Trellis Earth Products, Inc.

9125 S.W. Ridder Road, Suite D

Wilsonville, OR 97070

November 7, 2011

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, DC 20549

Attention: Jay Ingram, Esq., Legal Branch Chief

| Re: | Trellis Earth Products, Inc. |

Registration Statement on Form S-1

Filed September 23, 2011

File No. 333-176970

Ladies and Gentlemen:

In connection with the filing today of Amendment No. 1 to the above-referenced Registration Statement on Form S-1, the following responses address the comments of the reviewing Staff of the United States Securities and Exchange Commission (the “Staff”) as set forth in a comment letter dated October 19, 2011 relating to the above-referenced registration statement of Trellis Earth Products, Inc. (“Trellis” or the "Company") The answers set forth herein refer to each of the Staff’s comments by number.

General

1. Please note the updating requirements of Rule 8-08 of Regulation S-X.

Response:

The Company notes the updating requirements of Rule 8-08 of Regulation S-X. An update to the financial statements is not required with the current filing.

2. Prior to the effectiveness of the registration statement, please arrange to have FINRA callus or provide us with a letter indicating that FINRA has cleared the underwriting arrangements for the offering.

Response:

Prior to the effectiveness of the registration statement, the Company will have FINRA call the Staff or provide the Staff with a letter indicating that FINRA has cleared the underwriting arrangements for the offering, in accordance with the Staff’s comment.

3. We note that you have provided numerous factual statements, but you do not always indicate whether the source of this information is management's belief, industry data, general articles, or any other source. If this information is based upon management's belief, please indicate that this is the case, and provide an explanation for the basis of your belief. If this information is based upon other sources, please provide us with copies of these sources. Please also disclose in your filing the date of these sources and whether the information represents the most recently available data and, therefore, remain reliable. Finally, if you funded or were otherwise affiliated with any of the sources that you cite, please disclose this. Otherwise, please confirm that these sources are widely available to the public. If any sources are not publicly available, either file consents or explain to us why you are not required to do so under Rule 436 of Regulation C and Section 7 of the Securities Act of 1933, as amended. To expedite our review, please provide us with copies of each source, clearly marked to highlight the portion or section that contains this information and cross-reference it to the appropriate location in your filing.

Response:

The registration statement has been revised throughout in accordance with the Staff’s comment. The Company was not funded or otherwise affiliated with any of the sources cited. To the Company’s knowledge, all the information represents the most recent available data and therefore remains reliable. The sources are widely available to the public. Copies of each source, clearly marked to highlight the portion or section that contains the information and cross-referenced to the appropriate location in the filing, is being provided supplementally.

4. We note that you have yet to file some of the exhibits, including the legal opinion. Please file these exhibits as soon as possible so that we will have sufficient time to review them. We may have comments on these materials.

Response:

The legal opinion has been filed. The remaining exhibits will be filed with the next amendment..

Calculation of Registration Fee

5. In a footnote to the table, please indicate that the Proposed Maximum Aggregate Offering Price includes shares that the underwriters have the option to purchase to cover over-allotments, if any.

Response:

Footnote 1 to the fee table has been revised to disclose the amount of the over-allotment option included in the Proposed Maximum Aggregate Offering Price.

Summary Financial Data, page 4

6. Please add pro forma columns to the statement of operations data presented for the year ended December 31, 2010 and six months ended June 30, 2011 that give effect to the conversion of preferred stock into common stock and the $654,775 in offering proceeds that will be used to repay debt as discussed on page 12. In doing so, please ensure that you include footnotes to the table showing the amount of each pro forma adjustment and how you computed it, including any pro forma adjustments to the numerator and/or denominator used in computing basic and diluted loss per share. The only IPO shares that should be shown as outstanding in the pro forma column for the denominator used in computing basic and diluted loss per share should be those necessary to repay the debt discussed on page 12. The denominator used in computing pro forma basic and diluted loss per share should also give effect to the impact of the August 3, 2011 conversion of your preferred stock into common stock.

Response:

As Company counsel Jeff Cahlon discussed with Lisa Etheridge, the repayment of the debt will occur following the closing of the offering, and as a result, should not be separately be included in a pro forma column that does not otherwise reflect the sale of all of the shares in the offering. A pro forma column has been added to the statement of operations data for the conversion of the preferred shares into common stock and offering (including the repayment of debt that will occur following the closing of the offering).

7. Please revise to also include a pro forma column in the balance sheet data section on page 4. Please discuss in footnotes to the balance sheet data section the amounts of the pro forma adjustments to each balance sheet line item and show how they were computed. Please do the same for each additional adjustment necessary to arrive at the pro forma as adjusted amounts. Similarly revise your disclosures in the capitalization table on page 13.

Response:

A pro forma column in the balance sheet data section and footnotes have been added in accordance with the Staff’s comment. The capitalization table on page 13 has been similarly revised in accordance with the Staff’s comment. See also the Company’s response to comment 10.

Use of Proceeds

8. In footnote four, please disclose the interest rate and maturity date of the inventory financing note due Zhejiang Wafa Ecosystem Science & Technology Co. Ltd. Refer to Instruction 4 to Item 504 of Regulation S-K.

Response:

Footnote 4 has been revised to disclose the interest rate and maturity date of the inventory financing note due Zwest in accordance with the Staff’s comment.

9. We note your reference on page 13 to "all the other uses for the proceeds" and "the remaining net proceeds." As it appears you have allocated 100% of the expected net proceeds, please clarify what you mean by "other uses" and "remaining net proceeds."

Response:

The references to “all the other uses for the proceeds” and “remaining” net proceeds have been removed from the “Use of Proceeds” section.

Capitalization, page 13

10. Please revise both the pro forma and pro forma as adjusted columns to give effect to the$654,775 in offering proceeds that will be used to repay debt as discussed on page 12.Similarly revise the summary financial data section on page 4.

Response:

As Company counsel Jeff Cahlon discussed with Lisa Etheridge, the repayment of the debt will occur following the closing of the offering, and as a result, should not be separately be included in a pro forma column that does not otherwise reflect the sale of all of the shares in the offering.

11. It appears that the amounts presented in your table on page 13 for additional paid in capital and common stock issued and outstanding as of June 30, 2011 are not consistent with the amounts presented on page F-19. Please revise your filing as necessary to present the correct amounts.

Response:

The filing has been revised to present the correct amounts in accordance with the Staff’s comment.

Dilution, page 14

12. Please disclose your treatment of the preferred stock on a historical and pro forma basis in computing the amounts shown in the dilution table. Supplementally explain to us your rationale.

Response:

The dilution section has been revised to explain that it gives effect to the conversion of the Seed Series Preferred Stock into common stock. The rationale for this treatment is that the Company is selling common stock in the offering, and therefore treating the preferred as having been converted (in fact, all preferred stock was converted to common shares in August 2011) provides the most useful information to investors.

Management's Discussion and Analysis ... , page 15

Results of Operations, page 16

Six Months Ended June 30, 2011, page 16

13. We note your statement that the increase in your cost of revenues for the six months ended June 30, 2011 compared to the six months ended June 30, 2010 was due to the increase in revenues and price increases in 2011 from your contract manufacturer in China. Please disclose the extent to which each of these factors affected your cost of revenues. Refer to Item 303(a)(3) of Regulation S-K. This comment also applies to "Sales" and "Cost of Revenues" on page 18 for the year ended December 31, 2010 compared to the year ended December 31, 2009.

Response:

The disclosure on pages 17 and 18 has been revised in accordance with the Staff’s comment.

Year Ended December 31, 2010…, page 18

14. In this subheading, you describe these numbers as "unaudited." Please tell us why this is appropriate given that you have included audited financial statements for the years ended December 31, 2009 and 2010.

The word “unaudited” has been removed from the subheading.

Liquidity and Capital Resources, page 19

15. Please revise to quantify the amount of any cash or cash equivalents held in financial institutions located outside of the United States as of December 31, 2010 and June 30,2011. If applicable, please also revise to disclose the nature and extent of any restrictions on your ability to transfer these funds to the United States.

Response:

“Liquidity and Capital Resources” has been revised to disclose that the Company did not have any cash or cash equivalents held in financial institutions located outside of the United States as of December 31, 2010 and June 30, 2011.

Business, page 22

Use of Bioplastics, page 24

16. We note your statement, "Bioplastics are commonly compounds or blends of plastics that incorporate renewable biomass sources, such as soybeans (hulls or oil), cornstarch, pea orpotato starch polylactic acid." Please disclose whether you use certain of these or other materials to create your bioplastics.

Response:

The “Business” section has been revised to disclose that the only biomass source the Company currently uses in its products is cornstarch. See page 24.

Customers, Marketing and Distribution, page 26

Bunzl Distribution and other Customers

17. We note your disclosure that you do not have a long-term written contract with Bunzl. Please disclose whether you have an oral contract with Bunzl. If you have an oral contract, please tell us what consideration you gave to filing a written summary of the oral contract as an exhibit to the registration statement. Refer to Question 146.04 of our Regulation S-K Compliance and Disclosure Interpretations. This comment also applies to your relationship as the exclusive importer of Zwest's production into the United States.

Response:

The registration statement has been revised to clarify that the Company is not party to any oral contract with Bunzl or Zwest.

Current Production, page 27

18. On page 28, you state that you "will have the option" of having your products produced at five other factories in Asia. Please clarify whether you are guaranteed this option or whether there are simply five other factories in Asia that currently provide the same services as Zwest.

Response:

The registration statement has been revised to clarify that the Company is aware of five other factories in Asia that currently are capable of producing substantially the same products as those produced for the Company by Zwest. See page 28.

Competitive Advantages, page 29

19. We note your disclosures that you believe you can produce your products at a cost savings compared to conventional plastics. We further note your hypothetical calculations of the costs of production on page 29. Please revise your disclosures to provide the basis for these statements and calculations.

Response:

The Competitive Advantages section has been revised to provide the basis for the Company’s statements and calculations in accordance with the Staff’s comment. See page 29.

Manufacturing Strategy, page 30

20. You state that you plan to lease additional space in Oregon and in Illinois. Please disclose whether you have identified these facilities and whether you have entered into any discussions or agreements for leasing these facilities. Please also disclose the extent of any discussions you have entered into and the material terms of any agreements you have entered into.

Response:

The following disclosure has been added on page 30:

“In Oregon, we have identified a location near our current headquarters owned by our current landlord and are in negotiations with the landlord with respect to a lease. In Illinois, we have identified a location and begun negotiations with its owner with respect to a lease. We have not yet entered into any leases or other agreements for such facilities in Oregon or Illinois.”

Management, page 33

21. You state, "John P. Metcalf has served as a director and as our Chairman of the Audit Committee, the Compensation Committee, and the Nominating Committee since August2011." However, on page 34, you state, "Prior to completion of this offering, our board of directors will have an audit committee, a compensation committee and a nominating committee . ..." Additionally, on page 35, you state that your board of directors acts as your audit committee. Please revise your disclosures to clarify whether these committees currently exist, as evidenced by your statement regarding John P. Metcalf, or whether you have yet to form these committees, as evidenced by your statements on pages 34 and 35.

Response:

The registration statement has been revised to clarify that the Company’s audit committee, compensation committee and nominating committee already exist. See page 34.

Executive Compensation, page 36

Summary Compensation Table, page 36

22. Please provide the information required by Item 402 of Regulation S-K for your principal financial officer. Refer to Item 402(a)(3)(ii) of Regulation S-K.

Response:

The Company is a smaller reporting company and as such, under Instruction to Item 402(m)(2) of Regulation S-K, “no disclosure need be provided for any executive officer, other than the PEO, whose total compensation … does not exceed $100,000.” Because the Company’s principal financial officer’s total compensation for the last fiscal year was less than $100,000, he may be omitted from the summary compensation table.

23. You state that Mr. Collins agreed not to disclose any of your proprietary information. Please clarify whether this agreement extends only to the term of the employment agreement and for the two-year period thereafter or whether it extends indefinitely.

Response:

The registration statement has been revised to clarify that the period during which Mr. Collins agreed not to disclose any of the Company’s proprietary information is for the term of the employment agreement and the two-year period thereafter.

Director Compensation, page 37

24. We note your statement that "[t]he chairman of your audit committee, compensation committee, and nominating committee receives additional compensation of $20,000annually, 10,000 options vesting upon agreement to serve, and 250 shares of common stock granted quarterly." Please clarify whether this additional compensation is granted for each chairman position or whether this is the total additional compensation that will be granted to the director who holds all three chairman positions.

Response:

The director compensation disclosure has been clarified in accordance with the Staff’s comment.

Underwriting, page 43

25. You reference Aegis Capital Corp. as the representative of the underwriters, and you refer to underwriters throughout the registration statement. However, the only underwriter you identify is Aegis Capital Corp. Please clarify whether you have more than one underwriter, and revise your disclosures accordingly.

Response:

The Company anticipates that there will be more than one underwriter, but the Company has not yet determined who any additional underwriters may be. The registration statement will be revised prior to going effective to identify any additional underwriters.

Audited Financial Statements

Notes to Financial Statements, page F-7

Note B—Summary of Significant Accounting Policies, page F-7

26. Please disclose the types of costs included in selling, general and administrative expenses. Please also disclose whether you include inbound freight charges, purchasing and receiving costs, inspection costs, warehousing costs, internal transfer costs, and the other costs of your distribution network in the cost of revenues line item. With the exception of warehousing costs, if you currently exclude a portion of these costs from cost of revenues, please disclose:

• here and in a footnote the line items that these excluded costs are included in and the amounts included in each line item for each period presented, and

• in MD&A that your gross profit may not be comparable to those of other entities, since some entities include all of the costs related to their distribution network in cost of revenues and others like you exclude a portion of them from gross profit, including them instead in a line item such as selling, general and administrative expenses.

Response:

The following disclosure has been added to Note B:

“The Company’s cost of revenues includes cost of products purchased for distribution, inbound freight charges, purchasing and receiving costs, the cost of internal inspection and quality control, depreciation of manufacturing assets and all direct costs related to distribution of the Company’s products.

The Company’s selling, general and administrative expenses include payroll and associated costs, advertising, professional fees and other corporate administrative costs. Selling, general and administrative expenses also include depreciation and amortization expense for assets.”

The Company believes that its cost of revenues and gross profit presentation is comparable to other companies in the distribution business. The Company does not exclude the typical cost items from the cost of revenues line on the statements of operation. Therefore, the Company has not added the disclosure referenced in the second bullet point of the Staff’s comment.

27. Please revise your accounting policy footnotes to indicate if you include an allocation of your depreciation to cost of revenues. If you do not include depreciation in your cost of revenues, please revise your description of cost of revenues on the face of your statement of operations and elsewhere throughout the filing to read somewhat as follows: "Cost of revenues (exclusive of depreciation shown separately below)." Please also remove any references in the filing to gross profit or gross profit margin, if you do not include a portion of your depreciation in cost of revenues. See SAB Topic 1 1:B.

Response:

The Company does not include an allocation of the depreciation to cost of revenues because its revenues are not generated from its production. The Company does not currently have any fixed assets related to production activities; all of the Company’s fixed assets are related to office and administrative activities. As a result of the foregoing, the Company has not revised its disclosures related to cost of revenues, gross profit or gross profit margin.

Note F—Property, Plant and Equipment, Net, page F-11

28. Please revise to disclose why assets of $70,000 as of December 31, 2010 and $56,250 as of December 31, 2009 have not been placed in service. Please also disclose when you expect these assets to be placed in service.

Response:

The following disclosure has been added under Note F:

“These assets will be placed in service after the Company's ancillary production equipment has been installed in order to facilitate the operation. The Company expects to have these assets installed during the first quarter of fiscal 2012.”

Note H—Notes Payable, page F-11

29. Please tell us what consideration you gave to filing the promissory notes issued to Zwest as exhibits to the registration statement. Refer to Item 601(b)(10) of Regulation S-K.

Response:

The only outstanding note issued to Zwest has been added as Exhibit 10.15. The $287,062 note referred to on page F-11 has been repaid and is no longer outstanding. As such, the $287,062 note is not material and has not been filed. Please see page F-13, which discloses that the $287,062 note has been repaid.

Note L—Stockholders’ Equity, page F-17

30. Please tell us which of the exhibits you have filed describe the terms of your convertible preferred shares. In particular, please tell us the exhibit (or exhibits) that specify the circumstances under which the preferred shares are convertible into common shares, the$1.00 conversion price, and the rights of preferred shareholders to receive dividends at a rate of $0.06 per share if declared by the Board of Directors.

Response:

As disclosed on pages F-17 and F-18, on August 3, 2011, all of the Company’s outstanding convertible preferred shares were converted to shares of common stock. As disclosed on page F-22, the Company reincorporated as a Nevada corporation on August 8, 2011. The terms of the convertible preferred stock that were described on page F-17 related to the Company’s Seed Series Preferred Stock under the Company’s articles of incorporation as an Oregon corporation as in effect prior to the conversion of the preferred stock into common stock and the Company’s subsequent reincorporation as a Nevada corporation. The Company’s articles of incorporation, as currently in effect, have been filed as Exhibits 3.1 and 3.2 to the registration statement. The Company does not currently have any outstanding shares of preferred stock, and, as indicated in Exhibits 3.1 and 3.2, no shares of preferred stock have been designated. Note L has been revised to clarify this matter.

Note M—Subsequent Events, page F-18

31. We note that subsequent to December 31, 2010, you issued 537,786 common shares for gross proceeds of $1,075,572. Please tell us the extent to which these shares were sold to unrelated third parties as compared to related parties including but not limited to employees, officers, directors, and affiliates.

Response:

Note M has been revised to disclose that of these 537,786 shares, 25,000 shares were sold to Neil Nelson, a director of the Company, and the remaining were sold to unrelated third parties. See also “Certain Relationships and Related Transactions” on page 38.

Unaudited Interim Financial Statements, page F-19

General

32. Please address the above comments in your interim financial statements as well.

Response:

The above comments have also been addressed in the Company’s interim financial statements.

Item 15. Recent Sales of Unregistered Securities

33. Please ensure that you discuss, in this section, all transactions required to be reported under Item 701 of Regulation S-K. In this regard, we note that it appears some of the transactions described on page F-31 are not described in this section.

Response:

Item 15 has been revised to discuss all required transactions in accordance with the Staff’s comment. See page II-2.

Item 16. Exhibits, page II-3

34. You identify Exhibit 10.14 as "Bunzl form of purchase order." However, the document filed as Exhibit 10.14 appears to be a promissory note between the company and Yueh-Hsia Hsiang aka Amanda. Please advise.

Response:

The note between the Company and Yueh-Hsia Hsiang was inadvertently filed as Exhibit 10.14. The note between the Company and Yueh-Hsia Hsiang does not need to be filed by the Company as it is no longer outstanding and is not material to the Company. The Company intended to file the Bunzl form of purchase order as Exhibit 10.14. Upon further analysis, the Company has determined that it is not required to file the Bunzl form of purchase order as an exhibit. As disclosed in the registration statement, the Company is not party to any long-term written contract with Bunzl or any oral contract with Bunzl. Any particular purchase order between the Company and Bunzl represents a contract entered into in the ordinary course of business..

The Company would like to be in a position to commence its roadshow during the week of November 28, 2011, and respectfully requests the Staff to review the Company’s amended registration statement to accommodate this schedule. The Company expects that final pricing information will be provided in a further amendment to the registration statement, and the Company does not expect to rely on Rule 430A. Requests for acceleration of the effectiveness of the registration statement will be submitted by the Company and the underwriters as soon as the Staff has advised the Company that it has no further comments to the registration statement. At the time of the request, the Company will furnish a letter acknowledging the SEC’s position with respect to declaration of effectiveness and Staff comments. The request of Aegis Capital Corp. will include the representation from the underwriters with respect to compliance with Rule 15c2-8. A copy of the letter from FINRA clearing the underwriting compensation arrangements for the offering will be forwarded to the Staff immediately upon its receipt. The Company believes that all other supplemental information requested by the Staff has been provided.

| | | Very Truly Yours, | |

| | | | |

| | | /s/ William Collins | |

| | | Chief Executive Officer | |

| | | | |

| | | | |

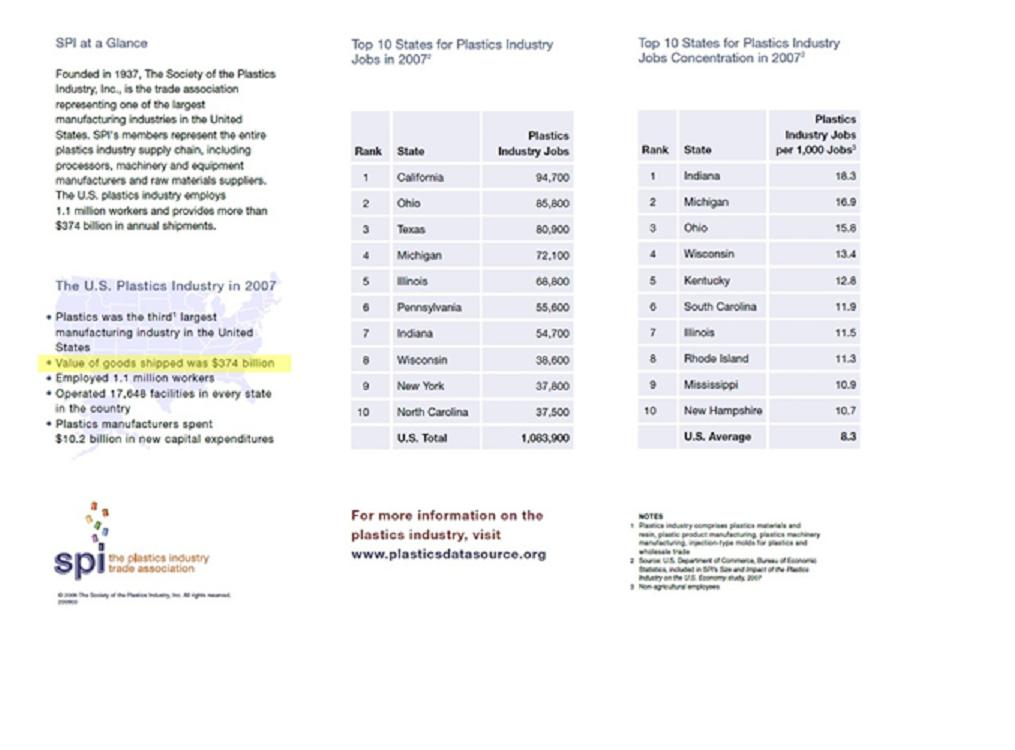

| 1. | The conventional plastics industry, one of the largest industries in the United States, currently represents over $1 billion per day in gross sales, according to the Society of the Plastics Industry, Inc, an industry trade association, as currently reported on the group’s website. |

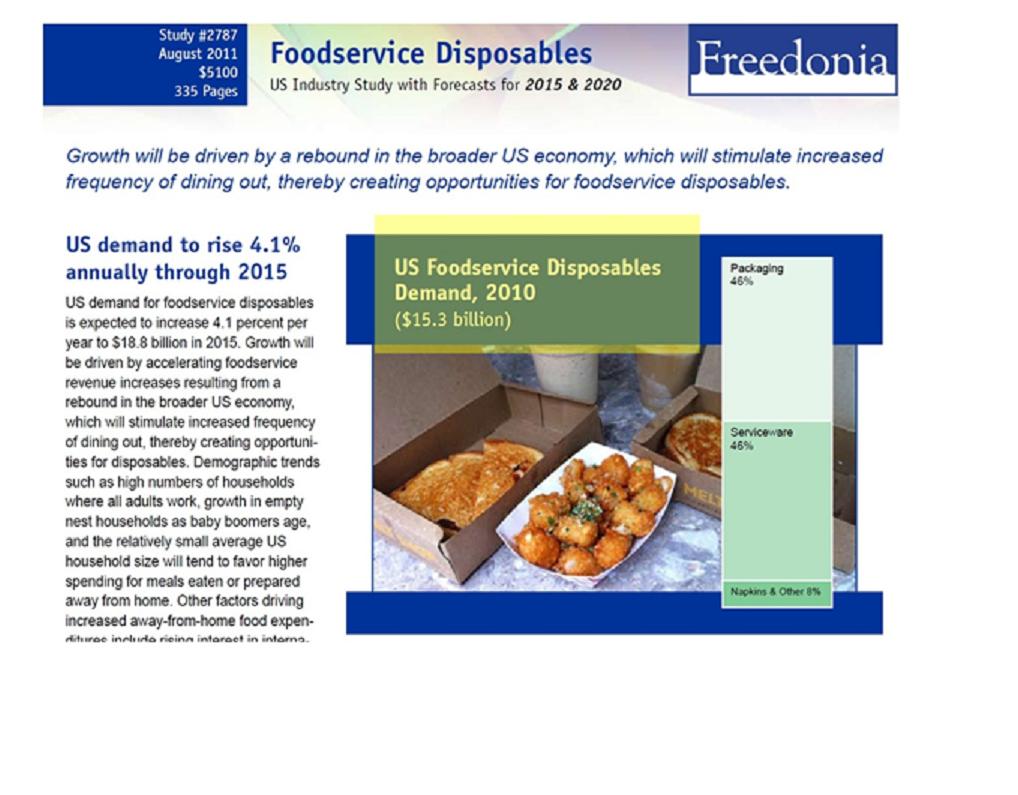

| 2. | Of this amount, disposable food packaging currently accounts for over $1 billion per month in U.S. sales, according to an August 2011study by The Freedonia Group, Inc., an independent research company. |

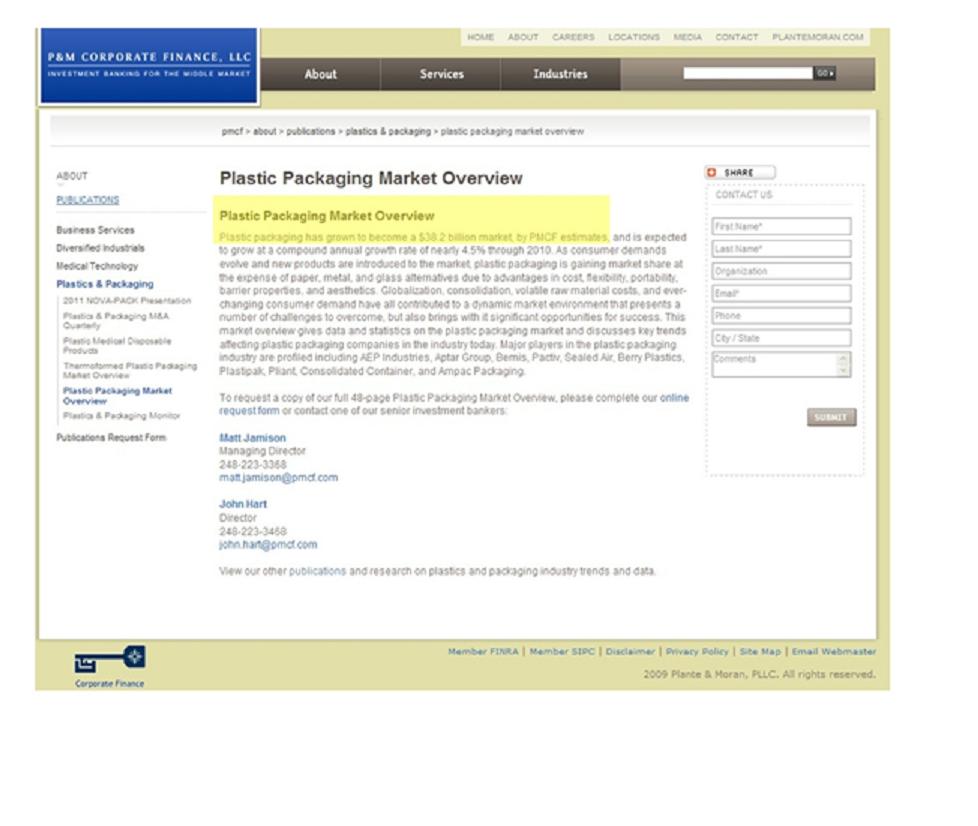

| 3. | A report published in 2009 by another research group, P&M Corporate Finance, LLC, estimates the total plastics packaging market to be $38.2 billion in U.S. sales per year. |

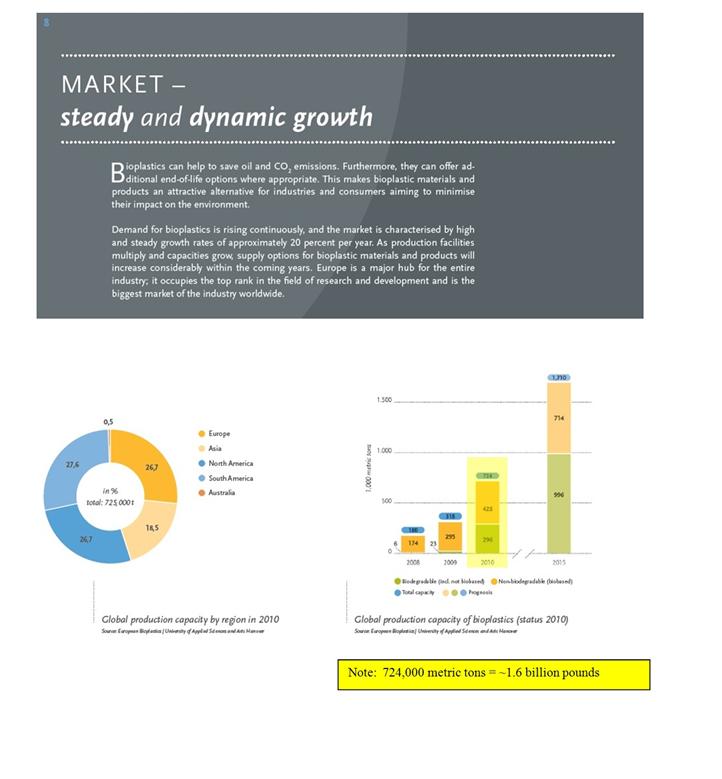

| 4. | The University of Applied Sciences and Arts in Hanover, Germany currently reports on its website that in 2010 global bioplastics capacity was an estimated 1.6 billion pounds. |

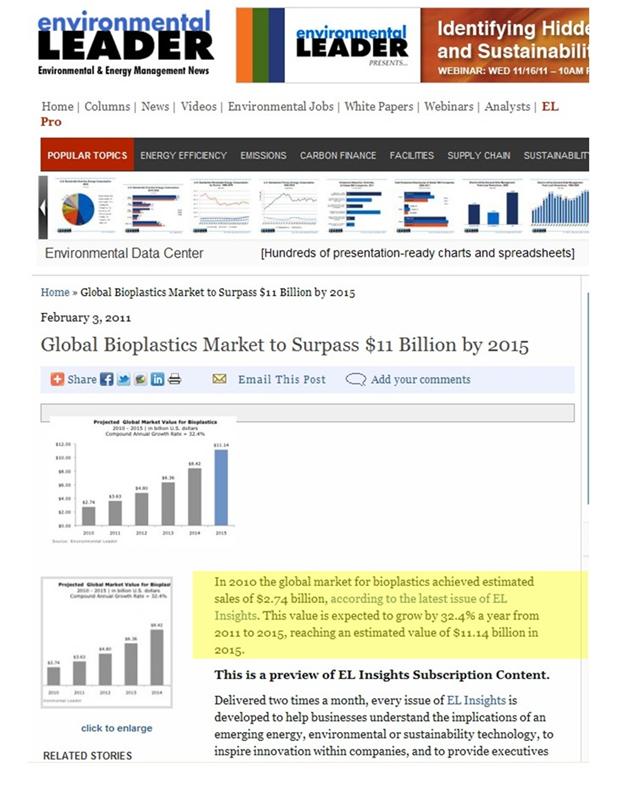

| 5. | The value of this capacity, as reported by Environmental and Energy Management News on February 3, 2011, was $2.7 billion, or less than one percent of the U.S. plastics market. |

| 6. | According to information currently posted by the U.S. Energy Information Administration on its website, in 2006, the most recent year for which data is available, 4.6% of U.S. petroleum consumption was used to make plastics. |

| 1. | The conventional plastics industry, one of the largest industries in the United States, currently represents over $1 billion per day in gross sales, according to the Society of the Plastics Industry, Inc, an industry trade association, as currently reported on the group’s website. |

| 2. | Of this amount, disposable food packaging currently accounts for over $1 billion per month in U.S. sales, according to an August 2011study by The Freedonia Group, Inc., an independent research company. |

| 3. | A report published in 2009 by another research group, P&M Corporate Finance, LLC, estimates the total plastics packaging market to be $38.2 billion in U.S. sales per year. |