UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2011

OR

| o | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

COMMISSION FILE NUMBER 000-53012

MEDICAL BILLING ASSISTANCE, INC.

(Exact Name of small business issuer as specified in its charter)

| Colorado | | 59-2851601 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

709 S. Harbor City Blvd., Suite 250, Melbourne, FL 32901

(Address of principal executive offices) (Zip Code)

Issuer’s telephone Number: (321) 725-0090

Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | | Accelerated filer o |

| | | |

Non-accelerated filer o | | Smaller reporting company x |

(Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of August 12, 2011, the issuer had 49,716,000 outstanding shares of Common Stock.

| | | Page |

| | PART I | |

| Item 1. | Financial Statements | 3 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operation | 12 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 17 |

| Item 4. | Controls and Procedures | 17 |

| | | |

| | PART II | |

| Item 1. | Legal Proceedings | 17 |

| Item 1A. | Risk Factors | 17 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 17 |

| Item 3. | Defaults Upon Senior Securities | 18 |

| Item 4. | (Removed and Reserved) | 18 |

| Item 5. | Other Information | 18 |

| Item 6. | Exhibits | 18 |

ITEM 1. FINANCIAL STATEMENTS.

| MEDICAL BILLING ASSISTANCE, INC. | |

| CONDENSED CONSOLIDATED BALANCE SHEETS | |

| | | | | | | |

| | | June 30, | | | December 31, | |

| | | 2011 | | | 2010 | |

| | | (unaudited) | | | | |

| ASSETS | | | | | | |

| Current assets | | | | | | |

| Cash | | $ | 87,913 | | | $ | 3,318 | |

| Accounts receivable, net | | | 43,526 | | | | - | |

| Prepaid expenses | | | 43,673 | | | | 7,811 | |

| Total current assets | | | 175,112 | | | | 11,129 | |

| | | | | | | | | |

| Property, plant and equipment, net | | | 4,617,829 | | | | 4,698,560 | |

| | | | | | | | | |

| Other assets | | | | | | | | |

| Deposits | | | 2,415 | | | | 4,415 | |

| | | | | | | | | |

| Total assets | | $ | 4,795,356 | | | $ | 4,714,104 | |

| | | | | | | | | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' DEFICIT | | | | | | | | |

| Current liabilities | | | | | | | | |

| Accounts payable and accrued expenses | | $ | 305,817 | | | $ | 194,092 | |

| Notes payable, current portion | | | 5,346,352 | | | | 163,399 | |

| Notes payable- related party, current portion | | | 19,301 | | | | 70,931 | |

| Convertible note payable | | | 53,000 | | | | | |

| Unearned revenue | | | 23,586 | | | | 23,586 | |

| Deferred income taxes | | | 50,019 | | | | 29,019 | |

| Other current liabilities | | | - | | | | 66,447 | |

| Total current liabilities | | | 5,798,075 | | | | 547,474 | |

| | | | | | | | | |

| Long term debt: | | | | | | | | |

| Deposits held | | | 47,399 | | | | 47,399 | |

| Notes payable, long term portion | | | - | | | | 5,253,229 | |

| Total long term debt | | | 47,399 | | | | 5,300,628 | |

| | | | | | | | | |

| Total liabilities | | | 5,845,474 | | | | 5,848,102 | |

| | | | | | | | | |

| Stockholders' deficit | | | | | | | | |

| Preferred stock, $0.01 par value; 1,000,000 shares authorized, Nil issued and outstanding | | | - | | | | - | |

| Common stock, $0.001 par value; 100,000,000 shares authorized, 49,716,000 shares issued and outstanding as of June 30, 2011 and December 31, 2010 | | | 49,716 | | | | 49,716 | |

| Additional paid in capital | | | 40,915 | | | | 40,915 | |

| Accumulated deficit | | | (1,140,749 | ) | | | (1,224,629 | ) |

| Total stockholders' deficit | | | (1,050,118 | ) | | | (1,133,998 | ) |

| | | | | | | | | |

| Total liabilities and stockholders' deficit | | $ | 4,795,356 | | | $ | 4,714,104 | |

| | | | | | | | | |

| See the accompanying notes to these unaudited condensed consolidated financial statements. | |

| MEDICAL BILLING ASSISTANCE, INC. | |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | |

| (unaudited) | |

| | | | | | | | | | | | | |

| | | Three months ended June 30, | | | Six months ended June 30, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| Revenues: | | | | | | | | | | | | |

| Rental revenue | | $ | 384,518 | | | $ | 342,156 | | | $ | 695,715 | | | $ | 626,868 | |

| | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | |

| Selling general and administrative | | | 263,851 | | | | 125,621 | | | | 427,017 | | | | 228,442 | |

| Depreciation | | | 40,365 | | | | 40,366 | | | | 80,730 | | | | 80,730 | |

| Total operating expenses | | | 304,216 | | | | 165,987 | | | | 507,747 | | | | 309,172 | |

| | | | | | | | | | | | | | | | | |

| Income from operations | | | 80,302 | | | | 176,169 | | | | 187,968 | | | | 317,696 | |

| | | | | | | | | | | | | | | | | |

| Other income (expense): | | | | | | | | | | | | | | | | |

| Miscellaneous income | | | 735 | | | | 1,011 | | | | 1,877 | | | | 2,051 | |

| Gain on settlement of debt | | | 67,365 | | | | - | | | | 67,365 | | | | - | |

| Interest expense, net | | | (77,998 | ) | | | (76,115 | ) | | | (152,330 | ) | | | (151,666 | ) |

| | | | | | | | | | | | | | | | | |

| Net income before provision for income taxes | | | 70,404 | | | | 101,065 | | | | 104,880 | | | | 168,081 | |

| | | | | | | | | | | �� | | | | | | |

| Income taxes (benefit) | | | 14,100 | | | | 20,213 | | | | 21,000 | | | | 33,616 | |

| | | | | | | | | | | | | | | | | |

| NET INCOME | | $ | 56,304 | | | $ | 80,852 | | | $ | 83,880 | | | $ | 134,465 | |

| | | | | | | | | | | | | | | | | |

| Net income per common share, basic | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

| | | | | | | | | | | | | | | | | |

| Net income per common share-fully diluted | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

| | | | | | | | | | | | | | | | | |

| Weighted average number of common shares outstanding, basic | | | 49,716,000 | | | | 49,716,000 | | | | 49,716,000 | | | | 49,716,000 | |

| | | | | | | | | | | | | | | | | |

| Weighted average number of common shares outstanding, fully diluted | | | 50,116,000 | | | | 49,716,000 | | | | 50,116,000 | | | | 49,716,000 | |

| | | | | | | | | | | | | | | | | |

| See the accompanying notes to these unaudited condensed consolidated financial statements. | |

| MEDICAL BILLING ASSISTANCE, INC. | |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | |

| (unaudited) | |

| | | | | | | |

| | | Six months ended June 30, | |

| | | 2011 | | | 2010 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | |

| Net Income | | $ | 83,880 | | | $ | 134,465 | |

| Adjustments to reconcile net income to cash provided by operating activities: | | | | | | | | |

| Depreciation | | | 80,730 | | | | 80,730 | |

| Gain on settlement of debt | | | (67,365 | ) | | | - | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Accounts receivable | | | (43,526 | ) | | | (60,889 | ) |

| Prepaid expenses and other | | | (33,862 | ) | | | 824 | |

| Accounts payable | | | 112,644 | | | | 21,793 | |

| Unearned income | | | - | | | | 23,103 | |

| Deferred income taxes | | | 21,000 | | | | 33,616 | |

| Net cash provided by operating activities | | | 153,501 | | | | 233,642 | |

| | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | | |

| Proceeds from deposits | | | - | | | | 1,337 | |

| Net cash provided by investing activities | | | - | | | | 1,337 | |

| | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | |

| Distributions to shareholders | | | - | | | | (467,055 | ) |

| Net payments on notes payable | | | (70,276 | ) | | | (41,667 | ) |

| Net payments on related party advances | | | (51,630 | ) | | | - | |

| Proceeds from issuance of convertible note payable | | | 53,000 | | | | - | |

| Net cash used in financing activities | | | (68,906 | ) | | | (508,722 | ) |

| | | | | | | | | |

| Net increase (decrease) in cash and cash equivalents | | | 84,595 | | | | (273,743 | ) |

| Cash and cash equivalents, beginning of period | | | 3,318 | | | | 403,542 | |

| | | | | | | | | |

| Cash and cash equivalents, end of period | | $ | 87,913 | | | $ | 129,799 | |

| | | | | | | | | |

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: | | | | | |

| Cash paid during the period for interest | | $ | 148,880 | | | $ | 151,666 | |

| Cash paid during the period for taxes | | $ | - | | | $ | - | |

| | | | | | | | | |

| See the accompanying notes to these unaudited condensed consolidated financial statements. | |

MEDICAL BILLING ASSISTANCE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2011

NOTE 1 – SIGNIFICANT ACCOUNTING POLICIES

A summary of the significant accounting policies applied in the presentation of the accompanying unaudited condensed consolidated financial statements follows:

General

The accompanying unaudited condensed consolidated financial statements of Medical Billing Assistance, Inc., (the “Company”), have been prepared in accordance with the rules and regulations (S-X) of the Securities and Exchange Commission (the "SEC") and with the instructions to Form 10-Q. Accordingly, they do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements.

In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. The results from operations for the three and six month periods ended June 30, 2011 are not necessarily indicative of the results that may be expected for the year ending December 31, 2011. The unaudited condensed consolidated financial statements should be read in conjunction with the consolidated December 31, 2010 financial statements and footnotes thereto included in the Company's SEC Form 10-K.

Basis of presentation

The Company was incorporated under the laws of Colorado on May 30, 2007.

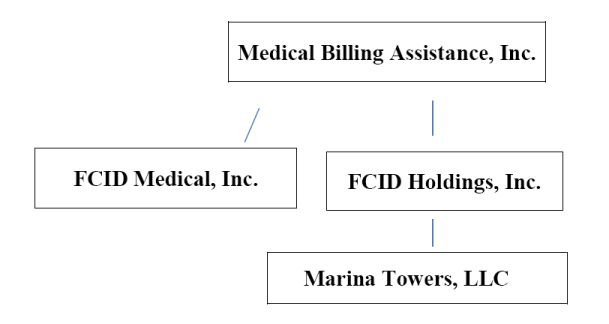

The unaudited condensed consolidated financial statements include the accounts of the Company, including FCID Holdings, Inc., FCID Medical, Inc., and Marina Towers, LLC. All significant intercompany balances and transactions have been eliminated in consolidation.

Gain on Settlement of Debt

On June 17, 2011, the Company disposed of I.V. Services, Ltd., Inc., a previous wholly-owned subsidiary the Company acquired in December 2010 for nil proceeds and with the acquirer assuming the of net liabilities of $67,365. Due to I.V. Services, Ltd. Inc. being inactive with no operations and or insignificant transactions, the Company considered the net liabilities assumed by the acquirer as settlement of debt.. As such, the In conjunction with the disposal, the Company recognized a $67,365 as income for the current period operations.

Use of Estimates

The preparation of the financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates.

Revenue Recognition

The Company recognizes revenue in accordance with Accounting Standards Codification subtopic 605-10, Revenue Recognition (“ASC 605-10”) which requires that four basic criteria must be met before revenue can be recognized: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred; (3) the selling price is fixed and determinable; and (4) collectability is reasonably assured. Determination of criteria (3) and (4) are based on management's judgments regarding the fixed nature of the selling prices of the products delivered and the collectability of those amounts. Provisions for discounts and rebates to customers, estimated returns and allowances, and other adjustments are provided for in the same period the related sales are recorded.

MEDICAL BILLING ASSISTANCE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2011

ASC 605-10 incorporates Accounting Standards Codification subtopic 605-25, Multiple-Element Arraignments (“ASC 605-25”). ASC 605-25 addresses accounting for arrangements that may involve the delivery or performance of multiple products, services and/or rights to use assets. The effect of implementing 605-25 on the Company's financial position and results of operations was not significant.

Segment Information

Accounting Standards Codification subtopic Segment Reporting 280-10 (“ASC 280-10”) establishes standards for reporting information regarding operating segments in annual financial statements and requires selected information for those segments to be presented in interim financial reports issued to stockholders. ASC 280-10 also establishes standards for related disclosures about products and services and geographic areas. Operating segments are identified as components of an enterprise about which separate discrete financial information is available for evaluation by the chief operating decision maker, or decision-making group, in making decisions how to allocate resources and assess performance. The information disclosed herein materially represents all of the financial information related to the Company’s principal operating segment.

Property and Equipment

Property and equipment are stated at cost. When retired or otherwise disposed, the related carrying value and accumulated depreciation are removed from the respective accounts and the net difference less any amount realized from disposition, is reflected in earnings. For financial statement purposes, property and equipment are recorded at cost and depreciated using the straight-line method over their estimated useful lives of 20 to 39 years.

Long-Lived Assets

The Company follows Accounting Standards Codification subtopic 360-10, Property, plant and equipment (“ASC 360-10”). The Statement requires that long-lived assets and certain identifiable intangibles held and used by the Company be reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Events relating to recoverability may include significant unfavorable changes in business conditions, recurring losses, or a forecasted inability to achieve break-even operating results over an extended period. The Company evaluates the recoverability of long-lived assets based upon forecasted undiscounted cash flows. Should impairment in value be indicated, the carrying value of intangible assets will be adjusted, based on estimates of future discounted cash flows resulting from the use and ultimate disposition of the asset. ASC 360-10 also requires assets to be disposed of be reported at the lower of the carrying amount or the fair value less costs to sell.

Income Taxes

The Company follows Accounting Standards Codification subtopic 740-10, Income Taxes (“ASC 740-10”) for recording the provision for income taxes. Deferred tax assets and liabilities are computed based upon the difference between the financial statement and income tax basis of assets and liabilities using the enacted marginal tax rate applicable when the related asset or liability is expected to be realized or settled. Deferred income tax expenses or benefits are based on the changes in the asset or liability during each period. If available evidence suggests that it is more likely than not that some portion or all of the deferred tax assets will not be realized, a valuation allowance is required to reduce the deferred tax assets to the amount that is more likely than not to be realized. Future changes in such valuation allowance are included in the provision for deferred income taxes in the period of change. Deferred income taxes may arise from temporary differences resulting from income and expense items reported for financial accounting and tax purposes in different periods. Deferred taxes are classified as current or non-current, depending on the classification of assets and liabilities to which they relate. Deferred taxes arising from temporary differences that are not related to an asset or liability are classified as current or non-current depending on the periods in which the temporary differences are expected to reverse and are considered immaterial.

MEDICAL BILLING ASSISTANCE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2011

Cash and Cash Equivalents

The Company considers cash to consist of cash on hand and investments having an original maturity of 90 days or less that are readily convertible into cash. As of June 30, 2011, the Company had $87,913 in cash.

Net income (loss) per share

The Company accounts for net income (loss) per share in accordance with Accounting Standards Codification subtopic 260-10, Earnings Per Share (“ASC 260-10”), which requires presentation of basic and diluted earnings per share (“EPS”) on the face of the statement of operations for all entities with complex capital structures and requires a reconciliation of the numerator and denominator of the basic EPS computation to the numerator and denominator of the diluted EPS.

Basic net income (loss) per share is computed by dividing net income (loss) by the weighted average number of shares of common stock outstanding during each period. It excludes the dilutive effects of potentially issuable common shares such as those related to our stock options. Diluted net income (loss) share is calculated by including potentially dilutive share issuances in the denominator. Diluted net income (loss) per share for three and six months ending June 30, 2011 reflects the effects of 400,000 shares potentially issuable upon the exercise of the Company's stock options (calculated using the treasury stock method) as of June 30, 2011. There were no potentially issuance common shares as of June 30, 2010.

Concentrations of credit risk

The Company’s financial instruments that is exposed to a concentration of credit risk is cash and accounts receivable. Effective December 31, 2010 and extending through December 31, 2012, all non-interest-bearing transaction accounts are fully insured by the Federal Deposit Insurance Corporation (FDIC), regardless of the balance of the account. Generally, the Company’s cash and cash equivalents in interest-bearing accounts may exceed FDIC insurance limits. The financial stability of these institutions is periodically reviewed by senior management.

Fair Value of Financial Instruments

Accounting Standards Codification subtopic 825-10, Financial Instruments (“ASC 825-10”) requires disclosure of the fair value of certain financial instruments. The carrying value of cash and cash equivalents, accounts payable and accrued liabilities, and short-term borrowings, as reflected in the balance sheets, approximate fair value because of the short-term maturity of these instruments. All other significant financial assets, financial liabilities and equity instruments of the Company are either recognized or disclosed in the financial statements together with other information relevant for making a reasonable assessment of future cash flows, interest rate risk and credit risk. Where practicable the fair values of financial assets and financial liabilities have been determined and disclosed; otherwise only available information pertinent to fair value has been disclosed. There were no items required to be measured at fair value on a recurring basis in the financial statement as of June 30, 2011.

The company follows Accounting Standards Codification subtopic 820-10, Fair Value Measurements and Disclosures (“ASC 820-10”) and Accounting Standards Codification subtopic 825-10, Financial Instruments (“ASC 825-10”), which permits entities to choose to measure many financial instruments and certain other items at fair value. Neither of these statements had an impact on the Company’s financial position, results of operations nor cash flows.

MEDICAL BILLING ASSISTANCE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2011

Share-Based Compensation

Share-based compensation issued to employees is measured at the grant date, based on the fair value of the award, and is recognized as an expense over the requisite service period. The Company measures the fair value of the share-based compensation issued to non-employees using the stock price observed in the arms-length private placement transaction nearest the measurement date (for stock transactions) or the fair value of the award (for non-stock transactions), which were considered to be more reliably determinable measures of fair value than the value of the services being rendered. The measurement date is the earlier of (1) the date at which commitment for performance by the counterparty to earn the equity instruments is reached, or (2) the date at which the counterparty’s performance is complete.

Recent Accounting Pronouncements

There were various other updates recently issued, most of which represented technical corrections to the accounting literature or application to specific industries and are not expected to a have a material impact on the Company’s consolidated financial position, results of operations or cash flows.

NOTE 2 — GOING CONCERN

The accompanying unaudited interim condensed financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates the realization of assets and the settlement of liabilities and commitments in the normal course of business. As shown in the accompanying financial statements, the Company has a working capital deficit and stockholders' deficit, and in all likelihood will be required to make significant future expenditures in connection with marketing efforts along with general administrative expenses. These conditions raise substantial doubt about the Company’s ability to continue as a going concern.

The Company incurred various non-recurring expenses in the last quarter of 2010 in connection with its share exchange agreement, and prior to the share exchange agreement, Marina Towers, LLC allocated large distributions to its members, leading in part to the Company’s working capital deficit. The Company generated positive cash flow from operations for the six months ended June 30, 2011 and 2010. The Company is also involved in development project efforts to purchase MRI centers and medical practices. Management believes that ongoing profitable operations of Marina Towers, LLC, along with successful completion of its business development plan will allow the Company to improve or eliminate its working capital deficit and will provide the opportunity for the Company to continue as a going concern. However, there can be no assurance that the Company will be successful in the completion of its business development plan and be able to improve or eliminate its working capital deficit.

NOTE 3 - PROPERTY, PLANT, AND EQUIPMENT

Property, plant and equipment at June 30, 2011 and December 31, 2010 are as follows:

| | | June 30, 2011 (unaudited) | | | December 31, 2010 | |

| Land | | $ | 1,000,000 | | | $ | 1,000,000 | |

| Building | | | 3,055,168 | | | | 3,055,168 | |

| Building improvements | | | 1,662,362 | | | | 1,662,362 | |

| | | | 5,717,530 | | | | 5,717,530 | |

| Less: accumulated depreciation | | | (1,099,701 | ) | | | (1,018,970 | ) |

| | | $ | 4,617,829 | | | $ | 4,698,560 | |

MEDICAL BILLING ASSISTANCE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2011

During the three months ended June 30, 2011 and 2010, depreciation expense charged to operations was $40,365 and $40,366, respectively.

During the six months ended June 30, 2011 and 2010, depreciation expense charged to operations was $80,730.

NOTE 4 - NOTE PAYABLE

The Company has a mortgage note payable on its commercial office building which is secured by land and the building, bears interest at a variable rate of prime plus .5% with a minimum rate of 5.5% per annum, with monthly interest only payments required through January 2010, then monthly principal and interest payments commencing in February 2010 using a 20 year amortization schedule recalculated monthly for interest rate changes, with all outstanding principal and interest due in full in January 2012. The principal balance on the loan at June 30, 2011 and December 31, 2010 was $5,346,352 and $5,416,628, respectively. Interest expense under the note for the six months ended June 30, 2011 and 2010 was $148,880 and $151,758, respectively.

The minimum future cash flow for the notes payable at June 30, 2011 is as follows:

| | | Amount | |

| Six months ending December 31, 2011 | | $ | 93,123 | |

| Year ended December 31, 2012 | | | 5,253,229 | |

| Total | | $ | 5,346,352 | |

NOTE 5 - CONVERTIBLE NOTE PAYABLE

On June 3, 2011, the Company issued a convertible note due nine months from the date of issuance with an interest rate of 8% per annum. The note is convertible into the Company's common stock at a at any time after 180 days, at the holder’s option, into common stock at the conversion rate of 61% of the lowest three trading days 10 days prior to notice of conversion. Prior to the 180 days, the Company is entitled to prepay at 125% of the outstanding principal and accrued interest 90 days following the date of the note, or 150% from the 91st day to 180 days following the date of the note.

NOTE 6 - RELATED PARTY TRANSACTIONS

The Company at June 30, 2011 and December 31, 2010 owed $Nil and $51,197, respectively, to a shareholder and former officer for non-interest bearing, due on demand working capital advances.

At June 30, 2011 and December 31, 2010 the Company owed a shareholder and former officer $Nil and $16,600, respectively, under an unsecured, due on demand note payable bearing interest at 6% per annum.

At June 30, 2011 the Company owed a related company by common control an amount of $19,300 under a unsecured, due on demand note payable bearing interest at 8% per annum.

NOTE 7-STOCK OPTIONS

Non Employee Stock Options

The following table summarizes in options outstanding and the related prices for the shares of the Company's common stock issued to non employees at June 30, 2011:

MEDICAL BILLING ASSISTANCE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2011

| | | | Options Outstanding | | | | | | Options Exercisable | |

| | | | | | | Weighted Average | | | Weighted | | | | | | Weighted | |

| �� | | | | | | Remaining | | | Average | | | | | | Average | |

| | Exercise | | Number | | | Contractual Life | | | Exercise | | | Number | | | Exercise | |

| | Prices | | Outstanding | | | (Years) | | | Price | | | Exercisable | | | Price | |

| | | | | | | | | | | | | | | | | |

| | $0.75 | | | 400,000 | | | | 1.50 | | | $ | 0.75 | | | | 400,000 | | | $ | 0.75 | |

Transactions involving stock options issued to non employees are summarized as follows:

| | | Number of Shares | | | Weighted Average Price Per Share | |

| | | | | | | | | |

| Outstanding at December 31, 2009: | | | - | | | $ | - | |

| Granted | | | 400,000 | | | | 0.75 | |

| Exercised | | | - | | | | - | |

| Outstanding at December 31, 2010: | | | 400,000 | | | | 0.75 | |

| Granted | | | - | | | | - | |

| Exercised | | | - | | | | - | |

| Expired | | | - | | | | - | |

| Outstanding at June 30, 2011: | | | 400,000 | | | $ | 0.75 | |

During the year ended December 31, 2010, the Company granted 400,000 non employee stock options in connection with the services rendered at the exercise price of $0.75 per share for the period of two years from date of grant. The options were fully vested at the time of grant.

The fair value of the vesting non employee options for the year ended December 31, 2010 were determined using the Black Scholes option pricing model with the following assumptions:

| Dividend yield: | -0-% |

| Volatility | 57% |

| Risk free rate: | 0.74% |

The determined fair value of the non employee options of $38,115 was charged to operations during the year ended December 31, 2010.

NOTE 8 – RECLASSIFICATION

During the six months ended June 30, 2011, the Company reclassified distribution in prior years in excess of additional paid in capital to retained earnings (deficit) retroactively.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

FORWARD LOOKING STATEMENTS

From time to time, we or our representatives have made or may make forward-looking statements, orally or in writing. Such forward-looking statements may be included in, but not limited to, press releases, oral statements made with the approval of an authorized executive officer or in various filings made by us with the Securities and Exchange Commission. Words or phrases "will likely result", "are expected to", "will continue", "is anticipated", "estimate", "project or projected", or similar expressions are intended to identify "forward-looking statements". Such statements are qualified in their entirety by reference to and are accompanied by the above discussion of certain important factors that could cause actual results to differ materially from such forward-looking statements.

Management is currently unaware of any trends or conditions other than those mentioned elsewhere in this management's discussion and analysis that could have a material adverse effect on the Company's consolidated financial position, future results of operations, or liquidity. However, investors should also be aware of factors that could have a negative impact on the Company's prospects and the consistency of progress in the areas of revenue generation, liquidity, and generation of capital resources. These include: (i) variations in revenue, (ii) possible inability to attract investors for its equity securities or otherwise raise adequate funds from any source should the Company seek to do so, (iii) increased governmental regulation, (iv) increased competition, (v) unfavorable outcomes to litigation involving the Company or to which the Company may become a party in the future and, (vi) a very competitive and rapidly changing operating environment. The risks identified here are not all inclusive. New risk factors emerge from time to time and it is not possible for management to predict all of such risk factors, nor can it assess the impact of all such risk factors on the Company's business or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements. Accordingly, forward-looking statements should not be relied upon as a prediction of actual results.

The financial information set forth in the following discussion should be read in conjunction with the consolidated financial statements of Medical Billing Assistance, Inc. included elsewhere herein.

OVERVIEW AND HISTORY

We were incorporated in the State of Colorado on May 30, 2007 to act as a holding corporation for I.V. Services Ltd., Inc. (“IVS”), a Florida corporation engaged in providing billing services to the medical community. IVS was incorporated in the State of Florida on September 28, 1987. On June 30, 2007, we issued the 8,000,000 common shares to Mr. Michael West in exchange for 100% of the capital stock of IVS.

On December 29, 2010, we entered into a Share Exchange Agreement (the “Share Exchange Agreement”) with FCID Medical, Inc., a Florida corporation (“FCID Medical”) and FCID Holdings, Inc., a Florida corporation (“FCID Holdings)”, which together will be referred to herein with FCID Medical as “FCID”, and the shareholders of FCID (the “FCID Shareholders”). Pursuant to the terms of the Share Exchange Agreement, the FCID Shareholders exchanged 100% of the outstanding common stock of FCID for a total of 40,000,000 shares of common stock of the Company, resulting in FCID Medical and FCID Holdings being 100% owned subsidiaries of the Company (the “Share Exchange”).

In connection with the Share Exchange Agreement, in addition to the foregoing and effective on the closing date, Michael West resigned as President, Treasurer and director of the Company and Steve West resigned as officer of the Company but retained a directorship with the Company. After such resignations, Christian Charles Romandetti was appointed President, Chief Executive Officer and a director of the Company, and Donald Bittar was appointed Chief Financial Officer, Treasurer and Secretary.

All of our operations are conducted out of our wholly-owned subsidiaries: FCID Medical and FCID Holdings. We have real estate holdings through FCID Holdings, Inc., under which Marina Towers, LLC is wholly-owned subsidiary. A diagram of our corporate structure is set below:

Our address is 709 S. Harbor City Blvd., Suite 250, Melbourne, FL 32901, and our telephone number is (321) 725-0090.

We are focusing the majority of our efforts on the business of FCID Medical. FCID Medical’s strategic plan is to provide MRI centers and medical practices in primarily rural communities with cost effective imaging and diagnostics, while fully complying with governmental regulations, guidelines and industry standards. Medical Billing Assistance ("MDBL") will be headquartered in Melbourne, FL in the Marina Towers, in a building owned by Marina Towers, LLC, a subsidiary of FCID Holdings, and will develop training capabilities as well as central billing systems in this location.

We are also pursuing the expansion of our business to include new medical avenues, including but not limited to, cancer research and diagnostics, electronic medical records, and evaluating cancer treatment options. For example, we are pursuing the following medical avenues: (i) 3D automated whole breast ultrasound, an FDA approved ultrasound system that provides painless and non-invasive tests through 2D, MPR and 3D images; (ii) the MedeFile system, a centralized electronic medical records system that gathers, processes, records and indexes all medical data for patients; and (iii) Cancer Treatment, a hypothermia cancer therapy.

FCID Holdings will manage our real estate holdings. With the completion of the Share Exchange Agreement, FCID Holdings, which owns a wholly-owned subsidiary known as Marina Towers, LLC, is one of our subsidiaries. Marina Towers, LLC operates Marina Towers, a 68,090 square foot Class A five-story office building that generates revenue and income that we will use to expand our operating businesses.

Results of Operations

Three months ended June 30, 2011 compared to three months ended June 30, 2010:

The following discussion involves our results of operations for the three months ended June 30, 2011 compared to the three months ended June 30, 2010.

Comparing our operations, we had revenues of $384,518 for the three months ended June 30, 2011, compared to revenues of $342,156 for the three months ended June 30, 2010. The increase in revenue of $42,362, or 12.4%, is primarily attributable to an increase in revenue generated by added tenants and escalation increases from our Marina Towers.

Operating expenses, which include general and administrative expenses for the three months ended June 30, 2011, were $263,851 compared to expenses of $125,521 for the three months ended June 30, 2010. The increase of $138,330, or 110.1%, is mainly attributable to legal, accounting and other professional expenses incurred operating a public entity. Depreciation of our building remained constant at $40,365 and $40,366 for the three months ended June 30, 2011 and 2011, respectively.

The major components of operating expenses include general and administrative, legal, accounting and professional fees associated maintaining a public entity.

We believe that the general and administrative expenses in current operations should remain fairly constant as our revenues develop. Each additional sale or service and correspondingly the gross profit of such sale or service have minimal offsetting operating expenses. Thus, additional sales could become profit at a higher return on sales rate as a result of not needing to expand operating expenses at the same pace.

During the three months ended June 30, 2011, we disposed of I.V. Services, Inc., a wholly-owned subsidiary of the Company that has been inactive since acquisition in December 2010 for net liability assumption by the purchaser. As such, we reported a gain of $67,365 for the three months ended June 30, 2011.

Interest expense, primarily composed of our mortgage interest on our building was $77,998 and $76,115 for the three months ended June 30, 2011 and 2010, respectively.

We had a net income of $56,304 for the three months ended June 30, 2011 compared to $80,852 for the same period last year. This decrease in net income of $24,548, or 30.4%, is mainly attributable to reasons as described above.

Six months ended June 30, 2011 compared to six months ended June 30, 2010:

The following discussion involves our results of operations for the six months ended June 30, 2011 compared to the six months ended June 30, 2010.

Comparing our operations, we had revenues of $695,715 for the six months ended June 30, 2011, compared to revenues of $626,868 for the six months ended June 30, 2010. The increase in revenue of $68,847, or 11.0%, is primarily attributable to an increase in revenue generated by added tenants and escalation increases from our Marina Towers.

Operating expenses, which include general and administrative expenses for the six months ended June 30, 2011, were $427,017 compared to expenses of $228,442 for the six months ended June 30, 2010. The increase of $198,575, or 86.9%, is mainly attributable to legal, accounting and other professional expenses incurred operating a public entity. Depreciation of our building remained constant at $80,730 for the six months ended June 30, 2011 and 2011.

The major components of operating expenses include general and administrative, legal, accounting and professional fees associated maintaining a public entity.

We believe that the general and administrative expenses in current operations should remain fairly constant as our revenues develop. Each additional sale or service and correspondingly the gross profit of such sale or service have minimal offsetting operating expenses. Thus, additional sales could become profit at a higher return on sales rate as a result of not needing to expand operating expenses at the same pace.

During the six months ended June 30, 2011, we disposed of I.V. Services, Inc., a wholly-owned subsidiary of the Company that has been inactive since acquisition in December 2010 for net liability assumption by the purchaser. As such, we reported a gain of $67,365 for the six months ended June 30, 2011.

Interest expense, primarily composed of our mortgage interest on our building was $152,330 and $151,666 for the six months ended June 30, 2011 and 2010, respectively.

We had a net income of $83,880 for the six months ended June 30, 2011 compared to $134,465 for the same period last year. This decrease in net income of $50,585, or 37.6%, is mainly attributable to reasons as described above.

The accompanying unaudited interim condensed financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates the realization of assets and the settlement of liabilities and commitments in the normal course of business. As shown in the accompanying financial statements, the Company has a working capital deficit and stockholders' deficit, and in all likelihood will be required to make significant future expenditures in connection with marketing efforts along with general administrative expenses. These conditions raise substantial doubt about the Company’s ability to continue as a going concern.

The Company incurred various non-recurring expenses in the last quarter of 2010 in connection with its share exchange agreement, and prior to the share exchange agreement Marina Towers, LLC allocated large distributions to its members ,leading in part to the Company’s working capital deficit. The Company generated positive cash flow from operations for the six months ended June 30, 2011 and 2010. The Company is also involved in development project efforts to purchase MRI centers, medical practices, to explore new medical avenues including but not limited to, cancer research and diagnostics, electronic medical records, and evaluating cancer treatment options. Management believes that ongoing profitable operations of Marina Towers, LLC, along with successful completion of its business development plan will allow the Company to improve or eliminate its working capital deficit and will provide the opportunity for the Company to continue as a going concern.

In addition, we expect that we will need to raise additional funds to pursue the next phase of our business plan with FCID Medical. We cannot assure that additional financing will be available when needed on favorable terms, or at all.

We expect to maintain a positive cash flow in our current operations with FCID Holdings, Inc. as our revenues develop. We cannot guarantee that we will be successful in generating sufficient revenues or other funds in the future to cover all operating costs.

Liquidity and Capital Resources

As of June 30, 2011, we had cash or cash equivalents of $87,913.

Net cash provided by operating activities was $153,501 for the six months ended June 30, 2011, compared to cash provided by operating activities of $233,642 for the same period last year. We anticipate that overhead costs in current operations will remain fairly constant as revenues develop.

Net cash flows used in investing activities was $-0- for the six months ended June 30, 2011, compared to $1,337 provided by for the six months ended March 31, 2010, primarily attributable to proceeds from deposits.

Cash flows used by financing activities was $68,906 for the six months ended June 30, 2011, compared to net cash used for financing activities of $508,722 for the six months ended June 30, 2010. During the six months ended June 30, 2011, we paid $70,276 towards our outstanding debt (primarily mortgage),$51,630 payments on related party advances and borrowed on convertible note of $53,000 compared with note repayments of $41,667 and distributions to owners of $467,055 for the same period last year.

Over the next twelve months we do not expect any significant capital costs to develop operations. We plan to buy office equipment to be used in our operations. We anticipate raising funds in an estimated amount of $2-3 million for the development of our operations.

We believe that we have sufficient capital in the short term for our current level of operations. This is because we have sufficient revenues generated from Marina Towers to maintain profitability in our operations and sources to maintain operations.

On January 26, 2011, we entered into an Investment Agreement and Registration Rights Agreement (the “Kodiak Agreement”) with Kodiak Capital Group, LLC. Pursuant to the Kodiak Agreement, Kodiak committed to purchase up to $7,000,000 of the Company’s common stock over thirty-six months. However, effective June 30, 2010, the parties mutually agreed to terminate the Kodiak Agreement and their respective obligations therein.

The Company is seeking to refinance its existing $5.3M mortgage debt during the third quarter of 2011.

There can be no assurance that our cash flow will increase in the near future from anticipated new business activities, or that revenues generated from our existing operations will be sufficient to allow us to continue to pursue new customer programs or profitable ventures.

OFF-BALANCE SHEET ARRANGEMENTS

We do not have any off-balance sheet arrangements.

INFLATION

It is our opinion that inflation has not had a material effect on our operations

CRITICAL ACCOUNTING POLICIES

Revenue Recognition

The Company recognizes revenue in accordance with Accounting Standards Codification subtopic 605-10, Revenue Recognition (“ASC 605-10”) which requires that four basic criteria must be met before revenue can be recognized: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred; (3) the selling price is fixed and determinable; and (4) collectability is reasonably assured. Determination of criteria (3) and (4) are based on management's judgments regarding the fixed nature of the selling prices of the products delivered and the collectability of those amounts. Provisions for discounts and rebates to customers, estimated returns and allowances, and other adjustments are provided for in the same period the related sales are recorded.

Long-Lived Assets

The Company follows Accounting Standards Codification subtopic 360-10, Property, plant and equipment (“ASC 360-10”). The Statement requires that long-lived assets and certain identifiable intangibles held and used by the Company be reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Events relating to recoverability may include significant unfavorable changes in business conditions, recurring losses, or a forecasted inability to achieve break-even operating results over an extended period. The Company evaluates the recoverability of long-lived assets based upon forecasted undiscounted cash flows. Should impairment in value be indicated, the carrying value of intangible assets will be adjusted, based on estimates of future discounted cash flows resulting from the use and ultimate disposition of the asset. ASC 360-10 also requires assets to be disposed of be reported at the lower of the carrying amount or the fair value less costs to sell.

Share-Based Compensation

Share-based compensation issued to employees is measured at the grant date, based on the fair value of the award, and is recognized as an expense over the requisite service period. The Company measures the fair value of the share-based compensation issued to non-employees using the stock price observed in the arms-length private placement transaction nearest the measurement date (for stock transactions) or the fair value of the award (for non-stock transactions), which were considered to be more reliably determinable measures of fair value than the value of the services being rendered. The measurement date is the earlier of (1) the date at which commitment for performance by the counterparty to earn the equity instruments is reached, or (2) the date at which the counterparty’s performance is complete.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

N/A.

ITEM 4. CONTROLS AND PROCEDURES.

Evaluation of Disclosure Controls and Procedures. Under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer, we evaluated the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Rule 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934 (the “Exchange Act”)) as of the end of the period covered by this report. Based upon that evaluation, our Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures as of the end of the period covered by this report were effective such that the information required to be disclosed by us in reports filed under the Exchange Act is (i) recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms and (ii) accumulated and communicated to our management to allow timely decisions regarding disclosure. A controls system cannot provide absolute assurance, however, that the objectives of the controls system are met, and no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within a company have been detected.

Changes in Internal Control Over Financial Reporting. During the most recent quarter ended June 30, 2011, there has been no change in our internal control over financial reporting (as defined in Rule 13a-15(f) and 15d-15(f) under the Exchange Act) ) that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

ITEM 1. LEGAL PROCEEDINGS.

We are not a party to any pending legal proceeding, nor is our property the subject of a pending legal proceeding, that is not in the ordinary course of business or otherwise material to the financial condition of our business. None of our directors, officers or affiliates is involved in a proceeding adverse to our business or has a material interest adverse to our business.

N/A.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS.

None.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES.

None.

ITEM 4. (REMOVED AND RESERVED).

ITEM 5. OTHER INFORMATION.

None.

Exhibit Number | | Description of Exhibit |

| | | |

| 31.1 | | Section 302 Certification of Principal Executive Officer |

| 31.2 | | Section 302 Certification of Principal Financial Officer |

| 32.1 | | Section 906 Certification of Principal Executive Officer |

| 32.2 | | Section 906 Certification of Principal Financial Officer |

| 101.INS | | XBRL Instance Document * | | | | | | | | | |

| 101.SCH | | XBRL Taxonomy Extension Schema Document * | | | | | | | | | |

| 101.CAL | | XBRL Taxonomy Calculation Linkbase Document * | | | | | | | | | |

| 101.LAB | | XBRL Taxonomy Labels Linkbase Document * | | | | | | | | | |

| 101.PRE | | XBRL Taxonomy Presentation Linkbase Document * | | | | | | | | | |

| 101.DEF | | XBRL Definition Linkbase Document * | | | | | | | | | |

*Attached as Exhibit 101 to this report are the following financial statements from the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2011 formatted in XBRL (eXtensible Business Reporting Language): (i) the Condensed Consolidated Balance Sheets, (ii) the Condensed Consolidated Statements of Operations and Comprehensive Income (Loss), (iii) the Condensed Consolidated Statements of Cash Flows, and (iv) related notes to these financial statements tagged as blocks of text. The XBRL-related information in Exhibit 101 to this Quarterly Report on Form 10-Q shall not be deemed “filed” or a part of a registration statement or prospectus for purposes of Sections 11 or 12 of the Securities Act of 1933, as amended, and is not filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of those sections.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | MEDICAL BILLING ASSISTANCE, INC. | |

| | | | |

| Date: August 15, 2011 | By: | /s/ Christian Charles Romandetti | |

| | | Christian Charles Romandetti, | |

| | | President and Chief Executive Officer (Principal Executive Officer) | |

| | | | |

| | | | |

| Date: August 15, 2011 | By: | /s/ Donald A. Bittar | |

| | | Donald A. Bittar | |

| | | Chief Financial Officer | |

| | | (Principal Financial Officer and Principal Accounting Officer) | |

19