UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIESEXCHANGE ACT OF 1934

For the quarterly period ended: September 30, 2013

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIESEXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File Number:000-53012

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | | 90-0687379 |

| (State or other jurisdiction of incorporation) | | (IRS Employer Identification No.) |

709 S. Harbor City Boulevard, Suite 250, Melbourne, Florida 32901

(Address of principal executive offices)

(321) 725-0090

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months, and (2) has been subject to such filing requirements for the past 90 days. YesxNo ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files. Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ¨ | | Accelerated filer | ¨ |

| | | | | |

| Non-accelerated filer | ¨ | | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes¨ Nox

As of November 14, 2013, there were 14,701,450 shares outstanding of the registrant’s common stock.

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

TABLE OF CONTENTS

| PART I. | FINANCIAL INFORMATION | | |

| | | | | |

| | ITEM 1 | Financial Statements | | |

| | | | | |

| | | Condensed consolidated balance sheets as of September 30, 2013 (unaudited) and December 31, 2012 | | 3 |

| | | | | |

| | | Condensed consolidated statements of operations for the three and nine months ended September 30, 2013 and 2012 (unaudited) | | 4 |

| | | | | |

| | | Condensed consolidated statement of stockholders’ deficit for the nine months ended September 30, 2013 (unaudited) | | 5 |

| | | | | |

| | | Condensed consolidated statements of cash flows for the nine months ended September 30, 2013 and 2012 (unaudited) | | 6 |

| | | | | |

| | | Notes to condensed consolidated financial statements (unaudited) | | 7-23 |

| | | | | |

| | ITEM 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 24-33 |

| | | | | |

| | ITEM 3. | Quantitative and Qualitative Disclosures about Market Risk | | 33 |

| | | | | |

| | ITEM 4. | Controls and Procedures | | 33 |

| | | | | |

| PART II. | OTHER INFORMATION | | |

| | | | | |

| | ITEM 1. | Legal Proceedings | | 35 |

| | ITEM 1A. | Risk Factors | | 35 |

| | ITEM 2. | Unregistered Sales of Equity Securities and Use of Proceeds | | 35 |

| | ITEM 3. | Defaults Upon Senior Securities | | 35 |

| | ITEM 4. | Mine Safety Disclosures | | 35 |

| | ITEM 5. | Other Information | | 35 |

| | ITEM 6. | Exhibits | | 35 |

| | | | | |

| | SIGNATURES | | 36 |

PART I

ITEM 1. FINANCIAL STATEMENTS

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| | | September 30, | | | December 31, | |

| | | 2013 | | | 2012 | |

| | | (unaudited) | | | | |

| ASSETS | | | | | | | | |

| Current assets | | | | | | | | |

| Cash | | $ | 197,020 | | | $ | 67,045 | |

| Cash-restricted | | | 258,311 | | | | 221,148 | |

| Accounts receivable | | | 1,174,488 | | | | 527,867 | |

| Employee loans | | | 35,000 | | | | - | |

| Prepaid and other current assets | | | 118,226 | | | | 69,970 | |

| Capitalized financing costs, current portion | | | 57,348 | | | | 57,348 | |

| Total current assets | | | 1,840,393 | | | | 943,378 | |

| | | | | | | | | |

| Property, plant and equipment, net of accumulated depreciation of $1,834,133 and $1,465,939 | | | 8,708,199 | | | | 8,756,631 | |

| | | | | | | | | |

| Other assets | | | | | | | | |

| Capitalized financing costs, long term portion | | | 152,226 | | | | 152,911 | |

| Patient list, net of accumulated amortization of $30,000 | | | 270,000 | | | | 275,609 | |

| Patents | | | 286,500 | | | | - | |

| Investments | | | 450,000 | | | | - | |

| Deposits | | | 2,713 | | | | 2,719 | |

| Total other assets | | | 1,161,439 | | | | 431,239 | |

| | | | | | | | | |

| Total assets | | $ | 11,710,031 | | | $ | 10,131,248 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' DEFICIT | | | | | | | | |

| Current liabilities | | | | | | | | |

| Accounts payable and accrued expenses | | $ | 871,860 | | | $ | 576,209 | |

| Line of credit, short term | | | 635,000 | | | | - | |

| Notes payable, current portion | | | 738,349 | | | | 690,586 | |

| Note payable, related party | | | 300,000 | | | | 300,000 | |

| Convertible note payable, net of unamortized debt discount of $106,744 and $160,543, respectively | | | 58,098 | | | | 43,537 | |

| Unearned revenue | | | 40,760 | | | | 39,438 | |

| Total current liabilities | | | 2,644,067 | | | | 1,649,770 | |

| | | | | | | | | |

| Long term debt: | | | | | | | | |

| Deposits held | | | 60,150 | | | | 47,399 | |

| Revolving line of credit, related party | | | 141,448 | | | | 153,330 | |

| Line of credit, long term | | | 502,196 | | | | - | |

| Notes payable, long term portion | | | 9,119,238 | | | | 9,410,296 | |

| Derivative liability | | | 210,961 | | | | 171,987 | |

| Total long term debt | | | 10,033,993 | | | | 9,783,012 | |

| | | | | | | | | |

| Total liabilities | | | 12,678,060 | | | | 11,432,782 | |

| | | | | | | | | |

| Stockholders' deficit | | | | | | | | |

| Preferred stock, $0.01 par value; 1,000,000 shares authorized, Nil issued and outstanding | | | - | | | | - | |

| Common stock, $0.001 par value; 100,000,000 shares authorized, 14,695,127 and 12,706,795 shares issued and outstanding as of September 30, 2013 and December 31, 2012, respectively | | | 14,695 | | | | 12,707 | |

| Additional paid in capital | | | 8,235,380 | | | | 7,244,993 | |

| Common stock subscriptions | | | - | | | | 100,000 | |

| Accumulated deficit | | | (9,218,104 | ) | | | (8,659,234 | ) |

| Total stockholders' deficit | | | (968,029 | ) | | | (1,301,534 | ) |

| | | | | | | | | |

| Total liabilities and stockholders' deficit | | $ | 11,710,031 | | | $ | 10,131,248 | |

See the accompanying notes to these unaudited condensed consolidated financial statements

FIRST CHOICE HEALTHCARE SOLUTIONS, INC

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

| | | Three months ended September 30, | | | Nine months ended September 30, | |

| | | 2013 | | | 2012 | | | 2013 | | | 2012 | |

| Revenues: | | | | | | | | | | | | | | | | |

| Net patient service revenue | | $ | 1,395,610 | | | $ | 798,077 | | | $ | 3,739,435 | | | $ | 1,707,694 | |

| Rental revenue | | | 259,120 | | | | 270,547 | | | | 786,546 | | | | 883,179 | |

| Total Revenue | | | 1,654,730 | | | | 1,068,624 | | | | 4,525,981 | | | | 2,590,873 | |

| | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | |

| Salaries and benefits | | | 735,888 | | | | 470,334 | | | | 2,000,436 | | | | 1,029,692 | |

| Other Operating expenses | | | 353,034 | | | | 282,813 | | | | 965,923 | | | | 589,442 | |

| General and administrative | | | 298,566 | | | | 376,143 | | | | 898,910 | | | | 987,861 | |

| Depreciation and amortization | | | 124,378 | | | | 73,518 | | | | 373,803 | | | | 187,420 | |

| Total operating expenses | | | 1,511,866 | | | | 1,202,808 | | | | 4,239,072 | | | | 2,794,415 | |

| | | | | | | | | | | | | | | | | |

| Net income (loss) from operations | | | 142,864 | | | | (134,184 | ) | | | 278,443 | | | | (203,542 | ) |

| | | | | | | | | | | | | | | | | |

| Other income (expense): | | | | | | | | | | | | | | | | |

| Miscellaneous income | | | 750 | | | | 750 | | | | 2,313 | | | | 2,250 | |

| Gain (Loss) on change in fair value of derivative liability | | | (1,631 | ) | | | - | | | | 187,351 | | | | - | |

| Amortization financing costs | | | (22,802 | ) | | | (14,337 | ) | | | (51,477 | ) | | | (43,011 | ) |

| Interest expense, net | | | (302,590 | ) | | | (135,652 | ) | | | (983,966 | ) | | | (372,515 | ) |

| Total other income (expense) | | | (326,273 | ) | | | (149,239 | ) | | | (845,779 | ) | | | (413,276 | ) |

| | | | | | | | | | | | | | | | | |

| Net loss before provision for income taxes | | | (183,409 | ) | | | (283,423 | ) | | | (558,870 | ) | | | (616,818 | ) |

| | | | | | | | | | | | | | | | | |

| Income taxes (benefit) | | | - | | | | - | | | | - | | | | (23,103 | ) |

| | | | | | | | | | | | | | | | | |

| NET LOSS | | $ | (183,409 | ) | | $ | (283,423 | ) | | $ | (558,870 | ) | | $ | (593,715 | ) |

| | | | | | | | | | | | | | | | | |

| Net loss per common share, basic and diluted | | $ | (0.01 | ) | | $ | (0.02 | ) | | $ | (0.04 | ) | | $ | (0.05 | ) |

| | | | | | | | | | | | | | | | | |

| Weighted average number of common shares outstanding, basic and diluted | | | 13,416,949 | | | | 12,706,795 | | | | 13,005,773 | | | | 12,623,962 | |

See the accompanying notes to these unaudited condensed consolidated financial statements

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

STATEMENT OF STOCKHOLDERS' DEFICIT

Nine Months Ended September 30, 2013

(unaudited)

| | | | | | | | | | | | | | | Additional | | | Common | | | | | | | |

| | | Preferred stock | | | Common stock | | | Paid in | | | Stock | | | Accumulated | | | | |

| | | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Subscriptions | | | Deficit | | | Total | |

| Balance, December 31, 2012 | | | - | | | $ | - | | | | 12,706,795 | | | $ | 12,707 | | | $ | 7,244,993 | | | $ | 100,000 | | | $ | (8,659,234 | ) | | $ | (1,301,534 | ) |

| Common stock issued for services rendered | | | - | | | | - | | | | 285,000 | | | | 285 | | | | 155,590 | | | | - | | | | - | | | | 155,875 | |

| Common stock issued for subscription | | | - | | | | - | | | | 66,666 | | | | 66 | | | | 99,934 | | | | (100,000 | ) | | | - | | | | - | |

| Common stock issued to acquire 10% in MedTech Diagnostics, LLC | | | - | | | | - | | | | 1,000,000 | | | | 1,000 | | | | 449,000 | | | | - | | | | - | | | | 450,000 | |

| Common stock issued to acquire patent rights from CFO | | | - | | | | - | | | | 636,666 | | | | 637 | | | | 285,863 | | | | - | | | | - | | | | 286,500 | |

| Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (558,870 | ) | | | (558,870 | ) |

| Balance, September 30, 2013 | | | - | | | $ | - | | | | 14,695,127 | | | $ | 14,695 | | | $ | 8,235,380 | | | $ | - | | | $ | (9,218,104 | ) | | $ | (968,029 | ) |

See the accompanying notes to these unaudited condensed consolidated financial statements

FIRST CHOICE HEALTHCARE SOLUTIONS, INC

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

| | | Nine months ended September 30, | |

| | | 2013 | | | 2012 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | | |

| Net Loss | | $ | (558,870 | ) | | $ | (593,715 | ) |

| Adjustments to reconcile net loss to cash used in operating activities: | | | | | | | | |

| Depreciation | | | 373,803 | | | | 187,420 | |

| Amortization of financing costs | | | 51,477 | | | | 43,011 | |

| Amortization of debt discount in connection with convertible note | | | 280,125 | | | | - | |

| Stock-based compensation | | | 155,875 | | | | - | |

| Loss on change in fair value of debt derivative | | | (187,351 | ) | | | - | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Accounts receivable | | | (646,621 | ) | | | (166,447 | ) |

| Accounts receivable-other | | | - | | | | (205,000 | ) |

| Prepaid expenses and other | | | (83,256 | ) | | | (72,973 | ) |

| Restricted funds | | | (37,163 | ) | | | (126,070 | ) |

| Accounts payable and accrued expenses | | | 306,412 | | | | 231,497 | |

| Unearned income | | | 1,322 | | | | 3,774 | |

| Deferred income taxes | | | - | | | | (23,103 | ) |

| Net cash used in operating activities | | | (344,247 | ) | | | (721,606 | ) |

| | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | | |

| Cash received from acquisition | | | - | | | | 48,761 | |

| Cash payments for acquisition | | | - | | | | (143,366 | ) |

| Purchase of equipment | | | (319,762 | ) | | | (2,473,799 | ) |

| Net increase (decrease) in deposits | | | 12,757 | | | | (323 | ) |

| Net cash used in investing activities | | | (307,005 | ) | | | (2,568,727 | ) |

| | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | |

| Net (payments) proceeds from related party line of credit | | | (11,882 | ) | | | 190,000 | |

| Proceeds from convertible note payable | | | 257,000 | | | | - | |

| Proceeds from lines of credit | | | 1,086,404 | | | | - | |

| Proceeds from notes payable | | | 152,659 | | | | 2,871,058 | |

| Proceeds from common stock subscription | | | - | | | | 100,000 | |

| Net payments on notes payable | | | (702,954 | ) | | | (202,002 | ) |

| Net cash provided by financing activities | | | 781,227 | | | | 2,959,056 | |

| | | | | | | | | |

| Net increase (decrease) in cash and cash equivalents | | | 129,975 | | | | (331,277 | ) |

| Cash and cash equivalents, beginning of period | | | 67,045 | | | | 528,303 | |

| | | | | | | | | |

| Cash and cash equivalents, end of period | | $ | 197,020 | | | $ | 197,026 | |

| | | | | | | | | |

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: | | | | |

| Cash paid during the period for interest | | $ | 703,841 | | | $ | 348,302 | |

| Cash paid during the period for taxes | | $ | - | | | $ | - | |

| | | | | | | | | |

| Supplemental Disclosure on non-cash investing and financing activities: | | | | | | | | |

| Common stock issued in connection with acquisition of First Choice Medical Group, Inc. | | $ | - | | | $ | 702,849 | |

| Common stock issued in connection with acquisition of patent | | $ | 286,500 | | | $ | - | |

| Common stock issued to acquire 10% interest in MedTech Diagnostics, LLC | | $ | 450,000 | | | $ | - | |

See the accompanying notes to these unaudited condensed consolidated financial statements.

FIRST CHOICE HEALTHCARE SOLUTIONS, INC

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2013

NOTE 1 — SIGNIFICANT ACCOUNTING POLICIES

A summary of the significant accounting policies applied in the presentation of the accompanying unaudited condensed consolidated financial statements follows:

General

The (a) condensed consolidated balance sheet as of December 31, 2012, which has been derived from the audited financial statements of First Choice Healthcare Solutions, Inc. (“FCHS” and including, where appropriate, its consolidated subsidiaries, the “Company”), and (b) the unaudited condensed consolidated interim financial statements as of September 30, 2013 of the Company have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information and the instructions to Form 10-Q and Rule 8-03 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. Operating results for the nine months ended September 30, 2013 are not necessarily indicative of results that may be expected for the year ending December 31, 2013. These unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto for the year ended December 31, 2012 included in the Company’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on April 1, 2013.

Basis of Presentation

The Company caused a certificate of merger (the “Certificate of Merger”) of Medical Billing Assistance, Inc., a Colorado corporation incorporated on May 30, 2007 (“Medical Billing”), to be filed whereby Medical Billing was merged with and into the Company. The effective date for the Certificate of Merger was April 4, 2012. The effect of the merger was that Medical Billing reincorporated from Colorado to Delaware (the “Reincorporation”). The Company is deemed to be the successor issuer of Medical Billing under Rule 12g-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

As a result of the Reincorporation, the Company changed its name to First Choice Healthcare Solutions, Inc. and its shares underwent an effective four-for-one reverse split. Other than the foregoing, the Reincorporation did not result in any change in the business, management, fiscal year, accounting, and location of the principal executive offices, assets or liabilities of the Company.

On April 2, 2012, the Company completed its acquisition of First Choice Medical Group of Brevard, LLC (“First Choice – Brevard”), pursuant to the Membership Interest Purchase Closing Agreement (the “Purchase Agreement”), dated the same date. The Company has been managing the practice of First Choice – Brevard since November 1, 2011, pursuant to a Management Services Agreement (the “Management Agreement”).

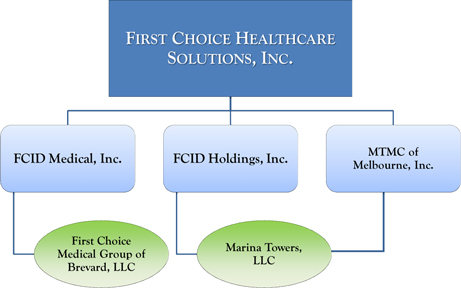

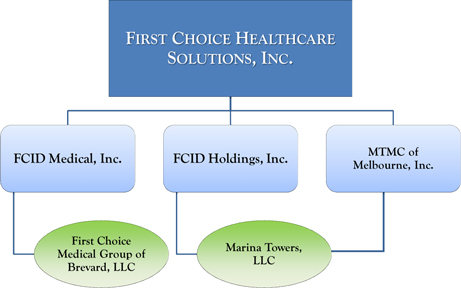

The unaudited condensed consolidated financial statements include the accounts of the Company and its direct and indirect wholly owned subsidiaries FCID Holdings, Inc., MTMC of Melbourne, Inc., Marina Towers, LLC, FCID Medical Inc. and First Choice - Brevard. All significant intercompany balances and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates.

FIRST CHOICE HEALTHCARE SOLUTIONS, INC

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2013

Patents

Intangible assets with finite lives are amortized over their estimated useful lives. Intangible assets with indefinite lives are not amortized, but are tested for impairment annually. The Company’s intangible assets with finite lives are patent costs, which are amortized over their economic or legal life, whichever is shorter. These patent costs were acquired on September 7, 2013 by the issuance of 636,666 shares of the Company’s common stock to a related party (See Note 11).The shares of common stock were valued at $286,500, which was estimated to be approximately the fair value of the patent acquired and did not materially differ from the fair value of the common stock.

Property and Equipment

Property and equipment are stated at cost. When retired or otherwise disposed, the related carrying value and accumulated depreciation are removed from the respective accounts and the net difference less any amount realized from disposition, is reflected in earnings. For financial statement purposes, property and equipment are recorded at cost and depreciated using the straight-line method over their estimated useful lives of 20 to 39 years.

Revenue Recognition

The Company recognizes revenue in accordance with Accounting Standards Codification subtopic 605-10, Revenue Recognition (“ASC 605-10”) which requires that four basic criteria be met before revenue can be recognized: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred; (3) the selling price is fixed or determinable; and (4) collectability is reasonably assured. Determination of criteria (3) and (4) are based on management's judgments regarding the fixed nature of the selling prices of the products delivered and the collectability of those amounts. Provisions for discounts and rebates to customers, estimated returns and allowances, and other adjustments are provided for in the same period the related sales are recorded.

ASC 605-10 incorporates Accounting Standards Codification subtopic 605-25, Multiple-Element Arraignments (“ASC 605-25”). ASC 605-25 addresses accounting for arrangements that may involve the delivery or performance of multiple products, services and/or rights to use assets. The effect of implementing ASC 605-25 on the Company's financial position and results of operations was not significant.

Segment Information

Accounting Standards Codification subtopic Segment Reporting 280-10 (“ASC 280-10”) establishes standards for reporting information regarding operating segments in annual financial statements and requires selected information for those segments to be presented in interim financial reports issued to stockholders. ASC 280-10 also establishes standards for related disclosures about products and services and geographic areas. Operating segments are identified as components of an enterprise about which separate discrete financial information is available for evaluation by the chief operating decision maker, or decision-making group, in making decisions how to allocate resources and assess performance. The information disclosed herein represents all of the material financial information related to the Company’s two principal operating segments (see Note 14 – Segment Information).

Long-Lived Assets

The Company follows Accounting Standards Codification subtopic 360-10, Property, Plant and Equipment (“ASC 360-10”). The Statement requires that long-lived assets and certain identifiable intangibles held and used by the Company be reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Events relating to recoverability may include significant unfavorable changes in business conditions, recurring losses, or a forecasted inability to achieve break-even operating results over an extended period. The Company evaluates the recoverability of long-lived assets based upon forecasted undiscounted cash flows. Should impairment in value be indicated, the carrying value of intangible assets will be adjusted, based on estimates of future discounted cash flows resulting from the use and ultimate disposition of the asset. ASC 360-10 also requires that assets to be disposed of be reported at the lower of the carrying amount or the fair value less costs to sell.

FIRST CHOICE HEALTHCARE SOLUTIONS, INC

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2013

Patient list

Patient list is comprised of acquired patients in connection with the acquisition of First Choice - Brevard and is amortized ratably over the estimated useful life of 15 years. Amortization for the three and nine months ended September 30, 2013 was $5,000 and $15,000, respectively, and for the three and nine months ended September 30, 2012 was $5,000 and $10,000, respectively. Accumulated amortization of patient list costs were $30,000 and $24,391 at September 30, 2013 and December 31, 2012, respectively.

Cash and Cash Equivalents

The Company considers cash and cash equivalents to consist of cash on hand and investments having an original maturity of 90 days or less that are readily convertible into cash. As of September 30, 2013, the Company had $197,020 in cash.

Capitalized Financing Costs

Capitalized financing costs represent costs incurred in connection with obtaining the debt financing. These costs are amortized ratably and charged to financing expenses over the term of the related debt. The amortization for the three and nine months ended September 30, 2013 was $22,802 and $51,477, respectively; and for the three and nine months ended September 30, 2012 was $14,337 and $43,011, respectively. Accumulated amortization of deferred financing costs was $127,940 and $76,464 at September 30, 2013 and December 31, 2012, respectively.

Concentrations of Credit Risk

The Company’s financial instruments that are exposed to a concentration of credit risk are cash and accounts receivable. Generally, the Company’s cash and cash equivalents in interest-bearing accounts may exceed FDIC insurance limits. The financial stability of these institutions is periodically reviewed by senior management.

Accounts Receivable

Accounts receivables are carried at their estimated collectible amounts net of doubtful accounts. Credit for accounts receivable is generally extended on a short-term basis; thus account receivables do not bear interest. Accounts receivable are periodically evaluated for collectability based on a rolling average of cash received as a percentage of gross billing.

Income Taxes

The Company follows Accounting Standards Codification subtopic 740-10, Income Taxes (“ASC 740-10”) for recording the provision for income taxes. Deferred tax assets and liabilities are computed based upon the difference between the financial statement and income tax basis of assets and liabilities using the enacted marginal tax rate applicable when the related asset or liability is expected to be realized or settled. Deferred income tax expenses or benefits are based on the changes in the asset or liability during each period. If available evidence suggests that it is more likely than not that some portion or all of the deferred tax assets will not be realized, a valuation allowance is required to reduce the deferred tax assets to the amount that is more likely than not to be realized. Future changes in such valuation allowance are included in the provision for deferred income taxes in the period of change. Deferred income taxes may arise from temporary differences resulting from income and expense items reported for financial accounting and tax purposes in different periods. Deferred taxes are classified as current or non-current, depending on the classification of assets and liabilities to which they relate. Deferred taxes arising from temporary differences that are not related to an asset or liability are classified as current or non-current depending on the periods in which the temporary differences are expected to reverse and are considered immaterial.

FIRST CHOICE HEALTHCARE SOLUTIONS, INC

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2013

Net Loss Per Share

The Company accounts for net loss per share in accordance with Accounting Standards Codification subtopic 260-10, Earnings Per Share (“ASC 260-10”), which requires presentation of basic and diluted earnings per share (“EPS”) on the face of the statement of operations for all entities with complex capital structures and requires a reconciliation of the numerator and denominator of the basic EPS computation to the numerator and denominator of the diluted EPS.

Basic net loss per share is computed by dividing net loss by the weighted average number of shares of common stock outstanding during each period. It excludes the dilutive effects of potentially issuable shares of common stock such as those related to our issued convertible debt, warrants and stock options (calculated using the treasury stock method). Fully diluted weighted average shares outstanding were 15,628,755 and 12,806,795 for the three months ended September 30, 2013 and 2012, respectively and 15,217,578 and 14,498,962 for the nine months ended September 30, 2013 and 2012, respectively.

Stock-Based Compensation

Share-based compensation issued to employees is measured at the grant date, based on the fair value of the award, and is recognized as an expense over the requisite service period. The Company measures the fair value of the share-based compensation issued to non-employees using the stock price observed in the arms-length private placement transaction nearest the measurement date (for stock transactions) or the fair value of the award (for non-stock transactions), which were considered to be more reliably determinable measures of fair value than the value of the services being rendered. The measurement date is the earlier of (1) the date at which commitment for performance by the counterparty to earn the equity instruments is reached, or (2) the date at which the counterparty’s performance is complete. As of September 30, 2013, the Company had no non-employee options outstanding to purchase shares of common stock.

Derivative Financial Instruments

Accounting Standards Codification subtopic 815-40, Derivatives and Hedging, Contracts in Entity’s own Equity (“ASC 815-40”) became effective for the Company on October 1, 2009. Certain of the Company’s convertible debt has conversion provisions based on a discount to the market price of the Company’s common stock.

Fair Value of Financial Instruments

Fair value estimates discussed herein are based upon certain market assumptions and pertinent information available to management as of September 30, 2013 and December 31, 2012. The respective carrying value of certain on-balance-sheet financial instruments approximated their fair values. These financial instruments include cash and accounts payable. Fair values were assumed to approximate carrying values for cash and payables because they are short term in nature and their carrying amounts approximate fair values or they are payable on demand.

Recent Accounting Pronouncements

There were various updates recently issued, most of which represented technical corrections to the accounting literature or application to specific industries and are not expected to a have a material impact on the Company’s condensed consolidated financial position, results of operations or cash flows.

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2013

NOTE 2 — LIQUIDITY

The Company incurred various non-recurring expenses in 2012 in connection with operating startup costs relating to the acquisition of a medical practice. Management believes the positive year-end earnings before interest, taxes, depreciation and amortization and the continuing trend of positive growth before interest, taxes, depreciation and amortization through September 30, 2013 will support improved liquidity. Moreover, subsequent to the end of the third quarter 2013 and as further detailed in Note 15 – Subsequent Events, the Company issued and sold to Hillair Capital Investments, L.P. a $2,320,000 8% Original Issue Discount Convertible Debenture, raising net proceeds of $2,000,000 less customary legal and due diligence fees. The Company then paid off or converted to equity a total of $1,238,480 in debt (see Note 15 – Subsequent Events); and modified its $1.5 million line of credit with CT Capital, providing for the reduction of the annual interest rate from 12% per annum to 6% per annum in exchange for the issuance of 100,000 restricted shares of the Company’s common stock.

The Marina Towers building is fully occupied. The Company believes that ongoing operations of Marina Towers, LLC, the current strong, positive cash balance along with continued execution of its business development plan will allow the Company to further improve its working capital; and that it will have sufficient capital resources to meet projected cash flow requirements through the date that is one year plus a day from the filing date of this report. However, there can be no assurance that the Company will be successful in fully executing its business development plan.

NOTE 3 — CASH - RESTRICTED

Cash-restricted is comprised of funds deposited to and held by the mortgage lender for payments of property taxes, insurance, replacements and major repairs of the Company's commercial building. The majority of the restricted funds are reserved for tenant improvements.

NOTE 4 — PROPERTY, PLANT, AND EQUIPMENT

Property, plant and equipment at September 30, 2013 and December 31, 2012 are as follows:

| | | September 30,

2013 | | | December 31,

2012 | |

| Land | | $ | 1,000,000 | | | $ | 1,000,000 | |

| Building | | | 3,055,168 | | | | 3,055,168 | |

| Building improvements | | | 1,758,818 | | | | 1,691,625 | |

| Medical office improvement | | | 1,410,028 | | | | 1,410,028 | |

| Automobiles | | | 29,849 | | | | 29,849 | |

| Computer equipment | | | 188,451 | | | | 186,549 | |

| Medical equipment | | | 2,204,641 | | | | 2,039,393 | |

| MRI center | | | 784,999 | | | | 705,118 | |

| Office equipment | | | 110,378 | | | | 104,840 | |

| | | | 10,542,332 | | | | 10,222,570 | |

| Less: accumulated depreciation | | | (1,834,133 | ) | | | (1,465,939 | ) |

| | | $ | 8,708,199 | | | $ | 8,756,631 | |

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2013

NOTE 4 — PROPERTY, PLANT, AND EQUIPMENT— Continued

During the three and nine months ended September 30, 2013, depreciation expense charged to operations was $130,885 and $373,803, respectively; and during the three and nine months ended September 30, 2012, depreciation expense charged to operations was $73,538 and $187,420, respectively.

NOTE 5 — INVESTMENTS

On September 7, 2013, the Company issued an aggregate of 1,000,000 shares of its common stock to acquire a 10% membership interest in MedTech Diagnostics, LLC, a Florida distributor of multi-test medical diagnostic equipment. The investment is recorded at cost, determined at the date of the acquisition, based on the fair value of the underlying issued common shares.

NOTE 6 — LINES OF CREDIT

Line of Credit, CT Capital

On June 18, 2013, the Company’s subsidiary, First Choice Medical Group of Brevard, LLC, entered into a Loan and Security Agreement (the “Loan Agreement”) with CT Capital. Ltd., d/b/a CT Capital, LP, a Florida limited liability partnership (the “Lender”). Under the Loan Agreement, the Lender committed to make an accounts receivable line of credit in the maximum aggregate amount of $1,500,000 to First Choice Medical Group of Brevard, LLC with an interest rate of 12% per annum (the “Loan”). The maturity date of the Loan is December 31, 2016 (the “Maturity Date”). Interest shall be due and payable monthly. Upon default, the interest may be adjusted to the highest rate permissible by law. The Loan is secured by the accounts receivable, and assets of the Company’s subsidiary, First Choice Medical Group of Brevard, LLC. The assets constitute the collateral for the repayment of the Loan. The Loan Agreement also includes covenants, representations, warranties, indemnities and events of default that are customary for facilities of this type. The advance rate is defined as: 80% of all receivables to be 120 days or less at the net collection rate of approximately 27% of total billings, excluding patient billings and collections. Additionally, allowable accounts receivable will also include 50% of all accounts receivable protected by Legal Letters of Protection. At any time, the Lender may convert all or any portion of the outstanding principal amount or interest on the Loan into the common stock of the Company at a price equal to $0.75 per share. The Company did not record an embedded beneficial conversion feature in the note since the fair value of the common stock did not exceed the conversion rate at the date of commitment.

As detailed in Note 15 – Subsequent Events, on November 8, 2013, in consideration for a fee of 100,000 shares of the Company’s common stock, restricted pursuant to Rule 144, CT Capital agreed to modify the line of credit to the Company’s subsidiary, First Choice Medical Group of Brevard, LLC. Under the loan modification agreement, the annual rate of interest was reduced from 12% per annum to 6% per annum and will remain at 6% until November 1, 2015. All other terms under the June 18, 2013 Loan and Security Agreement will remain the same.

The obligations of the Company under the Loan Agreement is guaranteed by certain affiliates of the Company, including a personal guarantee issued by the Company’s Chief Executive Officer.

Line of Credit, MTI Capital

On May 1, 2013, the Company entered into a loan commitment whereby MTI Capital LLC provided a line of credit up to $2,000,000 in the form of a convertible loan with interest at 12% per annum, payable monthly with principal due two years from the effective date of the loan. On August 28, 2013, the Company amended the loan agreement to change the conversion rate from $0.75 per share to $0.45 per share. At September 30, 2013, there was an outstanding balance of $502,196; however, as detailed in Note 15 – Subsequent Events, on November 8, 2013, MTI converted the then outstanding balance of $624,000 related party principal and interest amount on the loan, into shares of the Company’s common stock at a price equal to $0.45 per share for a total of 1,386,667 shares issued.

In the third quarter 2013, the Company did not record an embedded beneficial conversion feature in the note since the fair value of the common stock did not exceed the conversion rate at the date of commitment or amendment.

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2013

NOTE 7 — LINE OF CREDIT, RELATED PARTY

On February 1, 2012, the Company opened a $500,000 unsecured, revolving line of credit loan with CCR of Melbourne, Inc., an entity owned and controlled by the Company's Chief Executive Officer. The revolving line of credit loan matures on October 1, 2015 with interest at a per annum rate of 8.5% beginning March 1, 2012. Advances on the line of credit are at the sole discretion of CCR of Melbourne, Inc. As of September 30, 2013, $141,448 was outstanding. The Company accrued $3,883 and $7,089 as related party interest for the three and nine months ended September 30, 2013, respectively. The Company paid $1,391 and $3,331 as related party interest for the three and nine months ended September 30, 2012, respectively.

As detailed in Note 15 – Subsequent Events, on November 8, 2013, CCR converted the then outstanding balance of $142,483.52, representing all of the outstanding related party principal and interest amount on the loan, into shares of the Company’s common stock at a price equal to $0.45 per share for a total of 316,631 shares issued.

NOTE 8 — NOTE PAYABLE, RELATED PARTY

The Company entered into an unsecured loan agreement with HS Real Company, LLC (“HSR”) on May 17, 2012 for $100,000 at an interest rate of 12% per annum (the "HSR Note"). On August 5, 2012, HSR increased the principal amount to $250,000, and subsequently HSR advanced an additional $50,000 to the Company, bringing the aggregate principal amount of the HSR Note to $300,000, all of which was due and payable to HSR on December 31, 2012. The Company paid $9,290 and $27,642 as interest on the HSR note for the three and nine months ended September 30, 2013, respectively. The Company paid $5,912 and $7,782 as related party interest for the three and nine months ended September 30, 2012, respectively.

As detailed in Note 15 – Subsequent Events, on November 8, 2013, the Company paid off the HSR Note in full, remitting HSR $300,000 for the outstanding principal and interest balance due on the HSR Note.

NOTE 9 — CONVERTIBLE NOTES PAYABLE

Convertible notes payable at September 30, 2013 and December 31, 2012 are as follows:

| | | September 30,

2013 | | | December 31,

2012 | |

| Note payable, 8% per annum due September 18, 2013, net of unamortized debt discount of $160,543, respectively, including accrued interest | | $ | - | | | $ | 43,537 | |

| Note payable, 8% per annum due May 16, 2014, net of unamortized debt discount of $106,744, including accrued interest | | | 58,098 | | | | - | |

| | | | 58,098 | | | | 43,537 | |

| Less: current portion | | | (58,098 | ) | | | (43,537 | ) |

| | | $ | - | | | $ | - | |

February 19, 2013 Note Payable

On February 19, 2013, the Company entered into a Securities Purchase Agreement with an accredited investor (the “Lender”), in reliance upon the exemption from registration under Section 4(2) of the Securities Act of 1933, as amended (the “Securities Act”), for the sale of an 8% convertible note in the original principal amount of $103,500 (the “Note”). The total net proceeds the Company received from this offering were $100,000.

During the nine months ended September 30, 2013, the Company paid in full the above described Note payable.

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2013

NOTE 9 — CONVERTIBLE NOTES PAYABLE –Continued

The Company identified the embedded derivatives related to the above described Note, which included certain conversion features and reset provisions. The accounting treatment of derivative financial instruments requires that the Company record fair value of the derivatives as of the inception date of the Note and to fair value as of each subsequent reporting date. At the inception of the Note, the Company determined the aggregate fair value of $97,577 of embedded derivatives. The fair value of the embedded derivatives was determined using the Binomial Lattice Option Pricing Model based on the following assumptions: (1) dividend yield of 0%; (2) expected volatility of 98.67%, (3) weighted average risk-free interest rate of 0.17 % (4) expected life of 0.75 years, and (5) estimated fair value of the Company’s common stock of $1.94 per share. The determined fair value of the debt derivative of $97,577 was charged as a debt discount to the Note.

The charge of the amortization of debt discount for the three and nine months ended September 30, 2013 was $51,095 and $97,577, respectively. During the nine months ended September 30, 2013, the Company recorded a net gain on change in fair value of derivative liability relating to the above described note of $97,577.

August 14, 2013 Note Payable

On August 14, 2013, the Company entered into a Securities Purchase Agreement with an accredited investor (the “Lender”), in reliance upon the exemption from registration under Section 4(2) of the Securities Act of 1933, as amended (the “Securities Act”), for the sale of an 8% convertible note in the original principal amount of $153,500 (the “Note”). The total net proceeds the Company received from this offering were $151,000.

As detailed in Note 15 – Subsequent Events, on November 8, 2013, the Company retired the Note due the Lender originally due on November 21, 2013. The Company paid the Lender $188,850 in principal and interest, and accordingly recorded a gain from change in fair value of debt derivative of $171,987.

The Company identified the embedded derivatives related to the above described Note, which included certain conversion features and reset provisions. The accounting treatment of derivative financial instruments requires that the Company record fair value of the derivatives as of the inception date of the Note and to fair value as of each subsequent reporting date. At the inception of the Note, the Company determined the aggregate fair value of $128,748 of embedded derivatives. The fair value of the embedded derivatives was determined using the Binomial Lattice Option Pricing Model based on the following assumptions: (1) dividend yield of 0%; (2) expected volatility of 119.96%, (3) weighted average risk-free interest rate of 0.12 % (4) expected life of 0.75 years, and (5) estimated fair value of the Company’s common stock of $0.60 per share. The determined fair value of the debt derivative of $128,748 was charged as a debt discount to the Note.

At September 30, 2013, the Company marked to market the fair value of the debt derivatives contained in the Company’s convertible note and determined the aggregate fair value to be $210,961. The Company recorded a loss from change in fair value of debt derivatives of $82,213 for the nine months ended September 30, 2013 relating to the above described note. The fair value of the embedded derivatives was determined using Binomial Lattice Option Pricing Model based on the following assumptions: (1) dividend yield of 0%, (2) expected volatility of 134.94%, (3) weighted average risk-free interest rate of 0.04%, (4) expected life of 0.62 years, and (5) estimated fair value of the Company’s common stock of $1.34 per share.

The charge of the amortization of debt discount and costs for the three and nine months ended September 30, 2013 was $22,004 and $280,125, respectively.

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2013

NOTE 10 — NOTES PAYABLE

Notes payable as of September 30, 2013 and December 31, 2012 are comprised of the following:

| | | September 30,

2013 | | | December 31,

2012 | |

| Mortgage payable | | $ | 7,377,028 | | | $ | 7,444,580 | |

| Note payable, GE Capital (construction), MRI | | | 346,226 | | | | 450,604 | |

| Note payable, GE Capital (construction), 2 | | | 114,378 | | | | 153,340 | |

| Note Payable, GE Capital (MRI) | | | 1,647,155 | | | | 1,806,932 | |

| Note Payable, GE Capital (X-ray) | | | 193,904 | | | | 213,126 | |

| Note Payable, GE Arm | | | 119,999 | | | | - | |

| Note payable, Auto | | | 23,560 | | | | 27,300 | |

| Capital lease, Equipment | | | 35,337 | | | | - | |

| Note payable, Dr. Richard Newman | | | - | | | | 5,000 | |

| | | | 9,857,587 | | | | 10,100,882 | |

| Less: current portion | | | (738,349 | ) | | | (690,586 | ) |

| | | $ | 9,119,238 | | | $ | 9,410,296 | |

Mortgage Payable

On August 12, 2011, the Company refinanced its existing mortgage note payable as described below providing additional working capital funds. The aggregate amount of the note of $7,550,000 bears 6.10% interest per annum with monthly payments of $45,752.61 beginning in October 2011 based on a 30 year amortization schedule with all remaining principal and interest due in full on September 16, 2016. The note is secured by land and the building along with first priority assignment of leases and rents. Tenant rents are mailed to lockbox operated by the mortgage service company. In addition, the Company's Chief Executive Officer provided a limited personal guaranty.

In connection with the refinancing of the mortgage note payable, the Company incurred financing costs of $286,723. The capitalized financing costs are amortized ratably over the term of the mortgage note payable.

Note Payable – Equipment Financing

On May 21, 2012, the Company completed a financing with GE Healthcare Financial Services (“GE Capital”) for approximately $2.4 million.

As of September 30, 2012, the Company had drawn down a total of $450,000 against the first construction loan. This construction loan is payable in 35 monthly payments (first three payments are $nil) including interest at 7.38%, beginning the earlier of a) December 2012 or b) total advances have been made in the amount of $450,000.

On September 24, 2012, the Company drew down a total of $150,000 against the second construction loan. This construction loan is payable in 35 monthly payments (first three payments are $nil) including interest at 7.38%, beginning the earlier of a) December 2012 or b) total advances have been made in the amount of $150,000.

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2013

NOTE 10 — NOTES PAYABLE —Continued

The Company entered into an aggregate of $2,288,679 equipment finance leases subject to delivery and acceptance. All notes and finance leases have been personally guaranteed by the Company's Chief Executive Officer.

On August 22, 2012, the Company accepted the delivery of x-ray equipment under the equipment finance leases discussed above. As such, the component piece accepted of $212,389 is due over 60 months at $-0- the first three months; $4,300 for the remaining 57 months including interest at 7.9375% per annum. On March 8, 2013, the Company amended the finance lease to interest only payments of $1,384 for three months; $4,575 for the remaining 56 monthly payments.

On September 27, 2012, the Company accepted the delivery of MRI equipment under the equipment finance leases discussed above. As such, the component piece accepted of $1,771,390 is due over 60 months at $-0- the first three months; $38,152 for the remaining 57 months including interest at 7.9375% per annum. On March 8, 2013, the Company amended the finance lease to interest only payments of $11,779 for three months; $38,152 for the remaining 56 monthly payments.

On February 25, 2013, the Company accepted the delivery of C-arm equipment under the equipment finance leases discussed above. As such, the component piece accepted of $117,322 is due over 63 months at $-0- the first three months; $2,388 for the remaining 60 months including interest at 7.39% per annum.

Note Payable – Auto

On May 21, 2012, the Company issued a note payable, in the amount of $29,850, due in monthly installments of $593 including interest of 6.99%, due to mature in June 2017, and secured by related equipment.

Capital Lease – Equipment

On June 11, 2013, the Company entered into a lease agreement to acquire equipment with 48 monthly payments of $956.45 payable through June 1, 2017 with an effective interest rate of 14.002% per annum. The Company may elect to acquire the leased equipment at a nominal amount at the end of the lease.

Note Payable – Newman

In January 2013, the following note was paid in full.

In connection with the acquisition of First Choice – Brevard as described in Note 1 above, the Company assumed a $45,000 non-interest bearing, unsecured note payable to Dr. Richard Newman at $5,000 per month, maturing on January 1, 2013.

Aggregate maturities of long-term debt as of September 30, 2013 are as follows:

| | | Amount | |

| Three months ended December 31, 2013 | | $ | 413,780 | |

| Year ended December 31, 2014 | | | 740,543 | |

| Year ended December 31, 2015 | | | 719,433 | |

| Year ended December 31, 2016 and after | | | 7,983,831 | |

| Total | | $ | 9,857,587 | |

FIRST CHOICE HEALTHCARE SOLUTIONS, INC

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2013

NOTE 11 — RELATED PARTY TRANSACTIONS

As more fully described in Note 7 – Line of Credit, Related Party above, CCR of Melbourne, Inc., an entity owned and controlled by the Company’s Chief Executive Officer, provided a $500,000 unsecured, revolving line of credit to the Company. As of September 30, 2013, $141,448 was outstanding. The Company accrued $3,883 and $7,089 as related party interest for the three and nine months ended September 30, 2013, respectively. As further detailed in Note 15 – Subsequent Events, on November 8, 2013, CCR converted the outstanding balance of $142,483.52, representing all of the outstanding related party principal and interest amount on the loan, into shares of the Company’s common stock at a price equal to $0.45 per share for a total of 316,631 shares issued.

As more fully described in Note 8 – Note Payable, Related Party above, the Company entered into an unsecured loan agreement with HS Real Company, LLC (“HSR”) on May 17, 2012 for $100,000 at an interest rate of 12% per annum (the "HSR Note"). On August 5, 2012, HSR increased the principal amount to $250,000, and subsequently HSR advanced an additional $50,000 to the Company, bringing the aggregate principal amount of the HSR Note to $300,000, all of which was due and payable to HSR on December 31, 2012. The Company paid $9,290 and $27,642 as interest on the HSR note for the three and nine months ended September 30, 2013, respectively. Mr. Colin Halpern is both an Affiliate of HSR and a member of the Board of Directors of First Choice Healthcare Solutions, Inc. As further detailed in Note 15 – Subsequent Events, on November 8, 2013, the Company paid off the HSR Note, remitting HSR $300,000 for the outstanding principal and interest balance due on the HSR Note.

On September 7, 2013, the Company issued 636,666 shares of its common stock to Donald Bittar, the Company’s Chief Financial Officer to acquire a patent for a medical device he invented. The patent was valued at $286,500, which was estimated to be approximate fair value of the patent acquired and did not materially differ from the fair value of the common stock.

NOTE 12 — CAPITAL STOCK

During the nine months ended September 2013, the Company issued the following shares of common stock, restricted pursuant to Rule 144, to certain officers, directors, employees and professional service providers for services rendered:

| Shares Issued To | | Number of Shares Issued | |

| Board of Directors | | | 105,000 | |

| Officers and Employees1 | | | 756,666 | |

| Professional Service Providers | | | 60,000 | |

| Total | | | 921,666 | |

1 As detailed in Note 11 - Related Party Transactions above, shares issued to Officers and Employees includes 636,666 shares of common stock issued to Donald Bittar, the Company's CFO, to acquire a patent.

The shares were issued at fair market value on the date of service and their market value on date of issuance.

FIRST CHOICE HEALTHCARE SOLUTIONS, INC

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2013

NOTE 13 — STOCK OPTIONS AND WARRANTS

Warrants

The following table summarizes the warrants outstanding and the related exercise prices for the underlying shares of the Company's common stock as of September 30, 2013:

| | | | Warrants Outstanding | | | | | | Warrants Exercisable | |

| | | | | | | | | Weighted | | | | | | Weighted | |

| Price | | | Outstanding | | | Expiration Date | | Price | | | Exercisable | | | Price | |

| $ | 3.60 | | | | 1,875,000 | | | Dec 31, 2016 | | $ | 3.60 | | | | 1,875,000 | | | $ | 3.60 | |

Transactions involving stock warrants issued to non-employees are summarized as follows:

| | | Number of

Shares | | | Weighted

Average

Price

Per Share | |

| Outstanding at December 31, 2011: | | | 1,875,000 | | | $ | 3.60 | |

| Granted | | | - | | | | - | |

| Exercised | | | - | | | | - | |

| Expired | | | - | | | | - | |

| Outstanding at December 31, 2012: | | | 1,875,000 | | | | 3.60 | |

| Granted | | | - | | | | - | |

| Exercised | | | - | | | | - | |

| Expired | | | - | | | | - | |

| Outstanding at September 30, 2013: | | | 1,875,000 | | | $ | 3.60 | |

As of September 30, 2013, the Company had no outstanding options.

NOTE 14 — SEGMENT REPORTING

The Company reports segment information based on the “management” approach. The management approach designates the internal reporting used by management for making decisions and assessing performance as the source of the Company’s reportable segments. The Company has two reportable segments: Marina Towers, LLC and FCID Medical, Inc.

The Marina Towers, LLC segment derives revenue from the operating leases of its owned building, whereas FCID Medical segment derives revenue for medical services provided to patients.

Information concerning the operations of the Company's reportable segments is as follows:

FIRST CHOICE HEALTHCARE SOLUTIONS, INC

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2013

NOTE 14 — SEGMENT REPORTING —Continued

Summary Statement of Operations for the three months ended September 30, 2013:

| | | Marina | | | FCID | | | | | | Intercompany | | | | |

| | | Towers | | | Medical | | | Corporate | | | Eliminations | | | Total | |

| Revenue: | | | | | | | | | | | | | | | | | | | | |

| Net Patient Service Revenue | | $ | - | | | $ | 1,395,610 | | | $ | - | | | $ | - | | | $ | 1,395,610 | |

| Rental revenue | | | 365,839 | | | | - | | | | - | | | | (106,719 | ) | | | 259,120 | |

| Total Revenue | | | 365,839 | | | | 1,395,610 | | | | - | | | | (106,719 | ) | | | 1,654,730 | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | |

| Salaries & benefits | | | 3,000 | | | | 574,487 | | | | 158,401 | | | | - | | | | 735,888 | |

| Other operating expenses | | | 95,689 | | | | 357,696 | | | | - | | | | (100,351 | ) | | | 353,034 | |

| General and administrative | | | 21,791 | | | | 140,039 | | | | 136,736 | | | | - | | | | 298,566 | |

| Depreciation and amortization | | | 41,571 | | | | 91,272 | | | | - | | | | - | | | | 132,843 | |

| Total operating expenses | | | 162,051 | | | | 1,163,494 | | | | 295,137 | | | | (100,351 | ) | | | 1,520,331 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net income (loss) from operations: | | | 203,788 | | | | 232,116 | | | | (295,137 | ) | | | (6,368 | ) | | | 134,399 | |

| | | | | | | | | | | | | | | | | | | | | |

| Interest expense | | | (115,241 | ) | | | (78,039 | ) | | | (109,310 | ) | | | - | | | | (302,590 | ) |

| Amortization of financing costs | | | (14,337 | ) | | | - | | | | - | | | | - | | | | (14,337 | ) |

| Gain on change in derivative liability | | | - | | | | - | | | | (1,631 | ) | | | - | | | | (1,631 | ) |

| Other income (expense) | | | 750 | | | | - | | | | - | | | | - | | | | 750 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Income (loss): | | | 74,960 | | | | 154,077 | | | | (406,078 | ) | | | (6,368 | ) | | | (183,409 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Income taxes | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | |

| Net income (loss) | | $ | 74,960 | | | $ | 154,077 | | | $ | (406,078 | ) | | $ | (6,368 | ) | | $ | (183,409 | ) |

Summary Statement of Operations for the three months ended September 30, 2012:

| | | Marina | | | FCID | | | | | | Intercompany | | | | |

| | | Towers | | | Medical | | | Corporate | | | Eliminations | | | Total | |

| Revenue: | | | | | | | | | | | | | | | | | | | | |

| Net Patient Service Revenue | | $ | - | | | $ | 798,077 | | | $ | - | | | $ | - | | | $ | 798,077 | |

| Rental Revenue | | | 364,081 | | | | - | | | | - | | | | (93,534 | ) | | | 270,547 | |

| Total Revenue | | | 364,081 | | | | 798,077 | | | | - | | | | (93,534 | ) | | | 1,068,624 | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | |

| Salaries and benefits | | | 3,000 | | | | 406,055 | | | | 61,279 | | | | | | | | 470,334 | |

| Other operating expenses | | | 111,449 | | | | 319,039 | | | | | | | | (147,675 | ) | | | 282,813 | |

| General and administrative | | | 10,019 | | | | 173,525 | | | | 138,458 | | | | 54,141 | | | | 376,143 | |

| Depreciation and amortization | | | 40,365 | | | | 33,153 | | | | - | | | | - | | | | 73,518 | |

| Total operating expenses | | | 164,833 | | | | 931,772 | | | | 199,737 | | | | (93,534 | ) | | | 1,202,808 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net income (loss) from operations: | | | 199,248 | | | | (133,695 | ) | | | (199,737 | ) | | | - | | | | (134,184 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Interest expense | | | (116,576 | ) | | | (16,989 | ) | | | (2,087 | ) | | | - | | | | (135,652 | ) |

| Amortization of finance costs | | | (14,337 | ) | | | - | | | | - | | | | - | | | | (14,337 | ) |

| Other income (expense) | | | 750 | | | | - | | | | - | | | | - | | | | 750 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Income (loss): | | | 69,085 | | | | (150,684 | ) | | | (201,824 | ) | | | - | | | | (283,423 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Income taxes | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | |

| Net income (loss) | | $ | 69,085 | | | $ | (150,684 | ) | | $ | (201,824 | ) | | $ | - | | | $ | (283,423 | ) |

FIRST CHOICE HEALTHCARE SOLUTIONS, INC

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2013

NOTE 14 — SEGMENT REPORTING —Continued

Summary Statement of Operations for the nine months ended September 30, 2013:

| | | Marina | | | FCID | | | | | | Intercompany | | | | |

| | | Towers | | | Medical | | | Corporate | | | Eliminations | | | Total | |

| Revenue: | | | | | | | | | | | | | | | | | | | | |

| Net Patient Service Revenue | | $ | - | | | $ | 3,739,435 | | | $ | - | | | $ | - | | | $ | 3,739,435 | |

| Rental revenue | | | 1,104,405 | | | | - | | | | - | | | | (317,859 | ) | | | 786,546 | |

| Total Revenue | | | 1,104,405 | | | | 3,739,435 | | | | - | | | | (317,859 | ) | | | 4,525,981 | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | |

| Salaries & benefits | | | 9,000 | | | | 1,583,238 | | | | 408,198 | | | | - | | | | 2,000,436 | |

| Other operating expenses | | | 289,765 | | | | 994,017 | | | | - | | | | (317,859 | ) | | | 965,923 | |

| General and administrative | | | 61,132 | | | | 447,024 | | | | 390,755 | | | | - | | | | 898,911 | |

| Depreciation and amortization | | | 123,313 | | | | 258,955 | | | | - | | | | - | | | | 382,268 | |

| Total operating expenses | | | 483,210 | | | | 3,283,234 | | | | 798,953 | | | | (317,859 | ) | | | 4,247,538 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net income (loss) from operations: | | | 621,195 | | | | 456,201 | | | | (798,953 | ) | | | - | | | | 278,443 | |

| | | | | | | | | | | | | | | | | | | | | |

| Interest expense | | | (347,406 | ) | | | (208,773 | ) | | | (427,787 | ) | | | - | | | | (983,966 | ) |

| Amortization of financing costs | | | (43,011 | ) | | | - | | | | - | | | | - | | | | (43,011 | ) |

| Gain on change in derivative liability | | | - | | | | - | | | | 187,351 | | | | - | | | | 187,351 | |

| Other income (expense) | | | 2,313 | | | | - | | | | - | | | | - | | | | 2,313 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Income (loss): | | | 233,091 | | | | 247,428 | | | | (1,039,389 | ) | | | - | | | | (558,870 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Income taxes | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | |

| Net income (loss) | | $ | 233,091 | | | $ | 247,428 | | | $ | (1,039,389 | ) | | $ | - | | | $ | (558,870 | ) |

Summary Statement of Operations for the nine months ended September 30, 2012:

| | | Marina | | | FCID | | | | | | Intercompany | | | | |

| | | Towers | | | Medical | | | Corporate | | | Eliminations | | | Total | |

| Revenue: | | | | | | | | | | | | | | | | | | | | |

| Net Patient Service Revenue | | $ | - | | | $ | 1,707,694 | | | $ | - | | | $ | - | | | $ | 1,707,694 | |

| Rental Revenue | | | 1,094,466 | | | | - | | | | - | | | | (211,287 | ) | | | 883,179 | |

| Total Revenue | | | 1,094,466 | | | | 1,707,694 | | | | - | | | | (211,287 | ) | | | 2,590,873 | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | |

| Salaries and benefits | | | 9,000 | | | | 795,375 | | | | 225,317 | | | | | | | | 1,029,692 | |

| Other operating expenses | | | 289,937 | | | | 510,792 | | | | | | | | (211,287 | ) | | | 589,442 | |

| General and administrative | | | 52,983 | | | | 408,162 | | | | 526,716 | | | | | | | | 987,861 | |

| Depreciation and amortization | | | 121,095 | | | | 66,325 | | | | - | | | | - | | | | 187,420 | |

| Total operating expenses | | | 473,015 | | | | 1,780,654 | | | | 752,033 | | | | (211,287 | ) | | | 2,794,415 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net income (loss) from operations: | | | 621,451 | | | | (72,960 | ) | | | (752,033 | ) | | | - | | | | (203,542 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Interest expense | | | (348,227 | ) | | | (18,858 | ) | | | (5,430 | ) | | | - | | | | (372,515 | ) |

| Amortization of finance costs | | | (43,011 | ) | | | - | | | | - | | | | - | | | | (43,011 | ) |

| Other income (expense) | | | 2,250 | | | | - | | | | - | | | | - | | | | 2,250 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Income (loss): | | | 232,463 | | | | (91,818 | ) | | | (757,463 | ) | | | - | | | | (616,818 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Income taxes | | | (8,707 | ) | | | 3,439 | | | | 28,371 | | | | - | | | | 23,103 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net income (loss) | | $ | 223,756 | | | $ | (88,379 | ) | | $ | (729,092 | ) | | $ | - | | | $ | (593,715 | ) |

FIRST CHOICE HEALTHCARE SOLUTIONS, INC

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2013

NOTE 14 — SEGMENT REPORTING —Continued

Assets:

| | | Marina | | | FCID | | | | | | Intercompany | | | | |

| | | Towers | | | Medical | | | Corporate | | | Eliminations | | | Total | |

| Assets: | | | | | | | | | | | | | | | | | | | | |

| At September 30, 2013: | | $ | 4,878,723 | | | $ | 5,947,558 | | | $ | 883,750 | | | $ | - | | | $ | 11,710,031 | |

| At December 31, 2012: | | $ | 4,938,954 | | | $ | 5,183,592 | | | $ | 8,702 | | | $ | - | | | $ | 10,131,248 | |

| | | | | | | | | | | | | | | | | | | | | |

| Assets acquired | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, 2013 | | $ | - | | | $ | 54,255 | | | $ | - | | | $ | - | | | $ | 54,255 | |

| Three months ended September 30, 2012 | | $ | - | | | $ | 2,283,431 | | | $ | - | | | $ | - | | | $ | 2,283,431 | |

| Nine months ended September 30, 2013 | | $ | 67,192 | | | $ | 261,035 | | | $ | - | | | $ | - | | | $ | 328,227 | |

| Nine months ended September 30, 2012 | | $ | - | | | $ | 2,473,799 | | | $ | - | | | $ | - | | | $ | 2,473,799 | |

NOTE 15—SUBSEQUENT EVENTS

Hillair Capital Investments, L.P.

On November 8, 2013, First Choice Healthcare Solutions, Inc. (the “Company”) entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with Hillair Capital Investments L.P. ("Hillair") whereby the Company issued and sold (the “Debenture and Warrant Transaction”) to Hillair (i) a $2,320,000, 8% Original Issue Discount Convertible Debenture due December 28, 2013, subject to extension through November 1, 2015 (the “Debenture”), and (ii) a Common Stock Purchase Warrant (the “Warrant”) to purchase up to 2,320,000 shares of the Company’s common stock (the “Common Stock”). The closing of the Debenture and Warrant Transaction occurred on November 8, 2013 (“Original Issue Date”).

The Company issued to Hillair the Debenture and the Warrant for the purchase price of $2,000,000. At any time after the Original Issue Date until the Debenture is no longer outstanding, the Debenture shall be convertible, in whole or in part, into shares of Common Stock at the option of Hillair, subject to certain conversion limitations set forth in the Debenture. The Company, however, has reserved the right to pay the Debenture in cash. The conversion price for the Debenture is initially $1.00 per share, subject to adjustment upon certain events, as set forth in the Debenture. Hillair may not convert the Debenture into shares of common stock below $1.00 per share provided the Company abides by the conditions set forth in the Debenture, including, but not limited to, that the Company has not issued any securities below $1.00 per share and is able to pay all of its financial obligations in cash.

Interest on the Debenture accrues at the rate of 8% annually and is payable quarterly on August 1, November 1, February 1, and May 1, beginning on August 1, 2014, on any redemption, conversion and at maturity. Interest is payable in cash or at the Company’s option in shares of the Company’s common stock; provided certain conditions are met. Commencing on February 1, 2015, the Company will be obligated to redeem a certain amount under the Debenture on a quarterly basis, in an amount equal to 580,000, plus accrued but unpaid interest and any other amounts then owed to the holder of the Debenture as further set forth therein on each of February 1, 2015, May 1, 2015, August 1, 2015 and November 1, 2015 (the “Required Redemption Amount”) for each quarter, until the Debenture’s maturity date of November 1, 2015.

Commencing six (6) months after November 8, 2013, the Company may elect to prepay, without penalty, any portion of the principal amount of the Debenture, subject to providing advance notice to the holder of the Debenture, at 120% of the then outstanding principal amount of the Debenture, plus accrued but unpaid interest and any other amounts then owed to the holder of the Debenture as further set forth therein, subject to certain conditions set forth in the Debenture.

FIRST CHOICE HEALTHCARE SOLUTIONS, INC

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2013

NOTE 15 – SUBSEQUENT EVENTS –Continued

The Warrants may be exercised at any time on or after November 8, 2013 and on or prior to the close of business on June 27, 2017, at an exercise price of $1.35 per share, subject to adjustment upon certain events.

To secure the Company’s obligations under the Debenture, the Company granted Hillair a security interest in certain of its and its subsidiaries’ assets in the Company as described in the Security Agreement. In addition, certain of the Company’s subsidiaries agreed to guarantee the Company’s obligations pursuant to the Subsidiary Guarantees.

A summary of the use of proceeds received by the Company in the Hillair transaction is as follows:

| Payment in Full of Balance Due on HSR Note (See Notes 8 & 15) | | $ | 300,000.00 | |

| Payment in Full of Balance Due on Accredited Investor Loan (See Notes 9 & 15) | | | 188,850.00 | |

| Legal and Due Diligence Fees Associated with Hillair Transaction | | $ | 98,003.85 | |

| Expansion and Working Capital | | $ | 1,413,146.15 | |

| TOTAL PROCEEDS RECEIVED FROM HILLAIR | | $ | 2,000,000.00 | |

HS Real Company, LLC

As more fully described in Note 8 – Note Payable, Related Party, the Company entered into an unsecured loan agreement with HS Real Company, LLC (“HSR”) on May 17, 2012 for $100,000 at an interest rate of 12% per annum (the "HSR Note"). On August 5, 2012, HSR increased the principal amount to $250,000, and subsequently HSR advanced an additional $50,000 to the Company, bringing the aggregate principal amount of the HSR Note to $300,000, all of which was due and payable to HSR on December 31, 2012. On November 8, 2013, the Company paid off the HSR Note, remitting HSR $300,000 for the outstanding principal and interest balance due on the HSR Note.

Accredited Investor Loan

As more fully described in Note 9 – Convertible Notes Payable, on November 8, 2013, the Company retired the Note due an accredited investor originally due on November 21, 2013. The Company paid the Lender $188,850 in principal and interest, and accordingly recorded a gain from change in fair value of debt derivative of $171,987.

CCR of Melbourne, Inc.

As more fully described in Note 7 – Line of Credit, Related Party, on February 1, 2012, the Company opened a $500,000 unsecured, revolving line of credit loan with CCR of Melbourne, Inc., an entity owned and controlled by the Company's Chief Executive Officer. The revolving line of credit loan matures on October 1, 2015 with interest at a per annum rate of 8.5% beginning March 1, 2012. Advances on the line of credit are at the sole discretion of CCR of Melbourne, Inc. As of September 30, 2013, $141,448.19 was outstanding. On November 8, 2013, CCR converted the outstanding balance of $142,483.52, representing all of the outstanding related party principal and interest amount on the loan, into shares of the Company’s common stock at a price equal to $0.45 per share for a total of 316,631 shares to be issued.

MTI Capital, LLC

As more fully described in Note 6 – Lines of Credit, on May 1, 2013, the Company entered into a loan commitment whereby MTI Capital, LLC (“MTI” or the “Lender”) provided a line of credit up to $2,000,000 in the form of a convertible loan with interest at

FIRST CHOICE HEALTHCARE SOLUTIONS, INC

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2013

NOTE 15 – SUBSEQUENT EVENTS –Continued

12% per annum, payable monthly with principal due two years from the effective date of the loan. There was an outstanding balance of $505,325.91 including principal and interest as of September 30, 2013. At any time, the Lender may convert all or any portion of the outstanding principal amount or interest on the Loan into the common stock of the Company at a price equal to 0.45 per share. Advances on the line of credit are at the sole discretion of MTI. The Company did not record an embedded beneficial conversion feature in the note since the fair value of the common stock did not exceed the conversion rate at the date of commitment. On November 8, 2013, MTI converted the outstanding balance of $624,000 related party principal and interest amount on the loan, into shares of the Company’s common stock at a price equal to $0.45 per share for a total of 1,386,667 shares to be issued.

CT Capital LTD

On November 8, 2013, in consideration for a fee of 100,000 shares of the Company’s common stock, to be issued subject to SEC Rule 144, CT Capital agreed to modify the line of credit to the Company’s subsidiary, First Choice Medical Group of Brevard, LLC. Under the loan modification agreement, the annual rate of interest was reduced from 12% per annum to 6% per annum and will remain at 6% until November 1, 2015. All other terms under the June 18, 2013 Loan and Security Agreement will remain the same.

Hanover|Elite

On October 2, 2013, the Company entered into an agreement to engage the services of Elite Financial Communications Group, LLC, d/b/a Hanover|Elite. The terms of the agreement provide for a monthly retainer of a $6,000 and 300,000 shares of the Company’s common stock, subject to SEC Rule 144 restrictions, which shall be earned and issued quarterly as follows: 37,500 shares on January 3, 2014; 37,500 shares on April 3, 2014; 37,500 shares on July 3, 2014; and 187,500 shares on October 3, 2014.

As the Company’s investor and public relations counsel of record, Hanover|Elite will collaborate with management on developing, implementing and supporting a fully integrated corporate and shareholder communications platform; and generating meaningful awareness among and measurable support from the retail and institutional investment banking community for the Company, its compelling business plan and promising future growth potential. Jim Hock, Co-Managing Partner of Hanover|Elite and Co-Chairman of the National Investment Banking Association, will lead the IR/PR effort for the Company.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

This quarterly report on Form 10-Q and other reports filed by First Choice Healthcare Solutions, Inc. (the “Company”) from time to time with the U.S. Securities and Exchange Commission (the “SEC”) contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available to, the Company’s management as well as estimates and assumptions made by Company’s management. Readers are cautioned not to place undue reliance on these forward-looking statements, which are only predictions and speak only as of the date hereof. When used in the filings, the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan,” or the negative of these terms and similar expressions as they relate to the Company or the Company’s management identify forward-looking statements. Such statements reflect the current view of the Company with respect to future events and are subject to risks, uncertainties, assumptions, and other factors, including the risks contained in the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2012, relating to the Company’s industry, the Company’s operations and results of operations, and any businesses that the Company may acquire. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended, or planned.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance, or achievements. Except as required by applicable law, including the securities laws of the United States, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results.