0001415995 nyli:C000231049Member nyli:IberdrolaSACTIMember 2024-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22227

New York Life Investments ETF Trust

(Exact name of registrant as specified in charter)

51 Madison Avenue

New York, NY 10010

(Address of principal executive offices) (Zip code)

Kirk C. Lehneis

New York Life Investment Management LLC

51 Madison Avenue

New York, NY 10010

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-888-474-7725

Date of fiscal year end: April 30

Date of reporting period: October 31, 2024

Item 1. Reports to Stockholders.

| (a) | The Report to Shareholders is attached herewith. |

NYLI Hedge Multi-Strategy Tracker ETF

(formerly, IQ Hedge Multi-Strategy Tracker ETF)

SEMIANNUAL SHAREHOLDER REPORT | October 31, 2024

This semi-annual shareholder report contains important information about NYLI Hedge Multi-Strategy Tracker ETF (the "Fund") for the period of May 1, 2024 to October 31, 2024.You can find additional information about the Fund at dfinview.com/NYLIM. You can also request this information by contacting us at 1-888-474-7725.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference1,Footnote Reference2 |

|---|

| NYLI Hedge Multi-Strategy Tracker ETF | $28 | 0.54% |

| Footnote | Description |

Footnote1 | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

Footnote2 | Annualized. |

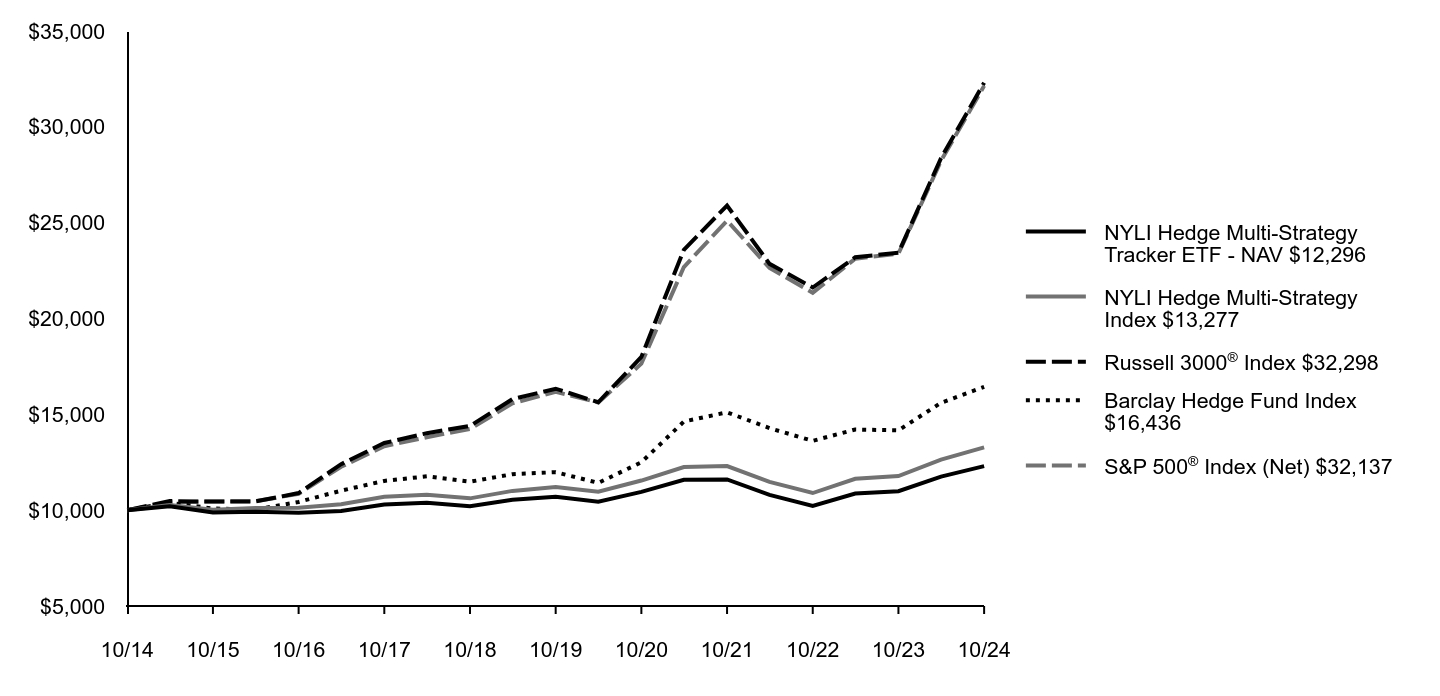

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 semiannual reporting periods of the Fund (or for the life of the Fund, if shorter). It assumes a $10,000 initial investment at the beginning of the first fiscal period in an appropriate, broad-based securities market index and other additional indexes, if applicable, for the same period.

| NYLI Hedge Multi-Strategy Tracker ETF - NAV 12,296 | NYLI Hedge Multi-Strategy Index13,277 | Russell 3000® Index32,298 | Barclay Hedge Fund Index16,436 | S&P 500® Index (Net)32,137 |

|---|

| 10/14 | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 |

| 04/15 | 10,205 | 10,267 | 10,474 | 10,382 | 10,408 |

| 10/15 | 9,882 | 10,018 | 10,449 | 10,088 | 10,455 |

| 04/16 | 9,920 | 10,113 | 10,455 | 10,029 | 10,465 |

| 10/16 | 9,866 | 10,132 | 10,892 | 10,428 | 10,855 |

| 04/17 | 9,961 | 10,307 | 12,398 | 11,017 | 12,262 |

| 10/17 | 10,300 | 10,703 | 13,504 | 11,527 | 13,338 |

| 04/18 | 10,384 | 10,802 | 14,016 | 11,765 | 13,807 |

| 10/18 | 10,203 | 10,616 | 14,395 | 11,483 | 14,235 |

| 04/19 | 10,546 | 11,005 | 15,793 | 11,878 | 15,576 |

| 10/19 | 10,702 | 11,204 | 16,337 | 11,983 | 16,175 |

| 04/20 | 10,436 | 10,963 | 15,629 | 11,423 | 15,617 |

| 10/20 | 10,957 | 11,546 | 17,995 | 12,497 | 17,645 |

| 04/21 | 11,586 | 12,252 | 23,587 | 14,623 | 22,684 |

| 10/21 | 11,606 | 12,302 | 25,894 | 15,106 | 25,107 |

| 04/22 | 10,798 | 11,479 | 22,852 | 14,278 | 22,637 |

| 10/22 | 10,216 | 10,894 | 21,617 | 13,616 | 21,339 |

| 04/23 | 10,871 | 11,634 | 23,196 | 14,208 | 23,120 |

| 10/23 | 10,988 | 11,780 | 23,429 | 14,164 | 23,385 |

| 04/24 | 11,752 | 12,636 | 28,369 | 15,602 | 28,228 |

| 10/24 | 12,296 | 13,277 | 32,298 | 16,436 | 32,137 |

NYLI Hedge Multi-Strategy Tracker ETF | 1

| Average Annual Total Returns for the Period-Ended October 31, 2024 | Inception Date | Six MonthsFootnote Reference1 | One Year | Five Years | Ten Years |

|---|

| NYLI Hedge Multi-Strategy Tracker ETF - NAV | 03/25/2009 | 4.63% | 11.91% | 2.82% | 2.09% |

NYLI Hedge Multi-Strategy IndexFootnote Reference2 | | 5.07% | 12.71% | 3.45% | 2.87% |

Russell 3000®IndexFootnote Reference3 | | 13.85% | 37.86% | 14.60% | 12.44% |

S&P 500® Index (Net)Footnote Reference4 | | 13.85% | 37.42% | 14.72% | 12.38% |

Barclay Hedge Fund IndexFootnote Reference5 | | 5.35% | 16.04% | 6.52% | 5.09% |

| Footnote | Description |

Footnote1 | Not annualized. |

Footnote2 | The NYLI Hedge Multi-Strategy Index is the underlying index of the Fund. The NYLI Hedge Multi-Strategy Index seeks to achieve performance similar to the overall hedge fund universe by replicating the “beta” portion of the hedge fund return characteristics over longer term periods and not on a daily basis. |

Footnote3 | In accordance with new regulatory requirements, the Fund has selected the Russell 3000® Index, which measures the performance of the largest 3,000 U.S. companies representing approximately 96% of the investable U.S. equity market, as a replacement for the S&P 500® Index (Net). |

Footnote4 | The S&P 500® (Net) Index is a well-known broad-based unmanaged index of 500 stocks, which is designed to represent the equity market in general. |

Footnote5 | The Barclay Hedge Fund Index is a measure of the average return of all hedge funds (excepting Funds of Funds) in the Barclay database. |

The Fund's past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Performance figures may reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. Visit newyorklifeinvestments.com/etf for the most recent performance.

| Fund's net assets | $625,647,502 |

| Total number of portfolio holdings | 151 |

| Portfolio turnover rate | 19% |

NYLI Hedge Multi-Strategy Tracker ETF | 2

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund; percentages indicated are based on the Fund's net assets.

Top Ten Holdings and/or Issuers*

| iShares Floating Rate Bond ETF | 17.2% |

| Invesco DB U.S. Dollar Index Bullish Fund | 7.1% |

| SPDR Bloomberg Convertible Securities ETF | 6.8% |

| SPDR Bloomberg Investment Grade Floating Rate ETF | 5.4% |

| Vanguard Short-Term Inflation-Protected Securities ETF | 5.4% |

| iShares Convertible Bond ETF | 3.8% |

| NYLI Merger Arbitrage ETF | 3.8% |

| iShares 0-5 Year TIPS Bond ETF | 3.6% |

| Vanguard FTSE Developed Markets ETF | 3.4% |

| iShares Core MSCI EAFE ETF | 3.0% |

* Excluding short-term investments

| Floating Rate - Investment Grade Funds | 22.6% |

| Short-Term Investments | 11.8 |

| Convertible Bond Funds | 10.6 |

| Treasury Inflation Protected Securities Funds | 9.0 |

| U.S. Dollar Fund | 7.1 |

| International Equity Core Funds | 6.4 |

| Merger Arbitrage Funds | 4.9 |

| Emerging Equity Funds | 4.6 |

| Bank Loan Funds | 4.4 |

| U.S. Large Cap Core Funds | 3.5 |

Availability of Additional Information

At dfinview.com/NYLIM, you can find additional information about the Fund, including the Fund's:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-888-474-7725.

Shareholders who have consented to receive a single annual or semiannual shareholder report at a shared address may revoke this consent by contacting their financial intermediary.

NYLI Hedge Multi-Strategy Tracker ETF | 3

NYLI Merger Arbitrage ETF

(formerly, IQ Merger Arbitrage ETF)

SEMIANNUAL SHAREHOLDER REPORT | October 31, 2024

This semi-annual shareholder report contains important information about NYLI Merger Arbitrage ETF (the "Fund") for the period of May 1, 2024 to October 31, 2024.You can find additional information about the Fund at dfinview.com/NYLIM. You can also request this information by contacting us at 1-888-474-7725.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference1 |

|---|

| NYLI Merger Arbitrage ETF | $40 | 0.76% |

| Footnote | Description |

Footnote1 | Annualized. |

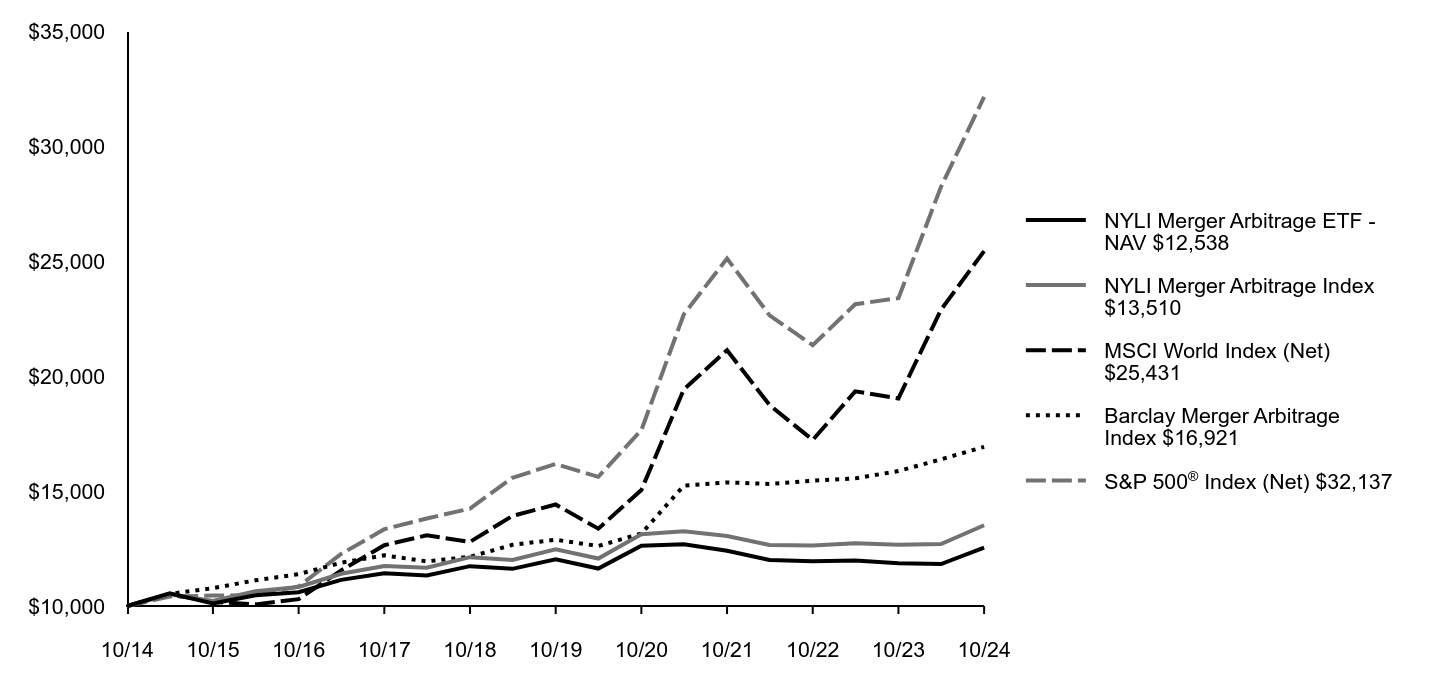

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 semiannual reporting periods of the Fund (or for the life of the Fund, if shorter). It assumes a $10,000 initial investment at the beginning of the first fiscal period in an appropriate, broad-based securities market index and other additional indexes, if applicable, for the same period.

| NYLI Merger Arbitrage ETF - NAV 12,538 | NYLI Merger Arbitrage Index13,510 | MSCI World Index (Net)25,431 | Barclay Merger Arbitrage Index16,921 | S&P 500® Index (Net)32,137 |

|---|

| 10/14 | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 |

| 04/15 | 10,551 | 10,512 | 10,509 | 10,527 | 10,408 |

| 10/15 | 10,106 | 10,223 | 10,177 | 10,777 | 10,455 |

| 04/16 | 10,467 | 10,640 | 10,071 | 11,116 | 10,465 |

| 10/16 | 10,602 | 10,825 | 10,298 | 11,384 | 10,855 |

| 04/17 | 11,135 | 11,401 | 11,546 | 11,882 | 12,262 |

| 10/17 | 11,421 | 11,743 | 12,643 | 12,202 | 13,338 |

| 04/18 | 11,331 | 11,662 | 13,072 | 11,941 | 13,807 |

| 10/18 | 11,733 | 12,124 | 12,789 | 12,136 | 14,235 |

| 04/19 | 11,616 | 12,004 | 13,919 | 12,662 | 15,576 |

| 10/19 | 12,033 | 12,468 | 14,413 | 12,880 | 16,175 |

| 04/20 | 11,628 | 12,064 | 13,362 | 12,609 | 15,617 |

| 10/20 | 12,621 | 13,120 | 15,042 | 13,150 | 17,645 |

| 04/21 | 12,682 | 13,248 | 19,418 | 15,235 | 22,684 |

| 10/21 | 12,402 | 13,042 | 21,122 | 15,372 | 25,107 |

| 04/22 | 12,000 | 12,656 | 18,735 | 15,309 | 22,637 |

| 10/22 | 11,946 | 12,634 | 17,219 | 15,450 | 21,339 |

| 04/23 | 11,975 | 12,731 | 19,331 | 15,549 | 23,120 |

| 10/23 | 11,863 | 12,661 | 19,024 | 15,867 | 23,385 |

| 04/24 | 11,825 | 12,691 | 22,885 | 16,377 | 28,228 |

| 10/24 | 12,538 | 13,510 | 25,431 | 16,921 | 32,137 |

NYLI Merger Arbitrage ETF | 1

| Average Annual Total Returns for the Period-Ended October 31, 2024 | Inception Date | Six MonthsFootnote Reference1 | One Year | Five Years | Ten Years |

|---|

| NYLI Merger Arbitrage ETF - NAV | 11/16/2009 | 6.04% | 5.69% | 0.83% | 2.29% |

NYLI Merger Arbitrage IndexFootnote Reference2 | | 6.45% | 6.70% | 1.62% | 3.05% |

MSCI World Index (Net)Footnote Reference3 | | 11.13% | 33.68% | 12.03% | 9.78% |

S&P 500® Index (Net)Footnote Reference4 | | 13.85% | 37.42% | 14.72% | 12.38% |

Barclay Merger Arbitrage IndexFootnote Reference5 | | 3.32% | 6.64% | 5.61% | 5.40% |

| Footnote | Description |

Footnote1 | Not annualized. |

Footnote2 | The NYLI Merger Arbitrage Index is the underlying index of the Fund. The NYLI Merger Arbitrage Index seeks to employ a systematic investment process designed to identify opportunities in companies whose equity securities trade in developed markets, including the U.S., and which are involved in announced mergers, acquisitions and other buyout-related transactions. |

Footnote3 | The MSCI World Index (Net) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. |

Footnote4 | The S&P 500® (Net) Index is a well-known broad-based unmanaged index of 500 stocks, which is designed to represent the equity market in general. |

Footnote5 | The Barclay Merger Arbitrage Index is a measure of the average net returns of all reporting merger arbitrage funds in the Barclay Hedge database. |

The Fund's past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit newyorklifeinvestments.com/etf for the most recent performance.

| Fund's net assets | $221,792,819 |

| Total number of portfolio holdings | 63 |

| Portfolio turnover rate | 146% |

NYLI Merger Arbitrage ETF | 2

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund; percentages indicated are based on the Fund's net assets.

Top Ten Holdings and/or Issuers*

| Discover Financial Services | 7.3% |

| Catalent, Inc. | 5.5% |

| Juniper Networks, Inc. | 5.0% |

| HashiCorp, Inc., Class A | 4.3% |

| DS Smith PLC | 4.1% |

| Frontier Communications Parent, Inc. | 3.7% |

| Marathon Oil Corp. | 3.4% |

| iShares Short Treasury Bond ETF | 3.3% |

| Smartsheet, Inc., Class A | 3.2% |

| Stericycle, Inc. | 2.8% |

* Excluding short-term investments

| Information Technology | 21.1% |

| Financials | 17.6 |

| Health Care | 10.7 |

| Short-Term Investments | 9.7 |

| Materials | 9.5 |

| Utilities | 8.2 |

| Consumer Discretionary | 6.4 |

| Industrials | 5.6 |

| Communication Services | 4.1 |

| Energy | 3.4 |

Availability of Additional Information

At dfinview.com/NYLIM, you can find additional information about the Fund, including the Fund's:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-888-474-7725.

Shareholders who have consented to receive a single annual or semiannual shareholder report at a shared address may revoke this consent by contacting their financial intermediary.

NYLI Merger Arbitrage ETF | 3

NYLI 500 International ETF

(formerly, IQ 500 International ETF)

SEMIANNUAL SHAREHOLDER REPORT | October 31, 2024

This semi-annual shareholder report contains important information about NYLI 500 International ETF (the "Fund") for the period of May 1, 2024 to October 31, 2024.You can find additional information about the Fund at dfinview.com/NYLIM. You can also request this information by contacting us at 1-888-474-7725.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference1,Footnote Reference2 |

|---|

| NYLI 500 International ETF | $13 | 0.25% |

| Footnote | Description |

Footnote1 | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

Footnote2 | Annualized. |

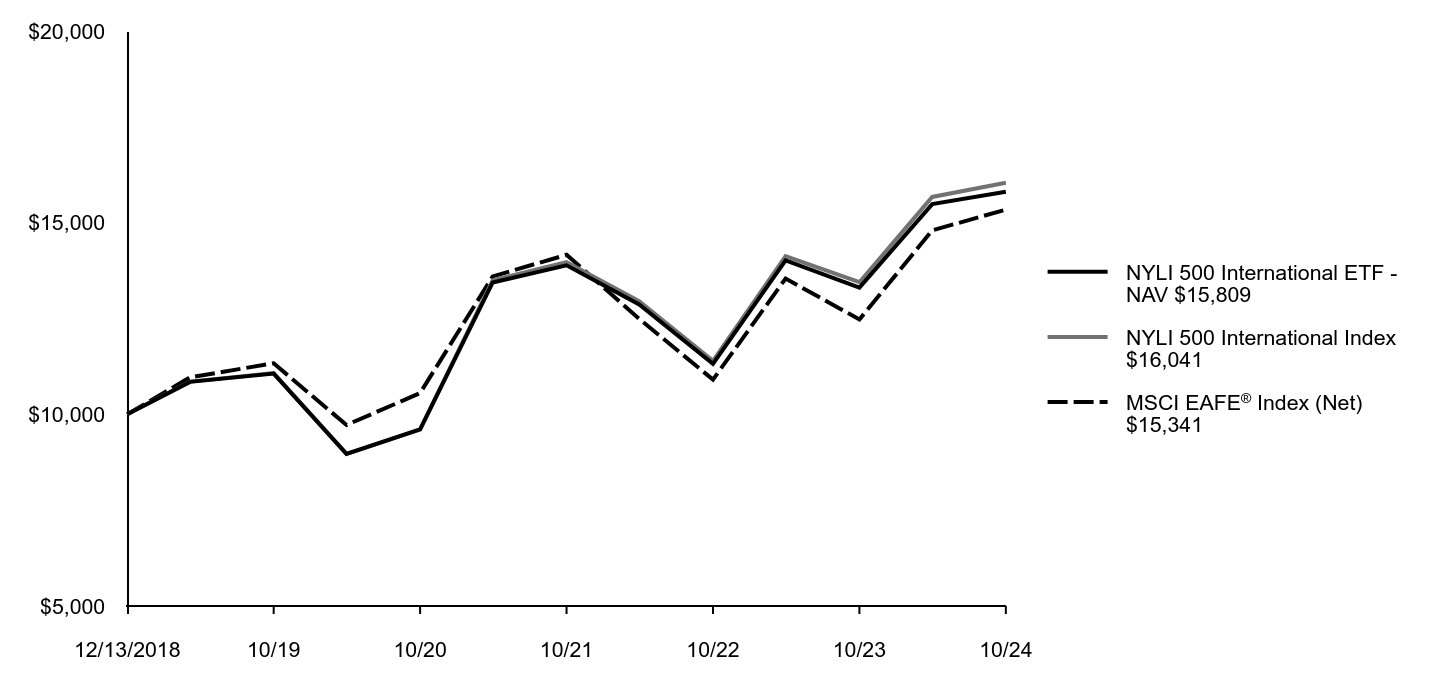

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 semiannual reporting periods of the Fund (or for the life of the Fund, if shorter). It assumes a $10,000 initial investment at the beginning of the first fiscal period in an appropriate, broad-based securities market index and other additional indexes, if applicable, for the same period.

| NYLI 500 International ETF - NAV 15,809 | NYLI 500 International Index16,041 | MSCI EAFE® Index (Net)15,341 |

|---|

| 12/13/2018 | 10,000 | 10,000 | 10,000 |

| 04/30/2019 | 10,847 | 10,853 | 10,965 |

| 10/31/2019 | 11,062 | 11,077 | 11,332 |

| 04/30/2020 | 8,968 | 8,967 | 9,722 |

| 10/31/2020 | 9,609 | 9,607 | 10,555 |

| 04/30/2021 | 13,441 | 13,500 | 13,599 |

| 10/31/2021 | 13,887 | 13,968 | 14,162 |

| 04/30/2022 | 12,865 | 12,949 | 12,491 |

| 10/31/2022 | 11,317 | 11,395 | 10,905 |

| 04/30/2023 | 14,014 | 14,128 | 13,543 |

| 10/31/2023 | 13,308 | 13,446 | 12,475 |

| 04/30/2024 | 15,483 | 15,671 | 14,799 |

| 10/31/2024 | 15,809 | 16,041 | 15,341 |

NYLI 500 International ETF | 1

| Average Annual Total Returns for the Period-Ended October 31, 2024 | Inception Date | Six MonthsFootnote Reference1 | One Year | Five Years | Since Inception |

|---|

| NYLI 500 International ETF - NAV | 12/13/2018 | 2.10% | 18.79% | 7.40% | 8.09% |

NYLI 500 International IndexFootnote Reference2 | | 2.36% | 19.30% | 7.69% | 8.36% |

MSCI EAFE® Index (Net)Footnote Reference3 | | 3.66% | 22.97% | 6.24% | 7.54% |

| Footnote | Description |

Footnote1 | Not annualized. |

Footnote2 | The NYLI 500 International Index is the underlying index of the Fund. The NYLI 500 International Index components are selected and weighted utilizing a rules-based methodology incorporating fundamental factors. The Methodology ranks the universe of eligible securities based on three fundamental factors: Sales, Market Share, and Operating Margin. The Market Share and Operating Margin ranks are determined relative to other eligible securities within the same sector, while the Sales rank is determined relative to all securities within the eligible universe. |

Footnote3 | The MSCI EAFE® Index (Net) consists of international stocks representing the developed world outside of North America. |

The Fund's past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Performance figures may reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. Visit newyorklifeinvestments.com/etf for the most recent performance.

| Fund's net assets | $99,227,173 |

| Total number of portfolio holdings | 502 |

| Portfolio turnover rate | 18% |

NYLI 500 International ETF | 2

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund; percentages indicated are based on the Fund's net assets.

Top Ten Holdings and/or Issuers*

| Deutsche Telekom AG | 1.2% |

| Glencore PLC | 1.2% |

| Toyota Motor Corp. | 1.2% |

| Shell PLC | 1.0% |

| Nestle SA | 1.0% |

| Roche Holding AG | 0.9% |

| TotalEnergies SE | 0.9% |

| Deutsche Post AG | 0.9% |

| Enel SpA | 0.9% |

| Vinci SA | 0.9% |

* Excluding short-term investments

| Japan | 26.8% |

| France | 11.3 |

| Germany | 11.1 |

| United Kingdom | 9.8 |

| Canada | 7.8 |

| United States | 6.6 |

| Australia | 5.1 |

| Spain | 3.3 |

| Italy | 3.0 |

| Switzerland | 2.3 |

Availability of Additional Information

At dfinview.com/NYLIM, you can find additional information about the Fund, including the Fund's:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-888-474-7725.

Shareholders who have consented to receive a single annual or semiannual shareholder report at a shared address may revoke this consent by contacting their financial intermediary.

NYLI 500 International ETF | 3

NYLI Candriam International Equity ETF

(formerly, IQ Candriam International Equity ETF)

SEMIANNUAL SHAREHOLDER REPORT | October 31, 2024

This semi-annual shareholder report contains important information about NYLI Candriam International Equity ETF (the "Fund") for the period of May 1, 2024 to October 31, 2024.You can find additional information about the Fund at dfinview.com/NYLIM. You can also request this information by contacting us at 1-888-474-7725.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference1,Footnote Reference2 |

|---|

| NYLI Candriam International Equity ETF | $8 | 0.15% |

| Footnote | Description |

Footnote1 | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

Footnote2 | Annualized. |

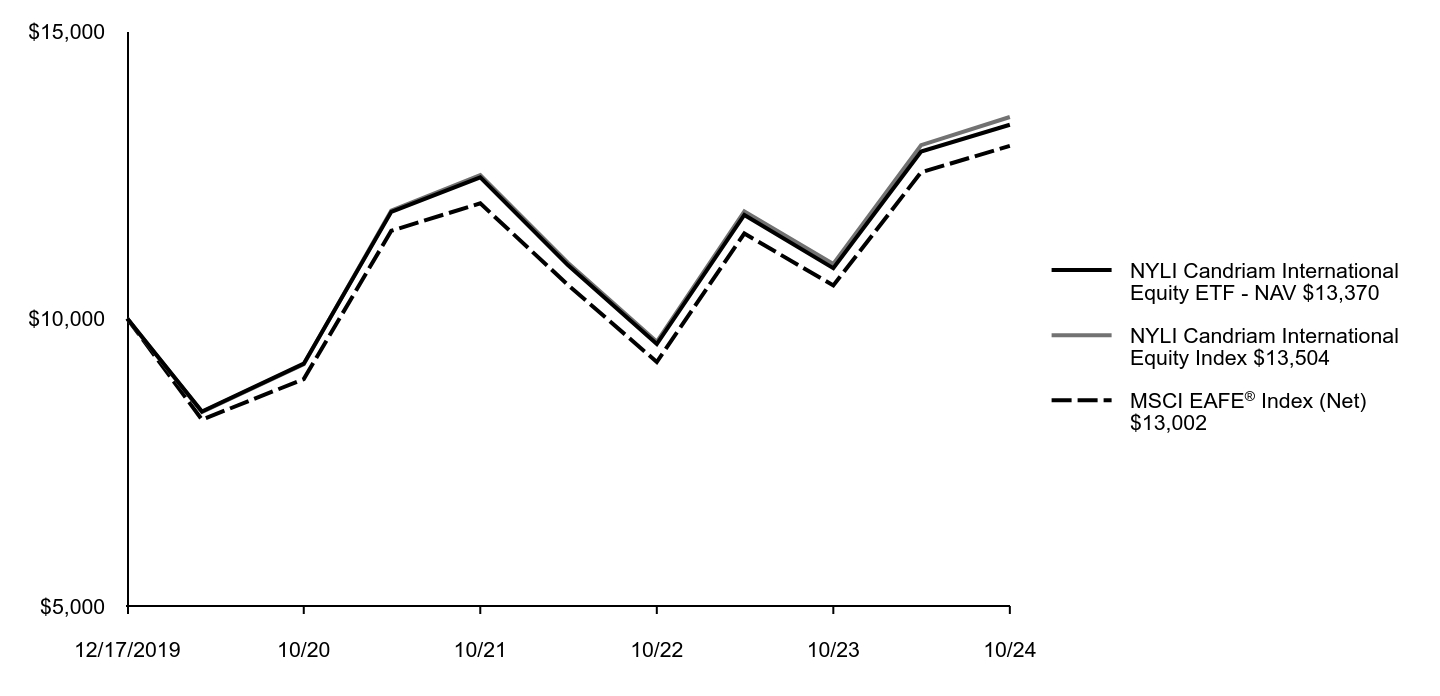

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 semiannual reporting periods of the Fund (or for the life of the Fund, if shorter). It assumes a $10,000 initial investment at the beginning of the first fiscal period in an appropriate, broad-based securities market index and other additional indexes, if applicable, for the same period.

| NYLI Candriam International Equity ETF - NAV 13,370 | NYLI Candriam International Equity Index13,504 | MSCI EAFE® Index (Net)13,002 |

|---|

| 12/17/2019 | 10,000 | 10,000 | 10,000 |

| 04/30/2020 | 8,382 | 8,373 | 8,240 |

| 10/31/2020 | 9,215 | 9,204 | 8,946 |

| 04/30/2021 | 11,856 | 11,877 | 11,526 |

| 10/31/2021 | 12,456 | 12,493 | 12,003 |

| 04/30/2022 | 10,929 | 10,969 | 10,587 |

| 10/31/2022 | 9,556 | 9,595 | 9,243 |

| 04/30/2023 | 11,801 | 11,863 | 11,478 |

| 10/31/2023 | 10,876 | 10,948 | 10,574 |

| 04/30/2024 | 12,903 | 13,015 | 12,543 |

| 10/31/2024 | 13,370 | 13,504 | 13,002 |

NYLI Candriam International Equity ETF | 1

| Average Annual Total Returns for the Period-Ended October 31, 2024 | Inception Date | Six MonthsFootnote Reference1 | One Year | Since Inception |

|---|

| NYLI Candriam International Equity ETF - NAV | 12/17/2019 | 3.62% | 22.93% | 6.14% |

NYLI Candriam International Equity IndexFootnote Reference2 | | 3.75% | 23.34% | 6.36% |

MSCI EAFE® Index (Net)Footnote Reference3 | | 3.66% | 22.97% | 5.53% |

| Footnote | Description |

Footnote1 | Not annualized. |

Footnote2 | The NYLI Candriam International Equity Index is the underlying index of the Fund. The NYLI Candriam International Equity Index is designed to deliver exposure to equity securities of companies meeting environmental, social and corporate governance (ESG) criteria developed by Candriam and weighted using a market-capitalization weighting methodology. |

Footnote3 | The MSCI EAFE® Index (Net) consists of international stocks representing the developed world outside of North America. |

The Fund's past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Performance figures may reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. Visit newyorklifeinvestments.com/etf for the most recent performance.

| Fund's net assets | $196,434,595 |

| Total number of portfolio holdings | 598 |

| Portfolio turnover rate | 9% |

NYLI Candriam International Equity ETF | 2

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund; percentages indicated are based on the Fund's net assets.

Top Ten Holdings and/or Issuers*

| Novo Nordisk A/S, Class B | 3.0% |

| ASML Holding NV | 2.3% |

| Nestle SA | 2.2% |

| SAP SE | 2.1% |

| Roche Holding AG | 2.0% |

| AstraZeneca PLC | 1.8% |

| Novartis AG | 1.8% |

| Toyota Motor Corp. | 1.7% |

| LVMH Moet Hennessy Louis Vuitton SE | 1.5% |

| Commonwealth Bank of Australia | 1.4% |

* Excluding short-term investments

| Japan | 25.8% |

| United Kingdom | 10.5 |

| United States | 8.8 |

| Germany | 8.4 |

| Australia | 7.5 |

| France | 7.2 |

| Switzerland | 5.9 |

| Netherlands | 4.1 |

| Denmark | 3.8 |

| Sweden | 2.9 |

Availability of Additional Information

At dfinview.com/NYLIM, you can find additional information about the Fund, including the Fund's:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-888-474-7725.

Shareholders who have consented to receive a single annual or semiannual shareholder report at a shared address may revoke this consent by contacting their financial intermediary.

NYLI Candriam International Equity ETF | 3

NYLI Candriam U.S. Mid Cap Equity ETF

(formerly, IQ Candriam U.S. Mid Cap Equity ETF)

SEMIANNUAL SHAREHOLDER REPORT | October 31, 2024

This semi-annual shareholder report contains important information about NYLI Candriam U.S. Mid Cap Equity ETF (the "Fund") for the period of May 1, 2024 to October 31, 2024.You can find additional information about the Fund at dfinview.com/NYLIM. You can also request this information by contacting us at 1-888-474-7725.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference1,Footnote Reference2 |

|---|

| NYLI Candriam U.S. Mid Cap Equity ETF | $8 | 0.15% |

| Footnote | Description |

Footnote1 | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

Footnote2 | Annualized. |

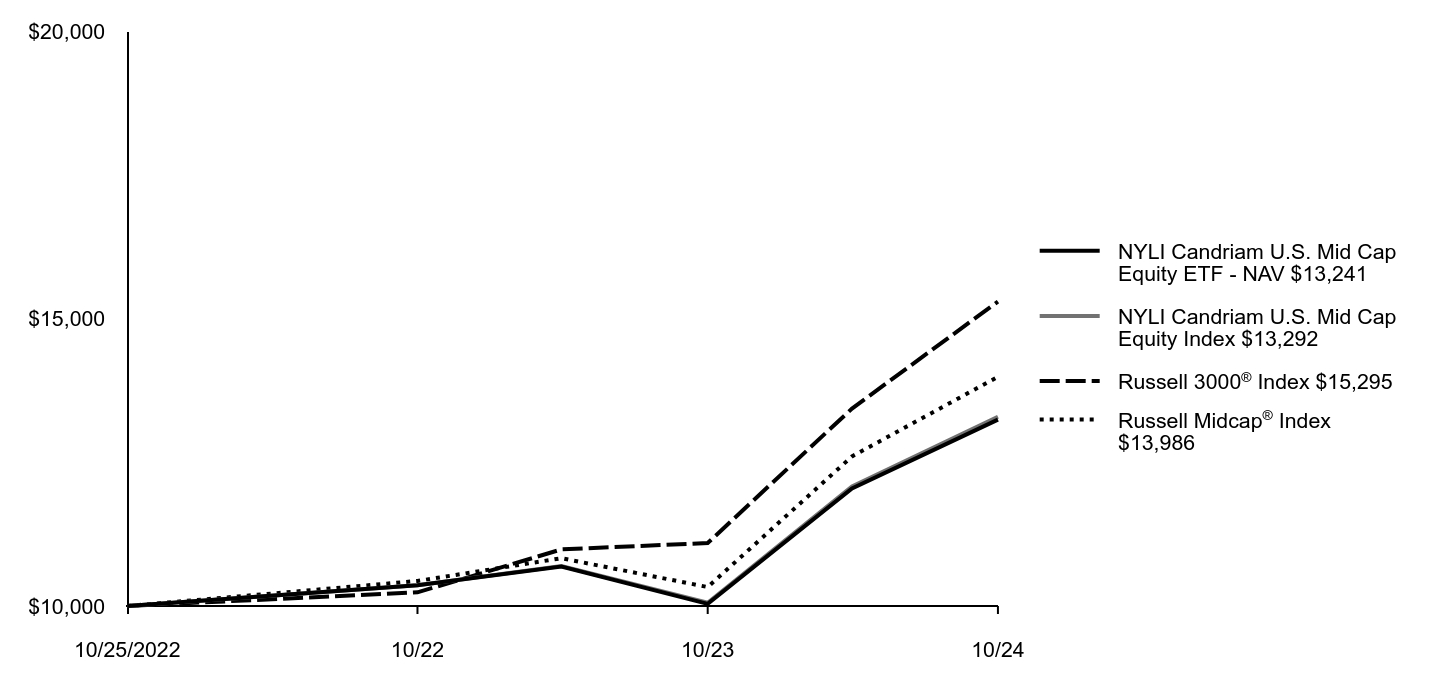

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 semiannual reporting periods of the Fund (or for the life of the Fund, if shorter). It assumes a $10,000 initial investment at the beginning of the first fiscal period in an appropriate, broad-based securities market index and other additional indexes, if applicable, for the same period.

| NYLI Candriam U.S. Mid Cap Equity ETF - NAV 13,241 | NYLI Candriam U.S. Mid Cap Equity Index13,292 | Russell 3000® Index15,295 | Russell Midcap® Index13,986 |

|---|

| 10/25/2022 | 10,000 | 10,000 | 10,000 | 10,000 |

| 10/31/2022 | 10,360 | 10,360 | 10,237 | 10,435 |

| 04/30/2023 | 10,685 | 10,695 | 10,984 | 10,831 |

| 10/31/2023 | 10,038 | 10,057 | 11,095 | 10,330 |

| 04/30/2024 | 12,044 | 12,079 | 13,434 | 12,602 |

| 10/31/2024 | 13,241 | 13,292 | 15,295 | 13,986 |

NYLI Candriam U.S. Mid Cap Equity ETF | 1

| Average Annual Total Returns for the Period-Ended October 31, 2024 | Inception Date | Six MonthsFootnote Reference1 | One Year | Since Inception |

|---|

| NYLI Candriam U.S. Mid Cap Equity ETF - NAV | 10/25/2022 | 9.93% | 31.90% | 14.92% |

NYLI Candriam U.S. Mid Cap Equity IndexFootnote Reference2 | | 10.04% | 32.16% | 15.14% |

Russell 3000®IndexFootnote Reference3 | | 13.85% | 37.86% | 23.43% |

Russell Midcap®IndexFootnote Reference4 | | 10.98% | 35.39% | 18.08% |

| Footnote | Description |

Footnote1 | Not annualized. |

Footnote2 | The NYLI Candriam U.S. Mid Cap Equity Index is the underlying index of the Fund. The NYLI Candriam U.S. Mid Cap Equity Index is designed to deliver exposure to U.S. mid-cap equity securities of companies meeting environmental, social and corporate governance (ESG) criteria developed by Candriam and weighted using a market-capitalization weighting methodology. |

Footnote3 | In accordance with new regulatory requirements, the Fund has selected the Russell 3000® Index, which measures the performance of the largest 3,000 U.S. companies representing approximately 96% of the investable U.S. equity market, as a replacement for the Russell Midcap® Index. |

Footnote4 | The Russell Midcap® Index measures the performance of the mid-cap segment of the U.S. equity universe and is a subset of the Russell 1000® Index, which includes approximately 800 of the smallest securities based on a combination of their market cap and current index membership. |

The Fund's past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Performance figures may reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. Visit newyorklifeinvestments.com/etf for the most recent performance.

| Fund's net assets | $228,101,994 |

| Total number of portfolio holdings | 222 |

| Portfolio turnover rate | 25% |

NYLI Candriam U.S. Mid Cap Equity ETF | 2

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund; percentages indicated are based on the Fund's net assets.

Top Ten Holdings and/or Issuers*

| Packaging Corp. of America | 1.0% |

| EMCOR Group, Inc. | 1.0% |

| Masco Corp. | 0.9% |

| Owens Corning | 0.8% |

| Pentair PLC | 0.8% |

| Yum China Holdings, Inc. | 0.8% |

| KeyCorp | 0.8% |

| Burlington Stores, Inc. | 0.8% |

| Gen Digital, Inc. | 0.8% |

| Kimco Realty Corp. | 0.8% |

* Excluding short-term investments

| Industrials | 20.3% |

| Consumer Discretionary | 14.2 |

| Information Technology | 13.6 |

| Financials | 13.4 |

| Health Care | 11.6 |

| Real Estate | 10.0 |

| Materials | 6.2 |

| Consumer Staples | 5.0 |

| Energy | 2.6 |

| Communication Services | 2.3 |

Availability of Additional Information

At dfinview.com/NYLIM, you can find additional information about the Fund, including the Fund's:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-888-474-7725.

Shareholders who have consented to receive a single annual or semiannual shareholder report at a shared address may revoke this consent by contacting their financial intermediary.

NYLI Candriam U.S. Mid Cap Equity ETF | 3

NYLI Candriam U.S. Large Cap Equity ETF

(formerly, IQ Candriam U.S. Large Cap Equity ETF)

SEMIANNUAL SHAREHOLDER REPORT | October 31, 2024

This semi-annual shareholder report contains important information about NYLI Candriam U.S. Large Cap Equity ETF (the "Fund") for the period of May 1, 2024 to October 31, 2024.You can find additional information about the Fund at dfinview.com/NYLIM. You can also request this information by contacting us at 1-888-474-7725.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference1,Footnote Reference2 |

|---|

| NYLI Candriam U.S. Large Cap Equity ETF | $5 | 0.09% |

| Footnote | Description |

Footnote1 | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

Footnote2 | Annualized. |

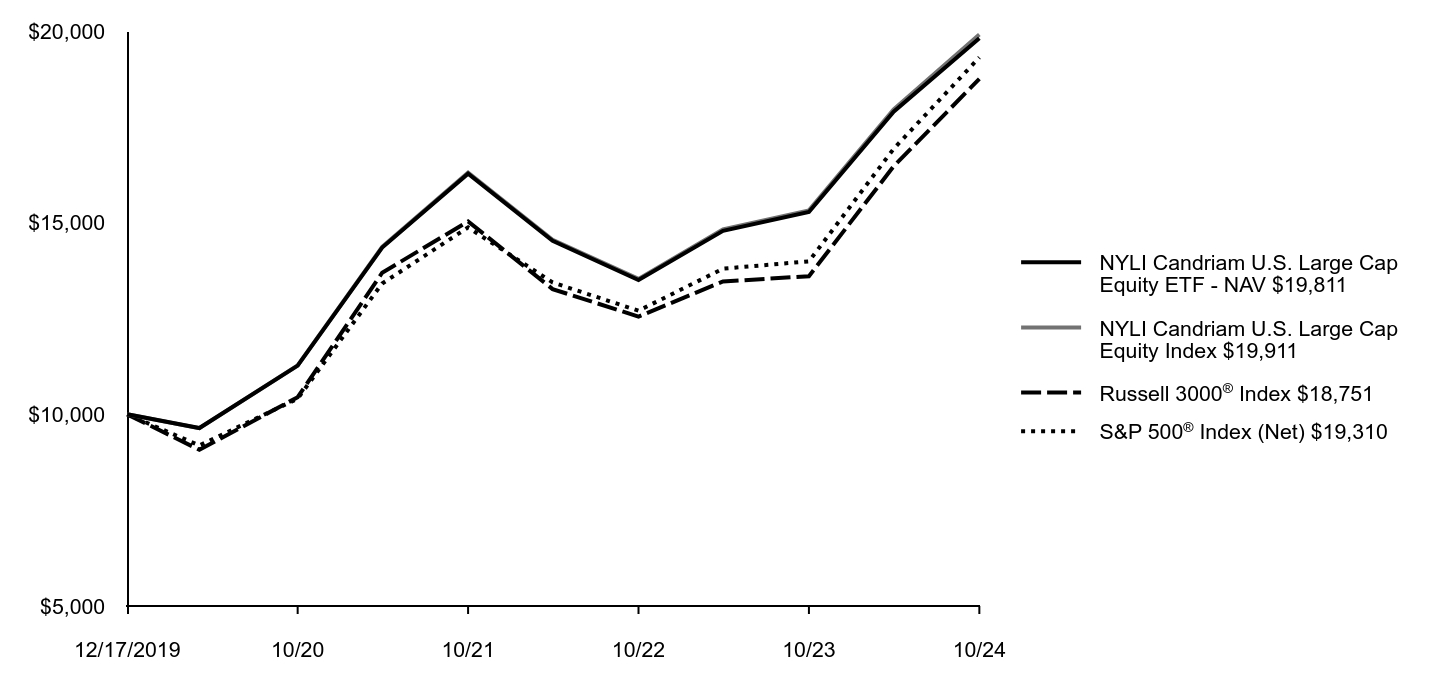

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 semiannual reporting periods of the Fund (or for the life of the Fund, if shorter). It assumes a $10,000 initial investment at the beginning of the first fiscal period in an appropriate, broad-based securities market index and other additional indexes, if applicable, for the same period.

| NYLI Candriam U.S. Large Cap Equity ETF - NAV 19,811 | NYLI Candriam U.S. Large Cap Equity Index19,911 | Russell 3000® Index18,751 | S&P 500® Index (Net)19,310 |

|---|

| 12/17/2019 | 10,000 | 10,000 | 10,000 | 10,000 |

| 04/30/2020 | 9,642 | 9,638 | 9,074 | 9,188 |

| 10/31/2020 | 11,271 | 11,273 | 10,447 | 10,409 |

| 04/30/2021 | 14,352 | 14,367 | 13,694 | 13,413 |

| 10/31/2021 | 16,279 | 16,305 | 15,033 | 14,876 |

| 04/30/2022 | 14,526 | 14,553 | 13,267 | 13,441 |

| 10/31/2022 | 13,504 | 13,532 | 12,550 | 12,703 |

| 04/30/2023 | 14,788 | 14,823 | 13,467 | 13,800 |

| 10/31/2023 | 15,277 | 15,320 | 13,602 | 13,991 |

| 04/30/2024 | 17,895 | 17,957 | 16,470 | 16,927 |

| 10/31/2024 | 19,811 | 19,911 | 18,751 | 19,310 |

NYLI Candriam U.S. Large Cap Equity ETF | 1

| Average Annual Total Returns for the Period-Ended October 31, 2024 | Inception Date | Six MonthsFootnote Reference1 | One Year | Since Inception |

|---|

| NYLI Candriam U.S. Large Cap Equity ETF - NAV | 12/17/2019 | 10.70% | 29.68% | 15.06% |

NYLI Candriam U.S. Large Cap Equity IndexFootnote Reference2 | | 10.88% | 29.96% | 15.18% |

Russell 3000®IndexFootnote Reference3 | | 13.85% | 37.86% | 13.77% |

S&P 500® Index (Net)Footnote Reference4 | | 14.08% | 38.02% | 14.46% |

| Footnote | Description |

Footnote1 | Not annualized. |

Footnote2 | The NYLI Candriam U.S. Large Cap Equity Index is the underlying index of the Fund. The NYLI Candriam U.S. Large Cap Equity Index is designed to deliver exposure to U.S. large-cap equity securities of companies meeting environmental, social and corporate governance (ESG) criteria developed by Candriam and weighted using a market capitalization weighting methodology. |

Footnote3 | In accordance with new regulatory requirements, the Fund has selected the Russell 3000® Index, which measures the performance of the largest 3,000 U.S. companies representing approximately 96% of the investable U.S. equity market, as a replacement for the S&P 500® Index (Net). |

Footnote4 | The S&P 500® (Net) Index is a well-known broad-based unmanaged index of 500 stocks, which is designed to represent the equity market in general. |

The Fund's past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Performance figures may reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. Visit newyorklifeinvestments.com/etf for the most recent performance.

| Fund's net assets | $380,389,014 |

| Total number of portfolio holdings | 285 |

| Portfolio turnover rate | 22% |

NYLI Candriam U.S. Large Cap Equity ETF | 2

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund; percentages indicated are based on the Fund's net assets.

Top Ten Holdings and/or Issuers*

| Apple, Inc. | 9.8% |

| Microsoft Corp. | 9.7% |

| Alphabet, Inc., Class A | 5.5% |

| Tesla, Inc. | 2.8% |

| UnitedHealth Group, Inc. | 2.1% |

| Visa, Inc., Class A | 1.9% |

| Mastercard, Inc., Class A | 1.7% |

| Procter & Gamble Co. (The) | 1.6% |

| Home Depot, Inc. (The) | 1.6% |

| Bank of America Corp. | 1.2% |

* Excluding short-term investments

| Information Technology | 36.8% |

| Financials | 16.3 |

| Consumer Discretionary | 9.3 |

| Communication Services | 7.5 |

| Industrials | 7.1 |

| Health Care | 6.8 |

| Consumer Staples | 5.5 |

| Real Estate | 3.7 |

| Materials | 3.6 |

| Utilities | 1.7 |

Availability of Additional Information

At dfinview.com/NYLIM, you can find additional information about the Fund, including the Fund's:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-888-474-7725.

Shareholders who have consented to receive a single annual or semiannual shareholder report at a shared address may revoke this consent by contacting their financial intermediary.

NYLI Candriam U.S. Large Cap Equity ETF | 3

NYLI CBRE NextGen Real Estate ETF

(formerly, IQ CBRE NextGen Real Estate ETF)

SEMIANNUAL SHAREHOLDER REPORT | October 31, 2024

This semi-annual shareholder report contains important information about NYLI CBRE NextGen Real Estate ETF (the "Fund") for the period of May 1, 2024 to October 31, 2024.You can find additional information about the Fund at dfinview.com/NYLIM. You can also request this information by contacting us at 1-888-474-7725.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference1,Footnote Reference2 |

|---|

| NYLI CBRE NextGen Real Estate ETF | $33 | 0.60% |

| Footnote | Description |

Footnote1 | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

Footnote2 | Annualized. |

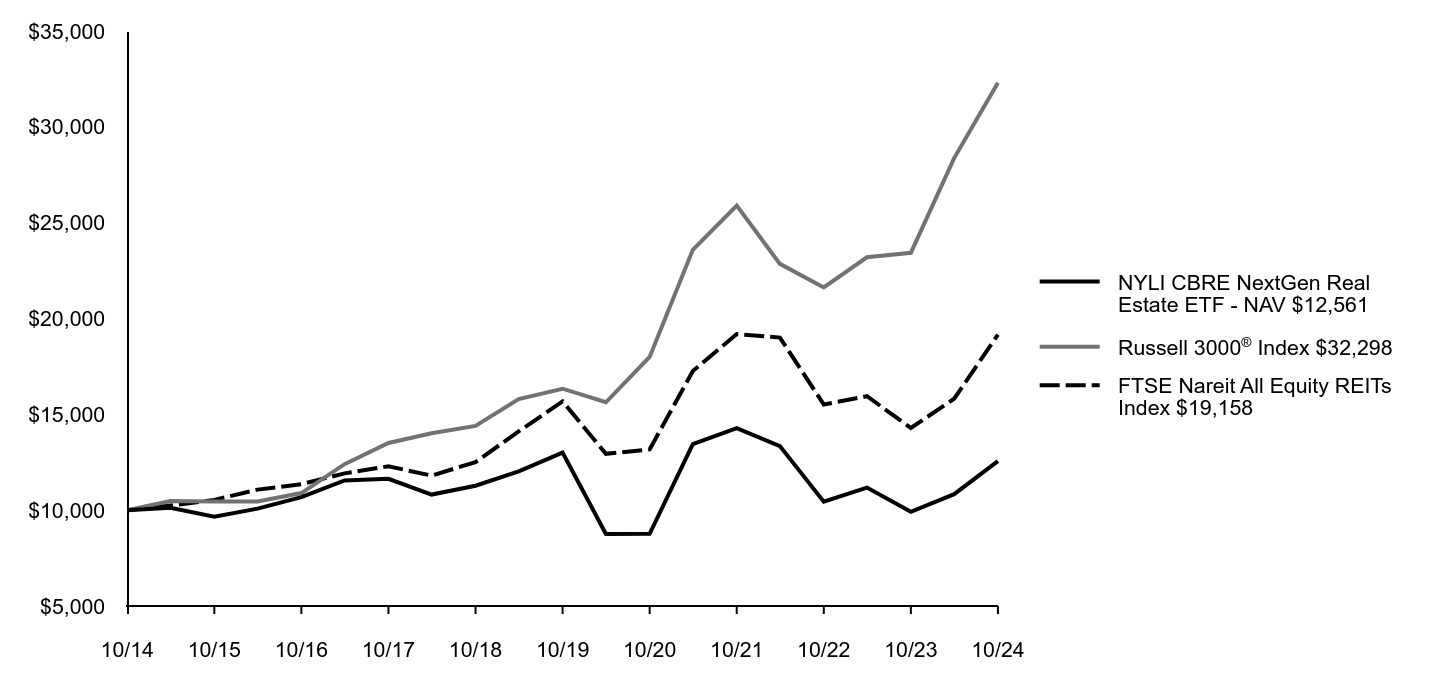

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 semiannual reporting periods of the Fund (or for the life of the Fund, if shorter). It assumes a $10,000 initial investment at the beginning of the first fiscal period in an appropriate, broad-based securities market index and other additional indexes, if applicable, for the same period.

| NYLI CBRE NextGen Real Estate ETF - NAV 12,561 | Russell 3000® Index32,298 | FTSE Nareit All Equity REITs Index19,158 |

|---|

| 10/14 | 10,000 | 10,000 | 10,000 |

| 04/15 | 10,130 | 10,474 | 10,242 |

| 10/15 | 9,659 | 10,449 | 10,535 |

| 04/16 | 10,078 | 10,455 | 11,073 |

| 10/16 | 10,683 | 10,892 | 11,355 |

| 04/17 | 11,550 | 12,398 | 11,921 |

| 10/17 | 11,639 | 13,504 | 12,289 |

| 04/18 | 10,813 | 14,016 | 11,801 |

| 10/18 | 11,275 | 14,395 | 12,509 |

| 04/19 | 12,021 | 15,793 | 14,110 |

| 10/19 | 13,001 | 16,337 | 15,676 |

| 04/20 | 8,758 | 15,629 | 12,939 |

| 10/20 | 8,764 | 17,995 | 13,167 |

| 04/21 | 13,447 | 23,587 | 17,256 |

| 10/21 | 14,284 | 25,894 | 19,189 |

| 04/22 | 13,344 | 22,852 | 19,002 |

| 10/22 | 10,439 | 21,617 | 15,512 |

| 04/23 | 11,180 | 23,196 | 15,945 |

| 10/23 | 9,917 | 23,429 | 14,288 |

| 04/24 | 10,837 | 28,369 | 15,813 |

| 10/24 | 12,561 | 32,298 | 19,158 |

NYLI CBRE NextGen Real Estate ETF | 1

| Average Annual Total Returns for the Period-Ended October 31, 2024 | Inception Date | Six MonthsFootnote Reference1 | One Year | Five Years | Ten Years |

|---|

| NYLI CBRE NextGen Real Estate ETF - NAV | 06/14/2011 | 15.91% | 26.67% | -0.69% | 2.31% |

NYLI CBRE NextGen Real Estate IndexFootnote Reference2 | | 16.31% | 27.50% | n/a | n/a |

Russell 3000®IndexFootnote Reference3 | | 13.85% | 37.86% | 14.60% | 12.44% |

FTSE Nareit All Equity REITs IndexFootnote Reference4 | | 21.15% | 34.09% | 4.09% | 6.72% |

| Footnote | Description |

Footnote1 | Not annualized. |

Footnote2 | The NYLI CBRE NextGen Real Estate Index is the underlying index of the Fund. The NYLI CBRE NextGen Real Estate Index is a rules-based, modified capitalization weighted, float adjusted index. The Underlying Index is designed to provide exposure to real estate sectors and companies that are expected to benefit from large trends (“NextGen Trends”) affecting property sectors of the global economy over a secular, multi-year time horizon. Effective September 1, 2022, the Fund changed it's underlying index and modified its principal investment startegies. The past performance in the graph and table prior to that date reflects the Fund's prior underlying index and principal invetsment strategies. |

Footnote3 | In accordance with new regulatory requirements, the Fund has selected the Russell 3000® Index, which measures the performance of the largest 3,000 U.S. companies representing approximately 96% of the investable U.S. equity market, as a replacement for the FTSE Nareit All Equity REITs Index. |

Footnote4 | The FTSE Nareit All Equity REITs Index measures the performance of all tax-qualified REITs with more than 50% of total assets in qualifying real estate assets other than mortgages secured by real property. |

The Fund's past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Performance figures may reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. Visit newyorklifeinvestments.com/etf for the most recent performance.

| Fund's net assets | $37,322,630 |

| Total number of portfolio holdings | 93 |

| Portfolio turnover rate | 17% |

NYLI CBRE NextGen Real Estate ETF | 2

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund; percentages indicated are based on the Fund's net assets.

Top Ten Holdings and/or Issuers*

| Digital Realty Trust, Inc. | 5.4% |

| Equinix, Inc. | 5.0% |

| Welltower, Inc. | 5.0% |

| Keppel DC REIT | 4.9% |

| American Tower Corp. | 4.7% |

| Prologis, Inc. | 4.6% |

| SBA Communications Corp. | 4.5% |

| Crown Castle, Inc. | 4.4% |

| Uniti Group, Inc. | 3.8% |

| Lineage, Inc. | 3.1% |

* Excluding short-term investments

| Industrial | 31.5% |

| Data Center | 17.8 |

| Infrastructure (Tower) | 17.4 |

| Health Care | 14.1 |

| Multi-Family Residential | 13.0 |

| Single-Family Residential | 2.7 |

| Manufactured Homes | 2.6 |

| Student Housing | 0.6 |

| Short-Term Investments | 0.2 |

Availability of Additional Information

At dfinview.com/NYLIM, you can find additional information about the Fund, including the Fund's:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-888-474-7725.

Shareholders who have consented to receive a single annual or semiannual shareholder report at a shared address may revoke this consent by contacting their financial intermediary.

NYLI CBRE NextGen Real Estate ETF | 3

NYLI FTSE International Equity Currency Neutral ETF

(formerly, IQ FTSE International Equity Currency Neutral ETF)

SEMIANNUAL SHAREHOLDER REPORT | October 31, 2024

This semi-annual shareholder report contains important information about NYLI FTSE International Equity Currency Neutral ETF (the "Fund") for the period of May 1, 2024 to October 31, 2024.You can find additional information about the Fund at dfinview.com/NYLIM. You can also request this information by contacting us at 1-888-474-7725.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference1 |

|---|

| NYLI FTSE International Equity Currency Neutral ETF | $10 | 0.20% |

| Footnote | Description |

Footnote1 | Annualized. |

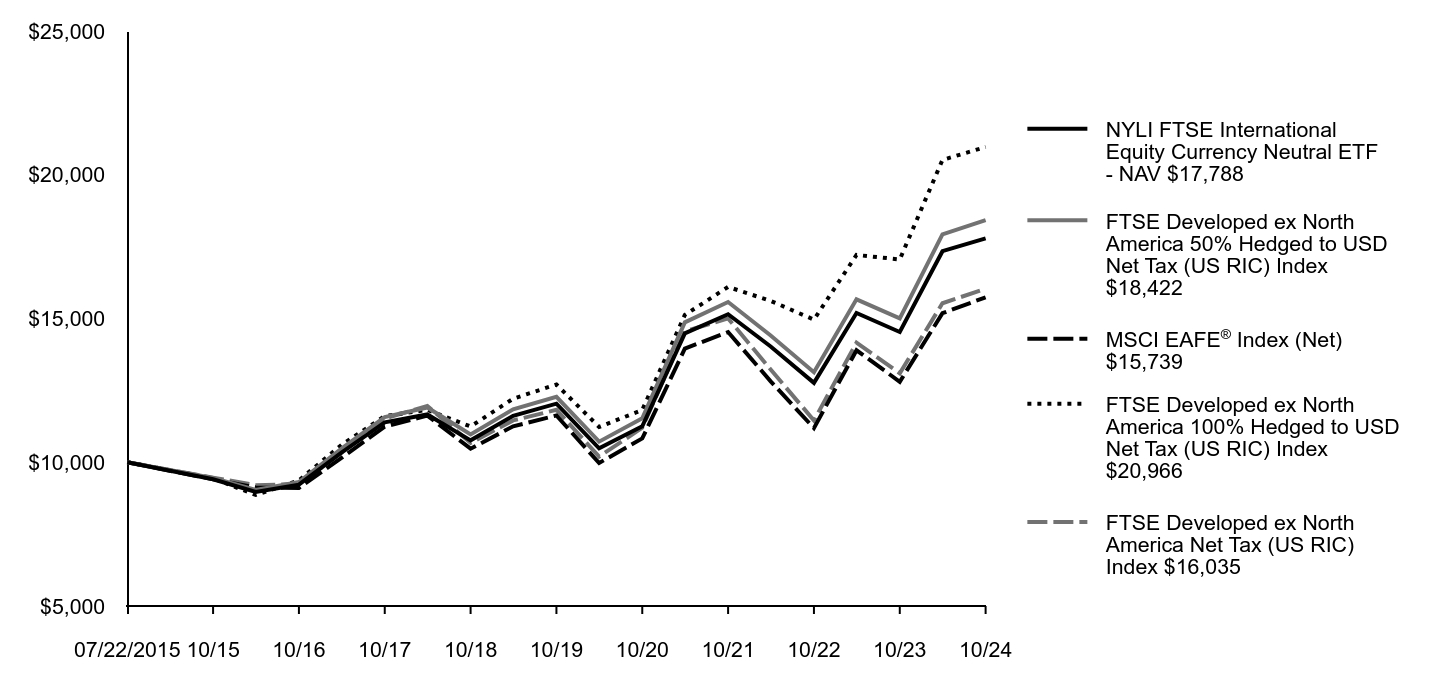

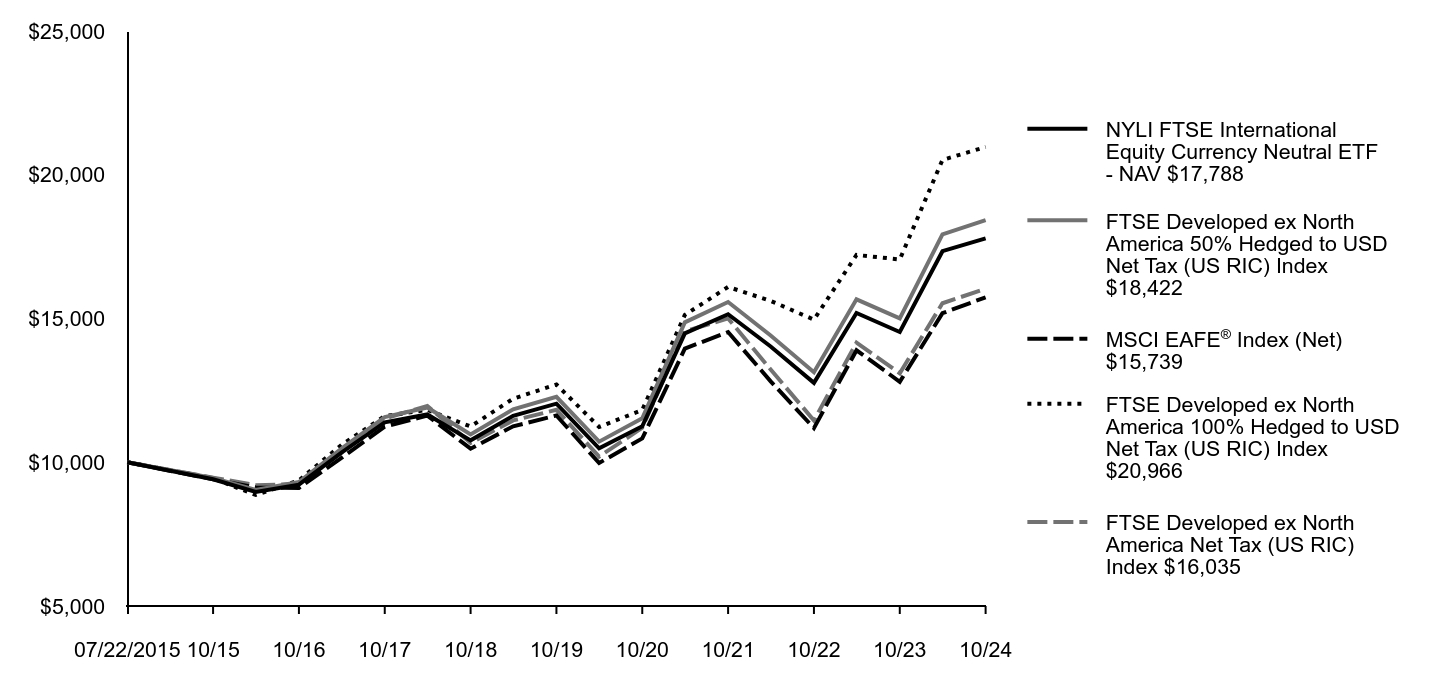

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 semiannual reporting periods of the Fund (or for the life of the Fund, if shorter). It assumes a $10,000 initial investment at the beginning of the first fiscal period in an appropriate, broad-based securities market index and other additional indexes, if applicable, for the same period.

| NYLI FTSE International Equity Currency Neutral ETF - NAV 17,788 | FTSE Developed ex North America 50% Hedged to USD Net Tax (US RIC) Index18,422 | MSCI EAFE® Index (Net)15,739 | FTSE Developed ex North America 100% Hedged to USD Net Tax (US RIC) Index20,966 | FTSE Developed ex North America Net Tax (US RIC) Index16,035 |

|---|

| 07/22/2015 | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 |

| 10/31/2015 | 9,408 | 9,451 | 9,410 | 9,441 | 9,462 |

| 04/30/2016 | 8,967 | 9,035 | 9,121 | 8,862 | 9,204 |

| 10/31/2016 | 9,219 | 9,311 | 9,107 | 9,369 | 9,242 |

| 04/30/2017 | 10,338 | 10,476 | 10,151 | 10,604 | 10,332 |

| 10/31/2017 | 11,387 | 11,572 | 11,241 | 11,605 | 11,517 |

| 04/30/2018 | 11,664 | 11,905 | 11,624 | 11,823 | 11,958 |

| 10/31/2018 | 10,762 | 10,968 | 10,471 | 11,243 | 10,672 |

| 04/30/2019 | 11,616 | 11,844 | 11,250 | 12,211 | 11,455 |

| 10/31/2019 | 12,039 | 12,274 | 11,627 | 12,704 | 11,823 |

| 04/30/2020 | 10,485 | 10,717 | 9,974 | 11,227 | 10,197 |

| 10/31/2020 | 11,250 | 11,527 | 10,829 | 11,818 | 11,200 |

| 04/30/2021 | 14,483 | 14,867 | 13,952 | 15,123 | 14,554 |

| 10/31/2021 | 15,148 | 15,575 | 14,530 | 16,098 | 15,003 |

| 04/30/2022 | 14,025 | 14,408 | 12,815 | 15,613 | 13,226 |

| 10/31/2022 | 12,761 | 13,132 | 11,188 | 14,961 | 11,454 |

| 04/30/2023 | 15,190 | 15,667 | 13,895 | 17,210 | 14,158 |

| 10/31/2023 | 14,530 | 15,003 | 12,800 | 17,054 | 13,094 |

| 04/30/2024 | 17,341 | 17,927 | 15,184 | 20,515 | 15,531 |

| 10/31/2024 | 17,788 | 18,422 | 15,739 | 20,966 | 16,035 |

NYLI FTSE International Equity Currency Neutral ETF | 1

| Average Annual Total Returns for the Period-Ended October 31, 2024 | Inception Date | Six MonthsFootnote Reference1 | One Year | Five Years | Since Inception |

|---|

| NYLI FTSE International Equity Currency Neutral ETF - NAV | 07/22/2015 | 2.58% | 22.42% | 8.12% | 6.40% |

FTSE Developed ex North America 50% Hedged to USD Net Tax (US RIC) IndexFootnote Reference2 | | 2.76% | 22.79% | 8.46% | 6.81% |

MSCI EAFE® Index (Net)Footnote Reference3 | | 3.66% | 22.97% | 6.24% | 5.01% |

FTSE Developed ex North America 100% Hedged to USD Net Tax (US RIC) IndexFootnote Reference4 | | 2.20% | 22.94% | 10.54% | 8.31% |

FTSE Developed ex North America Net Tax (US RIC) IndexFootnote Reference5 | | 3.25% | 22.46% | 6.28% | 5.22% |

| Footnote | Description |

Footnote1 | Not annualized. |

Footnote2 | The FTSE Developed ex North America 50% Hedged to USD Net Tax (US RIC) Index is the underlying index of the Fund. The FTSE Developed ex North America 50% Hedged to USD Net Tax (US RIC) Index is an equity benchmark of international stocks from developed markets, with approximately half of the currency exposure of the securities included in the Underlying Index “hedged” against the U.S. dollar on a monthly basis. |

Footnote3 | In accordance with new regulatory requirements, the Fund has selected the MSCI EAFE® Index (Net), which consists of international stocks representing the developed world outside of North America, as a replacement for the FTSE Developed ex North America 100% Hedged to USD Net Tax (US RIC) Index. |

Footnote4 | The FTSE Developed ex North America 100% Hedged to USD Net Tax (US RIC) Index, is comprised of large and mid-cap stocks in developed markets, excluding the U.S. and Canada and represents the performance without any impact from foreign exchange fluctuations. |

Footnote5 | The FTSE Developed ex North America Net Tax (US RIC) Index, is comprised of large- and mid-cap stocks in developed markets, excluding the U.S. and Canada. |

The Fund's past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit newyorklifeinvestments.com/etf for the most recent performance.

| Fund's net assets | $794,400,888 |

| Total number of portfolio holdings | 902 |

| Portfolio turnover rate | 6% |

NYLI FTSE International Equity Currency Neutral ETF | 2

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund; percentages indicated are based on the Fund's net assets.

Top Ten Holdings and/or Issuers*

| Novo Nordisk A/S, Class B | 1.8% |

| ASML Holding NV | 1.4% |

| SAP SE | 1.4% |

| Nestle SA | 1.3% |

| Samsung Electronics Co., Ltd. | 1.3% |

| Novartis AG | 1.2% |

| Roche Holding AG | 1.2% |

| AstraZeneca PLC | 1.1% |

| Toyota Motor Corp. | 1.1% |

| Shell PLC | 1.1% |

* Excluding short-term investments

| Japan | 23.8% |

| United Kingdom | 10.3 |

| United States | 8.4 |

| France | 8.2 |

| Germany | 8.0 |

| Australia | 7.5 |

| Switzerland | 5.7 |

| South Korea | 4.5 |

| Netherlands | 3.7 |

| Sweden | 3.0 |

Availability of Additional Information

At dfinview.com/NYLIM, you can find additional information about the Fund, including the Fund's:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-888-474-7725.

Shareholders who have consented to receive a single annual or semiannual shareholder report at a shared address may revoke this consent by contacting their financial intermediary.

NYLI FTSE International Equity Currency Neutral ETF | 3

NYLI U.S. Large Cap R&D Leaders ETF

(formerly, IQ U.S. Large Cap R&D Leaders ETF)

LRND/The NASDAQ Stock Market LLC

SEMIANNUAL SHAREHOLDER REPORT | October 31, 2024

This semi-annual shareholder report contains important information about NYLI U.S. Large Cap R&D Leaders ETF (the "Fund") for the period of May 1, 2024 to October 31, 2024.You can find additional information about the Fund at dfinview.com/NYLIM. You can also request this information by contacting us at 1-888-474-7725.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference1,Footnote Reference2 |

|---|

| NYLI U.S. Large Cap R&D Leaders ETF | $7 | 0.14% |

| Footnote | Description |

Footnote1 | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

Footnote2 | Annualized. |

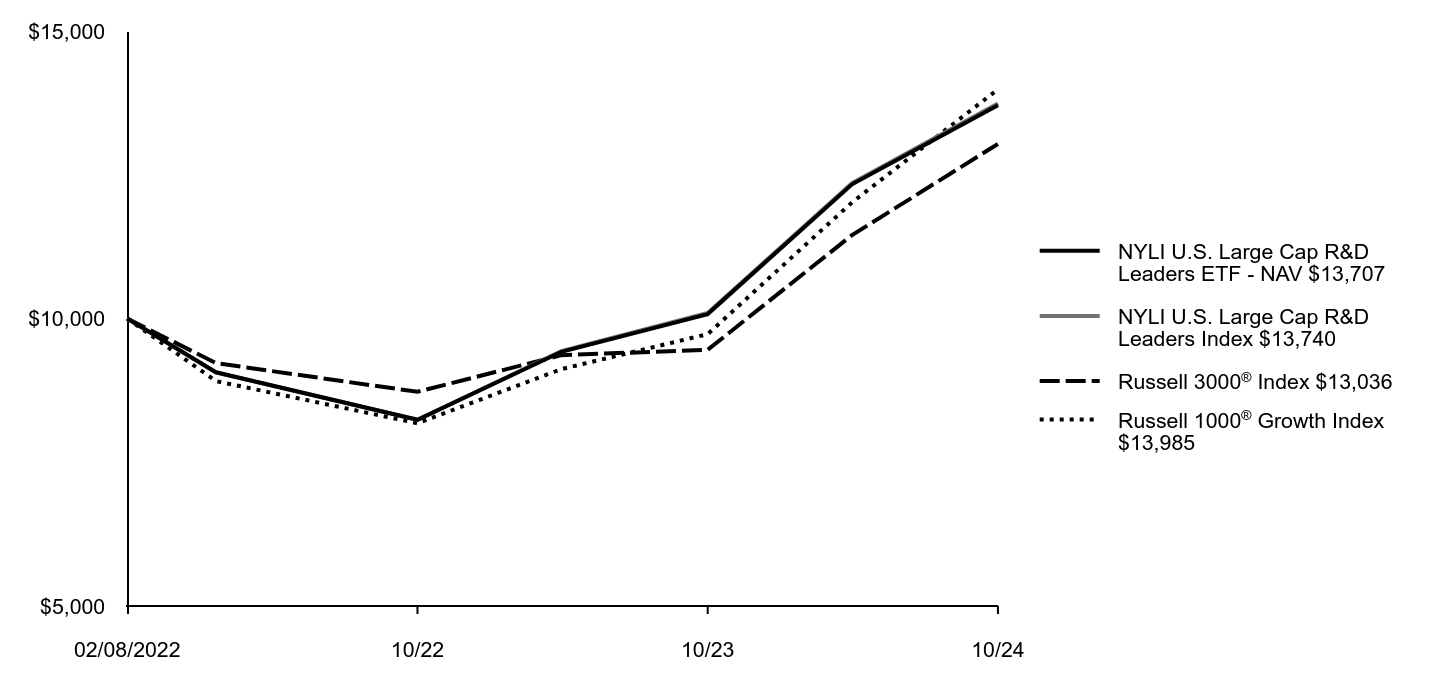

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 semiannual reporting periods of the Fund (or for the life of the Fund, if shorter). It assumes a $10,000 initial investment at the beginning of the first fiscal period in an appropriate, broad-based securities market index and other additional indexes, if applicable, for the same period.

| NYLI U.S. Large Cap R&D Leaders ETF - NAV 13,707 | NYLI U.S. Large Cap R&D Leaders Index13,740 | Russell 3000® Index13,036 | Russell 1000® Growth Index13,985 |

|---|

| 02/08/2022 | 10,000 | 10,000 | 10,000 | 10,000 |

| 04/30/2022 | 9,064 | 9,063 | 9,224 | 8,911 |

| 10/31/2022 | 8,238 | 8,240 | 8,725 | 8,178 |

| 04/30/2023 | 9,421 | 9,431 | 9,362 | 9,120 |

| 10/31/2023 | 10,077 | 10,096 | 9,456 | 9,728 |

| 04/30/2024 | 12,333 | 12,352 | 11,450 | 12,020 |

| 10/31/2024 | 13,707 | 13,740 | 13,036 | 13,985 |

NYLI U.S. Large Cap R&D Leaders ETF | 1

| Average Annual Total Returns for the Period-Ended October 31, 2024 | Inception Date | Six MonthsFootnote Reference1 | One Year | Since Inception |

|---|

| NYLI U.S. Large Cap R&D Leaders ETF - NAV | 02/08/2022 | 11.15% | 36.02% | 12.25% |

NYLI U.S. Large Cap R&D Leaders IndexFootnote Reference2 | | 11.24% | 36.09% | 12.35% |

Russell 3000®IndexFootnote Reference3 | | 13.85% | 37.86% | 10.20% |

Russell 1000® Growth IndexFootnote Reference4 | | 16.36% | 43.77% | 13.08% |

| Footnote | Description |

Footnote1 | Not annualized. |

Footnote2 | The NYLI U.S. Large Cap R&D Leaders Index is the underlying index of the Fund. The NYLI U.S. Large Cap R&D Leaders Index seeks to provide exposure to innovative companies by investing in the equities of US large cap companies that have the highest research and development (“R&D”) spending during the previous year. |

Footnote3 | In accordance with new regulatory requirements, the Fund has selected the Russell 3000® Index, which measures the performance of the largest 3,000 U.S. companies representing approximately 96% of the investable U.S. equity market, as a replacement for the Russell 1000® Growth Index. |

Footnote4 | The Russell 1000® Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe and includes those Russell 1000® Index companies with higher price-to-book ratios and higher forecasted growth values. |

The Fund's past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Performance figures may reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. Visit newyorklifeinvestments.com/etf for the most recent performance.

| Fund's net assets | $7,403,883 |

| Total number of portfolio holdings | 102 |

| Portfolio turnover rate | 6% |

NYLI U.S. Large Cap R&D Leaders ETF | 2

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund; percentages indicated are based on the Fund's net assets.

Top Ten Holdings and/or Issuers*

| Alphabet, Inc., Class A | 8.9% |

| Amazon.com, Inc. | 8.3% |

| Meta Platforms, Inc., Class A | 6.6% |

| Apple, Inc. | 6.0% |

| Microsoft Corp. | 5.4% |

| Intel Corp. | 3.2% |

| Merck & Co., Inc. | 3.1% |

| Johnson & Johnson | 2.9% |

| NVIDIA Corp. | 2.4% |

| Bristol-Myers Squibb Co. | 2.1% |

* Excluding short-term investments

| Information Technology | 37.6% |

| Health Care | 23.2 |

| Communication Services | 17.5 |

| Consumer Discretionary | 14.6 |

| Industrials | 4.7 |

| Financials | 1.2 |

| Consumer Staples | 0.8 |

| Materials | 0.3 |

| Short-Term Investments | 0.1 |

Availability of Additional Information

At dfinview.com/NYLIM, you can find additional information about the Fund, including the Fund's:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-888-474-7725.

Shareholders who have consented to receive a single annual or semiannual shareholder report at a shared address may revoke this consent by contacting their financial intermediary.

NYLI U.S. Large Cap R&D Leaders ETF | 3

NYLI Global Equity R&D Leaders ETF

(formerly, IQ Global Equity R&D Leaders ETF)

WRND/The NASDAQ Stock Market LLC

SEMIANNUAL SHAREHOLDER REPORT | October 31, 2024

This semi-annual shareholder report contains important information about NYLI Global Equity R&D Leaders ETF (the "Fund") for the period of May 1, 2024 to October 31, 2024.You can find additional information about the Fund at dfinview.com/NYLIM. You can also request this information by contacting us at 1-888-474-7725.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference1,Footnote Reference2 |

|---|

| NYLI Global Equity R&D Leaders ETF | $9 | 0.18% |

| Footnote | Description |

Footnote1 | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

Footnote2 | Annualized. |

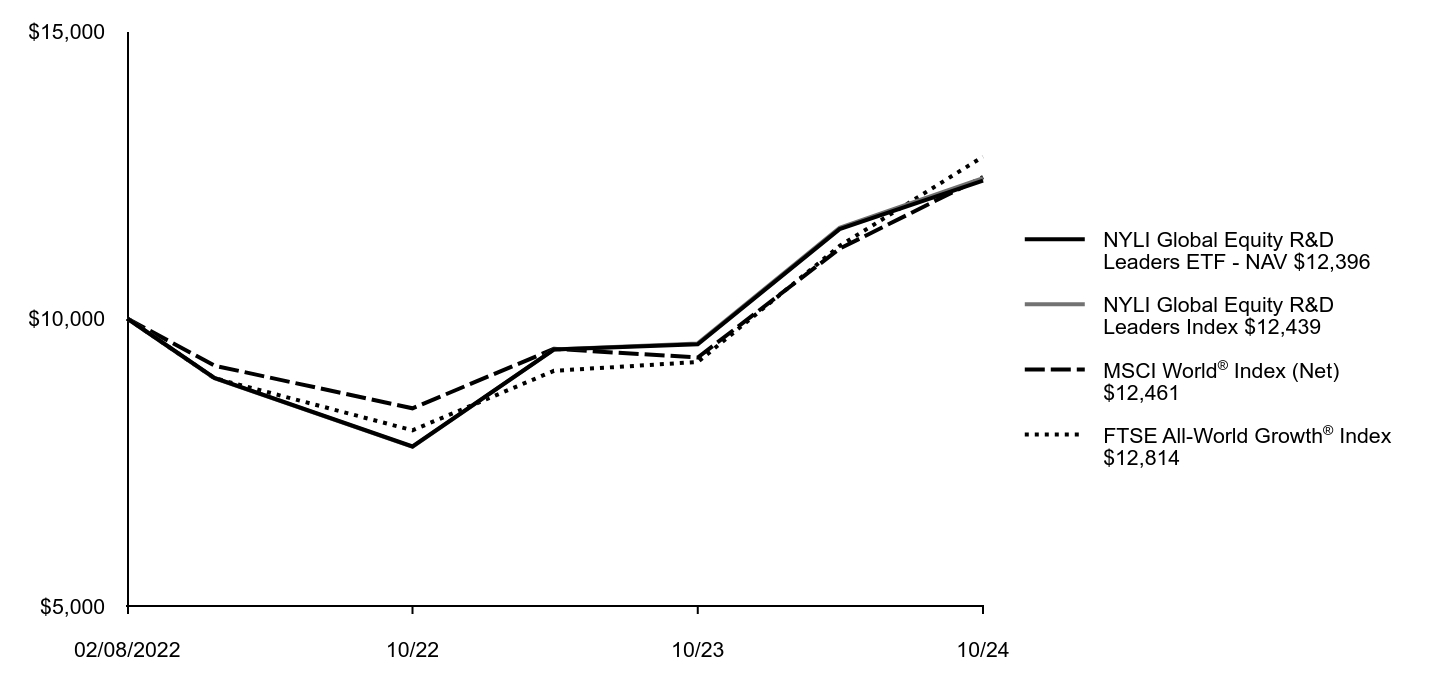

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 semiannual reporting periods of the Fund (or for the life of the Fund, if shorter). It assumes a $10,000 initial investment at the beginning of the first fiscal period in an appropriate, broad-based securities market index and other additional indexes, if applicable, for the same period.

| NYLI Global Equity R&D Leaders ETF - NAV 12,396 | NYLI Global Equity R&D Leaders Index12,439 | MSCI World® Index (Net)12,461 | FTSE All-World Growth® Index12,814 |

|---|

| 02/08/2022 | 10,000 | 10,000 | 10,000 | 10,000 |

| 04/30/2022 | 8,965 | 8,963 | 9,180 | 8,962 |

| 10/31/2022 | 7,775 | 7,768 | 8,438 | 8,056 |

| 04/30/2023 | 9,461 | 9,463 | 9,472 | 9,090 |

| 10/31/2023 | 9,553 | 9,567 | 9,322 | 9,244 |

| 04/30/2024 | 11,554 | 11,580 | 11,214 | 11,262 |

| 10/31/2024 | 12,396 | 12,439 | 12,461 | 12,814 |

NYLI Global Equity R&D Leaders ETF | 1

| Average Annual Total Returns for the Period-Ended October 31, 2024 | Inception Date | Six MonthsFootnote Reference1 | One Year | Since Inception |

|---|

| NYLI Global Equity R&D Leaders ETF - NAV | 02/08/2022 | 7.29% | 29.76% | 8.19% |

NYLI Global Equity R&D Leaders IndexFootnote Reference2 | | 7.42% | 30.02% | 8.32% |

MSCI World® Index (Net)Footnote Reference3 | | 11.13% | 33.68% | 8.40% |

FTSE All-World Growth®IndexFootnote Reference4 | | 13.78% | 38.62% | 9.51% |

| Footnote | Description |

Footnote1 | Not annualized. |

Footnote2 | The NYLI Global Equity R&D Leaders Index is the underlying index of the Fund. The NYLI Global Equity R&D Leaders Index s seeks to provide exposure to innovative companies by investing in the equities of companies that have the highest research and development (“R&D”) spending around the world. |

Footnote3 | In accordance with new regulatory requirements, the Fund has selected the MSCI World® Index (Net), which is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets as a replacement for the FTSE All-World Growth® Index. |

Footnote4 | The FTSE All-World Growth® Index measures the performance of the investable securities in the developed and emerging large and mid-cap growth segment of the market, which includes companies with higher growth earning potential. |

The Fund's past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Performance figures may reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. Visit newyorklifeinvestments.com/etf for the most recent performance.

| Fund's net assets | $6,603,301 |

| Total number of portfolio holdings | 202 |

| Portfolio turnover rate | 14% |

NYLI Global Equity R&D Leaders ETF | 2

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund; percentages indicated are based on the Fund's net assets.

Top Ten Holdings and/or Issuers*

| Amazon.com, Inc. | 5.7% |

| Alphabet, Inc., Class A | 5.1% |

| Meta Platforms, Inc., Class A | 4.1% |

| Apple, Inc. | 3.2% |

| Microsoft Corp. | 2.9% |

| Samsung Electronics Co., Ltd. | 2.6% |

| Volkswagen AG, 10.21% | 2.3% |

| Roche Holding AG | 1.8% |

| Intel Corp. | 1.7% |

| Merck & Co., Inc. | 1.7% |

* Excluding short-term investments

| United States | 59.3% |

| China | 9.7 |

| Germany | 8.9 |

| Japan | 7.6 |

| South Korea | 4.1 |

| Taiwan | 2.0 |

| France | 1.5 |

| United Kingdom | 1.4 |

| Switzerland | 1.2 |

| Sweden | 1.0 |

Availability of Additional Information

At dfinview.com/NYLIM, you can find additional information about the Fund, including the Fund's:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-888-474-7725.

Shareholders who have consented to receive a single annual or semiannual shareholder report at a shared address may revoke this consent by contacting their financial intermediary.

NYLI Global Equity R&D Leaders ETF | 3

(formerly, IQ Clean Oceans ETF)

SEMIANNUAL SHAREHOLDER REPORT | October 31, 2024

This semi-annual shareholder report contains important information about NYLI Clean Oceans ETF (the "Fund") for the period of May 1, 2024 to October 31, 2024.You can find additional information about the Fund at dfinview.com/NYLIM. You can also request this information by contacting us at 1-888-474-7725.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference1,Footnote Reference2 |

|---|

| NYLI Clean Oceans ETF | $23 | 0.45% |

| Footnote | Description |

Footnote1 | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

Footnote2 | Annualized. |

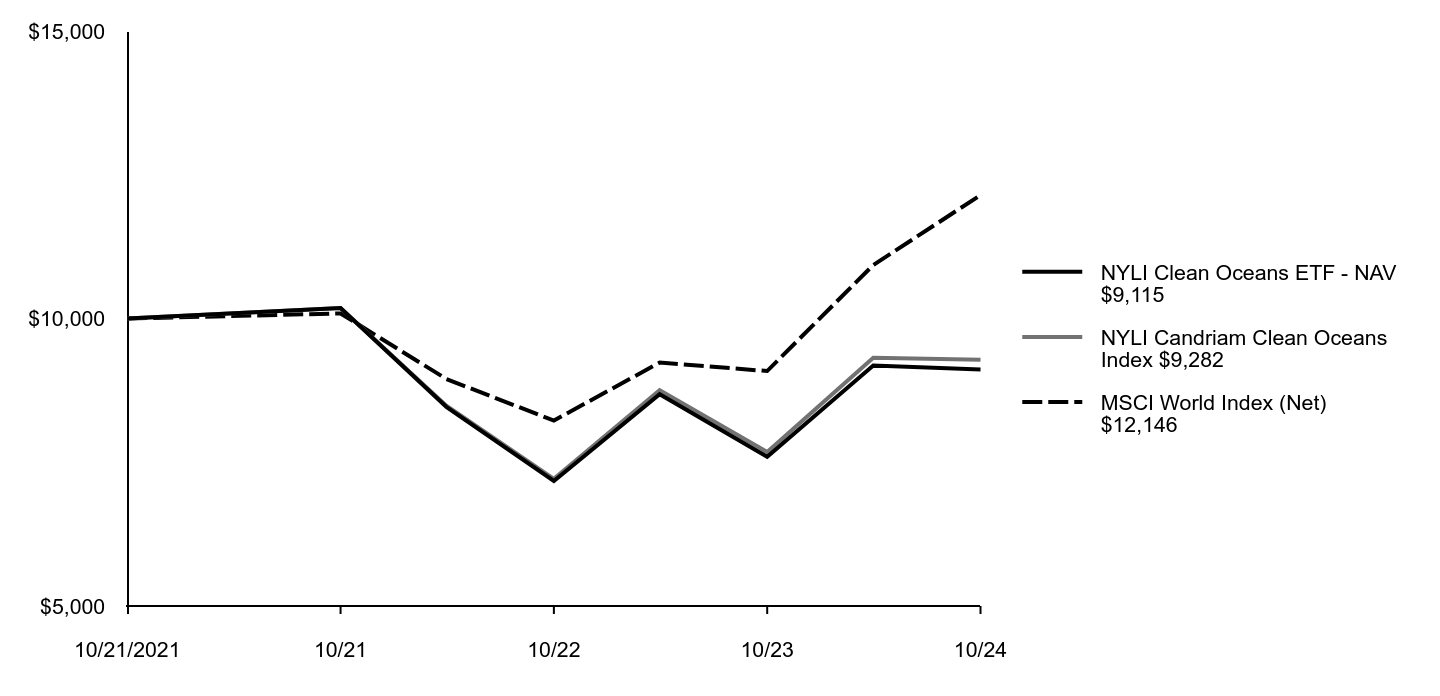

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 semiannual reporting periods of the Fund (or for the life of the Fund, if shorter). It assumes a $10,000 initial investment at the beginning of the first fiscal period in an appropriate, broad-based securities market index and other additional indexes, if applicable, for the same period.

| NYLI Clean Oceans ETF - NAV 9,115 | NYLI Candriam Clean Oceans Index9,282 | MSCI World Index (Net)12,146 |

|---|

| 10/21/2021 | 10,000 | 10,000 | 10,000 |

| 10/31/2021 | 10,182 | 10,184 | 10,088 |

| 04/30/2022 | 8,464 | 8,483 | 8,948 |

| 10/31/2022 | 7,175 | 7,211 | 8,224 |

| 04/30/2023 | 8,682 | 8,753 | 9,233 |

| 10/31/2023 | 7,594 | 7,679 | 9,086 |

| 04/30/2024 | 9,183 | 9,319 | 10,930 |

| 10/31/2024 | 9,115 | 9,282 | 12,146 |

NYLI Clean Oceans ETF | 1

| Average Annual Total Returns for the Period-Ended October 31, 2024 | Inception Date | Six MonthsFootnote Reference1 | One Year | Since Inception |

|---|

| NYLI Clean Oceans ETF - NAV | 10/21/2021 | -0.74% | 20.03% | -3.01% |

NYLI Candriam Clean Oceans IndexFootnote Reference2 | | -0.40% | 20.87% | -2.43% |

MSCI World Index (Net)Footnote Reference3 | | 11.13% | 33.68% | 6.63% |

| Footnote | Description |

Footnote1 | Not annualized. |

Footnote2 | The NYLI Candriam Clean Ocean Index is the underlying index of the Fund. The NYLI Candriam Clean Oceans Index incorporates thematic selection criteria designed to provide exposure to equity securities of companies that help to protect and/or achieve a cleaner ocean through reduced pollution and increased resource efficiency. |

Footnote3 | The MSCI World Index (Net) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. |

The Fund's past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Performance figures may reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. Visit newyorklifeinvestments.com/etf for the most recent performance.

| Fund's net assets | $4,868,344 |

| Total number of portfolio holdings | 80 |

| Portfolio turnover rate | 33% |

NYLI Clean Oceans ETF | 2

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund; percentages indicated are based on the Fund's net assets.

Top Ten Holdings and/or Issuers*

| Iberdrola SA | 3.3% |

| Ingersoll Rand, Inc. | 3.3% |

| Schneider Electric SE | 3.2% |

| Siemens AG | 3.2% |

| Exelon Corp. | 3.2% |

| Intel Corp. | 3.1% |

| Enel SpA | 3.1% |

| ABB Ltd. | 3.0% |

| Microsoft Corp. | 3.0% |

| National Grid PLC | 3.0% |

* Excluding short-term investments

| United States | 36.6% |

| Germany | 11.2 |

| United Kingdom | 8.5 |

| Spain | 7.1 |

| Switzerland | 5.9 |

| France | 5.1 |

| Denmark | 3.5 |

| Italy | 3.3 |

| Japan | 3.3 |

| China | 2.9 |

Availability of Additional Information

At dfinview.com/NYLIM, you can find additional information about the Fund, including the Fund's:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-888-474-7725.

Shareholders who have consented to receive a single annual or semiannual shareholder report at a shared address may revoke this consent by contacting their financial intermediary.

NYLI Clean Oceans ETF | 3

NYLI Cleaner Transport ETF

(formerly, IQ Cleaner Transport ETF)

SEMIANNUAL SHAREHOLDER REPORT | October 31, 2024

This semi-annual shareholder report contains important information about NYLI Cleaner Transport ETF (the "Fund") for the period of May 1, 2024 to October 31, 2024.You can find additional information about the Fund at dfinview.com/NYLIM. You can also request this information by contacting us at 1-888-474-7725.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference1,Footnote Reference2 |

|---|

| NYLI Cleaner Transport ETF | $23 | 0.45% |

| Footnote | Description |

Footnote1 | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

Footnote2 | Annualized. |

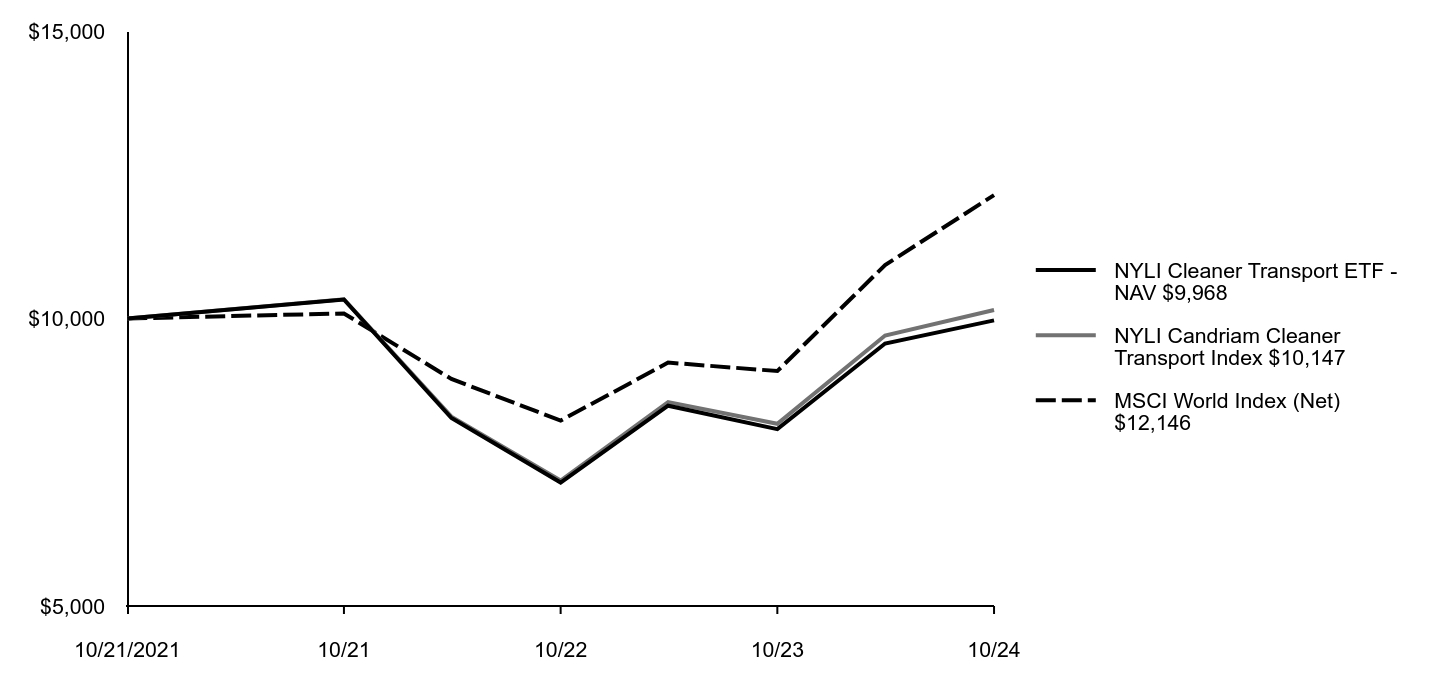

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 semiannual reporting periods of the Fund (or for the life of the Fund, if shorter). It assumes a $10,000 initial investment at the beginning of the first fiscal period in an appropriate, broad-based securities market index and other additional indexes, if applicable, for the same period.

| NYLI Cleaner Transport ETF - NAV 9,968 | NYLI Candriam Cleaner Transport Index10,147 | MSCI World Index (Net)12,146 |

|---|

| 10/21/2021 | 10,000 | 10,000 | 10,000 |

| 10/31/2021 | 10,330 | 10,333 | 10,088 |

| 04/30/2022 | 8,270 | 8,293 | 8,948 |

| 10/31/2022 | 7,147 | 7,182 | 8,224 |

| 04/30/2023 | 8,484 | 8,545 | 9,233 |

| 10/31/2023 | 8,076 | 8,169 | 9,086 |

| 04/30/2024 | 9,565 | 9,704 | 10,930 |

| 10/31/2024 | 9,968 | 10,147 | 12,146 |

NYLI Cleaner Transport ETF | 1

| Average Annual Total Returns for the Period-Ended October 31, 2024 | Inception Date | Six MonthsFootnote Reference1 | One Year | Since Inception |

|---|

| NYLI Cleaner Transport ETF - NAV | 10/21/2021 | 4.22% | 23.42% | -0.11% |

NYLI Candriam Cleaner Transport IndexFootnote Reference2 | | 4.57% | 24.22% | 0.48% |

MSCI World Index (Net)Footnote Reference3 | | 11.13% | 33.68% | 6.63% |

| Footnote | Description |

Footnote1 | Not annualized. |

Footnote2 | The NYLI Candriam Cleaner Transport Index is the underlying index of the Fund. The NYLI Candriam Cleaner Transport Index incorporates thematic selection criteria designed to provide exposure to equity securities of companies that support the transition to more environmentally efficient transportation technologies, such as electric vehicles, bicycles, motor vehicle parts manufacturers, and multi-passenger transportation. |

Footnote3 | The MSCI World Index (Net) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. |

The Fund's past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Performance figures may reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. Visit newyorklifeinvestments.com/etf for the most recent performance.

| Fund's net assets | $5,234,454 |

| Total number of portfolio holdings | 81 |

| Portfolio turnover rate | 24% |

NYLI Cleaner Transport ETF | 2

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund; percentages indicated are based on the Fund's net assets.

Top Ten Holdings and/or Issuers*

| Tesla, Inc. | 3.6% |

| BYD Co., Ltd., Class H | 3.6% |

| Taiwan Semiconductor Manufacturing Co., Ltd. | 3.3% |

| Hitachi Ltd. | 3.2% |

| Iberdrola SA | 3.2% |

| Alphabet, Inc., Class A | 3.2% |

| Siemens AG | 3.1% |

| Schneider Electric SE | 3.1% |

| ABB Ltd. | 3.0% |

| General Electric Co. | 3.0% |

* Excluding short-term investments

| United States | 36.0% |

| Japan | 14.5 |

| Germany | 13.4 |

| China | 9.2 |

| Taiwan | 5.7 |

| Spain | 3.9 |

| Switzerland | 3.2 |

| United Kingdom | 2.9 |

| Sweden | 2.8 |

| Denmark | 2.0 |

Availability of Additional Information

At dfinview.com/NYLIM, you can find additional information about the Fund, including the Fund's:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-888-474-7725.

Shareholders who have consented to receive a single annual or semiannual shareholder report at a shared address may revoke this consent by contacting their financial intermediary.

NYLI Cleaner Transport ETF | 3

NYLI Engender Equality ETF

(formerly, IQ Engender Equality ETF)

SEMIANNUAL SHAREHOLDER REPORT | October 31, 2024

This semi-annual shareholder report contains important information about NYLI Engender Equality ETF (the "Fund") for the period of May 1, 2024 to October 31, 2024.You can find additional information about the Fund at dfinview.com/NYLIM. You can also request this information by contacting us at 1-888-474-7725.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference1,Footnote Reference2 |

|---|

| NYLI Engender Equality ETF | $24 | 0.45% |

| Footnote | Description |

Footnote1 | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

Footnote2 | Annualized. |

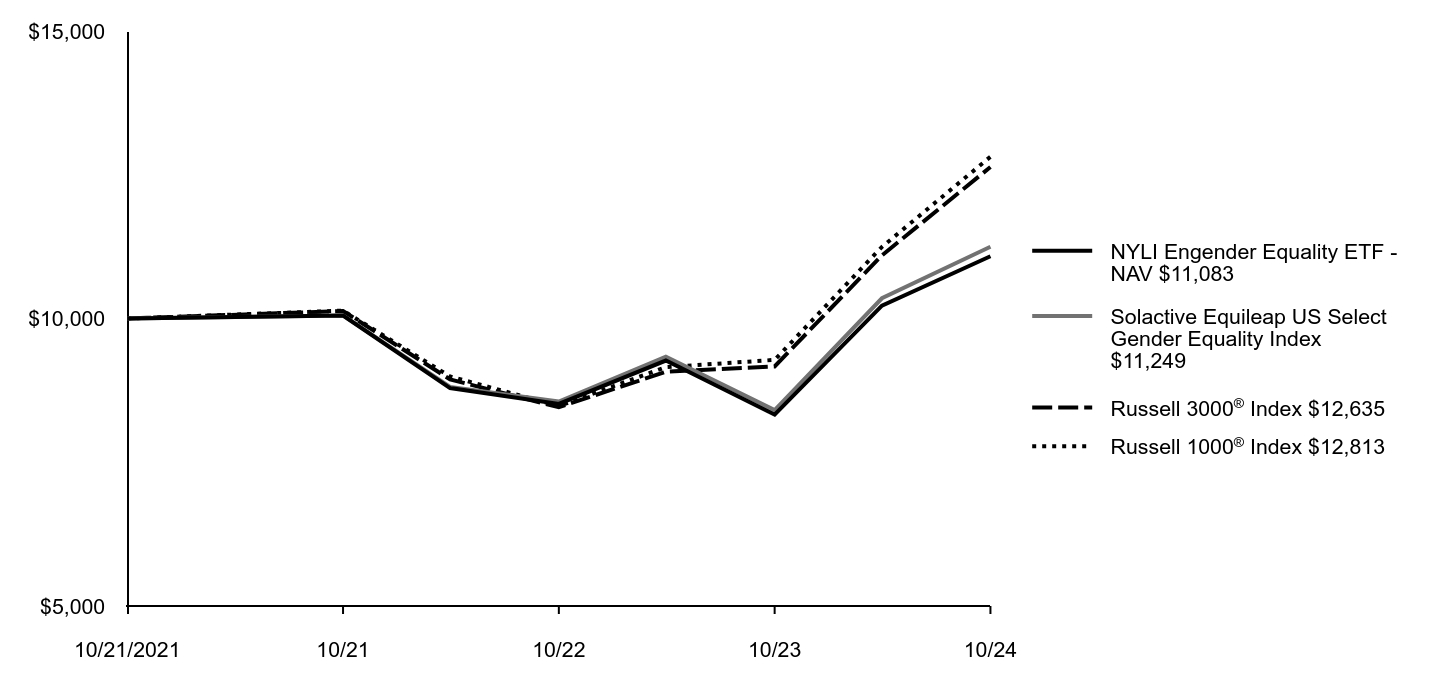

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 semiannual reporting periods of the Fund (or for the life of the Fund, if shorter). It assumes a $10,000 initial investment at the beginning of the first fiscal period in an appropriate, broad-based securities market index and other additional indexes, if applicable, for the same period.

| NYLI Engender Equality ETF - NAV 11,083 | Solactive Equileap US Select Gender Equality Index11,249 | Russell 3000® Index12,635 | Russell 1000® Index12,813 |

|---|

| 10/21/2021 | 10,000 | 10,000 | 10,000 | 10,000 |

| 10/31/2021 | 10,052 | 10,053 | 10,130 | 10,137 |

| 04/30/2022 | 8,790 | 8,810 | 8,940 | 8,992 |

| 10/31/2022 | 8,515 | 8,555 | 8,457 | 8,477 |

| 04/30/2023 | 9,269 | 9,335 | 9,074 | 9,155 |

| 10/31/2023 | 8,329 | 8,407 | 9,166 | 9,280 |

| 04/30/2024 | 10,225 | 10,352 | 11,098 | 11,245 |

| 10/31/2024 | 11,083 | 11,249 | 12,635 | 12,813 |

NYLI Engender Equality ETF | 1

| Average Annual Total Returns for the Period-Ended October 31, 2024 | Inception Date | Six MonthsFootnote Reference1 | One Year | Since Inception |

|---|

| NYLI Engender Equality ETF - NAV | 10/21/2021 | 8.39% | 33.07% | 3.45% |

Solactive Equileap US Select Gender Equality IndexFootnote Reference2 | | 8.67% | 33.80% | 3.96% |

Russell 3000®IndexFootnote Reference3 | | 13.85% | 37.86% | 8.03% |

Russell 1000®IndexFootnote Reference4 | | 13.95% | 38.07% | 8.53% |

| Footnote | Description |

Footnote1 | Not annualized. |

Footnote2 | The Solactive Equileap US Select Gender Equality Index is the underlying index of the Fund. The Solactive Equileap U.S. Gender Equality Index is a quantitative and investable index developed by Solactive AG. The Index is designed to track the U.S. large-, mid and small-capitalization companies that have the highest Equileap Score. |

Footnote3 | In accordance with new regulatory requirements, the Fund has selected the Russell 3000® Index, which measures the performance of the largest 3,000 U.S. companies representing approximately 96% of the investable U.S. equity market, as a replacement for the Russell 1000® Index. |

Footnote4 | The Russell 1000® Index measures the performance of the large-cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 1,000 of the largest securities based on a combination of their market cap and current index membership. |

The Fund's past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Performance figures may reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. Visit newyorklifeinvestments.com/etf for the most recent performance.

| Fund's net assets | $7,292,800 |

| Total number of portfolio holdings | 76 |

| Portfolio turnover rate | 38% |

NYLI Engender Equality ETF | 2

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund; percentages indicated are based on the Fund's net assets.

Top Ten Holdings and/or Issuers*

| Alcoa Corp. | 1.6% |

| DoorDash, Inc., Class A | 1.6% |

| Wells Fargo & Co. | 1.6% |

| Citigroup, Inc. | 1.5% |

| Bristol-Myers Squibb Co. | 1.5% |

| Lyft, Inc., Class A | 1.5% |

| Blackrock, Inc. | 1.5% |

| Marriott International, Inc., Class A | 1.5% |

| Illumina, Inc. | 1.5% |

| Salesforce, Inc. | 1.5% |

* Excluding short-term investments

| Financials | 18.1% |

| Health Care | 16.4 |

| Consumer Staples | 16.1 |

| Consumer Discretionary | 15.3 |

| Information Technology | 8.3 |

| Materials | 8.0 |

| Industrials | 6.9 |

| Communication Services | 6.7 |

| Real Estate | 4.1 |

| Short-Term Investments | 0.1 |

Availability of Additional Information

At dfinview.com/NYLIM, you can find additional information about the Fund, including the Fund's:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-888-474-7725.

Shareholders who have consented to receive a single annual or semiannual shareholder report at a shared address may revoke this consent by contacting their financial intermediary.

NYLI Engender Equality ETF | 3

(formerly, IQ Healthy Hearts ETF)

SEMIANNUAL SHAREHOLDER REPORT | October 31, 2024

This semi-annual shareholder report contains important information about NYLI Healthy Hearts ETF (the "Fund") for the period of May 1, 2024 to October 31, 2024.You can find additional information about the Fund at dfinview.com/NYLIM. You can also request this information by contacting us at 1-888-474-7725.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference1,Footnote Reference2 |

|---|

| NYLI Healthy Hearts ETF | $24 | 0.45% |

| Footnote | Description |

Footnote1 | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

Footnote2 | Annualized. |

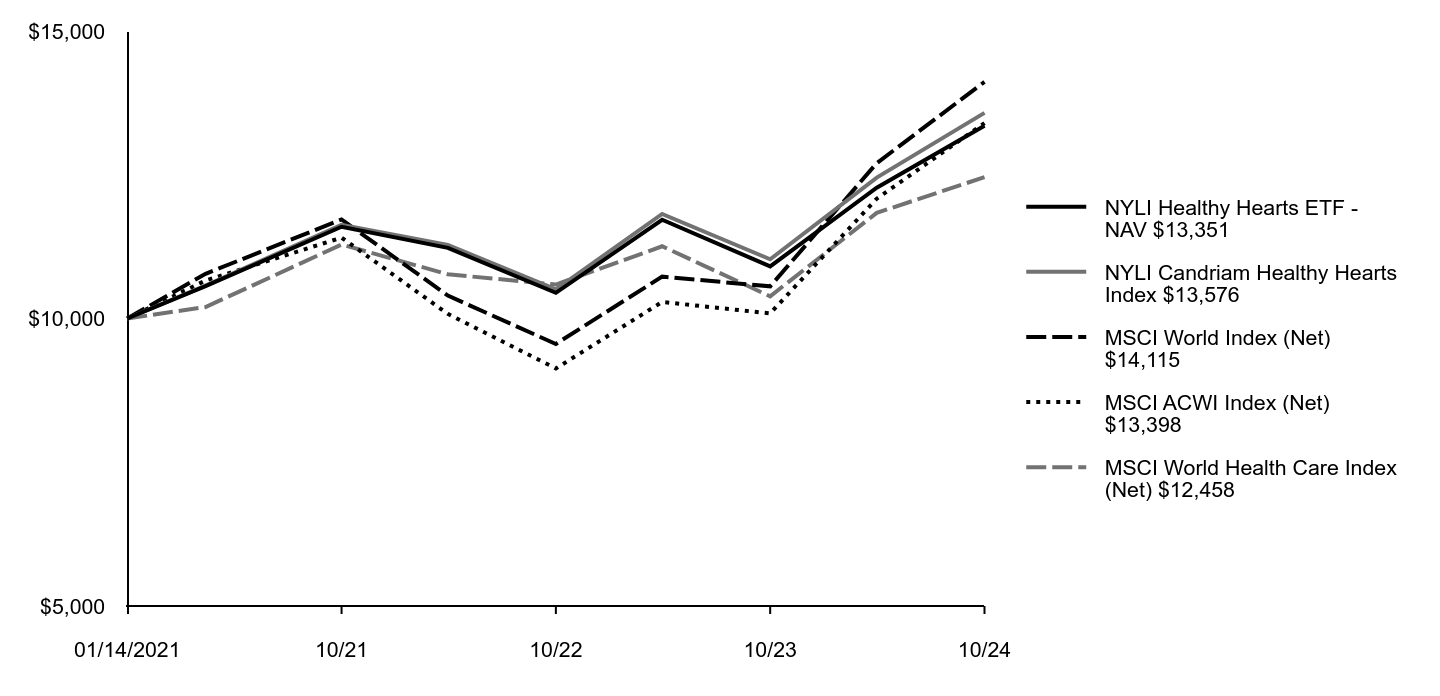

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 semiannual reporting periods of the Fund (or for the life of the Fund, if shorter). It assumes a $10,000 initial investment at the beginning of the first fiscal period in an appropriate, broad-based securities market index and other additional indexes, if applicable, for the same period.

| NYLI Healthy Hearts ETF - NAV 13,351 | NYLI Candriam Healthy Hearts Index13,576 | MSCI World Index (Net)14,115 | MSCI ACWI Index (Net)13,398 | MSCI World Health Care Index (Net)12,458 |

|---|

| 01/14/2021 | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 |

| 04/30/2021 | 10,562 | 10,573 | 10,777 | 10,660 | 10,199 |

| 10/31/2021 | 11,596 | 11,628 | 11,723 | 11,407 | 11,287 |

| 04/30/2022 | 11,229 | 11,280 | 10,398 | 10,080 | 10,769 |

| 10/31/2022 | 10,446 | 10,507 | 9,557 | 9,131 | 10,590 |

| 04/30/2023 | 11,717 | 11,818 | 10,729 | 10,288 | 11,256 |

| 10/31/2023 | 10,906 | 11,030 | 10,559 | 10,089 | 10,386 |

| 04/30/2024 | 12,275 | 12,450 | 12,702 | 12,084 | 11,837 |

| 10/31/2024 | 13,351 | 13,576 | 14,115 | 13,398 | 12,458 |

NYLI Healthy Hearts ETF | 1

| Average Annual Total Returns for the Period-Ended October 31, 2024 | Inception Date | Six MonthsFootnote Reference1 | One Year | Since Inception |

|---|

| NYLI Healthy Hearts ETF - NAV | 01/14/2021 | 8.77% | 22.42% | 7.91% |

NYLI Candriam Healthy Hearts IndexFootnote Reference2 | | 9.04% | 23.08% | 8.38% |

MSCI World Index (Net)Footnote Reference3 | | 11.13% | 33.68% | 9.50% |

MSCI ACWI Index (Net)Footnote Reference4 | | 10.87% | 32.79% | 8.01% |

MSCI World Health Care Index (Net)Footnote Reference5 | | 5.24% | 19.94% | 5.96% |

| Footnote | Description |

Footnote1 | Not annualized. |

Footnote2 | The NYLI Candriam Healthy Hearts Index is the underlying index of the Fund. The NYLI Candriam Healthy Hearts Index incorporates thematic selection criteria designed to provide exposure to equity securities of companies that are making a positive contribution to global health-related goals, such as by providing solutions for monitoring and curing heart diseases or helping people adopt a healthy lifestyle that limits cardiovascular risks. |

Footnote3 | In accordance with new regulatory requirements, the Fund has selected the MSCI World Index (Net), which is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed markets, as a replacement for the MSCI ACWI Index (Net). |

Footnote4 | The MSCI ACWI Index (Net) is an unmanaged free-float-adjusted market-capitalization-weighted index designed to measure the equity market performance of developed and emerging markets. |

Footnote5 | The MSCI World Health Care Index (Net) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets in the health-care sector. |