- APLE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B3 Filing

Apple Hospitality REIT (APLE) 424B3Prospectus supplement

Filed: 19 Mar 09, 12:00am

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-147414

SUPPLEMENT NO. 11 DATED MARCH 19, 2009

TO PROSPECTUS DATED APRIL 25, 2008

APPLE REIT NINE, INC.

The following information supplements the prospectus of Apple REIT Nine, Inc. dated April 25, 2008 and is part of the prospectus. This Supplement updates the information presented in the prospectus.Prospective investors should carefully review the prospectus, Supplement No. 9 (which is cumulative and replaces all prior Supplements), Supplement No. 10 and this Supplement No. 11.

| S – 3 | ||

| S – 4 | ||

| S – 5 | ||

| S – 6 | ||

| S – 7 | ||

| S – 9 | ||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | S – 10 | |

| S – 20 | ||

| S – 21 | ||

| F – 1 |

Certain forward-looking statements are included in the prospectus and in each supplement. These forward-looking statements may involve our plans and objectives for future operations, including future growth and availability of funds. These forward-looking statements are based on current expectations, which are subject to numerous risks and uncertainties. Assumptions relating to these statements involve judgments with respect to, among other things, the continuation of our offering of units, future economic, competitive and market conditions and future business decisions, together with local, national and international events (including, without limitation, acts of terrorism or war, and their direct and indirect effects on travel and the economy). All of these matters are difficult or impossible to predict accurately and many of them are beyond our control. Although we believe the assumptions relating to the forward-looking statements, and the statements themselves, are reasonable, any of the assumptions could be inaccurate and, therefore, there can be no assurance that these forward-looking statements will prove to be accurate. In light of the significant uncertainties inherent in these forward-looking statements, the inclusion of this information should not be regarded as a representation by us or any other person that our objectives and plans, which we consider to be reasonable, will be achieved.

S-1

“Courtyard by Marriott,” “Fairfield Inn,” “Fairfield Inn & Suites,” “TownePlace Suites,” “Marriott,” “SpringHill Suites” and “Residence Inn” are each a registered trademark of Marriott International, Inc. or one of its affiliates. All references below to “Marriott” mean Marriott International, Inc. and all of its affiliates and subsidiaries, and their respective officers, directors, agents, employees, accountants and attorneys. Marriott is not responsible for the content of this prospectus supplement, whether relating to hotel information, operating information, financial information, Marriott’s relationship with Apple REIT Nine, Inc., or otherwise. Marriott is not involved in any way, whether as an “issuer” or “underwriter” or otherwise, in the offering by Apple REIT Nine, Inc. and receives no proceeds from the offering. Marriott has not expressed any approval or disapproval regarding this prospectus supplement or the offering related to this prospectus supplement, and the grant by Marriott of any franchise or other rights to Apple REIT Nine, Inc. shall not be construed as any expression of approval or disapproval. Marriott has not assumed, and shall not have, any liability in connection with this prospectus supplement or the offering related to this prospectus supplement.

“Hampton Inn,” “Hampton Inn & Suites,” “Homewood Suites,” “Embassy Suites” and “Hilton Garden Inn” are each a registered trademark of Hilton Hotels Corporation or one of its affiliates. All references below to “Hilton” mean Hilton Hotels Corporation and all of its affiliates and subsidiaries, and their respective officers, directors, agents, employees, accountants and attorneys. Hilton is not responsible for the content of this prospectus supplement, whether relating to hotel information, operating information, financial information, Hilton’s relationship with Apple REIT Nine, Inc., or otherwise. Hilton is not involved in any way, whether as an “issuer” or “underwriter” or otherwise, in the offering by Apple REIT Nine, Inc. and receives no proceeds from the offering. Hilton has not expressed any approval or disapproval regarding this prospectus supplement or the offering related to this prospectus supplement, and the grant by Hilton of any franchise or other rights to Apple REIT Nine, Inc. shall not be construed as any expression of approval or disapproval. Hilton has not assumed, and shall not have, any liability in connection with this prospectus supplement or the offering related to this prospectus supplement.

S-2

We completed the minimum offering of units (with each unit consisting of one Common Share and one Series A Preferred Share) at $10.50 per unit on May 14, 2008. We are continuing the offering at $11 per unit in accordance with the prospectus. We registered to sell a total of 182,251,082 units. As of February 26, 2009, 133,470,238 units remain unsold. We will offer units until April 25, 2010, unless the offering is extended, provided that the offering will be terminated if all of the units are sold before then.

As of February 26, 2009, we had closed on the following sales of units in the offering:

Price Per Unit | Number of Units Sold | Gross Proceeds | Proceeds Net of Selling Commissions and Marketing Expense Allowance | |||||

$10.50 | 9,523,810 | $ | 100,000,000 | $ | 90,000,000 | |||

$11.00 | 39,257,034 | $ | 431,827,384 | $ | 388,644,646 | |||

Total | 48,780,844 | $ | 531,827,384 | $ | 478,644,646 | |||

Our distributions since the initial capitalization through December 31, 2008 totaled approximately $13 million and were paid at a monthly rate of $0.073334 per common share beginning in June 2008. For the same period our cash generated from operations was approximately $3.3 million. Due to the inherent delay between raising capital and investing that same capital in income producing real estate, we have had significant amounts of cash earning interest at short term money market rates. As a result, the difference between distributions paid and cash generated from operations has been funded from proceeds from the offering of units, and this portion of distributions is expected to be treated as a return of capital for federal income tax purposes. In May, 2008, our Board of Directors established a policy for an annualized dividend rate of $0.88 per common share, payable in monthly distributions. We intend to continue paying dividends on a monthly basis, consistent with the annualized dividend rate established by our Board of Directors. Our Board of Directors, upon the recommendation of the Audit Committee, may amend or establish a new annualized dividend rate. Since a portion of distributions has to date been funded with proceeds from the offering of units, our ability to maintain our current intended rate of distributions will be based on our ability to fully invest our offering proceeds and thereby increase our cash generated from operations. Since there can be no assurance of our ability to acquire properties that provide income at this level, there can be no assurance as to the classification or duration of distributions at the current rate. Proceeds of the offering which are distributed are not available for investment in properties. See “Risk Factors—We may be unable to make distributions to our shareholders,” on page 28 of the prospectus.

S-3

Recent Purchases

On March 6, 2009, through one of our indirect wholly-owned subsidiaries, we closed on the purchase of a hotel located in Round Rock, Texas. The gross purchase price for the hotel, which contains a total of 93 guest rooms, was $11,500,000.

On March 12, 2009, through one of our indirect wholly-owned subsidiaries, we closed on the purchase of a hotel located in Panama City, Florida. The gross purchase price for the hotel, which contains a total of 95 guest rooms, was $11,600,000.

Further information about our recently purchased hotels is provided in other sections below.

Loan Assumption

The purchase contract for the hotel located in Round Rock, Texas required us to assume a loan secured by the hotel. The current outstanding principal balance of the assumed loan is $4,175,225. The assumed loan has a non-recourse structure, which means that the lender generally must rely on the property, rather than the borrower, as the lender’s source of repayment in any collection action. There are exceptions to the non-recourse structure in certain situations, such as misappropriation of funds and environmental liabilities. In these situations, the lender would be permitted to seek repayment from the guarantor or indemnitor of the loan, which is one of our wholly-owned subsidiaries.

Source of Funds and Related Party Payments

Our recent purchases, which resulted in our ownership of two additional hotels, were funded by the proceeds from our ongoing offering of units.

We also used our offering proceeds to pay $462,000, representing 2% of the gross purchase price for our recent purchases, as a commission to Apple Suites Realty Group, Inc. This entity is owned by Glade M. Knight, who is one of our directors and our Chief Executive Officer.

We have entered into an advisory agreement with Apple Nine Advisors, Inc. to manage us and our assets. An annual fee ranging from 0.1% to 0.25% of total equity proceeds received by us in addition to certain reimbursable expenses will be payable for these services. Apple Nine Advisors, Inc. has entered into an agreement with Apple REIT Six, Inc. to provide certain management services to us. We will reimburse Apple Nine Advisors, Inc. for the cost of the services provided by Apple REIT Six, Inc. Apple Nine Advisors, Inc. in turn will pay Apple REIT Six, Inc. for the cost of the services provided by Apple REIT Six, Inc. Total advisory fees and reimbursable expenses incurred by the Company under the advisory agreement are included in general and administrative expenses and totaled approximately $766,000 for the year ended December 31, 2008. Apple Nine Advisors, Inc. is owned by Glade M. Knight, who is also the Chairman and Chief Executive Officer of Apple REIT Six, Inc.

S-4

Overview of Owned Hotels

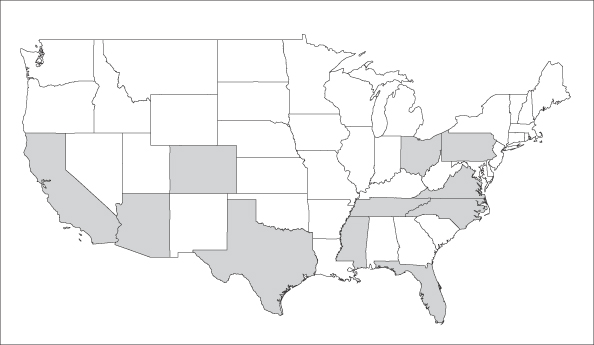

As a result of our recent purchases, we currently own 23 hotels, which are located in the states indicated in the map below:

ACQUISITIONS AND RELATED MATTERS

Each of our recently purchased hotels has been leased to one of our indirect wholly-owned subsidiaries, as the lessee, under a separate hotel lease agreement. For simplicity, the applicable lessee will be referred to below as the “lessee.”

Each hotel is managed under a separate management agreement between the applicable lessee and the manager. For simplicity, the applicable manager will be referred to below as the “manager.”

The hotel lease agreements and the management agreements are among the contracts described in another section below. The table below specifies the franchise, hotel owner, lessee and manager for our recently purchased hotels:

Hotel Location | Franchise (a) | Hotel Owner/Lessor | Lessee | Manager | ||||

Round Rock, Texas | Hampton Inn | Apple Nine SPE Round Rock, Inc. | Apple Nine Services Round Rock, Inc. | Vista Host, Inc. (b) | ||||

Panama City, Florida | Hampton Inn & Suites | Apple Nine Hospitality Ownership, Inc. | Apple Nine Hospitality Management, Inc. | LBAM-Investor Group, L.L.C. |

Notes for Table:

| (a) | All brand and trade names, logos or trademarks contained, or referred to, in this prospectus supplement are the properties of their respective owners. These references shall not in any way be construed as participation by, or endorsement of, our offering by any of our franchisors or managers. |

| (b) | The hotels specified were purchased from an affiliate of the indicated manager. |

We have no material relationship or affiliation with the hotel sellers or managers, except for the relationship resulting from our purchases, our management agreements for the hotels we own and any related documents.

S-5

FOR OUR PROPERTIES

Hotel Lease Agreements

Each of our recently purchased hotels is covered by a separate hotel lease agreement between the owner (one of our indirect wholly-owned subsidiaries) and the applicable lessee (another one of our indirect wholly-owned subsidiaries, as specified in the previous section). Each lease provides for an initial term of 10 years. The applicable lessee has the option to extend its lease term for two additional five-year periods, provided it is not in default at the end of the prior term or at the time the option is exercised.

Each lease provides for annual base rent and percentage rent. The annual base rent is payable in advance in equal monthly installments and will be adjusted each year in proportion to the Consumer Price Index (based on the U.S. City Average). Shown below is the annual base rent and the lease commencement date for our recently purchased hotels:

Hotel Location | Franchise | Annual Base Rent | Date of Lease Commencement | ||||

Round Rock, Texas | Hampton Inn | $ | 960,187 | March 6, 2009 | |||

Panama City, Florida | Hampton Inn & Suites | $ | 799,538 | March 12, 2009 | |||

The annual percentage rent depends on a formula that compares fixed “suite revenue breakpoints” with a portion of “suite revenue,” which is equal to gross revenue from guest rentals less sales and room taxes and credit card fees. The suite revenue breakpoints will be adjusted each year in proportion to the Consumer Price Index (based on the U.S. City Average). Specifically, the annual percentage rent is equal to the sum of (a) 17% of all suite revenue for the year, up to the applicable suite revenue breakpoint; plus (b) 55% of the suite revenue for the year in excess of the applicable suite revenue breakpoint, as reduced by base rent paid for the year.

Management Agreements

Each of our hotels is being managed by the manager under a separate management agreement between the manager and the applicable lessee (which is one of our wholly-owned subsidiaries, as specified in the previous section). The manager is responsible for managing and supervising the daily operations of the hotel and for collecting revenues for the benefit of the applicable lessee. The fees and other terms of these agreements are the result of commercial negotiations between otherwise unrelated parties. We believe that such fees and terms are appropriate for the hotels and the markets in which they operate.

Franchise Agreements

For the hotels franchised by Hilton Hotels Corporation or one of its affiliates, there is a franchise license agreement between the applicable lessee and Hilton Hotels Corporation or an affiliate. Each franchise license agreement provides for the payment of royalty fees and program fees to the franchisor. A percentage of gross room revenues is used to determine these payments. Apple Nine Hospitality, Inc. or another one of our subsidiaries has guaranteed the payment and performance of the lessee under the applicable franchise license agreement.

The fees and other terms of these agreements are the result of commercial negotiations between otherwise unrelated parties, and we believe that such fees and terms are appropriate for the hotels and the markets in which they operate. These agreements may be terminated for various reasons, including failure by the applicable lessee to operate in accordance with the standards, procedures and requirements established by the franchisor.

S-6

FINANCIAL AND OPERATING INFORMATION

FOR OUR PROPERTIES

Our hotels offer guest rooms and suites, together with related amenities, that are consistent with their operations. The hotels are located in developed or developing areas and in competitive markets. We believe the hotels are well-positioned to compete in their markets based on location, amenities, rate structure and franchise affiliation. In the opinion of management, each hotel is adequately covered by insurance. The following tables present further information about our hotels:

Table 1. General Information

Hotel Location | Franchise | Number of Rooms/ Suites | Gross Purchase Price | Average Daily Rate (Price) per Room/ Suite(a) | Federal Income Tax Basis for Depreciable Real Property Component of Hotel(b) | Purchase Date | |||||||||

Round Rock, Texas | Hampton Inn | 93 | $ | 11,500,000 | $ | 119 - 139 | $ | 10,658,652 | March 6, 2009 | ||||||

Panama City, Florida | Hampton Inn & Suites | 95 | 11,600,000 | $ | 159 - 189 | 9,995,450 | March 12, 2009 | ||||||||

| Total | 188 | $ | 23,100,000 | ||||||||||||

Notes for Table 1:

| (a) | The amounts shown are subject to change, and exclude discounts that may be offered to corporate, frequent and other select customers. |

| (b) | The depreciable life is 39 years (or less, as may be permitted by federal tax laws) using the straight-line method. The modified accelerated cost recovery system will be used for the hotel’s personal property component. |

Table 2. Loan Information (a)

Hotel Location | Franchise | Outstanding Principal Balance of Loan | Annual Interest Rate | Maturity Date | |||||

Round Rock, Texas | Hampton Inn | $ | 4,175,225 | 5.95% | May 2016 | ||||

Note for Table 2:

| (a) | This table describes a loan that (i) pre-dated our purchase, (ii) is secured by the indicated hotel, and (iii) was assumed by our purchasing subsidiary. The loan provides for monthly payments of principal and interest on an amortized basis. |

S-7

Table 3. Operating Information(a)

| PART A | Avg. Daily Occupancy Rates (%) | |||||||||||||||||||||

Hotel Location | Franchise | 2004 | 2005 | 2006 | 2007 | 2008 | ||||||||||||||||

Round Rock, Texas | Hampton Inn | 62 | % | 73 | % | 81 | % | 85 | % | 80 | % | |||||||||||

Panama City, Florida | Hampton Inn & Suites | — | — | — | — | — | ||||||||||||||||

| PART B | Revenue per Available Room/Suite ($) | |||||||||||||||||||||

Hotel Location | Franchise | 2004 | 2005 | 2006 | 2007 | 2008 | ||||||||||||||||

Round Rock, Texas | Hampton Inn | $ | 50 | $ | 61 | $ | 72 | $ | 81 | $ | 85 | |||||||||||

Panama City, Florida | Hampton Inn & Suites | — | — | — | — | — | ||||||||||||||||

Note for Table 3:

| (a) | Information is shown for the last five years of hotel operations, if applicable. |

Table 4. Tax and Related Information

Hotel Location | Franchise | Tax Year(a) | Real Property Tax Rate(b) | Real Property Tax | |||||||

Round Rock, Texas | Hampton Inn | 2008 | 2.2 | % | $ | 127,889 | |||||

Panama City, Florida | Hampton Inn & Suites | 2008 | (c) | 1.0 | % | $ | 14,790 | ||||

Notes for Table 4:

| (a) | Represents calendar year. |

| (b) | Property tax rate is an aggregate figure for county, city and other local taxing authorities (to the extent applicable). |

| (c) | The hotel property consisted of undeveloped land for a portion of the 2008 tax year, and the real property tax for 2008 is not necessarily indicative of property taxes expected for the hotel in the future. |

(Remainder of Page Intentionally Left Blank)

S-8

The following table sets forth selected financial data for the period November 9, 2007 (initial capitalization) through December 31, 2007 and the year ended December 31, 2008. Certain information in the table has been derived from the Company’s audited financial statements and notes thereto. This data should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations, and the Consolidated Financial Statements and Notes thereto, appearing elsewhere in this Supplement. During the period from the Company’s initial capitalization on November 9, 2007 to July 30, 2008, the Company owned no properties, had no revenue exclusive of interest income, and was primarily engaged in capital formation activities. Operations commenced on July 31, 2008 with the Company’s first property acquisition.

(in thousands except per share and statistical data) | Year Ended December 31, 2008 | For the period November 9, 2007 (initial capitalization) through December 31, 2007 | ||||||

Revenues: | ||||||||

Room revenue | $ | 9,501 | $ | — | ||||

Other revenue | 2,023 | — | ||||||

Total revenue | 11,524 | — | ||||||

Expenses: | ||||||||

Hotel operating expenses | 7,422 | — | ||||||

Taxes, insurance and other | 731 | — | ||||||

General and administrative | 1,288 | 15 | ||||||

Depreciation | 2,277 | — | ||||||

Interest (income) expense, net | (2,346 | ) | 2 | |||||

Total expenses | 9,372 | 17 | ||||||

Net income (loss) | $ | 2,152 | $ | (17 | ) | |||

Per Share: | ||||||||

Net income (loss) per common share | $ | 0.14 | $ | (1,684.60 | ) | |||

Distributions declared and paid per common share | $ | 0.51 | $ | — | ||||

Weighted-average common shares outstanding—basic and diluted | 15,852 | — | ||||||

Balance Sheet Data (at end of period): | ||||||||

Cash and cash equivalents | $ | 75,193 | $ | 20 | ||||

Investment in real estate, net | $ | 346,423 | $ | — | ||||

Total assets | $ | 431,619 | $ | 337 | ||||

Notes payable | $ | 38,647 | $ | 151 | ||||

Shareholders’ equity | $ | 389,740 | $ | 31 | ||||

Net book value per share | $ | 9.50 | $ | — | ||||

Other Data: | ||||||||

Cash Flow From (Used In): | ||||||||

Operating activities | $ | 3,317 | $ | (2 | ) | |||

Investing activities | $ | (315,322 | ) | $ | — | |||

Financing activities | $ | 387,178 | $ | (26 | ) | |||

Number of hotels owned at end of period | 21 | — | ||||||

Average Daily Rate (ADR) (a) | $ | 110 | $ | — | ||||

Occupancy | 59 | % | — | |||||

Revenue Per Available Room (RevPAR) (b) | $ | 65 | $ | — | ||||

Funds From Operations Calculation: | ||||||||

Net Income (loss) | $ | 2,152 | $ | (17 | ) | |||

Depreciation of real estate owned | 2,277 | — | ||||||

Funds from operations (c) | $ | 4,429 | $ | (17 | ) | |||

| (a) | Total room revenue divided by number of rooms sold. |

| (b) | ADR multiplied by occupancy percentage. |

| (c) | Funds from operations (FFO) is defined as net income (loss) (computed in accordance with generally accepted accounting principles—GAAP) excluding gains and losses from sales of depreciable property, plus depreciation and amortization. The Company considers FFO in evaluating property acquisitions and its operating performance and believes that FFO should be considered along with, but not as an alternative to, net income and cash flows as a measure of the Company’s activities in accordance with GAAP and is not necessarily indicative of cash available to fund cash needs. |

S-9

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(for the year ended December 31, 2008)

General

The Company is a Virginia corporation that intends to qualify as a Real Estate Investment Trust (“REIT”) for federal income tax purposes. The Company, which owned 21 properties as of December 31, 2008 and has limited operating history, was formed to invest in hotels, residential apartment communities and other income-producing real estate in selected metropolitan areas in the United States. The Company was initially capitalized November 9, 2007, with its first investor closing on May 14, 2008. The Company’s first hotel was acquired on July 31, 2008 with an additional 20 hotels purchased during the remainder of 2008.

Hotels Owned

The following table summarizes the location, brand, manager, gross purchase price, number of hotel rooms and date of purchase for each of the hotels the Company owned as of December 31, 2008. All dollar amounts are in thousands.

Location | Brand | Manager | Gross Purchase Price | Rooms | Date of Purchase | ||||||

Tucson, AZ | Hilton Garden Inn | Western | $ | 18,375 | 125 | 7/31/2008 | |||||

Santa Clarita, CA | Courtyard | Dimension | 22,700 | 140 | 9/24/2008 | ||||||

Charlotte, NC | Homewood Suites | McKibbon | 5,750 | 112 | 9/24/2008 | ||||||

Allen, TX | Hampton Inn & Suites | Gateway | 12,500 | 103 | 9/26/2008 | ||||||

Twinsburg, OH | Hilton Garden Inn | Gateway | 17,792 | 142 | 10/7/2008 | ||||||

Lewisville, TX | Hilton Garden Inn | Gateway | 28,000 | 165 | 10/16/2008 | ||||||

Duncanville, TX | Hilton Garden Inn | Gateway | 19,500 | 142 | 10/21/2008 | ||||||

Santa Clarita, CA | Hampton Inn | Dimension | 17,129 | 128 | 10/29/2008 | ||||||

Santa Clarita, CA | Residence Inn | Dimension | 16,600 | 90 | 10/29/2008 | ||||||

Santa Clarita, CA | Fairfield Inn | Dimension | 9,337 | 66 | 10/29/2008 | ||||||

Beaumont, TX | Residence Inn | Western | 16,900 | 133 | 10/29/2008 | ||||||

Pueblo, CO | Hampton Inn & Suites | Dimension | 8,025 | 81 | 10/31/2008 | ||||||

Allen, TX | Hilton Garden Inn | Gateway | 18,500 | 150 | 10/31/2008 | ||||||

Bristol, VA | Courtyard | LBA | 18,650 | 175 | 11/7/2008 | ||||||

Durham, NC | Homewood Suites | McKibbon | 19,050 | 122 | 12/4/2008 | ||||||

Hattiesburg, MS | Residence Inn | LBA | 9,793 | 84 | 12/11/2008 | ||||||

Jackson, TN | Courtyard | Vista | 15,200 | 94 | 12/16/2008 | ||||||

Jackson, TN | Hampton Inn & Suites | Vista | 12,600 | 83 | 12/30/2008 | ||||||

Pittsburgh, PA | Hampton Inn | Vista | 20,458 | 132 | 12/31/2008 | ||||||

Fort Lauderdale, FL | Hampton Inn | Vista | 19,290 | 109 | 12/31/2008 | ||||||

Frisco, TX | Hilton Garden Inn | Western | 15,050 | 102 | 12/31/2008 | ||||||

Total | $ | 341,199 | 2,478 | ||||||||

S-10

The purchase price for the hotels, net of debt assumed, was funded primarily by the Company’s ongoing best-efforts offering of Units. The Company assumed approximately $34.5 million of debt secured by three of its hotel properties. In addition, the Company assumed a non-mortgage note payable of $3.8 million in connection with the Lewisville, Texas Hilton Garden Inn hotel. The following table summarizes the interest rate, maturity date and principal amount assumed associated with each note payable. All dollar amounts are in thousands.

Location | Brand | Interest Rate | Maturity Date | Principal Assumed | ||||||

Lewisville, TX | Hilton Garden Inn | 0.00 | % | 12/31/2016 | $ | 3,750 | ||||

Duncanville, TX | Hilton Garden Inn | 5.88 | % | 5/11/2017 | 13,966 | |||||

Allen, TX | Hilton Garden Inn | 5.37 | % | 10/11/2015 | 10,787 | |||||

Bristol, VA | Courtyard | 6.59 | % | 8/1/2016 | 9,767 | |||||

| $ | 38,270 | |||||||||

The Company leases all of its hotels to its wholly-owned taxable REIT subsidiary (or a subsidiary thereof) under master hotel lease agreements. The Company also used the proceeds of its ongoing best-efforts offering to pay approximately $6.8 million, representing 2% of the gross purchase price for these hotels, as a brokerage commission to Apple Suites Realty Group, Inc. (“ASRG”), 100% owned by Glade M. Knight, the Company’s Chairman and Chief Executive Officer.

No goodwill was recorded in connection with any of the acquisitions.

Management and Franchise Agreements

Each of the Company’s hotels are operated and managed, under separate management agreements, by affiliates of one of the following companies: Dimension Development Two, LLC (“Dimension”), McKibbon Hotel Group, Inc. (“McKibbon”), Gateway Hospitality Group, Inc. (“Gateway”), LBAM-Investor Group, L.L.C. (“LBA”), Texas Western Management Partners, L.P. (“Western”) and Vista Host, Inc. (“Vista”). The agreements provide for initial terms of 1-5 years. Fees associated with the agreements generally include the payment of base management fees, incentive management fees, accounting fees, and other fees for centralized services which are allocated among all of the hotels that receive the benefit of such services. Base management fees are calculated as a percentage of gross revenues. Incentive management fees are calculated as a percentage of operating profit in excess of a priority return to the Company, as defined in the management agreements. The Company has the option to terminate the management agreements if specified performance thresholds are not satisfied. For the year ended December 31, 2008 the Company incurred approximately $441,000 in management fee expense.

Dimension, McKibbon, Gateway, LBA, Western or Vista is not affiliated with either Marriott or Hilton, and as a result, the hotels they manage were required to obtain separate franchise agreements with each respective franchisor. The Hilton franchise agreements generally provide for a term of 10 to 20 years. Fees associated with the agreements generally include the payment of royalty fees and program fees. The Marriott franchise agreements generally provide for initial terms of 13 to 20 years. Fees associated with the agreements generally include the payment of royalty fees, marketing fees, reservation fees and a communications support fee based on room revenues. For the year ended December 31, 2008 the Company incurred approximately $468,000 in franchise fee expense.

Results of Operations

During the period from the Company’s initial capitalization on November 9, 2007 to July 30, 2008, the Company owned no properties, had no revenue, exclusive of interest income and was primarily engaged in capital formation activities. During this period, the Company incurred miscellaneous start-up costs and interest expense related to an unsecured line of credit. The Company’s first investor closing under its ongoing best-efforts offering occurred on May 14, 2008 and the Company began operations on July 31, 2008 when it purchased its first hotel. During the remainder of 2008, the Company purchased an additional 20 hotel properties. As a result, a comparison of 2008 operating results to prior year results is not meaningful.

S-11

Hotel performance can be influenced by many factors including local competition, local and general economic conditions in the United States and the performance of individual managers assigned to each hotel. In evaluating financial condition and operating performance, the most important matters on which the Company focuses are revenue measurements, such as average occupancy, average daily rate (“ADR”) and revenue per available room (“RevPAR”), and expenses, such as hotel operating expenses, general and administrative and other expenses as described below.

During the past several quarters, the overall weakness in the U.S. economy has had a considerable negative impact on both consumer and business travel. As a result, lodging demand in most markets in the United States has declined. The Company expects this trend to continue into 2009 and will not reverse course until general economic conditions improve. The properties owned by the Company have shown results consistent with industry and brand averages for the short period of ownership. In its acquisition process, the Company has anticipated a certain amount of decline in income from historical results; however, there can be no assurance that actual results will meet expectations.

Revenues

The Company’s principal source of revenue is hotel room revenue and other related revenue. For the year ended December 31, 2008, the Company had total revenue of $11.5 million. These revenues reflect hotel operations for the 21 hotels acquired through December 31, 2008 for their respective periods of ownership by the Company. For the period from acquisition through December 31, 2008, the hotels achieved combined average occupancy of approximately 59%, ADR of $110 and RevPAR of $65. ADR is calculated as room revenue divided by the number of rooms sold, and RevPAR is calculated as occupancy multiplied by ADR.

Expenses

Hotel operating expenses for the year ended December 31, 2008 represent the expenses related to the 21 hotels acquired through December 31, 2008 for their respective periods owned. Hotel operating expenses consist of direct room expenses, hotel administrative expense, sales and marketing expense, utilities expense, repair and maintenance expense, franchise fees and management fees. For the year ended December 31, 2008, hotel operating expenses totaled $7.4 million or 64% of total revenue.

Taxes, insurance, and other expenses for the year ended December 31, 2008 were $731,000 or 6% of total revenue.

General and administrative expense for the year ended December 31, 2008 was $1.3 million. The principal components of general and administrative expense are advisory fees, legal fees, accounting fees and reporting expense.

Depreciation expense for the year ended December 31, 2008 was $2.3 million. Depreciation expense represents expense of the Company’s 21 hotel buildings and related improvements, and associated personal property (furniture, fixtures, and equipment) for their respective periods owned.

Interest expense for the year ended December 31, 2008 was $375,000. Interest expense primarily arose from debt assumed with the acquisition of four of the Company’s hotels, and from short-term financing under a line of credit facility which was outstanding from November 14, 2007 to May 14, 2008. During 2008, the Company also recognized $2.7 million in interest income, representing interest on excess cash invested in short-term money market instruments and certificates of deposit.

Related Party Transactions

The Company has significant transactions with related parties. These transactions cannot be construed to be at arms length and the results of the Company’s operations may be different than if conducted with non-related parties.

S-12

The Company has a contract with ASRG, to acquire and dispose of real estate assets for the Company. A fee of 2% of the gross purchase price or gross sale price in addition to certain reimbursable expenses is paid to ASRG for these services. As of December 31, 2008, payments to ASRG for services under the terms of this contract have totaled approximately $6.8 million since inception, which were capitalized as a part of the purchase price of the hotels. With the adoption of Financial Accounting Standards Board Statement No. 141R in January 2009, any additional amounts incurred under this contract will be expensed.

The Company is party to an advisory agreement with Apple Nine Advisors, Inc. (“A9A”) to provide management of the Company and its assets. An annual fee ranging from 0.1% to 0.25% of total equity proceeds received by the Company, in addition to certain reimbursable expenses, are payable for these services. A9A has entered into an agreement with Apple REIT Six, Inc. (“AR6”) to provide certain management services to the Company. The Company will reimburse A9A for the cost of the services provided by AR6. A9A will in turn reimburse AR6. Total advisory fees and reimbursable expenses incurred by the Company under the advisory agreement are included in general and administrative expenses and totaled approximately $766,000 for the year ended December 31, 2008 and $15,000 for the period November 9, 2007 (initial capitalization) through December 31, 2007.

ASRG and A9A are 100% owned by Glade M. Knight, Chairman and Chief Executive Officer of the Company.

Mr. Knight is also Chairman and Chief Executive Officer of Apple REIT Six, Inc., Apple REIT Seven, Inc. and Apple REIT Eight, Inc., other REITS. Members of the Company’s Board of Directors are also on the Board of Directors of Apple REIT Six, Inc., Apple REIT Seven, Inc. and Apple REIT Eight, Inc.

During the fourth quarter of 2008, the Company entered into a series of assignment of contracts with Apple REIT Eight, Inc. (“AR8”) to become the purchaser under three purchase contracts. The purchase contracts are for four hotels which are under construction: a Fairfield Inn & Suites and SpringHill Suites, both 200 room hotels located in Orlando, Florida, with a combined purchase price of $54.8 million, a 119 room SpringHill Suites hotel in Baton Rouge, Louisiana with a purchase price of $15.1 million and a 124 room Hampton Inn & Suites hotel in Rochester, Minnesota with a purchase price of $14.1 million. Under the terms and conditions of the contracts, AR8 assigned to the Company all of its rights and obligations under these purchase contracts. No consideration or fees was paid to AR8 for the assignment of the purchase contracts except for the reimbursement payment of the following: (i) initial deposits totaling $1.2 million made by AR8; and (ii) other costs totaling approximately $64,000 paid by AR8 to third parties. These reimbursement payments did not constitute or result in a profit for AR8.

Series B Convertible Preferred Stock

The Company has issued 480,000 Series B convertible preferred shares to Glade M. Knight, Chairman and Chief Executive Officer of the Company, in exchange for the payment by him of $0.10 per Series B convertible preferred share, or an aggregate of $48,000. The Series B convertible preferred shares are convertible into common shares pursuant to the formula and on the terms and conditions set forth below.

There are no dividends payable on the Series B convertible preferred shares. Holders of more than two-thirds of the Series B convertible preferred shares must approve any proposed amendment to the articles of incorporation that would adversely affect the Series B convertible preferred shares.

Upon the Company’s liquidation, the holder of the Series B convertible preferred shares is entitled to a priority liquidation payment before any distribution of liquidation proceeds to the holders of the common shares. However, the priority liquidation payment of the holder of the Series B convertible preferred shares is junior to the holders of the Series A preferred shares distribution rights. The holder of a Series B convertible preferred share is entitled to a liquidation payment of $11 per number of common shares each Series B convertible preferred share would be convertible into according to the formula described below. In the event that the

S-13

liquidation of the Company’s assets results in proceeds that exceed the distribution rights of the Series A preferred shares and the Series B convertible preferred shares, the remaining proceeds will be distributed between the common shares and the Series B convertible preferred shares, on an as converted basis.

Each holder of outstanding Series B convertible preferred shares shall have the right to convert any of such shares into common shares of the Company upon and for 180 days following the occurrence of any of the following events:

(1) substantially all of the Company’s assets, stock or business is sold or transferred through exchange, merger, consolidation, lease, share exchange, sale or otherwise, other than a sale of assets in liquidation, dissolution or winding up of the Company;

(2) the termination or expiration without renewal of the advisory agreement with A9A, or if the Company ceases to use ASRG to provide property acquisition and disposition services; or

(3) the Company’s common shares are listed on any securities exchange or quotation system or in any established market.

Upon the occurrence of any conversion event, each Series B convertible preferred share may be converted into a number of common shares based upon the gross proceeds raised through the date of conversion in the Company’s $2 billion offering according to the following table:

Gross Proceeds Raised from Sales of Units through Date of Conversion | Number of Common Shares through Conversion of One Series B Convertible Preferred Share | |

$400 million | 4.83721 | |

$500 million | 6.11068 | |

$600 million | 7.29150 | |

$700 million | 8.49719 | |

$800 million | 9.70287 | |

$900 million | 10.90855 | |

$ 1 billion | 12.11423 | |

$ 1.1 billion | 13.31991 | |

$ 1.2 billion | 14.52559 | |

$ 1.3 billion | 15.73128 | |

$ 1.4 billion | 16.93696 | |

$ 1.5 billion | 18.14264 | |

$ 1.6 billion | 19.34832 | |

$ 1.7 billion | 20.55400 | |

$ 1.8 billion | 21.75968 | |

$ 1.9 billion | 22.96537 | |

$ 2 billion | 24.17104 |

S-14

In the event that after raising gross proceeds of $2 billion, the Company raises additional gross proceeds in a subsequent public offering, each Series B convertible preferred share may be converted into an additional number of common shares based on the additional gross proceeds raised through the date of conversion in a subsequent public offering according to the following formula: (X/100 million) x 1.20568, where X is the additional gross proceeds rounded down to the nearest 100 million.

No additional consideration is due upon the conversion of the Series B convertible preferred shares. The conversion into common shares of the Series B convertible preferred shares will result in dilution of the shareholders’ interests.

Expense related to the issuance of 480,000 Series B convertible preferred shares to Mr. Knight will be recognized at such time when the number of common shares to be issued for conversion of the Series B shares can be reasonably estimated and the event triggering the conversion of the Series B shares to common shares occurs. The expense will be measured as the difference between the fair value of the common stock for which the Series B shares can be converted and the amounts paid for the Series B shares. Although the fair market value cannot be determined at this time, expense if the maximum offering is achieved could range from $0 to in excess of $127 million (assumes $11 per unit fair market value). Based on equity raised through December 31, 2008, if a triggering event had occurred, expense would have ranged from $0 to $25.5 million (assumes $11 per unit fair market value).

Liquidity and Capital Resources

The following is a summary of the Company’s significant contractual obligations as of December 31, 2008:

| Amount of Commitments Expiring per Period | |||||||||||||||

(000’s) | Total | Less than 1 Year | 2-3 Years | 4-5 Years | Over 5 Years | ||||||||||

Property Purchase Commitments | $ | 334,058 | $ | 281,958 | $ | 52,100 | $ | — | $ | — | |||||

Debt (including interest of $15.1 million) | 53,255 | 2,529 | 5,059 | 6,809 | 38,858 | ||||||||||

| $ | 387,313 | $ | 284,487 | $ | 57,159 | $ | 6,809 | $ | 38,858 | ||||||

The Company was initially capitalized on November 9, 2007, with its first investor closing on May 14, 2008. The Company’s principal source of liquidity will be cash on hand, the proceeds of its on-going best-efforts offering and the cash flow generated from properties the Company has or will acquire and any short term investments. In addition, the Company may borrow funds, subject to the approval of the Company’s board of directors.

The Company anticipates that cash flow, and cash on hand, will be adequate to cover its operating expenses and to permit the Company to meet its anticipated liquidity requirements, including anticipated distributions to shareholders and capital improvements. The Company intends to use the proceeds from the Company’s on-going best-efforts offering, and cash on hand, to purchase income producing real estate.

S-15

The Company is raising capital through a best-efforts offering of Units (each Unit consists of one common share and one Series A preferred share) by David Lerner Associates, Inc., the managing dealer, which receives selling commissions and a marketing expense allowance based on proceeds of the Units sold. The minimum offering of 9,523,810 Units at $10.50 per Unit was sold as of May 14, 2008, with proceeds net of commissions and marketing expenses totaling $90 million. Subsequent to the minimum offering and through December 31, 2008, an additional 31.5 million Units, at $11 per Unit, were sold, with the Company receiving proceeds, net of commissions, marketing expenses and other offering costs of approximately $310.5 million. The Company is continuing its offering at $11.00 per Unit. The Company will offer Units until April 25, 2010 unless the offering is extended, or terminated if all of the Units are sold before then.

To maintain its REIT status the Company is required to distribute at least 90% of its ordinary income. Distributions since the initial capitalization through December 31, 2008 totaled approximately $13.0 million and were paid at a monthly rate of $0.073334 per common share beginning in June 2008. For the same period the Company’s cash generated from operations was approximately $3.3 million. Due to the inherent delay between raising capital and investing that same capital in income producing real estate, the Company has had significant amounts of cash earning interest at short term money market rates. As a result, the difference between distributions paid and cash generated from operations has been funded from proceeds from the offering of Units, and this portion of distributions is expected to be treated as a return of capital for federal income tax purposes. In May, 2008, the Company’s Board of Directors established a policy for an annualized dividend rate of $0.88 per common share, payable in monthly distributions. The Company intends to continue paying dividends on a monthly basis, consistent with the annualized dividend rate established by its Board of Directors. The Company’s Board of Directors, upon the recommendation of the Audit Committee, may amend or establish a new annualized dividend rate and may change the timing of when distributions are paid. Since a portion of distributions has to date been funded with proceeds from the offering of Units, the Company’s ability to maintain its current intended rate of distribution will be based on its ability to fully invest its offering proceeds and thereby increase its cash generated from operations. Since there can be no assurance of the Company’s ability to acquire properties that provide income at this level, there can be no assurance as to the classification or duration of distributions at the current rate. Proceeds of the offering which are distributed are not available for investment in properties.

The Company has on-going capital commitments to fund its capital improvements. The Company is required, under all of the hotel management agreements and certain loan agreements, to make available, for the repair, replacement, refurbishing of furniture, fixtures, and equipment, a percentage of gross revenues provided that such amount may be used for the Company’s capital expenditures with respect to the hotels. The Company expects that this amount will be adequate to fund required repair, replacement, and refurbishments and to maintain the Company’s hotels in a competitive condition. As of December 31, 2008, the Company held with various lenders $1.3 million in reserves for capital expenditures. The Company has six major renovations scheduled for 2009. Total capital expenditures for these hotels are anticipated to be approximately $12 million.

As of December 31, 2008, the Company had entered into outstanding contracts for the purchase of 19 additional hotels for a total purchase price of approximately $329 million. Of these 19 hotels, 15 are under construction and should be completed over the next 12 to 18 months. The other four hotels are expected to close within the next three months. The Company also has one purchase contract for land that is subject to a feasibility study for the construction of a SpringHill Suites hotel. Although the Company is working towards acquiring these hotels, there are many conditions to closing that have not yet been satisfied and there can be no assurance that closings will occur under the outstanding purchase contracts. The Company also anticipates assuming outstanding mortgage loan obligations on four of the 19 properties, representing a source of funding of approximately $29.3 million of the total purchase price of the contracts outstanding as of December 31, 2008. It is anticipated the remainder of the purchase price will be funded from proceeds of the Company’s ongoing best-efforts offering of Units and cash on hand.

S-16

Subsequent Events

In January 2009, the Company declared and paid approximately $3.0 million in dividend distributions to its common shareholders, or $0.073334 per outstanding common share. The Company also closed on the issuance of 4.0 million Units through its ongoing best-efforts offering, representing gross proceeds to the Company of $44.5 million and proceeds net of selling and marketing costs of $40.0 million.

In February 2009, the Company declared and paid approximately $3.3 million in dividend distributions to its common shareholders, or $0.073334 per outstanding common share. The Company also closed on the issuance of 3.7 million Units through its ongoing best-efforts offering, representing gross proceeds to the Company of $41.0 million and proceeds net of selling and marketing costs of $36.9 million.

On January 5, 2009, the Company entered into a purchase contract for the potential acquisition of a Hampton Inn & Suites hotel in Yuma, Arizona. On February 4, 2009, this contract was terminated. The gross purchase price for the 90 room hotel was $11.3 million.

On January 6, 2009, the Company entered into a purchase contract for the potential acquisition of a Hampton Inn hotel in Holly Springs, North Carolina. The gross purchase price for the 124 room hotel is $14.9 million, and a refundable deposit of $100,000 was paid by the Company in connection with the contract. The hotel is currently under construction. The number of rooms refers to the expected number of rooms upon completion.

On January 21, 2009, the Company entered into a purchase contract for the potential purchase of approximately 500 acres of land to be used for natural gas production located on approximately 115 sites in Texas. The purchase contract is with a subsidiary of Chesapeake Energy Corporation. The total purchase price under the contract is approximately $150 million. The purchase contract also contemplates that at closing, the Company would enter into a long-term lease with a lessee that will use the land for natural gas production. A refundable deposit of $500,000 was paid by the Company in connection with this contract.

On January 29, 2009, the Company terminated a purchase contract for a hotel located in Portsmouth, New Hampshire. The hotel had a purchase price of $15.8 million, secured debt to be assumed by the Company totaling $9.7 million and contained 126 guest rooms. In connection with the termination of this contract, the initial deposit of $200,000 was repaid to the Company.

Impact of Inflation

Operators of hotels, in general, possess the ability to adjust room rates daily to reflect the effects of inflation. Competitive pressures may, however, limit the operators’ ability to raise room rates. Currently the Company is not experiencing any material impact from inflation.

Business Interruption

Being in the real estate industry, the Company is exposed to natural disasters on both a local and national scale. Although management believes there is adequate insurance to cover this exposure, there can be no assurance that such events will not have a material adverse effect on the Company’s financial position or results of operations.

Seasonality

The hotel industry historically has been seasonal in nature. Seasonal variations in occupancy at the Company’s hotels may cause quarterly fluctuations in its revenues. To the extent that cash flow from operations is insufficient during any quarter, due to temporary or seasonal fluctuations in revenue, the Company expects to utilize cash on hand to make distributions.

S-17

Critical Accounting Policies

The following contains a discussion of what the Company believes to be critical accounting policies. These items should be read to gain a further understanding of the principles used to prepare the Company’s financial statements. These principles include application of judgment; therefore, changes in judgments may have a significant impact on the Company’s reported results of operations and financial condition.

Capitalization Policy

The Company considers expenditures to be capital in nature based on the following criteria: (1) for a single asset, the cost must be at least $500, including all normal and necessary costs to place the asset in service, and the useful life must be at least one year; (2) for group purchases of 10 or more identical assets, the unit cost for each asset must be at least $50, including all normal and necessary costs to place the asset in service, and the useful life must be at least one year; (3) for major repairs to buildings, the repair must be at least $2,500 and the useful life of the asset must be substantially extended.

Impairment Losses Policy

The Company records impairment losses on hotel properties used in operations if indicators of impairment are present, and the sum of the undiscounted cash flows estimated to be generated by the respective properties is less than the properties’ carrying amounts. Impairment losses are measured as the difference between the asset’s fair value less cost to sell, and its carrying value. No impairment losses have been recorded to date.

Investment Policy

The purchase price of real estate properties acquired is allocated to the various components, such as land, buildings and improvements, intangible assets and in-place leases as appropriate, in accordance with Statement of Financial Accounting Standards No. 141, “Business Combinations”. The purchase price is allocated based on the fair value of each component at the time of acquisition. Generally, the Company does not acquire real estate assets that have significant in-place leases as lease terms for hotel properties are very short term in nature. The Company has not allocated any purchase price to intangible assets such as management contracts and franchise agreements as such contracts are generally at current market rates and any other value attributable to these contracts are not considered material.

Recent Accounting Pronouncements

In September 2006, the Financial Accounting Standards Board (“FASB”) issued Statement No. 157,Fair Value Measurements (“SFAS 157”). SFAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. The Statement applies under other accounting pronouncements that require or permit fair value measurements. Accordingly, this Statement does not require any new fair value measurements. In February 2008, the FASB released FASB Staff Position (FSP) FAS 157-2 – Effective Date of FASB Statement No. 157, which defers the effective date of SFAS 157 to fiscal years beginning after November 15, 2008 for all nonfinancial assets and liabilities, except those items that are recognized or disclosed at fair value in the financial statements on a recurring basis (at least annually). The effective date of the statement related to those items not covered by the deferral (all financial assets and liabilities or nonfinancial assets and liabilities recorded at fair value on a recurring basis) is for fiscal years beginning after November 15, 2007. The adoption of this statement did not have and is not anticipated to have a material impact on the Company’s results of operations or financial position.

In February 2007, FASB issued Statement No. 159,The Fair Value Option for Financial Assets and Financial Liabilities(“SFAS 159”). SFAS 159 permits entities to choose to measure many financial instruments and certain other items at fair value. The objective of the guidance is to improve financial reporting by providing entities with the opportunity to mitigate volatility in reported earnings caused by measuring related assets and

S-18

liabilities differently without having to apply complex hedge accounting provisions. SFAS 159 is effective as of the beginning of the first fiscal year that begins after November 15, 2007. SFAS 159 was effective for the Company beginning January 1, 2008. The Company has elected not to use the fair value measurement provisions of SFAS 159 and therefore, adoption of this standard did not have an impact on the financial statements.

In December 2007, FASB issued Statement No. 141R,Business Combinations (“SFAS 141R”). SFAS 141R revises Statement 141,Business Combinations, by requiring an acquirer to recognize the assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree at the acquisition date, measured at their fair values as of that date, with limited exceptions. This method replaces the cost-allocation process, which required the cost of an acquisition to be allocated to the individual assets acquired and liabilities assumed based on their estimated fair values. A significant change included in SFAS 141R is the requirement that costs incurred to effect an acquisition must be accounted for separately as expenses. These costs were previously capitalized as part of the cost of the acquisition. Another significant change is the requirement that pre-acquisition contingencies be recognized at fair value as of the date of acquisition if it is more likely than not that they will meet the definition of an asset or liability. SFAS 141R will be adopted by the Company in the first quarter of 2009. The adoption of this standard will have a material impact on the results of operations for the Company when it acquires real estate properties. In addition to other acquisition related costs, the Company will be required to expense the commission paid to ASRG. As of December 31, 2008, the Company had $380,000 in transaction costs related to outstanding contracts for the purchase of 19 hotel properties and other potential property acquisitions. These costs were recorded as deferred acquisition costs and included in other assets in the Company’s consolidated balance sheet as of December 31, 2008. In accordance with SFAS 141R, these costs will be expensed on January 1, 2009. If this statement had been effective for 2008, the Company would have recorded approximately $8.6 million in transaction costs in its consolidated statement of operations for the year ended December 31, 2008.

In December 2007, the FASB issued Statement No. 160,Noncontrolling Interests in Consolidated Financial Statements-an amendment of Accounting Research Bulletin No. 51 (“SFAS 160”). SFAS 160 requires that ownership interests in subsidiaries held by parties other than the parent be clearly identified, labeled, and presented in the consolidated statement of financial position within equity, but separate from the parent’s equity. The Statement also requires that the amount of consolidated net income attributable to the parent and to the noncontrolling interest be clearly identified and presented on the face of the consolidated statement of income. SFAS 160 will be adopted by the Company in the first quarter of 2009. The adoption of the statement is not anticipated to have a material impact on the Company’s results of operations or financial position.

In March 2008, FASB issued Statement No. 161,Disclosures about Derivative Instruments and Hedging Activities, an Amendment of FASB Statement No. 133 (“SFAS 161”). SFAS 161 is intended to improve transparency in financial reporting by requiring enhanced disclosures of an entity’s derivative instruments and hedging activities and their effects on the entity’s financial position, financial performance, and cash flows. SFAS 161 applies to all derivative instruments within the scope of SFAS No. 133,Accounting for Derivative Instruments and Hedging Activities (“SFAS 133”). It also applies to non-derivative hedging instruments and all hedged items designated and qualifying as hedges under SFAS 133. SFAS 161 is effective prospectively for financial statements issued for fiscal years and interim periods beginning after November 15, 2008, with early application encouraged. The Company does not currently have any instruments that qualify within the scope of SFAS 133, and therefore the adoption of this statement is not anticipated to have a material impact on the Company’s financial statements.

S-19

Set forth below are the audited consolidated financial statements of the Company as of December 31, 2008 and 2007, and the related consolidated statements of operations, shareholders’ equity, and cash flows for the year ended December 31, 2008 and for the period November 9, 2007 (initial capitalization) through December 31, 2007. These financial statements have been included herein in reliance on the report, also set forth below, of Ernst & Young LLP, an independent registered public accounting firm, and upon the authority of that firm as an expert in accounting and auditing.

S-20

The tables following this introduction set forth information with respect to certain of the prior real estate programs sponsored by Glade M. Knight, who is sometimes referred to as the “prior program sponsor.” These tables provide information for use in evaluating the programs, the results of the operations of the programs, and compensation paid by the programs. Information in the tables is current as of December 31, 2008. The tables are furnished solely to provide prospective investors with information concerning the past performance of entities formed by Glade M. Knight. Regulatory filings and annual reports of Cornerstone, Apple REIT Eight, Apple REIT Seven, Apple REIT Six, Apple Hospitality Five and Apple Hospitality Two will be provided upon request for no cost (except for exhibits, for which there is a minimal charge). In addition, Table VI of this Supplement contains detailed information on the property acquisitions of Apple REIT Six, Apple REIT Seven and Apple REIT Eight and is available without charge upon request of any investor or prospective investor. Please send all requests to Apple REIT Nine, Inc., 814 East Main Street, Richmond, VA 23219, Attn: Kelly Clarke; telephone: 804-344-8121.

In the five years ending December 31, 2008, Glade M. Knight sponsored only Cornerstone, Apple Hospitality Two, Apple Hospitality Five, Apple REIT Six, Apple REIT Seven and Apple REIT Eight, which have investment objectives similar to ours. Cornerstone, Apple Hospitality Two, Apple Hospitality Five, Apple REIT Six, Apple REIT Seven and Apple REIT Eight were formed to invest in existing residential rental properties and/or extended-stay and select-service hotels and possibly other properties for the purpose of providing regular monthly or quarterly distributions to shareholders and the possibility of long-term appreciation in the value of properties and shares.

On May 23, 2007, Apple Hospitality Two merged with and into an affiliate managed by ING Clarion Partners, LLC. Pursuant to the terms and conditions of the Agreement and Plan of Merger, dated as of February 15, 2007, upon the completion of the merger, the separate corporate existence of Apple Hospitality Two ceased. Each shareholder of Apple Hospitality Two received approximately $11.20 for each outstanding unit (consisting of one common share together with one Series A preferred share).

On October 5, 2007, Apple Hospitality Five merged with and into a subsidiary of Inland American Real Estate Trust, Inc. Pursuant to the terms and conditions of the Agreement and Plan of Merger, dated as of July 25, 2007, upon the completion of the merger, the separate corporate existence of Apple Hospitality Five ceased. Each shareholder of Apple Hospitality Five received approximately $14.05 for each outstanding unit (consisting of one common share together with one Series A preferred share).

The information in the following tables should not be considered as indicative of our capitalization or operations. Also past performance of prior programs is not necessarily indicative of our future results. Purchasers of units offered by our offering will not have any interest in the entities referred to in the following tables or in any of the properties owned by those entities as a result of the acquisition of Units in us.

See, “Apple Nine Advisors and Apple Suites Realty—Prior Performance of Programs Sponsored by Glade M. Knight” in the prospectus for additional information on certain prior real estate programs sponsored by Mr. Knight, including a description of the investment objectives which are deemed by Mr. Knight to be similar and dissimilar to those of the Company.

The following tables use certain financial terms. The following paragraphs briefly describe the meanings of these terms.

| • | “Acquisition Costs” means fees related to the purchase of property, cash down payments, acquisition fees, and legal and other costs related to property acquisitions. |

| • | “Cash Generated From Operations” means the excess (or the deficiency in the case of a negative number) of operating cash receipts, including interest on investments, over operating cash expenditures, including debt service payments. |

S-21

| • | “GAAP” refers to “Generally Accepted Accounting Principles” in the United States. |

| • | “Recapture” means the portion of taxable income from property sales or other dispositions that is taxed as ordinary income. |

| • | “Reserves” refers to offering proceeds designated for repairs and renovations to properties and offering proceeds not committed for expenditure and held for potential unforeseen cash requirements. |

| • | “Return of Capital” refers to distributions to investors in excess of net income. |

S-22

TABLE I: EXPERIENCE IN RAISING AND INVESTING FUNDS

Table I presents a summary of the funds raised and the use of those funds by Apple REIT Eight, Apple REIT Seven and Apple REIT Six, whose investment objectives are similar to those of Apple REIT Nine, and whose offering closed or was in progress within the three years ending December 31, 2008.

| Apple REIT Eight | Apple REIT Seven | Apple REIT Six | ||||||||||

Dollar Amount Offered | $ | 1,000,000,000 | $ | 1,000,000,000 | $ | 1,000,000,000 | ||||||

Dollar Amount Raised | 1,000,000,000 | 1,000,000,000 | 1,000,000,000 | |||||||||

LESS OFFERING EXPENSES: | ||||||||||||

Selling Commissions and Discounts | 10.00 | % | 10.00 | % | 10.00 | % | ||||||

Organizational Expenses | 0.15 | % | 0.19 | % | 0.21 | % | ||||||

Other | 0.00 | % | 0.00 | % | 0.00 | % | ||||||

Reserves | 0.50 | % | 0.50 | % | 0.50 | % | ||||||

Percent Available from Investment | 89.35 | % | 89.31 | % | 89.29 | % | ||||||

ACQUISITION COSTS: | ||||||||||||

Prepaid items and fees to purchase property (1) | 87.35 | % | 87.31 | % | 87.29 | % | ||||||

Cash down payment | 0.00 | % | 0.00 | % | 0.00 | % | ||||||

Acquisition fees (2) | 2.00 | % | 2.00 | % | 2.00 | % | ||||||

Other | 0.00 | % | 0.00 | % | 0.00 | % | ||||||

Total Acquisition Costs | 89.35 | % | 89.31 | % | 89.29 | % | ||||||

Percentage Leverage (excluding unsecured debt) | 12.89 | % | 11.06 | % | 7.00 | % | ||||||

Date Offering Began | July 2007 | March 2006 | April 2004 | |||||||||

Length of offering (in months) | 9 | 17 | 23 | |||||||||

Months to invest 90% of amount available for investment (measured from beginning of offering) | 11 | 22 | 21 | |||||||||

| (1) | This line item includes the contracted purchase price plus any additional closing costs such as transfer taxes, title insurance and legal fees. |

| (2) | Substantially all of the acquisition fees were paid to the sponsor or affiliates of the sponsor. The acquisition fees include real estate commissions paid on the acquisition. |

Information on prior programs is not indicative of our capitalization or operations and is not necessarily indicative of our future results.

Purchasers of Units in our offering will own no interest in these prior programs.

S-23

TABLE II: COMPENSATION TO SPONSOR AND ITS AFFILIATES

Table II summarizes the compensation paid to the Prior Program Sponsor and its Affiliates, and employee cost reimbursements to related entities (i) by programs organized by it and closed within three years ended December 31, 2008, and (ii) by all other programs during the three years ended December 31, 2008.

| Apple REIT Eight | Apple REIT Seven | Apple REIT Six | Apple Hospitality Five (4) | Apple Hospitality Two (3) | ||||||||||||

Date offering commenced | July 2007 | March 2006 | April 2004 | January 2003 | May 2001 | |||||||||||

Dollar amount raised | $ | 1,000,000,000 | $ | 1,000,000,000 | $ | 1,000,000,000 | $ | 500,000,000 | $ | 300,000,000 | ||||||

Amounts Paid to Prior Program Sponsor from Proceeds of Offering: | ||||||||||||||||

Acquisition fees | — | — | — | — | — | |||||||||||

Real Estate commission | 19,011,000 | 18,032,000 | 16,906,642 | 8,200,000 | 8,247,000 | |||||||||||

Advisory Fees (2) | 1,114,000 | 2,854,000 | 8,145,000 | 3,315,000 | 749,000 | |||||||||||

Other | — | — | — | — | — | |||||||||||

Employee payroll and benefits (5) | 1,871,000 | 3,155,000 | 5,532,000 | 2,754,135 | 4,378,624 | |||||||||||

Cash generated from operations before deducting payments to Prior Program Sponsor | 46,391,000 | 126,994,000 | 299,914,000 | 167,383,000 | 203,609,000 | |||||||||||

Management and Accounting Fees | — | — | — | — | — | |||||||||||

Reimbursements | — | — | — | — | 423,000 | |||||||||||

Leasing Fees | — | — | — | — | — | |||||||||||

Other Fees | — | — | — | — | 15,700,000 | (1) | ||||||||||

There have been no fees from property sales or refinancings.

| (1) | Effective January 31, 2003, Apple Hospitality Two acquired all shares of Apple Suites Advisors (previously owned by Mr. Glade Knight). As a result of this transaction, Mr. Knight received $2 million in cash and a note due in 2007 in the amount of $3.5 million. Additionally as the result of this transaction, Apple Hospitality Two’s Series B Preferred Shares were converted into approximately 1.3 million Series C Preferred Shares. The Series C Preferred Shares were valued at $10.2 million. |

| (2) | Effective February 1, 2003, Apple Hospitality Five advisory fees and related expenses were paid to Apple Hospitality Two. |

| (3) | On May 23, 2007, Apple Hospitality Two merged with and into an affiliate managed by ING Clarion Partners, LLC. |

| (4) | On October 5, 2007, Apple Hospitality Five merged with and into a subsidiary of Inland American Real Estate Trust, Inc. |

| (5) | Represents payroll and benefits expenses either directly incurred, or reimbursements to, Apple Fund Management (a subsidiary of Apple REIT Six and indirectly controlled by the Prior Performance Sponsor) or a prior related REIT organized and indirectly controlled by the Prior Program Sponsor. |

Information on prior programs is not indicative of our capitalization or operations and is not necessarily indicative of our future results.

Purchasers of Units in our offering will own no interest in these prior programs.

S-24

TABLE III: OPERATING RESULTS OF PRIOR PROGRAMS*

Table III presents a summary of the annual operating results for Apple REIT Eight, Apple REIT Seven, Apple REIT Six and Apple Hospitality Five, whose offerings closed or were in progress in the five year period ending December 31, 2008. Apple Hospitality Five merged with and into a subsidiary of Inland American Real Estate Trust, Inc. on October 5, 2007, therefore no results are presented for the year ended December 31, 2007. Table III is shown on both an income tax basis as well as in accordance with generally accepted accounting principles, the only significant difference being the methods of calculating depreciation.

| 2008 Apple REIT Eight | 2008 Apple REIT Seven | 2008 Apple REIT Six | 2007 Apple REIT Eight | 2007 Apple REIT Seven | 2007 Apple REIT Six | 2006 Apple REIT Seven | 2006 Apple REIT Six | 2006 Apple Hospitality Five | 2005 Apple REIT Six | 2005 Apple Hospitality Five | 2004 Apple REIT Six | 2004 Apple Hospitality Five | ||||||||||||||||||||||||||||||||||||||||

Gross revenues | $ | 133,284,000 | $ | 214,291,000 | $ | 264,302,000 | $ | 1,485,000 | $ | 138,564,000 | $ | 257,934,000 | $ | 20,345,000 | $ | 235,875,000 | $ | 125,369,000 | $ | 101,790,000 | $ | 109,413,000 | $ | 14,435,000 | $ | 90,260,000 | ||||||||||||||||||||||||||

Profit on sale of properties | — | — | — | — | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

Less: Operating expenses | 95,047,000 | 144,028,000 | 173,098,000 | 2,097,000 | 89,338,000 | 165,059,000 | 15,689,000 | 154,424,000 | 78,881,000 | 68,733,000 | 71,207,000 | 11,623,000 | 59,107,000 | |||||||||||||||||||||||||||||||||||||||

Interest income (expense) | (1,928,000 | ) | (3,766,000 | ) | (1,784,000 | ) | 6,343,000 | 997,000 | (1,853,000 | ) | 1,855,000 | (1,809,000 | ) | 134,000 | 2,126,000 | 127,000 | 328,000 | 421,000 | ||||||||||||||||||||||||||||||||||

Depreciation | 22,044,000 | 28,434,000 | 30,918,000 | 333,000 | 16,990,000 | 27,694,000 | 3,073,000 | 25,529,000 | 12,856,000 | 11,366,000 | 11,187,000 | 1,881,000 | 9,452,000 | |||||||||||||||||||||||||||||||||||||||

Net income (loss) GAAP basis | 14,265,000 | 38,063,000 | 58,502,000 | 5,398,000 | 33,233,000 | 63,328,000 | 3,438,000 | 54,113,000 | 33,766,000 | 23,817,000 | 27,146,000 | 1,259,000 | 22,122,000 | |||||||||||||||||||||||||||||||||||||||

Taxable income | — | — | — | — | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

Cash generated from operations | 39,714,000 | 69,025,000 | 88,747,000 | 5,563,000 | 49,957,000 | 89,848,000 | 5,158,000 | 81,363,000 | 47,008,000 | 28,907,000 | 38,504,000 | 2,904,000 | 30,955,000 | |||||||||||||||||||||||||||||||||||||||

Cash generated from sales | — | — | — | — | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

Cash generated from refinancing | — | — | — | — | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

Less: cash distributions to investors | 76,378,000 | 81,440,000 | 81,746,000 | 14,464,000 | 60,234,000 | 78,834,000 | 12,526,000 | 77,997,000 | 40,467,000 | 48,865,000 | 39,781,000 | 9,479,000 | 38,928,000 | |||||||||||||||||||||||||||||||||||||||

Cash generated after cash distribution | (36,664,000 | ) | (12,415,000 | ) | 7,001,000 | (8,901,000 | ) | (10,277,000 | ) | 11,014,000 | (7,368,000 | ) | 3,366,000 | 6,541,000 | (19,958,000 | ) | (1,277,000 | ) | (6,575,000 | ) | (7,973,000 | ) | ||||||||||||||||||||||||||||||

Less: Special items | — | — | — | — | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

Cash generated after cash distributions and special items | (36,664,000 | ) | (12,415,000 | ) | 7,001,000 | (8,901,000 | ) | (10,277,000 | ) | 11,014,000 | (7,368,000 | ) | 3,366,000 | 6,541,000 | (19,958,000 | ) | (1,277,000 | ) | (6,575,000 | ) | (7,973,000 | ) | ||||||||||||||||||||||||||||||

Capital contributions, net | 234,054,000 | 20,599,000 | 16,325,000 | 679,435,000 | 541,410,000 | 13,159,000 | 363,640,000 | 78,026,000 | (226,000 | ) | 471,784,000 | (2,103,000 | ) | 333,295,000 | 89,836,000 | |||||||||||||||||||||||||||||||||||||

Fixed asset additions | 759,346,000 | 129,589,000 | 33,434,000 | 87,643,000 | 391,227,000 | 15,635,000 | 318,157,000 | 62,075,000 | 9,231,000 | 570,034,000 | 35,525,000 | 181,047,000 | 66,218,000 | |||||||||||||||||||||||||||||||||||||||

Line of credit-change in (1) | 10,258,000 | — | — | — | — | — | 18,000,000 | (28,000,000 | ) | — | 28,000,000 | — | — | — | ||||||||||||||||||||||||||||||||||||||

S-25

TABLE III: OPERATING RESULTS OF PRIOR PROGRAMS*—(Continued)

| 2008 Apple REIT Eight | 2008 Apple REIT Seven | 2008 Apple REIT Six | 2007 Apple REIT Eight | 2007 Apple REIT Seven | 2007 Apple REIT Six | 2006 Apple REIT Seven | 2006 Apple REIT Six | 2006 Apple Hospitality Five | 2005 Apple REIT Six | 2005 Apple Hospitality Five | 2004 Apple REIT Six | 2004 Apple Hospitality Five | |||||||||||||||||||||

Cash generated (2) | (562,009,000 | ) | (121,828,000 | ) | (32,326,000 | ) | 561,985,000 | 97,833,000 | 7,101,000 | 44,554,000 | (9,788,000 | ) | (335,000 | ) | (106,842,000 | ) | (37,548,000 | ) | 142,766,000 | 14,810,000 | |||||||||||||

End of period cash | — | 20,609,000 | 935,000 | 562,009,000 | 142,437,000 | 33,261,000 | 44,604,000 | 26,160,000 | 1,082,000 | 35,948,000 | 1,082,000 | 142,790,000 | 38,630,000 | ||||||||||||||||||||

Tax and distribution data per $1,000 invested | |||||||||||||||||||||||||||||||||

Federal income tax results | |||||||||||||||||||||||||||||||||

Ordinary income | 42 | 45 | 70 | 11 | 50 | 72 | 38 | 66 | 78 | 50 | 57 | 24 | 58 | ||||||||||||||||||||

Capital gain | — | — | — | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||

Cash distributions to investors | |||||||||||||||||||||||||||||||||

Investment income | 42 | 45 | 70 | 11 | 50 | 72 | 38 | 66 | 78 | 50 | 57 | 24 | 58 | ||||||||||||||||||||

Long-term capital gain | — | — | — | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||

Return of capital | 38 | 35 | 12 | 25 | 30 | 8 | 22 | 14 | 4 | 30 | 23 | 26 | 22 | ||||||||||||||||||||

Source (on Cash basis) | |||||||||||||||||||||||||||||||||

Sales | — | — | — | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||

Refinancings | — | — | — | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||

Operations | 80 | 80 | 82 | 36 | 80 | 80 | 60 | 80 | 82 | 80 | 80 | 50 | 80 | ||||||||||||||||||||

Other | — | — | — | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||

Amount (in percentage terms) remaining invested in program properties at the end of the last year reported in the Table (original total acquisition cost of properties retained divided by original total acquisition cost of all properties in program) | 100 | % | 100 | % | 100 | % |

| * | Any rows not reflected from SEC Industry Guide 5 are not applicable to the programs. |

| (1) | Amount reflects change in Company’s short term credit facilities. |

| (2) | Amount reflects the net change in Company’s cash balance during the year. |