- TWTR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

Twitter (TWTR) CORRESPCorrespondence with SEC

Filed: 22 Jun 22, 12:00am

| Wilson Sonsini Goodrich & Rosati

650 Page Mill Road

O: 650.493.9300 |

June 22, 2022

BY EDGAR

United States Securities and Exchange Commission

Division of Corporation Finance

Office of Technology

100 F Street, N.E.

Washington, D.C. 20549

Attention: Jan Woo

Austin Pattan

Robert Littlepage

Claire DeLabar

Re: Twitter, Inc.

Annual Report on Form 10-K for the fiscal year ended December 31, 2021

Filed February 16, 2022

Quarterly Report on Form 10-Q for the quarter ended March 31, 2022

Filed May 2, 2022

File No. 001-36164

Ladies and Gentlemen:

On behalf of our client, Twitter, Inc. (“Twitter”), we submit this letter in response to comments from the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) received by letter dated June 15, 2022, concerning Twitter’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021 filed with the Commission on February 16, 2022 (the “Form 10-K”) and Twitter’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2022 filed with the Commission on May 2, 2022 (the “Form 10-Q”).

In this letter, we have recited the comments from the Staff in italicized, bold type and have followed each comment with Twitter’s response. Defined terms used in this letter but not otherwise defined have the meaning given to them in the Form 10-K or Form 10-Q, as the case may be.

Annual Report on Form 10-K filed February 16, 2022

Risk Factors

We rely on assumptions . . . , page 24

| 1. | We note your estimate that the average number of false or spam accounts during fiscal 2021 continues to represent fewer than 5% of mDAU. To the extent material, please disclose the methodology used in calculating these figures and the underlying judgements and assumptions used by management. |

Twitter respectfully informs the Staff that, as noted in the risk factor, its determination that the average of false or spam accounts during the fourth quarter of 2021 continued to represent fewer than 5%

AUSTIN BEIJING BOSTON BOULDER BRUSSELS HONG KONG LONDON LOS ANGELES NEW YORK PALO ALTO

SALT LAKE CITY SAN DIEGO SAN FRANCISCO SEATTLE SHANGHAI WASHINGTON, DC WILMINGTON, DE

Securities and Exchange Commission

June 22, 2022

Page 2

of mDAU during the quarter is based on an internal review of a sample of accounts and the application of Twitter’s business judgment. Twitter believes that it already adequately discloses the methodology that it uses in calculating these figures and the underlying assumptions and judgments of management to the extent material, as follows:

| - | On page 5 of the Form 10-K under the caption “Note Regarding Key Metrics”, Twitter: |

| • | provides its definition of mDAU; |

| • | notes that mDAU is calculated using internal company data; |

| • | notes that its calculation of mDAU is not based on any standardized industry methodology and is not necessarily calculated in the same manner as, or comparable to, similarly titled measures presented by other companies; |

| • | notes that its measures of mDAU growth and engagement may differ from estimates published by third parties or from similarly-titled metrics of competitors due to differences in methodology; |

| • | discloses that while Twitter believes its mDAU calculations are based on reasonable estimates for the applicable period of measurement, there are inherent challenges in measuring usage and engagement across Twitter’s large number of total accounts around the world; |

| • | explains that Twitter performs an internal review of a sample of accounts to estimate the average of false or spam accounts during a quarter, and that the false or spam accounts for a period represent the average of false or spam accounts in the samples during each monthly analysis period during a quarter; |

| • | explains that Twitter treats multiple accounts held by a single person or organization as multiple mDAU because Twitter permits people and organizations to have more than one account, and as such the calculations of mDAU may not accurately reflect the number of people or organizations using the Twitter platform; |

| • | states that Twitter continually seeks to improve its ability to estimate the total number of spam accounts and eliminate them from the calculation of mDAU; and |

| • | notes that, as part of its improvements in its spam detection capabilities, Twitter has suspended a large number of spam, malicious automation, and fake accounts, and after Twitter determines an account is spam, malicious automation, or fake, it stops counting it in its mDAU. |

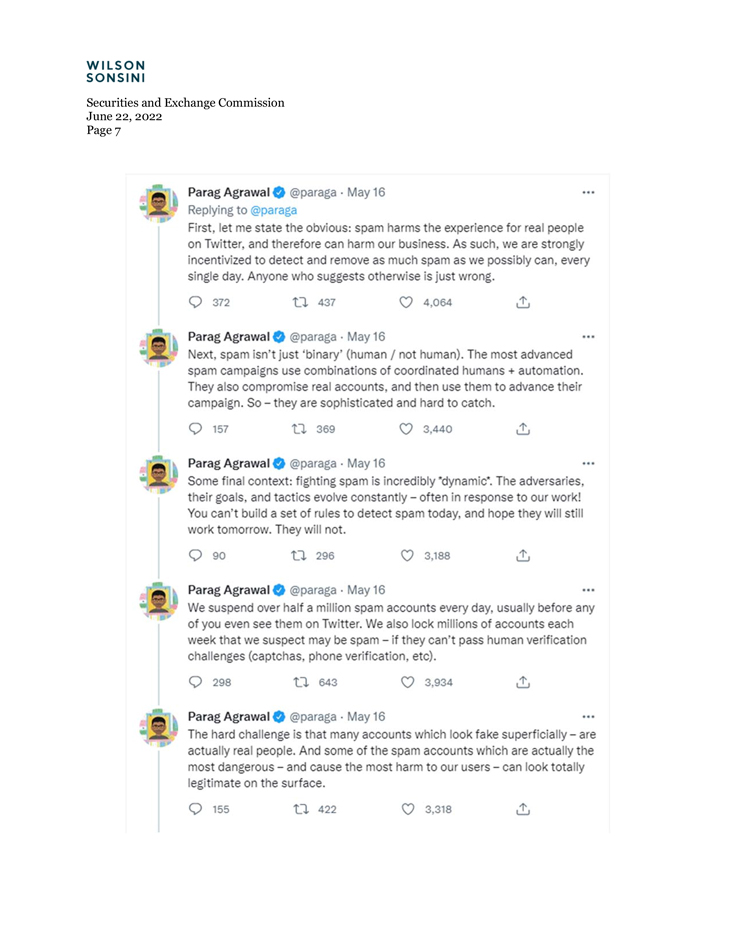

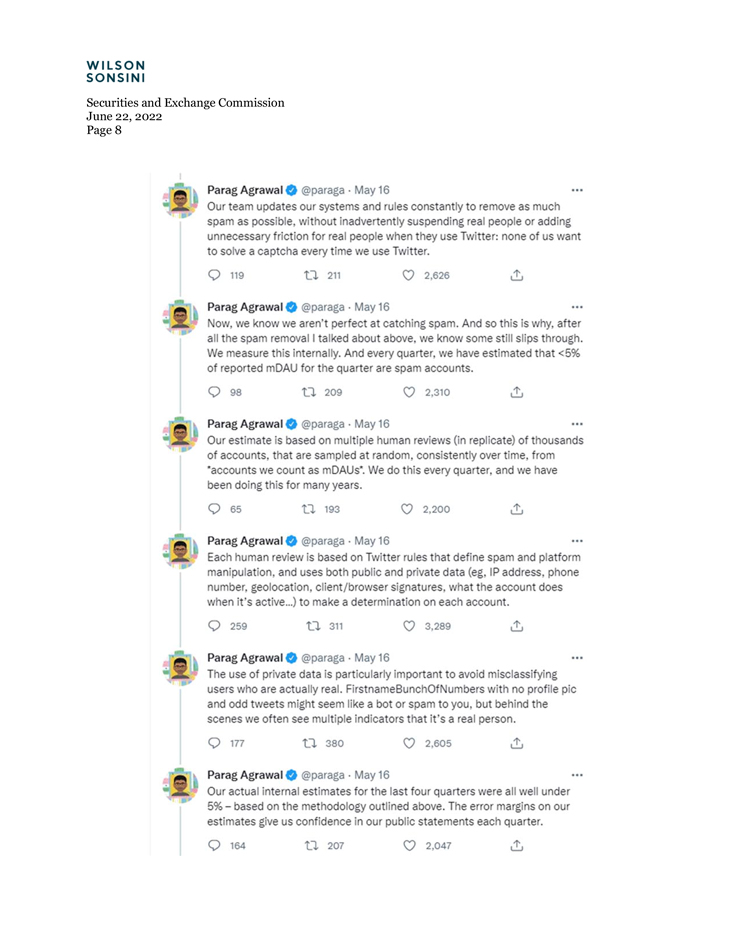

To elaborate on the referenced internal review, Twitter respectfully informs the Staff on a supplemental basis that the review is conducted manually by humans reviewing (in replicate) thousands of accounts, randomly chosen out of the accounts that Twitter counts as mDAU. This review is conducted every quarter and Twitter has been performing this review for many years. Each human review assesses the selected accounts against a complex set of Twitter rules that define spam and platform manipulation, and, at a high level, an account is deemed to be “false” or “spam” if it violates one or more of Twitter’s

Securities and Exchange Commission

June 22, 2022

Page 3

rules regarding spam and platform manipulation. In undertaking these assessments, Twitter uses both private and public data, including account activity, characteristics of how and when the account was registered on Twitter, contact information, and information shared via the account’s profile. The humans reviewing the random sample of accounts apply Twitter’s rules and use public and private data to make informed judgments about whether an account is false or spam. The assessments are also subject to a multi-step, multi-tier review process where each account is separately and independently reviewed and investigated by multiple trained labelers. On May 16, 2022, Twitter’s CEO, Parag Agrawal, included a high-level summary of this sample review process in a series of Tweets, a copy of which are included in the annex to this letter. Twitter has not provided this additional detail in its public filings because it does not view this incremental level of detail to be material to an investor. Information regarding this sample review process has been disclosed and is otherwise available publicly, including in Mr. Agrawal’s Tweets.

Quarterly Report on Form 10-Q for the period ended March 31, 2022

Management’s Discussion and Analysis of Financial Condition and Results of Operations

mDAU Recast, page 34

| 2. | You disclosed that an error was made in March 2019 which resulted in an overstatement of mDAU from the first quarter of 2019 through the fourth quarter of 2021. Please discuss how the error was discovered, when and by whom. Given that the error persisted for three years, please tell us how you concluded there was not a material weakness in your internal control over financial reporting and that your disclosure controls and procedures were effective as of March 31, 2022. |

Twitter respectfully informs the Staff that, for the reasons discussed below, it concluded that there was not a material weakness in its internal control over financial reporting and that its disclosure controls and procedures were effective as of March 31, 2022 because the overstatement of mDAU during the period from the first quarter of 2019 through the fourth quarter of 2021 was immaterial. In assessing the materiality of this overstatement, Twitter reviewed all relevant considerations relating to the overstatement in the context of the total mix of information, including both quantitative and qualitative factors.

As disclosed in the Form 10-Q, after the launch of a feature in March 2019 that allowed people to link separate accounts together in order to conveniently switch between accounts, the overstatement led to actions taken via the primary account resulting in all linked accounts being counted as mDAU. The overstatement was discovered in March 2022 by Twitter’s data scientists as part of investigating potential new product features that involved secondary accounts.

Twitter analyzed the impact of the overstatement from a quantitative perspective as follows:

The overstatement had no impact on any of Twitter’s key metrics other than mDAU, and had no impact on Twitter’s financial statements. With respect to mDAU, the overstatement represented less than one percent of mDAU for each of the quarters from the fourth quarter of 2020 through the fourth quarter of 2021. While data is not available prior to the fourth quarter of 2020 to recast mDAU for such periods under the corrected measurement methodology due to Twitter’s data retention policies, Twitter’s estimates suggest the prior period adjustments for other quarters in the applicable period are not likely to be greater than those in the fourth quarter of 2020 because it believes that usage of the feature to link separate accounts would have been likely to grow over time as more users discovered the feature.

Securities and Exchange Commission

June 22, 2022

Page 4

Twitter analyzed the impact of the overstatement from a qualitative perspective as follows:

The overstatement only impacted mDAU, which is only disclosed in management’s discussion and analysis of financial condition and results of operations, and not in Twitter’s financial statements. The overstatement had no effect on Twitter’s financial statements or the accompanying footnotes, earnings, or other trends, and had no impact on Twitter’s other key metrics. Twitter considered the importance of mDAU as a key metric to investors; the overstatement, however, did not change the trend in mDAU in any quarter from the fourth quarter of 2020 through the fourth quarter of 2021, and Twitter estimates suggest the adjustments are not likely to change the trend in mDAU in any prior quarter in the applicable period.

As a result of Twitter’s quantitative and qualitative analysis, Twitter concluded that the overstatement was immaterial, that there was not a material weakness in its internal control over financial reporting, and that its disclosure controls and procedures were effective as of March 31, 2022.

* * *

If the Staff has any questions or comments concerning the foregoing, or requires any further information, please contact me at (650) 849-3275 or dschnell@wsgr.com.

| Very truly yours, |

| WILSON SONSINI GOODRICH & ROSATI |

| Professional Corporation |

| /s/ Douglas K. Schnell |

| Douglas K. Schnell |

| cc: | Twitter, Inc. | |

Parag Agrawal | ||

Ned Segal | ||

Vijaya Gadde | ||

Sean Edgett | ||

| Simpson Thacher & Bartlett LLP | ||

Alan Klein | ||

Anthony Vernace | ||

Katherine Krause | ||

| Wilson Sonsini Goodrich & Rosati, Professional Corporation | ||

Katharine Martin | ||

Martin Korman | ||

Remi Korenblit | ||

Securities and Exchange Commission

June 22, 2022

Page 5

| PricewaterhouseCoopers LLP | ||

Dirk Tissera, Global Client Partner | ||