Revenue Recognition

Project ContractsThe Company recognizes contract revenue using the percentage-of-completion method, based primarily on contract cost incurred to date compared with total estimated contract. Contracts are segmented between types of services, such as Industrial Automation and Control and Automation Manufacturing, and accordingly, gross margin related to each activity is recognized as those services are rendered.

ServiceContractsThe Company has the potential to enter into a service related contract, after the completion of the project contract and placement of product. The Company also performs service related work for customers which need the Company’s expertise in areas of automation controls. The Company recognizes service revenue as service is performed.

Our consolidated revenues decreased by $316 thousand, or 42%, to $443.6 thousand for the year ended December 31, 2007, compared to $759.6 thousand for the year ended December 31, 2006. The decrease in revenues was due to a decrease in building contracts and also due to the natural attrition of our business for the year ended December 31, 2007, compared to, respectively, for the year ended December 31, 2006.

Additionally, our consolidated revenues increased by $1,973.7 thousand, or 655% to $2,275.2 thousand for the nine month period ended September 30, 2008, compared to $301.5 thousand for the nine month period ended September 30, 2007. The increase is primarily due to the acquisition of our second subsidiary Intecon and the revenue generated from this operation. Also in 2008, our contract backlog has increased in the ISS subsidiary as well. We anticipate that our consolidated revenues will increase in prospective years based on the size of our contract backlog and future acquisitions.

Cost of Revenues

Our cost of revenue is comprised of direct materials, direct labor, manufacturing overhead and other job related costs.

Our consolidated cost of revenues increased by $38.9 thousand, or 7%, to $559.6 thousand for the year ended December 31, 2007, compared to $520.7 thousand for the year ended December 31, 2006. The increase was due to increases in costs of goods sold, primarily in contract and service labor in production of work for the year ended December 31, 2007, compared to, respectively, for the year ended December 31, 2006.

�� Additionally, our consolidated cost of revenues increased by $1,326.8 thousand, or 732% to $1,508.0 thousand for the nine month period ended September 30, 2008, compared to $181.2 thousand for the nine month period ended September 30, 2007. The increase is primarily due to the addition of our second subsidiary Intecon and the cost of revenue generated from this operation.

Selling, General and Administrative Expenses

Consolidated selling, general and administrative expenses increased by $61.2 thousand, or 86%, to $132.1 thousand for the year ended December 31, 2007, compared to $70.9 thousand for the year ended December 31, 2006. This increase is primarily due to the additional expenses in our primary health coverage.

Additionally, our selling, general and administrative expenses increased by $82.4 thousand, or 84% to $197.4 thousand for the nine month period ended September 30, 2008, compared to $115.0 thousand for the nine month period ended September 30, 2007. The increase is primarily due to the addition of our second subsidiary Intecon on December 26, 2007.

Payroll and Related Expenses

Payroll expenses include administrative salaries and wages, officer compensation, social security, Medicare, Federal Unemployment Tax Act (FUTA) taxes, state unemployment taxes, and other related expenses incurred through the normal course of business.

21

Consolidated payroll and related expenses increased by $28.5 thousand, or 38%, to $103.5 thousand for the year ended December 31, 2007, compared to $75.0 thousand for the year ended December 31, 2006. The increase was due primarily from the hiring of additional employees and increases in salary compensation.

Additionally, our payroll and related expenses increased by $176.7 thousand, or 65% to $448.8 for the nine month period ended September 30, 2008, compared to $272.1 thousand for the nine month period ended September 30, 2007. The increase in payroll related expenses was due to increases in employees for our parent company, as well increases in employees for our subsidiaries ISS and Intecon. We anticipate that our payroll related expenses will increase as we continue to acquire additional companies and grow our business.

Professional Fees and Related Expenses

Professional fees include costs for legal, accounting, financial services and other related expenses.

Our consolidated professional fees and related expenses increased by $352.8 thousand, or 605%, to $411.1 thousand for the year ended December 31, 2007, compared to $58.3 thousand for the year ended December 31, 2006. The increase is due to expenses related to stock based compensation (see Stock based compensation below).

Additionally, our professional fees and related expenses increased by $3,478.6 thousand, or 1228% to $3,761.8 for the nine month period ended September 30, 2008, compared to $283.2 thousand for the nine month period ended September 30, 2007. The increase was primarily attributable to costs associated with legal, accounting, and financial services as a direct result of obtaining a public shell company and undergoing a two year audit for our company to become publicly traded. We also incurred consulting fees as we were in preparation of going public and establishing our board of directors and independent directors.

Stock Based Compensation (as a part of professional fees)

Stock based compensation relates to the value of common stock shares issued to the directors who serve on the board of directors and services for the Company.

Our stock based compensation increased by $315.0 thousand, or 100%, to $315.0 thousand for the year ended December 31, 2007, compared to $0 thousand for the year ended December 31, 2006.

Stock based compensation fees increased by $2,376.9 thousand, or 755% to $2,691.9 for the nine month period ended September 30, 2008, compared to $236.3 thousand for the nine month period ended September 30, 2007. The increase was primarily attributable to stock compensation issued to the directors who serve on the board of directors from the nine months period ended September 30, 2008. As a portion of the stock was prepaid to the officers of the Company for compensation in lieu of salary increases, the Company accreted the prepaid stock over the period of one year on a monthly basis.

Interest Expense

Interest expense costs are primarily related to imputed interest associated with our line of credit, credit cards, finance costs, and other related expenses. Interest income, which is minimal, consisted of interest associated with bank accounts and sales tax credits.

Consolidated interest expense, net increased by $5.5 thousand, or 56%, to $15.3 thousand for the year ended December 31, 2007, compared to $9.8 thousand for the year ended December 31, 2006. The increase was primarily attributable to interest expense for auto loans and lines of credit.

Additionally, our interest expense, net increased by $185.9 thousand or 5024%, to $189.6 thousand for the nine month period ended September 30, 2008, compared to $3.7 thousand for the nine month period ended September 30, 2007. This increase is primary due to interest expense incurred for our financing debt with Trafalgar within the first nine months of 2008. Also, interest expense increased due to the debt discounts associated with the Trafalgar financing.

As of the date of these financial statements, the Company has not issued the remaining $7,750,000 in debentures from Trafalgar. The Trafalgar debenture agreements have a premium and discount term associated. The following table represents the remaining current and long term portion of the debt discount and premium:

| | | | | |

Trafalgar Secured Redeemable Debenture Debt Premium/Discount allocation |

|

Current portion of secured redeemable debenture | | | $ | 1,343,519 | |

Accretion of premium on $1,500,000 | | | | 90,000 | |

Debt discount on $1,500,000 | | | | 6,000 | |

Debt discount on $750,000 | | | | 10,000 | |

Accretion on stock issued as debt discount | | | | 364,141 | |

| | |

|

| |

Total current portion of premium/discount | | | | (470,141 | ) |

| | | | | |

| | |

|

| |

Current portion of secured redeemable debenture, net | | | $ | 873,378 | |

| | | | | |

Long term portion of secured redeemable debenture | | | $ | 883,333 | |

Accretion of premium on $1,500,000 | | | | 90,000 | |

Debt discount on $1,500,000 | | | | 5,500 | |

Debt discount on $750,000 | | | | 1,667 | |

Accretion on stock issued as debt discount | | | | 109,141 | |

| | |

|

| |

Total long term portion of premium/discount | | | | (206,308 | ) |

| | | | | |

| | |

|

| |

Long term portion of secured redeemable debenture, net | | | $ | 677,025 | |

| | |

|

| |

22

Provision for Income Taxes

There were no amounts paid for federal income taxes during the years ended December 31, 2007 and 2006 or the period ended September 30, 2008.

Liquidity and Capital Resources

Financing

For the years ended December 31, 2007 and 2006, our total debt outstanding (net of acquisition liabilities) was $488,368 and $327,840 respectively. As of the date of this prospectus, we have been able to utilize financing through the debentures programs and revolving receivables credit facilities with Trafalgar in order to support new customer retention and the integration of our first two acquisitions at a very fast pace.

Plan of Operation and Financing Needs

Our capital formation strategy is based on three key tenets in creating a sustainable growth plan:

| | |

| • | Fortifying our cash conversion cycle by creating disciplined processes in administering our payables and collecting receivables for our sourcing and supply chain contracts. |

| | |

| • | Pursue our acquisition growth plan by utilizing our equity to yield better structures and pricing with our acquisition targets due to the current market constraints and need for consolidation in the fragmented automation controls and related market segments. |

| | |

| • | Maintaining a formidable capital structure that absorbs the shocks of certain volatile cycles while preserving capital in robust cycles by refinancing our current outstanding debt at more favorable terms and reaching out to the private and public equity markets. |

Total outstanding debt under the Debentures Facility (the “Debentures) and Asset Based Loan “Lock-Box” Facility (the “ABL”) with Trafalgar amounts to approximately $2,475,000 (including the $225,000 premium) and $800,000, respectively. Total principal and interest payments due under the Debentures for the calendar year of 2009 will amount to approximately $874,000.

We plan to utilize the ABL to support our cash conversion cycle against our receivables with existing and newly acquired customers, while servicing our payables, effectively. We also will look to balance our capital requirements with newly acquired equity capital that will serve as a conduit to supporting receivables growth through new customer retention. The new customer retention helps stabilize our existing receivables as well as provides us with additional cash resources to expand our Company. We firmly believe that sales and marketing is a key element in acquiring customers, so we will look to deploy equity capital at improving our sourcing relationships by determining what fits better in-house versus what belongs as OEM and sub-contracted services.

We seek to leverage both equity and debt capital to approach our acquisition strategy in the very fragmented automation controls market segments, which is robust and ripe for consolidation. We look to raise, at minimum, approximately $5,000,000 to $15,000,000 in capital (on an as needed basis) to support our acquisition campaign for the first two quarters of 2009. We are currently in discussions with interested target acquisitions that will bolster our geographic footprint, customer acquisition strategy, service diversification and in house operating capacity and infrastructure requirements. We have also thoroughly evaluated targets on the basis of leveraging economies of scale in our post-acquisition integration process.

As a public company, we believe a solid acquisition transaction process is not only about price, but about the structure of the deal. Given the current capital and credit constraints in today’s market, we have been able to establish terms with targets that rely heavily on stock as consideration, while complemented by future performance incentive milestones for the targets’ management teams and on the basis of the targets’ P&L performance metrics.

23

Summary of Cash Flow

Our total cash and cash equivalents increased by $11.7 thousand, or 32%, to $48.2 thousand at December 31, 2007, compared to $ 36.5 thousand at December 31, 2006. Our total cash and cash equivalents decreased by $94.4 thousand, or 80%, to $23.5 thousand at September 30, 2008, compared to $48.2 thousand at December 31, 2007, our summary cash flows for the years ended December 31, 2007, and 2006 and the nine months periods ended September 30, 2008 compared to September 30, 2007, respectively, were as follows (in thousands):

| | | | | | | |

| | Year Ended December 31, | |

| |

| |

| | 2007 | | 2006 | |

| |

| |

| |

Net cash (used) provided for operating activities | | $ | (3.4 | ) | $ | 10.3 | |

Net cash (used) provided for investing activities | | | 51.4 | | | (3.3 | ) |

Net cash (used) provided for financing activities | | | (36.3 | ) | | 22.8 | |

| | | | | | | |

| | Nine Months Ended September 30, | |

| |

| |

| | 2008 | | 2007 | |

| |

| |

| |

Net cash (used) provided for operating activities | | $ | (915.6 | ) | $ | 122.7 | |

Net cash (used) provided for investing activities | | | (6.2 | ) | | (7.5 | ) |

Net cash (used) provided for financing activities | | | 897.0 | | | (33.7 | ) |

Year Ended December 31, 2007 compared to Year Ended December 31, 2006 and the Nine Months Period September 30, 2008 compared to Nine Months Period September 30, 2007, respectively.

Operating activities

Our total cash provided by operating activities decreased by $13.7 thousand, or 133%, to $(3.4) thousand at December 31, 2007, compared to $10.3 thousand at December 31, 2006. Primarily attributable to effective Company recapitalization due to the reverse merger, and stock issued for services.

Additionally our total cash provided by operating activities decreased by $1,038.3 thousand, or 8,464%, to $(915.6) thousand at September 30, 2008, compared to $122.7 thousand at September 30, 2007. Primarily attributable to stock issued for services, inventories, and reoccurring net loss for the company and a large amount of receivables on account, due to the nature of the business most of our receivables are at a net 60 days if not longer.

We had no significant unusual cash outlays related to operating activities during Fiscal 2007 or Fiscal 2006. For the nine months ended September 30, 2008, we had a large amount of stock issued for services compared to September 30, 2007. We expect future cash provided (used) by operating activities to fluctuate, primarily as a result of fluctuations in our operating results, receivables collections, inventory management and timing of vendor payments.

Investing activities

Our total cash used for investing activities increased by $73 thousand, or 337%, to $51.4 thousand at December 31, 2007, compared to $(3.3) thousand at December 31, 2006. This is primarily attributable to our purchase of Intecon, Inc. which included $60.7 thousand in cash.

Additionally our total cash used by investing activities decreased by $1.3 thousand, or 18%, to $(6.2) thousand at September 30, 2008, compared to $(7.5) thousand at September 30, 2007. We expect future cash provided for investing activities to fluctuate as a result in acquiring additional plant and equipment.

24

Financing activities

Our total cash used for financing activities increased by $77.5 thousand, or 188%, to $(36.3) thousand at December 31, 2007, compared to $22.8 thousand at December 31, 2006. The decrease is a direct result of our use of cash to pay off outstanding debt to related parties and lines of credit. We also used financing to carry our payables through due to our industries lag in receivable return.

Additionally our total cash for financing activities increased by $930.8 thousand, or 2,757%, to $897.0 thousand at September 30, 2008, compared to $(33.8) thousand at September 30, 2007. The increase is primarily due to our securing of redeemable debentures to use for our operating needs. We expect future cash provided (used) by financing activities to secure additional capital funding for acquisitions and operational use. Additionally, we will use the cash provided by future financing to pay off outstanding debt and to carry our payables through due to our industry’s lag in receivable return.

Off-Balance Sheet Arrangements

We do not have any off balance sheet arrangements that are reasonably likely to have a current or future effect on our financial condition, revenues, and results of operations, liquidity or capital expenditures.

CRITICAL ACCOUNTING POLICIES AND USE OF ESTIMATES

The methods, estimates and judgments we use in applying our accounting policies have a significant impact on the results we report in our financial statements, which we discuss under the heading “Results of Operations” in our Management’s Discussion and Analysis. Some of our accounting policies require us to make difficult and subjective judgments, often as a result of the need to make estimates of matters that are inherently uncertain. We believe our critical accounting policies are those described below.

Concentrations

We maintain cash balances at highly-rated financial institutions in various states. Accounts at each institution are insured by the Federal Deposit Insurance Corporation (“FDIC”) up to $250,000 (a temporary increase which expires December 31, 2009). At December 31, 2007 and 2006 respectively, we had no account balances over federally insured limits.

Concentration of Supplier Risk

On December 31, 2007, we noted a high concentration of vendor supply from a single supplier in the automation industry. We determined that even if the specified supplier were to go out of business the Company would be able to receive supplies and materials from its other vendors.

Concentrations of Credit and Business Risk

Financial instruments that are potentially subject to a concentration of business risk consist of accounts receivable. The majority of accounts receivable and all contract work in progress are from clients in various industries and locations. Most contracts require payments as the projects progress. We generally do not require collateral, but in most cases can place liens against the property, plant or equipment constructed or terminate the contract if a material default occurs.

Allowance for Doubtful Accounts

We estimate our accounts receivable risks to provide allowances for doubtful accounts accordingly. We believe that our credit risk for accounts receivable is limited because of the way in which we conduct business largely in the areas of contracts. Accounts receivable includes the accrual of work in process and field service revenue. We recognize that there is a potential of not being paid in a relatively short period of time. In our line of construction there is a two to three month lag in receiving payment from our customers. Our evaluation includes the length of time receivables are past due, adverse situations that may affect a contract’s scope to be paid, and prevailing economic conditions. Due to the nature of our business, management performs an assessment of receivables and their collectability on a contract per contract basis. The evaluation is inherently subjective and estimates may be revised as more information becomes available.

25

Goodwill

The provisions of SFAS No. 142,Goodwill and other Intangible Assets, require the completion of an annual impairment test with any impairment recognized in current earnings. No triggering events have occurred which impair goodwill as of the date of these financial statements.

Revenue Recognition

Project ContractsWe recognize contract revenue using the percentage-of-completion method, based primarily on contract cost incurred to date compared with total estimated contract. Contracts are segmented between types of services, such as Industrial Automation and Control and Automation Manufacturing, and accordingly, gross margin related to each activity is recognized as those services are rendered.

ServiceContractsWe have the potential to enter into a service related contract, after the completion of the project contract and placement of product. We also perform service related work for customers which need our expertise in areas of automation controls. We recognize service revenue as service is performed.

Impairment of Long-Lived Assets

We account for long-lived assets in accordance with SFAS No. 144,Accounting for the Impairment or Disposal of Long-Lived Assets, which addresses financial accounting and reporting for the impairment and disposition of long-lived assets. We evaluate the recoverability of long-lived assets, other than indefinite life intangible assets, for impairment when events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Events and circumstances that may indicate that an asset is impaired include significant decreases in the market value of an asset, significant underperformance relative to expected historical or projected future results of operations, a change in the extent or manner in which an asset is used, significant declines in our stock price for a sustained period, shifts in technology, loss of key management or personnel, changes in our operating model or strategy and competitive forces. No such triggering events have occurred.

Stock-Based Compensation

Stock based compensation is accounted for using SFAS No. 123R,Accounting for Stock Based Compensation.Under SFAS 123R, establishes standards for the accounting for transactions in which an entity exchanges its equity instruments for goods or services. It also addresses transactions in which an entity incurs liabilities in exchange for goods or services that are based on the fair value of the entity’s equity instruments or that may be settled by the issuance of those equity instruments.

If we issue stock for services which are performed over a period of time, we capitalize the value paid in the equity section of our financial statements as its a non-cash equity transaction. The Company accretes the expense to stock based compensation expense on a monthly basis for services rendered within the period.

Income Taxes

Income taxes are provided for using the liability method of accounting in accordance with SFAS No. 109Accounting for Income Taxes, and clarified by FIN 48,Accounting for Uncertainty in Income Taxes--an interpretation of FASB Statement No. 109. Deferred tax assets and liabilities are determined based on differences between the financial reporting and tax basis of assets and liabilities and are measured using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. A valuation allowance is established when necessary to reduce deferred tax assets to the amount expected to be realized. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized.

26

The computation of limitations relating to the amount of such tax assets, and the determination of appropriate valuation allowances relating to the realizing of such assets, are inherently complex and require the exercise of judgment. As additional information becomes available, we continually assess the carrying value of our net deferred tax assets.

BUSINESS

Our Business

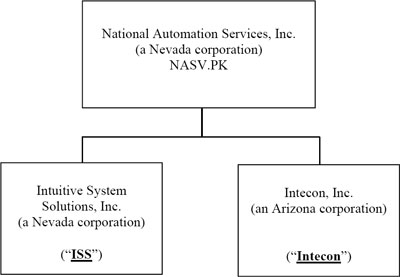

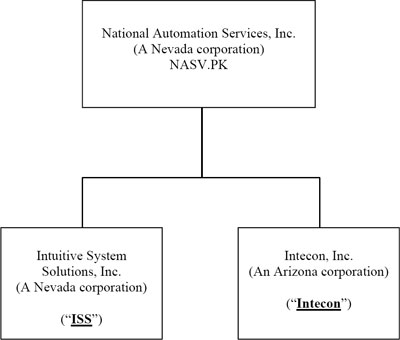

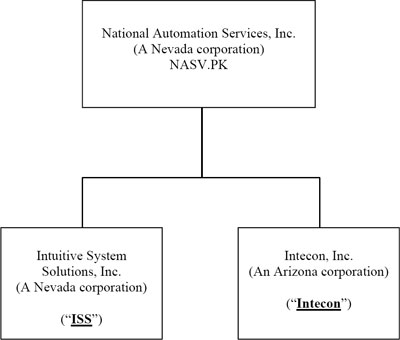

National Automation Services, Inc. is a holding company formed to acquire and operate specialized automation control companies located in the Southwestern United States. Currently, we own 100% of the capital stock of two operating subsidiaries: (1) Intuitive System Solutions, Inc., a Nevada corporation (“ISS”), based in Henderson, Nevada, and (2) Intecon, Inc., an Arizona corporation, based in Tempe, Arizona (“Intecon”). We conduct our business and operations through these two wholly-owned subsidiaries. Overall, we serve a diverse set of industries which utilize automation systems and controls, including water valley waste and treatment facilities, entertainment, hospitality, mining, medical, and manufacturing.

Since the acquisition of our current operating subsidiaries, we have strived to position ourselves as a leading system integrator and certified Underwriters Laboratories panel fabrication facility. We currently focus on two distinct lines of business: industrial automation control and automation manufacturing. Each of these lines is linked to the foundation of our business - integrated and automated systems controls.

Industrial Automation and Control

We have an experienced staff of electrical and control engineers, as well as project managers, with over 80 years combined experience in industrial automation and controls. Our business is currently focused in Nevada and Arizona, but we intend to expand through internal growth and key acquisitions across the Southwestern United States in 2009.

Automation Manufacturing

We are a certified Underwriters Laboratories panel fabrication facility. This nationally recognized regulatory body provides us with significant marketplace credibility for custom control panel assembly and fabrication to our clients.

Our mission is to build a national publically held company through acquisitions of small to medium sized privately held automation companies with geographical representation touching all of the major markets in the United States.

Our Organizational History

Original Incorporation

Our public holding company was originally incorporated in Nevada on January 27, 1997 under the name e-Biz Solutions, Inc. and subsequently changed its name and state of incorporation several times over several years, operating primarily as a Delaware public reporting company under the names JAWS Technologies, Inc. and JAWZ, Inc. between 1998 and 2001.

On June 19, 2006, JAWZ, Inc. changed its name to Ponderosa Lumber, Inc. Ponderosa Lumber, Inc. was a Delaware non-reporting public “shell” company with nominal assets whose sole business was to identify, evaluate and acquire through a reverse merger a target company with an operating business with the intent of continuing the acquired company’s business as a publicly held entity. On June 25, 2007, Ponderosa Lumber, Inc. converted from a Delaware corporation into a Colorado corporation.

27

On October 2, 2007, Ponderosa Lumber, Inc. changed its name to National Automation Services, Inc, a Colorado corporation (“NASV Colorado”).

Acquisitions of ISS and Intecon

On October 2, 2007, pursuant to the terms of a share exchange transaction, National Automation Services, Inc. acquired control of its wholly-owned subsidiary, Intuitive System Solutions, Inc., a Nevada corporation (“ISS”), through exchange of all ISS common stock for of 39,999,999 shares of common stock to the stockholders of ISS. For accounting purposes the acquisition has been treated as a recapitalization of ISS with ISS as the acquirer in this reverse merger. The historical financial statements prior to October 2, 2007 are those of ISS.

On December 26, 2007, the Company entered into an agreement to acquire Intecon as a wholly-owned operating subsidiary pursuant to a share exchange agreement by and among Intecon, the Intecon stockholders and the Company. The Company acquired 100% of the outstanding stock and voting rights of Intecon. The purchase of Intecon was conducted in order for National Automation Services, Inc. to grow as a part of its business objective. The consolidated income statement comprises the last 5 days of operating activities for the Intecon subsidiary. In exchange for the issuance of 300,000 shares of the Company’s common stock valued at $42,000, $300,000 in cash consideration to the Intecon stockholders, and $250,000 to payoff outstanding debt and credit lines on behalf of Intecon.

Reincorporation into Nevada

On December 28, 2007, NASV Colorado changed its state of incorporation from Colorado to Nevada by merging with and into National Automation Services, Inc., a new Nevada corporation formed as a wholly-owned subsidiary of NASV Colorado. On September 11, 2008, NASV Colorado was dissolved and ceased to exist. National Automation Services, Inc., a Nevada corporation, is the only surviving entity and continues to act as the holding company for our two wholly-owned operating subsidiaries, ISS and Intecon.

[Remainder of page intentionally left blank]

28

Current Corporate Structure

As of the date of this prospectus, our corporate structure is as follows:

Business Strategy

We are focused on expanding our position not only as a leading system integrator and UL Certified panel facility, but also as the provider of choice for a wide range of industries to provide services within the automation system and control industry. Our dedication and desire to improve and grow the overall operating performance of our acquired businesses emphasizes fiscal discipline in pursuit of these objectives for which we have implemented the following strategies:

Enhance and expand our customer base. We are dedicated to developing, enhancing, and expanding our well-managed, long-term relationships with our customers. We are focused on continuing to increase and improve our services offered through our two distinct lines of businesses - industrial automation and control and automation manufacturing. We intend on continuing to increase the awareness of our company and our products and services offered throughout our target markets.

Pursue strategic acquisitions and expansion opportunities. We intend on continuing to actively identify and assess a variety of strategic businesses, services and technologies that we believe will provide us with the opportunity to leverage our assets, cash flow and core competencies to expand domestically within the fragmented automation system and control industry. Before committing to an acquisition, we devote significant resources to due diligence and to developing a post-acquisition integration plan, including the identification and quantification of potential cost savings and synergies. Our ongoing acquisition strategy we believe will contribute significantly to our long-term growth and success.

Identification and implementation of operational improvements. We will continue to identify opportunities to further increase revenue, reduce costs and improve cash flow from operations. These include cost reduction synergies through centralized procurement of raw materials, cross-departmental and business unit shared resources and centralized product management functions.

[Remainder of page intentionally left blank]

29

Increase monetization of our services. We intend on continuing to increase our contract and service revenue through growth of our contract backlog and by enhancing the value of our services offered to our customers.

Optimize our business model. We are focused on optimizing our business model and, in particular, increasing our contract revenue base and implementing operational improvements.

Competitive Strengths

As we strive to position ourselves as a leading system integrator and UL Certified panel facility, we believe that our business model allows us the opportunity to provide our customers with an excellent product and quality service that amalgamates our strengths of design, implementation, training, execution, and experience. In this regard, we believe that our business strategy, which is based on certain of our core competencies, provides us with several significant competitive advantages:

Product & Project Management

As a system integrator and UL Certified panel facility with a strong and historic track record of project completion and client satisfaction, we believe that our exceptional ability to engineer, construct and manage complex projects often in geographically challenged locations provides us with a unique and distinct competitive advantage. We strive to complete our projects on schedule while meeting or exceeding all client specifications. We are continuously identifying cost efficiencies so our clients attain not only their performance requirements but also their budgetary needs.

CompellingServices and Sustainable Customer Proposition

We attract, maintain, and serve customers across a broad spectrum of industries by providing our diversified automation system and control services. We feel that our market diversity is a key strength of our company that will provide us with the ability to achieve more consistent growth and deliver solid returns in the long-term. While we aggressively work towards pursuing and serving new clients, we also believe in fostering long-term relationships we have built with our major customers allowing us to better understand and be more responsive to our customers’ needs.

Strong Ownership and Experienced Management Team

We believe the vast experience of our senior management team fosters an entrepreneurial culture, has a long track record of operational excellence, has a proven ability to acquire and integrate complementary businesses, coupled with the dedication and global experience of our board of directors will enable us to become one of the leading brands in the industry.

Successful, Disciplined Acquisition Program

To complement our organic growth, we have a highly disciplined due diligence program to evaluate, execute, and integrate acquisitions. We anticipate completing 10 to 20 acquisitions over the next three years with our dedication and commitment to improve the overall operating performance of our acquired businesses while significantly contributing to our long-term growth and success.

Management and Board Expertise

We believe that the extensive contacts and relationships of our executive officers and directors, who average more than 30 years of experience finding and executing business, investment and acquisition transactions, will enable us to evaluate and execute initial business combination opportunities successfully. Our executive officers and directors have strong reputations in the marketplace and long-term relationships with senior executives and decision-makers. We believe that these relationships will provide us with an important advantage in sourcing and structuring potential business combinations. Additionally, our executive officers and directors have extensive contacts with privately held lending institutions, bankers, attorneys and accountants, among others.

30

While the past successes of our executive officers and directors do not guarantee that we will successfully identify and consummate an initial business combination, they will play an important role in assisting us in finding potential targets and negotiating an agreement for our initial business combination.

Acquisition Strategy

We believe we can benefit from the expertise of the members of our management team in investing in and managing operating companies and that their skills in valuation, financial structuring, due diligence, governance and financial and management oversight will be valuable in our efforts to identify a business target.

We intend to use some or all of the following criteria to evaluate acquisition opportunities. However, we may enter into a business combination with a target business that does not meet any or all of these criteria if we believe that such target business has the potential to create significant stockholder value.

| | |

| • | An Established Business with a Proven Operating Track Record.We will seek established privately held businesses with strong financial performance, positive operating results, established or growing contract back logs, or businesses that our management team believes have the potential for positive operating cash flow. |

| | |

| • | Strong Market Place Presence.We will seek to acquire privately held businesses that have a history of operating within their local market place with a regional footprint for future growth and profitability. We will examine the ability of these target businesses to maintain and improve their advantages of expertise in the areas of UL control panels, automation systems, design, installation and customer service. |

| | |

| • | Ability for Growth.We will seek target companies where our management team has identified opportunities for growth through improved economies of scale, contract bidding, marketing efforts and other proven management strategies to augment the existing capabilities of our targets. |

Acquisition Sources and Target Market

We have commitments as of the date of this prospectus to incur additional substantial debt to consummate business combinations. Our mission is to build a national publically held company through acquisitions of small to medium sized privately held automation companies with geographical representation touching all of the major markets in the United States. We believe that there are numerous privately held acquisition candidates in the fragmented automation control and systems industry that we intend to target. Acquisition targets may be brought to our attention by our officers and directors, through their industry relationships located in the United States and elsewhere that regularly, in the course of their daily business activities, see numerous opportunities. We will not, however, acquire an entity with which any of our officers or directors, through their other business activities, is currently having acquisition or investment discussions.

Acquisition Selection and Structure

We intend to acquire 100% of all privately held companies in our target market through business combination. We provide our management with the flexibility of identifying and selecting prospective acquisition targets. In evaluating a prospective acquisition target, our management will consider, among other factors, the following factors likely to affect the performance of our investment:

| | |

| • | future earnings and growth potential; |

| | |

| • | financial condition and results of operation; |

| | |

| • | competitive position within the local market place; |

| | |

| • | stage of development within the automation control and system products and services offered; |

| | |

| • | reputation of services offered within the local market place; |

| | |

| • | experience and skill of the present management structure; |

| | |

| • | availability of additional personnel within the local market; |

| | |

| • | costs associated with consummation of the business combination. |

31

The criteria identified above are not intended to be exhaustive. Any evaluation relating to the merits of a particular business combination will be based, to the extent relevant, on the above factors as well as other considerations deemed relevant by our management in effecting a business combination consistent with our business objective. In evaluating a prospective acquisition target, we will conduct an extensive due diligence review that will encompass, among other things, a review of all relevant financial and other information which is made available to us. This due diligence review will be conducted by our directors, officers, acquisition committee and board of directors or by unaffiliated third parties we may engage, although we have no current intention to engage any such third parties.

We will also seek to have all owners of any prospective acquisition target execute agreements with us to continue to manage and run operations upon consummation of the acquisition, unless it is the intent of the owners not to continue to function in this capacity. In such case, we will evaluate the prospective acquisition target costs to replace the current management structure and we will seek to determine whether the transaction is advisable and in the best interests of us and our stockholders.

Although we intend to closely scrutinize the incumbent management of a prospective target business when evaluating the desirability of effecting a business combination, we cannot assure you that our assessment will prove to be correct. In addition, we cannot assure you that new members that join our management following a business combination will have the necessary skills, qualifications or abilities to manage operations within a public company. Following a business combination, we may seek to recruit additional managers to supplement or replace the incumbent management of the target business. We cannot assure you that we will have the ability to recruit such managers, or that any such managers we do recruit will have the requisite skills, knowledge or experience necessary to enhance the incumbent management, if any.

We believe it is possible that our attractiveness as a potential buyer of businesses may increase after consummation of several prospective acquisition targets and there will be additional acquisition opportunities as we grow and integrate our acquisitions. We intend on identifying multiple acquisition targets and to seek the most attractive acquisition target which provides the greatest opportunity for creating stockholder value. The determination of which entity is the most attractive would be based on our analysis of a variety of factors, including whether such acquisition would be in the best interests of our security holders, the purchase price, the terms of the sale, the perceived quality of the assets and the likelihood that the transaction will be consummated.

The time and costs required to select and evaluate an acquisition target and to structure and consummate the business combination cannot presently be ascertained with any degree of certainty. Any costs incurred with respect to the identification and evaluation of a prospective acquisition target with which a business combination is not ultimately consummated may result in a loss to us and reduce the amount of capital available to otherwise consummate a business combination. In no event will we pay any of our existing officers, directors or founding stockholders, or any entity with which they are affiliated, any finder’s fee in connection with the consummation of a business combination.

Acquisition Purchase Price and Determination of Fair Market Value

We intend to acquire 100% of all privately held companies in our target market through business combination. To accomplish this, we may seek to raise additional funds through credit facilities or other secured financings or a private offering of debt or equity securities if such funds are required to consummate such a business combination. We have commitments as of the date of this prospectus to incur additional substantial debt to consummate business combinations.

Prior to entering into an agreement for an acquisition target, the fair market value of such acquisition target will be determined by our directors and officers and submitted to our acquisition committee for review. Our acquisition committee will review all due diligence documentation with respect to any proposed acquisition targets and make recommendations to our board of directors to actively pursue or abandon negotiations with a potential acquisition target. The determination of fair market value of potential acquisition candidates will be based upon standards generally accepted by the financial community, such as actual and potential sales, earnings and cash flow and book value. We do not intend to seek a third party valuation or fairness opinion. However, in considering the entire fairness of a business combination to our stockholders, our acquisition committee and board of directors may determine that an independent valuation or fairness opinion will be necessary in satisfying its fiduciary duties under Nevada law, including in determining the fair market value of the acquired interests, in the event the valuation is a complex analysis. If no opinion is obtained, our public stockholders will be relying solely on the judgment of our officers, directors, acquisition committee and board of directors.

32

Industry Overview

The automation industry in the United States has been approximated to exceed over $500 billion in annual revenues per year. The automation industry is segmented, consisting of automation control and system divisions in companies that expand over various markets (Aerospace, Robotics, Transportation, Automotive, etc.). We estimate, based on various external sources, the total automation market consists of over 21,000 publically and privately held companies operating both domestically and internationally across the globe.

Suppliers and Raw Materials

We purchase and use components from third party suppliers to assemble our control panels, and we use the software that accompanies these components. The components and raw materials essential to the conduct of our business generally are available at competitive prices. Although we have a broad base of suppliers and contractors, we depend upon the ability of our suppliers and contractors to meet performance and quality specifications and delivery schedules.

Sales, Marketing and Advertising

Sales

We believe that sales drive our business so we do more than just look at bid jobs. We aggressively search for customers that our competitors don’t know about. We currently have sales specialists, Qualified in our industry to generate customers, and supply the customer contacts to our estimating specialists in our Nevada and Arizona locations.

On October 14, 2008, we entered into a verbal Siemens Solutions Program Partner agreement to supply automation and controls into the water and wastewater industries. Siemens AG is a world class manufacturer of automation equipment. The Siemens sales force and distributors coupled with our sales force gives us excellent sales force penetration and coverage in the Southwestern United States.

We also have sales relationships with all of the top automation hardware and software manufacturers including but not limited to General Electric, Rockwell Automation’s Allen-Bradley division and Schneider Electric’s Modicon division. These companies trust our experience to integrate their product.

Advertising

We are striving to build National Automation Services, Inc. into a nationally recognized brand. We have developed a “Brand Standards Manual” to help with the implementation and use of logos, letterhead and other products that brand our company. Our best advertising results have been through word of mouth. We still believe that this will continue to be the one of the better ways for us to grow into the future. We have made branding one of our highest priorities.

We are currently planning an advertising campaign to exhibit at three national and three regional level tradeshows during 2009. We are currently advertising in local publications in Nevada and Arizona. In 2009, we also plan to advertise in national level publications such as Control Engineering and Automation.com.

Backlog

Backlog is a measure of work yet to be performed on contracts that have been awarded. This equates to future revenues as the work is completed. Backlog is an indicator of the future of a company. An increase in backlog over time indicates a growing company. As backlog increases, more staff, resources or technology are required or more efficient use of current staff, resources and technology need to be added. This then increases revenues, and the cycle repeats itself.

33

Backlog holds some level of risk. Because it measures the uncompleted work on contracts that have been received, contracts can usually only be canceled with a cancelation fee. We minimize this issue as much as possible by maintaining adequate staff, sharing resources, or outsourcing to reduce the amount of time to complete the contracts. By keeping close contact and carefully screening our customers concerning viability of the project, we are able to bypass the contracts that we see as being troublesome and concentrate on the ones that will be profitable.

The following table contains a report of our backlog for the periods indicated for our operating subsidiaries Intecon and ISS:

Backlog Report

| | | | | | | |

| | December 31, 2007 | | September 30, 2008 | |

| |

| |

| |

Intecon, Inc. | | $ | 1,320,310 | | $ | 1,541,418 | |

Intuitive System Solutions, Inc. | | | 1,252,450 | | | 1,443,671 | |

| |

|

|

|

|

|

|

Total Backlog | | $ | 2,572,760 | | $ | 2,985,089 | |

| |

|

|

|

|

|

|

Customers - Corporations, Government Entities, and Original Equipment Manufacturers

Corporations

We are able to provide corporations with automation and control services in many vertical market sectors. Through our growth by acquisition, we have purchased companies with expertise in vertical markets. By leveraging the expertise of one of our subsidiaries in the food and beverage industries, we are able to support the food and beverage industries in locations where we have historically been unable to enter the market.

We are able to negotiate contracts to support large food, beverage, oil, and airline companies nationally with support at a local level. This is highly advantageous to large corporations that want to standardize the design and implementation of their automation and control systems.

Government Entities

We are able to negotiate contracts at the national level to provide product and services to government entities such as the Transportation Security Administration, Tennessee Valley Authority, and Bureau of Reclamation.

Original Equipment Manufacturers (OEMs)

We provide OEMs with design engineering services for product development when needed. This lowers overhead while providing the experience of a multi-talented controls system designer. Many times, our control panel shops can provide the OEM with control panels at a cost less than they can build it. Additionally, we are able to provide OEMs with national support at a local level on the equipment that they provide. This is of great benefit to the OEM because it eliminates the need for them to respond to warranty calls or provide startup services, and it also saves the OEM the expenses of travel, per diem, and lodging.

Products and Services

We have developed products for sale to OEMs as well as to the general marketplace. We have developed and provided control panels for large compressed air systems and flow control systems for a large air compressor manufacturer. We have also developed and distributed into the general marketplace a single point controller for evaporative coolers. We are currently looking for and developing new product for additional OEMs across the country.

34

We also provide many our customers a variety of automation and control services:

| | |

| • | Project Management – Our senior controls engineers provide service to our customers by managing their projects for them whether it is large or small. |

| | |

| • | Engineering Design – Our control systems designers can take a project from a concept to a functioning control system. |

| | |

| • | Programming – We have the expertise to program any piece of automation from Programmable Logic Controllers (PLCs), Supervisory Control and Data Acquisition (SCADA) control systems, variable frequency drives and Maintenance Enforcement Survey (MES) level data. |

| | |

| • | Field Service – Our field service technicians can support any type of automation that is serviceable. |

| | |

| • | Control Panel Fabrication – We are a certified Underwriters Laboratories (UL) panel fabrication facility. This nationally recognized regulatory body provides us with significant marketplace credibility for custom control panel assembly and fabrication to our clients. Most of our locations support a UL508 listed panel shop. |

| | |

| • | AutoCAD and Promise – We are able to provide our customers with state of the art drawings using the latest technological drafting software. |

Technology

We implement and provide technology to our customers. We have to constantly stay abreast of the ever changing technological offerings. We aggressively look for the best talent available to deliver our products and services to customers. We provide an environment that enables our engineers and technicians to be the best service possible. It is our employees that implement and evoke technology whenever possible to create a more efficient workplace and customer solution.

Proprietary Rights

We do not own or license any patents or trademarks, and we have no immediate plans to do so. We do, however, believe that we may have developed certain proprietary rights in the way we (i) construct our bids for automation control projects, (ii) use the relevant software to produce our designs and control panels, (iii) program the relevant software, (iv) assemble our control panels and hardware, and (v) achieve installation of our control panels and hardware. We have not filed any application with any government agency for protection or registration of intellectual property. We rely upon a combination of nondisclosure and other contractual arrangements to protect our proprietary rights. We may acquire additional intellectual property and proprietary rights through our future business acquisitions. While proprietary intellectual property is important to us, we believe the loss or expiration of any intellectual property right would not materially impact our business.

Competition

The automation control industry is intensely competitive. Many of our competitors have longer operating histories, greater name recognition, larger user bases and significantly greater financial, technical and sales and marketing resources than we do. A handful of larger automation control companies, such as Emerson Electric Company, Rockwell Automation, Inc. and Honeywell International, Inc. dominate the market as they offer national as well as worldwide support for the corporate and government clients they serve. Depending on the particular customer or market involved, our business competes on a variety of factors, such as price, quality, reliability, delivery, customer service, performance, applied technology, product innovation and product recognition. Brand identity, service to customers and quality are generally important competitive factors for our products and services, and there is considerable price competition. While our competitive position varies, we believe we are a progressing to be significant competitor in the marketplace.

35

Employees

As of December 8, 2008, our parent holding company has 5 full-time employees and 6 total employees, ISS has 9 full-time employees and 9 total employees, and Intecon has 13 full-time employees and 13 total employees. We have not experienced any work stoppages and we consider relations with our employees to be good.

PROPERTIES

The Company leases office space on a month to month basis under operating lease agreements with original lease periods of up to 5 years. The lease term begins on the date of initial possession of the lease property for purposes of recognizing lease expense on a straight-line basis over the term of the lease. Lease renewal periods are considered on a lease-by-lease basis and are generally not included in the initial lease term.

The Company’s lease obligation for its office in Henderson, Nevada is with a non-related third party for $2,800 per month, which is under a month to month rental agreement with no future annual minimum payments.

On December 26, 2007, the Company acquired its wholly owned subsidiary Intecon, Inc. which has an operating lease for its office and manufactoring services located in Tempe, Arizona. This operating lease is with a non-related third party for $6,974 per month with an annual increase. See table below for future payments to office rent:

| | | | | | | | | | | | | | | | |

From | | | Through | | | Sq. footage | | | $ per sq. ft | | | Annual rent | | | Monthly rent | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12/31/2007 | | | 4/30/2008 | | | 9,176 | | | 9.12 | | $ | 83,685 | | $ | 6,974 | |

5/1/2008 | | | 4/30/2009 | | | 9,176 | | | 9.36 | | $ | 85,887 | | $ | 7,157 | |

5/1/2009 | | | 4/30/2010 | | | 9,176 | | | 9.60 | | $ | 88,090 | | $ | 7,341 | |

5/1/2010 | | | 4/30/2011 | | | 9,176 | | | 9.84 | | $ | 90,292 | | $ | 7,524 | |

We do not own any property.

LEGAL PROCEEDINGS

We are not currently a party to any legal proceeding or governmental proceeding nor are we currently aware of any pending legal proceeding or governmental proceeding proposed to be initiated against us. There are no proceedings in which any of our current directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to us.

[Remainder of page intentionally left blank]

36

MANAGEMENT

Our executive officers and directors and their respective ages and positions as of December 18, 2008 are as follows:

| | |

Name | Age | Position |

|

|

|

Robert W. Chance | 51 | President, Chief Executive Officer, acting Chief Financial Officer and Director of National Automation Services, Inc. |

| | |

Jody R. Hanley | 47 | Director of National Automation Services, Inc.; President of Intuitive System Solutions, Inc. |

| | |

Manuel Ruiz | 44 | Secretary and Director of National Automation Services, Inc.; Secretary of Intuitive System Solutions, Inc. |

| | |

Robert H. O’Connor | 64 | Independent Director of National Automation Services, Inc. |

| | |

Brandon Spiker | 39 | Vice President of Operations of National Automation Services, Inc.; President of Intecon, Inc. |

| | |

David Marlow | 45 | Vice President of Sales and Marketing of National Automation Services, Inc.; Vice President of Sales of Intecon, Inc. |

|

|

|

Robert W. Chance has served as President, Chief Executive Officer and a director of National Automation Services, Inc. since 2007 and acting Chief Financial Officer since September 2008. From July 2005 to June 2007, Mr. Chance was Chief Operations Officer of Nytrox Systems while currently serving as Vice President of our wholly-owned subsidiary Intuitive System Solutions, Inc. Prior to July 2005, Mr. Chance held management positions in four Fortune 100 companies including Siemens, Johnson Controls, Honeywell IAC and Fisher Controls International over the course of his 30 year career in the automation and controls industry.

Jody R. Hanley has served as a director of National Automation Services, Inc. since 2007. He is the President and one of the original owners and founders of our wholly-owned subsidiary Intuitive System Solutions, Inc. Mr. Hanley has been involved in the day-to-day operations of Intuitive System Solutions, Inc. as an officer since April 2001. Mr. Hanley has over 21 years of supervisory and managerial experience including five years as a project manager and facility maintenance manager for Merck Medco, a Fortune 50 company.

Manuel Ruiz has served as Secretary and a director of National Automation Services, Inc. since 2007. He is one of the original owners and founders of our wholly-owned subsidiary Intuitive System Solutions, Inc. Mr. Ruiz has been involved in the day-to-day operations of Intuitive System Solutions, Inc. as an officer since April 2001. Mr. Ruiz has over 21 years of experience and expertise in PLC system programming and design including process control and electrical engineering. Mr. Ruiz also worked for Honeywell, a Fortune 100 Company, for over 2 years designing building automation systems and industrial related control projects.

Robert H. O’Connor has served as an independent director of National Automation Services, Inc. since 2007. Mr. O’Connor is currently the sole owner of O’Connor Mortgage and Investment Company (“OCMI”), which he established in 1981. Through OCMI, he has developed substantial business experience in the course of originating real estate and business loans through California with the Bay Area being the primary, but not exclusive venue for his activities. Mr. O’Connor has developed, built and acquired both commercial and residential properties. He is also an investor in early stage companies of varying kinds. Prior to founding OCMI, Mr. O’Connor was with Pacific Gas & Electric for 20 years.

Brandon Spiker has served as Vice President of Operations of National Automation Services, Inc. since December 31, 2007. He is the President of our wholly-owned subsidiary Intecon, Inc. Mr. Spiker has been involved in Intecon’s day-to-day operations since its formation in March 1999.

[Remainder of page intentionally left blank]

37

David Marlow has served as Vice President of Sales and Marketing of National Automation Services, Inc. since December 31, 2007. He is the Vice President of Sales of our wholly-owned subsidiary Intecon, Inc. and has been involved in Intecon’s day-to-day operations since its formation in March 1999. Mr. Marlow’s background is in sales and marketing of industrial process equipment and controls.

Family Relationships

There are no family relationships, or other arrangements or understandings between or among any of the directors, executive officers or other person pursuant to which such person was selected to serve as a director or officer.

Involvement in Certain Legal Proceedings

Our directors, executive officers and control persons have not been involved in any of the following events during the past five years:

| | |

| • | any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

| | |

| • | any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| | |

| • | being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; or |

| | |

| • | being found by a court of competent jurisdiction (in a civil action), the Securities and Exchange Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated. |

Board Committees and Director Independence

Our board of directors has established an audit committee, a compensation committee, a nominating committee, an acquisition committee and a management advisory board.

Audit Committee

The audit committee provides assistance to our board of directors in fulfilling its legal and fiduciary obligations in matters involving our accounting, auditing, financial reporting, internal control and legal compliance functions. The audit committee also oversees the audit efforts of our independent registered public accounting firm and takes those actions as it deems necessary to satisfy it that the auditors are independent of management. The audit committee currently consists of Robert O’Connor, an independent director of management.

Our board of directors has determined that it does not have a member of the board that qualifies as an “audit committee financial expert” as defined in the rules and regulations of the Securities and Exchange Commission, and is “independent” as the term is defined by Rule 4200(a)(15) of the NASDAQ Marketplace Rules. We believe that the members of our board of directors are collectively capable of analyzing and evaluating our financial statements and understanding internal controls and procedures for financial reporting. However, we are considering appointing an independent qualified financial expert to our board of directors in order to strengthen and improve its internal disclosure controls and procedures.

Compensation Committee

The compensation committee determines our compensation policies and forms of compensation provided to our directors and officers. The compensation committee also reviews and determines bonuses for our officers and other employees. In addition, the compensation committee reviews and determines stock-based compensation for our directors, officers, employees and consultants and administers our stock option plan. The current member of the compensation committee is Robert O’Connor, an independent director of management operations.

38

Nominating Committee

The nominating committee assists our board of directors in fulfilling its responsibilities relating to identification of individuals qualified to become board members and recommendation of director nominees to the board of directors prior to each annual meeting of stockholders and recommendation of nominees for any committee of the board. The nominating committee currently consists of Robert W. Chance and Robert H. O’Connor, one independent director and one member of management.

Acquisition Committee

The acquisition committee is responsible for reviewing our business acquisition strategy and activities and making recommendations to the board of directors with respect to those matters, as well as any other matters related to the general oversight and implementation of our business acquisition strategy. The acquisition committee currently consists of Robert W. Chance and Jody R. Hanley.

Management Advisory Board

The management advisory board provides our board of directors with information, advice, and recommendations concerning our business development, corporate strategy, financial management, and other general issues affecting our day-to-day operations. The management advisory board currently consists of Robert W. Chance, Jody R. Hanley and Brandon Spiker.

Director Independence

We believe that the following director is considered “independent” under Rule 4200(a) (15) of the National Association of Securities Dealers listing standards: Robert O’Connor.

EXECUTIVE COMPENSATION

Director Compensation

Our directors do not currently receive any cash compensation for service on our board of directors or any committee, although we do reimburse directors for their reasonable out-of-pocket expenses associated with attending meetings. Our directors are eligible for option and restricted stock grants.

No compensation was paid to our employee directors for services as a director during the year ended December 31, 2007. The following table sets forth information concerning the compensation of our non-employee directors for the fiscal year ended December 31, 2007. (See next page)

[Remainder of page intentionally left blank]

39

| | | | | | | | | | | | | | | |

Name | | Fees Earned

or Paid in

Cash

($) | | Stock

Awards

($) | | Option

Awards

($) | | Non-Equity

Incentive Plan

Compensation

($) | | Nonqualified

Deferred

Compensation

Earnings | | All Other

Compensation

($) | | Total

($) | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Robert O’Connor | | 0 | | 60,000 | | 0 | | 0 | | 0 | | 0 | | 0 | |

William Strachan (1) | | 0 | | 60,000 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| | |

| (1) | Mr. Strachan is no longer a director of our company and served as Chairman of our board of directors and an independent director from June 2007 to September 30, 2008. |

Executive Compensation

The following table sets forth all compensation paid to our Chief Executive Officer and the other executive officers who earned more than $100,000 per year during the last completed fiscal year for services provided to us during fiscal 2007 and 2006, and through the nine months of September 30, 2008. We refer to all of these officers collectively as our “named executive officers.”

Summary Compensation Table

| | | | | | | | | | | | | | | | |

Name &

Principal

Position | | Year | | Salary

($) | | Bonus

($) | | Stock

Awards

($) | | Option

Awards

($) | | Non-Equity

Incentive Plan

Compensation

($) | | All Other

Compensation

($) | | Total

($) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Robert W. Chance,

Chief Executive Officer | | 2007

2006 | | 78,923

4,492 | | 10,000

0 | | 0

0 | | 0

0 | | 0

0 | | 0

0 | | 88,923

4,492 |

Manuel Ruiz,

Secretary | | 2007

2006 | | 104,000

5,600 | | 10,000

0 | | 0

0 | | 0

0 | | 0

0 | | 0

0 | | 114,000

5,600 |

Jody R. Hanley, President of Intuitive Systems Solutions, Inc., a wholly-owned subsidiary | | 2007

2006 | | 104,000

5,600 | | 10,000

0 | | 0

0 | | 0

0 | | 0

0 | | 0

0 | | 114,000

5,600 |

Employment Agreements with Named Executive Officers

Robert Chance

On February 14, 2007, we entered into an employment agreement with Robert Chance. Pursuant to the employment agreement, we agreed to pay Mr. Chance $104,000 per year at monthly or more frequent intervals and to provide him with such supplemental benefits as we may from time to time provide to our full-time employees in similar positions as Mr. Chance. Mr. Chance is subject to certain non-compete restrictions for so long as he is employed by us and for a one-year period after the end of his employment. He is also subject to certain non-disclosure restrictions at all times during and after his employment. The term of the agreement is for a two-year period and will continue for successive periods of one year each, unless either party terminates the employment at the end of the then-current period by giving written notice at least 30 days prior to the end of such employment period. Mr. Chance’s employment will terminate upon the first to occur of the expiration of the period as described in the preceding sentence, the death or total and permanent disability of Mr. Chance, our election to terminate Mr. Chance due to a material breach by Mr. Chance of any of his covenants under the employment agreement, or our election to terminate Mr. Chance for cause.

[Remainder of page intentionally left blank]

40

On October 12, 2007, we amended Mr. Chance’s employment agreement to change the beginning of the term of the agreement to October 12, 2007 and to start all time periods stated in the agreement from the new date.

Jody Hanley

On February 14, 2007, entered into an employment agreement with Jody Hanley's. All of the material terms of our employment agreement with Mr.Hanley are identical to those of our employment agreement with Mr. Chance as described above.

On October 12, 2007, we amended Mr. Hanley’s employment agreement to change the begning of the term of the agreement to October 12, 2007 and to start all the time periods stated in the agreement from the new date.

Manuel Ruiz

On February 14, 2007, we entered into an employment agreement with Manuel Ruiz. All of the material terms of our employment agreement with Mr. Ruiz are identical to those of our employment agreement with Mr. Chance as described above.

On October 12, 2007, we amended Mr. Ruiz’s employment agreement to change the beginning of the term of the agreement to October 12, 2007 and to start all time periods stated in the agreement from the new date.

Termination of Employment, Change in Control or Change in Responsibilities of Named Executive Officers

Except as disclosed in this prospectus, there are no compensatory plans or arrangements with any named executive officer (including payments to be received from our parent company or any of our subsidiaries), which result or will result from the resignation, retirement or any other termination of employment of such named executive officer or from a change of control of our parent company or any of our subsidiaries or any change in such named executive officer’s responsibilities following a change in control.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Described below are certain transactions or series of transactions, since the beginning of our last fiscal year, between us and our executive officers, directors and the beneficial owners of 5% or more of our common stock, on an as converted basis, and certain persons affiliated with or related to these persons, including family members, in which they had or will have a direct or indirect material interest in an amount that exceeds the lesser of $120,000 or 1% of the average of our total assets as of year-end for the last three completed fiscal years, other than compensation arrangements that are otherwise required to be described under “Executive Compensation.”

In 2006, a director of the Company loaned $125,000 to the Company. In 2007, this loan was converted to 125,000 shares of preferred stock valued at $125,000. Per the terms of the agreement, the preferred shares were to be returned once the loan was paid in full. Pursuant to SFAS 150Accounting for Certain Financial Instruments with Characteristics of both Liabilities and Equity,the Company classified the instrument as a liability because as it embodies an unconditional obligation requiring the Company to redeem it by transferring its assets at a determinable date. As of March 31, 2008, the preferred shares were returned to the Company and $125,000 repaid to the director.

On October 2, 2007, pursuant to the terms of a share exchange transaction, National Automation Services, Inc. acquired control of its wholly-owned subsidiary, Intuitive System Solutions, Inc., a Nevada corporation (“ISS”), through exchange of all ISS common stock for of 39,999,999 shares of common stock to the stockholders of ISS. For accounting purposes the acquisition has been treated as a recapitalization of ISS with ISS as the acquirer in this reverse merger. The historical financial statements prior to October 2, 2007 are those of ISS.

41

On December 26, 2007, the Company entered into an agreement to acquire Intecon as a wholly-owned operating subsidiary pursuant to a share exchange agreement by and among Intecon, the Intecon stockholders and the Company. The Company acquired 100% of the outstanding stock and voting rights of Intecon. The purchase of Intecon was conducted in order for National Automation Services, Inc. to grow as a part of its business objective. The consolidated income statement comprises the last 5 days of operating activities for the Intecon subsidiary. In exchange for the issuance of 300,000 shares of the Company’s common stock valued at $42,000, $300,000 in cash consideration to the Intecon stockholders, and $250,000 to payoff outstanding debt and credit lines on behalf of Intecon.

On February 12, 2008, a director of the Board entered into a loan agreement with the Company in the amount of $35,000. Per the terms of the verbal agreement no interest was to be accumulated. As of the date of these financial statements the debt still remains outstanding.

On February 12, 2008, we entered into a loan agreement with one of our directors in the amount of $45,000. Under the terms of the verbal agreement, $10,000 of interest accrued on the loan, and the director received no stock or other consideration for his loan to us other than our promise to repay the loan. We repaid the loan on March 28, 2008.

On June 30, 2008, we borrowed $130,000 from an independent director of our board. On July 23, 2008, we paid $30,000 cash to the independent director on July 23, 2008 as partial payment of the loan. On September 22, 2008, we issued 357,153 shares of restricted common stock in order to satisfy the outstanding interest of the loan at August 31, 2008. As of the date of this prospectus, we still owe an outstanding balance on this loan in the amount of $50,000.

In December 2008, our president Mr. Chance transferred 112,500 shares of common stock beneficially owned by him to an affiliate of Trafalgar as security for the March 26, 2008 and June 21, 2008 financing transactions with Trafalgar.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information, as of December 18, 2008, with respect to the beneficial ownership of the outstanding common stock by (i) any holder of more than five (5%) percent; (ii) each of our executive officers and directors; and (iii) our directors and executive officers as a group. Except as otherwise indicated, each of the stockholders listed below has sole voting and investment power over the shares beneficially owned.

| | | | | | | | | |

Title of Class | | Name of

Beneficial Owner (1) | | Number of Shares

Beneficially Owned (2) | | Percentage

Ownership(2) | |

|

|

|

|

|

|

|

|

Common Stock | | Robert W. Chance + | | 7,189,133 | | | 10.50 | % | |

|

|

|

|

|

|