UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

Solicitation/Recommendation Statement

Under Section 14(d)(4) of the Securities Exchange Act of 1934

RELYPSA, INC.

(Name of Subject Company)

RELYPSA, INC.

(Name of Person Filing Statement)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

759531106

(CUSIP Number of Class of Securities)

John A. Orwin

President and Chief Executive Officer

Relypsa, Inc.

100 Cardinal Way

Redwood City, CA 94063

(650) 421-9500

(Name, address and telephone number of person authorized to receive

notices and communications on behalf of the persons filing statement)

With copies to:

Mark Roeder

Josh Dubofsky

Latham & Watkins LLP

140 Scott Drive

Menlo Park, California 94025

(650) 328-4600

| þ | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

This Schedule 14D-9 filing consists of the following communications relating to the proposed acquisition of Relypsa, Inc., a Delaware corporation (“Relypsa”) by Galenica AG, a public limited company existing under the laws of Switzerland (“Galenica”), pursuant to the terms of an Agreement and Plan of Merger, dated July 20, 2016, by and among Relypsa, Galenica and Vifor Pharma USA Inc., a Delaware corporation and an indirect wholly owned subsidiary of Galenica:

| | i. | Employee Frequently Asked Questions, dated July 21, 2016 (“Employee FAQ”). The Employee FAQ was first used or made available on July 21, 2016. |

| | ii. | Employee Meeting Presentation (the “Presentation”). The Presentation was first used or made available on July 21, 2016. |

Planned Acquisition of Relypsa by Galenica

Employee FAQ

Galenica and Relypsa have entered into a definitive merger agreement pursuant to which Galenica will acquire Relypsa in an all-cash transaction for $32 per share, or a total transaction value of approximately $1.53 billion. The $32 per share purchase price represents a premium of approximately 60% over the closing price of Relypsa’s common stock on July 20, 2016.

| 2. | Who is Galenica/Vifor Pharma? |

Galenica is a parent company of our ex-U.S. partner, Vifor Fresenius Medical Care Renal Pharma (VFMCRP).

Galenica is a company based in Berne, Switzerland that is a diversified group active throughout the healthcare market which, among other activities, develops, manufactures and markets pharmaceutical products, runs pharmacies, provides logistical and database services and sets up networks. Galenica has two Business Units, Vifor Pharma and Galenica Santé.

Vifor Pharma is a fully integrated specialty pharmaceutical company headquartered in Zurich. Vifor Pharma is a world leader in the discovery, development, manufacturing and marketing of pharmaceutical products for the treatment of iron deficiency. The company also offers a diversified portfolio of prescription medicines as well as over-the-counter (OTC) products.

VFMCRP, is a joint company between Vifor Pharma and Fresenius Medical Care, which develops and commercializes innovative and high quality therapies to improve the life of patients suffering from CKD worldwide. The company was founded at the end of 2010.

In August 2015, VFMCRP acquired the commercial rights to Veltassa outside the United States and Japan. Through Galenica’s acquisition of Relypsa, Vifor Pharma will acquire the global rights to Veltassa. Vifor

Pharma will also gain a fully-integrated commercial organization in the United States and significantly strengthen its presence in the U.S. cardio-renal market.

| 3. | Why did the Relypsa Board decide to sell Relypsa now? |

Following an informed, thoughtful and careful process, including a thorough assessment of strategic alternatives and the benefits and risks of remaining an independent company, Relypsa’s Board concluded that the transaction is in the best interest of the company and its stockholders and is the best option to maximize value for our stockholders.

| 4. | Can you provide more details on the transaction process (e.g. was it a competitive process, how long was the process)? |

We are not able to answer additional questions until a document called a Form 14D-9 has been filed with the U.S. Securities and Exchange Commission.

| 5. | Why is this acquisition good for Relypsa? |

We are very proud of the team that built Relypsa into the company it is today and brought Veltassa to patients in need.

We now have the opportunity to become part of a global company that is closely aligned in their commitment to people with cardio-renal diseases and the belief that Veltassa is an important medicine that can change the lives of patients.

As you may know, Galenica is a parent company of our ex-U.S. partner, VFMCRP, a joint company between Vifor Pharma and Fresenius Medical Care. Many of you have had the opportunity to interact with VFMCRP and know that they have been an excellent partner. Combining Relypsa with Vifor Pharma expands this relationship with the goal of creating a world-leading specialty pharmaceutical company focused on nephrology, cardiology and gastroenterology medicines.

By joining forces with Vifor Pharma and its joint company VFMCRP, we will have the financial resources, experience and infrastructure to maximize the success of our company and Veltassa worldwide. We believe this acquisition will provide exciting opportunities and that it greatly enhances our ability to continue our mission of improving patients’ lives.

| 6. | When will the acquisition of Relypsa be complete? |

We currently expect the acquisition to close in the third quarter of this year. The acquisition is subject to customary closing conditions, including the tender of a majority of the outstanding shares of Relypsa’s common stock and required antitrust approval in the United States. The transaction is not subject to a financing condition.

Until the closing of the transaction, Relypsa and Vifor Pharma will continue to operate as separate companies and it is business as usual for both companies.

If you have any questions about your responsibilities during this pre-closing period, please speak with your manager or any member of the senior management team.

| 7. | Will Relypsa’s offices still remain in Redwood City? |

Galenica has indicated that it intends to make Relypsa’s office in Redwood City the U.S. headquarters of its Vifor Pharma Business Unit.

| 8. | Will Relypsa’s management remain the same after the transaction? |

Vifor Pharma has expressed intent to retain the Relypsa leadership team in order to support the integration of Relypsa into Vifor Pharma, as well as the ongoing business and future development of Veltassa.

They expect to make decisions regarding the composition of the executive team following the closing of the transaction.

We realize a transformative transaction like this may result in uncertainty for employees. Vifor Pharma believes Relypsa’s talented people are vital to the ongoing success of the company and a key driver of the acquisition. While the details of the integration are being planned, the companies’ management teams intend to work together to cause as little disruption to Relypsa’s business as possible. During this time, we ask that you all continue to remain focused on serving our patients and ensuring the ongoing success of this great company that we have built.

| 9. | What does this mean for my employment? When will we know what the new organizational structure will be? |

Vifor Pharma believes Relypsa’s talented people are vital to the ongoing success of the company and a key driver of the acquisition. As such, we believe they intend to retain the vast majority of Relypsa’s employees in their current roles. They are committed to making and communicating specific plans as quickly as possible following the closing of the transaction. We believe this acquisition will provide exciting opportunities and that it greatly enhances our ability to continue our mission of improving patients’ lives.

| 10. | Is there a severance program in place for any positions that may be eliminated following the closing of the transaction? |

Vifor Pharma believes Relypsa’s talented people are vital to the ongoing success of the company and a key driver of the acquisition. As such, we believe they intend to retain the vast majority of Relypsa’s

employees in their current roles. They are committed to making and communicating specific plans as quickly as possible following the closing of the transaction.

However, if your position is eliminated, employees below the Vice President level will be eligible for severance pursuant to Relypsa’s Change in Control Separation Benefits Plan which is available on our intranet under HR/benefits. In general terms, based on your position level and length of service, severance for affected employees will range from 4 to 9 months. For employees at the Vice President level and above, severance will be governed by your employment contract.

| 11. | What if I choose not to work for the new company? |

If you choose not to continue your employment following the transaction, then it would be considered a resignation from the company, you would not participate in the Change in Control Separation Benefits Plan and all relevant policies and procedures relating to your resignation would apply.

| 12. | What does this mean for my salary and benefits? |

Under the terms of the merger agreement, through December 31, 2017, Vifor Pharma has agreed to provide continuing employees with (1) base salaries (or wage rates) and annual cash bonus opportunities that are not less favorable than those provided immediately prior to the closing of the transaction and (2) other compensation and benefits (including severance benefits, but excluding equity-based compensation and benefits provided pursuant to any defined benefit pension plans) that are substantially comparable in the aggregate to such compensation and benefits that were provided immediately prior to the closing of the transaction.

| 13. | What does the transaction mean for the 401(k) plan? |

There are currently no expected changes to Relypsa’s 401(k) plan.

| 14. | What happens to my restricted stock, stock options and/or RSUs? |

Unvested and outstanding Relypsa stock, stock options and RSUs will be fully accelerated and cashed out shortly after the closing.

| 15. | Can I trade my options/RSUs during the pre-closing period? |

Relypsa is under a company-wide blackout for all Relypsa employees and board members. This blackout will continue until the closing of the transaction, or until you are otherwise notified. All 10b5-1 plans with respect to Relypsa securities were terminated by Relypsa upon announcement of the acquisition. While this blackout does not prevent you from exercising options, it does prevent you from trading in shares acquired pursuant to an option exercise or from using a broker-assisted exercise program.

| 16. | What happens to my ESPP shares? |

Assuming the transaction closes, the current ESPP offering period will be the last offering period under Relypsa’s Employee Stock Purchase Plan and no new offering periods will begin. If the closing of the transaction occurs prior to the end of the current offering period, the current offering period will be shortened and participants’ accumulated contributions will be used to purchase shares of Relypsa common stock. Relypsa’s Employee Stock Purchase Plan will terminate upon completion of the tender offer. You may not elect to participate in the current offering period if you are not already a participant, and you may not increase your participation level if you are already a participant.

| 17. | Does Galenica grant equity awards to their employees? Will I be eligible? |

Galenica understands the importance of equity as a component of total compensation for employees and is in the process of evaluating the use of equity incentives as part of its compensation structure, and we would expect Galenica to communicate any decisions regarding post-closing equity compensation once they have been made.

| 18. | Will I receive my annual stock grant in August? |

Pursuant to the terms of the merger agreement, Relypsa is not permitted to make additional option grants or equity issuances pending completion of the transaction. Galenica expects to make decisions regarding post-closing equity compensation following the closing of the transaction. We will communicate new information when it becomes available and will provide answers to questions as soon as possible after decisions are made.

A leadership team on behalf of Galenica and Vifor Pharma will be visiting the Relypsa offices during the coming weeks to have conversations with Relypsa management. During these conversations, we will elaborate further regarding the process and address employee matters in a transparent manner.

| 20. | What may I say to vendors, partners, suppliers and others that I have contact with in the normal course of business? |

For those people that you are in contact with during the normal course of business, you can refer to the press release that was distributed to all employees and is also available on our company website. Management is reaching out to our partners, suppliers, key vendors and key opinion leaders.

In addition, you can use the following key messages:

| | • | | Galenica and Relypsa have entered a merger agreement under which Galenica will acquire Relypsa and Relypsa will become part of Galenica’s Vifor Pharma Business Unit. |

| | • | | Galenica/Vifor Pharma share a strong commitment to patients and closely aligned values with Relypsa and we are excited to continue our mission of improving patients’ lives as part of the combined organization. |

| | • | | Between now and the closing of the acquisition it will be business as usual for both Relypsa and Vifor Pharma, and there will be no immediate changes in how we conduct our business. |

| 21. | What should I do if I’m contacted by the media, investors or other members of the financial community or other third parties about the transaction? |

If you receive any external inquiries related to the transaction, please immediately refer them to Charlotte Arnold, VP of Corporate Communications and Investor Relations.

| 22. | If I have additional questions, who can I ask? |

We encourage you to speak with your manager or any member of the senior management team. For any benefit-related questions, please ask a member of the HR team. We realize that you may have many questions over the coming weeks regarding such items as job function, compensation, employee benefits and post-closing activities. We will communicate new information when it becomes available and will provide answers to questions as soon as possible after decisions are made.

Additional Information and Where to Find It

The tender offer (the “Offer”) for the outstanding shares of common stock of Relypsa, Inc. (the “Company”) has not yet commenced. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell any securities of the Company, nor is it a substitute for the tender offer materials that Galenica AG (“Parent”) and its acquisition subsidiary (“Merger Sub”) will file with the U.S. Securities and Exchange Commission (the “SEC”) upon commencement of the Offer. At the time the Offer is commenced, Parent and Merger Sub will file tender offer materials on Schedule TO, and the Company will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the Offer and the merger of Merger Sub with and into the Company, with the Company surviving as a wholly owned subsidiary of Parent (the “Merger”). The tender offer materials (including an Offer to Purchase, a related Letter of Transmittal and certain other tender offer documents) and the Solicitation/Recommendation Statement will contain important information. Investors and security holders of the Company are urged to read these documents carefully and in their entirety when they become available because they will contain important information that holders of Company securities should consider before making any decision regarding tendering their securities. The Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, will be made available to all holders of shares of the Company at no expense to them. The tender offer materials and the Solicitation/Recommendation Statement (when they become available) will be made available for free at the SEC’s website at www.sec.gov. Additional copies may be obtained for free under the “Investors” section of the Company’s website at www.Relypsa.com.

Forward-Looking Statements

This communication contains forward-looking statements, which are generally statements that are not historical facts. Words or phrases such as “believe,” “may,” “could,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “seek,” “plan,” “expect,” “should,” “would” or similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on the Company’s current plans, beliefs, estimates, assumptions and expectations and include without limitation statements regarding the planned completion of the Offer and the Merger. Forward-looking statements involve inherent risks and uncertainties and there are a number of important factors that could cause actual events to differ materially from those suggested or indicated by such forward-looking statements. These factors include risks and uncertainties related to, among other things: adverse conditions in the U.S. and international economies; the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; uncertainties as to the

timing of the Offer and the Merger; uncertainties as to the percentage of Company stockholders tendering their shares in the Offer; the possibility that competing offers will be made; the possibility that various closing conditions for the Offer or the Merger may not be satisfied or waived, including the failure to obtain necessary regulatory approvals; the effects of disruption caused by the transaction making it more difficult to maintain relationships with employees, collaborators, vendors and other business partners; the risk that stockholder litigation in connection with the Offer or the Merger may result in significant costs of defense, indemnification and liability; and risks and uncertainties pertaining to the business of the Company, including those detailed under “Risk Factors” and elsewhere in the Company’s public periodic filings with the SEC, as well as the Offer materials to be filed by Parent and Merger Sub and the Solicitation/Recommendation Statement to be filed by the Company in connection with the Offer.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement and the Company undertakes no obligation to revise or update this report to reflect events or circumstances after the date hereof, except as required by law.

Employee Meeting July 21, 2016

Forward-Looking Statements The statements included in this press release contain forward-looking statements, which are generally statements that are not historical facts. Forward-looking statements can be identified by the words “expects,” “anticipates,” “believes,” “intends,” “estimates,” “plans,” “will,” “outlook” and similar expressions. Forward-looking statements are based on management’s current plans, estimates, assumptions and projections, speak only as of the date they are made and include without limitation statements regarding the planned completion of the tender offer and the merger, statements regarding the anticipated filings and approvals relating to the tender offer and the merger, statements regarding the expected completion of the tender offer and the merger and statements regarding the ability of Vifor Pharma USA Inc. to complete the tender offer and the merger considering the various closing conditions. Galenica and Relypsa undertake no obligation to update any forward-looking statement in light of new information or future events, except as otherwise required by law. Forward-looking statements involve inherent risks and uncertainties, most of which are difficult to predict and are generally beyond the control of either company, including the following: (a) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; (b) the inability to complete the transaction due to the failure to satisfy conditions to the transaction; (c) the risk that the proposed transaction disrupts current plans and operations; (d) difficulties or unanticipated expenses in connection with integrating Relypsa into Galenica; (e) the risk that the acquisition does not perform as planned; and (f) potential difficulties in employee retention following the closing of the transaction. Actual results or outcomes may differ materially from those implied by the forward-looking statements as a result of the impact of a number of factors, many of which are discussed in more detail in the public reports of each company filed or to be filed with the SEC or the SIX Swiss Exchange. Additional Information This presentation and the description contained herein is for informational purposes only and is not a recommendation, an offer to buy, or the solicitation of an offer to sell any shares of Relypsa’s common stock. The tender offer referenced in this press release has not commenced. Upon commencement of the tender offer, Galenica and its indirect wholly owned subsidiary, Vifor Pharma USA Inc., will file with the U.S. Securities and Exchange Commission (the “SEC”) a Tender Offer Statement on Schedule TO containing an offer to purchase (the “Offer to Purchase”), a form of letter of transmittal (the “Letter of Transmittal”) and other related documents and, thereafter, Relypsa will file with the SEC a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer. Galenica, Vifor Pharma USA Inc. and Relypsa intend to mail these documents to the shareholders of Relypsa. THESE DOCUMENTS, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TENDER OFFER AND RELYPSA SHAREHOLDERS ARE URGED TO READ THEM CAREFULLY WHEN THEY BECOME AVAILABLE. Shareholders of Relypsa will be able to obtain a free copy of these documents (when they become available) and other documents filed by Relypsa, Galenica or Vifor Pharma USA Inc. with the SEC at the website maintained by the SEC at www.sec.gov. In addition, shareholders of Relypsa may obtain a free copy of these documents (when they become available) by visiting the “Investors” section of Relypsa’s website at http://investor.relypsa.com.

Speakers and Guests John Orwin – Chief Executive Officer, Relypsa Colin Bond - Chief Financial Officer, Vifor Pharma Michael Puri – Head of Global Human Resources, Vifor Pharma Mary Corbett - SVP Human Resources, Relypsa

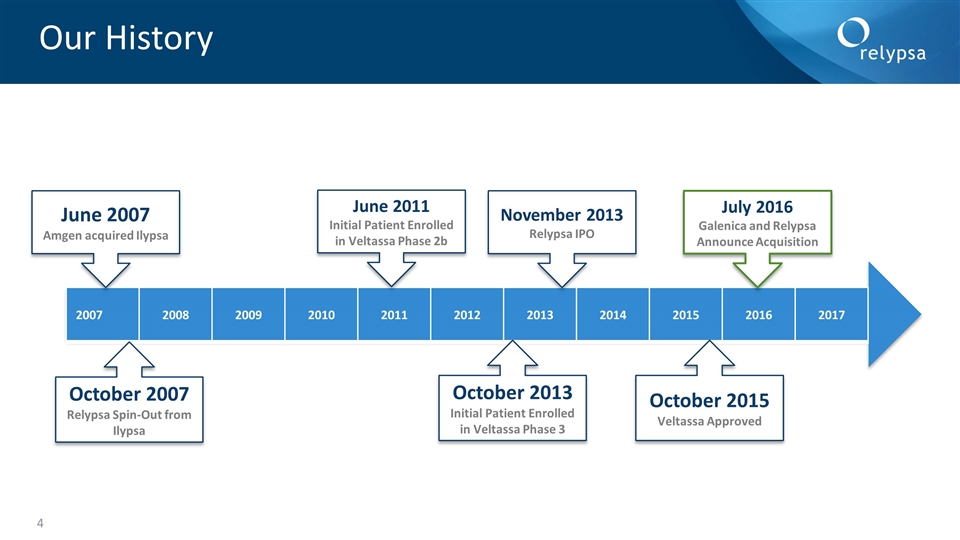

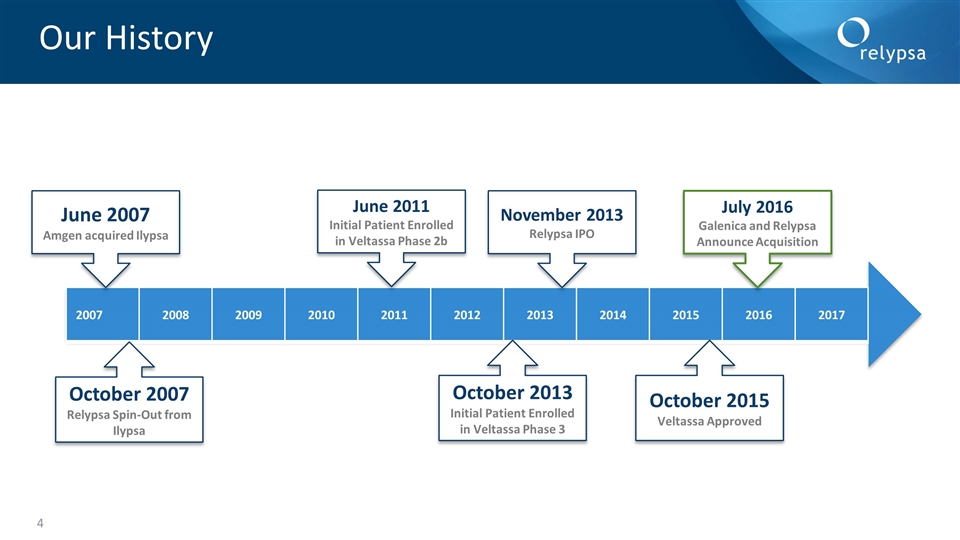

Our History 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 June 2007 Amgen acquired Ilypsa October 2007 Relypsa Spin-Out from Ilypsa November 2013 Relypsa IPO July 2016 Galenica and Relypsa Announce Acquisition October 2015 Veltassa Approved October 2013 Initial Patient Enrolled in Veltassa Phase 3 June 2011 Initial Patient Enrolled in Veltassa Phase 2b

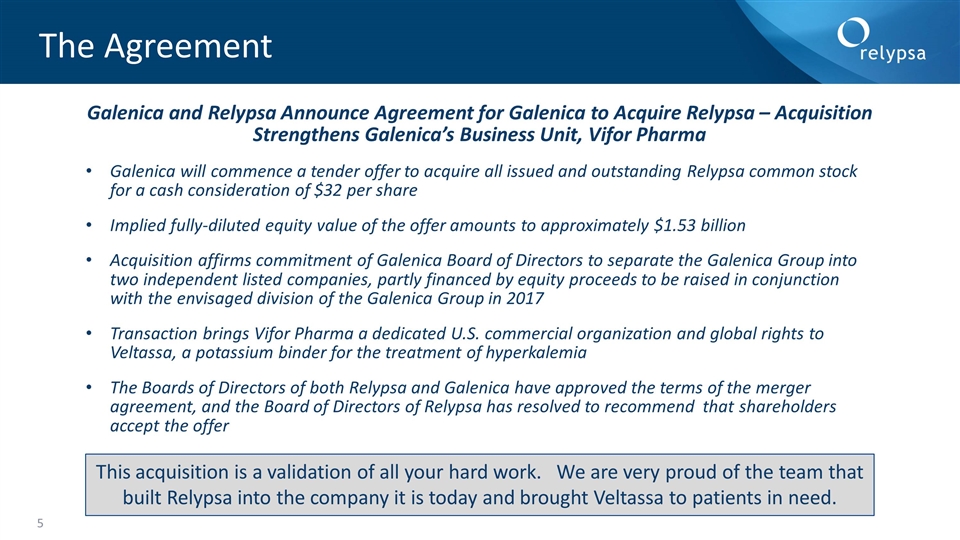

The Agreement Galenica and Relypsa Announce Agreement for Galenica to Acquire Relypsa – Acquisition Strengthens Galenica’s Business Unit, Vifor Pharma Galenica will commence a tender offer to acquire all issued and outstanding Relypsa common stock for a cash consideration of $32 per share Implied fully-diluted equity value of the offer amounts to approximately $1.53 billion Acquisition affirms commitment of Galenica Board of Directors to separate the Galenica Group into two independent listed companies, partly financed by equity proceeds to be raised in conjunction with the envisaged division of the Galenica Group in 2017 Transaction brings Vifor Pharma a dedicated U.S. commercial organization and global rights to Veltassa, a potassium binder for the treatment of hyperkalemia The Boards of Directors of both Relypsa and Galenica have approved the terms of the merger agreement, and the Board of Directors of Relypsa has resolved to recommend that shareholders accept the offer This acquisition is a validation of all your hard work. We are very proud of the team that built Relypsa into the company it is today and brought Veltassa to patients in need.

Galenica and Relypsa Our relationship with Galenica began with an excellent partnership Galenica is the parent company of our ex-U.S. partner, VFMCRP (Vifor Fresenius Medical Care Renal Pharma), a Vifor Pharma joint company Partnership was signed in August 2015 Combining Relypsa with Vifor Pharma expands this relationship with the goal of creating a world-leading specialty pharmaceutical company focused on nephrology, cardiology and gastroenterology medicines

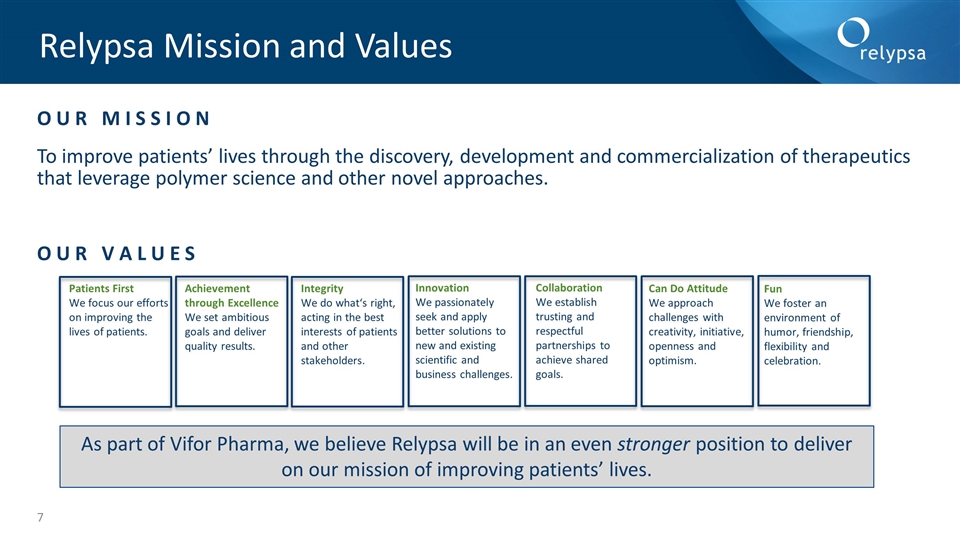

Relypsa Mission and Values O U R M I S S I O N To improve patients’ lives through the discovery, development and commercialization of therapeutics that leverage polymer science and other novel approaches. O U R V A L U E S Patients First We focus our efforts on improving the lives of patients. Achievement through Excellence We set ambitious goals and deliver quality results. Integrity We do what‘s right, acting in the best interests of patients and other stakeholders. Innovation We passionately seek and apply better solutions to new and existing scientific and business challenges. Collaboration We establish trusting and respectful partnerships to achieve shared goals. Fun We foster an environment of humor, friendship, flexibility and celebration. Can Do Attitude We approach challenges with creativity, initiative, openness and optimism. As part of Vifor Pharma, we believe Relypsa will be in an even stronger position to deliver on our mission of improving patients’ lives.

The Strategic Rationale A strategic merger of two companies committed to patients with cardio-renal disease Similar Values and Culture Maximize the Success of Veltassa Strength in Combining Resources Commitment to Patients the Priority

The Board Rationale An informed, thoughtful and careful process was conducted This included a thorough assessment of all our alternatives Including the benefits and risks of remaining an independent company Relypsa’s Board concluded that this transaction is in the best interest of the company and its stockholders We believe is the best option to maximize value for our stockholders You will be able to find additional information about this process and proposed transaction by reviewing a document called a Form 14D-9, which will be filed with the U.S. Securities and Exchange Commission in the coming days

Next Steps Vifor Pharma believes Relypsa’s talented people are vital to the ongoing success of the company and a key driver of the acquisition They intend to retain the vast majority of Relypsa’s employees in their current roles Vifor Pharma and Relypsa leadership will work together to develop an integration plan The acquisition is expected to be completed in the third quarter And most importantly, our mission remains the same – improving patients lives and ensuring the ongoing success of Veltassa We believe this acquisition will provide exciting opportunities and we look forward to our future as part of the Vifor Pharma family!

What does this mean to Relypsa employees? The vast majority of Relypsa’s employees will be retained in their current roles Current benefits, including the 401(k) plan, and salaries and cash compensation programs (corporate bonus and incentive programs) for continuing employees will continue through December 2017 Vested and unvested Relypsa stock already granted to current Relypsa employees will be fully accelerated (vested) and cashed out shortly after the closing The current Employee Stock Purchase Plan will end when the current offering period closes on August 31st, or earlier if the transaction closes before August 31st

Q&A Q: Does Galenica grant equity awards to their employees? A: Galenica understands the importance of equity as a component of total compensation for employees and is in the process of evaluating the use of equity incentives as part of its compensation structure. We would expect Galenica to communicate any decisions regarding post-closing equity compensation once they have been made. Q: Will I receive my annual stock grant in August? A: Under the terms of the merger agreement, Relypsa is not permitted to make additional option grants pending completion of the transaction. We would expect Galenica to communicate any decisions regarding post-closing equity compensation once they have been made. Q: Is there a severance program in place for any positions that may be eliminated following the closing of the transaction? A: If your position is eliminated, employees below the Vice President level will be eligible for severance pursuant to Relypsa’s Change in Control Separation Benefits Plan which is available on our intranet under HR/benefits. For employees at the Vice President level and above, severance will be governed by your employment contract.

Q&A Q: What may I say to vendors, partners, suppliers and others that I have contact with in the normal course of business? A: Please refer to the press release that was posted to our website. Management is reaching out to our partners, suppliers, key vendors and key opinion leaders. Q: What should I do if I’m contacted by the media, investors or other members of the financial community or third parties about the transaction? A: If you receive any external inquiries related to the transaction, please immediately refer them to Charlotte Arnold, VP, Corporate communications and Investor Relations Q: What do we do between now and closing? A: Until the closing of the transaction, Relypsa and Vifor Pharma will continue to operate as separate companies and it is business as usual for both companies.

Q&A Q: If I have additional questions, who can I ask? A: We encourage you to speak with your manager or any member of the senior management team. For any benefit related questions, please ask a member of the HR team. We realize that you may have many questions over the coming weeks regarding such items as job function, compensation, employee benefits and post-closing activities. We will communicate new information when it becomes available and will provide answers to questions as soon as possible after decisions are made. An employee Q&A will be distributed shortly.