information contained in any proxy solicitation materials used by VIEX or any other statements that it may otherwise make.

The Board does not endorse theVIEX nominees and recommends that you disregard any proxy card or solicitation materials that may be sent to you byVIEX.The Board also recommends you use the WHITE proxy card to vote AGAISNT the VIEX Proposal.

Voting to “WITHHOLD” with respect to any of the VIEX nominees on its proxy card is not the same as voting for the Board's nominees because a vote to “WITHHOLD” with respect to any of the VIEX nominees on its proxy card will revoke any proxy you previously submitted. Similarly, if you use the VIEX proxy card to vote against the VIEX proposal, you will revoke any proxy you previously submitted. If you have already voted using the VIEX proxy card, you have every right to change your vote by voting by Internet or by telephone by following the instructions on theWHITE proxy card, or by completing and mailing the enclosedWHITE proxy card in the enclosed pre-paid envelope. Only the latest validly executed proxy that you submit will be counted. Any proxy may be revoked at any time prior to its exercise at the Annual Meeting. See “Can I change my vote after submitting my proxy?” below. If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor, Innisfree, toll free at (888) 750-5834. Banks and brokers may call collect at (212) 750-5833.

What does it mean if I receive more than one set of proxy materials with a WHITE proxy card?

It generally means your shares are registered differently or are in more than one account. For example, you may own some shares directly as a stockholder of record and other shares through a broker, or you may own shares through more than one broker. In these situations you may receive multiple sets of proxy materials. In order to vote all the shares you own, you must sign and return all of theWHITE proxy cards or follow the instructions for any alternative voting procedure on each of theWHITE proxy cards you receive. EachWHITE proxy card you received came with its own prepaid return envelope. If you vote by mail, make sure you return eachWHITE proxy card in the return envelope that accompanied thatWHITE proxy card.

If VIEX proceeds with its previously announced alternative director nominations, you will likely receive multiple mailings from VIEX, and we will likely conduct multiple mailings prior to the date of the Annual Meeting so that stockholders have our latest proxy information and materials to vote. We will send you a newWHITE proxy card with each mailing, regardless of whether you have previously voted. Only the latest validly executed proxy you submit will be counted. If you wish to vote as recommended by the Board, you should only submit theWHITE proxy cards. See “What do I do if I receive a proxy card from VIEX?” above for more information.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

| • | You may submit another properly completed proxy card with a later date. |

| • | You may grant a subsequent proxy by telephone or on the Internet. |

| • | You may send a timely written notice that you are revoking your proxy to YuMe's Secretary at 1204 Middlefield Road, Redwood City, CA 94063. |

| • | You may attend the Annual Meeting and vote in person. Simply attending the Annual Meeting will not, by itself, revoke your proxy. |

If you have previously signed a proxy card sent to you by VIEX, you may change your vote by voting by Internet or by telephone by following the instructions on yourWHITE proxy card, or by signing and mailing the enclosedWHITE proxy card in the enclosed pre-paid envelope. Submitting a proxy card sent to you by VIEX will revoke votes you have previously made using YuMe’sWHITE proxy card.Only the latest validly executed proxy that you submit will be counted.

Beneficial Owner: Shares Registered in the Name of Broker, Bank or Other Agent

If your shares are held by your broker, bank as a nominee or other agent, you should follow the instructions provided by your broker, bank or other agent.

How are votes counted?

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count, for the proposal to elect directors, votes “For,” “Withhold” and broker non-votes, and, with respect to other proposals, votes “For” and “Against,” abstentions and broker non-votes. Broker non-votes will have no effect and will not be counted towards the vote total for any proposal.

What are abstentions?

Abstentions are shares present at the Annual Meeting that are voted “ABSTAIN” on any particular proposal. Abstentions are counted for the purpose of determining whether a quorum is present.

What are “broker non-votes”?

Generally, broker non-votes occur when shares held by a broker, bank, or other nominee in street name for a beneficial owner are not voted with respect to a particular proposal because the broker, bank, or other nominee has not received voting instructions from the beneficial owner and lacks discretionary voting power to vote those shares with respect to that particular proposal.

In an uncontested situation, a broker is entitled to vote shares held for a beneficial owner on “routine” matters without instructions from the beneficial owner of those shares. However, absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on “non-routine” matters, such as the election of our directors (Proposal No. 1).

Given the contested nature of the election, the rules of the New York Stock Exchange governing brokers' discretionary authority do not permit brokers to exercise discretionary authority regarding any of the proposals to be voted on at the Annual Meeting, whether “routine” or not.

If your shares are held in street name by a broker, bank or other nominee, it is critical that you cast your vote and instruct your broker, bank, or other nominee on how to vote if you want your vote to count at the Annual Meeting. If your shares are held in street name and you do not instruct your broker, bank, or other nominee how to vote on the proposals to be voted on at the Annual Meeting, no votes will be cast on your behalf.

Broker non-votes, if any, will not be counted for purposes of determining the number of shares represented and voted with respect to an individual proposal, and therefore will have no effect on the outcome of the vote on an individual proposal. Thus, if you do not give your broker specific voting instructions, your shares will not be voted on the proposals to be voted on at the Annual Meeting and will not be counted in determining the number of shares necessary for approval.

How many votes are needed to approve each proposal?

| • | For Proposal 1, the election of directors to serve until the 2019 Annual Meeting of Stockholders, the two nominees receiving the most “For” votes from the holders of shares present in person or represented by proxy and entitled to vote on the election of directors will be elected. Only votes “For” or “Withheld” will affect the outcome. Broker non-votes will have no effect. |

| • | For Proposal 2, ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2016, approval requires that the proposal receive “For” votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote. If you choose to “Abstain” on Proposal 2, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

| • | For Proposal 3, approval requires that the proposal receive “For” votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote. If you choose to “Abstain” on Proposal 3, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote at the Annual Meeting are present at the Annual Meeting in person or represented by proxy. On the Record Date, there were[●]shares outstanding and entitled to vote. Thus, the holders of[●] shares must be present in person or represented by proxy at the Annual Meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other agent) or if you vote in person at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, either the chairman of the Annual Meeting or the holders of a majority of shares present at the Annual Meeting in person or represented by proxy may adjourn the Annual Meeting to another date.

How can I find out the results of the voting at theAnnual Meeting?

Preliminary voting results may be announced at the Annual Meeting. In addition, final voting results will be published, if available, in a current report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to report preliminary results, and to file an additional Form 8-K to report the final results within four business days after the final results are known to us.

Background to Potential Contested Solicitation

On March 4, 2016, the Company received a notice from VIEX of its intent to nominate two director candidates for election to the YuMe Board at the Annual Meeting, in opposition to the nominees recommended by our Board. The key events and significant contacts between the Company and VIEX are outlined below.

On September 17, 2015, our Chairman and Chief Executive Officer, Jayant Kadambi, and our Vice President of Investor Relations, Gary J. Fuges, met with VIEX portfolio manager Eric Singer at the Deutsche Bank Technology Conference in Las Vegas, Nevada. Mr. Singer disclosed that his funds owned slightly less than five percent of the Company’s outstanding shares, and that the Company should expect a Schedule 13D filing in the next few days.

On October 7, 2015, VIEX filed a Schedule 13D disclosing its aggregate ownership of 1,796,937 shares of YuMe common stock, or 5.2 percent of our outstanding shares. Also on this date, Mr. Singer sent an email to Mr. Kadambi to request a call to discuss the Schedule 13D filing.

On October 8, 2015, Mr. Kadambi responded to Mr. Singer’s email.

On November 5, 2015, in an amended Schedule 13D filing, VIEX disclosed aggregate ownership of 2,431,294 shares of YuMe common stock, or 7.1 percent of the outstanding shares.

On November 5, 2015, the Company released its financial results for the quarter ended September 30, 2015 and conducted its scheduled conference call with analysts.

On November 9, 2015, per Mr. Singer’s request, Mr. Kadambi spoke with Mr. Singer over the phone to address any questions regarding the Company’s third quarter 2015 financial results.

On November 10, 2015, Lead Independent Director, Dan Springer met with Mr. Singer to communicate that the Board had a clear understanding of Mr. Singer’s previously-stated positions.

On November 19, 2015, in an amended Schedule 13D filing, VIEX disclosed aggregate ownership of 4,502,930 shares of YuMe common stock, or 13.1 percent of the outstanding shares.

On December 9, 2015, Mr. Singer emailed Mr. Fuges to request a call with Mr. Kadambi. Mr. Kadambi and Mr. Singer spoke later that morning.

On December 19, 2015, Mr. Singer emailed Mr. Kadambi requesting a response to his self-tender request and a curtailment of expenses.

On December 22, 2015, Mr. Fuges, on behalf of Mr. Kadambi, emailed Mr. Singer to address his December 19, 2016 inquiry.

On December 30, 2015, in an amended Schedule 13D filing, VIEX disclosed aggregate ownership of 4,893,240 shares of YuMe common stock, or 14.2 percent of outstanding shares.

On January 8, 2016, Mr. Singer emailed Mr. Kadambi to request a call. Later that day, Mr. Fuges called Mr. Singer and offered to schedule a meeting for Mr. Singer with Mr. Kadambi the following week in New York, as Company management was scheduled to present at the Needham Growth Conference in New York on January 12, 2016

On January 13, 2016, Mr. Kadambi and Mr. Fuges met with Mr. Singer at the Needham Growth Conference.

On February 11, 2016, in an amended Schedule 13D filing, VIEX disclosed aggregate ownership of 5,299,503 shares of YuMe common stock, or 15.4 percent of the outstanding shares.

On February 18, 2016, the Company released its financial results for the quarter and year ended December 31, 2015 and announced a $10 million share repurchase program it intended to complete over the following twelve months.

On that date, Mr. Singer exchanged emails with Mr. Springer regarding the Company’s quarterly results, guidance and its Cash Incentive Plan. Mr. Springer then copied Mitchell Habib, Chairman of the Board’s Compensation Committee, and Paul Porrini, our General Counsel and Corporate Secretary.

On February 19, 2016, Mr. Kadambi and Mr. Fuges hosted a previously-scheduled call for Mr. Singer to review the financial results released the previous afternoon. Mr. Singer expressed disappointment in the guidance, and stated that he still intended to nominate two new directors, and that he wished to conduct a proxy contest and would not be interested in settling.

Also on February 19, 2016 Mr. Singer emailed Mr. Springer with a list of statements Mr. Kadambi had made on YuMe quarterly earnings calls since November 2013.

On March 4, 2016, in an amended Schedule 13D filing, VIEX disclosed aggregate ownership of 5,379,831 shares of YuMe common stock, or 15.6 percent of the outstanding shares. VIEX also delivered a letter to the Board nominating Elias N. Nader and Mr. Singer for election to the Board at the Annual Meeting. The letter also included an advisory stockholder proposal requesting that the Board take the necessary steps to declassify the Board so that all directors are elected on an annual basis.

Later on March 4, 2016, the Company issued a press release commenting on VIEX’s amended Schedule 13D and letter in which the Company stated its openness to constructive input from all of its stockholders and cited its constructive dialogue in 2015 with its then-largest stockholder to evaluate and appoint the stockholder’s candidate for the Board. The Company also stated the intention of its Board and Nominating and Governance Committee to evaluate VIEX’s proposed director nominees.

On March 10, 2016, Mr. Kadambi and Mr. Singer spoke telephonically. Mr. Singer expressed he had no intention of seeking a settlement with the Company outside of the Company accepting all of his demands.

On March 14, 2016, Mr. Porrini contacted VIEX’s legal counsel to begin the evaluation process of VIEX’s nominees in accordance with the Company’s usual practice as set forth in its March 4, 2016 press release. Specifically, Mr. Porrini requested that the nominees complete the Company’s standard director and officer questionnaire and make themselves available for interviews with the Board’s Nominating and Governance Committee.

On March 15, 2016, VIEX responded to Mr. Porrini in a letter that stated that this screening process should not be necessary, and that prior to completing the standard questionnaire and making the nominees available, the Company and VIEX would need to reach a settlement that included the appointment of VIEX’s nominees and the Company’s agreement to submit to a binding proposal to declassify the Board at the Annual Meeting.

On March 18, 2016, VIEX filed its preliminary proxy statement with the Securities and Exchange Commission.

PROPOSAL 1

ELECTION OF DIRECTORS

Number of Directors; Board Structure

The Board is divided into three classes. Each class consists of, as closely as possible, one-third of the total number of directors, and each class has a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director's successor is duly elected and qualified. The term of the current Class III directors expires at the Annual Meeting. The term of the Class I directors expires at the 2017 Annual Meeting of Stockholders and the term of the Class II directors expires at the 2018 Annual Meeting of Stockholders.

Nominees

The Board has nominated the nominees listed below as Class III directors, to serve until the 2019 Annual Meeting of Stockholders and until his successor has been duly elected and qualified, or, if sooner, until the director's death, resignation or removal. Our Board nominees are the two newest members of our Board, both having been appointed in 2015 after constructive dialogue with, and referrals from, our stockholders. Both of our Board nominees are independent and have deep relevant prior operational experience directly related to our industry that complements the operational, financial and industry experience of our other directors. Our nominees were selected for appointment to the Board in 2015 following a thorough search process and constructive dialogue with our then largest stockholders. Prior to their selection and appointment, the nominees fully engaged in the Company’s vetting process including participation in several interviews and completion of the Company’s standard director questionnaire.

Directors are elected by a plurality of the votes of the holders of shares present in person or represented by proxy and entitled to vote on the election of directors at a meeting. The two nominees receiving the highest number of affirmative votes will be elected. Proxies may not be voted for more than two directors. Shares represented by duly executed proxies will be voted, if authority to do so is not withheld, for the election of the two nominees named below. If any nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead be voted for the election of a substitute nominee proposed by the Company if a vacancy would exist.The Board recommends that you vote on the enclosedWHITE proxy card or voting instruction form “FOR ALL” of the Board's nominees for election.

Each person nominated for election has agreed to serve if elected. The Company's management has no reason to believe that any nominee will be unable to serve.

Craig Forman, Age54

Mr. Forman has been a member of the Board since he was appointed to the Board in July 2015 following a thorough vetting process and constructive dialogue with our stockholders. Mr. Forman is a private investor and entrepreneur, and a former media, technology and telecommunications executive. Mr. Forman has also served as a telecommunications and technology industry executive, most recently as President of EarthLink Inc.’s consumer access and audience division, until 2009. Prior to joining EarthLink in 2006, Mr. Forman served as the vice president and general manager for Yahoo! Inc.’s media and information divisions, overseeing Yahoo! News, Yahoo! Sports and Yahoo! Finance. Prior to joining Yahoo, Mr. Forman led internet and new media divisions at Time Warner, was vice president for product management at the search engine Infoseek, and was director and editor of international business information services for Dow Jones. Since 2009, Mr. Forman has served as a director on a variety of public and private company boards. Mr. Forman is currently a member of the boards of directors of Digital Turbine, Inc., a mobile advertising and content software company (NASDAQ: APPS), McClatchy Co., a newspaper and information company (NYSE: MNI) and Yellow Media Ltd. (TSE:Y), a digital media and marketing solutions company. Mr. Forman served as executive chairman of WHERE, Inc., a leading mobile-advertising technology network acquired by eBay Inc., in 2011. Mr. Forman holds an AB degree from the Woodrow Wilson School of Public & International Affairs of Princeton University and a Masters of Law from Yale Law School. The Board believes that Mr. Forman’s depth of knowledge and experience with our Company, his other board service and his vast industry experience in the areas of networks, media and advertising, complement the experience and qualifications of the other directors on our Board and enable himto make valuable contributions to the Board.

Derek Harrar, Age45

Mr. Harrar was nominated for our Board by our then largest stockholder and has served as a member of the Board since he was appointed in October 2015 following thorough vetting process constructive dialogue with our stockholders. From 2010 to the present, Mr. Harrar serves as an advisor to private equity firms and their portfolio companies on technology, media and telecom investing and operating strategies.Mr. Harrar previously served as an executive at Comcast Corporation in several roles, including Senior Vice President and General Manager, Video Services, from 2007 to 2010; Vice President, Video Product Management, from 2006 to 2007; Vice President, Subscriber Equipment, from 2005 to 2006, and Vice President, Business Development from 2004 to 2005. Prior to joining Comcast, Mr. Harrar was Co-Founder and Vice President, Business Development at MegaSense, Inc., a developer of photonic micro-modules and micro-subsystems, and an investment banker with Morgan Stanley in Silicon Valley, California from 2001 to 2003 and New York, New York from 1993 to 2000. Since January 2014, Mr. Harrar has served on the board of directors of Brightcove, Inc., a global provider of cloud services for video delivery and monetization. Mr. Harrar holds a B.S. in Administration and Accounting from Washington and Lee University. The Board believes that Mr. Harrar's depth of knowledge and experience with our Company, his other board service and his vast industry experience in the areas of networks, media and video delivery, complement the experience and qualifications of the other directors on our Board and enable him to make valuable contributions to the Board.

Board Recommendation. The Board recommends that you vote on the enclosedWHITE proxy card or voting instruction form “FOR ALL” of the Board's nominees for election: Craig Forman and Derek Harrar.

Background to the Board's Recommendation in Favor of its Nominees. The Nominating and Governance Committee and the Board consider a number of factors and principles in determining the slate of director nominees for election to the Board. In particular, the Nominating and Governance Committee and the Board sought to evaluate and select the nominees according to the following criteria:

| | • | high standards of personal integrity; |

| | • | diverse personal and professional backgrounds; |

| | • | industry and operational experience; |

| | • | relevant expertise upon which to be able to offer advice and guidance to management; |

| | • | sufficient time to devote to the affairs of the Company; |

| | • | demonstrated excellence in his or her field with an ability to exercise sound business judgment; and |

| | • | commitment to the long-term interests of the Company's stockholders. |

The Nominating and Governance Committee and Board have evaluated each of Mr. Forman and Mr. Harrar as well as each of VIEX’s proposed nominees against the factors and principles YuMe uses to select nominees for director. Based on this evaluation, our Nominating and Governance Committee and the Board concluded that it is in the best interests of YuMe and its stockholders to vote “FOR ALL” of the Board's nominees to continue to serve as a director of YuMe.

The Board does not endorse the VIEX nominees and urges you not to sign or return any gold proxy card that may be sent to you by VIEX. Voting to “WITHHOLD” with respect to any of the VIEX nominees on its proxy card is not the same as voting for the Board's nominees because a vote to “WITHHOLD” with respect to any of the VIEX nominees on its proxy card will revoke any proxy you previously submitted. If you have already voted using the VIEX proxy card, you have every right to change your vote by voting by Internet or by telephone by following the instructions on theWHITE proxy card, or by signing and mailing the enclosedWHITE proxy card in the enclosed pre-paid envelope. Only the latest validly executed proxy that you submit will be counted — any proxy may be revoked at any time prior to its exercise at the Annual Meeting. See “Can I change my vote or revoke my proxy?” above for more information. If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor, Innisfree, toll free at (888) 750-5834. Banks and brokers may call collect at (212) 750-5833.

THE BOARD RECOMMENDS

A VOTE IN FAVOR OF EACH NAMED NOMINEE.

The following is a brief biography of each director whose term will continue after the Annual Meeting.

DIRECTORS CONTINUING IN OFFICE UNTIL THE 2017 ANNUAL MEETING OF STOCKHOLDERS

Jayant Kadambi, Age50

Mr. Kadambi is a founder of our Company; he has served as our President since August 2008, our Chief Executive Officer since August 2011, and as a member of the Board since our inception in December 2004. Prior to co-founding YuMe, Mr. Kadambi was Vice President, Research and Development of Netopia, Inc., a publicly-held manufacturer of DSL equipment and service provider for Internet service providers and carriers. He was a co-founder of StarNet Technologies, Inc., a voice over DSL company, which was acquired by Netopia, Inc. in 1999. Prior to co-founding StarNet, Mr. Kadambi held various technical and marketing positions in Advanced Micro Devices, Inc.’s networks division and AT&T Bell Labs, where he worked on high-speed LAN systems, hardware and DSL technologies. Mr. Kadambi received his B.S.E.E. and Masters in Electrical Engineering from Rensselaer Polytechnic Institute. The Board believes that Mr. Kadambi's depth of experience with our Company and his industry experience in areas of networking, hardware architecture and semiconductors allow him to make valuable contributions to the Board.

Ayyappan Sankaran, Age 54

Mr. Sankaran is a founder of our Company; he has served as our Chief Technology Officer since August 2008 and has been Vice President, Engineering and a member of the Board since our inception in December 2004. Mr. Sankaran was named Executive Vice President, Engineering and Chief Technology Officer in April 2013. Prior to co-founding YuMe, Mr. Sankaran was Director of Software Development at Netopia, Inc., a publicly-held manufacturer of DSL equipment and service provider for Internet service providers and carriers. He was a co-founder of StarNet Technologies, a voice-over-DSL company, which was acquired by Netopia in 1999. Prior to co-founding StarNet, Mr. Sankaran held various technical positions at Octel Communications (acquired by Lucent Technologies), Abbott Labs and Ready Systems. Mr. Sankaran holds a B.S.E.E. from the College of Engineering, Madras, India and a Masters in Electrical Engineering from the University of Texas. The Board believes that Mr. Sankaran's depth of experience with our Company and his industry experience in software architecture, design and development in real time embedded systems and voice and data networks allow him to make valuable contributions to the Board.

Daniel Springer, Age 52

Mr. Springer has been a member of the Board since October 2013. Since May 2015, Mr. Springer has been serving as Operating Partner of Advent International, a global private equity investor. From April 2004 to April 2014, Mr. Springer was the Chief Executive Officer and a member of the board of directors of Responsys Inc., a publicly held provider of email and cross-channel marketing solutions. Oracle Corporation acquired Responsys Inc. in February 2014. Prior to joining Responsys Inc., Mr. Springer served as the Managing Director of Modem Media, Inc., the Chief Executive Officer of Telleo, Inc., and Chief Marketing Officer of NextCard, Inc. He also has previous experience with McKinsey & Company, Inc., Data Resource, Inc./McGraw-Hill and Pacific Telephone and Telegraph Company. Mr. Springer holds a B.A. in Mathematics and Economics from Occidental College and an M.B.A. from Harvard University. The Board believes that Mr. Springer’s extensive experience as a Chief Executive Officer and a member of several boards of directors allow him to make valuable contributions to the Board.

DIRECTORS CONTINUING IN OFFICE UNTIL THE 2018 ANNUAL MEETING OF STOCKHOLDERS

Mitchell Habib, Age55

Mr. Habib has served as a member of the Board since June 2013. Since June 2014, Mr. Habib has been President and Chief Executive Officer of FCM LLC, a full service consulting firm supporting private equity clients and their portfolio businesses. Mr. Habib was the Chief Operating Officer of Nielsen Holdings N.V. (“Nielsen”), a global information and measurement company, from January 2012 through March 2014. Previously, Mr. Habib served as the Executive Vice President of Nielsen's Global Business Services division from 2007 until December 2011. Prior thereto, Mr. Habib served as Chief Information Officer for certain North American divisions of Citigroup and for several major divisions of General Electric. Mr. Habib holds a B.S. in Journalism and a Masters in Public Administration from the University of Florida. The Board believes that Mr. Habib's extensive managerial experience and experience working with data and information measurement, particularly in connection with media and advertisements, is valuable to the Board.

Adriel Lares, Age43

Mr. Lares has served as a member of the Board since June 2013. Mr. Lares served as the Chief Financial Officer of Lookout Inc., a security technology company, from February 2012 until July 2015 and remained in an advisory role through November 2015. Previously, Mr. Lares served as the Business Unit Leader of Hewlett-Packard Company's 3PAR division, which provides data storage solutions, from October 2010 until January 2012, and served as the Director of Finance and later the Treasurer and Chief Financial Officer of 3PAR, Inc., a data storage company, from 2001 until it was acquired by Hewlett-Packard Company in September 2010. Mr. Lares previously served as Chief Financial Officer of Techfuel, Inc., a reseller of high-end storage management solutions, a technology investment banker at Morgan Stanley & Co. Incorporated and a Treasury Analyst for the Walt Disney Company. Mr. Lares holds a B.A. in Economics from Stanford University. The Board believes that Mr. Lares’ expertise in finance, including accounting and financial reporting experience, as a Chief Financial Officer and in other finance roles, is valuable to the Board.

Christopher Paisley, Age63

Mr. Paisley has served as a member of the Board since November 2012. Mr. Paisley has served as the Dean's Executive Professor of Accounting at the Leavey School of Business at Santa Clara University since 2001. Mr. Paisley served as Chief Financial Officer of 3Com Corporation, a computer networking company, from 1985 to 2000. Mr. Paisley also serves on the boards of directors of Ambarella Corporation, a developer of video compression and image processing semiconductors, Equinix, Inc., a provider of network colocation and managed services, Fitbit, a wearables fitness and health company, and Fortinet, Inc., a provider of unified threat management solutions. He previously served as a director of Volterra Semiconductor Corporation, a provider of power management semiconductors, Bridge Bank and Control 4, a home automation company. Mr. Paisley holds a B.A. degree in business economics from the University of California at Santa Barbara and an M.B.A. from the Anderson School at the University of California at Los Angeles. The Board believes that Mr. Paisley’s expertise in finance, including accounting and financial reporting, experience as a Chief Financial Officer and in other finance roles and currently as a professor in the field of accounting and finance, allow him to make valuable contributions to the Board. Additionally, Mr. Paisley has extensive experience as a public company board member.

PROPOSAL 2

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected PricewaterhouseCoopers LLP as the Company's independent registered public accounting firm for the year ending December 31, 2016 and has further directed that management submit the selection of independent registered public accounting firm for ratification by the stockholders at the Annual Meeting. PricewaterhouseCoopers LLP has served as the Company's independent registered public accounting firm since its audit of the Company's financial statements as of and for the year ended December 31, 2010. Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

The Company's Bylaws, other governing documents or law do not require stockholder ratification of the selection of PricewaterhouseCoopers LLP as the Company's independent registered public accounting firm. However, the Board is submitting the selection of PricewaterhouseCoopers LLP to the stockholders for ratification as a matter of good corporate governance practice. If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting will be required to ratify the appointment of PricewaterhouseCoopers LLP.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FEES AND SERVICES

We regularly review the services and fees of our independent registered public accounting firm. These services and fees are also reviewed with our Audit Committee annually.

The following table represents aggregate fees billed to the Company for the years ended December 31, 2015 and December 31, 2014 by PricewaterhouseCoopers LLP, the Company's independent registered public accounting firm.

| | | Year ended December 31, | |

| | | 2015 | | | 2014 | |

| | | (in thousands) | |

Audit Fees(1) | | $ | 1,190 | | | $ | 1,220 | |

Tax Fees(2) | | | — | | | | — | |

All Other Fees(3) | | | 2 | | | | 7 | |

Total Fees | | $ | 1,192 | | | $ | 1,227 | |

(1) Audit fees consist of professional services rendered in connection with the audit of our consolidated financial statements and review of our quarterly consolidated financial statements.

(2) Represents fees for international tax consulting.

(3) Represents access fees for online accounting materials and consultation regarding global equity regulations.

All services and fees described above were approved by the Board or Audit Committee.

PRE-APPROVAL POLICIES AND PROCEDURES

Consistent with auditor independence requirements of the SEC and the Public Company Accounting Oversight Board, our Audit Committee is responsible for the pre-approval of audit and non-audit services rendered by the Company's independent registered public accounting firm, PricewaterhouseCoopers LLP. The Audit Committee has authorized its chairman to pre-approve certain services and associated fees up to $100,000, and any pre-approval decisions made pursuant to such delegation shall be reported to the full Audit Committee at its next scheduled meeting following such decision.

The Audit Committee has determined that the rendering of the services other than audit services by PricewaterhouseCoopers LLP is compatible with maintaining the independent registered public accounting firm’s independence.

THE BOARDRECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 2.

PROPOSAL 3

VIEX PROPOSALRELATING TO BOARD DECLASSIFICATION

VIEX has notified us of its intent to propose a resolution at the Annual Meeting that, if approved, would ask the Board “to take steps to declassify the board.” This proposal is advisory only and is referred to herein as the “VIEX Proposal.”

Proposal Relating To Board Declassification

RESOLVED, that the stockholders of the Company urge the Board to take all necessary steps (other than any steps that must be taken by stockholders) to eliminate the classification of the Board and to require that all directors be elected on an annual basis.

Board of Directors Statement

The Board recommends that stockholders vote“AGAINST” the VIEX Proposal relating to Board declassification for the following reasons:

The Board carefully considered the stockholder proposal, including the advantages and disadvantages, and believes, for the reasons noted below, that a classified board structure remains in the best interests of the Company and our stockholders.

CLASSIFIED BOARD PROMOTES CONTINUITY AND LEADERSHIP STABILITY. The Company's classified board is designed to promote continuity and stability of leadership to ensure that, at all times, a majority of the Company's directors have prior experience with, and knowledge of, the Company's operations, management and strategy. Board continuity is especially critical to developing, refining and executing our long-term strategic goals. The classified board structure helps directors to make sound strategic decisions in the long-term best interests of the Company and its stockholders, rather than focusing excessively on short-term results.

CLASSIFIED BOARD LEADS TO HIGH QUALITY DIRECTORS. A classified board can strengthen the Company's ability to recruit high quality directors who are willing to make a significant commitment to the Company and our stockholders for the long-term. The Board believes it is important that directors have the commitment to serve for an appropriate term given the initial and ongoing time investment required to properly understand our operations. This leads to experienced directors who are knowledgeable about our business and can be better positioned to make decisions that are in the best interests of the Company and our stockholders.

THREE-YEAR TERMS ENHANCE OUR BOARD'S INDEPENDENCE AND LONG-TERM STOCKHOLDER FOCUS. The Board also believes that a three-year term enhances the independence of our non-employee directors by providing them with more time to develop their understanding of, and experience with, the Company's business, making them less dependent on the views and perspectives of management. A longer term in office also helps insulate our directors against pressures from special interest groups that may be more focused on short-term results instead of the long-term interests of all stockholders. Our current board structure allows our directors to act independently and not be driven or distracted by concerns over annual nominations or elections, which helps enable them to resist destructive short-term thinking. The Board believes that the freedom to focus on the long-term interests of the Company and our stockholders leads to greater independence, the cornerstone of good corporate governance.

CLASSIFIED BOARD PROVIDES PROTECTION AGAINST POTENTIALLY ABUSIVE, UNFAIR AND INADEQUATE TAKEOVER ATTEMPTS AND MAY LEAD TO HIGHER VALUE TO STOCKHOLDERS IN THE EVENT OF A HOSTILE TAKEOVER. In an unsolicited takeover situation, a classified board can enhance our ability to achieve the best results for all of our stockholders. For example, a classified board structure furthers the ability of our Board to ultimately achieve the best possible outcome for all stockholders by providing the time and leverage necessary for our Board to evaluate and consider the fairness of any takeover proposal, consider alternative proposals, and take appropriate action without being subjected to the undue pressure and threat of an imminent removal of a majority of members of the Board. Without a classified board, a potential acquirer could gain control of our company by replacing a majority of the Board with its own slate of nominees at a single stockholders' meeting and without paying an appropriate premium to our stockholders. While our classified board structure can help achieve and protect stockholder value, protect long-term stockholders from abusive takeover tactics and help safeguard against sudden and disruptive takeover efforts by third parties to quickly take control of the Board, it does not prevent unsolicited takeover proposals or the consummation of such transactions.

CLASSIFIED BOARDS CONTINUE TO BE MORE PREVALENT IN SMALLER COMPANIES LIKE YUME.While board declassification may be a trend within larger market capitalization companies, smaller market capitalization companies continue to utilize a classified board structure. According to FactSet Research, 72% of companies that have completed an initial public offering within the last five years and have a market capitalization under $250 million have a classified board. This number is compared with 10% of the companies in the S&P 500 index. Regardless of the size of a company, we believe that each company must make a determination regarding corporate governance in light of its own particular financial and market circumstances. Simply because other companies have decided to remove their classified boards is not, in the Board's judgment, a persuasive reason to do so. Our Board does not believe that there is a single formula for corporate governance and you must take into consideration differences among companies, their management and the industries and markets in which they operate. The Board periodically reviews the Company's existing practices and retains or implements practices that it believes serve the best interests of the Company and its stockholders. This review has led the Board to conclude that our classified board structure should be maintained at this time.

The Board recognizes that there are differing views on board classification and believes that there are valid arguments for and against classified boards. The Board wishes to use this proposal as an opportunity for stockholders to express their view on this subject.

It is important to note that approval of the VIEX Proposal would not declassify the Board. Declassifying the Board would still require an amendment to the Company's Amended and Restated Certificate of Incorporation. The Certificate of Incorporation requires a vote of the holders of at least two-thirds of the voting power to remove the classified board structure.

Vote Required and Recommendation

Approval of this proposal requires the affirmative vote of a majority of the voting power of the issued and outstanding stock of the Company entitled to vote, present in person or represented by proxy at the Annual Meeting. Approval of this proposal would not declassify the Board. Declassifying the Board would still require an amendment to the Company’s Amended and Restated Certificate of Incorporation, as described in the preceding paragraph.

After careful consideration, the Board believes that a classified board structure remains in the best interests of the Company and its stockholders.

THE BOARD RECOMMENDS

A VOTE AGAINSTPROPOSAL3

CORPORATE GOVERNANCE

DIRECTOR INDEPENDENCE

In accordance with the listing rules of the New York Stock Exchange, a majority of the members of a listed company's Board must qualify as independent, as affirmatively determined by its board of directors. The Board consults with the Company’s counsel to ensure that the Board's determinations are consistent with relevant securities and other laws and regulations regarding the definition of independence, including those set forth in pertinent listing standards of the New York Stock Exchange, as in effect from time to time.

Our Board has determined that Mr. Forman, Mr. Habib, Mr. Harrar, Mr. Lares, Mr. Paisley and Mr. Springer are independent under the rules of the New York Stock Exchange. Our Board has determined that Mr. Kadambi and Mr. Sankaran are not independent because they are employees and executive officers of the Company.

The New York Stock Exchange listing rules generally require that, subject to specified exceptions, each member of our audit, compensation and governance committees be independent. Audit committee members must further satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act. In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors, or any other board committee: accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries; or be an affiliated person of the listed company or any of its subsidiaries. In addition, in determining the independence of any director who will serve on the Compensation Committee, the Board must consider certain additional factors specified in the New York Stock Exchange listing rules. Our Board has determined that all members of our Audit Committee, Compensation Committee and Nominating and Governance Committee are independent and all members of our Audit Committee and Compensation Committee satisfy the relevant additional independence requirements for the members of those committees.

BOARD LEADERSHIP STRUCTURE

The Board is currently led by Mr. Kadambi as the Chairman of the Board and Mr. Springer as the lead independent director of the Board. Mr. Springer was appointed as the lead independent director in March 2015.

The Company believes that, at this time, combining the positions of Chief Executive Officer and Chairman of the Board helps to ensure that the Board and management act with a common purpose. The Company believes that combining the positions facilitates the development and implementation of strategy and provides a single, clear chain of command to execute the strategic initiatives and business plans. In addition, the Company believes that a combined Chief Executive Officer/Chairman is better positioned to act as a bridge between management and the Board, facilitating the regular flow of information and providing valuable insight into the day-to-day operations of the Company. The Company believes that in addition to the leadership provided by our Chairman, the appointment of a lead independent director ensures that the Company benefits from effective oversight by its independent directors.

The Chairman oversees the planning of the annual Board calendar and, in consultation with the other directors, schedules and sets the agenda for meetings of the Board and leads the discussion at such meetings. In addition, the Chairman chairs the annual meeting of stockholders, is available in appropriate circumstances to speak on behalf of the Board, and performs such other functions and responsibilities as set forth in our Corporate Governance Guidelines or as requested by the Board from time to time.

The lead independent director presides at all meetings of the Board at which the Chairman is not present, including at executive sessions of the independent directors. The lead independent director serves as a liaison between the Chairman and the independent directors. The lead independent director is available under appropriate circumstances for consultation and direct communication with major stockholders and performs such other functions and responsibilities as set forth in our Corporate Governance Guidelines or as requested by the Board or the independent directors from time to time.

ROLE OF THE BOARD IN RISK OVERSIGHT

One of the Board's key functions is informed oversight of the Company's risk management process. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, and through its various standing committees that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk appropriate for the Company. Our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Audit Committee also monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of our internal audit function. Our Nominating and Governance Committee monitors the effectiveness of our corporate governance guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking.

EXECUTIVE SESSIONS OF INDEPENDENT DIRECTORS

To promote open discussion among the non-management directors, our Board periodically conducts executive sessions of independent directors during regularly scheduled Board meetings and at such other times if requested by an independent director. These sessions are led by the lead independent director or, in the absence of a lead independent director, an independent director as determined at the beginning of such executive session by the independent directors present. Mr. Kadambi and Mr. Sankaran do not attend these sessions.

MEETINGS OF THE BOARD

The Board met eleven times during 2015. Each incumbent Board member attended 75% or more of the aggregate number of meetings of the Board and of the committees on which they served during the portion of 2015 for which they were a director or committee member.

INFORMATION REGARDING COMMITTEES OF THE BOARD

The Board has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Governance Committee. The following table provides membership information for the year ended December 31, 2015 for each of the Board committees:

Name | | Audit | | Compensation | | Nominating and

Governance | |

Jayant Kadambi | | | | | | | | | | |

Ayyappan Sankaran | | | | | | | | | | |

Mitchell Habib | | | X | | | X | *** | | | |

Adriel Lares | | | X | | | | | | X | *** |

Christopher Paisley | | | X | *** | | | | | X | |

Daniel Springer | | | | | | X | | | | |

Ping Li* | | | | | | X | | | | |

David Weiden* | | | | | | | | | X | |

Craig Forman** | | | | | | X | | | X | |

Derek Harrar** | | | | | | | | | | |

Total meetings | | | 5 | | | 5 | | | 4 | |

* Mr. Li and Mr. Weiden served as directors until July 3, 2015.

** Mr. Forman was appointed to the Board, Compensation Committee and Nominating and Governance Committee on July 3, 2015. Mr. Harrar was appointed to the Board on October 2, 2015.

*** Committee Chairperson

Audit Committee