UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2008.

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the transition period from __________ to ___________

Commission file number 001-34136

China Cablecom Holdings, Ltd.

(Exact name of the Registrant as specified in its charter)

British Virgin Islands

(Jurisdiction of incorporation or organization)

1 Grand Gateway

1 Hongqiao Road

Shanghai, 200030

People’s Republic of China

(86) 21 6207-9731

(Address of principal executive offices)

Debra Chen, debra@chinacablecom.net, 27 Union Square West, Suite 501-502, New York, NY 10003

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of Each Class

ORDINARY SHARES, $.0005 PAR VALUE

Name of each exchange on which registered

The NASDAQ Capital Market LLC

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

On December 31, 2008, the registrant had 9,153,071 ordinary shares outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

o Large Accelerated filer | o Accelerated filer | x Non-accelerated filer |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

x US GAAP | o International Financial Reporting Standards as issued by the International Accounting Standards Board | o Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of the securities under a plan confirmed by a court.

TABLE OF CONTENTS

| | PART I | Page |

| Item 1. | Identity of Directors, Senior Management and Advisers | 6 |

| | | |

| Item 2. | Offer Statistics and Expected Timetable | 6 |

| | | |

| Item 3. | Key Information | 6 |

| A. | Selected financial data | 6 |

| B. | Capitalization and indebtedness | 9 |

| C. | Reasons for the offer and use of proceeds | 9 |

| D. | Risk factors | 10 |

| | | |

| Item 4. | Information on the Company | 21 |

| A. | History and Development of the Company | 21 |

| B. | Business overview | 24 |

| C. | Organizational structure | 31 |

| D. | Property, plants and equipment | 34 |

| | | |

| Item 4A. | Unresolved Staff Comments | 35 |

| | | |

| Item 5. | Operating and Financial Review and Prospects | 35 |

| | | |

| Item 6. | Directors, Senior Management and Employees | 42 |

| A. | Directors and senior management | 42 |

| B. | Compensation | 45 |

| C. | Board practices | 46 |

| D. | Employees | 49 |

| E. | Share ownership | 49 |

| | | |

| Item 7. | Major Shareholders and Related Party Transactions | 49 |

| A. | Major shareholders | 49 |

| B. | Related party transactions | 52 |

| C. | Interests of experts and counsel | 52 |

| | | |

| Item 8. | Financial Information | 52 |

| A. | Consolidated Statements and Other Financial Information | 52 |

| B. | Significant Changes | 52 |

| | | |

| Item 9. | The Offer and Listing | 53 |

| A. | Offer and listing details | 53 |

| B. | Plan of distribution | 55 |

| C. | Markets | 55 |

| D. | Selling shareholders | 55 |

| E. | Dilution | 55 |

| F. | Expenses of the issue | 55 |

| Item 10. | Additional Information | 55 |

| A. | Share capital | 55 |

| B. | Memorandum and articles of association | 56 |

| C. | Material contracts | 56 |

| D. | Exchange controls | 56 |

| E. | Taxation | 57 |

| F. | Dividends and paying agents | 64 |

| G. | Statement by experts | 64 |

| H. | Documents on display | 64 |

| I. | Subsidiary information | 65 |

| | | |

| Item 11. | Quantitative and Qualitative Disclosure About Market Risk | 65 |

| | | |

| Item 12. | Description of Securities Other Than Equity Securities | 65 |

| | | |

| | PART II | |

| | | |

| Item 13. | Defaults, Dividend Arrearages and Delinquencies | 66 |

| | | |

| Item 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds | 66 |

| | | |

| Item 15. | Controls and Procedures | 66 |

| | | |

| Item 16 | [Reserved] | 67 |

| | | |

| Item 16A | — Audit Committee Financial Expert | 67 |

| | | |

| Item 16B | — Code of Ethics | 67 |

| | | |

| Item 16C | — Principal Accountant Fees and Services | 67 |

| | | |

| Item 16D | — Exemption from the Listing Standards for Audit Committees | 68 |

| | | |

| Item 16E | — Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 68 |

| | | |

| Item 16F | — Change in Registrant’s Certifying Accountant | |

| | | |

| Item 16G | — Corporate Governance | |

| | | |

| | PART III | |

| | | |

| Item 17 | Financial Statements | 69 |

| | | |

| Item 18. | Financial Statements | |

| | | |

| Item 19 | Exhibits | |

| | | |

| Signatures | 73 |

CERTAIN INFORMATION

As used in this Annual Report on Form 20-F (the “Annual Report”), unless otherwise indicated, “we,” “us,” “our,” the “Company,” the “Corporation,” and “China Cablecom Holdings” refers to China Cablecom Holdings, Ltd., a company formed in the British Virgin Islands and its subsidiaries. All references to “China Cablecom,” and “China Cablecom Ltd.” refer to China Cablecom Ltd., a wholly owned subsidiary of China Cablecom Holdings, and the entity through which our operating businesses are held. All references to “China” or the “PRC” refer to the People’s Republic of China.

See Item 3: “Key Information” for historical information regarding the average rate between buying and selling as published by the people’s Bank of China with respect to Chinese Renminbi. You should not construe these translations as representations that the Chinese Renminbi amounts actually represent such US dollar amounts or could have been or could be converted into US dollars at the rates indicated or at any other rates. Such rates are the number Chinese Renminbi per one United States dollar quoted by the People’s Bank of China.

FORWARD-LOOKING STATEMENTS

This Annual Report contains ‘‘forward-looking statements’’ that represent our beliefs, projections and predictions about future events. All statements other than statements of historical fact are ‘‘forward-looking statements,’’ including any projections of earnings, revenue or other financial items, any statements of the plans, strategies and objectives of management for future operations, any statements concerning proposed new projects or other developments, any statements regarding future economic conditions or performance, any statements of management’s beliefs, goals, strategies, intentions and objectives, and any statements of assumptions underlying any of the foregoing. Words such as ‘‘may’’, ‘‘will’’, ‘‘should’’, ‘‘could’’, ‘‘would’’, ‘‘predicts’’, ‘‘potential’’, ‘‘continue’’, ‘‘expects’’, ‘‘anticipates’’, ‘‘future’’, ‘‘intends’’, ‘‘plans’’, ‘‘believes’’, ‘‘estimates’’ and similar expressions, as well as statements in the future tense, identify forward-looking statements.

These statements are necessarily subjective and involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any future results, performance or achievements described in or implied by such statements. Actual results may differ materially from expected results described in our forward-looking statements, including with respect to correct measurement and identification of factors affecting our business or the extent of their likely impact, the accuracy and completeness of the publicly available information with respect to the factors upon which our business strategy is based or the success of our business.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of whether, or the times by which, our performance or results may be achieved. Forward-looking statements are based on information available at the time those statements are made and management’s belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to, those factors discussed under the headings ‘‘Risk Factors’’, ‘‘Operating and Financial Review and Prospects,’’ ‘‘Information on Our Company” and elsewhere in this Annual Report.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

| A. | Directors and Senior Management |

Not required.

Not required.

Not required.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not required.

ITEM 3. KEY INFORMATION

A. Selected financial data

The following summary consolidated financial data for the period ended December 31, 2007 and the year ended December 31, 2008 have been derived from the Company’s audited consolidated financial statements included in this Annual Report beginning on page F-1. The following selected historical statement of income data for the years ended December 31, 2005 and 2006 and for the period from January 1, 2007 to September 30, 2007 and the selected historical balance sheet data as of December 31, 2005 and 2006 and September 30,2007 have been derived from the audited financial statements of Binzhou Guangdian Network Co., Ltd. (the “Predecessor Company”) not included in this Annual Report. This information is only a summary and should be read together with the consolidated financial statements, the related notes and other financial information included in this Annual Report. Summary consolidated financial data for the year ended December 31, 2004 could not be provided without unreasonable effort or expenses, and has therefore not been included in this Annual Report.

Certain factors that affect the comparability of the information set forth in the following table are described in the items “Operating and Financial Review and Prospects,” and the Financial Statements and related notes thereto included elsewhere in this Annual Report.

| | | Predecessor Company | | | | | | | |

| | | Year Ended December 31,2005 | | | Year Ended December 31,2006 | | | January 1 through September 30, 2007 | | | October 1 through December 31, 2007 | | | Year Ended December 31, 2008 | |

(in US$ thousands, except for share data) | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Statement of Income Data: | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Revenues, net | | | 7,804 | | | | 8,288 | | | | 5,020 | | | | 1,995 | | | | 23,439 | |

| | | | | | | | | | | | | | | | | | | | | |

| Gross profit | | | 5,066 | | | | 5,485 | | | | 2,340 | | | | 978 | | | | 10,002 | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating income (loss) | | | 3,628 | | | | 3,774 | | | | 532 | | | | (684 | ) | | | (5,123 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Interest expenses | | | (703 | ) | | | (721 | ) | | | (743 | ) | | | (1,474 | ) | | | (8,742 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) before income tax | | | 2,984 | | | | 3,154 | | | | 222 | | | | (2,095 | ) | | | (12,844 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net profit (loss) | | | 2,861 | | | | 2,925 | | | | 24 | | | | (2,155 | ) | | | (14,173 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Loss per share | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Basic | | | | | | | | | | | | | | | (0.87 | ) | | | (1.87 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Diluted | | | | | | | | | | | | | | | (0.87 | ) | | | (1.87 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Weighted average number ordinary shares, Basic and diluted | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Basic | | | | | | | | | | | | | | | 2,066,680 | | | | 7,417,512 | |

| | | | | | | | | | | | | | | | | | | | | |

| Diluted | | | | | | | | | | | | | | | 2,066,680 | | | | 7,417,512 | |

| | | Predecessor Company | | | | |

| | | As of December 31, 2005 | | | As of December 31, 2006 | | | As of September 30, 2007 | | | As of December 31, 2007 | | | As of December 31, 2008 | |

| | | | | | | | | | | | | | | | |

| (in US$ thousands) | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Balance Sheet Data: | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Cash | | | 355 | | | | 303 | | | | 867 | | | | 12,639 | | | | 29,182 | |

| | | | | | | | | | | | | | | | | | | | | |

| Prepaid expenses and advances | | | 1,791 | | | | 1,165 | | | | 667 | | | | 669 | | | | 9,236 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total current assets | | | 3,150 | | | | 2,649 | | | | 2,830 | | | | 16,194 | | | | 43,792 | |

| | | | | | | | | | | | | | | | | | | | | |

| Property, plant & equipment, net | | | 20,197 | | | | 20,946 | | | | 21,324 | | | | 20,722 | | | | 79,877 | |

| | | | | | | | | | | | | | | | | | | | | |

| Intangible assets, net | | | - | | | | | | | | - | | | | 18,363 | | | | 57,126 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total assets | | | 23,998 | | | | 23,840 | | | | 24,812 | | | | 69,496 | | | | 183,076 | |

| | | | | | | | | | | | | | | | | | | | | |

| Current portion of long term debt, net of discount | | | 1,859 | | | | 1,921 | | | | 1,998 | | | | 9,618 | | | | 9,482 | |

| | | | | | | | | | | | | | | | | | | | | |

| Accounts payable | | | 12,129 | | | | 9,624 | | | | 8,736 | | | | 2,461 | | | | 8,872 | |

| | | | | | | | | | | | | | | | | | | | | |

| Note payable – minority interest | | | - | | | | - | | | | - | | | | 17,218 | | | | 55,420 | |

| | | | | | | | | | | | | | | | | | | | | |

| Liabilities to be settled by minority interest | | | - | | | | - | | | | - | | | | 12,461 | | | | - | |

| | | | | | | | | | | | | | | | | | | | | |

| Total current liabilities | | | 14,943 | | | | 12,543 | | | | 13,895 | | | | 43,247 | | | | 83,067 | |

| | | | | | | | | | | | | | | | | | | | | |

| Convertible notes, net of discounts | | | - | | | | - | | | | - | | | | - | | | | 16,684 | |

| | | | | | | | | | | | | | | | | | | | | |

| Notes payable – minority interest, net of current portion | | | - | | | | - | | | | - | | | | 17,047 | | | | 51,778 | |

| | | | | | | | | | | | | | | | | | | | | |

| Notes payable, net of discount and current portion | | | - | | | | - | | | | - | | | | 7,478 | | | | - | |

| | | | | | | | | | | | | | | | | | | | | |

| Total liabilities | | | 14,943 | | | | 12,543 | | | | 13,895 | | | | 67,772 | | | | 151,528 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total stockholder’s equity | | | 9,055 | | | | 11,297 | | | | 10,917 | | | | 1,702 | | | | 29,779 | |

Exchange Rate Information

Our business is currently conducted in and from China in Renminbi. In this annual report, all references to “Renminbi” and “RMB” are to the legal currency of China and all references to U.S. dollars, dollars, $ and US$ are to the legal currency of the United States. The conversion of Renminbi into U.S. dollars in this annual report is based on the middle rate between buying and selling as published by the People’s Bank of China of the PRC. For reader convenience, this annual report contains translations of some Renminbi or U.S. dollar amounts for 2008 at US$1.00: RMB6.8346, which was the middle rate on December 31, 2008. The published middle rate on June 30, 2009 was US$1.00: RMB 6.8319. We make no representation that any Renminbi or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or Renminbi, as the case may be, at any particular rate, the rates stated below, or at all. The Chinese government imposes control over its foreign currency reserves in part through direct regulation of the conversion of Renminbi into foreign currency and through restrictions on foreign trade.

The following table sets forth the average middle rates for Renminbi expressed as per one U.S. dollar for the years 2004, 2005, 2006, 2007 and 2008:

| Year | | Renminbi Average(1) | |

| 2004 | | | 8.2768 | |

| 2005 | | | 8.1826 | |

| 2006 | | | 7.9579 | |

| 2007 | | | 7.6040 | |

| 2008 | | | 6.9451 | |

| (1) | Determined by averaging the middle rate between buying and selling rates on the last business day of each month during the relevant period. |

The following table sets forth the high and low middle rates for Renminbi expressed as per one U.S. dollar during the past six months.

| Month Ended | | High | | | Low | |

| December 31, 2008 | | | 6.8527 | | | | 6.8322 | |

| January 31, 2009 | | | 6.8399 | | | | 6.8360 | |

| February 28, 2009 | | | 6.8398 | | | | 6.8327 | |

| March 31, 2009 | | | 6.8395 | | | | 6.8293 | |

| April 30, 2009 | | | 6.8370 | | | | 6.8250 | |

| May 31, 2009 | | | 6.8324 | | | | 6.8201 | |

| June 30, 2009 | | | 6.8368 | | | | 6.8302 | |

B. Capitalization and Indebtedness

Not required.

C . Reasons for the Offer and Use of Proceeds

Not required.

D. Risk factors

Risks Relating to Our Business

Our subsidiary China Cablecom Ltd. is in default under certain of its debt obligations.

Our subsidiary China Cablecom Ltd. received from one of its lenders a notice of default as a result of China Cablecom Ltd.’s failure to make its scheduled April 9, 2009 principal and interest payment of approximately $2.2 million under a promissory note issued in connection with the $20.0 million bridge financing that preceded our merger with Jaguar Acquisition Corporation (the “Bridge Notes”). Accordingly, the lender gave notice that the April 2009 principal and interest payment and all other obligations under the promissory note held by such lender were immediately due and payable together with related penalties. As a result, China Cablecom Ltd. is currently in default under the Bridge Note. Such default may have material adverse effect on our operations, financial condition, and results of operations. The Company sought tolling agreements from all of the holders of the promissory notes issued in connection with the bridge financing that funds consisting of outstanding principal amount together with any unpaid and accrued interest (aggregating to approximately $11.0 million on the due date, including the approximate $2.2 million owed to the lender mentioned above), had been made available in a separate fund during the process of arranging for the conversion of Renminbi in China. While most lenders provided such tolling agreements, they were only effective until April 30, 2009 and as of June 30, 2009, the full amount of principal, interest and penalty provisions are now due and payable. We are currently working to resolve this matter with investors holding the Bridge Notes of China Cablecom Ltd. by negotiating a comprehensive debt restructuring package. However, there is no assurance that we will be able to agree to such a restructuring package as may be necessary to bring China Cablecom Ltd. out of default.

We have a very limited operating history, which may make it difficult for you to evaluate our business and prospects.

We acquired Binzhou Broadcasting and Television Information Network Co., Ltd. (“Binzhou Broadcasting”) in September 2007 and Hubei Chutian Video Communication Network Co., Ltd. (“Hubei Chutian”) in June 2008. As a result, our operating history is very limited and, accordingly, the revenue and income potential of our business and markets are unproven. Binzhou Broadcasting’s and Hubei Chutian’s historical operating results may not provide a meaningful basis for evaluating our business, financial performance and prospects, particularly in view of the fact that the networks comprising the operations of Binzhou Broadcasting and Hubei Chutian have historically been operated independently.

We also face numerous risks, uncertainties, expenses and difficulties frequently encountered by companies at an early stage of development. Some of these risks and uncertainties relate to our ability to:

| | · | develop new customers or new business from existing customers; |

| | · | expand the technical sophistication of the products we offer; |

| | · | respond effectively to competitive pressures; |

| | · | attract and retain qualified management and employees; and |

| | · | adverse effect on our business caused by the global financial crisis. |

We may not meet internal or external expectations regarding our future performance. If we are not successful in addressing these risks and uncertainties, our business, operating results and financial condition may be materially adversely affected.

We must make significant intercompany loans to Binzhou Broadcasting and Hubei Chutian to preserve our consolidation of the operating results of Binzhou Broadcasting for financial reporting purposes.

Although we are currently entitled to consolidate the financial position and operating results of Binzhou Broadcasting and Hubei Chutian in our financial statements under US GAAP, this is the result of the ratio of risk and rewards borne by us regarding the operations of the two businesses, which in turn is dependent on the significant level of intercompany debt we have extended to them. Pursuant to the terms of the Asset Transfer Agreement with the local state-owned enterprise, Binzhou Guangdian Network Co., Ltd. (“Binzhou SOE”), Binzhou Broadcasting must complete the payment for all assets to be transferred not later than August 2008, which was later extended to December 31, 2008, further extended to January 31, 2009 and further extended to December 31, 2009. Pursuant to the terms of the Asset Transfer Agreement with the local state-owned enterprise, Hubei Chutian Radio and Television Information Network Co., Ltd. (“Hubei SOE”), Hubei Chutian must complete the payment for all assets to be transferred not later than July 2009. To the extent the financing for such payment is not in the form of an intercompany loan from us, our ability to preserve the accounting treatment of Binzhou Broadcasting and Hubei Chutian will be jeopardized.

We are required to seek additional financing and to amend or modify the terms of our existing debts to meet these obligations. There can be no assurance that any such additional financing will be available on acceptable terms or at all or that such lenders will be willing to amend or modify the terms of the outstanding notes. Any such failure to secure additional financing by us will create a default under the terms of the two joint venture agreements between Jinan Youxiantong Network Technology Co., Ltd. (“JYNT”) and the Binzhou SOE and Hubei SOE and likely result in us no longer being entitled to consolidate the financial position and results of operations of Binzhou Broadcasting and Hubei Chutian.

The PRC television broadcasting industry may not digitalize as quickly as we expect, as a result of which our revenues would be materially adversely affected.

Our future success depends upon the pace at which PRC television network operators switch from analog to digital transmission. Various factors may cause PRC television network operators to convert from analog to digital transmission at a slow pace. The PRC government, which has strongly encouraged television network operators to digitalize their networks and has set a target of 2015 for all, except for up to six, analog channels to be switched off, may relax or cancel the 2015 target. Also, PRC television viewers may fail to subscribe to digital television services in sufficient numbers to support wide-scale digitalization.

Existing and emerging alternative platforms for delivering television programs, including terrestrial networks, Internet protocol television and satellite broadcasting networks present a significant competitive risk to our business.

We compete with traditional terrestrial television networks for the same pool of viewers. As technologies develop, other means of delivering information and entertainment to television viewers are evolving. For example, some telecommunications companies in the PRC are seeking to compete with terrestrial broadcasters and cable television network operators by offering Internet protocol television, or IPTV, which allows telecommunications companies to stream television programs through telephone lines. While the PRC Ministry of Information Industry, or the MII, so far has issued only five IPTV licenses, it may issue significantly more licenses in the future. In addition, the State Administration of radio, Film and Television (“SARFT”) issued a broadcast license last year to the PRC’s first direct satellite broadcast company, which is expected to begin commercial operation this year. To the extent that the terrestrial television networks, telecommunications companies and direct satellite television network operators compete successfully with us for viewers, our ability to attract and retain subscribers may be adversely affected.

Changes in the regulatory environment of, and government policies towards, the PRC television network industry could materially adversely affect our revenues.

Strong PRC government support has been a significant driver of the PRC television broadcasting industry’s transition from analog to digital transmission. Although the PRC government has set a target of 2015 for all television networks to switch to digital transmissions, terminating all analog transmissions except for up to six channels that will continue in service for the benefit of those unable to afford digital television, there is no assurance that the government will not change or adjust its digitalization policies at any time, including canceling or relaxing the target date for digitalization. If the digitalization process in the PRC were to be slowed down or otherwise adversely affected by any government action or inaction, we may not be able to develop new customers or attract new business from existing customers, and our revenues would be materially adversely affected.

Furthermore, the television broadcasting industry in the PRC is a highly regulated industry. Government regulations with respect to television broadcasting content, the amount and content of advertising, the pricing of pay-television subscriptions, the role of private-sector investment and the role of foreign investment significantly influence the business strategies and operating results of our customers. Among other things, the SARFT must approve the creation of new premium content channels and has the power to order television network operators to stop airing programs or advertising that it considers illegal or inappropriate. Any of such adverse government actions against television network operators could in turn cause us to lose existing or potential subscribers.

In China, the basic subscription fee for cable television is regulated, municipal cable television operators have to apply for approval at the local Price Bureau, which will then arrange public hearings to approve any subscription price changes. Although Binzhou Broadcasting has applied for and has acquired approval for a subscription fee raise from the Price Bureau in year 2006, there is no guarantee that any future partnership networks will succeed in getting approval for subscription fee raises for digital television services.

If significant numbers of television viewers in the PRC are unwilling to pay for digital television or value-added services, we may not be able to sustain our current revenue level.

We expect a substantial majority of our future revenue growth to be derived from the introduction of digital television subscriptions to viewers. However, we may be unsuccessful in promoting digital television or value-added services. In 2008, we expected 120,000 existing subscribers to upgrade to digital television, whereas only 2,000 subscribers actually upgraded their service. While we believe that this reduced rate of migration was due in part to transition issues and the lack of an effective marketing and rollout plan, television viewers in the PRC are accustomed to receiving television for free or for a very low price. Even viewers who are accustomed to paying for cable television subscriptions have historically paid very low rates and may not be willing to pay significantly higher rates for digital television services, or additional fees for value-added services. If we are unable to carry unique and compelling content to differentiate us from direct satellite TV service providers and telecom companies, or offer digital cable TV value-added services that meet viewers’ needs at an affordable price, we may find it difficult to persuade viewers to accept the pay-television model or pay more for digital cable television or value-added services than viewers have historically paid for analog cable television. In that event, our customers’ digital subscriber numbers may not grow and we may be unable to sustain our current revenue level.

Our officers and directors may allocate their time to other businesses, and may be affiliated with entities that may cause conflicts of interest. In particular, our principal shareholder and Executive Chairman is subject to potentially conflicting duties to another company he established to pursue business opportunities in the PRC.

Messrs. Ng and Pu and certain of our other officers and directors have the ability to allocate their time to other businesses and activities, thereby causing possible conflicts of interest in their determination as to how much time to devote to our affairs.

These individuals are engaged in several other business endeavors and are not obligated to devote any specific number of hours to our affairs. If other business affairs require them to devote more substantial amounts of time to such affairs, it could limit their ability to devote time to our affairs and could have a negative impact on our ongoing business. Certain of our officers and directors are now, and all of them may in the future become, affiliated with entities engaged in business activities similar to those intended to be conducted by us or otherwise, and accordingly, may have conflicts of interest in allocating their time and determining to which entity a particular investment or business opportunity should be presented. Moreover, in light of our officers’ and directors’ existing affiliations with other entities, they may have fiduciary obligations to present potential investment and business opportunities to those entities in addition to presenting them to us, which could cause additional conflicts of interest. While we do not believe that any of our officers or directors has a conflict of interest in terms of presenting to entities other than our investment and business opportunities that may be suitable for us, conflicts of interest may arise in the future in determining to which entity a particular business opportunity should be presented. We cannot assure you that any conflicts will be resolved in our favor. These possible conflicts may inhibit the activities of such officers and directors in seeking acquisition candidates to expand our geographic reach or broaden our service offerings. For a complete description of our management’s other affiliations, see “Directors and Management.” In any event, it cannot be predicted with any degree of certainty as to whether or not Mr. Ng, Mr. Pu or our other officers or directors will have a conflict of interest with respect to a particular transaction as such determination would be dependent upon the specific facts and circumstances surrounding such transaction at the time.

Mr. Ng, our Executive Chairman, entered into a settlement agreement with China Broadband, Inc., another company he organized to pursue broadband cable opportunities in the PRC, and certain of its shareholders and consultants, relating to possible claims that China Broadband and such shareholders and consultants suggested might be brought by China Broadband against Mr. Ng for his activities in forming China Cablecom. If the parties to the settlement agreement fail to observe the terms of the agreement, China Cablecom Holdings may be involved in burdensome and time-consuming litigation in order to establish clear entitlement to the Binzhou Broadcasting operations.

In particular, notwithstanding the terms of the settlement and the amendment to Mr. Ng’s employment agreement with China Broadband, Ltd., Mr. Ng’s continuing relationship with China Broadband could lead to future claims of violation of his duties to China Broadband in the event future acquisitions in the PRC are offered to us rather than China Broadband, notwithstanding the express terms of the revised employment agreement and provisions of the settlement agreement. Mr. Ng’s revised employment agreement with China Broadband contains an express provision permitting Mr. Ng to resign from China Broadband in the event an acquisition arises that involves the business of China Cablecom, which is how Mr. Ng currently intends to handle opportunities in the future that could create a situation similar to that which led to the settlement agreement.

The settlement agreement contains a provision recognizing that the provision of integrated cable television services in the People’s Republic of China and related activities is our business and the provision of stand-alone independent broadband services is the business of China Broadband. However, notwithstanding the terms of the settlement agreement and the amendment to Mr. Ng’s employment agreement with China Broadband, Mr. Ng’s continuing relationship with China Broadband could lead to future claims of violation of his duties to China Broadband in the event future acquisitions in the PRC are offered to China Cablecom Holdings rather than China Broadband, notwithstanding his current intention to resign in such circumstances.

If shareholders sought to sue our officers or directors, it may be difficult to obtain jurisdiction over the parties and access to the assets located in the PRC.

Because most of our officers and directors reside outside of the U.S., it may be difficult, if not impossible, to acquire jurisdiction over these persons in the event a lawsuit is initiated against such officers and directors by shareholders in the U.S. It also is unclear if extradition treaties now in effect between the U.S. and the PRC would permit effective enforcement of criminal penalties of the federal securities laws. Furthermore, because substantially all of our assets are located in the PRC, it would also be extremely difficult to access those assets to satisfy an award entered against us in U.S. court. Moreover, we have been advised that the PRC does not have treaties with the U.S. providing for the reciprocal recognition and enforcement of judgments of courts. As a result, it may not be possible for investors in the U.S. to enforce their legal rights, to effect service of process upon our directors or officers or to enforce judgments of U.S. courts predicated upon civil liabilities and criminal penalties of our directors and officers under federal securities laws.

The Chinese government could change its policies toward, or even nationalize, private enterprise, which could reduce or eliminate our interests.

Over the past several years, the Chinese government has pursued economic reform policies, including the encouragement of private economic activities and decentralization of economic regulation. The Chinese government may not continue to pursue these policies or may significantly alter them to our detriment from time to time without notice. Changes in policies by the Chinese government that result in a change of laws, regulations, their interpretation, or the imposition of high levels of taxation, restrictions on currency conversion or imports and sources of supply could materially and adversely affect our business and operating results. The nationalization or other expropriation of private enterprises by the Chinese government could result in the total loss of our investment in China.

Foreign exchange regulations in the PRC may affect our ability to pay dividends in foreign currency or conduct other foreign exchange business.

Renminbi, or RMB, is not presently a freely convertible currency, and the restrictions on currency exchanges may limit our ability to use revenues generated in RMB or to make dividends or other payments in U.S. dollars. The PRC government, through the State Administration for Foreign Exchange (“SAFE”), regulates conversion of RMB into foreign currencies. Currently, Foreign Invested Enterprises (such as China Cablecom) are required to apply for “Foreign Exchange Registration Certificates” and to renew those certificates annually. However, even with that certification, conversion of currency in the “capital account” (e.g. for capital items such as direct investments or loans) still requires the approval of SAFE. There is no assurance that SAFE approval will be obtained, and if it is not, it could impede our business activities.

The Onshore and Offshore Loan Agreements may be scrutinized by the SAFE

In June and July of 2008, China Cablecom entered into 2 loan agreements, whereby, China Cablecom extended 2 loans in U.S. dollars to Rich Dynamic Limited, a Hong Kong company, (“RDL”), which amount in aggregate, to U.S. dollars 38,000,000. These loans were utilized as payment to a shareholder (“Shareholder”) of Chengdu Chuanghong Jinsha Real Estate Co., Ltd. (“Chengdu Chuanghong”), for the purpose of acquiring 60% of the equity interest in this company. After payment was made to the Shareholder, 2 RMB loans were extended by the Shareholder to JYNT, pursuant to the loan agreements entered into between the Shareholder and JYNT, which amount in aggregate to RMB 224,000,000.

Although neither of the loan transactions contravenes PRC Law, we cannot ensure that the SAFE will not regard the transactional arrangement (taken as a whole) as an attempt to circumvent the SAFE’s scrutiny over foreign exchange. If the SAFE deems the transactional arrangement to be illegal, it may levy fines and restrict our ability to transfer funds to our PRC subsidiaries. As a result, the development of our business may be adversely affected.

We may have difficulty establishing adequate management, legal and financial controls in the PRC, which could result in misconduct and difficulty in complying with applicable laws and requirements.

As a quasi-governmental business in the PRC, our networks have not historically focused on establishing Western-style management and financial reporting concepts and practices, as well as modern banking, computer and other internal control systems. We may have difficulty in hiring and retaining a sufficient number of qualified internal control employees to work in the PRC. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards, especially on the operation level of our joint ventures with municipal cable TV network operators.

Being a foreign private issuer may exempt us from certain Securities and Exchange Commission requirements that provide shareholders the protection of information that must be made available to shareholders of United States public companies.

As a foreign private issuer. we are exempt from certain provisions applicable to United States public companies including:

| | · | The rules requiring the filing with the SEC of quarterly reports on Form 10-Q or current reports on Form 8-K; |

| | · | The sections of the Securities Exchange Act regulating the solicitation of proxies, consents or authorizations with respect to a security registered under the Securities Exchange Act; |

| | · | Provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information; and |

| | · | The sections of the Securities Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short swing” trading transactions (i.e., a purchase and sale, or a sale and purchase, of the issuer’s equity securities within less than six months). |

Because of these exemptions, our shareholders may not be afforded the same protections or information generally available to investors holding shares in public companies organized in the United States.

Risks Relating to our Corporate Structure

We exercise voting and economic control over Jinan Youxiantong Network Technology Co., Ltd. (“JYNT”) pursuant to contractual agreements with the shareholders of JYNT that may not be as effective as direct ownership.

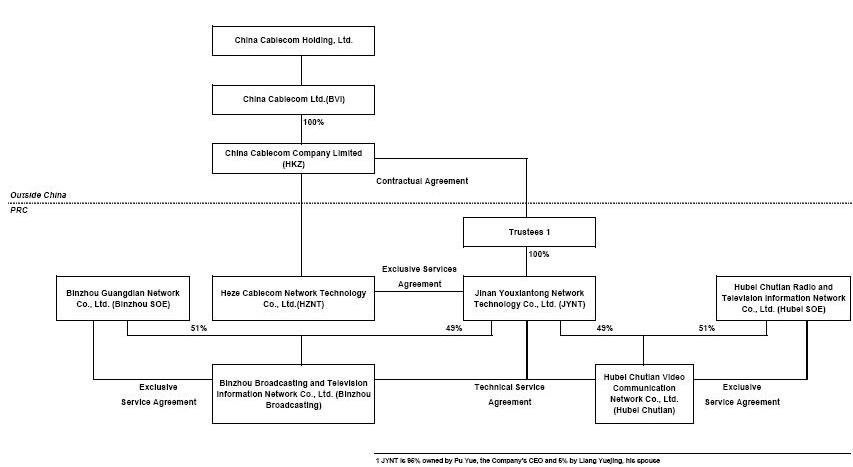

As a result of the contractual agreements entered into between our indirect subsidiary Heze Cablecom Network Technology Co., Ltd., a PRC company (“HZNT”), and the shareholders of JYNT, we control and are considered the primary beneficiary of JYNT, and are entitled to consolidate the financial results of JYNT, which includes JYNT’s 60% economic interest in the financial results of Binzhou Broadcasting and JYNT’s 60% economic interest in the financial results of Hubei Chutian. While the terms of these contractual agreements are designed to minimize the operational impact of governmental regulation of the media, cultural and telecommunications industries in the PRC, and provide us with voting control and the economic interests associated with the shareholders’ equity interest in JYNT, they are not accorded the same status at law as direct ownership of JYNT and may not be as effective in providing and maintaining control over JYNT as direct ownership. For example, we may not be able to take control of JYNT upon the occurrence of certain events, such as the imposition of statutory liens, judgments, court orders, death or capacity. If the PRC government proposes new laws or amends current laws that are detrimental to the contractual agreements with JYNT, such changes may effectively eliminate our control over the JYNT and our ability to consolidate the financial results of Binzhou Broadcasing and Hubei Chutian, JYNT’s sole operational assets. In addition, if the shareholders of JYNT fail to perform as required under those contractual agreements, we will have to rely on the PRC legal system to enforce those agreements, and there is no guarantee that we will be successful in an enforcement action.

Furthermore, if we, or HZNT, were found to be in violation of any existing PRC laws or regulations, the relevant regulatory authorities would have broad discretion to deal with such violation, including, but not limited to the following:

| | · | confiscating income; and/or |

| | · | requiring a restructure of ownership or operations. |

JYNT has a 49% equity interest in each of Binzhou Broadcasting and Hubei Chutian and the failure by the Binzhou SOE or the Hubei SOE to perform its obligations under the respective joint venture agreements and services agreements may negatively impact our ability to consolidate the financial operations of Binzhou Broadcasting and Hubei Chutian.

JYNT has entered into a joint venture agreement and a series of services agreements that, pursuant to applicable accounting principles, entitles JYNT to consolidate 60% of the operating results of Binzhou Broadcasting, although JYNT only has a 49% equity interest and the Binzhou SOE has retained control of the joint venture. JYNT has also entered into a joint venture agreement and a series of services agreements that, pursuant to applicable accounting principles, entitles JYNT to consolidate 60% of the operating results of Hubei Chutian, although JYNT only has a 49% equity interest and the local state-owned enterprise, Hubei Chutian Radio and Television Information Network Co., Ltd. (“Hubei SOE”) has retained control of the joint venture. Because JYNT lacks actual control over Binzhou Broadcasting and Hubei Chutian, JYNT, and us through our contractual arrangements with the shareholders of JYNT, are protected in our dealings with the Binzhou SOE and the Hubei SOE only to the extent provided for in the joint venture agreement and the services agreements. If either the Binzhou SOE or the Hubei SOE fails to observe the requirements of its respective joint venture agreement and other services agreements with JYNT, we may have to incur substantial costs and resources to enforce such arrangement, and rely on legal remedies under PRC law, including seeking specific performance or injunctive relief, and claiming damages, which may not be effective. If the shareholders of JYNT and us are unable to compel the Binzhou SOE or Hubei SOE to observe the requirements of its respective joint venture agreement and the services agreements, we may be forced to account for the financial results and position of Binzhou Broadcasting and Hubei Chutian pursuant to different accounting principles, effectively eliminating our sole operational assets.

The agreements that establish the structure for operating our business may result in the relevant PRC government regulators revoking or refusing to renew Binzhou Broadcasting’s or Hubei Chutian’s operating permit.

Each of Binzhou Broadcasting and Hubei Chutian obtains exclusive operating rights by entering into exclusive service agreements with Binzhou SOEs and Hubei SOEs, respectively, who are 100% owned by different levels of branches of SARFT in Binzhou Municipality and Hubei Municipality, respectively. Binzhou SOEs and Hubei SOEs enjoy the right to provide cable access services in their respective territories. Any foreign-invested enterprise incorporated in the PRC, such as our subsidiary, HZNT, is prohibited from conducting a business involving the transmission of broadcast television or the provision of cable access services. Our contractual arrangements with JYNT and its shareholders provide us with the economic benefits of Binzhou Broadcasting and Hubei Chutian. If SARFT determines that our control over JYNT, or our relationship with Binzhou Broadcasting or Hubei Chutian through those contractual arrangements, is contrary to their generally restrictive approach towards foreign participation in the PRC cable television industry, there can be no assurance that SARFT will not reconsider Binzhou Broadcasting’s or Hubei Chutian’s eligibility to hold exclusive rights to provide operating services or cable access services to Binzhou SOEs or Hubei SOEs. If that were to happen, we might have to discontinue all or a substantial portion of our business pending the approval of exclusive service and operating rights on the required operating permits held by Binzhou SOEs and Hubei SOEs. In addition, if we are found to be in violation of any existing or futures PRC laws or regulations, the relevant regulatory authorities, including the SARFT, would have broad discretion in dealing with such violation, including levying fines, confiscating our income, revoking the business licenses or operating licenses of our PRC affiliates and Binzhou SOE and Hubei SOE, requiring us to restructure the relevant ownership structure or operations, and requiring us to discontinue all or any portion of our operations. Any of these actions could cause significant disruption to our business operations and may materially and adversely affect our business, financial condition and results of operations.

Risks Relating to the People’s Republic of China

Adverse changes in economic policies of the PRC government could have a material adverse effect on the overall economic growth of the PRC, which could reduce the demand for our services and materially adversely affect our business.

All of our assets are located in and all of our revenue is sourced from the PRC. Accordingly, our business, financial condition, results of operations and prospects will be influenced to a significant degree by political, economic and social conditions in the PRC generally and by continued economic growth in the PRC as a whole.

The PRC economy differs from the economies of most developed countries in many respects, including the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. Although the PRC government has implemented measures since the late 1970s emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets and the establishment of improved corporate governance in business enterprises, a substantial portion of productive assets in the PRC is still owned by the PRC government. In addition, the PRC government continues to play a significant role in regulating industry development by imposing industrial policies. The PRC government also exercises significant control over the PRC’s economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies.

While the PRC economy has experienced significant growth over the past decade, growth has been uneven, both geographically and among various sectors of the economy. The PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures benefit the overall PRC economy, but may also have a negative effect on us. For example, our operating results and financial condition may be adversely affected by government control over capital investments or changes in tax regulations that are applicable to us.

Uncertainties in the interpretation and enforcement of PRC laws and regulations could limit the legal protections available to you and us.

The PRC legal system is a civil law system based on written statutes. Unlike common law systems, it is a system in which legal decisions have limited value as precedents. In 1979, the PRC government began to promulgate a comprehensive system of laws and regulations governing economic matters in general. The overall effect of legislation over the past three decades has significantly increased the protections afforded to various forms of foreign or private-sector investment in the PRC. These laws and regulations change frequently, and their interpretation and enforcement involve uncertainties. For example, we may have to resort to administrative and court proceedings to enforce the legal protections that we enjoy either by law or contract. However, since PRC administrative and court authorities have significant discretion in interpreting and implementing statutory and contractual terms, it may be more difficult to evaluate the outcome of administrative and court proceedings and the level of legal protection we enjoy than in more developed legal systems. These uncertainties may also impede our ability to enforce the contracts we have entered into. As a result, these uncertainties could materially adversely affect our business and operations.

Under the EIT Law, we, China Cablecom Company Limited, and China Cablecom each may be classified as a “resident enterprise” of the PRC. Such classification could result in unfavorable tax consequences to us, China Cablecom Company Limited, China Cablecom and our non-PRC security holders.

On March 16, 2007, the Fifth Session of the Tenth National People’s Congress passed the Enterprise Income Tax Law of the People’s Republic of China (the “EIT Law”), which became effective on January 1, 2008. Under the EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a “resident enterprise,” meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes, although the dividends paid to one resident enterprise from another may qualify as “tax-exempt income.” The implementing rules of the EIT Law define de facto management as “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise.

On April 22, 2009, the State Administration of Taxation issued the Notice on the Issues Regarding Recognition of Overseas Incorporated Domestically Controlled Enterprises as PRC Resident Enterprises Based on the De Facto Management Body Criteria, which was retroactively effective as of January 1, 2008. Under this notice, an overseas incorporated enterprise will be recognized as a PRC resident enterprise if it satisfies all of the following conditions: (i) the senior management responsible for daily production/business operations is primarily located in the PRC, and the location(s) where such senior management execute their responsibilities are primarily in the PRC; (ii) strategic financial and personnel decisions are made or approved by organizations or personnel located in the PRC; (iii) major properties, accounting ledgers, company seals and minutes of board meetings and shareholder meetings, etc., are maintained in the PRC; and (iv) 50% or more of the board members with voting rights or senior management habitually reside in the PRC. However, even under this new notice, it is still unclear whether PRC tax authorities would require us, China Cablecom Company Limited, and/or China Cablecom to be treated as a PRC resident enterprise.

If the PRC tax authorities determine that we, China Cablecom Company Limited, and/or China Cablecom is a “resident enterprise” for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow. First, we, China Cablecom Company Limited, and/or China Cablecom may be subject to enterprise income tax at a rate of 25% on our and/or China Cablecom’s worldwide taxable income, as the case may be, as well as PRC enterprise income tax reporting obligations. Second, although under the EIT Law and its implementing rules, dividends paid to us from China Cablecom’s PRC subsidiaries through China Cablecom Company Limited, its Hong Kong sub-holding company, assuming we, China Cablecom and China Cablecom Company Limited, are each treated as a “resident enterprise” under the EIT Law, may qualify as “tax-exempt income,” we cannot guarantee that such dividends will not be subject to withholding tax generally at a rate of 10% (or, if the Double Tax Avoidance Agreement between Hong Kong and Mainland China is applicable, 5%). Finally, the new “resident enterprise” classification could result in a situation in which a 10% PRC tax is imposed on dividends we pay to our non-PRC security holders and gains derived by our non-PRC security holders from transferring our securities, if such income is considered PRC-sourced income by the relevant PRC tax authorities.

If any such PRC taxes apply to a non-PRC security holder, such security holder may be entitled to a reduced rate of PRC taxes under an applicable income tax treaty and/or a foreign tax credit against such security holder’s domestic income tax liability (subject to applicable conditions and limitations). You should consult with your own tax advisors regarding the applicability of any such taxes, the effects of any applicable income tax treaties, and any available foreign tax credits.

Risks Relating to Being Incorporated in the British Virgin Islands

We are a British Virgin Islands company and, because the rights of shareholders under British Virgin Islands law differ from those under U.S. law, you may have fewer protections as a shareholder.

Our corporate affairs are governed by our Amended and Restated Memorandum and Articles of Association, the BVI Business Companies Act, 2004 (as amended) of the British Virgin Islands (the “Act”) and the common law of the British Virgin Islands. The rights of shareholders to take action against the directors, actions by minority shareholders and the fiduciary responsibility of the directors under British Virgin Islands law are governed by the Act and the common law of the British Virgin Islands. The common law of the British Virgin Islands is derived in part from comparatively limited judicial precedent in the British Virgin Islands as well as from English common law, which has persuasive, but not binding, authority on a court in the British Virgin Islands. The rights of shareholders and the fiduciary responsibilities of directors under British Virgin Islands law are not as clearly established as they would be under statutes or judicial precedent in some jurisdictions in the United States. In particular, the British Virgin Islands has a less developed body of securities laws as compared to the United States, and some states (such as Delaware) have more fully developed and judicially interpreted bodies of corporate law.

British Virgin Islands companies may not be able to initiate shareholder derivative actions, thereby depriving shareholders of the ability to protect their interests.

British Virgin Islands companies may not have standing to initiate a shareholder derivative action in a federal court of the United States. The circumstances in which any such action may be brought, and the procedures and defenses that may be available in respect to any such action, may result in the rights of shareholders of a British Virgin Islands company being more limited than those of shareholders of a company organized in the United States. Accordingly, shareholders may have fewer alternatives available to them if they believe that corporate wrongdoing has occurred. The British Virgin Islands courts are also unlikely to recognize or enforce against us judgments of courts in the United States based on certain liability provisions of U.S. securities law, and to impose liabilities against us, in original actions brought in the British Virgin Islands, based on certain liability provisions of U.S. securities laws that are penal in nature.

The laws of the British Virgin Islands provide statutory protection for minority shareholders.

Under the laws of the British Virgin Islands, there is some statutory law for the protection of minority shareholders under the Act. The principal protection under statutory law is that shareholders may bring an action to enforce our Amended and Restated Memorandum and Articles of Association. The Act sets forth the procedure to bring such a claim. Shareholders are entitled to have the affairs of the company conducted in accordance with the general law and the Amended and Restated Memorandum and Amended and Restated Articles of Association. Companies are not obligated to appoint an independent auditor and shareholders are not entitled to receive the audited financial statements of the company.

There are common law rights for the protection of shareholders that may be invoked (such rights have also now been given statutory footing under the Act), largely dependent on English company law, since the common law of the British Virgin Islands for business companies is limited. Under the general rule pursuant to English company law known as the rule in Foss v. Harbottle, a court will generally refuse to interfere with the management of a company at the insistence of a minority of its shareholders who express dissatisfaction with the conduct of the company’s affairs by the majority or the board of directors. However, every shareholder is entitled to have the affairs of the company conducted properly according to law and the constituent documents of the corporation. As such, if those who control the company have persistently disregarded the requirements of company law or the provisions of the company’s memorandum or articles of association, then the courts will grant relief. Generally, the areas in which the courts will intervene are the following: (i) an act complained of which is outside the scope of the authorized business or is illegal or not capable of ratification by the majority, (ii) acts that constitute fraud on the minority where the wrongdoers control the company, (iii) acts that infringe on the personal rights of the shareholders, such as the right to vote, and (iv) where the company has not complied with provisions requiring approval of a special or extraordinary majority of shareholders, which are more limited than the rights afforded minority shareholders under the laws of many states in the U.S.

The Act has introduced a series of remedies available to members. Where a company incorporated under the Act conducts some activity which breaches the Act or the company's memorandum and articles of association, the court can issue a restraining or compliance order. Members can now also bring derivative, personal and representative actions under certain circumstances. The traditional English basis for members' remedies have also been incorporated into the Act – where a member of a company considers that the affairs of the company have been, are being or are likely to be conducted in a manner likely to be oppressive, unfairly discriminating or unfairly prejudicial to him, he may now apply to the BVI court for an order on such conduct.

Any member of a company may apply to the BVI court for the appointment of a liquidator for the company and the court may appoint a liquidator for the company if it is of the opinion that it is just and equitable to do so.

The Act provides that any member of a company is entitled to payment of the fair value of his shares upon dissenting from any of the following: (a) a merger; (b) a consolidation; (c) any sale, transfer, lease, exchange or other disposition of more than 50 per cent in value of the assets or business of the company if not made in the usual or regular course of the business carried on by the company but not including (i) a disposition pursuant to an order of the court having jurisdiction in the matter, (ii) a disposition for money on terms requiring all or substantially all net proceeds to be distributed to the members in accordance with their respective interest within one year after the date of disposition, or (iii) a transfer pursuant to the power of the directors to transfer assets for the protection thereof; (d) a redemption of 10 percent, or fewer of the issued shares of the company required by the holders of 90 percent, or more of the shares of the company pursuant to the terms of the Act; and (e) an arrangement, if permitted by the court.

Generally any other claims against a company by its shareholders must be based on the general laws of contract or tort applicable in the British Virgin Islands or their individual rights as shareholders as established by the company's memorandum and articles of association.

If outstanding warrants are exercised, the underlying ordinary shares will be eligible for future resale in the public market. “Market overhang” from the warrants results in dilution and has an adverse effect on the ordinary shares’ market price.

We have outstanding warrants and unit purchase options to purchase an aggregate of up to 10,493,334 ordinary shares. If they are exercised, a substantial number of additional ordinary shares will be eligible for resale in the public market, which could adversely affect the market price.

Because we do not intend to pay dividends shareholders will benefit from an investment in our ordinary shares only if they appreciate in value.

We have never declared or paid any cash dividends on our ordinary shares. We currently intend to retain all future earnings, if any, for use in the operations and expansion of the business. As a result, we do not anticipate paying cash dividends in the foreseeable future. Any future determination as to the declaration and payment of cash dividends will be at the discretion of our Board of Directors and will depend on factors our Board of Directors deems relevant, including among others, our results of operations, financial condition and cash requirements, business prospects, and the terms of China Cablecom Holdings’ credit facilities, if any, and any other financing arrangements. Accordingly, realization of a gain on shareholders’ investments will depend on the appreciation of the price of the ordinary shares. There is no guarantee that our ordinary shares will appreciate in value.

There is a risk that we could be treated as a U.S. domestic corporation for U.S. federal income tax purposes, which could result in significantly greater U.S. federal income tax liability to us.

Section 7874(b) of the Internal Revenue Code of 1986, as amended (the “Code”) generally provides that a corporation organized outside the United States which acquires, directly or indirectly, pursuant to a plan or series of related transactions substantially all of the assets of a corporation organized in the United States will be treated as a domestic corporation for U.S. federal income tax purposes if shareholders of the acquired corporation, by reason of owning shares of the acquired corporation, own at least 80% (of either the voting power or the value) of the stock of the acquiring corporation after the acquisition. If Section 7874(b) were to apply to the Redomestication Merger and Business Combination (as each such term is defined in the section of this Annual Report entitled “Information on the Company”), then, among other things, we would be subject to U.S. federal income tax on our worldwide taxable income following the Redomestication Merger and Business Combination as if we were a domestic corporation. Although it is not expected that Section 7874(b) will apply to treat us as a domestic corporation for U.S. federal income tax purposes, this result is not entirely free from doubt. As a result, shareholders and warrant holders are urged to consult their tax advisors on this issue. The balance of this discussion (including the discussion in the section of this Annual Report entitled “Taxation—United States Federal Income Taxation”) assumes that we will be treated as a foreign corporation for U.S. federal income tax purposes.

We may qualify as a passive foreign investment company, or “PFIC,” which could result in adverse U.S. federal income tax consequences to U.S. investors.

In general, we will be classified as a PFIC for any taxable year in which either (1) at least 75% of our gross income (looking through certain corporate subsidiaries) is passive income or (2) at least 50% of the average value of our assets (looking through certain corporate subsidiaries) is attributable to assets that produce, or are held for the production of, passive income. Passive income generally includes, without limitation, dividends, interest, rents, royalties, and gains from the disposition of passive assets. If we are determined to be a PFIC for any taxable year during which a U.S. Holder (as defined in the section of this Annual Report captioned ‘‘Taxation – United States Federal Income Taxation – General’’) held our ordinary shares or warrants, the U.S. Holder may be subject to increased U.S. federal income tax liability and may be subject to additional reporting requirements. Based on the composition (and estimated values) of the assets and the nature of the income of us and our subsidiaries in 2008, we do not anticipate that we will be treated as a PFIC in 2008. Notwithstanding the foregoing, our view that we will not be treated as a PFIC in 2008 is not free from doubt because of, among other things, the significant cash position and uncertainties relating to the actual values of the other assets of us and our subsidiaries in 2008. Our actual PFIC status for any subsequent taxable year will not be determinable until after the end of such taxable year. Accordingly, there can be no assurance with respect to our status as a PFIC for 2008 or any subsequent taxable year. We urge U.S. Holders to consult their own tax advisors regarding the possible application of the PFIC rules. For a more detailed explanation of the tax consequences of PFIC classification to U.S. Holders, see the section of this Annual Report captioned ‘‘Taxation—United States Federal Income Taxation—Tax Consequences to U.S. Holders of Our Ordinary Shares and Warrants—Passive Foreign Investment Company Rules.’’

ITEM 4. INFORMATION ON THE COMPANY

A. History and Development of the Company.

China Cablecom Holdings was formed on October 25, 2007, in the British Virgin Islands, and operates through a wholly-owned subsidiary China Cablecom Ltd., a British Virgin Islands company, which (through subsidiaries) is a joint-venture provider of cable television services in the PRC, operating in partnership with a local state-owned enterprise (“SOE”) authorized by the PRC government to control the distribution of cable TV services. China Cablecom acquired the network it currently operates in Binzhou, Shandong Province in September 2007 and in Hubei Province in June 2008 by entering into a series of asset purchase and services agreements with a company organized by SOEs owned directly or indirectly by local branches of SARFT in five different municipalities to serve as a holding company of the relevant businesses.

China Cablecom Ltd.’s operating activity from October 6, 2006 (inception date) to September 30, 2007, was limited and related to its formation, and professional fees and expenses associated with its acquisition activities.

On September 20, 2007, China Cablecom Ltd. entered into a Purchase Agreement with several accredited investors (the “Purchase Agreement”), and consummated the private placement of 20,000,000 units, each unit consisting of (i) a promissory note in the face amount of $499,808, bearing interest at the rate of 10% per annum (the “Note”), and (ii) 19,167 detachable shares of China Cablecom Ltd.’s Class A Preferred Stock (the “Units”). As security for the Notes, Mr. Clive Ng pledged and granted to the investors, on a pro rata basis, a first priority lien on 50.1% of the ordinary shares of China Cablecom Ltd. owned by him. The proceeds of the sale and issuance of the Units were used in the following manner: (i) $12.0 million was used to finance the acquisition through contractual arrangements of Binzhou Broadcasting and (ii) $8 million was used for working capital, including payment of certain administrative, legal, investment banking and accounting fees, repayment of loans in the aggregate amount of $720,000 owed to Mr. Ng and a $475,000 loan made to Jaguar Acquisition Corporation (“Jaguar”). Jaguar used the proceeds of this loan for working capital expenses associated with completing its acquisition of China Cablecom Ltd. After its merger with and into China Cablecom Holdings, Jaguar ceased to exist and the loan was assumed by China Cablecom Holdings and continues to be in effect an intercompany obligation.

On April 9, 2008, pursuant to the terms of an Agreement and Plan of Merger, dated October 30, 2007 (“Merger Agreement”), Jaguar merged with and into (the “Redomestication Merger”) China Cablecom Holdings, its wholly-owned British Virgin Islands subsidiary, for the purpose of redomesticating Jaguar to the British Virgin Islands as part of the acquisition of China Cablecom Ltd., and China Cable Merger Co., Ltd., a wholly-owned British Virgin Islands subsidiary of China Cablecom Holdings (“China Cable Merger Co.”), merged with and into China Cablecom Ltd., resulting in China Cablecom Ltd. becoming a wholly-owned subsidiary of China Cablecom Holdings (the “Business Combination”).

At the closing of the Business Combination, China Cablecom Holdings issued to China Cablecom’s shareholders aggregate merger consideration of 2,066,680 of ordinary shares and China Cablecom Holdings assumed approximately $20 million in outstanding debt of China Cablecom.

In connection with the approval of the merger at the April 9, 2008 Special Meeting of Stockholders of Jaguar, the stockholders of Jaguar also approved (i) the adoption of China Cablecom Holdings’ 2007 Omnibus Securities and Incentive Plan, which provides for the grant of up to 10,000,000 ordinary shares of China Cablecom Holdings or cash equivalents to directors, officers, employees and/or consultants of China Cablecom Holdings and its subsidiaries; (ii) the grant of up to 8,120,000 ordinary shares (‘‘Performance Shares’’), pursuant to consulting and other arrangements to certain of Jaguar’s and China Cablecom’s insiders in connection with the Business Combination upon the achievement of certain financial goals of China Cablecom Holdings following the Business Combination; and (iii) the payment of cash bonuses of up to $5,000,000 to certain officers and directors of Jaguar and China Cablecom following the exercise of existing warrants after the Business Combination.

The Company consummated a convertible debt financing in May 2008 with current and new investors involving the issuance of an aggregate of $43.175 million principal amount at maturity of secured convertible notes and approximately 1.525 million ordinary shares to assist in securing its acquisition of Hubei Broadcasting. Interest was prepaid at closing, resulting in net proceeds (excluding existing investors who reinvested principal and interest repayments in the new issuance) to the Company of approximately $25.8 million. Chardan Capital Markets, LLC, Lazard Frères & Co. LLC and Roth Capital Partners , LLC acted as co-placement agents.

The 3-year senior secured convertible notes bear an interest rate of 9.99% per annum and are secured by a pledge of the stock of the Company’s wholly-owned subsidiary, China Cablecom Ltd., and all other assets owned by the Company outside of the People’s Republic of China. The notes are convertible into shares of the Company’s ordinary shares at a conversion price of $9.50 per share and are guaranteed by China Cablecom Ltd. as to the principal, interest and all other amounts due thereunder. In addition, the Company issued approximately 1.525 million ordinary shares to the investors and is obligated to issue an additional approximate 125,000 shares if the notes are not repaid upon the first anniversary of the closing and an additional approximate 300,000 shares if the notes are not repaid upon the second anniversary of the closing. Additionally, the Company has the ability to prepay the notes for a total of $34 million upon the first anniversary of their issuance and any time thereafter at prepayment amounts equal to such amount plus additional amounts equal to approximately 10 5/8% of the principal amount of maturity per annum of such notes, based on the number of days from such first anniversary to such date of prepayment. To the extent that the Company calls its outstanding warrants and such warrants are exercised, it is required to repay the notes with the net proceeds from such warrant exercise.

Joint Venture with Binzhou Guangdian Network Co., Ltd. and China Cablecom.

In September 2007, China Cablecom entered into a Framework Agreement through its affiliated company, JYNT, to purchase a 49% equity interest and 60% economic benefit in a newly created joint venture, Binzhou Broadcasting and Television Information Network Co., Ltd. (“Binzhou Broadcasting”). The local state-owned enterprise, Binzhou Guangdian Network Co., Ltd. (“Binzhou SOE”), agreed to contribute certain assets and businesses for a 51% equity interest in Binzhou Broadcasting. Binzhou SOE was organized in 2006 to aggregate various local state-owned cable assets and businesses within the city of Binzhou, China. Prior to the formation of Binzhou Broadcasting, Binzhou SOE consolidated the following five cable operating companies and networks:

| | · | Binzhou Guang Shi Network Co., Ltd.; |

| | · | Huiming Cable Network Co., Ltd.; |

| | · | Boxing Dian Guang Media Co., Ltd.; |

| | · | Zouping Cable Network Center; and |

| | · | Binzhou Guang Dian Cable Network Center. |