UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[X] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ ] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material under Rule 14a-12

Bridges Investment Fund, Inc.

| (Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

___________, 2017

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT

To the Shareholders of

Bridges Investment Fund, Inc.

The Special Meeting of the shareholders of Bridges Investment Fund, Inc. (the “Fund”), a Nebraska corporation, will be held at ______________________________, Omaha, Nebraska, on [Day, Month, Date], 2017, at __:00 _.m., Central Daylight Time, for the following purposes:

| 1. | To approve a new investment advisory agreement between the Fund and Bridges Investment Management, Inc. (“BIM” or the “Adviser”); |

| 2. | To re-elect the eight (8) current directors to serve on the Board of Directors until the next Annual Meeting of the shareholders and until their successors are elected and qualified; and |

| 3. | To transact such other business as may properly come before the meeting. |

The Board of Directors has fixed the close of business on ___________, 2017, as the record date for the determination of shareholders entitled to notice of, and to vote at, the Special Meeting. The transfer books of the Fund will not be closed.

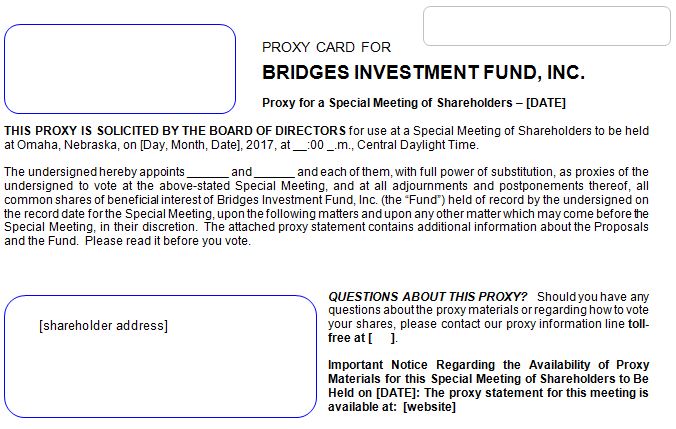

This proxy is solicited by the Board of Directors to be voted at the Special Meeting or any adjournment thereto. The cost of the proxy solicitations will be paid by BIM. Additional solicitation may be made by mail, personal interview, or telephone by _______________ (“____________”), a proxy solicitation firm, at the expense of BIM. This proxy statement and form of proxy card are first being mailed to shareholders on or around __________, 2017.

After careful consideration, the Board of Directors (the “Board”) recommends that you vote “FOR” Proposal 1 to approve the new investment advisory agreement and “FOR” Proposal 2 to elect each of the director nominees presented.

Detailed information about the proposals is contained in the enclosed materials. Your vote is very important to us regardless of the number of shares you own. Whether or not you plan to attend the Special Meeting in person, please read the Proxy Statement and cast your vote promptly. It is important that your vote be received by no later than the time of the meeting on [Day, Month, Date], 2017. Voting is quick and easy. Everything you need to vote is enclosed. To cast your vote, simply complete, sign and return the Proxy Card in the enclosed postage-paid envelope. In addition to voting by mail, you may vote by either telephone or via the Internet, as follows:

| TO VOTE BY TELEPHONE: | TO VOTE BY INTERNET: |

(1) Read the Proxy Statement and have your Proxy Card at hand. | (1) Read the Proxy Statement and have your Proxy Card at hand. |

(2) Call the toll-free number that appears on your Proxy Card. | (2) Go to the website that appears on your Proxy Card. |

(3) Enter the control number set forth on the Proxy Card and follow the simple instructions. | (3) Enter the control number set forth on the Proxy Card and follow the simple instructions. |

Please note that you may receive more than one set of proxy materials if you hold shares in more than one account. Please be sure to vote each account by utilizing one of the methods described on the Proxy Cards or by signing and dating each Proxy Card and enclosing it in the postage-paid envelope provided for each Proxy Card.

If you have any questions after considering the enclosed materials, please feel free to contact Nancy Dodge, Treasurer of the Fund, at (402) 397-4700.

All valid proxies obtained will be voted in favor of the approval of the new investment advisory agreement and the election of directors unless specified to the contrary. Each shareholder has the power to revoke his or her proxy at any time prior to the voting thereof by sending a letter to the Fund’s office or by executing a new proxy. The execution and delivery of a proxy will not affect your right to vote in person if you attend the Special Meeting. At the beginning of the meeting, all shareholders in attendance will be given an opportunity to revoke their proxies and to vote personally on each matter described herein.

The Annual Report for the year ended December 31, 2016, which includes a statement of assets and liabilities as of December 31, 2016, and a statement of income and expenses for the year ended that date, was mailed to Fund shareholders on or about February 22, 2017. Any shareholder who desires additional copies may obtain them from the Fund’s website at www.bridgesfund.com under “Resources” or upon written request to the Fund c/o U.S. Bancorp Fund Services, LLC, P.O. Box 701, Milwaukee, WI 53201-0701 or by calling 1-866-934-4700.

| By Order of the Board of Directors,

____________________________ Edson L. Bridges III President Bridges Investment Fund, Inc. |

BRIDGES INVESTMENT FUND, INC.

256 Durham Plaza

8401 West Dodge Road

Omaha, Nebraska 68114

PROXY STATEMENT

FOR THE SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON ___________, 2017

This proxy statement is being furnished to you in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Bridges Investment Fund, Inc. (the “Fund”), to be voted at the Special Meeting of Shareholders (the “Special Meeting”) to be held on [Day, Month, Date], 2017, at _____________________, Omaha, Nebraska, at __:00 _.m., Central Daylight Time, for the purposes set forth below and as described in greater detail in this Proxy Statement.

You are entitled to vote at the Special Meeting and at any adjournment(s) if you owned shares of any Fund at the close of business on ___________, 2017 (the “Record Date”). The date of the first mailing of the Proxy Cards and this Proxy Statement to shareholders will be on or about ___________, 2017.

The Board is soliciting proxies from shareholders of the Fund with respect to the following proposals:

| 1. | To approve a new investment advisory agreement between the Fund and Bridges Investment Management, Inc. |

| 2. | To re-elect eight (8) current Directors to serve on the Board of Directors until the next Annual Meeting of the shareholders and until their successors are elected and qualified; and |

| 3. | To transact such other business as may properly come before the meeting and any adjournment(s) thereof. |

Only shareholders of record at the close of business on the Record Date will be entitled to notice of, and to vote at, the Special Meeting. Shares represented by proxies, unless previously revoked, will be voted at the meeting in accordance with the instructions of the shareholders. If proxy cards have been executed, but no instructions are given, such proxies will be voted in favor of the proposals. To revoke a proxy, the shareholder giving such proxy must either: (1) submit to the Fund a subsequently dated proxy card; (2) deliver to the Fund a written notice of revocation; or (3) otherwise give notice of revocation in open meeting, in all cases prior to the exercise of the authority granted in the proxy.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting:

A copy of the most recent Annual Report was mailed to Fund shareholders on or about February 22, 2017. In addition, the Proxy Statement and the Fund’s most recent Annual and Semi-Annual Reports are available on the Internet at www.bridgesfund.com under “Resources” or upon written request to the Fund c/o U.S. Bancorp Fund Services, LLC, P.O. Box 701, Milwaukee, WI 53201-0701 or by calling 1-866-934-4700. The Fund will furnish, without charge, a copy of the Annual Report for the fiscal year ended December 31, 2016 or Semi-Annual Report for the period ended June 30, 2016, to any Fund shareholder upon request. To request a copy, please write or call the Fund as noted above. You may also call for information on how to obtain directions to be able to attend the Special Meeting and vote in person.

BACKGROUND INFORMATION FOR FUND SHAREHOLDERS

While we encourage you to read the full text of the enclosed Proxy Statement, for your convenience, we have provided a brief overview of the matters affecting the Fund that require a shareholder vote.

Q. Why am I receiving this proxy statement?

A. At an in-person meeting held on April 18, 2017, the Fund’s Board voted to approve a new investment advisory agreement with Bridges Investment Management, Inc. (“BIM” or “Adviser”) which agreement will be effective no sooner than the effective date of the change of control transaction of BIM. See the section titled “Transaction” below for additional information on the proposed transaction. The Board approved a new investment advisory agreement between the Fund and BIM (the “New Advisory Agreement”) on substantially identical terms as the existing investment advisory agreement, subject to approval by the Fund’s shareholders.

Pending shareholder approval of the New Advisory Agreement, the Board also approved at the April meeting, an interim advisory agreement (the “Interim Advisory Agreement”) between the Fund and BIM pursuant to Rule 15a-4 of the Investment Company Act of 1940, as amended (the “1940 Act”). The Interim Advisory Agreement would take effect upon the date of closing of the Transaction if shareholder approval of the New Advisory Agreement is not obtained prior to such date and the parties to the Merger Agreement decide to close the Transaction although Fund shareholder approval has not been attained. The Interim Advisory Agreement between the Fund and BIM would be effective for up to 150 days from its effective date and would terminate upon approval of the New Advisory Agreement by the shareholders. The Interim Advisory Agreement does not require shareholder approval.

The Fund is also requesting that shareholders re-elect the eight (8) members of the Board of Directors. Each of the proposals is discussed further below.

The Board recommends that you vote FOR the approval of the New Advisory Agreement and FOR the election of the directors.

Q. Why is the Fund asking me to vote on the New Advisory Agreement?

A. BIM currently serves as the Fund’s investment adviser, and has served as the Fund investment adviser since 2004. On or about April 17, 2017, BIM, its shareholders, and Bridges Holding Company (“BHC”), among other parties, entered into an Agreement and Plan of Merger (the “Merger Agreement”). Pursuant to the terms of the Merger Agreement, the common shareholders of BIM receive cash and/or shares in BHC in exchange for their BIM shares on the effective date (the “Transaction”). On or after the effective date, BHC will be the sole owner of BIM. Following the closing of the Transaction, Edson L. Bridges III (“Ted Bridges”) and Robert Bridges will collectively own approximately 13% of BHC. Because of the change of ownership, the Transaction is deemed to cause an “assignment” of the current investment advisory agreement with the Fund, which causes the existing advisory agreement to terminate. Shareholders are being asked to approve a new investment advisory agreement between the Adviser and the Fund to permit the Adviser to continue to serve as investment adviser to the Fund, despite the change in ownership.

Q: How will Fund shareholders be affected by the Transaction?

A: Your Fund investment will not change as a result of the Transaction. You will still own the same Fund shares and the underlying value of those shares will not change as a result of the Transaction. The Adviser will continue to manage the Fund according to the same objectives and policies as before, and it does not anticipate any significant changes to the Fund’s investment objectives or in the portfolio managers or other management personnel of the Advisor.

Q: Will the Transaction result in any important differences between the New Advisory Agreement compared to the current advisory agreement?

A: No. The terms of the New Advisory Agreement with BIM and the Fund are substantially identical to the current agreement. There will be no change in the contractual advisory fee rate the Fund pays or the investment advisory services it receives as a result of the Transaction. The Interim Advisory Agreement also is substantially similar to the New Advisory Agreement.

Q: What will happen if shareholders of the Fund do not approve the New Advisory Agreement before consummation of the Transaction?

A: If the parties to the Merger Agreement decide to close the Transaction prior to the approval of the Fund shareholders at this Special Meeting, BIM will continue to manage the Fund under the Interim Advisory Agreement but must place its compensation for its services during the interim period in escrow, pending Fund shareholder approval of the proposed new agreement.

Q: Why are shareholders being asked to elect the Board of Directors?

A: Currently, the Fund Board has eight (8) members, six of whom are independent directors (as defined below). From time to time, the Fund holds a shareholder meeting for the purpose of electing directors in order to comply with the requirements of the 1940 Act. Information about the Board nominees, including age, principal occupations during the past five years, and other information, such as each nominee’s experience, qualifications, attributes, or skills, is set forth in this Proxy Statement.

Q: Who is eligible to vote?

A: Shareholders who owned shares of the Fund at the close of business on ___________, 2017 (the “Record Date”) will be entitled to be present and vote at the Special Meeting. Those shareholders are entitled to one vote for each share beneficially owned of the Fund.

Q: How can I vote my shares?

A: You can vote or provide instructions in any one of four ways:

• By Internet through the website listed in the proxy voting instructions;

• By telephone by calling the toll-free number listed on your proxy card(s) and following the recorded instructions;

• By mail, by sending the enclosed proxy card(s) (completed, signed and dated) in the enclosed envelope; or

• In person at the Special Meeting.

Whichever method you choose, please take the time to read the full text of the Proxy Statement before you vote.

It is important that shareholders respond to ensure that there is a quorum for the Special Meeting. If we do not receive your response within a few weeks, you may be contacted by Fund Management or by__________ (“_____________”), the proxy solicitor engaged by BIM who will remind you to vote your shares and help you return your proxy. If a quorum is not present or sufficient votes to approve the proposals are not received by the date of the Special Meeting, the persons designated as proxies may adjourn the Special Meeting to a later date so that we can continue to seek additional votes.

Q: If I send my vote in now as requested, can I change it later?

A: Yes. Shareholders may revoke their proxy vote at any time before it is voted at the Special Meeting by: (i) delivering a written revocation to the Secretary of the Fund; (ii) submitting a subsequently executed proxy vote; or (iii) attending the Special Meeting and voting in person. Even if a shareholder plans to attend the Special Meeting, we ask that all shareholders return proxy card(s) or vote by telephone or Internet. This will help us to ensure that an adequate number of shares are present at the Special Meeting for consideration of the proposals. Shareholders should send notices of revocation to Bridges Investment Fund at the address set forth on page 1 of this Proxy Statement.

Q: What is the required vote to approve the proposals?

A: Approval of Proposal 1 requires the affirmative vote of a “majority of the outstanding voting securities” as defined under the 1940 Act (such a majority referred to herein as a “1940 Act Majority”), of such Fund. A 1940 Act Majority means the lesser of the vote of (i) 67% or more of the shares of the Fund entitled to vote thereon present at the Meeting, if the holders of more than 50% of such outstanding shares are present in person or represented by proxy; or (ii) more than 50% of such outstanding shares of the Fund entitled to vote thereon. However, Proposal 1 will only take effect if the Transaction also closes. The Transaction is conditioned, among other things, upon the Fund either obtaining the approval of the New Advisory Agreement by the shareholders of the Fund or entering into the Interim Advisory Agreement pending shareholder approval.

With respect to Proposal 2, Directors are elected when they receive a plurality of the votes cast by the shares entitled to vote in the election of the directors at the Special Meeting. This means that the eight (8) directors with the most votes will be elected as directors.

Q: Who is paying the costs of this solicitation?

A: BIM will pay the fees and expenses related to each proposal, including the cost of the preparation of these proxy materials and their distribution, and all other costs incurred with the solicitation of proxies, including any additional solicitation made by letter, telephone, or otherwise.

Q: Whom should I call for additional information about this Proxy Statement?

A: Please contact Nancy Dodge, Treasurer of the Fund, at (402) 397-4700.

PROPOSAL 1

APPROVAL OF NEW INVESTMENT ADVISORY AGREEMENT

WHAT ARE SHAREHOLDERS BEING ASKED TO APPROVE IN PROPOSAL 1?

The purpose of this Proposal 1 (“Proposal 1”) is to approve a new investment advisory agreement with the Fund’s Adviser.

BACKGROUND

The Fund

The Fund is a Nebraska corporation organized on March 20, 1963 and is registered with the Securities and Exchange Commission (“SEC”) as an open-end, diversified investment management company under the 1940 Act. The Fund commenced investment operations on July 1, 1963, and shares of stock were first sold to the general public on December 7, 1963. The Fund has conducted its business continuously since that year and has a fiscal year end of December 31.

Investment Adviser

Background

BIM has served as the investment advisor to the Fund since 2004, providing investment advice to the Fund. The Adviser was organized as a Nebraska corporation in 1994 and registered with the SEC as an investment adviser in December 1999.

In December 2000, voting trusts were entered into under which Edson L. Bridges II and Ted Bridges, as co-trustees, vote the shares representing greater than 80% of Bridges Investment Management, Inc. Class A voting common stock and greater than 80% of Bridges Investment Counsel, Inc. common stock. These voting trust agreements were extended for an additional ten years in March 2011. The BIC and BIM voting trusts were established to meet regulatory requirements of the Nebraska Department of Banking, Bureau of Securities requiring common control among entities that have investment adviser representatives registered with more than one registered investment adviser firm.

Ownership

Ted Bridges, Fund President and Director, currently owns 78.3% of the outstanding voting securities of the Adviser and 57.5% of the total outstanding securities of the Adviser. Other than Ted Bridges, no other director or officer of the Fund owns 5% or more of the voting securities of the Adviser. After the Transaction closes, the voting trust agreement will cease, and BHC will own 100% of BIM and Ted Bridges and Robert Bridges will collectively own approximately 13% of BHC.

Current Officers and Directors of Adviser

Ted Bridges is the President and CEO and a Board member of the Advisor. For additional information on Mr. Bridges, see the “Interested Directors” table below. The other directors of the Adviser are Edson L. Bridges II, Deborah L. Grant, Brian Kirkpatrick, and Douglas Plahn, and the other officers of the Adviser include: Nancy K. Dodge, Deborah L. Grant, Brian M. Kirkpatrick, Mary Ann Mason, Brian R. Miles, Douglas R. Plahn, and Patricia S. Rohloff. For additional information on Mr. Edson Bridges II, Ms. Dodge, Mr. Kirkpatrick, and Ms. Mason see the “Officers” table below.

Deborah L. Grant has served as Senior Vice President, Portfolio Management and Client Services for Bridges Investment Counsel, Inc., Vice President and Director for Bridges Investor Services, Inc., Senior Vice President and Director for BIM, Senior Vice President and Trust Officer for Provident Trust Company.

Brian R. Miles has served as Vice President for BIM, Executive Vice President and Chief Compliance Officer for Provident Trust Company, and Assistant to the President for Bridges Investment Counsel, Inc.

Douglas R. Plahn serves as Senior Vice President of Finance for Bridges Investment Counsel, Inc., Senior Vice President, CFO and Director for BIM, Partner of Modern Portfolio Consultants Company, d/b/a MPC Wealth Management, and Executive Vice President, Trust Officer, and Trust Investment Officer for Provident Trust Company.

Patricia S. Rohloff serves as an analyst for Bridges Investment Counsel, Inc., Vice President for BIM, and Trust Investment Officer for Provident Trust Company.

All of the Adviser’s current officers and directors (including its CEO) are actively engaged with the investment activities of BIM or an affiliate thereof, and their address is 256 Durham Plaza, 8401 West Dodge Road, Omaha, Nebraska 68114.

Officers and Directors of Adviser Post-Transaction

After the closing of the Transaction, Ted Bridges will continue as the President and CEO of the Adviser and Brian M. Kirkpatrick, Michael G. App, and Douglas R. Plahn will be executive officers of the Adviser, and the BIM board of directors will consist of Ted Bridges, Brian M. Kirkpatrick, Michael G. App, Douglas R. Plahn, and Brian R. Miles. Except for Mr. App, principal occupations for the directors and officers are provided above. After the closing of the Transaction, Michael G. App will serve as a Vice President of the Adviser, and his role will be in investment management. The Adviser currently intends to maintain the same physical location in Omaha, Nebraska.

Current Advisory Agreement

Under the investment advisory agreement (“Current Advisory Agreement”) between the Fund and the Adviser, which has continued in effect since 2004, the Adviser provides continuous investment supervision for the Fund in accordance with the Fund’s investment objectives, policies, and restrictions and oversees the day-to-day operations of the Fund, subject to the supervision of the Fund’s Board of Directors. The Adviser pays all costs related to the registration of the Fund with the SEC under the 1940 Act and all expenses of qualifying and maintaining the qualification of Fund shares under the securities laws of such states as the Fund may designate from time to time. In addition, the Adviser has agreed to waive its fee and/or reimburse operating expenses to the extent that total Fund expenses (exclusive of stamp and other taxes but including fees paid to the Adviser) exceed 1.50% of average net assets each year.

The Adviser also provides certain administrative services to the Fund, including: preparing and coordinating reports and other materials supplied to the Board of Directors; contributing to the preparation and filing of all securities filings, periodic financial reports, prospectuses, statements of additional information, proxies, marketing materials, tax returns, shareholder reports and other regulatory reports or filings required of the Fund; reviewing and approving all required notice filings necessary to maintain the Fund’s ability to sell shares in all states where the Fund currently does, or intends to do business; reviewing the preparation, printing and mailing of all materials (e.g., annual and semi-annual reports, proxy materials) required to be sent to shareholders; coordinating the annual proxy solicitation and shareholders’ meeting, if required; coordinating the preparation and payment of Fund related expenses; monitoring and overseeing the activities of the Fund’s servicing agents (i.e., Transfer Agent, Custodian, Fund Accountant, Administrator, etc.); and performs such additional services as may be agreed upon by the Adviser.

For its investment advisory services, the Fund pays the Adviser a quarterly fee of one-eighth (1/8th) of 1% of the Fund’s average net assets, resulting in an annualized rate of 0.50% of the Fund’s average net assets. In addition, the Fund pays the Adviser an annual fee not to exceed $42,000 for providing certain administrative services to the Fund. The annual fee may be adjusted from time-to-time by the Fund’s Board of Directors.

The table below shows the amount of advisory and administrative services fees paid by the Fund for fiscal years indicated below.

| | Advisory Fees | Administrative Services Fees |

| 2016 | $580,324 | $42,000 |

| 2015 | $602,038 | $42,000 |

| 2014 | $584,370 | $42,000 |

The Current Advisory Agreement will continue in effect only so long as such continuance is specifically approved at least annually by the Fund’s Board of Directors or by vote of a majority of the outstanding voting securities of the Fund. The Fund’s Board approved the Current Advisory Agreement at its meeting held November 15, 2016, and the term of the Current Advisory Agreement ends April 17, 2018. The Fund shareholders approved the form of Current Advisory Agreement at an Annual Meeting held on February 24, 2004, when the Fund retained BIM as its investment adviser. The Fund shareholders last approved the continuation of the Current Advisory Agreement at an Annual Meeting held on March 25, 2008. Since the February 2004 meeting, the Board has approved the Current Advisory Agreement each year, which agreement is unchanged. However, if the shareholders approve the New Advisory Agreement at the Special Meeting, the Current Advisory Agreement will terminate on the later of (i) the effective date of the Transaction, or (ii) one business day after the Special Meeting of Shareholders.

The Transaction

On April 17, 2017, BIM, its shareholders and BHC, among other parties, entered into an Agreement and Plan of Merger (the “Merger Agreement”). Pursuant to the terms of the Merger Agreement, the common shareholders of BIM receive cash and/or BHC shares in exchange for their BIM shares on the effective date of the Transaction. On or after the effective date, BHC will be the sole owner of BIM. BHC is a newly formed holding company, which will be owned primarily by MGI Holdings, Inc. (“MGI”), a subsidiary of the McCarthy Group LLC (“MGL”), an Omaha-based financial services company. The Bridges family will collectively own approximately 13% of BHC. This Transaction will be considered to constitute a change of control of BIM. Under the 1940 Act, certain changes in the equity ownership of an investment adviser may result in a “change of control” of that adviser. When a “change of control” occurs, any investment advisory agreements that an adviser has with respect to mutual funds automatically terminate.

Under the 1940 Act, a fund’s shareholders must approve any new investment advisory agreement for the fund. Therefore, the Fund’s shareholders must approve the New Advisory Agreement in order for BIM to continue to serve as adviser to the Fund after the effective date of the Transaction. If the Special Meeting is held on or after the effective date of the Transaction, the Fund anticipates entering into the Interim Advisory Agreement (which does not require shareholder approval). Such Interim Advisory Agreement shall have a term of no more than 150-days after the occurrence of the change of control. It is proposed that the New Advisory Agreement would take effect as early as June 30, 2017, if the Fund can obtain shareholder approval prior thereto and the Transaction closes on such date.

The Board has considered and approved the calling of this Special Meeting and solicitation of proxies for shareholders of the Fund to consider, among other things, and vote on approval of the New Advisory Agreement.

Board Considerations

At a meeting of the Board held in-person on April 18, 2017, the Board, including a majority of directors who are not “interested persons” (the “independent directors”) as that term is defined under the 1940 Act, voted to approve the proposed New Advisory Agreement between BIM and the Fund, thereby allowing BIM to continue to serve as investment adviser for the Fund after the change of ownership of the Advisor. The Board also voted to recommend that shareholders approve the New Advisory Agreement. The terms of the New Advisory Agreement are substantially identical to the terms of the Current Advisory Agreement between BIM and the Fund. See the section below titled: “Summary of the New Advisory Agreement and the Current Advisory Agreement.”

In the event the Fund is not able to obtain shareholder approval prior to the effective date of the Transaction, the Board, including a majority the independent directors, approved the Interim Advisory Agreement between the Fund and BIM, so that BIM could continue managing the Fund after the change of control. Pursuant to Rule 15a-4 under the 1940 Act, the Interim Advisory Agreement will allow the Fund an additional 150 days to obtain shareholder approval of the New Advisory Agreement. The terms of the Interim Advisory Agreement are substantially identical to the terms of the Current Advisory Agreement and New Advisory Agreement, except for the term of the agreement and references to certain provisions of Rule 15a-4. Additionally, under the Interim Advisory Agreement, management fees earned by BIM would be held in an interest-bearing escrow account until shareholders approve the New Advisory Agreement with BIM.

If the Fund’s shareholders do not approve BIM as the investment adviser for the Fund, then the Board will have to consider other alternatives for the Fund upon the expiration of the Current Advisory and Interim Advisory Agreements.

Legal Requirements in Approving the Interim Advisory and New Advisory Agreements

To avoid disruption of the Fund’s investment management and after considering the potential benefits to shareholders of retaining BIM as the Fund’s investment adviser, as discussed more fully below, the Board approved the New Advisory Agreement and the Interim Advisory Agreement. The New Advisory Agreement will be effective on the date of closing of the Transaction, assuming shareholder approval is obtained. The Interim Advisory Agreement would be effective on closing of the Transaction, if the parties to the Merger Agreement determine to close the transaction prior to the holding of the Fund special meeting of Fund shareholders, although Fund shareholder approval has not been received. As explained above, the Current Advisory Agreement will terminate automatically upon the change of control of BIM which is currently anticipated to occur on or about June 30, 2017, or such later date mutually agreed to by the parties to the Merger Agreement.

In approving the Interim Advisory Agreement, the Board has determined that it was prudent to act pursuant to the requirements of Rule 15a-4 under the 1940 Act. Under Rule 15a-4, an adviser can serve pursuant to an interim advisory agreement for up to 150 days while a fund seeks shareholder approval of a new investment advisory agreement. Rule 15a-4 imposes the following conditions, all of which are met in the case of the Interim Advisory Agreement:

(1) the compensation under the interim contract may be no greater than under the previous contract;

(2) the fund’s board of directors, including a majority of the independent directors, has voted in person to approve the interim contract before the previous contract is terminated;

(3) the fund’s board of directors, including a majority of the independent directors, determines that the scope and quality of services to be provided to the funds under the interim contract will be at least equivalent to the scope and quality of services provided under the previous contract;

(4) the interim contract provides that the fund’s board of directors or a majority of each fund’s outstanding voting securities may terminate the interim contract at any time, without the payment of any penalty, on not more than 10 calendar days’ written notice to the adviser;

(5) the interim contract contains the same provisions as the previous contract with the exception of effective and termination dates, provisions required by Rule 15a-4 and other differences determined to be immaterial by the fund’s board of directors;

(6) the interim contract provides in accordance with the specific provisions of Rule 15a-4 for the establishment of an interest-bearing escrow account for fees received under the interim contract pending approval of a new contract by shareholders; and

(7) the fund’s board of directors satisfies certain fund governance standards under Rule 0-1(a)(7) of the 1940 Act.

The Interim Advisory Agreement is to be implemented upon the change of control if shareholders have not already approved the New Advisory Agreement and will terminate upon the sooner to occur of (1) the date that is 150 days after the Transaction closing (i.e. the change of control event), or (2) the approval by the Fund’s shareholders of the proposed New Advisory Agreement. Under the Interim Advisory Agreement, the advisory fees earned by BIM during this interim period will be held in an interest-bearing escrow account at ______________ Bank. Fees that are paid to the escrow account, including interest earned, will be paid to BIM if the Fund shareholders approve the New Advisory Agreement within 150 days of the date of the Interim Advisory Agreement. If shareholders of the Fund do not approve the New Advisory Agreement within 150 days of the date of the Interim Advisory Agreement, then BIM will be paid, out of the escrow account, the lesser of: (1) any costs incurred in performing the Interim Investment Advisory Agreement, plus interest earned on the amount while in escrow; or (2) the total amount in the escrow account, plus interest.

Summary of the New Advisory Agreement and the Current Advisory Agreement

A copy of the proposed New Advisory Agreement is attached hereto as Exhibit A and a redlined version indicating changes between the Current Advisory Agreement and New Advisory Agreement is attached hereto as Exhibit B. The following description is only a summary. You should refer to Exhibit A for the New Advisory Agreement, as the description set forth in this Proxy Statement of the New Advisory Agreement is qualified in its entirety by reference to Exhibit A. The investment advisory services to be provided by BIM under the New Advisory Agreement and the Interim Advisory Agreement and the fee structure are identical to the services currently provided by BIM and the fee structure under the Current Advisory Agreement.

Advisory Services. Each of the New Advisory Agreement, Interim Advisory Agreement, and the Current Advisory Agreement states that, subject to the supervision and direction of the Board, BIM will provide a continuous investment program for the Fund, including investment research and management with respect to all securities and investments and cash equivalents in the Fund’s investment portfolio and invest and reinvest the assets of the Fund. The Adviser also shall determine from time to time what securities and other investments will be purchased, retained or sold by the Fund and shall execute or direct the execution of all such transactions with the issuer of such securities, with broker and dealers.

Payment of Expenses by Adviser. Under the New Advisory Agreement, the Interim Advisory Agreement, and the Current Advisory Agreement, the Advisor, at its own expense, shall furnish office space to the Fund and all necessary office facilities, equipment and personnel for managing the assets of the Fund. The Adviser shall also assume and pay all other expenses incurred by it in connection with the management of the assets of the Fund, all expenses of registering the Fund under the 1940 Act, of maintaining the registration of shares of the Fund under the Securities Act of 1933, and of initially qualifying and maintaining the qualification of shares of the Fund in whole or in part under the securities law of such states as the Fund may from time to time designate.

Payment of Expenses by the Fund. Under the New Advisory Agreement, the Interim Advisory Agreement, and the Current Advisory Agreement, the Fund is responsible for paying (i) charges of any depositaries or custodians appointed by it for the safekeeping of its cash, securities and other property and of any transfer agents and registrars of the Fund, (ii) the charges of legal counsel and of independent auditors (not including charges in respect of the registration and qualification of shares referred to above), (iii) all expenses of bookkeeping (to the extent that such bookkeeping services are not rendered by the Adviser in connection with the management of the assets of the Fund) and of publication of notices and reports to its shareholders, (iv) the expenses of printing and mailing stock certificates on any issue or sale of shares by the Fund, (v) all taxes and corporate fees payable to federal, state or other government agencies, and (vi) all stamp taxes.

Management Fees. The New Advisory Agreement, the Interim Advisory Agreement, and the Current Advisory Agreement contain an identical fee structure based on the Fund’s average net assets.

Duration and Termination. The term of the Current Advisory Agreement is April 17, 2017 through April 17, 2018. The New Advisory Agreement will not become effective until the later of the (i) the effective date of the Transaction or (ii) one business day after the date the Fund receives approval of the New Advisory Agreement from its shareholders. Both the Current Advisory Agreement and the New Advisory Agreement provide that the agreement will continue in effect for a period of one year, unless sooner terminated, and that they shall continue in effect for successive annual periods, with such continuation to be approved at least annually by the Board or by the vote of a majority of the outstanding securities of the Fund. Both the Current Advisory Agreement and the New Advisory Agreement may be terminated at any time, on 60 days’ prior written notice, by the Fund (by vote of the Board or by the vote of a majority of the outstanding voting securities of the Fund) without the payment of a penalty, or by BIM at any time, without the payment of a penalty, upon 60 days’ prior written notice.

The Interim Advisory Agreement is to be implemented upon the change of control if shareholders have not already approved the New Advisory Agreement and will terminate upon the sooner to occur of (1) the date that is 150 days after the Transaction closing (i.e. the change of control event), or (2) the approval by the Fund’s shareholders of the proposed New Advisory Agreement.

Board Recommendation of Approval

At an in-person meeting held on November 11, 2016, the Board received and reviewed substantial information regarding the Fund, the Adviser and the services provided by the Adviser to the Fund under the Current Advisory Agreement. At that meeting, the independent directors of the Board approved the Current Advisory Agreement for the current term of April 17, 2017 through April 17, 2018.

At a meeting held on February 21, 2017, representatives of MGL met with the Fund Board and provided information concerning MGL, and reasons for the proposed Transaction, noting their shared cultural similarities, including a strong commitment to customer service. Fund management also discussed with the Board the proposed Transaction and the potential benefits of the Transaction to the Fund and its shareholders.

At a meeting held on April 18, 2017, five of the six independent directors of the Fund were present and met in person and after deliberation outside the presence of and without participation by other directors or BIM officers, considered and approved the New Advisory Agreement and recommended approval of the New Advisory Agreement to the full Board. Also at that meeting, the Board met in person and considered and approved the New Advisory Agreement between the Fund and the Adviser.

At the April meeting and at a prior meeting held on November 11, 2016, the Board received and reviewed substantial information regarding the Fund, the Adviser and the services provided by the Adviser to the Fund under the Current Advisory Agreement and to be provided under the New Advisory Agreement. This information, together with the information provided to the Board throughout the course of the year, formed the primary (but not exclusive) basis for the Board’s determinations. Below is a summary of the factors considered by the Board and the conclusions that formed the basis for the Board’s approval of the New Advisory Agreement:

| * | The Board considered the nature, extent and quality of the Adviser’s overall services provided to the Fund as well as its specific responsibilities in all aspects of day-to-day investment management of the Fund. Despite the transition of ownership occurring in connection with the Transaction, the Board believes that the portfolio managers and other key personnel remain committed to the Adviser. The Board also considered the qualifications, experience and responsibilities of the portfolio managers, as well as the responsibilities of other key personnel of the Adviser involved in the day-to-day activities of the Fund, many of which have served for Fund for several years. |

| * | The Board further considered the resources and compliance structure of the Adviser, including information regarding its compliance program, its chief compliance officer and the Adviser’s compliance record, and the Adviser’s disaster recovery/business continuity plan. The Board concluded that the Adviser had the quality and depth of personnel, resources, investment methods and compliance policies and procedures essential to continue performing its duties under the New Advisory Agreement and that the nature, overall quality and extent of such management services are satisfactory. |

| * | The Board took into account that the New Advisory Agreement was substantially identical to the Current Advisory Agreement and that the services and fee structure provided thereunder were not expected to change. The Board also considered that the New Advisory Agreement would be submitted to shareholders for their approval at a Special Meeting of Shareholders. |

| * | The Board considered the Fund’s historical performance, the overall performance of the Adviser, historical costs of the services provided by the Adviser, and the Adviser’s fees under the New Advisory Agreement. In assessing the quality of the portfolio management delivered by the Adviser, the Board reviewed the short-term and long-term performance of the Fund. While the Board considered both short-term and long-term performance, it placed greater emphasis on longer term performance. |

| * | In considering whether the arrangements between BIM and the Fund comply with the conditions of Section 15(f) of the 1940 Act, the Board reviewed the conditions of the Section 15(f). Section 15(f) provides a non-exclusive safe harbor for an investment Adviser to an investment company or any of its affiliated persons to receive any amount or benefit in connection with a change of control of the investment adviser so long as two conditions are met. First, for a period of three years after closing of the transaction, at least 75% of the board members of the Fund cannot be “interested persons” (as defined in the 1940 Act) of the investment adviser or predecessor adviser. The directors considered the fact that officers and representatives to the parties to the Merger Agreement have represented to the Fund Board that BHC has acknowledged the Fund’s reliance on the benefits and protections provided by Section 15(f) of the Investment Company Act and has agreed not to take, or cause its affiliates to take, any action that would have the effect, directly or indirectly, of causing the requirement of Section 15(f) (or if applicable Rule 15a-4) not to be met in respect of the Transaction. Thus, at least 75% of the Directors would not be “interested persons” of BIM or its control persons for a period of three years after the change of control of the investment adviser. |

The second condition of Section 15(f) is that an “unfair burden” must not be imposed upon the Fund as a result of the transaction or any express or implied terms, conditions or understandings applicable thereto. The Board concluded that no “unfair burden” is being imposed upon the Fund. Further, there is no increase in the advisory or other fees paid to BIM under the New Advisory Agreement, and BIM intends to pay the transaction expenses of the Fund relating to the Transaction, including the solicitation of proxies and for the Special Meeting.

The Board also considered factors presented by BIM management, which included: (i) working together, BIM and MGL and its affiliates intend to build upon the foundation that BIM has worked for over six decades to create, continue to provide high level investment management and trust services for several generations into the future and further strengthen BIM’s strong investment expertise and experience; (ii) the Transaction will improve BIM’s efficiencies, so that BIM can provide greater breadth and depth of investment management expertise and client service to the Fund and its other clients; (iii) MGI brings capital, experience, relationships, insight, and investment expertise that is complementary to BIM’s existing core services and employee base; (iv) the companies share strong cultural similarities, including a strong commitment of service to their clients, a focus for growing the value of client assets in a disciplined, professional manner, a deep commitment to integrity, and improving capabilities, processes, and avenues to serve the clients; and (v) the Transaction may enhance the potential for business value growth, which in turn creates the opportunity to significantly greater resources to invest into the BIM, primarily in the form of people and technology and resources dedicated to the investment research and portfolio management processes.

No single factor was determinative in the Board’s decision to approve the New Advisory Agreement for the Fund, but rather the Board based its determination on the total mix of information available to the Directors. Based on a consideration of all the factors in their totality, the Board determined that the New Advisory Agreement with BIM, including the advisory fees, was fair and reasonable. The Board therefore determined that the approval of the New Advisory Agreement would be in the best interest of the Fund and its shareholders.

Vote Required for Proposal 1

Approval of the proposal to approve the New Advisory Agreement requires the vote of the “majority of the outstanding voting securities” of the Fund. Under the 1940 Act, a “majority of the outstanding voting securities” is defined as the lesser of: (1) 67% or more of the voting securities of the Fund entitled to vote present in person or by proxy at the Special Meeting, if the holders of more than 50% of the outstanding voting securities entitled to vote thereon are present in person or represented by proxy; or (2) more than 50% of the outstanding voting securities of the Fund entitled to vote thereon.

BASED ON ALL OF THE FOREGOING, THE BOARD RECOMMENDS THAT SHAREHOLDERS OF THE FUND VOTE FOR THE APPROVAL OF THE NEW ADVISORY AGREEMENT.

PROPOSAL 2

ELECTION OF DIRECTORS

WHAT ARE SHAREHOLDERS BEING ASKED TO APPROVE IN PROPOSAL 2?

The purpose of this Proposal 2 (“Proposal 2”) is to re-elect eight (8) existing members to serve on the Board of Directors. In accordance with the Fund’s Articles of Incorporation and By-Laws, the Fund’s Board of Directors set the size of the Fund’s Board of Directors at not fewer than three (3) nor more than fifteen (15). The Fund’s By-Laws provide for the election of these directors who will serve until the next Annual Meeting of the shareholders and until their successors are elected and qualified. The Fund’s Articles of Incorporation and By-Laws do not require the Fund to hold an Annual Meeting of Shareholders unless otherwise required by the 1940 Act or the Articles of Incorporation. The Fund’s By-Laws provide the Board of Directors discretion to select the date and time of such Meeting, provided if an Annual Meeting is held, such date is no longer than six months after the end of the Fund’s fiscal year or fifteen months after the Fund’s last annual meeting.

The persons named in the enclosed proxy intend to nominate and vote in favor of the election of the nominees, all of whom have consented to serve the term for which they are standing for election. If for any reason any of the nominees shall become unavailable for election, the vacancy may be filled by the Board of Directors in accordance with the By-Laws, and the proxy will be voted for nominees selected by the Board of Directors, unless the Board of Directors determines not to fill such vacancy.

The Board of Directors is currently comprised of six (6) independent directors – Daniel J. Brabec, Nathan Phillips Dodge III, Adam M. Koslosky, Robert Slezak, Kelly A. Walters, and Lyn Wallin Ziegenbein; and two (2) Interested Directors – Ted Bridges and Robert W. Bridges. Each current member of the Board of Directors is being nominated for re-election at the Special Meeting of Shareholders, and except for Mr. Brabec, each of the members of the Board of Directors was elected at the Fund’s Annual Meeting of Shareholders in 2013. Mr. Brabec was originally nominated as a Board member by Nathan Phillips Dodge III. The Nominating Committee has approved the nomination of all current Board members, including Mr. Brabec, for election as Fund directors.

Section 16(a) of the 1940 Act requires that two-thirds of the members of the Board of Directors of a mutual fund must have been elected by shareholders. The current Board of Directors is in compliance with this requirement. In order to continue to comply with the requirements of the 1940 Act, the Board is requesting that shareholders of the Fund vote for the full slate of eight (8) nominees.

WHO ARE THE NOMINEES TO THE BOARD?

The determination of an interested person is based on the definition in Section 2(a)(19) of the 1940 Act and Securities and Exchange Commission Release (Release No. IC-24083, dated October 14, 1999), providing additional guidance to investment companies about the types of professional and business relationships that may be considered to be material for purposes of Section 2(a)(19). Interested persons include a director or officer of the Fund who has a significant or material business or professional relationship with the Fund’s investment adviser, BIM. Those individuals who are not “interested persons” are disinterested persons for this disclosure. The Fund considers these proposed Board members to be “independent directors” exercising care, diligence and good business judgment with respect to the governance of the Fund.

The following table is a list of the current directors of the Fund, who are standing for re-election, their age, business address and principal occupation during the past five years, any affiliation with the Fund’s Adviser, the length of service to the Fund, and the names of any entities other than the Fund where they hold a position on the board of directors. Unless otherwise noted, an individual’s business address is 256 Durham Plaza, 8401 West Dodge Road, Omaha, Nebraska, 68114.

Name, Address (if applicable) and Age | | Position(s) Held with Fund | | Term of Office and Length of Time Served | | Number of Portfolios in Fund Complex Overseen by Director | | Principal Occupation(s) During the Past Five Years | | Other Trusteeships / Directorships Held by Director During the Past Five Years |

| Non-Interested/Independent Directors |

Daniel J. Brabec Age 58 | | Director | | One Year; Since 2015 | | 1 | | Director of Spectrum Financial Services, Inc., a financial services company, since 1999 and has served as Vice President, Secretary and Treasurer since 2000. | | Spectrum Financial Services, Inc. |

Nathan Phillips Dodge III Age: 53 | | Director | | One Year; Since 2010 | | 1 | | President, N.P. Dodge Company, commercial and residential real estate brokerage, 2014 – present; Executive Vice President, N.P. Dodge Company, 1993 - 2014. | | Lauritzen Corp.; First State Bank of Loomis |

Adam M. Koslosky Age: 60 | | Director Vice Chairman | | One Year; Since 2007 One Year Since 2016 | | 1 | | General Partner, Mack Investments, Ltd., from 1999- present; Tax Matters Partner and Manager, Tri Stone Property Group, LLC, from 2012 - present; Vice Chairman, and Chief Executive Officer, Magnolia Metal Corporation, a bronze bearing manufacturer, 2014-2015, President and Chief Executive Officer Magnolia Metal Corporation 1985 - 2014. | | Nebraska Methodist Hospital Foundation |

Name, Address (if applicable) and Age | | Position(s) Held with Fund | | Term of Office and Length of Time Served | | Number of Portfolios in Fund Complex Overseen by Director | | Principal Occupation(s) During the Past Five Years | | Other Trusteeships / Directorships Held by Director During the Past Five Years |

Robert Slezak(1) Age: 59 | | Director Chairman | | One Year; Since 2008 One Year; Since 2016 | | 1 | | Independent management consultant, 1999-present. | | United Western Bancorp, Inc.*(2); Pegasus Company |

Kelly A. Walters Age: 57 | | Director | | One Year; Since 2013 | | 1 | | Partner with Kuehl Capital Holdings LLC, 2015-present; CEO of Quarter Circle Capital, an affiliate of Kuehl Capital Holdings, 2016-present; President and CEO of Condor Hospitality Trust, Inc. (formerly Supertel Hospitality, Inc.), 2009-2015. | | Condor Hospitality Trust, Inc.* (3) |

Lyn Wallin Ziegenbein Age: 64 | | Director | | One Year; Since 2013 | | 1 | | Executive Director Emerita, Peter Kiewit Foundation, 2013-present; Executive Director, Peter Kiewit Foundation, 1983 – 2013. | | Assurity Life Insurance Company; Federal Reserve Bank of Kansas City-Omaha Branch; Lamp Rynearson Engineering |

| * | Indicates publicly traded company or SEC-registered investment company. |

(1) | Mr. Slezak serves as the Lead Independent Director. |

(2) | Mr. Slezak currently is not a member of the Board of Directors of United Western Bancorp, Inc. He resigned in 2013. |

(3) | Mr. Walters currently is not a member of the Board of Directors of Condor Hospitality Trust, Inc. He resigned in 2016. |

Name, Address (if applicable) and Age | | Position(s) Held with Fund | | Term of Office and Length of Time Served | | Number of Portfolios in Fund Complex Overseen by Director | | Principal Occupation(s) During the Past Five Years | | Other Trusteeships / Directorships Held by Director During the Past Five Years |

| Interested Directors |

Edson (“Ted”) L. Bridges III, CFA(1) Age: 58 | | President Chief Executive Officer Chief Investment Officer Director | | One Year; Since 1997 One Year; Since 2004 One Year; Since 2004 One Year; Since 1991 | | 1 | | President, Chief Executive Officer and Director, Bridges Investment Management, Inc., 2000-present; Executive Vice President, Bridges Investment Counsel, Inc., 1993-present; Vice President, Provident Trust Company, 1992-present (Chairman since 2011); held various positions at Bridges Investor Services Inc., 1987-present, most recently Chairman; Managing Partner, Modern Portfolio Consultants Company, d/b/a MPC Wealth Management, 2009-present. | | Bridges Investment Management, Inc.; Bridges Investment Counsel, Inc.; Bridges Investor Services, Inc.; Provident Trust Company; Stratus Fund, Inc.* (1) |

Robert W. Bridges, CFA(2) Age: 51 | | Director | | One Year; Since 2007 | | 1 | | Executive Director, Portfolio Manager, and Co-Head of Behavioral Finance at Sterling Capital Management LLC, 2014 – present; Also has worked in various capacities for Sterling Capital Management from 1996-2014. | | Bridges Investment Counsel, Inc.; Provident Trust Company |

| * | Indicates publicly traded company or SEC-registered investment company. |

(1) | Edson L. Bridges III is the son of Edson L. Bridges II and brother of Robert W. Bridges. Mr. Bridges III is an interested person because he is a director and officer of the Fund and a director and officer of the Fund’s investment adviser, BIM. Mr. Bridges is no longer a director of Stratus Fund, which fund ceased to exist when it was terminated in June 2016. |

(2) | Robert W. Bridges is the son of Edson L. Bridges II and brother of Edson L. Bridges III, both of whom are “affiliated persons” and “interested persons” of the Fund. Because of these relationships, Robert W. Bridges is considered to be both an affiliated and interested person. |

Board Composition and Leadership Structure

The Fund’s Board of Directors provides oversight of Fund management and operations of the Fund. Like all mutual funds, the day-to-day responsibility for the management and operation of the Fund is the responsibility of the various service providers to the Fund, such as the Fund’s Adviser, Administrator, Custodian and Transfer Agent, each of whom are discussed in greater detail in this Proxy Statement.

The Fund’s Board has structured itself in a manner that it believes allows it to effectively perform its oversight function. It has established an Audit Committee and an Administration and Nominating Committee, which are discussed in greater detail under “Committees” below. In addition, the independent directors of the Fund hold separate meetings without Fund management present, and have engaged their own independent counsel to advise them on matters relating to their responsibilities in connection with the Fund.

To rely on certain exemptive rules under the 1940 Act, the Fund Board conducts an annual evaluation of director independence, and currently over 75% of the Fund Directors are independent directors, including the Board Chairman, Robert Slezak, who has also been designated as the Lead Independent Director. In such roles, Mr. Slezak chairs meetings of the Board and executive sessions of the independent directors, works with Fund management to set Board meeting agendas and facilitates communication among the independent directors, their counsel and Fund management. In addition, Adam M. Koslosky has been elected by the Board to serve as Vice Chairman. The Vice Chairman of the Board performs the duties of the Chairman if the Chairman is absent or if the Chairman’s office is otherwise vacant. The Vice Chairman of the Board is also an independent director. The Board has determined that its leadership structure, in which the independent directors have elected a Chairman who is an independent director, designated a Lead Independent Director, and elected a Vice Chairman who is an independent director, each to function as described above, is appropriate in light of the services that the Adviser and its affiliates provide to the Fund and potential conflicts of interest that could arise from these relationships.

Board Oversight of Risk Management

Responsibility for risk oversight rests with the full Board of Directors. Committees of the Board assist the Board in carrying out this responsibility by focusing on key areas of risk inherent in Fund operations and business. As part of its risk oversight function, the Board has directed Fund management to evaluate and assess on an on-going basis, the enterprise risks facing the Fund and its operations. Based on Fund management’s evaluation, a determination is made as to the primary enterprise risks most applicable to the Fund. These primary enterprise risks are reviewed by Fund management with the Board on a periodic basis, but not less than annually, except for risks related to portfolio investment decisions which are reviewed by the Board at the Board’s quarterly meeting. The determination as to primary risks facing the Fund is not static, but subject to change from time to time based on economic, industry, regulatory and other factors impacting the Fund.

Director Qualifications

The Board of Directors believes that each Board member has the qualifications, experience, attributes, and skills appropriate for continued service as a Fund Board member in light of the Fund’s business and structure. The Board members have substantial business and professional backgrounds, which indicate they have the ability to access, critically review, and evaluate information provided to them. In addition, each Board member has served as an executive and/or board member for other organizations.

The following is a brief discussion of the experience, qualifications, attributes, and/or skills that led to the Board of Directors’ conclusion that the individuals identified below are qualified to serve as Board members of the Fund:

Daniel J. Brabec has been a Director of Spectrum Financial Services, Inc. in Omaha, Nebraska since February 1999 and has served as Vice President, Secretary, and Treasurer since 2000. He has directly managed real estate and commercial credit assets for a number of affiliates of Spectrum Financial Services, Inc. since January 2009. Prior to that, he served as a Director of Great Western Bank, Omaha, Nebraska and was its Chief Executive Officer and President from 2001 until its sale in 2008, and served as Controller for Great Western Bancorporation in an interim role from 1999 to 2001. He began his career in banking in 1985 joining Pioneer Bank, St Louis, Missouri after three years with Control Data Corporation and served as Executive Vice President, Security Officer, and Director of Rushmore Bank and Trust, Rapid City, South Dakota from 1993 to 1999. Over the years, Mr. Brabec has served on the Board of Directors of the United Way of the Black Hills, The United Way of the Midlands, and the Nebraska Association of Bankers and as a Director and Officer for the Nebraska Chapters of Young Presidents Organization and World Presidents Organization. Mr. Brabec holds a Bachelor’s Degree in Journalism from the University of Nebraska-Lincoln (1982), has completed the ABA’s Graduate School of Banking Program at the University of Colorado, and in June 2011, completed Columbia Business School’s Value Investing Executive Education Program. Mr. Brabec has more than 25 years of experience in the community banking industry and has had a key leadership role in various companies during his career. Because of these positions and his experience, Mr. Brabec contributes substantial business, corporate governance, and leadership experience.

Edson L. Bridges III, CFA, has been a full-time member of the professional staff of Bridges Investment Counsel, Inc. since August 1983. Mr. Bridges has been responsible for securities research and the investment management for an expanding base of discretionary management accounts, including the Fund, for over ten years. Mr. Bridges was elected President of the Fund on April 11, 1997, and became Chief Executive Officer on April 13, 2004. Mr. Bridges has been Executive Vice President of Bridges Investment Counsel, Inc. since February 1993, as well as a Director. Mr. Bridges is an officer and a Director of Bridges Investor Services, Inc. and Chairman of the Board of Provident Trust Company, as well as the Managing Partner of Modern Portfolio Consultants Company, d/b/a MPC Wealth Management since 2009. Since December 2000, Mr. Bridges has been President, Chief Executive Officer, and Director of Bridges Investment Management, Inc. Mr. Bridges became a Director of Stratus Fund, Inc., an open-end, regulated investment company located in Lincoln, Nebraska, in October, 1990 and was Chairman of the Audit Committee of the Stratus Fund. He served in those positions until June 2016, when that fund ceased to exist and was terminated. Mr. Bridges brings to the Board an understanding of the Fund’s history, business, and operations attributed to his long-standing commitment to, management of, and involvement with the Fund for more than 30 years, as well as his experience as a director of another investment company. Because of these positions, Mr. Bridges also provides the Board with an important insider perspective and management’s point-of-view about various aspects of the Fund’s business operations and strategies.

Robert W. Bridges, CFA, is an Executive Director, Portfolio Manager, and Co-Head of Behavioral Finance at Sterling Capital Management LLC. Sterling Capital Management LLC, located in Charlotte, North Carolina, is an investment management company founded in 1970. Mr. Bridges commenced his career with Sterling Capital Management, LLC in 1996 and served in a variety of capacities including client service, systems integration, and compliance and from 2000 to 2014, served as Director and Senior Equity Analyst. Mr. Bridges has been a Director of Bridges Investment Counsel, Inc. since December 2006. Prior to joining Sterling, Mr. Bridges served in accounting, research analysis, and several other roles for Bridges Investment Counsel, Inc. for six years. Mr. Bridges earned his B.S. in Business from Wake Forest University, and became a CFA charter holder in 2003. Mr. Bridges brings over 25 years’ experience in the investment company industry, and historical knowledge of management and operations of the Fund. Through his experiences, Mr. Bridges also is experienced with financial, accounting, regulatory, compliance, and investment matters.

Nathan Phillips Dodge III is President of N. P. Dodge Company, a leading commercial and residential real estate brokerage in the area of Omaha, Nebraska since April 2014, and served as Executive Vice President prior to that time. Mr. Dodge has worked at N.P. Dodge Company since October, 1993. After earning his BA in economics at Tufts University, Mr. Dodge held the following positions at the Federal National Mortgage Association in Washington, D.C.: Senior Housing Analyst, Senior Training Analyst, and Rural Product Manager. He helped develop, market, and manage various loan programs for Fannie Mae. Mr. Dodge is active in local civic organizations and has served as a director on a number of boards. Mr. Dodge possesses overall board experience, administrative competence, executive experience and leadership skills. As a result of these experiences, Mr. Dodge contributes a broad perspective of our community and leadership skills.

Adam M. Koslosky was elected Vice Chairman of the Board on October 14, 2016. Mr. Koslosky served as the Vice Chairman and Chief Executive Officer of Magnolia Metal Corporation until 2015. Magnolia Metal Corporation is a bronze bearing manufacturer located in Omaha, Nebraska. Prior to that, Mr. Koslosky served as President and Chief Executive Officer from 1985 – 2014 and commenced his career with Magnolia Metal Corporation in 1978 as Controller and Treasurer. Mr. Koslosky also is a general partner of Mack Investments, Ltd., and Tax Matters Partner and Manager of Tri Stone Property Group, LLC, both privately held investment and development companies located in Omaha, Nebraska. He has been a Director of Nebraska Methodist Hospital Foundation since 1993. Mr. Koslosky earned a BS in finance from Virginia Polytechnical Institute and State University (Virginia Tech) and has over 38 years of experience as an executive, providing him with broad leadership, organizational, and executive level management skills. Mr. Koslosky also has significant knowledge and experience in financial management, accounting processes, and corporate governance, derived in part, from his experience with a private investment company. From these experiences, he contributes substantial accounting and financial expertise and sophistication and experience with regulatory and investment matters.

Robert T. Slezak was elected Chairman of the Board on October 14, 2016. Prior to that, Mr. Slezak served as Vice Chairman of the Board since 2012. Mr. Slezak is currently an independent management consultant and has been since November 1999. Prior to that, Mr. Slezak served as Vice President, Chief Financial Officer, and Treasurer of the Ameritrade Holding Corporation from January 1989 to November 1999 and as a Director from October 1996 to September 2002. Mr. Slezak currently serves as a member of the board of directors of Pegasus Company, a developer of solar power projects and formerly served as a member of the board of directors of United Western Bancorp, Inc. until his resignation in 2013. Mr. Slezak has several years of experience as a financial officer of a publicly traded company and as a board member of publicly traded companies. From these experiences, he contributes to the Board substantial accounting and financial expertise and sophistication and experience with regulatory and corporate governance matters.

Kelly A. Walters is currently a partner with Kuehl Capital Holdings LLC and the Chief Executive Officer of Quarter Circle Capital, an affiliate of Kuehl Capital Holdings since 2016. Prior to those positions, Mr. Walters was the President and Chief Executive Officer (“CEO”) of Condor Hospitality Trust, Inc. (formerly Supertel Hospitality, Inc.) (“Condor”), a NASDAQ listed hospitality real estate investment trust based in Norfolk, Nebraska from April 2009 through February 2015. He also served as a member of the Board of Directors of Condor from April 2010 to March 2016. Prior to joining Condor, Mr. Walters was the Senior Vice President of Capital Markets at Investors Real Estate Trust (“IRET”) from October 2006 to March 2009. Prior to IRET, Mr. Walters was a Senior Vice President and Chief Investment Officer of Magnum Resources, Inc. (“Magnum”), a privately held real estate investment and operating company, from 1996 to 2006. Prior to Magnum, Mr. Walters was a Deputy Manager of Brown Brothers Harriman from 1993 to 1996, an Investment Manager at Peter Kiewit Sons, Inc. from 1985 to 1993, and a stockbroker at Piper, Jaffrey and Hopwood from 1983 to 1985. Mr. Walters earned his undergraduate degree in banking and finance from the University of Nebraska at Omaha, and his MBA from the University of Nebraska at Omaha. Mr. Walters has 34 years of experience in the investment industry, including over 20 years in senior and executive level positions. From his positions, Mr. Walters has an extensive knowledge of investments, corporate governance and leadership experience. From these experiences, he contributes to the Board substantial accounting and financial expertise and sophistication and experience with regulatory and corporate governance matters.

Lyn Wallin Ziegenbein is an attorney and currently serves as the Executive Director Emerita of the Peter Kiewit Foundation, a private foundation awarding charitable grants throughout Nebraska and portions of Iowa and Wyoming, since April 2013 and prior to that, served as the Executive Director of the Peter Kiewit Foundation since March, 1983. Ms. Wallin Ziegenbein has served on the Board of Directors of Assurity Life Insurance Company since 1984 and serves on the Board of Directors of Lamp Rynearson Engineering. Previously, Ms. Wallin Ziegenbein served on the Federal Reserve Bank of Kansas City’s Omaha Branch Board of Directors from 2006 to 2011. Ms. Wallin Ziegenbein’s prior experience also includes serving as a director of Norwest Bank Nebraska and Lincoln Telephone and Telegraph. Ms. Wallin Ziegenbein also served as an Assistant United States Attorney for Nebraska from 1978 to 1982. Ms. Wallin Ziegenbein earned her undergraduate degree in journalism from the University of Kansas and her law degree from Creighton University. Ms. Wallin Ziegenbein has over 34 years of experience as an executive and a director, and from these experiences contributes to the Board of Directors accounting and financial expertise and sophistication and experience with regulatory and corporate governance matters. During the past seven years, Ms. Wallin Ziegenbein has had primary responsibility of acquiring approximately 30 acres of blighted inner-city property for rejuvenation through a charitable partnership. This work has further strengthened her analytical skills of financial transactions.

Committees

For the fiscal year ended December 31, 2016, the Fund’s Audit Committee consisted of Messrs. Koslosky (Chair), Brabec and Slezak. The members of the Audit Committee are not “interested” persons of the Fund (as defined in the 1940 Act). The primary responsibilities of the Fund’s Audit Committee are to establish the scope of review for the annual audit by the Fund’s independent registered public accounting firm, and to work with representatives of the Fund’s independent registered public accounting firm to establish such guidelines and tests for the audit which are deemed appropriate and necessary. The Audit Committee met twice during the Fund’s most recent fiscal year. The Audit Committee has a charter, which is available on the Fund’s website at www.bridgesfund.com under “Resources.”

The Fund also has an Administrative and Nominating Committee, consisting of Mr. Dodge III, Ms. Wallin Ziegenbein (Chair) and Mr. Walters each of whom is not an “interested person” of the Fund. The primary responsibilities of the Administrative and Nominating Committee are to periodically review the composition of the Board of Directors, evaluate candidates’ qualifications for Board membership, including such candidates’ independence from the Fund’s investment manager, and make nominations for independent director membership on the Board. Although the Committee does not have a formal policy on diversity, the Committee periodically considers diversity when it reviews the Board’s composition and determines whether to add individuals with different backgrounds or skill sets from those already on the Board. The Committee’s Charter is available on the Fund’s website at www.bridgesfund.com under “Resources.”

The Administration and Nominating Committee will consider nominees recommended by Fund shareholders. Such recommendations should be in writing and addressed to the Fund, Attention: Administration and Nominating Committee, with the name, address, biographical information and telephone number of the person recommended and of the recommending person. In addition, the Administration and Nominating Committee periodically reviews and makes recommendations with respect to Board governance procedures, compensation, and the Fund’s investment advisory agreement. The Administrative and Nominating Committee met once during the Fund’s most recent fiscal year.

Director Share Ownership

The following table sets forth the aggregate dollar range of equity securities beneficially owned by each current director as of March 31, 2017:

Name of Director | Dollar Range of Equity Securities in the Fund |

| | None | $1 - $10,000 | $10,001 - $50,000 | $50,001 - $100,000 | Over $100,000 |

| Daniel J. Brabec | X | | | | |

| Edson L. Bridges III | | | | | X |

| Robert W. Bridges | | | | | X |

| Nathan Phillips Dodge III | | | | | X |

| Adam M. Koslosky | | | | | X |

| Robert Slezak | | | | X | |

| Kelly A. Walters | | | | | X |

| Lyn Wallin Ziegenbein | X | | | | |

As of the Record Date, each of the nominees and executive officers of the Fund owned individually and collectively as a group ____% of the outstanding shares of the Fund.

Director Interest in Adviser or Affiliates

As of December 31, 2016, neither the directors who are not “interested persons” of the Fund, as that term is defined in the 1940 Act, nor members of their immediate family, own securities beneficially or of record in the Adviser or any affiliate of the Adviser or in MGI or MGL or any of their affiliates. Accordingly, as of December 31, 2016, neither the directors, who are not “interested persons” of the Fund, as that term is defined in the 1940 Act, nor members of their immediate family, have direct or indirect interest, the value of which exceeds $120,000, in the Adviser or any of their affiliates or in MGI or MGL or any of their affiliates and have not had such an interest during the past five years and are not currently proposed. As disclosed under the section titled “Transaction” above, certain members of the Bridges family will own part of the BHC after the Transaction closes.

Michael C. Meyer, a former Fund director, is the Operating Partner of McCarthy Partners Management, LLC (“McCarthy Partners”) and has served in that position since 2013. McCarthy Partners is affiliated with BHC, MGL and MGI. Mr. Meyer served as a Fund director from 2008 - 2016, including as Chairman and Lead Independent Director from 2012 – 2016. He resigned from the Fund Board of Directors in October 2016 prior to the parties commencing negotiations regarding a potential transaction. Mr. Meyer currently owns 4,831 shares of the Fund.

Director Interest in Any Material Transactions with Adviser or Affiliates