© 2021 Avaya Inc. All rights reserved Investor Presentation 3Q FY21 August 9, 2021 Exhibit 99.2

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 2 Cautionary Note Regarding Forward-Looking Statements This presentation contains certain “forward-looking statements.” All statements other than statements of historical fact are “forward-looking” statements for purposes of the U.S. federal and state securities laws. These statements may be identified by the use of forward-looking terminology such as "anticipate," "believe," "continue," "could,“ "estimate," "expect," "intend," "may," "might," “our vision,” "plan," "potential," "preliminary," "predict," "should,“ "will," or “would” or the negative thereof or other variations thereof or comparable terminology. Avaya Holdings Corp. (the "Company") has based these forward-looking statements on its current expectations, assumptions, estimates and projections. These statements, including the Company’s outlook, do not include the potential impact of any business combinations, asset acquisitions, divestitures, strategic investments or other strategic transactions completed after the date hereof. While the Company believes these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond its control. Risks and uncertainties that may cause these forward-looking statements to be inaccurate include, among others, termination or modification of current contracts which could impair attainment of our OneCloud ARR metric; the duration, severity and impact of the coronavirus pandemic (“COVID-19”), including the emergence of new variants, as well as governmental and business responses to COVID-19, and the impact the pandemic and such responses have on our business, financial performance, liquidity and other factors discussed in the Company's Annual Report on Form 10-K and subsequent quarterly reports on Form 10-Q filed with the Securities and Exchange Commission (the “SEC”). These risks and uncertainties may cause the Company’s actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. For a further list and description of such risks and uncertainties, please refer to the Company’s filings with the SEC that are available at www.sec.gov. The Company cautions you that the list of important factors included in the Company’s SEC filings may not contain all of the material factors that are important to you. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this presentation may not in fact occur. The Company undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. These slides, as well as current and historical financial data, are available on our website at investors.avaya.com. None of the information included on the Company's website is incorporated by reference in this presentation.

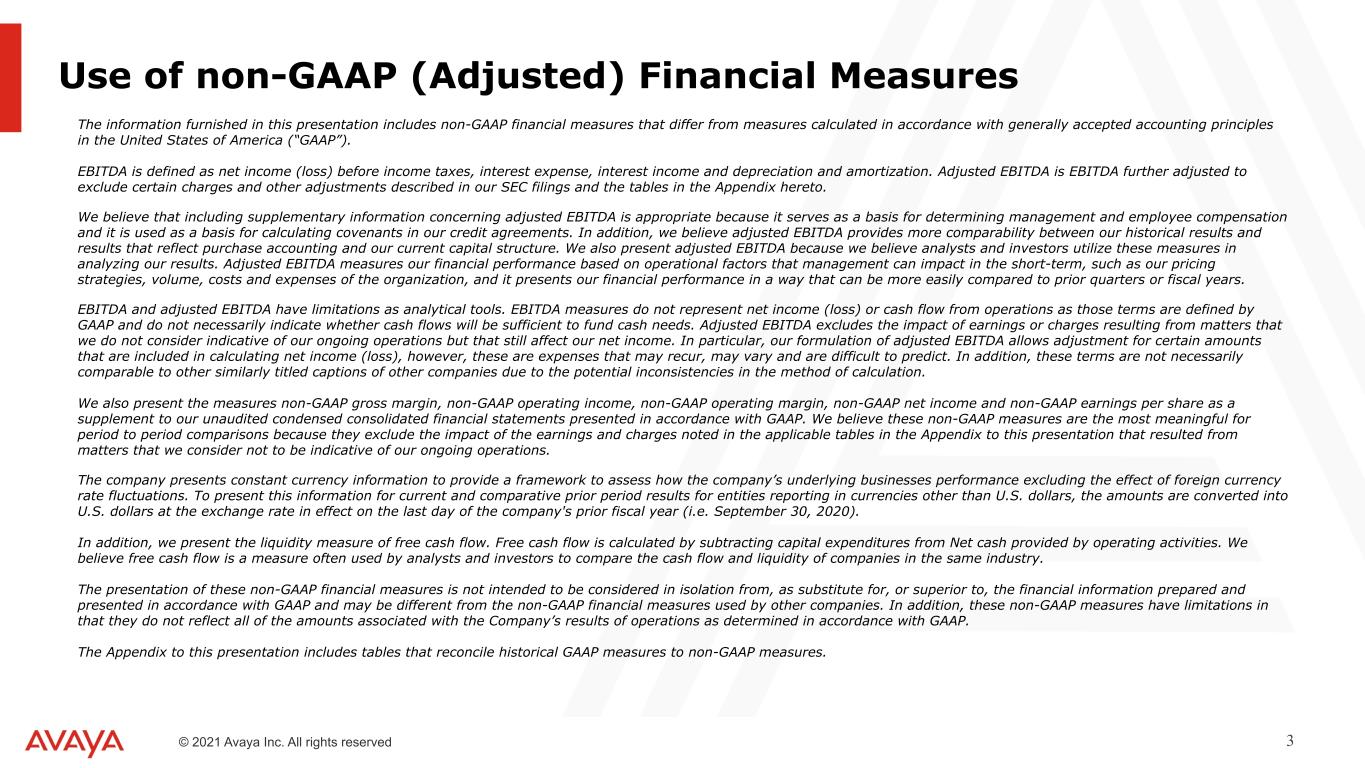

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 3 Use of non-GAAP (Adjusted) Financial Measures The information furnished in this presentation includes non-GAAP financial measures that differ from measures calculated in accordance with generally accepted accounting principles in the United States of America (“GAAP”). EBITDA is defined as net income (loss) before income taxes, interest expense, interest income and depreciation and amortization. Adjusted EBITDA is EBITDA further adjusted to exclude certain charges and other adjustments described in our SEC filings and the tables in the Appendix hereto. We believe that including supplementary information concerning adjusted EBITDA is appropriate because it serves as a basis for determining management and employee compensation and it is used as a basis for calculating covenants in our credit agreements. In addition, we believe adjusted EBITDA provides more comparability between our historical results and results that reflect purchase accounting and our current capital structure. We also present adjusted EBITDA because we believe analysts and investors utilize these measures in analyzing our results. Adjusted EBITDA measures our financial performance based on operational factors that management can impact in the short-term, such as our pricing strategies, volume, costs and expenses of the organization, and it presents our financial performance in a way that can be more easily compared to prior quarters or fiscal years. EBITDA and adjusted EBITDA have limitations as analytical tools. EBITDA measures do not represent net income (loss) or cash flow from operations as those terms are defined by GAAP and do not necessarily indicate whether cash flows will be sufficient to fund cash needs. Adjusted EBITDA excludes the impact of earnings or charges resulting from matters that we do not consider indicative of our ongoing operations but that still affect our net income. In particular, our formulation of adjusted EBITDA allows adjustment for certain amounts that are included in calculating net income (loss), however, these are expenses that may recur, may vary and are difficult to predict. In addition, these terms are not necessarily comparable to other similarly titled captions of other companies due to the potential inconsistencies in the method of calculation. We also present the measures non-GAAP gross margin, non-GAAP operating income, non-GAAP operating margin, non-GAAP net income and non-GAAP earnings per share as a supplement to our unaudited condensed consolidated financial statements presented in accordance with GAAP. We believe these non-GAAP measures are the most meaningful for period to period comparisons because they exclude the impact of the earnings and charges noted in the applicable tables in the Appendix to this presentation that resulted from matters that we consider not to be indicative of our ongoing operations. The company presents constant currency information to provide a framework to assess how the company’s underlying businesses performance excluding the effect of foreign currency rate fluctuations. To present this information for current and comparative prior period results for entities reporting in currencies other than U.S. dollars, the amounts are converted into U.S. dollars at the exchange rate in effect on the last day of the company's prior fiscal year (i.e. September 30, 2020). In addition, we present the liquidity measure of free cash flow. Free cash flow is calculated by subtracting capital expenditures from Net cash provided by operating activities. We believe free cash flow is a measure often used by analysts and investors to compare the cash flow and liquidity of companies in the same industry. The presentation of these non-GAAP financial measures is not intended to be considered in isolation from, as substitute for, or superior to, the financial information prepared and presented in accordance with GAAP and may be different from the non-GAAP financial measures used by other companies. In addition, these non-GAAP measures have limitations in that they do not reflect all of the amounts associated with the Company’s results of operations as determined in accordance with GAAP. The Appendix to this presentation includes tables that reconcile historical GAAP measures to non-GAAP measures.

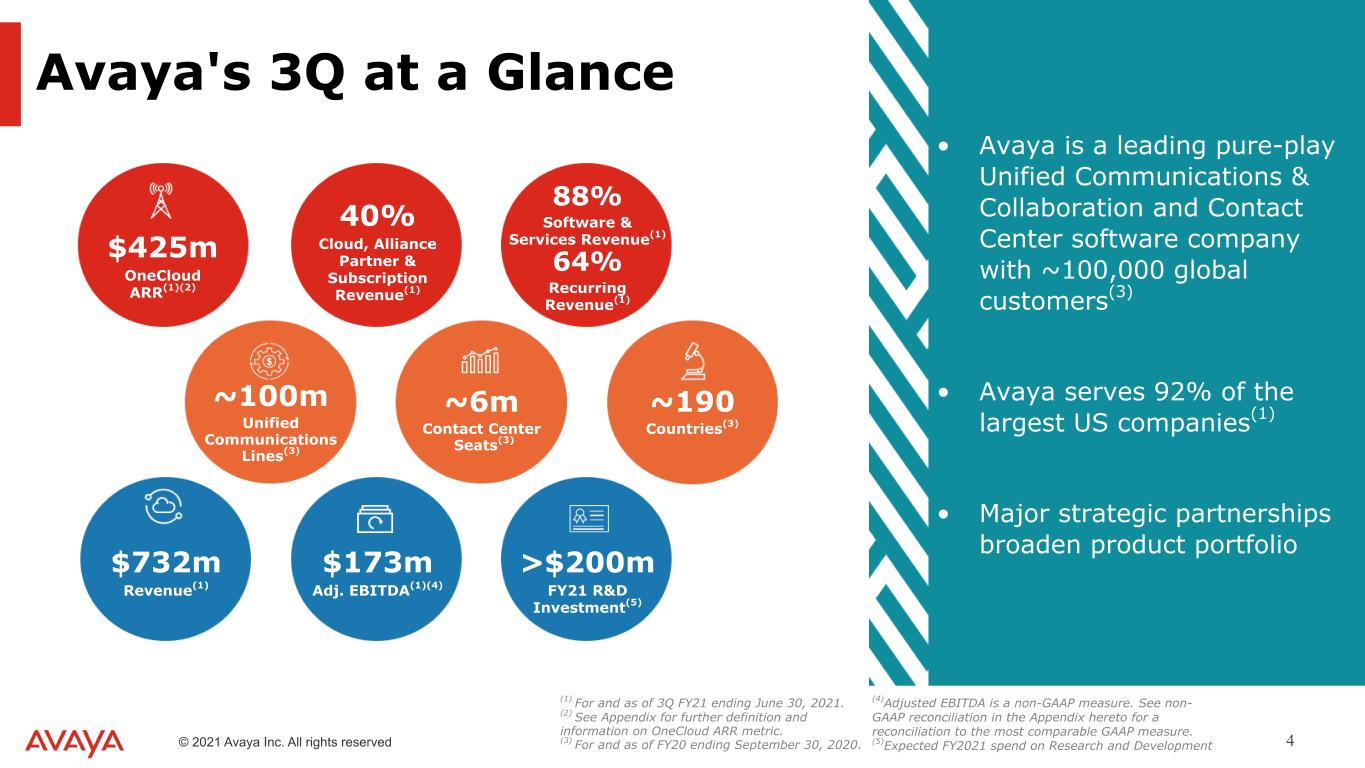

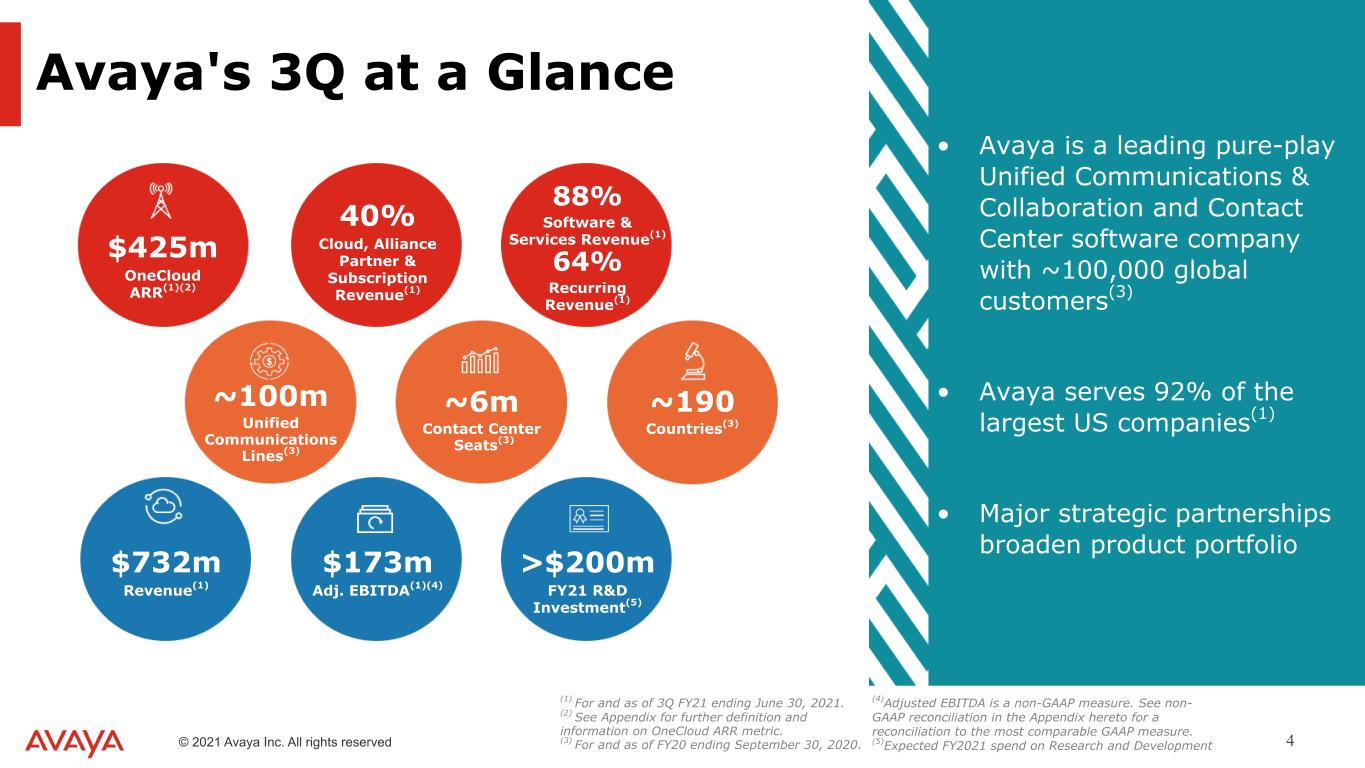

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 4 $173m Adj. EBITDA(1)(4) ~100m Unified Communications Lines(3) ~190 Countries(3) ~6m Contact Center Seats(3) (1) For and as of 3Q FY21 ending June 30, 2021. (2) See Appendix for further definition and information on OneCloud ARR metric. (3) For and as of FY20 ending September 30, 2020. $732m Revenue(1) >$200m FY21 R&D Investment(5) $425m OneCloud ARR(1)(2) • Avaya is a leading pure-play Unified Communications & Collaboration and Contact Center software company with ~100,000 global customers(3) • Avaya serves 92% of the largest US companies(1) • Major strategic partnerships broaden product portfolio Avaya's 3Q at a Glance 40% Cloud, Alliance Partner & Subscription Revenue(1) (4)Adjusted EBITDA is a non-GAAP measure. See non- GAAP reconciliation in the Appendix hereto for a reconciliation to the most comparable GAAP measure. (5)Expected FY2021 spend on Research and Development 88% Software & Services Revenue(1) 64% Recurring Revenue(1)

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 5 Arc of Avaya's Journey

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 6 Business Model Evolution

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 7 Source: Avaya management analysis derived from third party industry estimates Note: Charts not to scale against each other Note: Excludes Services and Devices TAMs of $22.3B and $18.3B in 2019 and 2023, respectively

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 8

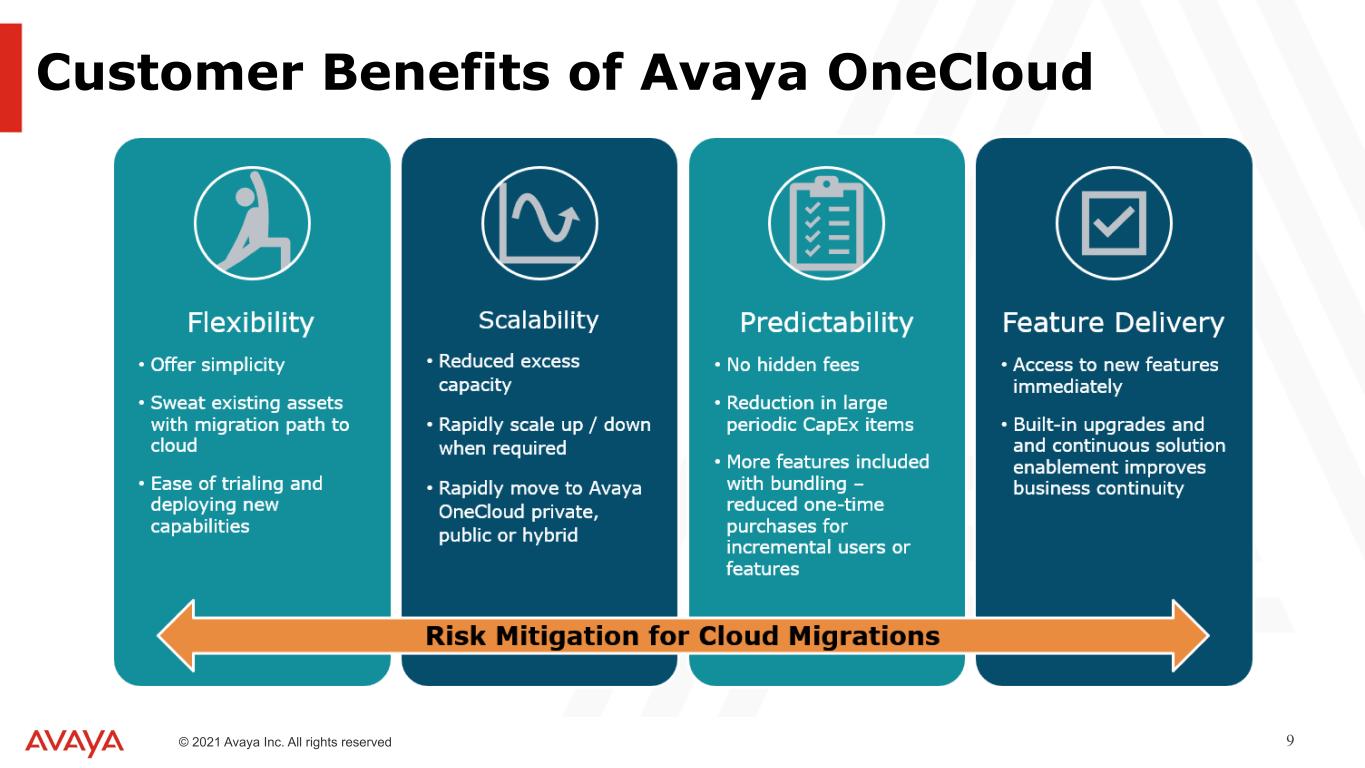

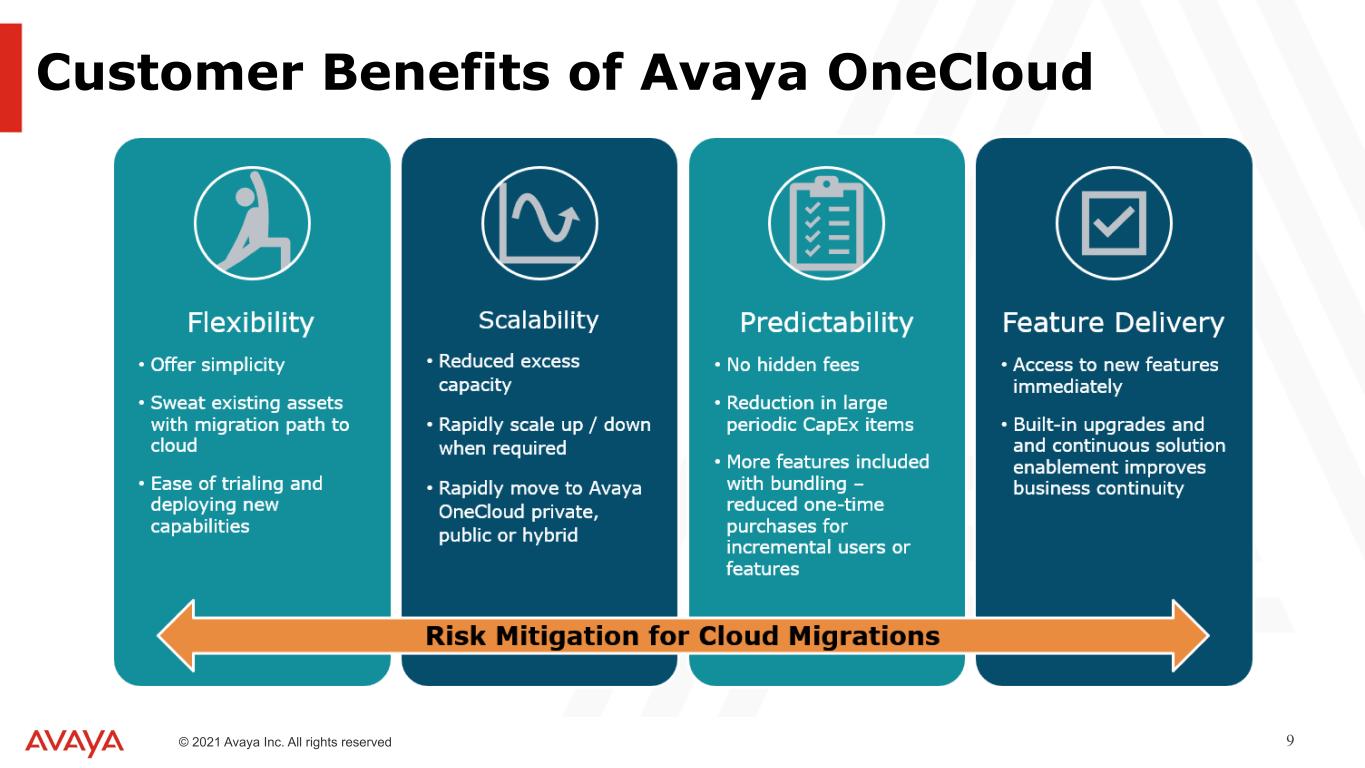

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 9 Customer Benefits of Avaya OneCloud

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 10 ESG – Enhancing Sustainable Value in an Evolving Landscape

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 11

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 12 Financial Overview 3Q FY21

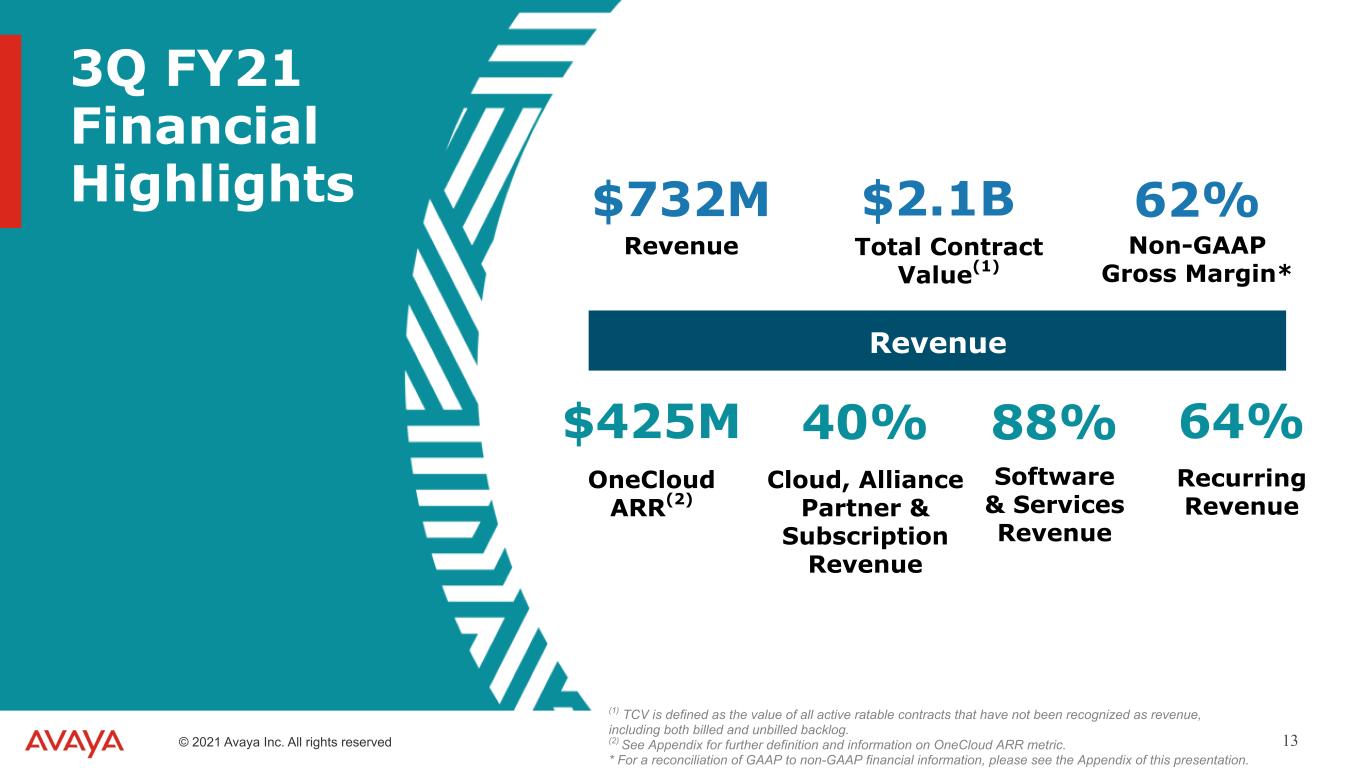

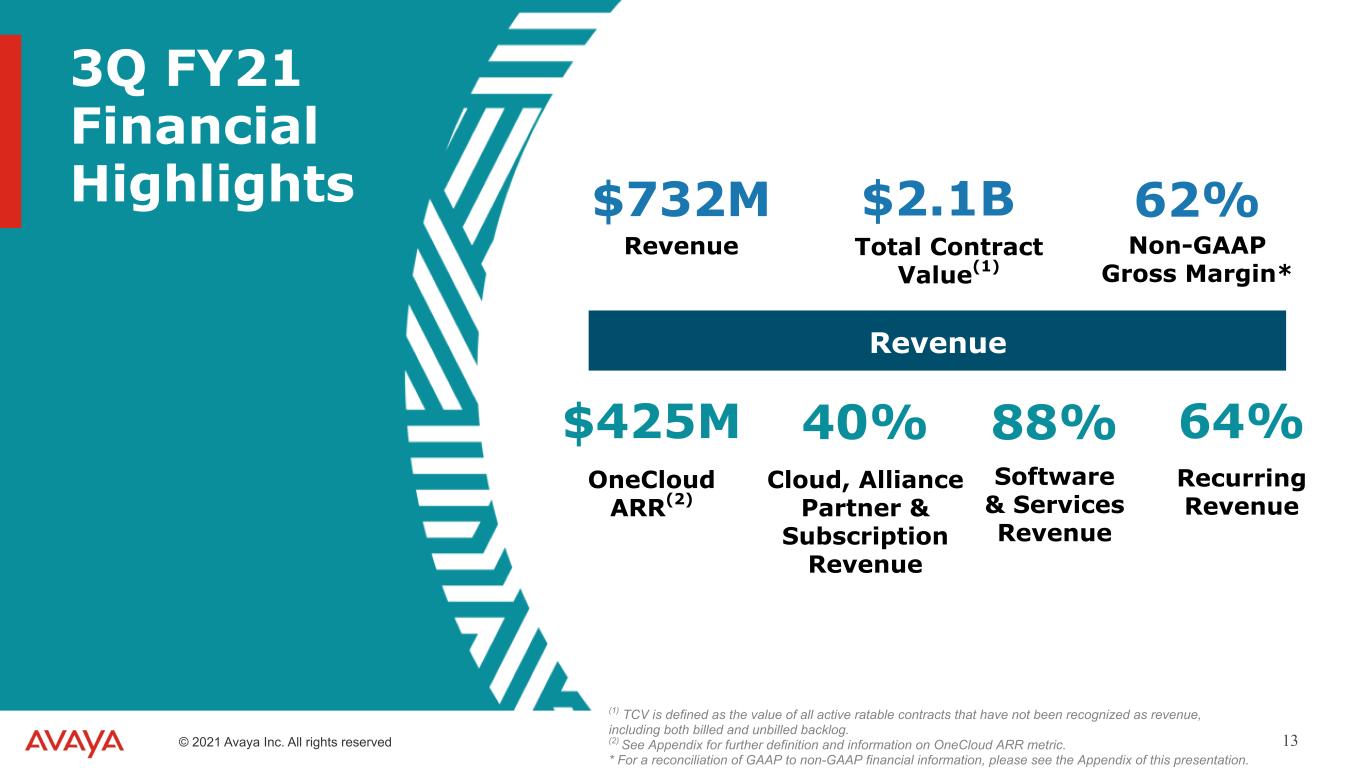

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 13 3Q FY21 Financial Highlights OneCloud ARR(2) Recurring Revenue Cloud, Alliance Partner & Subscription Revenue $425M 64%40% Revenue Total Contract Value(1) Non-GAAP Gross Margin* 62%$2.1B$732M Revenue Software & Services Revenue 88% (1) TCV is defined as the value of all active ratable contracts that have not been recognized as revenue, including both billed and unbilled backlog. (2) See Appendix for further definition and information on OneCloud ARR metric. * For a reconciliation of GAAP to non-GAAP financial information, please see the Appendix of this presentation.

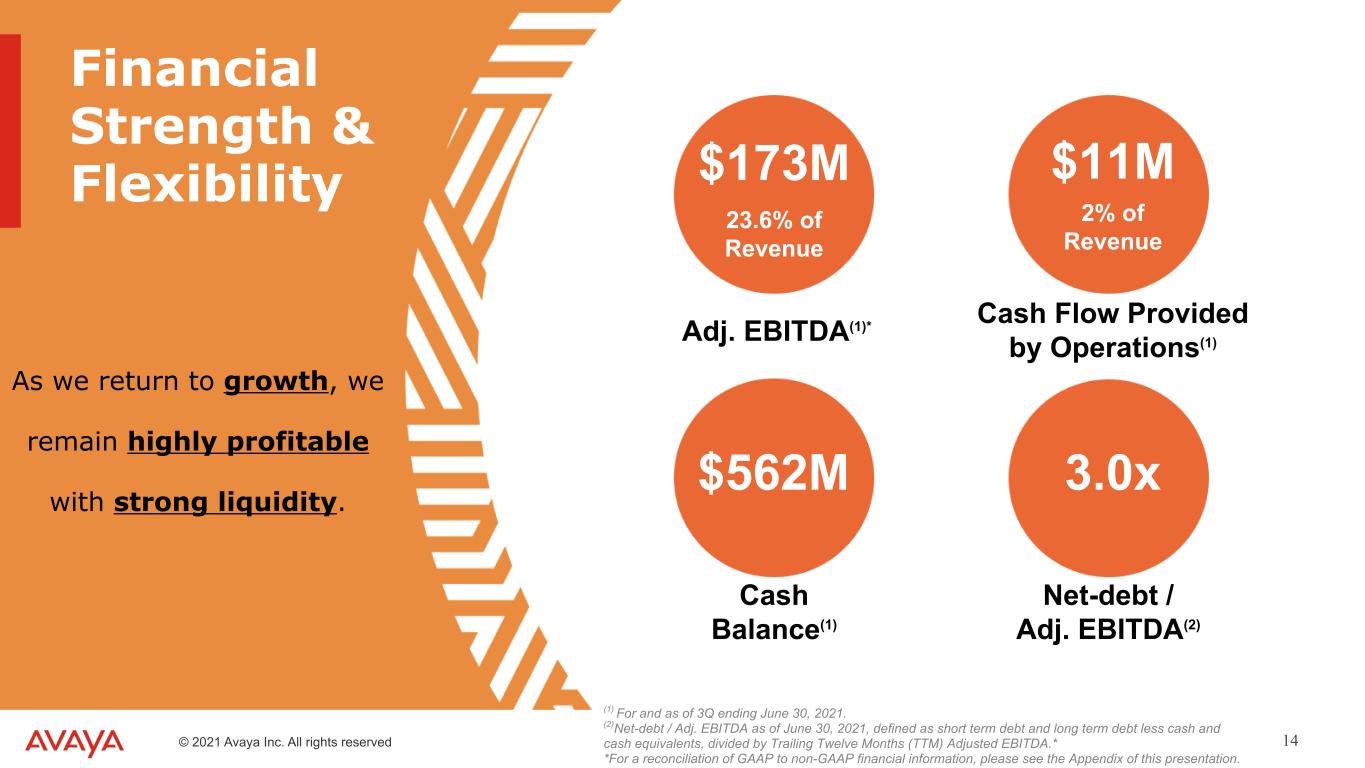

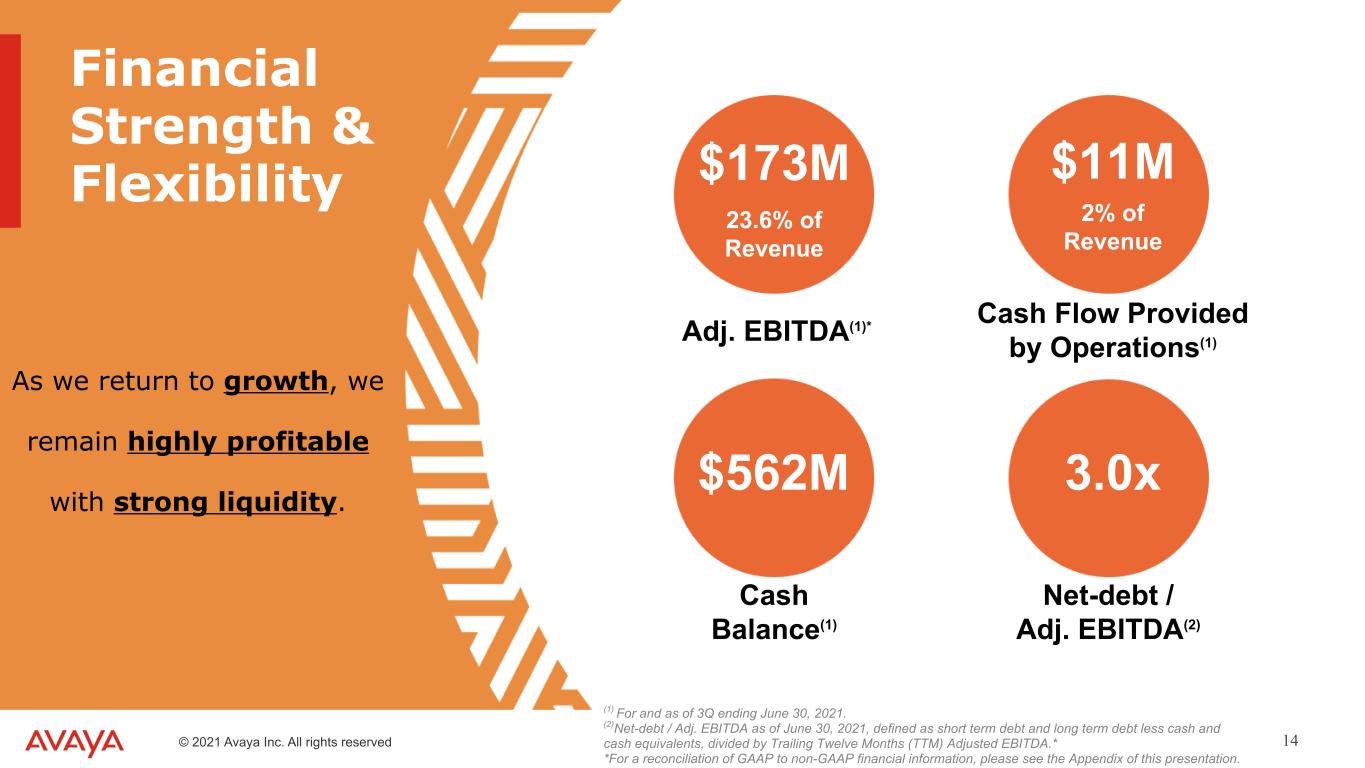

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 14 $173M 23.6% of Revenue $562M 3.0x As we return to growth, we remain highly profitable with strong liquidity. (1) For and as of 3Q ending June 30, 2021. (2)Net-debt / Adj. EBITDA as of June 30, 2021, defined as short term debt and long term debt less cash and cash equivalents, divided by Trailing Twelve Months (TTM) Adjusted EBITDA.* *For a reconciliation of GAAP to non-GAAP financial information, please see the Appendix of this presentation. $11M 2% of Revenue Financial Strength & Flexibility Adj. EBITDA(1)* Cash Flow Provided by Operations(1) Cash Balance(1) Net-debt / Adj. EBITDA(2)

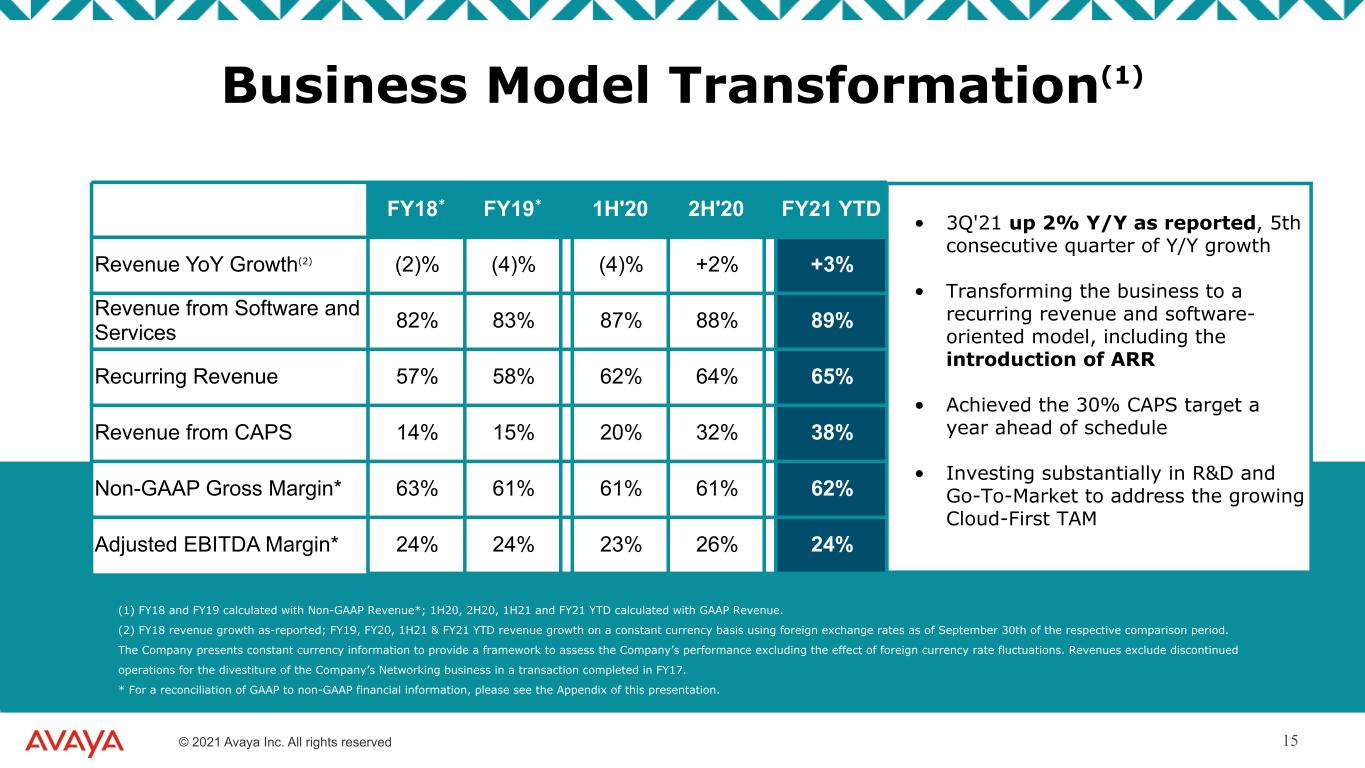

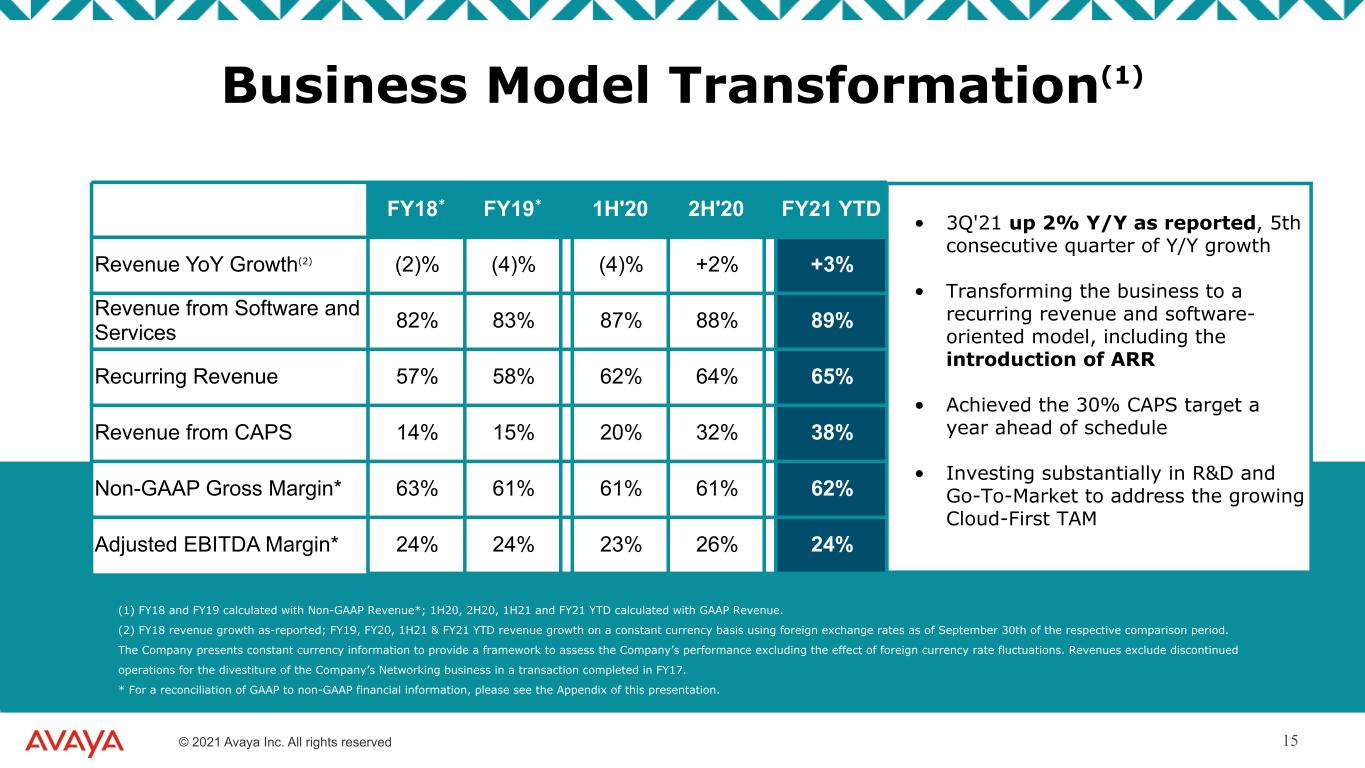

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 15 • 3Q'21 up 2% Y/Y as reported, 5th consecutive quarter of Y/Y growth • Transforming the business to a recurring revenue and software- oriented model, including the introduction of ARR • Achieved the 30% CAPS target a year ahead of schedule • Investing substantially in R&D and Go-To-Market to address the growing Cloud-First TAM FY18* FY19* 1H'20 2H'20 FY21 YTD Revenue YoY Growth(2) (2)% (4)% (4)% +2% +3% Revenue from Software and Services 82% 83% 87% 88% 89% Recurring Revenue 57% 58% 62% 64% 65% Revenue from CAPS 14% 15% 20% 32% 38% Non-GAAP Gross Margin* 63% 61% 61% 61% 62% Adjusted EBITDA Margin* 24% 24% 23% 26% 24% Business Model Transformation(1) (1) FY18 and FY19 calculated with Non-GAAP Revenue*; 1H20, 2H20, 1H21 and FY21 YTD calculated with GAAP Revenue. (2) FY18 revenue growth as-reported; FY19, FY20, 1H21 & FY21 YTD revenue growth on a constant currency basis using foreign exchange rates as of September 30th of the respective comparison period. The Company presents constant currency information to provide a framework to assess the Company’s performance excluding the effect of foreign currency rate fluctuations. Revenues exclude discontinued operations for the divestiture of the Company’s Networking business in a transaction completed in FY17. * For a reconciliation of GAAP to non-GAAP financial information, please see the Appendix of this presentation.

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 16 FY19 15% FY20 26% 3Q'19 16% 3Q'20 30% 3Q'21 40% OneCloud ARR Growth ($M) $35 $47 $69 $113 $191 $262 $344 $425 OneCloud ARR > $1M ARR 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21 2Q'21 3Q'21 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 CAPS as % Revenue See Appendix for further definition and information on OneCloud ARR metric. All Other CAPS Cloud & ARR Growth FY21 YTD 38%

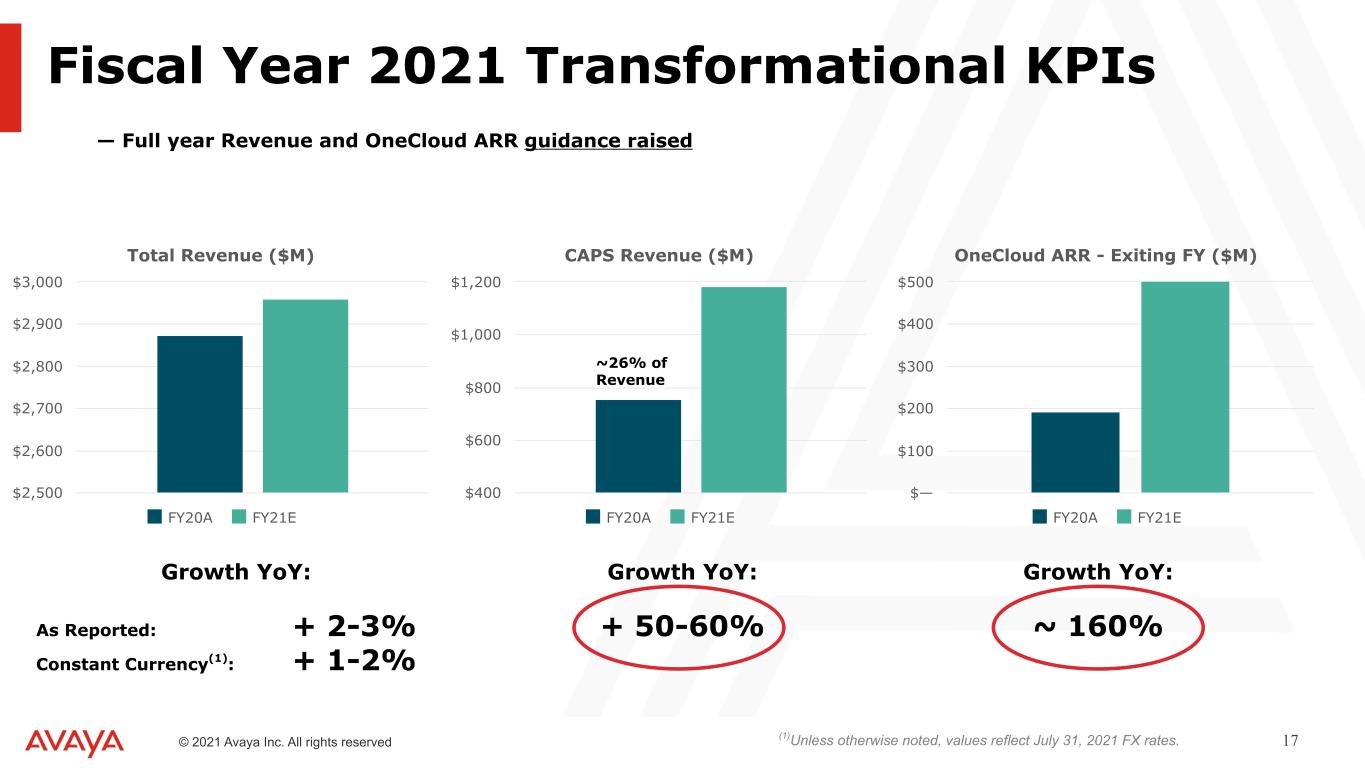

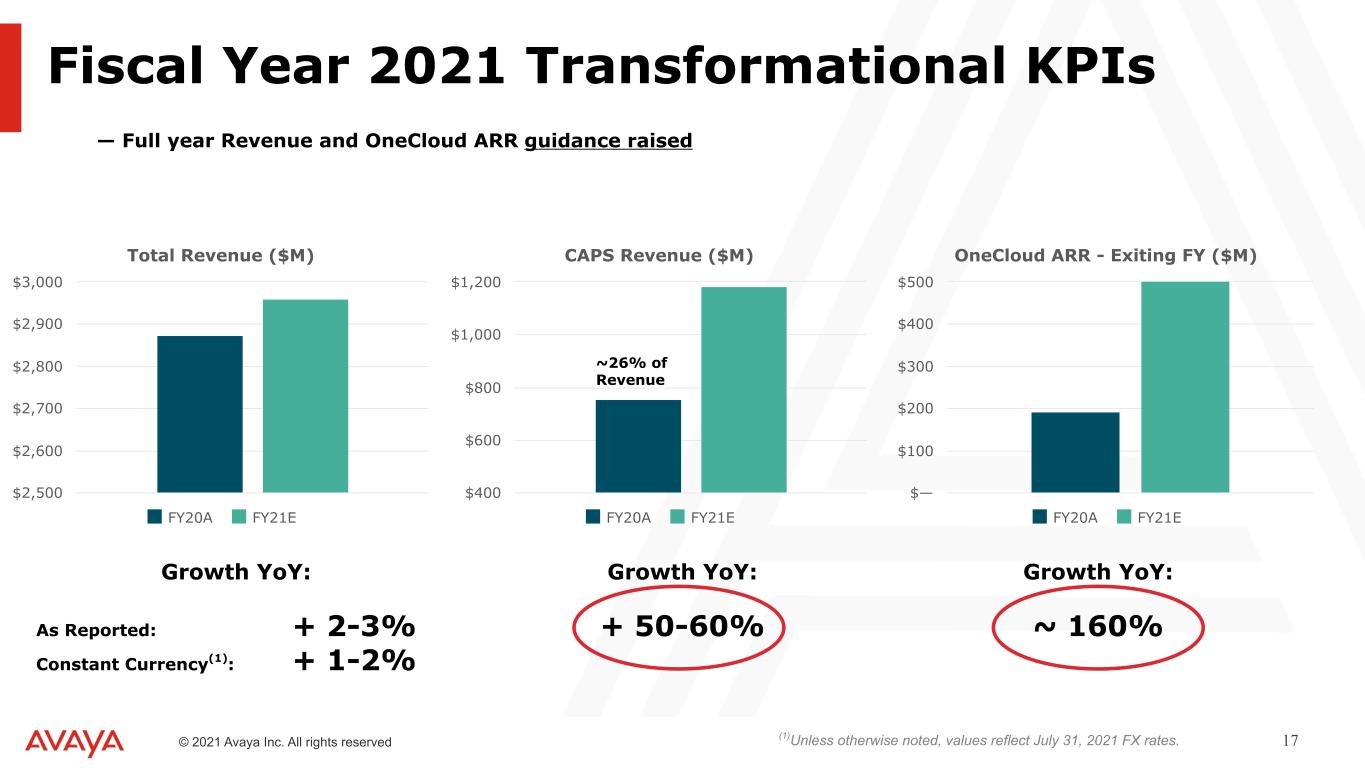

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 17 Fiscal Year 2021 Transformational KPIs — Full year Revenue and OneCloud ARR guidance raised Total Revenue ($M) FY20A FY21E $2,500 $2,600 $2,700 $2,800 $2,900 $3,000 CAPS Revenue ($M) FY20A FY21E $400 $600 $800 $1,000 $1,200 OneCloud ARR - Exiting FY ($M) FY20A FY21E $— $100 $200 $300 $400 $500 ~26% of Revenue Growth YoY: As Reported: + 2-3% Constant Currency(1): + 1-2% Growth YoY: + 50-60% Growth YoY: ~ 160% (1)Unless otherwise noted, values reflect July 31, 2021 FX rates.

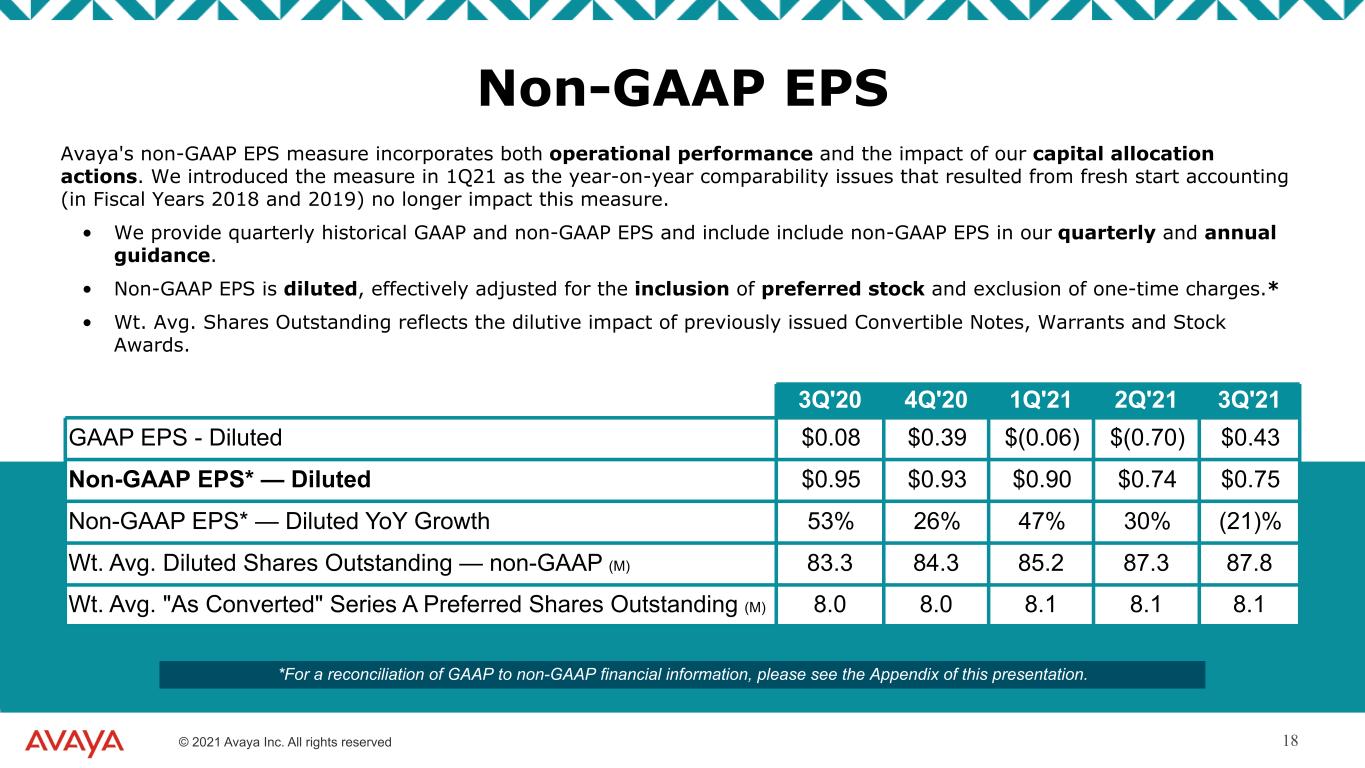

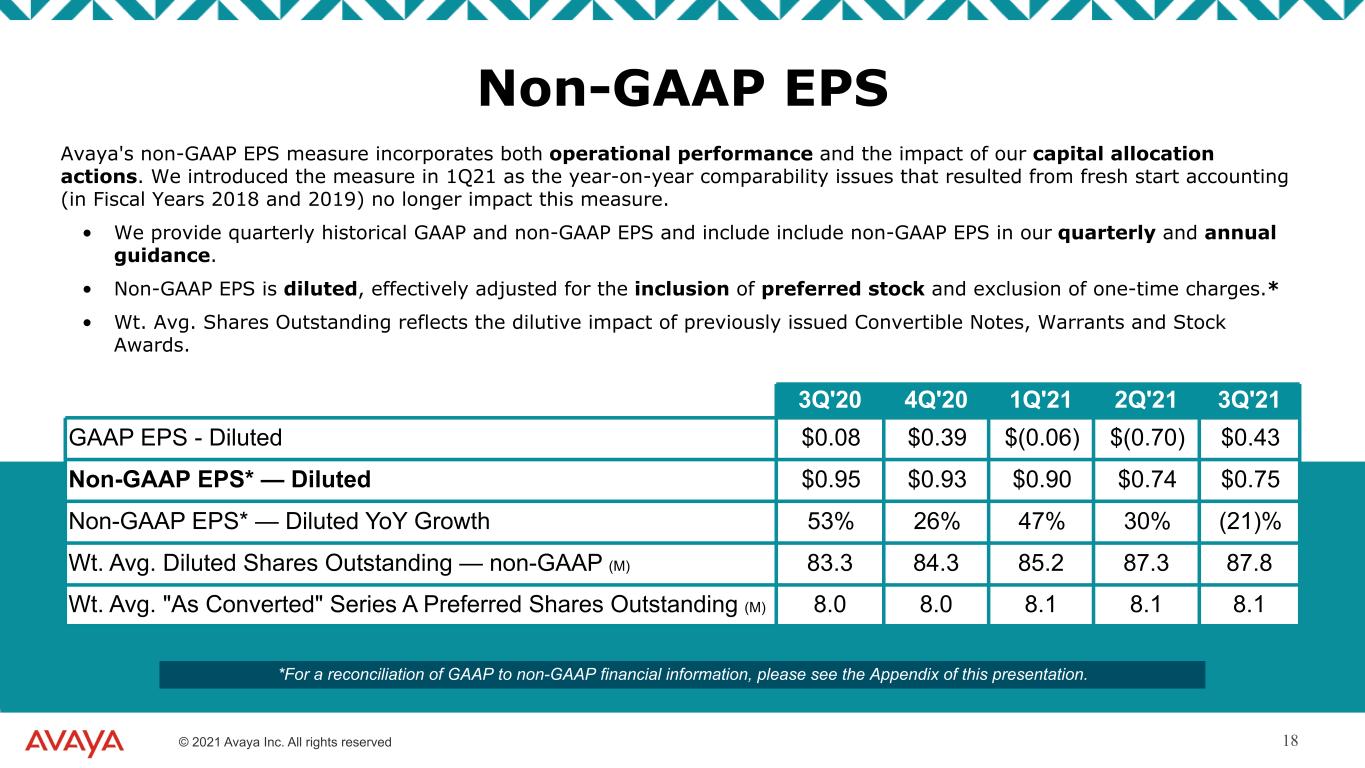

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 18 3Q'20 4Q'20 1Q'21 2Q'21 3Q'21 GAAP EPS - Diluted $0.08 $0.39 $(0.06) $(0.70) $0.43 Non-GAAP EPS* — Diluted $0.95 $0.93 $0.90 $0.74 $0.75 Non-GAAP EPS* — Diluted YoY Growth 53% 26% 47% 30% (21)% Wt. Avg. Diluted Shares Outstanding — non-GAAP (M) 83.3 84.3 85.2 87.3 87.8 Wt. Avg. "As Converted" Series A Preferred Shares Outstanding (M) 8.0 8.0 8.1 8.1 8.1 Non-GAAP EPS Avaya's non-GAAP EPS measure incorporates both operational performance and the impact of our capital allocation actions. We introduced the measure in 1Q21 as the year-on-year comparability issues that resulted from fresh start accounting (in Fiscal Years 2018 and 2019) no longer impact this measure. • We provide quarterly historical GAAP and non-GAAP EPS and include include non-GAAP EPS in our quarterly and annual guidance. • Non-GAAP EPS is diluted, effectively adjusted for the inclusion of preferred stock and exclusion of one-time charges.* • Wt. Avg. Shares Outstanding reflects the dilutive impact of previously issued Convertible Notes, Warrants and Stock Awards. *For a reconciliation of GAAP to non-GAAP financial information, please see the Appendix of this presentation.

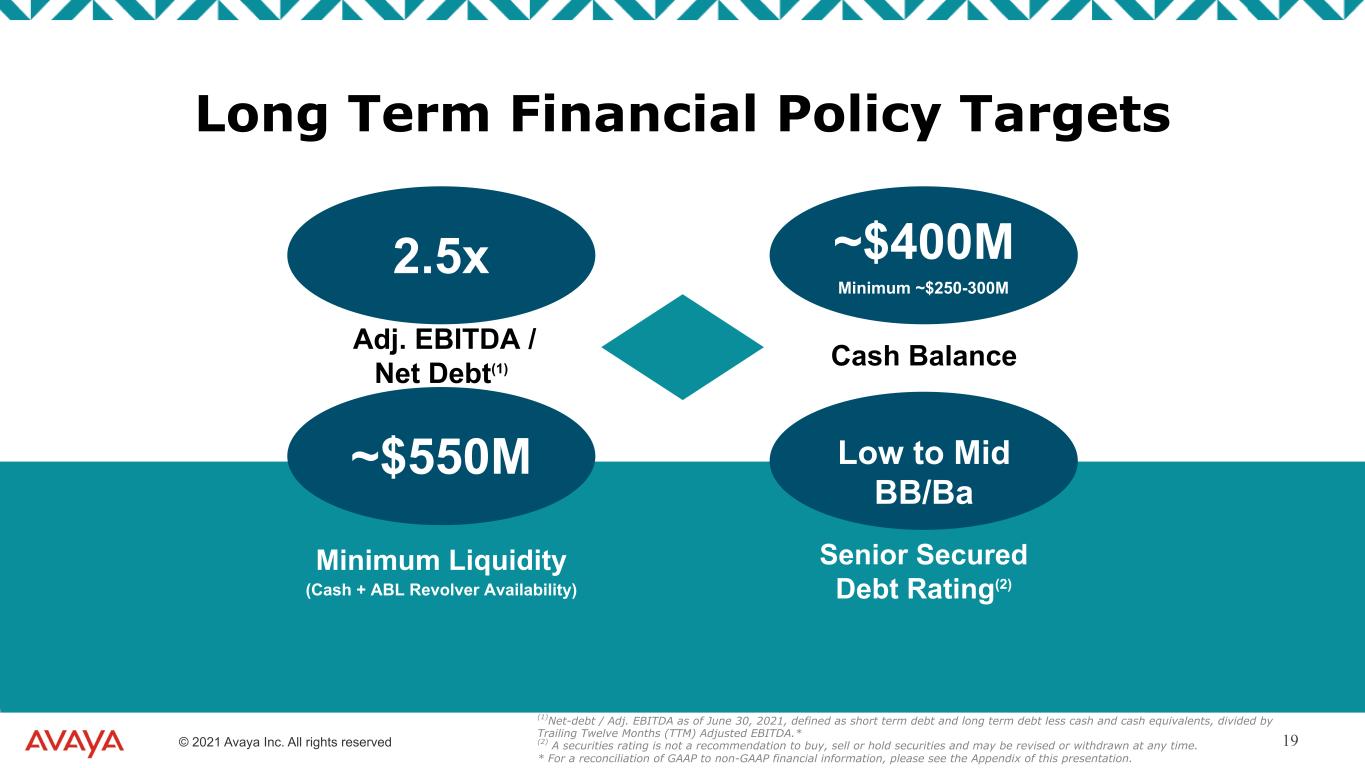

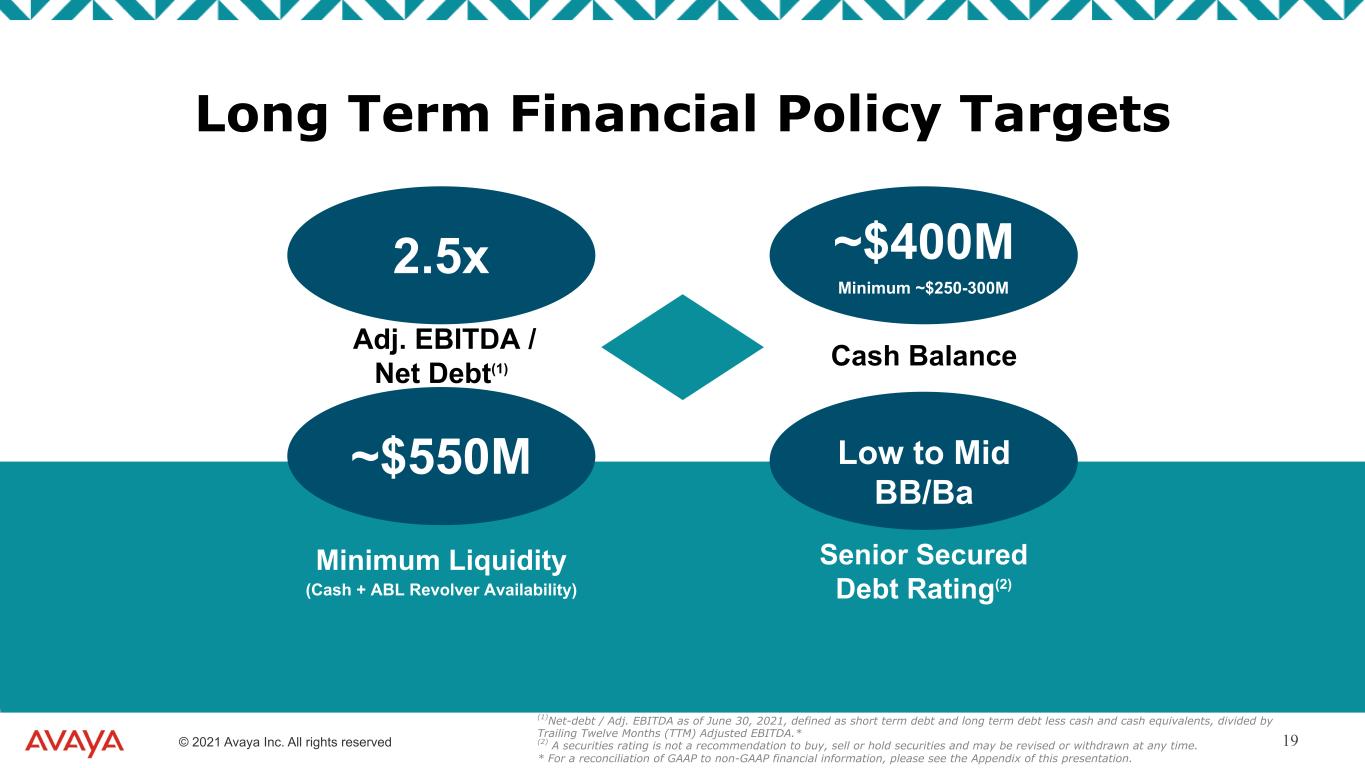

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 19 2.5x ~$550M Low to Mid BB/Ba ~$400M Adj. EBITDA / Net Debt(1) Cash Balance Minimum Liquidity (Cash + ABL Revolver Availability) Senior Secured Debt Rating(2) Minimum ~$250-300M (1)Net-debt / Adj. EBITDA as of June 30, 2021, defined as short term debt and long term debt less cash and cash equivalents, divided by Trailing Twelve Months (TTM) Adjusted EBITDA.* (2) A securities rating is not a recommendation to buy, sell or hold securities and may be revised or withdrawn at any time. * For a reconciliation of GAAP to non-GAAP financial information, please see the Appendix of this presentation. Long Term Financial Policy Targets

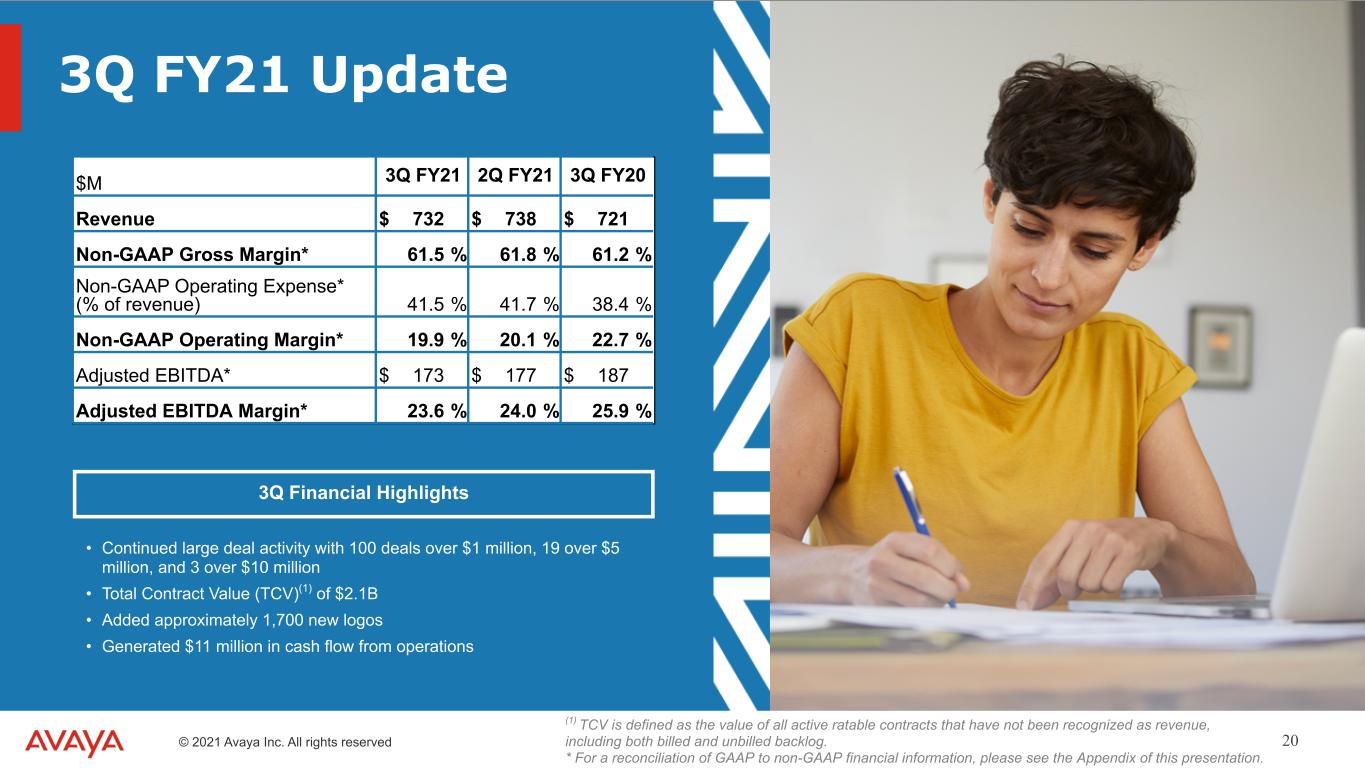

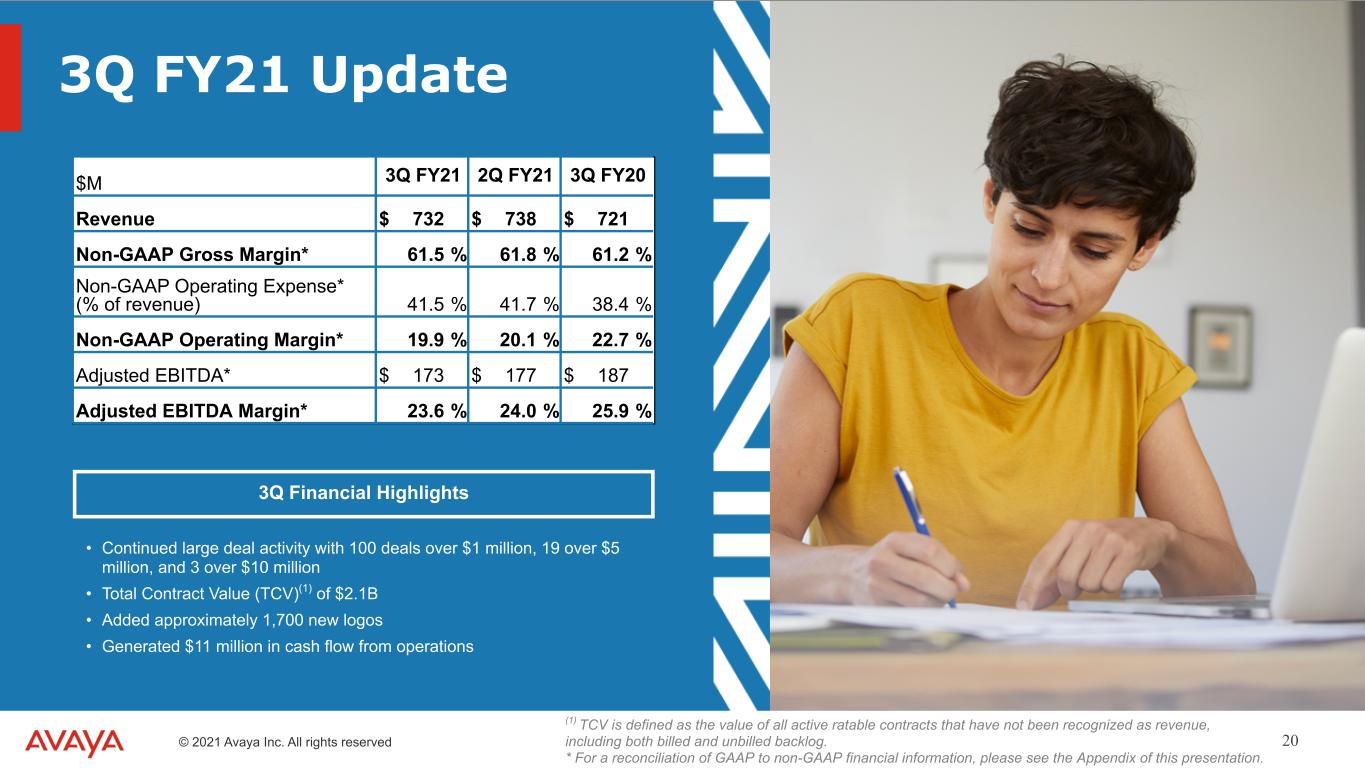

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 20 3Q Financial Highlights $M 3Q FY21 2Q FY21 3Q FY20 Revenue $ 732 $ 738 $ 721 Non-GAAP Gross Margin* 61.5 % 61.8 % 61.2 % Non-GAAP Operating Expense* (% of revenue) 41.5 % 41.7 % 38.4 % Non-GAAP Operating Margin* 19.9 % 20.1 % 22.7 % Adjusted EBITDA* $ 173 $ 177 $ 187 Adjusted EBITDA Margin* 23.6 % 24.0 % 25.9 % • Continued large deal activity with 100 deals over $1 million, 19 over $5 million, and 3 over $10 million • Total Contract Value (TCV)(1) of $2.1B • Added approximately 1,700 new logos • Generated $11 million in cash flow from operations (1) TCV is defined as the value of all active ratable contracts that have not been recognized as revenue, including both billed and unbilled backlog. * For a reconciliation of GAAP to non-GAAP financial information, please see the Appendix of this presentation. 3Q FY21 Update

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 21 Business Highlights ▪ 9mobile, one of the largest telecoms operators in Nigeria, has moved 1,500 users to Avaya OneCloud Subscription as the first step in delivering a flexible, multichannel contact center experience to customers. ▪ Agnes Scott College selected Avaya Cloud Office for its more than 1,000 users, citing affordability, a more modern experience, and compliance as key decision factors. ▪ The Atlanta Group, part of the worldwide Ardonagh Group and one of the largest and fastest-growing brokers in the UK insurance market, is using Avaya OneCloud CCaaS to deliver a single-agent experience, regardless of location. Avaya expanded its footprint across the business, displacing competitive systems previously used within the specific brands of their portfolio. ▪ A customer in South America who runs a very large family compensation fund with more than 3.4 million users, signed an Avaya OneCloud Subscription contract to provide a total experience transformation for service users, including UC, multi-experience Contact Center applications, and video across social media and traditional channels. ▪ Avaya Cloud Office was selected by Empire State Realty Trust for over 500 users across their 14 retail and office locations. In a competitive deal, Empire State Realty Trust said that the flexibility, scalability and cost savings Avaya Cloud Office brings were the key reasons behind their decision. ▪ Avaya was identified as a Leader in The Aragon Research Globe for Video Conferencing 2021. ▪ Avaya has been designated an Innovative Vendor and a Value Index Leader in the Capability category, and ranked among the top five CCaaS providers overall in the Ventana Research ‘2021 Value Index for Contact Center in the Cloud.’ ▪ Avaya was named a Leader in The Aragon Research Globe for Unified Communications and Collaboration (UC&C) 2021. The evaluation was based on completeness of strategy and performance. ▪ Avaya was named a “Major Player” in the 2021 IDC MarketScape for the worldwide CPaaS (Communications Platform as a Service) market. Avaya OneCloud™ CPaaS enables organizations to create and deliver more memorable experiences by assembling and combining business capabilities to achieve the outcomes they need, in the moment, for their customers and their teams. 3Q FY21 Update

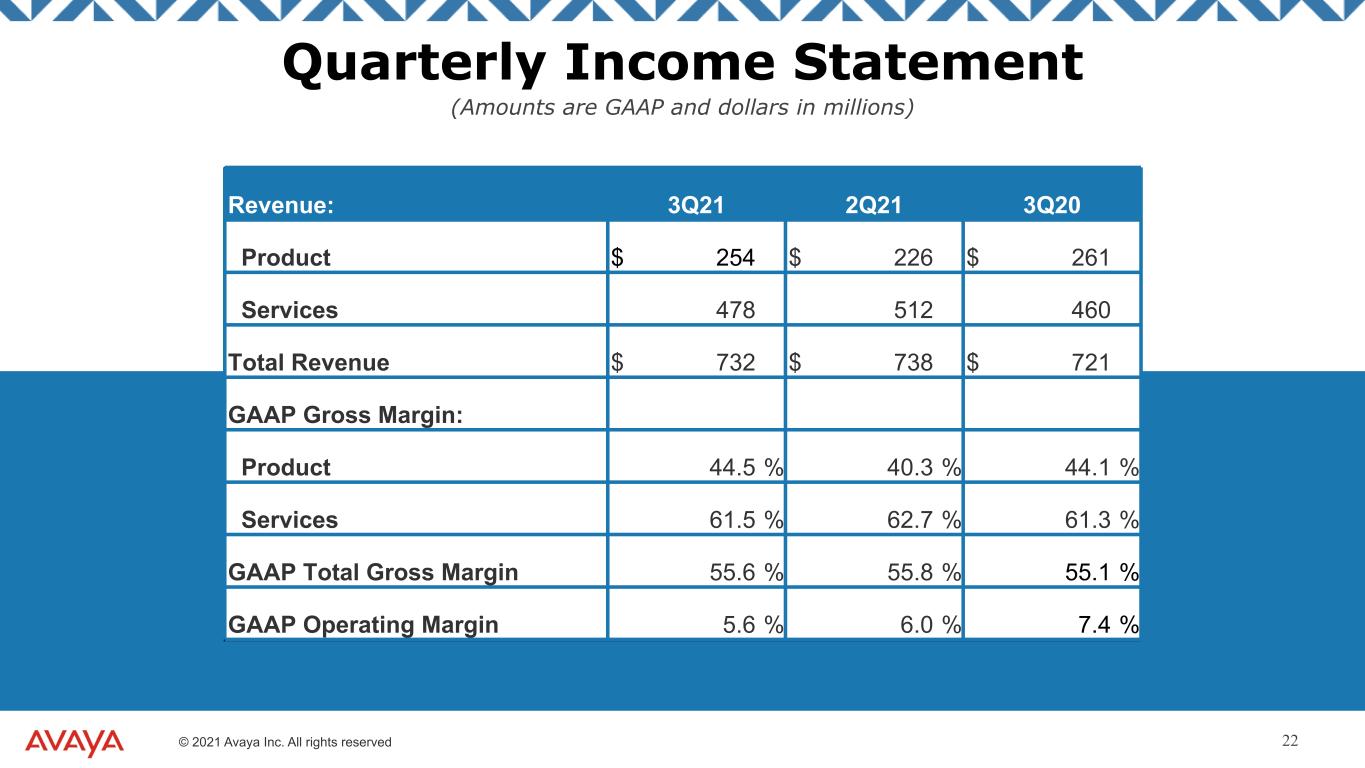

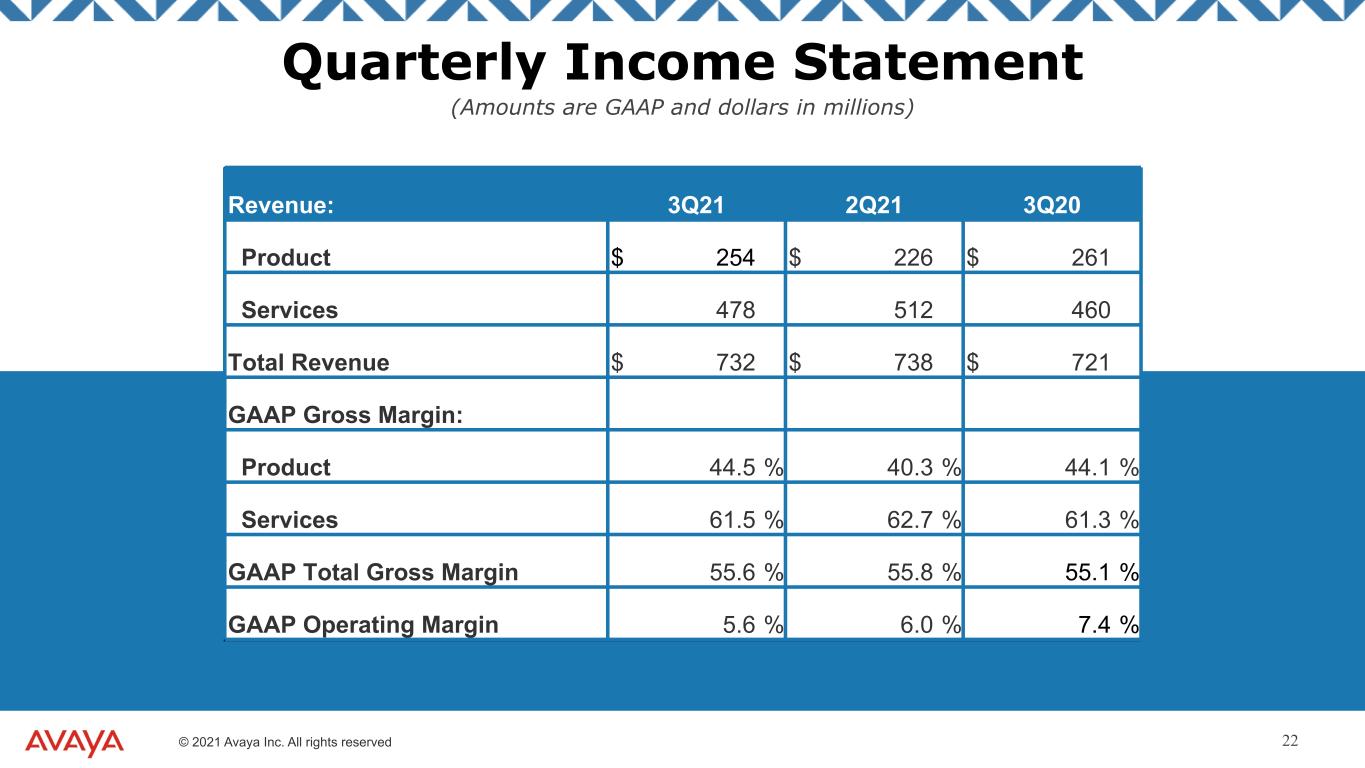

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 22 Revenue: 3Q21 2Q21 3Q20 Product $ 254 $ 226 $ 261 Services 478 512 460 Total Revenue $ 732 $ 738 $ 721 GAAP Gross Margin: Product 44.5 % 40.3 % 44.1 % Services 61.5 % 62.7 % 61.3 % GAAP Total Gross Margin 55.6 % 55.8 % 55.1 % GAAP Operating Margin 5.6 % 6.0 % 7.4 % Quarterly Income Statement (Amounts are GAAP and dollars in millions)

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 23 Uses of Cash 592 483 476 400 270 194 191 190 126 59 42 45 77 47 34 25 29 56 101 33 90 127 108 108 Net Cash Interest Payments Pension & Post Retirement Restructuring Cash Taxes Capex & Finance Lease (<3% of revenue) FY18A FY19A FY20A FY21E 0 100 200 300 400 500 600 700 ▪ All values in $M ▪ Net Cash Interest Payments includes interest payments on long-term debt and payments classified as adequate protection payments in connection with Chapter 11 proceedings, net of interest income ▪ Pension settlement payments to PBGC in connection with Chapter 11 proceedings not included within Pension & Post Retirement payments

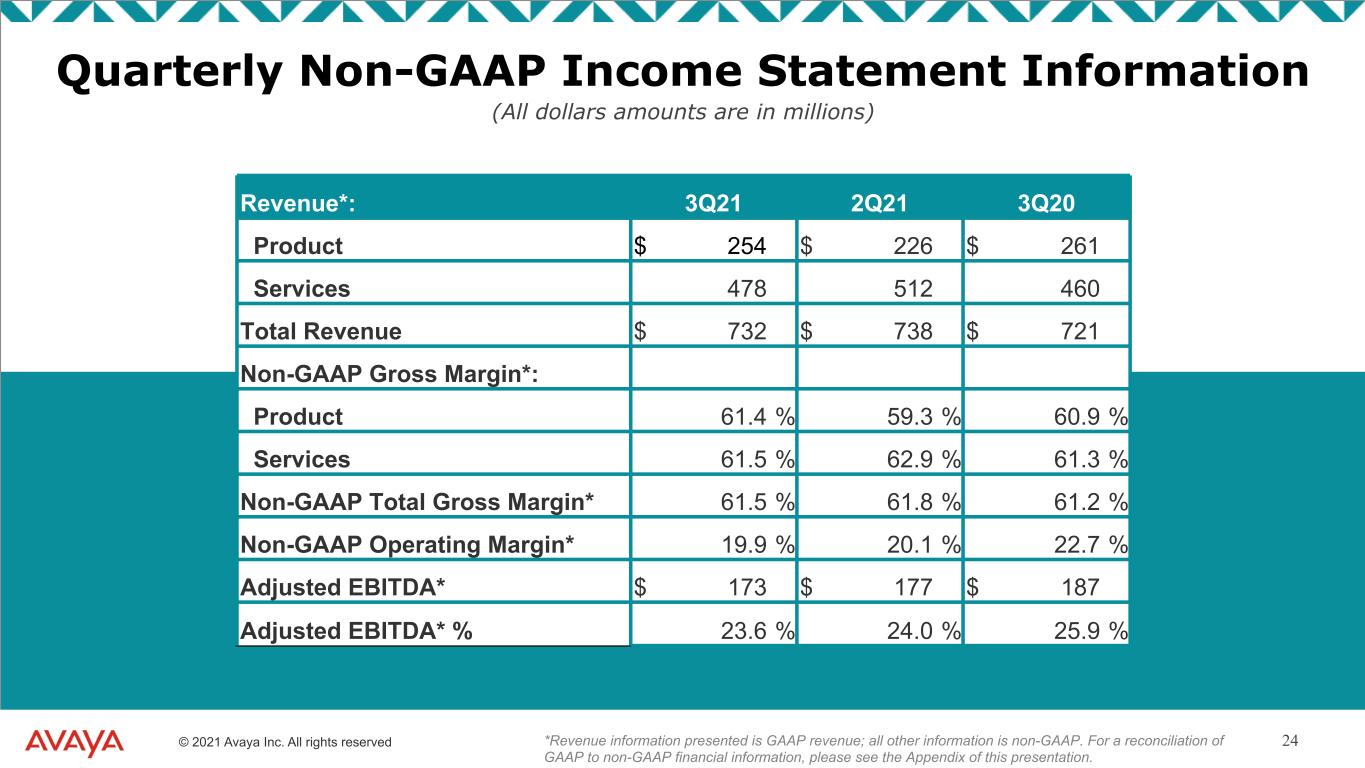

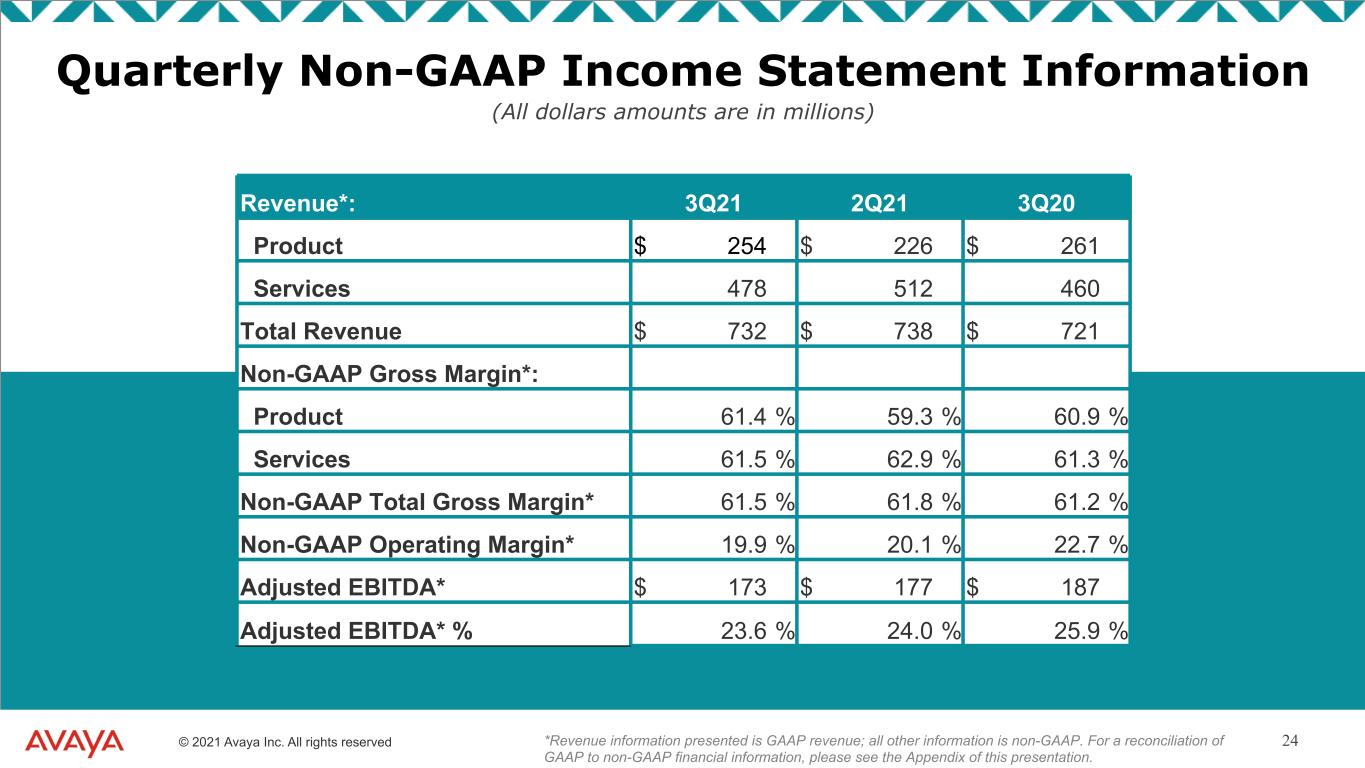

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 24 Revenue*: 3Q21 2Q21 3Q20 Product $ 254 $ 226 $ 261 Services 478 512 460 Total Revenue $ 732 $ 738 $ 721 Non-GAAP Gross Margin*: Product 61.4 % 59.3 % 60.9 % Services 61.5 % 62.9 % 61.3 % Non-GAAP Total Gross Margin* 61.5 % 61.8 % 61.2 % Non-GAAP Operating Margin* 19.9 % 20.1 % 22.7 % Adjusted EBITDA* $ 173 $ 177 $ 187 Adjusted EBITDA* % 23.6 % 24.0 % 25.9 % *Revenue information presented is GAAP revenue; all other information is non-GAAP. For a reconciliation of GAAP to non-GAAP financial information, please see the Appendix of this presentation. Quarterly Non-GAAP Income Statement Information (All dollars amounts are in millions)

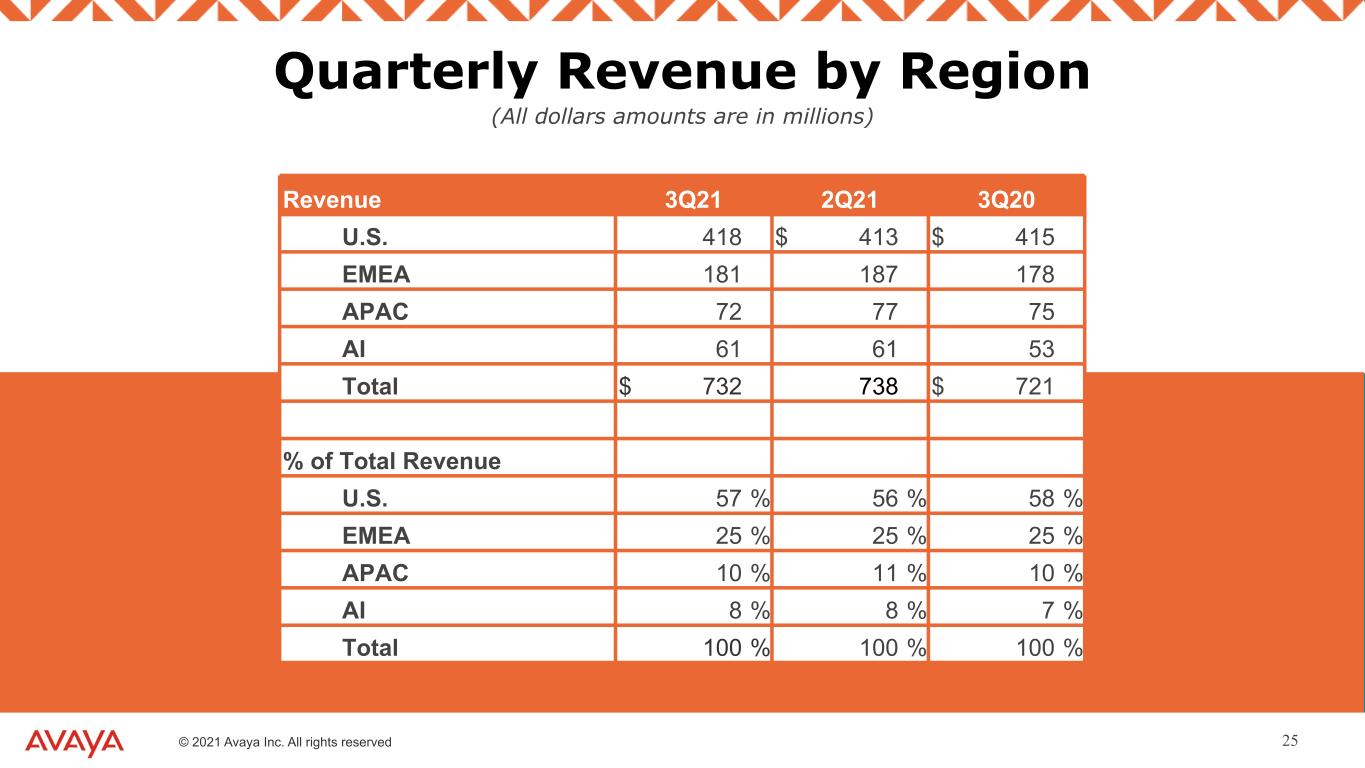

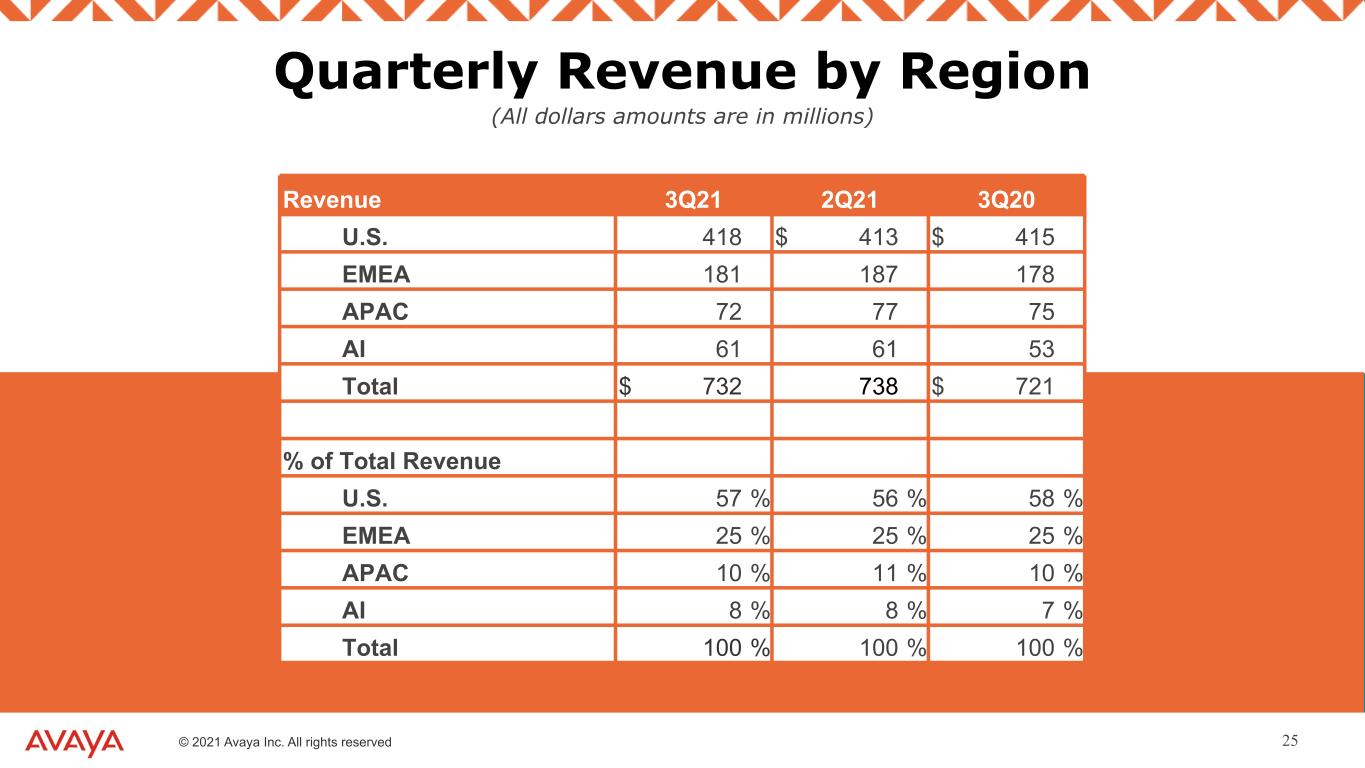

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 25 Quarterly Revenue by Region (All dollars amounts are in millions) Revenue 3Q21 2Q21 3Q20 U.S. 418 $ 413 $ 415 EMEA 181 187 178 APAC 72 77 75 AI 61 61 53 Total $ 732 738 $ 721 % of Total Revenue U.S. 57 % 56 % 58 % EMEA 25 % 25 % 25 % APAC 10 % 11 % 10 % AI 8 % 8 % 7 % Total 100 % 100 % 100 %

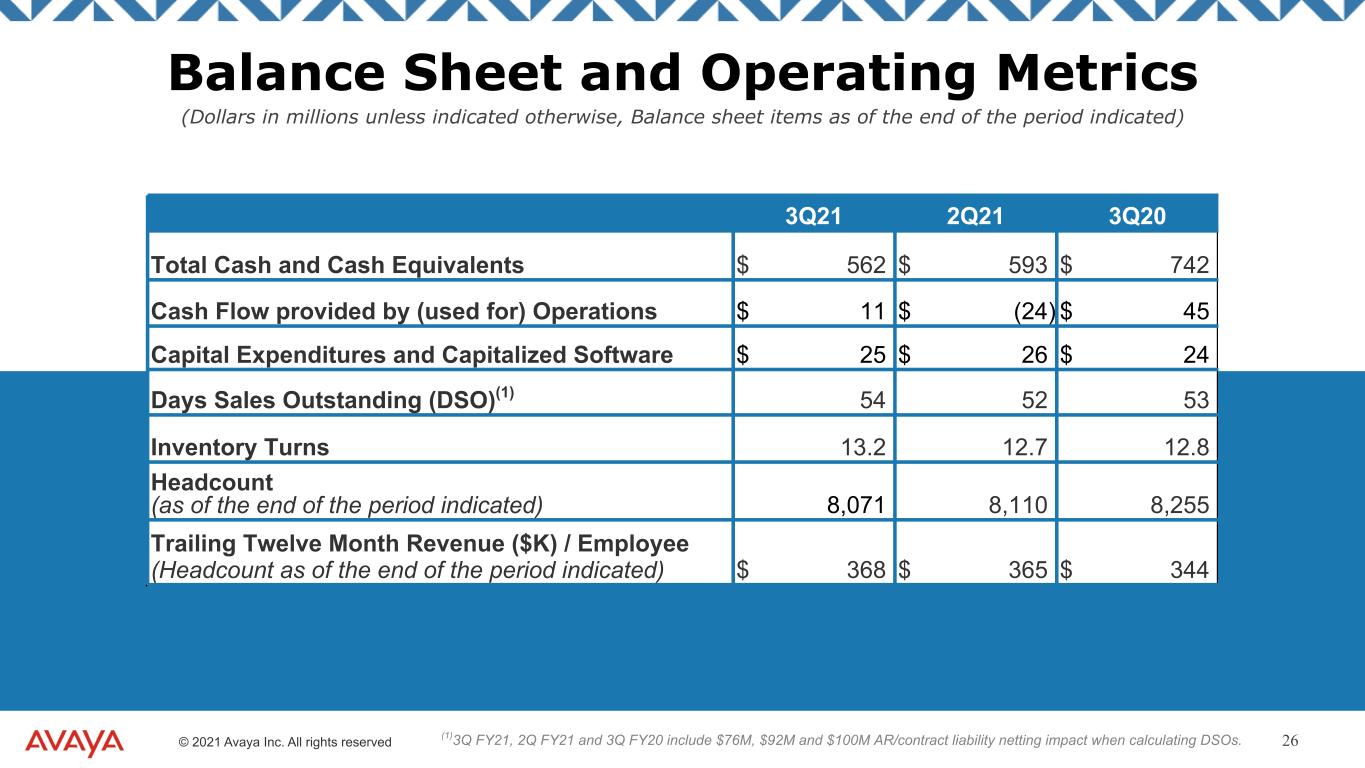

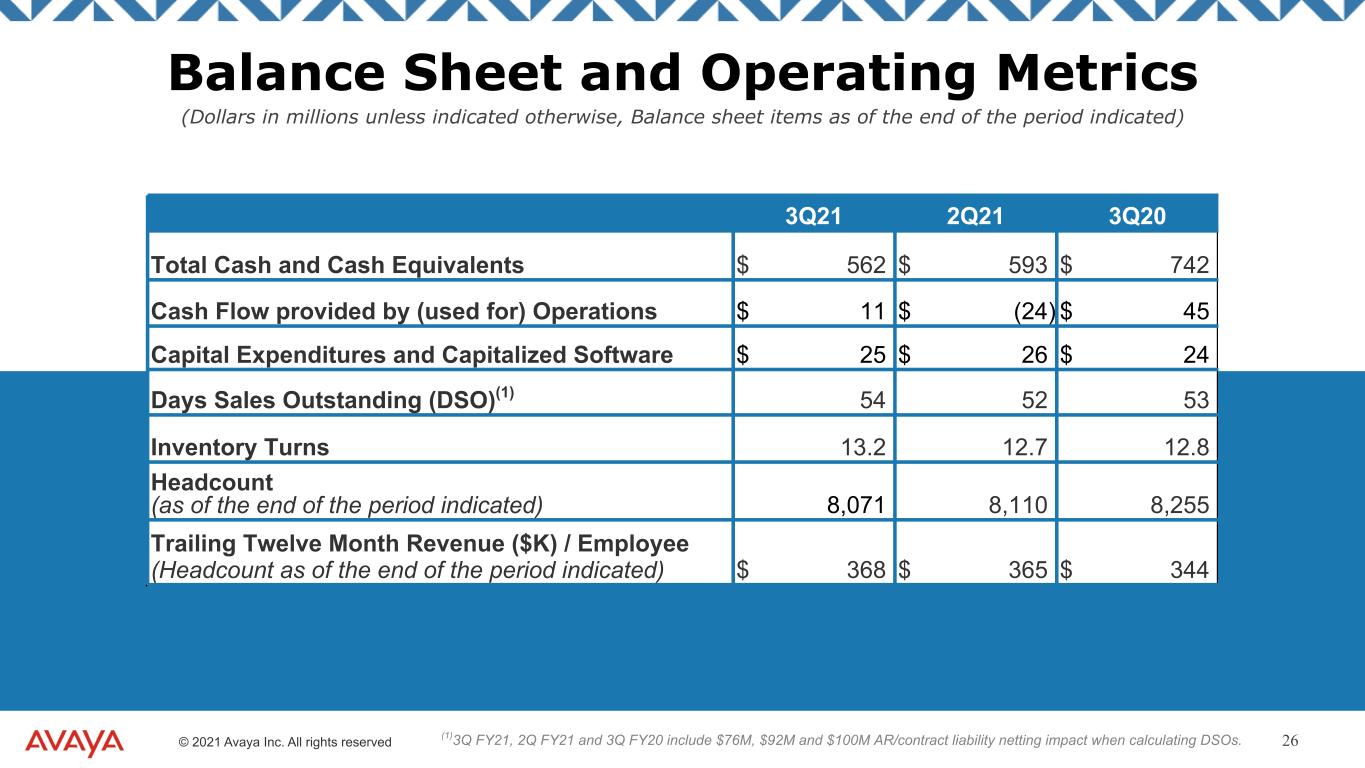

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 26 Balance Sheet and Operating Metrics (Dollars in millions unless indicated otherwise, Balance sheet items as of the end of the period indicated) 3Q21 2Q21 3Q20 Total Cash and Cash Equivalents $ 562 $ 593 $ 742 Cash Flow provided by (used for) Operations $ 11 $ (24) $ 45 Capital Expenditures and Capitalized Software $ 25 $ 26 $ 24 Days Sales Outstanding (DSO)(1) 54 52 53 Inventory Turns 13.2 12.7 12.8 Headcount (as of the end of the period indicated) 8,071 8,110 8,255 Trailing Twelve Month Revenue ($K) / Employee (Headcount as of the end of the period indicated) $ 368 $ 365 $ 344 (1)3Q FY21, 2Q FY21 and 3Q FY20 include $76M, $92M and $100M AR/contract liability netting impact when calculating DSOs.

© 2021 Avaya Inc. All rights reserved Appendix

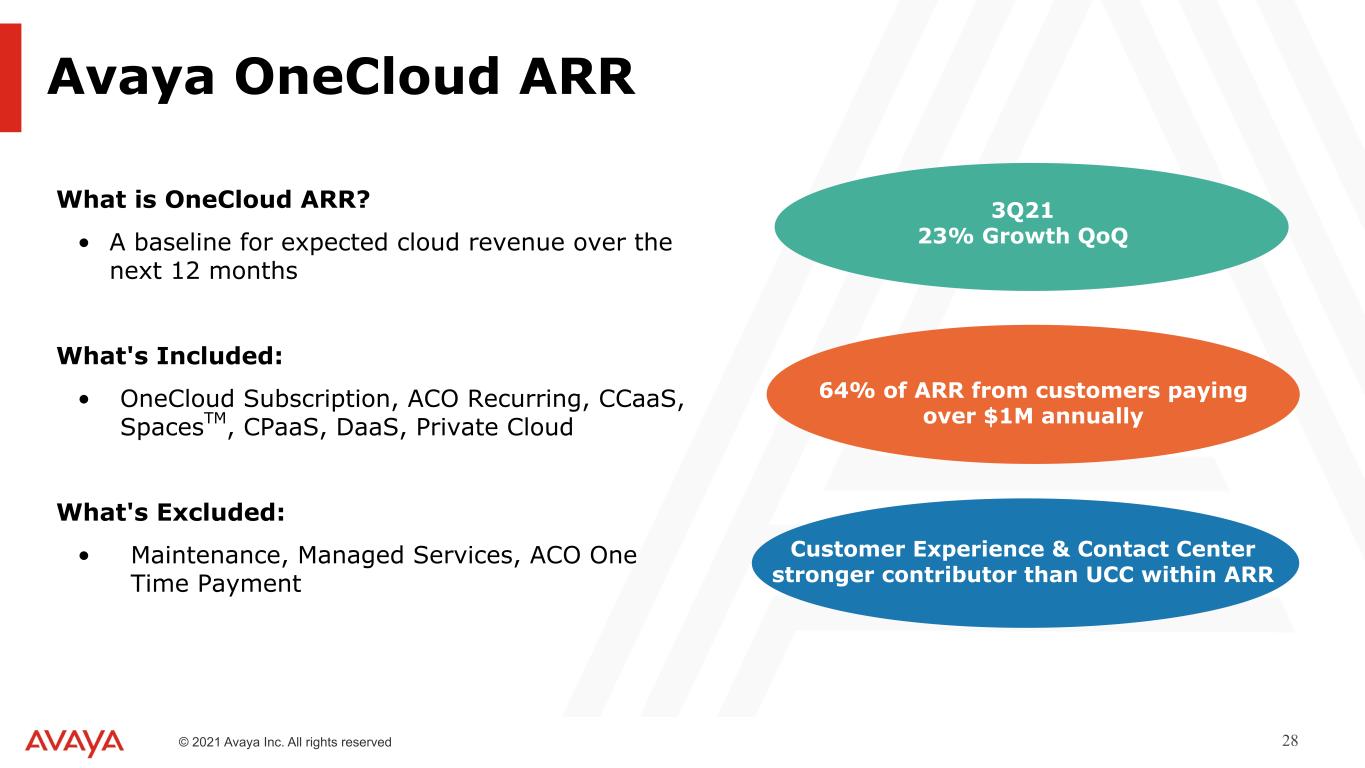

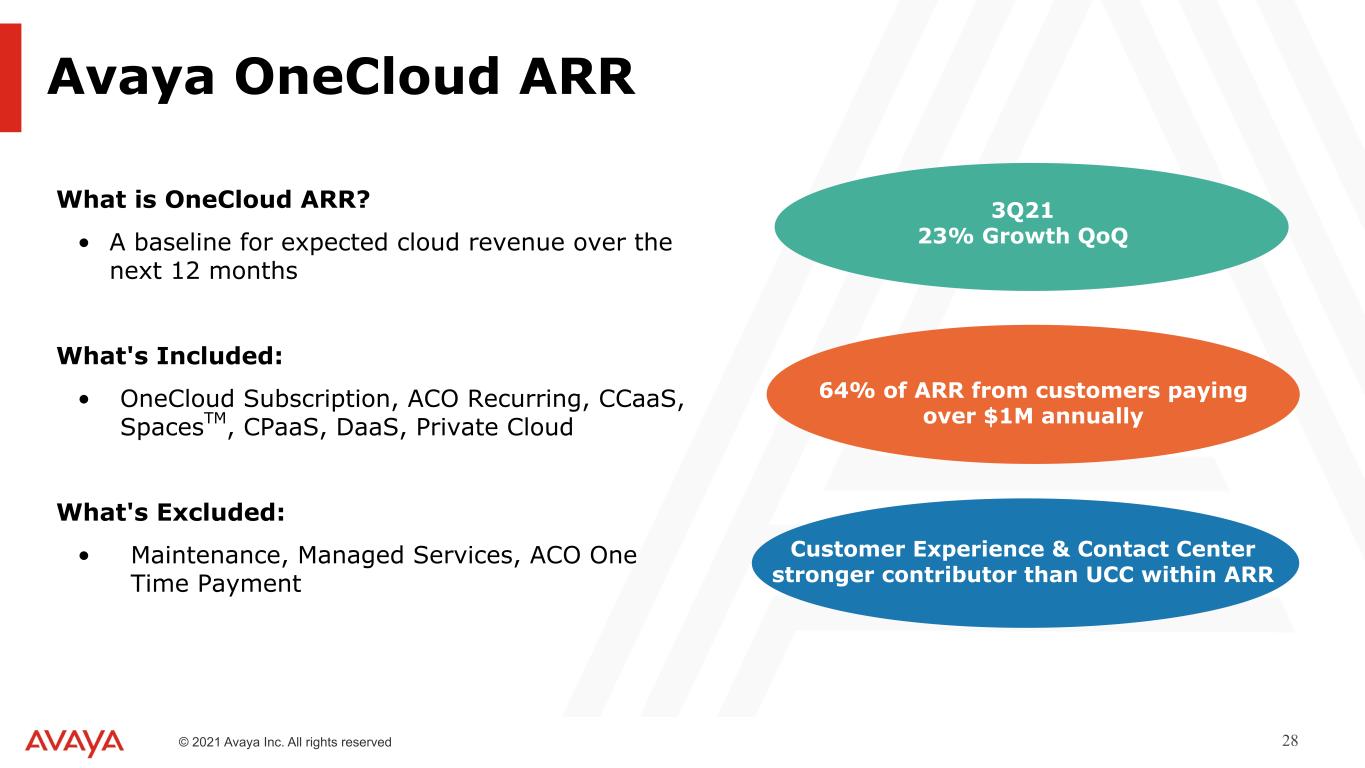

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 28 Avaya OneCloud ARR What is OneCloud ARR? • A baseline for expected cloud revenue over the next 12 months What's Included: • OneCloud Subscription, ACO Recurring, CCaaS, SpacesTM, CPaaS, DaaS, Private Cloud What's Excluded: • Maintenance, Managed Services, ACO One Time Payment 3Q21 23% Growth QoQ 64% of ARR from customers paying over $1M annually Customer Experience & Contact Center stronger contributor than UCC within ARR

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 29 Subscription Revenue & Cash Dynamics

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 30 Premise Subscription Revenue, ARR & Cash Dynamics

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 31 Three months ended, (In millions) June 30, 2021 March 31, 2021 June 30, 2020 Net income (loss) $ 43 $ (58) $ 9 Interest expense 54 59 51 Interest income — (1) (1) (Benefit from) provision for income taxes (46) 44 20 Depreciation and amortization 105 106 107 EBITDA 156 150 186 Impact of fresh start accounting adjustments (1) 1 1 1 Restructuring charges (2) 5 6 14 Acquisition-related costs 2 — — Share-based compensation 14 13 7 Pension and post-retirement benefit costs (1) — — Gain on post-retirement plan settlement — (14) — Change in fair value of Emergence Date Warrants — 22 3 (Gain) loss on foreign currency transactions (4) (1) 5 Gain on investments in equity securities — — (29) Adjusted EBITDA 173 177 187 Adjusted EBITDA Margin 23.6 % 24.0 % 25.9 % Non-GAAP Reconciliation Adjusted EBITDA (1) The impact of fresh start accounting adjustments in connection with the Company's emergence from bankruptcy. (2) Restructuring charges represent employee separation costs and facility exit costs (excluding the impact of accelerated depreciation expense) related to the Company's restructuring programs, net of sublease income.

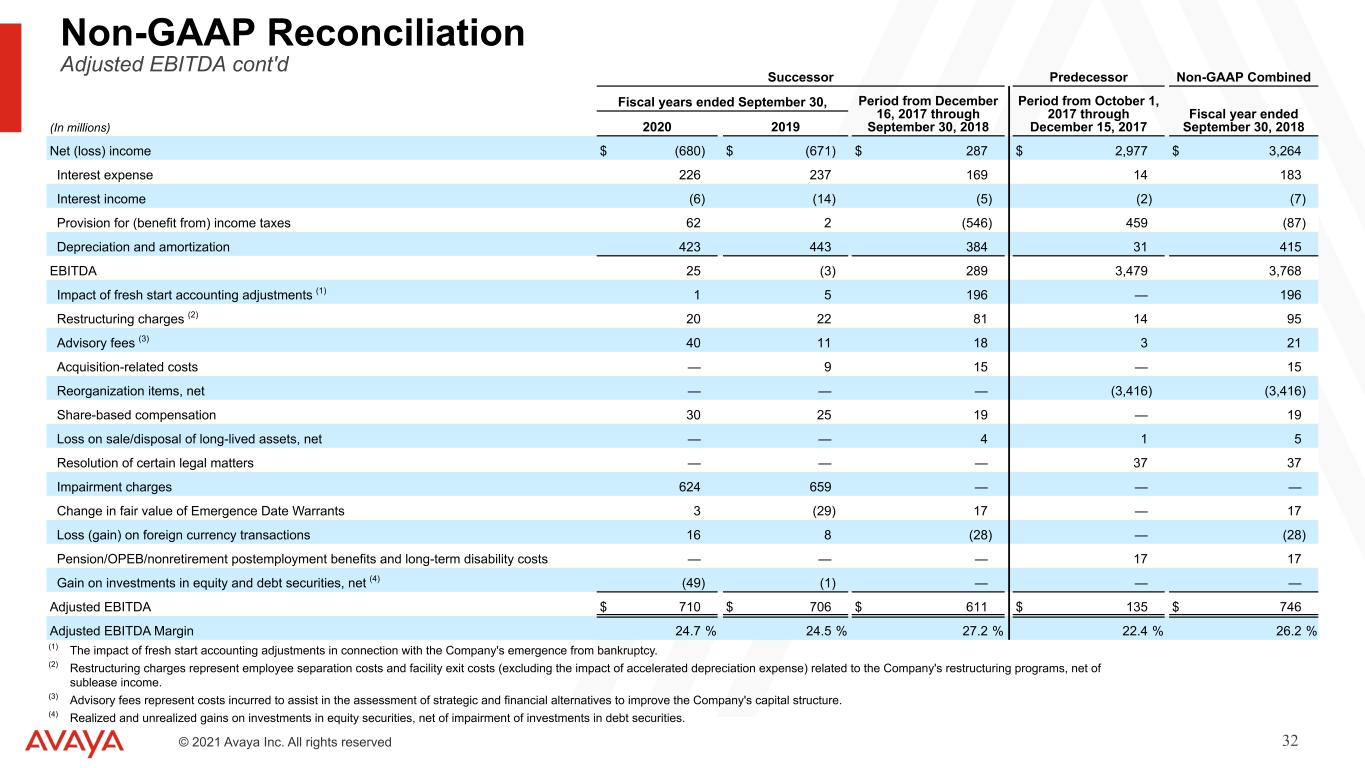

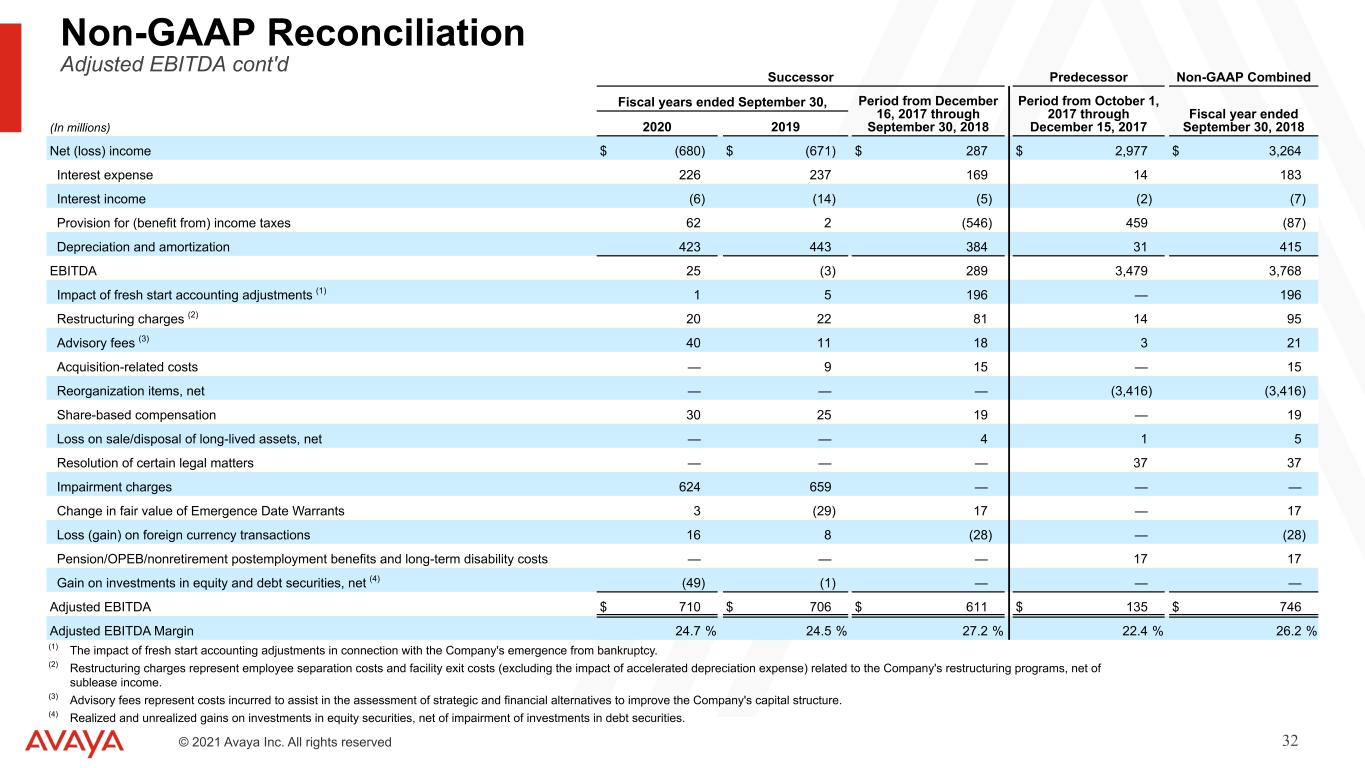

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 32 Successor Predecessor Non-GAAP Combined Fiscal years ended September 30, Period from December 16, 2017 through September 30, 2018 Period from October 1, 2017 through December 15, 2017 Fiscal year ended September 30, 2018(In millions) 2020 2019 Net (loss) income $ (680) $ (671) $ 287 $ 2,977 $ 3,264 Interest expense 226 237 169 14 183 Interest income (6) (14) (5) (2) (7) Provision for (benefit from) income taxes 62 2 (546) 459 (87) Depreciation and amortization 423 443 384 31 415 EBITDA 25 (3) 289 3,479 3,768 Impact of fresh start accounting adjustments (1) 1 5 196 — 196 Restructuring charges (2) 20 22 81 14 95 Advisory fees (3) 40 11 18 3 21 Acquisition-related costs — 9 15 — 15 Reorganization items, net — — — (3,416) (3,416) Share-based compensation 30 25 19 — 19 Loss on sale/disposal of long-lived assets, net — — 4 1 5 Resolution of certain legal matters — — — 37 37 Impairment charges 624 659 — — — Change in fair value of Emergence Date Warrants 3 (29) 17 — 17 Loss (gain) on foreign currency transactions 16 8 (28) — (28) Pension/OPEB/nonretirement postemployment benefits and long-term disability costs — — — 17 17 Gain on investments in equity and debt securities, net (4) (49) (1) — — — Adjusted EBITDA $ 710 $ 706 $ 611 $ 135 $ 746 Adjusted EBITDA Margin 24.7 % 24.5 % 27.2 % 22.4 % 26.2 % Non-GAAP Reconciliation Adjusted EBITDA cont'd (1) The impact of fresh start accounting adjustments in connection with the Company's emergence from bankruptcy. (2) Restructuring charges represent employee separation costs and facility exit costs (excluding the impact of accelerated depreciation expense) related to the Company's restructuring programs, net of sublease income. (3) Advisory fees represent costs incurred to assist in the assessment of strategic and financial alternatives to improve the Company's capital structure. (4) Realized and unrealized gains on investments in equity securities, net of impairment of investments in debt securities.

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 33 Non-GAAP Reconciliation Net Income (Loss) and Earnings (Loss) per Share Three months ended, June 30, 2021 March 31, 2021 December 31, 2020 September 30, 2020 June 30, 2020 GAAP Net Income (Loss) $ 43 $ (58) $ (4) $ 37 $ 9 Non-GAAP Adjustments: Impact of fresh start accounting 1 1 — 1 1 Restructuring charges, net(1) 5 7 4 2 19 Acquisition-related costs 2 — — — — Share-based compensation 14 13 14 9 7 Pension and post-retirement benefit costs (1) — — — — Gain on post-retirement plan settlement — (14) — — — Change in fair value of Emergence Date Warrants — 22 5 3 3 (Gain) loss on foreign currency transactions (4) (1) 2 — 5 Gain on investments in equity securities — — — — (29) Amortization of intangible assets 83 82 83 83 83 Income tax expense effects(2) (70) 20 (19) (49) (10) Non-GAAP Net Income $ 73 $ 72 $ 85 $ 86 $ 88 Dividends and accretion to preferred stockholders $ (1) $ (1) $ (1) $ (1) $ (1) Undistributed Non-GAAP Income 72 71 84 85 87 Percentage allocated to common stockholders(3) 91.3 % 91.3 % 91.2 % 91.2 % 91.2 % Numerator for Non-GAAP diluted earnings per common share $ 66 $ 65 $ 77 $ 78 $ 79 Diluted Weighted Average Shares - GAAP 88.0 84.6 83.8 84.3 83.3 Share adjustment(4) (0.2) 2.7 1.4 — — Diluted Weighted Average Shares - Non-GAAP 87.8 87.3 85.2 84.3 83.3 GAAP Earnings (Loss) per Share - Diluted $ 0.43 $ (0.70) $ (0.06) $ 0.39 $ 0.08 Non-GAAP Earnings per Share - Diluted $ 0.75 $ 0.74 $ 0.90 $ 0.93 $ 0.95 (1) Restructuring charges, net represent employee separation costs and facility exit costs related to the Company's restructuring programs, net of sublease income. (2) The Company’s calculation of non-GAAP income taxes reflects a 25% fixed non-GAAP effective tax rate based on a blended U.S. federal and state tax rate, given the Company’s operating structure. The non-GAAP effective tax rate may differ significantly from the GAAP effective tax rate. The non- GAAP effective tax rate could be subject to change for a number of reasons, including but not limited to, changes resulting from tax legislation, material changes in revenues or expenses and other significant events. The Company will continuously assess its estimated non-GAAP effective tax rate in connection with its calculation of non-GAAP net income and non-GAAP net income per diluted share in future periods. (3) The Company’s preferred shares are participating securities, which requires the application of the two-class method to calculate diluted earnings per share. Under the two-class method, undistributed earnings are allocated to common stock and participating securities according to their respective participating rights in undistributed earnings. The percentage allocated to common stockholders reflects the proportion of weighted average common stock outstanding to the weighted average of common stock and common stock equivalents (preferred shares). (4) Includes the impact of our bond hedge transaction which is anti-dilutive in diluted GAAP earnings (loss) per share but is expected to mitigate the dilutive effect of our convertible notes and therefore are included in the calculations of non-GAAP diluted shares outstanding. In periods with a GAAP net loss, the share adjustment also reflects the dilutive impact of certain securities, which are excluded from the computation of diluted GAAP loss per share as they are anti-dilutive.

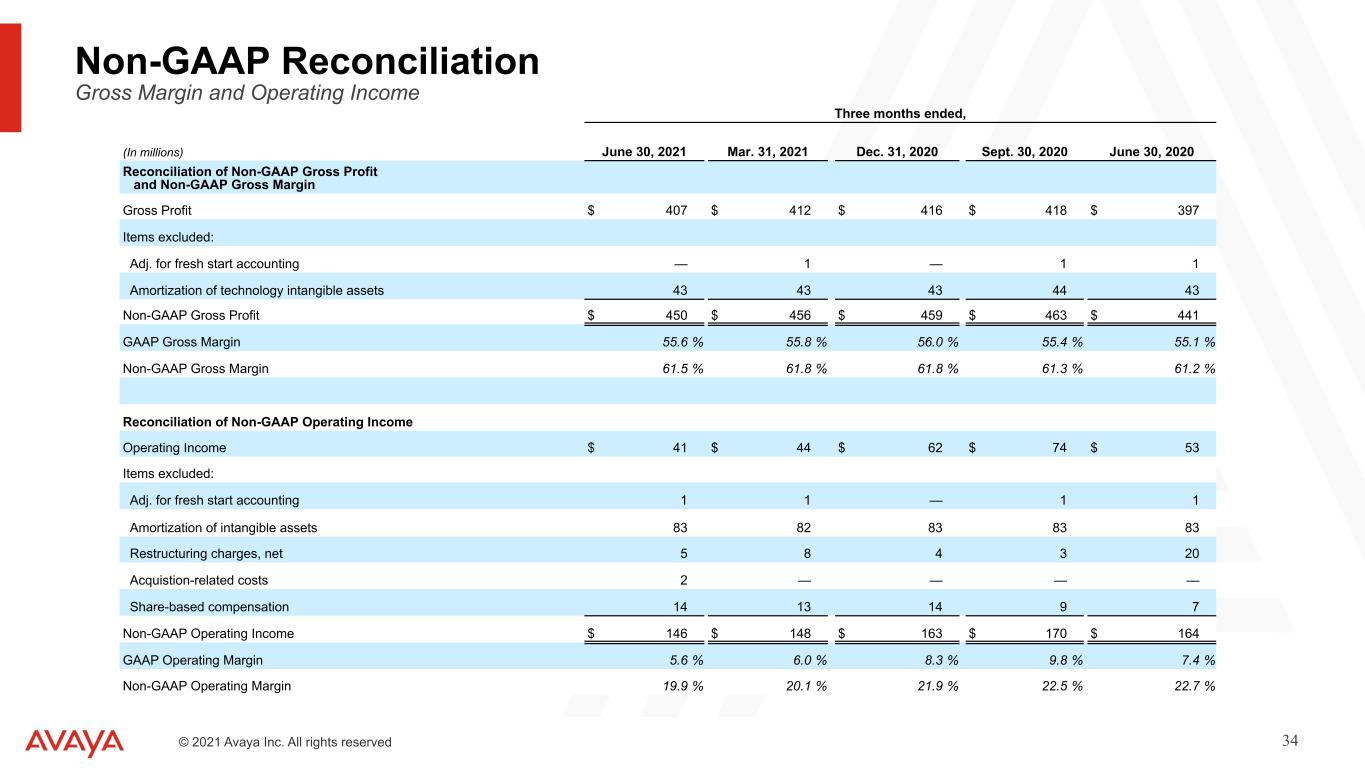

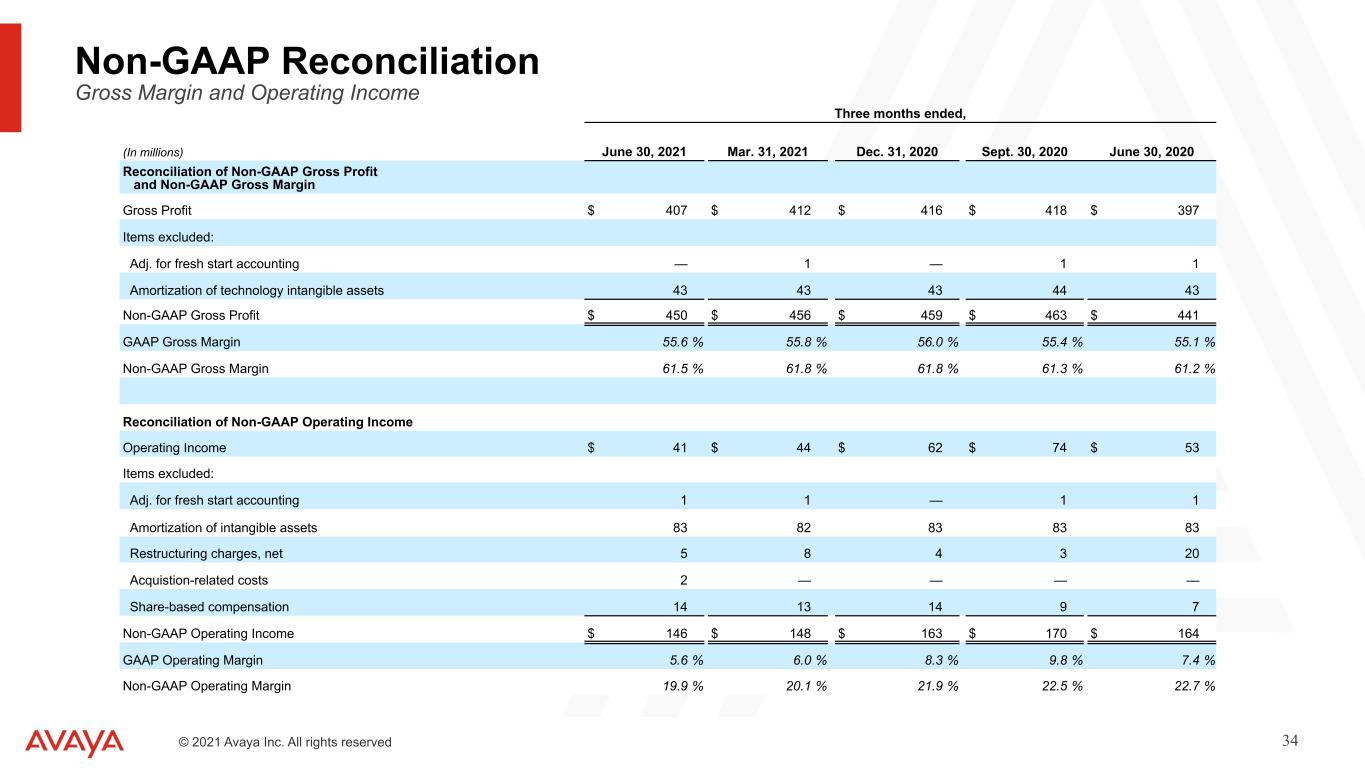

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 34 Non-GAAP Reconciliation Gross Margin and Operating Income Three months ended, (In millions) June 30, 2021 Mar. 31, 2021 Dec. 31, 2020 Sept. 30, 2020 June 30, 2020 Reconciliation of Non-GAAP Gross Profit and Non-GAAP Gross Margin Gross Profit $ 407 $ 412 $ 416 $ 418 $ 397 Items excluded: Adj. for fresh start accounting — 1 — 1 1 Amortization of technology intangible assets 43 43 43 44 43 Non-GAAP Gross Profit $ 450 $ 456 $ 459 $ 463 $ 441 GAAP Gross Margin 55.6 % 55.8 % 56.0 % 55.4 % 55.1 % Non-GAAP Gross Margin 61.5 % 61.8 % 61.8 % 61.3 % 61.2 % Reconciliation of Non-GAAP Operating Income Operating Income $ 41 $ 44 $ 62 $ 74 $ 53 Items excluded: Adj. for fresh start accounting 1 1 — 1 1 Amortization of intangible assets 83 82 83 83 83 Restructuring charges, net 5 8 4 3 20 Acquistion-related costs 2 — — — — Share-based compensation 14 13 14 9 7 Non-GAAP Operating Income $ 146 $ 148 $ 163 $ 170 $ 164 GAAP Operating Margin 5.6 % 6.0 % 8.3 % 9.8 % 7.4 % Non-GAAP Operating Margin 19.9 % 20.1 % 21.9 % 22.5 % 22.7 %

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 35 Non-GAAP Reconciliation Operating Expenses Three months ended, (In millions) June 30, 2021 Mar. 31, 2020 June 30, 2020 Reconciliation of Non-GAAP Operating Expenses Operating Expenses $ 366 $ 368 $ 344 Items excluded: Adj. for fresh start accounting 1 — — Amortization of intangible assets 40 39 40 Restructuring charges, net 5 8 20 Acquisition-related costs 2 — — Share-based compensation 14 13 7 Non-GAAP Operating Expenses $ 304 $ 308 $ 277 Non-GAAP Operating Expense % 41.5 % 41.7 % 38.4 %

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 36 Non-GAAP Reconciliation Revenue and Gross Margin Successor Predecessor Non-GAAP Combined Fiscal year ended September 30, 2019 Period from December 16, 2017 through September 30, 2018 Period from October 1, 2017 through December 15, 2017 Fiscal year ended September 30, 2018 (In millions) Reconciliation of Non-GAAP Revenue Revenue $ 2,887 $ 2,247 $ 604 $ 2,851 Adj. for fresh start accounting 21 206 — 206 Non-GAAP Revenue $ 2,908 $ 2,453 $ 604 $ 3,057 Reconciliation of Non-GAAP Gross Profit and Non- GAAP Gross Margin Gross Profit $ 1,575 $ 1,143 $ 362 $ 1,505 Items excluded: Adj. for fresh start accounting 37 264 — 264 Amortization of technology intangible assets 174 135 3 138 Loss on disposal of long-lived assets — 4 — 4 Share-based compensation — 1 — 1 Non-GAAP Gross Profit $ 1,786 $ 1,547 $ 365 $ 1,912 GAAP Gross Margin 54.6 % 50.9 % 59.9 % 52.8 % Non-GAAP Gross Margin 61.4 % 63.1 % 60.4 % 62.5 %

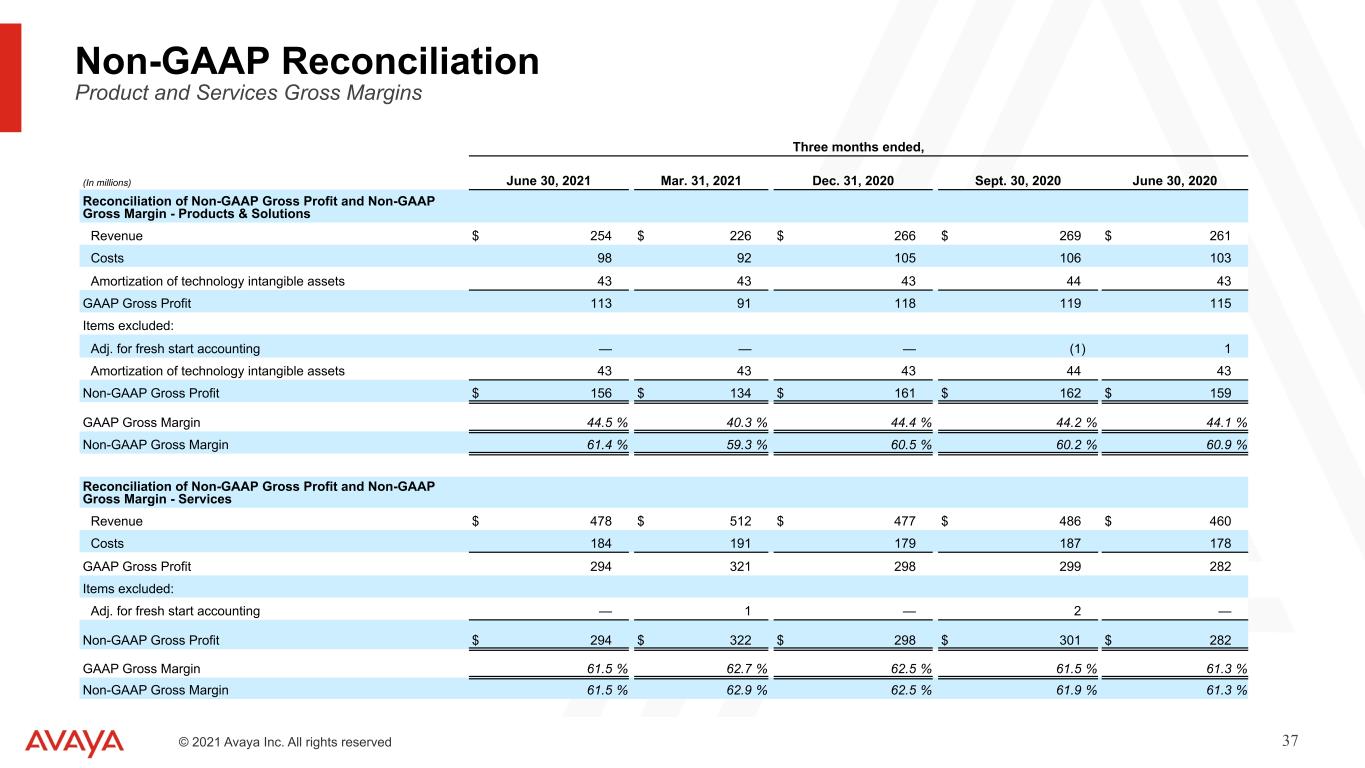

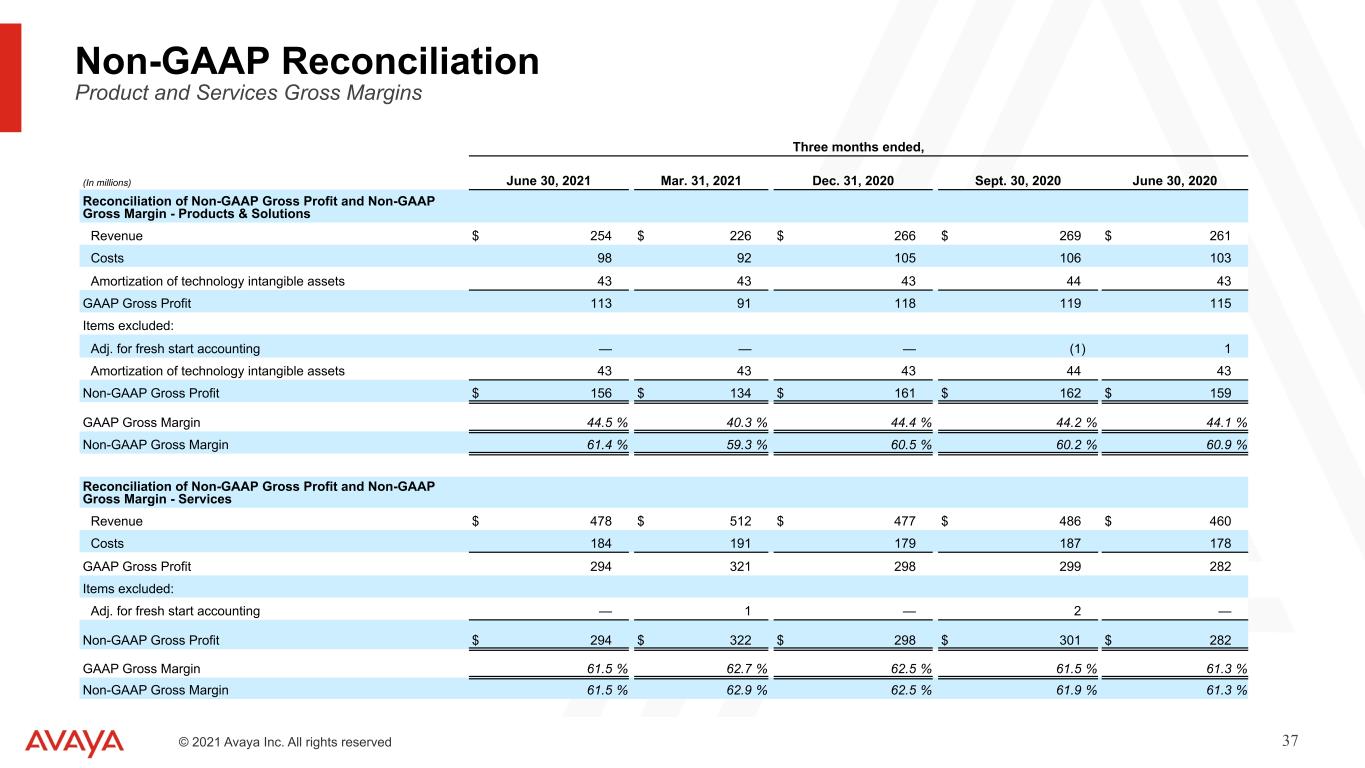

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 37 Non-GAAP Reconciliation Product and Services Gross Margins Three months ended, (In millions) June 30, 2021 Mar. 31, 2021 Dec. 31, 2020 Sept. 30, 2020 June 30, 2020 Reconciliation of Non-GAAP Gross Profit and Non-GAAP Gross Margin - Products & Solutions Revenue $ 254 $ 226 $ 266 $ 269 $ 261 Costs 98 92 105 106 103 Amortization of technology intangible assets 43 43 43 44 43 GAAP Gross Profit 113 91 118 119 115 Items excluded: Adj. for fresh start accounting — — — (1) 1 Amortization of technology intangible assets 43 43 43 44 43 Non-GAAP Gross Profit $ 156 $ 134 $ 161 $ 162 $ 159 GAAP Gross Margin 44.5 % 40.3 % 44.4 % 44.2 % 44.1 % Non-GAAP Gross Margin 61.4 % 59.3 % 60.5 % 60.2 % 60.9 % Reconciliation of Non-GAAP Gross Profit and Non-GAAP Gross Margin - Services Revenue $ 478 $ 512 $ 477 $ 486 $ 460 Costs 184 191 179 187 178 GAAP Gross Profit 294 321 298 299 282 Items excluded: Adj. for fresh start accounting — 1 — 2 — Non-GAAP Gross Profit $ 294 $ 322 $ 298 $ 301 $ 282 GAAP Gross Margin 61.5 % 62.7 % 62.5 % 61.5 % 61.3 % Non-GAAP Gross Margin 61.5 % 62.9 % 62.5 % 61.9 % 61.3 %

204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 0 – 0 – 0 TEXT © 2021 Avaya Inc. All rights reserved 38 Three Months Ended (In millions) June 30, 2021 Mar. 31, 2021 Dec. 31, 2020 Sept. 30, 2020 June 30, 2020 Net cash provided by (used for) operating activities $ 11 $ (24) $ 48 $ 70 $ 45 Less: Capital expenditures 25 26 27 26 24 Free cash flow $ (14) $ (50) $ 21 $ 44 $ 21 Free Cash Flow Net-Debt / Adjusted EBITDA (In millions) June 30, 2021 Debt maturing within one year $ — Long-term debt, net of current portion 2,806 Less: Cash and cash equivalents 562 Net-debt $ 2,244 Adjusted EBITDA (TTM) $ 740 Net-debt / Adjusted EBITDA 3.0 x Non-GAAP Reconciliation Supplemental Schedules