March 4, 2011

Mr. Larry Spirgel

Assistant Director

Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

| Re: | China Cablecom Holdings, Ltd. Form 20-F for the fiscal year ended December 31, 2009 Filed July 1, 2010 File No. 001-34136 |

Dear Mr. Spirgel:

We are submitting this correspondence via the EDGAR system in response to a comment letter issued by the Staff of the Securities and Exchange Commission (the “Commission”) on February 17, 2011 (the “Comment Letter”). The discussion below reflects our responses to the Comment Letter and is presented in the order of the numbered comments in the Staff’s letter. While we are not refiling our Annual Report on Form 20-F at this time, upon being advised by the Staff that the proposed disclosures are acceptable to the Staff, we will promptly file Amendment No. 1 to the 20-F on Form 20-F/A (the “Amended 20-F”), which will include all of the changes proposed in our correspondence with the Staff.

Form 20-F for the Fiscal Year Ended December 31 2009

General

| | 1. | We note your response to prior comment 12 from our letter dated December 6, 2010. |

| | ● | Please explain how you intend to list Pu Yue and Liang Yuejing as “Trustee 1” in the box designating the same. We do not see the change to the organizational chart. |

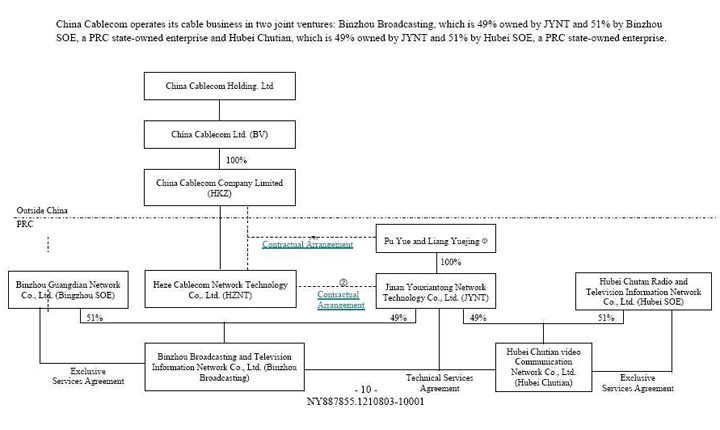

Response: We will replace “Trustee 1” with Pu Yue and Liang Yuejing in the chart. Please find the revised chart in Schedule 1 attached hereto.

| | ● | We note your disclosure that “China Cablecom does not have an equity interest in JYNT, but instead enjoys the economic benefits derived from JYNT through a series of contractual arrangements. JYNT is owned 95% by Pu Yue, China Cablecom’s Chief Executive Officer and 5% by Liang Yuejing, his spouse.” Please expand this disclosure to explain that Pu Yue and Liang Yuejing are “nominee shareholders” on behalf of China Cablecom Co. Ltd. (Hong Kong) and thereby hold the shares subject to the terms of a trustee arrangement, loan agreement, equity option purchase agreement and an equity pledge agreement as well as “other related documents” and explain the material terms of same. |

Response: We will clarify in the second paragraph under the heading “PRC Corporate Structure” on page 31 that JYNT is owned by China Cablecom’s two nominees, Pu Yue and Liang Yuejing, on behalf of China Cablecom’s subsidiaries through the contractual arrangements between the two nominees and our subsidiaries.

We will also summarize the material terms of the various agreements between the two nominee shareholders and HKZ or HZNT (in the section immediately below the corporate structure chart).

Please find our proposed revised disclosure as set forth in Schedule 1.

| | ● | Disclose the state of registration of all of these agreements, including with which PRC government authority each agreement, including, but not limited to the trustee arrangement, loan agreement, equity option purchase agreement and other relevant documents are required to be registered, are registered and are in the process of being registered. We note that our prior comment 14, below, regarding the equity pledge agreement. |

Response: At present, among the JYNT contractual control agreements, only the equity pledges under the equity pledge agreements are required to be registered; registration allows the equity pledges to be validated under the PRC Property Rights Law. We will disclose this point in the summary of equity pledge agreements (as set forth in Schedule 1) and the “Risk Factor - Risks Relating to Our Corporate Structure” (as set forth in Schedule 2).

| | ● | Your disclosure should be clear that pursuant to the terms of the Trustee Agreement, Pu Yue and Liang Yue accept and follow all instructions for JYNT corporate voting and action by China Cablecom Co. Ltd. (Hong Kong). |

Response: We will disclose this point in the summary of the trustee arrangements and equity option agreements. Please find our proposed revised disclosure as set forth in Schedule 1.

| | ● | Further, please add disclosure explaining the ways China Cablecom “enjoys the economic benefits” referenced herein. |

Response: We will disclose this rationale in the summary of the exclusive service agreement. Please find our proposed revised disclosure as set forth in Schedule 1.

| 2. | We note your response to prior comment 14 from our letter dated December 6, 2010. |

| | ● | Please expand this disclosure to detail the steps the company has taken in this process of registering the pledge with the competent local branch of the State Administration for Industry and Commerce in order to validate the pledge. |

Response: HZNT has duly executed the equity pledge agreements with the two nominee shareholders. HZNT is now coordinating with the nominee shareholders to prepare various equity pledge registration application documents (including Chinese versions of the equity pledge agreements, the application forms, etc.) in accordance with the requirements of the local competent State Administration for Industry and Commerce (“SAIC”). Once the registration application documents are in order, we will immediately submit them to the local SAIC to validate and prefect the equity pledges.

We will expand our disclosure on this point in the “Risk Factor - Risks Relating to Our Corporate Structure”. Please see our proposed expanded disclosure as set forth in Schedule 2.

| | ● | Please explain how you characterize these pledges as “already effective”, when it appears that the PRC Property Rights Law may not consider them to be enforceable until they are registered with the SAIC branches. |

Response: In our previous response, we acknowledged that the pledges are not effective yet and should be validated by registration. However, the equity pledge agreements are contractually effective as a contract pursuant to PRC Contract Law between the parties. Pursuant to the equity pledge agreements, the nominee shareholders have an obligation to promptly take necessary steps to register and prefect the equity pledge. If the nominee shareholders are not cooperative, HZNT may initiate arbitration procedures to enforce the same. We will expand our disclosure on this point in the “Risk Factor - Risks Relating to Our Corporate Structure”. Please see our proposed expanded disclosure as set forth in Schedule 2.

| 3. | Disclosure the steps you have taken pursuant to which you believe that these pledges are “already effective”. |

Response: Please see our response immediately above.

| 4. | We note your response to prior comment 15 and reissue the comment, with respect to the comment above. Please include a risk factor, if true, that if Mr Pu Yue or his wife, Liang Yuejing, as shareholders of JYNT, breach their obligations under the contractual arrangements, you may be unable to successfully enforce the pledges. You should include risk factor disclosure, as applicable, that all of these contractual arrangements are governed by PRC law and provide for the resolution of disputes through arbitration in the PRC. Accordingly, these contracts would be interpreted in accordance with PRC legal procedures and that the legal environment in the PRC is not as developed as in certain other jurisdictions, such as the United States. As a result, uncertainties in the PRC legal system could limit your ability to enforcement these contractual arrangements, which may make it difficult to exert effective control over your JYNT. |

Response: Please see our proposed revised disclosure as set forth in schedule 2.

| 5. | We note your response to prior comment 16 in our letter dated December 6, 2010 and reissue our comment, noting our concern above, to include risk factor disclosure, if true, that any failure by JYNT or its shareholders to perform their obligations under your contractual arrangements with them may have a material adverse effect on your business. You should include any relevant discussion that they may fail to take certain actions required for your business or follow your instructions despite their contractual obligations to do so. If they fail to perform their obligations under their respective agreements with you, you may have to rely on legal remedies under PRC law, including seeking specific performance or injunctive relief, which may not be effective. |

Response: Please see our proposed revised disclosure as set forth in schedule 2.

Item 15. Controls and Procedures

Management’s Annual Report on Internal Control over Financial Reporting, page 67

6. In your response to prior comment 23 from our letter dated December 6, 2010, you state that several people are involved in the conversion of your books from Chinese GAAP to US GAAP. A junior accountant drafts the adjustments which are then reviewed by a more senior person in connection with the controller. Finally, your senior-level management such as your CFO reviews the adjustments. For each of these persons, please tell us:

| | a. what role he or she takes in preparing your financial statements and evaluating the effectiveness of your internal control; |

Response: The individuals involved made GAAP adjustments (Chinese GAAP to US GAAP) at both the entity level and the consolidated level to the financial statements. The individuals did not have a role in evaluating the effectiveness of the Company’s internal control.

| | b. what relevant education and ongoing training he or she has had relating to U.S. GAAP; |

Response: Each individual has more than 10 years of experience in accounting and has at least a Bachelors Degree. All individuals involved receive ongoing training from the Company on US GAAP.

| | c. the nature of his or her contractual or other relationship to you; |

Response: The individuals are independent contractors to the Company.

| | d. whether he or she holds and maintains any professional designations such as Certified Public Accountant (U.S.) or Certified Management Accountant; and |

Response: Most of the individuals involved are members of the CICPA (China Institute of Certified Public Accountants).

| | e. about his or her professional experience, including experience in preparing and/or auditing financial statements prepared in accordance with U.S. GAAP and evaluating effectiveness of internal control over financial reporting. |

Response: All the individuals have extensive professional accounting experience with various other Companies, but not specifically US GAAP experience or internal control over financial reporting.

7. We also note from your response to prior comment 23 that Mr. Tong has some knowledge of US GAAP; however, we remain unclear regarding the extent of this knowledge.

| | a. Please tell us if Mr. Tong has attended any US institutions or educational programs that have provided a comprehensive education in US GAAP. |

Response: Mr. Tong did not attend US institutions or educational programs.

| | b. Please provide more specific details of Mr. Tong's audit experience. Describe for us the nature of each of the audit engagements of US GAAP financial statements referenced in your response. With respect to each of these engagements, please explain the nature of the specific work he performed, the approximate number of hours he spent on it, whether he was directly involved in US GAAP issues and if so provide details of these issues, |

Response: Mr. Tong was an auditor with PriceWaterhouseCoopers from 1995 to 2002. Selected US GAAP related audit engagements include:

● 2000-2002 Linkton.com and its predecessor, Intrinsic Inc.: Private company’s stand alone US GAAP financial reporting audit and quarterly review, more than 200 working hours in total

● 2000-2002 Lucent Technologies’ China subsidiaries: Review of group-reporting packaged prepared under US GAAP, more than 120 working hours.

● 2000-2002 Ericsson China subsidiaries: Review of group-reporting packaged prepared under US GAAP, more than 120 working hours

| | c. | Explain what in Mr. Tong's background, either experience or education, enabled him to lecture on US GAAP accounting topics. |

Response: Mr. Tong’s extensive experience as an auditor with PriceWaterhouse Coopers acquired over many years conducting US GAAP-related audits gave him the expertise to lecture on US GAAP accounting topics.

8. We note your response to prior comment 26 from our letter dated December 6, 2010. In light of the significance of the goodwill balance and going concern opinion, please disclose the percentage by which fair value exceeded carrying value as of the most recent step-one test for each reporting unit for each reporting period.

Otherwise disclose, if true, that none of your reporting units with significant goodwill is at risk of failing step one of the goodwill impairment test. Please provide us your proposed disclosures.

Response: The Company will make the proposed disclosure that none of our reporting units with signifcant goodwill is at risk of failing step one of the goodwill impairment test:

“For the year ended 2009, based upon a combination of factors, including the deteriorating macro-economic environment, declines in the stock market and the decline of our market capitalization significantly below the book value of our net assets, we concluded that potential goodwill impairment indicators existed in certain of our reporting units which had Goodwill. As a result, we performed a goodwill impairment analysis as of December 31, 2009 in accordance with SFAS No. 142, Goodwill and Other Intangible Assets (“SFAS 142”). Step 1 of the impairment analysis under SFAS 142 required that we evaluated whether our Company’s net book value exceeded our estimated fair value.

Although the Company’s market capitalization was less than our net assets, the Company believes that this was not a decisive factor, especially given the financial crisis of 2008 and 2009. Rather, if the fair value of our Company is estimated using other commonly used valuation techniques, such as discounted cash flow (DCF) models, we believe that the estimated fair value of our Company had exceeded its respective book value.

Accordingly, we believe our Company passed Step 1 of the goodwill impairment analysis under SFAS 142 for the period ended December 31, 2009.”

Note 14. Note Payable — Non-controlling Interest, page F-25

9. We note your response to prior comment 27 from our letter dated December 6, 2010. In light of the significance of the Binzhou SOE and Hubei SOE notes payable, please provide a description in the notes of any arrangements that result in Company's guarantee, pledge of assets or stock, etc. that provides security for the SOE debt. Furthermore, in the Operating and Financial Review and Prospects please discuss any material, impact of your servicing of SOE debt on your own liquidity.

Response:

None of the SOE debt is guaranteed, pledged for assets or stock or otherwise secured.

In the Operating and Financial Review and Prospects section we will add the following disclosure:

“Currently the Company is not servicing any part of the SOE debt, so the SOE debt has no effect on the Company’s current liquidity. If the Company were to service the SOE debt in the future, it would likely have a material effect on the Company’s liquidity.”

10. It appears from your disclosure that the note payable to Hubei SOE is payable on demand. Please explain to us your basis for classifying approximately $45.6 million of the note payable balance as a long-term liability on your balance sheet. Include in your response references to any US GAAP literature that you have relied upon as support for your policy.

Response:

The most basic definition of a liability, and the definition found in nearly every accounting textbook is:

“Probable economic sacrifices of economic benefits arising from present obligations of a particular entity to transfer assets or provide services to other entities in the future as a result of past transactions or events.”

Thus in evaluating whether the liability is long-term or short term the controlling issue is whether the “economic sacrifice” is probable in the short-term or long-term. Given that the note payable to Hubei SOE is payable to a related entity, and the payer is known to have certain financial difficulties (thus the Company’s recent debt restructuring and the Company auditor’s going concern opinion), the Company believes that the probability of this payable being demanded in the short-term is remote at best. Rather the payable is far more likely to come due at a much later date, beyond one year, when the Company’s financial condition may be better. Accordingly the Company has recorded the liability as long-term.

Note 20. Stockholders' Equity, page F-29

11. We note your response to prior comment 28 from our letter dated December 6, 2010. Please disclose the terms of the Series A and B convertible preferred shares, similar to what was provided in this response.

Response: We will include the description included in the response to prior comment 28 from the Staff’s letter dated December 6, 2010 in the Amended 20-F.

The Company acknowledges that:

| | ■ | the company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| | ■ | staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| | ■ | the company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

| | Sincerely, Sikan Tong Chief Financial Officer |