SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE QUARTERLY PERIOD ENDED June 30, 2017

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-33829

|

| | |

| Delaware | | 98-0517725 |

| (State or other jurisdiction of | | (I.R.S. employer |

| incorporation or organization) | | identification number) |

| | | |

| 5301 Legacy Drive, Plano, Texas | | 75024 |

| (Address of principal executive offices) | | (Zip code) |

(972) 673-7000

(Registrant's telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer", "accelerated filer", "smaller reporting company", and "emerging growth company" in Rule 12b-2 of the Securities Exchange Act of 1934.

|

| | | | | | | | |

Large Accelerated Filer x | | Accelerated Filer o | | Non-Accelerated Filer o | | Smaller Reporting Company o | | Emerging Growth Company o |

| | | (Do not check if a smaller reporting company) | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes o No x

As of July 25, 2017, there were 181,724,713 shares of the registrant's common stock, par value $0.01 per share, outstanding.

DR PEPPER SNAPPLE GROUP, INC.

FORM 10-Q

PART I - FINANCIAL INFORMATION

| |

ITEM 1. | Financial Statements (Unaudited) |

DR PEPPER SNAPPLE GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

For the Three and Six Months Ended June 30, 2017 and 2016

(Unaudited)

|

| | | | | | | | | | | | | | | |

| | For the | | For the |

| | Three Months Ended | | Six Months Ended |

| | June 30, | | June 30, |

| (in millions, except per share data) | 2017 | | 2016 | | 2017 | | 2016 |

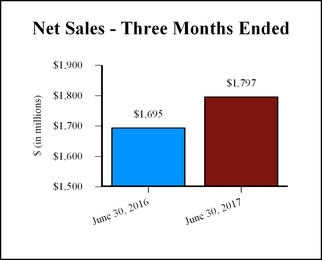

| Net sales | $ | 1,797 |

| | $ | 1,695 |

| | $ | 3,307 |

| | $ | 3,182 |

|

| Cost of sales | 718 |

| | 670 |

| | 1,325 |

| | 1,272 |

|

| Gross profit | 1,079 |

| | 1,025 |

| | 1,982 |

| | 1,910 |

|

| Selling, general and administrative expenses | 683 |

| | 590 |

| | 1,304 |

| | 1,136 |

|

| Depreciation and amortization | 25 |

| | 24 |

| | 50 |

| | 50 |

|

| Other operating income, net | (2 | ) | | (1 | ) | | (30 | ) | | (1 | ) |

| Income from operations | 373 |

| | 412 |

| | 658 |

| | 725 |

|

| Interest expense | 44 |

| | 33 |

| | 84 |

| | 66 |

|

| Interest income | (1 | ) | | (1 | ) | | (2 | ) | | (1 | ) |

| Loss on early extinguishment of debt | 49 |

| | — |

| | 49 |

| | — |

|

| Other income, net | (2 | ) | | (22 | ) | | (4 | ) | | (23 | ) |

| Income before provision for income taxes and equity in earnings of unconsolidated subsidiaries | 283 |

| | 402 |

| | 531 |

| | 683 |

|

| Provision for income taxes | 94 |

| | 142 |

| | 165 |

| | 241 |

|

| Income before equity in earnings of unconsolidated subsidiaries | 189 |

| | 260 |

| | 366 |

| | 442 |

|

| Equity in loss of unconsolidated subsidiaries, net of tax | (1 | ) | | — |

| | (1 | ) | | — |

|

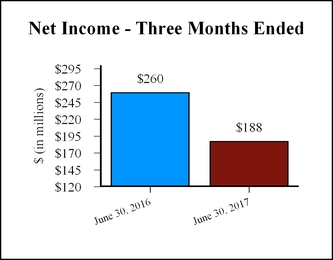

| Net income | $ | 188 |

| | $ | 260 |

| | $ | 365 |

| | $ | 442 |

|

| Earnings per common share: | | | | | | | |

| Basic | $ | 1.02 |

| | $ | 1.40 |

| | $ | 1.99 |

| | $ | 2.37 |

|

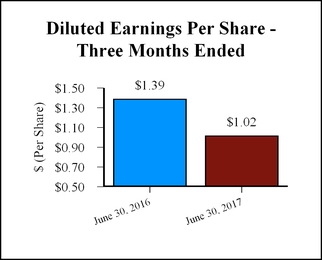

| Diluted | 1.02 |

| | 1.39 |

| | 1.98 |

| | 2.35 |

|

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 183.2 |

| | 185.7 |

| | 183.3 |

| | 186.7 |

|

| Diluted | 183.7 |

| | 186.5 |

| | 184.1 |

| | 187.7 |

|

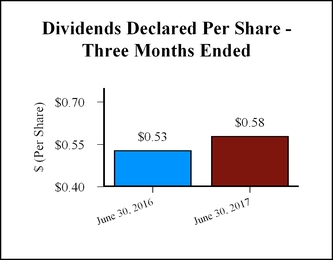

| Cash dividends declared per common share | $ | 0.58 |

| | $ | 0.53 |

| | $ | 1.16 |

| | $ | 1.06 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

DR PEPPER SNAPPLE GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

For the Three and Six Months Ended June 30, 2017 and 2016

(Unaudited)

|

| | | | | | | | | | | | | | | |

| | For the | | For the |

| | Three Months Ended | | Six Months Ended |

| | June 30, | | June 30, |

| (in millions) | 2017 | | 2016 | | 2017 | | 2016 |

| Comprehensive income | $ | 201 |

| | $ | 245 |

| | $ | 401 |

| | $ | 435 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

DR PEPPER SNAPPLE GROUP, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

As of June 30, 2017 and December 31, 2016

(Unaudited)

|

| | | | | | | |

| | June 30, | | December 31, |

| (in millions, except share and per share data) | 2017 | | 2016 |

| Assets |

| Current assets: | | | |

| Cash and cash equivalents | $ | 286 |

| | $ | 1,787 |

|

| Restricted cash and restricted cash equivalents | 89 |

| | — |

|

| Accounts receivable: | | | |

| Trade, net | 698 |

| | 595 |

|

| Other | 50 |

| | 51 |

|

| Inventories | 267 |

| | 202 |

|

| Prepaid expenses and other current assets | 165 |

| | 101 |

|

| Total current assets | 1,555 |

| | 2,736 |

|

| Property, plant and equipment, net | 1,120 |

| | 1,138 |

|

| Investments in unconsolidated subsidiaries | 23 |

| | 23 |

|

| Goodwill | 3,564 |

| | 2,993 |

|

| Other intangible assets, net | 3,788 |

| | 2,656 |

|

| Other non-current assets | 208 |

| | 183 |

|

| Deferred tax assets | 61 |

| | 62 |

|

| Total assets | $ | 10,319 |

| | $ | 9,791 |

|

| Liabilities and Stockholders' Equity |

| Current liabilities: | | | |

| Accounts payable | $ | 367 |

| | $ | 303 |

|

| Deferred revenue | 64 |

| | 64 |

|

| Short-term borrowings and current portion of long-term obligations | 312 |

| | 10 |

|

| Income taxes payable | 41 |

| | 4 |

|

| Other current liabilities | 796 |

| | 670 |

|

| Total current liabilities | 1,580 |

| | 1,051 |

|

| Long-term obligations | 4,391 |

| | 4,468 |

|

| Deferred tax liabilities | 859 |

| | 812 |

|

| Non-current deferred revenue | 1,086 |

| | 1,117 |

|

| Other non-current liabilities | 248 |

| | 209 |

|

| Total liabilities | 8,164 |

| | 7,657 |

|

| Commitments and contingencies |

| |

|

| Stockholders' equity: | | | |

| Preferred stock, $0.01 par value, 15,000,000 shares authorized, no shares issued | — |

| | — |

|

| Common stock, $0.01 par value, 800,000,000 shares authorized, 182,216,494 and 183,119,843 shares issued and outstanding as of June 30, 2017 and December 31, 2016, respectively | 2 |

| | 2 |

|

| Additional paid-in capital | — |

| | 95 |

|

| Retained earnings | 2,346 |

| | 2,266 |

|

| Accumulated other comprehensive loss | (193 | ) | | (229 | ) |

| Total stockholders' equity | 2,155 |

| | 2,134 |

|

| Total liabilities and stockholders' equity | $ | 10,319 |

| | $ | 9,791 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

DR PEPPER SNAPPLE GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Six Months Ended June 30, 2017 and 2016

(Unaudited) |

| | | | | | | |

| | For the |

| | Six Months Ended |

| | June 30, |

| (in millions) | 2017 | | 2016 |

| Operating activities: | | | |

| Net income | $ | 365 |

| | $ | 442 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation expense | 98 |

| | 95 |

|

| Amortization expense | 17 |

| | 16 |

|

| Amortization of deferred revenue | (32 | ) | | (32 | ) |

| Employee stock-based compensation expense | 16 |

| | 22 |

|

| Deferred income taxes | 48 |

| | 30 |

|

| Loss on early extinguishment of debt | 49 |

| | — |

|

| Gain on step acquisition of unconsolidated subsidiaries | (28 | ) | | — |

|

| Gain on extinguishment of multi-employer plan withdrawal liability | — |

| | (21 | ) |

| Unrealized gains on economic hedges | 7 |

| | (31 | ) |

| Other, net | 6 |

| | 2 |

|

| Changes in assets and liabilities, net of effects of acquisition: | | | |

| Trade accounts receivable | (72 | ) | | (74 | ) |

| Other accounts receivable | 10 |

| | (5 | ) |

| Inventories | (35 | ) | | (29 | ) |

| Other current and non-current assets | (95 | ) | | (80 | ) |

| Other current and non-current liabilities | (5 | ) | | (33 | ) |

| Trade accounts payable | 24 |

| | 81 |

|

| Income taxes payable | 37 |

| | 45 |

|

| Net cash provided by operating activities | 410 |

| | 428 |

|

| Investing activities: | | | |

| Acquisition of business | (1,550 | ) | | — |

|

| Cash acquired in step acquisition of unconsolidated subsidiaries | 3 |

| | — |

|

| Purchase of property, plant and equipment | (41 | ) | | (68 | ) |

| Purchase of intangible assets | (5 | ) | | — |

|

| Investment in unconsolidated subsidiaries | (1 | ) | | (6 | ) |

| Purchase of cost method investment | — |

| | (1 | ) |

| Proceeds from disposals of property, plant and equipment | 1 |

| | 3 |

|

| Other, net | (2 | ) | | (7 | ) |

| Net cash used in investing activities | (1,595 | ) | | (79 | ) |

| Financing activities: | | | |

| Proceeds from issuance of senior unsecured notes | 400 |

| | — |

|

| Repayment of senior unsecured notes | (248 | ) | | (500 | ) |

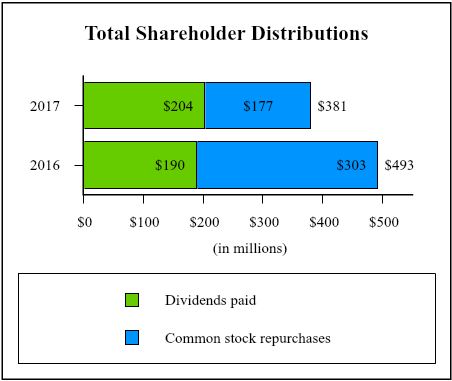

| Repurchase of shares of common stock | (177 | ) | | (303 | ) |

| Dividends paid | (204 | ) | | (190 | ) |

| Tax withholdings related to net share settlements of certain stock awards | (30 | ) | | (31 | ) |

| Proceeds from stock options exercised | 19 |

| | 12 |

|

| Premium on issuance of senior unsecured notes | 16 |

| | — |

|

| Proceeds from termination of interest rate swap | 13 |

| | — |

|

| Deferred financing charges paid | (5 | ) | | — |

|

| Capital lease payments | (5 | ) | | (4 | ) |

| Other, net | 1 |

| | — |

|

| Net cash used in financing activities | (220 | ) | | (1,016 | ) |

| Cash, cash equivalents, restricted cash and restricted cash equivalents — net change from: | | | |

| Operating, investing and financing activities | (1,405 | ) | | (667 | ) |

| Effect of exchange rate changes on cash, cash equivalents, restricted cash and restricted cash equivalents | 5 |

| | 1 |

|

| Cash, cash equivalents, restricted cash and restricted cash equivalents at beginning of period | 1,787 |

| | 911 |

|

| Cash, cash equivalents, restricted cash and restricted cash equivalents at end of period | $ | 387 |

| | $ | 245 |

|

See Note 14 for supplemental cash flow information.

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

DR PEPPER SNAPPLE GROUP, INC.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS' EQUITY

For the Six Months Ended June 30, 2017

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | Accumulated | | |

| | Common Stock | | Additional | | | | Other | | |

| | Issued | | Paid-In | | Retained | | Comprehensive | | Total |

| (in millions, except per share data) | Shares | | Amount | | Capital | | Earnings | | Loss | | Equity |

| Balance as of January 1, 2017 | 183.1 |

| | $ | 2 |

| | $ | 95 |

| | $ | 2,266 |

| | $ | (229 | ) | | $ | 2,134 |

|

| Shares issued under employee stock-based compensation plans and other | 1.0 |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Net income | — |

| | — |

| | — |

| | 365 |

| | — |

| | 365 |

|

| Other comprehensive income | — |

| | — |

| | — |

| | — |

| | 36 |

| | 36 |

|

| Dividends declared, $1.16 per share | — |

| | — |

| | 2 |

| | (214 | ) | | — |

| | (212 | ) |

| Deemed capital contribution from former shareholders of Bai Brands LLC | — |

| | — |

| | 2 |

| | — |

| | — |

| | 2 |

|

| Stock options exercised and stock-based compensation | — |

| | — |

| | 7 |

| | — |

| | — |

| | 7 |

|

| Common stock repurchases | (1.9 | ) | | — |

| | (106 | ) | | (71 | ) | | — |

| | (177 | ) |

| Balance as of June 30, 2017 | 182.2 |

| | $ | 2 |

| | $ | — |

| | $ | 2,346 |

| | $ | (193 | ) | | $ | 2,155 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

DR PEPPER SNAPPLE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

References in this Quarterly Report on Form 10-Q to "DPS" or "the Company" refer to Dr Pepper Snapple Group, Inc. and all entities included in the unaudited condensed consolidated financial statements.

This Quarterly Report on Form 10-Q refers to some of DPS' owned or licensed trademarks, trade names and service marks, which are referred to as the Company's brands. All of the product names included herein are either DPS' registered trademarks or those of the Company's licensors.

BASIS OF PRESENTATION

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP") for interim financial information and in accordance with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete consolidated financial statements. In the opinion of management, all adjustments, consisting principally of normal recurring adjustments, considered necessary for a fair presentation have been included. These unaudited condensed consolidated financial statements should be read in conjunction with the Company's audited consolidated financial statements and the notes thereto in the Company's Annual Report on Form 10-K for the year ended December 31, 2016 ("Annual Report").

PRINCIPLES OF CONSOLIDATION

DPS consolidates all wholly owned subsidiaries. The Company uses the equity method to account for investments in companies if the investment provides the Company with the ability to exercise significant influence over operating and financial policies of the investee. Consolidated net income includes DPS' proportionate share of the net income or loss of these companies. Judgment regarding the level of influence over each equity method investment includes considering key factors such as ownership interest, representation on the board of directors or similar governing body, participation in policy-making decisions and material intercompany transactions.

The Company is also required to consolidate entities that are variable interest entities (“VIEs”) of which DPS is the primary beneficiary. Judgments are made in assessing whether the Company is the primary beneficiary, including determination of the activities that most significantly impact the VIE’s economic performance.

The Company eliminates from its financial results all intercompany transactions between entities included in the unaudited condensed consolidated financial statements and the intercompany transactions with its equity method investees.

USE OF ESTIMATES

The process of preparing DPS' unaudited condensed consolidated financial statements in conformity with U.S. GAAP requires the use of estimates and judgments that affect the reported amount of assets, liabilities, revenue and expenses. These estimates and judgments are based on historical experience, future expectations and other factors and assumptions the Company believes to be reasonable under the circumstances. These estimates and judgments are reviewed on an ongoing basis and are revised when necessary. Changes in estimates are recorded in the period of change. Actual amounts may differ from these estimates.

RECLASSIFICATIONS

Unrealized gains and losses on derivatives classified as economic hedges have been reclassified from other, net to the unrealized gains on economic hedges caption within the operating activities section in the unaudited Condensed Consolidated Statements of Cash Flows for the prior period to conform to the current year's presentation, with no impact to total cash provided by (used in) operating, investing or financing activities.

Excess tax benefit on stock-based compensation in the unaudited Condensed Consolidated Statements of Cash Flows has been reclassified from financing activities to other, net within operating activities for the prior period to conform to the current year's presentation as a result of the adoption of Accounting Standards Update ("ASU") 2016-09, Compensation - Stock Compensation (Topic 718): Improvements to Employee Share Based Payment Accounting ("ASU 2016-09"). See Recently Adopted Provisions of U.S. GAAP below for further details on the impact of the adoption of ASU 2016-09 on the Company's unaudited condensed consolidated financial statements.

DR PEPPER SNAPPLE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited, Continued)

RECENTLY ISSUED ACCOUNTING STANDARDS

Effective in 2018

In May 2014, the Financial Accounting Standards Board ("FASB") issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606) ("ASU 2014-09"). The new guidance sets forth a new five-step revenue recognition model which replaces the prior revenue recognition guidance in its entirety and is intended to eliminate numerous industry-specific pieces of revenue recognition guidance that have historically existed in U.S. GAAP. The underlying principle of the new standard is that a business or other organization will recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects what it expects in exchange for the goods or services. The standard also requires more detailed disclosures and provides additional guidance for transactions that were not addressed completely in the prior accounting guidance. ASU 2014-09 provides alternative methods of initial adoption.

In August 2015, the FASB issued ASU 2015-14, Revenue from Contracts with Customers (Topic 606): Deferral of the Effective Date, which defers the effective date of ASU 2014-09 by one year to December 15, 2017 for interim and annual reporting periods beginning after that date and permitted early adoption of the standard, but not before the original effective date. In March 2016, the FASB issued ASU 2016-08, Revenue from Contracts with Customers (Topic 606): Principal versus Agent Considerations (Reporting Revenue Gross versus Net), which clarifies the implementation guidance on principal versus agent considerations for the new model. In April 2016, the FASB issued ASU 2016-10, Revenue from Contracts with Customers (Topic 606): Identifying Performance Obligations and Licensing, which clarifies the implementation guidance related to identifying performance obligations and licensing for the new model. In May 2016, the FASB issued ASU 2016-12, Revenue from Contracts with Customers (Topic 606): Narrow-Scope Improvements and Practical Expedients, which improves guidance on assessing collectibility, presentation of sales taxes, noncash consideration, and completed contracts and contract modifications at transition. These updates are effective concurrently with Topic 606 (ASU 2014-09).

At this point in time, the Company intends to adopt the above standards using the modified retrospective approach for the quarter ending March 31, 2018. In preparation for the Company's adoption of the new standards, management assembled a project management team, which has obtained representative samples of contracts and other forms of agreements with our customers and is evaluating the provisions contained within those documents based on the new guidance. While the Company does not expect this change to have a material impact on the Company's results of operations, financial position and cash flows once implemented on an annual basis, the Company does expect an increase in contract liabilities and a potential impact on its net sales in interim periods due to timing. The Company is still evaluating the disclosure requirements under these standards. As the Company completes its overall evaluation, the Company is also identifying and preparing to implement changes to its accounting policies, practices and controls to support the new standards.

In March 2017, the FASB issued ASU 2017-07, Compensation - Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost ("ASU 2017-07"). The ASU requires employers who offer defined benefit pension plans or other post-retirement benefit plans to report the service cost component within the same income statement caption as other compensation costs arising from services rendered by employees during the period. The ASU also requires the other components of net periodic benefit cost to be presented separately from the service cost component, in a caption outside of a subtotal of income from operations. Additionally, the ASU provides that only the service cost component is eligible for capitalization. ASU 2017-07 is effective for interim and annual reporting periods beginning after December 15, 2017, and early adoption is permitted. The standard requires retrospective adoption of the presentation of the components of net periodic benefit costs and prospective application of the capitalization of the service cost component in assets. The Company does not expect this will have a material impact on the consolidated financial statements.

Effective in 2019

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842) ("ASU 2016-02"). The ASU replaces the prior lease accounting guidance in its entirety. The underlying principle of the new standard is the recognition of lease assets and lease liabilities by lessees for substantially all leases, with an exception for leases with terms of less than twelve months. The standard also requires additional quantitative and qualitative disclosures. ASU 2016-02 is effective for interim and annual reporting periods beginning after December 15, 2018, and early adoption is permitted. The standard requires a modified retrospective approach, which includes several optional practical expedients. The Company does not intend to early adopt the standard. The Company has assembled a project management team and is in the early stages of evaluation. The Company anticipates the impact of the standard to be significant to its Consolidated Balance Sheet due to the amount of the Company's lease commitments. The Company is currently evaluating the other impacts that ASU 2016-02 will have on the consolidated financial statements.

DR PEPPER SNAPPLE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited, Continued)

RECENTLY ADOPTED PROVISIONS OF U.S. GAAP

As of January 1, 2017, the Company adopted ASU 2015-11, Inventory (Topic 330): Simplifying the Measurement of Inventory. This ASU requires inventories measured under any methods other than last-in, first-out ("LIFO") or the retail inventory method to be subsequently measured at the lower of cost or net realizable value, rather than at the lower of cost or market. Subsequent measurement of inventory using LIFO or the retail inventory method is unchanged by this ASU. The adoption of the ASU did not have a material impact on the Company's consolidated financial statements.

As of January 1, 2017, the Company adopted ASU 2016-09, which is part of the FASB's simplification initiative. The new standard provides for changes to accounting for stock compensation including 1) excess tax benefits and tax deficiencies related to share based payment awards will be recognized as income tax benefit or expense in the reporting period in which they occur; 2) excess tax benefits will be classified as an operating activity in the statement of cash flow; 3) the option to elect to estimate forfeitures or account for them when they occur; and 4) an increase in the tax withholding requirements threshold to qualify for equity classification. Beginning in 2017, the primary impact of adoption was the recognition of excess tax benefits for our stock awards in the provision for income taxes rather than additional paid-in capital. Additional amendments to the accounting for income taxes and minimum statutory withholding tax requirements had no impact to retained earnings. The Company elected to continue to estimate forfeitures expected to occur to determine the amount of compensation cost to be recognized in each period.

Adoption of the new standard resulted in the recognition of excess tax benefits in our provision for income taxes rather than paid-in capital of $1 million and $19 million, respectively, for the three and six months ended June 30, 2017. The presentation of excess tax benefits on stock-based compensation was adjusted retrospectively within the unaudited Condensed Consolidated Statements of Cash Flows, resulting in a $21 million increase in net cash provided by operating activities for the six months ended June 30, 2016, with a corresponding increase to net cash used in financing activities. The presentation requirements for cash flows related to employee taxes paid for withheld shares had no impact to any of the periods presented on the unaudited Condensed Consolidated Statements of Cash Flows as the Company has historically presented them as a financing activity.

As of January 1, 2017, the Company early adopted ASU No. 2016-18, Statement of Cash Flows (Topic 230), Restricted Cash ("ASU 2016-18"), which requires amounts generally described as restricted cash and restricted cash equivalents be included with cash and cash equivalents when reconciling the beginning and ending amounts shown on the statement of cash flows. The Company elected to early adopt the provisions of ASU 2016-18 as of January 1, 2017 and has revised its unaudited Condensed Consolidated Statements of Cash Flows for the six months ended June 30, 2017 and 2016 to reflect amounts described as restricted cash and restricted cash equivalents included with cash and cash equivalents in the reconciliation of beginning of period and end of period total amounts shown on the unaudited Condensed Consolidated Statements of Cash Flow. The adoption had no impact on amounts presented in the unaudited Condensed Consolidated Statements of Cash Flows for the six months ended June 30, 2016. Refer to Note 14 for the reconciliation of cash, cash equivalents, restricted cash and restricted cash equivalents as presented on the unaudited Condensed Consolidated Balance Sheets to the amounts as shown on the unaudited Condensed Consolidated Statements of Cash Flows.

2. Acquisitions

BAI BRANDS MERGER

Description of the Transaction

On November 21, 2016, we entered into an Agreement and Plan of Merger (the "Merger Agreement") with Bai Brands LLC ("Bai Brands"), pursuant to which we agreed to acquire Bai Brands for a cash purchase price of 1.7 billion, subject to certain adjustments in the Merger Agreement (the "Bai Brands Merger"). The acquisition of Bai Brands will further enable the Company to meet growing consumer demand for better-for-you beverages, as Bai Brands is positioned for expanding growth in key beverage segments.

On January 31, 2017, the Company funded the Bai Brands Merger with the net proceeds from the senior unsecured notes issued in December 2016 and cash on hand. In order to complete the Bai Brands Merger, the Company paid $1,548 million, net of the Company's previous ownership interest, in exchange for the remaining ownership interests and seller transaction costs. Additionally, $103 million was held back and placed in escrow.

As a result of the Bai Brands Merger, our existing 2.63% equity interest in Bai Brands was remeasured to fair value of $43 million, which resulted in a gain of $28 million that was recognized in the first quarter of 2017 and included in other operating income, net.

Two transactions related to the Bai Brands Merger were recognized separately from the acquisition of assets and assumptions of liabilities of Bai Brands:

| |

| • | The Company paid certain seller transaction costs, which included $2 million to reimburse Bai Brands for payments made on behalf of the Company for buyer acquisition-related costs, which were recorded as selling, general and administrative ("SG&A") expenses. The remainder of the seller transaction costs paid by the Company were accounted for by the Company as part of the consideration transferred. |

| |

| • | Bai Brands had an executory contract as of January 31, 2017, which compensated certain counterparties with Profit Interest Units from Bai Brands (the “Predecessor PIUs”). The Predecessor PIUs were based upon the counterparties completing service requirements and various performance criteria. As a result of the Bai Brands Merger, these Predecessor PIUs have fully vested and were converted into cash as of January 31, 2017 based upon the consideration paid by the Company to acquire Bai Brands. The cash was placed in escrow and will be released from escrow to the counterparties on certain anniversary dates as long as the counterparties are not in breach of the executory contract. Although none of the costs of these benefits have been paid by the Company, DPS will record SG&A expenses for the deferred compensation amounts payable to these counterparties by Bai Brands. For the three and six months ended June 30, 2017, the Company recognized $2 million of compensation expense related to performance on the executory contract. As of June 30, 2017, the total unrecognized compensation cost is $11 million and the period over which these costs are expected to be recognized is 15 months. |

The Company’s preliminary purchase price was $1,649 million, net of the Company's previous ownership interest. The components of the preliminary purchase price are presented below:

|

| | | |

| (in millions) | Preliminary Purchase Price |

| Cash paid to consummate Bai Brands Merger, net of the Company's previous ownership interest | $ | 1,550 |

|

| Holdback placed in escrow | 101 |

|

| Less: Seller transaction costs reimbursed to Bai Brands for payments made on behalf of the Company for its acquisition-related costs | (2 | ) |

Preliminary Purchase Price - Bai Brands(1) | $ | 1,649 |

|

| |

| (1) | The preliminary purchase price excludes the impact of the Company's pre-existing ownership interest. |

Acquisition and integration-related expenses of $1 million and $20 million were recognized during the three and six months ended June 30, 2017, respectively, and were included in SG&A expenses.

Escrow/Holdback Liability

The $101 million holdback placed in escrow, as of June 30, 2017, is made up of two components:

| |

| • | $90 million, which will be held in escrow to secure indemnification obligations of the sellers relating to the accuracy of representations and warranties and a working capital adjustment, which is currently in negotiation under the terms of the Merger Agreement. As of January 31, 2018, $80 million less any working capital adjustment will be released. The remaining $10 million will be released approximately 4 years after the acquisition date, subject to certain administrative conditions, and |

| |

| • | $11 million of unrecognized compensation associated with the Predecessor PIUs related to the performance of certain counterparties, which will be held in escrow and released over the next 15 months. |

The acquisition consideration held in escrow does not meet the definition of contingent consideration as provided under U.S. GAAP. The amount held in escrow was included in the preliminary purchase price as representations and warranties were expected to be valid as of the acquisition date. The escrow is included in restricted cash along with a corresponding amount in the liability section of the unaudited Condensed Consolidated Balance Sheets, which is allocated between other current liabilities and other non-current liabilities. Refer to Note 14 for additional information on location of the restricted cash on the unaudited Condensed Consolidated Balance Sheets.

Preliminary Purchase Price Allocation

The following table summarizes the preliminary allocation of the fair value of the assets acquired and liabilities assumed by major class for the Bai Brands Merger:

|

| | | | | | |

| (in millions) | | Fair Value | | Useful Life |

| Property, plant & equipment | | $ | 4 |

| | 5 - 10 years |

| Customer relationships | | 30 |

| | 7 years |

| Non-compete agreements | | 22 |

| | 2 - 4 years |

| Brands | | 1,073 |

| | Indefinite |

| Goodwill | | 568 |

| | Indefinite |

| Assumed liabilities, net of acquired assets | | (7 | ) | | N/A |

| Total | | $ | 1,690 |

| | |

The acquisition was accounted for as a business combination, and the identifiable assets acquired and liabilities assumed were recorded at their estimated fair values at the date of acquisition. We have completed our preliminary valuation to determine the fair value of the identifiable assets acquired and liabilities assumed. The fair values of the assets acquired were determined using various valuation techniques, including an income approach. The fair value measurements were primarily based on significant inputs that are not directly observable in the market and are considered Level 3 under the fair value measurements and disclosure framework. Key assumptions include cash flow projections of Bai Brands and the discount rate applied to those cash flows. The excess of the purchase price over the estimated fair values was recorded as goodwill.

In connection with this acquisition, the Company recorded goodwill of $568 million, which is deductible for tax purposes. The goodwill recognized was attributable to certain tax benefits the Company will realize over time, Bai Brands' management team and growth opportunities in a “better-for-you” beverage segment.

The Company recorded $34 million for the fair value of contingent liabilities assumed upon acquisition primarily related to existing manufacturing contracts. The fair value of the contingent liabilities was determined using discounted cash flows on expected future payments related to these contracts. The contingent liabilities will be evaluated each reporting period based on events and circumstances which may impact future payments under these contracts, and any changes in fair value will be recorded in the Company's unaudited Condensed Consolidated Statements of Income.

Pro Forma Information

The Company’s acquisition of Bai Brands is strategically significant to the future growth prospects of the Company; however at the time of the acquisition, the historical results of Bai Brands were immaterial to the Company’s consolidated financial results. Assuming the results of Bai Brands had been included in operations beginning on January 1, 2016, the estimated pro forma net operating revenues of the Company for the three and six months ended June 30, 2017 would have been approximately $1,797 million and $3,309 million, respectively, and for the three and six months ended June 30, 2016 would have been approximately $1,711 million and $3,207 million, respectively. The estimated pro forma net income, which includes the alignment of accounting policies, the effect of fair value adjustments related to the Bai Brands Merger, the associated tax effects and the impact of the additional debt to finance the Bai Brands Merger, for the three and six months ended June 30, 2017 would have been approximately $186 million and $352 million, respectively, and for the three and six months ended June 30, 2016 would have been approximately $245 million and $415 million, respectively. This estimated pro forma information is not necessarily indicative of the results that actually would have occurred had the Bai Brands Merger been completed on the date indicated or the future operating results.

Actual Results of Bai Brands

For the periods subsequent to the acquisition date that are included in the three and six months ended June 30, 2017, Bai Brands had net sales of $70 million and $105 million, respectively, and net loss of $6 million and $11 million, respectively. These results do not reflect the consolidation impact of the Company's acquisition of Bai Brands.

The following table reconciles the net sales and net loss of Bai Brands since the acquisition date to the impact of Bai Brands to the Company's consolidated results of operations:

|

| | | | | | | |

| | For the Three Months Ended June 30, | | For the Six Months Ended June 30, |

| (in millions) | 2017 | | 2017 |

| Net sales - Bai Brands | $ | 70 |

| | $ | 105 |

|

| Intercompany sales to Packaged Beverages Excluding Bai | (51 | ) | | (75 | ) |

| Incremental impact to consolidated net sales | $ | 19 |

| | $ | 30 |

|

|

| | | | | | | |

| | For the Three Months Ended June 30, | | For the Six Months Ended June 30, |

| (in millions) | 2017 | | 2017 |

| Net loss - Bai Brands | $ | (6 | ) | | $ | (11 | ) |

Impact of intercompany activity with Packaged Beverages Excluding Bai(1) | (1 | ) | | (7 | ) |

| Incremental impact to consolidated net income | $ | (7 | ) | | $ | (18 | ) |

___________________________

| |

| (1) | Impact of intercompany activity includes the elimination of intercompany net sales and the deferral of gross profit recognition on shipments of product still in Packaged Beverages Excluding Bai for the three and six months ended June 30, 2017, net of tax. |

DR PEPPER SNAPPLE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited, Continued)

Inventories consisted of the following:

|

| | | | | | | |

| | June 30, | | December 31, |

| (in millions) | 2017 | | 2016 |

| Raw materials | $ | 92 |

| | $ | 77 |

|

| Spare parts | 20 |

| | 22 |

|

| Work in process | 6 |

| | 5 |

|

| Finished goods | 182 |

| | 130 |

|

| Inventories at first in first out cost | 300 |

| | 234 |

|

| Reduction to LIFO cost | (33 | ) | | (32 | ) |

| Inventories | $ | 267 |

| | $ | 202 |

|

Approximately $201 million and $158 million of the Company's inventory was accounted for under the LIFO method of accounting as of June 30, 2017 and December 31, 2016, respectively. The reduction to LIFO cost reflects the excess of the current cost of LIFO inventories as of June 30, 2017 and December 31, 2016, over the amount at which these inventories were valued on the unaudited Condensed Consolidated Balance Sheets. For the three and six months ended June 30, 2017, there was no LIFO inventory liquidation. For the three and six months ended June 30, 2016, LIFO inventory liquidation increased the Company's gross profit by $2 million.

| |

| 4. | Prepaid Expenses and Other Current Assets and Other Current Liabilities |

The table below details the components of prepaid expenses and other current assets and other current liabilities:

|

| | | | | | | |

| | June 30, | | December 31, |

| (in millions) | 2017 | | 2016 |

| Prepaid expenses and other current assets: | | | |

| Customer incentive programs | $ | 72 |

| | $ | 24 |

|

| Derivative instruments | 15 |

| | 19 |

|

| Prepaid income taxes | 14 |

| | 18 |

|

| Current assets held for sale | 1 |

|

| 1 |

|

| Other | 63 |

| | 39 |

|

| Total prepaid expenses and other current assets | $ | 165 |

| | $ | 101 |

|

| Other current liabilities: | | | |

| Customer rebates and incentives | $ | 310 |

| | $ | 280 |

|

| Accrued compensation | 99 |

| | 134 |

|

| Insurance liability | 39 |

| | 36 |

|

| Interest accrual | 23 |

| | 24 |

|

| Dividends payable | 105 |

| | 97 |

|

| Derivative instruments | 9 |

| | 2 |

|

Holdback liability to former Bai Brands shareholders(1) | 89 |

| | — |

|

| Other | 122 |

| | 97 |

|

| Total other current liabilities | $ | 796 |

| | $ | 670 |

|

____________________________

| |

| (1) | Refer to Note 2 for additional information on holdback liability to former Bai Brands shareholders as of June 30, 2017. |

DR PEPPER SNAPPLE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited, Continued)

| |

| 5. | Goodwill and Other Intangible Assets |

GOODWILL

Changes in the carrying amount of goodwill by reporting unit are as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | |

| (in millions) | Beverage Concentrates | | WD Reporting Unit(1) | | DSD Reporting Unit(1) | | Bai | | Latin America Beverages | | Total |

| Balance as of January 1, 2016 | | | | | | | | | | | |

| Goodwill | $ | 1,733 |

| | $ | 1,222 |

| | $ | 189 |

| | $ | — |

| | $ | 24 |

| | $ | 3,168 |

|

| Accumulated impairment losses | — |

| | — |

| | (180 | ) | | — |

| | — |

| | (180 | ) |

| | 1,733 |

| | 1,222 |

| | 9 |

|

| — |

| | 24 |

| | 2,988 |

|

| Foreign currency impact | — |

| | — |

| | — |

| | — |

| | (3 | ) | | (3 | ) |

Acquisition activity(2) | — |

| | — |

| | — |

| | — |

| | 8 |

| | 8 |

|

| Balance as of December 31, 2016 | | | | | | | | | | | |

| Goodwill | 1,733 |

| | 1,222 |

| | 189 |

| | — |

| | 29 |

| | 3,173 |

|

| Accumulated impairment losses | — |

| | — |

| | (180 | ) | | — |

| | — |

| | (180 | ) |

| | 1,733 |

| | 1,222 |

| | 9 |

| | — |

| | 29 |

| | 2,993 |

|

| Foreign currency impact | — |

| | — |

| | — |

| | — |

| | 3 |

| | 3 |

|

Acquisition activity(3) | — |

| | — |

| | — |

| | 568 |

| | — |

| | 568 |

|

| Balance as of June 30, 2017 | | | | | | | | | | | |

| Goodwill | 1,733 |

| | 1,222 |

| | 189 |

| | 568 |

| | 32 |

| | 3,744 |

|

| Accumulated impairment losses | — |

| | — |

| | (180 | ) | | — |

| | — |

| | (180 | ) |

| | $ | 1,733 |

| | $ | 1,222 |

| | $ | 9 |

| | $ | 568 |

| | $ | 32 |

| | $ | 3,564 |

|

| |

| (1) | The Packaged Beverages Excluding Bai operating segment is comprised of two reporting units, the Direct Store Delivery ("DSD") system and the Warehouse Direct ("WD") system. |

| |

| (2) | Goodwill was recorded to the Latin America Beverages reporting unit during 2016 as a result of the step acquisition of Industria Embotelladora de Bebidas Mexicanas and Embotelladora Mexicana de Agua, S.A. de C.V. |

| |

| (3) | Goodwill was recorded to Bai during the six months ended June 30, 2017 as a result of the Bai Brands Merger. Refer to Note 2 for additional information about the Bai Brands Merger. |

DR PEPPER SNAPPLE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited, Continued)

INTANGIBLE ASSETS OTHER THAN GOODWILL

The net carrying amounts of intangible assets other than goodwill are as follows: |

| | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2017 | | December 31, 2016 |

| | Gross | | Accumulated | | Net | | Gross | | Accumulated | | Net |

| (in millions) | Amount | | Amortization | | Amount | | Amount | | Amortization | | Amount |

| Intangible assets with indefinite lives: | | | | | | | | | | | |

Brands(1) | $ | 3,699 |

| | $ | — |

| | $ | 3,699 |

| | $ | 2,621 |

| | $ | — |

| | $ | 2,621 |

|

Distribution rights(2) | 32 |

| | — |

| | 32 |

| | 27 |

| | — |

| | 27 |

|

| Intangible assets with definite lives: | | | | | | | | | | | |

Customer relationships(1) | 106 |

| | (77 | ) | | 29 |

| | 76 |

| | (76 | ) | | — |

|

Non-compete agreements(1) | 22 |

| | (1 | ) | | 21 |

| | — |

| | — |

| | — |

|

| Distribution rights | 16 |

| | (9 | ) | | 7 |

| | 16 |

| | (8 | ) | | 8 |

|

| Brands | 29 |

| | (29 | ) | | — |

| | 29 |

| | (29 | ) | | — |

|

| Bottler agreements | 19 |

| | (19 | ) | | — |

| | 19 |

| | (19 | ) | | — |

|

| Total | $ | 3,923 |

| | $ | (135 | ) | | $ | 3,788 |

| | $ | 2,788 |

| | $ | (132 | ) | | $ | 2,656 |

|

____________________________

| |

| (1) | As a result of the Bai Brands Merger, the Company recorded indefinite lived brand assets of $1,073 million and definite lived non-compete agreements and customer relationships of $22 million and $30 million, respectively. Refer to Note 2 for additional information. The remaining $5 million increase in brands with indefinite lives is due to foreign currency translation. |

| |

| (2) | In 2017, the Company reacquired certain indefinite lived distribution rights for $5 million. |

As of June 30, 2017, the weighted average useful lives of intangible assets with definite lives are as follows:

|

| | |

| | | Weighted Average Useful Life |

| Customer relationships | | 7 years |

| Non-compete agreements | | 4 years |

| Distribution rights | | 9 years |

| Total intangible assets with definite lives | | 6 years |

Amortization expense for intangible assets with definite lives for the three and six months ended June 30, 2017 and 2016 was as follows:

|

| | | | | | | | | | | | | | | |

| | For the Three Months Ended June 30, | | For the Six Months Ended June 30, |

| (in millions) | 2017 | | 2016 | | 2017 | | 2016 |

| Amortization expense for intangible assets with definite lives | $ | 1 |

| | $ | 1 |

| | $ | 3 |

| | $ | 2 |

|

Amortization expense of these intangible assets over the remainder of 2017 and the next four years is expected to be the following:

DR PEPPER SNAPPLE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited, Continued)

|

| | | |

| Year | Aggregate Amortization Expense (in millions) |

| July 1, 2017 through December 31, 2017 | $ | 3 |

|

| 2018 | 15 |

|

| 2019 | 14 |

|

| 2020 | 8 |

|

| 2021 | 6 |

|

IMPAIRMENT TESTING

The Company conducts impairment tests on goodwill and all indefinite lived intangible assets annually or more frequently if circumstances indicate that the carrying amount of an asset may not be recoverable. DPS did not identify any circumstances that indicated that the carrying amount of any goodwill or any indefinite lived intangible asset may not be recoverable as of June 30, 2017.

DR PEPPER SNAPPLE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited, Continued)

The following table summarizes the Company's long-term obligations:

|

| | | | | | | |

| | June 30, | | December 31, |

| (in millions) | 2017 | | 2016 |

| Senior unsecured notes | $ | 4,541 |

| | $ | 4,325 |

|

| Capital lease obligations | 162 |

| | 153 |

|

| Subtotal | 4,703 |

| | 4,478 |

|

| Less - current portion | (312 | ) | | (10 | ) |

| Long-term obligations | $ | 4,391 |

| | $ | 4,468 |

|

The following table summarizes the Company's short-term borrowings and current portion of long-term obligations: |

| | | | | | | |

| | June 30, | | December 31, |

| (in millions) | 2017 | | 2016 |

| Commercial paper | $ | — |

| | $ | — |

|

| Current portion of long-term obligations: | | | |

| Senior unsecured notes | 301 |

| | — |

|

| Capital lease obligations | 11 |

| | 10 |

|

| Short-term borrowings and current portion of long-term obligations | $ | 312 |

| | $ | 10 |

|

SENIOR UNSECURED NOTES

The Company's senior unsecured notes consisted of the following:

|

| | | | | | | | | | | | | | | | |

| (in millions) | | | | | | Principal Amount | | Carrying Amount |

| | | | | | | June 30, | | June 30, | | December 31, |

| Issuance | | Maturity Date | | Rate | | 2017 | | 2017 | | 2016 |

| 2018 Notes | | May 1, 2018 | | 6.82% | | 301 |

| | 301 |

| | 364 |

|

| 2019 Notes | | January 15, 2019 | | 2.60% | | 250 |

| | 250 |

| | 249 |

|

| 2020 Notes | | January 15, 2020 | | 2.00% | | 250 |

| | 247 |

| | 247 |

|

| 2021-A Notes | | November 15, 2021 | | 3.20% | | 250 |

| | 250 |

| | 249 |

|

| 2021-B Notes | | November 15, 2021 | | 2.53% | | 250 |

| | 247 |

| | 246 |

|

| 2022 Notes | | November 15, 2022 | | 2.70% | | 250 |

| | 271 |

| | 273 |

|

| 2023 Notes | | December 15, 2023 | | 3.13% | | 500 |

| | 496 |

| | 495 |

|

| 2025 Notes | | November 15, 2025 | | 3.40% | | 500 |

| | 495 |

| | 495 |

|

| 2026 Notes | | September 15, 2026 | | 2.55% | | 400 |

| | 396 |

| | 396 |

|

| 2027 Notes | | June 15, 2027 | | 3.43% | | 500 |

| | 498 |

| | 397 |

|

| 2038 Notes | | May 1, 2038 | | 7.45% | | 125 |

| | 135 |

| | 270 |

|

| 2045 Notes | | November 15, 2045 | | 4.50% | | 550 |

| | 558 |

| | 247 |

|

| 2046 Notes | | December 15, 2046 | | 4.42% | | 400 |

| | 397 |

| | 397 |

|

| | | | | | | $ | 4,526 |

| | $ | 4,541 |

| | $ | 4,325 |

|

DR PEPPER SNAPPLE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited, Continued)

The 2027 and 2045 Notes

In June 2017, the Company issued $400 million of senior unsecured notes, consisting of $100 million aggregate principal amount of 2027 Notes and $300 million aggregate principal amount of 2045 Notes in a private offering under Rule 144A under the Securities Act of 1933, as amended. The 2027 Notes and 2045 Notes have substantially identical terms, other than with respect to transfer restrictions and registration rights, as the previously issued 2027 Notes and 2045 Notes. The premium associated with these notes was approximately $16 million. Debt issuance costs related to the issuance of these notes were approximately $4 million. A portion of the proceeds from the issuance of the 2027 and 2045 Notes was used to complete the June 2017 tender offer described below. As of June 30, 2017, the remaining proceeds were invested in short-term investments, which are recorded in the cash and cash equivalents caption of the unaudited Condensed Consolidated Balance Sheets. Refer to Note 18 for additional information about the use of such excess proceeds to redeem the outstanding 2018 Notes in July 2017.

The 2018 and 2038 Notes

In June 2017, the Company completed a tender offer for a portion of its 2018 Notes and its 2038 Notes. As a result of these transactions, the Company retired, at a premium, an aggregate principal amount of approximately $63 million of the 2018 Notes and approximately $125 million of the 2038 Notes. The loss on early extinguishment of the 2018 Notes and the 2038 Notes was approximately $49 million, comprised of $62 million for the tender offer consideration, the early tender premium and write off of deferred financing costs, partially offset by a $13 million gain on the termination of interest rate swap related to the 2038 Notes. Refer to Note 7 for additional information on the termination of the interest rate swap.

Refer to Note 18 for additional information regarding the subsequent redemption of the remaining outstanding 2018 Notes in July 2017.

UNSECURED CREDIT AGREEMENT

In March 2017, the Company entered into a new five-year unsecured credit agreement (the "Credit Agreement"), which provides for a $500 million revolving line of credit (the "Revolver"). This Credit Agreement and Revolver fully replaced the Company's previous unsecured credit agreement and revolving line of credit, which was due to expire on September 25, 2017 and was terminated on March 16, 2017. There were no principal borrowings outstanding under the previous unsecured credit agreement upon termination. The Company incurred debt issuance costs of approximately $1 million in connection with the Credit Agreement during the six months ended June 30, 2017.

Borrowings under the Revolver bear interest at a floating rate per annum based upon the alternate base rate ("ABR") or the Eurodollar rate, in each case plus an applicable margin which varies based upon the Company's debt ratings. Rates range from 0.000% to 0.300% for the ABR loans and from 0.805% to 1.300% for Eurodollar loans. The ABR is defined as the greater of (a) JPMorgan Chase Bank's prime rate, (b) the Federal Reserve Bank of New York ("NYFRB") rate, as defined below, plus 0.500% and (c) the Adjusted LIBOR, as defined below, for a one month interest period plus 1.00%. The NYFRB rate is the greater of (a) the federal funds effective rate or (b) the overnight bank funding rate. The Adjusted LIBOR is the London interbank offered rate for dollars, adjusted for a statutory reserve rate set by the Board of Governors of the Federal Reserve System of the United States of America.

Additionally, the Revolver is available for the issuance of letters of credit, not to exceed $75 million. Letters of credit will reduce, on a dollar for dollar basis, the amount available under the Revolver.

The Credit Agreement further provides that we may request at any time, subject to the satisfaction of certain conditions, that the aggregate commitments under the facility be increased by a total amount not to exceed $250 million.

The Credit Agreement's representations, warranties, covenants and events of default are generally customary for investment grade credit and include a financial covenant that requires the Company to maintain a ratio as provided therein of Consolidated Total Debt to Consolidated EBITDA of no more than 3.50 to 1.00, tested quarterly. During the twelve month period following a Material Acquisition thereunder, the ratio may increase to no more than 4.00 to 1.00. Upon the occurrence of an event of default, among other things, amounts outstanding may be accelerated and the commitments may be terminated. The Company's obligations are guaranteed by certain of the Company's direct and indirect domestic subsidiaries. The Credit Agreement has a maturity date of March 16, 2022; however, with the consent of lenders holding more than 50% of the total commitments thereunder and subject to the satisfaction of certain conditions, the Company may extend the maturity date for up to two additional one-year terms.

DR PEPPER SNAPPLE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited, Continued)

The following table provides amounts utilized and available under our Revolver as of June 30, 2017:

|

| | | | | | | |

| (in millions) | Amount Utilized | | Balances Available |

| Revolver | $ | — |

| | $ | 500 |

|

| Letters of credit | — |

| | 75 |

|

As of June 30, 2017, the Company was in compliance with all financial covenant requirements relating to the Credit Agreement.

LETTERS OF CREDIT FACILITIES

In addition to the portion of the Revolver reserved for issuance of letters of credit, the Company has incremental letters of credit facilities. Under these facilities, $120 million is available for the issuance of letters of credit, $60 million of which was utilized as of June 30, 2017 and $60 million of which remains available for use.

BRIDGE FINANCING FOR BAI BRANDS MERGER

On November 21, 2016, the Company entered into a commitment letter for a 364-day bridge loan facility (the "Bridge Facility") in an aggregate principal amount of up to $1,700 million, in order to ensure that financing would be available for the Bai Brands Merger. On January 31, 2017, in accordance with its terms, the commitment under the Bridge Facility was automatically terminated upon the Company's funding of the Bai Brands Merger.

SHELF REGISTRATION STATEMENT

On August 10, 2016, the Company's Board of Directors (the "Board") authorized the Company to issue up to $2,000 million of securities from time to time. Subsequently, the Company filed a "well-known seasoned issuer" shelf registration statement (the "Shelf") with the SEC, effective September 2, 2016, which registered an indeterminate amount of securities for future sales. On September 16, 2016, the Company issued $400 million of 2026 Notes under the Shelf, leaving $1,600 million of securities authorized for issuance under the Shelf. On November 16, 2016, the Board replenished the authorized aggregate amount of securities available to be issued by an additional $400 million, which raised the full authorized amount to $2,000 million. On December 14, 2016, the Company issued an aggregate of $1,550 million of 2021, 2023, 2027 and 2046 Notes. As of June 30, 2017, $450 million remained authorized to be issued under the Shelf.

7. Derivatives

DPS is exposed to market risks arising from adverse changes in:

•interest rates;

•foreign exchange rates; and

| |

| • | commodity prices affecting the cost of raw materials and fuels, which are recorded in cost of sales and SG&A expenses, respectively. |

The Company manages these risks through a variety of strategies, including the use of interest rate contracts, foreign exchange forward contracts, commodity forward and future contracts and supplier pricing agreements. DPS does not hold or issue derivative financial instruments for trading or speculative purposes.

DR PEPPER SNAPPLE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited, Continued)

The Company formally designates and accounts for certain interest rate contracts and foreign exchange forward contracts that meet established accounting criteria under U.S. GAAP as either fair value or cash flow hedges. For derivative instruments that are designated and qualify as cash flow hedges, the effective portion of the gain or loss on the derivative instruments is recorded, net of applicable taxes, in Accumulated Other Comprehensive Loss ("AOCL"), a component of Stockholders' Equity in the unaudited Condensed Consolidated Balance Sheets. When net income is affected by the variability of the underlying transaction, the applicable offsetting amount of the gain or loss from the derivative instrument deferred in AOCL is reclassified to net income and is reported as a component of the unaudited Condensed Consolidated Statements of Income. For derivative instruments that are designated and qualify as fair value hedges, the effective change in the fair value of the instrument, as well as the offsetting gain or loss on the hedged item attributable to the hedged risk, are recognized immediately in current-period earnings. For derivatives that are not designated or are de-designated as a hedging instrument, the gain or loss on the instrument is recognized in earnings in the period of change. Cash flows from derivative instruments designated in a qualifying hedging relationship are classified in the same category as the cash flows from the hedged items.

Certain interest rate contracts qualify for the "shortcut" method of accounting for hedges under U.S. GAAP. Under the shortcut method, the hedges are assumed to be perfectly effective and no ineffectiveness is recorded in earnings. For all other designated hedges, the Company assesses whether the derivative instrument is effective in offsetting the changes in fair value or variability of cash flows at the inception of the derivative contract. DPS measures hedge ineffectiveness on a quarterly basis throughout the designated period. Changes in the fair value of the derivative instrument that do not effectively offset changes in the fair value of the underlying hedged item throughout the designated hedge period are recorded in earnings each period.

If a fair value or cash flow hedge were to cease to qualify for hedge accounting, or were terminated, the derivatives would continue to be carried on the balance sheet at fair value until settled and hedge accounting would be discontinued prospectively. If the underlying hedged transaction ceases to exist, any associated amounts reported in AOCL would be reclassified to earnings at that time.

INTEREST RATES

Fair Value Hedges

The Company is exposed to the risk of changes in the fair value of certain fixed-rate debt attributable to changes in interest rates and manages these risks through the use of receive-fixed, pay-variable interest rate swaps. Any ineffectiveness is recorded as interest during the period incurred. The following table presents information regarding these interest rate swaps and the associated hedging relationships:

|

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | Impact to the carrying value |

| ($ in millions) | | | | | | Method of | | | | of long-term debt |

| | | Hedging | | Number of | | measuring | | Notional | | June 30, | | December 31, |

| Period entered | | relationship | | instruments | | effectiveness | | value | | 2017 | | 2016 |

| November 2011 | | 2019 Notes | | 2 | | Short cut method | | $ | 100 |

| | $ | — |

| | $ | — |

|

| November 2011 | | 2021-A Notes | | 2 | | Short cut method | | 150 |

| | 1 |

| | — |

|

| November 2012 | | 2020 Notes | | 5 | | Short cut method | | 120 |

| | (2 | ) | | (2 | ) |

| December 2016 | | 2021-B Notes | | 2 | | Short cut method | | 250 |

| | (1 | ) | | (2 | ) |

| December 2016 | | 2023 Notes | | 2 | | Short cut method | | 150 |

| | (1 | ) | | (1 | ) |

| January 2017 | | 2022 Notes(2) | | 4 | | Regression | | 250 |

| | 22 |

| | 24 |

|

| June 2017 | | 2038 Notes(1) | | 1 | | Regression | | 50 |

| | 11 |

| | 22 |

|

| | | | | | | | | $ | 1,070 |

| | $ | 30 |

| | $ | 41 |

|

| |

| (1) | In June 2017, and in connection with the partial redemption of the 2038 Notes, the Company modified and partially terminated the outstanding interest rate swap on the 2038 Notes with a notional amount of $100 million and maturing in May 2038. The modified interest rate swap has identical terms to the original interest rate swap, except for a reduced notional amount of $50 million. The Company received $13 million as settlement for the modification and partial termination of the swap. |

DR PEPPER SNAPPLE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited, Continued)

As a result of this transaction, the Company de-designated the original hedging relationship. Under the original hedging relationship, the Company recorded $26 million as an increase to the carrying value of debt due to changes in the fair market value of the debt, pull to par adjustments and ineffectiveness. The Company recognized a $13 million gain into earnings, which reduced the loss on early extinguishment of debt, as part of the partial redemption of the 2038 Notes. The remaining $13 million increase in the carrying value of the outstanding 2038 Notes will be amortized into earnings over the remaining term of the 2038 Notes. The Company then designated the new interest rate swap contract as a fair value hedge with a notional amount of $50 million and maturing in May 2038 in order to effectively convert a portion of the outstanding 2038 Notes from fixed-rate debt to floating-rate debt. The Company uses regression analysis to assess the prospective and retrospective effectiveness of this hedging relationship.

| |

| (2) | In October 2016, the Company de-designated the hedging relationships between the four outstanding interest rate swaps and the 2022 Notes. The Company will amortize $25 million into earnings over the remaining term of the 2022 Notes which represents the increase to the carrying value of the debt upon de-designation consisting of changes in fair market value of the debt, pull to par adjustments and ineffectiveness recorded under the previous hedging relationship. The Company recorded the change in the fair value of the interest rate swaps after de-designation into interest expense. |

In January 2017, the Company re-designated the hedging relationships between the four outstanding interest rate swaps and the 2022 Notes, which were de-designated in 2016. The Company uses regression analysis to assess the prospective and retrospective effectiveness of these hedging relationships.

FOREIGN EXCHANGE

Cash Flow Hedges

The Company's Canadian and Mexican businesses purchase inventory through transactions denominated and settled in United States ("U.S.") dollars, a currency different from the functional currency of the those businesses. These inventory purchases are subject to exposure from movements in exchange rates. During the three and six months ended June 30, 2017 and 2016, the Company utilized foreign exchange forward contracts designated as cash flow hedges to manage the exposures resulting from changes in these foreign currency exchange rates. The intent of these foreign exchange contracts is to provide predictability in the Company's overall cost structure. These foreign exchange contracts, carried at fair value, have maturities between one and twelve months as of June 30, 2017. The Company had outstanding foreign exchange forward contracts with notional amounts of $68 million and $7 million as of June 30, 2017 and December 31, 2016, respectively.

COMMODITIES

Economic Hedges

DPS centrally manages the exposure to volatility in the prices of certain commodities used in its production process and transportation through forward and future contracts. The intent of these contracts is to provide a certain level of predictability in the Company's overall cost structure. During the three and six months ended June 30, 2017 and 2016, the Company held forward and future contracts that economically hedged certain of its risks. In these cases, a natural hedging relationship exists in which changes in the fair value of the instruments act as an economic offset to changes in the fair value of the underlying items. Changes in the fair value of these instruments are recorded in earnings throughout the term of the derivative instrument and are reported in the same line item of the unaudited Condensed Consolidated Statements of Income as the hedged transaction. Unrealized gains and losses are recognized as a component of unallocated corporate costs until the Company's operating segments are affected by the completion of the underlying transaction, at which time the gain or loss is reflected as a component of the respective segment's operating profit ("SOP"). The total notional values of derivatives related to economic hedges of this type were $238 million and $296 million as of June 30, 2017 and December 31, 2016, respectively.

DR PEPPER SNAPPLE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited, Continued)

FAIR VALUE OF DERIVATIVE INSTRUMENTS

The following table summarizes the location of the fair value of the Company's derivative instruments within the unaudited Condensed Consolidated Balance Sheets:

|

| | | | | | | | | |

| (in millions) | Balance Sheet Location | | June 30,

2017 | | December 31,

2016 |

| Assets: | | | | | |

| Derivative instruments designated as hedging instruments under U.S. GAAP: | | | | | |

| Interest rate contracts | Prepaid expenses and other current assets | | $ | 6 |

| | $ | 6 |

|

| Interest rate contracts | Other non-current assets | | 19 |

| | 21 |

|

| Derivative instruments not designated as hedging instruments under U.S. GAAP: | | | | | |

| Interest rate contracts | Prepaid expenses and other current assets | | — |

| | 4 |

|

| Commodity contracts | Prepaid expenses and other current assets | | 9 |

| | 9 |

|

| Interest rate contracts | Other non-current assets | | — |

| | 8 |

|

| Commodity contracts | Other non-current assets | | 10 |

| | 12 |

|

| Total assets | | | $ | 44 |

| | $ | 60 |

|

| Liabilities: | | | | | |

| Derivative instruments designated as hedging instruments under U.S. GAAP: | | | | | |

| Interest rate contracts | Other current liabilities | | $ | 1 |

| | $ | 1 |

|

| Foreign exchange forward contracts | Other current liabilities | | 6 |

| | — |

|

| Interest rate contracts | Other non-current liabilities | | 4 |

| | 7 |

|

| Derivative instruments not designated as hedging instruments under U.S. GAAP: | | | | | |

| Commodity contracts | Other current liabilities | | 2 |

| | 1 |

|

| Commodity contracts | Other non-current liabilities | | 5 |

| | — |

|

| Total liabilities | | | $ | 18 |

| | $ | 9 |

|

DR PEPPER SNAPPLE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited, Continued)

IMPACT OF CASH FLOW HEDGES

The following table presents the impact of derivative instruments designated as cash flow hedging instruments under U.S. GAAP to the unaudited Condensed Consolidated Statements of Income and Comprehensive Income:

|

| | | | | | | | | |

| | Amount of Loss Recognized in | | Amount of Loss Reclassified from AOCL into Income | | Location of Loss Reclassified from AOCL into Income |

| (in millions) | Other Comprehensive Loss ("OCI") | | |

| For the three months ended June 30, 2017: | | | | | |

| Interest rate contracts | $ | — |

| | $ | (2 | ) | | Interest expense |

| Foreign exchange forward contracts | (3 | ) | | (4 | ) | | Cost of sales |

| Total | $ | (3 | ) | | $ | (6 | ) | | |

| | | | | | |

| For the six months ended June 30, 2017: | | | | | |

| Interest rate contracts | $ | — |

| | $ | (4 | ) | | Interest expense |

| Foreign exchange forward contracts | (10 | ) | | (4 | ) | | Cost of sales |

| Total | $ | (10 | ) | | $ | (8 | ) | | |

| | | | | | |

| For the three months ended June 30, 2016: | | | | | |

| Interest rate contracts | $ | — |

| | $ | (2 | ) | | Interest expense |

| Foreign exchange forward contracts | — |

| | (1 | ) | | Cost of sales |

| Total | $ | — |

| | $ | (3 | ) | | |

| | | | | | |

| For the six months ended June 30, 2016: | | | | | |

| Interest rate contracts | $ | — |

| | $ | (4 | ) | | Interest expense |

| Foreign exchange forward contracts | (2 | ) | | (1 | ) | | Cost of sales |

| Total | $ | (2 | ) | | $ | (5 | ) | | |

There was no hedge ineffectiveness recognized in earnings for the three and six months ended June 30, 2017 and 2016 with respect to derivative instruments designated as cash flow hedges. During the next 12 months, the Company expects to reclassify pre-tax net losses of $16 million from AOCL into net income.

DR PEPPER SNAPPLE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited, Continued)

IMPACT OF FAIR VALUE HEDGES

The following table presents the impact of derivative instruments designated as fair value hedging instruments under U.S. GAAP to the unaudited Condensed Consolidated Statements of Income:

|

| | | | | | |

| | | Amount of Gain | | Location of Gain |

| (in millions) | | Recognized in Income | | Recognized in Income |

| For the three months ended June 30, 2017: | | | | |

| Interest rate contracts | | $ | 3 |

| | Interest expense |

| Interest rate contracts | | 13 |

| | Loss on early extinguishment of debt |

| Total | | $ | 16 |

| | |

| | | | | |

| For the six months ended June 30, 2017: | | | | |

| Interest rate contracts | | $ | 7 |

| | Interest expense |

| Interest rate contracts | | 13 |

| | Loss on early extinguishment of debt |

| Total | | $ | 20 |

| | |

| | | | | |

| For the three months ended June 30, 2016: | | | | |

| Interest rate contracts | | $ | 3 |

| | Interest expense |

| Total | | $ | 3 |

| | |

| | | | | |

| For the six months ended June 30, 2016: | | | | |

| Interest rate contracts | | $ | 7 |

| | Interest expense |

| Total | | $ | 7 |

| | |

For the three and six months ended June 30, 2017, $1 million loss on hedge ineffectiveness was recognized in earnings with respect to derivative instruments designated as fair value hedges for each period. For the three and six months ended June 30, 2016, $1 million and $2 million of hedge ineffectiveness charges were recognized in earnings with respect to derivative instruments designated as fair value hedges, respectively.

DR PEPPER SNAPPLE GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited, Continued)

IMPACT OF ECONOMIC HEDGES

The following table presents the impact of derivative instruments not designated as hedging instruments under U.S. GAAP to the unaudited Condensed Consolidated Statements of Income:

|

| | | | | | |

| | | Amount of Gain (Loss) | | Location of Gain (Loss) |

| (in millions) | | Recognized in Income | | Recognized in Income |

| For the three months ended June 30, 2017: | | | | |

Commodity contracts(1) | | $ | (4 | ) | | Cost of sales |

Commodity contracts(1) | | (6 | ) | | SG&A expenses |

| Total | | $ | (10 | ) | | |

| | | | | |

| For the six months ended June 30, 2017: | | | | |

Commodity contracts(1) | | $ | 17 |

| | Cost of sales |

Commodity contracts(1) | | (19 | ) | | SG&A expenses |

Interest rate contracts(2) | | 1 |

| | Interest expense |

| Total | | $ | (1 | ) | | |

| | | | | |

| For the three months ended June 30, 2016: | | | | |

Commodity contracts(1) | | $ | 10 |

| | Cost of sales |

Commodity contracts(1) | | 8 |

| | SG&A expenses |

| Total | | $ | 18 |

| | |

| | | | | |

| For the six months ended June 30, 2016: | | | | |

Commodity contracts(1) | | $ | 9 |

| | Cost of sales |

Commodity contracts(1) | | 8 |

| | SG&A expenses |

| Total | | $ | 17 |

| | |

| |

| (1) | Commodity contracts include both realized and unrealized gains and losses. |

| |

| (2) | Represents gains on the interest rate contracts related to the 2022 Notes prior to re-designation of hedging relationship in January 2017. |