As filed with the Securities and Exchange Commission on November 23, 2009

Registration No. 333-159607

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 4 to

FORM F-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

AUTOCHINA INTERNATIONAL LIMITED

(Exact name of registrant as specified in its charter)

| Cayman Islands | 5500 | Not Applicable |

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

No.322, Zhongshan East Road

Shijiazhuang, Hebei

People’s Republic of China

Tel: +86 311 8382 7688

Fax: +86 311 8381 9636

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

Yong Hui Li

No.322, Zhongshan East Road

Shijiazhuang, Hebei

People’s Republic of China

Tel: +86 311 8382 7688

Fax: +86 311 8381 9636

(Address, including zip code, and telephone number,

including area code, of agent for service)

With copies to:

| Mitchell S. Nussbaum, Esq. |

| Loeb & Loeb LLP |

| 345 Park Avenue |

| New York, New York 10154 |

| (212) 407-4000 |

| (212) 407-4990 — Facsimile |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE CHART

| Title of Each Class of Security Being Registered | | Amount Being Registered (1) | | Proposed Maximum Offering Price Per Security(2) | | | Proposed Maximum Aggregate Offering Price(2) | | | Amount of Registration Fee | |

| Ordinary Shares, par value $0.001 (3) | | | 3,298,716 | | Shares | | $ | 7.39 | (4) | | $ | 24,377,511.24 | | | $ | 1,360.27 | |

| Ordinary Shares, par value $0.001 (5) | | | 1,030,314 | | Shares | | $ | 7.39 | (4) | | $ | 7,614,020.46 | | | $ | 424.86 | |

| Ordinary Shares, par value $0.001 (6) | | | 705,790 | | Shares | | $ | 7.39 | (4) | | $ | 5,215,788.10 | | | $ | 291.04 | |

| Ordinary Shares, par value $0.001 (7) | | | 279,000 | | Shares | | $ | 7.39 | (4) | | $ | 2,061,810.00 | | | $ | 115.05 | |

| Ordinary Shares underlying warrants, par value $0.001 (8) | | | 1,430,000 | | Shares | | $ | 7.39 | (9) | | $ | 10,567,700.00 | | | $ | 589.68 | |

| Warrants (8) | | | 1,430,000 | | Warrants | | $ | - | | | $ | - | | | $ | - | (10) |

| | | | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | $ | 49,836,829.80 | | | $ | 2,780.90 | (11) |

| | (1) | Pursuant to Rule 416 of the Securities Act of 1933, as amended, the ordinary shares and warrants offered hereby also include such presently indeterminate number of shares of the Registrant’s ordinary shares and warrants as a result of stock splits, stock dividends or similar transactions. |

| | (2) | Estimated solely for the purpose of calculating the registration fee. |

| | (3) | Represents ordinary shares of the Registrant being registered for resale that have been issued to Honest Best Int’l Ltd., as described in this registration statement. |

| | (4) | Calculated pursuant to Rule 457(c) under the Securities Act of 1933, as amended, based on the average high and low price of the ordinary shares as quoted through the Over-The-Counter Bulletin Board on May 26, 2009. |

| | (5) | Represents ordinary shares of the Registrant being registered for resale that have been issued to the founding shareholders named in this registration statement. |

| (6) | Represents ordinary shares of the Registrant being registered for resale that have been issued in connection with the exercise of certain call options as described in this registration statement. |

| | (7) | Represents ordinary shares of the Registrant being registered for resale that have been issued in connection with the cashless exercise of the underwriters unit purchase options and the underlying warrants as described in this registration statement. |

| | (8) | Represents warrants and ordinary shares underlying the warrants of the Registrant being registered for resale that were originally issued in a private placement to the founding shareholders. |

| | (9) | Calculated pursuant to Rule 457(c) and Rule 457(g) under the Securities Act of 1933, as amended, based on the average high and low price of the ordinary shares as quoted through the Over-The-Counter Bulletin Board on May 26, 2009. |

| | (10) | Pursuant to Rule 457(i) of the Securities Act of 1933, as amended, no additional fee is due since a fee was already paid for registration of the ordinary shares underlying the warrants. |

Pursuant to Rule 429 under the Securities Act of 1933, the prospectus included in this registration statement is a combined prospectus relating to registration statement no. 333-147284 previously filed by the registrant on Form S-1 and declared effective February 27, 2008. This registration statement, which is a new registration statement, also constitutes post-effective amendment no. 1 on Form F-1 to registration statement 333-147284, and such post-effective amendment shall hereafter become effective concurrently with the effectiveness of this registration statement in accordance with Section 8(c) of the Securities Act of 1933.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

| The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. |

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED NOVEMBER 23, 2009 |

9,485,928 Ordinary Shares

1,430,000 Warrants

AutoChina International Limited

This prospectus relates to 6,743,820 ordinary shares and 1,430,000 warrants of AutoChina International Limited (“AutoChina”), a Cayman Island exempted company, that may be sold from time to time by the Selling Shareholders named in this prospectus. This includes (i) 3,298,716 ordinary shares held by Honest Best Int’l Ltd., (ii) 1,030,314 ordinary shares purchased by AutoChina’s founding shareholders, (iii) 705,790 ordinary shares issued in connection with the exercise of certain call options, (iv) 279,000 ordinary shares issued in connection with the cashless exercise of the underwriter unit purchase option (v) 1,430,000 warrants, and (vi) 1,430,000 ordinary shares underlying the warrants. The warrants and ordinary shares underlying the warrants registered for resale hereunder were originally issued in a private placement to Autochina’s founding shareholders, and were subsequently exchanged for warrants identical to those warrants issued in the Registrant’s initial public offering. Such exchanged warrants were then partially sold to insiders of AutoChina, as is further described in this registration statement.

This prospectus also relates to 2,742,108 ordinary shares of AutoChina, which are issuable upon the exercise of outstanding warrants issued in our initial public offering pursuant to a prospectus dated February 28, 2008.

The prices at which the Selling Shareholders may sell their shares will be determined by the prevailing market price for the shares or pursuant to privately negotiated transactions. Information regarding the Selling Shareholders and the times and manner in which they may offer and sell the shares or warrants under this prospectus is provided under “Selling Shareholders” in this prospectus.

AutoChina will not receive any of the proceeds from the sale of the shares or warrants under this prospectus, although AutoChina could receive up to $7,150,000 upon the exercise of all of the warrants held by the founding shareholders and $13,710,540 upon the exercise of all of the outstanding warrants issued in our initial public offering pursuant to a prospectus dated February 28, 2008. Any amounts we receive from such exercises will be used for general working capital purposes.

AutoChina’s ordinary shares, warrants and units (defined as consisting of one ordinary share and one warrant to purchase one ordinary share) are traded on the NASDAQ Stock Market under the symbols AUTC, AUTCW, and AUTCU, respectively. On November 20, 2009, the closing sale price of the ordinary shares, warrants and units was $24.05, $18.00 and $40.10, respectively. You are urged to obtain current market quotations of AutoChina’s ordinary shares and warrants before purchasing any of the shares and warrants being offered for sale pursuant to this prospectus.

The Selling Shareholders, and any broker-dealer executing sell orders on behalf of the Selling Shareholders, may be deemed to be “underwriters” within the meaning of the Securities Act of 1933. Commissions received by any broker-dealer may be deemed to be underwriting commissions under the Securities Act of 1933.

INVESTING IN OUR SECURITIES IS HIGHLY RISKY. YOU SHOULD INVEST IN OUR SECURITIES ONLY IF YOU CAN AFFORD TO LOSE YOUR ENTIRE INVESTMENT. FOR A DISCUSSION OF SOME OF THE RISKS INVOLVED, SEE “RISK FACTORS” BEGINNING ON PAGE 7 OF THIS PROSPECTUS.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of the prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2009.

This prospectus is not an offer to sell any securities other than the ordinary shares and warrants offered hereby. This prospectus is not an offer to sell securities in any circumstances in which such an offer is unlawful.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

We obtained statistical data, market data and other industry data and forecasts used throughout this prospectus from publicly available information. While we believe that the statistical data, industry data, forecasts and market research are reliable, we have not independently verified the data, and we do not make any representation as to the accuracy of the information.

| ENFORCEABILITY OF CIVIL LIABILITIES | 1 |

| | |

| PROSPECTUS SUMMARY | 2 |

| | |

| SUMMARY FINANCIAL DATA | 6 |

| | |

| RISK FACTORS | 7 |

| | |

| THE OFFERING | 30 |

| | |

| PER SHARE MARKET INFORMATION | 33 |

| | |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 34 |

| | |

| REASONS FOR THE OFFER AND USE OF PROCEEDS | 35 |

| | |

| EXPENSES RELATED TO THIS OFFERING | 35 |

| | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 36 |

| | |

| UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS | 63 |

| | |

| CAPITALIZATION | 70 |

| | |

| BUSINESS | 71 |

| | |

| DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 95 |

| | |

| PRINCIPAL SHAREHOLDERS | 108 |

| | |

| SHARES ELIGIBLE FOR FUTURE SALE | 110 |

| | |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 112 |

| | |

| DESCRIPTION OF SECURITIES | 119 |

| | |

| SELLING SHAREHOLDERS | 124 |

| | |

| PLAN OF DISTRIBUTION | 128 |

| | |

| TAXATION | 130 |

| | |

| LEGAL MATTERS | 136 |

| | |

| EXPERTS | 137 |

| | |

| WHERE YOU CAN FIND ADDITIONAL INFORMATION | 137 |

ENFORCEABILITY OF CIVIL LIABILITIES

AutoChina International Limited is a Cayman Islands exempted company and most of its executive offices are located outside of the United States in the People’s Republic of China. Most of its directors, officers and some of the experts named in this prospectus reside outside the United States. In addition, a substantial portion of its assets and the assets of its directors, officers and experts are located outside of the United States. As a result, you may have difficulty serving legal process within the United States upon AutoChina International Limited or any of these persons. AutoChina International Limited intends to abide by judgments issued in U.S. courts based upon the civil liability provisions of U.S. federal or state securities laws. Notwithstanding, you may also have difficulty enforcing, both in and outside the United States, judgments you may obtain in U.S. courts against AutoChina International Limited or these persons in any action, including actions based upon the civil liability provisions of U.S. federal or state securities laws.

Furthermore, there is substantial doubt that the courts of the Cayman Islands or the People’s Republic of China would enter judgments in original actions brought in those courts predicated on U.S. federal or state securities laws.

We have appointed CT Corporation System located at 111 Eighth Avenue, 13/F, New York, New York 10011 as our agent to receive service of process with respect to any action brought against us in the United States District Court for the Southern District of New York under the federal securities laws of the United States or of any state in the United States or any action brought against us in the Supreme Court of the State of New York in the County of New York under the securities laws of the State of New York.

PROSPECTUS SUMMARY

This summary highlights key information contained elsewhere in this prospectus and is qualified in its entirety by the more detailed information and financial statements included elsewhere in this prospectus. It may not contain all of the information that is important to you. You should read the entire prospectus, including “Risk Factors,” our consolidated financial statements and the related notes thereto and condensed consolidated financial statements and the related notes thereto, and the other documents to which this prospectus refers, before making an investment decision.

Unless otherwise stated in this prospectus,

| | Ÿ | references to “we,” “us” or “our company” refer to AutoChina International Limited; |

| | Ÿ | references to “ACG” refer to AutoChina Group Inc. (together with its subsidiaries and affiliated entities); |

| | Ÿ | references to “founding shareholders” refer collevtively to James Cheng-Jee Sha, Diana Chia-Huei Liu, William Tsu-Cheng Yu, Jimmy (Jim) Yee-Ming Wu and Gary Han Ming Chang, each of whom purchased AutoChina shares and warrants prior to our initial public offering; |

| | Ÿ | references to “PRC” or “China” refer to the People’s Republic of China; |

| | Ÿ | references to “dollars” or “$” refer to the legal currency of the United States; |

| | Ÿ | references to “Renminbi” or “RMB” refer to the legal currency of China; |

| | Ÿ | references to “public shareholders” refer to the holders of shares purchased in AutoChina’s initial public offering; and |

| | Ÿ | references to “business combination” refer to AutoChina’s transaction with AutoChina Group Inc. on April 9, 2009 pursuant to which AutoChina acquired all of the outstanding securities of ACG, resulting in ACG becoming a wholly owned subsidiary of AutoChina. |

Overview

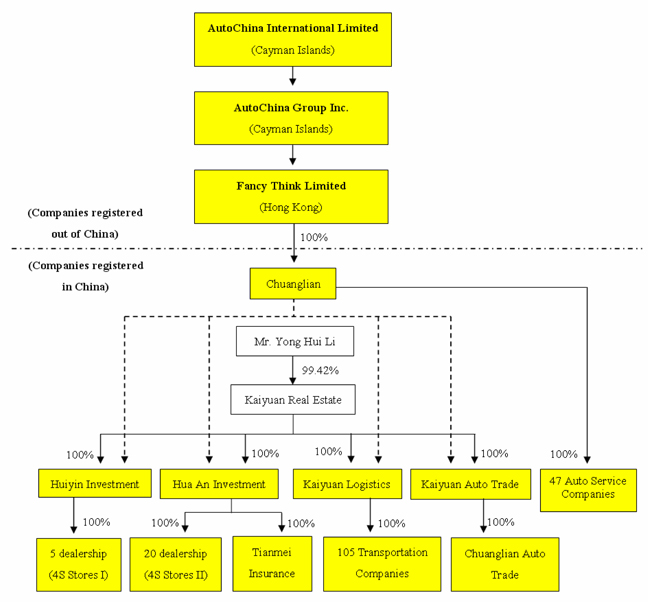

AutoChina International Limited (“AutoChina”) is a holding company whose primary business operations are conducted through its wholly owned subsidiary, AutoChina Group Inc. (together with its subsidiaries and affiliated entities, “ACG”).

AutoChina was incorporated in the Cayman Islands on October 16, 2007 under the name “Spring Creek Acquisition Corp.” as a blank check company for the purpose of acquiring, through a stock exchange, asset acquisition or other similar business combination, or controlling, through contractual arrangements, an operating business, that had its principal operations in Greater China (including Hong Kong, Macau and Taiwan).

On April 9, 2009, we acquired all of the outstanding securities of ACG from Honest Best Int’l Ltd., resulting in ACG becoming a wholly owned subsidiary of AutoChina. Promptly after the business combination with ACG, we changed our name to “AutoChina International Limited.”

Prior to the business combination with ACG, AutoChina had no operating business.

ACG was incorporated on July 27, 2007 in the Cayman Islands by Chairman and CEO, Yong Hui Li. Prior to the business combination, ACG operated in two primary business segments: (i) the commercial vehicle sales and leasing segment, which provides financing to customers to purchase commercial vehicles, and (ii) the automotive dealership segment, which sells of branded automobiles through its nationally recognized dealer network.

On June 15, 2009, ACG agreed to sell its automotive dealership segment pursuant to the terms of an acquisition agreement entered into between Kaiyuan Real Estate Development Co., Ltd. (“Hebei Kaiyuan”) and Xinjiang Guanghui Industry Investment (Group) Co. (“Xinjiang”). ACG controls Hebei Kaiyuan through certain contractual arrangements. In consideration of the acquisition, Xinjiang will pay Hebei Kaiyuan approximately RMB470 million ($68.8 million). ACG expects the sale to be consummated by the end of December 2009. If the transaction is consummated, then ACG’s business will consist solely of its commercial vehicle sales and leasing segment. Although ACG anticipates that the transaction will be consummated, if the transaction is not consummated, ACG will continue to own and operate the automotive dealership segment.

AutoChina’s principal executive office is located at No. 322, Zhongshan East Road; Shijiazhuang, Hebei; People’s Republic of China. Its telephone number is +86 311 8382 7688.

The Offering

| Ordinary shares offered: | 9,485,928 (1) shares |

Warrants offered: | 1,430,000 (2) warrants |

Exercisability | Each warrant is exercisable for one ordinary share. |

Exercise price | $5.00 per share |

Exercise period | The warrants became exercisable on October 9, 2009, six months after the completion of our initial business combination, subject to there being an effective registration statement relating to such warrants. The warrants will expire at 5:00 p.m., New York City time, on February 26, 2013 or earlier upon redemption. However, no warrant will be exercisable and we will not be obligated to issue ordinary shares unless at the time a holder seeks to exercise such warrant, a prospectus relating to the ordinary shares issuable upon exercise of the warrant is current and the ordinary shares have been registered or qualified or deemed to be exempt under the securities laws of the state of residence of the holder of the warrants. Accordingly, such warrants could expire worthless if we fail to maintain an effective registration statement relating to the ordinary shares issuable upon exercise of the warrants or fail to obtain an exemption under the securities laws of the state of residence of the holder of the warrants. |

Redemption | As provided in the Warrant Agreement governing the warrants, we may redeem the outstanding warrants with the prior consent of EarlyBirdCapital (the underwriter of our initial public offering). AutoChina does not believe that this provision is unusual in initial public offerings for special purpose acquisition companies. |

(1) Consists of: (i) 3,298,716 ordinary shares held by Honest Best Int’l Ltd., (ii) 1,030,314 ordinary shares purchased by AutoChina’s founding shareholders, (iii) 705,790 ordinary shares issued in connection with the exercise of certain call options as described in this registration statement, (iv) 279,000 ordinary shares issued in connection with the cashless exercise of the representatives unit purchase option and (v) 1,430,000 ordinary shares underlying warrants purchased by AutoChina’s founding shareholders, together with (vi) 2,742,108 ordinary shares issuable upon the exercise of outstanding warrants issued in our initial public offering pursuant to a prospectus dated February 28, 2008.

(2) Consists of 1,430,000 warrants purchased by AutoChina’s founding shareholders in connection with our initial public offering pursuant to a prospectus dated February 28, 2008.

| | ● in whole and not in part, |

| | |

| | ● at a price of $0.01 per warrant at any time while the warrants are exercisable (which will only occur if a registration statement relating to the ordinary shares issuable upon exercise of the warrants is effective and current), |

| | |

| | ● upon a minimum of 30 days’ prior written notice of redemption, and |

| | |

| | ● if, and only if, the last sales price of our ordinary shares equals or exceeds $11.50 per share for any 20 trading days within a 30-trading day period ending three business days before we send the notice of redemption. |

| | |

| | The redemption criteria for our warrants were established at a price which is intended to provide warrant holders a reasonable premium to the initial exercise price (since the redemption price is $11.50, as compared to a $5.00 exercise price) and provide a sufficient degree of liquidity to cushion the market reaction to our redemption call (since the trading price must be at or above $11.50 for 20 trading days within a 30 trading day period). AutoChina does not believe that the requirement that Earlybird consent to AutoChina calling the warrants for redemption is unusual for special purpose acquisition companies. If we call the warrants for redemption as described above, our management will have the option to require all holders that wish to exercise our warrants to do so on a “cashless basis,” though the warrant holders are not eligible to do so at their own option. In such event, each holder would pay the exercise price by surrendering the warrants for that number of our ordinary shares equal to the quotient obtained by dividing (x) the product of the number of ordinary shares underlying the warrants, multiplied by the difference between the exercise price of the warrants and the fair market value of an ordinary share by (y) the fair market value of an ordinary share. The “fair market value” is the average reported last sale price of the ordinary shares for the 10 trading days ending on the third trading day prior to the date on which the notice of redemption is sent to the holders of warrants. Since we may redeem the warrants only with the prior consent of EarlyBirdCapital and EarlyBirdCapital may hold warrants subject to redemption, EarlyBirdCapital may have a conflict of interest in determining whether or not to consent to such redemption. We cannot assure you that EarlyBirdCapital will consent to such redemption if it is not in its best interests even if it is in our best interests. |

NASDAQ symbol: Ordinary Shares Warrants | “AUTC” |

Use of proceeds: | AutoChina will not receive any of the proceeds from the sale of the shares or warrants under this prospectus, although AutoChina could receive up to $7,150,000 upon the exercise of all of the warrants held by the founding shareholders and $13,710,540 upon the exercise of all of the outstanding warrants issued in our initial public offering pursuant to a prospectus dated February 28, 2008. Any amounts we receive from such exercises will be used for general working capital purposes. |

Ordinary share outstanding as of June 30, 2009: | 10,995,720 (1) shares |

Warrants outstanding as of June 30, 2009: | 4,172,108 warrants |

Risk factors: | Prospective investors should carefully consider the Risk Factors beginning on Page 7 before buying the ordinary shares and warrants offered hereby. |

| | (1) | The number of outstanding ordinary shares excludes 4,172,108 ordinary shares issuable upon the exercise of outstanding warrants issued prior to our initial public offering. The warrants are all exerciseable at an exercise price of $5.00 per share. |

Risks Affecting AutoChina

In evaluating the resale of the shares of AutoChina’s ordinary shares, you should carefully read this prospectus and especially consider the factors discussed in the section titled “Risk Factors” commencing on page 7.

SUMMARY FINANCIAL DATA

The following selected consolidated statements of operations data for AutoChina for the years ended December 31, 2006, 2007 and 2008 of ACG and the selected consolidated balance sheet data for our company as of December 31, 2007 and 2008 have been derived from our audited financial statements included elsewhere in this registration statement. The following selected consolidated statements of operations data for AutoChina for the six months ended June 30, 2008 and 2009 and the selected consolidated balance sheet data for our company as of June 30, 2008 and 2009 have been derived from our unaudited financial statements included elsewhere in this registration statement. You should read the selected consolidated financial data in conjunction with those financial statements and the accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The following selected consolidated statements of operations data for AutoChina, for the year ended December 31, 2005 and 2004, and the selected consolidated balance sheet data for AutoChina as of December 31, 2006, 2005 and 2004 have been derived from ACG’s audited financial statements that are not included in this registration statement.

The consolidated financial statements are prepared and presented in accordance with U.S. GAAP. The historical results do not necessarily indicate the Company’s or ACG’s results expected for any future periods.

AUTOCHINA INTERNATIONAL LIMITED AND SUBSIDIARIES

Selected Consolidated Financial Data

(In thousands of U.S. Dollars, except per share amounts)

| | | June 30, | | | As of December 31, | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| Balance Sheet Data - | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 21,404 | | | $ | 17,406 | | | $ | 12,820 | | | $ | 7,449 | | | $ | 4,529 | | | $ | 3,256 | |

| Restricted cash | | $ | 53,348 | | | $ | 40,824 | | | $ | 24,734 | | | $ | 25,885 | | | $ | 8,486 | | | $ | - | |

| Total current assets | | $ | 204,566 | | | $ | 143,476 | | | $ | 109,907 | | | $ | 88,327 | | | $ | 33,175 | | | $ | 14,425 | |

| Total assets | | $ | 263,044 | | | $ | 180,045 | | | $ | 128,883 | | | $ | 103,723 | | | $ | 43,113 | | | $ | 18,529 | |

| Total current liabilities | | $ | 189,311 | | | $ | 112,052 | | | $ | 84,617 | | | $ | 75,200 | | | $ | 31,132 | | | $ | 31,132 | |

| Total liabilities | | $ | 190,284 | | | $ | 112,457 | | | $ | 84,617 | | | $ | 75,210 | | | $ | 31,137 | | | $ | 14,576 | |

| Total stockholders' equity | | $ | 64,889 | | | $ | 60,638 | | | $ | 37,805 | | | $ | 22,535 | | | $ | 9,145 | | | $ | 3,953 | |

| Noncontrolling interests | | $ | 7,871 | | | $ | 6,950 | | | $ | 6,461 | | | $ | 5,978 | | | $ | 2,831 | | | $ | 2,397 | |

| Total equity | | $ | 72,760 | | | $ | 67,588 | | | $ | 44,266 | | | $ | 28,513 | | | $ | 11,976 | | | $ | 6,350 | |

| | | Six Months Ended June 30, | | | For the Years Ended December 31, | |

| | | 2009 | | | 2008 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| Statement of Operations Data - | | | | | | | | | | | | | | | | | | | | | |

| Revenues | | $ | 323,225 | | | $ | 217,405 | | | $ | 442,824 | | | $ | 294,665 | | | $ | 152,696 | | | $ | 84,826 | | | $ | 37,586 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cost of sales | | | 303,071 | | | | 205,160 | | | | 414,672 | | | | 277,181 | | | | 144,646 | | | | 81,035 | | | | 35,867 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross profit | | | 20,154 | | | | 12,245 | | | | 28,152 | | | | 17,484 | | | | 8,050 | | | | 3,791 | | | | 1,719 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating expenses | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Selling and marketing | | | 4,908 | | | | 3,280 | | | | 6,692 | | | | 3,944 | | | | 2,439 | | | | 1,285 | | | | 38 | |

| General and administrative | | | 4,766 | | | | 3,198 | | | | 7,506 | | | | 5,402 | | | | 2,444 | | | | 1,200 | | | | 369 | |

| Other income, net | | | (532 | ) | | | (237 | ) | | | (836 | ) | | | (355 | ) | | | (97 | ) | | | (8 | ) | | | 4 | |

| Total operating expenses | | | 9,142 | | | | 6,241 | | | | 13,362 | | | | 8,991 | | | | 4,786 | | | | 2,477 | | | | 411 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income from operations | | | 11,012 | | | | 6,004 | | | | 14,790 | | | | 8,493 | | | | 3,264 | | | | 1,314 | | | | 1,308 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other income (expense) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest income | | | 219 | | | | 228 | | | | 560 | | | | 288 | | | | 125 | | | | 41 | | | | 3 | |

| Interest expense | | | (1,572 | ) | | | (1,315 | ) | | | (2,805 | ) | | | (2,111 | ) | | | (723 | ) | | | (208 | ) | | | (69 | ) |

| Accretion of share repurchase obligation | | | (310 | ) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Equity in earnings (loss) of unconsolidated subsidiaries | | | 37 | | | | (17 | ) | | | (40 | ) | | | 139 | | | | 417 | | | | 365 | | | | (6 | ) |

| Acquisition-related costs | | | (295 | ) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income from continuing operations before income taxes | | | 9,091 | | | | 4,900 | | | | 12,505 | | | | 6,809 | | | | 3,083 | | | | 1,512 | | | | 1,236 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income tax provision (benefit) | | | 2,539 | | | | 1,065 | | | | 3,009 | | | | 983 | | | | (29 | ) | | | (62 | ) | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income from continuing operations | | | 6,552 | | | | 3,835 | | | | 9,496 | | | | 5,826 | | | | 3,112 | | | | 1,574 | | | | 1,236 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from discontinued operations, net of taxes | | | - | | | | (151 | ) | | | (144 | ) | | | 209 | | | | (87 | ) | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | | 6,552 | | | | 3,684 | | | | 9,352 | | | | 6,035 | | | | 3,025 | | | | 1,574 | | | | 1,236 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income attributable to the noncontrolling interests | | | (1,059 | ) | | | (617 | ) | | | (1,309 | ) | | | (1,260 | ) | | | (283 | ) | | | (158 | ) | | | (406 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income attributable to shareholders | | $ | 5,493 | | | $ | 3,067 | | | $ | 8,043 | | | $ | 4,775 | | | $ | 2,742 | | | $ | 1,416 | | | $ | 830 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Earnings (loss) per ordinary share (1) - | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Continuing operations | | $ | 0.67 | | | $ | 0.42 | | | $ | 1.06 | | | $ | 0.59 | | | $ | 0.37 | | | $ | 0.18 | | | $ | 0.11 | |

| Discontinued operations | | $ | - | | | $ | (0.02 | ) | | $ | (0.02 | ) | | $ | 0.03 | | | $ | (0.01 | ) | | $ | - | | | $ | - | |

| Diluted | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Continuing operations | | $ | 0.62 | | | $ | 0.42 | | | $ | 1.06 | | | $ | 0.59 | | | $ | 0.37 | | | $ | 0.18 | | | $ | 0.11 | |

| Discontinued operations | | $ | - | | | $ | (0.02 | ) | | $ | (0.02 | ) | | $ | 0.03 | | | $ | (0.01 | ) | | $ | - | | | $ | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Weighted average number of ordinary shares outstanding (1) - | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 8,246,541 | | | | 7,745,625 | | | | 7,745,625 | | | | 7,745,625 | | | | 7,745,625 | | | | 7,745,625 | | | | 7,745,625 | |

| Diluted | | | 8,809,069 | | | | 7,745,625 | | | | 7,745,625 | | | | 7,745,625 | | | | 7,745,625 | | | | 7,745,625 | | | | 7,745,625 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Amounts attributable to shareholders | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income from continuing operations, net of taxes | | | 5,493 | | | | 3,218 | | | | 8,187 | | | | 4,566 | | | | 2,829 | | | | 1,416 | | | | 830 | |

| Discontinued operations, net of taxes | | | - | | | | (151 | ) | | | (144 | ) | | | 209 | | | | (87 | ) | | | - | | | | - | |

| Net income | | $ | 5,493 | | | $ | 3,067 | | | $ | 8,043 | | | $ | 4,775 | | | $ | 2,742 | | | $ | 1,416 | | | $ | 830 | |

| (1) | The calculation of weighted average number of ordinary shares outstanding and earnings (loss) per ordinary share reflects the retroactive restatement of the Company’s shareholders’ equity to account for the effect of the reverse merger. |

RISK FACTORS

You should carefully consider the following risk factors, together with all of the other information included in this prospectus.

Prior to the business combination, ACG consisted of two primary reportable segments: (i) the commercial vehicle sales and leasing segment, which provides financing to customers to acquire commercial vehicles, and (ii) the automotive dealership segment. On June 15, 2009, ACG agreed to sell its automotive dealership segment pursuant to the terms of an acquisition agreement entered into between Kaiyuan Real Estate Development Co., Ltd. (“Hebei Kaiyuan”) and Xinjiang Guanghui Industry Investment (Group) Co. (“Xinjiang”). ACG controls Hebei Kaiyuan through certain contractual arrangements. In consideration of the acquisition, Xinjiang will pay Hebei Kaiyuan approximately RMB470 million ($68.8 million). ACG expects the sale to be consummated by the end of December 2009.

If the transaction is consummated, then ACG’s business will consist solely of its commercial vehicle sales and leasing segment. Although ACG anticipates that the transaction will be consummated, if the transaction is not consummated, ACG will continue to own and operate the automotive dealership segment. The risk factors pertaining to each segment are discussed under separate headings below.

Risks Relating to our Business

ACG’s growth is dependent upon the availability of suitable sites, without which it may not be able to continue to increase revenues.

ACG leases a majority of the properties where its commercial vehicle financing centers are located. If and when ACG decides to open new commercial vehicle financing centers, the inability to acquire suitable real estate, either through lease or purchase, at favorable terms could limit the expansion of its commercial vehicle financing center base and could limit its expansion strategy.

Any security breach involving the misappropriation, loss or other unauthorized disclosure of confidential information, whether by ACG or by third-party service providers, could damage its reputation, expose it to the risks of litigation and liability, disrupt its business or otherwise harm its results of operations.

In the normal course of business, ACG collects, processes and retains sensitive and confidential customer information. Despite the security measures it has in place, its facilities and systems, and those of third-party service providers, could be vulnerable to security breaches, acts of vandalism, computer viruses, misplaced or lost data, programming or human errors or other similar events. Any security breach involving the misappropriation, loss or other unauthorized disclosure of confidential information, whether by ACG or by third-party service providers, could damage its reputation, expose it to the risks of litigation and liability, disrupt its business or otherwise harm its results of operations.

Claims that the software products and information systems that ACG relies on are infringing on the intellectual property rights of others could increase its expenses or inhibit it from offering certain services.

A number of entities, including some of ACG’s competitors, have sought, or may in the future obtain, patents and other intellectual property rights that cover or affect software products and other components of information systems that ACG relies on to operate its business.

While ACG is not aware of any claims that the software products and information systems that it relies upon are infringing on the intellectual property rights of others, litigation may be necessary to determine the validity and scope of third-party rights or to defend against claims of infringement. If a court determines that one or more of the software products or other components of information systems ACG uses infringe on intellectual property owned by others or ACG agrees to settle such a dispute, it may be liable for money damages. In addition, ACG may be required to cease using those products and components unless it obtains licenses from the owners of the intellectual property, redesign those products and components in such a way as to avoid infringement or cease altogether the use of those products and components. Each of these alternatives could increase ACG’s expenses materially or impact the marketability of its services. Any litigation, regardless of the outcome, could result in substantial costs and diversion of resources and could have a material adverse effect on ACG’s business. In addition, a third-party intellectual property owner might not allow ACG to use its intellectual property at any price, or on terms acceptable to it, which could compromise ACG’s competitive position.

Store closings result in unexpected costs that could result in write downs and expenses relating to the closings.

From time to time, in the ordinary course of ACG’s business, it closes certain stores, generally based on considerations of store profitability, competition, strategic factors and other considerations. Closing a store could subject ACG to costs including the write-down of leasehold improvements, equipment, furniture and fixtures. In addition, ACG could remain liable for future lease obligations.

The loss of any key members of the management team may impair ACG’s ability to identify and secure new contracts with customers or otherwise manage its business effectively.

ACG’s success depends, in part, on the continued contributions of its senior management. In particular, Mr. Yong Hui Li, our Chief Executive Officer, has been appointed by the Board of Directors to oversee and supervise the strategic direction and overall performance of ACG.

ACG relies on its senior management to manage its business successfully. In addition, the relationships and reputation that members of ACG’s management team have established and maintained with its customers contribute to ACG’s ability to maintain good customer relations, which is important to the direct selling strategy that ACG adopts. Employment contracts entered into between ACG and its senior management cannot prevent its senior management from terminating their employment, and the death, disability or resignation of Mr. Yong Hui Li or any other member of ACG’s senior management team may impair ACG’s ability to maintain business growth and identify and develop new business opportunities or otherwise to manage its business effectively.

ACG relies on its information technology, billing and credit control systems, and any problems with these systems could interrupt ACG’s operations, resulting in reduced cash flow.

ACG’s business cannot be managed effectively without its integrated information technology system. Accordingly, ACG runs various “real time” integrated information technology management systems for its financing business.

In addition, sophisticated billing and credit control systems are critical to ACG’s ability to increase revenue streams, avoid revenue loss and potential credit problems, and bill customers in a proper and timely manner. If adequate billing and credit control systems and programs are unavailable, or if upgrades are delayed or not introduced in a timely manner, or if ACG is unable to integrate such systems and software programs into its billing and credit systems, ACG may experience delayed billing which may negatively affect ACG’s cash flow and the results of its operations.

In case of a failure of ACG’s data storage system, ACG may lose critical operational or billing data or important email correspondence with its customers and suppliers. Any such data stored in the core data center may be lost if there is a lapse or failure of the disaster recovery system in backing up these data, or if the periodic offline backup is insufficient in frequency or scope, which may result in reduced cash flow and reduce revenues.

Natural disasters and adverse weather events can disrupt ACG’s business, which may result in reduced cash flow and reduce revenues.

ACG’s stores are concentrated in provinces and regions in China, including primarily Hebei, Shanxi, Shandong, Henan, Inner Mongolia Autonomous Region and Tianjin, in which actual or threatened natural disasters and severe weather events (such as severe snowstorms, earthquakes, fires and landslides) may disrupt store operations, which may adversely impact its business, results of operations, financial condition, and cash flows. Although ACG has, subject to certain deductibles, limitations, and exclusions, substantial insurance, it cannot assure you that it will not be exposed to uninsured or underinsured losses that could have a material adverse effect on its business, financial condition, results of operations, or cash flows. Additionally, ACG generally relies on third-party transportation operators and distributors for the delivery of vehicles from the manufacturer to ACG’s stores. Delivery may be disrupted for various reasons, many of which are beyond ACG’s control, including natural disasters, weather conditions or social unrest and strikes, which could lead to delayed or lost deliveries. For example, recently the southern regions of China experienced the most severe winter weather in nearly 50 years, causing, among other things, severe disruptions to all forms of transportation for several weeks in late January and early February 2008. This natural disaster also impacted the delivery of vehicles to stores. In addition, transportation conditions are often generally difficult in some of the regions where ACG sells automobiles and commercial vehicles. ACG currently does not have business interruption insurance to offset these potential losses, delays and risks, so a material interruption of its business operations could severely damage its business.

ACG may not succeed in identifying suitable acquisition targets, which could limit its ability to expand its operations and service offerings and enhance its competitiveness.

ACG has pursued and may in the future pursue strategic acquisition opportunities to increase its scale and geographic presence and expand the number of its product offerings. However, ACG may not be able to identify suitable acquisition or investment candidates, or, even if it does identify suitable candidates, it may not be able to complete those transactions on terms commercially favorable to it or at all, which could limit its competitiveness and its growth prospects.

ACG may face unforeseen liabilities and have difficulty integrating the operations of companies it acquires in the future.

If ACG acquires other companies in the future, it could face the following risks:

| | | difficulty in assimilating the target company’s personnel, operations, products, services and technology into its operations; |

| | | the presence of unforeseen or unrecorded liabilities; |

| | | disrupting its ongoing business; |

| | | impairing relationships with employees, manufacturers and customers; and |

| | | failing to obtain or retain key personnel at new or acquired finance centers. |

These difficulties could disrupt ACG’s ongoing business, distract its management and current employees and increase its expenses, including write-offs or impairment charges. Acquired companies also may not perform to ACG’s expectations for various reasons, including the loss of key personnel, key distributors, key suppliers or key customers, and its strategic focus may change. As a result, ACG may not realize the benefits it anticipated from the acquisition. If ACG fails to integrate acquired businesses or realize the expected benefits, it may lose the return on the investment in these acquisitions or incur additional transaction costs and its operations may be negatively impacted as a result. Further, any acquisition or investment that ACG attempts, whether or not completed, or any media reports or rumors with respect to any such transactions, may adversely affect its competitiveness, its growth prospects, and the value of its ordinary shares.

ACG requires various approvals, licenses, authorizations, certificates, filings and permits to operate its business and the loss of or failure to obtain or renew any or all of these approvals, licenses, authorizations, certificates, filings and permits could limit its ability to conduct its business.

In accordance with the laws and regulations of the PRC, ACG is required to maintain various approvals, licenses, authorizations, certificates, filings and permits in order to operate ACG’s business. ACG’s business could be affected by the promulgation of new laws and regulations introducing new requirements (such as new approvals, licenses, authorizations, certificates filings and/or permits). In addition, companies incorporated in the PRC will be required to pass an annual inspection conducted by the respective Administration of Industry and Commerce in order to retain valid business approvals, license, authorizations, certificates, filings and permits for their operations. As the PRC’s legislative system evolves, it is also not uncommon for new laws and regulations to be promulgated and put into effect on short notice. Failure to comply with these laws and regulations, pass these inspections, or the loss of or failure to renew its licenses, permits and certificates or any change in the government policies, could lead to temporary or permanent suspension of some of ACG’s business operations or the imposition of penalties on ACG, which could limit its ability to conduct its business.

AutoChina’s ability to pay dividends and utilize cash resources of its subsidiaries is dependent upon the earnings of, and distributions by, AutoChina’s subsidiaries and jointly-controlled enterprises, which could result in AutoChina having only little if any available for dividends.

AutoChina is a holding company with substantially all of ACG’s business operations conducted through its subsidiaries and jointly-controlled enterprises. AutoChina’s ability to make dividend payments depends upon the receipt of dividends, distributions or advances from its subsidiaries and jointly-controlled enterprises. The ability of its subsidiaries and jointly-controlled enterprises to pay dividends or other distributions may be subject to their earnings, financial position, cash requirements and availability, applicable laws and regulations and to restrictions on making payments to AutoChina or ACG contained in financing or other agreements. These restrictions could reduce the amount of dividends or other distributions that AutoChina receives from its subsidiaries and jointly-controlled enterprises, which could restrict its ability to fund its business operations and to pay dividends to its shareholders. AutoChina’s future declaration of dividends may or may not reflect its historical declarations of dividends and will be at the absolute discretion of the Board of Directors.

Wang Yan, the wife of Yong Hui Li, the chairman and chief executive officer of ACG and a director and the chairman and chief executive officer of AutoChina, is the beneficial owner of a substantial amount of AutoChina’s ordinary shares and Ms. Wang may take actions with respect to such shares which are not consistent with the interests of the other shareholders.

Wang Yan, the wife of Yong Hui Li, the chairman and chief executive officer of ACG and a director and the chairman and chief executive officer of AutoChina, beneficially owns approximately 80.31% of the outstanding ordinary shares of AutoChina as of the date of this registration statement, without taking into account AutoChina’s outstanding warrants and assuming that there are no other changes to the number of ordinary shares outstanding. Under SEC rules, Mr. Li may be deemed to beneficially own such shares. Ms. Wang may take actions with respect to such shares without the approval of other shareholders and which are not consistent with the interests of the other shareholders, including the election of the directors and other corporate actions of AutoChina such as:

| | | its merger with or into another company; |

| | | a sale of substantially all of its assets; and |

| | | amendments to its memorandum and articles of incorporation. |

The decisions of Ms. Wang may conflict with AutoChina’s interests or the interests of AutoChina’s other shareholders.

Prior to AutoChina’s business combination with ACG on April 9, 2009, AutoChina had not had operations, and ACG had not operated as a public company. Fulfilling AutoChina’s obligations incident to being a public company will be expensive for AutoChina and time consuming for its management, which may be distracted from the operations of the business.

Prior to AutoChina’s business combination with ACG on April 9, 2009, AutoChina had not had operations, and ACG had not operated as a public company. Although AutoChina has maintained disclosure controls and procedures and internal control over financial reporting as required under the federal securities laws with respect to its limited activities, it has not been required to maintain and establish these disclosure controls and procedures and internal control as will be required with respect to businesses such as ACG with substantial operations. Compliance with these obligations will require significant management time, place significant additional demands on AutoChina’s and ACG’s finance and accounting staffs and on their financial, accounting and information systems, and increase their insurance, legal and financial compliance costs. AutoChina may also need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge.

ACG may be subject to broad liabilities arising from environmental protection laws, which could result in significant expenses for ACG.

ACG may be subject to broad liabilities arising out of contamination at its currently and formerly owned or operated facilities, at locations to which hazardous substances were transported from such facilities, and at such locations related to entities formerly affiliated with it. Although for some such liabilities ACG believes it is entitled to indemnification from other entities, ACG cannot assure you that such entities will view their obligations as it does, or will be able to satisfy them. If ACG is liable for environmental claims, ACG could be required to pay significant penalties.

ACG’s business is capital intensive and ACG’s growth strategy may require additional capital that may not be available on favorable terms or at all, which could limit its ability to continue its operations.

ACG has, in the past, entered into loan agreements in order to raise additional capital. ACG’s business requires significant capital and although it believes that its current cash, cash flow from operations and the cash of AutoChina will be sufficient to meet its present and reasonably anticipated cash needs, it may, in the future, require additional cash resources due to changed business conditions, implementation of its strategy to expand its store network or other investments or acquisitions it may decide to pursue. If ACG’s own financial resources are insufficient to satisfy its capital requirements, it may seek to sell additional equity or debt securities or obtain additional credit facilities. The sale of additional equity securities could result in dilution to ACG’s shareholders. The incurrence of indebtedness would result in increased debt service obligations and could require ACG to agree to operating and financial covenants that would restrict its operations. Financing may not be available in amounts or on terms acceptable to ACG, if at all. Any failure by ACG to raise additional funds on terms favorable to it, or at all, could limit its ability to expand its business operations and could harm its overall business prospects.

Risks Relating to ACG’s Commercial Vehicle Sales and Leasing Business

Current economic conditions may result in reduced revenues for ACG.

ACG believes that many factors affect sales of new commercial vehicles and automotive retailers’ gross profit margins in China and in its particular geographic markets, including the economy, inflation, recession or economic slowdown, consumer confidence, housing markets, fuel prices, credit availability, the level of manufacturers’ production capacity, interest rates, product quality, affordability and innovation, employment/unemployment rates, the number of consumers whose vehicle leases are expiring, and the length of consumer loans on existing vehicles. Changes in interest rates could significantly impact industry new vehicle sales and vehicle affordability, due to the direct relationship between interest rates and monthly loan payments, a critical factor for many vehicle buyers, and the impact interest rates can have on customers’ borrowing capacity and disposable income.

The overall demand for vehicles increased significantly in China from 2001 to 2008. However, recently, certain adverse financial developments have impacted the global financial markets. Theses developments include a general slowing of economic growth both in China and globally, substantial volatility in equity securities markets, and volatility and tightening of liquidity in credit markets.

If this economic downturn continues, ACG’s business, financial condition and results of operations would likely be adversely affected, its cash position may further erode and it may be required to seek new financing, which may not be obtainable on acceptable terms or at all. ACG may also be required to reduce its capital expenditures, which in turn could hinder its ability to implement its business plan and to improve its productivity.

ACG’s operations, including, without limitation, its sales of finance and insurance, are subject to extensive governmental laws and regulations, the violation of which could lead to sanctions including termination of operations.

The automotive retailing industry, including ACG’s facilities and operations, is subject to a wide range of central and local laws and regulations, such as those relating to retail installment sales, leasing, sales of finance and insurance, licensing, consumer protection, consumer privacy, escheatment, health and safety, wage-hour and other employment practices. Specifically with respect to the sale of finance and insurance at its stores, ACG is subject to various laws and regulations, the violation of which could subject it to lawsuits or governmental investigations and adverse publicity, in addition to administrative, civil, or criminal sanctions. The violation of other laws and regulations to which ACG is subject also can result in administrative, civil, or criminal sanctions against it, which may include a cease and desist order against the subject operations or even revocation or suspension of its license to operate the subject business, as well as significant fines and penalties. Please refer to the section titled “Business–Governmental Regulations” in this Registration Statement for more information about the governmental regulations applicable to ACG.

Significant defaults by financing customers could significantly reduce ACG’s revenues.

ACG’s commercial vehicle sales and leasing business generates income from financing customers. ACG is acting as a primary lender to its customers and assuming the credit risk associated with the potential loan defaults of these customers. Although ACG does extensive pre-sale credit research on its customers and has a security interest in its leased vehicles, if customers fail to make payments when due, ACG may not be able to fully recover the outstanding fee and it could significantly reduce ACG’s revenues.

ACG’s ongoing expansion into commercial vehicle sales and leasing may be costly, time-consuming and difficult. If ACG does not successfully expand this business, its results of operations and prospects would not be as positive as anticipated.

ACG’s future success is dependent upon its ability to successfully expand its commercial vehicle sales and leasing business which it commenced in April 2008. ACG opened 103 commercial vehicle financing centers in 2008 and 2 additional commercial vehicle financing centers in January 2009, and it plans to open an additional 45 centers in China in 2009. ACG has limited experience with this business and may not be able to expand its sales in its existing or new markets due to a variety of factors, including the risk that customers in some areas may be unfamiliar with its brand or the commercial vehicle sales and leasing business model. Furthermore, ACG may fail to anticipate and address competitive conditions in the commercial vehicle sales and lease market. These competitive conditions may make it difficult or impossible for ACG to effectively expand this business. If ACG’s expansion efforts in existing and new markets are unsuccessful, its results of operations and prospects would be materially and adversely affected.

If required financing for ACG’s commercial leasing business were not available or not available on acceptable terms, the commercial leasing business might not be able to expand as quickly as expected, reducing ACG’s operating results.

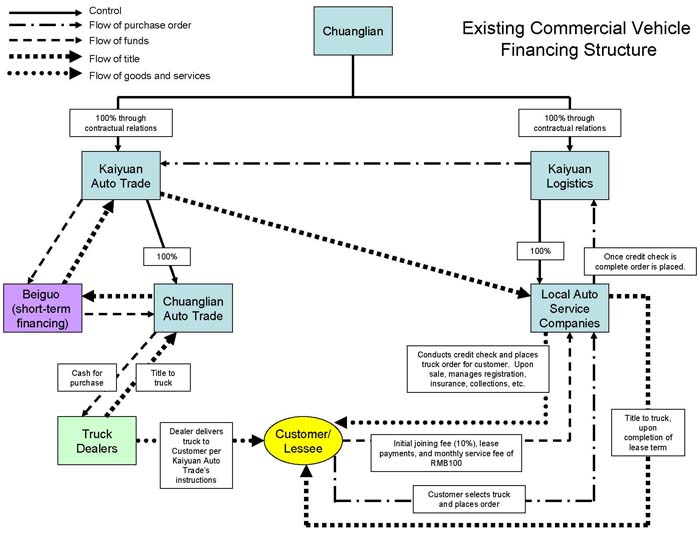

ACG’s ability to expand its commercial truck financing business is dependent on its ability to purchase commercial trucks for resale. Presently, such financing is arranged through financing arrangements with Beiguo Commercial Building Limited (“Beiguo”). The terms provided by Beiguo are on terms which are more favorable than ACG has historically been able to obtain from PRC commercial banks. However there can be no assurance that ACG can continue to receive such financing from Beiguo on such commercially favorable terms, or at all.

If financing from Beiguo were not available, ACG would fund its commercial vehicle purchases from its own cash reserves or financing provided by third-party financial institutions. There can be no assurance that ACG will have sufficient resources or be able to obtain adequate third party financing on as commercially favorable terms as that provided by Beiguo or at all. If suitable financing were not available, ACG would not be able to expand its commercial leasing business in as quickly as expected.

Our commercial vehicle sales and leasing segment has only been operating since 2008, and after the proposed sale of our automotive dealership business it will constitute our only operations. Therefore, our historical operating results do not provide sufficient information regarding our ongoing business in the future.

We put our commercial vehicle sales and licensing business in place in 2008. While this business has experienced significant growth, it is still substantially smaller than our dealership business. Therefore, our historical results will not be reflective of ongoing operations.

Our commercial vehicle sales and leasing segment has only been operating since 2008, and after the proposed sale of our automotive dealership business it will constitute our only operations. We cannot provide you with any comfort that we will be successful in operating this business.

We put our commercial vehicle sales and licensing business in place in 2008. While this business has experienced significant growth, it is still significantly smaller than our dealership business was and is a new and evolving market in China. Since, after the sale of our dealership business, we will be solely reliant on our commercial vehicle sales and leasing business, if the market for the type of services we offer does not develop as we expect or if we are unable to successfully manage our growth and development, we may go out of business.

Fuel shortages and fluctuations in fuel prices may adversely affect the demand for commercial vehicles.

Fuel prices are inherently volatile and have experienced significant rise from 2001 to 2008. Any surge in fuel prices will have an adverse effect on world economies and, in particular, on the world’s automobile industries. For example, in 2007, rising global oil prices and rising demand for fuel have led to fuel shortages in China. This is due in part to increased automobile ownership as well as government controls over fuel prices.

If the PRC central government continues to control the price of domestic refined oil to stabilize the market and demand for fuel in China continues to increase in line with rising annual GDP, it is possible that further shortages will occur. If the cost of fuel in the China continues to increase, consumers may elect to use alternative means of transportation, and demand for automobiles, particularly those with larger engine capacities, may decline.

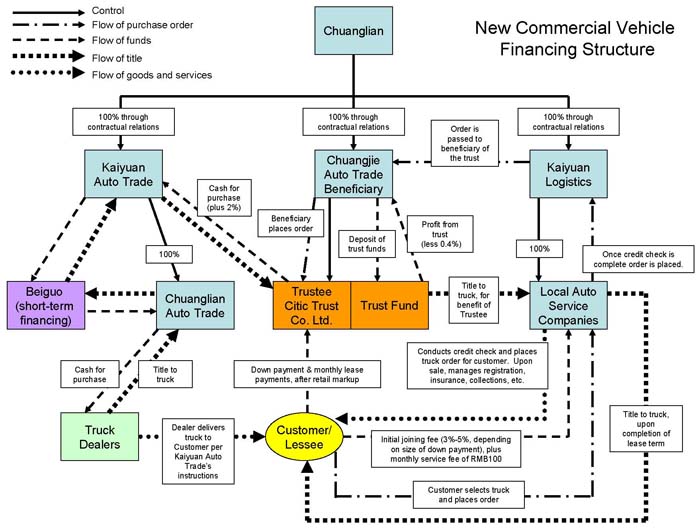

We may fail to successfully implement our new commercial vehicle financing structure resulting in increased administrative costs without the anticipated cost savings.

We are in the process of implementing a new commercial vehicle financing structure which we expect will reduce certain costs associated with our commercial vehicle financing business. This new structure involves a significant increase in administrative overhead which, if we fail to implement successfully, may increase our administrative expenses beyond the anticipated cost reductions.

We may have difficulty relating to the administration of the trust component of our new commercial vehicle financing structure resulting in additional costs and the loss of the benefit of the new structure.

As part of our new commercial vehicle financing structure we have established a trust fund which requires a third party trustee. We have, through Chuangjie Auto Trade our new wholly owned subsidiary, engaged Citic Trust Co. Ltd., a division of the Citic Group to act as trustee for this trust fund. The agreements governing the trust fund place certain obligations on us and the trustee in connection with the new commercial vehicle financing structure, however we or the trustee may encounter difficulties in performing these obligations which could result in Citic Trust being unable or unwilling to continue in its role as trustee. We may not be able to find a replacement for Citic Trust in a timely fashion, if at all. As a result, we may experience additional costs and delays in finding a replacement trustee and may lose the benefit of the new commercial vehicle financing structure temporarily or permanently.

Risks Relating to ACG’s Automotive Dealership Business

On June 15, 2009, ACG agreed to sell its automotive dealership segment pursuant to the terms of an acquisition agreement entered into between Kaiyuan Real Estate Development Co., Ltd. (“Hebei Kaiyuan”) and Xinjiang Guanghui Industry Investment (Group) Co. (“Xinjiang”). ACG controls Hebei Kaiyuan through certain contractual arrangements. Although ACG anticipates that the transaction will be consummated, if the transaction is not consummated, ACG will continue to own and operate the automotive dealership segment. The risk factors discussed under the heading “Risks Relating to ACG’s Automotive Dealership Business” are only related to the automotive dealership business.

ACG depends on its ability to enter into and renew leases for most of its properties, which may lead to disruptions of the business in the business if such leases are terminated.

ACG requires substantial storage facilities to store its inventory for motor vehicles (i.e. cars and commercial vehicles). ACG rents or leases most of its storage facilities and dealership lots from third parties under tenancy or lease agreements. Depending on market conditions for real estate, landlords or lessors may increase rentals to a rate not acceptable by ACG and which may lead to ACG not renewing the tenancies or leases upon their expirations. If these tenancies or leases are terminated and if there are no ready alternative locations of storage facilities and dealership lots for ACG to store its inventory and/or sell motor vehicles or if ACG is forced to accept the increased rentals or are not able to relocate to a suitable place, ACG’s business, results of operations and financial conditions could be materially and adversely affected.

Approximately 24 of 25 parcels of land and/or buildings in China leased and occupied by ACG for its automotive dealership facilities have certain title defects or lack documentation supporting claim to title and the use of the leased premises may be challenged and ACG may need to relocate its existing business operations. The Company estimates that the cost of relocating an automotive dealership would be approximately $850,000. As of the date of this registration statement, the Company is not, to its knowledge, facing any challenges to such titles which may result in relocation of the business operations.

Furthermore, if such plots of land leased to ACG are collectively-owned land and ACG operates its business on them for non-agricultural uses without special permission, subject to the Land Administration Law of the People’s Republic of China, the administrative departments at or above county level may order the termination of such leases.

In any of the above events, ACG may be required to terminate the existing leases and relocate its existing business operations. There can be no assurance that ACG can replace the existing leases with other comparative alternative premises without any material adverse effect on its operations.

The dealership business is substantially dependent on new vehicle sales levels in China and in its particular geographic markets and the level of gross profit margins that it can achieve on its sales of new vehicles, all of which are very difficult to predict. If new vehicle sales decline, ACG will experience poor operation results.

ACG believes that many factors affect sales of new vehicles and automotive retailers’ gross profit margins in China and in its particular geographic markets, including the economy, inflation, recession or economic slowdown, consumer confidence, housing markets, fuel prices, credit availability, the level of manufacturers’ production capacity, manufacturer incentives (and consumers’ reaction to such offers), intense industry competition, interest rates, the level of personal discretionary spending, product quality, affordability and innovation, employment/unemployment rates, the number of consumers whose vehicle leases are expiring, and the length of consumer loans on existing vehicles. Changes in interest rates could significantly impact industry new vehicle sales and vehicle affordability, due to the direct relationship between interest rates and monthly loan payments, a critical factor for many vehicle buyers, and the impact interest rates can have on customers’ borrowing capacity and disposable income. If there is a decline in the availability of credit for car purchasers provided by third-party financing companies, the ability of certain customers to purchase vehicles could be limited, resulting in a decline in sales or profits.

ACG is dependent upon the success and continued financial viability of the vehicle manufacturers and distributors with which it holds franchises. If such manufactures or distributors suffer reputational or financial harm, there may be fewer sales from our dealership business.

The success of ACG’s stores is dependent on vehicle manufacturers in several key respects. First, ACG relies exclusively on the various vehicle manufacturers for its new vehicle inventory. ACG’s ability to sell new vehicles is dependent on a vehicle manufacturer’s ability to produce and allocate to its stores an attractive, high quality, and desirable product mix at the right time in order to satisfy customer demand. Second, manufacturers generally support their franchisees by providing direct financial assistance in various areas, including, among others, inventory financing assistance and advertising assistance. Third, manufacturers provide product warranties and, in some cases, service contracts, to customers. ACG’s stores perform warranty and service contract work for vehicles under manufacturer product warranties and service contracts, and directly bill the manufacturer as opposed to invoicing the store customer. At any particular time, it has significant receivables from manufacturers for warranty and service work performed for customers. In addition, ACG relies on manufacturers to varying extents for original equipment manufactured replacement parts, training, product brochures and point of sale materials, and other items for its stores.

The core brands of vehicles that ACG sells are manufactured by BMW, Audi, Hyundai, Ford, General Motors (Chevrolet, Buick and Cadillac), ROEWE, Mazda, Ruida Kia, FAW Car, Qingling, Peugeot and FAW Toyota. In particular, Audi represented over 24% of ACG’s new vehicle revenue in 2008. ACG is subject to a concentration of risk in the event of financial distress, including potential bankruptcy, of a major vehicle manufacturer. In the event of such a bankruptcy, among other things, (i) the manufacturer could attempt to terminate all or certain of its franchises, and ACG may not receive adequate compensation for them, (ii) ACG may not be able to collect some or all of its significant receivables that are due from such manufacturers and it may be subject to preference claims relating to payments made by manufacturers prior to bankruptcy, (iii) ACG may not be able to obtain financing for its new vehicle inventory, or arrange financing for its customers for their vehicle purchases and leases, with the manufacturer’s captive finance subsidiary, which may cause ACG to finance its new vehicle inventory, and arrange financing for its customers, with alternate finance sources on less favorable terms, and (iv) consumer demand for their products could be reduced. These events may result in receivables due from such manufacturers and adversely impact its results of operations.

ACG’s new vehicle sales are impacted by the consumer incentive and marketing programs of vehicle manufacturers. Any reduction in those incentives could reduce sales and revenues.

Most vehicle manufacturers from time to time have established various incentive and marketing programs designed to spur consumer demand for their vehicles. In addition, certain manufacturers offer extended product warranties or free service programs to consumers. From time to time, manufacturers modify and discontinue these dealer assistance and consumer incentive and marketing programs, which could significantly reduce ACG’s new vehicle and aftermarket product sales, consolidated results of operations, and cash flows.

ACG is subject to restrictions imposed by, and significant influence from, vehicle manufacturers that may adversely impact its business, financial condition, results of operations, cash flows, and prospects, including its ability to acquire additional stores.

Vehicle manufacturers and distributors with whom ACG holds franchises have significant influence over the operations of ACG’s stores. The terms and conditions of its framework, franchise, and related agreements and the manufacturers’ interests and objectives may, in certain circumstances, conflict with its interests and objectives.

ACG’s framework, franchise, and related agreements also grant the manufacturer the right to terminate or compel ACG to sell its franchise for a variety of reasons (including uncured performance deficiencies, any unapproved change of ownership or management, or any unapproved transfer of franchise rights or impairment of financial standing or failure to meet capital requirements), subject to applicable franchise laws. From time to time, certain major manufacturers assert sales and customer satisfaction performance deficiencies under the terms of such framework and franchise agreements. Additionally, ACG’s framework agreements contain restrictions regarding a change in control, which may be outside of its control. While ACG believes that it will be able to renew all of its franchise agreements, it cannot guarantee that all of its franchise agreements will be renewed or that the terms of the renewals will be favorable to it. ACG cannot assure you that its stores will be able to comply with manufacturers’ sales, customer satisfaction performance, and other requirements in the future, which may affect its ability to acquire new stores or renew its franchise agreements, or subject it to other adverse actions, including termination or compelled sale of a franchise, any of which would significantly impact its ability to sell affected vehicles. Furthermore, ACG relies on the protection of state franchise laws in the states in which it operates and if those laws are repealed or weakened, its framework and related agreements may become more susceptible to termination, non-renewal, or renegotiation.

ACG’s operations are subject to extensive governmental laws and regulations, the violation of which could result in civil or criminal fines and/or sanctions.

The automotive retailing industry, including ACG’s facilities and operations, is subject to a wide range of central and local laws and regulations, such as those relating to motor vehicle sales, retail installment sales, leasing, licensing, consumer protection, consumer privacy, escheatment, environmental, vehicle emissions and fuel economy, health and safety, wage-hour and other employment practices. Specifically with respect to motor vehicle sales, retail installment sales, and leasing, ACG is subject to various laws and regulations, the violation of which could subject it to lawsuits or governmental investigations and adverse publicity, in addition to administrative, civil, or criminal sanctions. The violation of other laws and regulations to which ACG are subject also can result in administrative, civil, or criminal sanctions against it, which may include a cease and desist order against the subject operations or even revocation or suspension of its license to operate the subject business, as well as significant fines and penalties.

If ACG doesn’t locate suitable sites on which to expand its business its financial results could stagnate.

ACG leases a majority of the properties where its stores are located. If and when ACG decides to open new stores, the inability to acquire suitable real estate, either through lease or purchase, at favorable terms could limit the expansion of its lot base and could limit its expansion strategy and revenues could stagnate.

ACG’s business is subject to seasonal fluctuations. Disruptions to our business during usually busy quarters will lead to poor operating results for the year.

The third quarter has historically been the slowest period for vehicle sales. Conversely, the fourth quarter has historically been the busiest time for vehicle sales.Therefore, ACG generally realizes a higher proportion of its revenue and operating profit during the fourth quarter. If conditions arise that impair vehicle sales during the fourth quarter, revenues for that year will be significantly reduced.

ACG imports some vehicles for sale, and changes in taxes, duties, trade restrictions and other items may result in reduced sales of such vehicles.

ACG’s business involves the sale of new and used vehicles, vehicle parts or vehicles composed of parts that are manufactured outside China. As a result, ACG’s operations are subject to customary risks associated with imported merchandise, including fluctuations in the value of currencies, import duties, exchange controls, differing tax structures, trade restrictions, transportation costs, work stoppages and general political and economic conditions in foreign countries.