UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For fiscal year ended December 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report______________

For the transition period from __________ to ___________

Commission file number 001-34477

AUTOCHINA INTERNATIONAL LIMITED

(Exact name of the Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

Cayman Islands

(Jurisdiction of incorporation or organization)

No.322, Zhongshan East Road

Shijiazhuang, Hebei

People’s Republic of China

Tel: +86 311 8382 7688

Fax: +86 311 8381 9636

(Address of principal executive offices)

Yong Hui Li

No.322, Zhongshan East Road

Shijiazhuang, Hebei

People’s Republic of China

Tel: +86 311 8382 7688

Fax: +86 311 8381 9636

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | | Name of each exchange on which registered |

| Ordinary Shares, par value $0.001 per share | | OTC Bulletin Board |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the Issuer’s classes of capital or ordinary shares as of the close of the period covered by the annual report: 23,538,919 ordinary shares, par value $0.001 per share, as of December 31, 2011.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer.

| ¨ Large Accelerated filer | | x Accelerated filer | | ¨ Non-accelerated filer |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| x US GAAP | | ¨ International Financial | | ¨ Other |

| | | Reporting Standards as issued by | | |

| | | the International Accounting | | |

| | | Standards Board | | |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

¨ Item 17 ¨ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

¨ Yes x No

Table of Contents

| | | Page |

| PART I | | |

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 5 |

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE | 5 |

| ITEM 3. | KEY INFORMATION | 5 |

| ITEM 4. | INFORMATION ON OUR COMPANY | 22 |

| ITEM 4A. | UNRESOLVED STAFF COMMENTS | 35 |

| ITEM 5. | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 35 |

| ITEM 6. | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 55 |

| ITEM 7. | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 66 |

| ITEM 8. | FINANCIAL INFORMATION | 70 |

| ITEM 9. | THE OFFER AND LISTING | 70 |

| ITEM 10. | ADDITIONAL INFORMATION | 72 |

| ITEM 11. | QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK | 85 |

| ITEM 12. | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 86 |

| | | |

| PART II | | |

| ITEM 13. | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | 87 |

| ITEM 14. | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 87 |

| ITEM 15. | CONTROLS AND PROCEDURES | 87 |

| ITEM 16. | [RESERVED] | 89 |

| ITEM 16A. | AUDIT COMMITTEE FINANCIAL EXPERT | 89 |

| ITEM 16B. | CODE OF ETHICS | 90 |

| ITEM 16C. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 90 |

| ITEM 16D. | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | 91 |

| ITEM 16E. | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 91 |

| ITEM 16F. | CHANGES IN REGISTRANT’S CERTIFYING ACCOUNTANT | 91 |

| ITEM 16G. | CORPORATE GOVERNANCE | 93 |

| ITEM 16H. | MINE SAFETY DISCLOSURE | 93 |

| | | |

| PART III | | |

| ITEM 17. | FINANCIAL STATEMENTS | 94 |

| ITEM 18. | FINANCIAL STATEMENTS | 94 |

| ITEM 19. | EXHIBITS | 94 |

CERTAIN INFORMATION

Unless otherwise indicated and except where the context otherwise requires, in this Annual Report on Form 20-F references to:

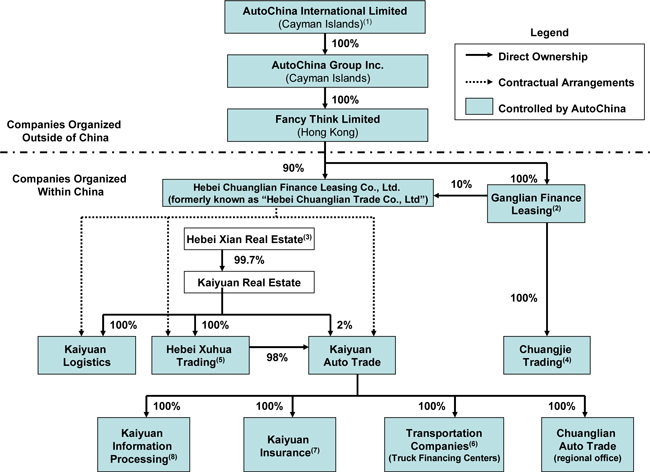

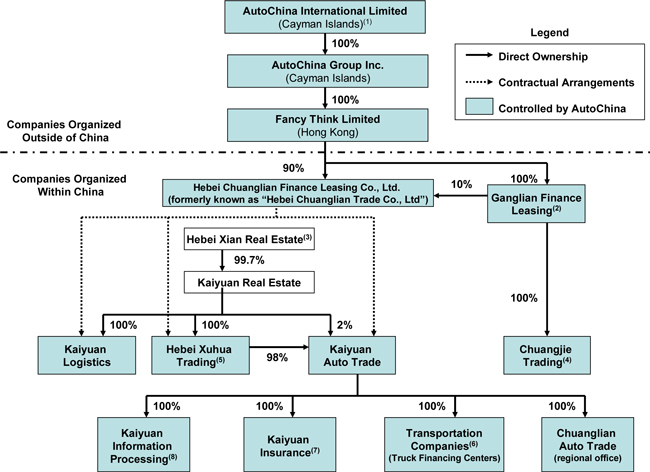

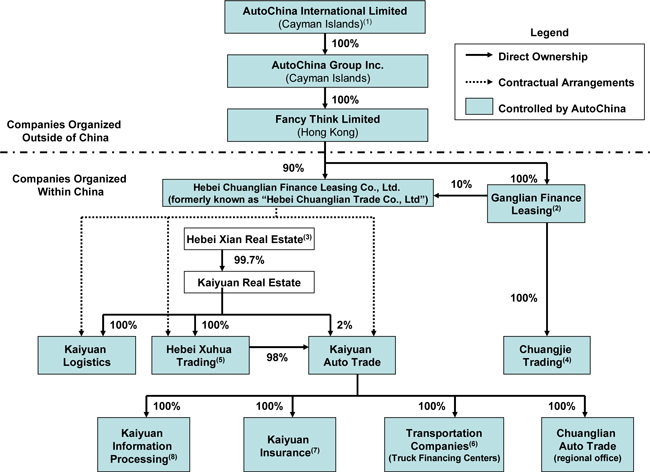

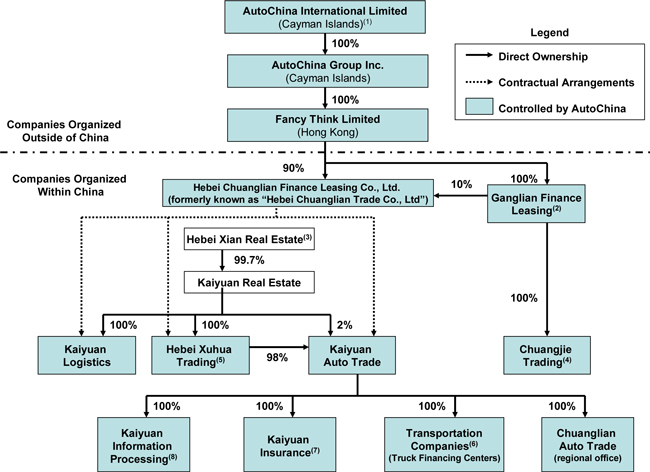

| · | “AutoChina”, “we,” “us”, “our” or “company” refer to AutoChina International Limited (together with its subsidiaries and affiliated entities); |

| · | “ACG” refers to AutoChina Group Inc. (together with its subsidiaries and affiliated entities); |

| · | “Auto Kaiyuan Companies” refers to Kaiyuan Logistics, Kaiyuan Auto Trade, and Hebei Xuhua Trading; |

| · | “PRC” or “China” refer to the People’s Republic of China; |

| · | “dollars” or “$” refer to the legal currency of the United States; and |

| · | “Renminbi” or “RMB” refer to the legal currency of China. |

FORWARD-LOOKING STATEMENTS

We believe that some of the information in this Annual Report on Form 20-F constitutes forward-looking statements within the definition of the Private Securities Litigation Reform Act of 1995. You can identify these statements by forward-looking words such as “may,” “expect,” “anticipate,” “contemplate,” “believe,” “estimate,” “intends,” and “continue” or similar words. You should read statements that contain these words carefully because they discuss future expectations, contain projections of future results of operations or financial condition or state other “forward-looking” information.

We believe it is important to communicate our expectations to our security holders. However, there may be events in the future that we are not able to predict accurately or over which we have no control. The risk factors and cautionary language included in this Annual Report on Form 20-F provide examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described by us in such forward-looking statements, including among other things:

| · | changing principles of generally accepted accounting principles; |

| · | outcomes of government reviews, inquiries, investigations and related litigation; |

| · | continued compliance with government regulations; |

| · | legislation or regulatory environments, requirements or changes adversely affecting the automobile business in China; |

| · | fluctuations in customer demand; |

| · | management of rapid growth; |

| · | general economic conditions; |

| · | changes in government policy; |

| · | the fluctuations in sales of commercial vehicles in China; |

| · | China’s overall economic conditions and local market economic conditions; |

| · | our ability to expand through strategic acquisitions and establishment of new locations; |

| · | our business strategy and plans; |

| · | the results of future financing efforts; and |

| · | and geopolitical events. |

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report.

All forward-looking statements included herein attributable to us are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Except to the extent required by applicable laws and regulations, we do not undertake any obligation to update these forward-looking statements to reflect events or circumstances after the date of this Annual Report or to reflect the occurrence of unanticipated events.

This Annual Report should be read in conjunction with our audited financial statements and the accompanying notes thereto, which are included in Item 18 of this Annual Report.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not required.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not required.

ITEM 3. KEY INFORMATION

| A. | Selected financial data |

The following selected consolidated financial data as of December 31, 2011 and 2010 and for the years ended December 31, 2011, 2010 and 2009 have been derived from the audited consolidated financial statements of AutoChina included in this Annual Report beginning on page F-1. The following summary consolidated financial data as of December 31, 2008 and 2007 and for the years ended December 31, 2008 and 2007 have been derived from the audited consolidated financial statements of ACG not included in this Annual Report. The below selected financial data does not include information relating to certain discontinued operations. This information is only a summary and should be read together with the consolidated financial statements, the related notes, the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations of AutoChina” and other financial information included in this Annual Report.

The consolidated financial statements are prepared and presented in accordance with generally accepted accounting principles in the United States, or “U.S. GAAP.” The results of operations of AutoChina in any period may not necessarily be indicative of the results that may be expected for any future period. See “Risk Factors” included elsewhere in this Annual Report.

AUTOCHINA INTERNATIONAL LIMITED AND SUBSIDIARIES

Selected Consolidated Financial Data

(In thousands of U.S. Dollars, except per share amounts)

| | | As of December 31, |

| | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 |

| | | | | | | | | | | |

| Balance Sheet Data – | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 43,019 | | | $ | 30,931 | | | $ | 36,768 | | | $ | 3,869 | | | $ | — | |

| Restricted cash | | $ | 159 | | | $ | — | | | $ | 12,450 | | | $ | — | | | $ | — | |

| Total current assets | | $ | 426,915 | | | $ | 355,273 | | | $ | 200,877 | | | $ | 170,096 | | | $ | 128,883 | |

| Total assets | | $ | 546,529 | | | $ | 500,206 | | | $ | 296,144 | | | $ | 180,387 | | | $ | 128,883 | |

| Total current liabilities | | $ | 256,247 | | | $ | 227,855 | | | $ | 187,146 | | | $ | 119,275 | | | $ | 91,078 | |

| Total liabilities | | $ | 256,247 | | | $ | 343,440 | | | $ | 246,169 | | | $ | 119,749 | | | $ | 91,078 | |

| Total equity | | $ | 290,282 | | | $ | 156,766 | | | $ | 49,975 | | | $ | 60,638 | | | $ | 37,805 | |

| | | For the Years Ended December 31, |

| | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 |

| | | | | | | | | | | |

| Statement of Operations Data – | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Revenues | | $ | 598,094 | | | $ | 618,073 | | | $ | 325,454 | | | $ | 36,298 | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | |

| Income from operations | | | 56,689 | | | | 47,444 | | | | 19,829 | | | | 1,343 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

| Other income (expense) | | | (17,140 | ) | | | (99,967 | ) | | | (90,281 | ) | | | 14 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from continuing operations | | | 26,130 | | | | (62,892 | ) | | | (74,280 | ) | | | 1,172 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

| Income from discontinued operations | | | — | | | | — | | | | 21,087 | | | | 6,871 | | | | 4,775 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net income (loss) attributable to shareholders | | $ | 26,130 | | | $ | (62,892 | ) | | $ | (53,193 | ) | | $ | 8,043 | | | $ | 4,775 | |

| | | | | | | | | | | | | | | | | | | | | |

| Earnings (loss) per share – | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Basic | | | | | | | | | | | | | | | | | | | | |

| Continuing operations | | $ | 1.11 | | | $ | (3.42 | ) | | $ | (8.26 | ) | | $ | 0.15 | | | $ | — | |

| Discontinued operations | | | — | | | | — | | | | 2.34 | | | | 0.89 | | | | 0.62 | |

| | | $ | 1.11 | | | $ | (3.42 | ) | | $ | (5.92 | ) | | $ | 1.04 | | | $ | 0.62 | |

| | | | | | | | | | | | | | | | | | | | | |

| Diluted | | | | | | | | | | | | | | | | | | | | |

| Continuing operations | | $ | 1.11 | | | $ | (3.42 | ) | | $ | (8.26 | ) | | $ | 0.15 | | | $ | — | |

| Discontinued operations | | | — | | | | — | | | | 2.34 | | | | 0.89 | | | | 0.62 | |

| | | $ | 1.11 | | | $ | (3.42 | ) | | $ | (5.92 | ) | | $ | 1.04 | | | $ | 0.62 | |

| B. | Capitalization and Indebtedness |

Not required.

| C. | Reasons for the Offer and Use of Proceeds |

Not required.

An investment in our securities involves risk. The discussion of risks related to our business contained in this Annual Report on Form 20-F comprises material risks of which we are aware. If any of the events or developments described actually occurs, our business, financial condition or results of operations would likely suffer. The discussion of risks related to our business contained in this Annual Report on Form 20-F also includes forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements.”

You should carefully consider the following risk factors, together with all of the other information included in this Annual Report on Form 20-F.

Risks Relating to our Business

Our growth is dependent upon, among other factors, the availability of suitable sites, without which it may not be able to continue to increase revenues.

We lease a majority of the properties where our commercial vehicle financing and service centers are located. If and when we decide to open new commercial vehicle financing and service centers, the inability to acquire suitable real estate, either through lease or purchase, at favorable terms could limit the expansion of our commercial vehicle financing center base and could limit our expansion strategy.

Competition may adversely affect us.

We believe we are the market leader in an underserved market. New competition may reduce our growth prospects or level of profitability. Competitors may attempt to copy or replicate our business model. This could have an adverse effect on our business.

We may have difficulty obtaining external financing to implement our organic growth strategy.

The primary means of growing our business is through leasing more commercial vehicles. This typically requires us to raise additional external financing. If we are unable to raise external financing it could limit our ability to grow our business.

We may have difficulty managing rapid growth.

As we grow we expect to add additional commercial vehicle financing and service centers to our store branch network. Managing a large number of separate physical locations could present us with administrative and logistical challenges that may inhibit our ability to grow. We may need to add additional personnel, information technology infrastructure, or physical locations to support our operations, which could adversely affect our operating performance.

We had a material weakness in our internal control in financial reporting for the year ended December 31, 2011 due to the lack of requisite U.S. GAAP experience of our finance team, which could result in our financial statements not being prepared properly.

In our assessment of the effectiveness of our internal control over financial reporting as of December 31, 2011, we determined that we had a material weakness related to the lack of requisite U.S. GAAP experience of our finance team, including those primarily responsible for the preparation of our books and records and financial statements. A material weakness makes it a reasonable possibility that a material misstatement of our company’s annual or interim financial statements will not be prevented or detected on a timely basis. In addition, since our internal control over financial reporting was not effective, we could not consider our disclosure controls and procedures to be effective.

In the event that the material weakness described above led to our financial statements not being prepared properly (which we currently do not believe to be the case), we would be required to restate our financial statements, which could result in a decline in our stock price.

Our limited operating history makes evaluating our business and prospects difficult.

The limited operating history our commercial vehicle sales, servicing, leasing and support business makes evaluating our business and prospects difficult.

We commenced our commercial vehicle sales, servicing, leasing and support business in March 2008. We opened 103, 54 and 143 commercial vehicle financing and service centers in 2008, 2009 and 2010, respectively, and 206 additional commercial vehicle financing and service centers in 2011 for a total of 506 centers at December 31, 2011. As of February 29, 2012, AutoChina opened an additional 5 centers, for a total of 511 centers. Accordingly, we have a limited operating history, which may not provide a meaningful basis for evaluating our business, financial performance and prospects. We may not have sufficient experience to address the risks frequently encountered by early stage companies, including our potential inability to:

| · | achieve and maintain our profitability and margins; |

| · | acquire and retain customers; |

| · | attract, train and retain qualified personnel; |

| · | maintain adequate control over our costs and expenses; |

| · | keep up with evolving industry standards and market developments; or |

| · | respond to competitive and changing market conditions. |

If we are unsuccessful in addressing any of the above risks, our business may be materially and adversely affected.

Also, we restated our financial statements as of and for the year ended December 31, 2009.

Any security breach involving the misappropriation, loss or other unauthorized disclosure of confidential information, whether by us or by third-party service providers, could damage our reputation, expose us to the risks of litigation and liability, disrupt our business or otherwise harm our results of operations.

In the normal course of business, we collect, process and retain sensitive and confidential customer information. Despite the security measures we have in place, our facilities and systems, and those of third-party service providers, could be vulnerable to security breaches, acts of vandalism, computer viruses, misplaced or lost data, programming or human errors or other similar events. Any security breach involving the misappropriation, loss or other unauthorized disclosure of confidential information, whether by us or by third-party service providers, could damage our reputation, expose us to the risks of litigation and liability, disrupt our business or otherwise harm our results of operations.

Store closings result in unexpected costs that could result in write downs and expenses relating to the closings.

From time to time, in the ordinary course of our business, we may close certain underperforming stores, generally based on considerations of store profitability, competition, strategic factors and other considerations. Closing a store could subject us to costs, including the write-down of leasehold improvements, equipment, furniture and fixtures. In addition, we could remain liable for future lease obligations.

The loss of any key members of the management team may impair our ability to identify and secure new contracts with customers or otherwise manage our business effectively.

Our success depends, in part, on the continued contributions of our senior management. In particular, Mr. Yong Hui Li, our Chief Executive Officer, has been appointed by the Board of Directors to oversee and supervise the strategic direction and overall performance of AutoChina.

AutoChina relies on its senior management to manage its business successfully. In addition, the relationships and reputation that members of our management team have established and maintained with our customers contribute to our ability to maintain good customer relations, which is important to the direct selling strategy that we adopt. Employment contracts entered into between us and our senior management cannot prevent our senior management from terminating their employment, and the death, disability or resignation of Mr. Yong Hui Li or any other member of our senior management team may impair our ability to maintain business growth and identify and develop new business opportunities or otherwise to manage our business effectively.

We rely on our information technology, billing and credit control systems, and any problems with these systems could interrupt our operations, resulting in reduced cash flow.

AutoChina’s business cannot be managed effectively without its integrated information technology system. Accordingly, we run various “real time” integrated information technology management systems for our financing business.

In addition, sophisticated billing and credit control systems are critical to our ability to increase revenue streams, avoid revenue loss and potential credit problems, and bill customers in a proper and timely manner. If adequate billing and credit control systems and programs are unavailable, or if upgrades are delayed or not introduced in a timely manner, or if we are unable to integrate such systems and software programs into our billing and credit systems, we may experience delayed billing which may negatively affect our cash flow and the results of operations.

In case of a failure of our data storage system, we may lose critical operational or billing data or important email correspondence with our customers and suppliers. Any such data stored in the core data center may be lost if there is a lapse or failure of the disaster recovery system in backing up these data, or if the periodic offline backup is insufficient in frequency or scope, which may result in reduced cash flow and reduce revenues.

Natural disasters and adverse weather events can disrupt our business, which may result in reduced cash flow and reduce revenues.

AutoChina’s stores are located across a diverse geographic area of China, including the Anhui, Beijing, Chongqing, Fujian, Gansu, Guangdong, Guangxi, Guizhou, Hebei, Henan, Hubei, Hunan, Inner Mongolia, Jiangsu, Jiangxi, Jilin, Liaoning, Ningxia, Shaanxi, Shandong, Shanghai, Shanxi, Sichuan, Tianjin, Yunnan and Zhejiang areas, in which actual or threatened natural disasters and severe weather events (such as severe snowstorms, earthquakes, fires and landslides) may disrupt store operations, which may adversely impact our business, results of operations, financial condition, and cash flows. Although we have, subject to certain deductibles, limitations, and exclusions, substantial insurance, we cannot assure you that we will not be exposed to uninsured or underinsured losses that could have a material adverse effect on our business, financial condition, results of operations, or cash flows. Additionally, we generally rely on third-party transportation operators and distributors for the delivery of vehicles from the manufacturer to our stores. Delivery may be disrupted for various reasons, many of which are beyond our control, including natural disasters, weather conditions or social unrest and strikes, which could lead to delayed or lost deliveries. For example, recently the southern regions of China experienced the most severe winter weather in nearly 50 years, causing, among other things, severe disruptions to all forms of transportation for several weeks in late January and early February 2008. This natural disaster also impacted the delivery of vehicles to stores. In addition, transportation conditions are often generally difficult in some of the regions where we sell automobiles and commercial vehicles. We currently do not have business interruption insurance to offset these potential losses, delays and risks, so a material interruption of our business operations could severely damage our business.

Our facilities and operations are subject to extensive governmental laws and regulations that require various approvals, licenses, authorizations, certificates, filings and permits to operate our business, and the violation or the loss of or failure to obtain or renew any or all of these approvals, licenses, authorizations, certificates, filings and permits could limit our ability to conduct our business or lead to sanctions including termination of operations.

The automotive industry, including our facilities and operations, is subject to a wide range of central and local laws and regulations, such as those relating to retail installment sales, leasing, sales of financing and insurance, licensing, consumer protection, consumer privacy, escheatment, health and safety, wage-hour and other employment practices. Specifically with respect to the sale of financing at its stores, AutoChina is subject to various laws and regulations, the violation of which could subject it to lawsuits or governmental investigations and adverse publicity, in addition to administrative, civil, or criminal sanctions. The violation of other laws and regulations to which we are subject also can result in administrative, civil, or criminal sanctions against us, which may include a cease and desist order against the subject operations or even revocation or suspension of our license to operate the subject business, as well as significant fines and penalties.

Our business could be affected by the promulgation of new laws and regulations introducing new requirements (such as new approvals, licenses, authorizations, certificates filings and/or permits). In accordance with the laws and regulations of the PRC, companies incorporated in the PRC will be required to pass an annual inspection conducted by the respective Administration of Industry and Commerce, or AIC, or an annual inspection jointly conducted by the respective AIC and other government authorities in order to retain valid approvals, license, authorizations, certificates, filings and permits for their operations. As the PRC’s legislative system evolves, it is also not uncommon for new laws and regulations to be promulgated and put into effect on short notice. Failure to comply with these laws and regulations, pass these inspections, or the loss of or failure to renew our licenses, permits and certificates or any change in the government policies, could lead to temporary or permanent suspension of some of our business operations or the imposition of penalties on us, which could limit our ability to conduct our business.

AutoChina’s ability to pay dividends and utilize cash resources of its subsidiaries is dependent upon the earnings of, and distributions by, AutoChina’s subsidiaries and jointly-controlled enterprises, which could result in AutoChina having little if any cash available for dividends.

AutoChina is a holding company with substantially all of its business operations conducted through its subsidiaries and jointly-controlled enterprises. AutoChina paid a special cash dividend in the amount of $0.25 per ordinary share in February 2012. However, AutoChina’s ability to make future dividend payments depends upon the receipt of dividends, distributions or advances from its subsidiaries and jointly-controlled enterprises. The ability of its subsidiaries and jointly-controlled enterprises to pay dividends or other distributions may be subject to their earnings, financial position, cash requirements and availability, applicable laws and regulations and to restrictions on making payments to AutoChina contained in financing or other agreements. These restrictions could reduce the amount of dividends or other distributions that AutoChina receives from its subsidiaries and jointly-controlled enterprises, which could restrict its ability to fund its business operations and to pay dividends to its shareholders. AutoChina’s future declaration of dividends may or may not reflect its historical declarations of dividends and will be at the absolute discretion of the Board of Directors.

Yong Hui Li, the Chairman and Chief Executive Officer of AutoChina, is the beneficial owner of a substantial amount of AutoChina’s ordinary shares and Mr. Li may take actions with respect to such shares which are not consistent with the interests of the other shareholders.

Yong Hui Li, the Chairman and Chief Executive Officer of AutoChina, beneficially owns approximately 65.8% of the outstanding ordinary shares of AutoChina as of the date of this Annual Report on Form 20-F, assuming that there are no other changes to the number of ordinary shares outstanding. Mr. Li may take actions with respect to such shares without the approval of other shareholders and which are not consistent with the interests of the other shareholders, including the election of the directors and other corporate actions of AutoChina such as:

| · | its merger with or into another company; |

| · | a sale of substantially all of its assets; and |

| · | amendments to its memorandum and articles of incorporation. |

The decisions of Mr. Li may conflict with AutoChina’s interests or the interests of AutoChina’s other shareholders.

We may be subject to broad liabilities arising from environmental protection laws, which could result in significant expenses for us.

We may be subject to broad liabilities arising out of contamination at our currently and formerly owned or operated facilities, at locations to which hazardous substances were transported from such facilities, and at such locations related to entities formerly affiliated with us. Although for some such liabilities we believe we are entitled to indemnification from other entities, we cannot assure you that such entities will view their obligations as we do, or will be able to satisfy them. If we are liable for environmental claims, we could be required to pay significant penalties.

AutoChina’s business is capital intensive and our growth strategy may require additional capital that may not be available on favorable terms or at all, which could limit our ability to continue our operations.

We have, in the past, entered into loan agreements in order to raise additional capital. Our business requires significant capital and although we believe that our current cash, other loan facilities and financing arrangement with affiliates will be sufficient to meet our present and reasonably anticipated cash needs, it may, in the future, require additional cash resources due to changed business conditions, implementation of our strategy to expand our store network or other investments or acquisitions we may decide to pursue. If our own financial resources are insufficient to satisfy our capital requirements, we may seek to sell additional equity or debt securities or obtain additional credit facilities. The sale of additional equity securities could result in dilution to our shareholders. Our existing debt service obligations do not have any operating and financial covenants that would restrict our operations, however, the incurrence of indebtedness would result in increased debt service obligations and could require us to agree to operating and financial covenants that would restrict our operations. Financing may not be available in amounts or on terms acceptable to us, if at all. Any failure by AutoChina to raise additional funds on terms favorable to us, or at all, could limit our ability to expand our business operations and could harm our overall business prospects.

A significant portion of our working capital is funded through loans from affiliates of our Chairman and CEO, Mr. Yong Hui Li, that may be called by the lenders at any time, which could materially and adversely affect AutoChina’s liquidity and AutoChina’s ability to fund and expand its business.

As of December 31, 2011, we had outstanding borrowings from affiliates of our Chairman and Chief Executive officer, Mr. Yong Hui Li, of approximately $36 million. We repaid approximately $31 million in January 2012 and intend to repay the remaining borrowings in fiscal 2012 through internal resource. These borrowings are interest bearing and for a perpetual term, but are callable at any time by the lenders. The lenders have not indicated to us if there is a maximum amount they are willing to lend to us, and there can be no assurance that they will lend us any more funds or that they will not call the loans for repayment. In the event such lenders determine to call these loans we will have to repay the loans from our cash reserves or financing provided by third-party financial institutions. There can be no assurance that we will have sufficient cash reserves or that we could secure additional financing from third parties on favorable terms or at all. If cash reserves or suitable financing were not available, we would have to divert working capital from growing our commercial leasing business, and we would not be able to expand our commercial leasing business as quickly as expected.

Current economic conditions may result in reduced revenues for AutoChina.

AutoChina believes that many factors affect sales of new commercial vehicles’ gross profit margins in China and in our particular geographic markets, including the economy, inflation, recession or economic slowdown, consumer confidence, housing markets, fuel prices, credit availability, the level of manufacturers’ production capacity, interest rates, product quality, affordability and innovation, employment/unemployment rates, the number of consumers whose vehicle leases are expiring, and the length of consumer loans on existing vehicles. Changes in interest rates could significantly impact industry new vehicle sales and vehicle affordability, due to the direct relationship between interest rates and monthly loan payments, a critical factor for many vehicle buyers, and the impact interest rates can have on customers’ borrowing capacity and disposable income. The financial crisis that began in late 2008 and the slow down of Chinese economy in late 2011 also significantly impacted commercial vehicle sales. If such a crisis occurred again, it is likely that commercial vehicle sales would be depressed again.

The overall demand for vehicles increased significantly in China from 2001 to 2011. However, recently, certain adverse financial developments have impacted the financial markets. These developments include a general slowing of economic growth both in China and globally, volatility in equity securities markets, and volatility and tightening of liquidity in credit markets in China.

If this economic downturn continues, our business, financial condition and results of operations would likely be adversely affected, our cash position may further erode and we may be required to seek new financing, which may not be obtainable on acceptable terms or at all. We may also be required to reduce our capital expenditures, which in turn could hinder our ability to implement our business plan and to improve our productivity.

We could incur unexpected expenses or liability if our vehicles are involved in major accidents.

In situations where our trucks are involved in major accidents where the loss of property or life is unusually high, we may face liability if the insurance coverage is not sufficient to cover the losses. Since all the commercial vehicles we lease are insured when the lease is entered into, we are usually able to recover the remaining value of the lease from our insurance policy. However, there have been limited situations when lessees are involved in major accidents and third parties had liability claims that insurance is not sufficient to cover in which case we may not recover the remaining value of the lease. In these situations AutoChina may also face liability depending on the outcome of litigation regarding the accident. The likelihood of these instances occurring is extremely difficult to predict or estimate. However, litigation and subsequent judgments against us from a major accident or accidents could adversely affect our profitability.

Significant defaults by financing customers could significantly reduce our revenues.

AutoChina’s commercial vehicle sales, servicing, leasing and support business generates income from financing customers. We are acting as a primary lender to our customers and assuming the credit risk associated with the potential loan defaults of these customers. Although we do extensive pre-sale credit research on our customers and have a security interest in our leased vehicles, if customers fail to make payments when due, we may not be able to fully recover the outstanding fee and it could significantly reduce our revenues. In addition, overall resale values for commercial vehicles could fall and inhibit or prevent us from recovering the residual value of our defaulted vehicles.

Our ongoing expansion of our commercial vehicle sales, servicing, leasing and support business may be costly, time-consuming and difficult. If we do not successfully expand our business, our results of operations and prospects would not be as positive as anticipated.

Our future success is dependent upon our ability to successfully expand our commercial vehicle sales, servicing, leasing and support business which we commenced in March 2008. We opened 103, 54 and 143 commercial vehicle financing and service centers in 2008, 2009 and 2010, respectively, and 206 additional commercial vehicle financing and service centers in 2011 for a total of 506 centers at December 31, 2011. As of February 29, 2012, AutoChina opened an additional 5 centers, for a total of 511 centers. We may not be able to expand our sales in our existing or new markets due to a variety of factors, including the risk that customers in some areas may be unfamiliar with our brand or the commercial vehicle sales, servicing, leasing and support business model. Furthermore, we may fail to anticipate and address competitive conditions in the commercial vehicle sales, servicing, leasing and support market. These competitive conditions may make it difficult or impossible for us to effectively expand this business. If our expansion efforts in existing and new markets are unsuccessful, our results of operations and prospects would be materially and adversely affected.

If required financing for our commercial leasing business is not available or not available on acceptable terms, the commercial leasing business might not be able to expand as quickly as expected, reducing our operating results.

Our ability to expand our commercial vehicle sales, servicing, leasing and support business is dependent on our ability to purchase commercial trucks for resale. Presently, such financing is arranged through financing arrangements with our affiliates, lease securitization and PRC commercial banks. The terms provided by our affiliates are on terms which are more favorable than we have historically been able to obtain from PRC commercial banks. However there can be no assurance that we can continue to receive such financing from our affiliates on such commercially favorable terms, or at all.

If financing from our affiliates were not available, we would fund our commercial vehicle purchases from our own cash reserves or financing provided by third-party financial institutions and lease securitization. There can be no assurance that we will have sufficient resources or be able to obtain adequate third party financing on as commercially favorable terms as that provided by our affiliates or at all. If suitable financing were not available, we would not be able to expand our commercial leasing business as quickly as expected.

Our commercial vehicle sales, servicing, leasing and support segment has only been operating since 2008, and after the sale of our automotive dealership business is the only business we operate. We cannot provide you with any comfort that we will be successful in operating this business.

We put our commercial vehicle sales, servicing, leasing and support business in place in 2008. Since, after the sale of our dealership business, we are solely reliant on our commercial vehicle sales, servicing, leasing and support business, if the market for the type of services we offer does not develop as we expect or if we are unable to successfully manage our growth and development, we may go out of business.

Fuel shortages and fluctuations in fuel prices may adversely affect the demand for commercial vehicles.

Fuel prices are inherently volatile and have experienced a significant fluctuation from 2001 to 2011. Any surge in fuel prices will have an adverse effect on world economies and, in particular, on the world’s automobile and trucking industries. For example, in 2007, rising global oil prices and rising demand for fuel have led to fuel shortages in China. This is due in part to increased automobile ownership as well as government controls over fuel prices.

If the PRC central government continues to control the price of domestic refined oil to stabilize the market and demand for fuel in China continues to increase in line with rising annual GDP, it is possible that further shortages will occur. If the cost of fuel in the China continues to increase, businesses may elect to use alternative means of shipping goods, and demand for commercial vehicles, particularly those with larger engine capacities, may decline.

We may have difficulty relating to the administration of the trust component of the commercial vehicle financing structure in which CITIC Trust has acted as an intermediary resulting in additional costs and the loss of the benefit of the new structure.

From September 2009 to November 2011, as part of our commercial vehicle financing structure we established the Trust Fund which required a third party trustee. We, through Chuangjie Trading, our subsidiary, engaged CITIC Trust Co., Ltd. (“CITIC Trust”) to act as trustee for this Trust Fund. As of November 2011, we ceased to engage CITIC Trust as an intermediary for any new leases. However, CITIC Trust continues to serve as an intermediary for existing leases until such leases are fully settled and/or expired. The agreements governing the Trust Fund place certain obligations on us and the trustee in connection with the new commercial vehicle financing structure, however we or the trustee may encounter difficulties in performing these obligations which could result in CITIC Trust being unable or unwilling to continue in its role as trustee. We may not be able to find a replacement for CITIC Trust in a timely fashion, if at all. As a result, we may experience additional costs and delays in finding a replacement trustee and may lose the benefit of the new commercial vehicle financing structure temporarily or permanently.

An inability to successfully operate our tire, diesel fuel and insurance product and service offerings (which we refer to as our value-added services) could adversely affect our operations and our profitability.

Under our tire, diesel fuel and insurance products and services, we are extending additional credit to our customers. If we are unable to operate this business successfully, we may lose money or incur unplanned credit losses. In addition, although we believe the costs of offering these new value-added services is low, the additional expenses, time, and labor required to offer these value-added services could adversely affect our operations. Furthermore, since the successful operation of these new value-added services relies on partnerships with retail tire, fuel and insurance vendors, if we are unable to secure enough relationships with vendors on favorable terms, it may adversely affect our ability to successfully offer tire, diesel and insurance products and services.

Excess supply in the PRC commercial vehicle market could reduce our profits and growth.

Heavy truck sales in the PRC have been growing rapidly in recent years, and this growth has encouraged foreign industry participants to enter the market in China through import or partnership with domestic firms. This may result in an excess supply of commercial vehicles in the market, particularly in light of the recent economic slowdown in China and around the world, which in turn could adversely affect margins on our commercial vehicle sales, servicing, leasing and support business.

AutoChina’s business is seasonal and an impairment of results of operations during certain portions of the year may have a disproportional effect on our results of operations for the year.

AutoChina generally experiences lower volumes of commercial vehicle sales, servicing, leasing and support in the first and third calendar quarters of each year as compared to the second and fourth quarters. This seasonality is generally attributable to decreased commercial vehicle activity during a portion of the first quarter due to the annual Chinese New Year holiday as well as historically weak commercial vehicle sales during the summer.

As a result, our revenues and operating income are typically lower in the first and third quarters and higher in the second and fourth quarters. Therefore, we generally realize a higher proportion of our revenue and operating profit during the second and fourth fiscal quarters. Other factors unrelated to seasonality, such as changes in economic condition, may exaggerate seasonality or cause counter-seasonal fluctuations in our revenues and operating income. If conditions arise that impair vehicle sales during the second and fourth fiscal quarters, the adverse effect on our revenues and operating profit for the year could be disproportionately large.

Claims that the software products and information systems that we rely on are infringing on the intellectual property rights of others could increase our expenses or inhibit us from offering certain services.

A number of entities, including some of our competitors, have sought, or may in the future obtain, patents and other intellectual property rights that cover or affect software products and other components of information systems that we rely on to operate our business.

While we are not aware of any claims that the software products and information systems that it relies upon are infringing on the intellectual property rights of others, litigation may be necessary to determine the validity and scope of third-party rights or to defend against claims of infringement. If a court determines that one or more of the software products or other components of information systems we use infringe on intellectual property owned by others or we agree to settle such a dispute, we may be liable for money damages. In addition, we may be required to cease using those products and components unless we obtain licenses from the owners of the intellectual property, redesigns those products and components in such a way as to avoid infringement or cease altogether the use of those products and components. Each of these alternatives could increase our expenses materially or impact the marketability of our services. Any litigation, regardless of the outcome, could result in substantial costs and diversion of resources and could have a material adverse effect on our business. In addition, a third-party intellectual property owner might not allow us to use our intellectual property at any price, or on terms acceptable to it, which could compromise our competitive position.

Risks to AutoChina’s Shareholders

Because AutoChina may not pay regular dividends on its ordinary shares, shareholders will generally benefit from an investment in AutoChina’s ordinary shares only if the shares appreciate in value.

Although AutoChina declared and paid a special cash dividend in the amount of $0.25 per ordinary share in February 2012 to its shareholders, AutoChina may not declare or pay any regular cash dividends on its ordinary shares in future. AutoChina currently intends to retain future earnings, if any, for use in the operations and expansion of the business. As a result, AutoChina may not anticipate paying regular cash dividends in the foreseeable future. Any future determination as to the declaration and payment of cash dividends, including a one-time special cash dividend, will be at the discretion of AutoChina’s Board of Directors and will depend on factors AutoChina’s Board of Directors deems relevant, including among others, AutoChina’s results of operations, financial condition and cash requirements, business prospects, and the terms of AutoChina’s credit facilities and other financing arrangements. If no dividends are paid, realization of a gain on a shareholders’ investments will depend on the appreciation of the price of AutoChina’s ordinary shares. There is no guarantee that AutoChina’s ordinary shares will appreciate in value.

Our ordinary shares have been delisted from the NASDAQ Stock Market LLC (“Nasdaq”) Capital Market and are now quoted on the Over-the-counter (“OTC”) Bulletin Board, which may limit the liquidity and price of its ordinary shares more than if the ordinary shares were quoted or listed on the Nasdaq Capital Market.

On July 15, 2011, we received a written notification from the Nasdaq Stock Market stating that we are not in compliance with the filing requirements for continued listing under Nasdaq Marketplace Rule 5250(c)(1). The Nasdaq notification was issued due to our failure to file our Annual Report on Form 20-F for the year ended December 31, 2011 with the SEC within the required time period. Nasdaq provided us until August 15, 2011 to submit a plan to regain compliance, and we submitted our plan to regain compliance on August 14, 2011. On September 8, 2011, we received a letter from Nasdaq stating that based on the review of public documents and the plan to regain compliance provided by us, Nasdaq’s staff determined that providing us until December 31, 2011 to file our Annual Report on Form 20-F for the period ended December 31, 2011 was not warranted, and that our securities would be delisted from Nasdaq on September 19, 2011, unless we appealed the determination. We appealed the staff determination regarding the delisting of our securities, and on October 4, 2011 our securities were suspended from trading pending the final determination of the appeal. On November 2, 2011 we received a letter from Nasdaq stating that, in addition to the Company not being in compliance with Listing Rule 5250(c)(1), Nasdaq determined that certain trading activity in the Company’s ordinary shares raised public interest concerns pursuant to Nasdaq Listing Rule 5101. On December 1, 2011, we attended an oral appeal hearing with Nasdaq. On January 18, 2012, we received the Nasdaq Hearings Panel’s decision to deny our appeal for continued listing on Nasdaq. We did not further appeal the Panel’s decision. As a result, our ordinary shares have been delisted from the NASDAQ Capital Market and the liquidity and trading price of ordinary shares may be adversely affected.

On February 28, 2012, our ordinary shares began to be quoted on the OTC Bulletin Board, a FINRA-regulated inter-dealer automated quotation system. Quotation of AutoChina’s ordinary shares on the OTC Bulletin Board limits the liquidity and price of its ordinary shares more than if the ordinary shares were quoted or listed on Nasdaq.

The staff of the SEC is conducting a non-public investigation relating to us, which may affect our reputation and therefore ability to conduct certain business.

The staff of the SEC is conducting a non-public investigation relating to us and, in this regard, we and some of our officers have received subpoenas for information. Furthermore, on January 6, 2012 we announced that we received a Wells Notice from the staff of the SEC, which we responded to. We have cooperated, and will continue to fully cooperate, with the SEC regarding this matter, including voluntarily providing information beyond that formally requested by the SEC staff, in an effort to assist in an expeditious conclusion of the staff’s investigation. However, the existence of the SEC’s investigation may adversely affect our reputation with regard to certain business dealings, whose nature and scope are difficult to predict.

Risks Related to AutoChina’s Corporate Structure and Restrictions on its Industry

Contractual arrangements in respect of certain companies in the PRC may be subject to challenge by the relevant governmental authorities and may affect our investment and control over these companies and their operations.

According to Foreign Investment Industries Guidance Catalogue, which was introduced in 1995 and was later amended in 1997, 2002, 2004 and 2007, our motor vehicle distribution business was classified as “restricted,” and foreign enterprises were not allowed to own controlling equity stakes in the motor vehicle distribution where the distributor has established more than 30 stores and sells products of various brands from different suppliers. Because our wholly-owned subsidiary ACG is a Cayman Islands company and it holds the equity interests of its PRC subsidiaries indirectly through Fancy Think Limited, a Hong Kong company, our PRC subsidiaries are treated as foreign invested enterprises under PRC laws and regulations. To comply with PRC laws and regulations, we conduct our operations in China through a series of contractual arrangements, (the “Enterprise Agreements”), entered into with the Auto Kaiyuan Companies and Hebei Kaiyuan Real Estate Development Co., Ltd., or the AKC Shareholder. Pursuant to the Enterprise Agreements, we, through our wholly-owned subsidiary ACG, have exclusive rights to obtain the economic benefits and assume the business risks of the Auto Kaiyuan Companies from their shareholders, and has control of the Auto Kaiyuan Companies. The Auto Kaiyuan Companies are considered variable interest entities, and AutoChina is the primary beneficiary. ACG’s relationships with the Auto Kaiyuan Companies and the AKC Shareholder are governed by the Enterprise Agreements between Hebei Chuanglian Finance Leasing Co. Ltd. (“Chuanglian”), an indirect wholly-owned subsidiary of ACG, and each of the Auto Kaiyuan Companies, which are the operating companies of ACG in the PRC. The Auto Kaiyuan Companies hold and their subsidiaries hold the relevant business licenses to carry out the business. Subject to the Real Rights Law of the PRC, the pledge of shares registered in the securities depository and clearing institution shall be established upon registration with the relevant securities depository and clearing institution and the pledge of other share rights shall be established upon registration with administrative department for industry and commerce. Therefore, an equity interest pledge, such as the ones granted pursuant to the Enterprise Agreements, without registration will be materially impaired. According to the Measure for Equity Pledge Registration with the Administrative Organs for Industry and Commerce, which took effect in 2008, the administration for industry and commerce has already begun accepting applications for pledge registrations. Failure to register the equity pledge may result in the pledge being unenforceable. The Company is in the process of registering the pledge of equity interest contemplated in the variable interest entity, or VIE documents. The Enterprise Agreements generally provide the following rights:

(i) the right to enjoy the economic benefits of these companies, to exercise management control over the operations of these companies, and to prevent leakages of assets and values to the registered owners of these companies; and

(ii) the right to acquire, if and when permitted by PRC law, the equity interests in these companies at no consideration or for a nominal price.

Pursuant to these Enterprise Agreements, we are able to consolidate the financial results of the Auto Kaiyuan Companies, which are accounted for as subsidiaries of us under the prevailing accounting principles. There can be no assurance that the relevant governmental authority will not challenge the validity of these contractual arrangements or that the governmental authorities in the PRC will not promulgate laws or regulations to invalidate such arrangements in the future.

If AutoChina’s ownership structure, contractual arrangements and businesses, or its PRC subsidiaries and Auto Kaiyuan Companies, are found to be in violation of any existing or future PRC laws or regulations, the relevant regulatory authorities would have broad discretion in dealing with such violations, including:

| · | revoking the business and operating licenses of AutoChina’s PRC subsidiaries or Auto Kaiyuan Companies, which business and operating licenses are essential to the operation of AutoChina’s business; |

| · | confiscating AutoChina’s income or the income of its PRC subsidiaries or Auto Kaiyuan Companies; |

| · | shutting down our commercial vehicle sales, servicing, leasing and support business; |

| · | discontinuing or restricting our operations or the operations of AutoChina’s PRC subsidiaries or Auto Kaiyuan Companies; |

| · | imposing conditions or requirements with which AutoChina, ACG, AutoChina’s PRC subsidiaries or Auto Kaiyuan Companies may not be able to comply; |

| · | requiring AutoChina, AutoChina’s PRC subsidiaries or Auto Kaiyuan Companies to restructure their relevant ownership structure, operations or contractual arrangements; |

| · | restricting or prohibiting AutoChina’s use of the proceeds from AutoChina’s initial public offering to finance its business and operations in China; and |

| · | taking other regulatory or enforcement actions that could be harmful to the business of the Auto Kaiyuan Companies. |

In March 2002, the State Development and Reform Commission and the Ministry of Commerce jointly promulgated a revised “Foreign Investment Industries Guidance Catalogue”, or the 2002 Catalogue, to replace the 1995 Catalogue. The 2002 Catalogue came into effect on April 1, 2002. In the 2002 Catalogue, general trading (excluding dealerships) and logistics businesses were added to the encouraged category. Enterprises falling under this category can be wholly owned by foreign enterprises. The 2002 Catalogue allows motor vehicle distribution businesses to be wholly owned by foreign enterprises by the end of 2007. In November 2004, a newly revised “Foreign Investment Industries Guidance Catalogue”, or the 2004 Catalogue, was promulgated to replace the 2002 Catalogue. The 2004 Catalogue came into effect on January 1, 2005 and did not amend the provisions in the 2002 Catalogue with respect to motor vehicle distribution. We intend to and are in the process of converting the existing contractual arrangements into direct equity interests owned by AutoChina. The 2004 Catalogue was further amended in 2007 by the authority. The latest revision is a reflection of macroeconomic policy-orientation since China’s “Eleventh Five-Year Plan”, and the end of the WTO transition period, objectively requiring further opening-up.

Due to the various necessary submission and approval procedures, the conversion of these contractual arrangements to a direct ownership structure is still in process, and the above-mentioned conversion would not adversely affect the tax payments and other financial matters of AutoChina and its subsidiaries. If before the completion of such conversion, any of these contractual arrangements is challenged by the governmental authorities, or the contracts for such arrangements are breached by the counterparties and we are unable to obtain a judgment to our favor to enforce our contractual rights, or if there is any change of the PRC laws or regulations to explicitly prohibit such arrangements, we may lose control over, and revenues from, these companies, which will materially affect our financial condition and results of operations. Such conversion may include various approvals from governmental authorities and submissions of related documents (e.g. proper land use rights certificates and/or tenancy agreements for buildings), therefore there can be no assurance that such approval may be obtained in due course.

The shareholder of the Auto Kaiyuan Companies may have potential conflicts of interest with AutoChina, which may materially and adversely affect AutoChina’s business and financial condition.

We, through our wholly-owned subsidiary ACG, have contractual arrangements with respect to operating the business with the Auto Kaiyuan Companies, and the shareholder of Auto Kaiyuan Companies is Kaiyuan Real Estate, a company registered in the PRC and wholly owned by our Chairman and CEO, Mr. Yong Hui Li. Although Auto Kaiyuan Companies and Kaiyuan Real Estate have given undertakings to act in the best interests of AutoChina, AutoChina cannot assure you that when conflicts arise, these individuals will act in AutoChina’s best interests or that conflicts will be resolved in AutoChina’s favor.

Changes in regulations related to lending or leasing could adversely affect or restrict our ability to operate our business.

Both lending and leasing in China are regulated by the government. Although we believe that our leasing subsidiaries hold the necessary licences and our partnership with CITIC Trust affords our operations with a certain amount of validation and protection from adverse government legislation, it is possible that changes to laws and regulations could occur and deter or prevent us from operating as planned. In such a situation we may have no means of operating our business profitably, or at all.

AutoChina may lose the ability to use and enjoy assets held by the Auto Kaiyuan Companies that are important to the operation of its business if such entity goes bankrupt or becomes subject to a dissolution or liquidation proceeding.

As part of our contractual arrangements with the Auto Kaiyuan Companies, the AKC Shareholder holds certain assets, such as the office premises of our headquarters, that are important to the operation of our business. If the Auto Kaiyuan Companies go bankrupt and all or part of its assets become subject to liens or rights of third-party creditors, we may be unable to continue some or all of our business activities, which could materially and adversely affect our business, financial condition and results of operations. If the Auto Kaiyuan Companies undergo a voluntary or involuntary liquidation proceeding, the unrelated third-party creditors may claim rights to some or all of these assets, thereby hindering our ability to operate our business, which could materially and adversely affect our business, financial condition and results of operations.

Contractual arrangements that our wholly-owned subsidiary ACG has entered into through its subsidiaries with the Auto Kaiyuan Companies may be subject to scrutiny by the PRC tax authorities and a finding that AutoChina, ACG or the Auto Kaiyuan Companies owe additional taxes could substantially reduce AutoChina’s consolidated net income and the value of your investment.

Under PRC laws and regulations, arrangements and transactions among related parties may be subject to audit or challenge by the PRC tax authorities. AutoChina could face adverse tax consequences if the PRC tax authorities determine that the contractual arrangements and transactions among its subsidiaries and the Auto Kaiyuan Companies do not represent an arm’s length price and adjust the income of AutoChina’s subsidiaries or that of the Auto Kaiyuan Companies in the form of a transfer pricing adjustment. A transfer pricing adjustment could, among other things, result in a reduction, for PRC tax purposes, of expense deductions recorded by the Auto Kaiyuan Companies, which could in turn increase its respective tax liabilities. In addition, the PRC tax authorities may impose late payment fees and other penalties on AutoChina’s affiliated entity for underpayment of taxes. AutoChina’s consolidated net income may be materially and adversely affected if its affiliated entities’ tax liabilities increase or if it is found to be subject to late payment fees or other penalties.

General Risks Relating to Conducting Business in China

Adverse changes in political and economic policies of the PRC government could impede the overall economic growth of China, which could reduce the demand for automobiles and trucks and damage AutoChina’s business and prospects.

AutoChina conducts substantially all of its operations and generates all its sales in China. Accordingly, AutoChina’s business, financial condition, results of operations and prospects are affected significantly by economic, political and legal developments in China. The PRC economy differs from the economies of most developed countries in many respects, including:

| · | the higher level of government involvement and regulation; |

| · | the early stage of development of the market-oriented sector of the economy; |

| · | the higher rate of inflation; |

| · | the higher level of control over foreign exchange; and |

| · | government control over the allocation of many resources. |

As the PRC economy has been transitioning from a planned economy to a more market-oriented economy, the PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. While these measures may benefit the overall PRC economy, they may also have a negative effect on AutoChina.

Although the PRC government has in recent years implemented measures emphasizing the utilization of market forces for economic reform, the PRC government continues to exercise significant control over economic growth in China through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and imposing policies that impact particular industries or companies in different ways.

In the past 20 years, the PRC has been one of the world’s fastest growing economies measured in gross domestic product. However, in conjunction with recent slowdowns in economies of the United States and European Union, the growth rate in China has declined in recent quarters. Any further adverse change in the economic conditions or any adverse change in government policies in China could have a material adverse effect on the overall economic growth and the level of consumer spending in China, which in turn could lead to a reduction in demand for automobiles and consequently have a material adverse effect on AutoChina’s business and prospects.

The PRC legal system embodies uncertainties that could limit the legal protections available to AutoChina and its shareholders.

Unlike common law systems, the PRC legal system is based on written statutes and decided legal cases have little precedential value. In 1979, the PRC government began to promulgate a comprehensive system of laws and regulations governing economic matters in general. The overall effect of legislation since then has been to significantly enhance the protections afforded to various forms of foreign investment in China. AutoChina’s PRC subsidiary, Chuanglian, is a wholly foreign-owned enterprise, and will be subject to laws and regulations applicable to foreign investment in China in general and laws and regulations applicable to wholly foreign-owned enterprises in particular. AutoChina’s PRC affiliated entities, the Auto Kaiyuan Companies, will be subject to laws and regulations governing the formation and conduct of domestic PRC companies. Relevant PRC laws, regulations and legal requirements may change frequently, and their interpretation and enforcement involve uncertainties. For example, AutoChina may have to resort to administrative and court proceedings to enforce the legal protection that AutoChina enjoys either by law or contract. However, since PRC administrative and court authorities have significant discretion in interpreting and implementing statutory and contractual terms, it may be more difficult to evaluate the outcome of administrative and court proceedings and the level of legal protection AutoChina enjoys than under more developed legal systems. Such uncertainties, including the inability to enforce AutoChina’s contracts and intellectual property rights, could materially and adversely affect AutoChina’s business and operations. In addition, confidentiality protections in China may not be as effective as in the United States or other countries. Accordingly, AutoChina cannot predict the effect of future developments in the PRC legal system, particularly with respect to its commercial vehicle sales servicing, leasing and support business, including the promulgation of new laws, changes to existing laws or the interpretation or enforcement thereof, or the preemption of local regulations by national laws. These uncertainties could limit the legal protections available to AutoChina and other foreign investors, including you.

Fluctuations in exchange rates could result in foreign currency exchange losses.

Because substantially all of our revenues, expenditures and cash are denominated in Renminbi and we report our financial results in U.S. dollars, appreciation or depreciation in the value of the Renminbi relative to the U.S. dollar would affect our financial results reported in U.S. dollars terms without giving effect to any underlying change in our business or results of operations. Fluctuations in the exchange rate will also affect the relative value of earnings from and the value of any U.S. dollar-denominated investments AutoChina makes in the future.

Since July 2005, the Renminbi has no longer been pegged to the U.S. dollar. Although currently the Renminbi exchange rate versus the U.S. dollar is restricted to a rise or fall of no more than 0.5% per day and the People’s Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate, the Renminbi may appreciate or depreciate significantly in value against the U.S. dollar in the medium- to long-term. Moreover, it is possible that in the future, PRC authorities may lift restrictions on fluctuations in the Renminbi exchange rate and lessen intervention in the foreign exchange market.

Very limited hedging transactions are available in China to reduce our exposure to exchange rate fluctuations. To date, we have not entered into any hedging transactions in an effort to reduce our exposure to foreign currency exchange risk. While we may decide to enter into hedging transactions in the future, the availability and effectiveness of these hedging transactions may be limited and we may not be able to successfully hedge our exposure at all. In addition, our currency exchange losses may be magnified by PRC exchange control regulations that restrict our ability to convert Renminbi into foreign currency.

Under the PRC EIT Law, we, ACG and/or Fancy Think Limited, ACG’s wholly-owned subsidiary, each may be classified as a “resident enterprise” of the PRC. Such classification could result in tax consequences to us, our non-PRC resident securityholders and ACG and/or Fancy Think Limited.

Under the EIT Law, enterprises are classified as resident enterprises and non-resident enterprises. An enterprise established outside of China with its “de facto management bodies” located within China is considered a “resident enterprise,” meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. The implementing rules of the EIT Law define “de facto management bodies” as a managing body that in practice exercises “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise; however, it remains unclear whether the PRC tax authorities would deem our managing body as being located within China. Due to the short history of the EIT Law and lack of applicable legal precedents, the PRC tax authorities determine the PRC tax resident treatment of a foreign (non-PRC) company on a case-by-case basis.

If the PRC tax authorities determine that we, ACG and/or Fancy Think Limited is a “resident enterprise” for PRC enterprise income tax purposes, a number of PRC tax consequences could follow. First, we, ACG and/or Fancy Think Limited may be subject to enterprise income tax at a rate of 25% on our, ACG’s and/or Fancy Think Limited’s worldwide taxable income, as well as PRC enterprise income tax reporting obligations. Second, under the EIT Law and its implementing rules, dividends paid between “qualified resident enterprises” are exempt from enterprise income tax. As a result, if we, ACG and Fancy Think Limited are treated as PRC “resident enterprises,” all dividends from Chuanglian to us (through Fancy Think Limited and ACG) would be exempt from PRC tax.

If Fancy Think Limited were treated as a PRC “non-resident enterprise” under the EIT Law, then dividends that Fancy Think Limited receives from Chuanglian (assuming such dividends were considered sourced within the PRC) (i) may be subject to a 5% PRC withholding tax, provided that Fancy Think Limited owns more than 25% of the registered capital of Chuanglian continuously within 12 months immediately prior to obtaining such dividend from Chuanglian, and the Arrangement between the Mainland of China and the Hong Kong Special Administrative Region for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income, or the PRC-Hong Kong Tax Treaty, were otherwise applicable, or (ii) if such treaty does not apply (i.e., because the PRC tax authorities may deem Fancy Think Limited to be a conduit not entitled to treaty benefits), may be subject to a 10% PRC withholding tax. Similarly, if we or ACG were treated as a PRC “non-resident enterprise” under the EIT Law, and Fancy Think Limited were treated as a PRC “resident enterprise” under the EIT Law, then dividends that we or ACG receive from Fancy Think Limited (assuming such dividends were considered sourced within the PRC) may be subject to a 10% PRC withholding tax. Any such taxes on dividends could materially reduce the amount of dividends, if any, we could pay to our shareholders.

Finally, the new “resident enterprise” classification could result in a situation in which a 10% PRC tax is imposed on dividends we pay to our investors that are non-resident enterprises so long as such non-resident enterprise investors do not have an establishment or place of business in China or, despite the existence of such establishment of place of business in China, the dividends we pay are not effectively connected with such establishment or place of business in China, to the extent that such dividends have their sources within the PRC. In such event, we may be required to withhold a 10% PRC tax on any dividends paid to our investors that are non-resident enterprises. Our investors that are non-resident enterprises also may be responsible for paying PRC tax at a rate of 10% on any gain realized from the sale or transfer of our ordinary shares or warrants in certain circumstances. We would not, however, have an obligation to withhold PRC tax with respect to such gain.