INVESTOR PRESENTATION NOVEMBER 2020 • NYSE: APLE Exhibit 99.1

COVER PHOTOS: HAMPTON INN & SUITES AND HOME2 SUITES, CAPE CANAVERAL, FL; HOMEWOOD SUITES, MIAMI, FL; SPRINGHILL SUITES, BURBANK, CA; COURTYARD, KIRKLAND, WA HILTON GARDEN INN, NASHVILLE, TN Certain statements made in this presentation are forward-looking statements, including statements regarding the impact to Apple Hospitality REIT, Inc.’s (the “Company,” “Apple Hospitality,” “Apple” or “APLE”) business and financial condition from, and measures being taken in response to, the COVID-19 situation. These forward-looking statements include statements regarding our intent, belief or current expectations and are based on various assumptions. These statements involve substantial risks and uncertainties. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. Forward-looking statements may include, but are not limited to, statements regarding net asset value and potential trading prices. Words such as “anticipates,” “believes,” “expects,” “estimates,” “projects,” “plans,” “intends,” “may,” “will,” “would,“ “outlook,” “strategy,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Actual results or outcomes may differ materially from those contemplated by the forward-looking statement. Further, forward-looking statements speak only as of the date they are made, and we undertake no obligation to update or reverse any forward-looking statement to reflect changed assumptions or the occurrence of unanticipated events or changes to future operating results, unless required to do so by law. Currently, one of the most significant factors that could cause actual outcomes to differ materially from the Company’s forward-looking statements is the adverse effect of COVID-19, including possible resurgences, on the Company’s business, financial performance and condition, operating results and cash flows, the real estate market and the hospitality industry specifically, and the global economy and financial markets generally. The significance, extent and duration of the impacts caused by the COVID-19 outbreak on the Company will depend on future developments, which are highly uncertain and cannot be predicted with confidence at this time, including the scope, severity and duration of the pandemic, the extent and effectiveness of the actions taken to contain the pandemic or mitigate its impact, the potential for additional hotel closures/consolidations that may be mandated or advisable, whether based on increased COVID-19 cases or other factors, the slowing or potential rollback of “reopenings” in certain states, and the direct and indirect economic effects of the pandemic and containment measures, among others. Such additional factors that might cause such differences include, but are not limited to, the ability of Apple Hospitality to effectively acquire and dispose of properties; the ability of Apple Hospitality to successfully integrate recent and pending transactions and implement its operating strategy; changes in general political, economic and competitive conditions and specific market conditions; reduced business and leisure travel due to travel-related health concerns, including the widespread outbreak of infectious or contagious diseases in the U.S. such as COVID-19; adverse changes in the real estate and real estate capital markets; financing risks; litigation risks; regulatory proceedings or inquiries; changes in laws or regulations or interpretations of current laws and regulations that impact Apple Hospitality’s business, assets or classification as a real estate investment trust; or other risks detailed in filings made by Apple Hospitality with the Securities and Exchange Commission (“SEC”). Although Apple Hospitality believes that the assumptions underlying the forward-looking statements contained herein are reasonable, any of the assumptions could be inaccurate, and therefore there can be no assurance that such statements included in this presentation will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by Apple Hospitality or any other person that the results or conditions described in such statements or the objectives and plans of Apple Hospitality will be achieved.

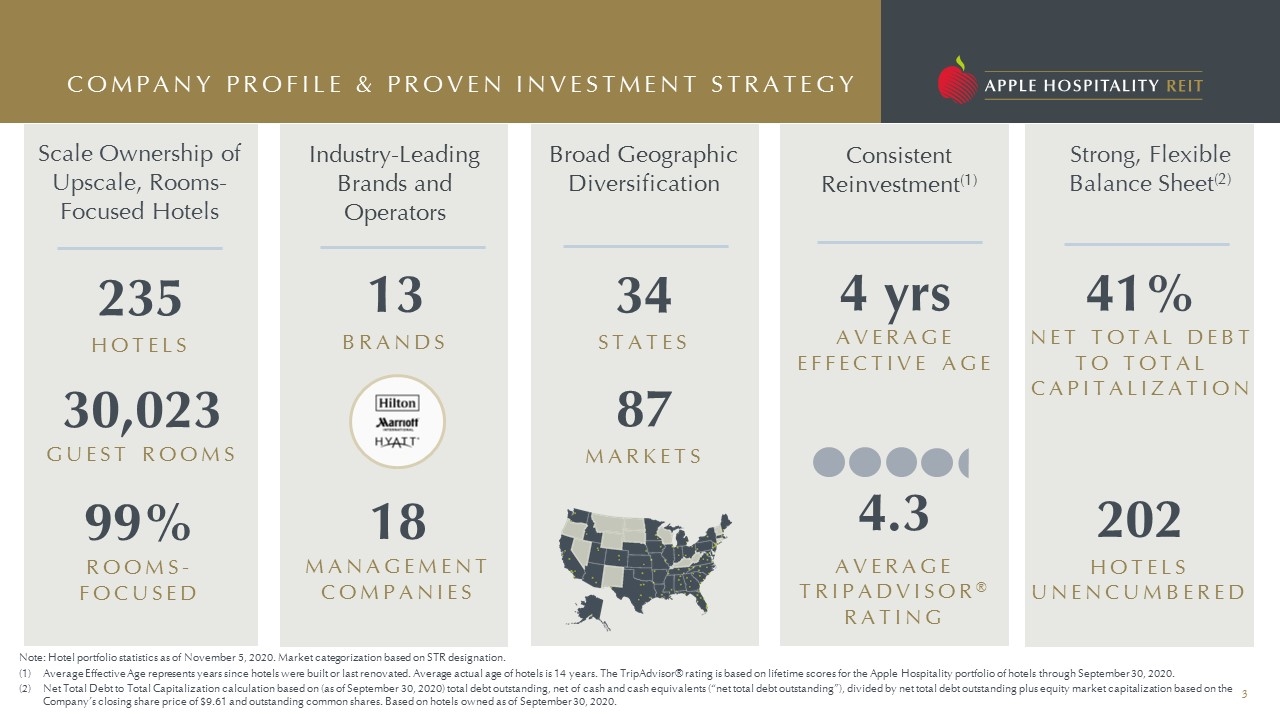

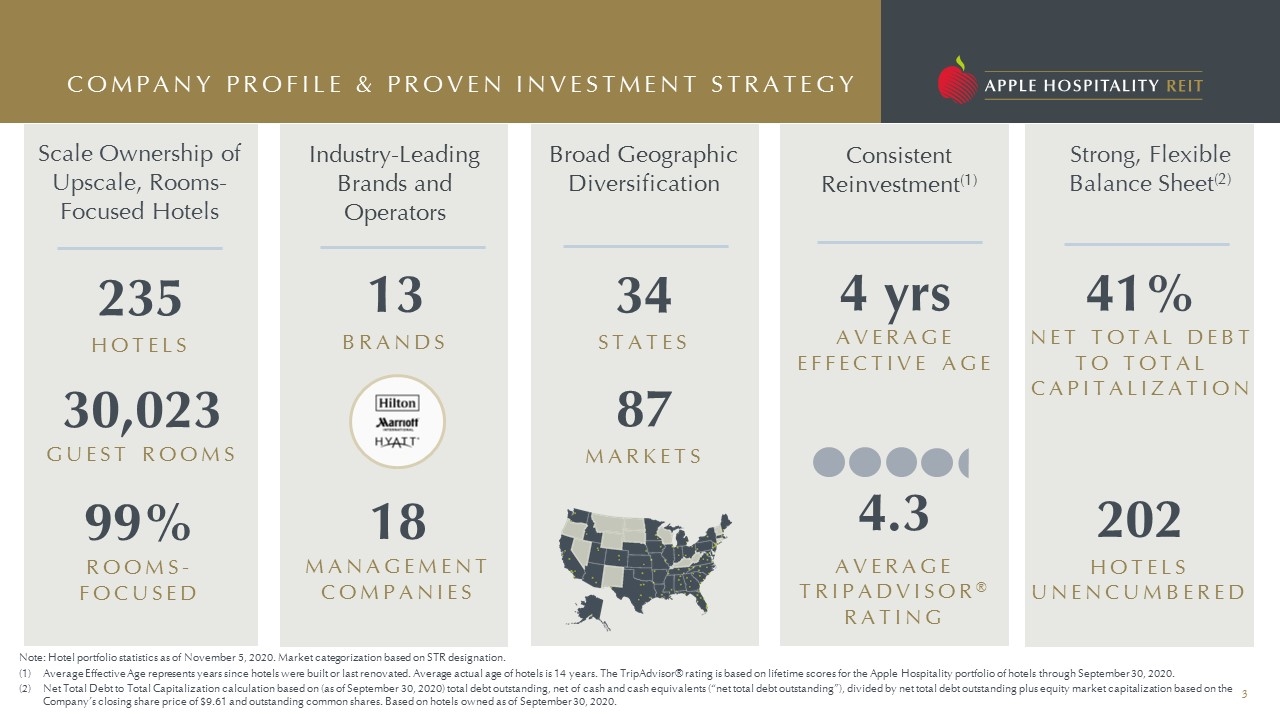

COMPANY PROFILE & PROVEN INVESTMENT STRATEGY Note: Hotel portfolio statistics as of November 5, 2020. Market categorization based on STR designation. Average Effective Age represents years since hotels were built or last renovated. Average actual age of hotels is 14 years. The TripAdvisor® rating is based on lifetime scores for the Apple Hospitality portfolio of hotels through September 30, 2020. Net Total Debt to Total Capitalization calculation based on (as of September 30, 2020) total debt outstanding, net of cash and cash equivalents (“net total debt outstanding”), divided by net total debt outstanding plus equity market capitalization based on the Company’s closing share price of $9.61 and outstanding common shares. Based on hotels owned as of September 30, 2020. 235 HOTELS Scale Ownership of Upscale, Rooms-Focused Hotels Strong, Flexible Balance Sheet(2) 4 yrs AVERAGE EFFECTIVE AGE 30,023 GUEST ROOMS 41% NET TOTAL DEBT TO TOTAL CAPITALIZATION 34 STATES Broad Geographic Diversification 18 MANAGEMENT COMPANIES Industry-Leading Brands and Operators 99% ROOMS-FOCUSED 87 MARKETS Consistent Reinvestment(1) 13 BRANDS 4.3 AVERAGE TRIPADVISOR® RATING 202 HOTELS UNENCUMBERED

VALUES Hospitality – We are thoughtful in our interactions with others and know that strong, caring relationships are the core of our industry. Resolve – We are passionate about the work we do and are steadfast in our commitment to our shareholders. Excellence – We are driven to succeed and improve through innovation and perseverance. Integrity – We are trustworthy and accountable. Teamwork – We support and empower one another, embracing diversity of opinion and background. We are a leading real estate investment company committed to increasing shareholder value through the distribution of attractive dividends and long-term capital appreciation. MISSION Average executive tenure with the Apple REIT Companies is 13 years Established and operated 8 public hospitality REITs Raised and invested approximately $7 billion in hotel assets Purchased 438 hotels Managed over $925 million in CapEx and renovation spending Sold 4 REITs in 3 transactions totaling $2.7 billion Merged 3 REITs and listed Company on NYSE Completed $1.3 billion Apple REIT Ten merger Representation on over 30 brand and industry advisory boards and councils MANAGEMENT TEAM WITH DEEP INDUSTRY EXPERIENCE OVER MULTIPLE HOTEL CYCLES COURTYARD, CHARLOTTESVILLE, VA COURTYARD, RICHMOND, VA HAMPTON INN & SUITES, PHOENIX, AZ

KEY TAKEAWAYS CASH FLOW POSITIVE BEGINNING IN JULY 2020 All of the Company’s 235 hotels are open and receiving reservations Efficient operating model of rooms-focused hotels allowed for swift operational changes and cost mitigation Retained hotel sales staff and enhanced sales strategy to focus on current demand drivers Scale ownership of rooms-focused hotels minimizes G&A load per key and provides fixed cost efficiencies Conservative capital structure minimizes debt service per key PORTFOLIO POSITIONED FOR OUTPERFORMANCE Portfolio of rooms-focused hotels are geographically diversified with broad consumer appeal Positioned to benefit from business expected to recover first Data-driven asset management team and industry-leading operators maximize property-level performance Potential for increased long-term operational efficiencies Well-maintained, high-quality portfolio with substantial long-term value BALANCE SHEET POISED FOR FUTURE GROWTH Conservative capital structure with staggered maturities and no cash burn bolsters liquidity position and preserves equity value Completion of amendments to unsecured credit facilities provides flexibility in current environment Poised to be acquisitive and optimize portfolio through opportunistic transactions COURTYARD, VIRGINIA BEACH, VA HILTON GARDEN INN, BIRMINGHAM, AL SPRINGHILL SUITES, ALEXANDRIA, VA

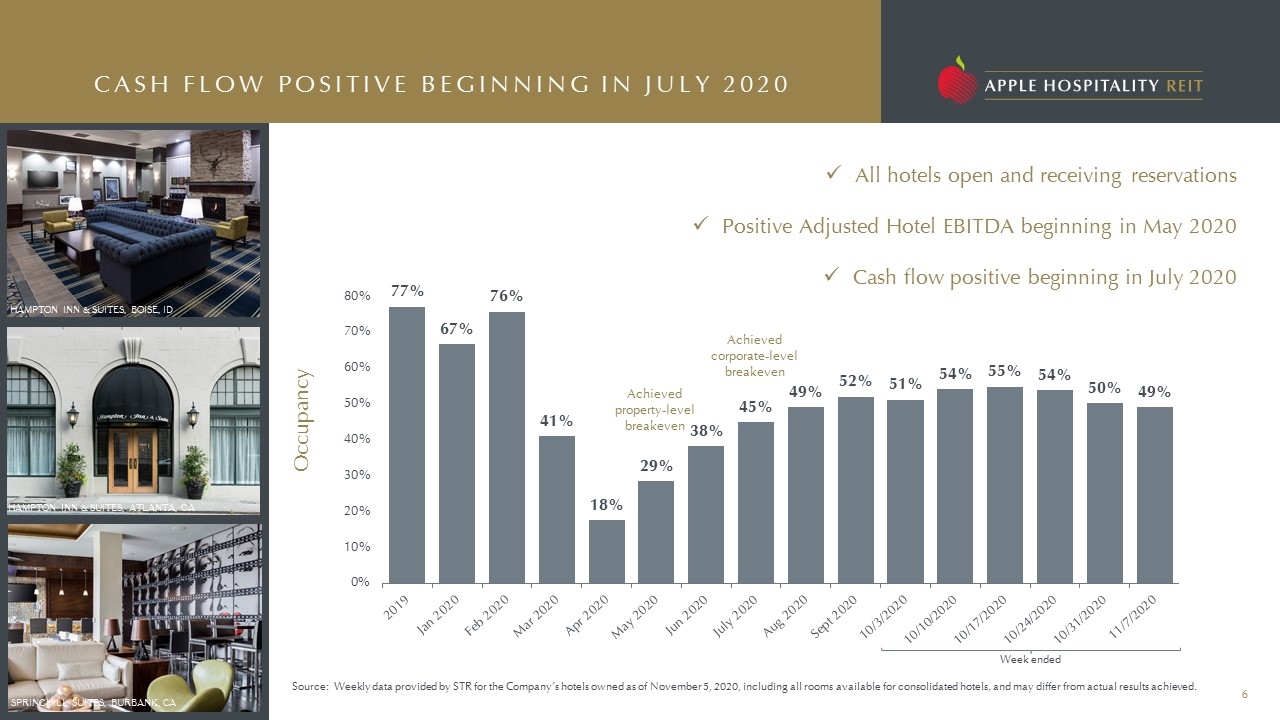

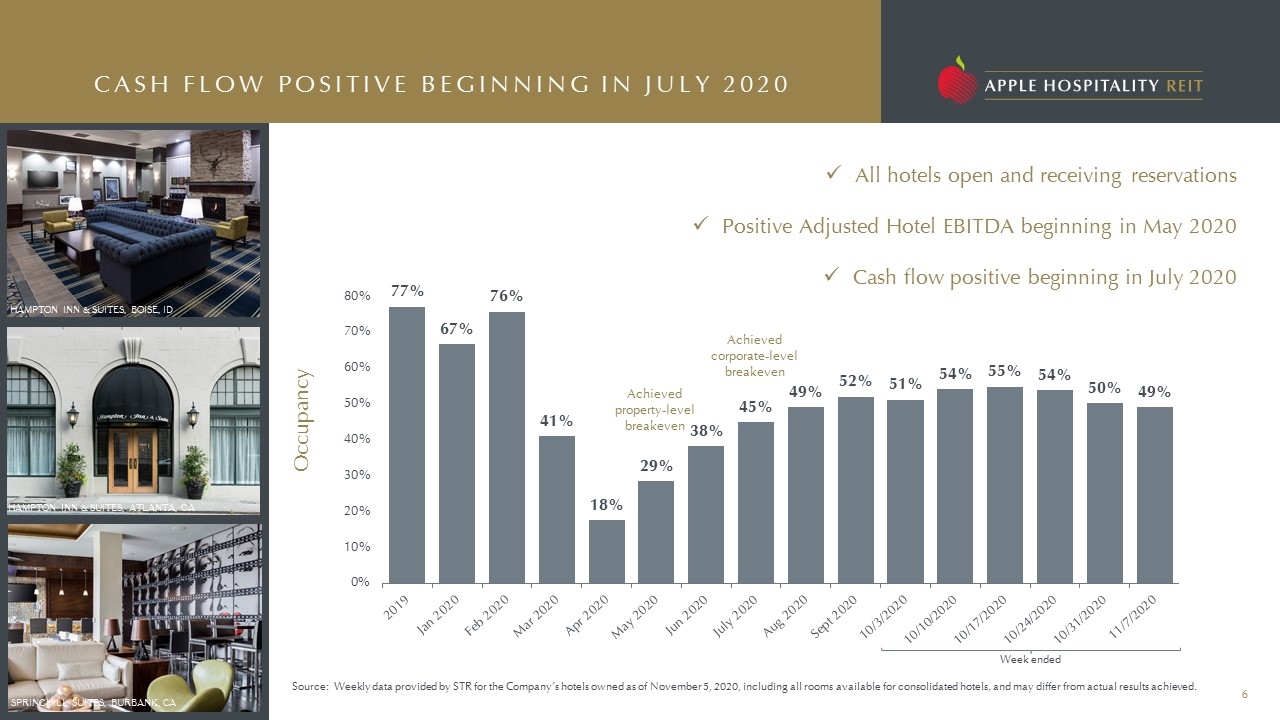

CASH FLOW POSITIVE BEGINNING IN JULY 2020 All hotels open and receiving reservations Positive Adjusted Hotel EBITDA beginning in May 2020 Cash flow positive beginning in July 2020 Occupancy Achieved corporate-level breakeven HAMPTON INN & SUITES, BOISE, ID HAMPTON INN & SUITES, ATLANTA, GA SPRINGHILL SUITES, BURBANK, CA Week ended Source: Weekly data provided by STR for the Company’s hotels owned as of November 5, 2020, including all rooms available for consolidated hotels, and may differ from actual results achieved. Achieved property-level breakeven

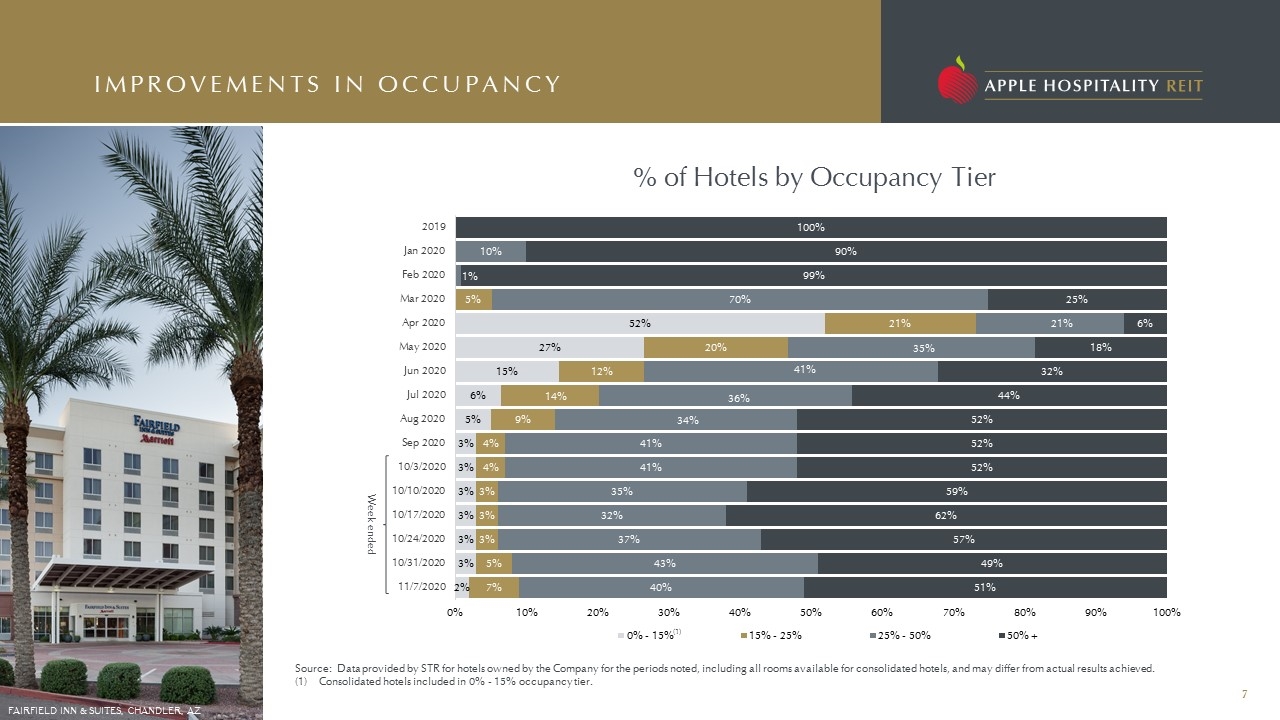

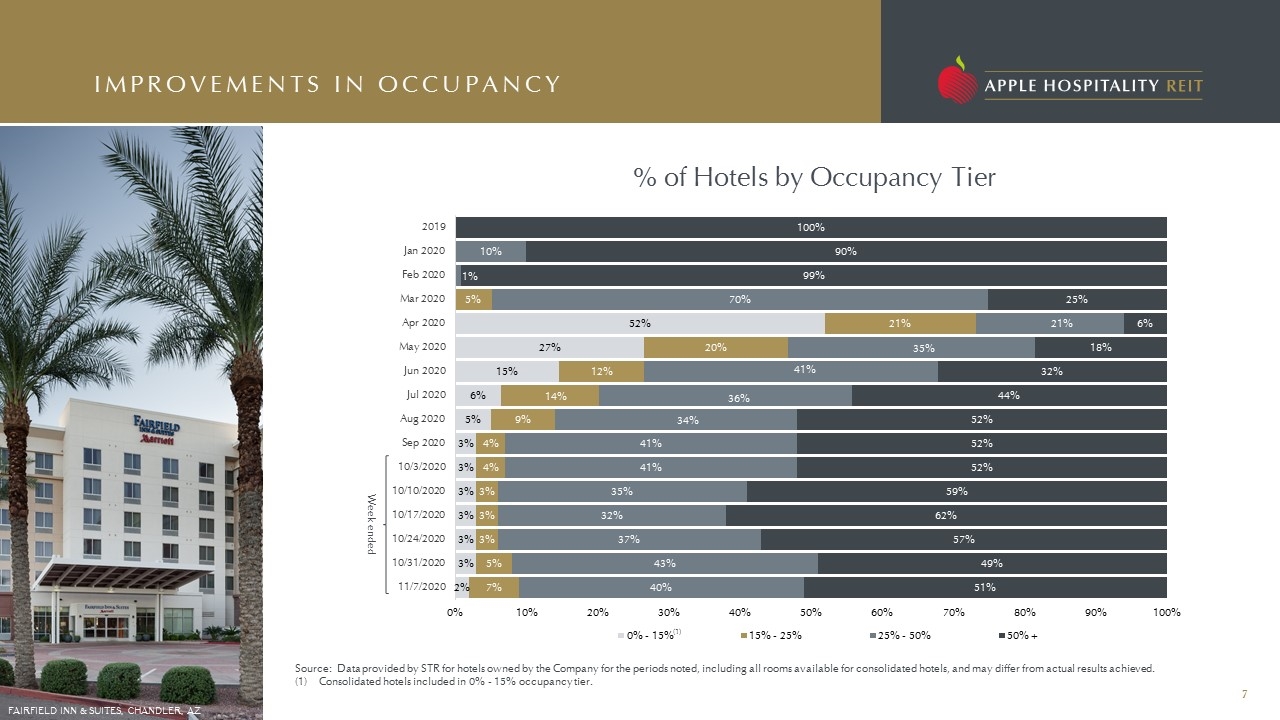

IMPROVEMENTS IN OCCUPANCY Week ended Source: Data provided by STR for hotels owned by the Company for the periods noted, including all rooms available for consolidated hotels, and may differ from actual results achieved. Consolidated hotels included in 0% - 15% occupancy tier. % of Hotels by Occupancy Tier FAIRFIELD INN & SUITES, CHANDLER, AZ (1)

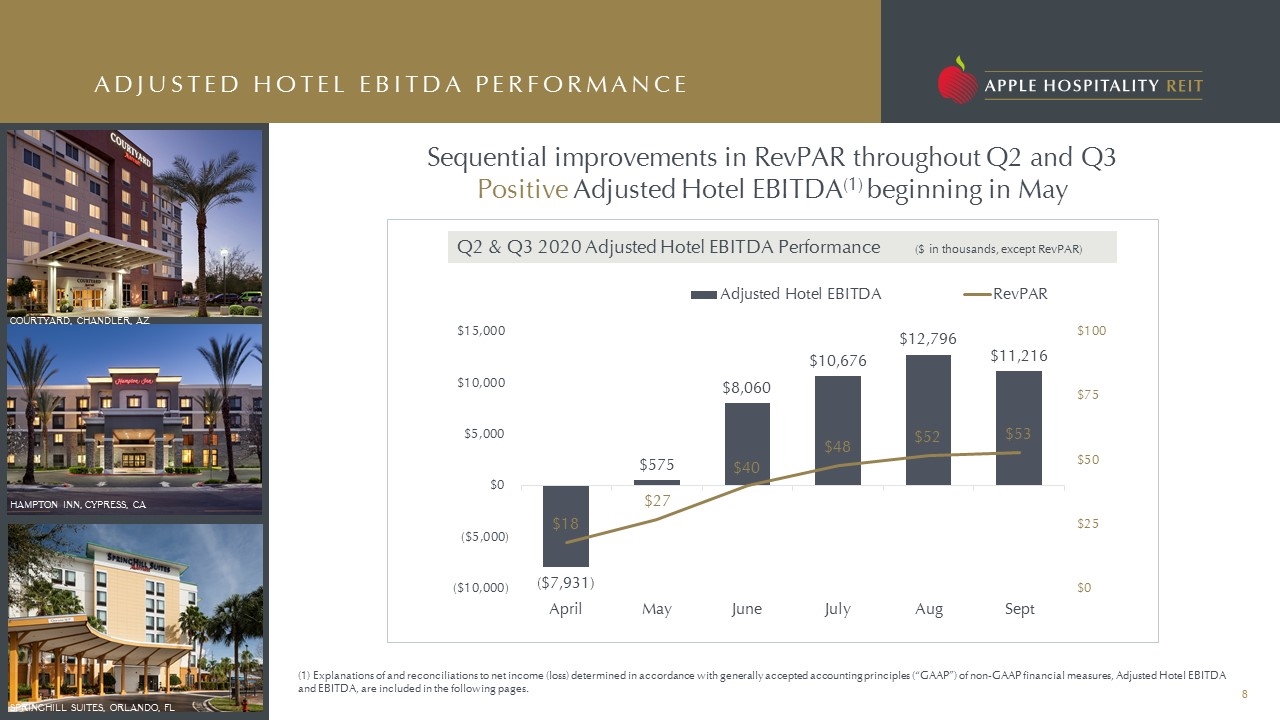

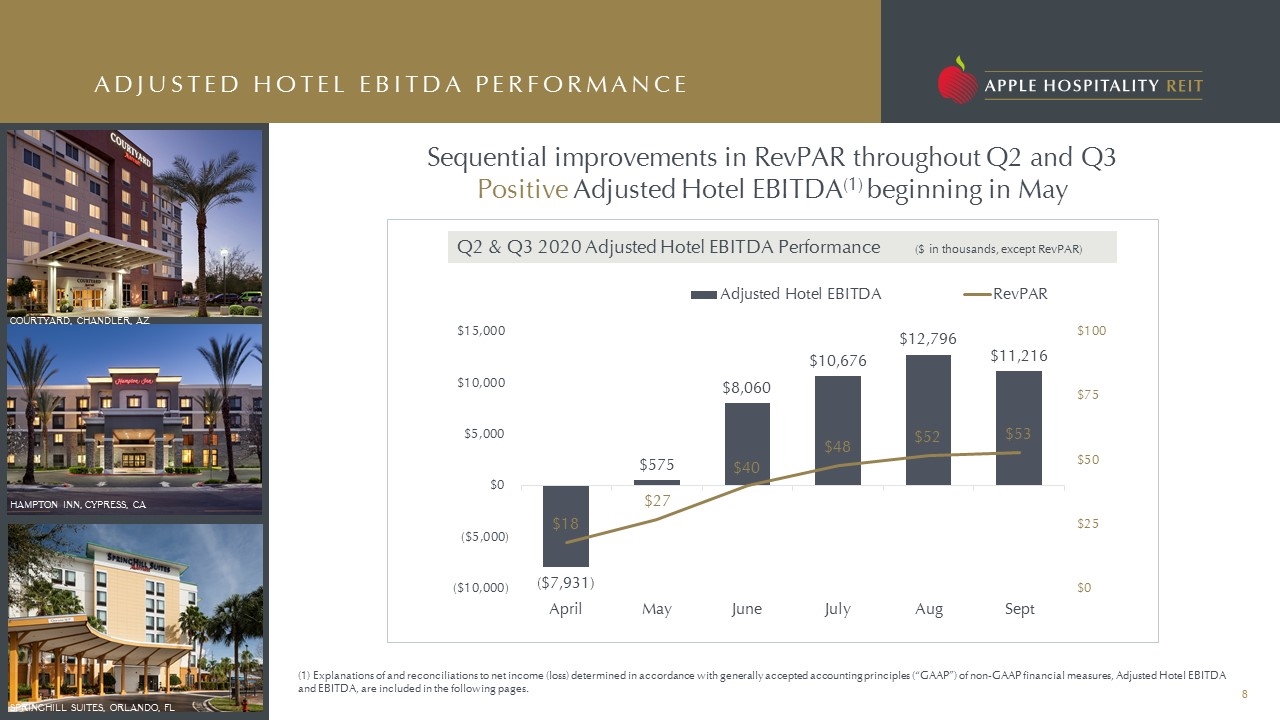

ADJUSTED HOTEL EBITDA PERFORMANCE SPRINGHILL SUITES, ORLANDO, FL HAMPTON INN, CYPRESS, CA COURTYARD, CHANDLER, AZ Sequential improvements in RevPAR throughout Q2 and Q3 Positive Adjusted Hotel EBITDA(1) beginning in May Q2 & Q3 2020 Adjusted Hotel EBITDA Performance ($ in thousands, except RevPAR) (1) Explanations of and reconciliations to net income (loss) determined in accordance with generally accepted accounting principles (“GAAP”) of non-GAAP financial measures, Adjusted Hotel EBITDA and EBITDA, are included in the following pages.

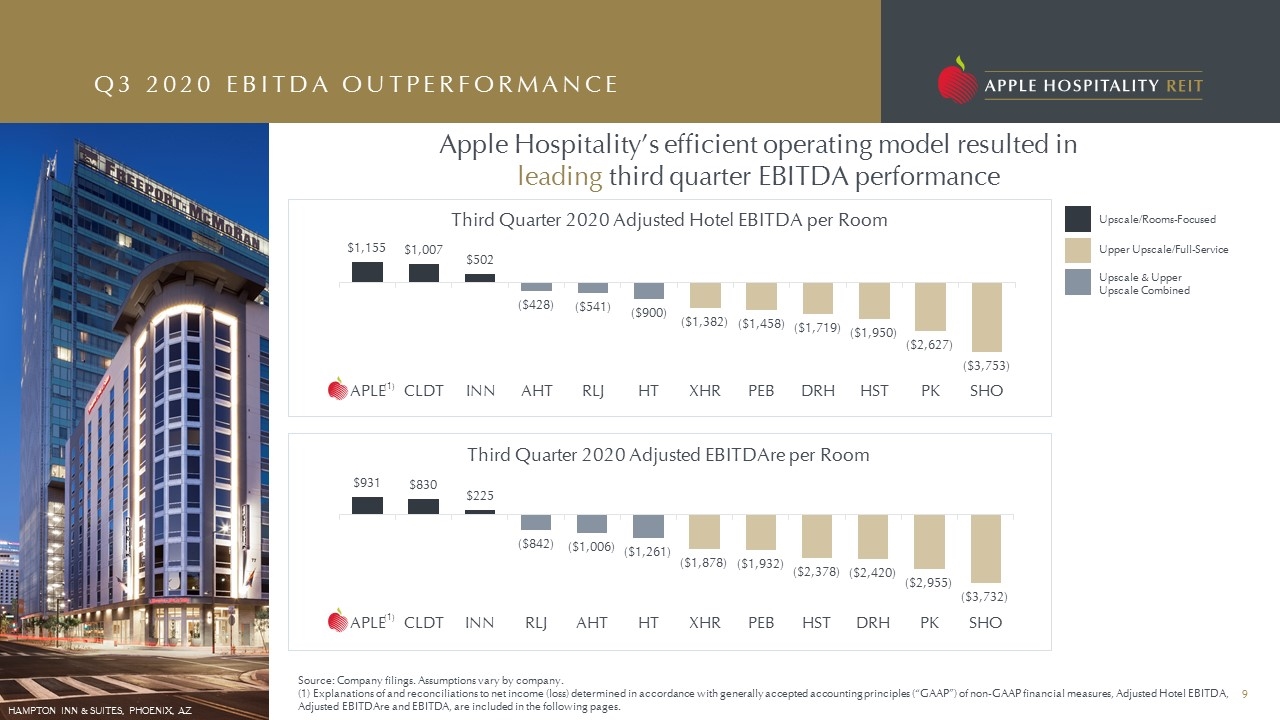

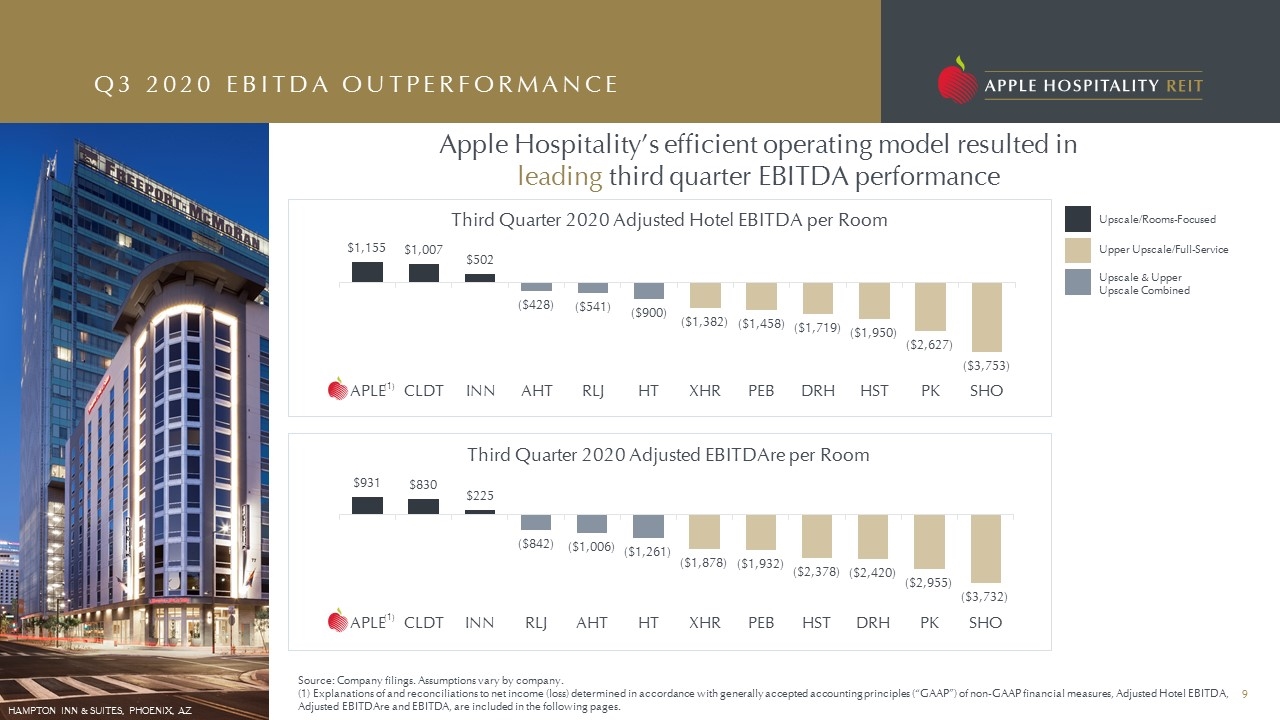

Apple Hospitality’s efficient operating model resulted in leading third quarter EBITDA performance Q3 2020 EBITDA OUTPERFORMANCE HAMPTON INN & SUITES, PHOENIX, AZ Source: Company filings. Assumptions vary by company. (1) Explanations of and reconciliations to net income (loss) determined in accordance with generally accepted accounting principles (“GAAP”) of non-GAAP financial measures, Adjusted Hotel EBITDA, Adjusted EBITDAre and EBITDA, are included in the following pages. Upscale/Rooms-Focused Upper Upscale/Full-Service Upscale & Upper Upscale Combined (1) (1)

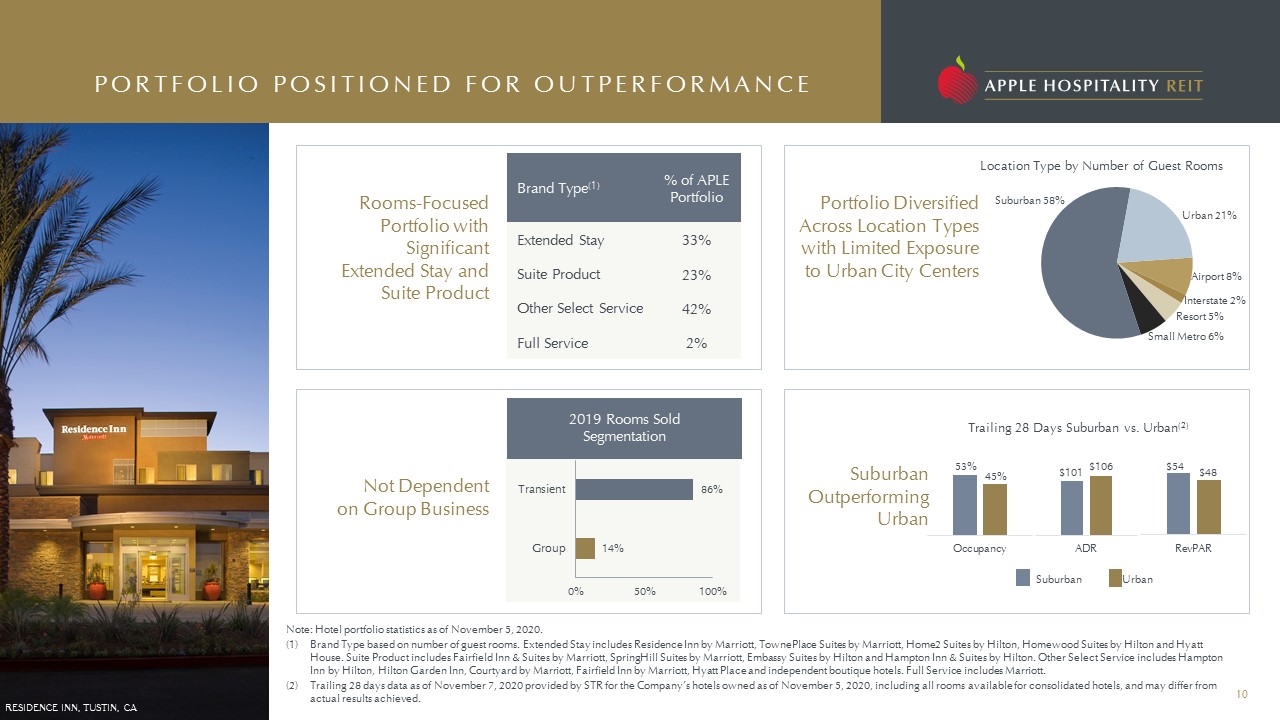

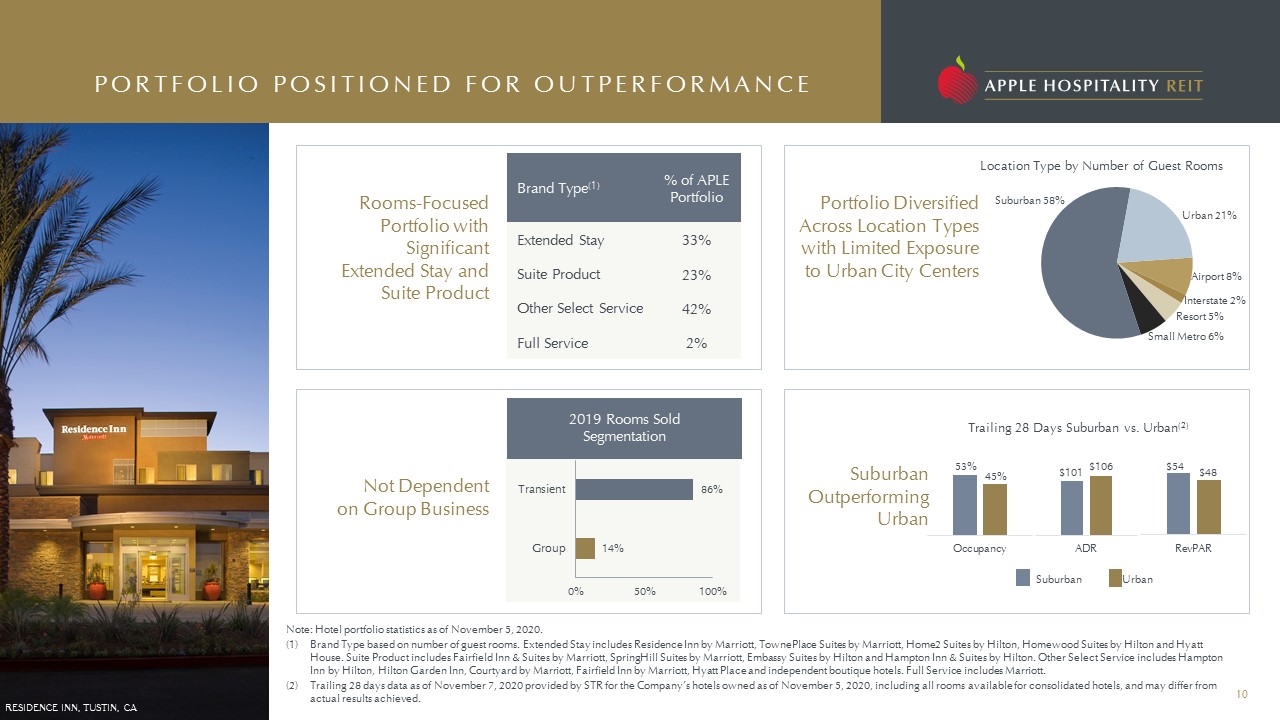

PORTFOLIO POSITIONED FOR OUTPERFORMANCE Brand Type(1) % of APLE Portfolio Extended Stay 33% Suite Product 23% Other Select Service 42% Full Service 2% Not Dependent on Group Business Portfolio Diversified Across Location Types with Limited Exposure to Urban City Centers Rooms-Focused Portfolio with Significant Extended Stay and Suite Product Trailing 28 Days Suburban vs. Urban(2) Suburban Urban Suburban Outperforming Urban Note: Hotel portfolio statistics as of November 5, 2020. Brand Type based on number of guest rooms. Extended Stay includes Residence Inn by Marriott, TownePlace Suites by Marriott, Home2 Suites by Hilton, Homewood Suites by Hilton and Hyatt House. Suite Product includes Fairfield Inn & Suites by Marriott, SpringHill Suites by Marriott, Embassy Suites by Hilton and Hampton Inn & Suites by Hilton. Other Select Service includes Hampton Inn by Hilton, Hilton Garden Inn, Courtyard by Marriott, Fairfield Inn by Marriott, Hyatt Place and independent boutique hotels. Full Service includes Marriott. Trailing 28 days data as of November 7, 2020 provided by STR for the Company’s hotels owned as of November 5, 2020, including all rooms available for consolidated hotels, and may differ from actual results achieved. 2019 Rooms Sold Segmentation RESIDENCE INN, TUSTIN, CA Location Type by Number of Guest Rooms

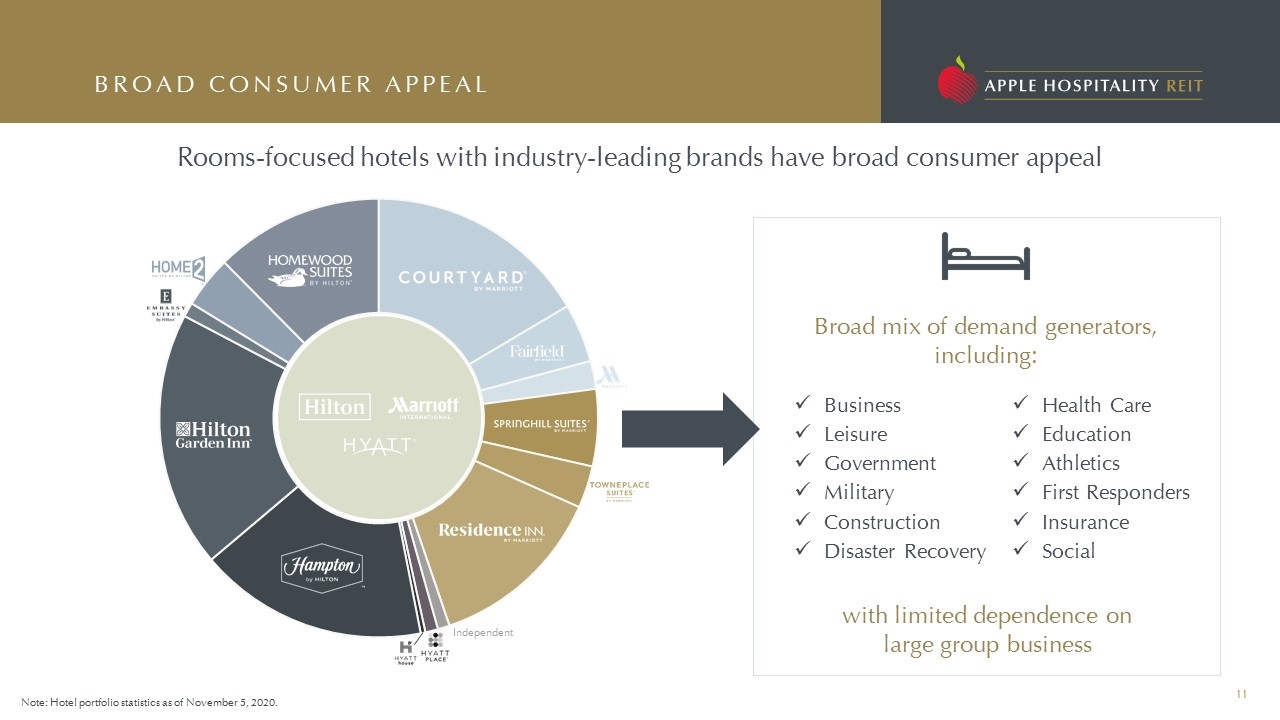

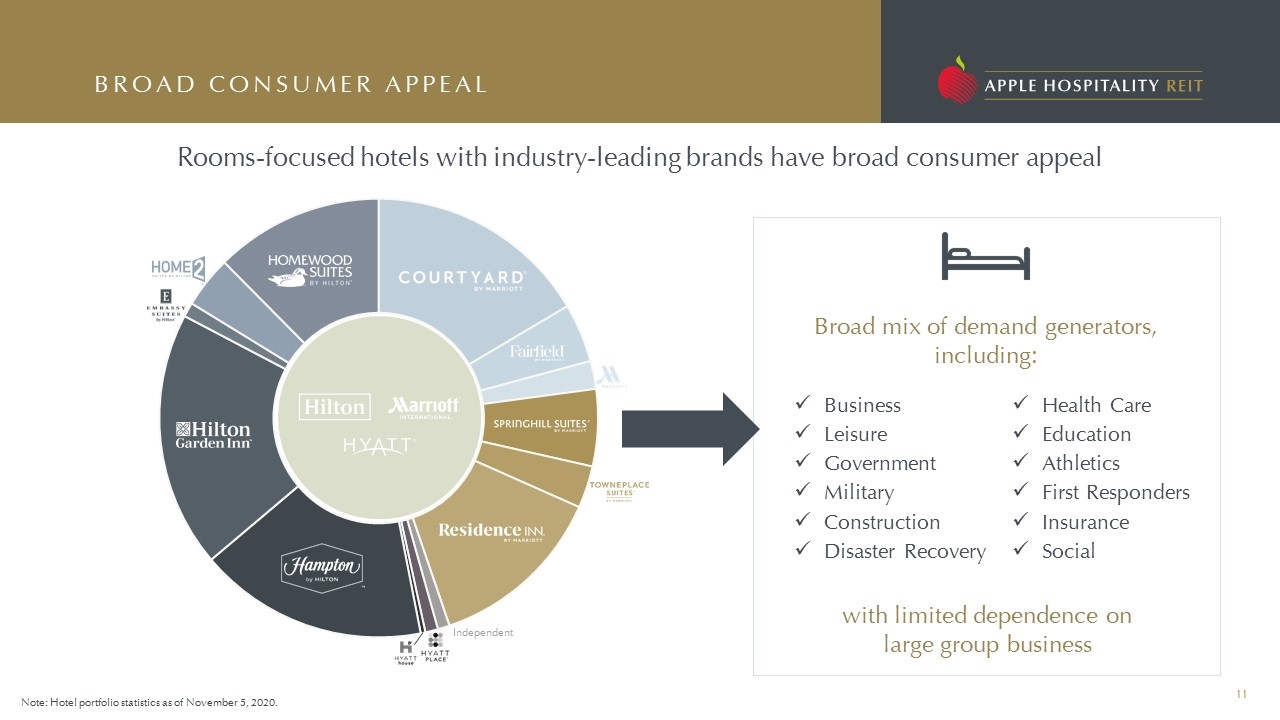

Business Leisure Government Military Construction Disaster Recovery Health Care Education Athletics First Responders Insurance Social Rooms-focused hotels with industry-leading brands have broad consumer appeal BROAD CONSUMER APPEAL Note: Hotel portfolio statistics as of November 5, 2020. Broad mix of demand generators, including: Independent with limited dependence on large group business

INDUSTRY-LEADING OPERATORS Analytical, data-driven asset management to maximize property-level performance Scale to negotiate attractive national contracts Strategic revenue management to optimize mix of business and maximize bottom-line performance Strong regional and national third-party operators with readily terminable contracts and flexibility to align performance goals HOME2 SUITES, ATLANTA, GA HILTON GARDEN INN, ANNAPOLIS, MD COURTYARD, WEST ORANGE, NJ Strategic Asset Management Approach 100% of Apple Hospitality’s portfolio operated by third-party property managers 94% of hotels independent of brand management 18 operating companies provide a platform for comparative analytics and shared best practices 23% of operators’ portfolios represented by Apple Hospitality on average, excluding brands

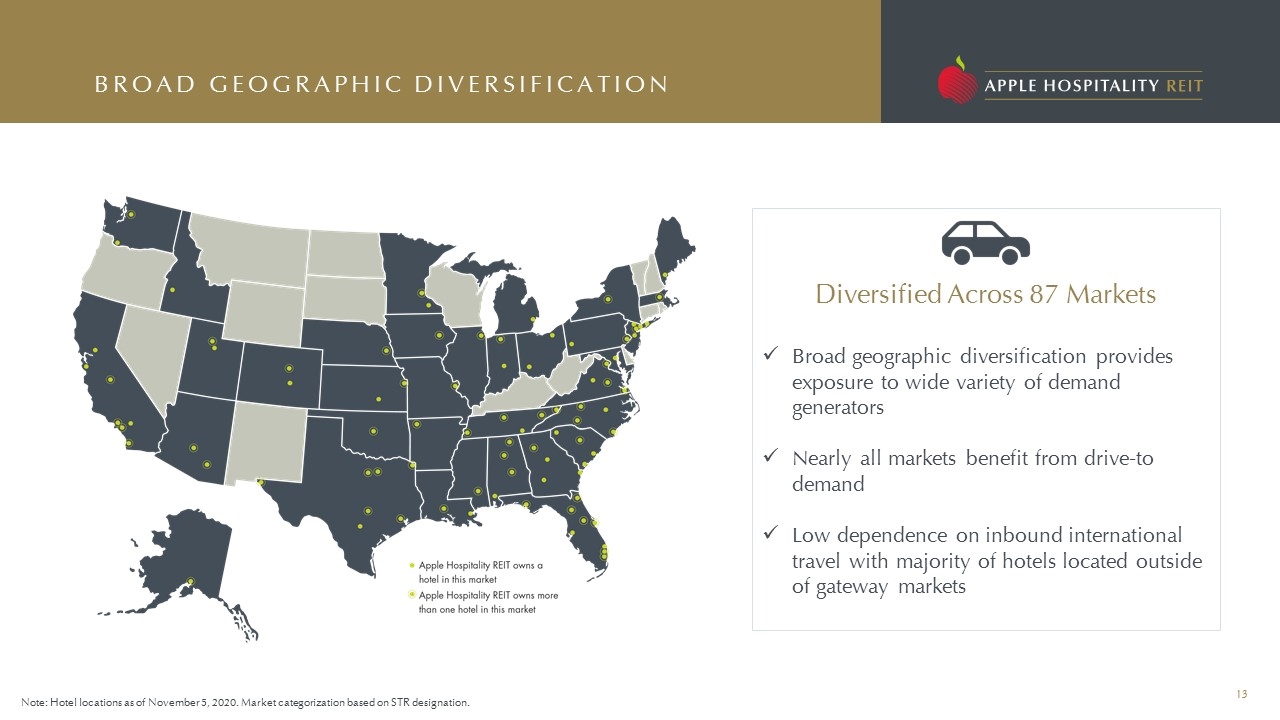

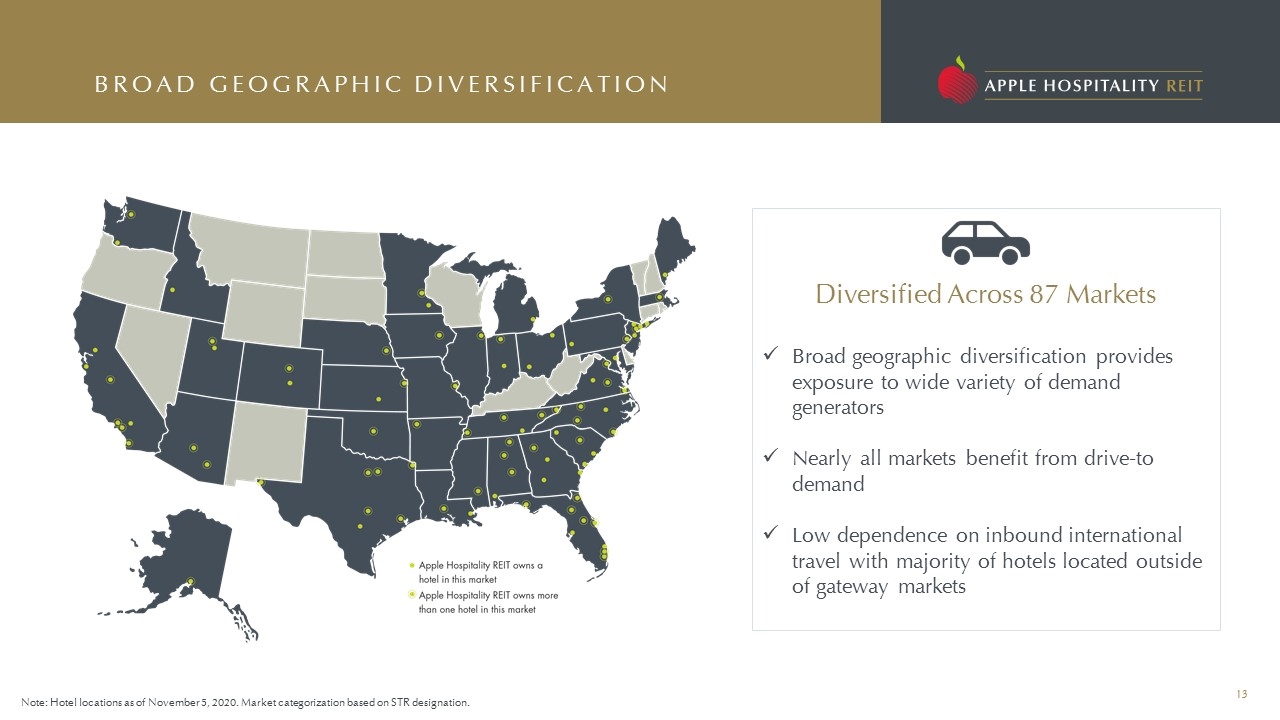

BROAD GEOGRAPHIC DIVERSIFICATION Broad geographic diversification provides exposure to wide variety of demand generators Nearly all markets benefit from drive-to demand Low dependence on inbound international travel with majority of hotels located outside of gateway markets Diversified Across 87 Markets Note: Hotel locations as of November 5, 2020. Market categorization based on STR designation.

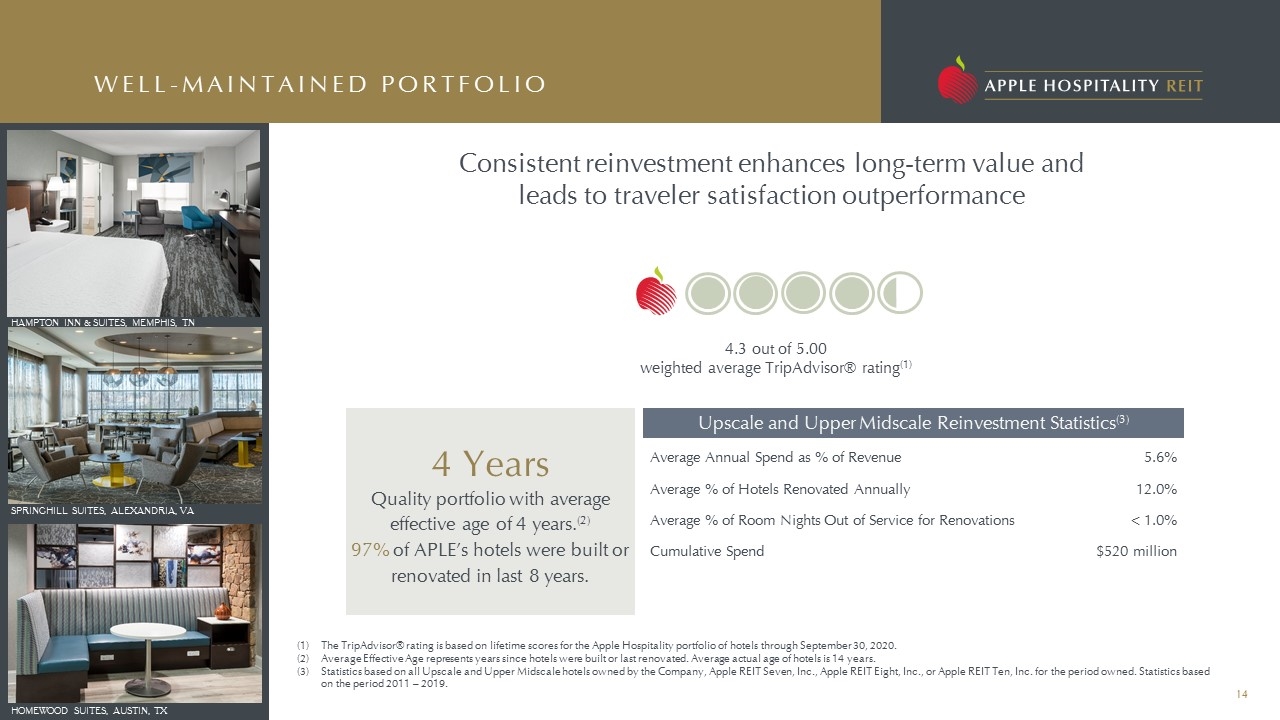

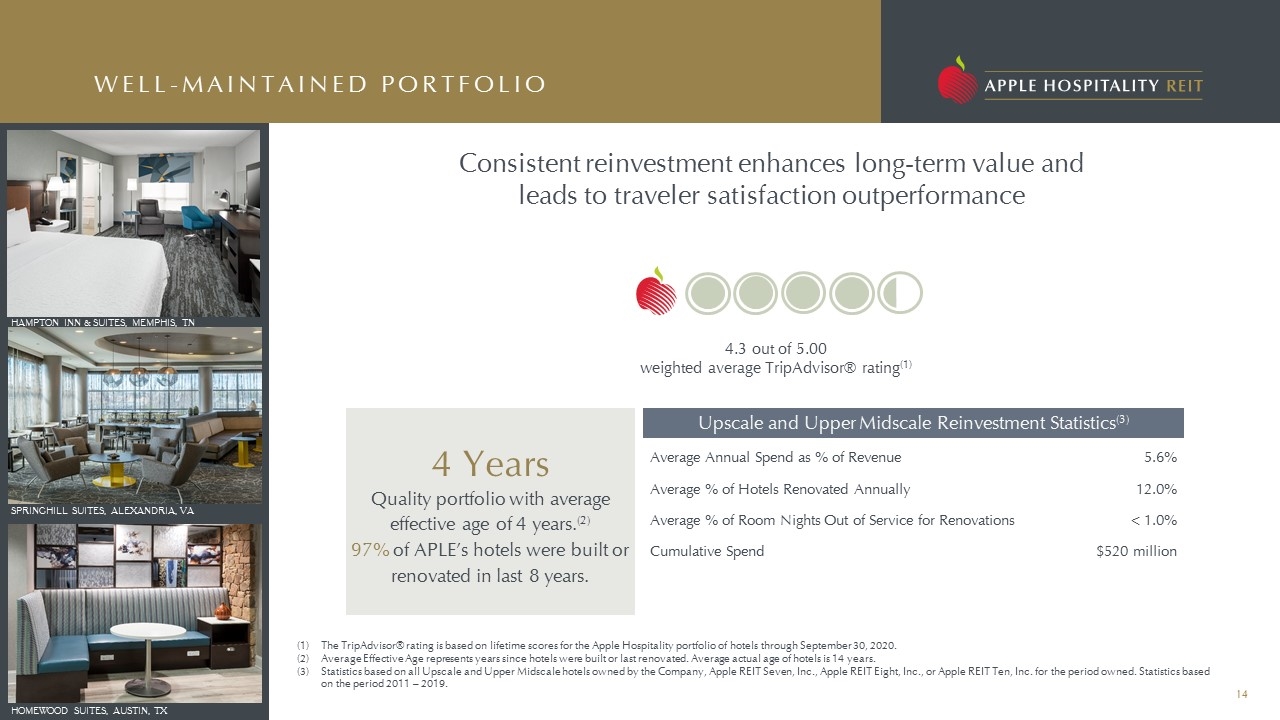

WELL-MAINTAINED PORTFOLIO HAMPTON INN & SUITES, MEMPHIS, TN SPRINGHILL SUITES, ALEXANDRIA, VA HOMEWOOD SUITES, AUSTIN, TX The TripAdvisor® rating is based on lifetime scores for the Apple Hospitality portfolio of hotels through September 30, 2020. Average Effective Age represents years since hotels were built or last renovated. Average actual age of hotels is 14 years. Statistics based on all Upscale and Upper Midscale hotels owned by the Company, Apple REIT Seven, Inc., Apple REIT Eight, Inc., or Apple REIT Ten, Inc. for the period owned. Statistics based on the period 2011 – 2019. 4.3 out of 5.00 weighted average TripAdvisor® rating(1) 4 Years Quality portfolio with average effective age of 4 years.(2) 97% of APLE’s hotels were built or renovated in last 8 years. Upscale and Upper Midscale Reinvestment Statistics(3) Average Annual Spend as % of Revenue 5.6% Average % of Hotels Renovated Annually 12.0% Average % of Room Nights Out of Service for Renovations < 1.0% Cumulative Spend $520 million Consistent reinvestment enhances long-term value and leads to traveler satisfaction outperformance

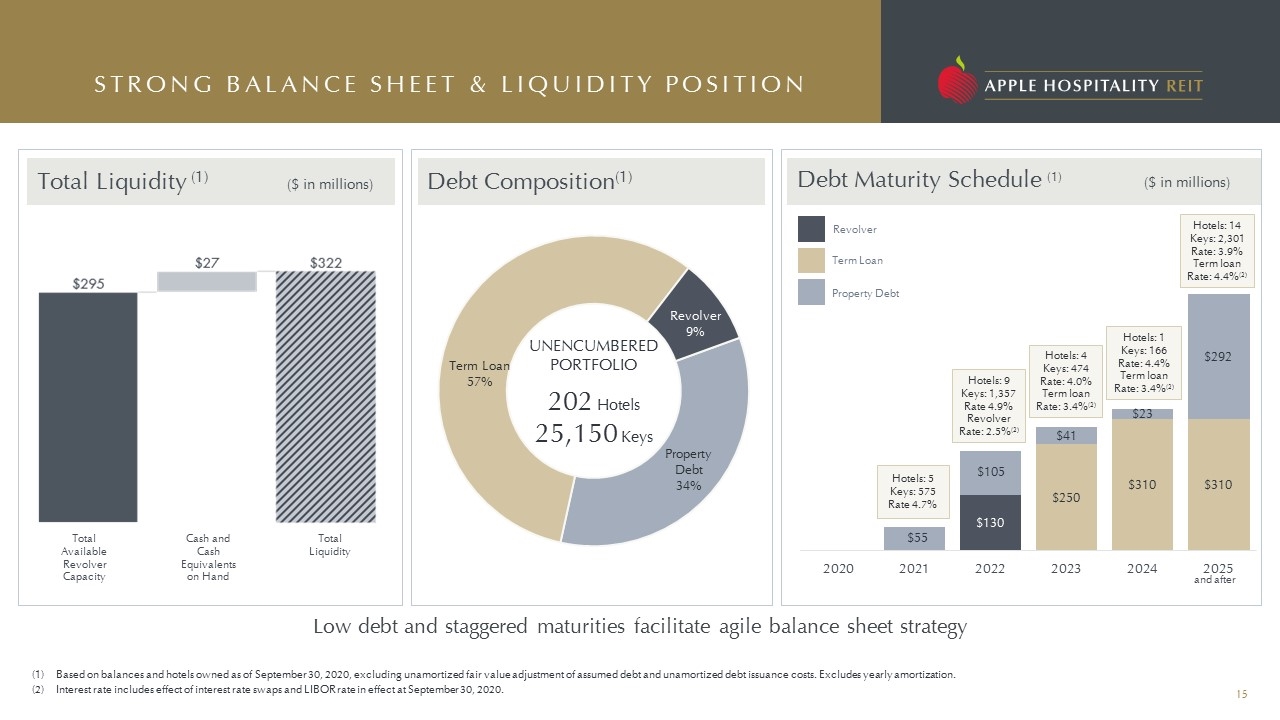

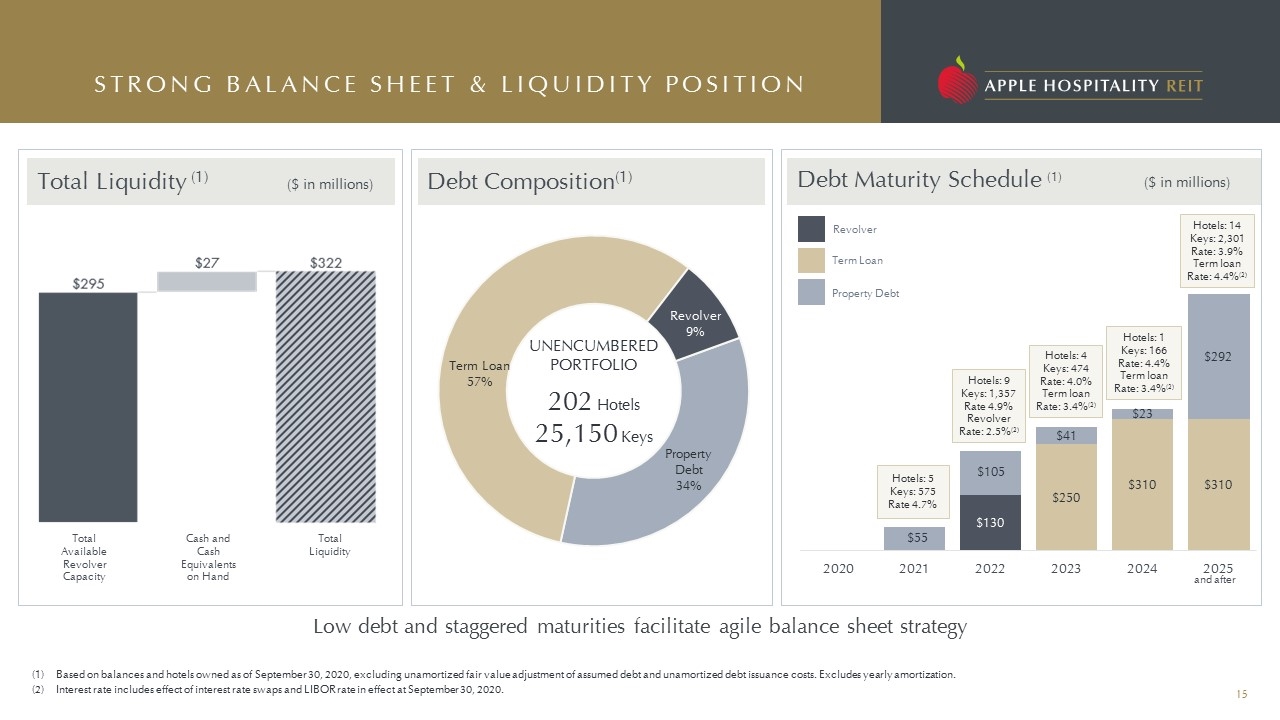

Debt Composition(1) STRONG BALANCE SHEET & LIQUIDITY POSITION Based on balances and hotels owned as of September 30, 2020, excluding unamortized fair value adjustment of assumed debt and unamortized debt issuance costs. Excludes yearly amortization. Interest rate includes effect of interest rate swaps and LIBOR rate in effect at September 30, 2020. Debt Maturity Schedule (1) ($ in millions) UNENCUMBERED PORTFOLIO 202 Hotels 25,150 Keys Hotels: 14 Keys: 2,301 Rate: 3.9% Term loan Rate: 4.4%(2) Hotels: 5 Keys: 575 Rate 4.7% Hotels: 9 Keys: 1,357 Rate 4.9% Revolver Rate: 2.5%(2) Hotels: 4 Keys: 474 Rate: 4.0% Term loan Rate: 3.4%(2) Hotels: 1 Keys: 166 Rate: 4.4% Term loan Rate: 3.4%(2) Low debt and staggered maturities facilitate agile balance sheet strategy and after Total Liquidity (1) ($ in millions) Total Available Revolver Capacity Cash and Cash Equivalents on Hand Total Liquidity Revolver Term Loan Property Debt

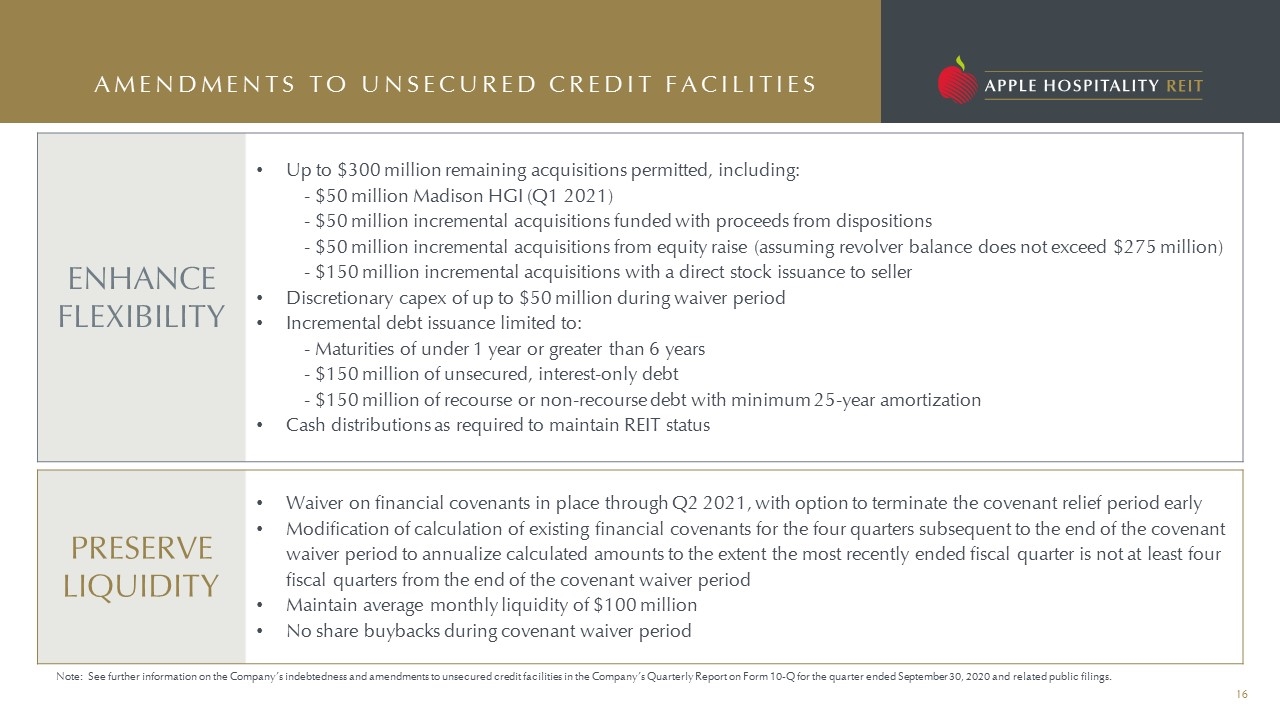

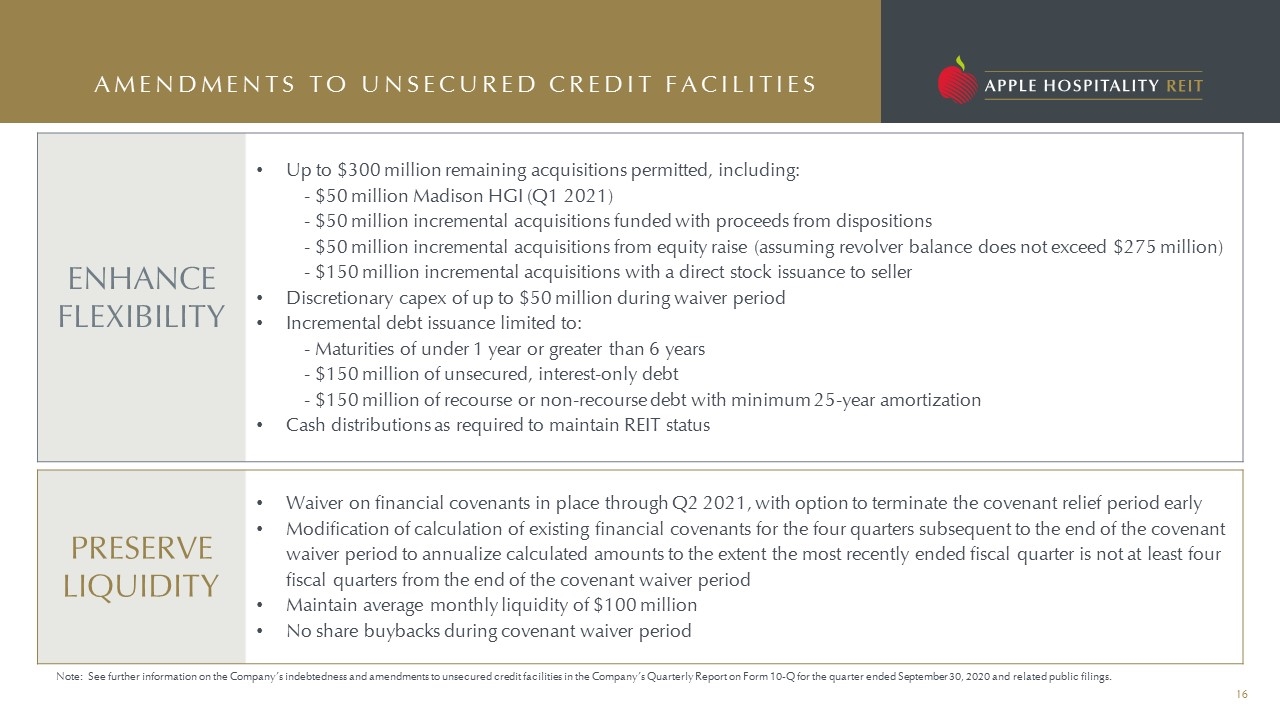

ENHANCE FLEXIBILITY Up to $300 million remaining acquisitions permitted, including: - $50 million Madison HGI (Q1 2021) - $50 million incremental acquisitions funded with proceeds from dispositions - $50 million incremental acquisitions from equity raise (assuming revolver balance does not exceed $275 million) - $150 million incremental acquisitions with a direct stock issuance to seller Discretionary capex of up to $50 million during waiver period Incremental debt issuance limited to: - Maturities of under 1 year or greater than 6 years - $150 million of unsecured, interest-only debt - $150 million of recourse or non-recourse debt with minimum 25-year amortization Cash distributions as required to maintain REIT status AMENDMENTS TO UNSECURED CREDIT FACILITIES PRESERVE LIQUIDITY Waiver on financial covenants in place through Q2 2021, with option to terminate the covenant relief period early Modification of calculation of existing financial covenants for the four quarters subsequent to the end of the covenant waiver period to annualize calculated amounts to the extent the most recently ended fiscal quarter is not at least four fiscal quarters from the end of the covenant waiver period Maintain average monthly liquidity of $100 million No share buybacks during covenant waiver period Note: See further information on the Company’s indebtedness and amendments to unsecured credit facilities in the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2020 and related public filings.

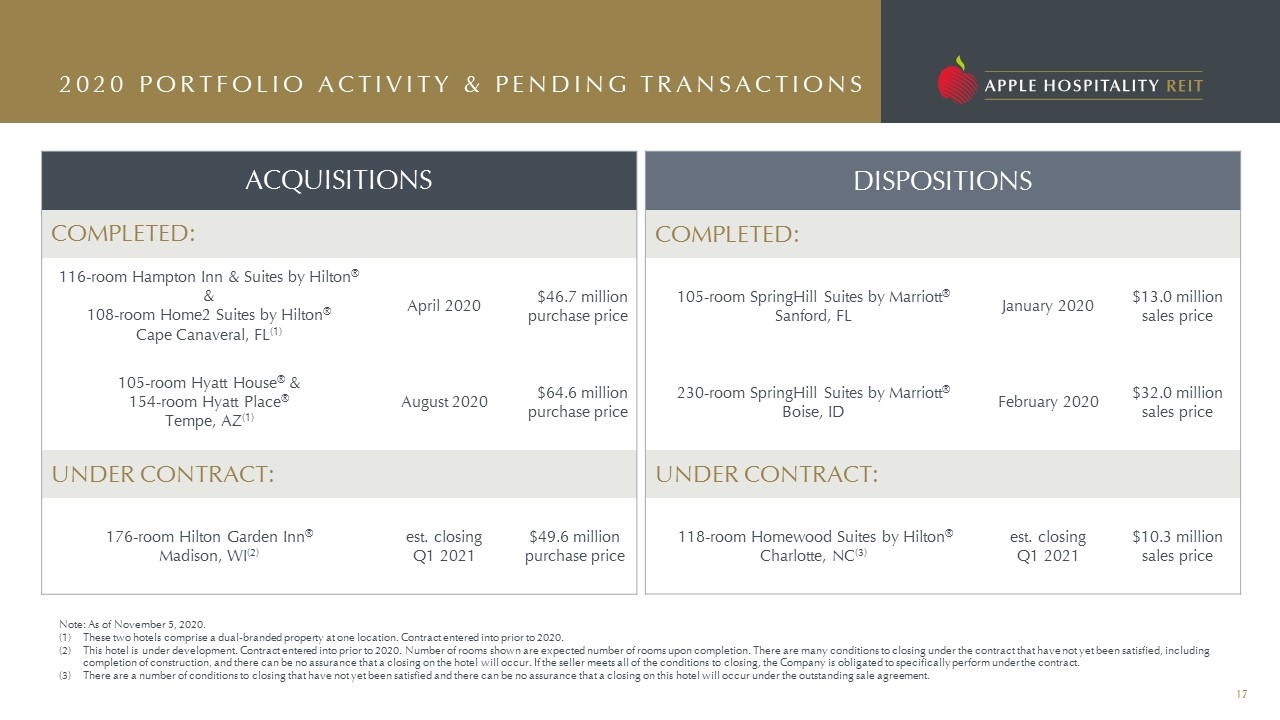

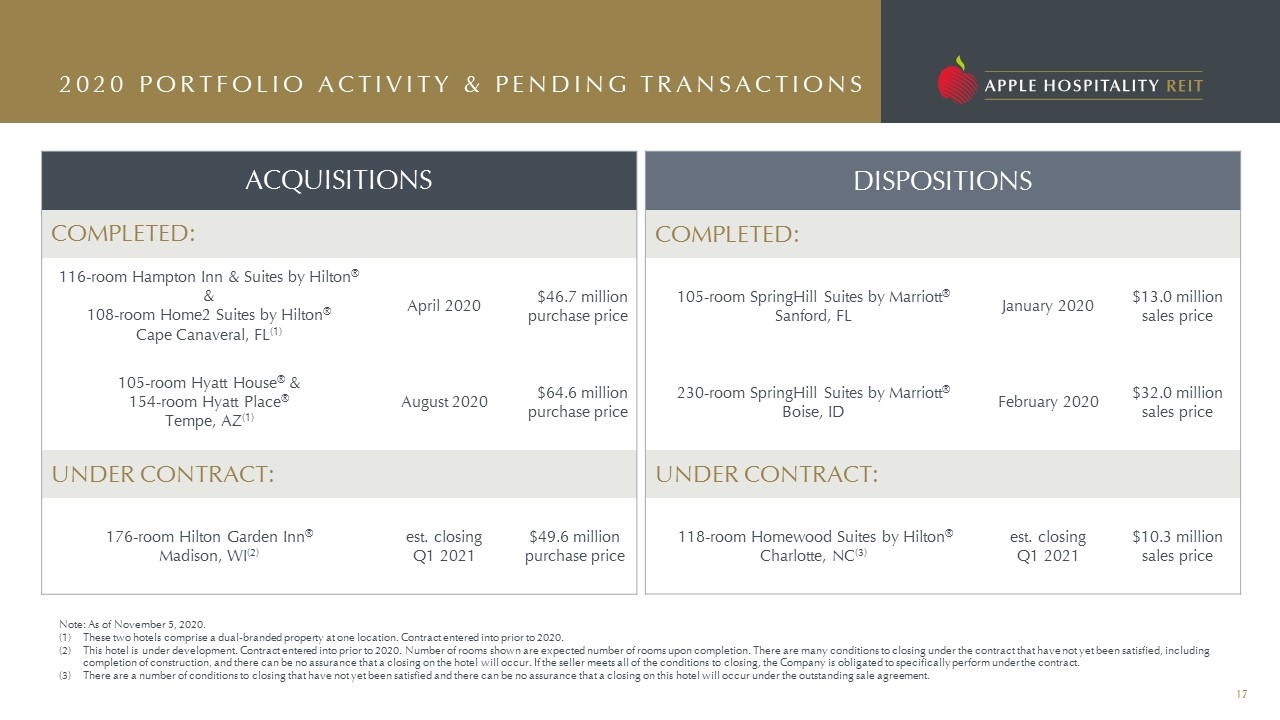

2020 PORTFOLIO ACTIVITY & PENDING TRANSACTIONS Note: As of November 5, 2020. These two hotels comprise a dual-branded property at one location. Contract entered into prior to 2020. This hotel is under development. Contract entered into prior to 2020. Number of rooms shown are expected number of rooms upon completion. There are many conditions to closing under the contract that have not yet been satisfied, including completion of construction, and there can be no assurance that a closing on the hotel will occur. If the seller meets all of the conditions to closing, the Company is obligated to specifically perform under the contract. There are a number of conditions to closing that have not yet been satisfied and there can be no assurance that a closing on this hotel will occur under the outstanding sale agreement. ACQUISITIONS COMPLETED: 116-room Hampton Inn & Suites by Hilton® & 108-room Home2 Suites by Hilton® Cape Canaveral, FL(1) April 2020 $46.7 million purchase price 105-room Hyatt House® & 154-room Hyatt Place® Tempe, AZ(1) August 2020 $64.6 million purchase price UNDER CONTRACT: 176-room Hilton Garden Inn® Madison, WI(2) est. closing Q1 2021 $49.6 million purchase price DISPOSITIONS COMPLETED: 105-room SpringHill Suites by Marriott® Sanford, FL January 2020 $13.0 million sales price 230-room SpringHill Suites by Marriott® Boise, ID February 2020 $32.0 million sales price UNDER CONTRACT: 118-room Homewood Suites by Hilton® Charlotte, NC(3) est. closing Q1 2021 $10.3 million sales price

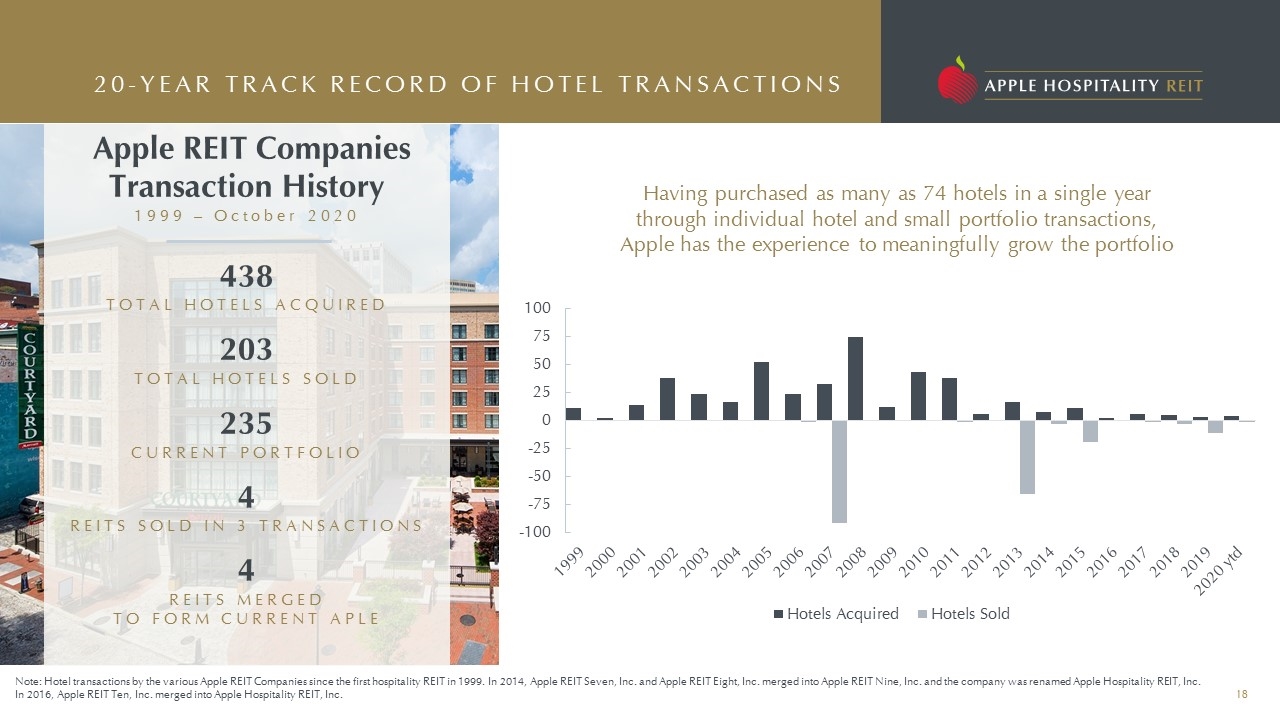

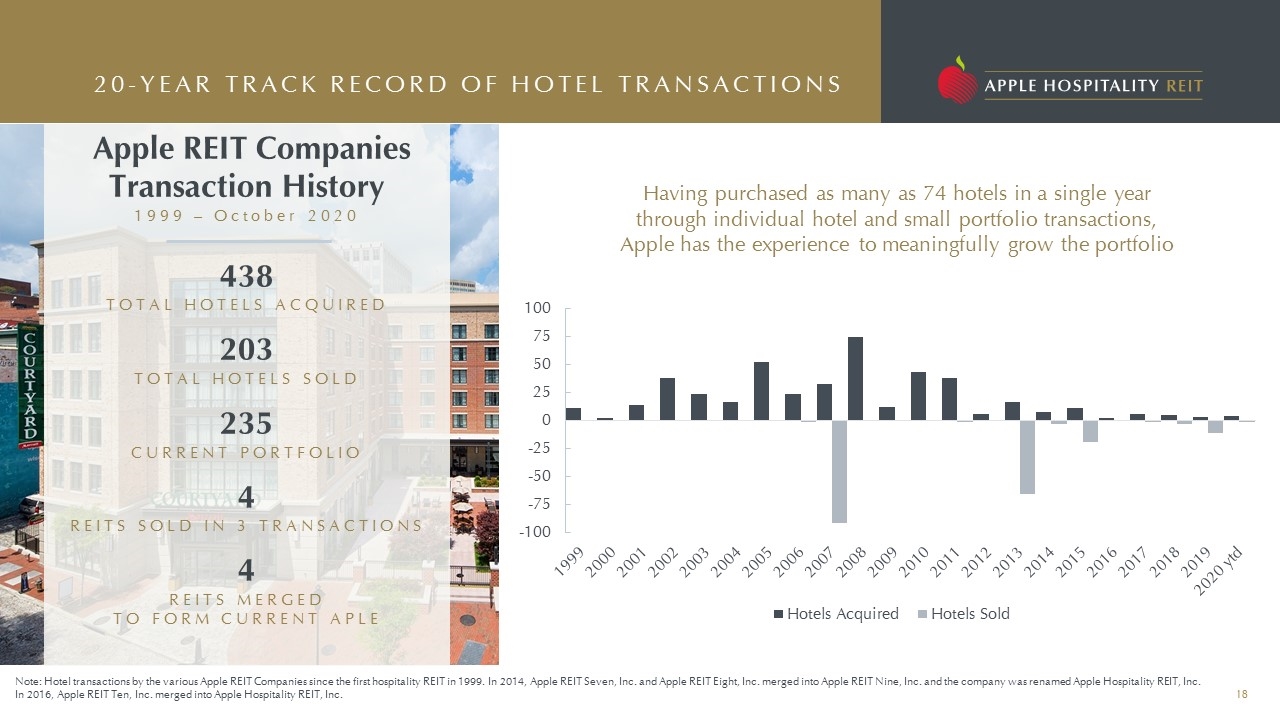

Apple REIT Companies Transaction History 1999 – October 2020 438 TOTAL HOTELS ACQUIRED 203 TOTAL HOTELS SOLD 235 CURRENT PORTFOLIO 4 REITS SOLD IN 3 TRANSACTIONS 4 REITS MERGED TO FORM CURRENT APLE Note: Hotel transactions by the various Apple REIT Companies since the first hospitality REIT in 1999. In 2014, Apple REIT Seven, Inc. and Apple REIT Eight, Inc. merged into Apple REIT Nine, Inc. and the company was renamed Apple Hospitality REIT, Inc. In 2016, Apple REIT Ten, Inc. merged into Apple Hospitality REIT, Inc. Having purchased as many as 74 hotels in a single year through individual hotel and small portfolio transactions, Apple has the experience to meaningfully grow the portfolio 20-YEAR TRACK RECORD OF HOTEL TRANSACTIONS

PROVEN INVESTMENT STRATEGY Concentrate on Upscale, rooms-focused hotels Efficient operating model of rooms-focused hotels has historically yielded high margins Low dependence on large group demand strengthens position in current environment Scale ownership minimizes relative G&A load and provides fixed cost efficiencies Align with the best brands in the rooms-focused category Invested in Marriott®, Hilton® and Hyatt® branded hotels with broad consumer appeal which benefit from strong reservation systems and loyalty programs Hire industry-leading operators and maximize performance through benchmarking and asset management Strong regional and national operators with readily terminable contracts align owner and operator to maximize performance in all market environments Analytical data-driven asset management maximizes property-level results Strategic revenue management optimizes mix of business and maximizes bottom-line performance Pursue broad geographic diversification Broad geographic diversification reduces portfolio volatility and provides exposure to numerous demand generators Enhance portfolio through accretive acquisitions, opportunistic dispositions and strategic reinvestment Well-maintained portfolio with average effective age of 4 years increases competitiveness Strategic acquisitions and dispositions optimize portfolio for long-term growth Maintain a strong, flexible balance sheet Strong balance sheet provides security through cycles Conservative capital structure with staggered maturities and no additional maturities in 2020 bolsters liquidity position Positioned to pursue accretive opportunities

ESG INITIATIVES COURTYARD, CAROLINA BEACH, NC

SUSTAINABILITY INITIATIVES Apple Hospitality is committed to enhancing and incorporating sustainability opportunities into our investment and asset management strategies, with a focus on minimizing our environmental impact through reductions in energy and water consumption and through improvements in waste management. Apple Hospitality Key Metrics for 2019(1) Approximately 19 Million Square Feet 245,000 MWh Energy Consumption 13.0 Total kWh per Square Foot 96% Portfolio Enrolled in Energy Star® Program 974,000 Kgals Water Consumption 12,100 Non-Recycled Waste in Tons 23% Diversion Rate With 13.0 total kWh per square foot as compared to an average of 26.0 total kWh per square foot reported by full-service REITs, the rooms-focused hotels we invest in are more operationally and environmentally efficient than full-service hotels.(2) Average utility costs per occupied room Full-Service Hotels(3) $9.28 Limited-Service Hotels(3)(4) $5.61 APLE(3) $4.78 Energy Management Systems LED Lighting Smart Irrigation Systems Energy & Water Conservation Guidelines Formal energy management program established in 2018 to ensure that energy, water and waste management are a priority not only within the Company, but also with our management companies and brands. Statistics are based on the Company’s rooms-focused hotels owned as of December 31, 2019. Includes average of total kWh per square foot as reported for 2018 by PK, SHO, HST and HT. Full-Service Hotels and Limited-Service Hotels based on 2018 data from U.S. Hotels HOST Almanac published by STR Analytics in 2019. APLE data based on 2019 actual results for all hotels owned in 2019. Average Upscale and Upper-Midscale Class. COURTYARD, PHOENIX, AZ

SOCIAL RESPONSIBILITY Apple Hospitality REIT has always been firmly committed to strengthening communities through charitable giving, by volunteering our time and talents, and by participating in the many philanthropic programs important to our employees and leaders within our industry, including our brands, the American Hotel & Lodging Association (AHLA) and our third-party management companies. We are dedicated to making a positive impact throughout our Company, the hotel industry, our local communities and the many communities our hotels serve. Key Metrics for Apple Hospitality since 2017 Apple Gives, an employee-led charitable organization, was formed in 2017 to expand our impact and further advance the achievement of our corporate philanthropic goals. 450+ HOURS volunteered BY APPLE HOSPITALITY EMPLOYEES 80+ Non-profit organizations helped BY APPLE HOSPITALITY Local Community Outreach Management Companies Brand Initiatives Industry Involvement Caring for others and our communities has always been at the forefront of our values. SPRINGHILL SUITES, ALEXANDRIA, VA

Board of Directors with Effective Experience Glade M. Knight – Executive Chairman Founder, Apple Hospitality REIT; Former Chairman/CEO, Cornerstone Realty NYSE:TCR Justin G. Knight – Director Chief Executive Officer, Apple Hospitality REIT Kristian M. Gathright – Director Former Executive Vice President & Chief Operating Officer, Apple Hospitality REIT Glenn W. Bunting – Director President, GB Corporation Jon A. Fosheim – Lead Independent Director Co-founder, Green Street Advisors Blythe J. McGarvie – Director Founder and Former Chief Executive Officer, Leadership for International Finance Daryl A. Nickel – Director Former Executive Vice President Lodging Development, Marriott® International L. Hugh Redd – Director Former Senior Vice President & Chief Financial Officer, General Dynamics GOVERNANCE Corporate Governance Aligns with Shareholders Audit, Compensation and Corporate Governance Committees are independent Regular executive sessions of independent directors De-staggered Board allows for annual elections of directors Required resignation of an incumbent director not receiving majority of votes cast in election 76% of executive target compensation is incentive based, with 50% based on shareholder returns Required share ownership of: 5 times base salary for CEO, 3 times base salary for other executive officers, and 2 times base cash compensation for directors Opted out of Virginia law requiring super majority vote for specified transactions Alignment with the best interests of our shareholders is at the forefront of our values. HILTON GARDEN INN, SACRAMENTO, CA

APPENDIX HAMPTON INN & SUITES, ROSEMONT, IL

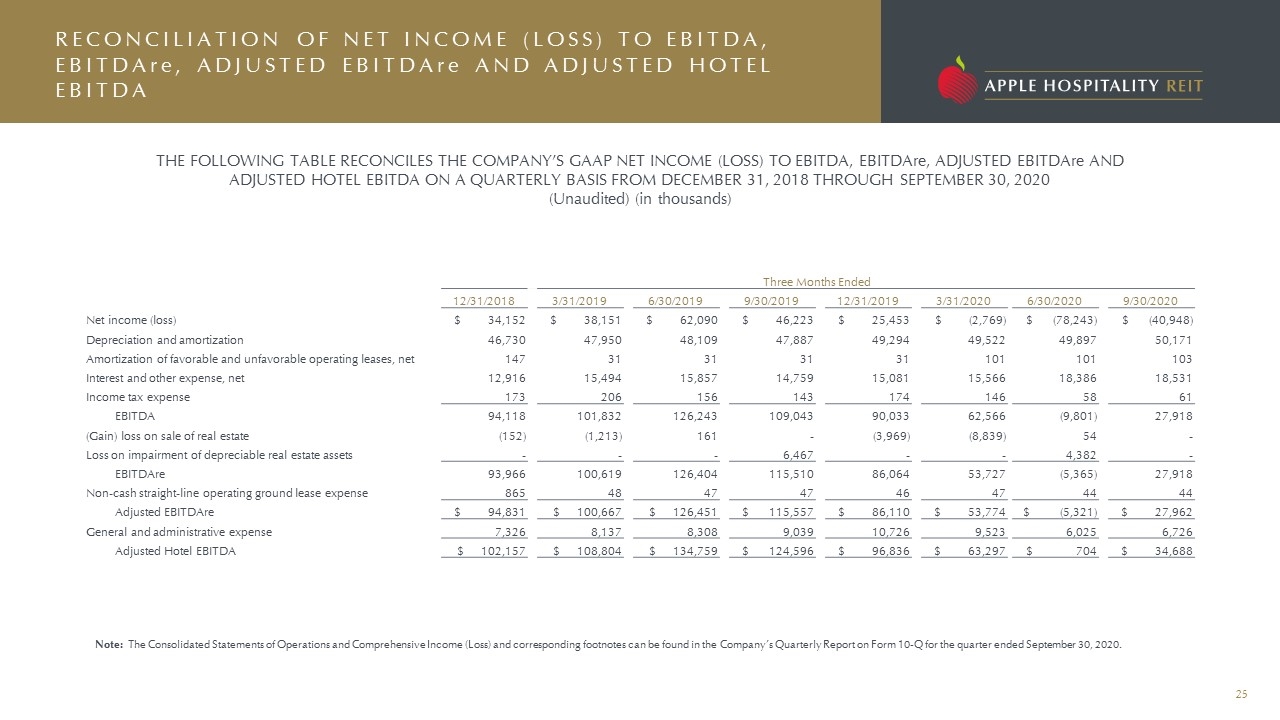

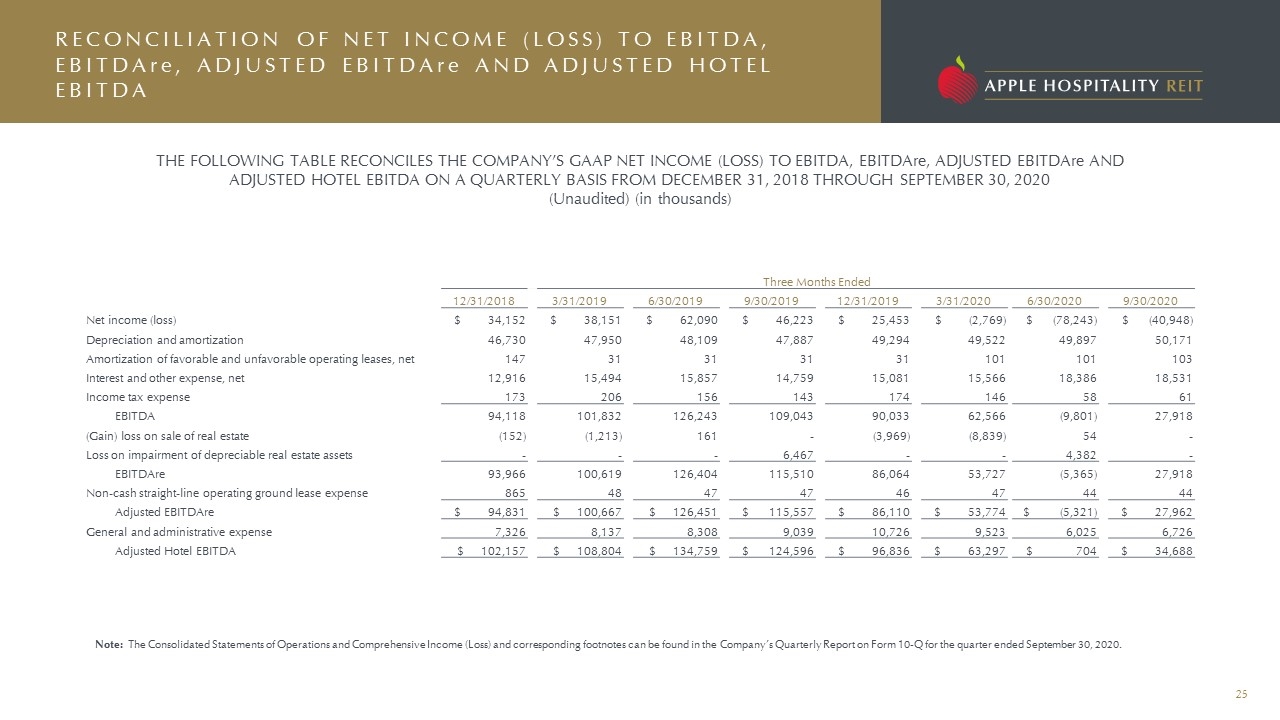

RECONCILIATION OF NET INCOME (LOSS) TO EBITDA, EBITDAre, ADJUSTED EBITDAre AND ADJUSTED HOTEL EBITDA THE FOLLOWING TABLE RECONCILES THE COMPANY’S GAAP NET INCOME (LOSS) TO EBITDA, EBITDAre, ADJUSTED EBITDAre AND ADJUSTED HOTEL EBITDA ON A QUARTERLY BASIS FROM DECEMBER 31, 2018 THROUGH SEPTEMBER 30, 2020 (Unaudited) (in thousands) Three Months Ended 12/31/2018 3/31/2019 6/30/2019 9/30/2019 12/31/2019 3/31/2020 6/30/2020 9/30/2020 Net income (loss) $ 34,152 $ 38,151 $ 62,090 $ 46,223 $ 25,453 $ (2,769) $ (78,243) $ (40,948) Depreciation and amortization 46,730 47,950 48,109 47,887 49,294 49,522 49,897 50,171 Amortization of favorable and unfavorable operating leases, net 147 31 31 31 31 101 101 103 Interest and other expense, net 12,916 15,494 15,857 14,759 15,081 15,566 18,386 18,531 Income tax expense 173 206 156 143 174 146 58 61 EBITDA 94,118 101,832 126,243 109,043 90,033 62,566 (9,801) 27,918 (Gain) loss on sale of real estate (152) (1,213) 161 - (3,969) (8,839) 54 - Loss on impairment of depreciable real estate assets - - - 6,467 - - 4,382 - EBITDAre 93,966 100,619 126,404 115,510 86,064 53,727 (5,365) 27,918 Non-cash straight-line operating ground lease expense 865 48 47 47 46 47 44 44 Adjusted EBITDAre $ 94,831 $ 100,667 $ 126,451 $ 115,557 $ 86,110 $ 53,774 $ (5,321) $ 27,962 General and administrative expense 7,326 8,137 8,308 9,039 10,726 9,523 6,025 6,726 Adjusted Hotel EBITDA $ 102,157 $ 108,804 $ 134,759 $ 124,596 $ 96,836 $ 63,297 $ 704 $ 34,688 Note: The Consolidated Statements of Operations and Comprehensive Income (Loss) and corresponding footnotes can be found in the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2020.

DEFINITIONS HYATT PLACE, JACKSONVILLE, FL Non-GAAP Financial Measures The Company considers the following non-GAAP financial measures useful to investors as key supplemental measures of its operating performance: Funds from Operations (“FFO”); Modified FFO (“MFFO”); Earnings Before Interest, Income Taxes, Depreciation and Amortization (“EBITDA”); Earnings Before Interest, Income Taxes, Depreciation and Amortization for Real Estate (“EBITDAre”); Adjusted EBITDAre (“Adjusted EBITDAre”); and Adjusted Hotel EBITDA (“Adjusted Hotel EBITDA”). These non-GAAP financial measures should be considered along with, but not as alternatives to, net income (loss), cash flow from operations or any other operating GAAP measure. FFO, MFFO, EBITDA, EBITDAre, Adjusted EBITDAre and Adjusted Hotel EBITDA are not necessarily indicative of funds available to fund the Company’s cash needs, including its ability to make cash distributions. Although FFO, MFFO, EBITDA, EBITDAre, Adjusted EBITDAre and Adjusted Hotel EBITDA, as calculated by the Company, may not be comparable to FFO, MFFO, EBITDA, EBITDAre, Adjusted EBITDAre and Adjusted Hotel EBITDA, as reported by other companies that do not define such terms exactly as the Company defines such terms, the Company believes these supplemental measures are useful to investors when comparing the Company’s results between periods and with other REITs. EBITDA, EBITDAre, Adjusted EBITDAre and Adjusted Hotel EBITDA EBITDA is a commonly used measure of performance in many industries and is defined as net income (loss) excluding interest, income taxes, depreciation and amortization. The Company believes EBITDA is useful to investors because it helps the Company and its investors evaluate the ongoing operating performance of the Company by removing the impact of its capital structure (primarily interest expense) and its asset base (primarily depreciation and amortization). In addition, certain covenants included in the agreements governing the Company’s indebtedness use EBITDA, as defined in the specific credit agreement, as a measure of financial compliance. In addition to EBITDA, the Company also calculates and presents EBITDAre in accordance with standards established by the National Association of Real Estate Investment Trusts (“Nareit”), which defines EBITDAre as EBITDA, excluding gains and losses from the sale of certain real estate assets (including gains and losses from change in control), plus real estate related impairments, and adjustments to reflect the entity’s share of EBITDAre of unconsolidated affiliates. The Company presents EBITDAre because it believes that it provides further useful information to investors in comparing its operating performance between periods and between REITs that report EBITDAre using the Nareit definition. The Company also considers the exclusion of non-cash straight-line operating ground lease expense from EBITDAre useful, as this expense does not reflect the underlying performance of the related hotels (Adjusted EBITDAre). The Company further excludes actual corporate-level general and administrative expense for the Company from Adjusted EBITDAre (Adjusted Hotel EBITDA) to isolate property-level operational performance over which the Company’s hotel operators have direct control. The Company believes Adjusted Hotel EBITDA provides useful supplemental information to investors regarding operating performance and is used by management to measure the performance of the Company’s hotels and effectiveness of the operators of the hotels.

DEFINITIONS CONTINUED RESIDENCE INN, BURBANK, CA FFO and MFFO The Company calculates and presents FFO in accordance with standards established by Nareit, which defines FFO as net income (loss) (computed in accordance with generally accepted accounting principles (“GAAP”)), excluding gains and losses from the sale of certain real estate assets (including gains and losses from change in control), extraordinary items as defined by GAAP, and the cumulative effect of changes in accounting principles, plus real estate related depreciation, amortization and impairments, and adjustments for unconsolidated affiliates. Historical cost accounting for real estate assets implicitly assumes that the value of real estate assets diminishes predictably over time. Since real estate values instead have historically risen or fallen with market conditions, most real estate industry investors consider FFO to be helpful in evaluating a real estate company’s operations. The Company further believes that by excluding the effects of these items, FFO is useful to investors in comparing its operating performance between periods and between REITs that report FFO using the Nareit definition. FFO as presented by the Company is applicable only to its common shareholders, but does not represent an amount that accrues directly to common shareholders. The Company calculates MFFO by further adjusting FFO for the exclusion of amortization of finance ground lease assets, amortization of favorable and unfavorable operating leases, net and non-cash straight-line operating ground lease expense, as these expenses do not reflect the underlying performance of the related hotels. The Company presents MFFO when evaluating its performance because it believes that it provides further useful supplemental information to investors regarding its ongoing operating performance. COMPARABLE HOTELS Comparable Hotels is defined as the 235 hotels owned by the Company as of September 30, 2020. For hotels acquired during the periods noted, the Company has included, as applicable, results of those hotels for periods prior to the Company's ownership, and for dispositions, results have been excluded for the Company's period of ownership. Results for periods prior to the Company's ownership have not been included in the Company's actual Consolidated Financial Statements and are included only for comparison purposes. Results included for periods prior to the Company's ownership are based on information from the prior owner of each hotel and have not been audited or adjusted. SAME STORE HOTELS Same Store Hotels is defined as the 228 hotels owned by the Company as of January 1, 2019 and during the entirety of the periods being compared. This information has not been audited.

TRADEMARK INFORMATION “Courtyard by Marriott®,” “Fairfield by Marriott®,” “Fairfield Inn by Marriott®,” “Fairfield Inn & Suites by Marriott®,” “Marriott® Hotels,” “Residence Inn by Marriott®,” “SpringHill Suites by Marriott®,” and “TownePlace Suites by Marriott®” are each a registered trademark of Marriott International, Inc. or one of its affiliates. All references to “Marriott®” mean Marriott International, Inc. and all of its affiliates and subsidiaries, and their respective officers, directors, agents, employees, accountants and attorneys. Marriott® is not responsible for the content of this presentation, whether relating to hotel information, operating information, financial information, Marriott®’s relationship with Apple Hospitality REIT, Inc., or otherwise. Marriott® was not involved in any way, whether as an “issuer” or “underwriter” or otherwise, in any Apple Hospitality REIT offering and received no proceeds from any offering. Marriott® has not expressed any approval or disapproval regarding this presentation, and the grant by Marriott® of any franchise or other rights to Apple Hospitality REIT shall not be construed as any expression of approval or disapproval. Marriott® has not assumed and shall not have any liability in connection with this presentation. “Embassy Suites by Hilton®,” “Hampton by Hilton®,” “Hampton Inn by Hilton®,” “Hampton Inn & Suites by Hilton®,” “Hilton Garden Inn®,” “Home2 Suites by Hilton®,” and “Homewood Suites by Hilton®” are each a registered trademark of Hilton Worldwide Holdings Inc. or one of its affiliates. All references to “Hilton®” mean Hilton Worldwide Holdings Inc. and all of its affiliates and subsidiaries, and their respective officers, directors, agents, employees, accountants and attorneys. Hilton® is not responsible for the content of this presentation, whether relating to hotel information, operating information, financial information, Hilton®’s relationship with Apple Hospitality REIT, Inc., or otherwise. Hilton® was not involved in any way, whether as an “issuer” or “underwriter” or otherwise, in any Apple Hospitality REIT offering and received no proceeds from any offering. Hilton® has not expressed any approval or disapproval regarding this presentation, and the grant by Hilton® of any franchise or other rights to Apple Hospitality REIT shall not be construed as any expression of approval or disapproval. Hilton® has not assumed and shall not have any liability in connection with this presentation. “Hyatt Place®” and “Hyatt House®” are each a registered trademark of Hyatt Hotels Corporation or one of its affiliates. All references to “Hyatt®” mean Hyatt Hotels Corporation and all of its affiliates and subsidiaries, and their respective officers, directors, agents, employees, accountants and attorneys. Hyatt® is not responsible for the content of this presentation, whether relating to hotel information, operating information, financial information, Hyatt®’s relationship with Apple Hospitality REIT, Inc., or otherwise. Hyatt® was not involved in any way, whether as an “issuer” or “underwriter” or otherwise, in any Apple Hospitality REIT offering and received no proceeds from any offering. Hyatt® has not expressed any approval or disapproval regarding this presentation, and the grant by Hyatt® of any franchise or other rights to Apple Hospitality REIT shall not be construed as any expression of approval or disapproval. Hyatt® has not assumed and shall not have any liability in connection with this presentation. HOMEWOOD SUITES, OMAHA, NE

CONTACT INFORMATION 814 East Main Street Richmond, VA 23219 (804) 344-8121 info@applehospitalityreit.com www.applehospitalityreit.com COURTYARD, RICHMOND, VA