ACG’s PRC Counsel, Zhong Lun Law Firm, advised that there is no foreseeable legal impediment to the conversion of these contractual arrangements to a direct ownership structure, or to the conversion of all of ACG’s other contractual arrangements since the applicable foreign investment restrictions have been lifted and conversion of all such arrangements would not adversely affect the tax payments and other financial matters of ACG. Due to the various necessary submission and approval procedures, the conversion for the above-mentioned companies is still in process. If before the completion of such conversion, any of these contractual arrangements is challenged by the governmental authorities, or the contracts for such arrangements are breached by the counterparties and ACG is unable to obtain a judgment to its favor to enforce its contractual rights, or if there is any change of the PRC laws or regulations to explicitly prohibit such arrangements, ACG may lose control over, and revenues from, these companies, which will materially affect ACG’s financial condition and results of operations. Such conversion may include various approvals from governmental authorities and submissions of related documents (e.g. proper land use rights certificates and/or tenancy agreements for buildings), therefore there can be no assurance that such approval may be obtained in due course.

The shareholder of the Auto Kaiyuan Companies may have potential conflicts of interest with AutoChina, which may materially and adversely affect AutoChina’s business and financial condition.

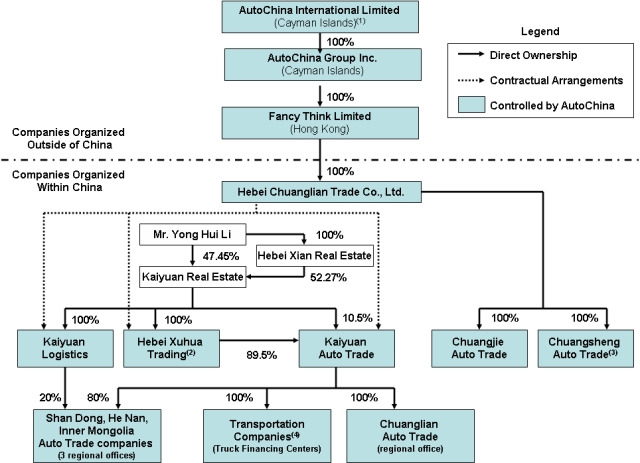

ACG has contractual arrangements with respect to operating the business with the Auto Kaiyuan Companies, and the shareholder of Auto Kaiyuan Companies is Kaiyuan Real Estate, a company registered in the PRC and wholly owned by ACG’s Chairman and CEO, Mr. Yong Hui Li. Although Auto Kaiyuan Companies and Kaiyuan Real Estate have given undertakings to act in the best interests of ACG, AutoChina cannot assure you that when conflicts arise, these individuals will act in AutoChina’s best interests or that conflicts will be resolved in AutoChina’s favor.

Changes in regulations related to lending or leasing could adversely affect or restrict our ability to operate our business.

Both lending and leasing in China are regulated by the government. Although we believe that our partnership with CITIC Trust affords our operations with a certain amount of validation and protection from adverse government legislation, it is possible that changes to laws and regulations could occur and deter or prevent us from operating as planned. In such a situation we may have no means of operating our business profitably, or at all.

AutoChina may lose the ability to use and enjoy assets held by the Auto Kaiyuan Companies that are important to the operation of its business if such entity goes bankrupt or becomes subject to a dissolution or liquidation proceeding.

As part of ACG’s contractual arrangements with the Auto Kaiyuan Companies and the AKC Shareholder holds certain assets that are important to the operation of AutoChina’s business. If the Auto Kaiyuan Companies go bankrupt and all or part of its assets become subject to liens or rights of third-party creditors, ACG may be unable to continue some or all of its business activities, which could materially and adversely affect ACG’s or AutoChina’s business, financial condition and results of operations. If the Auto Kaiyuan Companies undergo a voluntary or involuntary liquidation proceeding, the unrelated third-party creditors may claim rights to some or all of these assets, thereby hindering ACG’s ability to operate ACG’s business, which could materially and adversely affect ACG’s and AutoChina’s business, financial condition and results of operations.

Contractual arrangements ACG has entered into among its subsidiaries and the Auto Kaiyuan Companies may be subject to scrutiny by the PRC tax authorities and a finding that AutoChina, ACG or the Auto Kaiyuan Companies owe additional taxes could substantially reduce AutoChina’s consolidated net income and the value of your investment.

Under PRC laws and regulations, arrangements and transactions among related parties may be subject to audit or challenge by the PRC tax authorities. AutoChina or ACG could face adverse tax consequences if the PRC tax authorities determine that the contractual arrangements and transactions among its subsidiaries and the Auto Kaiyuan Companies do not represent an arm’s length price and adjust the income of AutoChina’s subsidiaries or that of the Auto Kaiyuan Companies in the form of a transfer pricing adjustment. A transfer pricing adjustment could, among other things, result in a reduction, for PRC tax purposes, of expense deductions recorded by the Auto Kaiyuan Companies, which could in turn increase its respective tax liabilities. In addition, the PRC tax authorities may impose late payment fees and other penalties on AutoChina’s affiliated entity for underpayment of taxes. AutoChina’s consolidated net income may be materially and adversely affected if its affiliated entities’ tax liabilities increase or if it is found to be subject to late payment fees or other penalties.

General Risks Relating to Conducting Business in China

Adverse changes in political and economic policies of the PRC government could impede the overall economic growth of China, which could reduce the demand for automobiles and trucks and damage AutoChina’s business and prospects.

ACG conducts substantially all of its operations and generates most of its sales in China. Accordingly, AutoChina’s business, financial condition, results of operations and prospects are affected significantly by economic, political and legal developments in China. The PRC economy differs from the economies of most developed countries in many respects, including:

| · | the higher level of government involvement and regulation; |

| · | the early stage of development of the market-oriented sector of the economy; |

| · | the higher rate of inflation; |

| · | the higher level of control over foreign exchange; and |

| · | government control over the allocation of many resources. |

As the PRC economy has been transitioning from a planned economy to a more market-oriented economy, the PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. While these measures may benefit the overall PRC economy, they may also have a negative effect on AutoChina.

Although the PRC government has in recent years implemented measures emphasizing the utilization of market forces for economic reform, the PRC government continues to exercise significant control over economic growth in China through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and imposing policies that impact particular industries or companies in different ways.

In the past 20 years, the PRC has been one of the world’s fastest growing economies measured in gross domestic product. However, in conjunction with recent slowdowns in economies of the United States and European Union, the growth rate in China has declined in recent quarters. Any further adverse change in the economic conditions or any adverse change in government policies in China could have a material adverse effect on the overall economic growth and the level of consumer spending in China, which in turn could lead to a reduction in demand for automobiles and consequently have a material adverse effect on AutoChina’s business and prospects.

The PRC legal system embodies uncertainties that could limit the legal protections available to AutoChina and its shareholders.

Unlike common law systems, the PRC legal system is based on written statutes and decided legal cases have little precedential value. In 1979, the PRC government began to promulgate a comprehensive system of laws and regulations governing economic matters in general. The overall effect of legislation since then has been to significantly enhance the protections afforded to various forms of foreign investment in China. AutoChina’s PRC subsidiary, Chuanglian, is a wholly foreign-owned enterprise, and will be subject to laws and regulations applicable to foreign investment in China in general and laws and regulations applicable to wholly foreign-owned enterprises in particular. AutoChina’s PRC affiliated entities, the Auto Kaiyuan Companies, will be subject to laws and regulations governing the formation and conduct of domestic PRC companies. Relevant PRC laws, regulations and legal requirements may change frequently, and their interpretation and enforcement involve uncertainties. For example, AutoChina may have to resort to administrative and court proceedings to enforce the legal protection that AutoChina enjoys either by law or contract. However, since PRC administrative and court authorities have significant discretion in interpreting and implementing statutory and contractual terms, it may be more difficult to evaluate the outcome of administrative and court proceedings and the level of legal protection AutoChina enjoys than under more developed legal systems. Such uncertainties, including the inability to enforce AutoChina’s or ACG’s contracts and intellectual property rights, could materially and adversely affect AutoChina’s or ACG’s business and operations. In addition, confidentiality protections in China may not be as effective as in the United States or other countries. Accordingly, AutoChina cannot predict the effect of future developments in the PRC legal system, particularly with respect to the automobile sales and financing sectors, including the promulgation of new laws, changes to existing laws or the interpretation or enforcement thereof, or the preemption of local regulations by national laws. These uncertainties could limit the legal protections available to AutoChina and other foreign investors, including you.

Fluctuations in exchange rates could result in foreign currency exchange losses.

Because substantially all of ACG’s revenues and expenditures are denominated in Renminbi and the cash of AutoChina is denominated in U.S. dollars, fluctuations in the exchange rate between the U.S. dollar and Renminbi will affect the relative purchasing power of such amounts and ACG’s balance sheet and earnings per share in U.S. dollars. In addition, AutoChina and ACG report their financial results in U.S. dollars, and appreciation or depreciation in the value of the Renminbi relative to the U.S. dollar would affect their financial results reported in U.S. dollars terms without giving effect to any underlying change in their business or results of operations. Fluctuations in the exchange rate will also affect the relative value of earnings from and the value of any U.S. dollar-denominated investments AutoChina or ACG make in the future.

Since July 2005, the Renminbi has no longer been pegged to the U.S. dollar. Although currently the Renminbi exchange rate versus the U.S. dollar is restricted to a rise or fall of no more than 0.5% per day and the People’s Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate, the Renminbi may appreciate or depreciate significantly in value against the U.S. dollar in the medium- to long-term. Moreover, it is possible that in the future, PRC authorities may lift restrictions on fluctuations in the Renminbi exchange rate and lessen intervention in the foreign exchange market.

Very limited hedging transactions are available in China to reduce AutoChina’s exposure to exchange rate fluctuations. To date, neither AutoChina nor ACG have entered into any hedging transactions in an effort to reduce their exposure to foreign currency exchange risk. While AutoChina may decide to enter into hedging transactions in the future, the availability and effectiveness of these hedging transactions may be limited and AutoChina may not be able to successfully hedge AutoChina’s exposure at all. In addition, AutoChina’s currency exchange losses may be magnified by PRC exchange control regulations that restrict AutoChina’s ability to convert Renminbi into foreign currency.

Under the PRC EIT Law, we, ACG and/or Fancy Think Limited, ACG’s wholly owned subsidiary, each may be classified as a “resident enterprise” of the PRC. Such classification could result in tax consequences to us, our non-PRC resident shareholders and ACG and/or Fancy Think Limited.

Under the EIT Law, enterprises are classified as resident enterprises and non-resident enterprises. An enterprise established outside of China with its “de facto management bodies” located within China is considered a “resident enterprise,” meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. The implementing rules of the EIT Law define “de facto management bodies” as a managing body that in practice exercises “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise; however, it remains unclear whether the PRC tax authorities would deem our managing body as being located within China. Due to the short history of the EIT Law and lack of applicable legal precedents, the PRC tax authorities determine the PRC tax resident treatment of a foreign (non-PRC) company on a case-by-case basis.

If the PRC tax authorities determine that we, ACG and/or Fancy Think Limited is a “resident enterprise” for PRC enterprise income tax purposes, a number of PRC tax consequences could follow. First, we, ACG and/or Fancy Think Limited may be subject to enterprise income tax at a rate of 25% on our, ACG’s and/or Fancy Think Limited’s worldwide taxable income, as well as PRC enterprise income tax reporting obligations. Second, under the EIT Law and its implementing rules, dividends paid between “qualified resident enterprises” are exempt from enterprise income tax. As a result, if we, ACG and Fancy Think Limited are treated as PRC “resident enterprises,” all dividends from Chuanglian to us (through Fancy Think Limited and ACG) would be exempt from PRC tax.

If Fancy Think Limited were treated as a PRC “non-resident enterprise” under the EIT Law, then dividends that Fancy Think Limited receives from Chuanglian (assuming such dividends were considered sourced within the PRC) (i) may be subject to a 5% PRC withholding tax, provided that Fancy Think Limited owns more than 25% of the registered capital of Chuanglian continuously within 12 months immediately prior to obtaining such dividend from Chuanglian, and the Arrangement between the Mainland of China and the Hong Kong Special Administrative Region for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income (the “PRC-Hong Kong Tax Treaty”) were otherwise applicable, or (ii) if such treaty does not apply (i.e., because the PRC tax authorities may deem Fancy Think Limited to be a conduit not entitled to treaty benefits), may be subject to a 10% PRC withholding tax. Similarly, if we or ACG were treated as a PRC “non-resident enterprise” under the EIT Law, and Fancy Think Limited were treated as a PRC “resident enterprise” under the EIT Law, then dividends that we or ACG receive from Fancy Think Limited (assuming such dividends were considered sourced within the PRC) may be subject to a 10% PRC withholding tax. Any such taxes on dividends could materially reduce the amount of dividends, if any, we could pay to our shareholders.

Finally, the new “resident enterprise” classification could result in a situation in which a 10% PRC tax is imposed on dividends we pay to our investors that are non-resident enterprises so long as such non-resident enterprise investors do not have an establishment or place of business in China or, despite the existence of such establishment of place of business in China, the dividends we pay are not effectively connected with such establishment or place of business in China, to the extent that such dividends have their sources within the PRC. In such event, we may be required to withhold a 10% PRC tax on any dividends paid to our investors that are non-resident enterprises. Our investors that are non-resident enterprises also may be responsible for paying PRC tax at a rate of 10% on any gain realized from the sale or transfer of our ordinary shares in certain circumstances. We would not, however, have an obligation to withhold PRC tax with respect to such gain.

Moreover, the State Administration of Taxation (“SAT”) released Circular Guoshuihan No. 698 (“Circular 698”) on December 15, 2009 that reinforces the taxation of non-listed equity transfers by non-resident enterprises through overseas holding vehicles. Circular 698 is retroactively effective from January 1, 2008. According to Circular 698, where a foreign (non-PRC resident) investor who indirectly holds shares in a PRC resident enterprise through a non-PRC offshore holding company indirectly transfers equity interests in a PRC resident enterprise by selling the shares of the offshore holding company, and the latter is located in a country or jurisdiction where the effective tax burden is less than 12.5% or where the offshore income of his, her, or its residents is not taxable, the foreign investor is required to provide the PRC tax authority in charge of that PRC resident enterprise with certain relevant information within 30 days of the transfer. The tax authorities in charge will evaluate the offshore transaction for tax purposes. In the event that the tax authorities determine that such transfer is abusing forms of business organization and a reasonable commercial purpose for the offshore holding company other than the avoidance of PRC income tax liability is lacking, the PRC tax authorities will have the power to re-assess the nature of the equity transfer under the doctrine of substance over form. A reasonable commercial purpose may be established when the overall international (including U.S.) offshore structure is set up to comply with the requirements of supervising authorities of international (including U.S.) capital markets. If the SAT’s challenge of a transfer is successful, it will deny the existence of the offshore holding company that is used for tax planning purposes. Since Circular 698 has a short history, there is uncertainty as to its application. We (or a foreign investor) may become at risk of being taxed under Circular 698 and may be required to expend valuable resources to comply with Circular 698 or to establish that we (or such foreign investor) should not be taxed under Circular 698, which could have a material adverse effect on our financial condition and results of operations (or such foreign investor’s investment in us).

If any such PRC taxes apply, a non-PRC resident shareholder may be entitled to a reduced rate of PRC taxes under an applicable income tax treaty and/or a foreign tax credit against such shareholder’s domestic income tax liability (subject to applicable conditions and limitations). Prospective investors should consult with their own tax advisors regarding the applicability of any such taxes, the effects of any applicable income tax treaties, and any available foreign tax credits. For further information, see the discussion in the section entitled “Taxation—PRC Taxation” below.

PRC regulation of loans and direct investment by offshore holding companies to PRC entities may delay or prevent AutoChina from using the proceeds AutoChina received from its business combination with ACG to make loans to AutoChina’s PRC subsidiaries and PRC affiliated entity or to make additional capital contributions to AutoChina’s PRC subsidiaries, which could materially and adversely affect AutoChina’s liquidity and AutoChina’s ability to fund and expand its business.

AutoChina is a Cayman Islands holding company conducting its operations though ACG, which is a Cayman Islands holding company conducting its operations in China through its PRC subsidiaries and its PRC affiliated entities, the Auto Kaiyuan Companies. Any loans AutoChina or ACG make to the PRC subsidiaries cannot exceed statutory limits and must be registered with the State Administration of Foreign Exchange, or SAFE, or its local counterparts. Under applicable PRC law, the government authorities must approve a foreign-invested enterprise’s registered capital amount, which represents the total amount of capital contributions made by the shareholders that have registered with the registration authorities. In addition, the authorities must also approve the foreign-invested enterprise’s total investment, which represents the total statutory capitalization of the company, equal to the company’s registered capital plus the amount of loans it is permitted to borrow under the law. The ratio of registered capital to total investment cannot be lower than the minimum statutory requirement and the excess of the total investment over the registered capital represents the maximum amount of borrowings that a foreign invested enterprise is permitted to have under PRC law. AutoChina or ACG might have to make capital contributions to the PRC subsidiaries to maintain the statutory minimum registered capital and total investment ratio, and such capital contributions involve uncertainties of their own, as discussed below. Furthermore, even if AutoChina or ACG make loans to their PRC subsidiaries that do not exceed their current maximum amount of borrowings, AutoChina or ACG will have to register each loan with SAFE or its local counterpart for the issuance of a registration certificate of foreign debts. In practice, it could be time-consuming to complete such SAFE registration process.

Any loans AutoChina or ACG make to a PRC affiliated entity, which is treated as a PRC domestic company rather than a foreign-invested enterprise under PRC law, are also subject to various PRC regulations and approvals. Under applicable PRC regulations, international commercial loans to PRC domestic companies are subject to various government approvals.

AutoChina cannot assure you that it will be able to complete the necessary government registrations or obtain the necessary government approvals on a timely basis, if at all, with respect to future loans by AutoChina or ACG to their PRC subsidiaries or PRC affiliated entities or with respect to future capital contributions by AutoChina or ACG to their PRC subsidiaries. If AutoChina or ACG fails to complete such registrations or obtain such approvals, AutoChina’s or ACG’s ability to capitalize or otherwise fund their PRC operations may be negatively affected, which could adversely and materially affect their liquidity and their ability to fund and expand their business.

A failure by AutoChina’s shareholders or beneficial owners who are PRC citizens or residents to comply with certain PRC foreign exchange regulations could restrict AutoChina’s ability to distribute profits, restrict AutoChina’s overseas and cross-border investment activities or subject AutoChina to liability under PRC laws, which could adversely affect AutoChina’s business and financial condition.

In October 2005, SAFE issued the Notice on Relevant Issues Concerning Foreign Exchange Administration for PRC Residents Engaging in Financing and Roundtrip Investments via Overseas Special Purpose Vehicles, or SAFE Circular 75. SAFE Circular 75 regulates the foreign exchange matters in relation to the use of a “special purpose vehicle” by PRC residents to seek offshore equity financing and conduct “round trip investment” in China. Under Circular 75, a “special purpose vehicle” refers an offshore entity established or controlled, directly or indirectly, by PRC residents or PRC entities for the purpose of seeking offshore equity financing using assets or interests owned by such PRC residents or PRC entities in onshore companies, while “round trip investment” refers to the direct investment in China by the PRC residents through the “special purpose vehicles,” including without limitation establishing foreign invested enterprises and using such foreign invested enterprises to purchase or control (by way of contractual arrangements) onshore assets. SAFE Circular 75 requires that, before establishing or controlling a “special purpose vehicle”, PRC residents and PRC entities are required to complete foreign exchange registration with the local offices of SAFE for their overseas investments. In addition, any PRC resident that is the shareholder of an offshore special purpose company is required to amend his or her SAFE registration with the SAFE or its competent local branch, with respect to that offshore special purpose company in connection with any of its increase or decrease of capital, transfer of shares, merger, division, equity investment or creation of any security interest over any assets located in China. To further clarify the implementation of SAFE Circular 75, SAFE issued SAFE Circular 106 on May 29, 2007. Under SAFE Circular 106, PRC subsidiaries of an offshore company governed by SAFE Circular 75 are required to coordinate and supervise the filing of SAFE registrations in a timely manner by the offshore holding company’s shareholders who are PRC residents. If these shareholders fail to comply, the PRC subsidiaries are required to report to the local SAFE authorities. If AutoChina’s shareholders who are PRC citizens or residents do not complete their registration with the local SAFE authorities, AutoChina’s PRC subsidiaries will be prohibited from distributing their profits and proceeds from any reduction in capital, share transfer or liquidation to AutoChina, and AutoChina may be restricted in its ability to contribute additional capital to its PRC subsidiaries.

AutoChina attempts to comply, and attempts to ensure that AutoChina’s shareholders, who are PRC citizens or residents, comply with the SAFE Circular 75 requirements. However, AutoChina cannot assure you that all of AutoChina’s shareholders who are PRC residents will comply with AutoChina’s request to make or obtain any applicable registrations or approvals required by the Circular 75 and Circular 106. Furthermore, AutoChina may not at all times be fully aware or informed of the identities of all AutoChina’s beneficial owners who are PRC citizens or residents, and AutoChina may not always be able to compel AutoChina’s beneficial owners to comply with the SAFE Circular 75 requirements. As a result, AutoChina cannot assure you that all of its shareholders or beneficial owners who are PRC citizens or residents will at all times comply with, or in the future make or obtain any applicable registrations or approvals required by, SAFE Circular 75 or other related regulations. Failure by any such shareholders or beneficial owners to comply with SAFE Circular 75 could subject AutoChina to fines or legal sanctions, restrict AutoChina’s overseas or cross-border investment activities, limit AutoChina’s subsidiaries’ ability to make distributions or pay dividends or affect AutoChina’s ownership structure, which could adversely affect AutoChina’s business and prospects.

Restrictions on currency exchange may limit ACG’s ability to utilize ACG’s revenues effectively and the ability of ACG’s PRC subsidiaries to obtain financing.

Substantially all of ACG’s revenues and operating expenses are denominated in Renminbi. Restrictions on currency exchange imposed by the PRC government may limit ACG’s ability to utilize revenues generated in Renminbi to fund ACG’s business activities outside China, if any, or expenditures denominated in foreign currencies. Under current PRC regulations, Renminbi may be freely converted into foreign currency for payments relating to “current account transactions,” which include among other things dividend payments and payments for the import of goods and services, by complying with certain procedural requirements. ACG’s PRC subsidiaries may also retain foreign exchange in their respective current account bank accounts, subject to a cap set by SAFE or its local counterpart, for use in payment of international current account transactions.

However, conversion of Renminbi into foreign currencies, and of foreign currencies into Renminbi, for payments relating to “capital account transactions,” which principally includes investments and loans, generally requires the approval of SAFE and other relevant PRC governmental authorities. Restrictions on the convertibility of the Renminbi for capital account transactions could affect the ability of ACG’s PRC subsidiaries to make investments overseas or to obtain foreign exchange through debt or equity financing, including by means of loans or capital contributions from the parent entity.

Any existing and future restrictions on currency exchange may affect the ability of ACG’s PRC subsidiaries or affiliated entities to obtain foreign currencies, limit ACG’s ability to utilize revenues generated in Renminbi to fund ACG’s business activities outside China that are denominated in foreign currencies, or otherwise materially and adversely affect ACG’s business.

In August 2008, SAFE promulgated Circular 142, a notice regulating the conversion by foreign investment enterprises, or “FIEs,” of foreign currency into Renminbi by restricting how the converted Renminbi may be used. Circular 142 requires that Renminbi converted from the foreign currency-dominated capital of a FIE may only be used for purposes within the business scope approved by the applicable government authority and may not be used for equity investments within the PRC unless specifically provided for otherwise. In addition, SAFE strengthened its oversight over the flow and use of Renminbi funds converted from the foreign currency-dominated capital of a FIE. The use of such Renminbi may not be changed without approval from SAFE, and may not be used to repay Renminbi loans if the proceeds of such loans have not yet been used. Violations of Circular 142 may result in severe penalties, including substantial fines as set forth in the SAFE rules.

You may experience difficulties enforcing foreign judgments or bringing original actions in China based on U.S. judgments against AutoChina, ACG, their subsidiaries and variable interest entities, officers, directors and shareholders, and others.

We have appointed CT Corporation System located at 111 Eighth Avenue, 13/F, New York, New York 10011 as our agent to receive service of process with respect to any action brought against us in the United States District Court for the Southern District of New York under the federal securities laws of the United States or of any state in the United States or any action brought against us in the Supreme Court of the State of New York in the County of New York under the securities laws of the State of New York, and intend to abide by judgments entered by such courts in such actions.

Notwithstanding, substantially all of AutoChina’s assets are located outside of the United States, and most of AutoChina’s current directors and executive officers reside outside of the United States. In addition, the PRC does not have treaties providing for reciprocal recognition and enforcement of judgments of courts with the United States or many other countries. As a result, recognition and enforcement in the PRC of these judgments in relation to any matter, including United States securities laws and the laws of the Cayman Islands, may be difficult or impossible. Furthermore, an original action may be brought in the PRC against AutoChina’s assets, its subsidiaries, officers, directors, shareholders and advisors only if the actions are not required to be arbitrated by PRC law and the facts alleged in the complaint give rise to a cause of action under PRC law. In connection with such an original action, a PRC court may award civil liabilities, including monetary damages.

We may qualify as a passive foreign investment company, or “PFIC,” which could result in adverse U.S. federal income tax consequences to U.S. investors.

In general, we will be treated as a PFIC for any taxable year in which either (1) at least 75% of our gross income (looking through certain 25% or more-owned corporate subsidiaries) is passive income or (2) at least 50% of the average value of our assets (looking through certain 25% or more-owned corporate subsidiaries) is attributable to assets that produce, or are held for the production of, passive income. Passive income generally includes, without limitation, dividends, interest, rents, royalties, and gains from the disposition of passive assets. If we are determined to be a PFIC for any taxable year (or portion thereof) that is included in the holding period of a U.S. Holder (as defined in the section of this prospectus supplement captioned “Taxation—United States Federal Income Taxation—General”) of our ordinary shares, the U.S. Holder may be subject to increased U.S. federal income tax liability and may be subject to additional reporting requirements. Based on the expected composition of the assets and income of us and our subsidiaries for our 2010 taxable year, we may be treated as a PFIC for our 2010 taxable year. However, our actual PFIC status for our 2010 taxable year or any subsequent taxable year will not be determinable until after the end of such taxable year. Accordingly, there can be no assurance with respect to our status as a PFIC for our 2010 taxable year or any future taxable year. We urge U.S. Holders to consult their own tax advisors regarding the possible application of the PFIC rules. For a more detailed explanation of the tax consequences of PFIC classification to U.S. Holders, see the section of this prospectus supplement captioned ‘‘Taxation—United States Federal Income Taxation—Tax Consequences to U.S. Holders—Passive Foreign Investment Company Rules.”

About This Prospectus Supplement

This document is in two parts. The first part is the prospectus supplement, which describes the specific terms of this offering and adds, updates and changes information contained in the accompanying base prospectus. The second part is the accompanying base prospectus, which gives more general information, some of which may not apply to this offering. This prospectus supplement and the information incorporated by reference herein supersedes and amends certain information in the accompanying base prospectus. This prospectus supplement and the accompanying base prospectus are part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration, under which we, from time to time, may sell up to $300 million in the aggregate of ordinary shares, preferred shares, warrants, subscription rights, debt securities, and units.

This prospectus supplement and the accompanying base prospectus include important information about us, our ordinary shares and other information you should know before investing. We urge you to read carefully this prospectus supplement and the accompanying base prospectus in their entirety, together with the information described under the headings “Incorporation of Certain Documents by Reference” in the accompanying base prospectus and “Where You Can Find More Information” in this prospectus supplement and in the accompanying base prospectus.

You should rely only on the information contained in, or incorporated by reference into, this prospectus supplement and the accompanying base prospectus. We have not, and the placement agents have not, authorized anyone to provide you with different or additional information. We are not, and the placement agents are not, making an offer of these securities in any jurisdiction where the offer is not permitted. You should assume that the information contained in this prospectus supplement, the accompanying base prospectus and the documents we incorporate by reference is accurate only as of its respective date or on the date which is specified in those documents. Our business, financial condition, results of operations and prospects may have changed since these dates.

Unless otherwise indicated, all information in this prospectus supplement assumes no exercise by the placement agents of their option to purchase up to an additional 300,000 ordinary shares from us at the initial price to the public less the placement agent fees for a period of 45 days following the date of this prospectus supplement.

This prospectus supplement contains translations of Renminbi amounts into U.S. dollars at specific rates solely for the convenience of the reader. The conversion of Renminbi into U.S. dollars in this prospectus supplement is based on the noon buying rate in The City of New York for cable transfers of Renminbi as certified for customs purposes by the Federal Reserve Bank of New York. Unless otherwise noted, all translations from Renminbi to U.S. dollars in this prospectus supplement were made at a rate of RMB 6.8260 to US$1.00, the noon buying rate in effect as of December 31, 2009. We make no representation that any Renminbi or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or Renminbi, as the case may be, at any particular rate, the rate stated above, or at all. The PRC government imposes control over its foreign currency reserves in part through direct regulation of the conversion of Renminbi into foreign currency and through restrictions on foreign trade.

Cautionary Note Regarding Forward-Looking Statements

We believe that some of the information in this prospectus supplement, the accompanying base prospectus and the documents we incorporate by reference constitutes forward-looking statements within the definition of the Private Securities Litigation Reform Act of 1995. You can identify these statements by forward-looking words such as “may,” “expect,” “anticipate,” “contemplate,” “believe,” “estimate,” “intends,” and “continue” or similar words. You should read statements that contain these words carefully because they discuss future expectations, contain projections of future results of operations or financial condition or state other “forward-looking” information.

We believe it is important to communicate our expectations to our security holders. However, there may be events in the future that we are not able to predict accurately or over which we have no control. The risk factors and cautionary language incorporated by reference into this prospectus supplement and the accompanying base prospectus provide examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described by us in such forward-looking statements, including among other things:

| · | changing principles of generally accepted accounting principles; |

| · | outcomes of government reviews, inquiries, investigations and related litigation; |

| · | continued compliance with government regulations; |

| · | legislation or regulatory environments, requirements or changes adversely affecting the automobile business in China; |

| · | fluctuations in customer demand; |

| · | management of rapid growth; |

| · | general economic conditions; |

| · | changes in government policy; |

| · | the fluctuations in sales of commercial vehicles in China; |

| · | China’s overall economic conditions and local market economic conditions; |

| · | ACG’s ability to expand through strategic acquisitions and establishment of new locations; |

| · | our business strategy and plans; |

| · | the results of future financing efforts; and |

| · | and geopolitical events |

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this prospectus supplement, the accompanying base prospectus and the documents we incorporate by reference.

All forward-looking statements included herein attributable to us are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Except to the extent required by applicable laws and regulations, we do not undertake any obligation to update these forward-looking statements to reflect events or circumstances after the date of this prospectus supplement, the accompanying base prospectus and the documents we incorporate by reference or to reflect the occurrence of unanticipated events.

Use of Proceeds

We estimate that our net proceeds from the sale of 2,000,000 ordinary shares in this offering will be approximately $65,710,610 after deducting estimated offering expenses of $789,390 and placement agent fees. Our net proceeds will be approximately $75,685,610, after deducting estimated offering expenses and placement agent fees, if the placement agents exercise the overallotment option in full.

We intend to use the net proceeds for general corporate purposes, which may include additions to working capital, capital expenditures, financing of acquisitions and other business combinations, and investments in or extensions of credit to our subsidiaries. Accordingly, management will have broad discretion on the use and application of the net proceeds from this offering.

Per Share Market Information and Dividends

AutoChina’s ordinary shares have been traded on the NASDAQ Capital Market since October 5, 2009 under the symbols AUTC. Prior to October 5, 2009, the ordinary shares had been quoted on the OTC Bulletin Board since March 28, 2008. Prior to March 28, 2008, AutoChina’s ordinary shares did not trade any market or exchange.

The table below reflects the high and low bid prices for AutoChina’s ordinary shares for the period from March 28, 2008 through October 5, 2009. The OTC Bulletin Board quotations reflect inter-dealer prices, are without retail markup, markdowns or commissions, and may not represent actual transactions. The table below also reflects the high and low sales prices on the NASDAQ Capital Market for the period from October 5, 2009 through March 5, 2010.

| | | | |

| | | | | | | |

| Annual Highs and Lows | | | | | | |

| 2008 | | $ | 7.30 | | | $ | 6.50 | |

| 2009 | | | 35.99 | | | | 6.50 | |

| 2010 (through March 22) | | | 48.50 | | | | 22.05 | |

| | | | | | | | | |

| Quarterly Highs and Lows | | | | | | | | |

| 2008 | | | | | | | | |

| First Quarter | | $ | N/A | (1) | | $ | N/A | |

| Second Quarter | | | 7.19 | | | | 7.15 | |

| Third Quarter | | | 7.18 | | | | 7.00 | |

| Fourth Quarter | | | 7.00 | | | | 6.50 | |

| 2009 | | | | | | | | |

| First Quarter | | $ | 8.00 | | | $ | 6.60 | |

| Second Quarter | | | 14.00 | | | | 6.50 | |

| Third Quarter | | | 15.00 | | | | 7.50 | |

| Fourth Quarter | | | 35.99 | | | | 11.00 | |

| 2010 | | | | | | | | |

| First Quarter (through March 5) | | $ | 40.96 | | | $ | 22.05 | |

| | | | | | | | | |

| Monthly Highs and Lows | | | | | | | | |

| February 2009 | | $ | 7.80 | | | $ | 7.00 | |

| March 2009 | | | 7.87 | | | | 7.00 | |

| April 2009 | | | 14.00 | | | | 6.50 | |

| May 2009 | | | 7.39 | | | | 7.00 | |

| June 2009 | | | 11.00 | | | | 7.39 | |

| July 2009 | | | 11.00 | | | | 7.70 | |

| August 2009 | | | 9.50 | | | | 8.50 | |

| September 2009 | | | 15.00 | | | | 9.50 | |

| October 2009 | | | 35.99 | | | | 11.00 | |

| November 2009 | | | 30.10 | | | | 23.07 | |

| December 2009 | | | 27.00 | | | | 15.37 | |

| January 2010 | | | 31.50 | | | | 22.05 | |

| February 2010 | | | 41.80 | | | | 26.39 | |

____________

(1) There were no trades of the AutoChina’s ordinary shares during this period

Number of Holders. As of February 28, 2010, there were 10 holders of record of our outstanding ordinary shares, though we believe that the number of beneficial holders is significantly greater.

Dividends. We have not paid any dividends on our ordinary shares to date and do not anticipate paying any in the foreseeable future. Any dividends paid will be solely at the discretion of our Board of Directors.

Capitalization and Indebtedness

The following table sets forth our consolidated capitalization as of December 31, 2009 on an actual basis and as adjusted to give effect to the sale by us of 2,000,000 of our ordinary shares in this offering with net proceeds of $65,710,610 after deducting placement agent fees and estimated offering expenses payable by us of $789,390 assuming no exercise of the placement agents’ overallotment option. You should read this table in conjunction with “Risk Factors” in this prospectus supplement, our consolidated financial statements and the related notes, thereto, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” found in our Annual Report on form 20-F for the fiscal year ended December 31, 2009, and the other financial information incorporated by reference into this prospectus supplement.

| | | As of December 31, 2009 | |

| | | (In thousands) | |

| | | Actual | | | As Adjusted | |

| Total Capitalization | | | | | | | | |

| Cash and Cash Equivalents | | $ | 36,768 | | | $ | 102,479 | |

| | | | | | | | | |

| Total Debt: | | | | | | | | |

| Short-term loan | | $ | 8,788 | | | $ | 8,788 | |

| Accounts payable, related parties | | $ | 117,725 | | | $ | 117,725 | |

| Total Debt | | $ | 126,513 | | | $ | 126,513 | |

| | | | | | | | | |

| Shareholders' Equity | | $ | 107,275 | | | $ | 172,986 | |

| | | | | | | | | |

| Total Capitalization | | $ | 233,788 | | | $ | 299,499 | |

Exchange Rate Information

We conduct our business in China and substantially all of our revenues are denominated in Renminbi. However, periodic reports made to shareholders will be expressed in U.S. dollars using the then current exchange rates. This prospectus supplement contains translations of Renminbi amounts into U.S. dollars at specified rates solely for the convenience of the reader. Unless otherwise noted, all translations from Renminbi to U.S. dollars were made at the noon buying rate in The City of New York for cable transfers in Renminbi per U.S. dollar as certified for customs purposes by the Federal Reserve Bank of New York, as of December 31, 2009, which was RMB6.8260 to US$1.00. No representation is made that the Renminbi amounts referred to in this prospectus supplement could have been or could be converted into U.S. dollars at any particular rate or at all. On February 26, 2010, the noon buying rate was RMB6.8258 to US$1.00.

The following table sets forth information concerning exchange rates between the Renminbi and the U.S. dollar for the periods indicated.

| | | Renminbi per U.S. Dollar – Noon Buying Rate | |

| | | | | | | | | | | | | |

| 2010 | | | | | | | | | | | | |

| February | | | 6.8258 | | | | 6.8330 | | | | 6.8258 | | | | 6.8285 | |

| January | | | 6.8269 | | | | 6.8295 | | | | 6.8258 | | | | 6.8268 | |

| 2009 | | | | | | | | | | | | | | | | |

| December | | | 6.8275 | | | | 6.8299 | | | | 6.8244 | | | | 6.8259 | |

| November | | | 6.8271 | | | | 6.8300 | | | | 6.8255 | | | | 6.8265 | |

| October | | | 6.8267 | | | | 6.8292 | | | | 6.8248 | | | | 6.8264 | |

| September | | | 6.8277 | | | | 6.8303 | | | | 6.8247 | | | | 6.8262 | |

| | | | | | | | | | | | | | | | | |

| Nine months ended September 30, 2009 | | | 6.8319 | | | | 6.8470 | | | | 6.8176 | | | | 6.8262 | |

| | | | | | | | | | | | | | | | | |

| Year ended December 31, 2009 | | | 6.8295 | | | | 6.8470 | | | | 6.8176 | | | | 6.8260 | |

| Year ended December 31, 2008 | | | 6.9193 | | | | 7.2946 | | | | 6.7800 | | | | 6.8230 | |

| Year ended December 31, 2007 | | | 7.5806 | | | | 7.8127 | | | | 7.2946 | | | | 7.2950 | |

| Year ended December 31, 2006 | | | 7.9579 | | | | 8.0702 | | | | 7.8041 | | | | 7.8040 | |

| Year ended December 31, 2005 | | | 8.1826 | | | | 8.2765 | | | | 8.0702 | | | | 8.0700 | |

Source: Federal Reserve Bank of New York

____________________________

(1) Annual averages are calculated from month-end rates. Monthly and interim period averages are calculated using the average of the daily rates during the relevant period.

Description of Ordinary Shares

General

AutoChina is authorized to issue 50,000,000 ordinary shares, par value $.001, and 1,000,000 shares of preferred stock, par value $.001. As of the date of this prospectus supplement, 17,679,866 ordinary shares are issued and outstanding, held by 10 holders of record. No shares of preferred stock are currently outstanding. The remaining authorized and unissued ordinary shares will be available for future issuance without additional shareholder approval. While the additional shares are not designed to deter or prevent a change of control, under some circumstances AutoChina could use them to create voting impediments or to frustrate persons seeking to effect a takeover or otherwise gain control, by, for example, issuing shares in private placements to purchasers who might side with the Board of Directors in opposing a hostile takeover bid.

AutoChina’s shareholders of record are entitled to one vote for each ordinary share held on all matters to be voted on by shareholders.

Members of AutoChina’s Board of Directors serve for indefinite terms. There is no cumulative voting with respect to the election of directors, with the result that the holders of more than 50% of the shares eligible to vote for the election of directors can elect all of the directors.

AutoChina’s ordinary shares have traded on the NASDAQ Capital Market since October 5, 2009 under the symbols AUTC. Prior to October 5, 2009, the ordinary shares had been quoted on the OTC Bulletin Board since March 28, 2008.

AutoChina’s shareholders have no conversion, preemptive or other subscription rights and there are no sinking fund or redemption provisions applicable to the ordinary shares.

Under the terms of the AutoChina International Limited 2009 Equity Incentive Plan, 1,675,000 AutoChina ordinary shares are reserved for issuance in accordance with its terms (provided, however, that dividend equivalent rights are payable solely in cash and therefore do not reduce the number of shares that may be granted under the incentive plan and that stock appreciation rights only reduce the number of shares available for grant under the plan by the number of shares actually received by the grantee). AutoChina currently has 1,202,784 ordinary shares issuable upon the exercise of outstanding stock options, and there are an additional 472,216 ordinary shares available for future grant or issuance pursuant to our equity incentive plan. Any other awards under the plan will be made by the Board of Directors. For more information about the AutoChina International Limited 2009 Equity Incentive Plan, please refer to “Directors, Senior Management and Employees - AutoChina International Limited 2009 Equity Incentive Plan” in the accompanying base prospectus.

Memorandum and Articles of Association

Objects of AutoChina

Under AutoChina’s Second Amended and Restated Memorandum of Association, the objects for which AutoChina is established are unlimited.

Directors

Directors materially interested in a proposal, arrangement or contract may be counted in determining the presence of a quorum and may vote at a meeting of the Board of Directors of AutoChina, so long as (i) the material facts as to the director’s interest are disclosed to the Board of Directors, and the Board authorizes the transaction in good faith by the affirmative votes of a majority of the disinterested directors, even though the disinterested directors be less than a quorum; or (ii) the transaction is fair to the company as of the time it is authorized, approved or ratified.

Subject to certain restrictions further described in AutoChina’s Second Amended and Restated Articles of Association, the Board of Directors may exercise all the powers of AutoChina to raise or borrow money and to mortgage or charge all or any part of the undertaking, property and assets (present and future) and uncalled capital of AutoChina and, subject to the law, to issue debentures, bonds and other securities, whether outright or as collateral security for any debt, liability or obligation of AutoChina or of any third party.

There are no age restrictions on AutoChina’s directors. No director is required to hold any shares in AutoChina by way of qualification.

Rights, Preferences and Restrictions of AutoChina’s Securities

Dividends. AutoChina has not paid any dividends on its ordinary shares to date and does not anticipate paying any in the foreseeable future. The Board of Directors of AutoChina may from time to time, however, declare dividends. Except in so far as the rights attaching to, or the terms of issue of, any share otherwise provide at that time, all dividends shall be declared and paid according to the amounts paid up on the shares in respect of which the dividend is paid, and all dividends shall be apportioned and paid pro rata according to the amounts paid up on the shares during any portion or portions of the period in respect of which the dividend is paid. No dividend or other moneys payable by AutoChina on or in respect of any share shall bear interest against AutoChina. All dividends unclaimed for one (1) year after having been declared may be invested or otherwise made use of by the Board of Directors of AutoChina for the benefit of AutoChina until claimed. Any dividend unclaimed after a period of six (6) years from the date of declaration shall be forfeited and shall revert to AutoChina.

Voting Rights. Subject to any special rights or restrictions as to voting attached to any shares at the time, each fully paid ordinary share in AutoChina is entitled to one vote. The Board of Directors of AutoChina does not stand for re-election at staggered intervals.

Rights to Share in AutoChina’s Profits or Liquidation Surplus. There are currently no special rights of AutoChina’s shareholders to share in its profits. There are currently no special rights, privileges or restrictions in effect as to the distribution of available surplus assets on liquidation attached to any class or classes of shares. If AutoChina is wound up and the assets available for distribution amongst the shareholders of AutoChina are more than sufficient to repay the whole of the capital paid up at the commencement of the winding up, the excess shall be distributed pari passu amongst such shareholders in proportion to the number of ordinary shares owned. If AutoChina is wound up, the liquidator may, with the authority of a special resolution and any other sanction required by law, divide among the shareholders in specie or kind the whole or any part of the assets of AutoChina as such liquidator sees fit.

Shareholder Rights

Any class of shares of AutoChina may, unless otherwise provided by the terms of issue of the shares of that class, be varied, modified or abrogated with the sanction of a special resolution passed at a separate general meeting of the holders of the shares of that class.

Annual General Meetings and Extraordinary General Meetings

An annual general meeting and any extraordinary general meeting may be called by not less than ten (10) clear days notice, but a general meeting may be called by shorter notice, subject to the law, if it is so agreed (i) in the case of an annual general meeting, by all members entitled to attend and vote thereat; and (ii) in the case of any other meeting, by a majority in the number of the members having the right to attend and vote at the meeting, being a majority together holding not less than ninety-five percent (95%) in nominal value of the issued shares giving that right.

Transfer Agent and Registrar

The Transfer Agent and Registrar for the AutoChina ordinary shares is American Stock Transfer & Trust Company, 59 Maiden Lane, Plaza Level, New York, NY 10038, (212) 936-5100.

Plan of Distribution

We entered into an engagement agreement, dated March 3, 2010, with Rodman & Renshaw, LLC and Chardan Capital Markets, LLC. Subject to the terms and conditions set forth in the engagement agreement, Rodman & Renshaw, LLC agreed to act as lead placement agent in connection with this offering and Chardan Capital Markets, LLC agreed to act as co-placement agent. The placement agents are not purchasing any shares for their own accounts. The placement agents agreed in the engagement agreement to use their reasonable best efforts to arrange for the sale of all of the securities being offered in this offering, but they are not required to arrange for the sale of any specific number or dollar amount of securities. We will enter into securities purchase agreements directly with the investors who purchase securities in this offering.

We currently anticipate that the closing of this offering will take place on or about March 26, 2010. On the closing date:

| · | we will receive funds in the amount of the aggregate purchase price of the ordinary shares sold; |

| · | we will irrevocably instruct the transfer agent to deliver the ordinary shares to the investors; and |

| · | the placement agents will receive the placement agent fees in accordance with the terms of the engagement agreement. |

We have agreed to pay the placement agents a commission of 5% (an aggregate fee equal to $3,500,000, assuming all shares offered are sold (not including the right granted to the placement agents to place up to additional 15% of the securities offered hereby)).

The estimated offering expenses payable by us, in addition to the maximum aggregate fees of approximately $3,500,000 due to the placement agents, are approximately $789,390, which include legal, accounting and printing costs, and various other fees associated with registering the securities and listing the ordinary shares. After deducting the fees due to the placement agents and our estimated offering expenses, we expect the net proceeds from this offering to be approximately $65,710,610 if the maximum number of shares are sold.

Certain investor funds will be deposited into an escrow account and held until jointly released by us and the lead placement agent on the date the securities are to be delivered to the investors. All funds will be held in a non-interest bearing account.

The following table shows the per share and total commissions we will pay to the placement agents in connection with the sale of ordinary shares offered pursuant to this prospectus supplement and the accompanying base prospectus, assuming the purchase of all of the ordinary shares offered hereby:

| Per Share | $ | 1.75 |

| Total | $ | 3,500,000 |

Because there is no minimum offering amount required as a condition to closing in this offering, the actual total offering commissions, if any, are not presently determinable and may be substantially less than the maximum amount set forth above. We have also granted the placement agents the right, exercisable within 45 days after the date of this prospectus supplement, to place up to an additional 300,000 shares at the offering price of $35.00.

The placement agents may be deemed an “underwriter” within the meaning of Section 2(11) of the Securities Act, and any commissions received by them and profit on any resale of our securities as principal might be deemed to be underwriting discounts and commissions under the Securities Act.

As underwriters, the placement agents and any broker-dealer or agent acting on their behalf would be subject to liability under the federal securities laws and would be required to comply with the requirements of the Securities Act and the Exchange Act, including without limitation, Rule 10b-5 and, to the extent applicable, Regulation M under the Exchange Act. These rules and regulations may limit the timing of sales of our securities by the placement agents or any broker-dealer or agent. Under these rules and regulations, the placement agents and any broker-dealer or agent acting on their behalf:

| · | may not engage in any stabilization activity in connection with our securities; |

| · | must furnish each broker which offers securities covered by this prospectus with the number of copies of this prospectus and any prospectus supplement that are required by each broker; and |

| · | may not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Exchange Act, until it has completed its participation in the distribution. |

Prior to the offering by AutoChina to the placement agents described herein, the placement agents beneficially owned no shares of AutoChina.

We have agreed to indemnify the placement agents and certain other persons against certain liabilities relating to or arising out of the placement agents’ activities under the engagement agreement. We have also agreed to contribute to payments the placement agents may be required to make in respect of such liabilities.

We have agreed with the investors in this offering that we will not issue or contract to issue any additional ordinary shares or ordinary share equivalents for a period of 30 days following the closing date of this offering, subject to certain limited exceptions set forth in the securities purchase agreement or pursuant to the limited right to sell additional shares granted to the placement agents.

The engagement agreement and the forms of securities purchase agreements we enter into with the investors in this offering will be included as exhibits to our Current Report on Form 6-K that will be filed with the SEC in connection with the consummation of this offering.

The per share purchase price was determined based on negotiations with the investors and discussions with the placement agents.

Taxation

The following summary of the material Cayman Islands, PRC and U.S. federal income tax consequences of an investment in our ordinary shares is based upon laws and relevant interpretations thereof in effect as of the date of this prospectus supplement, all of which are subject to change. This summary does not deal with all possible tax consequences relating to an investment in our ordinary shares, such as the tax consequences under state, local and other tax laws. As used in this discussion, references to “we,” “our,” or “us” refer only to AutoChina International Limited, and references to“ACG” refer only to AutoChina Group Inc.

Cayman Islands Taxation

The Government of the Cayman Islands will not, under existing legislation, impose any income, corporate or capital gains tax, estate duty, inheritance tax, gift tax or withholding tax upon us or our shareholders. The Cayman Islands are not party to any double taxation treaties.

No Cayman Islands stamp duty will be payable by you in respect of the issue or transfer of our ordinary shares. However, an instrument transferring title to an ordinary share, if brought into or executed in the Cayman Islands, would be subject to a nominal stamp duty.

PRC Taxation

The following is a summary of the material PRC tax consequences relating to the acquisition, ownership and disposition of our ordinary shares.

You should consult with your own tax adviser regarding the PRC tax consequences of the acquisition, ownership and disposition of our ordinary shares in your particular circumstances.

Resident Enterprise Treatment

On March 16, 2007, the Fifth Session of the Tenth National People’s Congress passed the Enterprise Income Tax Law of the PRC (“EIT Law”), which became effective on January 1, 2008. Under the EIT Law, enterprises are classified as “resident enterprises” and “non-resident enterprises.” Pursuant to the EIT Law and its implementing rules, enterprises established outside China whose “de facto management bodies” are located in China are considered “resident enterprises” and subject to the uniform 25% enterprise income tax rate on worldwide income. According to the implementing rules of the EIT Law, “de facto management body” refers to a managing body that in practice exercises overall management control over the production and business, personnel, accounting and assets of an enterprise.

On April 22, 2009, the State Administration of Taxation issued the Notice on the Issues Regarding Recognition of Enterprises that are Domestically Controlled as PRC Resident Enterprises Based on the De Facto Management Body Criteria, which was retroactively effective as of January 1, 2008. This notice provides that an overseas incorporated enterprise that is controlled domestically will be recognized as a “tax-resident enterprise” if it satisfies all of the following conditions: (i) the senior management responsible for daily production/business operations are primarily located in the PRC, and the location(s) where such senior management execute their responsibilities are primarily in the PRC; (ii) strategic financial and personnel decisions are made or approved by organizations or personnel located in the PRC; (iii) major properties, accounting ledgers, company seals and minutes of board meetings and stockholder meetings, etc., are maintained in the PRC; and (iv) 50% or more of the board members with voting rights or senior management habitually reside in the PRC.

Given the short history of the EIT Law and lack of applicable legal precedent, it remains unclear how the PRC tax authorities will determine the PRC tax resident status of a company organized under the laws of a foreign (non-PRC) jurisdiction, such as us, ACG and/or Fancy Think Limited. If the PRC tax authorities determine that we, ACG and/or Fancy Think Limited is a “resident enterprise” for PRC enterprise income tax purposes, a number of tax consequences could follow. First, we, ACG and/or Fancy Think Limited could be subject to the enterprise income tax at a rate of 25% on our, ACG’s and/or Fancy Think Limited’s worldwide taxable income, as well as PRC enterprise income tax reporting obligations. Second, the EIT Law provides that dividend income between “qualified resident enterprises” is exempt from income tax. As a result, if we, ACG and Fancy Think Limited are treated as PRC “resident enterprises,” all dividends paid from Chuanglian to us (through Fancy Think Limited and ACG) would constitute dividend income between “qualified resident enterprises” and would therefore qualify for tax exemption.

As of the date of this prospectus, there has not been a definitive determination as to the “resident enterprise” or “non-resident enterprise” status of us, ACG and/or Fancy Think Limited. However, since it is not anticipated that we, ACG and/or Fancy Think Limited would receive dividends or generate other income in the near future, we, ACG and Fancy Think Limited are not expected to have any income that would be subject to the 25% enterprise income tax on worldwide income in the near future. We, ACG and Fancy Think Limited will consult with the PRC tax authorities and make any necessary tax payment if we, ACG and/or Fancy Think Limited (based on future clarifying guidance issued by the PRC), or the PRC tax authorities, determine that we, ACG or Fancy Think Limited are a resident enterprise under the EIT Law, and if we, ACG or Fancy Think Limited were to have income in the future.

Dividends From Chuanglian

If Fancy Think Limited is not treated as a resident enterprise under the EIT Law, then dividends that Fancy Think Limited receives from Chuanglian may be subject to PRC withholding tax. The EIT Law and the implementing rules of the EIT Law provide that (A) an income tax rate of 25% will normally be applicable to investors that are “non-resident enterprises,” or non-resident investors, which (i) have establishments or premises of business inside the PRC, and (ii) the income in connection with their establishment or premises of business is sourced from the PRC or the income is earned outside the PRC but has actual connection with their establishments or places of business inside the PRC, and (B) a PRC withholding tax at a rate of 10% will normally be applicable to dividends payable to investors that are “non-resident enterprises,” or non-resident investors, which (i) do not have an establishment or place of business in the PRC or (ii) have an establishment or place of business in the PRC, but the relevant income is not effectively connected with the establishment or place of business, to the extent such dividends are derived from sources within the PRC.

As described above, the PRC tax authorities may determine the resident enterprise status of entities organized under the laws of foreign jurisdictions on a case-by-case basis. We, ACG and Fancy Think Limited are holding companies and substantially all of our, ACG’s and Fancy Think Limited’s income may be derived from dividends. Thus, if we, ACG, and/or Fancy Think Limited is considered as a “non-resident enterprise” under the EIT Law and the dividends paid to us, ACG and/or Fancy Think Limited are considered income sourced within the PRC, such dividends received may be subject to PRC withholding tax as described in the foregoing paragraph.

The State Council of the PRC, or a tax treaty between China and the jurisdiction in which a non-PRC investor resides, may reduce such income or withholding tax, with respect to such non-PRC investor. Pursuant to the PRC-Hong Kong Tax Treaty, if the Hong Kong resident enterprise that is not deemed to be a conduit by the PRC tax authorities owns more than 25% of the equity interest in a company in China continuously within 12 months prior to obtaining dividends from the company in China, the 10% PRC withholding tax on the dividends the Hong Kong resident enterprise receives from such company in China is reduced to 5%. We and ACG are Cayman Islands holding companies, and ACG has a subsidiary in Hong Kong (Fancy Think Limited), which in turn owns a 100% equity interest in Chuanglian.

As a result, if Fancy Think Limited were treated as a PRC “non-resident enterprise” under the EIT Law, then dividends that Fancy Think Limited receives from Chuanglian (assuming such dividends were considered sourced within the PRC) (i) may be subject to a 5% PRC withholding tax, if the PRC-Hong Kong Tax Treaty were applicable, or (ii) if such treaty does not apply (i.e., because the PRC tax authorities may deem Fancy Think Limited to be a conduit not entitled to treaty benefits), may be subject to a 10% PRC withholding tax. Similarly, if we or ACG were treated as a PRC “non-resident enterprise” under the EIT Law, and Fancy Think Limited were treated as a PRC “resident enterprise” under the EIT Law, then dividends that we or ACG receive from Fancy Think Limited (assuming such dividends were considered sourced within the PRC) may be subject to a 10% PRC withholding tax. Any such taxes on dividends could materially reduce the amount of dividends, if any, we could pay to our shareholders.

As of the date of this prospectus, there has not been a definitive determination as to the “resident enterprise” or “non-resident enterprise” status of us, ACG or Fancy Think Limited. As indicated above, however, Chuanglian is not expected to pay any dividends in the near future. We, ACG and Fancy Think Limited will consult with the PRC tax authorities and make any necessary tax withholding if, in the future, Chuanglian was to pay any dividends and we, ACG or Fancy Think Limited (based on future clarifying guidance issued by the PRC), or the PRC tax authorities, determine that either we, ACG or Fancy Think Limited is a non-resident enterprise under the EIT Law.

Dividends that Non-PRC Resident Investors Receive From Us; Gain on the Sale or Transfer of Our Ordinary Shares

If dividends payable to (or gains recognized by) our non-resident investors are treated as income derived from sources within the PRC, then the dividends that non-resident investors receive from us and any such gain on the sale or transfer of our ordinary shares may be subject to taxes under the PRC tax laws.

Under the EIT Law and the implementing rules of the EIT Law, PRC withholding tax at the rate of 10% is applicable to dividends payable to investors that are “non-resident enterprises,” or non-resident investors, which (i) do not have an establishment or place of business in the PRC or (ii) have an establishment or place of business in the PRC but the relevant income is not effectively connected with the establishment or place of business, to the extent that such dividends have their sources within the PRC. Similarly, any gain realized on the transfer of ordinary shares by such investors is also subject to 10% PRC income tax if such gain is regarded as income derived from sources within the PRC.

The dividends paid by us to non-resident investors with respect to our ordinary shares, or gain non-resident investors may realize from the sale or transfer of our ordinary shares, may be treated as PRC-sourced income and, as a result, may be subject to PRC tax at a rate of 10%. In such event, we may be required to withhold a 10% PRC tax on any dividends paid to non-resident investors. In addition, non-resident investors in our ordinary shares may be responsible for paying PRC tax at a rate of 10% on any gain realized from the sale or transfer of our ordinary shares if such non-resident investors and the gain satisfy the requirements under the EIT Law and its implementing rules. However, under the EIT Law and its implementing rules, we would not have an obligation to withhold income tax in respect of the gains that non-resident investors (including U.S. investors) may realize from the sale or transfer of our ordinary shares.

If we were to pay any dividends in the future, we would consult with the PRC tax authorities and if we (based on future clarifying guidance issued by the PRC), or the PRC tax authorities, determine that we must withhold PRC tax on any dividends payable by us under the EIT Law, we will make any necessary tax withholding on dividends payable to our non-resident investors. If non-resident investors as described under the EIT Law (including U.S. investors) realized any gain from the sale or transfer of our ordinary shares and if such gain were considered as PRC-sourced income, such non-resident investors would be responsible for paying 10% PRC income tax on the gain from the sale or transfer of our ordinary shares. As indicated above, under the EIT Law and its implementing rules, we would not have an obligation to withhold PRC income tax in respect of the gains that non-resident investors (including U.S. investors) may realize from the sale or transfer of our ordinary shares.

Moreover, the State Administration of Taxation (“SAT”) released Circular Guoshuihan No. 698 (“Circular 698”) on December 15, 2009 that reinforces the taxation of non-listed share transfers by non-resident enterprises through overseas holding vehicles. Circular 698 is retroactively effective from January 1, 2008. Circular 698 addresses indirect share transfers besides other issues. According to Circular 698, where a foreign (non-PRC resident) investor who indirectly holds shares in a PRC resident enterprise through a non-PRC offshore holding company indirectly transfers equity interests in a PRC resident enterprise by selling the shares of the offshore holding company, and the latter is located in a country or jurisdiction where the effective tax burden is less than 12.5% or where the offshore income of his, her, or its residents is not taxable, the foreign investor is required to provide the PRC tax authority in charge of that PRC resident enterprise with certain relevant information within 30 days of the transfer. The tax authorities in charge will evaluate the offshore transaction for tax purposes. In the event that the tax authorities determine that indirect share transfers through various arrangements of abusing forms of business organization are present, and a reasonable commercial purpose for the offshore holding company other than the avoidance of PRC income tax liability is lacking, the PRC tax authorities will have the power to re-assess the nature of the equity transfer under the doctrine of substance over form. A reasonable commercial purpose may be established when the overall international (including U.S.) offshore structure is set up to comply with the requirements of supervising authorities of international (including U.S.) capital markets. If the SAT’s challenge of a transfer is successful, it will deny the existence of the offshore holding company that is used for tax planning purposes and tax the seller on its capital gain from such transfer. Since Circular 698 has a short history, there is uncertainty as to its application. We (or a foreign investor) may become at risk of being taxed under Circular 698 and may be required to expend valuable resources to comply with Circular 698 or to establish that we (or such foreign investor) should not be taxed under Circular 698, which could have a material adverse effect on our financial condition and results of operations (or such foreign investor’s investment in us).

Penalties for Failure to Pay Applicable PRC Income Tax

Non-resident investors in us may be responsible for paying PRC tax at a rate of 10% on any gain realized from the sale or transfer of our ordinary shares if such non-resident investors and the gain satisfy the requirements under the EIT Law and its implementing rules, as described above.