- BRID Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Bridgford Foods (BRID) DEF 14ADefinitive proxy

Filed: 7 Feb 05, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

x |

Definitive Proxy Statement | |||||

¨ | Definitive Additional Materials | |||||

¨ | Soliciting Material Pursuant to Section 240.14a-12 | |||||

Bridgford Foods Corporation

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

BRIDGFORD FOODS CORPORATION

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

March 16, 2005

To the Shareholders of

BRIDGFORD FOODS CORPORATION:

The annual meeting of the shareholders of Bridgford Foods Corporation, a California corporation (the “Company”), will be held at the Four Points Sheraton, 1500 South Raymond Avenue, Fullerton, California, on Wednesday, March 16, 2005 at 10:00 a.m., for the following purposes:

(1) To elect eight directors to hold office for one year or until their successors are elected and qualified.

(2) To ratify the appointment of Haskell & White LLP as independent public accountants of the Company for the fiscal year commencing October 30, 2004.

(3) To transact such other business as may properly come before the meeting or any adjournment thereof.

Shareholders of record at the close of business on January 28, 2005 are entitled to notice of and to vote at said meeting or any adjournment thereof.

All shareholders are cordially invited to attend the meeting in person. HOWEVER, TO ASSURE YOUR REPRESENTATION AT THE MEETING, THE BOARD OF DIRECTORS RESPECTFULLY URGES YOU TO SIGN, DATE AND PROMPTLY RETURN THE ACCOMPANYING PROXY CARD IN THE ENCLOSED POSTAGE-PREPAID ENVELOPE. If you attend the meeting in person, you may withdraw your proxy and vote your own shares.

By order of the Board of Directors |

| /s/ WILLIAM L. BRIDGFORD |

| William L. Bridgford |

| President and Secretary |

Anaheim, California

February 7, 2005

BRIDGFORD FOODS CORPORATION

1308 North Patt Street, Anaheim, California 92801

PROXY STATEMENT

Annual Meeting of Shareholders to be held March 16, 2005

The enclosed proxy is solicited by the Board of Directors of Bridgford Foods Corporation, a California corporation (the “Company”), for use at the annual meeting of shareholders of the Company (the “Annual Meeting”) to be held at the Four Points Sheraton, 1500 South Raymond Avenue, Fullerton, California, on Wednesday, March 16, 2005 at 10:00 a.m., and at any adjournment thereof. All shareholders of record at the close of business on January 28, 2005 are entitled to notice of and to vote at such meeting. This Proxy Statement and the accompanying proxy are being mailed on or about February 7, 2005.

The persons named as proxies were designated by the Board of Directors and are officers and directors of the Company. Any proxy may be revoked or superseded by executing a later proxy or by giving notice of revocation in writing prior to, or at, the Annual Meeting, or by attending the Annual Meeting, withdrawing the proxy and voting in person. Attendance at the Annual Meeting will not in and of itself constitute revocation of the proxy. All proxies, which are properly completed, signed and returned to the Company prior to the Annual Meeting, and not revoked, will be voted in accordance with the instructions given in the proxy. If a choice is not specified in the proxy, the proxy will be voted FOR election of the director nominees proposed by the Board of Directors and FOR ratification of the Company’s appointment of Haskell & White LLP as independent public accountants for the Company. Management does not know of any matters which will be brought before the Annual Meeting other than those specifically set forth in the notice hereof. However, if any other matter properly comes before the Annual Meeting, it is intended that the proxies, or their substitutes, will vote on such matters in accordance with their best judgment.

Solicitation of proxies will be primarily by mail, although some of the officers, directors and employees of the Company may solicit proxies personally or by telephone. All expenses incurred in connection with this solicitation will be borne by the Company. The Company will reimburse brokers and others who incur costs to send proxy materials to beneficial owners of stock in a broker or nominee name.

At the close of business on January 28, 2005, there were 9,999,361 shares of common stock of the Company outstanding. The presence at the meeting of a majority of the outstanding shares, in person or by proxy relating to any matter to be acted upon at the meeting, is necessary to constitute a quorum for the meeting. Each share of common stock entitles the holder thereof to one vote on each matter to be voted upon by such shareholders and to cumulate votes for the election of directors. For purposes of the quorum and the discussion below regarding the vote necessary to take shareholder action, shareholders of record who are present at the meeting in person or by proxy and who abstain or withhold their vote, including brokers holding customers’ shares of record who cause abstentions to be recorded at the meeting, are considered shareholders who are present and entitled to vote and count toward the quorum. Brokers holding shares of record for customers generally are not entitled to vote on certain matters unless they receive voting instructions from their customers. As used herein, “uninstructed shares” means shares held by a broker who has not received instructions from its customers on such matters and the broker has so notified the Company on a proxy form in accordance with industry practice or has otherwise advised the Company that it lacks voting authority. As used herein, “broker non-vote” means the votes that could have been cast on the matter in question by brokers with respect to uninstructed shares if the brokers had received their customers’ instructions. The effect of proxies marked “withheld” as to any director nominee or “abstain” as to a particular proposal and broker non-votes on proposals Nos. 1 and 2 is discussed under each respective proposal.

PROPOSAL 1

ELECTION OF DIRECTORS

The directors of the Company are elected annually to serve until the next annual meeting of the shareholders or until their respective successors are elected. At the Annual Meeting, eight directors are to be elected. The election of directors shall be by the affirmative vote of the holders of a plurality of the shares voting in person or by proxy at the annual meeting. Every shareholder, or his proxy, entitled to vote upon the election of directors may cumulate his or her votes and give one candidate a number of votes equal to the number of directors to be elected multiplied by the number of votes to which his or her shares are entitled, or distribute his or her votes on the same principle among as many candidates as he or she thinks fit. No shareholder or proxy, however, shall be entitled to cumulate votes unless such candidate or candidates have been nominated prior to the voting and the shareholder has given notice at the meeting, prior to the voting, of the shareholder’s intention to cumulate such shareholder’s votes. If any one shareholder gives such notice, all shareholders may cumulate their votes for candidates in nomination. Except for Messer’s. William L. Bridgford and Todd Andrews, each of these individuals has served as a director since the last annual meeting. All current directorships are being filled.

The Company’s Board of Directors recommends that you vote FOR the election of each of the nominees named below. Unless otherwise instructed, shares represented by the proxies will be voted for the election of the nominees listed below. Broker non-votes and proxies marked “withheld” as to one or more of the nominees will result in the respective nominees receiving fewer votes. However, the number of votes otherwise received by the nominee will not be reduced by such action. Each nominee has indicated that he is willing and able to serve as director if elected. In the event that any of such nominees shall become unavailable for any reason, an event which management does not anticipate, it is intended that proxies will be voted for substitute nominees designated by management.

The following table and biographical summaries set forth, with respect to each nominee for director, his age, the positions he holds in the Company and the year in which he first became a director of the Company. Data with respect to the number of shares of the Company’s Common Stock beneficially owned by each of such directors as of January 28, 2005 appears on page 6 of this Proxy Statement.

Name | Age | Current Position at the Company(1) | Year First Became Director | |||

Allan L. Bridgford | 70 | Chairman of the Board and Member of the Executive Committee | 1952 | |||

Hugh Wm. Bridgford | 73 | Chairman of the Executive Committee, Vice President and Director | 1952 | |||

William L. Bridgford | 50 | President and Director and member of the Executive Committee | 2004 | |||

Robert E. Schulze | 70 | Director | 1980 | |||

Todd C. Andrews | 39 | Director | 2004 | |||

Paul A. Gilbert | 62 | Director | 1993 | |||

Richard A. Foster | 69 | Director | 2001 | |||

Paul R. Zippwald | 67 | Director, Audit Committee Chairman | 1992 |

| (1) | Robert E. Schulze was President of the Company until he retired June 30, 2004. Hugh Wm. Bridgford and Allan L. Bridgford are brothers. William L. Bridgford was elected to the Board of Directors on August 9, 2004 and he is the son of Hugh Wm. Bridgford and the nephew of Allan L. Bridgford. |

Directors

Allan L. Bridgford, elected Chairman of the Board in March of 1995, served previously as President of the Company for more than five years and has been a full-time employee of the Company since 1957. Mr. Bridgford has served as a member of the Executive Committee since 1972. Allan L. Bridgford reduced his work schedule to 80% since March of the 2000 fiscal year and his compensation was reduced as well.

2

Hugh Wm. Bridgford, elected Chairman of the Executive Committee and elected Vice President in March of 1995, previously served as Chairman of the Board of Directors of the Company for more than five years and has been a full time employee of the Company since 1955 and has served as a member of the Executive Committee since 1972.

Todd C. Andrews is a Certified Public Accountant and currently serves as Vice President and Controller of Public Storage, Inc. headquartered in Glendale, California. Mr. Andrews, a resident of Valencia, California, is a graduate of California State University, Northridge.

William L. Bridgford, elected President June of 2004, served previously as Secretary of the Company for more than the past five years and was elected as an Executive Officer in 2001 and has been a full-time employee of the Company since 1987.

Robert E. Schulze was elected President in March of 1995 and served previously as Executive Vice President, Secretary and Treasurer of the Company for more than five years. Mr. Schulze retired effective June 30, 2004.

Paul A. Gilbert is a Senior Vice President at SmithBarney citigroup for more than ten years and was formerly with Kidder, Peabody & Co. Incorporated, an investment banking firm.

Richard A. Foster was President of Interstate Electronics Corporation, a wholly owned subsidiary of Figgie International, Inc., from 1979 until his retirement in 1991. Mr. Foster also served as Vice President of Figgie International, Inc. from 1986 to 1991.

Paul R. Zippwald was Regional Vice President and Head of Commercial Banking for Bank of America NT&SA, North Orange County, California, for more than five years prior to his retirement in July 1992. Mr. Zippwald is currently retired.

The Company is considered a “controlled company” within the meaning of Rule 4350(c)(5) of the National Association of Securities Dealers (NASD) and is therefore exempted from various NASD rules pertaining to certain “independence” requirements of its directors. Nevertheless, the Board of Directors has determined that Messrs. Andrews, Gilbert, Foster and Zippwald are all “independent directors” within the meaning of Rule 4200 of the National Association of Securities Dealers

During fiscal year 2004 the Company’s Board of Directors held 12 regular monthly meetings. Each of the nominees holding office during this period attended at least 75% of the monthly meetings. Non-employee directors were paid $1,050 for each meeting attended. Employee directors received no additional compensation for their services.

Board Committees

During fiscal year 2004, Norman V. Wagner II resigned from the Board of Directors and Todd C. Andrews was elected to fill this vacancy. Steven H. Price died in July 2004 and William L. Bridgford was elected to fill this vacancy.

The Board of Directors maintains three committees, the Compensation Committee, the Nominating Committee and the Audit Committee. The Compensation Committee consisted of Messrs. Andrews, Gilbert, Foster, and Zippwald at the close of the Company’s fiscal year. Each member served without additional compensation. Each of the members of the Compensation Committee are non-employee directors and independent as defined under the NASD’s listing standards. The Compensation Committee is responsible for establishing and administering the Company’s compensation arrangements for all executive officers. The Compensation Committee held two formal meetings during fiscal 2004, each of which was attended by all committee members.

The Audit Committee consists of Messrs. Andrews, Gilbert, Foster and Zippwald, each of whom receive $300 or $500 per meeting, depending on length of meeting attended. The Audit Committee has been established

3

in accordance with SEC rules and regulations, and each of the members of the Audit Committee are independent directors as defined under the NASD’s listing standards. The Board of Directors believes that Mr. Andrews qualifies as a “financial expert” as such term is used in the rules and regulations of the SEC. The Audit Committee meets periodically with the Company’s independent public accountants and reviews the Company’s accounting policies and internal controls. It also reviews the scope and adequacy of the independent public accountants’ examination of the Company’s annual financial statements. In addition, the Audit Committee recommends the firm of independent public accountants to be retained by the Company and pre-approves services rendered by its independent public accountants. The Audit Committee held monthly formal meetings during fiscal 2004. All Audit Committee members attended the twelve monthly meetings, except one director who missed three meetings. In addition, the Audit Committee holds a pre-earnings release conference with the Company’s independent public accountants on a quarterly basis. The Audit Committee adopted a written Audit Committee Charter on May 8, 2000 and amended the charter on August 11, 2003

Nominating Committee

The Board of Directors has decided that the full Board should perform the functions of a nominating committee for the Company. It made that decision because the Board believes that selecting new Board nominees is one of the most important responsibilities the Board members have to our shareholders and, for that reason, all of the members of the Board should have the right and responsibility to participate in the selection process. In its role as nominating committee, the Board identifies and screens new candidates for Board membership. Nevertheless, actions of the Board, in its role as nominating committee, can be taken only with the affirmative vote of a majority of the independent directors on the Board. Our Board of Directors intends to adopt a charter setting forth the responsibilities of the Board when acting as a nominating committee and will post a copy of this charter on its website at www.bridgford.com upon adoption. The Board met in May and also in August during fiscal 2004 to ratify the appointment of two new directors in its role as nominating committee.

The Director Nominating Process. In identifying new Board candidates, the Board will seek recommendations from existing board members and executive officers. In addition, the Board intends to consider any candidates that may have been recommended by any of the Company’s shareholders who have chosen to make those recommendations in accordance with the procedures described below. The Board also has the authority to engage an executive search firm and other advisors as it deems appropriate to assist in identifying qualified candidates for the Board.

In assessing and selecting Board candidates, the Board will consider such factors, among others, as the candidate’s independence, experience, knowledge, skills and expertise, as demonstrated by past employment and board experience; the candidate’s reputation for integrity; and the candidate’s participation in local community and local, state, regional or national charitable organizations. When selecting a nominee from among candidates considered by the Board, it will conduct background inquiries of and interviews with the candidates the Board members believe are best qualified to serve as directors. The Board members will consider a number of factors in making their selection of a nominee from among those candidates, including, among others, whether the candidate has the ability, willingness and enthusiasm to devote the time and effort required of members of the Board; whether the candidate has any conflicts of interest or commitments that would interfere with the candidate’s ability to fulfill the responsibilities of directors of the Company, including membership on Board committees; whether the candidate’s skills and experience would add to the overall competencies of the Board; and whether the candidate has any special background or experience relevant to the Company’s business.

Shareholder Recommendation of Board Candidates. Any shareholder desiring to submit a recommendation for consideration by the Board of a candidate that the shareholder believes is qualified to be a Board nominee at any upcoming shareholders meeting may do so by submitting that recommendation in writing to the Board not later 120 days prior to the first anniversary of the date on which the proxy materials for the prior year’s annual meeting were first sent to shareholders. However, if the date of the upcoming annual meeting has been changed by more than 30 days from the date of the prior year’s meeting, the recommendation must be received within a reasonable time before the Company begins to print and mail its proxy materials for the upcoming annual meeting. In addition, the recommendation should be accompanied by the following information: (i) the name and address of the nominating shareholder and of the person or persons being recommended for consideration as a candidate for Board membership; (ii) the number of shares of voting stock of the Company that

4

are owned by the nominating shareholder, his or her recommended candidate and any other shareholders known by the nominating shareholder to be supporting the candidate’s nomination; (iii) a description of any arrangements or understandings, that relate to the election of directors of the Company, between the nominating shareholder, or any person that (directly or indirectly through one or more intermediaries) controls, or is controlled by, or is under common control with, such shareholder and any other person or persons (naming such other person or persons); (iv) such other information regarding each such recommended candidate as would be required to be included in a proxy statement filed pursuant to the proxy rules of the Securities and Exchange Commission; and (v) the written consent of each such recommended candidate to be named as a nominee and, if nominated and elected, to serve as a director.

Code of Ethics

The Company adopted a Code of Ethics that is applicable to, among others, its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, and posted the Code of Ethics on its website at www.bridgford.com.

Communications with the Board

Shareholders may communicate with the Board or any of the directors by sending written communications addressed to the Board or any of the directors, c/o Corporate Secretary, Bridgford Foods Corporation, 1308 North Patt Street, Anaheim, California 92801. All communications are compiled by the Corporate Secretary and forwarded to the Board or the individual director(s) accordingly.

Director Attendance at Annual Meetings

Directors are strongly encouraged to attend annual meetings of the Company’s shareholders. [All eight (8) directors attended the 2004 annual meeting of the Company’s shareholders.]

Executive Officers

The Company has four executive officers elected on an annual basis to serve at the pleasure of the Board of Directors:

Allan L. Bridgford | Chairman(1) | |

Hugh Wm. Bridgford | Vice President(1) | |

William L. Bridgford | President and Secretary (1) (2) | |

Raymond F. Lancy | Chief Financial Officer, Treasurer and Executive Vice President (1) |

| (1) | Members of the Company’s Executive Committee that acts in the capacity of Chief Executive Officer of the Company. |

| (2) | William L. Bridgford is the son of Hugh Wm. Bridgford and the nephew of Allan L. Bridgford. |

A biographical summary regarding Messrs. Allan L. Bridgford, William L. Bridgford and Hugh Wm. Bridgford is set forth above under the caption “Directors.” Biographical information with respect to the Company’s other executive officers is set forth below:

Raymond F. Lancy, age 51, has served as Treasurer of the Company for more than the past five years, was elected Chief Financial Officer in 2003 and was elected as an Executive Officer in 2001.

5

PRINCIPAL SHAREHOLDERS AND MANAGEMENT

The following table sets forth certain information known to the Company with respect to the beneficial ownership of the Company’s Common Stock as of January 28, 2005 by each shareholder known by the Company to be the beneficial owner of more than 5% of the Company’s Common Stock, by each director, and nominee for director by each executive officer named in the Summary Compensation Table and by all officers and directors as a group.

Amount and Nature of Shares Beneficially Owned

Name and Address of Beneficial Owner(1) | Sole Voting and Investment Power | Shared Voting and Investment Power(3) | Total Beneficially Owned(2) | Percentage of Outstanding Shares Beneficially Owned(2) | |||||

Bridgford Industries Incorporated 1707 Good-Latimer Expy. Dallas, TX 75226 | 7,156,396 | — | 7,156,396 | 71.6 | |||||

Hugh Wm. Bridgford 1707 Good-Latimer Expy. Dallas, TX 75226 | 47,917 | 7,156,396 | 7,204,313 | 72.0 | |||||

Allan L. Bridgford | 155,882 | 7,156,396 | 7,312,278 | 73.1 | |||||

Bruce H. Bridgford | 7,986 | 7,156,396 | 7,164,382 | 71.6 | |||||

Baron R.H. Bridgford 170 North Green St. Chicago, IL 60607 | 1,654 | 7,156,396 | 7,158,050 | 71.6 | |||||

Robert E. Schulze | 167,870 | — | 167,870 | 1.7 | |||||

William L. Bridgford | 31,175 | 7,156,396 | 7,187,571 | (4) | 71.9 | ||||

Raymond F. Lancy | 25,000 | — | 25,000 | (5) | * | ||||

Todd C. Andrews | 200 | 200 | |||||||

Paul A. Gilbert | 605 | — | 605 | * | |||||

Richard A. Foster | 2,234 | — | 2,234 | * | |||||

Paul R. Zippwald | 1,452 | — | 1,452 | * | |||||

All directors and officers as a group (12 persons) | 7,598,371 | 7,156,396 | 7,598,371 | (6) | 76.0 |

| * | Less than one percent (1%). |

| (1) | Unless otherwise indicated, the address of such beneficial owner is the Company’s principal executive offices, 1308 N. Patt Street, Anaheim, California 92801. |

| (2) | Applicable percentage of ownership at January 28, 2005 is based upon 9,999,361 shares of common stock outstanding. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and includes voting and investment power with respect to shares shown as beneficially owned. Shares of common stock subject to options or warrants currently exercisable or exercisable within 60 days of January 28, 2005 are deemed outstanding for computing the shares and percentage ownership of the person holding such options or warrants, but are not deemed outstanding for computing the percentage ownership of any other person or entity. |

| (3) | Represents shares beneficially owned by Bridgford Industries Incorporated, a Delaware corporation (“BII”), which presently has no other significant business or assets. Allan L. Bridgford, Hugh Wm. Bridgford, William L. Bridgford, Baron R.H. Bridgford and Bruce H. Bridgford presently own 16.06%, 10.54%, 7.48%, 9.54% and 10.29%, respectively, of the outstanding voting capital stock of BII and each has the right to vote as trustee or custodian for other shareholders of BII representing 0%, 0%, .58%, 1.75% and .63%, respectively, of such outstanding voting capital stock. The remaining percentage of BII stock is owned of record, or beneficially, by 32 additional members of the Bridgford family. The officers of BII jointly vote all shares. |

| (4) | Includes 25,000 shares that may be purchased upon exercise of options within 60 days of January 28, 2005. |

| (5) | Consists of 25,000 shares that may be purchased upon exercise of options within 60 days of January 28, 2005. |

| (6) | Includes 50,000 shares that may be purchased upon exercise of options within 60 days of January 28, 2005. |

The Company is not aware of any arrangements that may at a subsequent date result in a change of control of the Company.

6

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s directors, executive officers, and holders of more than 10% of the Company’s Common Stock, to file with the Securities and Exchange Commission (the “SEC”) initial reports of ownership and reports of changes in ownership of Common Stock of the Company. Officers, directors and 10% shareholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file. To the Company’s knowledge, based solely on the review of copies of such reports furnished to the Company and written representations that no other reports were required, during the fiscal year ended October 29, 2004, all of the Company’s officers, directors and 10% shareholders complied with all applicable Section 16(a) filing requirements.

COMPENSATION OF EXECUTIVE OFFICERS

The following table sets forth summary information concerning compensation paid or accrued by the Company for services rendered during the three fiscal years ended 2004, 2003, and 2002 to the Company’s chief executive officer and the four remaining most highly paid executive officers whose salary and bonus exceeded $100,000 (the “Named Executive Officers”).

Summary Compensation Table

| Annual Compensation | All Other Compen- sation($) | |||||||||

Name and Principal Position | Year | Salary($) | Bonus($) | |||||||

Allan L. Bridgford | 2004 2003 2002 | 230,512 213,252 277,509 | — 24,000 36,000 | (2) (2) | 73,907 | (3) | ||||

Robert E. Schulze | 2004 2003 2002 | 190,978 237,536 267,683 | — 30,000 45,000 | (2) (2) | ||||||

Hugh Wm. Bridgford | 2004 2003 2002 | 239,458 210,392 257,077 | — 30,000 45,000 | (2) (2) | 159,000 | (3) | ||||

William L. Bridgford | 2004 2003 2002 | 86,660 77,480 76,480 | 98,720 83,261 86,981 | | ||||||

Raymond F. Lancy(1) | 2004 2003 2002 | 150,600 145,400 140,000 | 35,000 40,000 49,000 | | — — | | ||||

| (1) | Hugh Wm. Bridgford, Allan L. Bridgford, William L. Bridgford and Raymond F. Lancy are members of the Company’s Executive Committee which acts in the capacity of Chief Executive Officer of the Company. |

| (2) | Represents deferred contingent compensation payable over periods of five years pursuant to bonuses granted by the Company’s Compensation Committee. |

| (3) | Represents premiums paid by the Company in connection with split-dollar insurance policies. |

| (4) | Robert Schulze retired as President on June 30, 2004 and William L. Bridgford was elected to serve as President. |

7

None of the Named Executive Officers exercised options during the fiscal year ended October 29, 2004. The following table sets forth certain information concerning the number of shares covered by both exercisable and unexercisable stock options as of October 29, 2004. Also reported are the values for “in the money” options which represent the positive spread between the exercise prices of any such existing stock options and $8.40, the closing price of Common Stock on October 29, 2004, as reported by The Nasdaq National Market.

Aggregated Option Exercises in Last Fiscal Year

and Fiscal Year-End Option Values

| Shares Acquired on Exercise(#) | Value Realized($) (market price at exercise less exercise price) | Number of Securities Underlying Unexercised Options at FY-End(#) | Value of Unexercised In-the-Money Options at FY-End($) | ||||||||||||

Name | Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||||

Allan L. Bridgford | 0 | $ | 0 | 0 | 0 | $ | 0 | $ | 0 | ||||||

Robert E. Schulze | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||

Hugh Wm. Bridgford | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||

William L. Bridgford | 0 | 0 | 25,000 | 0 | 0 | 0 | |||||||||

Raymond F. Lancy | 0 | 0 | 25,000 | 0 | 0 | 0 | |||||||||

RETIREMENT PLAN

The Company has a defined benefit plan (“Plan”) for those of its employees not covered by collective bargaining agreements. The Plan, administered by a major life insurance company, presently provides that participants receive an annual benefit on retirement equal to 1.5% of their total compensation from the Company during their period of participation from 1958. Benefits are not reduced by Social Security payments or by payments from other sources and are payable in the form of fully-insured monthly lifetime annuity contracts commencing at age 65 or the participant’s date of retirement, whichever is later. Based on projections used for computing benefits under the Plan, the estimated annual benefits at normal or current retirement would be as follows:

Allan L. Bridgford | $ | 63,416 | |

Robert E. Schulze | 59,591 | ||

Hugh Wm. Bridgford | 63,356 | ||

William L. Bridgford | 75,481 | ||

Raymond F. Lancy | 68,151 | ||

All officers | $ | 329,995 | |

8

SUPPLEMENTAL EXECUTIVE RETIREMENT PLAN

Retirement benefits otherwise available to key executives under the Company’s Plan have been limited by the effects of the Tax Equity and Fiscal Responsibility Act of 1982 (“TEFRA”) and the Tax Reform Act of 1986 (“TRA”). To offset the loss of retirement benefits associated with TEFRA and TRA, the Company has adopted a non-qualified “makeup” benefit plan (Supplemental Executive Retirement Plan). Benefits will be provided under this plan for members of the Executive Committee equal to 60% of their final average earnings minus any pension benefits and primary insurance amounts available to them under Social Security. However, in all cases the combined benefits are capped at $120,000 per year for Messer’s. Allan L. Bridgford, Robert E. Schulze and Hugh Wm. Bridgford. Benefits provided under this plan for William L. Bridgford and Raymond F. Lancy are calculated at 50% of final average earnings, capped at $200,000 per year, without offsets for other pension or Social Security benefits. Eligibility is determined by the Board of Directors of the Company and the projected annual benefits to be paid at normal or current retirement date to those presently selected are as follows:

Allan L. Bridgford | $ | 51,528 | |

Robert E. Schulze | 56,100 | ||

Hugh Wm. Bridgford | 61,080 | ||

William L. Bridgford | 159,350 | ||

Raymond F. Lancy | 158,596 | ||

All officers | $ | 486,654 | |

9

Notwithstanding anything to the contrary set forth in any of the Company’s previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this Proxy Statement, in whole or in part, the following reports of the Compensation Committee and the Audit Committee and the Performance Graph on page 12 shall not be incorporated by reference into such filings.

REPORT OF THE COMPENSATION COMMITTEE

The Compensation Committee of the Company consists of the outside members of the Board of Directors. As of October 29, 2004, the Compensation Committee consisted of Messrs. Andrews, Gilbert, Foster and Zippwald. The Company’s executive compensation policy’s aim is to attract, retain and motivate key employees while making sure that a relationship exists between executive compensation and the Company’s performance. Accordingly, the Company policy of compensation for its executive officers is to combine annual base salaries with bonuses based upon corporate performance.

Historically, the Company has been principally managed by an Executive Committee consisting of senior executive officers of the Company. The Executive Committee, as a unit, serves as the Company’s “Chief Executive Officer”. The Executive Committee currently consists of four members. The current members are Hugh Wm. Bridgford, Chairman of the Executive Committee, Allan L. Bridgford, Chairman of the Board of Directors, William L. Bridgford, President and Raymond F. Lancy, Chief Financial Officer, Vice President and Treasurer. For the last several years, the Compensation Committee has determined that Messers. Allan L. Bridgford, Hugh Wm. Bridgford and Robert E. Schulze (retired June 30, 2004) should be compensated on an equal basis with pro-rata adjustments for reduced work schedules.

The current compensation plan for Messer’s Allan L. Bridgford and Hugh Wm. Bridgford sets forth a minimum base salary of $2,000 per week plus incentive amounts that may be earned as additional future salary and/or as deferred contingent compensation (“bonuses”). The Compensation Committee deems continuity of management to be an important consideration for the long-term success of the business and, therefore, payments of bonuses are currently deferred over a five year period. No interest is paid or accrued on the earned but unpaid bonuses. Consistent with the compensation policy for all of the Company’s corporate officers, as discussed below, the principal factor used by the Compensation Committee to determine the bonuses to be paid the members of the Executive Committee is the measure of the Company’s performance which is based upon the Company’s pretax income and return on shareholders’ equity for the current fiscal year. For fiscal 2004, the base salary for Allan L. Bridgford was $83,200 and previously deferred salary was $147,312. For Hugh Wm. Bridgford the base salary was $104,000 and previously deferred salary totaled $135,458. For Robert E. Schulze who retired June 30, 2004, the base salary was $68,000 and the previously deferred salary was $122,978. The substantial reductions in bonuses earned this year compared to the prior year relate primarily to the decrease in pretax income for the same periods.

The Compensation Committee has elected not to provide incentive compensation to Messer’s. Allan L. Bridgford, Hugh Wm. Bridgford and Robert E. Schulze in the form of stock options, stock appreciation rights, restricted stock or other similar plans. The Compensation Committee also directs that perquisite compensation be minimal for members of the Executive Committee. Members of the Executive Committee are not to be provided with country club memberships or other similar perquisites.

Compensation for other executive officers is recommended to the Compensation Committee by Messer’s. Allan L. Bridgford, and Hugh Wm. Bridgford who regularly report to the Board of Directors and the Compensation Committee on compensation matters relating to other corporate officers. All corporate officers, top-level managers and many midlevel managers receive compensation determined by performance-based criteria, including both individual and team accomplishments.

COMPENSATION COMMITTEE Todd C. Andrews Richard A. Foster Paul A. Gilbert Paul R. Zippwald, Chairman |

10

REPORT OF THE AUDIT COMMITTEE

Pursuant to a meeting of the Audit Committee on January 26, 2005, the Audit Committee reports that it has: (i) reviewed and discussed the Company’s audited financial statements with management; (ii) discussed with the independent auditors the matters (such as the quality of the Company’s accounting principles and internal controls) required to be discussed by Statement on Auditing Standards No. 61; and (iii) received written confirmation from PricewaterhouseCoopers LLP that it is independent and written disclosures regarding such independence as required by Independence Standards Board No. 1, and discussed with the auditors the auditors’ independence. Based on the review and discussions referred to in items (i) through (iii) above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s annual report for the Company’s fiscal year ended October 29, 2004.

AUDIT COMMITTEE

Todd C. Andrews Richard A. Foster Paul A. Gilbert Paul R. Zippwald, Chairman |

11

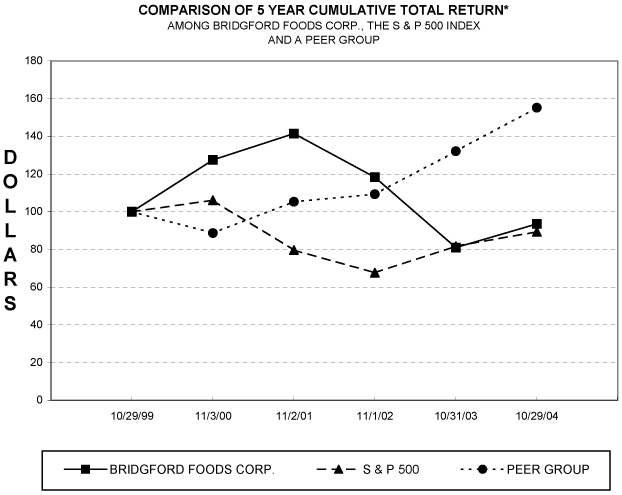

PERFORMANCE GRAPH

The comparative stock performance graph shown below compares the yearly change in cumulative value of Bridgford Foods Corporation’s common stock with certain index values for the five-year periods ended October 29, 2004. The graph sets the beginning value of Bridgford common stock and the indexes at $100. All calculations assume reinvestment of dividends on a monthly basis. The peer group consists of nine companies, including the companies that comprised the Meat Industry Group of Media General Financial Services. The group includes Bob Evans Farms, Inc.; Cagle’s, Inc.; Hormel Foods Corporation; Pilgrims Pride Corporation; Sanderson Farms Inc.; Seaboard Corp; Tyson Foods, Inc.; and United Heritage Corporation. The peer group index return consists of the weighted returns of each component issuer according to such issuer’s respective stock market capitalization at the beginning of each period for which a return is indicated.

NOTE: The stock price performance shown on the following graph is not necessarily indicative of future price performance.

| * | $100 invested on 10/29/99 in stock or index-including reinvestment of dividends. |

12

EMPLOYMENT CONTRACTS AND TERMINATION OF EMPLOYMENT AND CHANGE IN CONTROL AGREEMENTS

The Company has no employment contracts, severance agreements or change in control agreements.

As discussed in the Section entitled “Compensation of Executive Officers,” the Company has established a defined benefit plan and a non-qualified “makeup” benefit plan for the payment of retirement benefits to its executive officers and key employees.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The members of the Company’s Compensation Committee at October 29, 2004 consisted of Todd C. Andrews, Paul A. Gilbert, Richard A. Foster and Paul R. Zippwald. No member of the Compensation Committee is a former or current officer or employee of the Company or any of its subsidiaries. The Company is not aware of any transaction involving any member of the Compensation Committee that would require disclosure for “Compensation Committee Interlocks and Insider Participation”.

RELATED PARTY TRANSACTIONS

The Company is not aware of any related party transactions that would require disclosure.

13

PROPOSAL 2

INDEPENDENT PUBLIC ACCOUNTANTS

The Audit Committee of the Board of Directors has, subject to ratification by the shareholders, appointed Haskell & White LLP as independent public accountants for the Company for the fiscal year commencing October 30, 2004. PricewaterhouseCoopers LLP was the Company’s independent public accountant since 1958. In determining whether the proposal has been approved, abstentions will be counted as votes against the proposal and broker non-votes will not be counted as votes for or against the proposal or as votes present and voting on the proposal.

Proxies received in response to this solicitation will be voted in favor of the approval of such firm unless otherwise specified in the proxy. In the event of a negative vote on such ratification, the Audit Committee of the Board of Directors will reconsider its selection. Representatives of PricewaterhouseCoopers LLP and Haskell & White LLP will be present at the meeting and available for questions and will have the opportunity to make a statement if they so desire.

FEES BILLED BY PRICEWATERHOUSECOOPERS LLP DURING THE FISCAL YEARS ENDED

OCTOBER 29, 2004 AND OCTOBER 31, 2003

Audit Fees:

Audit fees billed by PricewaterhouseCoopers LLP for the audit of the 2004 annual financial statements and the review of the financial statements included in our quarterly reports on Form 10-Q in fiscal 2004 totaled $163,000.

Audit fees billed by PricewaterhouseCoopers LLP for the audit of our 2003 annual financial statements and the review of the financial statements included in our quarterly reports on Form 10-Q in fiscal 2003 totaled $140,000.

Audit-Related Fees:

We did not incur any audit-related fees billed by PricewaterhouseCoopers LLP during the fiscal years ended October 29, 2004 and October 31, 2003. Such audit-related fees typically consist of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of our consolidated financial statements and are not reported under “Audit Fees.” These services may include consultations related to the Sarbanes-Oxley Act and consultations concerning financial accounting and reporting standards.

Tax Fees:

Fees billed by PricewaterhouseCoopers LLP for professional services for tax compliance, tax advice and tax planning during the fiscal year ended October 29, 2004 totaled $4,000.

Fees billed by PricewaterhouseCoopers LLP for professional services for tax compliance, tax advice and tax planning during the fiscal year ended October 31, 2003 totaled $77,000.

The fees disclosed under this category are comprised by services that include assistance related to state tax compliance services.

14

All Other Fees:

We did not incur any other fees billed by PricewaterhouseCoopers LLP during the fiscal year ended October 29, 2004 or during the fiscal year ended October 31, 2003.

SHAREHOLDER PROPOSALS

Proposals of shareholders intended to be presented at the 2006 Annual Meeting of Shareholders must be received at the Company’s principal office no later than October 9, 2005 in order to be considered for inclusion in the proxy statement and form of proxy relating to that meeting.

Additionally, if the Company is not provided notice of a shareholder proposal, which the shareholder has not previously sought to include in the Company’s proxy statement, by December 23, 2005, the Company will be allowed to use its discretionary voting authority when the proposal is raised at the meeting, without any discussion of the matter in the proxy statement.

15

OTHER MATTERS

The Board of Directors is not aware of any matters to be acted upon at the meeting other than the election of directors and the ratification of the appointment of Haskell & White LLP. If, however, any other matter shall properly come before the meeting, the persons named in the proxy accompanying this statement will have discretionary authority to vote all proxies with respect thereto in accordance with their best judgment.

FINANCIAL STATEMENTS

The annual report of the Company for the fiscal year ended October 29, 2004 accompanies this Proxy Statement but is not a part of the proxy solicitation material.

By order of the Board of Directors |

| /s/ WILLIAM L. BRIDGFORD |

| William L. Bridgford |

| President and Secretary |

February 7, 2005

FORM 10-K

The Corporation will furnish without charge to each person whose proxy is being solicited, upon request of any such person, a copy of the Annual Report of the Corporation on Form 10-K for the fiscal year ended October 29, 2004, as filed with the Securities and Exchange Commission, including financial statements and schedules thereto. Such report was filed with the Securities and Exchange Commission on January 27, 2005. Requests for copies of such report should be directed to the Treasurer, Bridgford Foods Corporation, P.O. Box 3773, Anaheim, California 92803.

16

Bridgford Foods Corporation

This proxy is solicited on behalf of the Board of Directors

2005 ANNUAL MEETING OF SHAREHOLDERS

To Be Held on March 16, 2005

The undersigned shareholder of BRIDGFORD FOODS CORPORATION, a California corporation, hereby acknowledges receipt of the Notice of Annual Meeting of Shareholders and Proxy Statement, each dated February 7, 2005, and hereby appoints Hugh Wm. Bridgford and Allan L. Bridgford, and each of them, proxies and attorneys-in-fact, with full power to each of substitution, on behalf and in the name of the undersigned, to represent the undersigned at the 2005 Annual Meeting of Shareholders of BRIDGFORD FOODS CORPORATION, to be held on March 16, 2005 at 10:00 a.m., local time, at the Four Points Sheraton, 1500 South Raymond Avenue, Fullerton, California, and at any adjournment thereof, and to vote all shares of Common Stock which the undersigned would be entitled to vote if then and there personally present, on the matters set forth below:

THIS PROXY WILL BE VOTED AS DIRECTED OR, IF NO CONTRARY DIRECTION IS INDICATED, WILL BE VOTED FOR THE ELECTION OF THE EIGHT DIRECTOR NOMINEES LISTED BELOW AND FOR THE RATIFICATION OF THE APPOINTMENT OF HASKELL & WHITE LLP AS INDEPENDENT PUBLIC ACCOUNTANTS AND AS SAID PROXIES DEEM ADVISABLE ON SUCH OTHER MATTERS AS MAY PROPERLY COME BEFORE THE MEETING.

(Continued and to be marked, dated and signed, on the other side)

| Address Change/Comments (Mark the corresponding box on the reverse side) |

Ù FOLD AND DETACH HERE Ù

Please Mark Here for Address Change or Comments | ¨ | |||||||||||||||

| SEE REVERSE SIDE | ||||||||||||||||

| FOR all nominees listed below (except as indicated) | WITHHOLD AUTHORITY (to vote for all nominees) | FOR | AGAINST | ABSTAIN | ||||||||||||

1. | ELECTION OF DIRECTORS: Nominees:

01 Hugh Wm. Bridgford 02 Allan L. Bridgford 03 Robert E. Schulze 04 Paul A. Gilbert | ¨ | ¨ | 2. | PROPOSAL TO RATIFY APPOINTMENT OF Haskell & White LLP AS THE INDEPENDENT PUBLIC ACCOUNTANTS FOR THE COMPANY FOR 2005: | ¨ | ¨ | ¨ | ||||||||

05 Richard A. Foster 06 Todd C. Andrews 07 William L. Bridgford 08 Paul R. Zippwald | and in their discretion, upon such other matter or matters that may properly come before the meeting or any adjournment thereof. | |||||||||||||||

Withheld for the nominees you list below: (Write that | ||||||||||||||||

nominees name in the space provided below.) | ||||||||||||||||

| Dated: , 2005 | ||||

| Name (Please Print) | ||||

| (Signature) | ||||

| (Signature) | ||||

| (This proxy should be marked, dated and signed by the shareholder (s) exactly as his or her name appears hereon, and returned promptly in the enclosed envelope. Persons signing in fiduciary capacity should so indicate. If shares are held by joint tenants or as community property, both should sign.) | ||||

Ù FOLD AND DETACH HERE Ù