Fifty-Sixth

Annual Shareholder Report

2018

Beginning on January 1, 2021, as permitted by regulations adopted by the SEC, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund (defined herein) or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website (www.bridgesfund.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-866-934-4700 or by sending an e-mail request to fund@bridgesinv.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1-866-934-4700 or by send an e-mail request to fund@bridgesinv.com to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary.

1125 South 103rd Street - Suite 580 – Omaha, NE 68124

P: (402) 397-4700 F: (402) 397-1555 www.bridgesfund.com

(This Page Intentionally Left Blank.)

Contents of Report

| Page 1 | Shareholder Letter |

| Exhibit 1 | Portfolio Transactions During the |

| Page 5 | Period from July 1, 2018 through |

| | December 31, 2018 |

| Exhibit 2 | Selected Historical Financial Information |

| Pages 6-7 | |

| Pages 8-9 | Expense Example |

| Page 10 | Allocation of Portfolio Holdings |

| Pages 11-26 | Financial Statements and Report of |

| | Independent Registered Public |

| | Accounting Firm |

| Page 27 | Privacy Policy |

| Pages 28-29 | Additional Disclosures |

| MD&A 1 – 11 | Management Discussion and Analysis |

IMPORTANT NOTICES

Must be preceded or accompanied by a Prospectus.

Opinions expressed herein are those of Edson L. Bridges III and are subject to change. They are not guarantees and should not be considered investment advice.

Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. Current and future portfolio holdings are subject to risk. Please refer to the Schedule of Investments for complete fund holdings.

The S&P 500 Index is a broadly based unmanaged composite of 500 stocks which is widely recognized as representative of price changes for the U.S. equity market in general. The Russell 1000 Growth Index is an unmanaged composite of stocks that measures the performance of the stocks of companies with higher price-to-book ratios and higher forecasted growth values from a universe of the 1,000 largest U.S. companies based on total market capitalization. You cannot invest directly in a specific index.

Free Cash Flow is a measure of financial performance calculated as operating cash flow minus capital expenditures. Free cash flow (FCF) represents the cash that a company is able to generate after laying out the money required to maintain or expand its asset base.

The Price-to-Earnings Ratio or P/E ratio is a ratio for valuing a company that measures its current share price relative to its per-share earnings.

Earnings growth for a Fund holding does not guarantee a corresponding increase in market value of the holding or the Fund.

Mutual fund investing involves risk. Principal loss is possible. Small and medium capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. The Fund invests in foreign securities which involve political, economic and currency risks, greater volatility and differences in accounting methods.

While the fund is no-load, management fees and other expenses still apply.

The Bridges Investment Fund is distributed by Quasar Distributors, LLC.

January 16, 2019

Dear Shareholder:

Performance

Bridges Investment Fund had a total return of -3.76% for the one-year period ending December 31, 2018. By comparison, the S&P 500 (SPX or “the Index”) had a total return of -4.38%, while the Russell 1000 Growth Index had a total return of -1.51% for the year. The Fund had annualized total returns of 7.93%, 6.65%, and 12.20% for the 3, 5, and 10-year periods ending December 31, 2018, compared to total returns of 9.26%, 8.49%, and 13.12% for the S&P 500, and 11.15%,10.40%, and 15.29% for the Russell 1000 Growth Index over the same periods of time. Three, five, and ten-year periods are annualized. The Fund’s gross expense ratio is 0.80%, as disclosed in the most recent Prospectus.

Performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance stated above. Performance data current to the most recent month end may be obtained by calling 866-934-4700.

Review of 2018 and Outlook for 2019

Volatility returned to the capital markets with a vengeance in 2018, after an uncharacteristically placid 2017. Downside volatility was especially pronounced in late January – early February, when the SP&P 500 declined 12% in eight trading days.

After the sharp decline early in the year, stocks moved steadily higher through the end of the third quarter, propelled by strong corporate earnings growth.

However, equities sold off sharply in early October, initially based on hawkish comments from new Federal Reserve Chairman Powell. While Powell moderated his stance later in the quarter, investors also focused on a variety of other issues in the quarter, ranging from concerns about the strength of future earnings growth, the timing of the next recession, risks around trade and tariff negotiations with China, softening global economic data, and continued dysfunction in Washington.

The fourth quarter was the worst for stocks since 2008, and equities posted their worst December since 1931. The S&P 500 declined 20.2% between October 2 and December 26 (technically a “bear market”), and while the SPX rallied 6.5% over the last four trading days of the year, the Index ended the year with a total return of -4.38%, its first negative year since 2008.

The critical question for investors is whether the fourth quarter’s stock decline is signaling the onset of a recession, or whether the fourth quarter pullback in stock prices represents a normal correction within the context of a continuation of the current economic expansion.

While economic data has shown signs of softening since mid-2018, in our view, there are few indications that a recession is imminent.

Shareholder Letter | January 16, 2019 |

The decline in stock prices during the fourth quarter of 2018 improved equity valuations materially. The S&P 500 ended the third quarter with a valuation of 16.4x estimated 2019 earnings, and it closed 2018 trading at 14.6x estimated 2019 earnings. (Notably, consensus earnings estimates for the S&P 500 for 2019 fell from $179 to $171 during the quarter).

We have established a 2019 year-end “fair value” target range of 2,550-3,175 for the S&P 500 (15.0x-18.0x estimated 2019 earnings of $170-177), which implies upside of roughly 15% from the S&P’s 2018 year-end level of 2,506 to the midpoint of our range of fair value. Our preliminary year-end 2020 fair value target range is 2,700-3,350 (15.0-18.0x estimated 2020 earnings of $180-187). Our single point year-end fair value estimates for 2019 and 2020 are 2,900 and 3,100 respectively.

We expect continued equity market volatility in 2019, and we would not be surprised if stocks traded 20-25% below and above the 2018 year-end level of the S&P 500 of 2,506 during the upcoming year.

The salient risks that impact our outlook for 2019 are the same as those that contributed to the capital markets volatility in the fourth quarter:

| | 1. | Corporate earnings growth is likely to slow in 2019, as the effects of the 2017 corporate income tax recede. In our view, company management commentary coincident with the release of fourth quarter earnings in January will be more important than usual, given the market’s reaction to third quarter earnings, which were generally in line with expectations, but which in many cases were viewed as “not good enough” and/or were accompanied by tepid forward commentary by management. |

| | | |

| | 2. | Economic data showed some softening during the fourth quarter; investors will be keenly attuned to data points that may suggest the onset of the next recession as the first half of 2019 unfolds. |

| | | |

| | 3. | The Fed’s response to economic data in the first half of 2019 will be critical; a continued hawkish stance would likely result in periods of material stock price weakness. |

| | | |

| | 4. | Trade policy with China will also be an important factor impacting capital markets; further political dysfunction and uncertainty emanating from Washington is also a key risk factor in the first half of 2019. |

While we expect 2019 to be volatile and challenging, we are constructive on the long-term outlook for equities given the level of current valuations and our expectation that long-term corporate earnings growth will be positive.

Our Portfolio

The Fund’s portfolio continues to be comprised primarily of companies with strong balance sheets, high levels of profitability, and a demonstrated ability to grow business value over the long-term despite periodically challenging economic conditions.

Shareholder Letter | January 16, 2019 |

The Fund’s ten largest individual stock holdings as of December 31, 2018, included:

| | MasterCard | | | 7.57 | % |

| | Apple | | | 6.84 | |

| | Alphabet | | | 5.39 | |

| | Amazon | | | 4.86 | |

| | iShares S&P Mid Cap ETF | | | 4.30 | |

| | Visa | | | 3.42 | |

| | iShares S&P Small Cap ETF | | | 3.36 | |

| | Booking Holdings | | | 3.01 | |

| | Berkshire Hathaway Class B | | | 2.64 | |

| | Union Pacific | | | 2.50 | |

The following table summarizes the changes we made in the Fund in 2018:

NEW BUYS: | ADDS: | TRIMS: | SELLS: |

| Microsoft | BlackRock | Booking Holdings | UPS |

| Old Dominion | Boeing | Celgene | |

| S&P Global | Booking Holdings | MasterCard | |

| United Health | Continental | | |

| XPO Logistics | Resources | | |

| | EOG Resources | | |

| | FedEx | | |

| | Home Depot | | |

| | Iqvia | | |

| | Lowe’s | | |

| | Martin Marietta | | |

| | Materials | | |

The companies that were the most additive to the Fund’s return in 2018 included Amazon, MasterCard, PayPal, Starbucks, Thermo Fisher Scientific, and Visa.

The companies that were the largest drag on performance in 2018 included Apple, Blackrock. Capital One, Celgene, Facebook, FedEx, iShares Core S&P Mid Cap ETF, and Wells Fargo.

We believe the Fund’s holdings are both 1) well-positioned to grow their business value over the next several years, and 2) valued at levels that are reasonably attractive over the long-run given our assessment of their business value growth potential.

From a valuation standpoint, we believe the Fund’s holdings are attractively valued looking out over the next several years. At present, the Fund’s portfolio trades at 16.0x estimated 2019 earnings and 14.0x estimated 2020 earnings, with a projected long-term annual earnings growth of 11-13%. This compares with the 14.7x 2019 P/E, 13.3x 2020 P/E, and 5-6% long term annual earnings growth projected for the S&P 500.

Within the context of challenging and volatile capital markets conditions, investment philosophy and process are important guides that provide us with a framework to evaluate investment opportunities. Our investment process continues to emphasize core tenets of: 1) focusing on high quality businesses with favorable prospects for growing intrinsic value at attractive rates over time, 2) incorporating a strong valuation discipline, and 3) employing a long-term approach to the process of investing in equities.

Shareholder Letter | January 16, 2019 |

Our primary investment goal is to identify and own companies that have strong franchise characteristics and attractive valuation metrics, such that business value growth generated over the long-term leads to positive shareholder returns.

Our investment management approach is based on the premise that over the long run, good businesses produce growth in underlying business value, which in turn drives investment returns for their shareholders that is commensurate with business value growth.

We seek to identify and own high-quality businesses that trade at a discount to our appraisal of their fair value, and that are growing business value for their shareholders at attractive rates.

We continue to favor equities that have strong and durable business franchises and a demonstrated ability to grow revenues, free cash flow, earnings, dividends, and underlying business value at solid rates notwithstanding a sluggish and highly competitive global economic environment.

Over time, we expect to benefit from our investment approach in two ways: 1) as our companies move from being undervalued relative to our appraisal of fair value toward our estimate of fair value (positive change in valuation), and 2) from the growth in our companies’ underlying business value over time, which is driven by increasing revenues, earnings, dividends, and free cash flow.

We are confident that our investment approach should be effective over time, as stock prices tend to track underlying changes in business value over the long-run. Periods of broad stock market weakness, such as the fourth quarter of 2018, create more opportunities for us to identify attractive new equity investment candidates, and/or to add to existing holdings at attractive valuation levels.

The Fund will hold its 56th annual meeting on April 2, 2019. Fund management will provide its outlook for the capital markets and the Fund for 2019 and beyond. We appreciate your continued investment in Bridges Investment Fund and we encourage all shareholders to attend this year’s annual meeting.

| | Sincerely, |

| | |

| |  |

| | |

| | Edson L. Bridges III, CFA |

| | President and Chief Executive and Investment Officer |

Exhibit 1

BRIDGES INVESTMENT FUND, INC.

PORTFOLIO TRANSACTIONS

DURING THE PERIOD FROM

JULY 1, 2018 THROUGH DECEMBER 31, 2018

(Unaudited)

| | | Bought or | | | Held After | |

Securities | | Received | | | Transactions | |

| Common Stock Unless | | $1,000 Par | | | $1,000 Par | |

| Described Otherwise | | Value (M) | | | Value (M) | |

| | | or Shares | | | or Shares | |

| | | | | | | |

| BlackRock, Inc. | | | 500 | | | | 9,500 | |

| Boeing Co. | | | 500 | | | | 2,500 | |

| Booking Holdings, Inc. | | | 100 | | | | 2,700 | |

Cigna Corp.(1) | | | 6,085 | | | | 6,085 | |

| Continental Resources, Inc. | | | 2,000 | | | | 47,000 | |

| EOG Resources, Inc. | | | 5,000 | | | | 20,000 | |

| FedEx Corp. | | | 2,000 | | | | 10,000 | |

| Home Depot, Inc. | | | 1,000 | | | | 11,000 | |

| IQVIA Holdings, Inc. | | | 3,000 | | | | 8,000 | |

| Lowe’s Companies, Inc. | | | 2,000 | | | | 9,000 | |

| Martin Marietta Materials, Inc. | | | 5,000 | | | | 8,000 | |

| Microsoft Corp. | | | 25,000 | | | | 25,000 | |

| Old Dominion Freight Line, Inc. | | | 12,000 | | | | 12,000 | |

| S&P Global, Inc. | | | 13,000 | | | | 13,000 | |

| UnitedHealth Group, Inc. | | | 3,000 | | | | 8,000 | |

| XPO Logistics, Inc. | | | 20,000 | | | | 20,000 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | Sold or | | | Held After | |

Securities | | Exchanged | | | Transactions | |

| Common Stock Unless | | $1,000 Par | | | $1,000 Par | |

| Described Otherwise | | Value (M) | | | Value (M) | |

| | | or Shares | | | or Shares | |

| | | | | | | | | |

| Celgene Corp. | | | 6,000 | | | | 44,000 | |

Express Scripts Holding Co.(1) | | | 25,000 | | | | — | |

| MasterCard, Inc. | | | 8,000 | | | | 62,000 | |

| United Parcel Service, Inc. | | | 10,000 | | | | — | |

(1) | Cigna Corp. shares were received as a result of merger with Express Scripts Holding Co. |

Exhibit 2

BRIDGES INVESTMENT FUND, INC.

SELECTED HISTORICAL FINANCIAL INFORMATION

(Unaudited)

– – – – – – – – – Year End Statistics – – – – – – – – – –

| Valuation | | | Net | | | Shares | | | Net Asset | | | Dividend/ | | | Capital | |

| Date | | | Assets | | | Outstanding | | | Value/Share | | | Share | | | Gains/Share | |

| 07-01-63 | | | $ | 109,000 | | | | 10,900 | | | $ | 10.00 | | | $ | — | | | $ | — | |

| 12-31-63 | | | | 159,187 | | | | 15,510 | | | | 10.13 | | | | .07 | | | | — | |

| 12-31-64 | | | | 369,149 | | | | 33,643 | | | | 10.97 | | | | .28 | | | | — | |

| 12-31-65 | | | | 621,241 | | | | 51,607 | | | | 12.04 | | | | .285 | | | | .028 | |

| 12-31-66 | | | | 651,282 | | | | 59,365 | | | | 10.97 | | | | .295 | | | | — | |

| 12-31-67 | | | | 850,119 | | | | 64,427 | | | | 13.20 | | | | .295 | | | | — | |

| 12-31-68 | | | | 1,103,734 | | | | 74,502 | | | | 14.81 | | | | .315 | | | | — | |

| 12-31-69 | | | | 1,085,186 | | | | 84,807 | | | | 12.80 | | | | .36 | | | | — | |

| 12-31-70 | | | | 1,054,162 | | | | 90,941 | | | | 11.59 | | | | .37 | | | | — | |

| 12-31-71 | | | | 1,236,601 | | | | 93,285 | | | | 13.26 | | | | .37 | | | | — | |

| 12-31-72 | | | | 1,272,570 | | | | 93,673 | | | | 13.59 | | | | .35 | | | | .08 | |

| 12-31-73 | | | | 1,025,521 | | | | 100,282 | | | | 10.23 | | | | .34 | | | | .07 | |

| 12-31-74 | | | | 757,545 | | | | 106,909 | | | | 7.09 | | | | .35 | | | | — | |

| 12-31-75 | | | | 1,056,439 | | | | 111,619 | | | | 9.46 | | | | .35 | | | | — | |

| 12-31-76 | | | | 1,402,661 | | | | 124,264 | | | | 11.29 | | | | .38 | | | | — | |

| 12-31-77 | | | | 1,505,147 | | | | 145,252 | | | | 10.36 | | | | .428 | | | | .862 | |

| 12-31-78 | | | | 1,574,097 | | | | 153,728 | | | | 10.24 | | | | .481 | | | | .049 | |

| 12-31-79 | | | | 1,872,059 | | | | 165,806 | | | | 11.29 | | | | .474 | | | | .051 | |

| 12-31-80 | | | | 2,416,997 | | | | 177,025 | | | | 13.65 | | | | .55 | | | | .0525 | |

| 12-31-81 | | | | 2,315,441 | | | | 185,009 | | | | 12.52 | | | | .63 | | | | .0868 | |

| 12-31-82 | | | | 2,593,411 | | | | 195,469 | | | | 13.27 | | | | .78 | | | | .19123 | |

| 12-31-83 | | | | 3,345,988 | | | | 229,238 | | | | 14.60 | | | | .85 | | | | .25 | |

| 12-31-84 | | | | 3,727,899 | | | | 278,241 | | | | 13.40 | | | | .80 | | | | .50 | |

| 12-31-85 | | | | 4,962,325 | | | | 318,589 | | | | 15.58 | | | | .70 | | | | .68 | |

| 12-31-86 | | | | 6,701,786 | | | | 407,265 | | | | 16.46 | | | | .688 | | | | .86227 | |

| 12-31-87 | | | | 7,876,275 | | | | 525,238 | | | | 15.00 | | | | .656 | | | | 1.03960 | |

| 12-31-88 | | | | 8,592,807 | | | | 610,504 | | | | 14.07 | | | | .85 | | | | 1.10967 | |

| 12-31-89 | | | | 10,895,182 | | | | 682,321 | | | | 15.97 | | | | .67 | | | | .53769 | |

| 12-31-90 | | | | 11,283,448 | | | | 744,734 | | | | 15.15 | | | | .67 | | | | .40297 | |

| 12-31-91 | | | | 14,374,679 | | | | 831,027 | | | | 17.30 | | | | .66 | | | | .29292 | |

| 12-31-92 | | | | 17,006,789 | | | | 971,502 | | | | 17.51 | | | | .635 | | | | .15944 | |

| 12-31-93 | | | | 17,990,556 | | | | 1,010,692 | | | | 17.80 | | | | .6225 | | | | .17075 | |

| 12-31-94 | | | | 18,096,297 | | | | 1,058,427 | | | | 17.10 | | | | .59 | | | | .17874 | |

| 12-31-95 | | | | 24,052,746 | | | | 1,116,620 | | | | 21.54 | | | | .575 | | | | .19289 | |

| 12-31-96 | | | | 29,249,488 | | | | 1,190,831 | | | | 24.56 | | | | .55 | | | | .25730 | |

| 12-31-97 | | | | 36,647,535 | | | | 1,262,818 | | | | 29.02 | | | | .5075 | | | | .30571 | |

| 12-31-98 | | | | 48,433,113 | | | | 1,413,731 | | | | 34.26 | | | | .44 | | | | 2.11648 | |

Exhibit 2

(Continued)

BRIDGES INVESTMENT FUND, INC.

SELECTED HISTORICAL FINANCIAL INFORMATION

(Unaudited)

– – – – – – – – – Year End Statistics – – – – – – – – – –

| Valuation | | | Net | | | Shares | | | Net Asset | | | Dividend/ | | | Capital | |

| Date | | | Assets | | | Outstanding | | | Value/Share | | | Share | | | Gains/Share | |

| 12-31-99 | | | $ | 69,735,684 | | | | 1,508,154 | | | $ | 46.24 | | | $ | .30 | | | $ | .91088 | |

| 12-31-00 | | | | 71,411,520 | | | | 1,850,301 | | | | 38.59 | | | | .40 | | | | .80880716 | |

| 12-31-01 | | | | 60,244,912 | | | | 1,940,494 | | | | 31.05 | | | | .26 | | | | — | |

| 12-31-02 | | | | 45,854,541 | | | | 1,989,769 | | | | 23.05 | | | | .20 | | | | — | |

| 12-31-03 | | | | 62,586,435 | | | | 2,016,560 | | | | 31.04 | | | | .24 | | | | — | |

| 12-31-04 | | | | 74,281,648 | | | | 2,230,038 | | | | 33.31 | | | | .305 | | | | — | |

| 12-31-05 | | | | 80,715,484 | | | | 2,305,765 | | | | 35.01 | | | | .2798 | | | | — | |

| 12-31-06 | | | | 82,754,479 | | | | 2,336,366 | | | | 35.42 | | | | .2695 | | | | — | |

| 12-31-07 | | | | 77,416,617 | | | | 2,258,380 | | | | 34.28 | | | | .2364 | | | | 2.5735 | |

| 12-31-08 | | | | 49,448,417 | | | | 2,257,410 | | | | 21.91 | | | | .2603 | | | | — | |

| 12-31-09 | | | | 67,435,343 | | | | 2,303,377 | | | | 29.28 | | | | .17 | | | | — | |

| 12-31-10 | | | | 75,014,486 | | | | 2,307,301 | | | | 32.51 | | | | .126 | | | | — | |

| 12-31-11 | | | | 73,779,028 | | | | 2,266,478 | | | | 32.55 | | | | .1586 | | | | — | |

| 12-31-12 | | | | 83,361,384 | | | | 2,256,216 | | | | 36.95 | | | | .207 | | | | — | |

| 12-31-13 | | | | 110,155,511 | | | | 2,335,264 | | | | 47.17 | | | | .2408 | | | | 1.62945 | |

| 12-31-14 | | | | 122,102,388 | | | | 2,463,893 | | | | 49.56 | | | | .265 | | | | 1.71490 | |

| 12-31-15 | | | | 116,368,311 | | | | 2,378,851 | | | | 48.92 | | | | .2725 | | | | .5244 | |

| 12-31-16 | | | | 122,877,447 | | | | 2,381,534 | | | | 51.60 | | | | .2929 | | | | .47505 | |

| 12-31-17 | | | | 144,610,324 | | | | 2,387,530 | | | | 60.57 | | | | .2033 | | | | 2.11478 | |

| 12-31-18 | | | | 151,571,438 | | | | 2,640,626 | | | | 57.40 | | | | .2798 | | | | .6652 | |

BRIDGES INVESTMENT FUND, INC.

EXPENSE EXAMPLE

DECEMBER 31, 2018

(Unaudited)

As a shareholder of the Bridges Investment Fund, Inc., you incur ongoing costs, including management fees; services fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (July 1, 2018 – December 31, 2018).

ACTUAL EXPENSES

The first line of the table below provides information about actual account values and actual expenses. Although the Fund charges no sales load or transactions fees, you will be assessed fees for outgoing wire transfers (including redemption requests), returned checks or stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. To the extent that the Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which a Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example below. The example includes, but is not limited to, management fees, shareholder servicing fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, interest expense or dividends on short positions taken by the Fund and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | Expenses Paid |

| | Beginning | Ending | During Period* |

| | Account Value | Account Value | July 1, 2018 – |

| | July 1, 2018 | December 31, 2018 | December 31, 2018 |

| Actual | $1,000.00 | $ 913.40 | $3.76 |

| Hypothetical | | | |

| (5% annualized return | | | |

| before expenses) | $1,000.00 | $1,021.27 | $3.97 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.78%, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

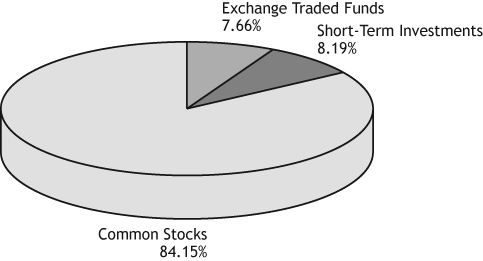

BRIDGES INVESTMENT FUND, INC.

ALLOCATION OF PORTFOLIO HOLDINGS

PERCENTAGE OF TOTAL INVESTMENTS

DECEMBER 31, 2018

(Unaudited)

COMPONENTS OF PORTFOLIO HOLDINGS

| Common Stocks | | $ | 130,017,414 | |

| Exchange Traded Funds | | | 11,841,400 | |

| Short-Term Investments | | | 12,651,630 | |

| Total | | $ | 154,510,444 | |

BRIDGES INVESTMENT FUND, INC.

SCHEDULE OF INVESTMENTS

DECEMBER 31, 2018

Title of Security | | Shares | | | Cost | | | Value | |

| COMMON STOCKS - 85.78% | | | | | | | | | |

Administrative and Support Services – 5.01% | | | | | | | | | |

| Booking Holdings, Inc. (a) | | | 2,700 | | | $ | 1,768,506 | | | $ | 4,650,534 | |

| PayPal Holdings, Inc. (a) | | | 35,000 | | | | 871,561 | | | | 2,943,150 | |

| | | | | | | $ | 2,640,067 | | | $ | 7,593,684 | |

| | | | | | | | | | | | | |

| Amusement, Gambling, and | | | | | | | | | | | | |

Recreation Industries – 2.17% | | | | | | | | | | | | |

| The Walt Disney Co. | | | 30,000 | | | $ | 1,588,580 | | | $ | 3,289,500 | |

| | | | | | | | | | | | |

| Beverage and Tobacco | | | | | | | | | | | | |

Product Manufacturing – 1.75% | | | | | | | | | | | | |

| Altria Group, Inc. | | | 15,000 | | | $ | 451,341 | | | $ | 740,850 | |

| PepsiCo, Inc. | | | 13,000 | | | | 632,331 | | | | 1,436,240 | |

| Philip Morris International, Inc. | | | 7,000 | | | | 338,718 | | | | 467,320 | |

| | | | | | | $ | 1,422,390 | | | $ | 2,644,410 | |

| | | | | | | | | | | | | |

Broadcasting (except Internet) – 1.35% | | | | | | | | | | | | |

| Comcast Corp. – Class A | | | 60,000 | | | $ | 1,381,050 | | | $ | 2,043,000 | |

| | | | | | | | | | | | |

| Building Material and Garden | | | | | | | | | | | | |

Equipment and Supplies Dealers – 1.80% | | | | | | | | | | | | |

| Home Depot, Inc. | | | 11,000 | | | $ | 1,466,587 | | | $ | 1,890,020 | |

| Lowe’s Companies, Inc. | | | 9,000 | | | | 718,941 | | | | 831,240 | |

| | | | | | | $ | 2,185,528 | | | $ | 2,721,260 | |

| | | | | | | | | | | | | |

Chemical Manufacturing – 4.33% | | | | | | | | | | | | |

| Allergan Plc | | | 15,000 | | | $ | 2,160,150 | | | $ | 2,004,900 | |

| Ecolab, Inc. | | | 15,000 | | | | 1,436,988 | | | | 2,210,250 | |

| Gilead Sciences, Inc. | | | 17,000 | | | | 1,306,096 | | | | 1,063,350 | |

| Johnson & Johnson | | | 10,000 | | | | 866,300 | | | | 1,290,500 | |

| | | | | | | $ | 5,769,534 | | | $ | 6,569,000 | |

| | | | | | | | | | | | | |

| Computer and Electronic | | | | | | | | | | | | |

Product Manufacturing – 14.67% | | | | | | | | | | | | |

| Alphabet, Inc. – Class A (a) | | | 4,000 | | | $ | 847,059 | | | $ | 4,179,840 | |

| Alphabet, Inc. – Class C (a) | | | 4,010 | | | | 844,083 | | | | 4,152,796 | |

| Apple, Inc. | | | 67,000 | | | | 1,138,677 | | | | 10,568,581 | |

See accompanying Notes to the Financial Statements.

Percentages are stated as a percent of net assets.

BRIDGES INVESTMENT FUND, INC.

SCHEDULE OF INVESTMENTS

(Continued)

DECEMBER 31, 2018

Title of Security | | Shares | | | Cost | | | Value | |

| COMMON STOCKS (Continued) | | | | | | | | | |

| Computer and Electronic | | | | | | | | | |

Product Manufacturing (Continued) | | | | | | | | | |

| QUALCOMM, Inc. | | | 35,000 | | | $ | 1,399,408 | | | $ | 1,991,850 | |

| Thermo Fisher Scientific, Inc. | | | 6,000 | | | | 879,267 | | | | 1,342,740 | |

| | | | | | | $ | 5,108,494 | | | $ | 22,235,807 | |

| | | | | | | | | | | | | |

Couriers and Messengers – 1.06% | | | | | | | | | | | | |

| FedEx Corp. | | | 10,000 | | | $ | 1,659,664 | | | $ | 1,613,300 | |

| | | | | | | | | | | | |

| Credit Intermediation and | | | | | | | | | | | | |

Related Activities – 6.09% | | | | | | | | | | | | |

| Ameriprise Financial, Inc. | | | 10,000 | | | $ | 971,393 | | | $ | 1,043,700 | |

| Capital One Financial Corp. | | | 30,000 | | | | 864,556 | | | | 2,267,700 | |

| JPMorgan Chase & Co. | | | 30,000 | | | | 1,721,192 | | | | 2,928,600 | |

| Wells Fargo & Co. | | | 65,000 | | | | 1,722,623 | | | | 2,995,200 | |

| | | | | | | $ | 5,279,764 | | | $ | 9,235,200 | |

| | | | | | | | | | | | | |

| Data Processing, Hosting and | | | | | | | | | | | | |

Related Services – 0.97% | | | | | | | | | | | | |

| Fiserv, Inc. (a) | | | 20,000 | | | $ | 971,166 | | | $ | 1,469,800 | |

| | | | | | | | | | | | |

| Electrical Equipment, Appliance, and | | | | | | | | | | | | |

Component Manufacturing – 0.91% | | | | | | | | | | | | |

| Eaton Corp. Plc | | | 20,000 | | | $ | 891,712 | | | $ | 1,373,200 | |

| | | | | | | | | | | | | |

Food Services and Drinking Places – 1.27% | | | | | | | | | | | | |

| Starbucks Corp. | | | 30,000 | | | $ | 561,001 | | | $ | 1,932,000 | |

| | | | | | | | | | | | | |

Insurance Carriers and Related Activities – 4.77% | | | | | | | | | | | | |

| Berkshire Hathaway, Inc. – Class B (a) | | | 20,000 | | | $ | 678,649 | | | $ | 4,083,600 | |

| Cigna Corp. | | | 6,085 | | | | 813,159 | | | | 1,155,663 | |

| UnitedHealth Group, Inc. | | | 8,000 | | | | 1,948,207 | | | | 1,992,960 | |

| | | | | | | $ | 3,440,015 | | | $ | 7,232,223 | |

| | | | | | | | | | | | | |

Machinery Manufacturing – 1.41% | | | | | | | | | | | | |

| Roper Technologies, Inc. | | | 8,000 | | | $ | 335,931 | | | $ | 2,132,160 | |

| | | | | | | | | | | | | |

Mining (except Oil and Gas) – 0.91% | | | | | | | | | | | | |

| Martin Marietta Materials, Inc. | | | 8,000 | | | $ | 1,469,187 | | | $ | 1,374,960 | |

See accompanying Notes to the Financial Statements.

Percentages are stated as a percent of net assets.

BRIDGES INVESTMENT FUND, INC.

SCHEDULE OF INVESTMENTS

(Continued)

DECEMBER 31, 2018

Title of Security | | Shares | | | Cost | | | Value | |

| COMMON STOCKS (Continued) | | | | | | | | | |

Nonstore Retailers – 4.95% | | | | | | | | | |

| Amazon.com, Inc. (a) | | | 5,000 | | | $ | 1,231,664 | | | $ | 7,509,850 | |

| | | | | | | | | | | | | |

Oil and Gas Extraction – 2.40% | | | | | | | | | | | | |

| Continental Resources, Inc. (a) | | | 47,000 | | | $ | 1,375,415 | | | $ | 1,888,930 | |

| EOG Resources, Inc. | | | 20,000 | | | | 2,044,419 | | | | 1,744,200 | |

| | | | | | | $ | 3,419,834 | | | $ | 3,633,130 | |

| | | | | | | | | | | | | |

Other Information Services – 1.90% | | | | | | | | | | | | |

| Facebook, Inc. – Class A (a) | | | 22,000 | | | $ | 2,108,799 | | | $ | 2,883,980 | |

| | | | | | | | | | | | |

| Petroleum and Coal | | | | | | | | | | | | |

Products Manufacturing – 1.58% | | | | | | | | | | | | |

| Chevron Corp. | | | 22,000 | | | $ | 1,206,019 | | | $ | 2,393,380 | |

| | | | | | | | | | | | |

| Professional, Scientific, and | | | | | | | | | | | | |

Technical Services – 16.07% | | | | | | | | | | | | |

| Amgen, Inc. | | | 10,000 | | | $ | 1,609,946 | | | $ | 1,946,700 | |

| Biogen, Inc. (a) | | | 3,500 | | | | 756,617 | | | | 1,053,220 | |

| Celgene Corp. (a) | | | 44,000 | | | | 1,947,085 | | | | 2,819,960 | |

| Cognizant Technology | | | | | | | | | | | | |

| Solutions Corp. – Class A | | | 10,000 | | | | 545,270 | | | | 634,800 | |

| IQVIA Holdings, Inc. (a) | | | 8,000 | | | | 855,439 | | | | 929,360 | |

| MasterCard, Inc. – Class A | | | 62,000 | | | | 1,091,601 | | | | 11,696,300 | |

| Visa, Inc. – Class A | | | 40,000 | | | | 1,087,480 | | | | 5,277,600 | |

| | | | | | | $ | 7,893,438 | | | $ | 24,357,940 | |

| | | | | | | | | | | | | |

Publishing Industries (except Internet) – 1.68% | | | | | | | | | | | | |

| Microsoft Corp. | | | 25,000 | | | $ | 2,700,132 | | | $ | 2,539,250 | |

| | | | | | | | | | | | | |

Rail Transportation – 2.55% | | | | | | | | | | | | |

| Union Pacific Corp. | | | 28,000 | | | $ | 806,918 | | | $ | 3,870,440 | |

| | | | | | | | | | | | | |

| Securities, Commodity Contracts, | | | | | | | | | | | | |

| and Other Financial Investments | | | | | | | | | | | | |

and Related Activities – 3.92% | | | | | | | | | | | | |

| BlackRock, Inc. | | | 9,500 | | | $ | 2,275,270 | | | $ | 3,731,790 | |

See accompanying Notes to the Financial Statements.

Percentages are stated as a percent of net assets.

BRIDGES INVESTMENT FUND, INC.

SCHEDULE OF INVESTMENTS

(Continued)

DECEMBER 31, 2018

Title of Security | | Shares | | | Cost | | | Value | |

| COMMON STOCKS (Continued) | | | | | | | | | |

| Securities, Commodity Contracts, | | | | | | | | | |

| and Other Financial Investments | | | | | | | | | |

and Related Activities (Continued) | | | | | | | | | |

| S&P Global, Inc. | | | 13,000 | | | $ | 2,334,390 | | | $ | 2,209,220 | |

| | | | | | | $ | 4,609,660 | | | $ | 5,941,010 | |

| | | | | | | | | | | | | |

Support Activities for Transportation – 0.75% | | | | | | | | | | | | |

| XPO Logistics, Inc. (a) | | | 20,000 | | | $ | 1,785,818 | | | $ | 1,140,800 | |

| | | | | | | | | | | | |

| Transportation Equipment | | | | | | | | | | | | |

Manufacturing – 0.53% | | | | | | | | | | | | |

| Boeing Co. | | | 2,500 | | | $ | 754,671 | | | $ | 806,250 | |

| | | | | | | | | | | | | |

Truck Transportation – 0.98% | | | | | | | | | | | | |

| Old Dominion Freight Line, Inc. | | | 12,000 | | | $ | 1,611,257 | | | $ | 1,481,880 | |

| TOTAL COMMON STOCKS | | | | | | $ | 62,832,293 | | | $ | 130,017,414 | |

| | | | | | | | | | | | | |

| EXCHANGE TRADED FUNDS – 7.81% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Funds, Trusts, and Other | | | | | | | | | | | | |

Financial Vehicles – 7.81% | | | | | | | | | | | | |

| iShares Core S&P Mid-Cap ETF | | | 40,000 | | | $ | 3,684,766 | | | $ | 6,642,400 | |

| iShares Core S&P Small-Cap ETF | | | 75,000 | | | | 2,746,435 | | | | 5,199,000 | |

| TOTAL EXCHANGE TRADED FUNDS | | | | | | $ | 6,431,201 | | | $ | 11,841,400 | |

| | | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS – 8.35% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Mutual Funds – 8.35% | | | | | | | | | | | | |

| SEI Daily Income Trust Treasury – | | | | | | | | | | | | |

| Class F, 2.254% (b) | | | 12,651,630 | | | $ | 12,651,630 | | | $ | 12,651,630 | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | $ | 12,651,630 | | | $ | 12,651,630 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS – 101.94% | | | | | | $ | 81,915,124 | | | $ | 154,510,444 | |

| LIABILITIES IN EXCESS | | | | | | | | | | | | |

| OF OTHER ASSETS – (1.94)% | | | | | | | | | | | (2,939,006 | ) |

| TOTAL NET ASSETS – 100.00% | | | | | | | | | | $ | 151,571,438 | |

See accompanying Notes to the Financial Statements.

Percentages are stated as a percent of net assets.

| (a) | Non Income Producing. |

| (b) | The rate shown is the annualized seven day yield as of December 31, 2018. |

BRIDGES INVESTMENT FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

DECEMBER 31, 2018

| ASSETS: | | | |

| Investments in securities, at fair value (cost: $81,915,124) | | $ | 154,510,444 | |

| Receivables | | | | |

| Fund shares issued | | | 296,240 | |

| Dividends and interest | | | 104,632 | |

| Prepaid expenses | | | 11,534 | |

| | | | | |

| TOTAL ASSETS: | | $ | 154,922,850 | |

| | | | | |

| LIABILITIES: | | | | |

| Payables | | | | |

| Distributions to shareholders | | $ | 47,942 | |

| Payable for securities purchased | | | 3,020,545 | |

| Payable for capital shares redeemed | | | 1,000 | |

| Payable to Adviser | | | 201,257 | |

| Accrued expenses | | | 80,668 | |

| | | | | |

| TOTAL LIABILITIES: | | $ | 3,351,412 | |

| | | | | |

| TOTAL NET ASSETS | | $ | 151,571,438 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Capital Stock | | $ | 77,511,135 | |

| Total distributable earnings | | | 74,060,303 | |

| | | | | |

| TOTAL NET ASSETS | | $ | 151,571,438 | |

| | | | | |

| SHARES OUTSTANDING | | | | |

| ($0.0001 par value; 100,000,000 shares authorized) | | | 2,640,626 | |

| | | | | |

| NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE | | $ | 57.40 | |

See accompanying Notes to the Financial Statements.

BRIDGES INVESTMENT FUND, INC.

STATEMENT OF OPERATIONS

FOR THE YEAR ENDED DECEMBER 31, 2018

| INVESTMENT INCOME: | | | |

| Dividend income | | $ | 1,704,796 | |

| Interest income | | | 176,517 | |

| | | | | |

| Total investment income | | $ | 1,881,313 | |

| | | | | |

| EXPENSES: | | | | |

| Advisory fees | | $ | 805,327 | |

| Administration fees | | | 148,926 | |

| Fund accounting fees | | | 58,221 | |

| Independent director’s expenses and fees | | | 52,000 | |

| Other | | | 48,351 | |

| Professional services | | | 45,466 | |

| Dividend disbursing and transfer agent fees | | | 40,932 | |

| Custody fees | | | 19,730 | |

| Printing and supplies | | | 13,144 | |

| | | | | |

| Total expenses | | $ | 1,232,097 | |

| | | | | |

| NET INVESTMENT INCOME: | | $ | 649,216 | |

| | | | | |

| NET REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | | | | |

| Net realized gain on investments | | | 3,216,011 | |

| Net change in unrealized depreciation of investments | | | (10,380,404 | ) |

| | | | | |

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS: | | | (7,164,393 | ) |

| | | | | |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (6,515,177 | ) |

See accompanying Notes to the Financial Statements.

BRIDGES INVESTMENT FUND, INC.

STATEMENTS OF CHANGES IN NET ASSETS

FOR THE YEARS ENDED DECEMBER 31, 2018 AND 2017

| | | 2018 | | | 2017 | |

| | | | | | | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 649,216 | | | $ | 470,275 | |

| Net realized gain on investments | | | 3,216,011 | | | | 3,908,751 | |

| Net change in unrealized | | | | | | | | |

| appreciation of investments | | | (10,380,404 | ) | | | 22,198,167 | |

| | | | | | | | | |

| Net increase/(decrease) in | | | | | | | | |

| net assets resulting | | | | | | | | |

| from operations | | $ | (6,515,177 | ) | | $ | 26,577,193 | |

| | | | | | | | | |

| Distributions to shareholders: | | | | | | | | |

| Distributions to shareholders | | | (2,453,611 | ) | | | (5,378,632 | )(1) |

| | | | | | | | | |

| Total distributions | | $ | (2,453,611 | ) | | $ | (5,378,632 | ) |

| | | | | | | | | |

| Capital Share Transactions: | | | | | | | | |

| Net increase in net assets | | | | | | | | |

| from capital share transactions | | | 15,929,902 | | | | 534,316 | |

| | | | | | | | | |

| Total increase in net assets | | $ | 6,961,114 | | | $ | 21,732,877 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of the Year | | $ | 144,610,324 | | | $ | 122,877,447 | |

| End of the Year | | $ | 151,571,438 | | | $ | 144,610,324 | (2) |

See accompanying Notes to the Financial Statements.

(1) | Includes net investment income distribution of $477,481 and net realized gain distribution of $4,901,151. |

(2) | Includes accumulated undistributed net investment income of $78,400. |

BRIDGES INVESTMENT FUND, INC.

FINANCIAL HIGHLIGHTS

For a Fund share outstanding throughout the year

| | | Years Ended December 31, | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| Net asset value, | | | | | | | | | | | | | | | |

| beginning of year | | $ | 60.57 | | | $ | 51.60 | | | $ | 48.92 | | | $ | 49.56 | | | $ | 47.17 | |

| | | | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income(1) | | | 0.29 | | | | 0.20 | | | | 0.29 | | | | 0.27 | | | | 0.26 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain/(loss) on investments | | | (2.51 | ) | | | 11.08 | | | | 3.15 | | | | (0.12 | ) | | | 4.11 | |

| Total from | | | | | | | | | | | | | | | | | | | | |

| investment operations | | | (2.22 | ) | | | 11.28 | | | | 3.44 | | | | 0.15 | | | | 4.37 | |

| | | | | | | | | | | | | | | | | | | | | |

Less dividends and distributions: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net | | | | | | | | | | | | | | | | | | | | |

| investment income | | | (0.28 | ) | | | (0.20 | ) | | | (0.29 | ) | | | (0.27 | ) | | | (0.27 | ) |

| Dividends from net realized gain | | | (0.67 | ) | | | (2.11 | ) | | | (0.47 | ) | | | (0.52 | ) | | | (1.71 | ) |

| Total distributions | | | (0.95 | ) | | | (2.31 | ) | | | (0.76 | ) | | | (0.79 | ) | | | (1.98 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 57.40 | | | $ | 60.57 | | | $ | 51.60 | | | $ | 48.92 | | | $ | 49.56 | |

| | | | | | | | | | | | | | | | | | | | | |

Total return | | | (3.76 | )% | | | 21.98 | % | | | 7.09 | % | | | 0.33 | % | | | 9.37 | % |

| | | | | | | | | | | | | | | | | | | | | |

Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | | $ | 151,571 | | | $ | 144,610 | | | $ | 122,877 | | | $ | 116,368 | | | $ | 122,102 | |

| Ratio of net expenses to | | | | | | | | | | | | | | | | | | | | |

| average net assets | | | 0.77 | % | | | 0.79 | % | | | 0.82 | % | | | 0.80 | % | | | 0.80 | % |

| Ratio of net investment income | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 0.40 | % | | | 0.35 | % | | | 0.60 | % | | | 0.54 | % | | | 0.55 | % |

| Portfolio turnover rate | | | 2.8 | % | | | 4.7 | % | | | 10.7 | % | | | 13.2 | % | | | 13.6 | % |

See accompanying Notes to the Financial Statements.

(1) | Net investment income per share is calculated using the ending balances prior to consideration of adjustment for permanent book-to-tax differences. |

BRIDGES INVESTMENT FUND, INC.

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2018

| | |

| (1) | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

| | |

| | Bridges Investment Fund, Inc. (the “Fund”) is registered under the Investment Company Act of 1940 as a diversified, open-end management investment company. The primary investment objective of the Fund is long-term capital appreciation. In pursuit of that objective, the Fund invests primarily in common stocks. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services – Investment Companies. |

| | A. | Investments – |

| | | |

| | | Security transactions are recorded on trade date. Dividend income is recognized on the ex-dividend date, and interest income is recognized on an accrual basis. Discount and premium on fixed income securities is accreted or amortized into interest income using the effective interest method. Withholding taxes on foreign dividends, if any, have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. |

| | | |

| | | The net realized gain (loss) from the sales of securities is determined for income tax and accounting purposes on the basis of the cost of specific securities. |

| | | |

| | | Securities owned are reflected in the accompanying Statement of Assets and Liabilities and the Schedule of Investments at fair value based on quoted market prices. Bonds and other fixed-income securities (other than repurchase agreements and demand notes) are valued using market quotations or a matrix method provided by an independent pricing service. Other securities traded on a national securities exchange are valued at the last reported sale price at the close of regular trading on each day the exchange is open for trading. Securities listed on the NASDAQ National Market System for which market quotations are readily available are valued using the NASDAQ Official Closing Price (“NOCP”). If no sales were reported on that day, quoted market price represents the closing bid price. |

| | | |

| | | Investments in registered open-end management investment companies will be valued based upon the Net Asset Values (“NAVs”) of such investments and are categorized as Level 1 of the fair value hierarchy. |

| | | Securities for which prices are not readily available are valued by the Fund’s valuation committee (the “Valuation Committee”) at a fair value determined in good faith under procedures established by and under the general supervision of the Fund’s Board of Directors (the “Board”). |

| | | |

| | | The Valuation Committee concludes that a price determined under the Fund’s valuation procedures is not readily available if, among other things, the Valuation Committee believes that the value of the security might be materially affected by an intervening significant event. A significant event may be related to a single issuer, to an entire market sector, or to the entire market. These events may include, among other things: issuer-specific events including rating agency action, earnings announcements and corporate actions, significant fluctuations in domestic or foreign markets, natural disasters, armed conflicts, and government actions. In the event that the market quotations are not readily available, the fair value of such securities will be determined in good faith, taking into consideration: (i) fundamental analytical data relating to the investment; (ii) the nature and duration of restrictions on disposition of the securities; and (iii) an evaluation of the forces which influence the market in which these securities are purchased and sold. The members of the Valuation Committee shall continuously monitor for significant events that might necessitate the use of fair value procedures. |

| | | It is the Fund’s policy to comply with the requirements of the Internal Revenue Code applicable to Regulated Investment Companies (“RICs”) to distribute all of its taxable income to shareholders. Therefore, no Federal income tax provision for the Fund is required. Under applicable foreign tax law, a withholding tax may be imposed on interest, dividends, and capital gains earned on foreign securities. |

| | | |

| | | The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. In addition, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the year that the income or realized gains or losses were recorded by the Fund. The Fund has not reclassified the components of its capital accounts for the year ended December 31, 2018. |

| | | |

| | | The Fund has not recorded any liability for material unrecognized tax benefits as of December 31, 2018. It is the Fund’s policy to recognize accrued interest and penalties related to uncertain benefits in income tax expense as appropriate. |

| | C. | Distribution To Shareholders – |

| | | The Fund records and pays dividends to shareholders on a quarterly basis on the ex-dividend date. Distribution of net realized gains, if any, are recorded and made on an annual basis to shareholders on the ex-dividend date. |

| | | The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in Net Assets from operations during the reporting period. Actual results could differ from those estimates. |

| | E. | Fair Value Measurements – |

| | | GAAP defines fair value as the price that a Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. A three-tier hierarchy is used to maximize the use of observable market data “inputs” and minimize the use of unobservable “inputs” and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below: |

| | | | Level 1 – | Unadjusted quoted prices in active markets for identical investments. |

| | | | | |

| | | | Level 2 – | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| | | | | |

| | | | Level 3 – | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

| | | The valuation techniques used by the Fund to measure fair value for the year ended December 31, 2018, maximized the use of observable inputs and minimized the use of unobservable inputs. During the year ended December 31, 2018, no securities held by the Fund were deemed Level 3. |

| | | The following is a summary of the inputs used as of December 31, 2018, in valuing the Fund’s investments carried at fair value: |

| | | | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | | Investments | | | | | | | | | | | | |

| | | Common Stocks | | $ | 130,017,414 | | | $ | — | | | $ | — | | | $ | 130,017,414 | |

| | | Exchange Traded Funds | | | 11,841,400 | | | | — | | | | — | | | | 11,841,400 | |

| | | Short-Term Investments | | | 12,651,630 | | | | — | | | | — | | | | 12,651,630 | |

| | | Total Investments | | | | | | | | | | | | | | | | |

| | | in Securities | | $ | 154,510,444 | | | $ | — | | | $ | — | | | $ | 154,510,444 | |

| | | Refer to the Schedule of Investments for further information on the classification of investments. |

| (2) | INVESTMENT ADVISORY CONTRACT AND OTHER TRANSACTIONS WITH AFFILIATES |

| | |

| | Under an Investment Advisory Contract, Bridges Investment Management, Inc. (the “Investment Adviser”) furnishes investment advisory services for the Fund. In return, the Fund has agreed to pay the Investment Adviser a management fee computed on a quarterly basis at the rate of 1/8 of 1% of the average month-end net asset value of the Fund during the quarter, equivalent to 1/2 of 1% per annum. Certain officers and directors of the Fund are also officers and directors of the Investment Adviser. These officers do not receive any compensation from the Fund other than that which is received indirectly through the Investment Adviser. For the year ended December 31, 2018, the Fund incurred $805,327 in advisory fees. |

| | |

| | The contract between the Fund and the Investment Adviser provides that total expenses of the Fund in any year, exclusive of taxes, but including fees paid to the Investment Adviser, shall not exceed, in total, a maximum of 1 and 1/2% of the average month end net asset value of the Fund for the year. Amounts, if any, expended in excess of this limitation are reimbursed by the Investment Adviser as specifically identified in the Investment Advisory Contract. There were no amounts reimbursed during the year ended December 31, 2018. |

| | |

| | The Fund has entered into a Board-approved contract with the Investment Adviser in which the Investment Adviser acts as primary administrator to the Fund at an annual rate of $42,000, through quarterly payments of $10,500, and U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services, acts as sub-administrator to the Fund. These administrative expenses are shown as Administration fees on the Statement of Operations. As of December 31, 2018, $10,500 was due to the Investment Adviser for its services as primary administrator. This liability is included in the Accrued expenses on the Statement of Assets and Liabilities. |

| | |

| | Quasar Distributors, LLC (the “Distributor”), a registered broker-dealer, acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares. The Distributor is an affiliate of U.S. Bancorp Fund Services, LLC. |

| | The cost of long-term investment purchases during the years ended December 31, 2018 and 2017, was: |

| | | | 2018 | | | 2017 | |

| | Non U.S. government securities | | $ | 13,350,177 | | | $ | 6,131,388 | |

| | Net proceeds from sales of long-term investments during the years ended December 31, 2018 and 2017, were: |

| | | 2018 | | | 2017 | |

| Non U.S. government securities | | $ | 4,123,707 | | | $ | 11,827,740 | |

| | There were no long-term U.S. government transactions for the years ended December 31, 2018 and 2017. |

| (4) | NET ASSET VALUE |

| | |

| | The NAV per share represents the effective price for all subscriptions and redemptions. |

| | Shares of capital stock issued and redeemed during the years ended December 31, 2018 and 2017, were as follows: |

| | | | 2018 | | | 2017 | |

| | Shares sold | | | 282,909 | | | | 58,623 | |

| | Shares issued to shareholders in | | | | | | | | |

| | reinvestment of net investment income | | | 35,999 | | | | 80,953 | |

| | | | | 139,576 | | | | 318,908 | |

| | Shares redeemed | | | (65,812 | ) | | | (133,580 | ) |

| | Net increase | | | 253,096 | | | | 5,996 | |

| | Value of capital stock issued and redeemed during the years ended December 31, 2018 and 2017, were as follows: |

| | | | 2018 | | | 2017 | |

| | Net proceeds from shares sold | | $ | 17,920,252 | | | $ | 3,365,936 | |

| | Reinvestment of distributions | | | 2,191,443 | | | | 4,807,312 | |

| | | | | 20,111,695 | | | | 8,173,248 | |

| | Cost of shares redeemed | | | (4,181,793 | ) | | | (7,638,932 | ) |

| | Net increase | | $ | 15,929,902 | | | $ | 534,316 | |

| (6) | DISTRIBUTIONS TO SHAREHOLDERS |

| | |

| | On March 29, 2018, June 29, 2018, September 28, 2018 and December 31, 2018, the Fund declared and paid ordinary income distributions to shareholders of record on March 28, 2018, June 28, 2018, September 27, 2018 and December 28, 2018, respectively. These distributions were calculated at $0.02, $0.07, $0.075 and $0.1148 per share. |

| | Additionally, on December 7, 2018, the Fund declared and paid a long-term capital gain distribution of $0.6652 per share to shareholders of record on December 6, 2018. |

| | |

| (7) | FEDERAL INCOME TAX INFORMATION |

| | |

| | The tax character of distributions during the years ended December 31, 2018 and 2017 were as follows: |

| | | | Ordinary | | | Long-Term | | | Return of | |

| | | | Income | | | Capital Gain | | | Capital | |

| | 12/31/18 | | $ | 720,658 | | | $ | 1,732,953 | | | $ | — | |

| | 12/31/17 | | $ | 397,152 | | | $ | 4,901,133 | | | $ | 80,347 | |

| As of December 31, 2018, the components of the tax basis cost of investments and net unrealized appreciation were as follows: |

| | Federal tax cost of investments | | $ | 81,915,124 | |

| | Unrealized appreciation | | $ | 74,615,857 | |

| | Unrealized depreciation | | | (2,020,537 | ) |

| | Net unrealized appreciation | | $ | 72,595,320 | |

| | As of December 31, 2018, the components of distributable earnings on a tax basis were as follows: |

| | Net unrealized appreciation | | $ | 72,595,320 | |

| | Undistributed ordinary income | | $ | 6,958 | |

| | Undistributed long term gains | | | 1,458,025 | |

| | Accumulated gain | | | 1,464,983 | |

| | Other accumulated gain/(loss) | | | — | |

| | Total distributable earnings | | $ | 74,060,303 | |

| | As of December 31, 2018, the Fund did not have any capital loss carryovers. |

| | |

| (8) | NEW ACCOUNTING PRONOUNCEMENTS |

| | |

| | In August 2018, FASB issued ASU 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework – Changes to the Disclosure Requirements for Fair Value Measurement (“ASU 2018-13”). The primary focus of ASU 2018-13 is to improve the effectiveness of the disclosure requirements for fair value measurements. The changes affect all companies that are required to include fair value measurement disclosures. In general, the amendments in ASU 2018-13 are effective for all entities for fiscal years and interim periods within those fiscal years, beginning after December 15, 2019. An entity is permitted to early adopt the removed or modified disclosures upon the issuance of ASU 2018-13 and may delay adoption of the additional disclosures, which are required for public companies only, until their effective date. Management has chosen to adopt this disclosure in this report. |

| | |

| | In August 2018, the Securities and Exchange Commission issued Final Rule Release No. 33-10532, Disclosure Update and Simplification, which in part amends certain disclosure requirements of Regulation S-X that have become redundant, duplicative, overlapping, outdated, or superseded, in light of other |

| | Commission disclosure requirements, U.S. Generally Accepted Accounting Principles, or changes in the information environment. The amendments are intended to facilitate the disclosure of information to investors and simplify compliance without significantly altering the total mix of information provided to investors. Management has chosen to adopt this disclosure in this report. |

| | |

| (9) | SUBSEQUENT EVENTS |

| | |

| | In preparing these financial statements, the Fund has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued, and has concluded that there are no subsequent events of note through the date of issuance. |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Directors of Bridges Investment Fund, Inc.

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Bridges Investment Fund, Inc. (the “Fund”) as of December 31, 2018, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, including the related notes, and the financial highlights for each of the five years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2018, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2018, by correspondence with the custodian and brokers. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2011.

COHEN & COMPANY, LTD.

Milwaukee, Wisconsin

February 20, 2019

PRIVACY POLICY NOTICE

(Unaudited)

Protecting your privacy is important to Bridges Investment Fund, Inc. We want you to understand what information we collect and how we use it. In order to provide our shareholders with a broad range of financial products and services as effectively and conveniently as possible, we use technology to manage and maintain shareholder information. The following policy serves as a standard for Bridges Investment Fund, Inc. for the collection, use, retention, and security of nonpublic personal information.

What Information We Collect

In order to serve you better, we may collect nonpublic personal information about you from the following sources:

| | • | Information we receive from you in connection with opening an account or establishing and maintaining a shareholder relationship with us, whether in writing or oral; |

| | | |

| | • | Information about your transactions with us or our affiliates; and |

| | | |

| | • | Information we receive from third parties such as your accountants, attorneys, life insurance agents, family members, financial institutions, custodians, trustees and credit bureaus. |

“Nonpublic personal information” is nonpublic information about you that we obtain in connection with providing a financial product or service to you. For example, nonpublic personal information includes the contents of your application, account balance, transaction history and the existence of a relationship with us.

What Information We Disclose

We do not disclose any nonpublic personal information about you to anyone, except as permitted by law. We are permitted to disclose nonpublic personal information about you to other third parties in certain circumstances. For example, we may disclose nonpublic personal information about you to third parties to assist us in servicing your account with us.

If you decide to close your account(s) or become an inactive shareholder, we will adhere to the privacy policies and practices as described in this notice.

Our Security Procedures

We also take steps to safeguard shareholder information. We restrict access to your personal and account information to those who need to know that information to provide products and services to you. Violators of these standards will be subject to disciplinary measures. We maintain physical, electronic, and procedural safeguards that comply with federal standards to guard your nonpublic personal information.

ADDITIONAL DISCLOSURES

INVESTMENT ADVISORY AGREEMENT DISCLOSURE (Unaudited)

As required by the terms of the investment advisory agreement, the Fund’s Independent Board members vote for the continuance of the agreement no less than annually. On November 28, 2018, the Fund’s investment advisory agreement with Bridges Investment Management, Inc. (“BIM”) was approved by the Independent Board for a period commencing on July 31, 2019 through July 30, 2020.

In approving the continuance of the investment advisory agreement, the independent directors of the Fund reviewed the financial resources of BIM, the investment performance record, types of securities purchased, and asset size of the Fund in comparison with funds of similar size and comparable investment objectives, the operating costs relative to other funds, and other factors including the quality of investment advice and other services set forth in a special study prepared annually for the Board by the investment manager. In addition, the independent Directors reviewed the expertise, personnel, and the resources BIM is willing to commit to the management of the Fund, its compliance program, the cost of comparable services and the benefits to be received by BIM.

With respect to BIM’s financial resources, BIM provided the Fund’s Board of Directors information showing (as of December 31, 2017) total assets of $25,294,950, no long-term debt, and total shareholders’ equity of $20,701,716 with a current ratio (current assets to current liabilities) of 1.4x and an equity to total assets ratio of 81.84%.

The directors reviewed and focused on the Fund’s past performance and operations in their evaluation and decision. Based on information gathered from a leading mutual fund evaluator, the Fund directors compared the Fund’s performance criteria to funds with similar investment objectives. The total fund comparison universe varied depending on the time frame of the comparison and other investment parameters included, but with respect to funds with a growth investment objective, the Fund ranked, on percentile terms, in the 39th percentile over a trailing 12-month period, 75th over a 3-year period, 69th over a 5-year period, and 77th over a 10-year period. (as of October 31, 2018)

The Fund directors reviewed the asset allocation of the Fund, including the percentage of Fund assets invested in stocks (91.6% as of September 30, 2018) and bonds (0.00% as of September 30, 2018). They also reviewed a number of current ratios for the Fund’s portfolio, including the current price/earnings ratio of Fund stocks (22.0x as of September 30, 2018) price/cash ratio (15.6x) and price/book ratio (4.0x), as well as the Fund’s turnover ratio, which at 5% for the trailing twelve months, was still well below the average turnover ratio average of 54% for a comparison group of large cap growth funds. The directors also reviewed the Fund’s expense ratio, which was 0.80% for the period ending September 30, 2018, compared to an average of 1.91% for a peer group of funds selected as the comparison group.

The Fund Board also reviewed the extent to which economies of scale would be realized as the Fund grows, and the expected impact of any growth in Fund assets on the Fund’s fee structure, including fees and expenses which are not directly related to the size of the Fund, and provisions in agreements with service providers which carry a lower basis charge if the Fund asset base increases.

With respect to the Fund’s compliance program, the Fund directors were provided information concerning both the historical practices to ensure compliance by Fund personnel, as well as current actions taken to strengthen the Fund’s compliance structure.

The Board of Directors noted that Edson L. Bridges III has more than 35 years of experience with the Fund’s portfolio and thus is very familiar with the Fund’s history and operations. The Board of Directors further noted that Edson L. Bridges III has been responsible for the day-to-day management of the Fund’s portfolio since April 11, 1997, with Brian Kirkpatrick as the back-up person in this position.

At each Board of Directors meeting, the Board reviews the brokerage commissions and fees paid with respect to securities transactions undertaken for the Fund’s portfolio during the prior three-month period for the cost efficiency of the services provided by the brokerage firms involved, all of which brokerage firms are non-affiliated with the Fund and BIM. The Fund’s Board of Directors reviewed in May, 2018 an annual disclosure for 2017 on soft dollar commission arrangements of BIM and the benefits that BIM and its clients may receive from the Fund’s portfolio transactions. The Board has regularly reviewed the brokerage commissions paid on each portfolio security transaction since 1995, and the actions taken by the management during the prior quarter with respect to portfolio transactions and commission levels have been approved by the Board of Directors.

MANAGEMENT’S DISCUSSION AND ANALYSIS

(Unaudited)

Introduction

The following information is provided in response to Item 22 in the Form N-1A to be filed annually under the Investment Company Act of 1940 with the Securities and Exchange Commission in Washington, D.C. The Form N-1A prescribes certain information that is to be included in the Prospectus for the Fund.

Item 22(b)(3)

The Directors, as a group, were paid a total of $52,000 by Bridges Investment Management, Inc. for their attendance at Audit and Administration/Nominating Committee meetings in addition to Board of Directors and Independent Board meetings held during 2018. These fees were reimbursed by the Fund in the calendar quarter that followed the date such payment was made.

The Officers, as a group, were not paid any compensation by the Fund for their services during 2018. During the most recent fiscal year ended December 31, 2018, the Fund paid its investment adviser, Bridges Investment Management, Inc., $805,327 in fees under the investment advisory contract.

Item 22(b)(5)

Officers and Directors

The Board is responsible for managing the Fund’s business affairs and for exercising all the Fund’s powers except those reserved for the shareholders. The following tables give information about each Board member and the senior officers of the Fund. Where required, the tables separately list Board members who are “interested persons” of the Fund (i.e., “Interested” Board members) and those who are not (i.e., “Independent” Board members). In addition, the Fund’s Statement of Additional Information includes additional information about Fund directors and is available, from the Fund’s website at http://www.bridgesfund.com or by calling 1.800.939.8401.

**The determination of an interested person is based on the definition in Section 2(a)(19) of the Investment Company Act of 1940, and Securities and Exchange Commission Release (Release No. IC-24083, dated October 14, 1999), providing additional guidance to investment companies about the types of professional and business relationships that may be considered to be material for purposes of Section 2(a)(19). Interested persons include a director or officer of the Fund who has a significant or material business or professional relationship with the Fund’s investment adviser, Bridges Investment Management, Inc. Those individuals who are not “interested persons” are disinterested persons for this disclosure. Bridges Investment Fund, Inc. considers these proposed Board members to be “independent directors” exercising care, diligence and good business judgement with respect to the governance of the Fund.**

Disclosure Regarding Fund Directors and Officers

**Disinterested Persons Also Known as Independent Directors**

| Name, Age, | |

| Position with | |

| Fund and Term | |

of Office | Principal Occupation(s) and Directorships* |

| Daniel J. Brabec | Mr. Brabec is a Director of Spectrum Financial Services, Inc. in |

| Age: 60 | Omaha, Nebraska since February 1999 and serves as Senior Vice |

| | President of Spectrum. He has directly managed real estate |

| Director | and commercial credit assets for a number of affiliates of |

| (2015 – present) | Spectrum Financial Services, Inc. since January 2009. Prior to |

| | that, he served as a Director of Great Western Bank, Omaha, Nebraska and was its Chief Executive Officer and President from 2001 until its sale in 2008, and served as Controller for Great Western Bancorporation in an interim role from 1999 to 2001. He began his career in banking in 1985 joining Pioneer Bank, St Louis, Missouri after three years with Control Data Corporation and served as Executive Vice President, Security Officer and Director of Rushmore Bank and Trust, Rapid City, South Dakota from 1993 to 1999. Mr. Brabec has been determined to be an “audit committee financial expert” within the meaning of the Sarbanes Oxley Act of 2002 and the regulations related thereto by the Fund’s Board of Directors. |

| | |

| Nathan Phillips | Mr. Dodge is the President of NP Dodge Company since April |

| Dodge III | 2014, and prior to that position, served as the Executive Vice |

| Age: 55 | President. He has worked at NP Dodge Company since |

| | October, 1993. Mr. Dodge is also a principal officer and |

| Director | director of a number of subsidiary and affiliated companies in |

| (2010 – present) | the property management, insurance, and real estate |

| syndication fields. Mr. Dodge became a Director of Lauritzen Corp. in 2008 and of First State Bank of Loomis in 2003. |

| | |

| Jeffrey C. Royal | Mr. Royal is the President of Dundee Bank, a community bank |

| Age: 42 | located in Omaha, Nebraska. He has served in that position |

| | since January 2006. Prior to joining Dundee Bank, he was |

| Director | Second Vice President of First National Bank of Omaha. |