VIA EDGAR

October 10, 2019

Robert Klein Securities and Exchange CommissionDivision of Corporate Finance Washington, D.C. 20549 | |

| Re: | Fincera Inc. Amendment No. 1 to Form 20-F for the Fiscal Year Ended December 31, 2018Filed May 30, 2019File No. 001-34477 |

Fincera Inc., a Cayman Islands exempted company (the “Company”), hereby provides responses to the letter of the staff (the “Staff”) of the United States Securities and Exchange Commission, dated September 10, 2019, regarding the Company’s Annual Report on Form 20-F (the “2018 Annual Report”) and addressed to Mr. Jason Wang (the “Staff’s Letter”).

In this letter, the comments from the Staff have been produced in bold type, and each Staff comment is followed by the Company’s response.

[Remainder of page intentionally left blank]

The Company’s responses to the Staff’s comments set forth in the Staff’s Letter are as follows:

| Comment Number | Comment and Response |

Information on Our Company

History and Development of the Company, page 33

1.

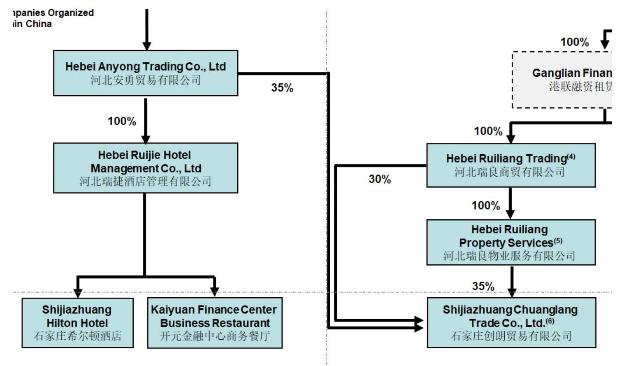

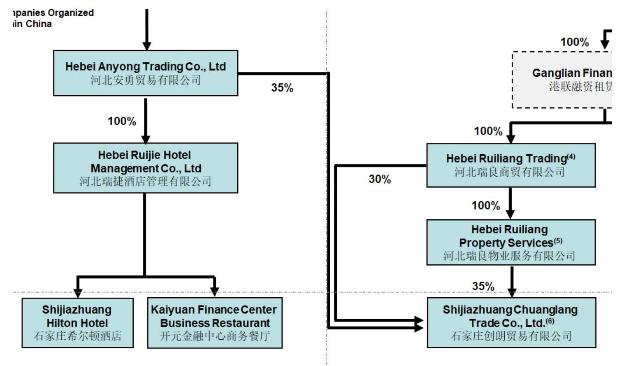

We note the disclosure of your corporate structure as of February 28, 2019 on page 34. In the chart, we note that Hebei Anyong Trading Co., Ltd. has a 30% direct ownership in Hebei Ruiliang Trading. In addition, we note that Ganglian Finance Leasing has a 100% direct ownership in Hebei Ruiliang Trading. Please explain how these entities can have a combined direct ownership in Hebei Ruiliang Trading that is greater than 100% or revise your future filings to provide the correct ownership percentages.

COMPANY RESPONSE: The Company acknowledges the Staff’s comment and advises the Staff that Hebei Anyong Trading Co., Ltd. does not have any ownership interest in Hebei Ruiliang Trading. The 30% figure shown in the chart refers to Hebei Ruiliang Trading’s 30% ownership of Shijiazhuang Chuanglan Trade Co., Ltd. In addition, Hebei Anyong Trading Co., Ltd. holds a 35% ownership of Shijiazhuang Chuanglan Trade Co., Ltd. and the remaining 35% is held by Hebei Ruiliang Property Services.

The Company proposes to include the following modification to this portion of the corporate structure chart that includes separate ownership lines for the 35% that Hebei Anyong Trading Co., Ltd. and the 30% that Hebei Ruiliang Trading hold in Shijiazhuang Chuanglan Trade Co., Ltd. in an effort to make the chart more transparent to the reader:

2.

We also note that the Ganglian Finance Leasing and Hebei Chuanglian Finance Leasing Co., Ltd. entities (the "DiscOps Entities") are both classified as part of discontinued operations in your chart. Please clarify whether all of the wholly-owned subsidiaries and other entities consolidated by the DiscOps Entities are also classified in discontinued operations as well, or if they are still included in continuing operations. If the wholly-owned subsidiaries and other entities are still part of your continuing operations, tell us why and how they will consolidate up to the Company after discontinuation of the DiscOps Entities. Please advise, or revise your chart in future filings to accurately reflect your current corporate structure.

COMPANY RESPONSE: The Company acknowledges the Staff’s comment and advises the Staff that not all of the activities of Ganglian Finance Leasing (“Ganglian Finance”) and Hebei Chuanglian Finance Leasing Co., Ltd. (“Hebei Chuanglian”) are classified as discontinued operations. These entities also have activities that are classified in continuing operations. As a result, the Company does not plan to eliminate Ganglian Finance Leasing and Hebei Chuanglian Finance Leasing Co., Ltd. after their activities classified as discontinued operations are completed.

By way of background, due to the Company’s strategic shift away from its legacy business of commercial vehicle sales, leasing and support to its Internet-based business, which was launched in late 2014, certain legacy business activities of Ganglian Finance and Hebei Chuanglian are classified as discontinued operations. The Company’s basis for determining the scope of discontinued operations is prioritized by business activity, and then by legal entity separation. The subsidiaries consolidated by Hebei Chuanglian and Ganglian Finance do not conduct the legacy business and thus are not a part of discontinued operations. Therefore, because both Hebei Chuanglian and Ganglian Finance also conduct activities classified as continuing operations, only a portion of their activities are classified as discontinued operations.

The Company acknowledges the Staff’s comment and proposes to include the following modified legend to the corporate structure chart in future filings to make it clear to the reader that Ganglian Finance and Hebei Chuanglian have both discontinued and continuing operations:

Notes to Consolidated Financial Statements

Note 2 - Going Concern, page F-11

3.

We note your disclosure stating that since the third quarter of 2018, the Company began converting its existing wholly-owned store distribution network into a broker distribution network not owned by the Company, which will operate under a revenue sharing arrangement. Please address the following items:

●

Tell us more details about the steps the Company has undertaken for the "conversion." In this regard, tell us whether it was sold to third parties for cash consideration, what were the terms of that agreement, if the "conversion" has been completed, and where the conversion(s) are reflected in your financial statements.

COMPANY RESPONSE: The Company acknowledges the Staff’s comment and advises the Staff that no wholly-owned subsidiaries were divested as part of the conversion. When the Company referred to its store distribution network in its disclosures as being “wholly-owned” it was because the network was staffed, managed, and operated entirely by the Company and its own employees. In that context, the term “wholly-owned” was not intended to refer to ownership of subsidiary entities. Also, prior to the conversion, there were no franchisees or third parties operating the Company’s stores. Therefore, the conversion to the broker distribution network primarily involved severing ties with existing employees (some of whom entered into agreements with the Company to act as brokers instead) and exiting operating lease agreements for the physical locations (some of which were assumed by the new brokers).

The key steps undertaken in the conversion from the legacy structure to the broker distribution network, which has been completed, were as follows:

●

All of the employees in the Company’s store distribution network resigned from the Company

●

Parties who wanted to work with the Company as brokers entered into a series of agreements, including a revenue sharing agreement

●

Store operating leases were either terminated or transferred to brokers.

Brokers are responsible for their own operating costs and staffing their organizations as needed and have the opportunity to earn income based on a revenue sharing agreement (see below response for more detail on the revenue sharing agreements).

Accordingly, the impact on the Company of the conversion into a broker distribution network was the termination of employees, termination or transfer of real estate operating leases, and entry into revenue sharing agreements. Furthermore, the Company did not incur material termination costs as a result of the conversion. As such, the conversion is reflected in the financial statements in the following ways:

●

The termination of employees has resulted in lower operating expenses on the Income Statement.

●

The termination of real estate operating leases has resulted in lower operating expenses on the Income Statement and a smaller right of use asset and lease liability on the balance sheet under the new ASC 842 lease standard.

●

Revenues have been accounted for gross, while amounts shared with brokers under the revenue sharing agreements have been reported as operating expenses.

●

Tell us, and disclose in your future filings, the terms of the revenue sharing agreement that will be in effect going forward.

COMPANY RESPONSE: The Company acknowledges the Staff’s comment and proposes to include the following disclosure in future filings:

As consideration for the referral and collection services provided, brokers participating in the broker distribution network are entitled to a portion of the facilitation fees generated by the Company. The Company records the portion of the facilitation fees shared with the brokers as commission expenses. The commission is calculated based on a proprietary formula with a number of factors, including but not limited to: the amount of loans facilitated during a given period as a result of the referrals, the outstanding balance of the loans originated by the brokers, and the status of any overdue payments on the loans referred.

●

Since these businesses were converted from wholly-owned subsidiaries to no longer being owned, tell us how you considered presenting them as discontinued operations.

Under ASC 205, a disposal of a component of an entity or a group of components of an entity shall be reported in discontinued operations if the disposal represents a strategic shift that has (or will have) a major effect on an entity’s operations and financial results.

The Company determined that the conversion of its store distribution network was not within the scope of ASC 205-20 for several reasons. First, the store network did not meet the definition of a component, mainly because the store network was meant to support the Company’s core businesses and its cash flows could not be clearly distinguished as a separate part of the Company. Second, the conversion of the store network did not represent a strategic shift because the Company was continuing its core business in the same geographical areas before and after the conversion, which did not meet the requirements in ASC 205-20-45-1C. Finally, the store network was not an acquired business or nonprofit activity, nor was it being classified as held for sale, precluding it from the scope of ASC 205-20-15-2(b).

Tell us which entities in your corporate structure, as disclosed on page 34, are impacted as a result of this arrangement.

Beijing Yihaoche Technology and Dianfubao Investment were parties to the real estate operating leases and the employment arrangements that were terminated, both of which remain as subsidiaries of the Company.

Note 3 - Basis of Presentation and Summary of Significant Accounting Policies

Revenue Recognition, page F-15

4.

We note your disclosure that the Company adopted ASC 606 using the modified retrospective approach on January 1, 2018. Please tell us, and disclose in your future filings, if there was any impact or change to the timing of revenue recognition in the current period, as compared to the guidance in effect in previous periods, as a result of your adoption. To the extent that there were any significant changes, provide an explanation of those changes with quantification.

COMPANY RESPONSE: There was no impact or change to the timing of revenue recognition in the current period, as compared to the guidance in effect in previous periods, as a result of the Company’s adoption of ASC 606. The Company acknowledges the Staff’s comment and will disclose this information in its future filings.

Other Income, page F-16

5.

We note your accounting treatment and disclosure relating to promotional cash incentives and referral incentives. Please revise your future filings to quantify the respective amounts for all reporting periods presented.

COMPANY RESPONSE: The Company acknowledges the Staff’s comment and will include the requested disclosure in its future filings.

Note 5 - Loans, Net, page F-23

6.

We note your disclosure on page F-11 that the Company sold non-performing loans with a total amount of RMB 2,724 million to third parties during 2018. In addition, from July 2017 and onwards, we note that the Company re-developed the loan transaction process in order to eliminate the need for the Company to use its own working capital for the initial loan funding. However, the total amount of loans on your balance sheet increased from December 31, 2017 to December 31, 2018. Please address the following items:

●

Tell us whether the Company continues to recognize loans on the balance sheet under the new re-developed transaction process and provide us with your accounting policy explaining your basis for recognition of loans on- or off-balance sheet.

COMPANY RESPONSE: In July 2017, the Company did re-develop its loan transaction process in order to eliminate the need for the Company to use its own working capital for the initial loan funding. Under the new loan transaction process, the Company does not recognize the loan on its balance sheet because the Company does not initially fund the loan.

Nonetheless, if there are not enough investors to purchase loans (new or secondhand loans) on the Company’s peer-to-peer lending platform (“P2P”), or there are delinquent loans, the Company may step in and purchase loans – even though it is not obligated to do so. When the Company purchases such loans, the purchased loans appear on the Company’s balance sheet in Loans, net.

As disclosed in the Company’s filing, during 2018 specifically, a great number of investors withdrew from the peer-to-peer financial market in China. As a result the Company started buying a large amount of unfunded loans to continue satisfying borrowers’ requests on its P2P lending platform. As a result, the amount of loans on the Company’s balance sheet increased from December 31, 2017 to December 31, 2018.

●

In light of your response to the above bullet point, tell us why the total amount of loans on the balance sheet increased from December 31, 2017 to December 31, 2018 despite the fact that you changed your loan transactional process and sold a significant amount of your non-performing loans.

COMPANY RESPONSE: The reason loans on the balance sheet increased from December 31, 2017 to December 31, 2018 is that there were a significant amount of investor withdrawals that caused the amount of purchased loans by the Company to increase during the period. In addition, non-performing loans are typically purchased by the Company from investors (for the protection of those investors) and then eventually sold off to third parties. Thus, unless all of the purchased non-performing loans during the period are also sold during the same period, the purchase of non-performing loans tends to increase the total amount of loans reported on the balance sheet.

●

Tell us, and disclose in your future filings, how you define non-performing loans and quantify the amount of non-performing loans on your balance sheet at the end of each reporting period.

COMPANY RESPONSE: The Company defines non-performing loans as those more than 90 days past due. The Company acknowledges the Staff’s comment and notes that the amount of non-performing loans on the Company’s balance sheet at the end of each reporting period is already disclosed in Note 5 – Loans, net. The Company will specify that loans more than 90 days past due are considered to be “non-performing” in its future filings.

●

Tell us, and disclose in your future filings, your charge-off policy for delinquent loans.

COMPANY RESPONSE:

Loans are evaluated on a case-by-case basis taking into account factors including, but not limited to, delinquent time and collection status. The likely amount of recoveries based on existing collateral are discounted to the present period by the interest rate on the debt to calculate a current recovery value. Any excess amount owed to the Company beyond the present value of the recovery value is taken as a provision. Once all legal remedies have been pursued and no further recoveries are deemed likely, the loan is charged off.

7.

We note that you have a provision for credit losses of RMB 8,196 relating to your loans to CeraVest borrowers in the amount of RMB 1,981,706. We also note your tabular disclosure of the movements to the provision for credit losses included on page F-24. Please address the following:

●

Tell us the terms of these loans, including average duration and interest rate. In addition, tell us whether the maturity date, interest rate or other terms have been modified or extended for any of these loans.

COMPANY RESPONSE: Loans to CeraVest borrowers are held directly by the Company and are comprised of a mix of the three loan products that the Company offers:

1.

Qingying: 180-day loans with a 8.62% interest rate

2.

Yueying: 30-day loans with a 8.1% interest rate

3.

Zhongying: Up to 12 30-month periods with a 9.02% interest rate

None of the original terms of any of these loans have been modified or extended.

●

Tell us, and revise your future filings to disclose, more granular information about how you assess and calculate your provision for credit losses on these loans , including the various criteria (e.g., performing vs. non-performing, etc.) you use to determine your provision.

COMPANY RESPONSE: The Company acknowledges the Staff’s comment and proposes to include the following disclosure in future filings:

The Company considers that its P2P platform loans represent large groups of smaller-balance homogeneous loans with similar general credit risk characteristics. The Company utilizes a migration model that estimates the provision for credit losses based on loan grading migration and the historical recovery rate of each loan grade.

Loan Grading

Delinquent CeraVest loans are classified into five grades based on the number of days overdue:

| Grading | Overdue days |

| Pass (PS) | < 30 days |

| Special mention (SM) | >= 30 days and < 90 days |

| Sub standard (SS) | >= 90 days and < 180 days |

| Doubtful (DF) | >= 180 days and < 365 days |

| Loss (LS) | >= 365 days |

SS, DF, and LS graded loans are considered to be non-performing.

The Company applied the following provision rates based on loan grading during the periods presented. Provision rates are estimated based on collection status of the loans and historical collection experience.

| Loan grading | CeraVest loan balance as of 31 December, 2018 (excludes security deposit, RMB’000) | Provision rate | Provision and accrued marketing expense (RMB’000) |

| | A | B | A*B |

| PS | 6,837,397 | 0.0065% | 442 |

| SM | 6,186 | 2.71% | 167 |

| SS | 19,164 | 4.23% | 811 |

| DF | 8,871 | 6.23% | 553 |

| LS | 3,417 | 23.16% | 791 |

| Total | 6,877,035 | | 2,764 |

| Loan grading | CeraPay loan balance as of 31 December, 2018 (RMB’000) | Provision rate | Provision and accrued marketing expense (RMB’000) |

| | A | B | A*B |

| PS | 2,325,003 | 0.0056% | 130 |

| SM | 2,481 | 3.63% | 90 |

| SS | 7,972 | 7.99% | 636 |

| DF | 6,602 | 9.01% | 595 |

| LS | 19,854 | 34.77% | 6,903 |

| Total | 2,361,912 | | 8,354 |

●

In your future filings, revise your tabular rollforward of the movements to the provision for credit losses to disaggregate the net (addition) / reversal line item into the various gross components. For example, disclose the gross amount charged to expense, gross amount of loans charged off, recoveries or other components.

The Company acknowledges the Staff’s comment and will include disclosure of the gross components of the provision for credit losses in future filings, should those items exist.

8.

We note your disclosure on page F-24 that as of December 31, 2018, the Company has five overdue loans to other borrowers, three of which have resigned with extended terms and new interest rates as they became defaulted in 2018. Please provide us with your analysis explaining how you considered these to be and accounted for them as troubled debt restructurings in the scope of ASC 310-40.

COMPANY RESPONSE: The five overdue loans to other borrowers were negotiated and made by the Company directly to the borrowers on an individual basis. At December 31, 2018, the terms of three of the loans had been modified in an attempt to facilitate repayment: one loan was extended by one year, while the other two loans were extended by two years and their interest rates were increased from 18.0% to 19.2%. The company determined that these modifications met the definition of a concession as defined within ASC 310-40.

According to ASC 310-40-15-5 “A restructuring of a debt constitutes a troubled debt restructuring for purposes of this Subtopic if the creditor for economic or legal reasons related to the debtor's financial difficulties grants a concession to the debtor that it would not otherwise consider.”

In this case, the granted concession was that the Company extended the maturity date of three of the loans an additional 1-2 years. This type of concession is specifically mentioned in ASC 310-40-15-9: “Extension of the maturity date or dates at a stated interest rate lower than the current market rate for new debt with similar risk.” Furthermore, although the interest rate was also increased on two of the loans (from 18.0% to 19.20%), given the high-risk default status of the loans, the marginal increase in interest rate was still considered by the Company to be below the market interest rate for new debt with similar risk characteristics, which is specifically mentioned in ASC 310-40-15-16: “A temporary or permanent increase in the contractual interest rate as a result of a restructuring does not preclude the restructuring from being considered a concession because the new contractual interest rate on the restructured debt could still be below market interest rates for new debt with similar risk characteristics. In that situation, a creditor shall consider all aspects of the restructuring in determining whether it has granted a concession.”

The Company referenced ASC 310-40-35 for guidance on the subsequent measurement and recognition for these offline loans and recognized impairment for these loans as it is probable that the Company will be unable to collect all amounts due according to the original contractual terms of the loan agreements. The Company then determined that the derecognition criteria contained in ASC 310-40-40 did not apply because the Company still has rights to the assets (the delinquent loans). Finally the Company referenced 310-40-50 regarding disclosure requirements and applied the following ASC 310-40-50-1 in its disclosures (Note 5 – Loans, net on page F-34), which states: “As of the date of each balance sheet presented, a creditor shall disclose, either in the body of the financial statements or in the accompanying notes, the amount of commitments, if any, to lend additional funds to debtors owing receivables whose terms have been modified in troubled debt restructurings.”

9.

We note your disclosure on page F-25 that the Company reclassified a portion of the provision for credit losses to accrued marketing expenses during the year ended December 31, 2017. We also note that these accrued marketing expenses were subsequently reversed during 2018, resulting in a gain recognized in the income statement. Please provide us with your accounting analysis, with reference to authoritative literature, supporting your treatment, classification and presentation of these items in both 2017 and 2018.

COMPANY RESPONSE: In July 2017, the Company re-developed its loan transaction process. Prior to the change, all platform loans were reported on the Company’s balance sheet, along with the associated provision for bad debt. After the change, loans successfully facilitated by the Company’s P2P platform do not appear on the Company’s balance sheet because they are owned by the investors.

Although the Company does not enter into any written legal guarantees should one of these loans become delinquent, in practice the Company typically repurchases delinquent loans from investors. This practice is done mainly for marketing purposes, because positive investor experiences lead to positive word-of-mouth advertising and referrals. So, even though the loans were not on the Company’s balance sheet, the Company still faced a potential liability from successfully facilitated platforms loans because it voluntarily repurchased those loans that became delinquent. The Company referred to ASC 460, but determined that because there was no contract between the Company and the investor requiring the Company to make payments based on a borrower’s failure to pay, there was no guarantee present. Instead, to account for this potential liability the Company determined that it should recognize an accrued marketing liability and allocate a portion of the provision to accrued marketing expense. Therefore, as a result of the July 2017 loan transaction process change, as loans that were previously held by the Company were sold on the P2P platform, the Company reclassified a portion of their associated provision for credit losses to accrued marketing liability, and the related provision expenses to accrued marketing expense, in order to better account for the costs of this potential repurchase activity.

Furthermore, initially after the July 2017 loan transaction process was changed, the Company’s P2P platform was including delinquent and non-delinquent CeraPay loans among the loans that were being sold to investors. As a result, this led to a larger charge to accrued marketing expense to account for potential future delinquent loan repurchases than if none of the loans were delinquent. During 2018, when the Company repurchased and sold these delinquent loans to third parties, the previously accrued marketing expense was reversed, which led to the large reversal of accrued marketing expense in 2018.

The Company acknowledges the Staff’s reminder that the Company and its management is responsible for the accuracy and adequacy of the disclosure in the filing(s), notwithstanding any review, comments, action or absence of action by the Staff.

Should you have any questions concerning any of the foregoing please contact me via e-mail at jcwang@fincera.net or by telephone at (858) 997-0680.

Sincerely,

Jason Wang

Fincera Inc.

cc: