UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[ x ] ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2008

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to ______

Commission File Number 000-52940

American Nano Silicon Technologies, Inc.

(Exact name of registrant as specified in its charter)

| | | |

| California | | 33-0726410 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

c/o American Union Securities | | |

100 Wall Street 15th Floor | | |

| New York, New York | | 10005 |

| (Address of principal executive offices) | | (Zip Code) |

(212) 232-0120

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Non-accelerated filer o | Accelerated filer o | Smaller reporting company þ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No þ

The number of shares out standing of the issuer's common stock, as of January 12, 2009, was 26,558,767.

TABLE OF CONTENTS

| | | Page |

| Part I | |

| | | |

ITEM 1. | DESCRIPTION OF BUSINESS | 3 |

| | | |

| ITEM 2. | DESCRIPTION OF PROPERTIES | 12 |

| | | |

| ITEM 3. | LEGAL PROCEEDINGS | 17 |

| | | |

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS | 17 |

| | | |

| Part II | |

| | | |

| ITEM 5. | MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | 18 |

| | | |

| ITEM 6. | MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION | 19 |

| | | |

| ITEM 7. | FINANCIAL STATEMENTS | F-1 |

| | | |

| ITEM 8. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 23 |

| | | |

| ITEM 8A. | CONTROLS AND PROCEDURES | 23 |

| | | |

| ITEM 8B. | OTHER INFORMATION | 23 |

| | | |

| Part III | |

| | | |

| ITEM 9. | DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS, CONTROL PERSONS AND CORPORATE GOVERANCE; COMPLIANCE WITH SECTION 16(a) | 24 |

| | | |

| ITEM 10. | EXECUTIVE COMPENSATION | 25 |

| | | |

| ITEM 11. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 26 |

| | | |

| ITEM 12. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE | 27 |

| | | |

| ITEM 13. | EXHIBITS | 27 |

| | | |

| ITEM 14. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 28 |

PART I

The information in this document contains forward-looking statements which involve risks and uncertainties, including statements regarding our capital needs, business strategy and expectations. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “will,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “forecast,” “project,” or “continue,” the negative of such terms or other comparable terminology. You should not rely on forward-looking statements as predictions of future events or results. Any or all of our forward-looking statements may turn out to be wrong. They can be affected by inaccurate assumptions, risks and uncertainties and other factors which could cause actual events or results to be materially different from those expressed or implied in the forward-looking statements.

In evaluating these statements, you should consider various factors, including the risks described under “Risk Factors” and elsewhere. These factors may cause our actual results to differ materially from any forward-looking statement. In addition, new factors emerge from time to time and it is not possible for us to predict all factors that may cause actual results to differ materially from those contained in any forward-looking statements. We disclaim any obligation to publicly update any forward-looking statements to reflect events or circumstances after the date of this document, except as required by applicable law.

ITEMS 1. DESCRIPTION OF BUSINESS

In this document, references to the “company,” “we,” “us” and “our” refer to American Nano Silicon Technologies, Inc. and our predecessors and subsidiaries, unless the context otherwise requires.

History of the Company

The Company was incorporated as a California corporation on September 6, 1996 under the name CorpHQ, Inc. On January 24, 1997 we agreed to acquire 100% of the assets and liabilities of Community Business Network International (“CBNI”), a California unincorporated association controlled by Steven Crane and Art F. Aviles, our former Chief Executive Officer and former President, respectively, in exchange for 3,242,417 shares of our common stock. Concurrent with the acquisition, our board of directors ratified all outstanding agreements, including but not limited to employment and indemnification agreements and promissory notes, by and between CBNI, Mr. Crane, Mr. Aviles and certain employees and consultants.

Following the acquisition until December 1999, we operated an online “virtual” community comprised of small and home based businesses at www.hqonline.com and later at www.corphq.com. Through that vehicle, we marketed various products and services to our members, and marketed the capabilities of our members to larger business organizations. These products and services included printed and electronic marketing and advertising materials, websites, advertising, communications and design consultation, and business management and marketing consultation.

On July 6, 1999 we acquired Source Capital Partners, Inc., (“Source”) a privately held, financial consulting services company. Under the term of the acquisition, which was accounted for as a pooling of interests, we exchanged 7926 shares, of our common stock for 100% of the ownership interest in Source.

On December 30, 1999, we entered into a letter of intent to merge with BusinessMall.com Inc. (f/k/a Progressive Telecommunications Corporation) in an all-stock transaction.

Until December 31, 1999, our main business activity was providing marketing, advertising and financial consultation and services produced by members of its Internet-based subscriber network. We also provided yearly subscriptions to and advertising space on its Internet site to small and home-based service businesses.

On February 29, 2000, we agreed to transfer the ownership of our Source subsidiary to Source Capital Partners LLC, (“The Partners”), a limited liability company operated by Steven Glazer, a subsidiary officer and a member of the Company’s board of directors, and Gregg Davis, a subsidiary officer. In the transaction, we exchanged all issued and outstanding shares of Source to The Partners in exchange for 7926 shares of our common stock, termination of all agreements between the parties and indemnification of the Company by The Partners against any liabilities arising out of the operations of Source during the period that it operated as our subsidiary.

We operated under a joint venture with BusinessMall.com Inc. during the 2000 fiscal year while integrating their operations. On August 14, 2000, we received notice of an involuntary Bankruptcy filing by creditors of BusinessMall.com Inc. We terminated our relationship with BusinessMall.com Inc. at that time.

At a meeting of our stockholders held on September 27, 2000 our new business activity was approved. From that date though approximately June, 2007, we engaged in business management consulting and investing activities. Our business strategy during that period primarily involved the development, acquisition and operation of minority- owned portfolio companies focused on consumer products and commercial technologies, as well as development of consulting and other business relationships with client companies that demonstrated synergies with our core businesses.

From 2001 through approximately June 2007, we served as business incubator, organizing, investing in, and providing comprehensive management support and a variety of resources to portfolio companies. Our portfolio companies included My Personal Salon Inc., a lifestyle products company; Safeguard Technology International, Inc., a distributor and integrator of high technology products and services for residential and corporate security; Circles of Life USA Inc., a wellness products company; Pressto Food & Beverage Inc., the owner of patented self-heating/cooling beverage and foods containers; National Beverage Bottling Inc., a water bottling and beverage distribution company; South Bay Financial Solutions, Inc., a real-estate, marketing and public relations firm; and The Giving Card Inc., an affinity card and merchant rebate facilitator.

On May 10, 2004 we reported that our Board of Directors had approved a ten-for-one forward stock split covering all of our issued and outstanding shares of common stock effective May 18, 2004. Furthermore, we had issued other securities which were convertible, exchangeable or exercisable into shares of our common stock. The common stock underlying these derivative securities were also adjusted to reflect the forward stock split.

On February 28, 2005, we announced the organization of a wholly-owned subsidiary, CorpHQ UK Ltd., in the United Kingdom (“CorpHQ UK”), for the principal purpose of funding new portfolio companies in the United Kingdom, and to create vehicles to develop European markets for CorpHQ’s US portfolio companies.

In November 2006, in the face of declining revenues and operating losses, our management determined to consider a potential business transaction with a company in an unrelated sector if it would result in greater value then continuing to pursue our business of providing management services.

Effective as of May 24, 2007, we entered into a Stock Purchase and Share Exchange Agreement (the “Exchange Agreement”) with American Nano Silicon Technologies, Inc., a Delaware corporation (“American Nano-Delaware”), the shareholders of American Nano-Delaware and Nanchong Chunfei Nano-Silicon Technologies Co. Ltd. (“Nanchong Chunfei”), pursuant to which, among other things,

| · | We agreed to change our name from CorpHQ, Inc. to our current name, American Nano Silicon Technologies, Inc., |

| · | We agreed to amend its Articles of Incorporation to provide for a reduction of the number of authorized shares from two billion (2,000,000,000) shares of common stock without par value to two hundred million (200,000,000) shares of common stock, par value $.001 per share, |

| · | We agreed to reverse split the issued and outstanding shares of Old Common Stock into shares of New Common Stock in the ratio of 1,302 shares of Old Common Stock for each share of New Common Stock, |

| · | We agreed to buy all of the issued and outstanding shares of American Nano-Delaware in exchange for issuing 25,181,450 shares of New Common Stock to the shareholders of American Nano-Delaware, |

| · | Our controlling shareholders, Steven Crane and Gregg Davis, sold of all of their interest in the Company, which represented an aggregate of 558,520 shares of New Common Stock, to Huakang Zhou, a shareholder of American Nano-Delaware, |

| · | We agreed to transfer all of our existing business as existing prior to the Exchange Agreement together with and related assets (the “CorpHQ Business”) to South Bay Financial Solutions, Inc., an existing subsidiary of the Company (“South Bay”), |

| · | We agreed to sell South Bay to Mr. Crane and Mr. Davis in exchange for South Bay together with Mr. Crane and Mr. Davis assuming all of the liabilities relating to the CorpHQ Business, and |

| · | The existing officers and directors were required to resign and appoint in their place new officers and directors associated with American Nano-Delaware. |

In connection with the Exchange Agreement, the following events occurred:

| · | On June 29, 2007, Mr. Crane and Mr. Davis resigned as directors leaving and Mr. Art F. Aviles as the sole director. Mr. Aviles appointed Mr. Pa Fachun, Mr. Zhou Jian, Mr. Zhang Changlong, and Mr. David Smith as directors and then resigned himself. |

| · | On June 29, 2007 our Board appointed Mr. Pu Fachun as Chairman, President and Treasurer and Mr. David H. Smith as Secretary. |

| · | On August 9, 2007, we amended our Articles of Incorporation to change our name to American Nano Silicon Technologies, Inc., effect a 1302:1 reverse stock split and decrease our authorized common stock from 2 billion shares to 200 million shares with a par value of $0.0001. |

| · | On November 6, 2007 issued 25,181,450 shares of New Common Stock to the shareholders of American Nano-Delaware in return for all of the outstanding stock of American Nano-Delaware, resulting in American Nano-Delaware becoming our wholly-owned subsidiary. |

| · | On January 8, 2008, we quitclaimed the remaining assets pertaining to the CorpHQ Business to South Bay and on January 8, 2008, we executed a Spin-Off Agreement with South Bay and Mr. Crane and Mr. Davis. Pursuant to the Spin-Off Agreement provided for Mr. Crane and Mr. Davis received all of the outstanding shares of South Bay in consideration for South Bay assuming all liabilities pertaining to the CorpHQ business and for South Bay, Mr. Crane, and Mr. Davis indemnifying the Company against such liabilities. |

Following the acquisition of American Nano-Delaware (our wholly owned subsidiary), our new management ceased pursuing the CorpHQ Business and made the business of American Nano-Delaware the primary business of the Company. American Delaware-Nano is a holding company that directly holds one majority-owned subsidiary, Nanchong Chunfei and, through Nanchong Chunfei, indirectly holds two additional majority-owned subsidiaries.

We may contingent liabilities resulting from the CorpHQ Business and for any actions or omissions of the Company prior to the consummation of the transactions undertaken pursuant to the Exchange Agreement (the “Exchange Transactions”). The risk exists that the Securities and Exchange Commission might deem the Company to have operated in violation of the Investment Company Act of 1940 prior to the consummation of the Exchange Transactions.

Additionally, we have determined that pursuant to applicable corporate law, the Company was required to have provided dissenters rights to all qualifying shareholders. As the Company did not provide dissenters rights, we are subject to contingent liabilities to such qualifying shareholders under applicable corporate law.

Below is a more detailed historical corporate background of American Nano Silicon Technologies, Inc., specifically before it merged with CorpHQ, Inc.

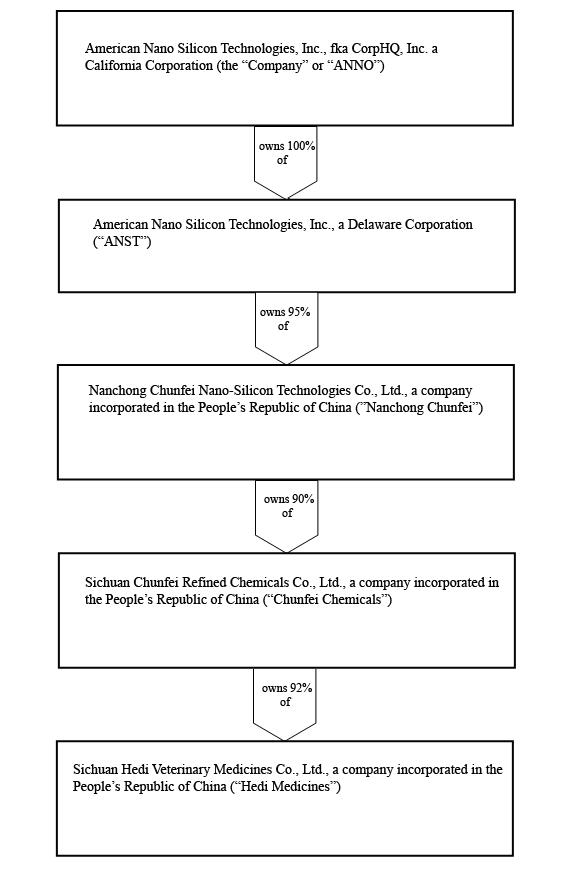

American Nano-Silicon Technologies, Inc. (“ANST”) was incorporated on August 8, 2006 under the laws of the State of Delaware. On August 26, 2006, ANST acquired 95% interest of Nanchong Chunfei Nano-Silicon Technologies Co., Ltd. (“Nanchong Chunfei”), a company incorporated in the People’s Republic of China (the “PRC” or “China”) in August 2006. Nanchong Chunfei directly owns 90% of Sichuan Chunfei Refined Chemicals Co., Ltd. (“Chunfei Chemicals”), a Chinese corporation established under the laws of PRC on January 6, 2006. Chunfei Chemicals itself owns 92% of Sichuan Hedi Veterinary Medicines Co., Ltd. (“Hedi Medicines”), also a Chinese company incorporated under the law of PRC on June 27, 2002.

The Company's business is approved for:

1, Nanchong Chunfei nano-crystalline silicon technology Limited’s business scope is: production and sale of household chemical products, fine chemical products, chemical raw and auxiliary materials, nano-technology development and research, and nano-crystalline silicon production and sales.

2, Sichuan Chunfei Refine Chemical Company Limited’s business scope is: production and sale of household chemical products, fine chemical products, cosmetics, chemical raw and auxiliary materials.

3, Sichuan Hedi animal Pharmaceutical Co., Ltd’s business scope is: production and sale of animal medicine powder, feed additives.

Our Business

Nanchong Chunfei was organized to produce and sell fine chemical products and chemical intermediaries and Chinese herbal medicines for animal use, and to perform research and development in the fields of nano-technology and micro-nano silicon products.

Since the establishment, the Chinese Companies have been establishing management systems and corporate governance structures, hiring and training personnel, and developing business and investment plan.

Industry overview and market condition

According to statistical data collected by the Refined Chemicals’ Information Center, the annual demand for non-phosphorus auxiliary agent in the Chinese detergent and washing products industry is more than one million tons. Use of non-phosphorus agents will continue to grow as wider areas of China follow the international practice of banning the use of phosphorus in detergents. Micro-Nano Silicon™ can perform better than market leader 4A zeolite at a similar price, currently around 3,000 Yuan/ton. The Company believes that the prospects in this 3 billion Yuan market are bright.

Sichuan, the Company's headquarter, is a major production base of the Chinese detergent industry. Provincial requirement for non-phosphorus auxiliary agent is about 200,000 tons/year, or about 20% of Chinese domestic demand. Nearby Chongqing and Chengdu cities are home to several large-scale plastic and rubber plants which use a large amount of white carbon black, for which Micro-Nano Silicon™ can substitute in its fine reinforcing agent application.

Other emerging applications for Micro-Nano Silicon™ are as catalysts and surfactants for fine chemical production, and in nano-metric functional ceramics -- new high-tech ceramics specially designed for air purification and water treatment. Experts have predicted that by 2010, the market sales value of high-tech ceramics materials will reach 150 billion US dollars worldwide.

The Micro-Nano Silicon product are ultra fine crystal structured chemicals that is used in the chemical industry for phosphorus additives, as a reinforcing agent for the rubber industry, and for paint and cover agents for coatings in the paper-making industry.

The Micro-Nano Silicon product is currently the only sub-nano new material for large-scale production in China and is to be used as a substitute for current chemical agents.

Micro-Nano Silicon™ is the most effective non-phosphorus auxiliary agent available in the market today. It will compete against the most commonly used phosphorus-free auxiliary agent in synthetic detergent, 4A zeolite which is inferior to Micro-Nano Silicon™ at ion-exchange, and slow-acting at energy-saving lower wash temperatures. Other disadvantages of 4A Zeolite are that it is insoluble in water, liable to re-deposit dirt, and tending to dull the color of clothes after washing. Micro-Nano Silicon™ addresses all these deficiencies.

Micro-Nano Silicon™ is adaptable to many uses. At present the Chinese Companies’ market research indicates that Micro-Nano Silicon™ should gain broad acceptance in the Chinese washing products industry. However, should it lose that market, the Chinese Companies expect to be able to sell Micro-Nano Silicon to the Chinese petrochemical, plastics, rubber, paper, ceramics and other industries. The equipment and techniques of the production line are similarly adaptable, which allows the Chinese Companies to switch to producing white carbon black, alumina, calcium phosphate and other chemical products with simple modifications and variation of key inputs.

Our Products

Currently, one core product of our company is Micro-Nano Silicon™, so called because of its ultra-micro crystalline structure and its major ingredient, silicon. Its basic building blocks are silicon dioxide and quartz. Under the effect of a special catalyst, those materials polymerize and crystallize into the compound of this chemical formula:

Na Na Na

| | |

O O O

| | |

Na—O—Si—O—Al—O—Si—O—Na

| |

O O

| |

Na Na

This is a three-dimensional crystal with a tetravalent and electrically neutral silicon atom. The aluminum atom is a trivalent atom sharing four oxygen atoms with one negative charge combined. The hole in the middle of the crystal can capture a positive ion. The compound can have complex reaction with ions of calcium, magnesium, iron, copper, and manganese. Since it is ultra-white, ultra-small, phosphorus-free, with special crystalline structure and chelating and filtering performance, this unique compound lends itself to a use in washing products, as well as cosmetics and other products.

The Company have completed the pilot-scale test of Micro-Nano Silicon™; output of the pilot plant is currently about 10 tons per day. The pilot-scale test products have been successfully used by leading Chinese washing products companies Chengdu Lanfeng Group, White Cat Group and Libai Group. Actual customer orders for this first phase amounted to 20,500 tons of Micro-Nano Silicon™.

Micro-Nano Silicon™ can effectively chelate calcium and magnesium ions in water, softening it in order to improve the washing effect and to prevent damage to clothes. In this way the product actually reduces the amount of detergent required for washing a load of laundry, so it is an economical product. In addition to its use in the detergent industry, Micro-Nano Silicon™ can also be used as a water softener for drinking water and sewage treatment.

Additionally, Micro-Nano Silicon™ can substitute for white carbon black in applications in the paper, rubber, plastics, petrochemical and ceramics industries. White carbon black commonly sells in China at a market price of 4000~8000 Yuan/ton for ordinary, and 9000~20000 Yuan/ton for ultrafine.

With good hiding power and color strength, Micro-Nano Silicon™ can also substitute for titanium dioxide (TiO2) powder in paints, inks, synthetic fibers, plastics, paper, ceramics and other products. Delivery price in the U.S. for TiO2 powder was about 1980~2200 Dollars/ton, and that in Europe was approximately 2050~2060 Euros/ton, and the spot price in the Asia-Pacific region was about 2200~2300 Dollar/ton (CandF basis). Annual average consumption growth in China for TiO2 is expected to continue to be around 10%~15% for the near future.

Our Chinese subsidiaries’ location offers advantages with respect to supply of raw materials and proximity to end users.

Quartz is a raw material used in the production of Micro-Nano Silicon™, and there are abundant quartz mineral resources in nearby Chinese districts such as Hechuan and Qingchuan. Another raw material, bauxite, is abundant relatively nearby in Hechuan, Chongqing, Guizhou and other places within reasonable distance for truck or railway transportation. Similarly other raw materials such as caustic soda, calcined soda, sodium sulphate anhydrous and calcium carbonate powder are also available in large quantity, good quality and competitive cost in Sichuan province.

Raw Materials and Our Principal Suppliers

Our raw materials mainly come from Chinese domestic suppliers (detailed in the table below), and the supply of raw materials could meet our production needs and normal reserves. Our production are based on the monthly marketing plan to determine the production tasks, and then to determine the purchase of raw materials.

Name of Raw Material Suppliers | Source of Raw Materials |

| Chongqing Shangshe Chemical Co.,Ltd. | Chongqing City |

| Sichuan Sirui Packing Co., Ltd. | Sichuan Yibing |

| Shehong Hengtong Logistics Co., Ltd. | Sichuan Shehong |

| Zigong Haoming Chemical Co.,Ltd. | Sichuan Zigong |

| Nanchong South Chemical Co.,Ltd. | Sichuan Nanchong |

| Chongqing Tianditong Co.,Ltd. | Chongqing City |

| Guizhou Yindu Trade Service Co.,Ltd. | Guizhou Zunyi |

| Nanchong Shirong Chemical Co.,Ltd. | Sichuan Nanchong |

The raw materials and packaging materials have their rich resources and a wide range of supply channels, not a monopoly supplier. Therefore, we don’t have any independence on one or more suppliers.

Employees

As of September 30, 2008, the Company has 174 full-time staff and employees.

| Department | | Headcount | |

| Management and Administrative | | 39 | |

| Sales and Marketing | | 15 | |

| Production | | 112 | |

| Research and Development | | 8 | |

| | | | |

| Total | | 174 | |

Among our eight scientific researchers, six of whom are senior researchers. We do not have any payment obligations for any retirees and are not currently retaining any contractors. The Company currently has 174 full time employees. The Company purchases pension insurance, medical insurance and unemployment insurance for all full time employees in accordance with China's Labor Law. The Company's employees are not represented by a collective bargaining unit. Management considers the Company's relationships with its employees to be satisfactory, and management believes that should the Company require additional employees at any of its facilities that it will be able to meet its needs from the locally available labor pool.

Distribution

We are currently producing and selling Micro- Nano Silicon. For the fiscal year ended September 30, 2008, we sold to a large number of regional businesses and enterprises engaged in the chemicals business. Since then, we have modified our sales method to include distributors who purchase our product for re-sale. This product is only available to a selected group of distributors and can not be directly purchased by the general public. Chongqing Trading Company, Ltd is the most significant customer among all distributors. While it comprises over 32% of total sales for the year ended September 30, 2008. In the future, if we are able to raise additional capital, we expect to add more sales force to market our products beyond our regional base of customers.

Customers

The following is a breakdown of the Company's substantial customers by revenues. For the fiscal year ended September 30, 2008, we sold to a large number of businesses and enterprises engaged in the chemicals business. Since then, we have modified our sales method to include distributors who purchase our product for re-sale. We do not believe we are dependent on their partnerships to maintain our sales growth. We feel the relationships we have established in the past will enable to us to continue to market and sell our products if the relationships with our current distributors were to terminate.

| Customer Name | Percentage of Revenues for FY ended 9/30/08 |

| | |

| Chongqing Trading Company Ltd | 32.81% |

| Sichuan Chunfei Daily Chemical Ltd | 12.43% |

| Nanchong Nanfang Chemical Company | 6.76% |

| Chengdu Jilong Chemcial Company | 5.60% |

Marketing and Advertising

In 2008, we launched a new distribution method, by having other companies in chemical business to represent our products and re-sell it to the third parties including both institutions and individuals. From time to time, we also sponsor charitable events such as hope school projects, to increase public awareness of benefits of our products and spread the acceptance and influence of our brand.

Competition

The market for 4A zeolite is very fragmented and therefore we believe we can rely on the loyalty of our existing customers along with our high quality customer service to build our reputation and product acceptance.

Some inbound competitors within 4A zeolite market include:

| · | Tex Chemical Co. Ltd.: established in 1989 and based in Shanghai, is a exporter and producer of detergent agents including 4A zeolite and sodium percarbonate. We estimate their annual revenue to be approximately $10 million USD. |

| · | Xiamen Xindakang Inorganic Materials Co, Ltd.: established in 2005 and based in Fujian, is a manufacturer of 4A zeolite. We estimate their annual revenue to be approximately $8 million USD. |

| · | Laiyu Chemical Co. Ltd: established in 1984 and based in Shandong, is a trading company that trades on 4A zeolite as an agent. We estimate their revenue from 4A zeolite to be approximately $2 million USD. |

| · | Changsha Xianshanyuan Agriculture & Technology Co., Ltd: established in 2006 and based in Hunan, is a manufacturer of 4A zeolite. We estimate their revenue to be approximately $5 million USD. |

Based upon our surveys and research, we believe the detergent agent, which 4A zeolite is the current industry standard in China, is very segmented and regionalized. By the feedback we have received from our customers, we believe that the unique features of our product enable us to challenge 4A zeolite for the leadership in the industry in the near future.

We do not face direct competition for our products in local marketplace. This is due to the fact that our product is unique and patented technology. Currently, the industry standard is 4A zeolite, a phosphorus-free auxiliary agent. Although we do not face direct competition, we do have high barriers to widely spread the acceptance of our products. We are primarily rely on the loyalty of our existing customers along with our high quality customer service to build our reputation and product acceptance.

Government Regulation

Our production processes, which we own the patents are under the long-term protection by the China Government Laws and Regulations. Our production and operations were examined and approved by China Government's authority, and is supported and protected through its business license scope. We have also been granted the right to import and export products, and because of China's relatively lower cost of labor, we anticipate that our products will also be proven competitive throughout the international market.

Cost of Compliance with Environmental Laws

Management believes that our factory standards meet the requirements of the China Government and local environmental laws and other related regulations, workers security regulations, Air Protection Law, Water Resources Protection Act, Resource Conservation Recovery Act, and so on. We have all licenses required for our production, and we have been in compliance with all applicable governmental laws and regulations.

Management believes that our products are environmentally-friendly green products, no pollution to the environment, and its protection fees will not cause any significant impact on the operation, the production costs, and our profitability and competitiveness. However, management can give no assurance that new or additional laws or regulations relating to the environment will not result in material costs in the future.

The Company is governed by the Income Tax Law of the People’s Republic of China concerning foreign invested companies, which, until January 2008, generally subject to tax at a statutory rate of 33% (30% state income tax plus 3% local income tax) on income reported in the statutory financial statements after appropriate tax adjustments.

On March 16, 2007, the National People's Congress of China approved the Corporate Income Tax Law of the People's Republic of China (the New CIT Law), which is effective from January 1, 2008. Under the new law, the corporate income tax rate applicable to all companies, including both domestic and foreign-invested companies, will be 25%, replacing the current applicable tax rate of 33%. For the year ended September 30, 2008 and 2007, the income tax provision for the Company was $63,786 and $0, respectively.

The income tax expense of $63,786 for the year ended September 30, 2008 was solely attributed to the net income from our sales of Micro-Nano Silicon products.

Foreign Exchange

Foreign exchange in China is principally governed by the PRC Foreign Exchange Control Regulations promulgated by the State Council and enforced on April 1, 1996, and the Regulations on the Administration of Foreign Exchange Settlement, Sale and Payment promulgated by the State Council and enforced on July 1, 1996. Under these regulations, upon payment of the applicable taxes, foreign-invested enterprises may convert the dividends they received in Renminbi into foreign currencies and remit such amounts outside China through their foreign exchange bank accounts.

If a foreign-invested enterprise needs foreign exchange transaction services in relation to the current account item, it may make such payment through its foreign exchange account or make an exchange and payment at one of the designated foreign exchange banks by providing applicable receipts and certificates, and without an approval from the State Administration of Foreign Exchange, or SAFE. If a foreign-invested enterprise distributes dividends to its shareholders, it will be deemed as foreign exchange transaction services in relation to the current account item, therefore, as long as it provides the board resolutions and other documents authorizing the distribution of dividends, it may make such payment through its foreign exchange account or make an exchange and payment at one of the designated foreign exchange banks.

Notwithstanding the above, foreign exchange conversion matters under the capital account item are still subject to regulatory restrictions, and a prior approval from SAFE or its relevant branches is required before conversion between Renminbi and other foreign currencies.

ITEM 2. DESCRIPTION OF PROPERTIES

Production and Facilities

Our plants are located on land for which we paid $872,976 for a land use right. This gives us the exclusive use of the property until July 2051. This form of land tenure is roughly comparable to a leasehold interest under the system of land tenure. The project site is located at the Chunfei Industrial Park, Gaoping, Nanchong, Sichuan province, in an economic development zone plentifully supplied with low-cost water, electricity, gas and communication facilities. It is near the Chengdu-to-Nanchong expressway, the Nanchong-to-Chongqing expressway and the Nanchong railway station, and enjoys very good transportation links.

The Company announced the completion of a new product line in 2008. The new Nano-Silicon product line has a designed annum output capacity of 50K tons. The new launched product line has been offically placed in the Company's daily operational activities on July, 2008.

Through the end of its 2008 financial year, the Chinese Companies had invested $3,142,216 in gross plant and equipment, and had construction in progress of $2,751,576. The equipment is standard chemical industry equipment, saleable in the second-hand equipment market in the worst case scenario.

The construction area of the Raymond mill plant is 1,500 square meters (50m×30m), enough for installation of 4 sets of Raymond mills and ancillary equipment. There will be a ball milling plant of brick-concrete structure, 2,500 square meters (50m×50m), with ten underground pools for storing Ball milling slurry. The firing plant construction area will be 8,000 square meters with four sets of rotary kilns systems, and there will be a tank area of 5,000 square meters.

There will be a calcination plant of 3,000 square meters, large enough for installation of six melting furnaces for water glass, adjacent to a storage area of 2,500 square meters.

The main engineering plant of the Micro-Nano Silicon™ process includes a 3,500 square meter filtration plant of brick-concrete construction and two floors – the first floor is for bauxite slug filtration plant and the second for filtration of Micro-Nano Silicon™ finished products. A cooling system is to be installed in the plant ceiling.

There is to be a brick-concrete reaction tank and reserve tank installation 3,500 square meter total construction area as well as a proposed flash evaporation plant of 2,160 square meters and five cooling pools of 1,000 square meters. Most raw materials are to be stored in two warehouses of total construction area of 8,000 square meters, while quartz can be left outside in a 4,500 square meter yard. Another two warehouses of total construction area of 8,000 square meters are to contain 40 kilo bags of finished product. At plant capacity of 416 daily tons, these finished goods storage facilities can handle ten days of production.

Other facilities will include a 2,000 square meter machine repair plant, offices and dormitories of 15,000 square meters, and a chemical laboratory of 1500 square meters.

Item 1A. Risk Factors

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risk Related To Our Business

We need additional capital

We require substantial additional financing to implement our business plan and to cover unanticipated expenses. The timing and amount of any such capital requirements cannot be predicted at this time. There can be no assurance that any such financing will be available on acceptable terms, or at all. If financing is not available on satisfactory terms or at all, we may be unable to expand at the rate desired or we may be required to significantly curtail or cease our business activities. If additional funds are raised through the issuance of equity or convertible debt securities, the percentage ownership of our shareholders will be reduced and such securities may have rights, preferences and privileges senior to those of the common stock. If capital is raised through a debt financing, we would likely become subject to restrictive covenants relating to our operations and finances. Our revenues and gross profits have decreased in the first three quarters of 2008 since we lack sufficient working capital to purchase the raw materials needed to produce Micro-Nano Silicon, thereby reducing the amount of Micro-Nano Silicon available for we to sell.

We face significant competition and may not be able to successfully compete

Our current and future competitors are likely to have substantially greater financial, technical and marketing resources, larger customer bases, longer operating histories, more developed infrastructures, greater brand recognition, and more established relationships in the industry than we have, each of which may allow them to gain greater market share. As a result, our competitors may be able to develop and expand their offerings more rapidly, adapt to new or emerging technologies and changes more quickly, take advantage of acquisitions and other opportunities more readily, achieve greater economies of scale and devote greater resources to the marketing and sale of their technology and products than we can. There can be no assurance that we will successfully differentiate our current and proposed technology and products from the technologies and products of our competitors, that the marketplace will consider our technology and products to be superior to competing technologies and products, or that we will be able to compete successfully with our competitors.

Our business is subject to factors outside our control

Our business may be affected by a variety of factors, many of which are outside our control. Factors that may affect our business include:

| · | The success of our research and development efforts |

| · | Competition |

| · | Our ability to attract qualified personnel |

| · | The amount and timing of operating costs and capital expenditures necessary to establish our business, operations, and infrastructure |

| · | Government regulation |

| · | General economic conditions as well as economic conditions specific to the nanotechnology industry |

Our ability to protect our patents and other proprietary rights is uncertain, exposing us to the possible loss of competitive advantage

Our intellectual property rights are important to our business. Currently, there are limited safeguards in place to protect our intellectual property rights, and the protective steps we intend to take may be inadequate to deter misappropriation of those rights. We have filed and intend to continue to file patent applications. If a particular patent is not granted, the value of the invention described in the patent would be diminished. Further, even if these patents are granted, they may be difficult to enforce. Efforts to enforce our patent rights could be expensive, distracting for management, unsuccessful, cause our patents to be invalidated, and frustrate commercialization of products. Additionally, even if patents are issued, and are enforceable, others may independently develop similar, superior, or parallel technologies to any technology developed by us, or our technology may prove to infringe upon patents or rights owned by others. Thus, the patents held by us may not afford us any meaningful competitive advantage. Our inability to maintain our intellectual property rights could have a material adverse effect on our business, financial condition and ability to implement our business plan. If we are unable to derive value from our intellectual property, the value of your investment in us will decline.

We maybe exposed to potential risks relating to our internal controls over financial reporting and our ability to have those controls attested to by our independent auditors

As directed by Section 404 of the Sarbanes-Oxley Act of 2002, or SOX 404, the SEC adopted rules requiring public companies to include a report of management on the company’s internal controls over financial reporting in their annual reports, including Form 10-K. We are subject to this requirement commencing with our fiscal year ending September 30, 2008 and a report of our management is included under Item 8A of this Annual Report on Form 10-K. In addition, SOX 404 requires the independent registered public accounting firm auditing a company’s financial statements to also attest to and report on the operating effectiveness of such company’s internal controls. However, this annual report does not include an attestation report because under current law, we will not be subject to these requirements until our annual report for the fiscal year ending September 30, 2009. We can provide no assurance that we will comply with all of the requirements imposed thereby. There can be no assurance that we will receive a positive attestation from our independent auditors. In the event we identify significant deficiencies or material weaknesses in our internal controls that we cannot remediate in a timely manner or we are unable to receive a positive attestation from our independent auditors with respect to our internal controls, investors and others may lose confidence in the reliability of our financial statements.

Risks Related to Our Company

We depend on key personnel and attracting qualified management personnel

Our success depends to a significant degree upon the management skills of Pu Fachun, our President. The loss of his services would have a material adverse effect on our company. We do not maintain key person life insurance for any of our officers or employees. Our success also depends upon our ability to attract and retain qualified marketing and sales executives and other personnel. We compete for qualified personnel against numerous companies, including larger, more established companies with significantly greater financial resources. There can be no assurance that we will be successful in attracting or retaining such personnel, and the failure to do so could have a material adverse effect on our business.

Risks Related to Our Industry

We are facing the risk of failure to spread and widely stretch our product nationally, because our product is currently not recognized as an industry standard. The industry standard is 4A zeolite, a phosphorus-free auxiliary agent. Although we do not face direct competition, we do have high barriers to widely spread the acceptance of our products. We are primarily rely on the loyalty of our existing customers along with our high quality customer service to build our reputation and product acceptance.

Risks Related to Doing Business in China.

Adverse changes in economic and political policies of the People's Republic of China government could have a material adverse effect on the overall economic growth of China, which could adversely affect our business.

Political Risk

All of our operations are outside the United States and are located in China, which exposes it to risks, such as exchange controls and currency restrictions, currency fluctuations and devaluations, changes in local economic conditions, changes in Chinese laws and regulations, exposure to possible expropriation or other Chinese government actions, and unsettled political conditions. These factors may have a material adverse effect on our operations or on our business, results of operations and financial condition.

China's economy differs from the economies of most developed countries in many respects, including with respect to the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. While the People's Republic of China economy has experienced significant growth in the past 20 years, growth has been uneven across different regions and among various economic sectors of China. The People's Republic of China government has implemented various measures to encourage economic development and guide the allocation of resources. Some of these measures benefit the overall People's Republic of China economy, but may also have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax regulations that are applicable to us. Since early2004, the People's Republic of China government has implemented certain measures to control the pace of economic growth. Such measures may cause a decrease in the level of economic activity in China, which in turn could adversely affect our results of operations and financial condition.

Economic Risk

We face risks associated with currency exchange rate fluctuation, any adverse fluctuation may adversely affect our operating margins.

Although the Company is incorporated in the United States, all of our current revenues are in Chinese currency. Conducting business in currencies other than US dollars subjects the Company to fluctuations in currency exchange rates that could have a negative impact on our reported operating results. Fluctuations in the value of the US dollar relative to other currencies impact our revenue; cost of revenues and operating margins and result in foreign currency translation gains and losses. Historically, the Company has not engaged in exchange rate hedging activities. Although the Company may implement hedging strategies to mitigate this risk, these strategies may not eliminate our exposure to foreign exchange rate fluctuations and involve costs and risks of their own, such as ongoing management time and expertise, external costs to implement the strategy and potential accounting implications.

Legal Risk

The Chinese legal and judicial system may negatively impact foreign investors.

In 1982, the National Peoples Congress amended the Constitution of China to authorize foreign investment and guarantee the "lawful rights and interests" of foreign investors in China. However, China's system of laws is not yet comprehensive. The legal and judicial systems in China are still rudimentary, and enforcement of existing laws is inconsistent. Many judges in China lack the depth of legal training and experience that would be expected of a judge in a more developed country. Because the Chinese judiciary is relatively inexperienced in enforcing the laws that do exist, anticipation of judicial decision-making is more uncertain than would be expected in a more developed country. It may be impossible to obtain swift and equitable enforcement of laws that do exist, or to obtain enforcement of the judgment of one court by a court of another jurisdiction. China's legal system is based on written statutes; a decision by one judge does not set a legal precedent that is required to be followed by judges in other cases. In addition, the interpretation of Chinese laws may be varied to reflect domestic political changes.

The promulgation of new laws, changes to existing laws and the preemption of local regulations by national laws may adversely affect foreign investors. However, the trend of legislation over the last 20 years has significantly enhanced the protection of foreign investment and allowed for more control by foreign parties of their investments in Chinese enterprises. There can be no assurance that a change in leadership, social or political disruption, or unforeseen circumstances affecting China's political, economic or social life, will not affect the Chinese government's ability to continue to support and pursue these reforms. Such a shift could have a material adverse effect on the company business and prospects.

Risk Related to Our Common Stock

Our common stock price may fluctuate significantly

Because we are a developmental stage company, there are few objective metrics by which our progress may be measured. Consequently, we expect that the market price of our common stock will likely fluctuate significantly. We do not expect to generate substantial revenue from the license or sale of our nanotechnology for several years, if at all. In the absence of product revenue as a measure of our operating performance, we anticipate that investors and market analysts will assess our performance by considering factors such as:

| · | announcements of developments related to our business; |

| · | developments in our strategic relationships with scientists within the nanotechnology field; |

| · | our ability to enter into or extend investigation phase, development phase, commercialization phase and other agreements with new and/or existing partners; |

| · | announcements regarding the status of any or all of our collaborations or products; |

| · | market perception and/or investor sentiment regarding nanotechnology as the next technological wave; |

| · | announcements regarding developments in the nanotechnology field in general; |

| · | the issuance of competitive patents or disallowance or loss of our patent rights; and |

| · | quarterly variations in our operating results. |

We will not have control over many of these factors but expect that our stock price may be influenced by them. As a result, our stock price may be volatile and you may lose all or part of your investment.

Our securities are very thinly traded. Accordingly, it may be difficult to sell shares of the common stock without significantly depressing the value of the stock. Unless we are successful in developing continued investor interest in our stock, sales of our stock could continue to result in major fluctuations in the price of the stock.

Shareholder interest in us may be substantially diluted as a result of the sale of additional securities to fund our plan of operation

Our Certificate of Incorporation authorizes the issuance of an aggregate of 200,000,000 shares of common stock. Of these shares, an aggregate of 26,558,767 shares of common stock have been issued, and no shares of preferred stock have been issued. Therefore, approximately 173,441,233 shares of common stock remain available for issuance by us to raise additional capital, in connection with technology development or for other corporate purposes. Issuances of additional shares of common stock would result in dilution of the percentage interest in our common stock of all stockholders ratably, and might result in dilution in the tangible net book value of a share of our common stock, depending upon the price and other terms on which the additional shares are issued. In addition, the issuance of additional shares of common stock upon exercise of the warrants, or even the prospect of such issuance, may be expected to have an effect on the market for the common stock, and may have an adverse impact on the price at which shares of common stock trade.

If securities or industry analysts do not publish research reports about our business, or if they make adverse recommendations regarding an investment in our stock, our stock price and trading volume may decline. The trading market for our common stock will be influenced by the research and reports that industry or securities analysts publish about our business. We do not currently have and may never obtain research coverage by industry or securities analysts. If no industry or securities analysts commence coverage of us, the trading price of our stock could be negatively impacted. In the event we obtain industry or security analyst coverage, if one or more of the analysts downgrade our stock or comment negatively on our prospects, our stock price would likely decline. If one of more of these analysts cease to cover us or our industry or fails to publish reports about us regularly, our common stock could lose visibility in the financial markets, which could also cause our stock price or trading volume to decline.

We do not intend to declare dividends on our common stock

We will not distribute cash to our stockholders until and unless we can develop sufficient funds from operations to meet our ongoing needs and implement our business plan. The time frame for that is inherently unpredictable, and you should not plan on it occurring in the near future, if at all.

Our common stock is deemed to be “penny stock” as that term is defined in Rule 3a51-1 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These requirements may reduce the potential market for our common stock by reducing the number of potential investors. This may make it more difficult for investors in our common stock to sell shares to third parties or to otherwise dispose of them. This could cause our stock price to decline. Penny stocks are stock:

| § | With a price of less than $5.00 per share; |

| § | That are not traded on a “recognized” national exchange; |

| § | Whose prices are not quoted on the NASDAQ automated quotation system (NASDAQ listed stock must still have a price of not less than $5.00 per share); or |

| § | In issuers with net tangible assets less than $2.0 million (if the issuer has been in continuous operation for at least three years) or $10.0 million (if in continuous operation for less than three years), or with average revenues of less than $6.0 million for the last three years. |

Broker-dealers dealing in penny stocks are required to provide potential investors with a document disclosing the risks of penny stocks. Moreover, broker-dealers are required to determine whether an investment in a penny stock is a suitable investment for a prospective investor. Many brokers have decided not to trade “penny stocks” because of the requirements of the penny stock rules and, as a result, the number of broker-dealers willing to act as market makers in such securities is limited. In the event that we remain subject to the “penny stock rules” for any significant period, there may develop an adverse impact on the market, if any, for our securities. Because our securities are subject to the “penny stock rules,” investors will find it more difficult to dispose of our securities.

Item 1B. Unresolved Staff Comments.

We currently do not have any unresolved comments or issues with the Staff of the Corporation Finance Division of the U.S. Securities and Exchange Commission.

We have not been involved in any material litigation or claims arising from our ordinary course of business. We are not aware of any material potential litigation or claims against us which would have a material adverse effect upon our results of operations or financial condition.

None.

PART II

ITEM 5. MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Market Information

Our common stock is currently quoted on the OTCBB under the symbol “ANNO”. There is a limited trading market for our common stock. The following table sets forth the range of high and low bid quotations for each quarter within the last two fiscal years, and the subsequent interim period. These quotations as reported by the OTCBB reflect inter-dealer prices without retail mark-up, mark-down, or commissions and may not necessarily represent actual transactions.

| Period | | High | | | Low | |

| Quarter Ended March 31, 2006 | | $ | 1.01 | | | $ | 0.06 | |

| Quarter Ended June 30, 2006 | | $ | 0.06 | | | $ | 0.06 | |

| Quarter Ended September 30, 2006 | | $ | 0.06 | | | $ | 0.06 | |

| Quarter Ended December 31, 2006 | | $ | 0.06 | | | $ | 0.06 | |

| | | | | | | | | |

| Quarter Ended March 31, 2007 | | $ | 0.06 | | | $ | 0.06 | |

| Quarter Ended June 30, 2007 | | $ | 0.25 | | | $ | 0.06 | |

| Quarter Ended September 30, 2007 | | $ | 0.35 | | | $ | 0.15 | |

| Quarter Ended December 31, 2007 | | $ | 0.40 | | | $ | 0.11 | |

| | | | | | | | | |

| Quarter Ended March 31, 2008 | | $ | 0.11 | | | $ | 0.11 | |

| Quarter Ended June 30, 2008 | | $ | 1.23 | | | $ | 0.25 | |

| Quarter Ended September 30, 2008 | | $ | 1.10 | | | $ | 0.51 | |

| Quarter Ended December 31, 2008 | | $ | 2.00 | | | $ | 0.51 | |

Security Holders

As of September 30, 2008 in accordance with our transfer agent records, we had 1,328 shareholders of record, holding 26,558,767 common shares.

Equity Compensation Plans

We do not have any equity compensation plans. We have not granted any stock options or other equity awards since our inception.

The following discussion should be read in conjunction with the financial statements and the notes thereto appearing elsewhere in this Form 10-K. The following discussion contains forward-looking statements reflecting our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. You are also urged to carefully review and consider our discussions regarding the various factors which affect our business, including the information provided under the caption “Risk Factors.” See the cautionary note regarding forward-looking statements at the beginning of Part I of this Form 10-K.

General

American Nano-Silicon Technologies, Inc. (the “Company” or “ANNO”) was originally incorporated in the State of California on September 6, 1996 as CorpHQ, Inc. (“CorpHQ).

Initially, the Company was engaged in the business activities of providing marketing, advertising and financial consulting services until December 31, 1999. Since then, the Company explored a few business ventures and switched its business strategy to be involved in the development, acquisition and operation of minority-owned portfolio companies focus on consumer products and commercial technologies, as well as development of consulting and other business relationships with client companies that have demonstrated synergies with the Company’s core businesses.

On May 24, 2007, the Company entered into a Stock Purchase and Share Exchange Agreement (the “Exchange Agreement”) with American Nano Silicon Technologies, Inc., a Delaware corporation (“ANST”), the shareholders of ANST and Nanchong Chunfei Nano-Silicon Technologies Co., Ltd. (“Nanchong Chunfei”), a corporation registered in the People’s Republic of China (“PRC” or “China”).

In connection with the Exchange Agreement, the following major events occurred:

| · | On August 9, 2007, the Company changed its name from CorpHQ, Inc. to American Nano Silicon Technologies, Inc. and effected a 1302 to 1 reverse stock split and decreased its authorized common stock from 2 billion shares to 200 millions shares with a par value of $0.0001. |

| · | On November 9, 2007, the Company issued 25,740,000 shares of New common stock to the shareholders of ANST in exchange for all of the outstanding stock of ANST, resulting in ANST becoming a wholly-owned subsidiary of the Company. |

| · | The Board of Directors elected to discontinue its original business activities in the Company and has transferred all of the existing assets and liabilities to South Bay Financial Solutions, Inc. |

The Share Exchange resulted in a change in control of the Company as the Shareholders of ANST became the majority shareholders of the Company. Also, the original shareholders and directors of the Company resigned and the shareholders of ANST were elected as directors of the Company and appointed as its executive officers.

For accounting purpose, this transaction has been accounted for as a reverse acquisition under the purchase method. Accordingly, ANST and its subsidiaries are treated as the continuing entity for accounting purposes.

American Nano-Silicon Technologies, Inc. (“ANST”) was incorporated on August 8, 2006 under the laws of the State of Delaware. On August 26, 2006, ANST acquired 95% interest of Nanchong Chunfei Nano-Silicon Technologies Co., Ltd. (“Nanchong Chunfei”), a company incorporated in the People’s Republic of China (the “PRC” or “China”) in August 2006. Nanchong Chunfei directly owns 90% of Sichuan Chunfei Refined Chemicals Co., Ltd. (“Chunfei Chemicals”), a Chinese corporation established under the laws of PRC on January 6, 2006. Chunfei Chemicals itself owns 92% of Sichuan Hedi Veterinary Medicines Co., Ltd. (“Hedi Medicines”), also a Chinese company incorporated under the law of PRC on June 27, 2002.

Collectively, ANST, Nachong Chunfie, Chunfei Chemicals and Hedi Medicines are hereinafter referred to as the “Company”.

The Company is primarily engaged in the business of manufacturing and distributing refined consumer chemical products through its subsidiary, Chunfei Chemicals, and veterinary drugs through another subsidiary, Hedi Medicines.

The accompanying consolidated financial statements of the Company and its subsidiaries have been prepared in accordance with generally accepted accounting principles in the United States of America.

The information included in this Form 10-K should be read in conjunction with the Company’s Form 10/A filing dated on September 18, 2008.

Overview

We primarily manufacture and sell refined consumer chemical products. Currently, our products are sold throughout Sichuan province, China. We expect to incur substantial additional costs, including costs related to ongoing research and development activities. Our future cash requirements depend on many factors, including continued scientific progress in research and development programs. The time and costs involved in obtaining regulatory approvals, the costs involved in filing, prosecuting and enforcing patents, competing technological and market development and the cost of product commercialization. We will require external financing to sustain our operations, perhaps for a significant period of time. We intend to seek additional funding through grants and through public or private financing transactions. Successful future operations are subject to a number of technical and business risks, including our continued ability to obtain future funding, satisfactory product development, regulatory approvals and market acceptance for our products.

Results of Operations for Fiscal Year Ended September 30, 2008 Compared with the Fiscal Year Ended September 30, 2007

Our net sales totaled $2.85 million for the fiscal year ended September 30, 2008, a 38.02% increase compared to our net sales of $2.07 million for the fiscal year ended September 30, 2007. The growth in net sales primarily resulted from the completion of our new Nano-Silicon product line. The product line was launched and placed in our daily operational activities in July 2008. The new launched product line has a designed annual output of 50K tons. Because of this new launched product line which materially enhanced our production capacity, we expect that we are going to realize a considerable increase of net sales in the coming year of 2009.

In addition, our new distribution method that was launched in 2008 also contributed in our increasing net sales of 2008 compare to 2007, primarily by the use of sale agents to represent our products and re-sale to the third parties. The positive feedback and awareness of our products has resulted in higher sales compared to the traditional distribution channel.

We are currently producing and selling Micro-Nano Silicon. For the fiscal year ended September 30, 2008, we sold to a large number of our products to regional businesses and enterprises engaged in chemical business. We have modified our sales method to include distributors who purchase our product for re-sale. Our products are only available to a selected group of distributors and can not be directly purchased by the general public. Chongqing Trading Company, Ltd is the most significant customer among all distributors who makes up over 32% of our total sales for the year ended September 30, 2008. In the future, if we are able to raise additional capital, we expect to add more sales force to market our products beyond our regional base of customers.

Cost of Sales

Cost of sales for the year ended September 30, 2008 was $2.48 million compared with $1.64 million for the fiscal year ended September 30, 2007. This 51.21% increase in cost of sales was primarily caused by the increased sales volume and the cost of raw materials.

Gross profit

Gross profit decreased to $0.37 million for the fiscal year ended September 30, 2008 from that of $0.42 million of the year ended September 30, 2007. This represents a 12.48% decline, which reflects the increase in the cost of goods sold. Our gross profit margin decreased to 13.12% from 20.69% for the same period of the previous year primarily due to the increase of the cost of the sales as we started the new product line of micro nano silicon. Once we commence full scale production, we expect our gross profit margin to be significantly higher as we are able to control over our production costs because of the production volume.

Selling expenses and General and Administrative Expenses

Our selling, general and administrative, or SG&A, expenses include costs associated with salaries and other expenses related to research and other administrative costs. In addition, we have incurred expenses through the use of consultants and other outsourced service providers.

Our overall SG&A expenses were $244,162 or 8.54% of net sales for the fiscal year ended September 30, 2008 compared with $443,154 or 21.40% of net sales for the year ended September 30, 2007. This higher level SG&A expenses to net sales ratio for the previous year was because we incurred a significant professional fees of $200,000 related to going public. We did not incur such expense for the current year.

Net Loss

Net Loss from continuing operation decreased to $6,739 for the fiscal year ended September 30, 2008 compared with that of $90,780 for the fiscal year ended September 30, 2007. This 92.57% decrease in loss is a result of the increased production and sales of our Micro-Nano Silicon products. As this product segment is gaining more market awareness, we were able to generate a net income before tax of $173,774 for the year ended September 30, 2008 compare to the net loss of $37,225 for the year ended September 30, 2007.

During the next twelve months, we expect to take the following steps in connection with the further development of our business and the implementation of our plan of operations:

We will require outside capital to implement our business plan. We will have to expand our management team with qualified personnel. However, there can be no assurance that our management will be successful in completing the capital raise to implement the corporate infrastructure that supports operations at the levels called for by our business plan, or to conclude a successful sales and marketing plan with third parties to attain significant market penetration or that will generate sufficient revenues to meet our expenses or to achieve or maintain profitability.

We break down our property, plant and equipment for years ended September 30, 2008 and 2007 as follows:

| | | As of September 30, | |

| | | 2008 | | | 2007 | |

| Machinery & equipment | | $ | 2,776,378 | | | $ | 604,835 | |

| Automobiles | | | - | | | | 56,867 | |

| Plant & Buildings | | | 4,241,069 | | | | 2,846,200 | |

| Total | | | 7,017,447 | | | | 3,507,902 | |

| | | | | | | | | |

| Less: accumulated depreciation | | | (256,622 | ) | | | (84,868 | ) |

| Add: construction in process | | | 2,751,577 | | | | 2,425,410 | |

| | | | | | | | | |

| Property, plant and equipment | | $ | 9,512,402 | | | $ | 5,848,444 | |

Liquidity and Capital Resources

As of September 30, 2008, we had cash and cash equivalents of $16,194 and working capital of $103,916, as compared with cash and cash equivalents of $423,700 and working capital of $922,358 as of September 30, 2007, representing a decline in cahs and cash equivalent of $407,506 or 2516.4%. The decrease was mainly attributed to the capital expenditure in our newly launched Nano-Silicon product line. Also, our decreased net working capital was primarily a result of the disposal of our existing inventories.

In terms of Long-term Liability, our long-term loan is consist of the following:

| | | Balance at September 30, | |

| | | 2008 | | | 2007 | |

| a) Loan payable to Nanchong City Bureau of Finance | | | | | | |

maturing in 2011, a fixed interest rate of 0.47% per month | | $ | 589,110 | | | $ | 533,846 | |

| | | | | | | | | |

| b) Individual loans from unrelated parties, | | | | | | | | |

| fixed interest range from 3% to 10% per month, | | | | | | | | |

| all with three year term, maturing in 2010 | | | 88,367 | | | | 96,607 | |

| | | | | | | | | |

| c) Individual loans from unrelated parties, | | | | | | | | |

| bear no interest, maturing in 2011 | | | 1,906,892 | | | | - | |

| | | | | | | | | |

| c) Individual loans from unrelated parties with a fixed interest | | | | | | | | |

| rate of 2% per month untill 12/31/2007, maturing on 3/30/2010 | | | 58,911 | | | | 306,961 | |

| | | | | | | | | |

| Total | | $ | 2,643,280 | | | $ | 937,414 | |

We have engaged in related party transactions that are reasonably likely to affect our liquidity or the availability of capital resources. The Company periodically has receivables from its affiliates, owned by Mr. Fachun Pu, the majority shareholder and the president of the Company. The Company expects all outstanding amounts due from its affiliate will be repaid and no allowance is considered necessary. The Company also periodically borrows money from its shareholders to finance the operations.

For the fiscal years ended September 30, 2008 and 2007, the details of loans to/from related parties are as follows:

| | | 2008 | | | 2007 | |

| Receivable from Chunfei Daily Chemical | | $ | 244,837 | | | $ | 176,492 | |

| Receivable from Chunfei Real Estate | | | 106,040 | | | | 96,096 | |

| Receivable from officer and employees | | | - | | | | - | |

| Total | | | 350,877 | | | | 272,588 | |

| | | | | | | | | |

| Loan From Chunfei Daily Chemical | | $ | - | | | $ | 7,207 | |

| Loan From Chunfei Real Estate | | | 47,209 | | | | 108,136 | |

| Loan From Zhang Qiwei (shareholder) | | | 1,473 | | | | 74,738 | |

| Loan From Pu, Fachun (shareholder) | | | 857,155 | | | | - | |

| Loan From other officer and employee | | | 7,364 | | | | 10,142 | |

| Total | | | 913,201 | | | | 200,223 | |

Cash used in investing activities totaled $3.16 million for the fiscal year ended September 30, 2008 compared to $423,672 for the fiscal year ended September 30, 2007. We invested $3,070,385 more in the constructions of our plant and equipments for the year ended September 30, 2008 than for the year ended September 30, 2007.

Cash generated from financing activities totaled $2,201,368 in fiscal year 2008 as compared to $628,535 in 2007. This was mainly attributed to the more proceeds received from our long term loan. In fiscal year 2008, we have came up with the proceeds from long term loan of $1.53 million which we have no of that during fiscal year 2007.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements.

Critical Accounting Policies

Our consolidated financial information has been prepared in accordance with U.S. GAAP, which requires us to make judgments, estimates and assumptions that affect (1) the reported amounts of our assets and liabilities, (2) the disclosure of our contingent assets and liabilities at the end of each fiscal period and (3) the reported amounts of revenues and expenses during each fiscal period. We continually evaluate these estimates based on our own historical experience, knowledge and assessment of current business and other conditions, our expectations regarding the future based on available information and reasonable assumptions, which together form our basis for making judgments about matters that are not readily apparent from other sources. Some of our accounting policies require a higher degree of judgment than others in their application.

When reviewing our financial statements, the following should also be considered: (1) our selection of critical accounting policies, (2) the judgment and other uncertainties affecting the application of those policies, and (3) the sensitivity of reported results to changes in conditions and assumptions. We believe the following accounting policies involve the most significant judgment and estimates used in the preparation of our financial statements.

Revenue recognition

The Company utilizes the accrual method of accounting. In accordance with the provisions of Staff Accounting Bulletin (“SAB”) 104, sales revenue is recognized when products are shipped and payments of the customers and collection are reasonably assured. Payments received before all of the relevant criteria for revenue recognition are satisfied are recorded as unearned revenue.

The Company follows the guidance of the Securities and Exchange Commission’s Staff Accounting Bulletin 104 (“SAB No.104”) for revenue recognition. The Company records revenue when persuasive evidence of an arrangement exists, product delivery has occurred and the title and risk of loss transfer to the buyer, the sales price to the customer is fixed or determinable, and collectability is reasonably assured. For sale of AM, HM, live stock feed additive, and FGW biological preservatives for agriculture businesses, the Company derives the majority of its revenue from sales contracts with customers with revenues being generated upon the shipment of goods. Persuasive evidence of an arrangement is demonstrated via invoice, product delivery is evidenced by warehouse shipping log as well as a signed bill of lading from the trucking or rail company and title transfers upon shipment, based on either free on board (“FOB”) factory or destination terms; the sales price to the customer is fixed upon acceptance of the purchase order and there is no separate sales rebate, discount, or volume incentive. When the Company recognizes revenue, no provisions are made for returns because, historically, there have been very few sales returns and adjustments that have impacted the ultimate collection of revenues.

Foreign currency translation

The Company’s functional currency is the Renminbi (“RMB”). For financial reporting purposes, RMB has been translated into United States dollars ("USD") as the reporting currency. Assets and liabilities are translated at the exchange rate in effect at the balance sheet date. Revenues and expenses are translated at the average rate of exchange prevailing during the reporting period. Translation adjustments arising from the use of different exchange rates from period to period are included as a component of stockholders' equity as "Accumulated other comprehensive income". Gains and losses resulting from foreign currency translations are included in accumulated other comprehensive income. There is no significant fluctuation in exchange rate for the conversion of RMB to USD after the balance sheet date.

Recent Accounting Pronouncements